Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - IBERIABANK CORP | earningsreleaseq32016.htm |

| 8-K - 8-K - IBERIABANK CORP | a8-kearningsreleasecoverpa.htm |

focused

3 Q 1 6 E a r n i n g s

C o n f e r e n c e C a l l

S u p p l e m e n t a l

P r e s e n t a t i o n

O c t o b e r 2 6 , 2 0 1 6

Exhibit 99.2

2

Safe Harbor

To the extent that statements in this PowerPoint presentation relate to future plans, objectives, financial results or performance

of IBERIABANK Corporation, these statements are deemed to be forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Such statements, which are based on management’s current information, estimates and

assumptions and the current economic environment, are generally identified by the use of the words “plan”, “believe”, “expect”,

“intend”, “anticipate”, “estimate”, “project” or similar expressions. The Company’s actual strategies, results and financial

condition in future periods may differ materially from those currently expected due to various risks and uncertainties. Forward-

looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual

results or financial condition to differ materially from those expressed in or implied by such statements. Consequently, no

forward-looking statement can be guaranteed. Except to the extent required by applicable law or regulation, the Company

undertakes no obligation to revise or update publicly any forward-looking statement for any reason.

This PowerPoint presentation supplements information contained in the Company’s earnings release dated October 26, 2016, and

should be read in conjunction therewith. The earnings release may be accessed on the Company’s web site,

www.iberiabank.com, under “Investor Relations” and then “Financial Information” and then “Press Releases.”

Non-GAAP Financial Measures

This PowerPoint presentation contains financial information determined by methods other than in accordance with GAAP. The

Company’s management uses core non-GAAP financial metrics (“Core”) in their analysis of the Company’s performance to identify

core revenues and expenses in a period that directly drive operating net income in that period. These Core measures typically

adjust GAAP performance measures to exclude the effects of the amortization of intangibles and include the tax benefits

associated with revenue items that are tax-exempt, as well as adjust income available to common shareholders for certain

significant activities or transactions that in management’s opinion can distort period-to-period comparisons of the Company’s

performance. Reference is made to “Non-GAAP Financial Measures” and “Caution About Forward Looking Statements” in the

earnings release which also apply to certain disclosures in this PowerPoint presentation.

Safe Harbor And Non-GAAP Financial Measures

3

3Q16 Highlights

• Total revenues down $4 million, or 2%, and core revenues down $3 million, or 1%

• Net interest margin and cash margin declined eight and 10 basis points, respectively, on a linked quarter basis

• The primary drivers of margin decline were interest accrual reversals for loans moved to non-accrual status,

accelerated bond premium amortization, and increased cash and liquidity during 3Q16

• Non-interest income decreased 8% linked quarter primarily due to lower mortgage income as the mortgage

locked pipeline declined and a $1.1 million negative fair value adjustment of loans moved to held for investment

Client

Growth

Revenues

Expenses

High Quality

Focus

• Period-end total loan growth of 1% in 3Q16; 6% annualized growth rate

• Period-end legacy loan growth of 4%; 14% annualized growth rate

• Total deposits up 4%, though average deposits up 1%

• Very good non-interest bearing deposit growth

• Originated/renewed $1 billion in loans in 3Q16, down 1% on a linked quarter basis

• Non-performing assets increased $126 million, or 62%, as energy loan resolution “conveyor belt” progresses

• Energy loans declined to 4.0% of total loans and energy-related reserves were 4.9% of total energy loans

• Total “risk-off trade” in energy, indirect auto, and Acadiana-based loans now down $727 million cumulatively

• Well positioned for increase in interest rates -- very asset sensitive and we have not elected to extend duration

• 65% of 3Q16 originations/renewals were floating rate; at 9/30/16, 56% of total loan portfolio has floating rates

• Total expenses down $1 million, or 1%, and core expenses down $1 million, or 1%

• Primary increases in core expenses were health care costs and professional services expense

• Core tangible efficiency ratio remained stable at 60%

4

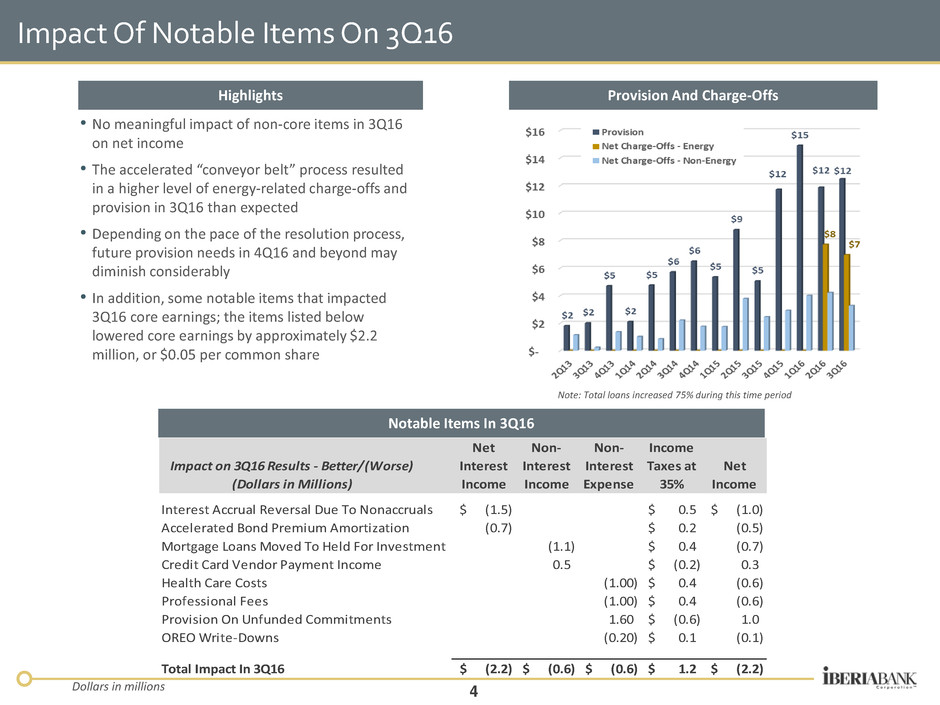

Impact Of Notable Items On 3Q16

• No meaningful impact of non-core items in 3Q16

on net income

• The accelerated “conveyor belt” process resulted

in a higher level of energy-related charge-offs and

provision in 3Q16 than expected

• Depending on the pace of the resolution process,

future provision needs in 4Q16 and beyond may

diminish considerably

• In addition, some notable items that impacted

3Q16 core earnings; the items listed below

lowered core earnings by approximately $2.2

million, or $0.05 per common share

Highlights

Dollars in millions

Notable Items In 3Q16

Note: Total loans increased 75% during this time period

Provision And Charge-Offs

Impact on 3Q16 Results - Better/(Worse)

(Dollars in Millions)

Net

Interest

Income

Non-

Interest

Income

Non-

Interest

Expense

Income

Taxes at

35%

Net

Income

Interest Accrual Reversal Due To Nonaccruals (1.5)$ 0.5$ (1.0)$

Accelerated Bond Premium Amortization (0.7) 0.2$ (0.5)

Mortgage Loans Moved To Held For Investment (1.1) 0.4$ (0.7)

Credit Card Vendor Payment Income 0.5 (0.2)$ 0.3

Health Care Costs (1.00) 0.4$ (0.6)

Professional Fees (1.00) 0.4$ (0.6)

Provision On Unfunded Commitments 1.60 (0.6)$ 1.0

OREO Write-Downs (0.20) 0.1$ (0.1)

Total Impact In 3Q16 (2.2)$ (0.6)$ (0.6)$ 1.2$ (2.2)$

5

GAAP EPS

3Q16 Summary EPS Results

• Income available to common shareholders of $44 million,

down $5 million, or 11%, compared to 2Q16

• 3Q16 GAAP EPS of $1.08, down 11% compared to 2Q16

and up 5% compared to 3Q15

• 3Q16 Core EPS of $1.08, down 9% compared to 2Q16

• Provision increased $1 million - our second highest

quarterly level of provision over the last six years

• 3Q16 Core Pre-Tax Pre-Provision EPS of $2.07, down 1%

linked quarter, and up 22% compared to 3Q15

• 3Q16 Core ROA of 0.94% and Core ROTCE of 10.30%

CORE EPS CORE Pre-Provision Pre-Tax EPS

Highlights

6

Client Growth

• Total period-end loan growth of $202 million, or 1%

• Acquired loans declined $227 million, or 8%, and aggregate

“risk off” assets declined $139 million during 3Q16

• Legacy loans grew $429 million, or 4% (14% annualized rate)

• $1 billion in loan originations in 3Q16, down 1% versus 2Q16

Loan Highlights

Dollars in millions

Deposits – Period-End And Average GrowthLoans – Period-End Growth

Deposit Highlights

• Period-end total deposits grew $660 million, or 4%, vs. 6/30/16

• Average total deposits grew $97 million, or 1% vs. 2Q16

• Very strong growth in non-interest bearing deposits, up $248

million, or 5%, on a period-end basis and up $142 million, or

3%, on an average balance basis

7

Revenues – Net Interest Income

HighlightsQuarterly Yield/Cost Trend

Drivers Of Change In Margin

• Tax-Equivalent net interest income up $1 million, or 1%

• Tax-Equivalent net interest margin down eight basis points

and cash margin down 10 basis points on a linked quarter

basis

• Margin decline primarily due to reversals of interest

accruals for loans moved to non-accrual status,

accelerated bond premium amortization and increased

cash and liquidity during 3Q16

• Average earnings assets increased $366 million, or 2%,

driven primarily by $446 million in average legacy loan

growth (total average loans grew $231 million, or 2%,

equal to a 6% annualized growth rate)

Dollars in millions

Net Interest Income Net Interest

($Millions) Margin

162.8$ 2Q16 3.61%

6.3 Legacy Loan Volume Increase 0.02

(2.3) Lower Acquired Loan Portfolio (0.02)

(1.5) Interest Accrual Reversals (0.03)

(0.7) Accelerated Bond Premium Amortization (0.02)

0.2 Increased Cash & Liquidity (0.03)

(0.8) Higher Deposit Balances (0.02)

(0.5) All Other Factors 0.01

163.4$ 3Q16 3.53%

8

Revenues/ Interest Rate Risk

Highlights

Assets Liabilities

• Loans: 44% fixed and 56% floating

• Adjustable loans composition:

Prime-based 43%

LIBOR-based 54%

All other 3%

• Most LIBOR-based loans are priced off of 30-Day LIBOR

• Floors on approximately 30% of adjustable loans

• Bond portfolio had an effective duration of 3.0 years

• Asset-sensitive from an interest rate risk perspective

• The degree of asset-sensitivity is a function of the reaction

of competitors to changes in deposit pricing

• The level of asset sensitivity has increased over time

• Forward curve has a positive impact on net interest income

over 12-month period

• Estimated impact of the next 25 basis point increase in the

Federal Funds Rate would equate to a $0.05 increase in

quarterly EPS

12-Month Net Interest Income Scenarios

• Non-interest-bearing equated to 29% of total deposits

• Non-interest-bearing deposits up $248 million, or 5%, on

a period-end basis, and up $142 million, or 3%, on an

average balance basis

• Interest-bearing deposit cost of 0.44% and total deposit

cost of 0.32%, both up two basis points from 2Q16

• No significant change in deposit rates since Fed Funds

move in 4Q15

• Cost of interest-bearing liabilities increased three basis

points to 0.53%

9

Revenues – Non-Interest Income

• No meaningful non-core

income in 3Q16, so change

in income was due to core

income changes

• Core non-interest income

declined $3.3 million, or

5%, compared to 2Q16:

Mortgage income

decreased $4.2 million,

or 16%

Title revenues decreased

$0.1 million, or 2%

Credit card income

increased $0.8 million on

a linked quarter basis

Continued strong

Treasury Management

income, up 7% on a

linked quarter basis

HighlightsDrivers Of Non-Interest Income Change Quarter-Over-Quarter

Dollars in millions

10

Revenues – Mortgage Income

Highlights

Volume Trends

Mortgage Income Trends

• Mortgage income of $21.8 million, down $4.2 million, or 16%:

Loan originations down 1% to $699 million in 3Q16

Sales volumes of $706 million (5% higher than in 2Q16)

$3.5 million higher gains (+15%) on higher sales volume

Lower market value adjustments were driven by a decrease

in the rate lock commitment pipeline and a rate decline

$1.1 million negative fair value adjustment in 3Q16 for loans

transferred to held for investment (“HFI”)

Dollars in millions

Mortgage Weekly Locked Pipeline

11

Expense Control

• Total core revenues were down $3 million, or 1%,

compared to 2Q16 while core expenses were

down $1 million, or 1%, over that period

• Our core tangible efficiency ratio remained at 60%

in 3Q16, essentially unchanged from 2Q16

• Notable items included elevated costs associated

with health care, professional services, partially

offset by reduced provision for unfunded

commitments

Highlights

Efficiency Ratio Trends

Drivers Of Expense Change Quarter-Over-Quarter

Dollars in millions

12

Summary

• Good loan growth (despite “risk-off trade”) and exceptional deposit growth

• Continued resolution of energy portfolio resulted in higher level of NPAs, associated interest accrual reversals,

and continued elevated energy charge-offs and provisioning

• Margin compression driven by interest accrual reversals, accelerated bond premium amortization and excess

liquidity

• Operating leverage remained stable as expenses declined; tangible core efficiency ratio remained at 60%

• Notable items negatively impacted 3Q16 EPS by five cents per share

• Well positioned for rising rates

• Active shareholder focus in 2016 (6% increase in shareholder dividend, share repurchase program, and

preferred stock issuance)

Guidance

• Consolidated loan growth for full-year 2016 expected to be 5%, with annualized growth of 4% in 4Q16

• Our expectations assume no change in interest rates; the next 25 basis point Fed move would add five cents EPS

• Continued margin compression assuming no changes in market interest rates

• Full year loan loss provision of $50 million (implying $11 million in loan loss provision in 4Q16)

• Core expenses for full year 2016 of approximately $548 million (implying $136 million core expenses in 4Q16)

• Core EPS of $4.40 to $4.45 for full year 2016 (implying core EPS in the range of $1.13 to $1.18 in 4Q16)

The Company’s guidance is subject to risks, uncertainties, and assumptions which could, individually or collectively, cause actual results

or financial condition to differ materially from those anticipated above. Reference is made to “Caution About Forward-Looking

Statements” in the earnings release which also applies to this guidance.

Summary Remarks And Guidance

13

“Risk-Off” Focus

• Purpose: reduce current exposures to

avoid future potential loss exposures

(though some near-term cost)

• $727 million in cumulative risk-off

trade since the beginning of 2015

• An estimated pre-tax opportunity cost

of $5.5 million during 2015 and $11.1

million for YTD 2016, or approximately

$0.06 EPS per quarter after-tax

• Percentage of total loans at September

30, 2016:

Energy loans equal 4.0% (3.94% at

October 21, 2016)

Indirect Auto loans equal 1.0%

Multi-Family loans equal 4.3%

Construction and Land loans equal

6.1% (46% of Total Risk Based

Capital*)

Non-Owner Occupied CRE equals

27% (201% of Total Risk Based

Capital*)

Highlights Risk Off Trend (Period-End)

Dollars in millions

($62) mm,

-9%

($28) mm,

-16%

($49) mm,

-4%

Linked Qtr

Change

* Preliminary

14

Continued Resolution of Energy Portfolio

Highlights

Energy Loan Portfolio Asset Quality

Declining Energy Loan Balances

Energy-Related Criticized Assets

• Energy-related loans equated to 4.0% of total loans, down

$62 million, or 9%, compared to 6/30/16

• Increase in energy-related non-performing assets were

from loans that were previously deemed criticized in prior

periods

• The majority of this increase is from seven relationships;

two-thirds of the increase is from loans in the E&P portfolio

• 89% of energy-related loan balances on non-accrual remain

current with their payments

• Resolution of energy credits continues as they “roll down

the conveyor belt”

• Criticized energy-related loans increased $6 million, or 2%

• 42% of energy loans were classified

• 53% of energy loans were criticized

• Energy-related non-accrual loans were up $93 million to

$154 million, or 25.6% of the energy portfolio

• Energy provision of $1 million as credit conditions

stabilized in the quarter; energy charge-offs of $7 million

• Allowance for energy-related loans was $29 million; equal

to 4.9% of the energy-related loans outstanding.

E&P:

$100mm

Dollars in millions

Services:

$54mm

Midstream:

$0mm

15

Continued Strong Credit Results

Highlights Favorable Overall NPA Trends

NPAs To Total AssetsNon-Energy-Related NPAs

The Company’s Total

Assets Increased By $5.0

Billion, Or 32%, During This

Period

• Continued workout of covered and other acquired portfolios

• Legacy NPAs/Assets equal to 1.33%, an increase of 70 basis

points on a linked-quarter basis

• Legacy loans past due 30 days or more (excluding non-

accruals) equal to 0.37% of total legacy loans

• Annualized legacy net charge-offs equal to 0.33% of average

legacy loans in 3Q16, compared to 0.38% in 2Q16

• Loan loss provision of $12 million for 3Q16; exceeded net

charge-offs in 3Q16 by $2 million

Dollars in millions

Source: SNL Financial – Publicly Traded Bank Holding Companies With Total Assets Between $10 - $30 Billion

16

Credit Quality Trends

Highlights

• Continued decline in acquired and energy loans

• Good non-energy loan growth

• Energy-related net charge-offs remain elevated,

while net charge-offs for non-energy loans

declined to annualized nine basis points of

average loans

• Energy-related net charge-offs accounted for

68% of total net charge-offs in 3Q16

• Provision exceeded net charge-offs

• Non-energy-related allowance increased to

0.84% of loans

• No energy loans were past due (excluding non-

accruing loans)

• Non-energy-related past dues declined in 3Q16

• NPAs increased $126 million, or 62%, of which

$93 million, or 74% of the total increase in NPAs

in 3Q16 were energy-related

• Non-energy NPAs were 0.84% of total assets

Energy And Non-Energy Asset Quality

$millions % Loans $millions % Loans $millions % Loans $millions % Chg

Loans Outstandings

Energy 732 5.1% 662 4.5% 600 4.0% (62) -9%

Non-Energy 13,720 94.9% 14,061 95.5% 14,325 96.0% 264 2%

Total 14,451$ 100.0% 14,723$ 100.0% 14,924$ 100.0% 202$ 1%

Net Charge-Offs

Energy - 0.00% 8 4.44% 7 4.39% (1) -10%

Non-Energy 4 0.12% 4 0.12% 3 0.09% (1) -22%

Total 4$ 0.11% 12$ 0.33% 10$ 0.27% (2)$ -14%

Provision 15$ 12$ 12$ 1$ 5%

Reserve Build 11 (0) 2 2$ n.m.

Coverage Ratio 372% 100% 122%

Allowance For Loan Losses

Energy 38 5.26% 33 4.99% 28 4.71% (5) -15%

Non-Energy 108 0.79% 114 0.81% 120 0.84% 6 5%

Total 147$ 1.01% 147$ 1.00% 148$ 0.99% 1$ 1%

Loans 30-89 Days Past Due

Energy - 0.00% 3 0.46% - 0.00% (3) n.m.

Non-Energy 59 0.43% 56 0.40% 50 0.35% (6) -10%

Total 59$ 0.41% 59$ 0.40% 50$ 0.34% (9)$ -15%

NPAs: %Assets %Assets %Assets

Energy 46 6.32% 61 9.19% 154 25.62% 93 153%

Non-Energy 169 0.87% 141 0.72% 175 0.87% 33 24%

Total 215$ 1.07% 202$ 1.00% 328$ 1.58% 126$ 62%

3Q16 Linked Quarter Chg.1Q16 2Q16

APPENDIX

18

Louisiana And Texas MSAs Our Other MSAs

Local Market Conditions – MSA Unemployment Trends

• Prior to 2014, nearly all unemployment rates below national

average

• Louisiana markets exhibit seasonality (December peaks)

• Uptick in unemployment rates in Lafayette

• Lake Charles, Baton Rouge and Houston remain near the

national average

• Houston and Dallas in downward tandem until year-end 2014

• All MSAs exhibiting improvement in unemployment rates

• Many markets are near national average in magnitude

and trend

• Unemployment in Mobile remains at elevated level

• Lowest unemployment rates in Arkansas MSAs

19

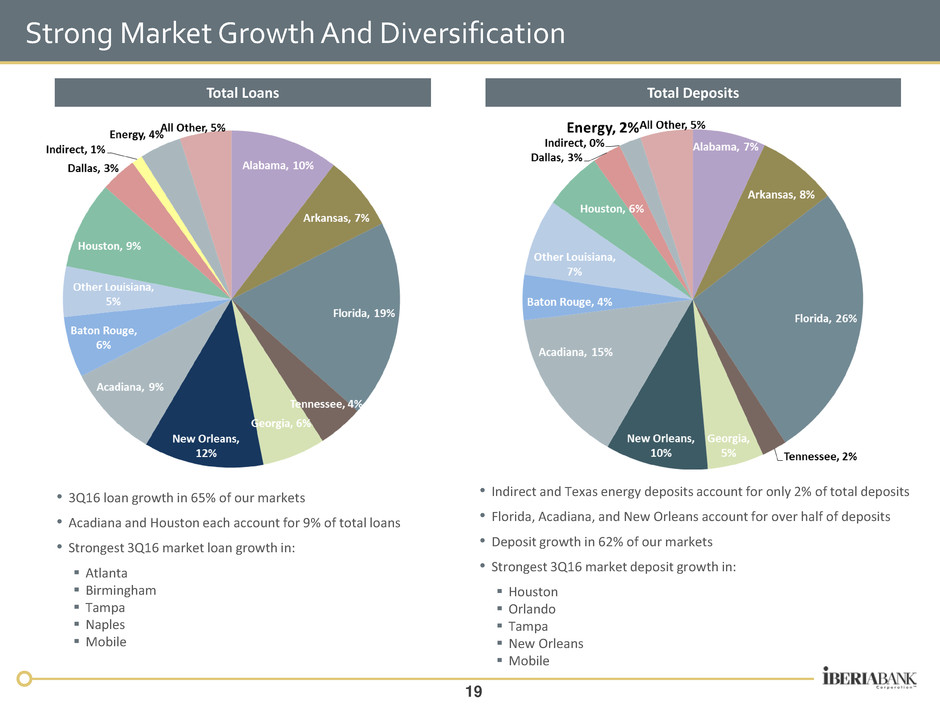

Total Loans

Strong Market Growth And Diversification

• 3Q16 loan growth in 65% of our markets

• Acadiana and Houston each account for 9% of total loans

• Strongest 3Q16 market loan growth in:

Atlanta

Birmingham

Tampa

Naples

Mobile

Total Deposits

• Indirect and Texas energy deposits account for only 2% of total deposits

• Florida, Acadiana, and New Orleans account for over half of deposits

• Deposit growth in 62% of our markets

• Strongest 3Q16 market deposit growth in:

Houston

Orlando

Tampa

New Orleans

Mobile

20

Seasonal Influences

Legacy Loan Growth

• Loan growth typically softer in first quarter, stronger in second

quarter and somewhat slower in the third quarter

• Mortgage and title income typically are softer in fourth and first

quarters and stronger in second and third quarters

• Payroll taxes and retirement contributions decrease ratably

throughout the year

Dollars in millions

Seasonal Revenue Trends

Seasonal Expense Trends

21

Non-Interest Income And Expense Trend Details

Dollars in millions

Non-interest Income ($ millions) 3Q15 4Q15 1Q16 2Q 16 3Q 16 $ Change

%

Change

Service Charges on Deposit Accounts 11.3$ 11.4$ 11.0$ 10.9$ 11.1$ 0.1$ 1%

ATM / Debit Card Fee Income 3.6 3.6 3.5 3.6 3.5 (0.2) -5%

BOLI Proceeds and CSV Income 1.1 1.1 1.2 1.4 1.3 (0.1) -8%

Mortgage Income 20.6 16.8 19.9 26.0 21.8 (4.2) -16%

Title Revenue 6.6 5.4 4.7 6.1 6.0 (0.1) -2%

Broker Commissions 3.8 4.1 3.8 3.7 3.8 0.1 2%

Other Non-interest Income 8.2 9.9 11.5 11.3 12.3 1.1 9%

Core Non-Interest Income 55.2$ 52.3$ 55.6$ 63.0$ 59.8$ (3.3)$ -5%

Gain (Loss) on Sale of Investments, Net 0.3 - 0.2 1.8 - (1.8) -99%

Other Non-core non-interest income 1.9 0.2 - - - - 0%

Total Non-interest Income 57.4$ 52.5$ 55.8$ 64.8$ 59.8$ (5.1)$ -8%

Non-interest Expense ($ millions) 3Q15 4Q15 1Q16 2Q 16 3Q 16 $ Change

%

Change

Mortgage Commissions 6.7$ 4.9$ 4.6$ 7.3$ 6.9$ (0.4)$ -5%

Hospitalization Expense 5.9 5.5 5.6 5.3 6.6 1.3 24%

Other Salaries and Benefits 69.3 71.2 70.1 72.3 71.5 (0.8) -1%

Salaries and Employee Benefits 81.8$ 81.6$ 80.3$ 85.0$ 85.0$ 0.1$ 0%

Credit/Loan Related 5.2 2.5 2.7 2.9 1.9 (1.0) -34%

Occupancy and Equipment 17.9 16.9 16.9 16.8 16.5 (0.2) -1%

Amortization of Acquisition Intangibles 2.3 1.8 2.1 2.1 2.1 - 0%

All Other Non-interest Expense 33.2 31.3 32.9 32.7 32.5 (0.1) 0%

Core Non-Interest Expense 140.5$ 134.1$ 134.9$ 139.4$ 138.1$ (1.3)$ -1%

Severance 0.3 1.8 0.5 0.1 - (0.1) -100%

Storm-related expenses - - - - - - 0%

Impairment of Long-lived Assets, net of gains o 1.7 3.4 1.0 (1.3) - 1.3 -100%

Debt Prepayment - - - - - - 0%

Consulting and Professional - - - 0.6 - (0.6) -100%

Other Non-interest Expense 0.2 (0.2) 1.1 0.6 - (0.6) -100%

Merger-Related Expenses 2.2 (0.2) - - - - 0%

Total Non-interest Expense 145.0$ 139.0$ 137.5$ 139.5$ 138.1$ (1.4)$ -1%

Core Tangible Efficiency Ratio 64.8% 61.1% 60.3% 60.0% 60.1%

3Q16 vs. 2Q16

3Q16 vs. 2Q16

22

GAAP And Non-GAAP Cash Margin

• Adjustments represent accounting impacts

of purchase discounts on acquired loans

and related accretion as well as the

indemnification asset and related

amortization on the covered portfolio

Dollars in millions

Balances, as

Reported Adjustments

As Adjusted

Non-GAAP

3Q15

Average Balance 17,712$ 91$ 17,803$

Income 155.1$ (7.5)$ 147.6$

Rate 3.50% -0.20% 3.31%

4Q15

Average Balance 17,688$ 87$ 17,775$

Income 161.1$ (10.7)$ 150.4$

Rate 3.64% -0.29% 3.38%

1Q16

Average Balance 17,873$ 86$ 17,959$

Income 161.4$ (6.5)$ 154.9$

Rate 3.64% -0.16% 3.48%

2Q16

Average Balance 18,155$ 84$ 18,239$

Income 162.8$ (8.6)$ 154.2$

Rate 3.61% -0.20% 3.41%

3Q16

Average Balance 18,521$ 77$ 18,598$

Income 163.4$ (9.1)$ 154.3$

Rate 3.53% -0.22% 3.31%

23

Strong Capital Position

• On May 9, 2016, issued $55 million in Non-Cumulative

Perpetual Preferred Stock

• Additional Preferred Stock improved our capital ratios:

Tier 1 Leverage by 29 basis points

Tier 1 Risk Based Capital by 32 basis points

Total Risk-Based Capital Ratios by 32 basis points

• Preferred Stock had a year-to-date cost of $7.0 million, or

$0.17 negative impact to EPS until fully deployed

• On May 4, 2016, the Company’s Board of Directors of the

Company authorized the repurchase of up to 950,000

common shares

• To date, 202,506 common shares were purchased at a

weighted average price of $57.61 per common share

• During 3Q16, the Company did not repurchase any shares

of its commons stock

Highlights

Preferred Stock Issuance

Capital Ratios (Preliminary)

Share Repurchase Program

• Issued $55 million in preferred stock in 2Q16 with an

additional cost of $0.02 EPS in 3Q16

• Many regulatory capital ratios for both IBERIABANK

Corporation and IBERIABANK increased relative to June

30, 2016 as a result of quarterly earnings

• Continuing to grow capital organically

• No common shares were repurchased in 3Q16

• On September 12, 2016, the Company increased the

quarterly cash dividend on common shares by 6%

IBERIABANK Corporation Capital Ratios 2Q16 3Q16 Change

Common Equity Tier 1 (CET1) ratio 10.07% 10.13% 6 bps

Tier 1 Leverage 9.70% 9.70% 0 bps

Tier 1 Risk-Based 10.84% 10.89% 5 bps

Total Risk-Based 12.46% 12.47% 1 bps

IBERIABANK and Subsidiaries Capital Rat 2Q16 3Q16 Change

Common Equity Tier 1 (CET1) ratio 10.39% 10.51% 12 bps

Tier 1 Leverage 9.30% 9.37% 7 bps

Tier 1 Risk-Based 10.39% 10.51% 12 bps

Total Risk-Based 11.33% 11.43% 10 bps

24

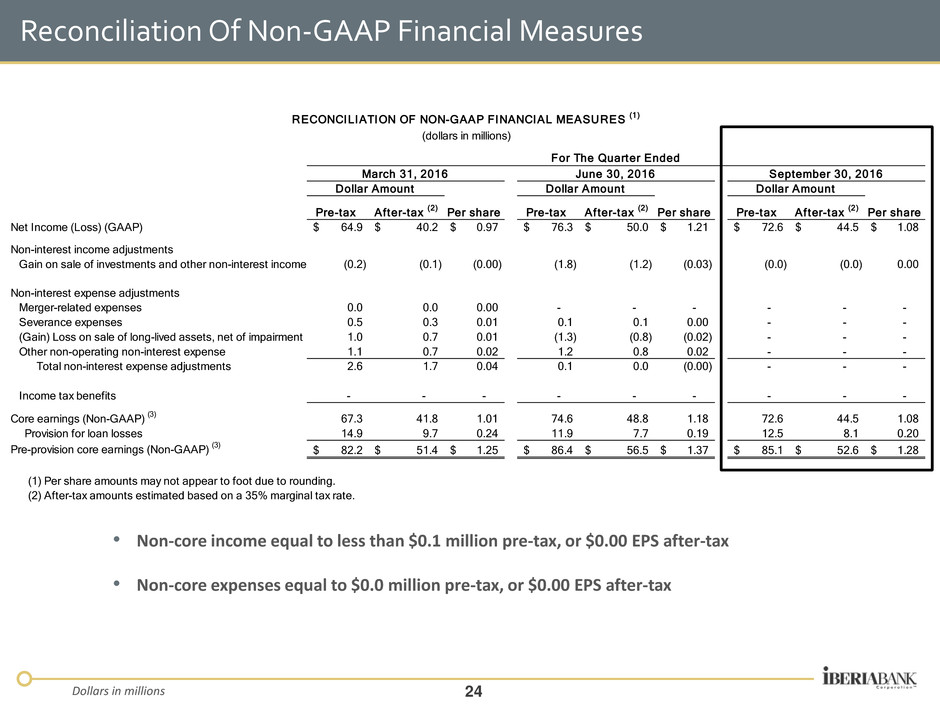

Pre-tax After-tax (2) Per share Pre-tax After-tax (2) Per share Pre-tax After-tax (2) Per share

Net Income (Loss) (GAAP) 64.9$ 40.2$ 0.97$ 76.3$ 50.0$ 1.21$ 72.6$ 44.5$ 1.08$

Non-interest income adjustments

Gain on sale of investments and other non-interest income (0.2) (0.1) (0.00) (1.8) (1.2) (0.03) (0.0) (0.0) 0.00

Non-interest expense adjustments

Merger-related expenses 0.0 0.0 0.00 - - - - - -

Severance expenses 0.5 0.3 0.01 0.1 0.1 0.00 - - -

(Gain) Loss on sale of long-lived assets, net of impairment 1.0 0.7 0.01 (1.3) (0.8) (0.02) - - -

Other non-operating non-interest expense 1.1 0.7 0.02 1.2 0.8 0.02 - - -

Total non-interest expense adjustments 2.6 1.7 0.04 0.1 0.0 (0.00) - - -

Income tax benefits - - - - - - - - -

Core earnings (Non-GAAP) (3) 67.3 41.8 1.01 74.6 48.8 1.18 72.6 44.5 1.08

Provision for loan losses 14.9 9.7 0.24 11.9 7.7 0.19 12.5 8.1 0.20

Pre-provision core earnings (Non-GAAP) (3) 82.2$ 51.4$ 1.25$ 86.4$ 56.5$ 1.37$ 85.1$ 52.6$ 1.28$

(1) Per share amounts may not appear to foot due to rounding.

(2) After-tax amounts estimated based on a 35% marginal tax rate.

Dollar Amount Dollar Amount Dollar Amount

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (1)

(dollars in millions)

For The Quarter Ended

March 31, 2016 June 30, 2016 September 30, 2016

Reconciliation Of Non-GAAP Financial Measures

• Non-core income equal to less than $0.1 million pre-tax, or $0.00 EPS after-tax

• Non-core expenses equal to $0.0 million pre-tax, or $0.00 EPS after-tax

Dollars in millions

25

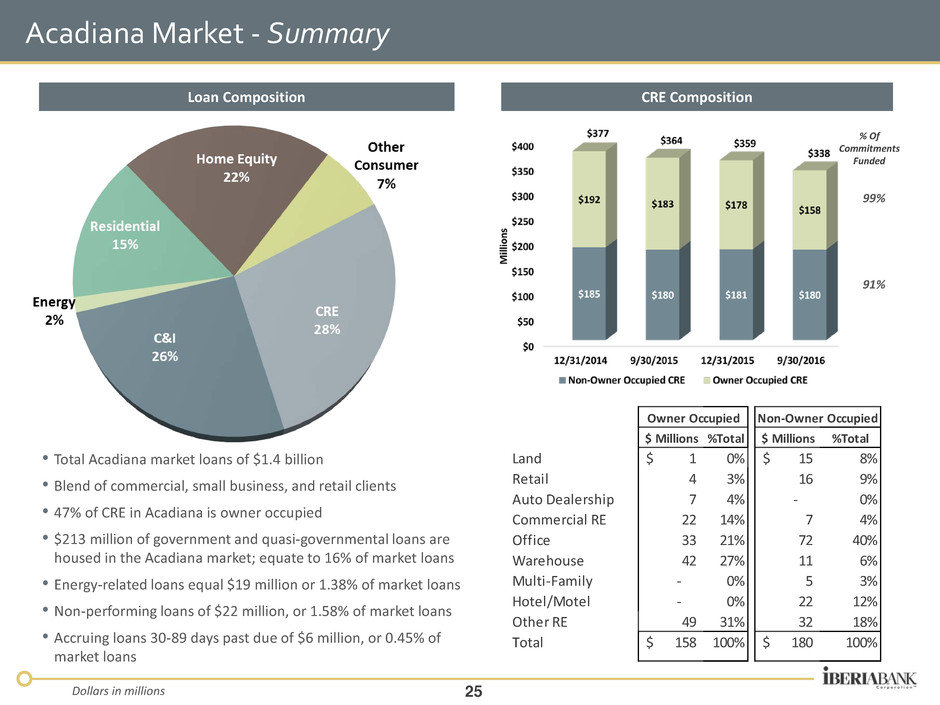

Acadiana Market - Summary

• Total Acadiana market loans of $1.4 billion

• Blend of commercial, small business, and retail clients

• 47% of CRE in Acadiana is owner occupied

• $213 million of government and quasi-governmental loans are

housed in the Acadiana market; equate to 16% of market loans

• Energy-related loans equal $19 million or 1.38% of market loans

• Non-performing loans of $22 million, or 1.58% of market loans

• Accruing loans 30-89 days past due of $6 million, or 0.45% of

market loans

Loan Composition CRE Composition

% Of

Commitments

Funded

99%

91%

Dollars in millions

$ Millions %Total $ Millions %Total

Land 1$ 0% 15$ 8%

Retail 4 3% 16 9%

Auto Dealership 7 4% - 0%

Commercial RE 22 14% 7 4%

Office 33 21% 72 40%

Warehouse 42 27% 11 6%

Multi-Family - 0% 5 3%

Hotel/Motel - 0% 22 12%

Other RE 49 31% 32 18%

Total 158$ 100% 180$ 100%

Owner Occupied Non-Owner Occupied

26

Houston Market - Summary

• Total Houston market loans equal to $1.8 billion

• Vast majority of portfolio is commercial (very little retail)

• 93% of Home Equity portfolio has an LTV of 80% or better

• 47% of CRE in Houston is owner occupied

• Energy-related loans of $528 million or 30% of market loans

• Non-performing loans, including Texas energy loans, equate

to $168 million or 9.40% of market loans

• Accruing loans 30-89 days past due equate to $0.5 million, or

0.02%

Loan Composition CRE Composition

% Of

Commitments

Funded

98%

85%

Dollars in millions

$ Millions %Total $ Millions %Total

Retail 2$ 1% 46$ 15%

Churches 16 6% - 0%

Hospitals 22 8% 9 3%

Convenience Store 20 7% - 0%

Office 50 19% 46 15%

Warehouse 77 29% 38 13%

Multi-Family - 0% 121 40%

Other RE 82 30% 44 14%

Total 269$ 100% 304$ 100%

Owner Occupied Non-Owner Occupied