Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Howmet Aerospace Inc. | d278490d8k.htm |

Exhibit 99.1

Launching November 1, 2016

ARCONIC

Innovation, engineered.

Important Information

Forward–Looking Statements

This presentation contains statements that relate to future events and expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include those containing such words as “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “guidance,” “goal,” “intends,” “may,” “outlook,” “plans,” “projects,” “seeks,” “sees,” “should,” “targets,” “will,” “would,” or other words of similar meaning. All statements that reflect Arconic’s expectations, assumptions or projections about the future, other than statements of historical fact, are forward-looking statements, including, without limitation, forecasts relating to the growth of the aerospace, automotive, commercial transportation and other end markets; statements and guidance regarding future financial results or operating performance; statements about Arconic’s strategies, outlook, business and financial prospects; statements regarding potential share gains; and statements regarding the separation. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict. Although Arconic believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions, it can give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties. Such risks and uncertainties include, but are not limited to: (a) the possibility that various closing conditions for the separation may not be satisfied; (b) the impact of the separation on the businesses of Arconic; (c) deterioration in global economic and financial market conditions generally; (d) unfavorable changes in the markets served by Alcoa; (e) the impact of changes in foreign currency exchange rates on costs and results; (f) the inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations anticipated from restructuring programs and productivity improvement, cash sustainability, technology advancements, and other initiatives; (g) changes in discount rates or investment returns on pension assets; (h) Arconic’s inability to realize expected benefits, in each case as planned and by targeted completion dates, from acquisitions, divestitures, facility closures, curtailments, expansions, or joint ventures; (i) the impact of cyber attacks and potential information technology or data security breaches; (j) political, economic, and regulatory risks in the countries in which Arconic operates or sells products; (k) material adverse changes in aluminum industry conditions, including fluctuations in London Metal Exchange-based aluminum prices; (l) the outcome of contingencies, including legal proceedings, government or regulatory investigations, and environmental remediation; and (m) the other risk factors discussed in Alcoa Inc.’s Form 10-K for the year ended December 31, 2015, and other reports filed with the U.S. Securities and Exchange Commission (SEC). Alcoa Inc./Arconic Inc. disclaims any obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable law. Market projections are subject to the risks discussed above and other risks in the market.

ARCONIC

2

Important Information (continued)

Non-GAAP Financial Measures

Some of the information included in this presentation is derived from Alcoa Inc.’s consolidated financial information but is not presented in Alcoa Inc.’s financial statements prepared in accordance with accounting principles generally accepted in the United States of America (GAAP). Certain of these data are considered “non-GAAP financial measures” under SEC rules. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. Reconciliations to the most directly comparable GAAP financial measures and management’s rationale for the use of the non-GAAP financial measures can be found in the Appendix to this presentation.

Arconic has not provided a reconciliation of the forecasted range for adjusted EBITDA margin on a segment and combined segments basis for fiscal 2016 and 2017 to the most directly comparable GAAP financial measures because Arconic is unable to quantify certain amounts that would be required to be included in the GAAP measure without unreasonable efforts and Arconic believes such reconciliations would imply a degree of precision that would be confusing or misleading to investors. In particular, reconciliation of guidance for adjusted EBITDA margin to the most directly comparable GAAP measure is not available without unreasonable efforts on a forward-looking basis due to the variability and complexity with respect to the charges and other components excluded from these non-GAAP measures, such as the effects of the Warrick cold metal plan, foreign currency movements, equity income, gains or losses on sales of assets, and taxes. These reconciling items are in addition to the inherent variability already included in the GAAP measure which includes, but is not limited to, price/mix, volume, and the impact of the impending separation of Alcoa Inc. Any reference to historical EBITDA means adjusted EBITDA, for which we have provided calculations and reconciliations in the Appendix.

Other Information

The separation of Alcoa Inc. into two standalone companies – Arconic Inc. (the new name for Alcoa Inc.) and Alcoa Corporation – is scheduled to become effective before the opening of the market on November 1, 2016. Upon separation, Arconic comprises the Engineered Products and Solutions

(EPS), Global Rolled Products (GRP) (other than the rolling mill operations in Warrick, Indiana (“Warrick”) and the 25.1% equity investment in the

Ma’aden Rolling Company in Saudi Arabia), and Transportation and Construction Solutions (TCS) segments. References in this presentation to “Combined Segments” reflect the combined performance of the EPS, GRP and TCS segments, and, where noted, do not include Warrick, which becomes a part of Alcoa Corporation upon separation. Arconic will exit the North American Packaging business at its Tennessee Operations following the expiration of the toll processing and services agreement with Alcoa Corporation.

ARCONIC

3

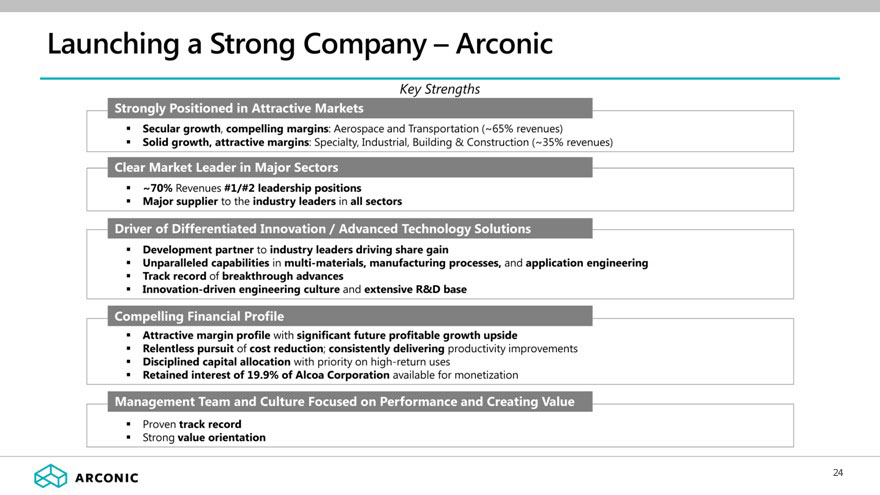

Launching a Strong Company – Arconic

Key Strengths

Strongly Positioned in Attractive Markets

Secular growth, compelling margins: Aerospace and Transportation (~65% revenues)

Solid growth, attractive margins: Specialty, Industrial, Building & Construction (~35% revenues)

Clear Market Leader in Major Sectors

~70% Revenues #1/#2 leadership positions Major supplier to the industry leaders in all sectors

Driver of Differentiated Innovation / Advanced Technology Solutions

Development partner to industry leaders driving share gain

Unparalleled capabilities in multi-materials, manufacturing processes, and application engineering Track record of breakthrough advances Innovation-driven engineering culture and extensive R&D base

Compelling Financial Profile

Attractive margin profile with significant future profitable growth upside

Relentless pursuit of cost reduction; consistently delivering productivity improvements Disciplined capital allocation with priority on high-return uses Retained interest of 19.9% of Alcoa Corporation available for monetization

Management Team and Culture Focused on Performance and Creating Value

Proven track record Strong value orientation

4

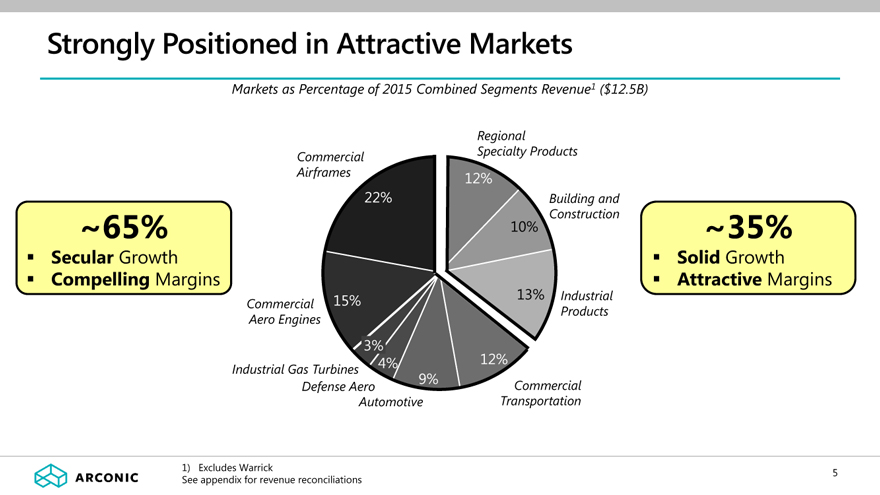

Strongly Positioned in Attractive Markets

Markets as Percentage of 2015 Combined Segments Revenue1 ($12.5B)

~65%

Secular Growth

Compelling Margins

Commercial Airframes

Commercial Aero Engines

Industrial Gas Turbines Defense Aero Automotive

Regional

Specialty Products

Building and Construction

Industrial Products

Commercial Transportation

22%

12%

15%

3%

4%

9%

12%

13%

10%

~35%

Solid Growth

Attractive Margins

1) Excludes Warrick

See appendix for revenue reconciliations

ARCONIC

5

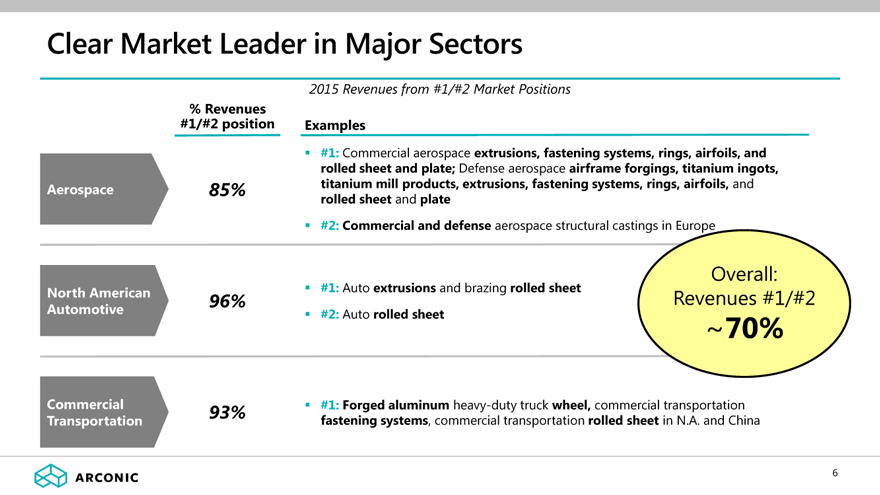

Clear Market Leader in Major Sectors

2015 Revenues from #1/#2 Market Positions

% Revenues #1/#2 position

Examples

Aerospace

85%

#1: Commercial aerospace extrusions, fastening systems, rings, airfoils, and rolled sheet and plate; Defense aerospace airframe forgings, titanium ingots, titanium mill products, extrusions, fastening systems, rings, airfoils, and rolled sheet and plate

#2: Commercial and defense aerospace structural castings in Europe

North American Automotive

#1: Auto extrusions and brazing rolled sheet

96%

#2: Auto rolled sheet

Commercial Transportation

93%

#1: Forged aluminum heavy-duty truck wheel, commercial transportation fastening systems, commercial transportation rolled sheet in N.A. and China

Overall:

Revenues #1/#2

~70%

ARCONIC

6

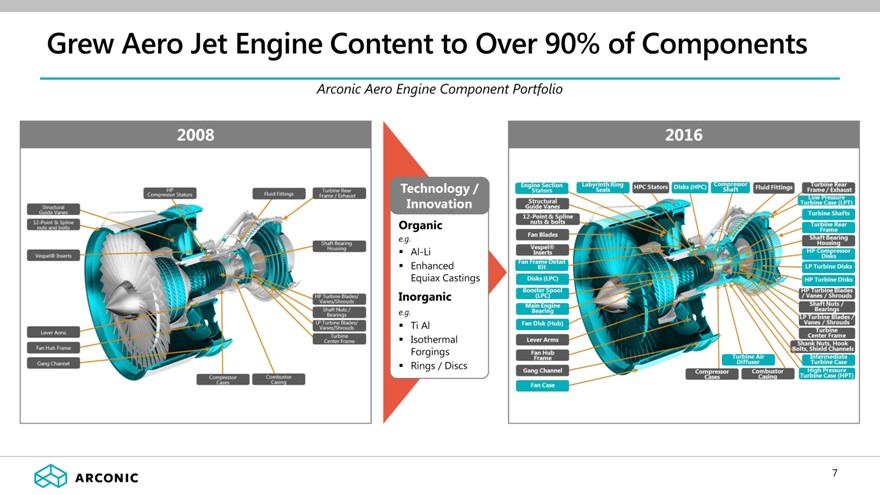

Grew Aero Jet Engine Content to Over 90% of Components

Arconic Aero Engine Component Portfolio

2008

Technology / Innovation

Organic

e.g.

Al-Li ? Enhanced Equiax Castings

Inorganic

e.g. :

Ti Al ? Isothermal Forgings ? Rings / Discs

2016

7

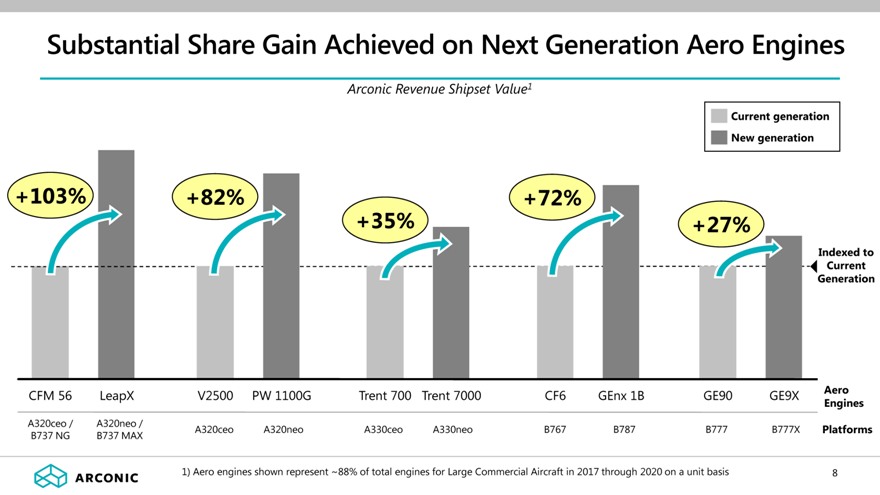

Substantial Share Gain Achieved on Next Generation Aero Engines

Arconic Revenue Shipset Value1

Current generation

New generation

+103%

+82%

+72%

+35%

+27%

Indexed to Current Generation

CFM 56

LeapX

V2500

PW 1100G

Trent 700

Trent 7000

CF6

GEnx 1B

GE90

GE9X

Aero Engines

A320ceo / B737 NG

A320neo / B737 MAX

A320ceo

A320neo

A330ceo

A330neo

B767

B787

B777

B777X

Platforms

1) Aero engines shown represent ~88% of total engines for Large Commercial Aircraft in 2017 through 2020 on a unit basis

ARCONIC

8

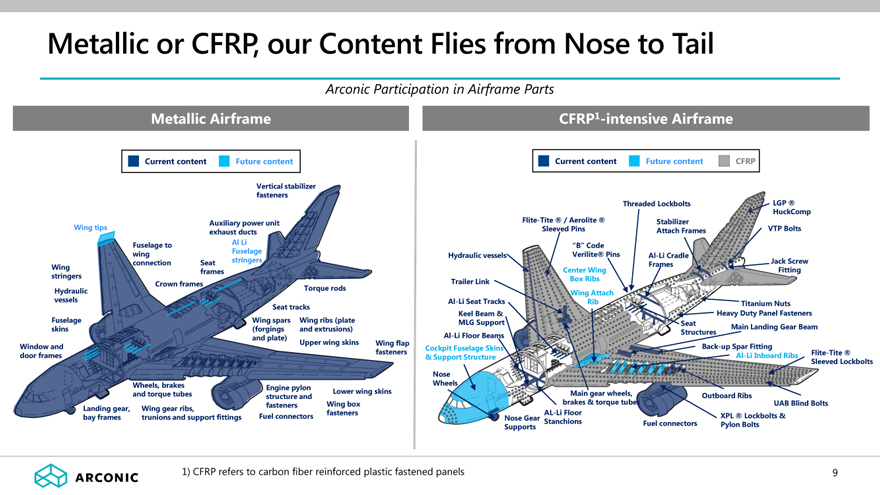

Metallic or CFRP, our Content Flies from Nose to Tail Arconic Participation in Airframe Parts Metallic Airframe Current content Future content Wing tips Wing stringers Hydraulic vessels Fuselage skins Window and door frames Fuselage to wing connection Crown frames Seat frames Auxiliary power unit exhaust ducts Al Li Fuselage stringers Vertical stabilizer fasteners Landing gear, bay frames Wheels, brakes and torque tubes Wing gear ribs, trunions and support fittings Torque rods Seat tracks Wing spars (forgings and plate) Wing ribs (plate and extrusions) Upper wing skins Wing flap fasteners Lower wing skins Wing box fasteners Engine pylon structure and fasteners Fuel connectors CFRP1-intensive Airframe Current content Future content CFRP Hydraulic vessels Trailer Link Al-Li Seat Tracks Keel Beam & MLG Support Al-Li Floor Beams Cockpit Fuselage Skins & Support Structure Nose Wheels Flite-Tite ® / Aerolite ® Sleeved Pins “B” Code Verilite® Pins Center Wing Box Ribs Wing Attach Rib Nose Gear Supports AL-Li Floor Stanchions Main gear wheels, brakes & torque tubes Threaded Lockbolts Stabilizer Attach Frames Al-Li Cradle FramesLGP ® HuckComp VTP Bolts Jack Screw Fitting Seat Structures Titanium Nuts Heavy Duty Panel Fasteners Main Landing Gear Beam Back-up Spar Fitting Al-Li Inboard Ribs Flite-Tite ® Sleeved Lockbolts Outboard Ribs Fuel connectors XPL ® Lockbolts & Pylon Bolts UAB Blind Bolts 1) CFRP refers to carbon fiber reinforced plastic fastened panels ARCONIC 9

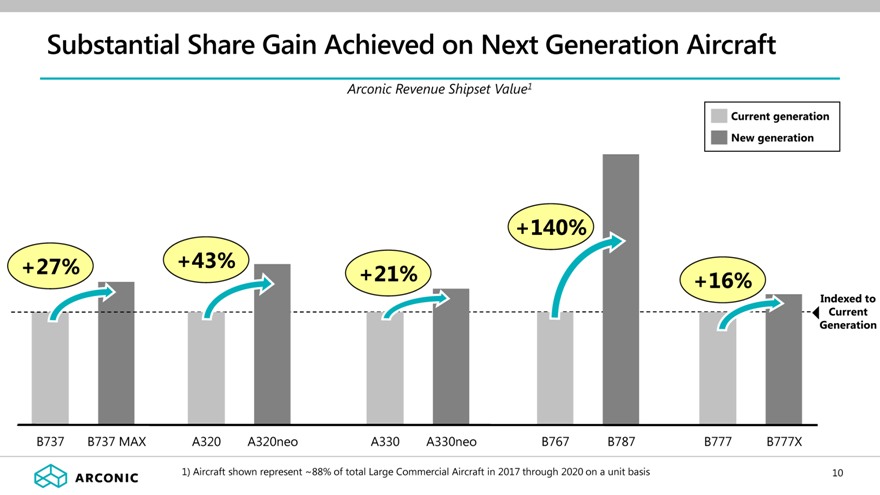

Substantial Share Gain Achieved on Next Generation Aircraft Arconic Revenue Shipset Value1 Current generation New generation +27% +43% +21% +140% +16% Indexed to Current Generation B737 B737 MAX A320 A320neo A330 A330neo B767 B787 B777 B777X 1) Aircraft shown represent ~88% of total Large Commercial Aircraft in 2017 through 2020 on a unit basis ARCONIC 10

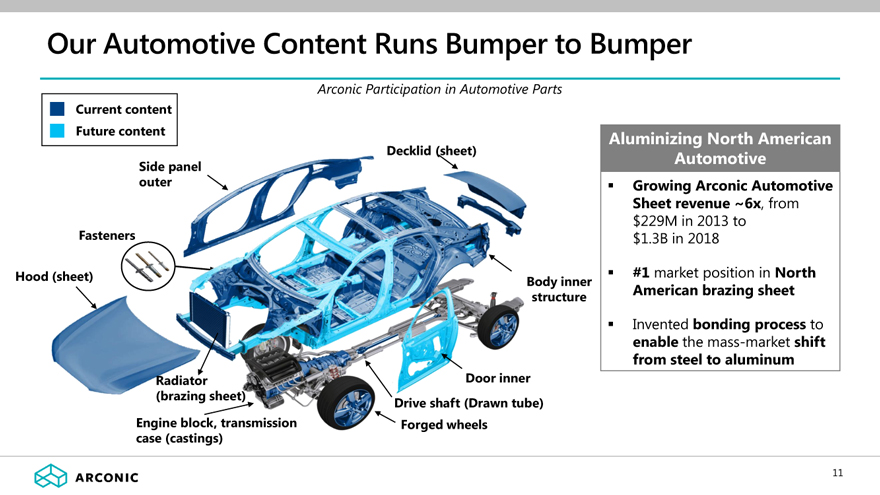

Our Automotive Content Runs Bumper to Bumper Arconic Participation in Automotive Parts Current content Future content Side panel outer Fasteners Hood (sheet) Decklid (sheet) Radiator (brazing sheet) Engine block, transmission case (castings) Body inner structure Door inner Drive shaft (Drawn tube) Forged wheels Aluminizing North American Automotive Growing Arconic Automotive Sheet revenue ~6x, from $229M in 2013 to $1.3B in 2018 #1 market position in North American brazing sheet Invented bonding process to enable the mass-market shift from steel to aluminum ARCONIC 11

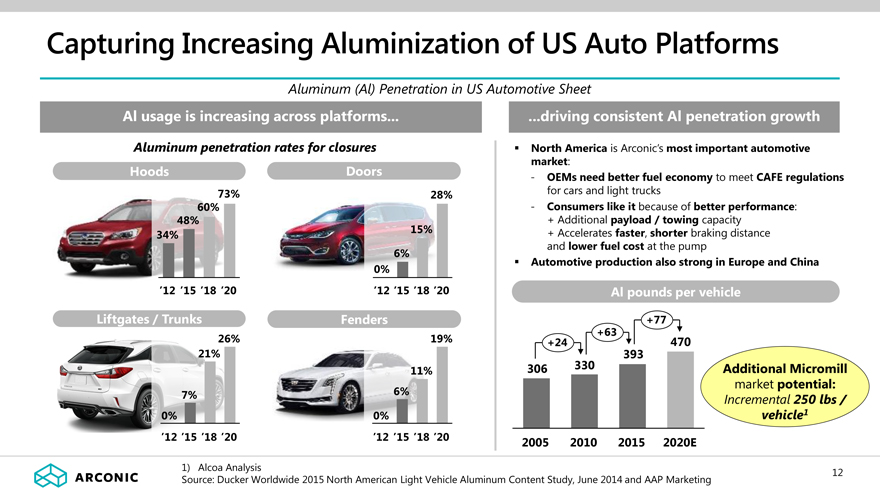

Capturing Increasing Aluminization of US Auto Platforms

Aluminum (Al) Penetration in US Automotive Sheet

Al usage is increasing across platforms

Aluminum penetration rates for closures

Hoods Doors

73% 28% 60% 48% 34% 15% 6% 0%

‘12 ‘15 ‘18 ‘20 ‘12 ‘15 ‘18 ‘20

Liftgates / Trunks Fenders

26% 19% 21% 11%

7% 6%

0% 0%

‘12 ‘15 ‘18 ‘20 ‘12 ‘15 ‘18 ‘20

...driving consistent Al penetration growth

North America is Arconic’s most important automotive market:

- OEMs need better fuel economy to meet CAFE regulations for cars and light trucks

- Consumers like it because of better performance:

+ Additional payload / towing capacity

+ Accelerates faster, shorter braking distance and lower fuel cost at the pump

Automotive production also strong in Europe and China

Al pounds per vehicle

+77 +63 +24 470

393

306 330 Additional Micromill market potential:

Incremental 250 lbs / vehicle1

2005 2010 2015 2020E

1) Alcoa Analysis Source: Ducker Worldwide 2015 North American Light Vehicle Aluminum Content Study, June 2014 and AAP Marketing

12

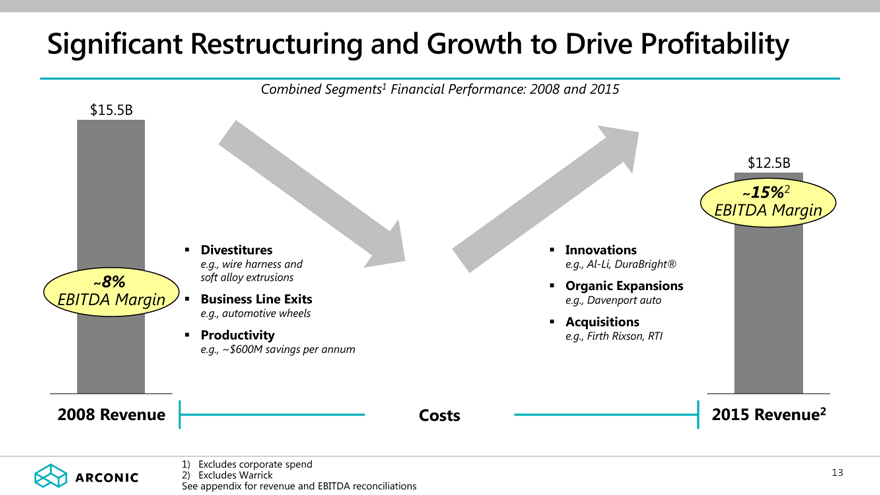

Significant Restructuring and Growth to Drive Profitability Combined Segments1 Financial Performance: 2008 and 2015 $15.5B EBITDA ~8% Margin Divestitures e.g., wire harness and soft alloy extrusions Business Line Exits e.g., automotive wheels Productivity e.g., ~$600M savings per annum Innovations e.g., Al-Li, DuraBright® Organic Expansions e.g., Davenport auto Acquisitions e.g., Firth Rixson, RTI $12.5B ~15%2 EBITDA Margin 2008 Revenue Costs 2015 Revenue2 1) Excludes corporate spend 2) Excludes Warrick See appendix for revenue and EBITDA reconciliations ARCONIC 12

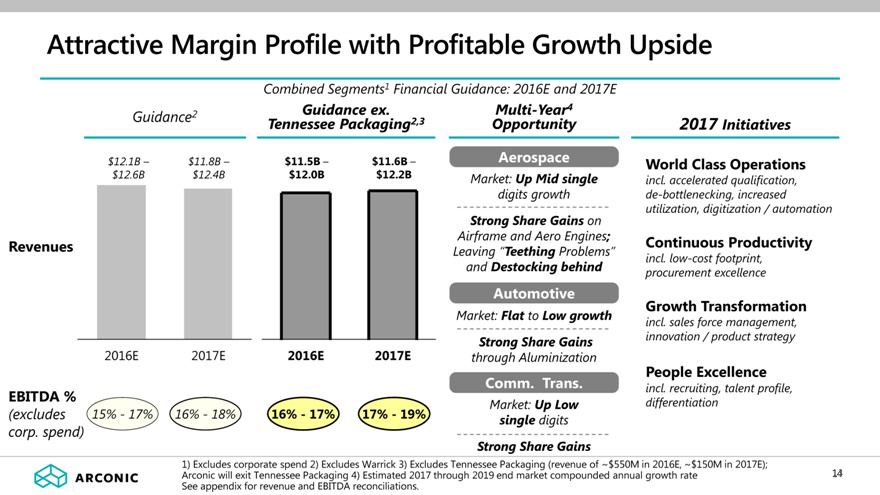

Attractive Margin Profile with Profitable Growth Upside

Combined Segments1 Financial Guidance: 2016E and 2017E

Guidance2

$12.1B – $11.8B – $12.6B $12.4B

Revenues

2016E 2017E

Guidance ex. Tennessee Packaging2,3

$11.5B – $11.6B – $12.0B $12.2B

2016E 2017E

Multi-Year4 Opportunity

Aerospace

Market: Up Mid single digits growth Strong Share Gains on Airframe and Aero Engines;

Leaving “Teething Problems” and Destocking behind

Automotive

Market: Flat to Low growth Strong Share Gains through Aluminization

Comm. Trans.

Market: Up Low single digits Strong Share Gains

2017 Initiatives

World Class Operations

incl. accelerated qualification, de-bottlenecking, increased utilization, digitization / automation

Continuous Productivity

incl. low-cost footprint, procurement excellence

Growth Transformation

incl. sales force management, innovation / product strategy

People Excellence

incl. recruiting, talent profile, differentiation

EBITDA %

(excludes 15% - 17% 16% - 18% 16% - 17% 17% - 19% corp. spend)

1) Arconic Excludes will corporate exit Tennessee spend Packaging 2) Excludes 4) Warrick Estimated 3) 2017 Excludes through Tennessee 2019 end Packaging market (revenue compounded of ~$ annual 550M in growth 2016E, rate ~$150M in 2017E); See appendix for revenue and EBITDA reconciliations.

13

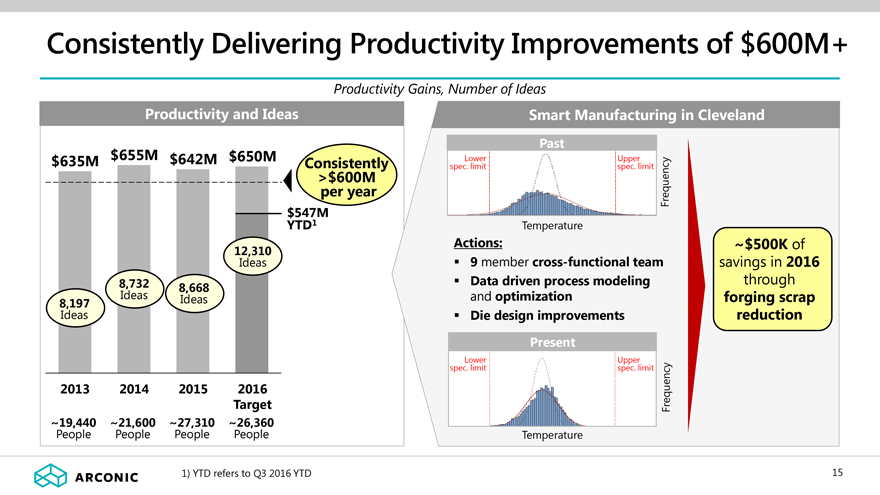

Consistently Delivering Productivity Improvements of $600M+

Productivity Gains, Number of Ideas

Productivity and Ideas

$635M $655M $642M $650M

Consistently

>$600M per year $547M YTD1

12,310

Ideas

8,732 8,668

Ideas Ideas

8,197

Ideas

2013 2014 2015 2016 Target

~19,440 ~21,600 ~27,310 ~26,360

People People People People

Smart Manufacturing in Cleveland

Past

Lower Upper

spec. limit spec. limit

Frequency

Temperature

Actions: ~$500K of

9 member cross-functional team savings in 2016

Data driven process modeling through

and optimization forging scrap

Die design improvements reduction

Present

Lower Upper

spec. limit spec. limit

Frequency

Temperature

1) YTD refers to Q3 2016 YTD 15

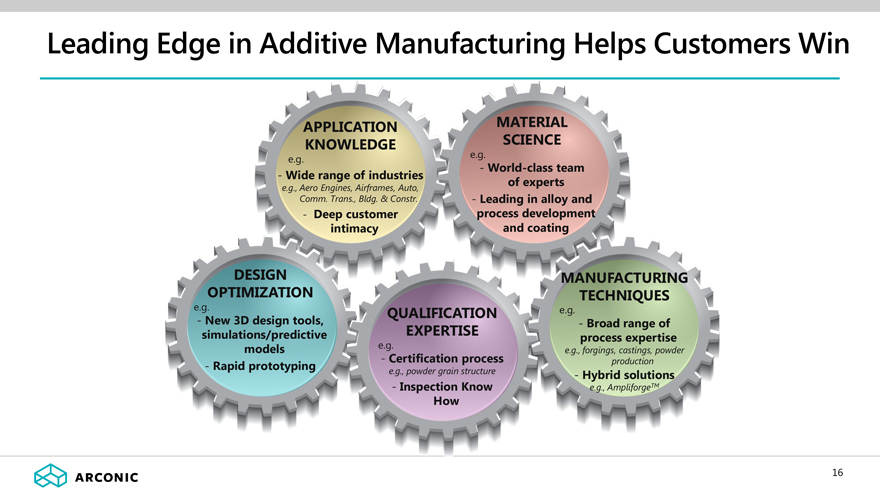

Leading Edge in Additive Manufacturing Helps Customers Win

APPLICATION MATERIAL KNOWLEDGE SCIENCE

e.g. e.g.

- World-class team

- Wide range of industries

e.g., Aero Engines, Airframes, Auto, of experts Comm. Trans., Bldg. & Constr. - Leading in alloy and

- Deep customer process development intimacy and coating

DESIGN MANUFACTURING OPTIMIZATION TECHNIQUES e.g. QUALIFICATION e.g.

- New 3D design tools, - Broad range of simulations/predictive EXPERTISE process expertise

models e.g. e.g., forgings, castings, powder

- Certification process production

- Rapid prototyping e.g., powder grain structure

- Hybrid solutions

- Inspection Know e.g., AmpliforgeTM

How

16

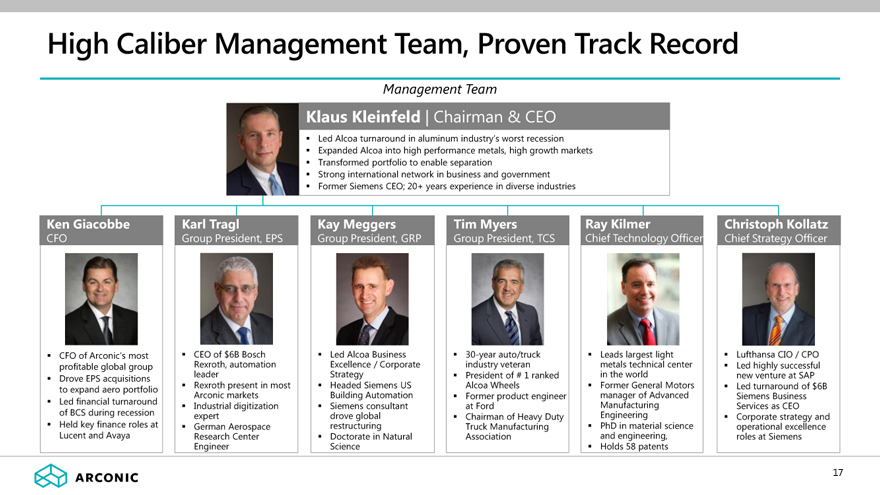

High Caliber Management Team, Proven Track Record

Management Team

Klaus Kleinfeld Chairman & CEO

Led Alcoa turnaround in aluminum industry’s worst recession

Expanded Alcoa into high performance metals, high growth markets

Transformed portfolio to enable separation

Strong international network in business and government

Former Siemens CEO; 20+ years experience in diverse industries

Ken Giacobbe

CFO

CFO of Arconic’s most profitable global group

Drove EPS acquisitions to expand aero portfolio

Led financial turnaround of BCS during recession

Held key finance roles at Lucent and Avaya

Karl Tragl

Group President, EPS

CEO of $6B Bosch Rexroth, automation leader

Rexroth present in most Arconic markets

Industrial digitization expert

German Aerospace Research Center Engineer

Kay Meggers

Group President, GRP

Led Alcoa Business Excellence / Corporate Strategy

Headed Siemens US Building Automation

Siemens consultant drove global restructuring

Doctorate in Natural Science

Tim Myers

Group President, TCS

30-year auto/truck industry veteran

President of # 1 ranked Alcoa Wheels

Former product engineer at Ford

Chairman of Heavy Duty Truck Manufacturing Association

Ray Kilmer

Chief Technology Officer

Leads largest light metals technical center in the world

Former General Motors manager of Advanced Manufacturing Engineering

PhD in material science and engineering,

Holds 58 patents

Christoph Kollatz

Chief Strategy Officer

Lufthansa CIO / CPO

Led highly successful new venture at SAP

Led turnaround of $6B Siemens Business Services as CEO

Corporate strategy and operational excellence roles at Siemens

ARCONIC

14

Independent Board, Broad and Deep Relevant Experience

Board of Directors

Klaus Kleinfeld

Chairman and CEO, Arconic Inc.

Patricia Russo

Lead Director, Arconic Inc.

Chairman,

Hewlett Packard Enterprise and former CEO, Alcatel Lucent

Amy Alving

former Senior Vice President and Chief Technology Officer, Leidos Holdings, Inc; Defense Science Board

Arthur Collins, Jr.

former Chairman and CEO, Medtronic, Inc.; director, The Boeing Company

Rajiv Gupta

Chairman, Delphi Automotive PLC and Senior Advisor, New Mountain Capital, LLC.

Sean Mahoney

private investor & former Partner & head of the Financial Sponsors Group at Goldman, Sachs & Co.

E. Stanley O’Neal

former Chairman and CEO, Merrill Lynch & Co., Inc.

John Plant

former Chairman, President and CEO, TRW Automotive

L. Rafael Reif

President, Massachusetts Institute of Technology

Julie Richardson

former Partner and the head of the New York office, Providence Equity Partners LLC

Ulrich Schmidt

former Executive Vice President and CFO, Spirit Aerosystems Holdings, Inc.

Martin Sorrell

founder and CEO, WPP plc

Ratan Tata

Chairman Emeritus, Tata Sons Limited

ARCONIC

15

Customer and Talent Focused Culture

Mission and Values

ARCONIC

Everyone, Everyday,

Everywhere…

We win when our customers win – we innovate, deliver and operate as world class.

We excel as high performance teams – safely, with respect and integrity.

ARCONIC

16

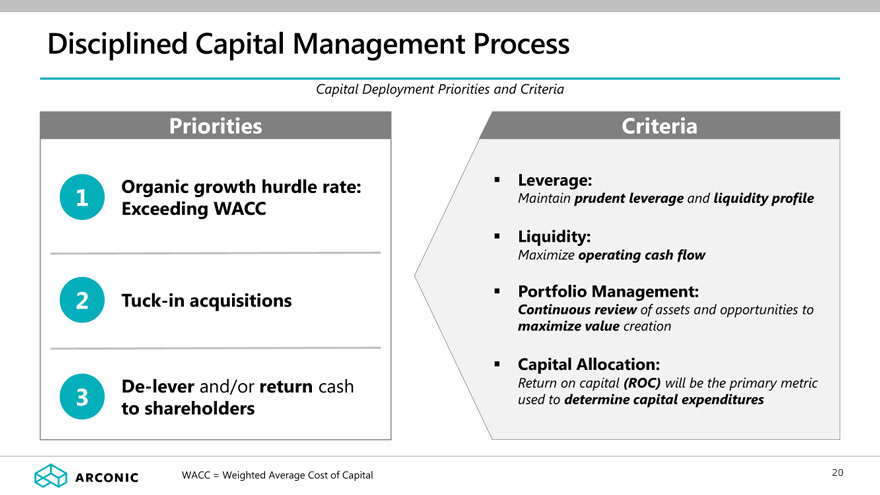

Disciplined Capital Management Process

Capital Deployment Priorities and Criteria

Priorities

1 Organic growth hurdle rate: Exceeding WACC

2 Tuck-in acquisitions

3 De-lever and/or return cash to shareholders

Criteria

Leverage:

Maintain prudent leverage and liquidity profile

Liquidity:

Maximize operating cash flow

Portfolio Management:

Continuous review of assets and opportunities to maximize value creation

Capital Allocation:

Return on capital (ROC) will be the primary metric used to determine capital expenditures

WACC = Weighted Average Cost of Capital

ARCONIC

17

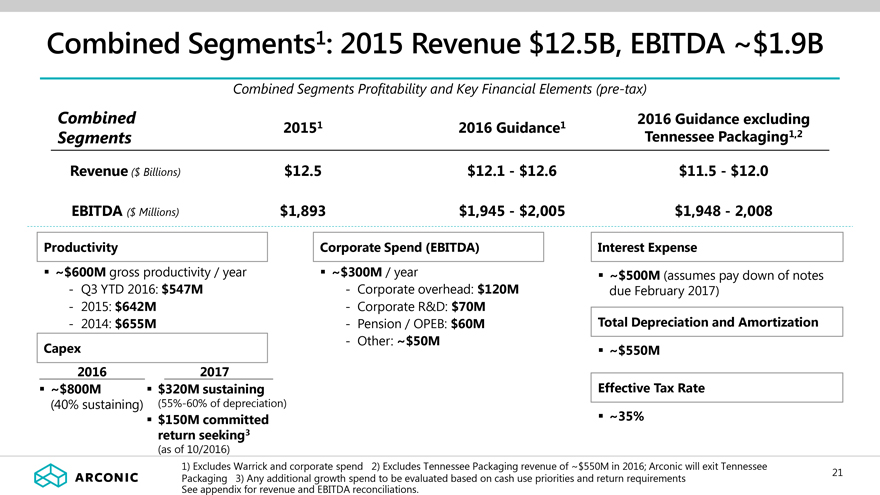

Combined Segments1: 2015 Revenue $12.5B, EBITDA ~$1.9B

Combined Segments Profitability and Key Financial Elements (pre-tax)

Combined 2016 Guidance excluding

20151 2016 Guidance1

Segments Tennessee Packaging1,2

Revenue ($ Billions) $12.5 $12.1 - $12.6 $11.5 - $12.0

EBITDA ($ Millions) $1,893 $1,945 - $2,005 $1,948 - 2,008

Productivity

~$600M gross productivity / year

- Q3 YTD 2016: $547M

- 2015: $ 642M

- 2014: $ 655M

Capex

2016 2017

~$800M $320M sustaining

(40% sustaining) (55%-60% of depreciation)

$150M committed

return seeking3

(as of 10/2016)

Corporate Spend (EBITDA)

~$300M / year

- Corporate overhead: $120M

- Corporate R&D: $70M

- Pension / OPEB: $60M

- Other: ~$50M

Interest Expense

~$500M (assumes pay down of notes

due February 2017)

Total Depreciation and Amortization

~$550M

Effective Tax Rate

~35%

1) Excludes Warrick and corporate spend 2) Excludes Tennessee Packaging revenue of ~$550M in 2016; Arconic will exit Tennessee

Packaging 3) Any additional growth spend to be evaluated based on cash use priorities and return requirements

See appendix for revenue and EBITDA reconciliations.

21

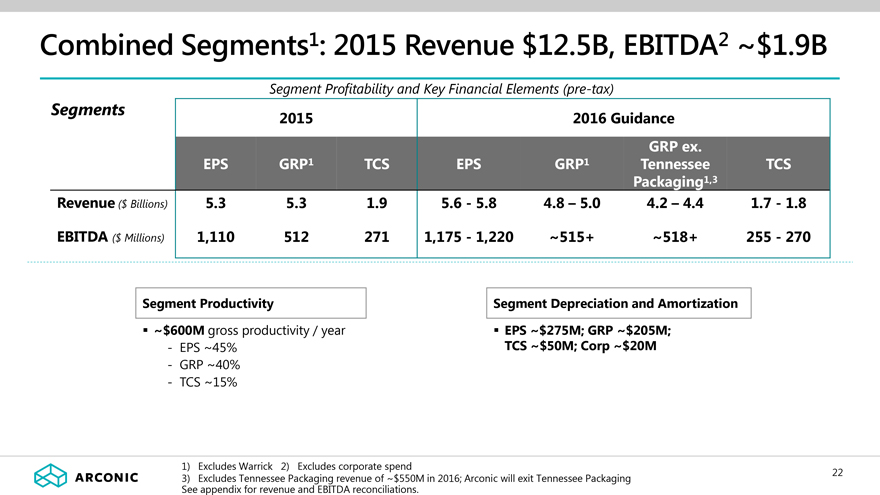

Combined Segments1: 2015 Revenue $12.5B, EBITDA2 ~$1.9B

Segment Profitability and Key Financial Elements (pre-tax)

Segments 2015 2016 Guidance

GRP ex.

EPS GRP1 TCS EPS GRP1 Tennessee TCS

Packaging1,3

Revenue ($ Billions) 5.3 5.3 1.9 5.6 - 5.8 4.8 – 5.0 4.2 – 4.4 1.7 - 1.8

EBITDA ($ Millions) 1,110 512 271 1,175 - 1,220 ~515+ ~518+ 255 - 270

Segment Productivity

~$600M gross productivity / year

- EPS ~45%

- GRP ~40%

- TCS ~15%

Segment Depreciation and Amortization

EPS ~$275M; GRP ~$205M;

TCS ~$50M; Corp ~$20M

1) Excludes Warrick 2) Excludes corporate spend

3) Excludes Tennessee Packaging revenue of ~$550M in 2016; Arconic will exit Tennessee Packaging

See appendix for revenue and EBITDA reconciliations.

22

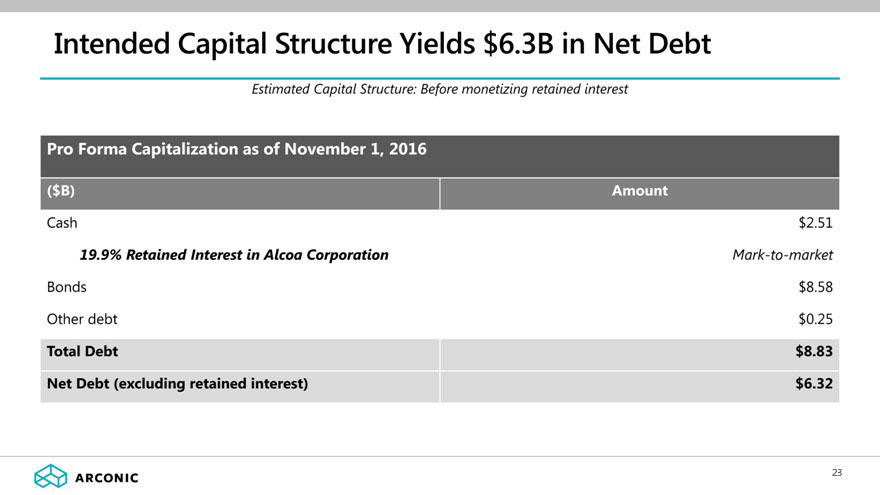

Intended Capital Structure Yields $6.3B in Net Debt

Estimated Capital Structure: Before monetizing retainer interest

Pro Forma Capitalization as of November 1, 2016

($B) Amount

Cash $2.51

19.9% Retained Interest in Alcoa Corporation Mark-to-market

Bonds $8.58

Other debt $0.25

Total Debt $8.83

Net Debt (excluding retained interest) $6.32

ARCONIC 20

Launching a Strong Company – Arconic

Key Strengths

Strongly Positioned in Attractive Markets

Secular growth, compelling margins: Aerospace and Transportation (~65% revenues)

Solid growth, attractive margins: Specialty, Industrial, Building & Construction (~35% revenues)

Clear Market Leader in Major Sectors

~70% Revenues #1/#2 leadership positions Major supplier to the industry leaders in all sectors

Driver of Differentiated Innovation / Advanced Technology Solutions

Development partner to industry leaders driving share gain

Unparalleled capabilities in multi-materials, manufacturing processes, and application engineering Track record of breakthrough advances Innovation-driven engineering culture and extensive R&D base

Compelling Financial Profile

Attractive margin profile with significant future profitable growth upside

Relentless pursuit of cost reduction; consistently delivering productivity improvements Disciplined capital allocation with priority on high-return uses Retained interest of 19.9% of Alcoa Corporation available for monetization

Management Team and Culture Focused on Performance and Creating Value

Proven track record Strong value orientation

21

Appendix

ARCONIC

Innovation, engineered.

ARCONIC 22

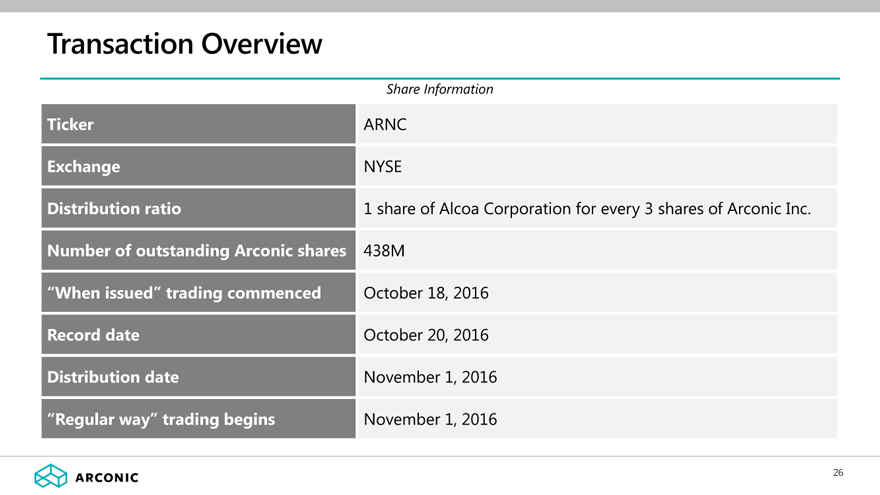

Transaction Overview

Share Information

Ticker ARNC

Exchange NYSE

Distribution ratio 1 share of Alcoa Corporation for every 3 shares of Arconic Inc.

Number of outstanding Arconic shares 438M

“When issued” trading commenced October 18, 2016

Record date October 20, 2016

Distribution date November 1, 2016

“Regular way” trading begins November 1, 2016

ARCONIC 23

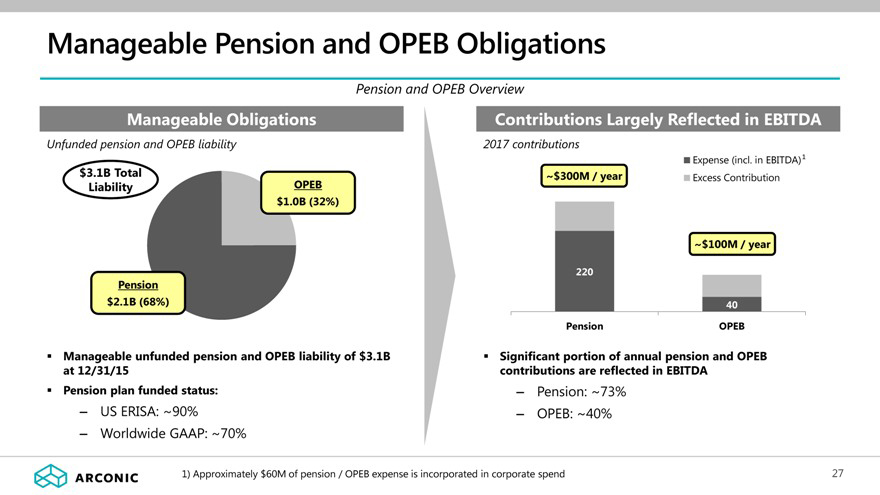

Manageable Pension and OPEB Obligations

Pension and OPEB Overview

Manageable Obligations

Unfunded pension and OPEB liability $3.1B Total OPEB

Liability $1.0B (32%)

Pension $2.1B (68%)

Manageable unfunded pension and OPEB liability of $3.1B at 12/31/15 Pension plan funded status:

US ERISA: ~90%

Worldwide GAAP: ~70%

Contributions Largely Reflected in EBITDA

2017 contributions

Expense (incl. in EBITDA) 1

~$300M / year Excess Contribution

~$100M / year

220

40 Pension OPEB

Significant portion of annual pension and OPEB contributions are reflected in EBITDA

Pension: ~73%

OPEB: ~40%

1) Approximately $60M of pension / OPEB expense is incorporated in corporate spend

24

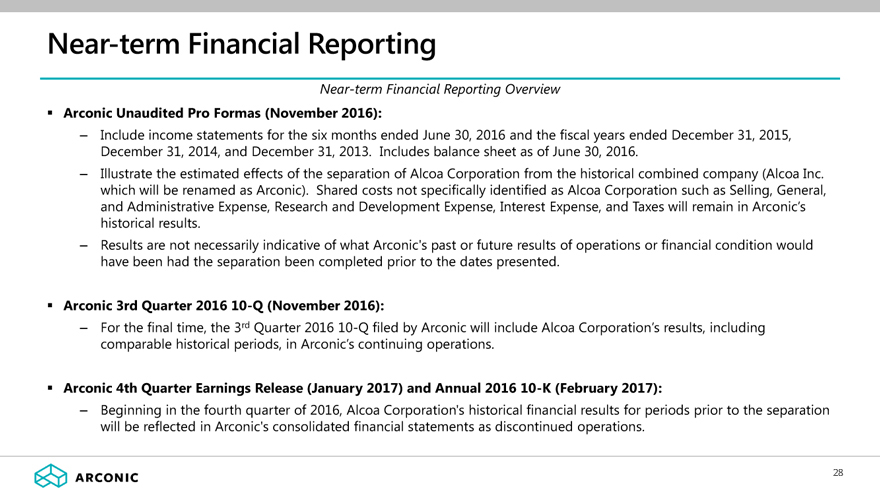

Near-term Financial Reporting

Near-term Financial Reporting Overview

Arconic Unaudited Pro Formas (November 2016):

- Include income statements for the six months ended June 30, 2016 and the fiscal years ended December 31, 2015, December 31, 2014, and December 31, 2013. Includes balance sheet as of June 30, 2016.

- Illustrate the estimated effects of the separation of Alcoa Corporation from the historical combined company (Alcoa Inc. which will be renamed as Arconic). Shared costs not specifically identified as Alcoa Corporation such as Selling, General, and Administrative Expense, Research and Development Expense, Interest Expense, and Taxes will remain in Arconic’s historical results.

- Results are not necessarily indicative of what Arconic’s past or future results of operations or financial condition would have been had the separation been completed prior to the dates presented.

Arconic 3rd Quarter 2016 10-Q (November 2016):

- For the final time, the 3rd Quarter 2016 10-Q filed by Arconic will include Alcoa Corporation’s results, including comparable historical periods, in Arconic’s continuing operations.

Arconic 4th Quarter Earnings Release (January 2017) and Annual 2016 10-K (February 2017):

- Beginning in the fourth quarter of 2016, Alcoa Corporation’s historical financial results for periods prior to the separation will be reflected in Arconic’s consolidated financial statements as discontinued operations.

ARCONIC 25

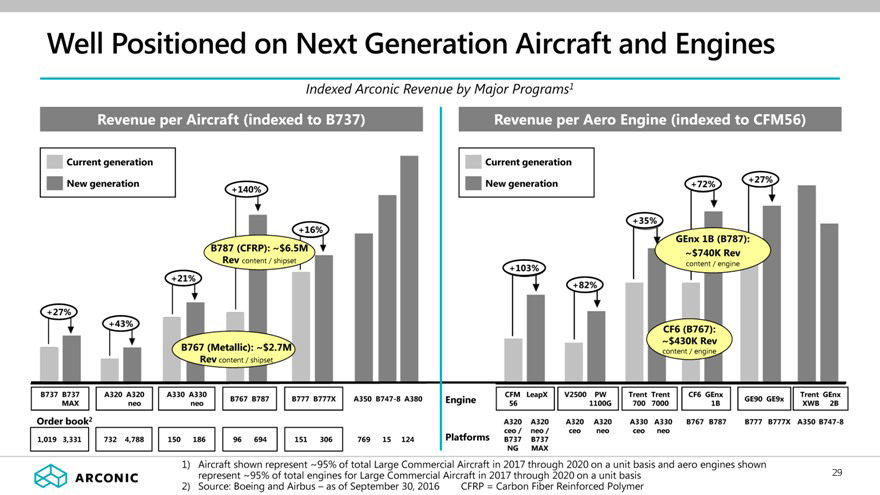

Well Positioned on Next Generation Airframes and Engines

Indexed Arconic Revenue by Major Programs1

Revenue per Airframe (indexed to B737 NG)

Current generation

New generation

+27% +43% +21% +140% +16% B787 (CFRP): ~$6.5M Rev content / shipset

B767 (Metallic): ~$2.7M Rev content / shipset

B737 B737 MAX A320 A320 neo A330 A330 neo B767 B787 B777 B777X A350 B747-8 A380

Order book2

1,019 3,331 732 4,788 150 186 96 694 151 306 769 15 124

Revenue per Aero Engine (indexed to CFM56)

Current generation

New generation

+103% +82% +35% +72% +27%

GEnx 1B (B787): ~$740K Rev content / engine

CF6 (B767): ~$430K Rev content / engine

Engine

CFM LeapX 56 V2500 PW 1100G Trent Trent 700 7000 CF6 GEnx 1B GE90 GE9x Trent GEnx XWB 2B

Platforms

A320 ceo / B737 NG A320 neo / B737 MAX A320 ceo A320 neo A330 ceo A330 neo B767 B787 B777 B777X A350 B747-8

1) Aircraft shown represent ~95% of total Large Commercial Aircraft in 2017 through 2020 on a unit basis and aero engines shown represent ~95% of total engines for Large Commercial Aircraft in 2017 through 2020 on a unit basis

2) Source: Boeing and Airbus – as of September 30, 2016 CFRP = Carbon Fiber Reinforced Polymer

ARCONIC 26

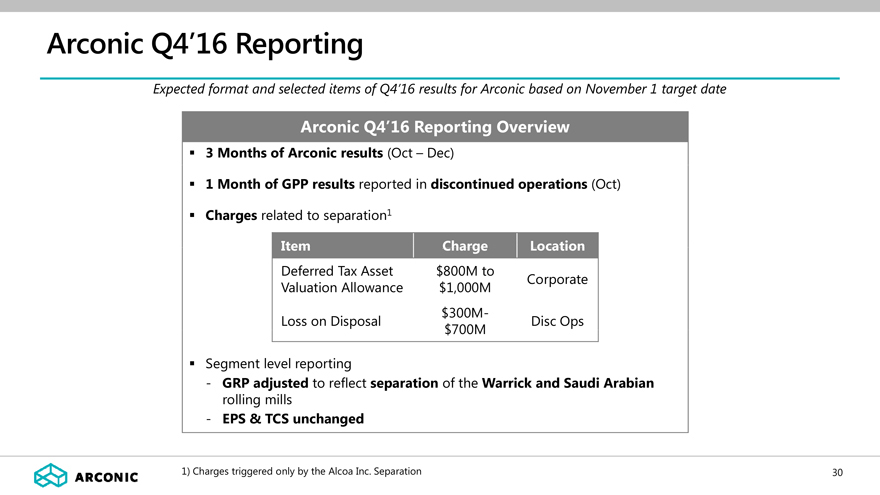

Arconic Q4’16 Reporting

Expected format and selected items of Q4’16 results for Arconic based on November 1 target date

Arconic Q4’16 Reporting Overview

3 Months of Arconic results (Oct – Dec)

1 Month of GPP results reported in discontinued operations (Oct)

Charges related to separation1

Item Charge Location

Deferred Tax Asset $800M to Corporate

Valuation Allowance $1,000M

$300M-

Loss on Disposal Disc Ops

$700M

Segment level reporting

- GRP adjusted to reflect separation of the Warrick and Saudi Arabian

rolling mills

- EPS & TCS unchanged

1) Charges triggered only by the Alcoa Inc. Separation 30

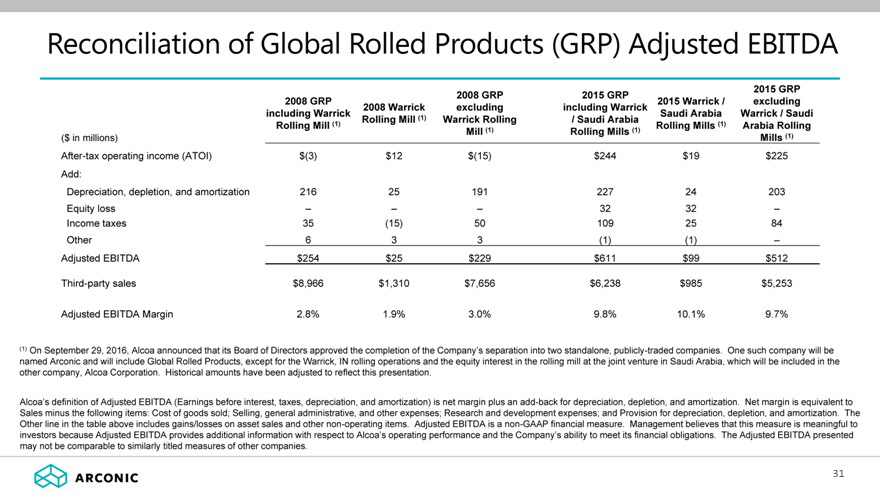

Reconciliation of Global Rolled Products (GRP) Adjusted EBITDA

2008 GRP2015 GRP2015 GRP

2008 GRP 2015 Warrick /excluding

2008 Warrickexcludingincluding Warrick

including Warrick Saudi ArabiaWarrick / Saudi

Rolling Mill (1)Warrick Rolling/ Saudi Arabia

Rolling Mill (1) Rolling Mills (1)Arabia Rolling

Mill (1)Rolling Mills (1)

($ in millions) Mills (1)

After-tax operating income (ATOI) $(3) $12$(15)$244$19$225

Add:

Depreciation, depletion, and amortization 216 2519122724203

Equity loss – ––3232–

Income taxes 35 (15)501092584

Other 6 33(1)(1)–

Adjusted EBITDA $254 $25$229$611$99$512

Third-party sales $8,966 $1,310$7,656$6,238$985$5,253

Adjusted EBITDA Margin 2.8% 1.9%3.0%9.8%10.1%9.7%

(1) On September 29, 2016, Alcoa announced that its Board of Directors approved the completion of the Company’s separation into two standalone, publicly-traded companies. One such company will be named Arconic and will include Global Rolled Products, except for the Warrick, IN rolling operations and the equity interest in the rolling mill at the joint venture in Saudi Arabia, which will be included in the other company, Alcoa Corporation. Historical amounts have been adjusted to reflect this presentation.

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. The Other line in the table above includes gains/losses on asset sales and other non-operating items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.

27

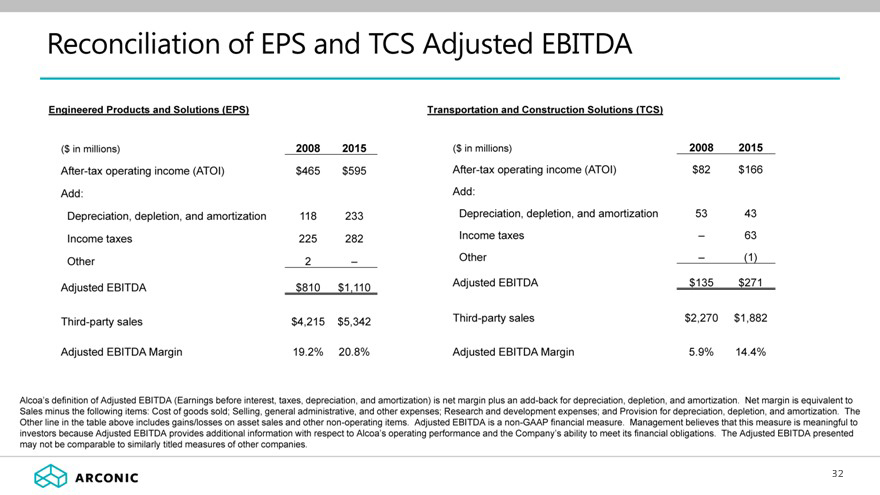

Reconciliation of EPS and TCS Adjusted EBITDA

Engineered Products and Solutions (EPS) Transportation and Construction Solutions (TCS)

($ in millions) 2008 2015($ in millions)20082015

After-tax operating income (ATOI) $465 $595After-tax operating income (ATOI)$82$166

Add: Add:

Depreciation, depletion, and amortization 118 233Depreciation, depletion, and amortization5343

Income taxes 225 282Income taxes–63

Other 2 –Other–(1)

Adjusted EBITDA $810 $1,110Adjusted EBITDA$135$271

Third-party sales $4,215 $5,342Third-party sales$2,270$1,882

Adjusted EBITDA Margin 19.2% 20.8%Adjusted EBITDA Margin5.9%14.4%

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. The Other line in the table above includes gains/losses on asset sales and other non-operating items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.

28

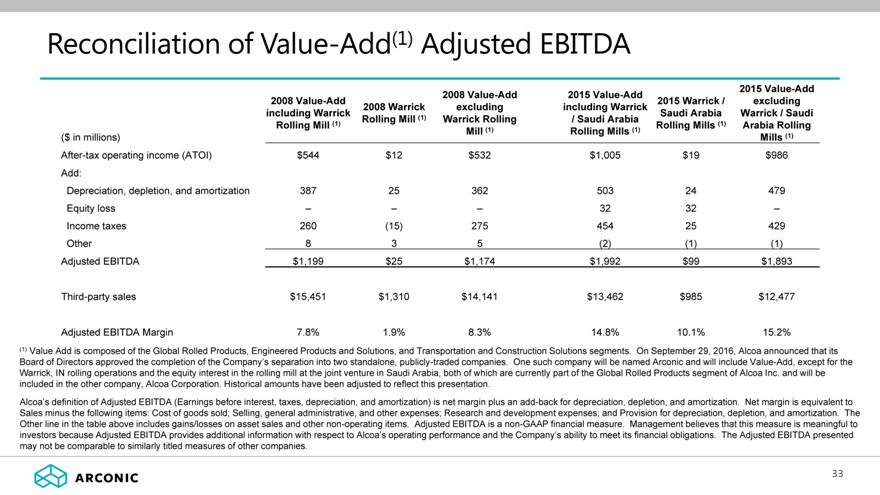

Reconciliation of Value-Add(1) Adjusted EBITDA

2008 Value-Add2015 Value-Add2015 Value-Add

2008 Value-Add 2015 Warrick /excluding

2008 Warrickexcludingincluding Warrick

including Warrick Saudi ArabiaWarrick / Saudi

Rolling Mill (1)Warrick Rolling/ Saudi Arabia

Rolling Mill (1) Rolling Mills (1)Arabia Rolling

Mill (1)Rolling Mills (1)

($ in millions) Mills (1)

After-tax operating income (ATOI) $544 $12$532$1,005$19$986

Add:

Depreciation, depletion, and amortization 387 2536250324479

Equity loss – ––3232–

Income taxes 260 (15)27545425429

Other 8 35(2)(1)(1)

Adjusted EBITDA $1,199 $25$1,174$1,992$99$1,893

Third-party sales $15,451 $1,310$14,141$13,462$985$12,477

Adjusted EBITDA Margin 7.8% 1.9%8.3%14.8%10.1%15.2%

(1) Value Add is composed of the Global Rolled Products, Engineered Products and Solutions, and Transportation and Construction Solutions segments. On September 29, 2016, Alcoa announced that its

Board of Directors approved the completion of the Company’s separation into two standalone, publicly-traded companies. One such company will be named Arconic and will include Value-Add, except for the Warrick, IN rolling operations and the equity interest in the rolling mill at the joint venture in Saudi Arabia, both of which are currently part of the Global Rolled Products segment of Alcoa Inc. and will be included in the other company, Alcoa Corporation. Historical amounts have been adjusted to reflect this presentation.

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. The Other line in the table above includes gains/losses on asset sales and other non-operating items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.

29