Attached files

| file | filename |

|---|---|

| EX-99.4 - EXHIBIT 99.4 - STATE BANK FINANCIAL CORP | stbz_ex994x20160930-8k.htm |

| EX-99.3 - EXHIBIT 99.3 - STATE BANK FINANCIAL CORP | stbz_ex993x20160930-8k.htm |

| EX-99.1 - EXHIBIT 99.1 - STATE BANK FINANCIAL CORP | pressrelease093016.htm |

| 8-K - 8-K - STATE BANK FINANCIAL CORP | a8kcoverpage093016.htm |

3rd Quarter 2016

Earnings Presentation

Joe Evans, Chairman and CEO

Tom Wiley, Vice Chairman and President

Sheila Ray, EVP and Chief Financial Officer

David Black, EVP and Chief Credit Officer

October 27, 2016

State Bank Financial Corporation

2

Cautionary Note Regarding Forward-Looking

Statements

This presentation contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements, which are based on certain

assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of the words “will,” “expect,” “should,” “anticipate,” “may,” and

“project,” as well as similar expressions. Pro forma financial information is not a guarantee of future results and is presented for informational purposes only. These forward-

looking statements include, but are not limited to, statements regarding our proposed acquisitions of NBG Bancorp (“NBG”) and its subsidiary and S Bankshares and its

subsidiary, including our belief that these acquisitions will provide entry into attractive new markets and other key transaction assumptions, statements regarding our significant

opportunity for deposit growth in the Atlanta and Augusta markets, statements regarding our focus on improving efficiency, including our target burden ratio and target

efficiency ratio, statements regarding remaining accretable discount and its future benefits, including statements related to base accretion, and other statements about

expected developments or events, our future financial performance, and the execution of our strategic goals. Forward-looking statements are not guarantees of future

performance and are subject to risks, uncertainties and assumptions (“risk factor”) that are difficult to predict with regard to timing, extent, likelihood and degree. Therefore,

actual results and outcomes may materially differ from what may be expressed or forecasted in such forward-looking statements. We undertake no obligation to update, amend

or clarify forward-looking statements, whether as a result of new information, future events or otherwise. Risk factors including, without limitation, the following:

• completion of the transactions with NBG and S Bankshares is dependent on, among other things, receipt of regulatory approvals and S Bankshares shareholder approval, the

timing of which cannot be predicted and which may not be received at all;

• the impact of the completion of the transactions with NBG and S Bankshares on our financial statements will be affected by the timing of the transactions;

• the transactions may be more expensive to complete and the anticipated benefits, including anticipated cost savings and strategic gains, may be significantly harder or take

longer to achieve than expected or may not be achieved in their entirety as a result of unexpected factors or events;

• the integration of NBG’s and S Bankshares’ business and operations into ours may be more costly than anticipated or have unanticipated adverse results related to NBG’s,

S Bankshares’ or our existing businesses;

• our ability to achieve anticipated results from the transactions with NBG and S Bankshares will depend on the state of the economic and financial markets going forward;

• general economic conditions (both generally and in our markets) may be less favorable than expected, which could result in, among other things, a deterioration in credit

quality, a reduction in demand for credit and a decline in real estate values;

• a general decline in the real estate and lending markets, particularly in our market areas, could negatively affect our financial results;

• restrictions or conditions imposed by our regulators on our operations may make it more difficult for us to achieve our goals;

• legislative or regulatory changes, including changes in accounting standards and compliance requirements, may adversely affect us;

• competitive pressures among depository and other financial institutions may increase significantly;

• changes in the interest rate environment may reduce margins or the volumes or values of the loans we make or have acquired;

• other financial institutions have greater financial resources and may be able to develop or acquire products that enable them to compete more successfully than we can;

• our ability to attract and retain key personnel can be affected by the increased competition for experienced employees in the banking industry;

• adverse changes may occur in the bond and equity markets;

• war or terrorist activities may cause deterioration in the economy or cause instability in credit markets; and

• economic, governmental or other factors may prevent the projected population, residential and commercial growth in the markets in which we operate.

In addition, risk factors include, but are not limited to, the risk factors described in Item 1A, Risk Factors, in our Annual Report on Form 10-K for the most recently ended fiscal

year. These and other risk factors are representative of the risk factors that may emerge and could cause a difference between an ultimate actual outcome and a forward-

looking statement.

3

Income Statement Highlights

(dollars in thousands, except per share data) 3Q16 2Q16 3Q15

Interest income on loans $26,580 $25,406 $24,218

Accretion income on loans 9,335 13,961 11,156

Interest income on invested funds 4,714 4,726 4,050

Total interest income 40,629 44,093 39,424

Interest expense 2,504 2,371 1,977

Net interest income 38,125 41,722 37,447

Provision for loan and lease losses 88 6 (265)

Net interest income after provision for loan losses 38,037 41,716 37,712

Total noninterest income 9,769 10,230 8,894

Total noninterest expense 28,480 30,674 32,416

Income before income taxes 19,326 21,272 14,190

Income tax expense 6,885 7,287 5,071

Net income $12,441 $13,985 $9,119

Diluted earnings per share .34 .38 .25

Dividends per share .14 .14 .07

Tangible book value per share 13.99 13.77 13.78

Balance Sheet Highlights (period-end)

Total loans $2,346,346 $2,345,096 $2,139,691

Organic 2,030,457 2,004,858 1,694,949

Purchased non-credit impaired 189,053 205,705 285,419

Purchased credit impaired 126,836 134,533 159,323

Total assets 3,616,384 3,586,503 3,388,673

Noninterest-bearing deposits 890,588 829,673 823,146

Total deposits 2,959,292 2,885,490 2,795,188

Shareholders’ equity 561,134 553,356 532,161

Results Summary

1 Denotes a non-GAAP financial measure; for more information, refer to Table 8 of the 3Q16 earnings press release

Note: Consolidated financial results contained throughout this presentation are unaudited; numbers may not add due to rounding

3Q16 net income of $12.4

million, or $.34 per diluted

share

Interest income on loans

and invested funds up 11%

from 3Q15

Noninterest income

increased 10% compared

to 3Q15

Noninterest expense down

12% from 3Q15

$.14 quarterly dividend

represents an attractive

2.5% yield at end of 3Q16

and 42% payout ratio in

2016 YTD

1

4

Enhancing Fundamental Performance

Interest

Income

Noninterest

Income

Core Deposit

Funding

Noninterest income contribution of $9.8mm in 3Q16

Mortgage income (+6%), SBA income (+12%), and payroll fee income (+14%)

are all higher YTD 2016 compared to YTD 2015

Average noninterest-bearing deposits represent 29% of average total deposits

Increased deposit market share in Atlanta while strengthening #1 market share

in Middle Georgia

Ongoing focus on expense control led to quarterly decline in noninterest

expense

Burden ratio1 was 2.22% for the first nine months of 2016, down from 2.62%

for the comparable period in 2015

Efficiency

Interest income on loans and invested funds increased $1.2mm (+4%) from

2Q16 and $3.0mm (+11%) from 3Q15

Net interest margin excluding accretion expanded to 3.57% in 3Q16

Average loans increased $80.0mm from the previous quarter

1 Ratio defined as annualized noninterest expense minus annualized noninterest income, excluding (amortization)/accretion of FDIC receivable, divided by average assets

5

Strong Revenue Trends – Interest Income

Growth in interest income from

organic and PNCI portfolios helped

offset the wind down of PCI loans

Total interest income (excluding

accretion) of $31.3mm in 3Q16

compared to $28.3mm in 3Q15 and

$18.7mm in 3Q14

($ i

n

000

s)

Net interest margin significantly

impacted by quarterly accretion

volatility

Net interest margin excluding

accretion of 3.57% as of 3Q16 has

improved 5 bps from 3Q15 and 57

bps from 3Q14

$17.8

$31.3

5,000

10,000

15,000

20,000

25,000

30,000

35,000

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Interest Income and Accretion

Interest Income Accretion

7.38%

4.54%

3.11% 3.57%

2%

3%

4%

5%

6%

7%

8%

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Net Interest Margin

NIM NIM excluding Accretion

6

Payroll fee income increased 12% year-over-year,

benefiting from an expanded product offering

Strong Revenue Trends – Noninterest Income

3Q16 mortgage production of $149mm, leading to a 4%

year-over-year increase in fee income

SBA production of $17mm in 3Q16

Servicing portfolio grew to $131mm in 3Q16

Total 3Q16 noninterest income of $9.8mm

($ i

n

000

s)

0

2,000

4,000

6,000

8,000

10,000

12,000

3Q15 4Q15 1Q16 2Q16 3Q16

Service Charge Other Mortgage Payroll SBA

0

50

100

150

200

0

1,000

2,000

3,000

4,000

3Q15 4Q15 1Q16 2Q16 3Q16

Pr

o

d

u

cti

o

n

($

in

m

m

)

N

o

n

in

ter

es

t

In

com

e

($ i

n

000

s)

Income Production

1,000

1,050

1,100

1,150

1,200

0

250

500

750

1,000

1,250

1,500

3Q15 4Q15 1Q16 2Q16 3Q16

# o

f C

lien

ts

N

o

n

in

ter

es

t

In

com

e

($ i

n

000

s)

Income Number of Clients

0

5

10

15

20

25

30

35

0

500

1,000

1,500

2,000

3Q15 4Q15 1Q16 2Q16 3Q16

Pr

o

d

u

cti

o

n

($

in

m

m

)

N

o

n

in

ter

es

t

In

com

e

($ i

n

000

s)

Income Production

7

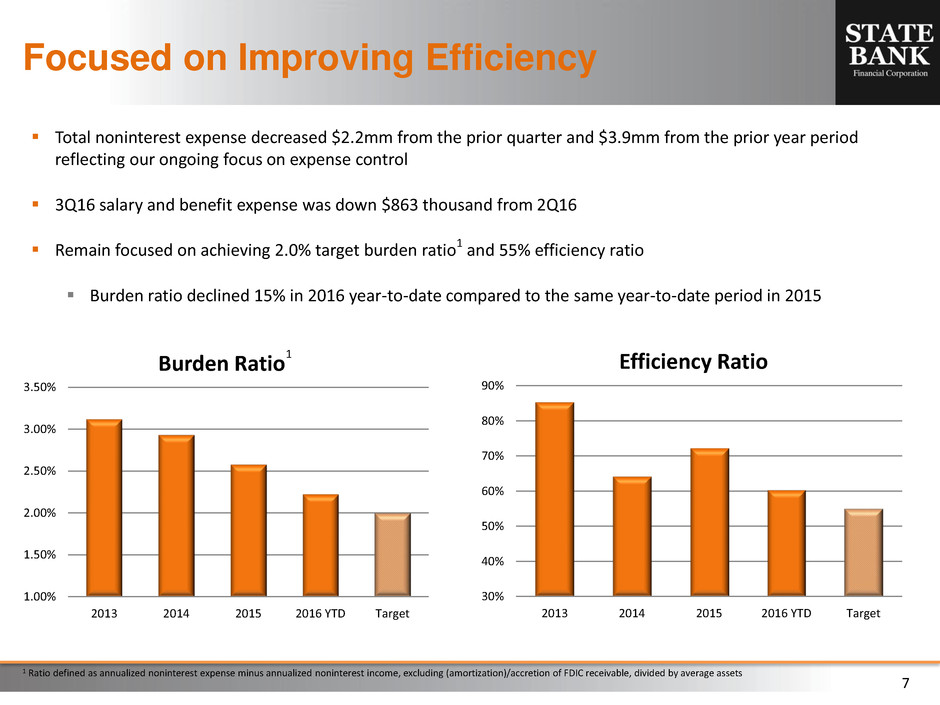

Focused on Improving Efficiency

Total noninterest expense decreased $2.2mm from the prior quarter and $3.9mm from the prior year period

reflecting our ongoing focus on expense control

3Q16 salary and benefit expense was down $863 thousand from 2Q16

Remain focused on achieving 2.0% target burden ratio1 and 55% efficiency ratio

Burden ratio declined 15% in 2016 year-to-date compared to the same year-to-date period in 2015

1 Ratio defined as annualized noninterest expense minus annualized noninterest income, excluding (amortization)/accretion of FDIC receivable, divided by average assets

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

2013 2014 2015 2016 YTD Target

Burden Ratio

1

30%

40%

50%

60%

70%

80%

90%

2013 2014 2015 2016 YTD Target

Efficiency Ratio

8

Core Deposit Funding

($ i

n

m

m

)

N

IB

/ Tot

al D

ep

o

sit

s

Attractive, low-cost core deposit mix focused on transaction-based funding

Note: Average deposit balances

($ in mm)

Deposit Composition 2012 % 2013 % 2014 % 2015 % 2016 YTD %

Noninterest-bearing 342 16% 413 20% 490 23% 758 27% 844 29%

Interest-bearing transaction 318 15% 336 16% 386 18% 519 19% 529 18%

Savings & MMA 1,030 48% 928 44% 911 42% 1,060 38% 1,065 37%

CDs 476 22% 431 20% 380 18% 437 16% 427 15%

Total Deposits $2,166 $2,107 $2,166 $2,773 $2,865

10%

15%

20%

25%

30%

35%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

2012 2013 2014 2015 2016 YTD

Deposit Mix

NIB IB Transaction Savings & MMA CDs NIB / Total Deposits

9

Core Deposit Funding

Maintain leading market share in middle Georgia (Macon and Warner Robins), with significant opportunity

for growth in Atlanta and Augusta markets

Continued focus on increasing

transaction deposits, which

include NIB demand deposits

and IB transaction accounts

Average noninterest-bearing

deposits represent 29% of total

deposits

Cost of funds remains low at 34

bps as of 3Q16

($ i

n

m

m

)

Note: Average deposit balances

.00%

.10%

.20%

.30%

.40%

.50%

0

200

400

600

800

1,000

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Transaction Deposit Accounts

Interest-bearing Noninterest-bearing Cost of Funds($ in mm)

Deposit Regi 2012 % 2013 % 2014 % 2015 % 2016 YTD %

Atlanta 870 40% 798 38% 869 40% 1,080 39% 1,138 40%

Middle Georgia 1,296 60% 1,309 62% 1,297 60% 1,271 46% 1,311 46%

Augusta - - - - - - 422 15% 415 15%

Total Deposits $2,166 $2,107 $2,166 $2,773 $2,865

10

0

125

250

375

500

500

1,000

1,500

2,000

2,500

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Total Loan Portfolio

Organic PNCI PCI New Loan Fundings

Loan Portfolio

To

ta

l L

o

an

s

($

in

m

m

)

1 New loan fundings include new loans funded and net loan advances on existing commitments

1

New loan originations in

excess of $390mm, offset

by record level of

paydowns

Organic and PNCI loans

increased $8.9mm in the

quarter and $239mm year-

over-year to end 3Q16 at

$2.2B

N

ew

Lo

an

Fu

n

d

in

gs ($ i

n

m

m

)

($ in mm)

Loan Composition 2012 2013 2014 2015 3Q16

Construction, land & land development $230 $251 $313 $501 $496

Other commercial real estate 458 550 636 736 803

Total commercial real estate 688 802 949 1,236 1,299

Residential real estate 43 67 135 210 196

Owner-occupied real estate 172 175 212 281 292

C&I and Leases 74 71 123 267 391

Consumer 8 9 9 21 41

Total Organic & PNCI Loans 986 1,123 1,428 2,015 2,220

PCI Loans 475 257 206 146 127

Total Loans $1,460 $1,381 $1,635 $2,160 $2,346

11

Loan Portfolio and CRE Composition

1 Organic and PNCI loans as of September 30, 2016

Commercial Real Estate Composition

Significant industry, client, source of

repayment, and geographic diversity in

the CRE portfolio

Construction, land & land development

(AD&C) comprises both commercial and

residential construction, which make up

16% and 12%, respectively, of total CRE

CRE

36%

AD&C

22%

SFR

9%

OORE

13%

C&I

14%

Leases

4%

Consumer

2%

Loan Portfolio

1

($ in mm) Organic PNCI Total % of Total CRE

CRE

Retail $181 $22 $203 16%

Office 139 7 146 11%

Multifamily 119 9 128 10%

Hospitality 104 5 108 8%

Industrial 73 7 81 6%

Farmland 27 - 27 2%

Sr. Housing 23 4 26 2%

Mini Storage 21 3 23 2%

Restaurant 21 1 21 2%

C-Store 18 0 18 1%

Other 19 1 20 2%

Total $744 $58 $803 62%

Construction, Land & Land Development

Commercial Construction $201 - $201 16%

Residential Construction 152 0 153 12%

Land & Development 133 $10 142 11%

Total $486 $10 $496 38%

Total Commercial Real Estate $1,231 $68 $1,299

12

Continue to successfully resolve

distressed assets as purchased

credit impaired loans are down

20% year-over-year

OREO balances remain relatively

low at $10.6mm as of 3Q16

Asset Quality Remains Sound

($ i

n

m

m

)

0

10

20

30

40

50

0

100

200

300

400

500

2012 2013 2014 2015 3Q16

OR

EO

($ i

n

m

m

)

PCI

Lo

an

s ($

in

m

m

)

PCI Loans & OREO

PCI Loans OREO

0.00%

0.50%

1.00%

1.50%

2.00%

0

5

10

15

20

2012 2013 2014 2015 3Q16

Nonperforming Loans

Organic PNCI NPLs / Organic Loans

Total organic NPAs of $6.5mm,

representing .32% of organic loans

and OREO

Average net charge-offs were .05% in

3Q16, down from .47% last quarter

Past due organic loans of just .09%,

compared to .18% at 2Q16

Allowance to organic loans is 1.07%,

down from 1.10% last quarter, and

covers NPAs by 3.3 times