Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - WESTAR ENERGY INC /KS | wr-09302016x8xkexhibit992.htm |

| EX-99.1 - EXHIBIT 99.1 - WESTAR ENERGY INC /KS | wr-09302016x8xkexhibit991.htm |

| 8-K - 8-K - WESTAR ENERGY INC /KS | wr-09302016xearningsreleas.htm |

Westar Energy

Investor Update – November 1, 2016

Forward-Looking Disclosures

NOVEMBER 1, 2016 INVESTOR UPDATE 2

Forward Looking Statements

Forward-looking statements: Certain matters discussed in this news release are “forward-looking statements.” The Private Securities Litigation

Reform Act of 1995 has established that these statements qualify for safe harbors from liability. Forward-looking statements may include words

like “believe,” “anticipate,” “target,” “expect,” “pro forma,” “estimate,” “intend,” “guidance” or words of similar meaning. Forward-looking

statements describe future plans, objectives, expectations or goals. Although Westar Energy believes that its expectations are based on reasonable

assumptions, all forward-looking statements involve risk and uncertainty. The factors that could cause actual results to differ materially from these

forward-looking statements include those discussed herein as well as (1) those discussed in the company's Annual Report on Form 10-K for the

year ended Dec. 31, 2015 (a) under the heading, “Forward-Looking Statements,” (b) in ITEM 1. Business, (c) in ITEM 1A. Risk Factors, (d) in

ITEM 7. Management's Discussion and Analysis of Financial Condition and Results of Operations, and (e) in ITEM 8. Financial Statements and

Supplementary Data: Notes 13 and 15; (2) those discussed in the company's Quarterly Reports on Form 10-Q filed on Aug. 2, 2016 and Nov. 1,

2016, (a) under the heading "Forward-Looking Statements." (b) in ITEM 2. Management's Discussion and Analysis of Financial Condition and

Results of Operations, (c) in Part I, Financial Information, ITEM 1. Financial Statements: Notes 3, 11 and 12, and (d) ITEM 1A. Risk Factors; and

(3) other factors discussed in the company's filings with the Securities and Exchange Commission. Any forward-looking statement speaks only as

of the date such statement was made, and the company does not undertake any obligation to update any forward-looking statement to reflect

events or circumstances after the date on which such statement was made.

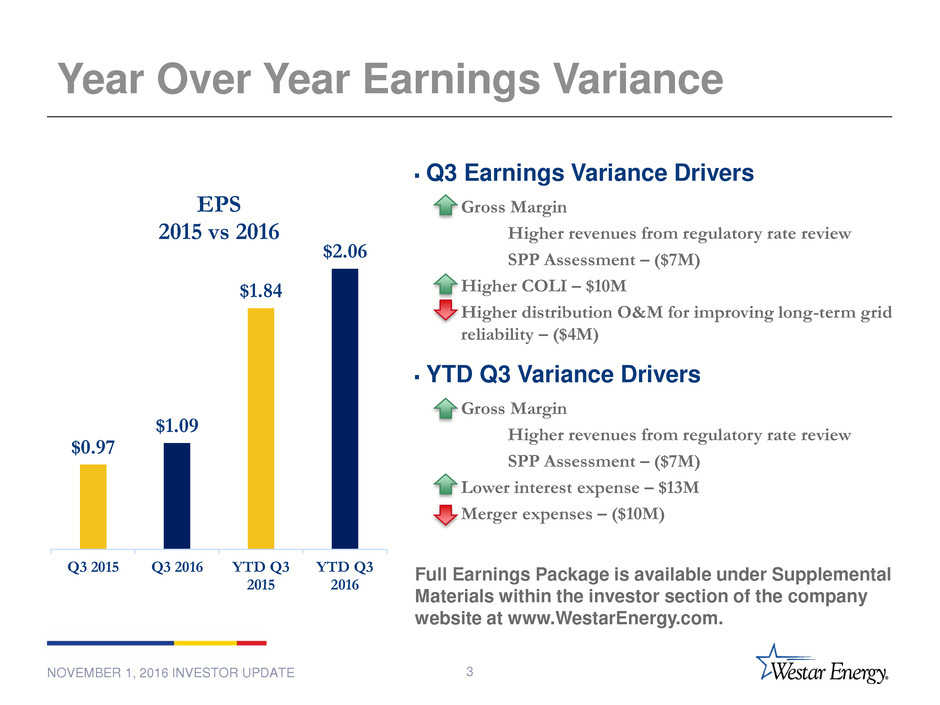

Year Over Year Earnings Variance

$0.97

$1.09

$1.84

$2.06

Q3 2015 Q3 2016 YTD Q3

2015

YTD Q3

2016

EPS

2015 vs 2016

NOVEMBER 1, 2016 INVESTOR UPDATE 3

Q3 Earnings Variance Drivers

Gross Margin

Higher revenues from regulatory rate review

SPP Assessment – ($7M)

Higher COLI – $10M

Higher distribution O&M for improving long-term grid

reliability – ($4M)

YTD Q3 Variance Drivers

Gross Margin

Higher revenues from regulatory rate review

SPP Assessment – ($7M)

Lower interest expense – $13M

Merger expenses – ($10M)

Full Earnings Package is available under Supplemental

Materials within the investor section of the company

website at www.WestarEnergy.com.

Additional Earnings Detail

Merger Related Expenses

Q3 -- $1.9M

YTD Q3 -- $9.8M

Weather Estimate

Q3 -- $0.01 /share weather compared to 2015 -- $0.02/share compared to normal

YTD Q3 – ($0.03)/share weather compared to 2015 -- ($0.01)/share compared to normal

COLI

Q3 -- $10.2M

YTD Q3 -- $16.7M

Will record at least an additional $4.7M of COLI in Q4

Sales

≈50% of industrial decline is due to chemical and oil sector down both for the year and quarter

Top 3 customers of sector showed 2.5% growth in the Q3

Construction & pet products sectors are up for the quarter and year

Reaffirm 2016 Guidance $2.38 - $2.53, with a bias towards the upper end

O&M/SGA guidance driver does not include the merger related expenses for the year

NOVEMBER 1, 2016 INVESTOR UPDATE 4

Status of Approval Process

NOVEMBER 1, 2016 INVESTOR UPDATE

Successful

Execution

5

Approval Process

Stakeholder Filing Approval Add’l Info

KCC

FERC

NRC

SEC

HSR Act

FCC

Docket No. 16-KCPE-593-ACQ

Docket No. 50-482

Docket No. EC16-146

WR Shareholders

GXP Shareholders

Declared effective August 19, 2016

Shareholders Approved - September 26, 2016

≈92% of votes cast approved

Shareholders Approved - September 26, 2016

≈96% of votes cast approved

Early termination of HSR waiting period

MPSC

Settlement w/ Staff & OPC reached awaiting

MPSC approval (Case No. EE-2017-0113)

DOJ Voluntary antitrust inquiry closed 10/21/16

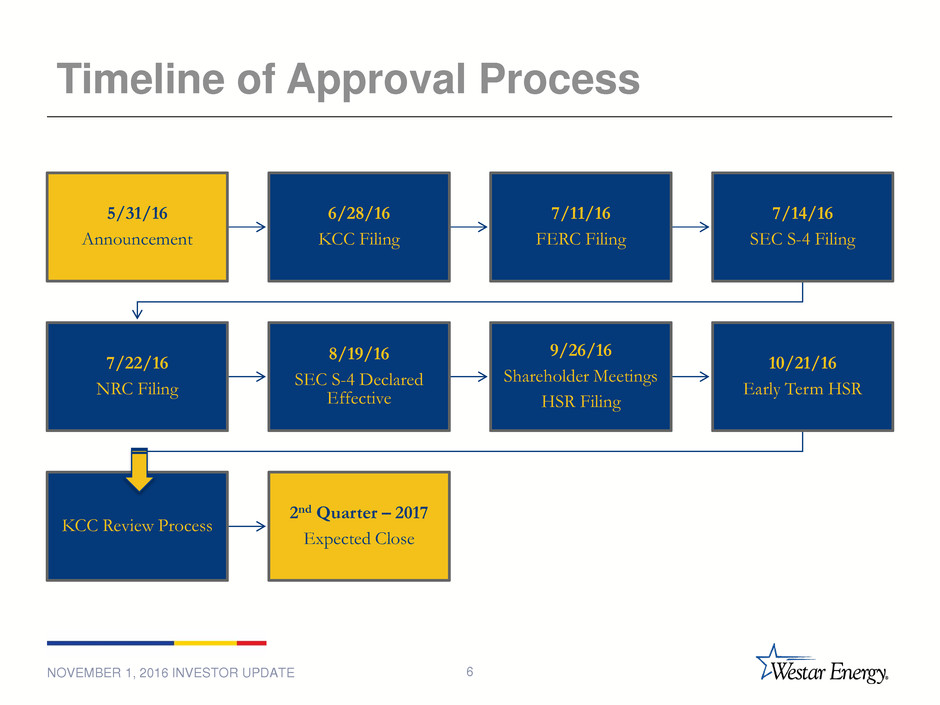

Timeline of Approval Process

NOVEMBER 1, 2016 INVESTOR UPDATE 6

5/31/16

Announcement

6/28/16

KCC Filing

7/11/16

FERC Filing

7/14/16

SEC S-4 Filing

7/22/16

NRC Filing

8/19/16

SEC S-4 Declared

Effective

9/26/16

Shareholder Meetings

HSR Filing

10/21/16

Early Term HSR

KCC Review Process

2nd Quarter – 2017

Expected Close