Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - WASHINGTON REAL ESTATE INVESTMENT TRUST | q32016earningsrelease.htm |

| 8-K - 8-K - WASHINGTON REAL ESTATE INVESTMENT TRUST | q32016earningsrelease8-k.htm |

| ||||||

Washington Real Estate Investment Trust | ||||||

Third Quarter 2016 | ||||||

| ||||||

Supplemental Operating and Financial Data | ||||||

Contact: | 1775 Eye Street, NW | |||||

Tejal R. Engman | Suite 1000 | |||||

Director of Investor Relations | Washington, DC 20006 | |||||

E-mail: tengman@washreit.com | (202) 774-3200 | |||||

(301) 984-9610 fax | ||||||

Company Background and Highlights |

Third Quarter 2016 |

Washington Real Estate Investment Trust ("Washington REIT") is a self-administered equity real estate investment trust investing in income-producing properties in the greater Washington, DC region. Washington REIT has a diversified portfolio with investments in office, retail, and multifamily properties and land for development.

Third Quarter 2016 Highlights

• | Reported net income attributable to the controlling interests of $79.7 million, or $1.07 per diluted share, compared to $0.6 million, or $0.01 per diluted share, in the third quarter of 2015 |

• | Reported NAREIT Funds from Operations (FFO) of $33.0 million, or $0.44 per diluted share, compared to $29.9 million, or $0.44 per diluted share in the third quarter of 2015 |

• | Reported Core FFO of $0.45 per diluted share for the third quarter 2016 |

• | Achieved same-store Net Operating Income (NOI) growth of 1.9%, with same-store rental growth of 1.5% over third quarter 2015 |

• | Achieved same-store NOI growth of 3.5% for the retail portfolio, 1.7% for the multifamily portfolio and 1.0% for the office portfolio over third quarter 2015 |

• | Improved overall portfolio physical occupancy to 93.2%, 250 basis points higher than third quarter 2015 and 210 basis points higher than second quarter 2016 |

• | Raised the bottom end and thereby tightened our 2016 Core FFO guidance by $0.01 to a range of $1.75 to $1.77 per fully diluted share |

• | Completed the second sale transaction of the suburban Maryland office portfolio, comprising approximately 491,000 square feet for aggregate sale proceeds of $128.5 million |

• | Issued 904,000 shares at an average price of $33.32 per share through the Company’s At-the-Market (ATM) program, raising gross proceeds of approximately $30.1 million to fund value-add opportunities, including development, in 2017 |

Of the 288,000 square feet of commercial leases signed, there were 62,000 square feet of new leases and 226,000 square feet of renewal leases. New leases had an average rental rate increase of 12.7% over expiring lease rates and a weighted average lease term of 6.4 years. Commercial tenant improvement costs were $43.36 per square foot and leasing commissions were $15.02 per square foot for new leases. Renewal leases had an average rental rate increase of 15.8% from expiring lease rates and a weighted average lease term of 4.0 years. Commercial tenant improvement costs were $9.92 per square foot and leasing commissions were $4.00 per square foot for renewal leases.

On September 22, 2016, Washington REIT completed the second of two separate transactions for its suburban Maryland office portfolio. The sale of 51 Monroe and One Central Plaza, comprising approximately 491,000 square feet for aggregate sales proceeds of $128.5 million was structured in a reverse-1031 exchange in conjunction with the acquisition of Riverside Apartments.

In July 2016, Washington REIT entered into a seven year $150.0 million unsecured term loan maturing on July 21, 2023 with a deferred draw period of up to six months. The Company expects to draw on the term loan in the fourth quarter this year and the first quarter of 2017 to refinance pre-payable and maturing secured debt. Washington REIT entered into forward swaps from floating interest rates to a 2.86% all-in fixed interest rate for $150.0 million commencing on March 31, 2017.

During the quarter, Washington REIT issued 904,000 shares at an average price of $33.32 per share through the Company’s ATM program, raising gross proceeds of approximately $30.1 million. The proceeds are expected to be used to fund value-add opportunities, including development, in 2017. Subsequent to quarter end, the Company paid down approximately $102.0 million of secured debt, completing the targeted reduction of $266.0 million of secured debt in 2016.

As of September 30, 2016, Washington REIT owned a diversified portfolio of 49 properties, totaling approximately 6 million square feet of commercial space and 4,480 multifamily units, and land held for development. These 49 properties consist of 19 office properties, 16 retail centers and 14 multifamily properties. Washington REIT shares are publicly traded on the New York Stock Exchange (NYSE:WRE).

Company Background and Highlights |

Third Quarter 2016 |

Net Operating Income Contribution by Sector - Third Quarter 2016

Certain statements in our earnings release and on our conference call are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements in this earnings release preceded by, followed by or that include the words “believe,” “expect,” “intend,” “anticipate,” “potential,” “project,” “will” and other similar expressions. Such statements involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially. Such risks, uncertainties and other factors include, but are not limited to, the potential for federal government budget reductions, changes in general and local economic and real estate market conditions, the timing and pricing of lease transactions, the availability and cost of capital, fluctuations in interest rates, tenants' financial conditions, levels of competition, the effect of government regulation, the impact of newly adopted accounting principles, and other risks and uncertainties detailed from time to time in our filings with the SEC, including our 2015 Form 10-K and subsequent Quarterly Reports on Form 10-Q. We assume no obligation to update or supplement forward-looking statements that become untrue because of subsequent events.

Supplemental Financial and Operating Data Table of Contents | ||

September 30, 2016 | ||

Schedule | Page | |

Key Financial Data | ||

Capital Analysis | ||

Long Term Debt Analysis | ||

Portfolio Analysis | ||

Growth and Strategy | ||

Acquisition and Disposition Summary | ||

Tenant Analysis | ||

Appendix | ||

Consolidated Statements of Operations (In thousands, except per share data) (Unaudited) | |

Nine Months Ended | Three Months Ended | ||||||||||||||||||||||||||

OPERATING RESULTS | 9/30/2016 | 9/30/2015 | 9/30/2016 | 6/30/2016 | 3/31/2016 | 12/31/2015 | 9/30/2015 | ||||||||||||||||||||

Real estate rental revenue | $ | 236,312 | $ | 227,325 | $ | 79,770 | $ | 79,405 | $ | 77,137 | $ | 79,102 | $ | 78,243 | |||||||||||||

Real estate expenses | (86,073 | ) | (84,546 | ) | (29,164 | ) | (28,175 | ) | (28,734 | ) | (27,688 | ) | (28,109 | ) | |||||||||||||

150,239 | 142,779 | 50,606 | 51,230 | 48,403 | 51,414 | 50,134 | |||||||||||||||||||||

Real estate depreciation and amortization | (82,104 | ) | (80,127 | ) | (30,905 | ) | (25,161 | ) | (26,038 | ) | (28,808 | ) | (29,349 | ) | |||||||||||||

Income from real estate | 68,135 | 62,652 | 19,701 | 26,069 | 22,365 | 22,606 | 20,785 | ||||||||||||||||||||

Interest expense | (41,353 | ) | (44,534 | ) | (13,173 | ) | (13,820 | ) | (14,360 | ) | (15,012 | ) | (14,486 | ) | |||||||||||||

Other income | 205 | 547 | 83 | 83 | 39 | 162 | 163 | ||||||||||||||||||||

Acquisition costs | (1,178 | ) | (1,937 | ) | — | (1,024 | ) | (154 | ) | (119 | ) | (929 | ) | ||||||||||||||

Casualty gain and real estate impairment (loss), net | 676 | (5,909 | ) | — | 676 | — | — | — | |||||||||||||||||||

Gain on sale of real estate | 101,704 | 31,731 | 77,592 | 24,112 | — | 59,376 | — | ||||||||||||||||||||

Loss on extinguishment of debt | — | (119 | ) | — | — | — | — | — | |||||||||||||||||||

General and administrative | (15,018 | ) | (15,269 | ) | (4,539 | ) | (4,968 | ) | (5,511 | ) | (4,854 | ) | (4,911 | ) | |||||||||||||

Income tax benefit (expense) | 691 | (70 | ) | (2 | ) | 693 | — | (64 | ) | (42 | ) | ||||||||||||||||

Net income | 113,862 | 27,092 | 79,662 | 31,821 | 2,379 | 62,095 | 580 | ||||||||||||||||||||

Less: Net loss from noncontrolling interests | 32 | 515 | 12 | 15 | 5 | 38 | 67 | ||||||||||||||||||||

Net income attributable to the controlling interests | $ | 113,894 | $ | 27,607 | $ | 79,674 | $ | 31,836 | $ | 2,384 | $ | 62,133 | $ | 647 | |||||||||||||

Per Share Data: | |||||||||||||||||||||||||||

Net income attributable to the controlling interests | $ | 1.59 | $ | 0.40 | $ | 1.07 | $ | 0.44 | $ | 0.03 | $ | 0.91 | $ | 0.01 | |||||||||||||

Fully diluted weighted average shares outstanding | 71,520 | 68,290 | 74,133 | 71,912 | 68,488 | 68,371 | 68,305 | ||||||||||||||||||||

Percentage of Revenues: | |||||||||||||||||||||||||||

Real estate expenses | 36.4 | % | 37.2 | % | 36.6 | % | 35.5 | % | 37.3 | % | 35.0 | % | 35.9 | % | |||||||||||||

General and administrative | 6.4 | % | 6.7 | % | 5.7 | % | 6.3 | % | 7.1 | % | 6.1 | % | 6.3 | % | |||||||||||||

Ratios: | |||||||||||||||||||||||||||

Adjusted EBITDA / Interest expense | 3.3 | x | 2.9 | x | 3.5 | x | 3.4 | x | 3.0 | x | 3.1 | x | 3.2 | x | |||||||||||||

Net income attributable to the controlling interests / Real estate rental revenue | 48.2 | % | 12.1 | % | 99.9 | % | 40.1 | % | 3.1 | % | 78.5 | % | 0.8 | % | |||||||||||||

4

Consolidated Balance Sheets (In thousands) (Unaudited) | |

9/30/2016 | 6/30/2016 | 3/31/2016 | 12/31/2015 | 9/30/2015 | |||||||||||||||

Assets | |||||||||||||||||||

Land | $ | 573,315 | $ | 573,315 | $ | 561,256 | $ | 561,256 | $ | 572,880 | |||||||||

Income producing property | 2,092,201 | 2,072,166 | 2,095,306 | 2,076,541 | 2,074,425 | ||||||||||||||

2,665,516 | 2,645,481 | 2,656,562 | 2,637,797 | 2,647,305 | |||||||||||||||

Accumulated depreciation and amortization | (634,945 | ) | (613,194 | ) | (714,689 | ) | (692,608 | ) | (677,480 | ) | |||||||||

Net income producing property | 2,030,571 | 2,032,287 | 1,941,873 | 1,945,189 | 1,969,825 | ||||||||||||||

Development in progress, including land held for development | 37,463 | 35,760 | 27,313 | 36,094 | 35,256 | ||||||||||||||

Total real estate held for investment, net | 2,068,034 | 2,068,047 | 1,969,186 | 1,981,283 | 2,005,081 | ||||||||||||||

Investment in real estate held for sale, net | — | 41,704 | — | — | 5,010 | ||||||||||||||

Cash and cash equivalents | 8,588 | 22,379 | 23,575 | 23,825 | 21,012 | ||||||||||||||

Restricted cash | 10,091 | 11,054 | 9,889 | 13,383 | 12,544 | ||||||||||||||

Rents and other receivables, net of allowance for doubtful accounts | 62,989 | 58,970 | 63,863 | 62,890 | 62,306 | ||||||||||||||

Prepaid expenses and other assets | 100,788 | 99,150 | 118,790 | 109,787 | 117,167 | ||||||||||||||

Other assets related to properties sold or held for sale | — | 5,147 | — | — | 278 | ||||||||||||||

Total assets | $ | 2,250,490 | $ | 2,306,451 | $ | 2,185,303 | $ | 2,191,168 | $ | 2,223,398 | |||||||||

Liabilities | |||||||||||||||||||

Notes payable | $ | 744,063 | $ | 743,769 | $ | 743,475 | $ | 743,181 | $ | 742,971 | |||||||||

Mortgage notes payable | 251,232 | 252,044 | 333,853 | 418,052 | 418,400 | ||||||||||||||

Lines of credit | 125,000 | 269,000 | 215,000 | 105,000 | 195,000 | ||||||||||||||

Accounts payable and other liabilities | 54,629 | 52,722 | 56,348 | 45,367 | 54,131 | ||||||||||||||

Dividend payable | — | — | — | 20,434 | — | ||||||||||||||

Advance rents | 10,473 | 10,178 | 11,589 | 12,744 | 10,766 | ||||||||||||||

Tenant security deposits | 8,634 | 8,290 | 9,604 | 9,378 | 9,225 | ||||||||||||||

Liabilities related to properties sold or held for sale | — | 2,338 | — | — | 329 | ||||||||||||||

Total liabilities | 1,194,031 | 1,338,341 | 1,369,869 | 1,354,156 | 1,430,822 | ||||||||||||||

Equity | |||||||||||||||||||

Preferred shares; $0.01 par value; 10,000 shares authorized | — | — | — | — | — | ||||||||||||||

Shares of beneficial interest, $0.01 par value; 100,000 shares authorized | 745 | 737 | 683 | 682 | 682 | ||||||||||||||

Additional paid-in capital | 1,368,438 | 1,338,101 | 1,193,750 | 1,193,298 | 1,192,202 | ||||||||||||||

Distributions in excess of net income | (309,042 | ) | (366,352 | ) | (376,041 | ) | (357,781 | ) | (399,421 | ) | |||||||||

Accumulated other comprehensive loss | (4,870 | ) | (5,609 | ) | (4,225 | ) | (550 | ) | (2,288 | ) | |||||||||

Total shareholders' equity | 1,055,271 | 966,877 | 814,167 | 835,649 | 791,175 | ||||||||||||||

Noncontrolling interests in subsidiaries | 1,188 | 1,233 | 1,267 | 1,363 | 1,401 | ||||||||||||||

Total equity | 1,056,459 | 968,110 | 815,434 | 837,012 | 792,576 | ||||||||||||||

Total liabilities and equity | $ | 2,250,490 | $ | 2,306,451 | $ | 2,185,303 | $ | 2,191,168 | $ | 2,223,398 | |||||||||

5

Funds from Operations (In thousands, except per share data) (Unaudited) | |

Nine Months Ended | Three Months Ended | ||||||||||||||||||||||||||

9/30/2016 | 9/30/2015 | 9/30/2016 | 6/30/2016 | 3/31/2016 | 12/31/2015 | 9/30/2015 | |||||||||||||||||||||

Funds from operations(1) | |||||||||||||||||||||||||||

Net income | $ | 113,862 | $ | 27,092 | $ | 79,662 | $ | 31,821 | $ | 2,379 | $ | 62,095 | $ | 580 | |||||||||||||

Real estate depreciation and amortization | 82,104 | 80,127 | 30,905 | 25,161 | 26,038 | 28,808 | 29,349 | ||||||||||||||||||||

Gain on sale of depreciable real estate | (101,704 | ) | (30,277 | ) | (77,592 | ) | (24,112 | ) | — | (59,376 | ) | — | |||||||||||||||

NAREIT funds from operations (FFO) | 94,262 | 76,942 | 32,975 | 32,870 | 28,417 | 31,527 | 29,929 | ||||||||||||||||||||

Loss on extinguishment of debt | — | 119 | — | — | — | — | — | ||||||||||||||||||||

Casualty (gain) and real estate impairment loss, net | (676 | ) | 5,909 | — | (676 | ) | — | — | — | ||||||||||||||||||

(Gain) loss on sale of non depreciable real estate | — | (1,404 | ) | — | — | — | — | 50 | |||||||||||||||||||

Severance expense | 828 | 1,001 | 242 | 126 | 460 | — | — | ||||||||||||||||||||

Relocation expense | 16 | 90 | 16 | — | — | — | — | ||||||||||||||||||||

Acquisition and structuring expenses | 1,403 | 2,532 | 37 | 1,107 | 259 | 189 | 1,034 | ||||||||||||||||||||

Core FFO (1) | $ | 95,833 | $ | 85,189 | $ | 33,270 | $ | 33,427 | $ | 29,136 | $ | 31,716 | $ | 31,013 | |||||||||||||

Allocation to participating securities(2) | (329 | ) | (184 | ) | (200 | ) | (99 | ) | (90 | ) | (180 | ) | (47 | ) | |||||||||||||

NAREIT FFO per share - basic | $ | 1.32 | $ | 1.13 | $ | 0.44 | $ | 0.46 | $ | 0.41 | $ | 0.46 | $ | 0.44 | |||||||||||||

NAREIT FFO per share - fully diluted | $ | 1.31 | $ | 1.12 | $ | 0.44 | $ | 0.46 | $ | 0.41 | $ | 0.46 | $ | 0.44 | |||||||||||||

Core FFO per share - fully diluted | $ | 1.34 | $ | 1.24 | $ | 0.45 | $ | 0.46 | $ | 0.42 | $ | 0.46 | $ | 0.45 | |||||||||||||

Common dividend per share | $ | 0.90 | $ | 0.90 | $ | 0.30 | $ | 0.30 | $ | 0.30 | $ | 0.30 | $ | 0.30 | |||||||||||||

Average shares - basic | 71,348 | 68,168 | 73,994 | 71,719 | 68,301 | 68,204 | 68,186 | ||||||||||||||||||||

Average shares - fully diluted (for FFO and FAD) | 71,520 | 68,290 | 74,133 | 71,912 | 68,488 | 68,371 | 68,305 | ||||||||||||||||||||

(1) See "Supplemental Definitions" on page 27 of this supplemental for the definitions of FFO and Core FFO. | |||||||||||||||||||||||||||

(2) Adjustment to the numerators for FFO and Core FFO per share calculations when applying the two-class method for calculating EPS. | |||||||||||||||||||||||||||

6

Funds Available for Distribution (In thousands, except per share data) (Unaudited) | |

Nine Months Ended | Three Months Ended | ||||||||||||||||||||||||||

9/30/2016 | 9/30/2015 | 9/30/2016 | 6/30/2016 | 3/31/2016 | 12/31/2015 | 9/30/2015 | |||||||||||||||||||||

Funds available for distribution(1) | |||||||||||||||||||||||||||

NAREIT FFO | $ | 94,262 | $ | 76,942 | $ | 32,975 | $ | 32,870 | $ | 28,417 | $ | 31,527 | $ | 29,929 | |||||||||||||

Non-cash loss on extinguishment of debt | — | 119 | — | — | — | — | — | ||||||||||||||||||||

Tenant improvements and incentives | (14,071 | ) | (12,378 | ) | (4,889 | ) | (7,639 | ) | (1,543 | ) | (6,792 | ) | (5,231 | ) | |||||||||||||

Leasing commissions | (5,616 | ) | (4,469 | ) | (1,251 | ) | (3,350 | ) | (1,015 | ) | (2,426 | ) | (1,714 | ) | |||||||||||||

Recurring capital improvements | (3,291 | ) | (2,752 | ) | (1,146 | ) | (1,237 | ) | (908 | ) | (3,296 | ) | (1,326 | ) | |||||||||||||

Straight-line rent, net | (2,245 | ) | (811 | ) | (682 | ) | (880 | ) | (683 | ) | (533 | ) | (680 | ) | |||||||||||||

Non-cash fair value interest expense | 132 | 109 | 46 | 44 | 42 | 41 | 38 | ||||||||||||||||||||

Non-real estate depreciation and amortization | 2,672 | 2,999 | 846 | 876 | 950 | 980 | 938 | ||||||||||||||||||||

Amortization of lease intangibles, net | 2,694 | 2,651 | 898 | 853 | 943 | 925 | 913 | ||||||||||||||||||||

Amortization and expensing of restricted share and unit compensation | 2,661 | 3,884 | 292 | 850 | 1,519 | 1,123 | 863 | ||||||||||||||||||||

Funds available for distribution (FAD) | 77,198 | 66,294 | 27,089 | 22,387 | 27,722 | 21,549 | 23,730 | ||||||||||||||||||||

(Loss) gain on sale of non depreciable real estate | — | (1,404 | ) | — | — | — | — | 50 | |||||||||||||||||||

Non-share-based severance expense | 407 | 196 | 242 | 126 | 39 | — | — | ||||||||||||||||||||

Relocation expense | 16 | 107 | 16 | — | — | — | — | ||||||||||||||||||||

Acquisition and structuring expenses | 1,403 | 2,532 | 37 | 1,107 | 259 | 189 | 1,034 | ||||||||||||||||||||

Casualty (gain) and real estate impairment loss, net | (676 | ) | 5,909 | — | (676 | ) | — | — | — | ||||||||||||||||||

Core FAD (1) | $ | 78,348 | $ | 73,634 | $ | 27,384 | $ | 22,944 | $ | 28,020 | $ | 21,738 | $ | 24,814 | |||||||||||||

(1) See "Supplemental Definitions" on page 29 of this supplemental for the definitions of FAD and Core FAD. | |||||||||||||||||||||||||||

7

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) (In thousands) (Unaudited) | |

Nine Months Ended | Three Months Ended | ||||||||||||||||||||||||||

9/30/2016 | 9/30/2015 | 9/30/2016 | 6/30/2016 | 3/31/2016 | 12/31/2015 | 9/30/2015 | |||||||||||||||||||||

Adjusted EBITDA (1) | |||||||||||||||||||||||||||

Net income | $ | 113,862 | $ | 27,092 | $ | 79,662 | $ | 31,821 | $ | 2,379 | $ | 62,095 | $ | 580 | |||||||||||||

Add: | |||||||||||||||||||||||||||

Interest expense | 41,353 | 44,534 | 13,173 | 13,820 | 14,360 | 15,012 | 14,486 | ||||||||||||||||||||

Real estate depreciation and amortization | 82,104 | 80,127 | 30,905 | 25,161 | 26,038 | 28,808 | 29,349 | ||||||||||||||||||||

Income tax (benefit) expense | (691 | ) | 70 | 2 | (693 | ) | — | 65 | 42 | ||||||||||||||||||

Casualty (gain) and real estate impairment loss, net | (676 | ) | 5,909 | — | (676 | ) | — | — | — | ||||||||||||||||||

Non-real estate depreciation | 405 | 449 | 101 | 152 | 152 | 149 | 168 | ||||||||||||||||||||

Severance expense | 828 | 1,001 | 242 | 126 | 460 | — | — | ||||||||||||||||||||

Relocation expense | 16 | 90 | 16 | — | — | — | — | ||||||||||||||||||||

Acquisition and structuring expenses | 1,403 | 2,532 | 37 | 1,107 | 259 | 189 | 1,034 | ||||||||||||||||||||

Less: | |||||||||||||||||||||||||||

Net (gain) loss on sale of real estate | (101,704 | ) | (31,681 | ) | (77,592 | ) | (24,112 | ) | — | (59,376 | ) | 50 | |||||||||||||||

Loss on extinguishment of debt | — | 119 | — | — | — | — | — | ||||||||||||||||||||

Adjusted EBITDA | $ | 136,900 | $ | 130,242 | $ | 46,546 | $ | 46,706 | $ | 43,648 | $ | 46,942 | $ | 45,709 | |||||||||||||

(1) Adjusted EBITDA is earnings before interest expense, taxes, depreciation, amortization, gain on sale of real estate, real estate impairment, gain/loss on extinguishment of debt, severance expense, relocation expense, acquisition and structuring expenses, gain from non-disposal activities and allocations to noncontrolling interests. We consider Adjusted EBITDA to be an appropriate supplemental performance measure because it permits investors to view income from operations without the effect of depreciation, and the cost of debt or non-operating gains and losses. Adjusted EBITDA is a non-GAAP measure. | |||||||||||||||||||||||||||

8

Long Term Debt Analysis ($'s in thousands) | |

9/30/2016 | 6/30/2016 | 3/31/2016 | 12/31/2015 | 9/30/2015 | |||||||||||||||

Balances Outstanding | |||||||||||||||||||

Secured | |||||||||||||||||||

Conventional fixed rate | $ | 251,232 | $ | 252,044 | $ | 333,853 | $ | 418,052 | $ | 418,400 | |||||||||

Unsecured | |||||||||||||||||||

Fixed rate bonds | 594,905 | 594,658 | 594,411 | 594,164 | 594,002 | ||||||||||||||

Term loans | 149,158 | 149,111 | 149,064 | 149,017 | 148,969 | ||||||||||||||

Credit facility | 125,000 | 269,000 | 215,000 | 105,000 | 195,000 | ||||||||||||||

Unsecured total | 869,063 | 1,012,769 | 958,475 | 848,181 | 937,971 | ||||||||||||||

Total | $ | 1,120,295 | $ | 1,264,813 | $ | 1,292,328 | $ | 1,266,233 | $ | 1,356,371 | |||||||||

Weighted Average Interest Rates | |||||||||||||||||||

Secured | |||||||||||||||||||

Conventional fixed rate | 5.3 | % | 5.3 | % | 5.4 | % | 5.2 | % | 5.2 | % | |||||||||

Unsecured | |||||||||||||||||||

Fixed rate bonds | 4.7 | % | 4.7 | % | 4.7 | % | 4.7 | % | 4.7 | % | |||||||||

Term loans (1) | 2.7 | % | 2.7 | % | 2.7 | % | 2.7 | % | 2.7 | % | |||||||||

Credit facility | 1.5 | % | 1.4 | % | 1.4 | % | 1.4 | % | 1.2 | % | |||||||||

Unsecured total | 3.9 | % | 3.6 | % | 3.7 | % | 4.0 | % | 3.7 | % | |||||||||

Weighted Average | 4.2 | % | 3.9 | % | 4.1 | % | 4.4 | % | 4.2 | % | |||||||||

(1) Washington REIT entered into an interest rate swap to swap from a LIBOR plus 110 basis points floating interest rate to a 2.72% all-in fixed interest rate commencing October 15, 2015. | |||||||||||||||||||

Note: The current debt balances outstanding are shown net of discounts, premiums and unamortized debt costs (see page 10 of this Supplemental). | |||||||||||||||||||

9

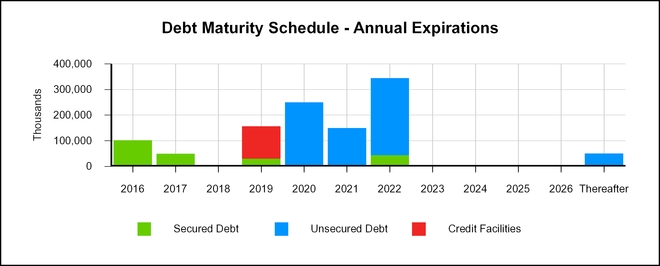

Long Term Debt Maturities (in thousands, except average interest rates) | |

Future Maturities of Debt | |||||||||||||||||

Year | Secured Debt | Unsecured Debt | Credit Facilities | Total Debt | Avg Interest Rate | ||||||||||||

2016 | $ | 101,865 | (1) | $ | — | $ | — | $ | 101,865 | 7.3% | |||||||

2017 | 49,038 | — | — | 49,038 | 3.2% | ||||||||||||

2018 | — | — | — | — | |||||||||||||

2019 | 31,280 | — | 125,000 | (2) | 156,280 | 2.3% | |||||||||||

2020 | — | 250,000 | — | 250,000 | 5.1% | ||||||||||||

2021 | — | 150,000 | (3) | — | 150,000 | 2.7% | |||||||||||

2022 | 44,517 | 300,000 | — | 344,517 | 4.0% | ||||||||||||

2023 | — | — | — | — | |||||||||||||

2024 | — | — | — | — | |||||||||||||

2025 | — | — | — | — | |||||||||||||

2026 | — | — | — | — | |||||||||||||

Thereafter | — | 50,000 | — | 50,000 | 7.4% | ||||||||||||

Scheduled principal payments | $ | 226,700 | $ | 750,000 | $ | 125,000 | $ | 1,101,700 | 4.2% | ||||||||

Scheduled amortization payments | 20,649 | — | — | 20,649 | 4.8% | ||||||||||||

Net discounts/premiums | 4,307 | (2,069 | ) | — | 2,238 | ||||||||||||

Loan costs, net of amortization | (424 | ) | (3,868 | ) | — | (4,292 | ) | ||||||||||

Total maturities | $ | 251,232 | $ | 744,063 | $ | 125,000 | $ | 1,120,295 | 4.2% | ||||||||

Weighted average maturity =4.4 years

(1) The maturity date of the $101.9 million mortgage note secured by 2445 M Street was January 6, 2017, but could be prepaid, without penalty, beginning on October 6, 2016. We prepaid the mortgage on October 6, 2016, after providing notice to the lender of our intention to prepay in September 2016. Therefore, this mortgage note is shown as a 2016 maturity in the above chart.

(2) Maturity date for credit facility may be extended for up to two additional 6-month periods at Washington REIT's option.

(3) Washington REIT entered into an interest rate swap to swap from a LIBOR plus 110 basis points floating interest rate to a 2.72% all-in fixed interest rate commencing October 15, 2015.

10

Debt Covenant Compliance | |

Unsecured Notes Payable | Unsecured Line of Credit and Term Loans | ||||||||

Quarter Ended September 30, 2016 | Covenant | Quarter Ended September 30, 2016 | Covenant | ||||||

% of Total Indebtedness to Total Assets(1) | 39.9 | % | ≤ 65.0% | N/A | N/A | ||||

Ratio of Income Available for Debt Service to Annual Debt Service | 3.6 | ≥ 1.5 | N/A | N/A | |||||

% of Secured Indebtedness to Total Assets(1) | 8.9 | % | ≤ 40.0% | N/A | N/A | ||||

Ratio of Total Unencumbered Assets(2) to Total Unsecured Indebtedness | 2.8 | ≥ 1.5 | N/A | N/A | |||||

% of Net Consolidated Total Indebtedness to Consolidated Total Asset Value(3) | N/A | N/A | 35.7 | % | ≤ 60.0% | ||||

Ratio of Consolidated Adjusted EBITDA(4) to Consolidated Fixed Charges(5) | N/A | N/A | 3.39 | ≥ 1.50 | |||||

% of Consolidated Secured Indebtedness to Consolidated Total Asset Value(3) | N/A | N/A | 8.1 | % | ≤ 40.0% | ||||

% of Consolidated Unsecured Indebtedness to Unencumbered Pool Value(6) | N/A | N/A | 32.1 | % | ≤ 60.0% | ||||

Ratio of Unencumbered Adjusted Net Operating Income to Consolidated Unsecured Interest Expense | N/A | N/A | 4.49 | ≥ 1.75 | |||||

(1) Total Assets is calculated by applying a capitalization rate of 7.50% to the EBITDA(4) from the last four consecutive quarters, excluding EBITDA from acquired, disposed, and non-stabilized development properties. | |||||||||

(2) Total Unencumbered Assets is calculated by applying a capitalization rate of 7.50% to the EBITDA(4) from unencumbered properties from the last four consecutive quarters, excluding EBITDA from acquired, disposed, and non-stabilized development properties. | |||||||||

(3) Consolidated Total Asset Value is the sum of unrestricted cash plus the quotient of applying a capitalization rate to the annualized NOI from the most recently ended quarter for each asset class, excluding NOI from disposed properties, acquisitions during the past 6 quarters, development, major redevelopment and low occupancy properties. To this amount, we add the purchase price of acquisitions during the past 6 quarters plus values for development, major redevelopment and low occupancy properties. | |||||||||

(4) Consolidated Adjusted EBITDA is defined as earnings before noncontrolling interests, depreciation, amortization, interest expense, income tax expense, acquisition costs, extraordinary, unusual or nonrecurring transactions including sale of assets, impairment, gains and losses on extinguishment of debt and other non-cash charges. | |||||||||

(5) Consolidated Fixed Charges consist of interest expense excluding capitalized interest and amortization of deferred financing costs, principal payments and preferred dividends, if any. | |||||||||

(6) Unencumbered Pool Value is the sum of unrestricted cash plus the quotient of applying a capitalization rate to the annualized NOI from unencumbered properties from the most recently ended quarter for each asset class excluding NOI from disposed properties, acquisitions during the past 6 quarters, development, major redevelopment and low occupancy properties. To this we add the purchase price of unencumbered acquisitions during the past 6 quarters and values for unencumbered development, major redevelopment and low occupancy properties. | |||||||||

11

Capital Analysis (In thousands, except per share amounts) | |

Three Months Ended | |||||||||||||||||||||||||||

9/30/2016 | 6/30/2016 | 3/31/2016 | 12/31/2015 | 9/30/2015 | |||||||||||||||||||||||

Market Data | |||||||||||||||||||||||||||

Shares Outstanding | $ | 74,579 | $ | 73,651 | $ | 68,326 | $ | 68,191 | $ | 68,180 | |||||||||||||||||

Market Price per Share | 31.12 | 31.46 | 29.21 | 27.06 | 24.93 | ||||||||||||||||||||||

Equity Market Capitalization | $ | 2,320,898 | $ | 2,317,060 | $ | 1,995,802 | $ | 1,845,248 | $ | 1,699,727 | |||||||||||||||||

Total Debt | $ | 1,120,295 | $ | 1,264,813 | $ | 1,292,328 | $ | 1,266,233 | $ | 1,356,371 | |||||||||||||||||

Total Market Capitalization | $ | 3,441,193 | $ | 3,581,873 | $ | 3,288,130 | $ | 3,111,481 | $ | 3,056,098 | |||||||||||||||||

Total Debt to Market Capitalization | 0.33 | :1 | 0.35 | :1 | 0.39 | :1 | 0.41 | :1 | 0.44 | :1 | |||||||||||||||||

Earnings to Fixed Charges(1) | 6.9x | 3.3x | 1.2x | 5.1x | 1.0x | ||||||||||||||||||||||

Debt Service Coverage Ratio(2) | 3.3x | 3.2x | 2.8x | 2.9x | 2.9x | ||||||||||||||||||||||

Dividend Data | Nine Months Ended | Three Months Ended | |||||||||||||||||||||||||

9/30/2016 | 9/30/2015 | 9/30/2016 | 6/30/2016 | 3/31/2016 | 12/31/2015 | 9/30/2015 | |||||||||||||||||||||

Total Dividends Declared | $ | 65,155 | $ | 61,510 | $ | 22,364 | $ | 22,147 | $ | 20,644 | $ | 20,493 | $ | 20,491 | |||||||||||||

Common Dividend Declared per Share | $ | 0.90 | $ | 0.90 | $ | 0.30 | $ | 0.30 | $ | 0.30 | $ | 0.30 | $ | 0.30 | |||||||||||||

Payout Ratio (Core FFO basis) | 67.2 | % | 72.6 | % | 66.7 | % | 65.2 | % | 71.4 | % | 65.0 | % | 66.7 | % | |||||||||||||

Payout Ratio (Core FAD basis) | 82.6 | % | 83.3 | % | 81.1 | % | 93.8 | % | 73.2 | % | 93.8 | % | 83.3 | % | |||||||||||||

(1) The ratio of earnings to fixed charges is computed by dividing earnings by fixed charges. For this purpose, earnings consist of income from continuing operations attributable to the controlling interests plus fixed charges, less capitalized interest. Fixed charges consist of interest expense, including amortized costs of debt issuance, plus interest costs capitalized. The earnings to fixed charges ratios for the three months ended September 30, 2016, June 30, 2016 and December 31, 2015 include gains on the sale of real estate of $77.6 million, $24.1 million and $59.4 million, respectively. | |||||||||||||||||||||||||||

(2) Debt service coverage ratio is computed by dividing Adjusted EBITDA (see page 8) by interest expense and principal amortization. | |||||||||||||||||||||||||||

12

Same-Store Portfolio Net Operating Income (NOI) Growth & Rental Rate Growth 2016 vs. 2015 | |

Nine Months Ended September 30, | Rental Rate | Three Months Ended September 30, | Rental Rate | ||||||||||||||||||||||||

2016 | 2015 | % Change | Growth | 2016 | 2015 | % Change | Growth | ||||||||||||||||||||

Cash Basis: | |||||||||||||||||||||||||||

Multifamily | $ | 24,604 | $ | 23,824 | 3.3 | % | 0.2 | % | $ | 8,184 | $ | 8,045 | 1.7 | % | 0.5 | % | |||||||||||

Office | 59,546 | 58,477 | 1.8 | % | 1.1 | % | 19,969 | 19,719 | 1.3 | % | 0.8 | % | |||||||||||||||

Retail | 33,173 | 33,214 | (0.1 | )% | 3.1 | % | 11,463 | 11,044 | 3.8 | % | 2.5 | % | |||||||||||||||

Overall Same-Store Portfolio (1) | $ | 117,323 | $ | 115,515 | 1.6 | % | 1.4 | % | $ | 39,616 | $ | 38,808 | 2.1 | % | 1.1 | % | |||||||||||

GAAP Basis: | |||||||||||||||||||||||||||

Multifamily | $ | 24,584 | $ | 23,812 | 3.2 | % | 0.1 | % | $ | 8,179 | $ | 8,039 | 1.7 | % | 0.5 | % | |||||||||||

Office | 58,792 | 57,423 | 2.4 | % | 1.7 | % | 19,565 | 19,372 | 1.0 | % | 1.7 | % | |||||||||||||||

Retail | 34,204 | 33,946 | 0.8 | % | 2.8 | % | 11,834 | 11,438 | 3.5 | % | 2.0 | % | |||||||||||||||

Overall Same-Store Portfolio (1) | $ | 117,580 | $ | 115,181 | 2.1 | % | 1.6 | % | $ | 39,578 | $ | 38,849 | 1.9 | % | 1.5 | % | |||||||||||

(1) Non same-store properties were: |

Acquisitions: |

Multifamily - The Wellington and Riverside Apartments |

Development/Redevelopment: |

Multifamily - The Maxwell |

Office - Silverline Center and The Army Navy Club Building |

Sold properties: |

Multifamily - Country Club Towers and Munson Hill Towers |

Office - Dulles Station II, Wayne Plaza, 600 Jefferson Plaza, 6110 Executive Boulevard, West Gude, 51 Monroe Street and One Central Plaza |

Retail - Montgomery Village Center |

13

Same-Store Portfolio Net Operating Income (NOI) Detail (In thousands) | |

Three Months Ended September 30, 2016 | |||||||||||||||||||

Multifamily | Office | Retail | Corporate and Other | Total | |||||||||||||||

Real estate rental revenue | |||||||||||||||||||

Same-store portfolio | $ | 13,936 | $ | 31,900 | $ | 15,404 | $ | — | $ | 61,240 | |||||||||

Non same-store - acquired and in development (1) | 9,784 | 8,746 | — | — | 18,530 | ||||||||||||||

Total | 23,720 | 40,646 | 15,404 | — | 79,770 | ||||||||||||||

Real estate expenses | |||||||||||||||||||

Same-store portfolio | 5,757 | 12,335 | 3,570 | — | 21,662 | ||||||||||||||

Non same-store - acquired and in development (1) | 3,998 | 3,504 | — | — | 7,502 | ||||||||||||||

Total | 9,755 | 15,839 | 3,570 | — | 29,164 | ||||||||||||||

Net Operating Income (NOI) | |||||||||||||||||||

Same-store portfolio | 8,179 | 19,565 | 11,834 | — | 39,578 | ||||||||||||||

Non same-store - acquired and in development (1) | 5,786 | 5,242 | — | — | 11,028 | ||||||||||||||

Total | $ | 13,965 | $ | 24,807 | $ | 11,834 | $ | — | $ | 50,606 | |||||||||

Same-store portfolio NOI (from above) | $ | 8,179 | $ | 19,565 | $ | 11,834 | $ | — | $ | 39,578 | |||||||||

Straight-line revenue, net for same-store properties | 4 | (347 | ) | (188 | ) | — | (531 | ) | |||||||||||

FAS 141 Min Rent | 1 | 249 | (233 | ) | — | 17 | |||||||||||||

Amortization of lease intangibles for same-store properties | — | 502 | 50 | — | 552 | ||||||||||||||

Same-store portfolio cash NOI | $ | 8,184 | $ | 19,969 | $ | 11,463 | $ | — | $ | 39,616 | |||||||||

Reconciliation of NOI to net income | |||||||||||||||||||

Total NOI | $ | 13,965 | $ | 24,807 | $ | 11,834 | $ | — | $ | 50,606 | |||||||||

Depreciation and amortization | (12,055 | ) | (14,971 | ) | (3,640 | ) | (239 | ) | (30,905 | ) | |||||||||

General and administrative | — | — | — | (4,539 | ) | (4,539 | ) | ||||||||||||

Interest expense | (996 | ) | (2,218 | ) | (205 | ) | (9,754 | ) | (13,173 | ) | |||||||||

Other income | — | — | — | 83 | 83 | ||||||||||||||

Gain on sale of real estate | — | — | — | 77,592 | 77,592 | ||||||||||||||

Income tax expense | — | — | — | (2 | ) | (2 | ) | ||||||||||||

Net income | 914 | 7,618 | 7,989 | 63,141 | 79,662 | ||||||||||||||

Net loss attributable to noncontrolling interests | — | — | — | 12 | 12 | ||||||||||||||

Net income attributable to the controlling interests | $ | 914 | $ | 7,618 | $ | 7,989 | $ | 63,153 | $ | 79,674 | |||||||||

(1) For a list of non-same-store properties and held for sale and sold properties, see page 13 of this Supplemental. | |||||||||||||||||||

14

Same-Store Net Operating Income (NOI) Detail (In thousands) | |

Three Months Ended September 30, 2015 | |||||||||||||||||||

Multifamily | Office | Retail | Corporate and Other | Total | |||||||||||||||

Real estate rental revenue | |||||||||||||||||||

Same-store portfolio | $ | 13,616 | $ | 31,248 | $ | 14,895 | $ | — | $ | 59,759 | |||||||||

Non same-store - acquired and in development (1) | 5,327 | 12,368 | 789 | — | 18,484 | ||||||||||||||

Total | 18,943 | 43,616 | 15,684 | — | 78,243 | ||||||||||||||

Real estate expenses | |||||||||||||||||||

Same-store portfolio | 5,577 | 11,876 | 3,457 | — | 20,910 | ||||||||||||||

Non same-store - acquired and in development (1) | 2,271 | 4,736 | 192 | — | 7,199 | ||||||||||||||

Total | 7,848 | 16,612 | 3,649 | — | 28,109 | ||||||||||||||

Net Operating Income (NOI) | |||||||||||||||||||

Same-store portfolio | 8,039 | 19,372 | 11,438 | — | 38,849 | ||||||||||||||

Non same-store - acquired and in development (1) | 3,056 | 7,632 | 597 | — | 11,285 | ||||||||||||||

Total | $ | 11,095 | $ | 27,004 | $ | 12,035 | $ | — | $ | 50,134 | |||||||||

Same-store portfolio NOI (from above) | $ | 8,039 | $ | 19,372 | $ | 11,438 | $ | — | $ | 38,849 | |||||||||

Straight-line revenue, net for same-store properties | 5 | (294 | ) | (198 | ) | — | (487 | ) | |||||||||||

FAS 141 Min Rent | 1 | 158 | (250 | ) | — | (91 | ) | ||||||||||||

Amortization of lease intangibles for same-store properties | — | 483 | 54 | — | 537 | ||||||||||||||

Same-store portfolio cash NOI | $ | 8,045 | $ | 19,719 | $ | 11,044 | $ | — | $ | 38,808 | |||||||||

Reconciliation of NOI to net income | |||||||||||||||||||

Total NOI | $ | 11,095 | $ | 27,004 | $ | 12,035 | $ | — | $ | 50,134 | |||||||||

Depreciation and amortization | (7,905 | ) | (17,487 | ) | (3,708 | ) | (249 | ) | (29,349 | ) | |||||||||

General and administrative | — | — | — | (4,911 | ) | (4,911 | ) | ||||||||||||

Interest expense | (2,464 | ) | (3,003 | ) | (227 | ) | (8,792 | ) | (14,486 | ) | |||||||||

Other income | — | — | — | 163 | 163 | ||||||||||||||

Acquisition costs | — | — | — | (929 | ) | (929 | ) | ||||||||||||

Income tax expense | — | — | — | (42 | ) | (42 | ) | ||||||||||||

Net income (loss) | 726 | 6,514 | 8,100 | (14,760 | ) | 580 | |||||||||||||

Net income attributable to noncontrolling interests | — | — | — | 67 | 67 | ||||||||||||||

Net income (loss) attributable to the controlling interests | $ | 726 | $ | 6,514 | $ | 8,100 | $ | (14,693 | ) | $ | 647 | ||||||||

(1) For a list of non-same-store properties and held for sale and sold properties, see page 13 of this Supplemental. | |||||||||||||||||||

15

Net Operating Income (NOI) by Region | |

Percentage of NOI | |||||||

Q3 2016 | YTD 2016 | ||||||

DC | |||||||

Multifamily | 5.6 | % | 5.6 | % | |||

Office | 23.0 | % | 23.8 | % | |||

Retail | 1.4 | % | 1.5 | % | |||

30.0 | % | 30.9 | % | ||||

Maryland | |||||||

Multifamily | 2.3 | % | 2.4 | % | |||

Office | 4.8 | % | 8.6 | % | |||

Retail | 14.7 | % | 14.4 | % | |||

21.8 | % | 25.4 | % | ||||

Virginia | |||||||

Multifamily | 19.7 | % | 16.9 | % | |||

Office | 21.2 | % | 19.9 | % | |||

Retail | 7.3 | % | 6.9 | % | |||

48.2 | % | 43.7 | % | ||||

Total Portfolio | 100.0 | % | 100.0 | % | |||

16

Same-Store Portfolio and Overall Physical Occupancy Levels by Sector | ||||

Physical Occupancy - Same-Store Properties (1), (2) | |||||||||||||||

Sector | 9/30/2016 | 6/30/2016 | 3/31/2016 | 12/31/2015 | 9/30/2015 | ||||||||||

Multifamily (calculated on a unit basis) | 96.4 | % | 95.1 | % | 95.3 | % | 94.4 | % | 93.5 | % | |||||

Multifamily | 95.6 | % | 94.8 | % | 94.5 | % | 94.3 | % | 93.2 | % | |||||

Office | 92.3 | % | 91.7 | % | 91.2 | % | 91.0 | % | 90.8 | % | |||||

Retail | 95.6 | % | 92.1 | % | 91.2 | % | 91.5 | % | 95.4 | % | |||||

Overall Portfolio | 94.2 | % | 92.7 | % | 92.1 | % | 92.1 | % | 92.9 | % | |||||

Physical Occupancy - All Properties (2) | |||||||||||||||

Sector | 9/30/2016 | 6/30/2016 | 3/31/2016 | 12/31/2015 | 9/30/2015 | ||||||||||

Multifamily (calculated on a unit basis) | 94.5 | % | 94.7 | % | 95.2 | % | 93.9 | % | 92.6 | % | |||||

Multifamily | 94.2 | % | 94.4 | % | 94.5 | % | 93.4 | % | 92.3 | % | |||||

Office | 90.5 | % | 87.5 | % | 87.8 | % | 87.6 | % | 87.8 | % | |||||

Retail | 95.6 | % | 92.1 | % | 91.2 | % | 91.5 | % | 94.4 | % | |||||

Overall Portfolio | 93.2 | % | 91.1 | % | 90.6 | % | 90.2 | % | 90.7 | % | |||||

(1) Non same-store properties were: |

Acquisitions: |

Multifamily - The Wellington and Riverside Apartments |

Development/Redevelopment: |

Multifamily - The Maxwell |

Office - Silverline Center and The Army Navy Club Building |

Sold properties: |

Multifamily - Munson Hill Towers |

Office - Dulles Station II, Wayne Plaza, 600 Jefferson Plaza, 6110 Executive Boulevard, West Gude, 51 Monroe Street and One Central Plaza |

Retail - Montgomery Village Center |

(2) Physical occupancy is calculated as occupied square footage as a percentage of total square footage as of the last day of that period, except for the rows labeled "Multifamily (calculated on a unit basis)," on which physical occupancy is calculated as occupied units as a percentage of total available units as of the last day of that period. |

17

Same-Store Portfolio and Overall Economic Occupancy Levels by Sector | ||||

Economic Occupancy - Same-Store Properties(1) | |||||||||||||||

Sector | 9/30/2016 | 6/30/2016 | 3/31/2016 | 12/31/2015 | 9/30/2015 | ||||||||||

Multifamily | 96.1 | % | 95.5 | % | 94.4 | % | 94.5 | % | 95.0 | % | |||||

Office | 92.1 | % | 91.1 | % | 90.0 | % | 91.6 | % | 91.4 | % | |||||

Retail | 91.8 | % | 89.3 | % | 89.7 | % | 92.0 | % | 93.5 | % | |||||

Overall Portfolio | 93.0 | % | 91.7 | % | 90.9 | % | 92.4 | % | 92.8 | % | |||||

Economic Occupancy - All Properties | |||||||||||||||

Sector | 9/30/2016 | 6/30/2016 | 3/31/2016 | 12/31/2015 | 9/30/2015 | ||||||||||

Multifamily | 94.6 | % | 95.3 | % | 93.9 | % | 93.2 | % | 92.7 | % | |||||

Office | 89.5 | % | 86.6 | % | 86.9 | % | 88.3 | % | 87.7 | % | |||||

Retail | 91.8 | % | 89.3 | % | 89.7 | % | 91.1 | % | 92.3 | % | |||||

Overall Portfolio | 91.5 | % | 89.3 | % | 89.0 | % | 90.0 | % | 89.8 | % | |||||

(1) Non same-store properties were: |

Acquisitions: |

Multifamily - The Wellington and Riverside Apartments |

Development/Redevelopment: |

Multifamily - The Maxwell |

Office - Silverline Center and The Army Navy Club Building |

Sold properties classified as continuing operations: |

Multifamily - Munson Hill Towers |

Office - Dulles Station II, Wayne Plaza, 600 Jefferson Plaza, 6110 Executive Boulevard, West Gude, 51 Monroe Street and One Central Plaza |

Retail - Montgomery Village Center |

18

Acquisition and Disposition Summary | ||||

Acquisition Summary | ||||||||||||||||

Location | Acquisition Date | Property type | # of units | 9/30/2016 Leased Percentage | Investment (in thousands) | |||||||||||

Riverside Apartments | Alexandria, VA | May 20, 2016 | Multifamily | 1,222 | 95.7 | % | $ | 244,750 | ||||||||

Disposition Summary | ||||||||||||||||

Location | Disposition Date | Property Type | Square feet | Contract Sales Price | GAAP Gain | |||||||||||

Maryland Office Portfolio, Transaction II | various | September 22, 2016 | Office | 491,000 | $ | 128,500 | $ | 77,592 | ||||||||

Maryland Office Portfolio, Transaction I | various | June 27, 2016 | Office | 692,000 | 111,500 | 23,585 | ||||||||||

Dulles Station, Phase II (1) | Herndon, VA | May 26, 2016 | Office | N/A | 12,100 | 527 | ||||||||||

(1) Land held for future development and an interest in a parking garage.

19

Development/Re-development Summary | ||||

Property and Location | Total Rentable Square Feet or # of Units | Anticipated Total Cost (in thousands) | Cash Cost to Date | Anticipated Construction Completion Date | Leased % | ||||

Development Summary | |||||||||

The Trove, Arlington, VA | 401 units | $ | 124,287 | $ | 17,336 | third quarter 2019 | N/A | ||

Re-development Summary | |||||||||

The Army Navy Club Building (1), Washington DC | 108,000 square feet | $ | 4,045 | $ | 595 | first quarter 2017 | 50% | ||

Spring Valley Village | 7,200 additional square feet | $ | 6,000 | $ | 913 | fourth quarter 2017 | N/A | ||

(1) This re-development project primarily consists of adding amenities, to include a lounge and conference center with access to the rooftop and a renovated penthouse, and upgrading the building's lobby and other common areas.

20

Commercial Leasing Summary - New Leases | |

3rd Quarter 2016 | 2nd Quarter 2016 | 1st Quarter 2016 | 4th Quarter 2015 | 3rd Quarter 2015 | |||||||||||||||||||||||||||||||||||

Gross Leasing Square Footage | |||||||||||||||||||||||||||||||||||||||

Office Buildings | 60,538 | 28,154 | 32,249 | 220,374 | 93,389 | ||||||||||||||||||||||||||||||||||

Retail Centers | 1,342 | 6,313 | 11,777 | — | 74,102 | ||||||||||||||||||||||||||||||||||

Total | 61,880 | 34,467 | 44,026 | 220,374 | 167,491 | ||||||||||||||||||||||||||||||||||

Weighted Average Term (years) | |||||||||||||||||||||||||||||||||||||||

Office Buildings | 6.4 | 6.1 | 7.7 | 6.5 | 6.8 | ||||||||||||||||||||||||||||||||||

Retail Centers | 8.3 | 8.0 | 9.8 | 0.0 | 10.2 | ||||||||||||||||||||||||||||||||||

Total | 6.4 | 6.5 | 8.3 | 6.5 | 8.3 | ||||||||||||||||||||||||||||||||||

Weighted Average Free Rent Period (months) (1) | |||||||||||||||||||||||||||||||||||||||

Office Buildings | 6.1 | 5.9 | 7.5 | 7.1 | 12.8 | ||||||||||||||||||||||||||||||||||

Retail Centers | 3.9 | 1.2 | 7.6 | 0.0 | 2.7 | ||||||||||||||||||||||||||||||||||

Total | 6.1 | 5.3 | 7.5 | 7.1 | 9.0 | ||||||||||||||||||||||||||||||||||

Rental Rate Increases: | GAAP | CASH | GAAP | CASH | GAAP | CASH | GAAP | CASH | GAAP | CASH | |||||||||||||||||||||||||||||

Rate on expiring leases | |||||||||||||||||||||||||||||||||||||||

Office Buildings | $ | 39.31 | $ | 39.01 | $ | 34.80 | $ | 35.43 | $ | 30.91 | $ | 31.78 | $ | 32.57 | $ | 33.76 | $ | 27.72 | $ | 28.67 | |||||||||||||||||||

Retail Centers | 43.67 | 46.15 | 28.92 | 29.11 | 11.93 | 12.04 | — | — | 22.32 | 22.77 | |||||||||||||||||||||||||||||

Total | $ | 39.40 | $ | 39.17 | $ | 33.73 | $ | 34.27 | $ | 25.83 | $ | 26.50 | $ | 32.57 | $ | 33.76 | $ | 25.33 | $ | 26.06 | |||||||||||||||||||

Rate on new leases | |||||||||||||||||||||||||||||||||||||||

Office Buildings | $ | 44.06 | $ | 40.80 | $ | 39.83 | $ | 37.09 | $ | 40.60 | $ | 36.84 | $ | 39.45 | $ | 36.62 | $ | 36.46 | $ | 33.53 | |||||||||||||||||||

Retail Centers | 60.89 | 55.00 | 28.13 | 26.45 | 16.22 | 14.45 | — | — | 27.61 | 26.14 | |||||||||||||||||||||||||||||

Total | $ | 44.42 | $ | 41.10 | $ | 37.69 | $ | 35.14 | $ | 34.08 | $ | 30.85 | $ | 39.45 | $ | 36.62 | $ | 32.55 | $ | 30.26 | |||||||||||||||||||

Percentage Increase | |||||||||||||||||||||||||||||||||||||||

Office Buildings | 12.1 | % | 4.6 | % | 14.5 | % | 4.7 | % | 31.4 | % | 15.9 | % | 21.1 | % | 8.5 | % | 31.6 | % | 17.0 | % | |||||||||||||||||||

Retail Centers | 39.4 | % | 19.2 | % | (2.7 | )% | (9.1 | )% | 35.9 | % | 20.0 | % | — | % | — | % | 23.7 | % | 14.8 | % | |||||||||||||||||||

Total | 12.7 | % | 4.9 | % | 11.8 | % | 2.5 | % | 31.9 | % | 16.4 | % | 21.1 | % | 8.5 | % | 28.5 | % | 16.1 | % | |||||||||||||||||||

Total Dollars | $ per Sq Ft | Total Dollars | $ per Sq Ft | Total Dollars | $ per Sq Ft | Total Dollars | $ per Sq Ft | Total Dollars | $ per Sq Ft | ||||||||||||||||||||||||||||||

Tenant Improvements | |||||||||||||||||||||||||||||||||||||||

Office Buildings | $ | 2,682,882 | $ | 44.32 | $ | 1,356,810 | $ | 48.19 | $ | 1,571,632 | $ | 48.73 | $ | 13,946,572 | $ | 63.29 | $ | 4,775,584 | $ | 51.14 | |||||||||||||||||||

Retail Centers | — | — | 111,840 | 17.72 | 203,276 | 17.26 | — | — | 5,220,923 | 70.46 | |||||||||||||||||||||||||||||

Subtotal | $ | 2,682,882 | $ | 43.36 | $ | 1,468,650 | $ | 42.61 | $ | 1,774,908 | $ | 40.31 | $ | 13,946,572 | $ | 63.29 | $ | 9,996,507 | $ | 59.68 | |||||||||||||||||||

Leasing Commissions (1) | |||||||||||||||||||||||||||||||||||||||

Office Buildings | $ | 890,195 | $ | 14.70 | $ | 375,882 | $ | 13.35 | $ | 505,349 | $ | 15.67 | $ | 3,165,371 | $ | 14.36 | $ | 1,173,511 | $ | 12.57 | |||||||||||||||||||

Retail Centers | 39,380 | 29.34 | 80,461 | 12.75 | 103,983 | 8.83 | — | — | 1,212,567 | 16.36 | |||||||||||||||||||||||||||||

Subtotal | $ | 929,575 | $ | 15.02 | $ | 456,343 | $ | 13.24 | $ | 609,332 | $ | 13.84 | $ | 3,165,371 | $ | 14.36 | $ | 2,386,078 | $ | 14.25 | |||||||||||||||||||

Tenant Improvements and Leasing Commissions | |||||||||||||||||||||||||||||||||||||||

Office Buildings | $ | 3,573,077 | $ | 59.02 | $ | 1,732,692 | $ | 61.54 | $ | 2,076,981 | $ | 64.40 | $ | 17,111,943 | $ | 77.65 | $ | 5,949,095 | $ | 63.71 | |||||||||||||||||||

Retail Centers | 39,380 | 29.34 | 192,301 | 30.47 | 307,259 | 26.09 | — | — | 6,433,490 | 86.82 | |||||||||||||||||||||||||||||

Total | $ | 3,612,457 | $ | 58.38 | $ | 1,924,993 | $ | 55.85 | $ | 2,384,240 | $ | 54.15 | $ | 17,111,943 | $ | 77.65 | $ | 12,382,585 | $ | 73.93 | |||||||||||||||||||

(1) In prior quarters we disclosed leasing commissions and incentives (i.e. free rent) in the aggregate. In the interest of providing more granular data regarding our leasing costs, we are disclosing leasing commissions and free rent separately. We continue to disclose leasing commissions in terms of both total dollars and costs per square foot. We are disclosing free rent costs in terms of weighted average months of free rent per lease. Prior quarters have been recasted to conform with the current quarter's presentation.

21

Commercial Leasing Summary - Renewal Leases | |

3rd Quarter 2016 | 2nd Quarter 2016 | 1st Quarter 2016 | 4th Quarter 2015 | 3rd Quarter 2015 | |||||||||||||||||||||||||||||||||||

Gross Leasing Square Footage | |||||||||||||||||||||||||||||||||||||||

Office Buildings | 151,722 | 30,787 | 193,275 | 42,033 | 191,599 | ||||||||||||||||||||||||||||||||||

Retail Centers | 74,535 | 9,076 | 27,243 | 32,594 | 53,415 | ||||||||||||||||||||||||||||||||||

Total | 226,257 | 39,863 | 220,518 | 74,627 | 245,014 | ||||||||||||||||||||||||||||||||||

Weighted Average Term (years) | |||||||||||||||||||||||||||||||||||||||

Office Buildings | 3.7 | 4.6 | 7.1 | 6.6 | 2.8 | ||||||||||||||||||||||||||||||||||

Retail Centers | 4.7 | 6.3 | 11.6 | 3.3 | 4.4 | ||||||||||||||||||||||||||||||||||

Total | 4.0 | 5.0 | 7.6 | 5.1 | 3.1 | ||||||||||||||||||||||||||||||||||

Weighted Average Free Rent Period (months) (1) | |||||||||||||||||||||||||||||||||||||||

Office Buildings | 2.4 | 4.4 | 7.9 | 4.8 | 0.7 | ||||||||||||||||||||||||||||||||||

Retail Centers | — | 0.7 | 5.1 | — | 0.1 | ||||||||||||||||||||||||||||||||||

Total | 1.8 | 3.3 | 7.5 | 3.2 | 0.6 | ||||||||||||||||||||||||||||||||||

Rental Rate Increases: | GAAP | CASH | GAAP | CASH | GAAP | CASH | GAAP | CASH | GAAP | CASH | |||||||||||||||||||||||||||||

Rate on expiring leases | |||||||||||||||||||||||||||||||||||||||

Office Buildings | $ | 35.85 | $ | 36.37 | $ | 30.13 | $ | 31.53 | $ | 36.53 | $ | 38.93 | $ | 35.61 | $ | 37.12 | $ | 35.23 | $ | 37.43 | |||||||||||||||||||

Retail Centers | 25.03 | 25.28 | 32.56 | 47.14 | 24.53 | 26.67 | 21.30 | 22.56 | 23.21 | 23.72 | |||||||||||||||||||||||||||||

Total | $ | 32.28 | $ | 32.72 | $ | 30.69 | $ | 35.08 | $ | 35.04 | $ | 37.42 | $ | 29.36 | $ | 30.76 | $ | 32.61 | $ | 34.44 | |||||||||||||||||||

Rate on new leases | |||||||||||||||||||||||||||||||||||||||

Office Buildings | $ | 42.20 | $ | 40.38 | $ | 34.42 | $ | 32.44 | $ | 40.55 | $ | 37.12 | $ | 37.01 | $ | 34.12 | $ | 31.37 | $ | 30.29 | |||||||||||||||||||

Retail Centers | 27.61 | 26.58 | 41.78 | 46.62 | 41.49 | 35.39 | 25.08 | 23.50 | 26.63 | 26.10 | |||||||||||||||||||||||||||||

Total | $ | 37.39 | $ | 35.84 | $ | 36.10 | $ | 35.67 | $ | 40.66 | $ | 36.90 | $ | 31.80 | $ | 29.49 | $ | 30.34 | $ | 29.38 | |||||||||||||||||||

Percentage Increase | |||||||||||||||||||||||||||||||||||||||

Office Buildings | 17.7 | % | 11.0 | % | 14.2 | % | 2.9 | % | 11.0 | % | (4.7 | )% | 3.9 | % | (8.1 | )% | (11.0 | )% | (19.1 | )% | |||||||||||||||||||

Retail Centers | 10.3 | % | 5.1 | % | 28.3 | % | (1.1 | )% | 69.2 | % | 32.7 | % | 17.8 | % | 4.2 | % | 14.7 | % | 10.0 | % | |||||||||||||||||||

Total | 15.8 | % | 9.5 | % | 17.6 | % | 1.7 | % | 16.0 | % | (1.4 | )% | 8.3 | % | (4.1 | )% | (7.0 | )% | (14.7 | )% | |||||||||||||||||||

Total Dollars | $ per Sq Ft | Total Dollars | $ per Sq Ft | Total Dollars | $ per Sq Ft | Total Dollars | $ per Sq Ft | Total Dollars | $ per Sq Ft | ||||||||||||||||||||||||||||||

Tenant Improvements | |||||||||||||||||||||||||||||||||||||||

Office Buildings | $ | 2,243,523 | $ | 14.79 | $ | 153,365 | $ | 4.98 | $ | 6,945,781 | $ | 35.94 | $ | 1,580,078 | $ | 37.59 | $ | 580,967 | $ | 3.03 | |||||||||||||||||||

Retail Centers | — | — | — | — | 626,200 | 22.99 | — | — | 36,540 | 0.68 | |||||||||||||||||||||||||||||

Subtotal | $ | 2,243,523 | $ | 9.92 | $ | 153,365 | $ | 3.85 | $ | 7,571,981 | $ | 34.34 | $ | 1,580,078 | $ | 21.17 | $ | 617,507 | $ | 2.52 | |||||||||||||||||||

Leasing Commissions (1) | |||||||||||||||||||||||||||||||||||||||

Office Buildings | $ | 780,080 | $ | 5.14 | $ | 198,223 | $ | 6.44 | $ | 2,801,717 | $ | 14.50 | $ | 443,229 | $ | 10.54 | $ | 464,150 | $ | 2.41 | |||||||||||||||||||

Retail Centers | 124,121 | 1.67 | 74,824 | 8.24 | 394,380 | 14.48 | 59,302 | 1.82 | 104,730 | 1.96 | |||||||||||||||||||||||||||||

Subtotal | $ | 904,201 | $ | 4.00 | $ | 273,047 | $ | 6.85 | $ | 3,196,097 | $ | 14.49 | $ | 502,531 | $ | 6.73 | $ | 568,880 | $ | 2.31 | |||||||||||||||||||

Tenant Improvements and Leasing Commissions | |||||||||||||||||||||||||||||||||||||||

Office Buildings | $ | 3,023,603 | $ | 19.93 | $ | 351,588 | $ | 11.42 | $ | 9,747,498 | $ | 50.44 | $ | 2,023,307 | $ | 48.13 | $ | 1,045,117 | $ | 5.44 | |||||||||||||||||||

Retail Centers | 124,121 | 1.67 | 74,824 | 8.24 | 1,020,580 | 37.47 | 59,302 | 1.82 | 141,270 | 2.64 | |||||||||||||||||||||||||||||

Total | $ | 3,147,724 | $ | 13.92 | $ | 426,412 | $ | 10.70 | $ | 10,768,078 | $ | 48.83 | $ | 2,082,609 | $ | 27.90 | $ | 1,186,387 | $ | 4.83 | |||||||||||||||||||

(1) In prior quarters we disclosed leasing commissions and incentives (i.e. free rent) in the aggregate. In the interest of providing more granular data regarding our leasing costs, we are disclosing leasing commissions and free rent separately. We continue to disclose leasing commissions in terms of both total dollars and costs per square foot. We are disclosing free rent costs in terms of weighted average months of free rent per lease. Prior quarters have been recasted to conform with the current quarter's presentation.

22

10 Largest Tenants - Based on Annualized Commercial Income | |

September 30, 2016 | |

Tenant | Number of Buildings | Weighted Average Remaining Lease Term in Months | Percentage of Aggregate Portfolio Annualized Commercial Income | Aggregate Rentable Square Feet | Percentage of Aggregate Occupied Square Feet | ||||||||

World Bank | 1 | 51 | 6.19 | % | 210,354 | 3.83 | % | ||||||

Advisory Board Company | 2 | 32 | 4.13 | % | 199,878 | 3.64 | % | ||||||

Engility Corporation | 1 | 12 | 2.95 | % | 134,126 | 2.44 | % | ||||||

Capital One | 1 | 66 | 2.81 | % | 136,556 | 2.48 | % | ||||||

Squire Patton Boggs (USA) LLP (1) | 1 | 7 | 2.78 | % | 110,566 | 2.01 | % | ||||||

Booz Allen Hamilton, Inc. | 1 | 112 | 2.58 | % | 222,989 | 4.06 | % | ||||||

Epstein, Becker & Green, P.C. | 1 | 147 | 1.54 | % | 55,318 | 1.01 | % | ||||||

Alexandria City School Board | 1 | 152 | 1.36 | % | 84,693 | 1.54 | % | ||||||

Hughes Hubbard & Reed LLP | 1 | 17 | 1.34 | % | 53,208 | 0.97 | % | ||||||

Morgan Stanley Smith Barney Financing | 1 | 53 | 1.16 | % | 49,395 | 0.90 | % | ||||||

Total/Weighted Average | 62 | 26.84 | % | 1,257,083 | 22.88 | % | |||||||

(1) The spaced leased to Squire Patton Boggs (USA) LLP is currently subleased to Advisory Board Company, who has signed an extension to make the lease coterminous with the remaining Advisory Board Company leases expiring on May 31, 2019.

23

Industry Diversification | |

September 30, 2016 | |

Industry Classification (NAICS) | Annualized Base Rental Revenue | Percentage of Aggregate Annualized Rent | Aggregate Rentable Square Feet | Percentage of Aggregate Square Feet | ||||||||

Office: | ||||||||||||

Professional, Scientific, and Technical Services | $ | 61,189,674 | 48.06 | % | 1,683,820 | 50.91 | % | |||||

Finance and Insurance | 21,944,430 | 17.23 | % | 481,340 | 14.55 | % | ||||||

Other Services (except Public Administration) | 12,116,628 | 9.52 | % | 304,639 | 9.21 | % | ||||||

Information | 7,878,273 | 6.19 | % | 191,434 | 5.79 | % | ||||||

Health Care and Social Assistance | 5,040,861 | 3.96 | % | 149,949 | 4.53 | % | ||||||

Wholesale Trade | 4,466,277 | 3.51 | % | 103,177 | 3.12 | % | ||||||

Educational Services | 4,452,864 | 3.50 | % | 140,917 | 4.26 | % | ||||||

Administrative and Support and Waste Management and Remediation Services | 2,123,473 | 1.67 | % | 48,891 | 1.48 | % | ||||||

Public Administration | 2,069,409 | 1.63 | % | 41,968 | 1.27 | % | ||||||

Real Estate and Rental and Leasing | 1,821,467 | 1.43 | % | 44,132 | 1.33 | % | ||||||

Accommodation and Food Services | 1,480,061 | 1.16 | % | 34,771 | 1.05 | % | ||||||

Construction | 871,891 | 0.68 | % | 27,363 | 0.83 | % | ||||||

Other | 1,875,454 | 1.46 | % | 55,351 | 1.67 | % | ||||||

Total | $ | 127,330,762 | 100.00 | % | 3,307,752 | 100.00 | % | |||||

Retail: | ||||||||||||

Wholesale Trade | $ | 28,446,715 | 58.96 | % | 1,541,393 | 71.69 | % | |||||

Accommodation and Food Services | 7,270,508 | 15.07 | % | 233,372 | 10.85 | % | ||||||

Finance and Insurance | 4,116,897 | 8.53 | % | 54,899 | 2.55 | % | ||||||

Other Services (except Public Administration/Government) | 3,294,766 | 6.83 | % | 100,966 | 4.70 | % | ||||||

Arts, Entertainment, and Recreation | 1,960,747 | 4.06 | % | 115,586 | 5.38 | % | ||||||

Health Care and Social Assistance | 1,190,234 | 2.47 | % | 31,602 | 1.47 | % | ||||||

Manufacturing | 502,322 | 1.04 | % | 17,547 | 0.82 | % | ||||||

Educational Services | 422,188 | 0.87 | % | 25,598 | 1.19 | % | ||||||

Information (Broadcasting, Publishing, Telecommunications) | 354,305 | 0.73 | % | 8,347 | 0.39 | % | ||||||

Other | 692,921 | 1.44 | % | 20,740 | 0.96 | % | ||||||

Total | $ | 48,251,603 | 100.00 | % | 2,150,050 | 100.00 | % | |||||

24

Lease Expirations | |

September 30, 2016 | |

Year | Number of Leases | Rentable Square Feet | Percent of Rentable Square Feet | Annualized Rent (1) | Average Rental Rate | Percent of Annualized Rent (1) | ||||||||||||||

Office: | ||||||||||||||||||||

2016 | 11 | 40,154 | 1.14 | % | $ | 1,578,306 | $ | 39.31 | 1.03 | % | ||||||||||

2017 | 51 | 432,843 | 12.25 | % | 17,571,662 | 40.60 | 11.47 | % | ||||||||||||

2018 | 45 | 280,219 | 7.93 | % | 11,885,227 | 42.41 | 7.76 | % | ||||||||||||

2019 | 57 | 592,344 | 16.76 | % | 23,475,382 | 39.63 | 15.32 | % | ||||||||||||

2020 | 43 | 411,272 | 11.64 | % | 19,913,473 | 48.42 | 13.00 | % | ||||||||||||

2021 and thereafter | 200 | 1,776,877 | 50.28 | % | 78,802,207 | 44.35 | 51.42 | % | ||||||||||||

407 | 3,533,709 | 100.00 | % | $ | 153,226,257 | 43.36 | 100.00 | % | ||||||||||||

Retail: | ||||||||||||||||||||

2016 | 3 | 16,978 | 0.78 | % | $ | 505,140 | $ | 29.75 | 0.95 | % | ||||||||||

2017 | 41 | 228,432 | 10.49 | % | 6,540,380 | 28.63 | 12.29 | % | ||||||||||||

2018 | 36 | 333,599 | 15.32 | % | 4,813,345 | 14.43 | 9.04 | % | ||||||||||||

2019 | 33 | 160,133 | 7.35 | % | 4,539,780 | 28.35 | 8.53 | % | ||||||||||||

2020 | 39 | 432,969 | 19.89 | % | 7,681,963 | 17.74 | 14.43 | % | ||||||||||||

2021 and thereafter | 136 | 1,005,089 | 46.17 | % | 29,138,612 | 28.99 | 54.76 | % | ||||||||||||

288 | 2,177,200 | 100.00 | % | $ | 53,219,220 | 24.44 | 100.00 | % | ||||||||||||

Total: | ||||||||||||||||||||

2016 | 14 | 57,132 | 1.00 | % | $ | 2,083,446 | $ | 36.47 | 1.01 | % | ||||||||||

2017 | 92 | 661,275 | 11.58 | % | 24,112,042 | 36.46 | 11.68 | % | ||||||||||||

2018 | 81 | 613,818 | 10.75 | % | 16,698,572 | 27.20 | 8.09 | % | ||||||||||||

2019 | 90 | 752,477 | 13.18 | % | 28,015,162 | 37.23 | 13.57 | % | ||||||||||||

2020 | 82 | 844,241 | 14.78 | % | 27,595,436 | 32.69 | 13.37 | % | ||||||||||||

2021 and thereafter | 336 | 2,781,966 | 48.71 | % | 107,940,819 | 38.80 | 52.28 | % | ||||||||||||

695 | 5,710,909 | 100.00 | % | $ | 206,445,477 | 36.15 | 100.00 | % | ||||||||||||

(1) Annualized Rent is equal to the rental rate effective at lease expiration (cash basis) multiplied by 12. | ||||||||||||||||||||

25

Schedule of Properties | |

September 30, 2016 | |

PROPERTIES | LOCATION | YEAR ACQUIRED | YEAR CONSTRUCTED | NET RENTABLE SQUARE FEET | |||||

Office Buildings | |||||||||

515 King Street | Alexandria, VA | 1992 | 1966 | 75,000 | |||||

Courthouse Square | Alexandria, VA | 2000 | 1979 | 118,000 | |||||

Braddock Metro Center | Alexandria, VA | 2011 | 1985 | 348,000 | |||||

1600 Wilson Boulevard | Arlington, VA | 1997 | 1973 | 169,000 | |||||

Fairgate at Ballston | Arlington, VA | 2012 | 1988 | 143,000 | |||||

Monument II | Herndon, VA | 2007 | 2000 | 208,000 | |||||

925 Corporate Drive | Stafford, VA | 2010 | 2007 | 134,000 | |||||

1000 Corporate Drive | Stafford, VA | 2010 | 2009 | 136,000 | |||||

Silverline Center | Tysons, VA | 1997 | 1972/1986/1999/2014 | 545,000 | |||||

John Marshall II | Tysons, VA | 2011 | 1996/2010 | 223,000 | |||||

1901 Pennsylvania Avenue | Washington, DC | 1977 | 1960 | 102,000 | |||||

1220 19th Street | Washington, DC | 1995 | 1976 | 103,000 | |||||

1776 G Street | Washington, DC | 2003 | 1979 | 265,000 | |||||

2000 M Street | Washington, DC | 2007 | 1971 | 231,000 | |||||

2445 M Street | Washington, DC | 2008 | 1986 | 290,000 | |||||

1140 Connecticut Avenue | Washington, DC | 2011 | 1966 | 183,000 | |||||

1227 25th Street | Washington, DC | 2011 | 1988 | 136,000 | |||||

Army Navy Club Building | Washington, DC | 2014 | 1912/1987 | 108,000 | |||||

1775 Eye Street | Washington, DC | 2014 | 1964 | 186,000 | |||||

Subtotal | 3,703,000 | ||||||||

26

Schedule of Properties (continued) | |

September 30, 2016 | |

PROPERTIES | LOCATION | YEAR ACQUIRED | YEAR CONSTRUCTED | NET RENTABLE SQUARE FEET | |||||

Retail Centers | |||||||||

Bradlee Shopping Center | Alexandria, VA | 1984 | 1955 | 171,000 | |||||

Shoppes of Foxchase | Alexandria, VA | 1994 | 1960/2006 | 134,000 | |||||

800 S. Washington Street | Alexandria, VA | 1998/2003 | 1955/1959 | 46,000 | |||||

Concord Centre | Springfield, VA | 1973 | 1960 | 76,000 | |||||

Gateway Overlook | Columbia, MD | 2010 | 2007 | 220,000 | |||||

Frederick County Square | Frederick, MD | 1995 | 1973 | 227,000 | |||||

Frederick Crossing | Frederick, MD | 2005 | 1999/2003 | 295,000 | |||||

Centre at Hagerstown | Hagerstown, MD | 2002 | 2000 | 331,000 | |||||

Olney Village Center | Olney, MD | 2011 | 1979/2003 | 199,000 | |||||

Randolph Shopping Center | Rockville, MD | 2006 | 1972 | 82,000 | |||||

Montrose Shopping Center | Rockville, MD | 2006 | 1970 | 145,000 | |||||

Takoma Park | Takoma Park, MD | 1963 | 1962 | 51,000 | |||||

Westminster | Westminster, MD | 1972 | 1969 | 150,000 | |||||

Wheaton Park | Wheaton, MD | 1977 | 1967 | 74,000 | |||||

Chevy Chase Metro Plaza | Washington, DC | 1985 | 1975 | 50,000 | |||||

Spring Valley Village | Washington, DC | 2014 | 1941/1950 | 78,000 | |||||

Subtotal | 2,329,000 | ||||||||

27

Schedule of Properties (continued) | |

September 30, 2016 | |

PROPERTIES | LOCATION | YEAR ACQUIRED | YEAR CONSTRUCTED | NET RENTABLE SQUARE FEET (1) | |||||

Multifamily Buildings / # units | |||||||||

Clayborne / 74 | Alexandria, VA | 2008 | 2008 | 60,000 | |||||

Riverside Apartments / 1,222 | Alexandria, VA | 2016 | 1971 | 1,266,000 | |||||

Park Adams / 200 | Arlington, VA | 1969 | 1959 | 173,000 | |||||

Bennett Park / 224 | Arlington, VA | 2007 | 2007 | 214,000 | |||||

The Paramount / 135 | Arlington, VA | 2013 | 1984 | 141,000 | |||||

The Maxwell / 163 | Arlington, VA | 2014 | 2014 | 139,000 | |||||

The Wellington / 711 | Arlington, VA | 2015 | 1960 | 842,000 | |||||

Roosevelt Towers / 191 | Falls Church, VA | 1965 | 1964 | 170,000 | |||||

The Ashby at McLean / 256 | McLean, VA | 1996 | 1982 | 274,000 | |||||

Bethesda Hill Apartments / 195 | Bethesda, MD | 1997 | 1986 | 225,000 | |||||

Walker House Apartments / 212 | Gaithersburg, MD | 1996 | 1971/2003 | 157,000 | |||||

3801 Connecticut Avenue / 307 | Washington, DC | 1963 | 1951 | 178,000 | |||||

Kenmore Apartments / 374 | Washington, DC | 2008 | 1948 | 268,000 | |||||

Yale West / 216 | Washington, DC | 2014 | 2011 | 238,000 | |||||

Subtotal (4,480 units) | 4,345,000 | ||||||||

TOTAL | 10,377,000 | ||||||||

(1) Multifamily buildings are presented in gross square feet. | |||||||||

28

Supplemental Definitions | |

September 30, 2016 | |

Adjusted EBITDA (a non-GAAP measure) is earnings attributable to the controlling interest before interest expense, taxes, depreciation, amortization, real estate impairment, casualty gain, gain on sale of real estate, gain/loss on extinguishment of debt, severance expense, relocation expense, acquisition and structuring expenses and gain/loss from non-disposal activities. |

Annualized base rent ("ABR") is calculated as monthly base rent (cash basis) per the lease, as of the reporting period, multiplied by 12. |

Debt service coverage ratio is computed by dividing earnings attributable to the controlling interest before interest expense, taxes, depreciation, amortization, real estate impairment, gain on sale of real estate, gain/loss on extinguishment of debt, severance expense, relocation expense, acquisition and structuring expenses and gain/loss from non-disposal activities by interest expense (including interest expense from discontinued operations) and principal amortization. |

Debt to total market capitalization is total debt divided by the sum of total debt plus the market value of shares outstanding at the end of the period. |

Earnings to fixed charges ratio is computed by dividing earnings attributable to the controlling interest by fixed charges. For this purpose, earnings consist of income from continuing operations (or net income if there are no discontinued operations) plus fixed charges, less capitalized interest. Fixed charges consist of interest expense (excluding interest expense from discontinued operations), including amortized costs of debt issuance, plus interest costs capitalized. |

Economic occupancy is calculated as actual real estate rental revenue recognized for the period indicated as a percentage of gross potential real estate rental revenue for that period. We determine gross potential real estate rental revenue by valuing occupied units or square footage at contract rates and vacant units or square footage at market rates for comparable properties. We do not consider percentage rents and expense reimbursements in computing economic occupancy percentages. |

NAREIT Funds from operations ("NAREIT FFO") is defined by National Association of Real Estate Investment Trusts, Inc. (“NAREIT”) in an April, 2002 White Paper as net income (computed in accordance with generally accepted accounting principles (“GAAP”) excluding gains (or losses) associated with sales of property, impairment of depreciable real estate and real estate depreciation and amortization. We consider NAREIT FFO to be a standard supplemental measure for equity real estate investment trusts (“REITs”) because it facilitates an understanding of the operating performance of our properties without giving effect to real estate depreciation and amortization, which historically assumes that the value of real estate assets diminishes predictably over time. Since real estate values have instead historically risen or fallen with market conditions, we believe that NAREIT FFO more accurately provides investors an indication of our ability to incur and service debt, make capital expenditures and fund other needs. NAREIT FFO is a non-GAAP measure. |

Core Funds From Operations ("Core FFO") is calculated by adjusting NAREIT FFO for the following items (which we believe are not indicative of the performance of Washington REIT’s operating portfolio and affect the comparative measurement of Washington REIT’s operating performance over time): (1) gains or losses on extinguishment of debt, (2) expenses related to acquisition and structuring activities, (3) executive transition costs and severance expense related to corporate reorganization and related to executive retirements or resignations, (4) property impairments, casualty gains and losses, and gains or losses on sale not already excluded from NAREIT FFO, as appropriate, and (5) relocation expense. These items can vary greatly from period to period, depending upon the volume of our acquisition activity and debt retirements, among other factors. We believe that by excluding these items, Core FFO serves as a useful, supplementary measure of Washington REIT’s ability to incur and service debt, and distribute dividends to its shareholders. Core FFO is a non-GAAP and non-standardized measure, and may be calculated differently by other REITs. |

Funds Available for Distribution ("FAD") is calculated by subtracting from NAREIT FFO (1) recurring expenditures, tenant improvements and leasing costs, that are capitalized and amortized and are necessary to maintain our properties and revenue stream (excluding items contemplated prior to acquisition or associated with development / redevelopment of a property) and (2) straight line rents, then adding (3) non-real estate depreciation and amortization, (4) non-cash fair value interest expense and (5) amortization of restricted share compensation, then adding or subtracting the (6) amortization of lease intangibles, (7) real estate impairment and (8) non-cash gain/loss on extinguishment of debt, as appropriate. FAD is included herein, because we consider it to be a performance measure of a REIT’s ability to incur and service debt and to distribute dividends to its shareholders. FAD is a non-GAAP and non-standardized measure, and may be calculated differently by other REITs. |

Core Funds Available for Distribution ("Core FAD") is calculated by adjusting FAD for the following items (which we believe are not indicative of the performance of Washington REIT’s operating portfolio and affect the comparative measurement of Washington REIT’s operating performance over time): (1) gains or losses on extinguishment of debt, (2) costs related to the acquisition of properties, (3) non-share-based severance expense related to corporate reorganization and related to executive retirements or resignations, (4) property impairments, casualty gains and losses, and gains or losses on sale not already excluded from FAD, as appropriate, and (5) relocation expense. These items can vary greatly from period to period, depending upon the volume of our acquisition activity and debt retirements, among other factors. We believe that by excluding these items, Core FAD serves as a useful, supplementary performance measure of Washington REIT’s ability to incur and service debt, and distribute dividends to its shareholders. Core FAD is a non-GAAP and non-standardized measure, and may be calculated differently by other REITs. |

Net Operating Income (“NOI”) is a non-GAAP measure defined as real estate rental revenue less real estate expenses. NOI is calculated as net income, less non-real estate revenue and the results of discontinued operations (including the gain on sale, if any), plus interest expense, depreciation and amortization, general and administrative expenses, acquisition costs, real estate impairment, casualty gains and losses, and gain or loss on extinguishment of debt. We also present NOI on a cash basis ("Cash NOI") which is calculated as NOI less the impact of straightlining of rent and amortization of market intangibles. We provide NOI as a supplement to net income calculated in accordance with GAAP. As such, it should not be considered an alternative to net income as an indication of our operating performance. It is the primary performance measure we use to assess the results of our operations at the property level. |

29

Physical occupancy is calculated as occupied square footage as a percentage of total square footage as of the last day of that period. Multifamily unit basis physical occupancy is calculated as occupied units as a percentage of total units as of the last day of that period. |

Recurring capital expenditures represent non-accretive building improvements and leasing costs required to maintain current revenues. Recurring capital expenditures do not include acquisition capital that was taken into consideration when underwriting the purchase of a building or which are incurred to bring a building up to "operating standard." |

Rent increases on renewals and rollovers are calculated as the difference, weighted by square feet, of the net ABR due the first month after a term commencement date and the net ABR due the last month prior to the termination date of the former tenant's term. |

Same-store portfolio properties include all stabilized properties that were owned for the entirety of the current and prior reporting periods, and exclude properties under redevelopment or development and properties purchased or sold at any time during the periods being compared. We define redevelopment properties as those for which we expect to spend significant development and construction costs on existing or acquired buildings pursuant to a formal plan which has a current impact on operating results, occupancy and the ability to lease space with the intended result of a higher economic return on the property. Redevelopment and development properties are included in the same-store pool upon completion of the redevelopment or development, and the earlier of achieving 90% occupancy or two years after completion. |

Same-store portfolio net operating income (NOI) growth is the change in the NOI of the same-store portfolio properties from the prior reporting period to the current reporting period. |

30