Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - HollyFrontier Corp | d284102dex991.htm |

| EX-2.1 - EX-2.1 - HollyFrontier Corp | d284102dex21.htm |

| 8-K - 8-K - HollyFrontier Corp | d284102d8k.htm |

Acquisition of Petro-Canada Lubricants Inc. October 2016 Exhibit 99.2

HOLLYFRONTIER DISCLOSURE STATEMENT Statements made during the course of this presentation that are not historical facts are “forward looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are inherently uncertain and necessarily involve risks that may affect the business prospects and performance of HollyFrontier Corporation, and actual results may differ materially from those discussed during the presentation. Such risks and uncertainties include but are not limited to failure of HollyFrontier Corporation to close the Petro-Canada Lubricants Acquisition, failure to receive required governmental approvals to close the Petro-Canada Lubricants Acquisition, successful integration of Petro Canada Lubricants Inc.’s business with HollyFrontier Corporation, the actions of actual or potential competitive suppliers and transporters of refined petroleum or lubricant products in HollyFrontier’s and Petro Canada’s markets, the demand for and supply of crude oil, refined products and lubricant products, the spread between market prices for refined products and market prices for crude oil, the possibility of constraints on the transportation of refined products, the possibility of inefficiencies or shutdowns in refinery operations or pipelines, effects of governmental regulations and policies, the availability and cost of financing to HollyFrontier, the effectiveness of HollyFrontier’s capital investments and marketing strategies, HollyFrontier's efficiency in carrying out construction projects, the possibility of terrorist attacks and the consequences of any such attacks, and general economic conditions. Additional information on risks and uncertainties that could affect the business prospects and performance of HollyFrontier is provided in the most recent reports of HollyFrontier filed with the Securities and Exchange Commission. All forward-looking statements included in this presentation are expressly qualified in their entirety by the foregoing cautionary statements. The forward-looking statements speak only as of the date hereof and, other than as required by law, HollyFrontier undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Our pending Petro-Canada Lubricants Acquisition may not be consummated. The Petro-Canada Lubricants Acquisition is subject to closing conditions and regulatory approvals. If these conditions are not satisfied or waived, the Petro-Canada Lubricants Acquisition will not be consummated. If the closing of the Petro-Canada Lubricants Acquisition is substantially delayed or does not occur at all, or if the terms of the Petro-Canada Lubricants Acquisition are required to be modified substantially due to regulatory concerns, we may not realize the anticipated benefits of the Petro-Canada Lubricants Acquisition fully or at all. Certain of the conditions remaining to be satisfied include the absence of a law or order prohibiting the transactions contemplated by the share purchase agreement, approval under the Investment Canada Act, and the expiration of any waiting periods under the Competition Act (Canada) and Hart-Scott Rodino Act, as amended, with respect to the Petro-Canada Lubricants Acquisition.

PETRO-CANADA LUBRICANTS | Transaction Overview 1) Trailing twelve month EBITDA $149MMM (CAD$198MM) Financial Details: CAD$1,125 MM purchase price (approximately US$845 MM) for Petro-Canada Lubricants Inc. CAD$783 MM (US$587 MM) purchase price net of CAD$342 MM (approximately US$257 MM) working capital Purchase funded with a combination of cash and debt Immediately accretive transaction Expected to generate US $100-200 MM of annual EBITDA 4x trailing twelve month EBITDA¹ multiple net of working capital, 6x purchase price Transaction expected to close First Quarter, 2017

Assets acquired include: 15,600 barrel per day lubricants production capacity located in Mississauga, Ontario Largest producer of base oils in Canada Dual train production facility with Hydrotreating and Catalytic Dewaxing Units Patented HT Purity Process which eliminates 99.9% of impurities Differentiated lubricants product portfolio Base Oil (Group II/II+, III/III+), White Oils, Specialty Products and Finished lubricants Only North American producer of high-margin Group III base oils Downstream integrated into finished/packaged lubes and specialties 3 inline blenders and multi-step batch blending operation Packaging capabilities range from 1 liter to bulk containers Extensive Brand Portfolio Perpetual and exclusive license for use of the Petro-Canada trademark in Lubricants Brands include: PURITY, Puretol, Krystol, Duron, Supreme, Hydrex, Sentron, Turboflo, Vultrex, Enduratex, Paraflex, Puredrill, Purewax Industry leading product innovation and R&D capability Global sales organization with locations in Canada, the US, Europe and China PETRO-CANADA LUBRICANTS | Transaction Overview

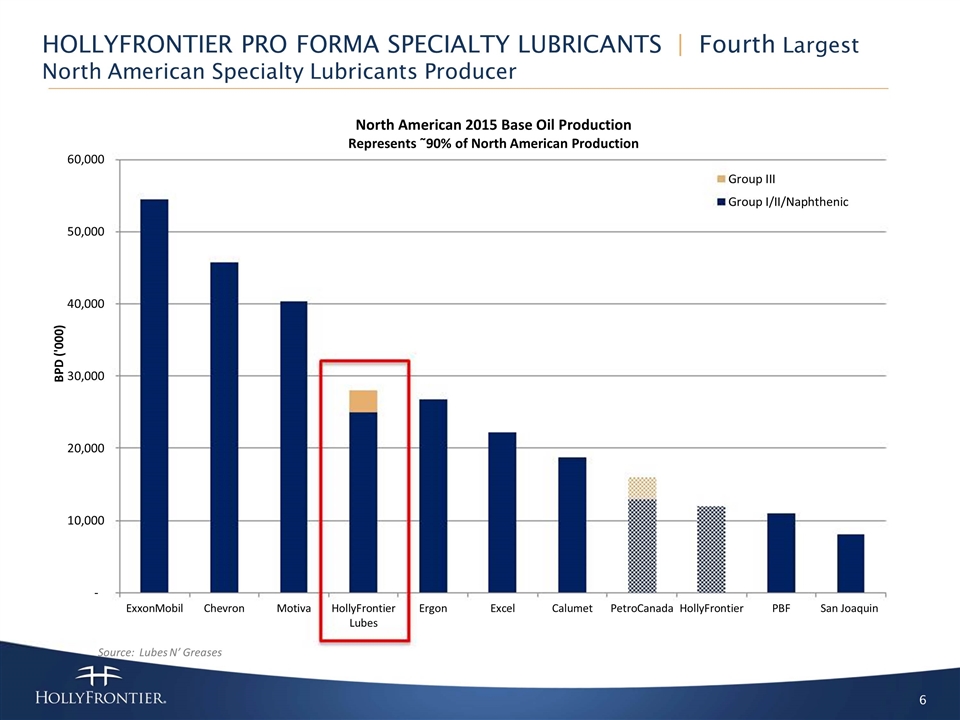

High Value Products and Stable Cash Flows Specialty Lubricants margins are significantly higher and more stable than fuels margins Differentiated lubricants product portfolio The only North American premium margin Group III base oil producer Strong brand portfolio Diversification and Scale HFC diversification from pure play inland independent transportation fuel refiner Pro forma, HFC becomes the fourth largest specialty lubricants producer in North America ˜28,000 BPD of specialty lubricants capacity, ˜10% of North American production Lubricant and Lubricant Additive companies trade at premium earnings and EBITDA multiples to Refiners Strong Growth Platform Growing market demand for Group III/III+ base oil driven by increasing industry standards Favorable industry fundamentals driving demand for premium lubricant products Global distribution capabilities Industry leading product innovation and R&D capability Synergies with Tulsa lubricants business Feedstock optimization to increase production of Group III/III+ base oils and premium products PETRO-CANADA LUBRICANTS | Strategic Rational

Source: Lubes N’ Greases HOLLYFRONTIER PRO FORMA SPECIALTY LUBRICANTS | Fourth Largest North American Specialty Lubricants Producer

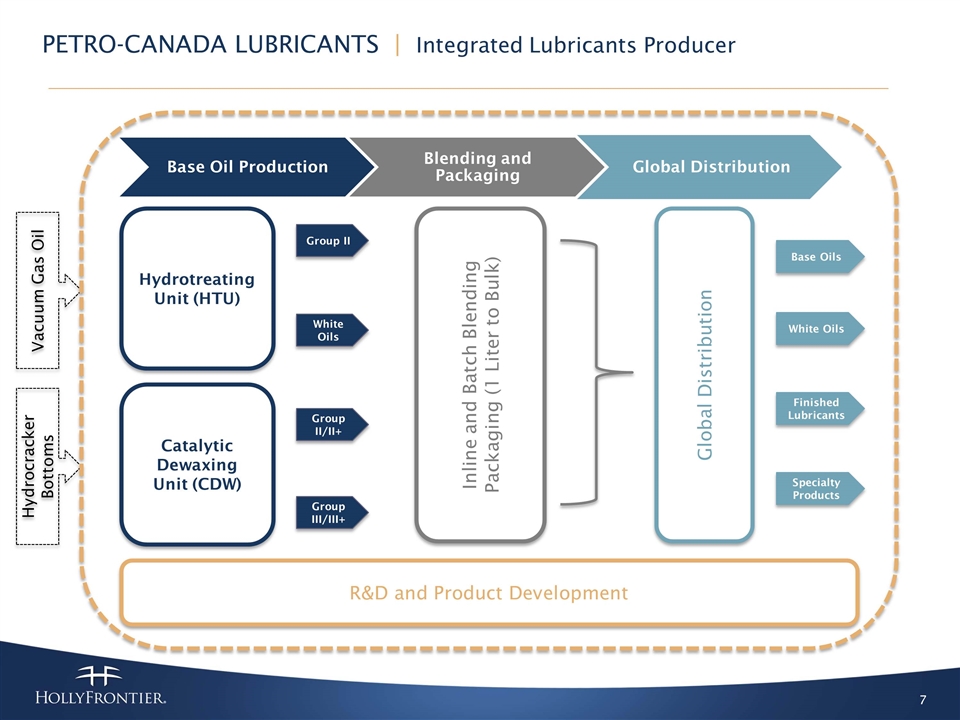

Hydrotreating Unit (HTU) Catalytic Dewaxing Unit (CDW) Inline and Batch Blending Packaging (1 Liter to Bulk) R&D and Product Development Global Distribution Group II White Oils Group II/II+ Group III/III+ Base Oils White Oils Finished Lubricants Specialty Products Vacuum Gas Oil Hydrocracker Bottoms PETRO-CANADA LUBRICANTS | Integrated Lubricants Producer Base Oil Production Blending and Packaging Global Distribution

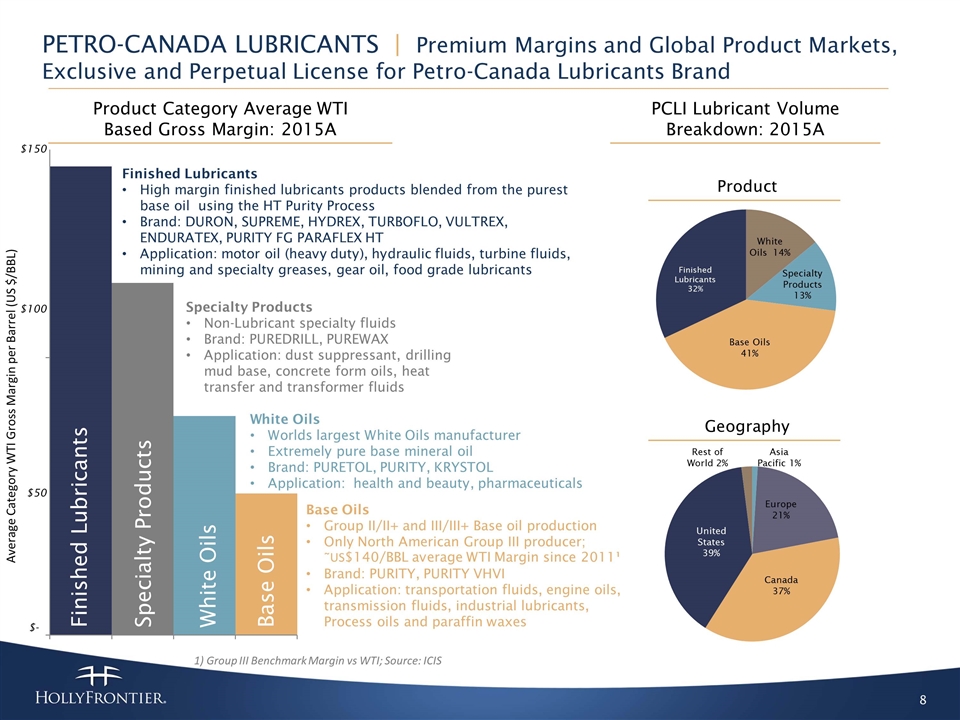

Finished Lubricants High margin finished lubricants products blended from the purest base oil using the HT Purity Process Brand: DURON, SUPREME, HYDREX, TURBOFLO, VULTREX, ENDURATEX, PURITY FG PARAFLEX HT Application: motor oil (heavy duty), hydraulic fluids, turbine fluids, mining and specialty greases, gear oil, food grade lubricants White Oils Worlds largest White Oils manufacturer Extremely pure base mineral oil Brand: PURETOL, PURITY, KRYSTOL Application: health and beauty, pharmaceuticals Base Oils Group II/II+ and III/III+ Base oil production Only North American Group III producer; ˜US$140/BBL average WTI Margin since 2011¹ Brand: PURITY, PURITY VHVI Application: transportation fluids, engine oils, transmission fluids, industrial lubricants, Process oils and paraffin waxes Specialty Products Non-Lubricant specialty fluids Brand: PUREDRILL, PUREWAX Application: dust suppressant, drilling mud base, concrete form oils, heat transfer and transformer fluids PCLI Lubricant Volume Breakdown: 2015A Product $150 Geography $- PETRO-CANADA LUBRICANTS | Premium Margins and Global Product Markets, Exclusive and Perpetual License for Petro-Canada Lubricants Brand $100 $50 Finished Lubricants Base Oils White Oils Specialty Products Product Category Average WTI Based Gross Margin: 2015A 1) Group III Benchmark Margin vs WTI; Source: ICIS

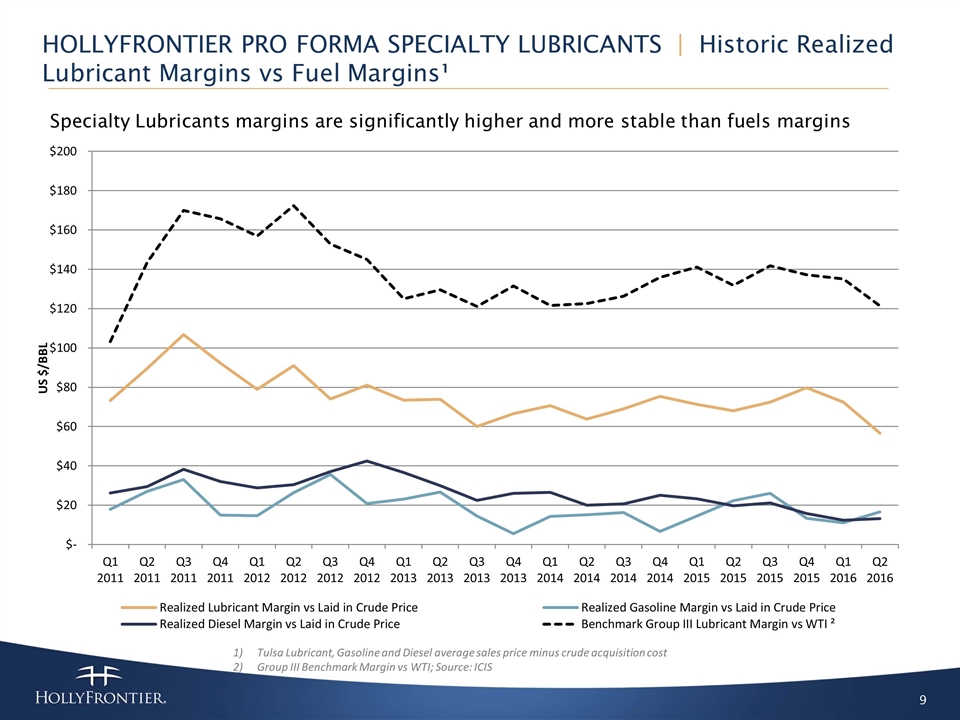

Specialty Lubricants margins are significantly higher and more stable than fuels margins Tulsa Lubricant, Gasoline and Diesel average sales price minus crude acquisition cost Group III Benchmark Margin vs WTI; Source: ICIS HOLLYFRONTIER PRO FORMA SPECIALTY LUBRICANTS | Historic Realized Lubricant Margins vs Fuel Margins¹

PETRO-CANADA LUBRICANTS | Synergy and Optimization Opportunity Expect US$20 MM+ in potential synergies by 2018 Tulsa product integration and product upgrade opportunity Sales and distribution synergy opportunity for Tulsa Products Transportation cost savings Additional Optimization Opportunity Feedstock replacement and optimization Increased production of higher value products Increase Group III/III+ Base Oil yield Increased penetration in niche high growth markets

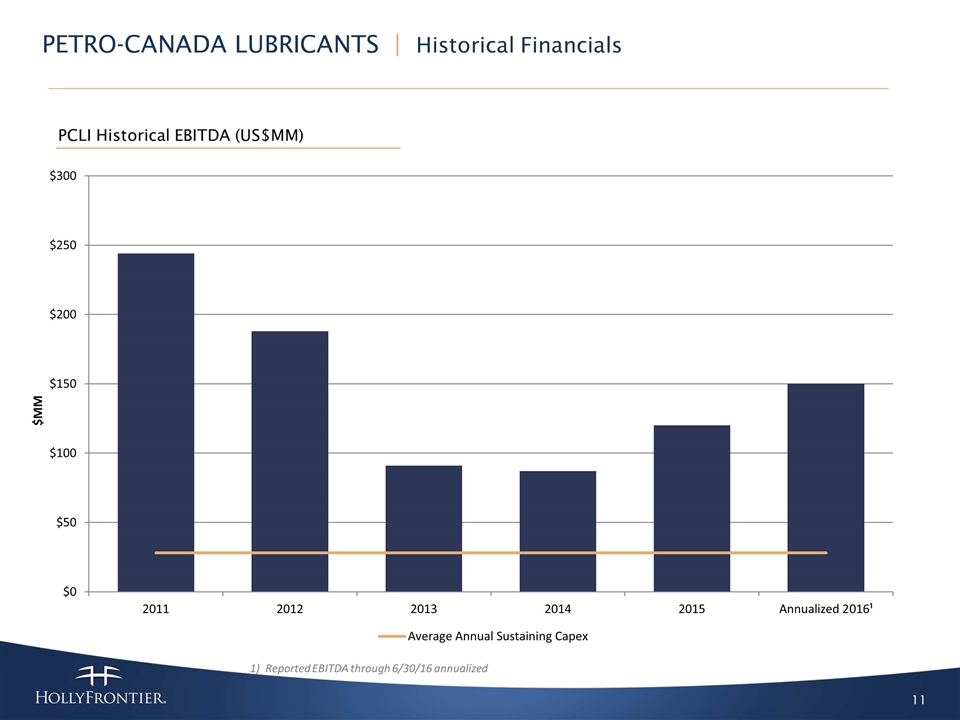

PETRO-CANADA LUBRICANTS | Historical Financials PCLI Historical EBITDA (US$MM) 1) Reported EBITDA through 6/30/16 annualized

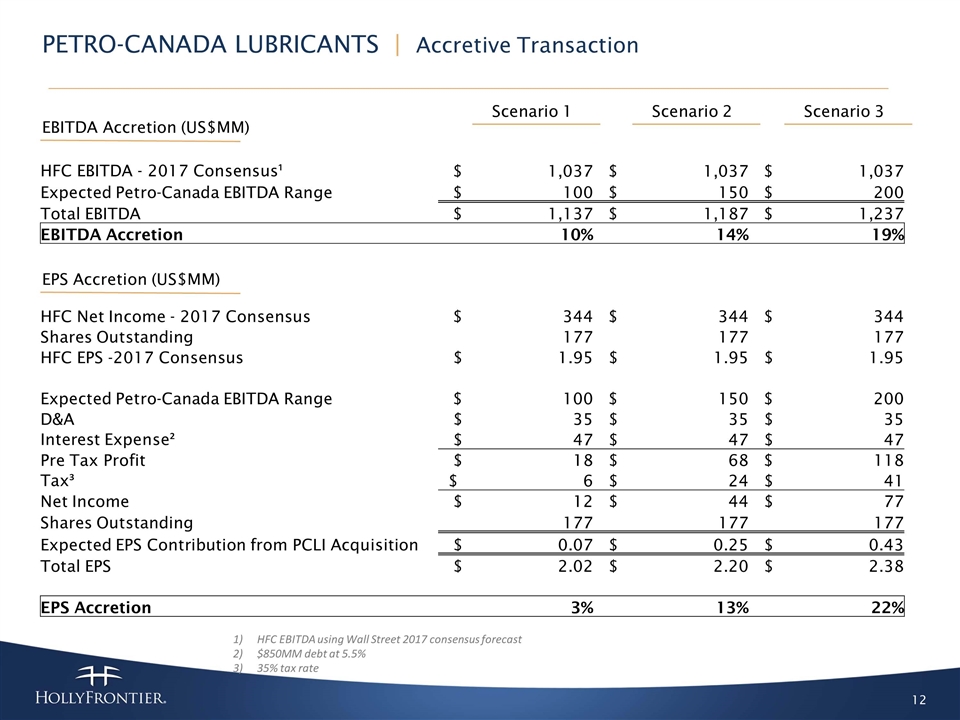

HFC EBITDA - 2017 Consensus¹ $ 1,037 $ 1,037 $ 1,037 Expected Petro-Canada EBITDA Range $ 100 $ 150 $ 200 Total EBITDA $ 1,137 $ 1,187 $ 1,237 EBITDA Accretion 10% 14% 19% HFC Net Income - 2017 Consensus $ 344 $ 344 $ 344 Shares Outstanding 177 177 177 HFC EPS -2017 Consensus $ 1.95 $ 1.95 $ 1.95 Expected Petro-Canada EBITDA Range $ 100 $ 150 $ 200 D&A $ 35 $ 35 $ 35 Interest Expense² $ 47 $ 47 $ 47 Pre Tax Profit $ 18 $ 68 $ 118 Tax³ $ 6 $ 24 $ 41 Net Income $ 12 $ 44 $ 77 Shares Outstanding 177 177 177 Expected EPS Contribution from PCLI Acquisition $ 0.07 $ 0.25 $ 0.43 Total EPS $ 2.02 $ 2.20 $ 2.38 EPS Accretion 3% 13% 22% PETRO-CANADA LUBRICANTS | Accretive Transaction Scenario 1 HFC EBITDA using Wall Street 2017 consensus forecast $850MM debt at 5.5% 35% tax rate EPS Accretion (US$MM) EBITDA Accretion (US$MM) Scenario 2 Scenario 3

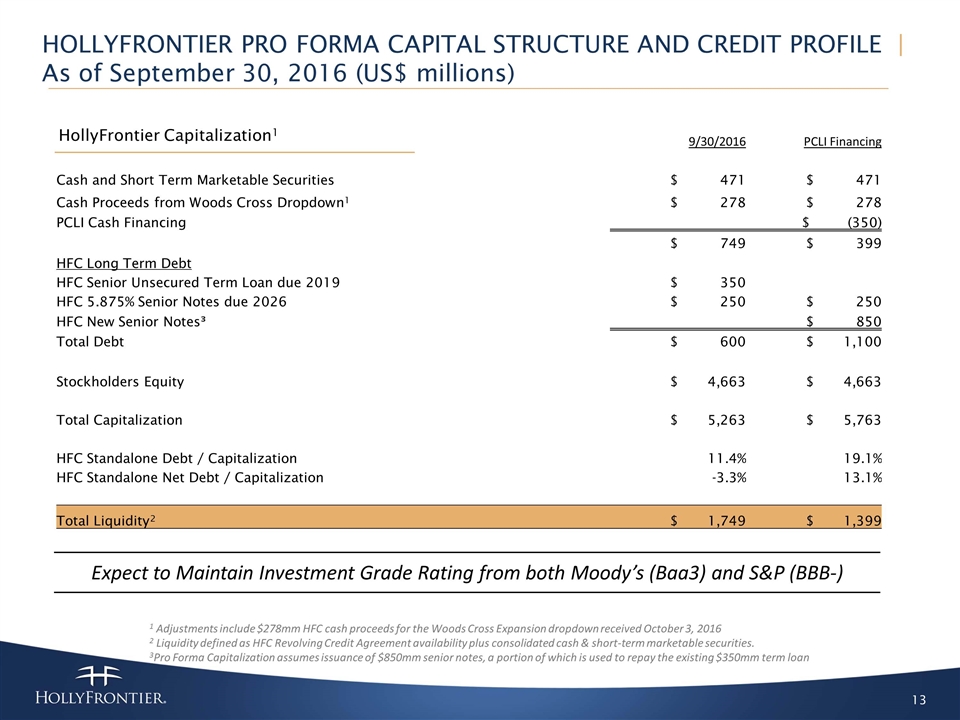

9/30/2016 PCLI Financing Cash and Short Term Marketable Securities $ 471 $ 471 Cash Proceeds from Woods Cross Dropdown1 $ 278 $ 278 PCLI Cash Financing $ (350) $ 749 $ 399 HFC Long Term Debt HFC Senior Unsecured Term Loan due 2019 $ 350 HFC 5.875% Senior Notes due 2026 $ 250 $ 250 HFC New Senior Notes³ $ 850 Total Debt $ 600 $ 1,100 Stockholders Equity $ 4,663 $ 4,663 Total Capitalization $ 5,263 $ 5,763 HFC Standalone Debt / Capitalization 11.4% 19.1% HFC Standalone Net Debt / Capitalization -3.3% 13.1% Total Liquidity2 $ 1,749 $ 1,399 HollyFrontier Capitalization1 HOLLYFRONTIER PRO FORMA CAPITAL STRUCTURE AND CREDIT PROFILE | As of September 30, 2016 (US$ millions) 1 Adjustments include $278mm HFC cash proceeds for the Woods Cross Expansion dropdown received October 3, 2016 2 Liquidity defined as HFC Revolving Credit Agreement availability plus consolidated cash & short-term marketable securities. 3Pro Forma Capitalization assumes issuance of $850mm senior notes, a portion of which is used to repay the existing $350mm term loan Expect to Maintain Investment Grade Rating from both Moody’s (Baa3) and S&P (BBB-)

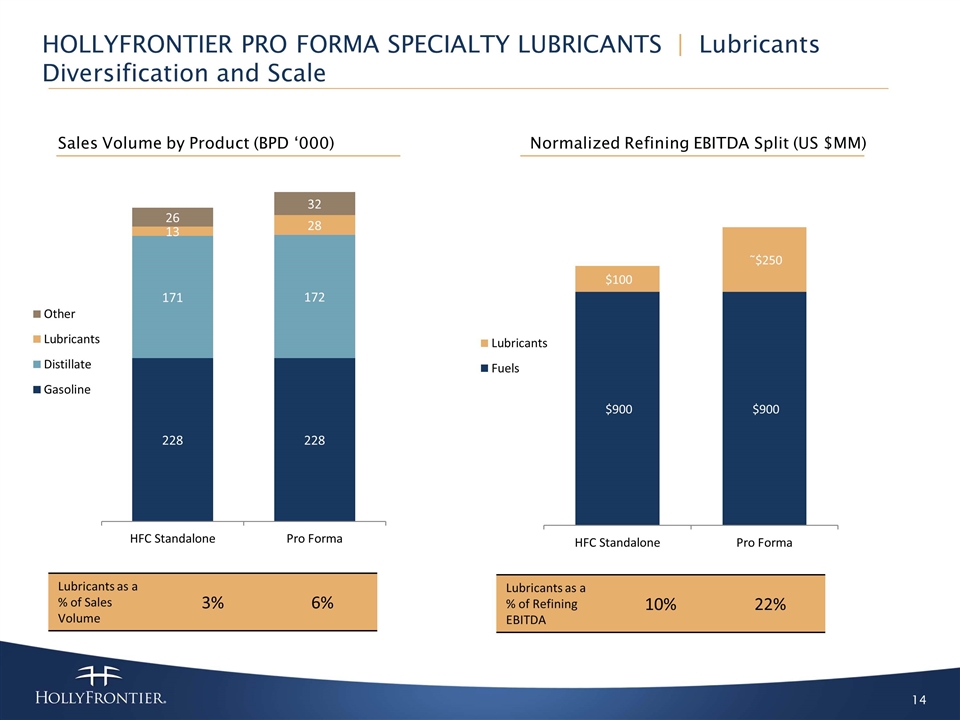

Sales Volume by Product (BPD ‘000) Normalized Refining EBITDA Split (US $MM) Lubricants as a % of Sales Volume 3% 6% Lubricants as a % of Refining EBITDA 10% 22% HOLLYFRONTIER PRO FORMA SPECIALTY LUBRICANTS | Lubricants Diversification and Scale

Appendix

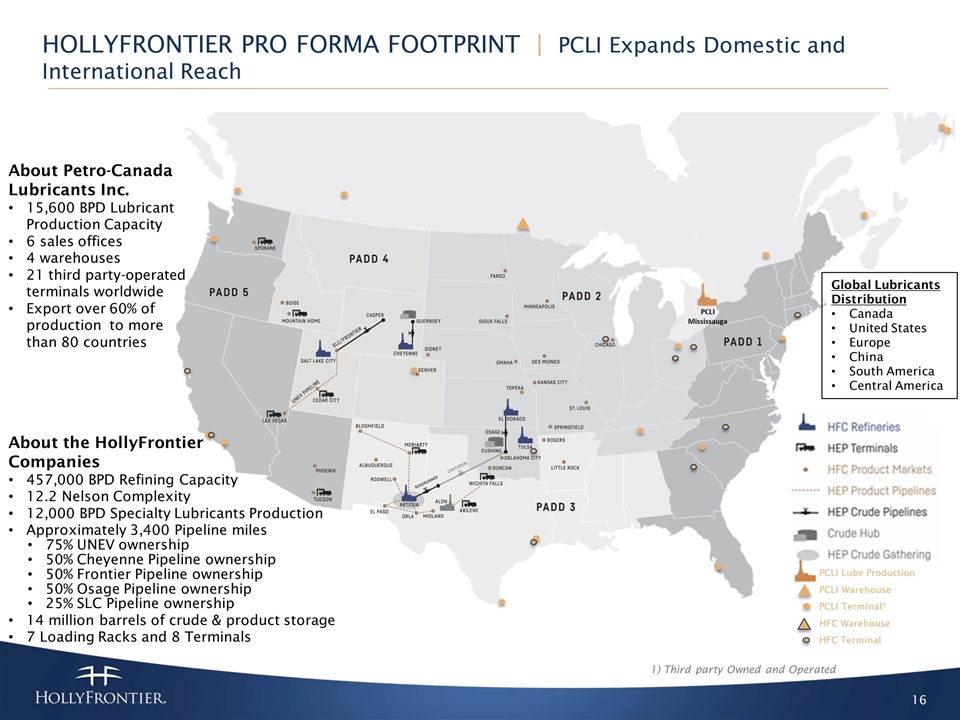

1) Third party Owned and Operated About Petro-Canada Lubricants Inc. 15,600 BPD Lubricant Production Capacity 6 sales offices 4 warehouses 21 third party-operated terminals worldwide Export over 60% of production to more than 80 countries HFC Lube Production PCLI Warehouse PCLI Terminal¹ PCLI Mississauga HOLLYFRONTIER PRO FORMA FOOTPRINT | PCLI Expands Domestic and International Reach About the HollyFrontier Companies 457,000 BPD Refining Capacity 12.2 Nelson Complexity 12,000 BPD Specialty Lubricants Production Approximately 3,400 Pipeline miles 75% UNEV ownership 50% Cheyenne Pipeline ownership 50% Frontier Pipeline ownership 50% Osage Pipeline ownership 25% SLC Pipeline ownership 14 million barrels of crude & product storage 7 Loading Racks and 8 Terminals Global Lubricants Distribution Canada United States Europe China South America Central America PCLI Lube Production PCLI Warehouse PCLI Terminal¹ HFC Warehouse HFC Terminal

DEFINITIONS Non GAAP measurements: We report certain financial measures that are not prescribed or authorized by U. S. generally accepted accounting principles ("GAAP"). We discuss management's reasons for reporting these non-GAAP measures below. Although management evaluates and presents these non-GAAP measures for the reasons described below, please be aware that these non-GAAP measures are not alternatives to revenue, operating income, income from continuing operations, net income, or any other comparable operating measure prescribed by GAAP. In addition, these non-GAAP financial measures may be calculated and/or presented differently than measures with the same or similar names that are reported by other companies, and as a result, the non-GAAP measures we report may not be comparable to those reported by others. EBITDA: Earnings before interest, taxes, depreciation and amortization, which we refer to as EBITDA, is calculated as net income plus (i) interest expense and loss of earl extinguishment of debt, net of interest income, (ii) income tax provision, and (iii) depreciation, depletion and amortization. EBITDA is not a calculation provided for under GAAP; however, the amounts included in the EBITDA calculation are derived from amounts included in our consolidated financial statements. EBITDA should not be considered as an alternative to net income or operating income as an indication of our operating performance or as an alternative to operating cash flow as a measure of liquidity. EBITDA is not necessarily comparable to similarly titled measures of other companies. EBITDA is presented here because it is a widely used financial indicator used by investors and analysts to measure performance. EBITDA is also used by our management for internal analysis and as a basis for financial covenants. Our historical EBITDA is reconciled to net income under the section entitled “Reconciliation to Amounts Reported Under Generally Accepted Accounting Principles” in HollyFrontier Corporation’s 2015 10-K filed February 24, 2016. Expected EBITDA: is based on HollyFrontier Corporation’s projections for the newly acquired Petro-Canada Lubricants Inc. Projects are based on historical EBITDA performance as reported by Suncor Energy combined with the expectation of future potential synergy and optimization opportunity.

2828 N. Harwood, Suite 1300 Dallas, Texas 75201 (214) 954-6510 www.hollyfrontier.com Julia Heidenreich | VP, Investor Relations Craig Biery | Manager, Investor Relations Investors@hollyfrontier.com 214-954-6150