Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - GENERAL CABLE CORP /DE/ | exhibit993_masanovichpress.htm |

| EX-99.1 - EXHIBIT 99.1 - GENERAL CABLE CORP /DE/ | exhibit991_earningsrelease.htm |

| EX-10.1 - EXHIBIT 10.1 - GENERAL CABLE CORP /DE/ | exhibit101_masanovichoffer.htm |

| 8-K - 8-K - GENERAL CABLE CORP /DE/ | bgc2016q3earnings8-k.htm |

1

Consolidated Adjusted

Operating Income

3rd Quarter 2nd Quarter

2016 2015 2016

In millions, except per share amounts

Operating

Income EPS

Operating

Income EPS

Operating

Income EPS

Reported $ 4.7 $(0.29) $ 24.8 $(0.59) $ 53.3 $ 0.57

Adjustments to Reconcile Operating Income/EPS

Non-cash convertible debt interest expense

(1)

- 0.01 - 0.01 - 0.01

Mark to market (gain) loss on derivative instruments

(2)

- (0.01) - 0.15 - (0.05)

Restructuring and divestiture costs

(3)

24.1 0.29 14.2 0.27 16.7 0.25

Legal and investigative costs

(4)

0.8 0.01 2.1 0.04 1.1 0.02

(Gain) loss on sale of assets

(5)

(6.4) (0.08) - - (46.5) (0.86)

FCPA Accrual

(7)

- - - - 5.0 0.09

Loss on deconsolidation of Venezuela

(8)

- - 12.0 0.25 - -

Venezuela (income)/loss

(8)

- - (0.8) (0.02) - -

Asia-Pacific and Africa (income) loss

(9)

8.9 0.14 (4.9) 0.15 19.4 0.27

Total Adjustments 27.4 0.36 22.6 0.85 (4.3) (0.27)

Adjusted $ 32.1 $ 0.07 $ 47.4 $ 0.26 $ 49.0 $ 0.30

Note 1: The table above reflects EPS adjustments based on the Company's full year effective tax rate for 2016 and 2015 of 50% and 40%, respectively

Note 2: See footnote definitions on slide 6

Exhibit 99.2

2

Segment Adjusted Operating Income

North America, Europe and Latin America

Note: See footnote definitions on slide 6

North America Operating Income

Q3 Q4 Q1 Q2 Q3

In millions 2015 2015 2016 2016 2016

As reported $ 17.9 $ 6.1 $ 17.7 $ 73.8 $ 10.0

Adjustments to Reconcile Operating Income

Restructuring and divestiture costs (3) 11.1 5.4 8.0 13.4 22.9

Legal and investigative costs (4) 4.0 6.0 5.8 1.1 0.8

Foreign Corrupt Practices Act (FCPA) accrual (7) - 4.0 - 5.0 -

(Gain) loss on the sale of assets (5) - - - (53.2) (0.5)

Total Adjustments 15.1 15.4 13.8 (33.7) 23.2

Adjusted $ 33.0 $ 21.5 $ 31.5 $ 40.1 $ 33.2

Europe Operating Income

Q3 Q4 Q1 Q2 Q3

In millions 2015 2015 2016 2016 2016

As reported $ 3.2 $ (1.3) $ 7.7 $ (1.5) $ 10.8

Adjustments to Reconcile Operating Income

Restructuring and divestiture costs (3) - 7.2 3.6 1.7 0.3

(Gain) loss on the sale of assets (5) - - - 8.4 (5.9)

(Gain) loss on deconsolidation of Venezuela (8) 12.5 - - - -

Total Adjustments 12.5 7.2 3.6 10.1 (5.6)

Adjusted $ 15.7 $ 5.9 $ 11.3 $ 8.6 $ 5.2

Latin America Operating Income

Q3 Q4 Q1 Q2 Q3

In millions 2015 2015 2016 2016 2016

As reported $ (1.2) $ (3.2) $ (3.7) $ 0.4 $ (7.1)

Adjustments to Reconcile Operating Income

Restructuring and divestiture costs (3) 3.1 2.7 2.5 1.6 0.8

Legal and investigative costs (4) (1.9) 1.3 - -

(Gain) loss on the sale of assets (5) - - - (1.7) -

(Gain) loss on deconsolidation of Venezuela (8) (0.5) - - -

Venezuela (income)/loss (8) (0.8) - - -

Total Adjustments (0.1) 4.0 2.5 (0.1) 0.8

Adjusted $ (1.3) $ 0.8 $ (1.2) $ 0.3 $ (6.3)

Core Operations - Total Adjusted Operating Income $ 47.4 $ 28.2 $ 41.6 $ 49.0 $ 32.1

3

Metal Adjusted Net Sales

Note: See footnote definitions on slide 6

North America 3rd Quarter Full Year

2016 2015 2016 2016

In millions Net Sales Net Sales Net Sales Net Sales

As reported $ 496.1 $ 571.9 $ 1,565.2 $ 1,819.5

Adjustments to Reconcile Net Sales

Metal adjustment (10) - (12.1) - (118.6)

Total Adjustments - (12.1) - (118.6)

Adjusted $ 496.1 $ 559.8 $ 1,565.2 $ 1,700.9

Europe 3rd Quarter Full Year

2016 2015 2016 2016

In millions Net Sales Net Sales Net Sales Net Sales

As reported $ 212.1 $ 231.0 $ 663.5 $ 743.7

Adjustments to Reconcile Net Sales

Metal adjustment (10) - (3.9) - (37.7)

Total Adjustments - (3.9) - (37.7)

Adjusted $ 212.1 $ 227.1 $ 663.5 $ 706.0

Latin America 3rd Quarter Full Year

2016 2015 2016 2016

In millions Net Sales Net Sales Net Sales Net Sales

As reported $ 158.0 $ 169.2 $ 481.2 $ 563.3

Adjustments to Reconcile Net Sales

Metal adjustment (10) - (7.0) - (62.7)

Total Adjustments - (7.0) - (62.7)

Adjusted $ 158.0 $ 162.2 $ 481.2 $ 500.6

Asia and Africa 3rd Quarter Full Year

2016 2015 2016 2016

In millions Net Sales Net Sales Net Sales Net Sales

As reported $ 58.3 $ 124.3 $ 238.5 $ 435.1

Adjustments to Reconcile Net Sales

Metal adjustment (10) - (4.2) - (40.5)

Total Adjustments - (4.2) - (40.5)

Adjusted $ 58.3 $ 120.1 $ 238.5 $ 394.6

4

Adjusted Other Income (Expense)

Note: See footnote definitions on slide 6

3rd Quarter 2nd Quarter

2016 2015 2016

In millions

Other Income

(Expense)

Other Income

(Expense)

Other Income

(Expense)

As reported $ (2.1) $ (28.9) $ 8.0

Adjustments to Reconcile Other Income (Expense)

Mark to market (gain) loss on derivative instruments (2) (0.8) 8.2 (3.6)

Venezuela other (income) expense (8) - 0.1 -

Asia-Pacific and Africa other (income) loss (9) 1.4 14.7 (1.9)

Total Adjustments 0.6 23.0 (5.5)

Adjusted $ (1.5) $ (5.9) $ 2.5

5

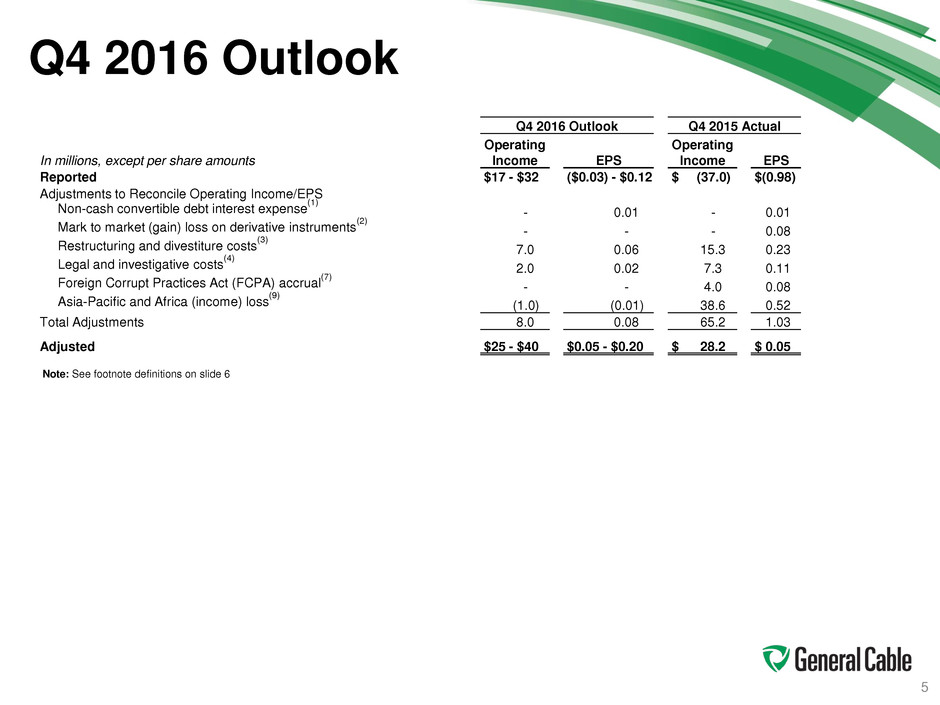

Q4 2016 Outlook

Note: See footnote definitions on slide 6

Q4 2016 Outlook Q4 2015 Actual

In millions, except per share amounts

Operating

Income EPS

Operating

Income EPS

Reported $17 - $32 ($0.03) - $0.12 $ (37.0) $(0.98)

Adjustments to Reconcile Operating Income/EPS

Non-cash convertible debt interest expense

(1)

- 0.01 - 0.01

Mark to market (gain) loss on derivative instruments

(2)

- - - 0.08

Restructuring and divestiture costs

(3)

7.0 0.06 15.3 0.23

Legal and investigative costs

(4)

2.0 0.02 7.3 0.11

Foreign Corrupt Practices Act (FCPA) accrual

(7)

- - 4.0 0.08

Asia-Pacific and Africa (income) loss

(9)

(1.0) (0.01) 38.6 0.52

Total Adjustments 8.0 0.08 65.2 1.03

Adjusted $25 - $40 $0.05 - $0.20 $ 28.2 $ 0.05

6

Footnotes

(1) - The Company's adjustment for the non-cash convertible debt interest expense reflects the accretion of the equity component of the 2029 convertible notes, which is reflected in

the income statement as interest expense.

(2) - Mark to market (gains) and losses on derivative instruments represents the current period changes in the fair value of commodity instruments designated as economic hedges.

The Company adjusts for the changes in fair values of these commodity instruments as the earnings associated with the underlying contracts have not been recorded in the same

period.

(3) - Restructuring and divestiture costs represent costs associated with the Company's announced restructuring and divestiture programs. Examples consist of, but are not limited to,

employee separation costs, asset write-downs, accelerated depreciation, working capital write-downs, equipment relocation, contract terminations, consulting fees and legal costs

incurred as a result of the programs. The Company adjusts for these charges as management believes these costs will not continue at the conclusion of both the restructuring and

divestiture programs.

(4) - Legal and investigative costs represents costs incurred for external legal counsel and forensic accounting firms in connection with the restatement of our financial statements and

the Foreign Corrupt Practices Act investigation. The Company adjusts for these charges as management believes these costs will not continue at the conclusion of these

investigations which are considered to be outside the normal course of business.

(5) - Gain and losses on the sale of assets are the result of divesting certain General Cable businesses. The Company adjusts for these gains and losses as management believes

the gains and losses are one-time in nature and will not occur as part of the ongoing operations.

(6) - New customer incentive reflects a one-time charge related to an inventory exchange program the Company executed within its automotive ignition wire business. The Company

adjusted operating income for this customer incentive as management believes this was a one-time charge that will not occur as part of the ongoing operations. Further, the Company

sold this business in the second quarter of 2016.

(7) - Foreign Corrupt Practices Act (FCPA) accrual is the Company's estimate of the profits and pre-judgment interest that may be disgorged to resolve the ongoing investigation. The

Company adjusts for this accrual as management believes this is a one-time charge and will not occur as part of ongoing operations.

(8) - The Venezuela (income) loss adjustment reflects the removal of the impact of Venezuelan operations prior to its deconsolidation effective at the end of Q3 2015. Effective as of

the end of the third quarter 2015, the Venezuelan subsidiary was deconsolidated and accounted for using the cost method of accounting. The loss on the deconsolidation of

Venezuela is the one-time charge associated with the deconsolidation. The Company adjusted for this loss as management believes the deconsolidation of Venezuela was one-time

in nature and will not occur as part of the ongoing operations.

(9) - The adjustment excludes the impact of operations in the Asia Pacific and Africa segment which are not considered "core operations" under the Company's new strategic

roadmap. The Company is in the process of divesting or closing these operations which are not expected to continue as part of the ongoing business. For accounting purposes, the

operations in Asia Pacific and Africa do not meet the requirements to be presented as discontinued operations.

(10) - The metal adjustment to net sales is the Company's estimate of metal price volatility to revenues from one period to another.

(11) - Excludes depreciation and amortization in Asia Pacific and Africa for the twelve months ended 2015 and the last twelve months as of Q3 2016 of $5.8 million and $11.5 million,

respectively.