Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Smart Sand, Inc. | d219314dex231.htm |

| EX-10.12 - EX-10.12 - Smart Sand, Inc. | d219314dex1012.htm |

| EX-5.1 - EX-5.1 - Smart Sand, Inc. | d219314dex51.htm |

| EX-1.1 - EX-1.1 - Smart Sand, Inc. | d219314dex11.htm |

Table of Contents

As filed with the Securities and Exchange Commission on October 25, 2016

Registration No. 333-213692

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Smart Sand, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 1400 | 45-2809926 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

24 Waterway Avenue, Suite 350

The Woodlands, Texas 77380

(281) 231-2660

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Charles E. Young

Chief Executive Officer

24 Waterway Avenue, Suite 350

The Woodlands, Texas 77380

(281) 231-2660

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Ryan J. Maierson Latham & Watkins LLP 811 Main Street, Suite 3700 Houston, Texas 77002 (713) 546-5400 |

Alan Beck Julian J. Seiguer Vinson & Elkins L.L.P. 1001 Fannin Street, Suite 2500 Houston, Texas 77002 (713) 758-2222 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) | ||||

| Common Stock, par value $0.001 per share |

12,207,425 | $18.00 | $219,733,650 | $23,948 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 1,592,273 shares of common stock that the underwriters have the option to purchase. |

| (2) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended. |

| (3) | The Registrant previously paid $10,070 of the total registration fee in connection with a previous filing of this Registration Statement. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 25, 2016

PROSPECTUS

10,615,152 Shares

Smart Sand, Inc.

Common Stock

This is our initial public offering. We are offering 9,100,000 shares of common stock and the selling stockholders are offering 1,515,152 shares of common stock.

Prior to this offering, there has been no public market for our common stock. It is currently estimated that the initial public offering price will be between $15.00 and $18.00 per share. We have applied to list our common stock on the NASDAQ Global Select Market under the symbol “SND.” We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, or JOBS Act.

You should consider the risks we have described in “Risk Factors” beginning on page 16.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

Per Share |

Total | |||

| Initial public offering price |

$ | $ | ||

| Underwriting discounts and commissions(1) |

$ | $ | ||

| Proceeds, before expenses, to Smart Sand, Inc. |

$ | $ | ||

| Proceeds, before expenses, to the selling stockholders |

$ | $ |

| (1) | We refer you to “Underwriting” beginning on page 127 of this prospectus for additional information regarding underwriting compensation. |

The selling stockholders have granted the underwriters the option to purchase up to an additional 1,592,273 shares of common stock on the same terms and conditions if the underwriters sell more than 10,615,152 shares of common stock in this offering. We will not receive any proceeds from the sale of shares held by the selling stockholders.

The underwriters expect to deliver the common stock on or about , .

| Credit Suisse |

Goldman, Sachs & Co. |

| Jefferies |

| Simmons & Company International Energy Specialists of Piper Jaffray |

Tudor, Pickering, Holt & Co. | Deutsche Bank Securities | ||

The date of this prospectus is , .

Table of Contents

Table of Contents

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 4 | ||||

| 5 | ||||

| 7 | ||||

| 7 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 14 | ||||

| 16 | ||||

| 16 | ||||

| 27 | ||||

| Risks Related to This Offering and Ownership of Our Common Stock |

30 | |||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 41 | ||||

| 42 | ||||

| 44 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

46 | |||

| 46 | ||||

| 46 | ||||

| 47 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| Six Months Ended June 30, 2016 Compared to Six Months Ended June 30, 2015 |

54 | |||

| Year Ended December 31, 2015 Compared to the Year Ended December 31, 2014 |

56 | |||

| 58 | ||||

| 60 | ||||

| 61 | ||||

| 61 | ||||

| 61 | ||||

| 62 | ||||

| 62 | ||||

| 64 | ||||

| 65 | ||||

| 65 | ||||

| 66 | ||||

| 67 | ||||

| 68 |

i

Table of Contents

| 68 | ||||

| 71 | ||||

| 72 | ||||

| 72 | ||||

| 72 | ||||

| 73 | ||||

| 74 | ||||

| 75 | ||||

| 77 | ||||

| 77 | ||||

| 78 | ||||

| 78 | ||||

| 80 | ||||

| 82 | ||||

| 83 | ||||

| 87 | ||||

| 88 | ||||

| 89 | ||||

| 90 | ||||

| 90 | ||||

| 90 | ||||

| 90 | ||||

| Environmental and Occupational Health and Safety Regulations |

91 | |||

| 95 | ||||

| 95 | ||||

| 96 | ||||

| 96 | ||||

| 99 | ||||

| 100 | ||||

| 100 | ||||

| 101 | ||||

| 104 | ||||

| 110 | ||||

| 111 | ||||

| 113 | ||||

| 113 | ||||

| 113 | ||||

| 115 | ||||

| Procedures for Review, Approval and Ratification of Related Person Transactions |

115 | |||

| 115 | ||||

| 115 | ||||

| 116 | ||||

| 116 | ||||

| 116 | ||||

| 116 | ||||

| 118 | ||||

| 118 | ||||

| 120 | ||||

| 120 | ||||

| 120 |

ii

Table of Contents

| 121 | ||||

| 121 | ||||

| 121 | ||||

| 121 | ||||

| 123 | ||||

| 123 | ||||

| 123 | ||||

| 123 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS |

125 | |||

| 126 | ||||

| 126 | ||||

| 127 | ||||

| 128 | ||||

| Additional Withholding Tax on Payments Made to Foreign Accounts |

128 | |||

| 129 | ||||

| 135 | ||||

| 135 | ||||

| 135 | ||||

| 136 | ||||

| F-1 | ||||

| A-1 |

You should rely only on the information contained in this prospectus or in any free writing prospectus prepared by us or on behalf of us or to which we have referred you. Neither we, the selling stockholders, nor the underwriters have authorized any other person to provide you with information different from that contained in this prospectus and any free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we, the selling stockholders, nor the underwriters are making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Please read “Risk Factors” and “Forward-Looking Statements.”

Industry and Market Data

The data included in this prospectus regarding the industry in which we operate, including descriptions of trends in the market and our position and the position of our competitors within our industries, is based on a variety of sources, including independent publications, government publications, information obtained from customers, distributors, suppliers and trade and business organizations and publicly available information, as well as our good faith estimates, which have been derived from management’s knowledge and experience in the industry in which we operate. The industry data sourced from The Freedonia Group is from its Industry Study #3302, “Proppants in North America,” published in September 2015. The industry data sourced from Spears & Associates is from its “Hydraulic Fracturing Market 2005-2017” published in the second quarter 2016 and its “Drilling and Production Outlook” published in June 2016. The industry data sourced from PropTester, Inc. and Kelrik, LLC is from its “2015 Proppant Market Report” published in March 2016. The industry data sourced from Baker Hughes is from its “North America Rotary Rig Count” published in July 2016. We believe that the third-party sources are reliable and that the third-party information included in this prospectus or in our estimates is accurate and complete.

iii

Table of Contents

This summary provides a brief overview of information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our common stock. You should read the entire prospectus carefully, including the financial statements and the notes to those financial statements included in this prospectus. Unless indicated otherwise, the information presented in this prospectus assumes an initial public offering price of $16.50 per share (the midpoint of the price range set forth on the cover page of this prospectus) and that the underwriters do not exercise their option to purchase additional shares. You should read “Risk Factors” for more information about important risks that you should consider carefully before buying our common stock.

Unless the context otherwise requires, references in this prospectus to “Smart Sand, Inc.,” “our company,” “we,” “our” and “us,” or like terms, refer to Smart Sand, Inc. and its subsidiaries. References to the “selling stockholders” refer to the selling stockholders that are offering shares of common stock in this offering and have granted the underwriters an option to purchase additional shares to cover any over-allotments. Unless otherwise indicated, and other than the consolidated financial statements and the related notes included elsewhere in this prospectus, information presented in this prospectus is adjusted to reflect our 2,200 for 1 stock split that we will effect after the effective date of the registration statement of which this prospectus forms a part and prior to the completion of this offering. We have provided definitions for some of the terms we use to describe our business and industry and other terms used in this prospectus in the “Glossary of Terms” beginning on page A-1 of this prospectus.

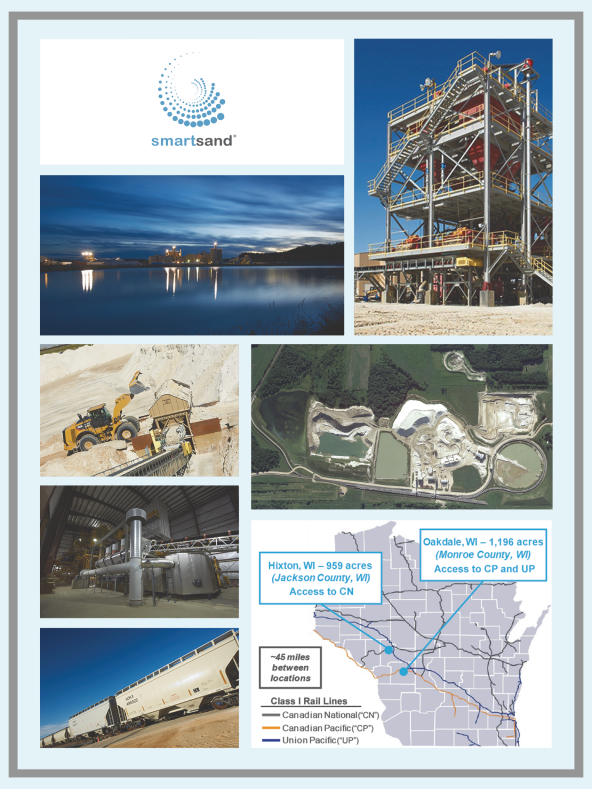

We are a pure-play, low-cost producer of high-quality Northern White raw frac sand, which is a preferred proppant used to enhance hydrocarbon recovery rates in the hydraulic fracturing of oil and natural gas wells. We sell our products primarily to oil and natural gas exploration and production companies, such as EOG Resources, and oilfield service companies, such as Weatherford, under a combination of long-term take-or-pay contracts and spot sales in the open market. We believe that the size and favorable geologic characteristics of our sand reserves, the strategic location and logistical advantages of our facilities and the industry experience of our senior management team have positioned us as a highly attractive source of raw frac sand to the oil and natural gas industry.

We own and operate a raw frac sand mine and related processing facility near Oakdale, Wisconsin, at which we have approximately 244 million tons of proven recoverable sand reserves and approximately 92 million tons of probable recoverable sand reserves as of June 30, 2016, respectively. We began operations with 1.1 million tons of processing capacity in July 2012 and expanded to 2.2 million tons capacity in August 2014 with an additional expansion to 3.3 million tons in September 2015. Our integrated Oakdale facility, with on-site rail infrastructure and wet and dry sand processing facilities, has access to two Class I rail lines and enables us to process and cost-effectively deliver up to approximately 3.3 million tons of raw frac sand per year. We believe that with further development and permitting the Oakdale facility could ultimately be expanded to allow production of up to 9 million tons of raw frac sand per year.

In addition to the Oakdale facility, we own a second property in Jackson County, Wisconsin, which we call the Hixton site. The Hixton site is also located adjacent to a Class I rail line and is fully permitted to initiate operations and is available for future development. As of August 2014, our Hixton site had approximately 100 million tons of proven recoverable sand reserves.

For the year ended December 31, 2015 and six months ended June 30, 2016, we generated net income (loss) of approximately $5.0 million and $(2.0) million, respectively, and Adjusted EBITDA of approximately

1

Table of Contents

$23.9 million and $6.4 million, respectively. For the definition of Adjusted EBITDA and a reconciliation to its most directly comparable financial measure calculated and presented in accordance with Generally Accepted Accounting Principles (“GAAP”), please read “Selected Historical Consolidated Financial Data—Non-GAAP Financial Measures.”

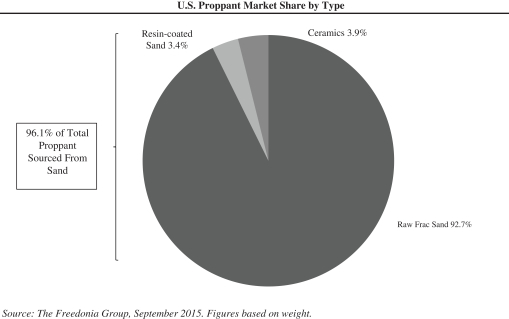

Over the past decade, exploration and production companies have increasingly focused on exploiting the vast hydrocarbon reserves contained in North America’s unconventional oil and natural gas reservoirs by utilizing advanced techniques, such as horizontal drilling and hydraulic fracturing. In recent years, this focus has resulted in exploration and production companies drilling more and longer horizontal wells, completing more hydraulic fracturing stages per well and utilizing more proppant per stage in an attempt to maximize the volume of hydrocarbon recoveries per wellbore. From 2010 to 2015 frac sand demand experienced strong growth, growing at an average annual rate of 25%. In addition, raw frac sand’s share of the total proppant market continues to increase, growing from approximately 78% in 2010 to approximately 92% in 2015 as exploration and production companies continue to look closely at overall well cost, completion efficiency and design optimization, which has led to a greater use of raw frac sand in comparison to resin-coated sand and manufactured ceramic proppants.

Northern White raw frac sand, which is found predominantly in Wisconsin and limited portions of Minnesota and Illinois, is highly valued by oil and natural gas producers as a preferred proppant due to its favorable physical characteristics. We believe that the market for high-quality raw frac sand, like the Northern White raw frac sand we produce, particularly finer mesh sizes, will grow based on the potential recovery in the development of North America’s unconventional oil and natural gas reservoirs as well as the increased proppant volume usage per well. According to Kelrik, a notable driver impacting demand for fine mesh sand is increased proppant loadings, specifically, larger volumes of proppant placed per frac stage. Kelrik expects the trend of using larger volumes of finer mesh materials, such as 100 mesh sand and 40/70 sand, to continue.

We believe that we will be able to successfully execute our business strategies because of the following competitive strengths:

| • | Long-lived, strategically located, high-quality reserve base. We believe our Oakdale facility is one of the few raw frac sand mine and production facilities that has the unique combination of a large high-quality reserve base of primarily fine mesh sand that is contiguous to its production and primary rail loading facilities. Our Oakdale facility is situated on 1,196 acres in a rural area of Monroe County, Wisconsin, on a Class I rail line, and contains approximately 244 million tons of proven recoverable reserves and approximately 92 million tons of probable recoverable reserves as of June 30, 2016. We have an implied current proven reserve life of approximately 73 years based on our current annual processing capacity of 3.3 million tons per year. As of July 31, 2016, we have utilized 135 acres for facilities and mining operations, or only 11.3% of this location’s acreage. We believe that with further development and permitting, the Oakdale facility ultimately could be expanded to allow production of up to 9 million tons of raw frac sand per year. |

We believe our reserve base positions us well to take advantage of current market trends of increasing demand for finer mesh raw frac sand. Approximately 80% of our reserve mix today is 40/70 mesh substrate and 100 mesh substrate, considered to be the finer mesh substrates of raw frac sand. We believe that if oil and natural gas exploration and production companies continue recent trends in drilling and completion techniques to increase lateral lengths per well, the number of frac stages per well, the amount of proppant used per stage and the utilization of slickwater completions, that the demand for the finer grades of raw frac sand will continue to increase, which we can take advantage of due to the high percentage of high-quality, fine mesh sand in our reserve base.

2

Table of Contents

We also believe that having our mine, processing facilities and primary rail loading facilities at our Oakdale facility provides us with an overall low-cost structure, which enables us to compete effectively for sales of raw frac sand and to achieve attractive operating margins. The proximity of our mine, processing plants and primary rail loading facilities at one location eliminates the need for us to truck sand on public roads between the mine and the production facility or between wet and drying processing facilities, eliminating additional costs to produce and ship our sand.

In addition to the Oakdale facility, we own the Hixton site in Jackson County, Wisconsin. The Hixton site is a second fully permitted location adjacent to a Class I rail line that is fully permitted to initiate operations and is available for future development. As of August 2014, our Hixton site had approximately 100 million tons of proven recoverable sand reserves.

| • | Intrinsic logistics advantage. We believe that we are one of the few raw frac sand producers with a facility custom-designed for the specific purpose of delivering raw frac sand to all of the major U.S. oil and natural gas producing basins by an on-site rail facility that can simultaneously accommodate multiple unit trains. Our on-site transportation assets at Oakdale include approximately seven miles of rail track in a double-loop configuration and three rail car loading facilities that are connected to a Class I rail line owned by Canadian Pacific. We believe our customized on-site logistical configuration typically yields lower operating and transportation costs compared to manifest train or single-unit train facilities as a result of our higher rail car utilization, more efficient use of locomotive power and more predictable movement of product between mine and destination. In addition, we have recently constructed a transload facility on a Class I rail line owned by Union Pacific in Byron Township, Wisconsin, approximately 3.5 miles from the Oakdale facility. This transload facility allows us to ship sand directly to our customers on more than one Class I rail carrier. This facility commenced operations in June 2016 and provides increased delivery options for our customers, greater competition among our rail carriers and potentially lower freight costs. With the addition of this transload facility, we believe we are the only mine in Wisconsin with dual served railroad shipment capabilities on the Canadian Pacific and Union Pacific rail networks. Our Hixton site is also located adjacent to a Class I rail line. |

| • | Significant organic growth potential. We believe that we have a significant pipeline of attractive opportunities to expand our sales volumes and our production capacity at our Oakdale facility, which commenced commercial operations in July 2012 and was expanded to 3.3 million tons of annual processing capacity in September 2015. We currently have one wet plant and one dryer in storage at Oakdale that would allow us to increase our annual processing capacity to approximately 4.4 million tons should market demand increase sufficiently to warrant capacity expansion. We believe these units could be installed and operational in approximately six to nine months from commencement of construction. We believe, under current regulations and permitting requirements, that we can ultimately expand our annual production capacity at Oakdale to as much as 9 million tons. Other growth opportunities include the ability to expand our Byron Township transload facility to handle multiple unit trains simultaneously and to invest in transload facilities located in the shale operating basins. Investments in additional rail loading facilities should enable us to provide more competitive transportation costs and allow us to offer additional pricing and delivery options to our customers. We also have opportunities to expand our sales into the industrial sand market which would provide us the opportunity to diversify our customer base and sales product mix. |

Additionally, as of July 31, 2016, we have approximately 2.1 million tons of washed raw frac sand inventory at our Oakdale facility available to be processed through our dryers and sold in the market. This inventory of available washed raw frac sand provides us with the ability to quickly meet changing market demand and strategically sell sand on a spot basis to expand our market share of raw frac sand sales if market conditions are favorable.

| • | Strong balance sheet and financial flexibility. We believe that as a public company we will have a strong balance sheet and ample liquidity to pursue our growth initiatives. At the closing of this offering, |

3

Table of Contents

| we expect to have approximately $45 million in liquidity from cash on hand. In addition, in connection with the repayment in full and retirement of our existing credit facility with a portion of the proceeds of this offering, we are in the process of negotiating a new $40 to 50 million revolving credit facility, which we expect will be effective at or shortly after the completion of this offering. Additionally, unlike some of our peers, we have minimal exposure to unutilized rail cars. We currently have 855 rail cars under long-term leases, of which 710 are currently rented to our customers, which minimizes our exposure to storage and leasing expense for rail cars that are currently not being utilized for sand shipment and provides us greater flexibility in managing our transportation costs prospectively. |

| • | Focus on safety and environmental stewardship. We are committed to maintaining a culture that prioritizes safety, the environment and our relationship with the communities in which we operate. In August 2014, we were accepted as a “Tier 1” participant in Wisconsin’s voluntary “Green Tier” program, which encourages, recognizes and rewards companies for voluntarily exceeding environmental, health and safety legal requirements. In addition, we committed to certification under ISO standards and, in April 2016, we received ISO 9001 and ISO 14001 registrations for our quality management system and environmental management system programs, respectively. We believe that our commitment to safety, the environment and the communities in which we operate is critical to the success of our business. We are one of a select group of companies who are members of the Wisconsin Industrial Sand Association, which promotes safe and environmentally responsible sand mining standards. |

| • | Experienced management team. The members of our senior management team bring significant experience to the market environment in which we operate. Their expertise covers a range of disciplines, including industry-specific operating and technical knowledge as well as experience managing high-growth businesses. |

Our principal business objective is to be a pure-play, low-cost producer of high-quality raw frac sand and to increase stockholder value. We expect to achieve this objective through the following business strategies:

| • | Focusing on organic growth by increasing our capacity utilization and processing capacity. We intend to continue to position ourselves as a pure-play producer of high-quality Northern White raw frac sand, as we believe the proppant market offers attractive long-term growth fundamentals. While demand for proppant has declined since late 2014 in connection with the downturn in commodity prices and the corresponding decline in oil and natural gas drilling and production activity, we believe that the demand for proppant will increase over the medium and long term as commodity prices rise from their recent lows, which will lead producers to resume completion of their inventory of drilled but uncompleted wells and undertake new drilling activities. We expect this demand growth for raw frac sand will be driven by increased horizontal drilling, increased proppant loadings per well (as operators increase lateral length and increase proppant per lateral foot above current levels), increased wells drilled per rig and the cost advantages of raw frac sand over resin-coated sand and manufactured ceramics. As market dynamics improve, we will continue to evaluate economically attractive facility enhancement opportunities to increase our capacity utilization and processing capacity. For example, our current annual processing capacity is approximately 3.3 million tons per year, and we believe that with further development and permitting the Oakdale facility could ultimately be expanded to allow production to as much as 9 million tons of raw frac sand per year. |

| • | Optimizing our logistics infrastructure and developing additional origination and destination points. We intend to further optimize our logistics infrastructure and develop additional origination and destination points. We expect to capitalize on our Oakdale facility’s ability to simultaneously accommodate multiple unit trains to maximize our product shipment rates, increase rail car utilization and lower transportation costs. With our recently developed transloading facility located on the Union Pacific rail network approximately 3.5 miles from our Oakdale facility, we have the ability to ship our raw frac |

4

Table of Contents

| sand directly to our customers on more than one Class I rail carrier. This facility provides increased delivery options for our customers, greater competition among our rail carriers and potentially lower freight costs. In addition, we intend to continue evaluating ways to reduce the landed cost of our products at the basin for our customers, such as investing in transload and storage facilities and assets in our target shale basins to increase our customized service offerings and provide our customers with additional delivery and pricing alternatives, including selling product on an “as-delivered” basis at our target shale basins. |

| • | Focusing on being a low-cost producer and continuing to make process improvements. We will focus on being a low-cost producer, which we believe will permit us to compete effectively for sales of raw frac sand and to achieve attractive operating margins. Our low-cost structure results from a number of key attributes, including, among others, our (i) relatively low royalty rates compared to other industry participants, (ii) balance of coarse and fine mineral reserve deposits and corresponding contractual demand that minimizes yield loss and (iii) Oakdale facility’s proximity to two Class I rail lines and other sand logistics infrastructure, which helps reduce transportation costs, fuel costs and headcount needs. We have strategically designed our operations to provide low per-ton production costs. For example, we completed the construction of a natural gas connection to our Oakdale facility in October 2015 that provides us the optionality to source lower cost natural gas (as compared to propane under current commodity pricing) as a fuel source for our drying operations. In addition, we seek to maximize our mining yields on an ongoing basis by targeting sales volumes that more closely match our reserve gradation in order to minimize mining and processing of superfluous tonnage and continue to evaluate the potential of mining by dredge to reduce the overall cost of our mining operations. |

| • | Pursuing accretive acquisitions and greenfield opportunities. At the closing of this offering, we expect to have approximately $45 million of liquidity in the form of cash on hand and anticipate entering into a new $40 to 50 million revolving credit facility with third-party lenders at or shortly after the completion of this offering. We believe this level of liquidity will position us to pursue strategic acquisitions to increase our scale of operations and our logistical capabilities as well as to potentially diversify our mining and production operations into locations other than our current Oakdale and Hixton locations. We may also grow by developing low-cost greenfield projects, where we can capitalize on our technical knowledge of geology, mining and processing. |

| • | Maintaining financial strength and flexibility. We plan to pursue a disciplined financial policy to maintain financial strength and flexibility. We believe that our cash on hand, expected borrowing capacity and ability to access debt and equity capital markets after this offering will provide us with the financial flexibility necessary to achieve our organic expansion and acquisition strategy. |

Our Oakdale facility is purpose-built to exploit the reserve profile in place and produce high-quality raw frac sand. Unlike some of our competitors, our mine, processing plants and primary rail loading facilities are in one location, which eliminates the need for us to truck sand on public roads between the mine and the production facility or between wet and dry processing facilities. Our on-site transportation assets include approximately seven miles of rail track in a double-loop configuration and three rail car loading facilities that are connected to a Class I rail line owned by Canadian Pacific, which enables us to simultaneously accommodate multiple unit trains and significantly increases our efficiency in meeting our customers’ raw frac sand transportation needs. We ship a substantial portion of our sand volumes (approximately 56% from April 1, 2016 to July 31, 2016) in unit train shipments through rail cars that our customers own or lease and deliver to our facility. We believe that we are one of the few raw frac sand producers with a facility custom-designed for the specific purpose of delivering raw frac sand to all of the major U.S. oil and natural gas producing basins by an on-site rail facility that can simultaneously accommodate multiple unit trains. Our ability to handle multiple rail car sets allows for the efficient transition of locomotives from empty inbound trains to fully loaded outbound trains at our facility.

5

Table of Contents

We believe our customized on-site logistical configuration yields lower overall operating and transportation costs compared to manifest train or single-unit train facilities as a result of our higher rail car utilization, more efficient use of locomotive power and more predictable movement of product between mine and destination. Unit train operations such as ours can double or triple the average number of loads that a rail car carries per year, reducing the number of rail cars needed to support our operations and thus limiting our exposure to unutilized rail cars and the corresponding storage and lease expense. We believe that our Oakdale facility’s connection to the Canadian Pacific rail network, combined with our unit train logistics capabilities, will provide us enhanced flexibility to serve customers located in shale plays throughout North America. In addition, we have invested in a transloading facility on the Union Pacific rail network in Byron Township, Wisconsin, approximately 3.5 miles from our Oakdale facility. This facility is operational and provides us with the ability to ship directly on the Union Pacific network to locations in the major operating basins in the Western and Southwestern United States, which should facilitate more competitive pricing among our rail carriers. With the addition of this transload facility, we believe we are the only raw frac sand mine in Wisconsin with dual served railroad shipment capabilities on the Canadian Pacific and Union Pacific, which should provide us more competitive logistics options to the market relative to other Wisconsin based sand mining and production facilities.

In addition to the Oakdale facility, our Hixton site consists of approximately 959 acres in Jackson County, Wisconsin. The Hixton site is fully permitted to initiate operations and is available for future development. As of August 2014, our Hixton site had approximately 100 million tons of proven recoverable sand reserves. This location is located on a Class I rail line, the Canadian National.

The following tables provide key characteristics of our Oakdale facility and Hixton site (as of June 30, 2016, unless otherwise stated):

Our Oakdale Facility

| Facility Characteristic |

Description | |

| Site geography |

Situated on 1,196 contiguous acres, with on-site processing and rail loading facilities. | |

| Proven recoverable reserves |

244 million tons. | |

| Probable recoverable reserves |

92 million tons. | |

| Deposits |

Sand reserves of up to 200 feet; grade mesh sizes 20/40, 30/50, 40/70 and 100 mesh. | |

| Proven reserve mix |

Approximately 19% of 20/40 and coarser substrate, 41% of 40/70 mesh substrate and approximately 40% of 100 mesh substrate. Our 30/50 gradation is a derivative of the 20/40 and 40/70 blends. | |

| Excavation technique |

Generally shallow overburden allowing for surface excavation. | |

| Annual processing capacity |

3.3 million tons with the ability to increase to 4.4 million tons within approximately six to nine months. | |

| Logistics capabilities |

Dual served rail line logistics capabilities. On-site transportation infrastructure capable of simultaneously accommodating multiple unit trains and connected to the Canadian Pacific rail network. Additional transload facility located approximately 3.5 miles from the Oakdale facility in Byron Township that provides access to the Union Pacific network. | |

| Royalties |

$0.50 per ton sold of 70 mesh or coarser substrate. | |

| Expansion Capabilities |

We believe that with further development and permitting the Oakdale facility could ultimately be expanded to allow production of up to 9 million tons of raw frac sand per year. |

6

Table of Contents

Our Hixton Site

| Facility Characteristic |

Description | |

| Site geography |

Situated on 959 contiguous acres with access to a Canadian National Class I rail line. | |

| Proven recoverable reserves |

100 million tons. | |

| Deposits |

Sand reserves with an average thickness of 120 feet; grade mesh sizes 20/40, 30/50, 40/70 and 100 mesh. | |

| Proven reserve mix |

Approximately 72% of 70 mesh and coarser substrate and approximately 28% of 100 mesh substrate. | |

| Logistics capabilities |

Planned on-site transportation infrastructure capable of simultaneously accommodating multiple unit trains and connected to the Canadian National rail network. | |

| Royalties |

$0.50 per ton sold of 70 mesh or coarser substrate. |

Our Customers and Contracts

We sell raw frac sand under long-term take-or-pay contracts as well as in the spot market if we have excess production and the spot market conditions are favorable. Beginning January 1, 2017, we will have approximately 1.0 million tons of average annual production (or approximately 30.6% of our current annual production capacity) contracted under long-term take-or-pay contracts, with a volume-weighted average remaining term of approximately 3.7 years. For the year ended December 31, 2015 and the six months ended June 30, 2016, we generated approximately 96.4% and 99.6%, respectively, of our revenues from raw frac sand delivered under long-term take-or-pay contracts.

Demand for proppants in 2015 and through the first half of 2016 has dropped due to the downturn in commodity prices since late 2014 and the corresponding reduction in oil and natural gas drilling, completion and production activity. This change in demand has impacted contract discussions and negotiated terms with our customers as existing contracts have been adjusted resulting in a combination of reduced average selling prices per ton, adjustments to take-or-pay volumes and length of contract. We believe we have mitigated the short-term negative impact on revenues of some of these adjustments through contractual shortfall and reservation payments. In the current market environment, customers have begun to purchase more volumes on a spot basis as compared to committing to term contracts, and we expect this trend to continue in the near term until oil and natural gas drilling and completion activity begins to increase. However, should drilling and completion activity return to higher levels, we believe customers would more actively consider contracting proppant volumes under term contracts rather than continuing to rely on buying proppant on a spot basis in the market.

Third Quarter 2016 Sales Volumes

We sold approximately 229,000 tons of sand in the three months ended September 30, 2016, compared to approximately 193,000 tons of sand sold in the three months ended June 30, 2016, a quarter-over-quarter increase of approximately 19%. During the three months ended September 30, 2016, the average selling price per ton was $40.66 as compared to $35.53 for the three months ended June 30, 2016. We are currently in the process of finalizing our financial results for the third quarter 2016.

Industry Trends Impacting Our Business

Unless otherwise indicated, the information set forth under “—Industry Trends Impacting Our Business,” including all statistical data and related forecasts, is derived from The Freedonia Group’s Industry Study #3302, “Proppants in North America,” published in September 2015, Spears & Associates’ “Hydraulic Fracturing

7

Table of Contents

Market 2005-2017” published in the second quarter 2016, PropTester, Inc. and Kelrik, LLC’s “2015 Proppant Market Report” published in March 2016 and Baker Hughes’ “North America Rotary Rig Count” published in July 2016. While we are not aware of any misstatements regarding the proppant industry data presented herein, estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors.”

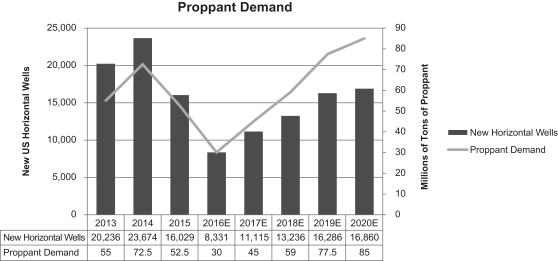

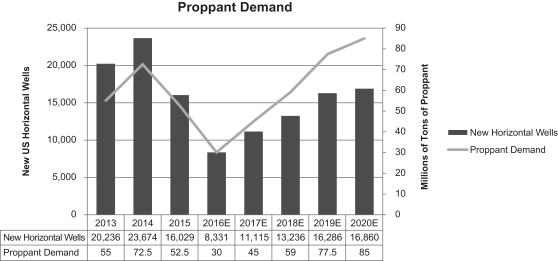

Demand Trends

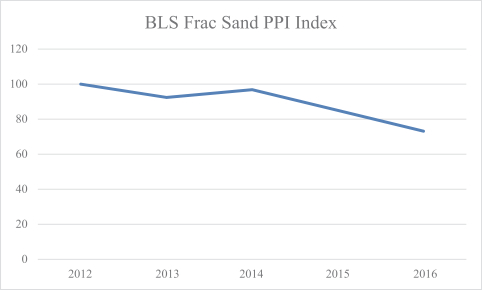

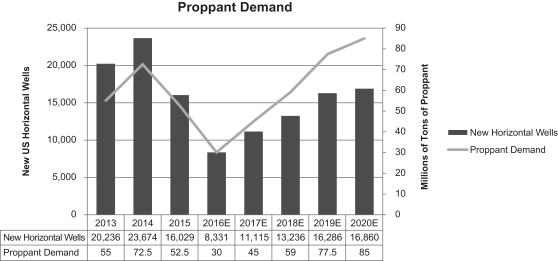

According to Spears, the U.S. proppant market, including raw frac sand, ceramic and resin-coated proppant, was approximately 52.5 million tons in 2015. Kelrik estimates that the total raw frac sand market in 2015 represented approximately 92.3% of the total proppant market by weight. Market demand in 2015 dropped by approximately 28% from 2014 record demand levels (and a further estimated decrease of 43% in 2016 from 2015) due to the downturn in commodity prices since late 2014, which led to a corresponding decline in oil and natural gas drilling and production activity. According to the Freedonia Group, during the period from 2009 to 2014, proppant demand by weight increased by 42% annually. Spears estimates from 2016 through 2020 proppant demand is projected to grow by 23.2% per year, from 30 million tons per year to 85 million tons per year, representing an increase of approximately 55 million tons in annual proppant demand over that time period.

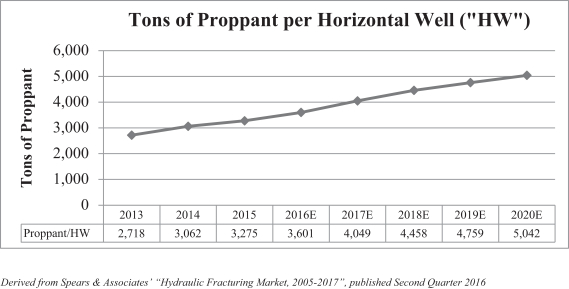

Demand growth for raw frac sand and other proppants is primarily driven by advancements in oil and natural gas drilling and well completion technology and techniques, such as horizontal drilling and hydraulic fracturing. These advancements have made the extraction of oil and natural gas increasingly cost-effective in formations that historically would have been uneconomic to develop. While current horizontal rig counts have fallen significantly from their peak of approximately 1,370 in 2014, rig count grew at an annual rate of 18.7% from 2009 to 2014. Additionally, the percentage of active drilling rigs used to drill horizontal wells, which require greater volumes of proppant than vertical wells, has increased from 42.2% in 2009 to 68.4% in 2014, and as of July 2016 the percentage of rigs drilling horizontal wells is 77% according to the Baker Hughes Rig Count. Moreover, the increase of pad drilling has led to a more efficient use of rigs, allowing more wells to be drilled per rig. As a result of these factors, well count, and hence proppant demand, has grown at a greater rate than overall rig count. Spears estimates that in 2019, proppant demand will exceed the 2014 peak (of approximately 72.5 million tons) and reach 77.5 millions tons even though the projection assumes approximately 10,000 fewer wells will be drilled. Spears estimates that average proppant usage per well will be approximately 5,000 tons per well by 2020. Kelrik notes that current sand-based slickwater completions use in excess of 7,500 tons per well of proppant.

8

Table of Contents

While demand for proppant has declined since late 2014 in connection with the downturn in commodity prices and the corresponding decline in oil and natural gas drilling and production activity, we believe that the demand for proppant will increase over the medium and long term as commodity prices rise from their recent lows, which will lead producers to resume completion of their inventory of drilled but uncompleted wells and undertake new drilling activities. Further, we believe that demand for proppant will be amplified by the following factors:

| • | improved drilling rig productivity, resulting in more wells drilled per rig per year; |

| • | completion of exploration and production companies’ inventory of drilled but uncompleted wells; |

| • | increases in the percentage of rigs that are drilling horizontal wells; |

| • | increases in the length of the typical horizontal wellbore; |

| • | increases in the number of fracture stages per foot in the typical completed horizontal wellbore; |

| • | increases in the volume of proppant used per fracturing stage; |

| • | renewed focus of exploration and production companies to maximize ultimate recovery in active reservoirs through downspacing; and |

| • | increasing secondary hydraulic fracturing of existing wells as early shale wells age. |

Recent growth in demand for raw frac sand has outpaced growth in demand for other proppants, and industry analysts predict that this trend will continue. As well completion costs have increased as a proportion of total well costs, operators have increasingly looked for ways to improve per well economics by lowering costs without sacrificing production performance. To this end, the oil and natural gas industry is shifting away from the use of higher-cost proppants towards more cost-effective proppants, such as raw frac sand. Evolution of completion techniques and the substantial increase in activity in U.S. oil and liquids-rich resource plays has further accelerated the demand growth for raw frac sand.

In general, oil and liquids-rich wells use a higher proportion of coarser proppant while dry gas wells typically use finer grades of sand. In the past, with the majority of U.S. exploration and production spending focused on oil and liquids-rich plays, demand for coarser grades of sand exceeded demand for finer grades; however, due to innovations in completion techniques, demand for finer grade sands has also shown a considerable resurgence. According to Kelrik, a notable driver impacting demand for fine mesh sand is increased proppant loadings, specifically, larger volumes of proppant placed per frac stage. Kelrik expects the trend of using larger volumes of finer mesh materials such as 100 mesh sand and 40/70 sand, to continue.

Supply Trends

In recent years, through the fall of 2014, customer demand for high-quality raw frac sand outpaced supply. Several factors contributed to this supply shortage, including:

| • | the difficulty of finding raw frac sand reserves that meet API specifications and satisfy the demands of customers who increasingly favor high-quality Northern White raw frac sand; |

| • | the difficulty of securing contiguous raw frac sand reserves large enough to justify the capital investment required to develop a processing facility; |

| • | the challenges of identifying reserves with the above characteristics that have rail access needed for low-cost transportation to major shale basins; |

| • | the hurdles to securing mining, production, water, air, refuse and other federal, state and local operating permits from the proper authorities; |

9

Table of Contents

| • | local opposition to development of certain facilities, especially those that require the use of on-road transportation, including moratoria on raw frac sand facilities in multiple counties in Wisconsin and Minnesota that hold potential sand reserves; and |

| • | the long lead time required to design and construct sand processing facilities that can efficiently process large quantities of high-quality raw frac sand. |

Supplies of high-quality Northern White raw frac sand are limited to select areas, predominantly in western Wisconsin and limited areas of Minnesota and Illinois. The ability to obtain large contiguous reserves in these areas is a key constraint and can be an important supply consideration when assessing the economic viability of a potential raw frac sand facility. Further constraining the supply and throughput of Northern White raw frac sand, is that not all of the large reserve mines have onsite excavation and processing capability. Additionally, much of the recent capital investment in Northern White raw frac sand mines was used to develop coarser deposits in western Wisconsin. With the shift to finer sands in the liquid and oil plays, many mines may not be economically viable as their ability to produce finer grades of sand may be limited.

Our Relationship with Our Sponsor

Our sponsor is a fund managed by Clearlake Capital Group, L.P., which, together with its affiliates and related persons, we refer to as Clearlake. Clearlake is a private investment firm with a sector-focused approach. The firm seeks to partner with world-class management teams by providing patient, long-term capital to dynamic businesses that can benefit from Clearlake’s operational and strategic expertise. The firm’s core target sectors include technology, communications and business services; industrials, energy and power; and consumer products and services. Clearlake currently has over $3.0 billion of assets under management. We believe our relationship with Clearlake provides us with a unique resource to effectively compete for acquisitions within the industry by being able to take advantage of their experience in acquiring businesses to assist us in seeking out, evaluating and closing attractive acquisition opportunities over time.

An investment in our common stock involves risks that include the demand for sand-based proppants and other risks. You should carefully consider the risks described under “Risk Factors” and the other information in this prospectus before investing in our common stock.

Principal Executive Offices and Internet Address

Our principal executive offices are located at 24 Waterway Avenue, Suite 350, The Woodlands, Texas 77380, and our telephone number is (281) 231-2660. Following the closing of this offering, our website will be located at www.smartsand.com. We expect to make our periodic reports and other information filed with or furnished to the Securities and Exchange Commission, or the SEC, available, free of charge, through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus.

10

Table of Contents

Our Emerging Growth Company Status

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may, for up to five years, take advantage of specified exemptions from reporting and other regulatory requirements that are otherwise applicable generally to public companies. These exemptions include:

| • | the presentation of only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in this prospectus; |

| • | deferral of the auditor attestation requirement on the effectiveness of our system of internal control over financial reporting; |

| • | exemption from the adoption of new or revised financial accounting standards until they would apply to private companies; |

| • | exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; and |

| • | reduced disclosure about executive compensation arrangements. |

We may take advantage of these provisions until we are no longer an emerging growth company, which will occur on the earliest of (i) the last day of the fiscal year following the fifth anniversary of this offering, (ii) the last day of the fiscal year in which we have more than $1.0 billion in annual revenue, (iii) the date on which we issue more than $1.0 billion of non-convertible debt over a three-year period and (iv) the date on which we are deemed to be a “large accelerated filer,” as defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

We have elected to take advantage of all of the applicable JOBS Act provisions, except that we will elect to opt out of the exemption that allows emerging growth companies to extend the transition period for complying with new or revised financial accounting standards (this election is irrevocable).

Accordingly, the information that we provide you may be different than what you may receive from other public companies in which you hold equity interests.

11

Table of Contents

| Issuer |

Smart Sand, Inc. |

| Common stock offered by us |

9,100,000 shares. |

| Common stock offered by the selling stockholders |

1,515,152 shares. |

| Common stock outstanding after this offering |

31,638,712 shares. |

| Option to purchase additional shares |

The selling stockholders have granted the underwriters a 30-day option to purchase up to an aggregate of 1,592,273 additional shares of our common stock held by the selling stockholders to cover over-allotments. |

| Shares held by our selling stockholders after this offering |

21,009,979 shares (or 19,417,707 shares, if the underwriters exercise in full their option to purchase additional shares). |

| Use of proceeds |

We expect to receive approximately $138.6 million of net proceeds, based upon the assumed initial public offering price of $16.50 per share (the midpoint of the price range set forth on the cover page of this prospectus), after deducting underwriting discounts and estimated offering expenses payable by us. |

| We intend to use a portion of the net proceeds from this offering to redeem all of the outstanding shares of our Redeemable Series A Preferred Stock (“Preferred Stock”), to repay in full the outstanding indebtedness under our existing revolving credit facility, which will be terminated, and the remaining net proceeds for general corporate purposes. Please read “Use of Proceeds.” |

| We will not receive any of the proceeds from the sale of shares of our common stock by the selling stockholders in this offering, including pursuant to any exercise by the underwriters of their option to purchase additional shares of our common stock from the selling stockholders. |

| Registration rights agreement |

Pursuant to a registration rights agreement, we will, subject to the terms and conditions thereof, agree to register the shares of our common stock owned by certain stockholders, including the selling stockholders, following the closing of this offering. See “Certain Relationships and Related Party Transactions—Registration Rights Agreement.” |

| Dividend policy |

We do not anticipate paying any cash dividends on our common stock. In addition, we expect the new revolving credit facility that we are in the process of negotiating will place certain restrictions on our ability to pay cash dividends. Please read “Dividend Policy.” |

12

Table of Contents

| Listing and trading symbol |

We have applied to list our common stock on the NASDAQ Global Select Market (the “NASDAQ”) under the symbol “SND.” |

| Risk factors |

You should carefully read and consider the information set forth under the heading “Risk Factors” and all other information set forth in this prospectus before deciding to invest in our common stock. |

The information above includes 350,167 shares of voting, but unvested, restricted stock. The information above does not include shares of common stock reserved for issuance pursuant to the 2016 Plan (as defined in “Executive Compensation—Equity Compensation Plans—2016 Incentive Award Plan”). Additionally, the information above does not include 3,998,896 shares of common stock that are issuable upon the exercise of outstanding warrants held by certain of our existing stockholders that we expect to be exercisable shortly after the completion of this offering. Assuming all warrants are exercised, we will have 35,637,609 shares of common stock outstanding and our selling stockholders will hold 25,008,876 shares of our common stock (or 23,416,603 shares, if the underwriters exercise in full their option to purchase additional shares).

13

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following table presents summary historical consolidated financial data of Smart Sand, Inc. as of the dates and for the periods indicated. The summary historical consolidated financial data as of and for the years ended December 31, 2015 and 2014 are derived from the audited financial statements appearing elsewhere in this prospectus. The summary historical consolidated interim financial data as of June 30, 2016 and for the six months ended June 30, 2016 and 2015 are derived from the unaudited interim financial statements appearing elsewhere in this prospectus. The unaudited condensed financial statements have been prepared on the same basis as our unaudited financial statements and, in our opinion, include all adjustments, consisting of normal recurring adjustments, that are considered necessary for a fair presentation of the financial position, results of operations and cash flows for such periods. Historical results are not necessarily indicative of future results.

The summary historical consolidated data presented below should be read in conjunction with “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes and other financial data included elsewhere in this prospectus.

| Year Ended December 31, |

Six Months Ended June 30, |

|||||||||||||||

| 2015 | 2014 | 2016 | 2015 | |||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||

| Revenues |

$ | 47,698 | $ | 68,170 | $ | 18,853 | $ | 23,525 | ||||||||

| Cost of goods sold |

21,003 | 29,934 | 11,869 | 12,288 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

26,695 | 38,236 | 6,984 | 11,237 | ||||||||||||

| Operating expenses |

||||||||||||||||

| Salaries, benefits and payroll taxes |

5,055 | 5,088 | 2,295 | 2,828 | ||||||||||||

| Depreciation and amortization |

388 | 160 | 181 | 169 | ||||||||||||

| Selling, general and administrative |

4,669 | 7,222 | 1,926 | 2,547 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

10,112 | 12,470 | 4,402 | 5,544 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

16,583 | 25,766 | 2,582 | 5,693 | ||||||||||||

| Other (expenses) income: |

||||||||||||||||

| Preferred stock interest expense(1) |

(5,078 | ) | (5,601 | ) | (3,123 | ) | (2,434 | ) | ||||||||

| Other interest expense |

(2,748 | ) | (2,231 | ) | (1,671 | ) | (1,048 | ) | ||||||||

| Other income |

362 | 370 | 189 | 351 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other (expense) income(1) |

(7,464 | ) | (7,462 | ) | (4,605 | ) | (3,131 | ) | ||||||||

| Loss on extinguishment of debt |

— | (1,230 | ) | — | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) before income tax expense (benefit)(1) |

9,119 | 17,074 | (2,023 | ) | 2,562 | |||||||||||

| Income tax expense (benefit) |

4,129 | 9,518 | (56 | ) | 1,633 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net and comprehensive income (loss)(1) |

$ | 4,990 | $ | 7,556 | ($ | 1,967 | ) | $ | 929 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Per share information: |

||||||||||||||||

| Net income (loss) per common share(1): |

||||||||||||||||

| Basic(2) |

$ | 496.42 | $ | 754.23 | $ | (195.20 | ) | $ | 92.51 | |||||||

| Diluted(3) |

$ | 415.83 | $ | 633.44 | $ | (195.20 | ) | $ | 77.39 | |||||||

| Weighted-average number of common shares: |

||||||||||||||||

| Basic |

10,052 | 10,018 | 10,077 | 10,042 | ||||||||||||

| Diluted |

12,000 | 11,929 | 12,016 | 12,004 | ||||||||||||

14

Table of Contents

| Year Ended December 31, |

Six Months Ended June 30, |

|||||||||||||||

| 2015 | 2014 | 2016 | 2015 | |||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||

| Balance Sheet Data (at period end): |

||||||||||||||||

| Property, plant and equipment, net |

$ | 108,928 | $ | 85,815 | $ | 106,451 | $ | 107,398 | ||||||||

| Total assets |

133,050 | 109,629 | 123,963 | 125,948 | ||||||||||||

| Total stockholders’ equity (deficit)(1) |

3,729 | (1,957 | ) | 2,103 | (694 | ) | ||||||||||

| Cash Flow Statement Data: |

||||||||||||||||

| Net cash provided by operating activities |

$ | 30,703 | $ | 22,137 | $ | 6,070 | $ | 11,446 | ||||||||

| Net cash used in investing activities |

(29,375 | ) | (30,888 | ) | (690 | ) | (21,806 | ) | ||||||||

| Net cash provided by (used in) financing activities |

1,766 | 7,434 | (7,408 | ) | 9,983 | |||||||||||

| Other Data: |

||||||||||||||||

| Capital expenditures(4) |

$ | 28,102 | $ | 34,719 | $ | (1,365 | ) | $ | 22,624 | |||||||

| Adjusted EBITDA(5) |

23,881 | 33,330 | 6,391 | 9,418 | ||||||||||||

| Production costs(5) |

10,114 | 20,690 | 5,654 | 6,040 | ||||||||||||

| (1) | Amounts previously reported have been updated to reflect the impact of the immaterial correction disclosed in Note 1 to the unaudited interim financial statements as of and for the six months ended June 30, 2016 and 2015 and in Note 1 to the audited financial statements as of and for the years ended December 31, 2015 and 2014. |

| (2) | Pro forma basic net income (loss) per share of common stock, after giving effect to the 2,200 for 1 stock split to be effected prior to the completion of this offering, would have been $0.23 and $0.34 for the years ended December 31, 2015 and 2014 and $(0.09) and $0.04 for the six months ended June 30, 2016 and 2015. |

| (3) | Pro forma diluted net income (loss) per share of common stock, after giving effect to the 2,200 for 1 stock split to be effected prior to the completion of this offering, would have been $0.19 and $0.29 for the years ended December 31, 2015 and 2014 and $(0.09) and $0.04 for the six months ended June 30, 2016 and 2015. |

| (4) | Negative capital expenditures for the six months ended June 30, 2016 resulted from various deposits received for projects included in construction-in-progress. |

| (5) | For our definitions of the non-GAAP financial measures of Adjusted EBITDA and production costs and reconciliations of Adjusted EBITDA and production costs to our most directly comparable financial measures calculated and presented in accordance with GAAP, please read “Selected Historical Consolidated Financial Data—Non-GAAP Financial Measures.” |

15

Table of Contents

Investing in shares of our common stock involves a high degree of risk. You should carefully consider the risks described below with all of the other information included in this prospectus before deciding to invest in shares of our common stock. If any of the following risks were to occur, our business, financial condition, results of operations, and cash flows could be materially adversely affected. In that case, the trading price of our common stock could decline and you could lose all or part of your investment.

Risks Inherent in Our Business

Our business and financial performance depend on the level of activity in the oil and natural gas industry.

Substantially all of our revenues are derived from sales to companies in the oil and natural gas industry. As a result, our operations are dependent on the levels of activity in oil and natural gas exploration, development and production. More specifically, the demand for the proppants we produce is closely related to the number of oil and natural gas wells completed in geological formations where sand-based proppants are used in fracturing activities. These activity levels are affected by both short- and long-term trends in oil and natural gas prices, among other factors.

In recent years, oil and natural gas prices and, therefore, the level of exploration, development and production activity, have experienced a sustained decline from the highs in the latter half of 2014. Beginning in September 2014 and continuing through early 2016, increasing global supply of oil, including a decision by the Organization of the Petroleum Exporting Countries (“OPEC”) to sustain its production levels in spite of the decline in oil prices, in conjunction with weakened demand from slowing economic growth in the Eurozone and China, has created downward pressure on crude oil prices resulting in reduced demand for our products and pressure to reduce our product prices. If these conditions persist, this will adversely impact our operations. Furthermore, the availability of key resources that impact drilling activity has experienced significant fluctuations and could impact product demand.

A prolonged reduction in oil and natural gas prices would generally depress the level of oil and natural gas exploration, development, production and well completion activity and would result in a corresponding decline in the demand for the proppants we produce. Such a decline would have a material adverse effect on our business, results of operation and financial condition. The commercial development of economically-viable alternative energy sources (such as wind, solar, geothermal, tidal, fuel cells and biofuels) could have a similar effect. In addition, certain U.S. federal income tax deductions currently available with respect to oil and natural gas exploration and development, including the repeal of the percentage depletion allowance for oil and natural gas properties, may be eliminated as a result of proposed legislation. Any future decreases in the rate at which oil and natural gas reserves are discovered or developed, whether due to the passage of legislation, increased governmental regulation leading to limitations, or prohibitions on exploration and drilling activity, including hydraulic fracturing, or other factors, could have a material adverse effect on our business and financial condition, even in a stronger oil and natural gas price environment.

We have had difficulty maintaining compliance with the covenants and ratios required under our existing revolving credit facility. We may have similar difficulties with the new revolving credit facility that we are in the process of negotiating. Failure to maintain compliance with these financial covenants or ratios could adversely affect our business, financial condition, results of operations and cash flows.

We have historically relied on our existing revolving credit facility and, following the closing of this offering, will expect to rely on the new revolving credit facility that we are in the process of negotiating to provide liquidity and support for our operations and growth objectives, as necessary. We expect that the new revolving credit facility will require, us to comply with certain financial covenants and ratios. Our ability to comply with these restrictions and covenants in the future is uncertain and will be affected by the levels of cash flow from our operations and events or circumstances beyond our control, including events and circumstances that may stem from the condition of financial markets and commodity price levels. For example, as of

16

Table of Contents

September 30, 2015, our total leverage ratio exceeded the threshold of 3.00 to 1.00 under our existing revolving credit facility. We were in compliance with all other covenants at that time. On December 18, 2015, we entered into the fourth amendment to our existing revolving credit facility which, among other things, waived the event of default related to the September 30, 2015 leverage ratio. At June 30, 2016, we were in compliance with the covenants contained in our existing revolving credit facility.

In the event that we are unable to access sufficient capital to fund our business and planned capital expenditures, we may be required to curtail potential acquisitions, strategic growth projects, portions of our current operations and other activities. A lack of capital could result in a decrease in our operations, subject us to claims of breach under customer and supplier contracts and may force us to sell some of our assets or issue additional equity on an untimely or unfavorable basis, each of which could adversely affect our business, financial condition, results of operations and cash flows.

We may not have a credit facility at the closing of this offering and may be unable to obtain financing or enter into a credit facility on acceptable terms or at all in the future.

We are currently in the process of negotiating a new revolving credit facility with unaffiliated third-party lenders. However, at the closing of this offering, we may not have the revolving credit facility in place or commitments from any lenders to enter into future financing agreements. Depending on the impact of then-prevailing economic conditions and financial, business, regulatory and other factors, some of which are beyond our control, there can be no assurances that we will be able to enter into the revolving credit facility or any other debt agreements in the future. Additionally, entering into the revolving credit facility will require (i) execution and delivery of the credit agreement and all related documents and legal opinions; (ii) delivery of officers’ certificates, financial information and organizational documents; (iii) satisfaction of conditions related to perfection of liens; (iv) obtaining all required consents and (v) payment of all fees and other amounts due to the lenders under the credit agreement, none of which are assured. As such, we may be unable to obtain financing or enter into a credit facility on acceptable terms or at all.

A substantial majority of our revenues have been generated under contracts with a limited number of customers, and the loss of, material nonpayment or nonperformance by or significant reduction in purchases by any of them could adversely affect our business, results of operations and financial condition.

As of July 31, 2016, we were contracted to sell raw frac sand produced from our Oakdale facility under four long-term take-or-pay contracts with a weighted average remaining life of approximately 2.1 years. Beginning January 1, 2017, the volume-weighted average remaining term pursuant to these take-or-pay contracts is 3.7 years. Because we have a small number of customers contracted under long-term take-or-pay contracts, these contracts subject us to counterparty risk. The ability or willingness of each of our customers to perform its obligations under a contract with us will depend on a number of factors that are beyond our control and may include, among other things, the overall financial condition of the counterparty, the condition of the U.S. oil and natural gas exploration and production industry, continuing use of raw frac sand in hydraulic fracturing operations and general economic conditions. In addition, in depressed market conditions, our customers may no longer need the amount of raw frac sand for which they have contracted or may be able to obtain comparable products at a lower price. If our customers experience a significant downturn in their business or financial condition, they may attempt to renegotiate or declare force majeure under our contracts. For example, a number of our existing contracts have recently been adjusted resulting in a combination of reduced average selling prices per ton, adjustments to take-or-pay volumes and length of contract, and one of our customers recently initiated negotiations to extend the commencement date of their contract. In the current market environment, customers have begun to purchase more volumes on a spot basis as compared to committing to term contracts, and we expect this trend to continue in the near term until oil and natural gas drilling and completion activity begins to increase. If any of our major customers substantially reduces or altogether ceases purchasing our raw frac sand and we are not able to generate replacement sales of raw frac sand into the market, our business, financial condition and results of operations could be adversely affected until such time as we generate replacement sales in the market. In addition, as contracts expire, depending on market conditions at the time, our customers may

17

Table of Contents

choose not to extend these contracts which could lead to a significant reduction of sales volumes and corresponding revenues cash flows and financial condition if we are not able to replace these contracts with new sales volumes. Additionally, even if we were to replace any lost contract volumes, under current market conditions, lower prices for our product could materially reduce our revenues, cash flow and financial condition. Currently we have one contract of 1.1 million tons per year that matures in November 2016, and we have no assurances that this contract will be renewed beyond its current term.

We are exposed to the credit risk of our customers, and any material nonpayment or nonperformance by our customers could adversely affect our business, results of operations and financial condition.