Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENTEGRIS INC | d276429d8k.htm |

| EX-99.1 - EX-99.1 - ENTEGRIS INC | d276429dex991.htm |

Earnings Summary Third Quarter FY 2016 October 26, 2016 Exhibit 99.2

SAFE HARBOR Certain information contained in this presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve substantial risks and uncertainties that could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements. Statements that include such words as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “may,” “will,” “should” or the negative thereof and similar expressions as they relate to Entegris or our management are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. These risks include, but are not limited to, fluctuations in the market price of Entegris’ stock, Entegris’ future operating results, other acquisition and investment opportunities available to Entegris, general business and market conditions and other factors. Additional information concerning these and other risk factors may be found in previous financial press releases issued by Entegris and Entegris’ periodic public filings with the Securities and Exchange Commission, including discussions appearing under the headings “Risks Relating to our Business and Industry,” “Risks Related to Our Indebtedness,” “Manufacturing Risks,” “International Risks” and “Risks Related to Owning Our Common Stock” in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed with the Securities and Exchange Commission on February 29, 2016, as well as other matters and important factors disclosed previously and from time to time in the filings of Entegris with the U.S. Securities and Exchange Commission. Except as required under the federal securities laws and the rules and regulations of the Securities and Exchange Commission, we undertake no obligation to update publicly any forward-looking statements contained herein.

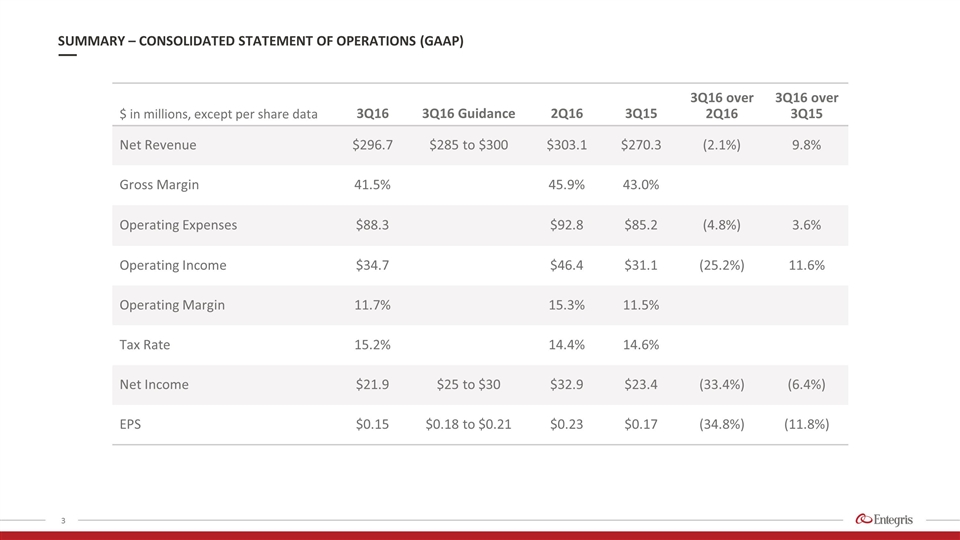

$ in millions, except per share data 3Q16 3Q16 Guidance 2Q16 3Q15 3Q16 over 2Q16 3Q16 over 3Q15 Net Revenue $296.7 $285 to $300 $303.1 $270.3 (2.1%) 9.8% Gross Margin 41.5% 45.9% 43.0% Operating Expenses $88.3 $92.8 $85.2 (4.8%) 3.6% Operating Income $34.7 $46.4 $31.1 (25.2%) 11.6% Operating Margin 11.7% 15.3% 11.5% Tax Rate 15.2% 14.4% 14.6% Net Income $21.9 $25 to $30 $32.9 $23.4 (33.4%) (6.4%) EPS $0.15 $0.18 to $0.21 $0.23 $0.17 (34.8%) (11.8%) SUMMARY – CONSOLIDATED STATEMENT OF OPERATIONS (GAAP)

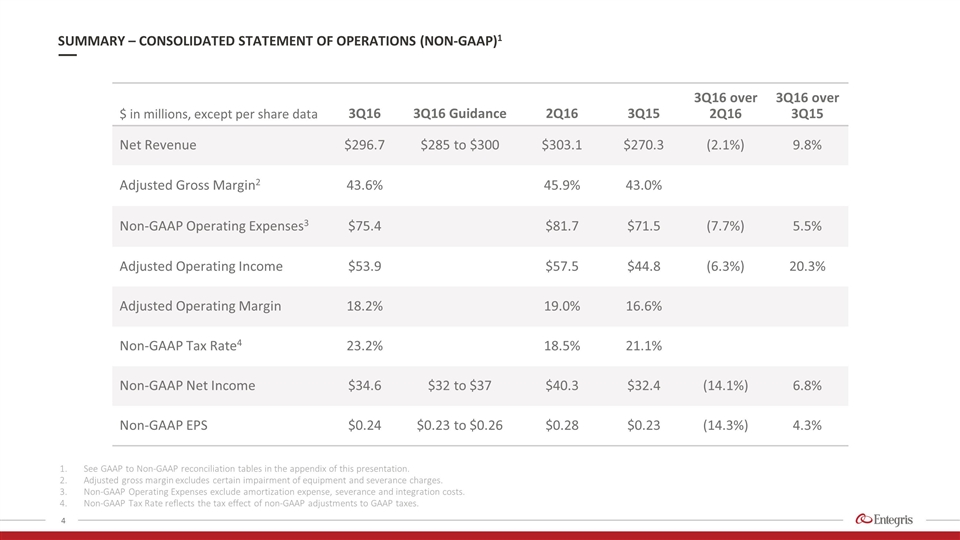

$ in millions, except per share data 3Q16 3Q16 Guidance 2Q16 3Q15 3Q16 over 2Q16 3Q16 over 3Q15 Net Revenue $296.7 $285 to $300 $303.1 $270.3 (2.1%) 9.8% Adjusted Gross Margin2 43.6% 45.9% 43.0% Non-GAAP Operating Expenses3 $75.4 $81.7 $71.5 (7.7%) 5.5% Adjusted Operating Income $53.9 $57.5 $44.8 (6.3%) 20.3% Adjusted Operating Margin 18.2% 19.0% 16.6% Non-GAAP Tax Rate4 23.2% 18.5% 21.1% Non-GAAP Net Income $34.6 $32 to $37 $40.3 $32.4 (14.1%) 6.8% Non-GAAP EPS $0.24 $0.23 to $0.26 $0.28 $0.23 (14.3%) 4.3% SUMMARY – CONSOLIDATED STATEMENT OF OPERATIONS (NON-GAAP)1 See GAAP to Non-GAAP reconciliation tables in the appendix of this presentation. Adjusted gross margin excludes certain impairment of equipment and severance charges. Non-GAAP Operating Expenses exclude amortization expense, severance and integration costs. Non-GAAP Tax Rate reflects the tax effect of non-GAAP adjustments to GAAP taxes.

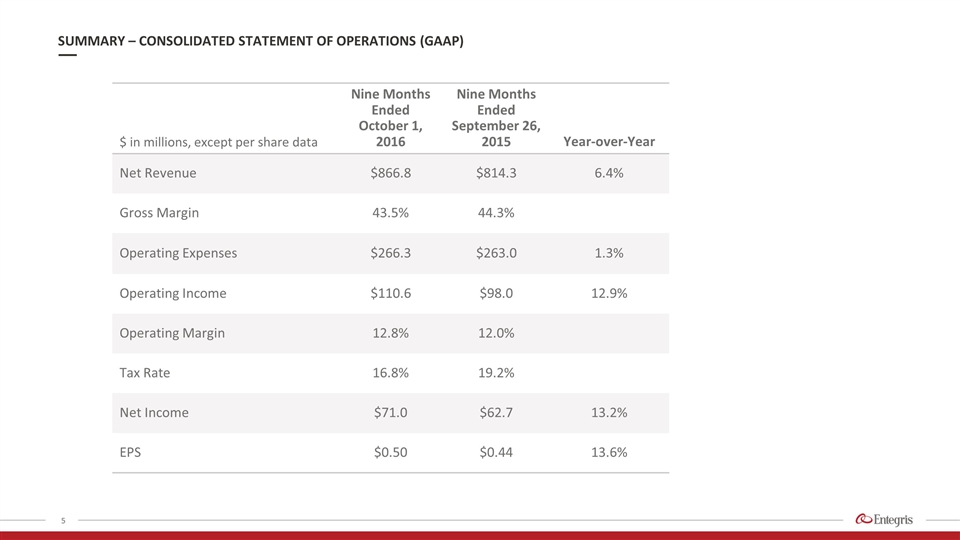

$ in millions, except per share data Nine Months Ended October 1, 2016 Nine Months Ended September 26, 2015 Year-over-Year Net Revenue $866.8 $814.3 6.4% Gross Margin 43.5% 44.3% Operating Expenses $266.3 $263.0 1.3% Operating Income $110.6 $98.0 12.9% Operating Margin 12.8% 12.0% Tax Rate 16.8% 19.2% Net Income $71.0 $62.7 13.2% EPS $0.50 $0.44 13.6% SUMMARY – CONSOLIDATED STATEMENT OF OPERATIONS (GAAP)

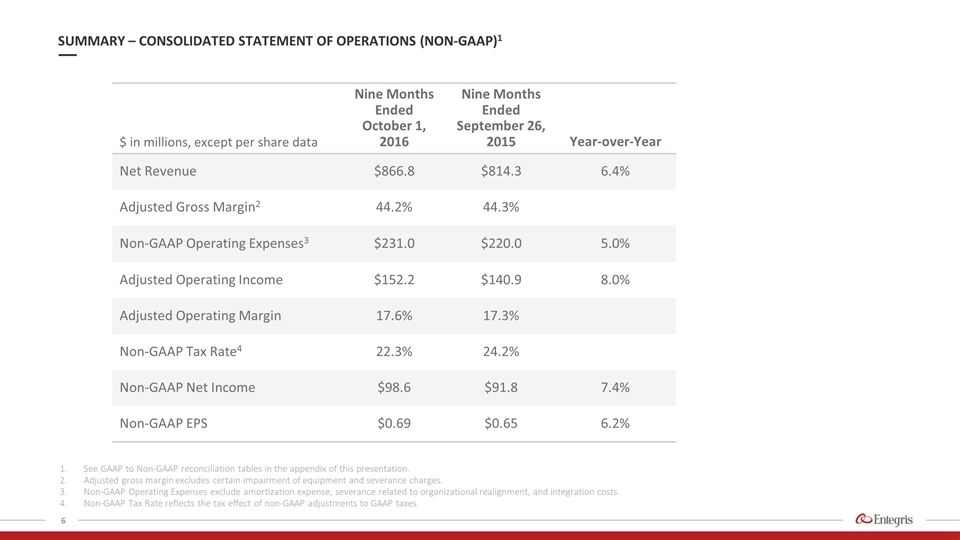

$ in millions, except per share data Nine Months Ended October 1, 2016 Nine Months Ended September 26, 2015 Year-over-Year Net Revenue $866.8 $814.3 6.4% Adjusted Gross Margin2 44.2% 44.3% Non-GAAP Operating Expenses3 $231.0 $220.0 5.0% Adjusted Operating Income $152.2 $140.9 8.0% Adjusted Operating Margin 17.6% 17.3% Non-GAAP Tax Rate4 22.3% 24.2% Non-GAAP Net Income $98.6 $91.8 7.4% Non-GAAP EPS $0.69 $0.65 6.2% SUMMARY – CONSOLIDATED STATEMENT OF OPERATIONS (NON-GAAP)1 See GAAP to Non-GAAP reconciliation tables in the appendix of this presentation. Adjusted gross margin excludes certain impairment of equipment and severance charges. Non-GAAP Operating Expenses exclude amortization expense, severance related to organizational realignment, and integration costs. Non-GAAP Tax Rate reflects the tax effect of non-GAAP adjustments to GAAP taxes.

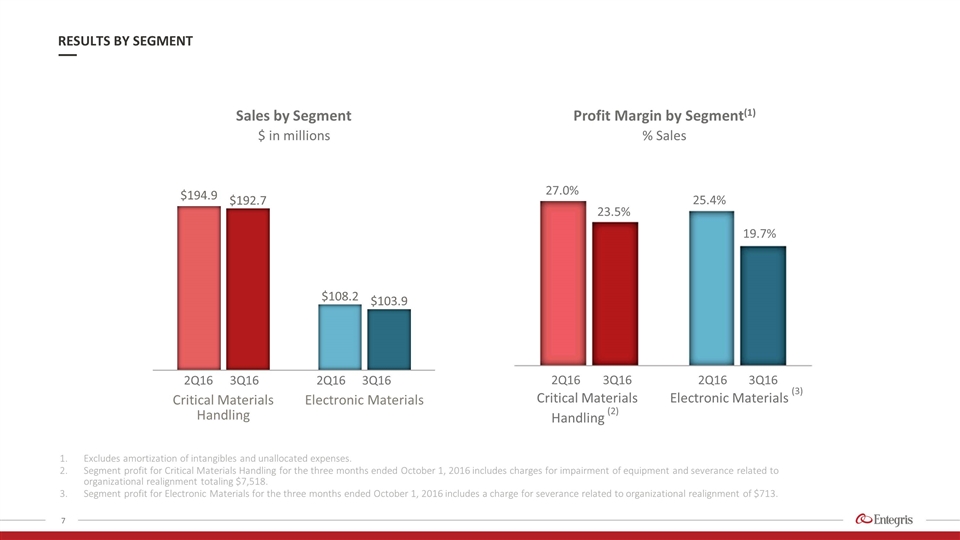

Excludes amortization of intangibles and unallocated expenses. Segment profit for Critical Materials Handling for the three months ended October 1, 2016 includes charges for impairment of equipment and severance related to organizational realignment totaling $7,518. Segment profit for Electronic Materials for the three months ended October 1, 2016 includes a charge for severance related to organizational realignment of $713. RESULTS BY SEGMENT Sales by Segment 2Q16 3Q16 2Q16 3Q16 $ in millions Profit Margin by Segment(1) 2Q16 3Q16 2Q16 3Q16 % Sales 27.0% 25.4% 23.5% 19.7% Critical Materials Handling (2) Electronic Materials (3)

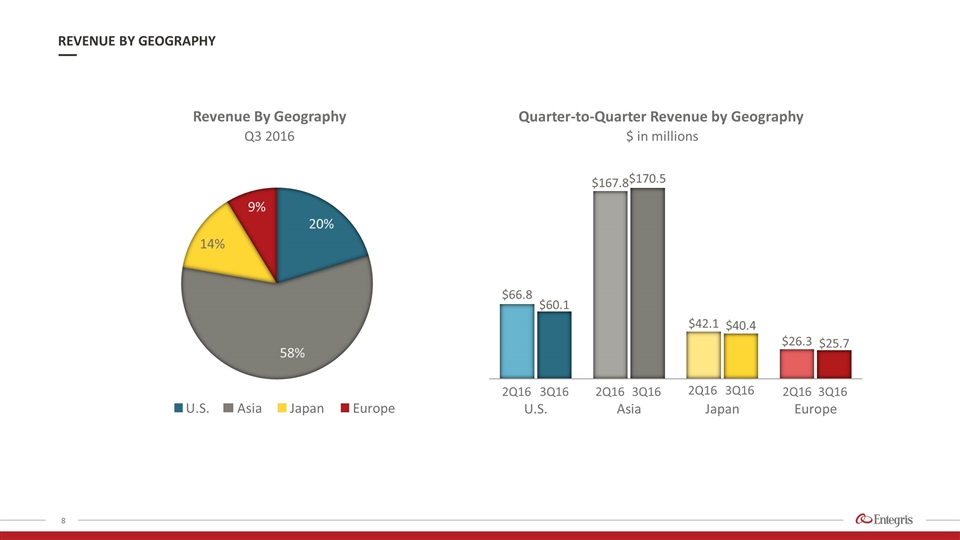

REVENUE BY GEOGRAPHY Revenue By Geography Asia Japan Europe U.S. Quarter-to-Quarter Revenue by Geography $ in millions 2Q16 3Q16 2Q16 3Q16 2Q16 3Q16 Q3 2016 2Q16 3Q16

$ in millions 3Q16 2Q16 3Q15 $ Amount % Total $ Amount % Total $ Amount % Total Cash & Cash Equivalents $411.8 24.0% $373.7 22.0% $301.1 18.1% Accounts Receivable, net $167.6 9.8% $180.6 10.7% $184.3 11.1% Inventories $186.0 10.9% $181.1 10.7% $188.4 11.3% Net PP&E $315.5 18.4% $322.7 19.0% $315.7 18.9% Total Assets $1,713.6 $1,695.5 $1,666.5 Current Liabilities(1) $237.7 13.9% $187.1 11.0% $209.1 12.5% Long-term debt, excluding current maturities $508.8 29.7% $582.2 34.3% $605.1 36.3% Total Liabilities $816.4 47.6% $834.3 49.2% $896.4 53.8% Total Shareholders’ Equity $897.2 52.4% $861.2 50.8% $770.1 46.2% AR - DSOs 51.5 54.4 62.2 Inventory Turns 3.8 3.6 3.3 SUMMARY – BALANCE SHEET ITEMS 1. Current Liabilities in 3Q15, 2Q16, 3Q16 includes $50 million, $50 million, and $100 million of current maturities of long term debt.

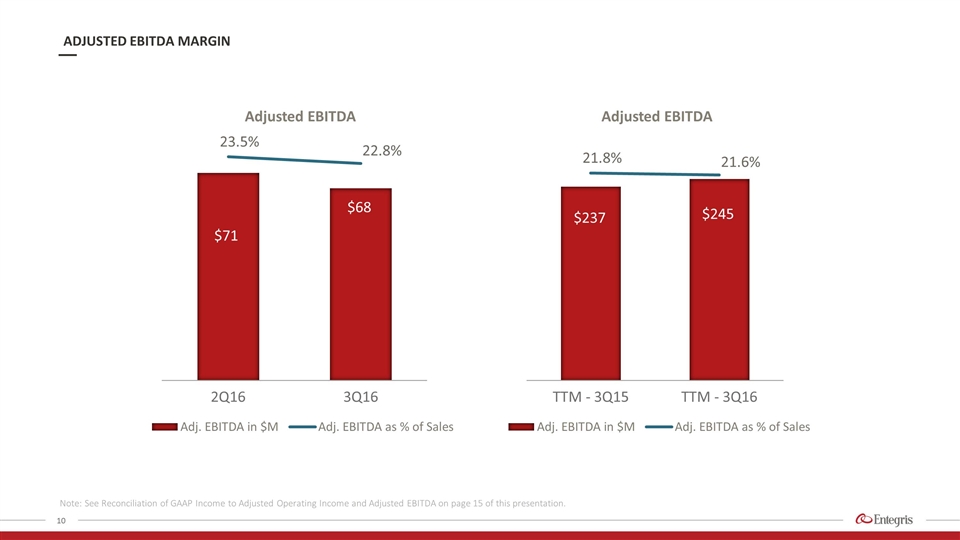

Note: See Reconciliation of GAAP Income to Adjusted Operating Income and Adjusted EBITDA on page 15 of this presentation. ADJUSTED EBITDA MARGIN

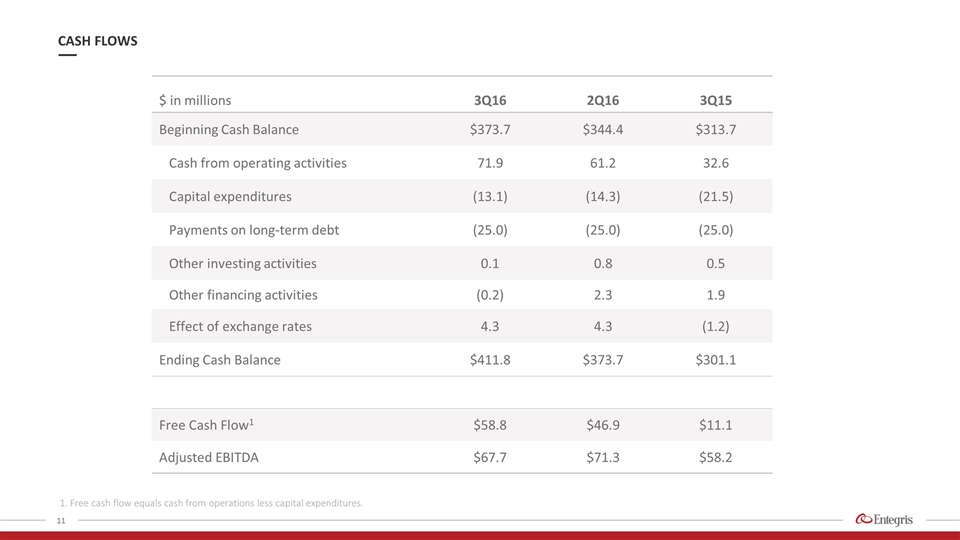

$ in millions 3Q16 2Q16 3Q15 Beginning Cash Balance $373.7 $344.4 $313.7 Cash from operating activities 71.9 61.2 32.6 Capital expenditures (13.1) (14.3) (21.5) Payments on long-term debt (25.0) (25.0) (25.0) Other investing activities 0.1 0.8 0.5 Other financing activities (0.2) 2.3 1.9 Effect of exchange rates 4.3 4.3 (1.2) Ending Cash Balance $411.8 $373.7 $301.1 Free Cash Flow1 $58.8 $46.9 $11.1 Adjusted EBITDA $67.7 $71.3 $58.2 CASH FLOWS 1. Free cash flow equals cash from operations less capital expenditures.

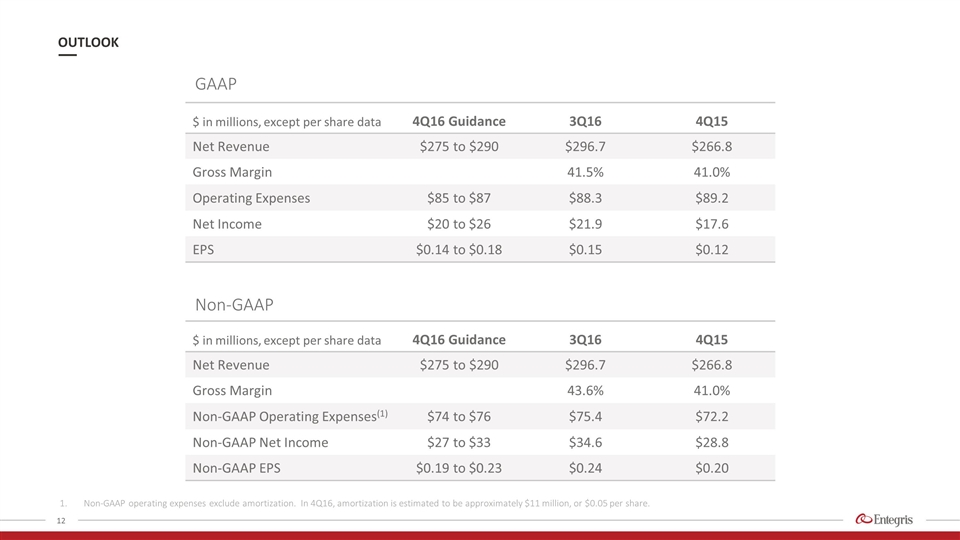

OUTLOOK GAAP $ in millions, except per share data 4Q16 Guidance 3Q16 4Q15 Net Revenue $275 to $290 $296.7 $266.8 Gross Margin 41.5% 41.0% Operating Expenses $85 to $87 $88.3 $89.2 Net Income $20 to $26 $21.9 $17.6 EPS $0.14 to $0.18 $0.15 $0.12 $ in millions, except per share data 4Q16 Guidance 3Q16 4Q15 Net Revenue $275 to $290 $296.7 $266.8 Gross Margin 43.6% 41.0% Non-GAAP Operating Expenses(1) $74 to $76 $75.4 $72.2 Non-GAAP Net Income $27 to $33 $34.6 $28.8 Non-GAAP EPS $0.19 to $0.23 $0.24 $0.20 Non-GAAP Non-GAAP operating expenses exclude amortization. In 4Q16, amortization is estimated to be approximately $11 million, or $0.05 per share.

Entegris® and the Entegris Rings Design® are trademarks of Entegris, Inc. ©2016 Entegris, Inc. All rights reserved.

APPENDIX: NON-GAAP RECONCILIATION TABLES

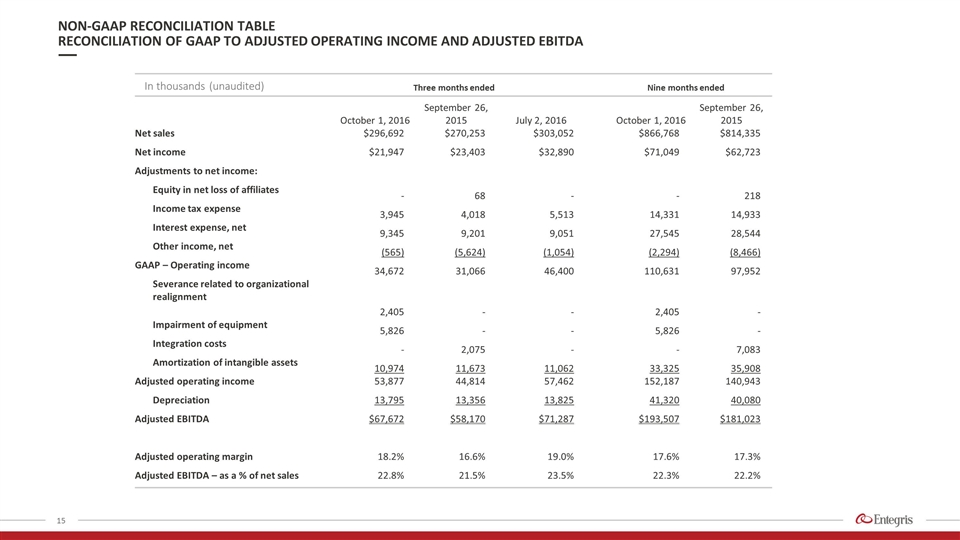

NON-GAAP RECONCILIATION TABLE RECONCILIATION OF GAAP TO ADJUSTED OPERATING INCOME AND ADJUSTED EBITDA In thousands (unaudited) Three months ended Nine months ended October 1, 2016 September 26, 2015 July 2, 2016 October 1, 2016 September 26, 2015 Net sales $296,692 $270,253 $303,052 $866,768 $814,335 Net income $21,947 $23,403 $32,890 $71,049 $62,723 Adjustments to net income: Equity in net loss of affiliates - 68 - - 218 Income tax expense 3,945 4,018 5,513 14,331 14,933 Interest expense, net 9,345 9,201 9,051 27,545 28,544 Other income, net (565) (5,624) (1,054) (2,294) (8,466) GAAP – Operating income 34,672 31,066 46,400 110,631 97,952 Severance related to organizational realignment 2,405 - - 2,405 - Impairment of equipment 5,826 - - 5,826 - Integration costs - 2,075 - - 7,083 Amortization of intangible assets 10,974 11,673 11,062 33,325 35,908 Adjusted operating income 53,877 44,814 57,462 152,187 140,943 Depreciation 13,795 13,356 13,825 41,320 40,080 Adjusted EBITDA $67,672 $58,170 $71,287 $193,507 $181,023 Adjusted operating margin 18.2% 16.6% 19.0% 17.6% 17.3% Adjusted EBITDA – as a % of net sales 22.8% 21.5% 23.5% 22.3% 22.2%

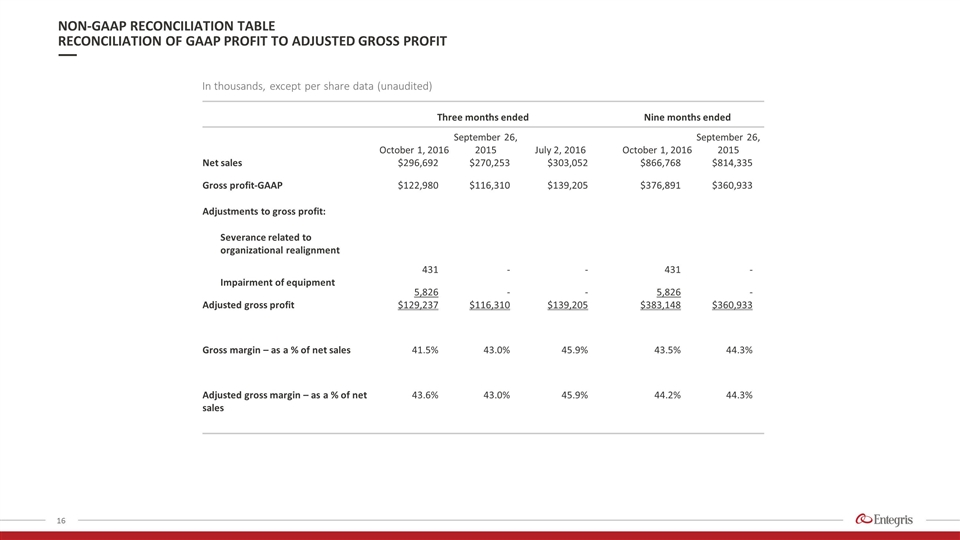

NON-GAAP RECONCILIATION TABLE RECONCILIATION OF GAAP PROFIT TO ADJUSTED GROSS PROFIT Three months ended Nine months ended October 1, 2016 September 26, 2015 July 2, 2016 October 1, 2016 September 26, 2015 Net sales $296,692 $270,253 $303,052 $866,768 $814,335 Gross profit-GAAP $122,980 $116,310 $139,205 $376,891 $360,933 Adjustments to gross profit: Severance related to organizational realignment 431 - - 431 - Impairment of equipment 5,826 - - 5,826 - Adjusted gross profit $129,237 $116,310 $139,205 $383,148 $360,933 Gross margin – as a % of net sales 41.5% 43.0% 45.9% 43.5% 44.3% Adjusted gross margin – as a % of net sales 43.6% 43.0% 45.9% 44.2% 44.3% In thousands, except per share data (unaudited)

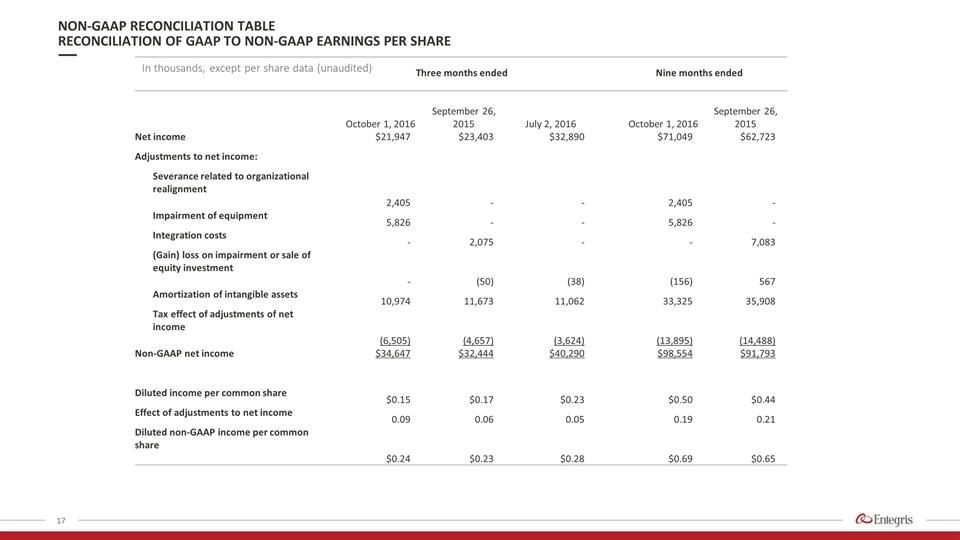

NON-GAAP RECONCILIATION TABLE RECONCILIATION OF GAAP TO NON-GAAP EARNINGS PER SHARE Three months ended Nine months ended October 1, 2016 September 26, 2015 July 2, 2016 October 1, 2016 September 26, 2015 Net income $21,947 $23,403 $32,890 $71,049 $62,723 Adjustments to net income: Severance related to organizational realignment 2,405 - - 2,405 - Impairment of equipment 5,826 - - 5,826 - Integration costs - 2,075 - - 7,083 (Gain) loss on impairment or sale of equity investment - (50) (38) (156) 567 Amortization of intangible assets 10,974 11,673 11,062 33,325 35,908 Tax effect of adjustments of net income (6,505) (4,657) (3,624) (13,895) (14,488) Non-GAAP net income $34,647 $32,444 $40,290 $98,554 $91,793 Diluted income per common share $0.15 $0.17 $0.23 $0.50 $0.44 Effect of adjustments to net income 0.09 0.06 0.05 0.19 0.21 Diluted non-GAAP income per common share $0.24 $0.23 $0.28 $0.69 $0.65 In thousands, except per share data (unaudited)