Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - Zendesk, Inc. | a2016q3tweetexhibit993fi.htm |

| EX-99.1 - EXHIBIT 99.1 - Zendesk, Inc. | zen_8-kxq3x2016xex991x7.htm |

| EX-3.1 - EXHIBIT 3.1 - Zendesk, Inc. | zendesk-amendedandrestated.htm |

| 8-K - 8-K - Zendesk, Inc. | zen_8-kxq3.htm |

Zendesk Shareholder Letter Q3 2016 - 1

v

Third Quarter 2016

Shareholder Letter

November 01, 2016

Exhibit 99.2

Zendesk Shareholder Letter Q3 2016 - 2

Mikkel Svane

CEO

In case you haven’t noticed, a lot has changed at

Zendesk. Over the past year we have invested

to broaden our family of products. Last week,

we unveiled our new corporate branding and

an expanded product portfolio, furthering our

vision of delivering better customer experiences.

The new Zendesk family of products represents

Zendesk’s shift from a single customer service

product to a unified product family focused on

improving customer relationships. The Zendesk

family of products helps organizations understand

their customers, improve communication, and

offer support where and when it’s needed most.

For the third quarter of 2016, we achieved

revenue of $80.7 million. While this represents

substantial growth of 45% over the third quarter

of 2015 and exceeded our previously published

guidance, we feel we did not execute to our

fullest potential. In July, we realigned our

sales and marketing activities with the goal

of more efficiently winning new business and

expanding within our installed customer base.

That reorganization caused more employee

turnover and disruption than we had expected

and impacted our ability to convert pipeline into

closed business, especially late in the quarter

and in our largest Americas region. We also fell

short of our expectations on service uptime,

disappointing our customers in ways that aren’t

acceptable. We’ve taken immediate action to

address this issue, as discussed in more

detail below.

Despite those challenges, there was much to

be excited about in our business performance

during the quarter. Our core low-touch business

continued to thrive, with the result being that a

very substantial portion of our business is being

closed with short and highly efficient sales cycles.

We crossed 87,000 paid customer accounts, a

number that demonstrates our success in landing

new customers. Additionally, we remain focused

on landing with larger organizations, continuing

to employ our land-and-expand strategy to

efficiently manage our customer acquisition costs.

We have high confidence in our ability to expand

with many of these new customers.

Elena Gomez

CFO

Marc Cabi

Strategy & IR

Zendesk Shareholder Letter Q3 2016 - 3

Third quarter 2016 financial summary

(in thousands, except per share data)

Three Months Ended September 30,

GAAP Results 2016 2015

Revenue $ 80,717 $ 55,661

Gross profit 56,851 38,622

Gross margin 70.4% 69.4%

Operating loss $ (26,213) $ (18,807)

Operating margin -32.5% -33.8%

Net loss $ (25,826) $ (18,924)

Net loss per share (0.27) (0.22)

Non-GAAP Results

Non-GAAP gross profit $ 60,090 $ 40,407

Non-GAAP gross margin 74.4% 72.6%

Non-GAAP operating loss $ (4,256) $ (4,131)

Non-GAAP operating margin -5.3% -7.4%

Non-GAAP net loss $ (3,869) $ (4,248)

Non-GAAP net loss per share (0.04) (0.05)

We remain focused on scaling our operations

and delivering year-over-year operating margin

improvement. For the third quarter of 2016 versus

the third quarter of 2015, we expanded GAAP gross

margin to 70.4% from 69.4% and GAAP operating

margin to -32.5% from -33.8%. When comparing the

same periods on a non-GAAP basis, we expanded

gross margin to 74.4% from 72.6% and operating

margin to -5.3% from -7.4%.

With the re-architecting of our go-to-market

organization largely complete and the roll-out of

our new brand messaging and family of products,

we believe we are well positioned to close out

2016 and turn to 2017. We will maintain our focus on

sustaining high growth while demonstrating scale

through improved operating margins over time as

we pursue our ultimate goal of helping organizations

build better relationships with their customers.

Zendesk Shareholder Letter Q3 2016 - 4

The new Zendesk

As we prepare for the future of Zendesk, we

look back at our accomplishments over the

last 9 years. We have come a long way with

our customers, who define innovation in a

new economy where listening to the voice of

the customer and customer satisfaction are

prerequisites for success. We have learned so

much from our next-generation customers like

AdRoll, Instacart, Lonely Planet, MailChimp,

Shopify, and a long list of others. They have

demonstrated that building relationships and

loyalty through a journey of customer interactions

and experiences is how to achieve success, not

one-off transactions of the days past. In fact,

today’s most successful companies are moving

away from an old view that customers need to be

managed and automated, to a new view where

building customer relationships is at the core of

their business.

The new reality is that business software must

be built for customers f irst. Modern software

should allow companies to deliver positive

experiences without being held back by the

inefficiencies of silos created by departments

and functions within companies.

We embark on a new journey to provide our

customers with software tools that allow

companies to broaden how they address their

customer relationships. Our future strategy is not

to replicate an old view of CRM -- defined by sales

automation, marketing automation, and service

automation -- rather, our vision is to build software

for relationships first.

Last week, we introduced our new and

expanded product family that is designed to help

organizations build better customer relationships.

Customer support remains a core part of that

effort, as does delivering products that enable

customers to communicate with companies across

multiple channels. In addition, we are expanding

our software to better understand customers.

Zendesk Shareholder Letter Q3 2016 - 5

A beautifully simple system for

tracking, prioritizing, and solving

customer support tickets

A self-service destination with

articles, interactive forums, and

community that helps customers

help themselves

Live chat software that provides a fast

and responsive way to connect with

customers in the moment

Call center software for more

personal and productive phone

support conversations

Message software that helps

companies engage customers on

their favorite messaging apps

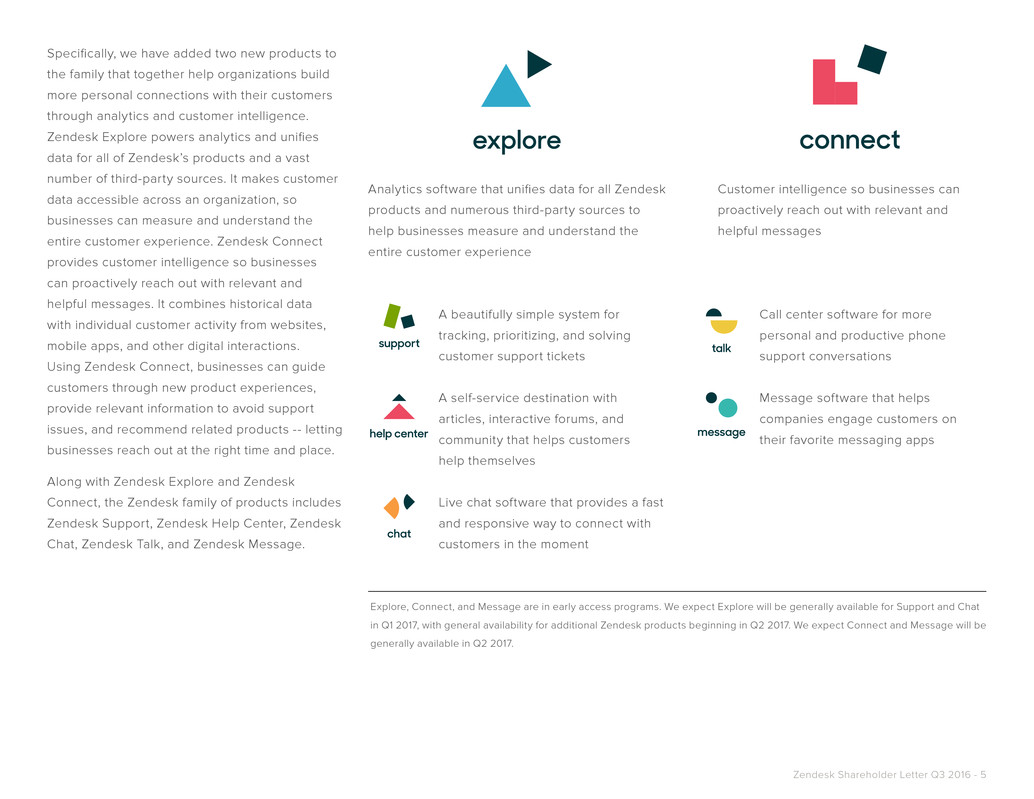

Analytics software that unifies data for all Zendesk

products and numerous third-party sources to

help businesses measure and understand the

entire customer experience

Customer intelligence so businesses can

proactively reach out with relevant and

helpful messages

Specifically, we have added two new products to

the family that together help organizations build

more personal connections with their customers

through analytics and customer intelligence.

Zendesk Explore powers analytics and unifies

data for all of Zendesk’s products and a vast

number of third-party sources. It makes customer

data accessible across an organization, so

businesses can measure and understand the

entire customer experience. Zendesk Connect

provides customer intelligence so businesses

can proactively reach out with relevant and

helpful messages. It combines historical data

with individual customer activity from websites,

mobile apps, and other digital interactions.

Using Zendesk Connect, businesses can guide

customers through new product experiences,

provide relevant information to avoid support

issues, and recommend related products -- letting

businesses reach out at the right time and place.

Along with Zendesk Explore and Zendesk

Connect, the Zendesk family of products includes

Zendesk Support, Zendesk Help Center, Zendesk

Chat, Zendesk Talk, and Zendesk Message.

Explore, Connect, and Message are in early access programs. We expect Explore will be generally available for Support and Chat

in Q1 2017, with general availability for additional Zendesk products beginning in Q2 2017. We expect Connect and Message will be

generally available in Q2 2017.

Zendesk Shareholder Letter Q3 2016 - 6

A scalable brand

Along with new products, we introduced our entirely

new brand identity for Zendesk. Our challenge was

to create a new brand system that allowed us to

have unique identities for our individual products,

while unifying them under our company brand.

Drawing inspiration from our roots in Danish design,

we unveiled unique logos for each of our products

built on a concept called “Relationshapes.” Each

product is identified by the interaction of two

everyday shapes. Those shapes come together as a

large “Z” to form our new corporate identity.

Our brand has long played a key role in our success.

As we look to the future, the Zendesk brand will

continue to expand toward our broader addressable

market of products for better customer relationships.

Zendesk Shareholder Letter Q3 2016 - 7

Product investment

A big part of our move toward being a unified family

of products is our investments in making sure our

products work well together. We are investing in

their deep and seamless integration. All of them

share a common interface and are being developed

to support a single login and ultimately, a shared

customer data platform.

To underscore our commitment to these goals

and the expanded reach of our products, we are

pleased to announce the appointment of Adrian

McDermott as our President of Products. Over

the last six years, Adrian has been instrumental in

translating our aspirations into software built for

better customer relationships. In this new leadership

role, he will continue moving us forward on the path

toward building out our unified product family, and

transforming the customer and agent experience.

Scaling and maturing

our infrastructure

As the ongoing relationship between organizations

and their customers becomes central to the

success of modern business models, we recognize

and appreciate the trust our customers have

placed in us to help manage those relationships.

We’ve worked hard to earn that trust by investing

in our infrastructure to support the high traffic

volume needs of our biggest and fastest growing

customers. Zendesk now processes individual

customer service requests at a rate of over 1 billion

per year.

As recent attacks on internet infrastructure have

revealed, businesses are increasingly dependent on

the availability and performance of mission critical

services like ours to manage their operations.

Zendesk is not immune to these disruptions and,

over the course of 2016, our customers have

been impacted by them as well as other incidents

more directly under our control. That customer

experience is not acceptable to us and we are

redoubling our efforts to ensure the availability and

Adrian McDermott

President of Products

Tom Keiser

Chief Information Officer &

SVP Technology Operations

performance of our products are best-in-class. As

part of that effort, we have brought our infrastructure

and technology operations organizations under the

leadership of Tom Keiser. He joined us as our CIO

in the second quarter and will now also serve as

our SVP of Technology Operations. We believe that

Tom, who managed operations teams at scale while

at Gap and LBrands and has been transformative

in his short tenure at Zendesk, is the right leader to

help continue to mature this part of our organization.

Another aspect of our evolving operations

strategy is the continued refinement of our hosting

infrastructure to optimize for reliability, performance,

and cost. We currently provide our services through

a combination of co-located managed data centers

and cloud infrastructure providers such as Amazon

Web Services (AWS) and Google Cloud Platform.

Earlier this year, Zendesk successfully launched its

first AWS implementation in the APAC region. As

a result, our pursuit of opportunities to leverage

efficient, scalable, and resilient managed hosting

solutions has accelerated. During the third quarter,

we launched two US-based AWS instances. We will

continue to evaluate the success of these efforts

over the next few quarters and our approach to

infrastructure investments.

Zendesk Shareholder Letter Q3 2016 - 8

Expanding developer channels

Earlier this year, we announced an integration

with Google Play that allows Zendesk customers

to automatically convert Google Play Store

reviews into support tickets. We expanded on

this in the third quarter, releasing the Channel

Framework, which allows developers to build

their own integrations and bring customer

communications from anywhere into Zendesk.

With the Channel Framework, Zendesk customers

can turn reviews, comments, and messages into

two-way customer service conversations. These

channel integrations are currently available on our

redesigned Apps Marketplace. We also updated

the marketplace with better search and browsing

of our apps. We expect the Apps Marketplace

to be the foundation for a new multi-product

experience where customers will soon be able

to install apps into Chat and other emerging

products.

Zendesk Shareholder Letter Q3 2016 - 9

Advanced

Voice

Key accomplishments

Jan

2015

Zendesk

Neighbor

Foundation

Facebook

Messenger

Analyst Day

Zendesk

MessageAnalytics

Gartner MQ

Visionary

Forrester

Wave

Pathfinder

Automatic

Answers

65K 75K 85K80K

1,000

Employee Count

Paid Customer Accounts

July

2016

1,500

70K

Satisfaction

Prediction

1,200

Jan

2016

60K

Gartner MQ

Leader

Premium

Live Chat SMS

Google Play

Help Center

“Copenhagen”

Channel

Framework

New

Products

RebrandIndia Of_f_ice

Opening

Of_f_ice 365

Customers

Notable customer success stories from the third

quarter include Vend, a cloud point-of-sale software

company based in New Zealand. Zendesk is at the

heart of Vend’s award-winning support. Following

the announcement of our Automatic Answers

machine learning feature in July, the company was

excited to be a part of the early access program to

test it on their email and web form channels. With

over 6,000 interactions per month with retailers

from over 100 countries, Automatic Answers is

now solving a couple of hundred requests per

month without any input from a retailer advocate.

Automatic Answers has helped Vend’s retail

customers get the answers they seek faster, without

creating extra work for their support team.

Other noteworthy customers that recently joined

us or expanded with us include:

• Instacart, a popular internet-based grocery

delivery service

• MailChimp, an online email marketing solution

• Konami Gaming, innovators of slot machines

and gaming enterprise management systems

• Neato Robotics, a robotics company making

automatic, cordless robot vacuums

• Easynvest, a Brazilian investment

management company

Advanced

Voice

Key accomplishments

Jan

2015

Zendesk

Neighbor

Foundation

Facebook

Messenger

Analyst Day

Zendesk

MessageAnalytics

Gartner MQ

Visionary

Forrester

Wave

Pathfinder

Automatic

Answers

65K 75K 85K80K

1,000

Employee Count

Paid Customer Accounts

July

2016

1,500

70K

Satisfaction

Prediction

1,200

Jan

2016

60K

Gartner MQ

Leader

Premium

Live Chat SMS

Google Play

Help Center

“Copenhagen”

Channel

Framework

New

Products

RebrandIndia Of_f_ice

Opening

Of_f_ice 365

Key accomplishments

Timeline not to scale

Zendesk Shareholder Letter Q3 2016 - 10

Operating metrics

Earlier in 2016, we shared our goal of focusing

our sales and marketing investments on pursuing

opportunities we believe result in building a

repeatable and efficient model for customer

acquisition. With our Chief Revenue Officer

Bryan Cox on board, we’ve refined our go-to-

market strategy to focus on these low-touch,

more efficient sales cycle opportunities, while

still driving efforts to land and pursue expansion

opportunities within larger organizations.

As a proxy of our success with larger

opportunities, we measure our number of

contracts signed with an annual value of $50,000

or greater. In the third quarter, we closed 44%

more of these contracts versus a year ago. We

saw a decrease in the average size of these

transactions as compared to the same period last

year, which reflects the unpredictable nature of

closing some of our largest opportunities.

Another metric we use to gauge our penetration

within larger organizations is represented by

the percentage of recurring revenue generated

by customers with more than 100 agents, which

remained strong at 33% in the third quarter of

2016 versus 31% in the third quarter of 2015.

Our dollar-based net expansion rate at the end

of the third quarter was 114%. This result is in line

with expectations and, similar to last quarter, is

impacted by the anniversary of large wins in the

same period of 2015. The combined churn and

contraction rate, which is a component of this

metric, has not significantly changed since the

time of our IPO. We expect our dollar-based net

expansion rate to range between 110-120% over

the next several quarters.

% of total quarter-ending MRR

from paid customer accounts with 100+ seats

Zendesk Shareholder Letter Q3 2016 - 11

Corporate Social Responsibility

At Zendesk, corporate social responsibility is

a core component of our brand. In September,

we were proud to receive the Corporate Partner

Award for our dedication and commitment

to building neighborhood and community

partnerships at the 39th Annual Wu Yee Gala

hosted in San Francisco. Wu Yee Children’s

Services connects diverse and low-income

families to critical health and education resources.

We have had the pleasure of offering the

agency our community space located in our San

Francisco headquarters to host family dinners,

graduation ceremonies, and even a Frozen Sing-

Along night for Wu Yee families.

Also in September, Mikkel gave the keynote

address at the C.H.E.F.S. Class 61 graduation

ceremony, which was hosted in our community

space. C.H.E.F.S. (Conquering Homelessness

through Employment in Food Services) is a

five-month culinary training program operated

by Episcopal Community Services that prepares

homeless and formerly homeless individuals for

jobs in food services.

FPO

Zendesk Shareholder Letter Q3 2016 - 12

Financial measures and cash flows

Our mission to demonstrate scale through year-

over-year margin improvement continued during

the third quarter of 2016. During this quarter, we

achieved gross margin expansion based primarily

on continued improvement in utilization of our

capitalized internal-use software, employee

resources, and data center capacity. GAAP gross

margin increased to 70.4% in the third quarter of

2016 compared to 69.1% in the second quarter

of 2016. GAAP gross margin in the third quarter

of 2015 was 69.4%. Non-GAAP gross margin

increased to 74.4% in the third quarter of 2016

compared to 73.3% in the second quarter of 2016.

Non-GAAP gross margin in the third quarter of

2015 was 72.6%.

GAAP operating loss for the third quarter of 2016

was $26.2 million compared to GAAP operating

loss for the second quarter of 2016 of $26.3

million. GAAP operating loss for the third quarter

of 2015 was $18.8 million. Non-GAAP operating

loss for the third quarter of 2016 was $4.3 million,

which was better than our outlook for the quarter,

and compares to non-GAAP operating loss for the

second quarter of 2016 of $5.6 million. Non-GAAP

operating loss for the third quarter of 2015 was

$4.1 million.

GAAP operating margin improvement is attributed

to improvements in gross margin, and overall

productivity gains in administrative and research

and development costs. GAAP operating margin

for the third quarter of 2016 improved to -32.5%

from -35.4% in the second quarter of 2016. GAAP

operating margin was -33.8% in the third quarter

of 2015. Non-GAAP operating margin improved

to -5.3% in the third quarter of 2016 from -7.6% in

the second quarter of 2016. Non-GAAP operating

margin was -7.4% in the third quarter of 2015.

GAAP net loss for the third quarter of 2016 was

$25.8 million or $0.27 per share compared to

GAAP net loss of $26.3 million or $0.28 per share

for the second quarter of 2016. GAAP net loss

was $18.9 million or $0.22 per share for the third

quarter of 2015.

Non-GAAP net loss for the third quarter of 2016

was $3.9 million or $0.04 per share compared to

non-GAAP net loss of $5.6 million or $0.06 per

share for the second quarter of 2016. Non-GAAP

net loss was $4.2 million or $0.05 per share

for the third quarter of 2015. Weighted average

shares used to compute both GAAP and non-

GAAP net loss per share for the third quarter of

2016 was 94.1 million.

Non-GAAP results for the third quarter of

2016 exclude $21.0 million in share-based

compensation and related expenses (including

$0.6 million of employer tax related to employee

stock transactions and $0.4 million of amortized

share-based compensation capitalized in internal-

use software), and $1.0 million of amortization of

purchased intangibles. Non-GAAP results for the

second quarter of 2016 exclude $19.7 million in

share-based compensation and related expenses

(including $0.7 million of employer tax related to

employee stock transactions and $0.4 million of

amortized share-based compensation capitalized

in internal-use software), and $1.0 million of

amortization of purchased intangibles. Non-GAAP

results for the third quarter of 2015 exclude $14.0

million in share-based compensation and related

expenses (including $0.2 million of employer tax

related to employee stock transactions and $0.3

million of amortized share-based compensation

capitalized in internal-use software), $0.3 million

of acquisition related costs, and $0.4 million of

amortization of purchased intangibles.

During the third quarter of 2016, net cash from

operating activities was -$0.6 million. We ended

the third quarter of 2016 with $77.6 million of cash

and equivalents, and we had an additional $133.8

million of short-term marketable securities and

$71.1 million in long-term marketable securities.

Zendesk Shareholder Letter Q3 2016 - 13

Guidance

The evolution and scaling of our core product to

meet our customers’ needs, introduction of an

expanded family of products, and the unveiling

of our new brand provide a solid foundation upon

which we believe we can continue to capitalize

and grow our business. We are also excited by

the immediate impact our new leaders have had

on helping us understand the different dynamics

of our business and setting us up to execute more

sustainably over the next year. Our core low-

touch, high velocity business segment continues

to grow at a highly predictable pace. We enter

the fourth quarter of 2016 with a healthy pipeline

of new and large prospective opportunities.

Our financial guidance for the remainder of 2016

reflects the fact that many of our early go-to-market

strategies to capitalize on larger opportunities

remain unpredictable from quarter to quarter. We

are confident in our ability to build a company that

can sustain solid revenue growth and meet our goal

of $1 billion in revenues in 2020.

For the fourth quarter of 2016, we expect revenue

to range between $86.0 and $88.0 million and we

expect our GAAP operating loss to range between

$29.0 and $30.0 million. We expect our non-GAAP

operating loss for the fourth quarter of 2016 to

range between $5.0 and $6.0 million. Our GAAP

operating loss for the fourth quarter of 2016 is

estimated to include share-based compensation

and related expenses of approximately $23.0

million, and amortization of purchased intangibles

of approximately $1.0 million.

For the full year of 2016, we expect revenue

to range between $309.0 and $311.0 million.

We expect our GAAP operating loss for the

full year of 2016 to range between $108.5 and

$109.5 million, and we expect our non-GAAP

operating loss to range between $22.0 and

$23.0 million. Our GAAP operating loss for the

full year of 2016 is estimated to include share-

based compensation and related expenses of

approximately $82.7 million, and amortization

of purchased intangibles of approximately

$3.8 million.

The timing of our data center investments and

our decision to supplement our co-located data

center investments with the use of third-party

hosting solutions may impact the allocation of

cash flows between cash flows from operations

and cash used for investing activities. We

currently estimate our net cash from operating

activities and free cash flow for the fourth quarter

of 2016 to be positive.

We continue to target to be free cash flow

positive for the full year of 2017.

This target regarding free cash flow includes cash

used for purchases of property and equipment

and internal-use software development costs. We

have not reconciled free cash flow guidance to

net cash from operating activities for this future

period because we do not provide guidance

on the reconciling items between net cash from

operating activities and free cash flow, as a result

of the uncertainty regarding, and the potential

variability of, these items. The actual amount

of such reconciling items will have a significant

impact on our free cash flow and, accordingly, a

reconciliation of net cash from operating activities

to free cash flow for the period is not available

without unreasonable effort.

Finally, we estimate we will have approximately

95.6 million weighted average shares outstanding

for the fourth quarter of 2016 and 93.1 million

weighted average shares outstanding for the full

year of 2016, each based only on current shares

outstanding and anticipated activity associated

with equity incentive plans.

Zendesk Shareholder Letter Q3 2016 - 14

Condensed

consolidated statements

of operations

(In thousands, except per

share data; unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2016 2015 2016 2015

Revenue $80,717 $55,661 $223,376 $146,122

Cost of revenue 23,866 17,039 68,318 47,491

Gross profit 56,851 38,622 155,058 98,631

Operating expenses:

Research and development 22,953 16,031 66,683 43,517

Sales and marketing 43,899 29,079 119,421 79,725

General and administrative 16,212 12,319 48,149 33,982

Total operating expenses 83,064 57,429 234,253 157,224

Operating loss (26,213) (18,807) (79,195) (58,593)

Other income (expense), net 681 145 745 (428)

Loss before provision for income taxes (25,532) (18,662) (78,450) (59,021)

Provision for income taxes 294 262 800 554

Net loss (25,826) (18,924) (79,250) (59,575)

Net loss per share, basic and diluted $(0.27) $(0.22) $(0.86) $(0.71)

Weighted-average shares used to compute

net loss per share, basic and diluted

94,085

87,777

92,274

83,536

Zendesk Shareholder Letter Q3 2016 - 15

Condensed consolidated

balance sheets

(In thousands, except par

value; unaudited)

September 30, 2016 December 31, 2015

Assets

Current Assets:

Cash and cash equivalents $77,589 $ 216,226

Marketable securities 133,758 29,414

Accounts receivable, net of allowance for doubtful accounts of $1,213 and

$763 as of September 30, 2016 and December 31, 2015, respectively

37,645

26,168

Prepaid expenses and other current assets 19,437 11,423

Total current assets 268,429 283,231

Marketable securities, noncurrent 71,139 22,336

Property and equipment, net 57,507 56,540

Goodwill and intangible assets, net 54,848 57,050

Other assets 4,504 3,529

Total assets $456,427 $ 422,686

Liabilities and stockholders’ equity

Current liabilities:

Accounts payable $5,491 $ 9,332

Accrued liabilities 12,839 9,742

Accrued compensation and related benefits 17,929 14,115

Deferred revenue 110,174 84,210

Total current liabilities 146,433 117,399

Deferred revenue, noncurrent 1,538 1,405

Other liabilities 9,922 10,592

Total liabilities 157,893 129,396

Stockholders’ equity:

Preferred stock, par value $0.01 per share — —

Common stock, par value $0.01 per share 953 905

Additional paid-in capital 595,135 511,183

Accumulated other comprehensive loss (1,730) (2,225)

Accumulated deficit (295,172) (215,921)

Treasury stock, at cost (652) (652)

Total stockholders’ equity 298,534 293,290

Total liabilities and stockholders’ equity $456,427 $ 422,686

Zendesk Shareholder Letter Q3 2016 - 16

Three Months Ended

September 30,

2016 2015

Cash flows from operating activities

Net loss $(25,826) $(18,924)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization 6,853 4,868

Share-based compensation 19,995 13,442

Other 622 207

Excess tax benefit from share-based award activity (133) (29)

Changes in operating assets and liabilities:

Accounts receivable (9,355) (9,692)

Prepaid expenses and other current assets 459 (900)

Other assets and liabilities (1,449) (257)

Accounts payable (1,641) (856)

Accrued liabilities 842 991

Accrued compensation and related benefits (286) (96)

Deferred revenue 9,353 11,068

Net cash used in operating activities (566) (178)

Cash flows from investing activities

Purchases of property and equipment (4,084) (6,825)

Internal-use software development costs (1,540) (1,165)

Purchases of marketable securities (80,469) (21,144)

Proceeds from maturities of marketable securities 7,495 12,405

Proceeds from sale of marketable securities 25,613 14,333

Cash paid for the acquisition of Zopim, net of cash acquired — (551)

Net cash used in investing activities (52,985) (2,947)

Cash flows from financing activities

Proceeds from exercise of employee stock options 10,499 797

Taxes paid related to net share settlement of equity awards (281) (278)

Proceeds from employee stock purchase plan 3,032 2,295

Excess tax benefit from share-based award activity 133 29

Net cash provided by financing activities 13,383 2,843

Effect of exchange rate changes on cash and cash equivalents (279) (1)

Net decrease in cash and cash equivalents (40,447) (283)

Cash and cash equivalents at the beginning of period 118,036 255,669

Cash and cash equivalents at the end of period $77,589 $255,386

Condensed consolidated

statements of cash flows

(In thousands; unaudited)

Zendesk Shareholder Letter Q3 2016 - 17

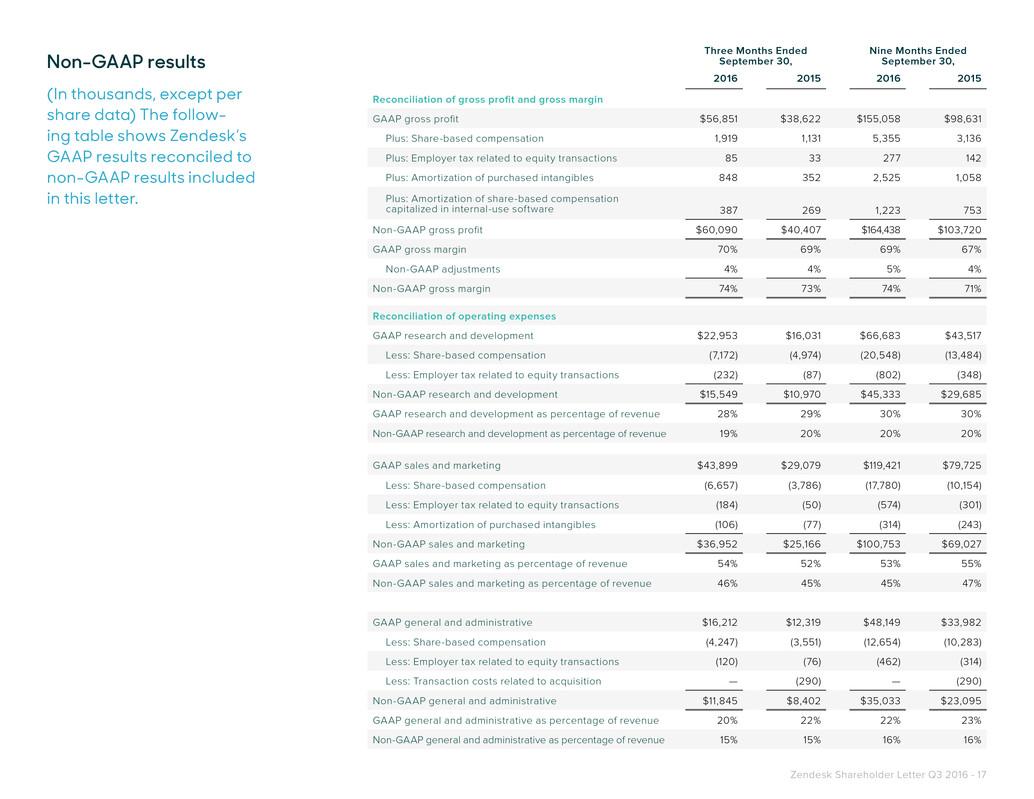

Non-GAAP results

(In thousands, except per

share data) The follow-

ing table shows Zendesk’s

GAAP results reconciled to

non-GAAP results included

in this letter.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2016 2015 2016 2015

Reconciliation of gross profit and gross margin

GAAP gross profit $56,851 $38,622 $155,058 $98,631

Plus: Share-based compensation 1,919 1,131 5,355 3,136

Plus: Employer tax related to equity transactions 85 33 277 142

Plus: Amortization of purchased intangibles 848 352 2,525 1,058

Plus: Amortization of share-based compensation

capitalized in internal-use software

387

269

1,223

753

Non-GAAP gross profit $60,090 $40,407 $164,438 $103,720

GAAP gross margin 70% 69% 69% 67%

Non-GAAP adjustments 4% 4% 5% 4%

Non-GAAP gross margin 74% 73% 74% 71%

Reconciliation of operating expenses

GAAP research and development $22,953 $16,031 $66,683 $43,517

Less: Share-based compensation (7,172) (4,974) (20,548) (13,484)

Less: Employer tax related to equity transactions (232) (87) (802) (348)

Non-GAAP research and development $15,549 $10,970 $45,333 $29,685

GAAP research and development as percentage of revenue 28% 29% 30% 30%

Non-GAAP research and development as percentage of revenue 19% 20% 20% 20%

GAAP sales and marketing $43,899 $29,079 $119,421 $79,725

Less: Share-based compensation (6,657) (3,786) (17,780) (10,154)

Less: Employer tax related to equity transactions (184) (50) (574) (301)

Less: Amortization of purchased intangibles (106) (77) (314) (243)

Non-GAAP sales and marketing $36,952 $25,166 $100,753 $69,027

GAAP sales and marketing as percentage of revenue 54% 52% 53% 55%

Non-GAAP sales and marketing as percentage of revenue 46% 45% 45% 47%

GAAP general and administrative $16,212 $12,319 $48,149 $33,982

Less: Share-based compensation (4,247) (3,551) (12,654) (10,283)

Less: Employer tax related to equity transactions (120) (76) (462) (314)

Less: Transaction costs related to acquisition — (290) — (290)

Non-GAAP general and administrative $11,845 $8,402 $35,033 $23,095

GAAP general and administrative as percentage of revenue 20% 22% 22% 23%

Non-GAAP general and administrative as percentage of revenue 15% 15% 16% 16%

Zendesk Shareholder Letter Q3 2016 - 18

(continued...)

Non-GAAP results

(In thousands, except per

share data) The follow-

ing table shows Zendesk’s

GAAP results reconciled to

non-GAAP results included

in this letter.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2016 2015 2016 2015

Reconciliation of operating loss and operating margin

GAAP operating loss $(26,213) $(18,807) $(79,195) $(58,593)

Plus: Share-based compensation 19,995 13,442 56,337 37,057

Plus: Employer tax related to equity transactions 621 246 2,115 1,105

Plus: Amortization of purchased intangibles 954 429 2,839 1,301

Plus: Transaction costs related to acquisition — 290 — 290

Plus: Amortization of share-based compensation

capitalized in internal-use software

387

269

1,223

753

Non-GAAP operating loss $(4,256) $(4,131) $(16,681) $(18,087)

GAAP operating margin (32)% (34)% (35)% (40)%

Non-GAAP adjustments 27% 27% 28% 28%

Non-GAAP operating margin (5)% (7)% (7)% (12)%

Reconciliation of net loss

GAAP net loss $(25,826) $(18,924) $(79,250) $(59,575)

Plus: Share-based compensation 19,995 13,442 56,337 37,057

Plus: Employer tax related to equity transactions 621 246 2,115 1,105

Plus: Amortization of purchased intangibles 954 429 2,839 1,301

Plus: Transaction costs related to acquisition — 290 — 290

Plus: Amortization of share-based compensation

capitalized in internal-use software

387

269

1,223

753

Non-GAAP net loss $(3,869) $(4,248) $(16,736) $(19,069)

Reconciliation of net loss per share, basic and diluted

GAAP net loss per share, basic and diluted $(0.27) $(0.22) $(0.86) $(0.71)

Non-GAAP adjustments to net loss 0.23 0.17 0.68 0.48

Non-GAAP net loss per share, basic and diluted $(0.04) $(0.05) $(0.18) $(0.23)

Weighted-average shares used to compute

net loss per share, basic and diluted

94,085

87,777

92,274

83,536

Computation of free cash flow

Net cash provided by (used in) operating activities $(566) $(178) $3,994 $(4,951)

Less: purchases of property and equipment (4,084) (6,825) (12,494) (14,231)

Less: internal-use software development costs (1,540) (1,165) (4,313) (3,548)

Free cash flow $(6,190) $(8,168) $(12,813) $(22,730)

Zendesk Shareholder Letter Q3 2016 - 19

About Zendesk

Zendesk builds software for better customer relationships. It empowers

organizations to improve customer engagement and better understand their

customers. More than 87,000 paid customer accounts in over 150 countries and

territories use Zendesk products. Based in San Francisco, Zendesk has operations

in the United States, Europe, Asia, Australia, and South America. Learn more at

www.zendesk.com.

Forward-Looking Statements

This shareholder letter contains forward-looking statements, including, among other

things, statements regarding Zendesk’s future financial performance, its continued

investment to grow its business, and progress towards its long-term financial

objectives. The words such as “may,” “should,” “will,” “believe,” “expect,” “anticipate,”

“target,” “project,” and similar phrases that denote future expectation or intent

regarding Zendesk’s financial results, operations, and other matters are intended

to identify forward-looking statements. You should not rely upon forward-looking

statements as predictions of future events.

The outcome of the events described in these forward-looking statements is

subject to known and unknown risks, uncertainties, and other factors that may cause

Zendesk’s actual results, performance, or achievements to differ materially, including

(i) adverse changes in general economic or market conditions; (ii) Zendesk’s ability

to adapt its customer service platform to changing market dynamics and customer

preferences or achieve increased market acceptance of its platform; (iii) Zendesk’s

expectation that the future growth rate of its revenues will decline, and that, as

its costs increase, Zendesk may not be able to generate sufficient revenues to

achieve or sustain profitability; (iv) Zendesk’s limited operating history, which makes

it difficult to evaluate its prospects and future operating results; (v) Zendesk’s ability

to effectively manage its growth and organizational change; (vi) the market in

which Zendesk operates is intensely competitive, and Zendesk may not compete

effectively; (vii) the development of the market for software as a service business

software applications; (viii) Zendesk’s ability to sell its live chat software as a

standalone service and more fully integrate its live chat software with its customer

service platform; (ix) Zendesk’s ability to integrate We Are Cloud SAS with its existing

corporate operations, to sell its analytics software as a standalone service, and to

integrate Zendesk’s analytics software with Zendesk’s customer service platform; (x)

breaches in Zendesk’s security measures or unauthorized access to its customers’

data; (xi) service interruptions or performance problems associated with Zendesk’s

technology and infrastructure; (xii) real or perceived errors, failures, or bugs in

its products; (xiii) Zendesk’s substantial reliance on its customers renewing their

subscriptions and purchasing additional subscriptions; and (xiv) Zendesk’s ability to

effectively expand its sales capabilities.

The forward-looking statements contained in this shareholder letter are also subject

to additional risks, uncertainties, and factors, including those more fully described

in Zendesk’s filings with the Securities and Exchange Commission, including its

Quarterly Report on Form 10-Q for the quarter ended June 30, 2016. Further

information on potential risks that could affect actual results will be included in the

subsequent periodic and current reports and other filings that Zendesk makes with

the Securities and Exchange Commission from time to time, including its Quarterly

Report on Form 10-Q for the quarter ended September 30, 2016.

Forward-looking statements represent Zendesk’s management’s beliefs and

assumptions only as of the date such statements are made. Zendesk undertakes

no obligation to update any forward-looking statements made in this shareholder

letter to reflect events or circumstances after the date of this shareholder letter or

to reflect new information or the occurrence of unanticipated events, except as

required by law.

About Non-GAAP Financial Measures

To provide investors and others with additional information regarding Zendesk’s

results, the following non-GAAP financial measures were disclosed: non-GAAP

gross profit and gross margin, non-GAAP operating expenses, non-GAAP operating

loss and operating margin, non-GAAP net loss, non-GAAP net loss per share, basic

and diluted, and free cash flow.

Specifically, Zendesk excludes the following from its historical and prospective non-

GAAP financial measures, as applicable:

Share-based Compensation and Amortization of Share-based Compensation

Capitalized in Internal-use Software: Zendesk utilizes share-based compensation

to attract and retain employees. It is principally aimed at aligning their interests

with those of its stockholders and at long-term retention, rather than to address

operational performance for any particular period. As a result, share-based

compensation expenses vary for reasons that are generally unrelated to financial

and operational performance in any particular period.

Employer Tax Related to Employee Stock Transactions: Zendesk views the amount

of employer taxes related to its employee stock transactions as an expense that

is dependent on its stock price, employee exercise and other award disposition

activity, and other factors that are beyond Zendesk’s control. As a result, employer

taxes related to its employee stock transactions vary for reasons that are generally

unrelated to financial and operational performance in any particular period.

Amortization of Purchased Intangibles and Acquisition Related Expenses: Zendesk

views amortization of purchased intangible assets, including the amortization of the

cost associated with an acquired entity’s developed technology, as items arising

from pre-acquisition activities determined at the time of an acquisition. While these

intangible assets are evaluated for impairment regularly, amortization of the cost

of purchased intangibles is an expense that is not typically affected by operations

during any particular period. Zendesk views acquisition related expenses as events

that are not necessarily reflective of operational performance during a period.

In particular, Zendesk believes the consideration of measures that exclude such

expenses can assist in the comparison of operational performance in different

periods which may or may not include such expenses.

Zendesk Shareholder Letter Q3 2016 - 20

Zendesk provides disclosures regarding its free cash flow, which is defined as

net cash from operating activities, less purchases of property and equipment and

internal-use software development costs. Zendesk uses free cash flow, among other

measures, to evaluate the ability of its operations to generate cash that is available

for purposes other than capital expenditures and capitalized software development

costs. Zendesk believes that information regarding free cash flow provides investors

with an important perspective on the cash available to fund ongoing operations.

Zendesk uses non-GAAP financial information to evaluate its ongoing operations

and for internal planning and forecasting purposes. Zendesk’s management does

not itself, nor does it suggest that investors should, consider such non-GAAP

financial measures in isolation from, or as a substitute for, financial information

prepared in accordance with GAAP. Zendesk presents such non-GAAP financial

measures in reporting its financial results to provide investors with an additional

tool to evaluate Zendesk’s operating results. Zendesk believes these non-GAAP

financial measures are useful because they allow for greater transparency with

respect to key metrics used by management in its financial and operational

decision-making. This allows investors and others to better understand and

evaluate Zendesk’s operating results and future prospects in the same manner as

management.

Zendesk’s management believes it is useful for itself and investors to review, as

applicable, both GAAP information that may include items such as share-based

compensation expense, amortization of share-based compensation capitalized

in internal-use software, amortization of purchased intangibles, transaction costs

related to acquisitions, and the non-GAAP measures that exclude such information

in order to assess the performance of Zendesk’s business and for planning

and forecasting in subsequent periods. When Zendesk uses such a non-GAAP

financial measure with respect to historical periods, it provides a reconciliation of

the non-GAAP financial measure to the most closely comparable GAAP financial

measure. When Zendesk uses such a non-GAAP financial measure in a forward-

looking manner for future periods, and a reconciliation is not determinable

without unreasonable effort, Zendesk provides the reconciling information that is

determinable without unreasonable effort and identifies the information that would

need to be added or subtracted from the non-GAAP measure to arrive at the

most directly comparable GAAP measure. Investors are encouraged to review the

related GAAP financial measures and the reconciliation of these non-GAAP financial

measures to their most directly comparable GAAP financial measure as detailed above.

About Operating Metrics

Zendesk reviews a number of operating metrics to evaluate its business, measure

performance, identify trends, formulate business plans, and make strategic

decisions. These include the number of paid customer accounts for its customer

service platform (Zendesk Support) and live chat software (Zendesk Chat), dollar-

based net expansion rate, monthly recurring revenue represented by its churned

customers, and the percentage of its monthly recurring revenue originating from

customers with more than 100 agents.

Zendesk defines the number of paid customer accounts at the end of any particular

period as the sum of the number of accounts on its customer service platform,

exclusive of its legacy Starter plan, free trials or other free services, and the number

of accounts using its live chat software, exclusive of free trials or other free services,

each as of the end of the period and as identified by a unique account identifier. Use

of Zendesk’s customer service platform and live chat software requires separate

subscriptions and each of these accounts are treated as a separate paid customer

account. Existing customers may also expand their utilization of Zendesk’s customer

service platform or live chat software by adding new accounts and a single

consolidated organization or customer may have multiple accounts across each

of Zendesk’s customer service platform and live chat software to service separate

subsidiaries, divisions, or work processes. Each of these accounts is also treated as

a separate paid customer account. Zendesk does not currently incorporate accounts

using its analytics software into the determination of the number of paid customer

accounts. Accounts that subscribe to Zendesk’s Essential plan are included in the

determination of the number of paid customer accounts.

Zendesk’s dollar-based net expansion rate provides a measurement of its ability to

increase revenue across its existing customer base through expansion of authorized

agents associated with a paid customer account, upgrades in subscription plans,

and the purchase of additional features on Zendesk’s customer service platform,

such as voice subscriptions, as offset by churn, contraction in authorized agents

associated with a paid customer account, and downgrades in subscription plans.

Zendesk’s dollar-based net expansion rate is based upon monthly recurring

revenue for a set of paid customer accounts on its customer service platform and

live chat software. Monthly recurring revenue for a paid customer account is a

legal and contractual determination made by assessing the contractual terms of

each paid customer account, as of the date of determination, as to the revenue

Zendesk expects to generate in the next monthly period for that paid customer

account, assuming no changes to the subscription and without taking into account

any one-time discounts or any platform usage above the subscription base, if

any, that may be applicable to such subscription. Monthly recurring revenue is

not determined by reference to historical revenue, deferred revenue, or any other

United States generally accepted accounting principles, or GAAP, financial measure

over any period. It is forward-looking and contractually derived as of the date of

determination.

Zendesk calculates its dollar-based net expansion rate by dividing the retained

revenue net of contraction and churn by Zendesk’s base revenue. Zendesk defines

its base revenue as the aggregate monthly recurring revenue of the paid customer

accounts on Zendesk’s customer service platform and live chat software as of

the date one year prior to the date of calculation. Zendesk defines the retained

revenue net of contraction and churn as the aggregate monthly recurring revenue

of the same customer base included in the measure of base revenue at the end

of the annual period being measured. The dollar-based net expansion rate is also

adjusted to eliminate the effect of certain activities that Zendesk identifies involving

Zendesk Shareholder Letter Q3 2016 - 21

the transfer of agents between paid customer accounts, consolidation of customer

accounts, or the split of a single paid customer account into multiple paid customer

accounts. In addition, the dollar-based net expansion rate is adjusted to include paid

customer accounts in the customer base used to determine retained revenue net of

contraction and churn that share common corporate information with customers in

the customer base that are used to determine the base revenue. Giving effect to this

consolidation results in Zendesk’s dollar-based net expansion rate being calculated

across approximately 74,300 customers, as compared to the approximately 87,400

total paid customer accounts as of September 30, 2016. To the extent that Zendesk

can determine that the underlying customers do not share common corporate

information, Zendesk does not aggregate paid customer accounts associated with

reseller and other similar channel arrangements for the purposes of determining its

dollar-based net expansion rate. While not material, Zendesk believes the failure to

account for these activities would otherwise skew the dollar-based net expansion

metrics associated with customers that maintain multiple paid customer accounts

on its customer service platform or live chat software and paid customer accounts

associated with reseller and other similar channel arrangements.

Starting in the quarter ended March 31, 2016, Zendesk began incorporating

operating metrics associated with its live chat software into its dollar-based

net expansion rate. Zendesk does not currently incorporate operating metrics

associated with its analytics software into its measurement of dollar-based net

expansion rate.

For a more detailed description of how Zendesk calculates its dollar-based net

expansion rate, please refer to Zendesk’s periodic reports filed with the Securities

and Exchange Commission.

Zendesk calculates its monthly recurring revenue represented by its churned

customers on an annualized basis by dividing base revenue associated with paid

customer accounts on Zendesk’s customer service platform that churn, either

by termination of the subscription or failure to renew, during the annual period

being measured, by Zendesk’s base revenue. Zendesk’s monthly recurring

revenue represented by its churned customers excludes expansion or contraction

associated with paid customer accounts on Zendesk’s customer service platform

and the effect of upgrades or downgrades in subscription plan. The monthly

recurring revenue represented by its churned customers is adjusted to exclude paid

customer accounts that churned from the customer base used that share common

corporate information with customer accounts that did not churn from the customer

base during the annual period being measured. While not material, Zendesk

believes the failure to make this adjustment could otherwise skew the monthly

recurring revenue represented by its churned customers as a result of customers

that maintain multiple paid customer accounts on its customer service platform.

Zendesk’s percentage of monthly recurring revenue that is generated by customers

with 100 or more agents is determined by dividing the monthly recurring revenue for

paid customer accounts with more than 100 agents on its customer service platform

as of the measurement date by the monthly recurring revenue for all paid customer

accounts on its customer service platform as of the measurement date. Zendesk

determines the customers with 100 or more agents as of the measurement date based

on the number of activated agents at the measurement date and includes adjustments

to aggregate paid customer accounts that share common corporate information.

Zendesk determines the annualized value of a contract by annualizing the monthly

recurring revenue for such contract.

Zendesk does not currently incorporate operating metrics associated with its live

chat software or its analytics software into its measurement of monthly recurring

revenue represented by its churned customers or percentage of monthly recurring

revenue that is generated by customers with 100 or more agents.

Zendesk’s freemium plans include its legacy Starter plan for its customer service

platform, its Lite plan for its live chat software, and its Inbox service for facilitating

and simplifying email collaboration on group email aliases. Zendesk believes

these services provide exposure to its brand and establish a relationship that can

facilitate further adoption of its customer service platform and live chat software as

organizations grow in size and their service needs grow more complex. A customer

account on Zendesk’s freemium plans is considered active based on whether

functionality of the service has been utilized within the 90-day period preceding

the measurement date. A single consolidated organization or customer may have

multiple freemium customer accounts across each of Zendesk’s customer service

platform, live chat software, and Inbox service. Each of these accounts is treated as

a separate customer account on Zendesk’s freemium products.

About customer metrics

Source and contact: Zendesk, Inc.

September

30, 2015

December

31, 2015

March

31, 2016

June

30, 2016

September

30, 2016

Paid customer accounts on

Zendesk Support (approx.) 32,700 35,700 39,900 43,700 47,400

+ Paid customer accounts on

Zendesk Chat (approx.) 31,600 33,400 35,700 37,800 40,000

= Approximate number of

paid customer accounts 64,300 69,100 75,600 81,500 87,400

Investor contact: Media contact:

Marc Cabi, +1 415-852-3877 Matt Hicks, +1 415-529-5606

ir@zendesk.com press@zendesk.com