Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - HELIUS MEDICAL TECHNOLOGIES, INC. | exhibit32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - HELIUS MEDICAL TECHNOLOGIES, INC. | exhibit31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - HELIUS MEDICAL TECHNOLOGIES, INC. | exhibit31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - HELIUS MEDICAL TECHNOLOGIES, INC. | exhibit23-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

|

[X] |

Annual report pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934. |

| [ ] | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

For the transition period from _______to _______

Commission File No. 000-55364

HELIUS MEDICAL TECHNOLOGIES,

INC.

(Exact name of registrant as specified in its

charter)

| WYOMING | 36-4787690 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

Suite 400, 41 University Drive

Newtown,

Pennsylvania, 18940

(Address of principal executive offices) (Zip

Code)

Registrant’s telephone number, including area code: (215) 809-2018

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| None | Toronto Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: Class A Common Stock

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

[ ] No [X]

Indicate by check mark if the

registrant is not required to file reports pursuant to Section 13 or Section

15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or

15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days:

Yes [X] No [ ]

Indicate by check mark whether

the registrant has submitted electronically and posted on its corporate Web

site, if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T (Section §232.405 of this chapter) during

the preceding 12 months (or for such shorter period that the registrant was

required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [ ] | Smaller reporting company |

| [X] | |||

| (Do not check if a smaller | |||

| reporting company) |

Indicate by check mark whether

the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act).

Yes [ ] No [X]

The aggregate market value of the common equity held by non-affiliates of the registrant on September 30, 2015, based on the closing price on that date of CAD $0.84 (USD $0.61), was approximately $39,359,835. As of October 31, 2016 there were 84,534,684 shares of the registrant’s common stock outstanding.

Explanatory Note

This Amendment No. 1 to the Annual Report on Form 10-K (this “Amendment No. 1”) of Helius Medical Technologies, Inc. (the “Company”) amends the Company’s Annual Report on Form 10-K for the year ended March 31, 2016, which was filed with the Securities and Exchange Commission (“SEC”) on June 28, 2016 (the “Original Filing”). The Company is filing this Amendment No. 1 to include an audit report that is signed by our independent registered public accountants as required by Article 2 of Regulation S-X, and Section 302 and 906 certifications.

This Amendment No. 1 speaks as of the filing date of the Original Filing, does not reflect events which may have occurred since the filing date of the Original Filing, and does not amend or modify any disclosure made in the Original Filing except to incorporate changes to Form 10-K Page F-2, Exhibits 23.1, 31.1, 31.2, and 32.1.

This additional disclosure does not revise or alter the Company’s financial statements and any forward-looking statements contained in the Original Filing. As required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), this Amendment No. 1 contains new certifications by our principal executive officer and principal financial officer, which are being filed or furnished as exhibits to this Amendment No. 1.

TABLE OF CONTENTS

1

In this annual report on Form 10-K, unless otherwise specified, references to “we,” “us,” “our,” “Helius” or “the Company” mean Helius Medical Technologies, Inc. (formerly known as “0996445 B.C. Ltd.”) and its wholly-owned subsidiaries, NeuroHabilitation Corporation, or NHC, and Helius Medical Technologies (Canada), Inc., unless the context otherwise requires. All financial information is stated in U.S. dollars unless otherwise specified. Our financial statements are prepared in accordance with accounting principles generally accepted in the United States, or U.S. GAAP.

FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K (“Annual Report”) includes certain statements that may constitute “forward-looking statements.” All statements contained in this Annual Report, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. These statements are based on management’s expectations at the time the statements are made and are subject to risks, uncertainty, and changes in circumstances, which may cause actual results, performance, financial condition or achievements to differ materially from anticipated results, performance, financial condition or achievements. All statements contained herein that are not clearly historical in nature are forward-looking and the words “anticipate,” “believe,” “calls for,” “could” “depends,” “estimate,” “expect,” “extrapolate,” “foresee,” “goal,” “intend,” “likely,” “might,” “plan,” “project,” “propose,” “potential,” “target,” “think,” and similar expressions, or that events or conditions “may,” “should occur” “will,” “would,” or any similar expressions are generally intended to identify forward-looking statements.

The forward-looking statements in this Annual Report include but are not limited to statements relating to: enrollment and future plans for our clinical trials, progress of and reports of results from clinical studies, clinical development plans, product development activities, other products not yet developed or acquired, our product candidate success, plans for U.S. Food and Drug Administration (“FDA”) filings and their subsequent approvals, other foreign or domestic regulatory filings by us or our collaboration partners, our ability to commercialize the product(s), the safety and efficacy of our product candidate, the timeline for our improvement plans, our market awareness, our ability to compete effectively, the ability and limitation of our manufacturing source(s), our distribution network, the adequacy of our intellectual property protection, our future patent approvals, potential infringement of our intellectual property, future litigation waged against us and its outcome, any product liability we may incur, the sufficiency of our operating insurance, including sufficient product liability insurance, our limited operating history, our dependence on a small number of employees, employee conflicts of interest, our dependence on outside scientists and third party research institutions, our future expenses and cash flow, our ability to become profitable, our future financing arrangements, our ability to accurately report our financial position, our accountants’ future perspective including any going concerns, our ability to maintain effective internal controls, any future stock price, the potential dilution of the stock, future sales of the Company’s equity securities, any future Financial Industry Regulatory Authority sales practice requirements, the ability of a limited number of shareholders to take shareholder action without the involvement of the management or the Company’s other shareholders, future disclosure requirements, future regulatory risks, our relationship with the U.S. Army, our ability to use existing reimbursement codes or receive reimbursement codes from the American Medical Association and the U.S. Department of Health and Human Services, and our ability to receive reimbursement coverage under Medicare, Medicaid or under other insurance plans. These and additional risks and uncertainties are more fully described in this Annual Report and our other public filings with the Securities and Exchange Commission (“SEC”).

Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions at the time they were made, they are subject to risks and uncertainties, known and unknown, which could cause actual results and developments to differ materially from those expressed or implied in such statements. Forward-looking statements are not guarantees of future performance and actual results may differ significantly from such forward-looking statements. Factors that could cause the actual results to differ materially from those in the forward-looking statements include future economic, competitive, reimbursement and regulatory conditions; new product introductions, demographic trends, the intellectual property landscape, litigation, financial market conditions, continued availability of capital and financing, and, future business decisions made by us and our competitors. All of these factors are difficult or impossible to predict accurately and many of them are beyond our control. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Undue reliance should not be placed on forward looking statements which speak only as of the date they are made. Except as required by applicable securities laws, the Company undertakes no obligation to update or alter these forward-looking statements (and expressly disclaims any such intention or obligation to do so) in the event that management's beliefs, estimates, opinions, or other factors should change.

1

INDUSTRY AND MARKET DATA

In this Annual Report, we reference information, statistics and estimates regarding the medical devices and healthcare industries. We have obtained this information from various independent third-party sources, including independent industry publications, reports by market research firms and other independent sources. This information involves a number of assumptions and limitations, and we have not independently verified the accuracy or completeness of this information. Some data and other information are also based on the good faith estimates of management, which are derived from our review of internal surveys, general information discussed in the industry, and independent sources. We believe that these external sources and estimates are reliable but have not independently verified them. The industries in which we operate are subject to a high degree of uncertainty, change, and risk due to a variety of factors, including those described in “Item 1A. Risk Factors.” These and other factors could cause results to differ materially from those expressed in this report and other publications.

2

PART I

| ITEM 1. | BUSINESS |

Our Business

We are a medical technology company focused on neurological wellness and our mission statement is to:

“Develop, license and acquire unique, non-invasive treatments designed to help patients affected by neurological symptoms caused by disease or trauma.”

Our first product in development, the portable neuromodulation stimulator (“PoNS™”) device, exemplifies this mission as the device, when used in combination with physiotherapy, is designed to enhance the brain’s ability to compensate for damage due to trauma or disease.

Improving the process by which the brain can reorganize itself and compensate for damage, or even augment how we learn, has far-reaching implications for the treatment of disease as well as for the healthy population. We intend to pursue these opportunities using our platform PoNS™ technology. Neuroplasticity, the ability of the brain to reorganize a neural network or re-task neurons and form new synaptic connections, is core to all cerebral learning, training, and rehabilitation. Neuromodulation is the alteration of nerve activity in response to the delivery of electrical stimulation or chemical agents. Our proprietary PoNS™ device is designed to induce Cranial Nerve Non Invasive Neuromodulation through a dramatic increase in stimulation of the facial and trigeminal nerves which innervate the tongue. This appears to enhance neuroplasticity and benefit persons with neurological, cognitive, sensory, and motor disorders when combined with the rehabilitation process.

Traditional rehabilitation interventions have typically involved medication and various forms of therapies, including physical therapy. Our patented PoNS™ device has been developed to deliver to the tongue a non-invasive neurostimulation, in a form that induces neuromodulation. Published studies, suggest neurologic diseases and disorders such as Traumatic Brain Injury (TBI), Multiple Sclerosis (MS), Stroke, Parkinson’s disease, Alzheimer’s diseases, Depression, Attention Deficit Hyperactivity Disorder, and Autism, all have symptoms that may benefit from enhanced neuromodulation as a component of their rehabilitation therapy.

When the PoNS™ device is placed into and held in the patient’s mouth, it stimulates the trigeminal and facial nerves that innervate the anterior two-thirds of the human tongue using a sequenced pattern of superficial electrical stimulation. This stimulation excites a natural flow of neural impulses to the brainstem and cerebellum that is designed to effect changes in the function of these targeted brain structures. A series of studies, which are further described below, suggest that prolonged activation of 20 minutes or more of neuronal circuits, when combined with physical therapy, initiate a durable neuronal reorganization with a variety of positive results, including the correction of gait/balance impairments resulting from TBI. These results represent what we refer to as anecdotal evidence, and must be confirmed by a larger well-controlled, independently reviewed scientific study. Successful results from FDA approved and reviewed clinical trials are required prior to regulatory clearance for sale in the U.S.

The inventors of the PoNS™ device conducted a series of Institutional Review Board sanctioned feasibility studies, case studies, and one placebo-controlled study. In total, these studies involved approximately 260 patients using the first generation PoNS™ device in conjunction with physical or cognitive therapy at the University of Wisconsin-Madison. An Institutional Review Board is a scientific and patient advocacy board that reviews the validity and safety of clinical trials on behalf of patients. A “feasibility study” is a study with a small sample size that allows for early clinical evaluation for proof of principle and initial clinical safety data. A feasibility study may be appropriate early in device development when clinical experience is necessary because nonclinical testing methods are not available or adequate to provide the information needed to advance the developmental process. We use the term “case study” to mean a study of one patient that may support at most anecdotal evidence of efficacy. By “placebo-controlled study,” we mean a way of testing a medical therapy in which, in addition to a group of subjects that receives the treatment to be evaluated, a separate control group receives an artificial “placebo” treatment which is specifically designed to have no real effect. These studies were conducted primarily at the Tactile Communication and Neurorehabilitation Laboratory, or TCNL, at the University of Wisconsin-Madison with the approval and oversight by the university’s Institutional Review Board, which is required for scientific studies involving human subjects.

3

Based on the prior results in subjects with MS, a further controlled feasibility study in 14 MS subjects was independently performed at the Montreal Neurological Institute in 2015 using the next generation PoNS™ device to treat gait and balance disorder associated with MS. The results of this study were consistent with the previously completed studies on MS and further supported the device’s safety and efficacy in this cohort.

As described below, we have developed the PoNS™ device to secure FDA clearance for commercial use in treating balance disorder in TBI subjects. We are conducting a clinical trial of our PoNS™ device for the treatment of balance disorder in patients with TBI. Should the PoNS™ device be cleared by the FDA, we believe the addressable market for our product device to treat balance disorder associated with TBI is potentially over $5.0 billion. According to the U.S. Center for Disease Control and Prevention, approximately 5.3 million individuals in the U.S. were living with permanent TBI symptoms in 1999, and the incidence of new TBI diagnoses, as measured by hospitalizations and emergency department visits, has increased between 2001 and 2010. Additionally, the Brain Injury Association of America estimates that approximately 40% of patients diagnosed with TBI experience balance disturbance. Our addressable market estimate for TBI in the U.S. is based on the number of persons living with TBI (5.3 million) multiplied by the rate of balance disturbance in TBI patients (40%), and multiplied by the expected price per unit of our product.

In addition to the ongoing TBI study, we plan on conducting a registrational clinical trial of our PoNS™ device for the treatment of gait and balance disorder in patients with MS. Should the PoNS™ device be cleared by the FDA, we believe the addressable markets for our PoNS™ device to treat gait and balance disorder associated with MS is potentially over $500 million. According to the National Multiple Sclerosis Society, there are approximately 400,000 individuals in the U.S. with MS. Our addressable market estimate for MS is calculated by multiplying the estimated number of persons with MS by the rate of balance disturbance in MS patients (50%) and the expected price per unit of our product.

Supporting our three issued U.S. medical method patents, are a further twenty-one issued design and utility patents. Additional domestic and international patent filings for the PoNS™ device connected to both further medical methods and other designs and utility are a key component of the value of the Company and will continue to be expanded.

Our Principal Product

The predecessor to the current PoNS™ device was developed in 2008 at the TCNL. Since then, we have conducted a significant amount of experimentation, research, and development to arrive at the present-day PoNS™ device. We have completed the technical and product design phases of the PoNS™ device as well as the manufacturing development phase which will enable us to manufacture the device commercially. We are performing the registration clinical trials for FDA clearance with the device for use in treating balance disorder in TBI subjects and plan to launch a registrational clinical trial for MS subjects in late 2016.

We anticipate that the full commercial device will be ready for release in the fourth quarter of calendar year 2016, and we expect to produce the PoNS™ device in accordance with FDA’s Quality System Regulation, or QSR, current good manufacturing practices, or cGMPs, and in compliance with European and Canadian regulatory requirements. Previously, we disclosed that we anticipated that the full commercial device would be ready for release in the first quarter of calendar 2016. We delayed the commercial device build based on our revised forecast for the clinical trial completion.

The PoNS™ device is ergonomically designed for patient comfort, is relatively light, contains a replaceable hygienic mouthpiece, a rechargeable battery and allows for technical data logging and communications. See Figure 1.

4

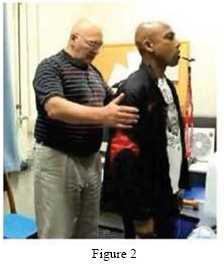

The PoNS™ device is an electrical pulse generator that delivers controlled electrical stimulation to the tongue. Pulses are generated and organized by a counter, timer, and wave-shaping electronic components. The device is held lightly in place by the lips and teeth around the neck of the tab that goes into the mouth and rests on the anterior and superior part of the tongue. See Figure 2.

The paddle-shaped tab of the device has a hexagonally patterned array of 143 gold-plated circular electrodes (1.50 mm diameter, on 2.34 mm centers) that is created by a photolithographic process used to make printed circuit boards. It is designed to use low-level electrical current to stimulate the lingual branch projections of at least two cranial nerves in the anterior tongue through the gold-plated electrodes. Device function is controlled by four buttons: On, Off, Intensity Up, and Intensity Down.

A rechargeable lithium- polymer battery with built-in charge safety circuitry provides power. While the voltage and pulse timing to each electrode are programmed into the device and cannot be altered, the stimulus intensity can be adjusted by the user. The sensation produced by the array is similar to the feeling of drinking a carbonated beverage. The waveform is specifically designed to minimize the potential for tissue irritation.

When the PoNS™ device is turned off, the intensity setting automatically resets to zero. Upon first introduction to the device stimulation, subjects are instructed to press the “Up” intensity button and hold it for approximately 4-5 seconds to reach sensation threshold. Subjects will frequently notice that the sensation intensity decreases 2-4 minutes after stimulation onset. Subjects are instructed to simply increase the sensation level to return to the predetermined perceptual midpoint of their individual perceptual dynamic range.

5

Ximedica

We have completed the design phase of the PoNS™ device and we will subcontract the building of commercial quantities of the device to Ximedica, LLC (“Ximedica”), a contract manufacturer based in Providence, Rhode Island, that we selected after an exhaustive procurement process. We place an emphasis on protecting our patented technology, trade secrets and know-how and only share confidential information on a need to know basis, even with our manufacturers. We expect that the PoNS™ device will require some very light assembly and labeling that will be performed by Ximedica. Ximedica is registered as a medical device manufacturer in good standing with the FDA, and is certified with International Organization for Standardization (ISO) 13485, a comprehensive quality management system for the design and manufacture of medical devices.

We are currently evaluating commercial-scale manufacturers for the PoNS™ device with the goal of building sufficient stock to warehouse and ship the product to our distributor, who will in turn manage customer distribution.

U.S. Army

We are designing the PoNS™ device with the cooperation of the U.S. Army pursuant to an agreement known as a cooperative research and development agreement, (the “CRADA”). The U.S. Army was interested in signing the CRADA because of the very high incidence of TBI in soldiers and the fact that there are very few proven, effective treatments available for those soldiers who suffer from chronic TBI symptoms. Department of Defense statistics show that incidence of TBI in the U.S. Army has numbered approximately 30,000 per year from 2012 to 2014 in active duty personnel, and over 300,000 U.S. military personnel have been diagnosed with TBI since 2000. Of the 30,000 active duty personnel who suffer from TBI annually, we estimate that approximately 20-30% will develop chronic symptoms related to their TBI. While the number of cases of TBI among active duty personnel may vary based on troop levels maintained by the federal government, our primary target market will be the large number of retired soldiers who suffer from chronic TBI symptoms as this population is less subject to material, year-to-year fluctuation. The Army has expressed its desire to distribute our PoNS™ device to service members who would benefit, should the device be cleared by the FDA. However, the U.S. Army is not under any obligation to purchase our product under the CRADA or any other agreement with us, and there is no assurance that the U.S. Army will ultimately purchase our product.

Pursuant to the CRADA, as amended, the laboratories of the U.S. Army Medical Material Agency (“USAMMA”) and the U.S. Army Medical Material Development Activity (“USAMMDA”) (collectively, the “Army Laboratories”), agreed to cooperate with NHC on research for the ongoing design and development to determine if the PoNS™ device can be developed for commercial use in assisting physical therapy in the treatment of soldiers and others with military relevant neurological manifestations of TBI, including but not limited to Tinnitus, post-traumatic stress disorder, or PTSD, pain and any subsequent indications identified by the parties. The CRADA may be terminated by NHC or the Army Laboratories unilaterally at any time by providing the other party written notice at least 30 days prior to the desired termination date. In addition, the CRADA automatically expires on December 31, 2017 unless modified in writing by the parties, provided that the CRADA is subject to a four-year automatic extension as required for both FDA clearance in the event that a pre-market approval application with the FDA is required for a PoNS™ indication in respect of aid to therapy for chronic balance deficits resulting from TBI as well as for commercialization of the PoNS™ device.

We will initially seek FDA clearance only for treatment of patients with chronic balance deficit due to TBI. The U.S. Army has expressed an interest in supplying PoNS™ devices to the military personnel who need it, subject to our ability to demonstrate its safety and effectiveness and our ability to obtain such FDA clearance. Based on this interest, we estimate that there is a sufficient potential market of active duty and retired soldiers who could potentially benefit from the PoNS™ device due to their chronic TBI symptoms. However, the U.S. Army has not made any guarantees and is not otherwise under any contractual obligations to purchase PoNS™ devices, even if we do demonstrate effectiveness and obtain FDA clearance.

If we are able to complete development of the PoNS™ device and obtain FDA clearance of the device to treat chronic balance deficit due to mild to moderate TBI, we plan to develop the PoNS™ device to treat other indications, or symptoms caused by neurological disorders. As set forth in the January 12, 2015 amendment of our CRADA, the U.S. Army has also expressed interest in our development of the PoNS™ device to treat other symptoms of TBI or any other indications caused by neurological disorders. We would be required to commit our own resources to sponsor the regulatory process for these additional indications. However, the Army Laboratories has agreed in the January 12, 2015 amendment to our CRADA to be responsible for supporting the execution of studies using the PoNS™ device as a treatment for mutually agreed-upon military relevant neurological disorders, which could include but not be limited to Tinnitus, PTSD, sleep regulation and pain (headache) and any subsequent indications identified by the parties. The amount of such support, if any, and the terms of such responsibility to support such studies are not yet negotiated and we have no assurance that we can ultimately reach agreement with the Army Laboratories on such amount or terms of support. There can be no assurance that the Army Laboratories will not otherwise attempt to renegotiate its responsibilities under the CRADA.

6

Food and Drug Administration

To date, no prior premarket notifications for clearance of the PoNS™ device have been submitted by NHC to the FDA, but the Army Laboratories, which previously was responsible as the regulatory sponsor until such role was assumed by NHC, submitted a request for information with the FDA with respect to the potential classification of the PoNS™ device through what is known as a 513(g) request for information. In response to a 513(g) request, the FDA provides information regarding the classification of the device or the requirements applicable to a device under the Federal Food, Drug, and Cosmetic Act, or the FD&C Act. Under the 513(g) request, the Army Laboratories sought guidance from the FDA regarding the classification of the PoNS™ device and the applicable requirements under the FD&C Act. As a result of this process, the FDA responded with guidance on pursuing de novo classification of the PoNS™ device as a Class II medical device.

We plan to utilize the de novo classification process to obtain Class II classification and 510(k) clearance from the FDA for the PoNS™ device. We have been deemed by the FDA through the pre-submission process a non-significant risk device in the context of the TBI clinical trial and thus do not need an Investigation Device Exemption to complete our clinical trials. We are seeking to complete a safety and effectiveness clinical trial by the first quarter of calendar year 2017 and will thereafter submit a request for de novo classification and the premarketing notification (i.e., 510(k)) to the FDA. Previously, we had sought to complete the safety and effectiveness clinical trial by the first quarter of calendar year 2016.

On a parallel path to our request for de novo classification and premarket notification to the FDA, we expect to submit an application for the clearances of the PoNS™ device for both TBI and MS indications to Europe for a CE Mark and to Health Canada (the department of the government of Canada with responsibility for national public health). Our goal is that the CE Mark and Canadian clearance for the PoNS™ device will be obtained in early 2017.

On April 29, 2014, NHC, as cooperator, entered into Notice of Modification No. 1 of the CRADA, with Advanced NeuroRehabilitation LLC (“ANR”), one of our significant shareholders, the inventors, and the Army Laboratories, whereby NHC will no longer provide expertise and training in the design of clinical study protocols or for U.S. Army and/or VA personnel in the physical therapy interventions required for clinical studies. In addition, pursuant to the amended CRADA, ANR will share all data with USAMMA and NHC will provide all data supporting clinical claims for regulatory approval.

On January 12, 2015, NHC, as cooperator, entered into Notice of Modification No. 2 of the CRADA, with ANR, the inventors, and the Army Laboratories. Under this amendment to the CRADA, the Army Laboratories agreed to transfer some of the CRADA responsibilities to NHC. We believe the Army Laboratories agreed to transfer certain responsibilities to us under the CRADA to enable us to accelerate development of the PoNS™ device for the eventual potential treatment of soldiers. One of the material changes reflected in the amendment to the CRADA is the shifting from the Army Laboratories to NHC of sole responsibility as the regulatory sponsor for all interactions with the FDA in order to gain approval and clearance from the FDA, including the initial 513(g) submission. As part of the amendments to the CRADA, NHC has agreed to be responsible to fund the FDA process as well as to provide the supply of all devices to support all studies governed by the CRADA. While under the amendments NHC gains control of the FDA regulatory process, the amendments materially increase the financial burden on NHC to meet these funding and supply obligations. The amendments also extend from two to four years both the time for regulatory approval in the event a pre-market approval application, or PMA, is required by the FDA as well as for commercialization of the PoNS™ device.

While NHC has sole responsibility as the regulatory sponsor under the CRADA, the U.S. Army Medical Research and Materiel Command (“USAMRMC”) has entered into a sole-source contractual agreement to support the execution of the registration trial for treatment of balance disorder associated with mild to moderate TBI. The objective of this contract is to defray the costs of the registration trial. The Army Laboratories also agreed in the January 12, 2015 amendment to our CRADA to be responsible for supporting the execution of studies using the PoNS™ device as a treatment for mutually agreed-upon military relevant neurological disorders, which could include but not be limited to Tinnitus, PTSD, and pain and any subsequent indications identified by the parties. The amount of such support, if any, and the terms of such responsibility to support such clinical studies are not yet negotiated and we have no assurance that we can ultimately reach agreement with the Army Laboratories on such amount or terms of support, and there can be no assurance that the Army Laboratories will not otherwise attempt to renegotiate its responsibilities under the CRADA. The Army Laboratories may terminate their obligations under the CRADA at any time upon 30 days prior written notice to us. If there are insufficient funds available to cover the necessary research and development costs for our product, the Army Laboratories could terminate the CRADA and cease research and development efforts which could jeopardize our ability to commercialize our PoNS™ device.

7

On July 7, 2015, the Company announced that NHC entered into a sole source cost sharing contract with the USAMRMC. The contract will support the Company’s registrational trial investigating the safety and effectiveness of the PoNS™ device. Under the contract, the USAMRMC will reimburse the Company for approximately 62% of the initially budgeted costs related to the registrational trial of up to a maximum amount of $2,996,244. The sole source cost sharing agreement expires December 31, 2016. As of March 31, 2016, the Company has received a total of $1,458,374 in respect of expenses reimbursed.

On December 28, 2015, NHC, as cooperator, entered into Notice of Modification No. 3 of the CRADA, with ANR, the inventors, and the Army Laboratories to extend the expiration date of the CRADA to December 31, 2017.

Our Market

NHC is in the neurostimulation market. According to a study by Grand View Research, the neurostimulation market was valued at $3.4 billion in 2013 and is expected to grow at a compounded annual growth rate of 14.4% from 2014 to 2020. The leading sectors in the industry are Spinal Cord Stimulation, Deep Brain Stimulation, Sacral Nerve Stimulation and Vagal Nerve Stimulation. We believe that due to the significant lack of non-invasive devices, non-invasive stimulation addresses only approximately 3% of the overall neurostimulation market today. This allows for a significant market opportunity for the Company.

Market Competition

The neurostimulation market is competitive and growing. Our competitors in the industry are predominantly large, publically-traded companies that have a history in the market, have significantly easier access to resources and have an established product pipeline. The combined clinical research and product development done by the industry, including by us and all of our competitors, is foundational, and neurostimulation has slowly become integrated into neurological therapy. This foundation has allowed for new and innovative neurostimulation companies to enter the market.

We believe that our technology, the PoNS™ device, introduces an innovative target and method of stimulation because targeting the tongue for neurostimulation provides several clear advantages, which are discussed below. While we believe that the factors described below competitively distinguish our technologies and provide the PoNS™ device a competitive advantage for non-invasive neuromodulation therapy, we note that these factors are only supported by anecdotal evidence of efficacy from the initial work done at the TCNL Laboratories. We believe that our pilot study on MS done at the Montreal Neurological Institute and Hospital and Concordia University’s PERFORM Center using functional MRI provides scientific evidence of efficacy, and from our Press Release dated November 2, 2015, we announced that our device met all of its study objectives and that the results suggested the device may be facilitating neural plasticity. We therefore are making the assumption that the results of our current TBI clinical trial program will be positive and further support these claims at that time.

Advantages of the PoNS™ Device

|

|

• |

Other technologies stimulate other branches of the trigeminal nerve. We target the lowest branch of the trigeminal nerve, which is found in the tongue. It is also the largest branch, having the highest amount of nerve fibers of the three branches. |

|

|

• |

Stimulating the tongue also allows for the simultaneous stimulation of a second cranial nerve found in the tongue, the facial nerve. The ability to stimulate more than one nerve alone differentiates us from our competition. However, it has not been scientifically proven that stimulating additional nerves adds to the efficacy of the treatment. |

8

• |

The tongue has an anatomically unique surface with a high density of receptors, a consistently moist and conductive environment, constant pH, constant temperature and a direct connection to the brain through at least two cranial nerves. | |

| • | We believe that the trigeminal and facial cranial nerves offer a high-bandwidth pathway for impulses to directly affect the central nervous system. The trigeminal and facial nerves project directly onto several areas of the brain, primarily the brainstem (trigeminal and solitary nuclei), cerebellum, cochlear nuclei and spinal cord. Secondary targets include the limbic system, basal ganglia and thalamus. We believe that this range of projections allows impulses be sent through sites regulating dozens of functions. | |

| • | Unlike Deep Brain Stimulation devices, implantable vagal nerve devices and other invasive forms of electrical stimulation, the tongue allows for neurostimulation to be delivered non-invasively and portably. This opens the door for integration of neurostimulation with a wide range of therapies previously unexplored for neurological rehabilitation. |

Reimbursement

If we complete our clinical trials and obtain FDA clearance, and ultimately receive customer orders for the PoNS™ device, we plan to submit applications for appropriate reimbursement codes so that insurers, including Medicare and Medicaid, are able to pay for the device. We plan to seek coverage and reimbursement of the PoNS™ device from public payers, such as Medicare and Medicaid, as well as private payers. There are complex laws, regulations and guidance that set forth Medicare coverage and reimbursement policies. To help us navigate the regulatory complexities, we have engaged consultants to assist us with our reimbursement strategy.

From time to time, Congress enacts laws that impact Medicare coverage and reimbursement policy. In addition, the Centers for Medicare & Medicaid Services, or CMS, regularly engage in rulemaking activities and issues instructions and guidance that may affect Medicare coverage and reimbursement policy. Similarly, the federal and state governments may enact future laws or issue regulations or guidance that may impact Medicaid coverage and reimbursement policies, or the coverage and reimbursement policies of private insurers. We must ensure that we are in full compliance with all applicable requirements, and that we remain abreast of potential legislative or regulatory developments that could impact its business. For all payers, the PoNS™ device must fit within an identifiable coverage category and fully meet the requirements of such category.

Once we complete our clinical trials and obtain FDA clearance, and ultimately receive customer orders for the PoNS™ device, we intend to seek coverage for the PoNS™ device under the Medicare part B durable medical equipment benefit. This will involve ensuring that the PoNS™ device meets all of the criteria for coverage under that benefit. In addition, as part of the coverage process, we may have to submit an application request to CMS to revise the Healthcare Common Procedure Coding System, or HCPCS, level II national code set so that the PoNS™ device becomes eligible to be covered and reimbursed, not only by Medicare, but by other public and private payers. The HCPCS Level II Code Set is a standardized coding set used for claims submitted to public and private payers that identifies particular products, supplies and services. At present, we do not believe that the PoNS™ device would fit easily within an existing HCPCS code. Thus, we are considering submitting a request to CMS for a new HCPCS code and are evaluating our options with our consultants. An applicant can request that (1) a new permanent code be added to the HCPCS level II national code set; (2) the language used to describe an existing code be modified; or (3) an existing code be deleted. However, prior to submitting its coding request application, we must satisfy several criteria, including but not limited to receiving documentation of the FDA’s approval of the device and having sufficient claims activity or volume in the United States (evidenced by 3 months of marketing activity). The national codes are updated annually. Coding requests must be received by January 3 of the current year to be considered for the January update of the following year.

If we do submit such a request for a new HCPCS code, it will be reviewed by the CMS HCPCS Workgroup, which is comprised of representatives of CMS, Medicaid state agencies, and the Pricing, Data Analysis and Coding contractor. The HCPCS Workgroup meets monthly and determines whether each coding request warrants a change to the HCPCS national coding set.

In addition, Medicare and other insurers must find that the PoNS™ device is medically reasonable and necessary for the treatment of patients’ illness or injuries. If Medicare and other insurers find that the PoNS™ device does not meet their medical necessity criteria, it will not be reimbursed. Medicare and commercial insurers must also develop a payment amount for the PoNS™ device. If that amount is inadequate to cover the costs of the PoNS™ device, healthcare providers will be unlikely to use this device.

9

Deployment

Our PoNS™ device has a design feature that stops delivering therapy every fourteen weeks. This is expected to require patients to return to their physician or physical therapy center, or PTC, for assessment of their progress and reestablishment of challenging physical therapy to achieve higher goals. We currently expect the device to be inspected visually by the physical therapist, reset for another fourteen weeks of treatment, and the tongue array would be replaced by a new one to ensure no degradation of the electrodes occurs. We expect this business model feature to ensure proper support for patients in the early phase of their therapy.

We expect physicians will be informed to prescribe both the PoNS™ device and the “local” trained PTCs for their patients to receive the PoNS™ device and certified their training. We anticipate supporting the launch of the PoNS™ device with the development and implementation of a hub services center to help facilitate the healthcare transaction.

Upon discharge from the PTC, patients are expected to be monitored in their home therapy through the PTCs. At the end of their prescribed treatment, we expect patients to be directed back to their physician for assessment and then return to the PTC for additional treatment as well as replacement of the tongue array if the fourteen weeks have expired.

PoNS™ in the U.S. Army

If it ultimately decides to purchase PoNS™ devices from us, we expect that the U.S. Army would deploy the device to Active Duty Personnel through their rehabilitation centers under orders from the central medical command. All personnel are expected to be certified PoNS™ trainers supported by live, paper and video-based training materials developed through this project by the U.S. Army.

We have also approached the Canadian and United Kingdom Armed Forces to discuss their support of a similar program in Canada and discussions are ongoing. We also intend to pursue other military organizations in relevant countries based on need and size of potential deployment.

PoNS™ in Civilian Population

We believe that a key to deployment success will be to create a national framework of PoNS™-trained Physical Therapists (PTs). We have developed a training certification program where PTs can become certified PoNS™ therapists after on-line and in-person training. We expect there to be a strong financial incentive for the PT community to partner with us because PoNS™ training offers substantial opportunity for growth for the PTs. We anticipate that PTs will be able to use existing reimbursement codes for the physical therapy portion of the therapy. As discussed above, we plan to apply for reimbursement codes for the PoNS™ device.

We will concentrate our efforts in the United States, Canadian and UK marketplaces as first launch markets. We are currently uncertain which of these three markets will launch first, primarily due to the relative speed of the regulatory process, and there is no assurance that any will launch at all. Following the initial launch of marketplaces, we intend to commercialize the PoNS™ device in the rest of Europe, Australia and Japan as second phase countries (2018-2019) and Brazil, India and other markets as phase III countries (2019-2020). Previously, we disclosed that we intended to commercialize the PoNS™ device in the phase II countries in 2017 and the phase III countries in 2018. This change is based on the timing of our current clinical trial.

In November 2014 we signed a development and distribution agreement with Altair (a Russian company based in Moscow) to apply for registration and distribute the PoNS™ device in the territories of the former Soviet Union. Thus far the device has received a letter of conformity as an adjunct to physical therapy in Russia and Uzbekistan following regulatory applications to the health authorities of these two countries.

10

Licensed Intellectual Property

Pursuant to the Second Amended and Restated Patent Sub-License agreement dated as of June 6, 2014 entered into between ANR and NHC (the “Sublicense Agreement”), ANR has granted NHC a worldwide, exclusive license to make, have made, use, lease and sell devices utilizing certain patent applications, which are collectively referred to as the “Patent Pending Rights.” The Patent Pending Rights relate to the PoNSTM device and include the following patents and patent applications, which cover a device that noninvasively delivers neurostimulation through the skin or intra- orally to the brain stem via the trigeminal nerve, the facial nerve or both:

| U.S. Patent

Application No. |

Application Filing Date |

Status | U.S. Patent No. |

Issue Date | Subject Matter |

| 12/348,301 | 1/4/2009 | Issued | 8,849,407 | 9/30/2014 | non-invasive neurostimulation of the skin combined with simultaneous physical therapy to provide neurorehabilitation of a patient to treat various maladies including, e.g., TBI, stroke and Alzheimer’s disease |

| 14/340,144 | 7/24/2014 | Issued | 8,909,345 | 12/9/2014 | non- invasive neurostimulation within a patient’s mouth combined with physical therapy to provide neurorehabilitation of a patient to treat various maladies including, e.g., TBI, stroke, and Alzheimer’s disease |

| 14/341,141 | 7/25/2014 | Issued | 9,020,612 | 4/28/2015 | non- invasive neurostimulation within a patient’s mouth combined with cognitive therapy to provide neurorehabilitation of a patient resulting in improved reading comprehension and increased attention span as well as the treatment various maladies including, but not limited to, TBI, stroke, and Alzheimer’s disease |

| 14/615,766 | 2/6/2015 | Pending | N/A | N/A | non- invasive neurostimulation within a patient’s mouth combined with stimulation of the patient’s vision, hearing, vestibular systems, or somatosensory systems for the treatment of tinnitus |

| 14/689,462 | 4/17/2015 | Pending | N/A | N/A | non- invasive neurostimulation of a patient’s skin combined with cognitive therapy to provide neurorehabilitation of a patient resulting in improved reading comprehension and increased attention span as well as the treatment various maladies including, e.g., TBI, stroke, and Alzheimer’s disease |

| 14/815,171 | 7/31/2015 | Pending | N/A | N/A | non- invasive neurostimulation of a patient’s mouth combined with therapy to provide neurorehabilitation of a patient, with a focus on features of a neurostimulation device |

| 61/019,061 (Provisional) |

1/4/2008 | Expired | N/A | N/A | N/A |

| 61/020,265 (Provisional) |

1/10/2008 | Expired | N/A | N/A | N/A |

11

U.S. Patent Nos. 8,909,345 and 9,020,612 and U.S. Patent Application Nos. 14/615,766, 14/689,462 and 14/815,171 claim priority to U.S. Patent No. 8,849,407.

A U.S. provisional patent application provides the means to establish an early effective filing date for a later filed nonprovisional patent application. Therefore, though the two provisional applications have expired, they establish a priority date for U.S. Patent Nos. 8,849,407, 8,909,345, 9,020,612, and U.S. Patent Application Nos. 14/615,766, 14/689,462, 14/815,171 and any future filings that claim priority. We intend to file additional continuation applications in the USPTO claiming priority to U.S. Patent Application Nos. 14/615,766, 14/689,462, and 14/815,171 to protect other aspects of the PoNSTM device and related non- invasive neurostimulation techniques.

ANR, which is one of Helius’ significant shareholders, holds an interest in the Patent Pending Rights pursuant to an exclusive license from the inventors. U.S. Patent Application Nos. 14/615,766, 14/689,462, 14/815,171 are included in the exclusive license as the exclusive license agreement covers (i) U.S. Patent Application No. 12/348,301 and Provisional Application No. 61/019,061, (ii) any patents issuing therefrom and (iii) any patents claiming priority to U.S. Patent Application No. 12/348,301 or Provisional Application No. 61/019,061, which U.S. Patent Application Nos. 14/615,766, 14/689,462, 14/815,171 claim priority through such provisional application as well as through Provisional Application 61/020,265.

In addition, ANR has agreed that ownership of any improvements, enhancements or derivative works of the Patent Pending Rights that are developed by NHC or ANR shall be owned by NHC, provided that if NHC decides not to patent such improvements, ANR may choose to pursue patent rights independently. Pursuant to the Sublicense Agreement, NHC has agreed to pay ANR royalties equal to 4% of NHC’s revenues collected from the sale of devices covered by the Patent Pending Rights and services related to the therapy or use of devices covered by the Patent Pending Rights in therapy services. The Sublicense Agreement provides that the sublicense granted by ANR to NHC, if in good standing, shall not be cancelled, limited or impaired in any way should there be a termination of the master license granted by the inventors to ANR, which was acknowledged by the inventors in the Sublicense Agreement. On June 6, 2014, NHC and ANR entered into a second amended and restated sublicense agreement, or the Second Sublicense Agreement, which acknowledges the Reverse Merger (see “Our Corporate History - Acquisition of NeuroHabilitation Corporation and Concurrent Financing” below), and adds us as a party to the agreement.

The license of the Patent Pending Rights are subject to the right of the government of the United States, which funded certain research relating to the development of the PoNSTM device, to a nonexclusive, non- transferable, irrevocable, paid- up license to use the Patent Pending Rights for governmental purposes. In addition, NHC has granted a perpetual, royalty-free license to the Patent Pending Rights back to ANR for non- profit research and development activities which do not compete with NHC’s business and to produce and derive revenues from devices and services in connection with investigational uses of the PoNSTM device and related technology.

The license of the Patent Pending Rights is also subject to the terms of the CRADA. In the event that Helius is not willing or is unable to commercialize the PoNSTM technology within four years from the expiration of the CRADA, the Company is required to transfer possession, ownership and sponsorship/holdership of the regulation application, regulatory correspondence and supporting regulatory information related technology to USAMRMC and grant the U.S. Government a non-exclusive, irrevocable license to any patent, copyright, data rights, proprietary information or regulatory information for the U.S. Government to commercialize the technology.

12

Company Owned Intellectual Property

On July 17, 2015, the Company announced that the USPTO issued the Company its first patent related to the design of the current PoNSTM device. U.S. Patent No. 9,072,889, “Systems for Providing Non-Invasive Neurorehabilitation of a Patient,” issued on July 7, 2015, is the first patent Helius has received related specifically to the new device design.

The Company filed 27 U. S. patent applications related to various technical and ornamental aspects of the PoNSTM device. The Company filed eleven non-provisional patent applications that describe various technical features in the current version device and 16 design patent applications describing various ornamental designs. Helius is the sole assignee for these 27 U.S. patent filings. Prior to issuance, once the USPTO determines that a patent application meets all of the statutory requirements for patentability it provides a notice of allowance. In addition to the first issued patent (U.S. Patent No. 9,072,889), the USPTO has issued three utility patents, 16 design patents and provided notices of allowance for utility applications as summarized in the table below:

| U.S. Patent Application No. |

Application Filing Date |

Status | U.S. Patent No. |

Issue Date | Subject Matter |

| 14/558,768 | 12/3/2014 | Issued | 9,072,889 | 7/7/2015 | Utility application covering overall system design, including controller and mouthpiece |

| 14/559,123 | 12/3/2014 | Issued | 9,272,133 | 3/1/2016 | Utility application covering strain relief mechanisms for the connection between the mouthpiece and the controller |

| 14/558,787 | 12/3/2014 | Issued | 9,227,051 | 1/5/2016 | Utility application covering shape of the mouthpiece |

| 14/558,789 | 12/3/2014 | Issued | 9,283,377 | 3/15/2016 | Utility application covering center of gravity of the mouthpiece |

| 14/559,080 | 12/3/2014 | Allowed | TBD | TBD | Utility application covering structural support of the mouthpiece |

| 14/559,105 | 12/3/2014 | Allowed | TBD | TBD | Utility application covering glue wells of the mouthpiece |

| 29/510,741 | 12/3/2014 | Issued | D750264 | 2/23/2016 | Design application covering an alternative version of the current PoNS™ device (over-ear double boom design) |

| 29/510,742 | 12/3/2014 | Issued | D749746 | 2/16/2016 | Design application covering an alternative version of the current PoNS™ device (overhead minimal interference design) |

| 29/510,743 | 12/3/2014 | Issued | D752236 | 3/22/2016 | Design application covering system design used in the current PoNS™ device |

| 29/510,745 | 12/3/2014 | Issued | D750265 | 2/23/2016 | Design application covering an alternative mouthpiece not used in the current PoNS™ device |

13

| U.S. Patent Application No. |

Application Filing Date |

Status | U.S. Patent No. |

Issue Date | Subject Matter |

| 29/510,754 | 12/3/2014 | Issued | D750794 | 3/1/2016 | Design application covering the controller used in the PoNS™ device |

| 29/510,755 | 12/3/2014 | Issued | D751215 | 3/8/2016 | Design application covering an alternative controller not used in the current PoNS™ device |

| 29/510,746 | 12/3/2014 | Issued | D750266 | 2/23/2016 | Design application covering an alternative mouthpiece not used in the current PoNS™ device |

| 29/510,749 | 12/3/2014 | Issued | D750268 | 2/23/2016 | Design application covering an alternative mouthpiece not used in the current PoNS™ device |

| 29/510,747 | 12/3/2014 | Issued | D751213 | 3/8/2016 | Design application covering an alternative mouthpiece not used in the current PoNS™ device |

| 29/510,748 | 12/3/2014 | Issued | D750267 | 2/23/2016 | Design application covering an alternative mouthpiece not used in the current PoNS™ device |

| 29/510,750 | 12/3/2014 | Issued | D753315 | 4/5/2016 | Design application covering mouthpiece used in the current PoNS™ device |

| 29/510,751 | 12/3/2014 | Issued | D751722 | 3/15/2016 | Design application covering an alternative controller not used in the current PoNS™ device |

| 29/510,752 | 12/3/2014 | Issued | D752766 | 3/29/2016 | Design application covering an alternative controller not used in the current PoNS™ device |

| 29/510,753 | 12/3/2014 | Issued | D753316 | 4/5/2016 | Design application covering an alternative controller not used in the current PoNS™ device |

| 29/510,744 | 12/3/2014 | Issued | D760397 | 6/28/2016 | Design application covering system design used in the current PoNS™ device |

| 29/510,756 | 12/3/2014 | Issued | D759830 | 6/21/2016 | Design application covering system design used in the current PoNS™ device |

Additionally, Helius has filed three international applications, and 14 foreign design applications: seven in Canada, three in China, three in Russia, and one community design in Europe. The following three applications filed in China, which have been assigned to China Medical Systems Holdings LTD. pursuant to an asset purchase agreement (the “Strategic Agreement”) dated effective October 9, 2015 with A&B have issued:

14

| Chinese Patent Application No. |

Application Filing Date |

Status | Chinese Patent No. |

Issue Date | Subject Matter |

| 201530177804.4 | 6/3/2015 | Issued | CN303597712S | 2/24/2016 | Design application covering the system design currently used in the PoNSTM 4.0 device |

| 201530178171.9 | 6/3/2015 | Issued | CN303597713S | 2/24/2016 | Design application covering the mouthpiece design currently used in the PoNSTM 4.0 device |

| 201530177398.1 | 6/3/2015 | Issued | CN303597711S | 2/24/2016 | Design application covering the controller design currently used in the PoNSTM 4.0 device |

Further, the three design applications filed in Russia have been allowed, and the Canadian Design applications and European community design have issued:

| Russian Design Application No. |

Application Filing Date |

Status | Russian Patent No. |

Issue Date | Subject Matter |

| 2015501883 | 6/3/2015 | Allowed | TBD | TBD | Design application covering the system design currently used in the PoNSTM 4.0 device |

| 2015501882 | 6/3/2015 | Allowed | TBD | TBD | Design application covering the mouthpiece design currently used in the PoNSTM 4.0 device |

| 2015501881 | 6/3/2015 | Allowed | TBD | TBD | Design application covering the controller design currently used in the PoNSTM 4.0 device |

| Canadian Design Application No. |

Application Filing Date |

Status | Canadian Patent No. |

Issue Date | Subject Matter |

| 162676 | 6/2/2015 | Issued | 162676 | 2/29/2016 | Design application covering system design used in the current PoNSTM device |

| 162672 | 6/2/2015 | Issued | 162672 | 2/29/2016 | Design application covering an alternative mouthpiece not used in the current PoNSTM device |

| 162671 | 6/2/2015 | Issued | 162671 | 2/29/2016 | Design application covering an alternative mouthpiece not used in the current PoNSTM device |

| 162674 | 6/2/2015 | Issued | 162674 | 2/29/2016 | Design application covering mouthpiece used in the current PoNSTM device |

| 162675 | 6/2/2015 | Issued | 162675 | 2/29/2016 | Design application covering an alternative controller not used in the current PoNSTM device |

| 162670 | 6/2/2015 | Issued | 162670 | 2/29/2016 | Design application covering the controller used in the PoNSTM device |

| 162673 | 6/2/2015 | Issued | 162673 | 2/29/2016 | Design application covering system design used in the current PoNSTM device |

| EU Community Design Application No. |

Application Filing Date |

Status | EU Community Design Reg. No. |

Issue Date | Subject Matter |

| 002712026 | 6/3/2015 | Issued | 002712026 | 9/4/2015 | Design application covering several aspects of the system design currently used in the PoNSTM 4.0 device |

Currently, Helius uses four trademarks in connection with the operation of the business: PoNSTM, NeuroHabilitation, NHC and Helius Medical Technologies. Helius owns the rights to the PoNSTM mark by virtue of an assignment agreement having an effective date of October 27, 2014 and entered into with ANR and the inventors of the PoNSTM technology. Helius is the sole owner of the rights in the NeuroHabilitation and NHC trademarks, and Helius is the owner of the rights in the Helius Medical Technologies mark. On October 31, 2014, Helius filed trademark applications in the USPTO for these four trademarks.

On January 7, 2015, Helius filed trademark applications with the Canada Intellectual Property Office, claiming priority to the corresponding U.S. applications filed on October 31, 2014. The Company is the owner of the rights in the NeuroHabilitation, NHC, and PoNS marks in Canada, and Helius is the owner of the rights in the Helius Medical Technologies mark in Canada. The Company has also applied for the PoNS trademark in Canada, Europe, Russia and China.

We take precautions to safeguard our intellectual property, and it has been and may be the subject of lawsuits. See Part I Item 3, “Legal Proceedings.”

15

Government Regulation

Our products under development and our operations are subject to significant government regulation. In the United States, our products are regulated as medical devices by the FDA and other federal, state, and local regulatory authorities. The following is a general description of the review and clearance process of the FDA for medical devices.

FDA Regulation of Medical Devices

The FDA and other U.S. and foreign governmental agencies regulate, among other things, the following activities with respect to medical devices:

| • | design, development and manufacturing; | |

| • | testing, labeling, content and language of instructions for use and storage; | |

| • | clinical trials; | |

| • | product storage and safety; | |

| • | marketing, sales and distribution; | |

| • | pre-market clearance and approval; | |

| • | record keeping procedures; | |

| • | advertising and promotion; | |

| • | recalls and field safety corrective actions; | |

|

• |

post-market surveillance, including reporting of deaths or serious injuries and malfunctions that, if they were to recur, could lead to death or serious injury; | |

| • | post-market approval studies; and | |

| • | product import and export. |

In the United States, numerous laws and regulations govern all the processes by which medical devices are brought to market and marketed. These include the FD&C Act and the FDA’s implementing regulations, among others.

The FDA Review, Clearance and Approval Process

Each medical device we seek to commercially distribute in the United States must first receive either clearance under Section 510(k) of the FD&C Act, receive de novo down-classification, or pre-market approval, or PMA, from the FDA, unless specifically exempted by the FDA. FDA review and approval is required for each application of a device, regardless of whether the device has been approved for other applications. The FDA classifies all medical devices into one of three classes. Devices deemed to pose the lowest risk are categorized as either Class I or II, which requires the manufacturer to submit to the FDA a 510(k) pre-market notification submission requesting clearance of the device for commercial distribution in the United States, unless the device is exempted from this requirement. Devices deemed by the FDA to pose the greatest risk, such as life sustaining, life-supporting or implantable devices, or devices deemed not substantially equivalent to a previously 510(k) cleared device are categorized as Class III and require submission and approval of a PMA application.

In the 510(k) clearance process, the FDA must determine that a proposed device is “substantially equivalent” to a device legally on the market, known as a “predicate” device, with respect to intended use, technology and safety and effectiveness, in order to clear the proposed device for marketing. Clinical data is sometimes required to support a determination of substantial equivalence. The PMA pathway requires an applicant to demonstrate the safety and effectiveness of the device based, in part, on extensive data, including, but not limited to, technical, preclinical, clinical trial, manufacturing and labeling data. The PMA process is typically required for devices that are deemed to pose the greatest risk, such as life-sustaining, life-supporting or implantable devices. However, some devices are automatically subject to the PMA pathway regardless of the level of risk they pose, because they have not previously been classified into a lower risk class by the FDA. Manufacturers of these devices may request that the FDA review such devices in accordance with the de novo classification procedure, which allows a manufacturer whose novel device would otherwise require the submission and approval of a PMA prior to marketing to request down-classification of the device on the basis that the device presents low or moderate risk. If the FDA agrees with the down-classification, the applicant will then receive approval to market the device. This device type can then be used as a predicate device for future 510(k) submissions.

16

We intend to utilize the de novo classification procedures to seek marketing authorization for the PoNS™ device, because there is currently no predicate cleared or approved by the FDA for commercial distribution and no existing classification decision by the FDA for such a device. The process of obtaining regulatory clearances or approvals, or completing the de novo classification process, to market a medical device can be costly and time consuming, and we may not be able to successfully obtain pre-market reviews on a timely basis, if at all.

If the FDA requires us to go through a lengthier, more rigorous examination for the PoNS™ device, introducing the product could be delayed or canceled, which could cause our launch to be delayed. In addition, the FDA may determine that the PoNS™ device requires the more costly, lengthy and uncertain PMA process. For example, if the FDA disagrees with our determination that the de novo classification procedures are the appropriate path to obtain marketing authorizations for the PoNS™ device, the FDA may require us to submit a PMA application, which is generally more costly and uncertain and can take from one to three years, or longer, from the time the application is submitted to the FDA until an approval is obtained. Further, even with respect to those future products where a PMA is not required, we cannot be certain that we will be able to obtain 510(k) clearances with respect to those products.

510(k) Clearance Process

To obtain 510(k) clearance, we must submit a pre-market notification to the FDA demonstrating that the proposed device is substantially equivalent to a previously-cleared 510(k) device or is a device that was in commercial distribution before May 28, 1976 for which the FDA has not yet called for the submission of PMA applications. The FDA’s 510(k) clearance process usually takes from three to 12 months from the date the application is submitted and filed with the FDA, but may take significantly longer and clearance is never assured. Although many 510(k) pre-market notifications are cleared without clinical data, in some cases, the FDA requires significant clinical data to support substantial equivalence. In reviewing a pre-market notification submission, the FDA may request additional information, including clinical data, which may significantly prolong the review process.

After a device receives 510(k) clearance, any subsequent modification of the device that could significantly affect its safety or effectiveness, or that would constitute a major change in its intended use, will require a new 510(k) clearance or could require PMA. The FDA requires each manufacturer to make this determination initially, but the FDA may review any such decision and may disagree with a manufacturer’s determination. If the FDA disagrees with a manufacturer’s determination, the FDA may require the manufacturer to cease marketing and/or recall the modified device until 510(k) clearance or PMA is obtained. Under these circumstances, the FDA may also subject a manufacturer to significant regulatory fines or other penalties. In addition, the FDA is currently evaluating the 510(k) process and may make substantial changes to industry requirements, including which devices are eligible for 510(k) clearance, the ability to rescind previously granted 510(k)s and additional requirements that may significantly impact the process.

De novo Classification Process

If a previously unclassified new medical device does not qualify for the 510(k) pre-market notification process because no predicate device to which it is substantially equivalent can be found, the device is automatically classified Class III regardless of the level of risk it poses. The Food and Drug Administration Modernization Act of 1997 established a new route to market for low to moderate risk medical devices that are automatically placed into Class III due to the absence of a predicate device, called the “Request for Evaluation of Automatic Class III Designation,” or the de novo classification procedure. This procedure allows a manufacturer whose novel device is automatically classified into Class III to request down-classification of its medical device into Class I or Class II on the basis that the device presents low or moderate risk, rather than requiring the submission and approval of a PMA application. Prior to the enactment of the Food and Drug Administration Safety and Innovation Act, or FDASIA, in July 2012, a medical device could only be eligible for de novo classification if the manufacturer first submitted a 510(k) premarket notification and received a determination from the FDA that the device was not substantially equivalent. The FDASIA streamlined the de novo classification pathway by permitting manufacturers to request de novo classification directly without first submitting a 510(k) premarket notification to the FDA and receiving a not substantially equivalent determination. Under the FDASIA, the FDA is required to classify the device within 120 days following receipt of the de novo application. If the manufacturer seeks reclassification into Class II, the manufacturer must include a draft proposal for special controls that are necessary to provide a reasonable assurance of the safety and effectiveness of the medical device. In addition, the FDA may reject the reclassification petition if it identifies a legally marketed predicate device that would be appropriate for a 510(k) or determines that the device is not low to moderate risk or that general controls would be inadequate to control the risks and special controls cannot be developed.

17

We plan to utilize the de novo classification process to obtain marketing authorization for the PoNS™ device under development, and we plan to seek Class II classification. In order to be placed in Class II, the FDA would need reasonable assurance of safety and effectiveness of the PoNS™ device. Under Class II, general controls (e.g., premarket notification) and special controls (e.g., specific performance testing) would be applicable. Our goal would be to complete in six months a safety and effectiveness clinical trial using the PoNS™ device, initially only for the treatment of balance disorder in patients with mild to moderate TBI and balance disorder associated with MS. Our overall goal for submission of the de novo application and FDA clearance of a 510(k) would be 24 months from December 2014. The application to the FDA will be made after the completion of the registration trial, which we anticipate will be completed in the first quarter of calendar year 2017. Originally, we anticipated that the registration trial would be completed at the end of 2015, but that timing was revised due to slower than expected enrollment. We have invested resources to expand recruiting to recoup for time lost. It will take us approximately four weeks to prepare the premarket notification to the FDA. We thus anticipate that we will be applying for clearance in the first half of calendar year 2017. To the extent the FDA completes its review in 90 days, we anticipate clearance by the third quarter of calendar year 2017.

Obtaining FDA clearance, de novo down-classification, or approval for medical devices can be expensive and uncertain, generally takes from several months to several years, and generally requires detailed and comprehensive scientific and clinical data. Notwithstanding the expense, these efforts may never result in FDA clearance. Even if we were to obtain regulatory clearance, it may not be for the uses we believe are important or commercially attractive, in which case we would not be permitted to market our product for those uses.

Pre-market Approval Process

A PMA application must be submitted if the medical device is in Class III (although the FDA has the discretion to continue to allow certain pre-amendment Class III devices to use the 510(k) process) or cannot be cleared through the 510(k) process. A PMA application must be supported by, among other things, extensive technical, preclinical, clinical trial, manufacturing and labeling data to demonstrate to the FDA’s satisfaction the safety and effectiveness of the device for its intended use.

After a PMA application is submitted and filed, the FDA begins an in-depth review of the submitted information, which typically takes between one and three years, but may take significantly longer. During this review period, the FDA may request additional information or clarification of information already provided. Also during the review period, an advisory panel of experts from outside the FDA may be convened to review and evaluate the application and provide recommendations to the FDA as to the approvability of the device. In addition, the FDA will conduct a pre-approval inspection of the manufacturing facility to ensure compliance with Quality System Regulations, or QSR, which impose elaborate design development, testing, control, documentation and other quality assurance procedures in the design and manufacturing process. The FDA may approve a PMA application with post-approval conditions intended to ensure the safety and effectiveness of the device including, among other things, restrictions on labeling, promotion, sale and distribution and collection of long-term follow-up data from patients in the clinical study that supported approval. Failure to comply with the conditions of approval can result in materially adverse enforcement action, including the loss or withdrawal of the approval. New PMA applications or supplements are required for significant modifications to the manufacturing process, labeling of the product and design of a device that is approved through the PMA process. PMA supplements often require submission of the same type of information as an original pre-market approval application, except that the supplement is limited to information needed to support any changes from the device covered by the original PMA application, and may not require as extensive clinical data or the convening of an advisory panel.

Clinical Trials

A clinical trial is typically required to support a PMA application and is sometimes required for a 510(k) pre-market notification. After a trial begins, the FDA may place it on hold or terminate it if, among other reasons, it concludes that the clinical subjects are exposed to an unacceptable health risk. Any trials we conduct must be conducted in accordance with FDA regulations as well as other federal regulations and state laws concerning human subject protection and privacy. Moreover, the results of a clinical trial may not be sufficient to obtain clearance or approval of the product, and separate clinical trials will be necessary to obtain clearance for multiple uses of one device.

18

Risks of Delay from the FDA Clearance Process and Regulatory Compliance Risks

The FDA can delay, limit or deny clearance or approval of a device for many reasons, including:

|

• |