Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - REV Group, Inc. | d251368dex231.htm |

| EX-21.1 - EX-21.1 - REV Group, Inc. | d251368dex211.htm |

| EX-10.4 - EX-10.4 - REV Group, Inc. | d251368dex104.htm |

| EX-10.3 - EX-10.3 - REV Group, Inc. | d251368dex103.htm |

| EX-10.2 - EX-10.2 - REV Group, Inc. | d251368dex102.htm |

| EX-4.2 - EX-4.2 - REV Group, Inc. | d251368dex42.htm |

Table of Contents

As filed with the Securities and Exchange Commission on October 24, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

REV Group, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 3711 | 26-3013415 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

111 East Kilbourn Avenue, Suite 2600

Milwaukee, WI 53202

(414) 290-0190

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

| Tim Sullivan | Dean Nolden | |

| Chief Executive Officer | Chief Financial Officer |

111 East Kilbourn Avenue, Suite 2600

Milwaukee, WI 53202

(414) 290-0191

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Richard D. Truesdell, Jr. Derek J. Dostal Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 (212) 450-4000 |

Pamela S. Krop General Counsel 1441 Brickell Avenue, Suite 1007 Miami, FL 33131 (786) 279-7022 |

Marc D. Jaffe Wesley C. Holmes Latham & Watkins LLP 885 Third Avenue New York, NY 10022 (212) 906-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ |

|

| ||||

| Title Of Each Class Of Securities To Be Registered |

Proposed Maximum Aggregate |

Amount Of Registration Fee | ||

| Common stock, $0.001 par value |

$100,000,000 | $11,590 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933, amended. |

| (2) | Includes the offering price of shares of common stock that may be sold if the option to purchase additional shares of common stock granted to the underwriters is exercised. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 24, 2016

PRELIMINARY PROSPECTUS

Shares

REV Group, Inc.

Common Stock

$ per share

This is the initial public offering of our common stock. Prior to this offering, there has been no public market for our common stock. We are selling shares of our common stock. We currently expect the initial public offering price to be between $ and $ per share of common stock.

We intend to apply to list the shares of common stock on the under the symbol “REVG.”

The selling stockholders have granted the underwriters an option to purchase up to additional shares of common stock at the initial public offering price less the underwriting discount. We will not receive any proceeds from the sale of shares by the selling stockholders.

Investing in shares of our common stock involves risk. See “Risk Factors” beginning on page 22.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds to us before expenses |

$ | $ | ||||||

| Proceeds to the selling stockholders before expenses |

$ | $ | ||||||

| (1) | See “Underwriting” for additional information regarding total underwriter compensation. |

The underwriters expect to deliver the shares of common stock to investors on or about , 2016.

Joint Book-Running Managers

| Goldman, Sachs & Co. | Morgan Stanley | Baird | ||

| BMO Capital Markets |

Credit Suisse |

Deutsche Bank Securities |

| Jefferies | Wells Fargo Securities | Stifel |

Prospectus dated , 2016

Table of Contents

| Page | ||||

| ii | ||||

| ii | ||||

| ii | ||||

| ii | ||||

| 1 | ||||

| 22 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| 47 | ||||

| 48 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

50 | |||

| 76 | ||||

| 100 | ||||

| 109 | ||||

| 125 | ||||

| 128 | ||||

| 130 | ||||

| 132 | ||||

| 137 | ||||

| 139 | ||||

| 142 | ||||

| 147 | ||||

| 147 | ||||

| 147 | ||||

| Index to the Consolidated Financial Statements | F-1 | |||

Neither we, the selling stockholders nor the underwriters have authorized anyone to provide any information other than that contained in this prospectus or to which we have referred you. We, the selling stockholders and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the selling stockholders and the underwriters are offering to sell, and seeking offers to buy, these securities only in jurisdictions where offers and sales are permitted. You should assume that the information in this prospectus is accurate only as of the date on the cover page, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, prospects, financial condition and results of operations may have changed since that date.

Through and including , 2017 (25 days after the date of this prospectus), all dealers that effect transactions in shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

For investors outside the United States: We and the selling stockholders have not, and the underwriters have not, done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for this purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States. See “Underwriting.”

i

Table of Contents

Prior to May 25, 2016, our fiscal year ended on October 31 of each year. Effective May 25, 2016, we changed our fiscal year to be the 52- or 53-week period ending on the last Saturday in October. References to a particular fiscal year refer to the year in which that fiscal year ends. For example, all references to “fiscal year 2016” relate to the 52-week period ending October 29, 2016, and all references to “fiscal year 2015” relate to the year ended October 31, 2015. Each of our fiscal years is divided into four 13-week fiscal quarters. Each fiscal quarter is grouped into two 4-week monthly reporting periods and one 5-week monthly reporting period, although quarters may occasionally consist of “4-5-5” or “4-4-6” monthly periods, depending on the calendar and the additional week in a 53-week fiscal year.

Certain numbers or percentages in this prospectus may not sum due to rounding.

We own or have rights to copyrights, trademarks, service marks or trade names that we use in connection with the operation of our business. Solely for convenience, some of the copyrights, trademarks, service marks and trade names referred to in this prospectus are listed without the ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trademarks, service marks, trade names and domain names. Some of the trademarks we own or have the right to use include, but are not limited to: E-ONE, KME, Kovatch Mobile Equipment, American Emergency Vehicles, Horton Emergency Vehicles, Leader Emergency Vehicles, Wheeled Coach, Collins Bus, Champion Bus, Goshen Coach, ENC, ElDorado National, McCoy Miller, Marque, Capacity of Texas, Capacity Trucks, Lay-Mor, Goldshield Fiberglass, Fleetwood RV, Monaco, American Coach, Road Rescue, Frontline, World Trans, Federal Coach, Krystal Coach and Holiday Rambler. The copyrights, trademarks, service marks and trade names of other companies appearing in this prospectus are, to our knowledge, the property of their respective owners.

This prospectus includes information with respect to market share and industry conditions obtained directly or indirectly from publicly available information, industry publications and surveys, reports from government agencies and our own estimates based on our management’s knowledge of and experience in the markets in which we compete. Unless otherwise indicated, industry information and information about our competitive position contained in this prospectus is based on our internal research and estimates. Our internal estimates are based upon our understanding of industry conditions, and such information has not been verified by any independent sources. While we believe that such information and estimates are reasonable and reliable, neither we, the selling stockholders nor the underwriters have independently verified market and industry data from third parties. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

NON-GAAP FINANCIAL INFORMATION

We report our financial results in accordance with U.S. generally accepted accounting principles (“GAAP”). However, management believes that the evaluation of our ongoing operating results may be enhanced by a presentation of Adjusted EBITDA and Adjusted Net Income, which are non-GAAP financial measures. Adjusted EBITDA represents net income before interest expense, income taxes, depreciation and amortization as adjusted for certain non-recurring, one-time and other adjustments which we believe are not indicative of our underlying operating performance and Adjusted Net Income represents net income as adjusted for certain after-tax, non-recurring, one-time and other adjustments which we believe are not indicative of our underlying

ii

Table of Contents

operating performance as well as for the add-back of certain non-cash intangible amortization, in each case as discussed more fully in “Prospectus Summary—Summary Consolidated Financial Data.”

We believe that the use of Adjusted EBITDA and Adjusted Net Income provide additional meaningful methods of evaluating certain aspects of our operating performance from period to period on a basis that may not be otherwise apparent under GAAP when used in addition to, and not in lieu of, GAAP measures. See “Prospectus Summary—Summary Consolidated Financial Data” for a discussion of our use of Adjusted EBITDA and Adjusted Net Income in this prospectus, including the reasons that we believe this information is useful to management and to investors and a reconciliation of Adjusted EBITDA and Adjusted Net Income to the most closely comparable financial measures calculated in accordance with GAAP.

iii

Table of Contents

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, especially “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes, before deciding to buy shares of our common stock. Unless otherwise indicated or the context requires otherwise, references in this prospectus to the “Company,” “REV,” “we,” “us” and “our” refer to REV Group, Inc. and its consolidated subsidiaries. References to “LTM July 30, 2016” refer to the twelve-month period ended July 30, 2016. Results and other data for LTM July 30, 2016 have been calculated by subtracting the results or other data for the nine months ended August 1, 2015 from the sum of the applicable results or other data for fiscal year 2015 and the nine months ended July 30, 2016.

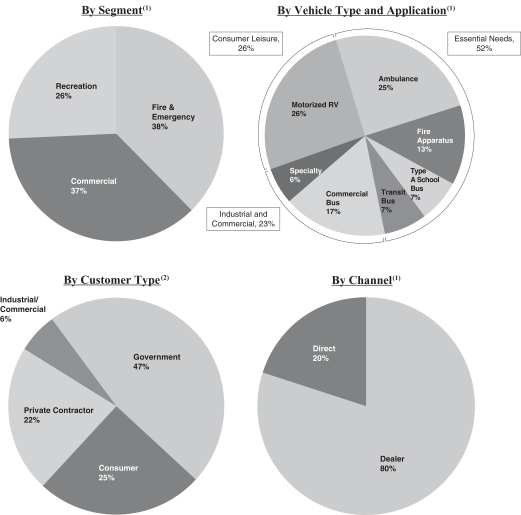

Our Company

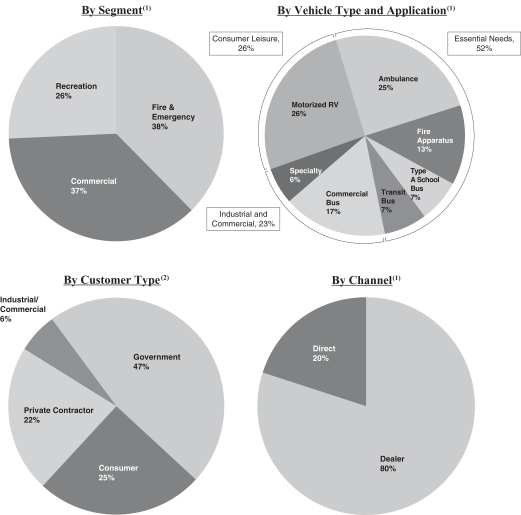

REV is a leading designer, manufacturer and distributor of specialty vehicles and related aftermarket parts and services. We serve a diversified customer base primarily in the United States through three segments: Fire & Emergency, Commercial and Recreation. We provide customized vehicle solutions for applications including: essential needs (ambulances, fire apparatus, school buses, mobility vans and municipal transit buses), industrial and commercial (terminal trucks, cut-away buses and street sweepers) and consumer leisure (recreational vehicles (“RVs”) and luxury buses). Our brand portfolio consists of 26 well-established principal vehicle brands including many of the most recognizable names within our served markets. Several of our brands pioneered their specialty vehicle product categories and date back more than 50 years. We believe that in most of our markets, we hold the first or second market share position and estimate that approximately 72% of our net sales during LTM July 30, 2016 came from products where we hold such share positions.

In fiscal year 2015, we sold approximately 18,500 units and we currently have an estimated installed base of approximately 300,000 vehicles in operation. We believe this provides us with a competitive advantage and recurring replacement vehicle sales as many customers are brand-loyal and fleet owners frequently seek to standardize their in-service fleets through repeat purchases of existing brands and product configurations. The specialty vehicle market is a complex and attractive market characterized by: (i) numerous niche markets with annual sales volumes generally between 3,000 and 25,000 units, (ii) highly customized vehicle configurations addressing unique customer applications and (iii) specialized customer bases and distribution channels (both dealer and direct). We believe the specialty vehicle market has historically been addressed primarily by smaller, less sophisticated companies, which has created an opportunity for market leadership by scaled and highly efficient producers such as REV. Under our current leadership, our focus on product innovation, life-cycle value leadership and operational improvement has strengthened our brands and market position while driving growth and expanding margins.

Our products are sold to municipalities, government agencies, private contractors, consumers and industrial and commercial end users. We have a diverse customer base with our top 10 customers representing less than 25% of our net sales in LTM July 30, 2016, with no single customer representing more than 8% of our net sales over the same period. Our top 10 customers have maintained relationships with REV and its predecessor companies for an average of approximately 20 years. We believe our diverse end markets are favorably exposed to multiple secular growth drivers such as: rising municipal spending, a growing aged population, growing urbanization, growing student populations, the increasing popularity of outdoor and active lifestyles and the replacement of existing in-service vehicles including legislated replacements. In addition to these favorable underlying drivers of growth, we believe certain of our markets will benefit over the next several years from

1

Table of Contents

incremental demand created by the underinvestment in fleets following the 2008 recession. For example, as set forth in the charts below in “—Our Markets,” we estimate that the cumulative pent-up replacement demand in the fire and emergency market is approximately 15,000 units, which represents 144% of the total fire and emergency market unit sales volume in the United States and Canada in 2015.

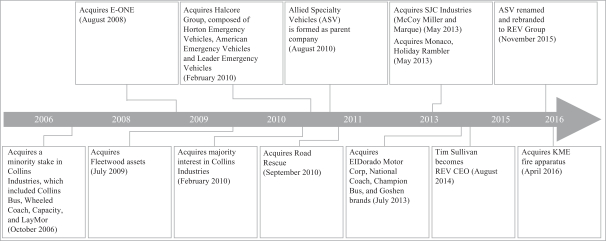

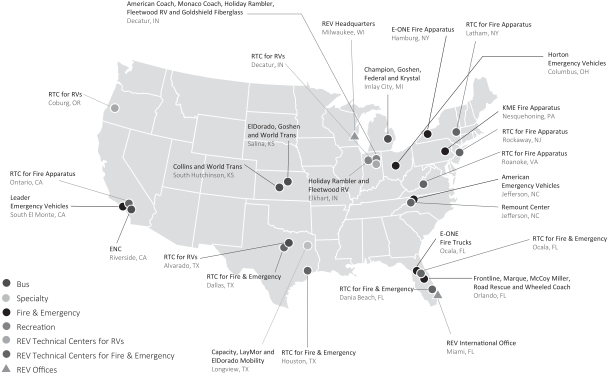

Our business model utilizes our unique scale to drive profitable organic and acquisitive growth. We seek to gain market share by delivering high-quality products with customized attributes tailored to our customers’ product specifications, while simultaneously reducing costs and shortening delivery lead times. We aim to achieve this by standardizing and optimizing certain processes across our segments in areas including: procurement, engineering and product development, lean manufacturing, dealer management, pricing and aftermarket parts sales. We believe our manufacturing and service network, consisting of 15 manufacturing facilities and 11 aftermarket service locations (called Regional Technical Centers or “RTCs”), provides us with a competitive advantage through the sharing of best practices, manufacturing flexibility based on relative facility utilization levels, delivery costs and lead times, economies of scale, customer service capabilities and a complementary distribution system. Our business consists primarily of design, engineering, integration and assembly activities, which require low levels of capital expenditures. Additionally, our business has a highly variable cost structure that results in operational flexibility which, we believe, when combined with low levels of capital expenditures, can produce high returns on invested capital. Furthermore, our broad presence across the specialty vehicle market and large manufacturing and distribution network are important differentiators in our ability to grow through acquisitions. We seek to make synergistic acquisitions that further enhance our existing market positions or enter REV into new, attractive product segments. In the past 10 years, we have successfully integrated nine acquisitions and have demonstrated the ability to grow and enhance the earnings profile of acquired businesses by either consolidating acquired businesses into our existing plant footprint or by introducing REV processes into the newly acquired businesses to drive profitable growth.

Our management team has an average of 28 years of experience in highly specialized industrial manufacturing and aftermarket parts and services businesses. Beginning in 2014, our new leadership team introduced several initiatives to accelerate growth and improve our profitability. These initiatives included: improving brand management, strengthening distribution, implementing a centralized enterprise-wide procurement strategy, growing adjacent and aftermarket products and services, improving production processes within our facilities, driving down total cost of quality, implementing value-based pricing strategies and reducing fixed costs.

We have delivered strong financial and operating results from fiscal year 2014 to LTM July 30, 2016, as set forth below:

| (1) | We increased our net sales to $1,844 million, a compound annual growth rate, or “CAGR,” of 4.5%; |

| (2) | We improved our operating performance, specifically: |

| • | Net income grew to $31 million, representing a CAGR of 575%; |

| • | Adjusted Net Income grew to $51 million, representing a CAGR of 122%; |

| • | Adjusted EBITDA grew to $117 million, representing a CAGR of 50%; and |

| (3) | We drove approximately 210 basis points and 279 basis points of expansion in our operating income and Adjusted EBITDA margins, respectively. |

See “—Summary Consolidated Financial Data” below for additional information regarding our non-GAAP measures, including a reconciliation of these measures to their most directly comparable GAAP measure.

2

Table of Contents

Our Products and Markets

We primarily sell new specialty vehicles which we design, engineer and manufacture in our production facilities. We are also focused on growing our higher gross margin aftermarket business which consists of parts sales, service and other ancillary revenue opportunities generated by our installed base of approximately 300,000 vehicles. We believe the majority of our new vehicle sales represent the replacement of in-service vehicles which are past their useful life, with additional sales derived from fleet expansions, new customers and adjacent product introductions.

The following charts show a breakdown of our net sales:

| (1) | For LTM July 30, 2016. |

| (2) | For fiscal year 2015. |

3

Table of Contents

The following chart sets forth summary information regarding our primary product line categories and end markets for our segments:

| Fire & Emergency |

Commercial |

Recreation | ||||

| Overview | The Fire & Emergency segment manufactures a wide range of fire apparatus and ambulance products. Fire & Emergency products are sold to municipal fire departments, EMS providers, and private fleets, typically purchasing through dealers. | The Commercial segment manufactures transit and shuttle buses, Type A school buses, mobility vans and other specialty vehicles including sweepers and terminal trucks distributed both through dealers and direct. Commercial products are sold to municipalities, schools, and commercial and industrial customers. | The Recreation segment manufactures motorized RV products sold to brand-loyal, repeat customers who purchase through dealers. | |||

| Selected Products |

|

|

| |||

| Principal Brands | Fire Apparatus

|

|

| |||

|

| |||||

| Ambulance |

||||||

|

|

| ||||

|

|

|||||

|

|

|||||

|

|

|||||

| Estimated Addressable Market Size(1) | ~$3 billion | ~$5 billion | ~$3 billion | |||

| Estimated Addressable Market Units(1) | Ambulance: ~6,200 Fire Apparatus: ~4,200 |

Type A School Bus: ~7,500 Cutaway Bus: ~15,000 Transit Bus: ~4,100 Mobility Vans: ~23,100 Terminal Trucks and Sweepers: ~7,400 |

Class A: ~21,900 Class C: ~22,100 | |||

| Estimated REV Market Share by Units(1) | ~41% | ~19% | Class A – ~13% Class C – ~1% | |||

| LTM 7/30/16 Net Sales(2) | $695 million | $684 million | $476 million | |||

| Market Positions for Selected Products | #1 in Ambulance #2 in Fire Apparatus |

#1 in Type A School Bus #1 in Small & Medium Size Commercial Bus #2 in Terminal Trucks #1 in Light Broom Sweepers |

15% Class A market share YTD July 2016 representing a 200 basis points increase from the prior year period. We believe we are the industry’s fastest growing Class A participant. | |||

| (1) | Based on 2015 market volumes in the United States and Canada. |

| (2) | Does not reflect the elimination of intersegment sales of approximately $10.4 million for the LTM July 30, 2016. |

4

Table of Contents

Our Fire & Emergency segment sells fire apparatus equipment under the Emergency One (“E-ONE”) and Kovatch Mobile Equipment (“KME”) brands and ambulances under the American Emergency Vehicles (“AEV”), Horton Emergency Vehicles (“Horton”), Leader Emergency Vehicles (“Leader”), Marque, McCoy Miller, Road Rescue, Wheeled Coach and Frontline brands. We believe we are the largest manufacturer by unit volume of fire and emergency vehicles in the United States and have one of the industry’s broadest portfolios of products including Type I ambulances (aluminum body mounted on a heavy truck-style chassis), Type II ambulances (van conversion ambulance typically favored for non-emergency patient transportation), Type III ambulances (aluminum body mounted on a van-style chassis), pumpers (fire apparatus on a custom or commercial chassis with a water pump and small tank to extinguish fires), ladder trucks (fire apparatus with stainless steel or aluminum ladders), tanker trucks and rescue and other vehicles. Each of our brands is distinctly positioned and targets certain price and feature points in the market such that dealers often carry and customers often buy more than one REV Fire & Emergency product line.

Our Commercial segment serves the bus market through the following principal brands: Collins Bus, Goshen Coach, ENC, ElDorado National, Krystal Coach, Federal Coach, Champion and World Trans. We serve the terminal truck market through the Capacity brand, the sweeper market through the Lay-Mor brand and the mobility market through the ElDorado Mobility brand. We are a leading producer of small- and medium-sized buses, Type A school buses, transit buses, terminal trucks and street sweepers in the United States. Our products in the Commercial segment include cut-away buses (customized body built on various types and sizes of commercial chassis), transit buses (large municipal buses where we build our own chassis and body), luxury buses (bus-style limo or high-end luxury conversions), street sweepers (three- and four-wheel versions used in road construction activities), terminal trucks (specialized vehicle which moves freight in warehouses or intermodal yards and ports), Type A school buses (small school bus built on commercial chassis), and mobility vans (mini-van converted to be utilized by wheelchair passengers). Within each market segment, we produce a large number of customized configurations to address the diverse needs of our customers.

Our Recreation segment serves the RV market through four principal brands: American Coach, Fleetwood RV, Monaco Coach and Holiday Rambler. We believe these brands are among the longest standing, most recognized brands in the RV industry. Prior to the 2008 recession, as segments of larger public companies, they generated over $2 billion of annual sales in each of the calendar years 2004 and 2005 and represented approximately 36% of the Class A market in calendar year 2005 and an even higher percentage share of just the diesel portion of the Class A market. Under these four brands, REV provides a variety of highly recognized models such as: American Eagle, Dynasty, Discovery, Bounder and Pace Arrow, among others. Our products in the Recreation segment currently include only Class A motorized RVs (motorhomes built on a heavy duty chassis with either diesel or gas engine configurations) and Class C motorized RVs (motorhomes built on a commercial truck or van chassis). The Recreation segment also includes Goldshield Fiberglass, which produces a wide range of custom molded fiberglass products for the RV and broader industrial markets. Within our Recreation segment, we are one of the top producers of Class A diesel and gas motorized RVs with a 15% market share for calendar year-to-date July 2016 and we believe we are the fastest-growing participant in the market place based on market share, with our unit sales growing 22% for calendar year-to-date July 2016 compared to the same period last year. We are focused on recapturing the significant market share which our four principal brands enjoyed prior to 2008.

To enhance our market-leading positions, we continue to focus on new product development across our three segments. New product development is primarily designed to provide our customers with high-quality products that have varied and unique feature sets and product capabilities at attractive price points. We introduced eight new products in fiscal year 2016 to date. We currently have 11 new products in development that we anticipate will be released in fiscal year 2017. In addition to new product development, our businesses are continuously customizing and designing our vehicles to meet individual customers’ needs and applications. In our RV business specifically, our new model design cycle follows similar timelines as the automotive industry, whereby new models and configurations are introduced or upgraded annually.

5

Table of Contents

Beginning in fiscal year 2016, we are helping our customers obtain third-party financing (purchase or leasing) for their equipment purchases from us. We believe that offering customers finance options to purchase vehicles from us will help REV form a more complete relationship with our customers, help drive incremental vehicle sales and allow us to participate in finance revenue streams from third parties through arrangement fees.

Our Markets

We operate primarily in the United States in the fire and emergency, commercial and recreation markets. For LTM July 30, 2016 our net sales to international markets (including Canada) amounted to $76 million, representing approximately 4% of our overall net sales for the period. We sell internationally through dealers and agents to end markets that utilize U.S.-style chassis and product configurations.

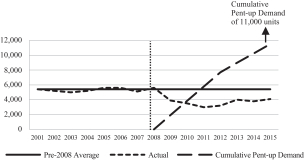

Fire and Emergency Markets

According to industry sources, there were approximately 10,400 fire apparatus and ambulance units shipped in 2015 in the United States and Canada, representing a 10% and 30% increase over the annual industry volumes for 2014 and 2011, respectively. Fire and emergency products are used by municipalities and private contractors to provide essential services such as emergency response, patient transport and fire suppression, among other activities. Nearly all fire apparatus and ambulances are customized in some form; however, they share many common production, sales and component attributes such as similar manufacturing and engineering processes, raw materials (aluminum, lights, wire harnesses, paint and coatings, among others), and dealer-based distribution channels. The sales prices for our fire and emergency products can vary considerably given their highly customized nature, but generally range from $160,000 to $1,200,000 for fire apparatus and from $65,000 to $350,000 for ambulances. Demand is driven primarily by the replacement of in-service fleets, as well as by factors such as a growing aged population and a growing overall population (driving increased patient transportation and emergency response needs), new real estate developments, taller buildings (requiring more aerial vehicles), international airport growth (requiring Federal Aviation Administration-specified ARFF vehicles), and higher municipal funding levels. Local tax revenues are an important source of funding for fire and emergency response departments in addition to Federal grant money and locally raised funding. We estimate that ambulances have useful lives of five to seven years and generally operate on a 24/7 schedule, driving significant annual mileage which ultimately creates a replacement or remount sale as their underlying chassis wears out. We estimate fire apparatus have useful lives of 10 to 30 years and generally operate at lower levels of annual miles driven and, outside of major metropolitan areas, often become obsolete before they wear out. We believe there is significant pent-up replacement demand for fire apparatus and ambulances as annual unit shipment levels since the 2008 recession have remained well below pre-recession averages. As set forth in the charts below, we estimate the cumulative pent-up replacement demand at approximately 15,000 units, which we believe is incremental to ongoing normalized levels of demand.

We believe that a growing aged population, longer life expectancy, urbanization and the increasing use of emergency vehicles for non-critical care transport are all positive trends for the ambulance market. Further, the Patient Protection and Affordable Care Act and the resulting creation of federal and state healthcare exchanges have resulted in broader healthcare insurance coverage nationally, allowing ambulance service providers to realize higher reimbursement rates and increased ambulance utilization levels, as ambulance service providers historically provided care and transport for a significant number of individuals who had limited or no insurance.

6

Table of Contents

| Fire Apparatus | Ambulance | |

| Unit Sales | Unit Sales | |

|

|

| |

|

Source: Fire Apparatus Manufacturers’ Association, Management estimates |

Source: National Truck Equipment Association — Ambulance Manufacturers Division, Management estimates |

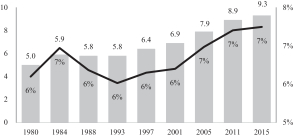

Commercial Markets

REV’s Commercial segment addresses a broad variety of products and end markets. The transit and shuttle bus market includes applications such as airport car rental and hotel/motel shuttles, paramedical transit vehicles for hospitals and nursing homes, tour and charter operations, daycare and student transportation, mobility vans for wheelchair users, and numerous other applications. According to industry sources, shipments of cutaway buses (those buses that are up to 35 feet in length) were approximately 15,000 units in 2015. We believe the commercial bus markets we serve will sustain positive long-term growth supported by growing levels of urbanization which will require increasing commercial bus usage, increased government transportation spending, an aging and growing U.S. population driving demand for shuttle buses and mobility vans, a necessary replacement cycle for public and private bus customers and the introduction of new bus products.

The demand for school buses is driven by the need for student transportation primarily in the United States and Canada. Within this market, we believe important demand drivers are the increasing number of students, the replacement cycle of in-service vehicles, substitution by private contract companies as the provider of student transportation from school districts (thus requiring the purchase of new buses) and legislated replacements. Insurance providers and state legislatures are increasingly requiring replacement of non-conforming vans which often drives a substitution purchase of our Type A product because of its numerous legislated safety features and benefits versus traditional van products. There are more than 14,000 school districts in the United States responsible for operating approximately 500,000 school buses. Approximately 19% of the school buses sold in 2015 were Type A buses, which we produce, and the remainder were Type B and C buses which we do not currently produce.

Terminal truck demand is driven by replacement of in-service fleets, growth in trade and the increased use of intermodal freight services and warehouses. We anticipate ongoing growth in global trade will result in higher future intermodal freight traffic growth. Sweeper demand is also driven by replacement of in-service fleets by contractors and rental companies as well as growth in infrastructure and construction spending. Sweepers are used in various applications within the construction and road and highway infrastructure markets.

7

Table of Contents

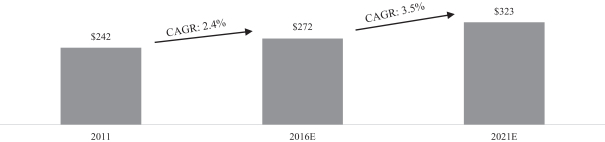

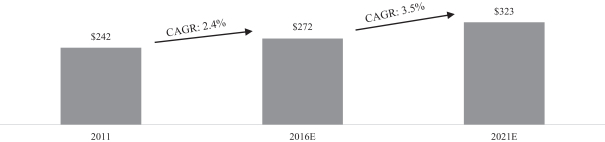

U.S. State and Local Transportation Spending

$ Bn

| Source: | USGovernmentspending.com |

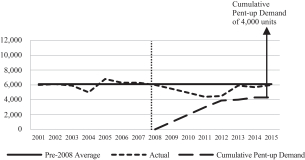

Recreation Markets

The RV industry includes various types and configurations of both motorized and towable RVs of which we currently manufacture and sell Class A (diesel and gas) and Class C motorized RVs. Motorized RVs are self-contained units built on motor vehicle chassis with their own lighting, plumbing, heating, cooking, refrigeration, sewage holding and water storage facilities. Class A RVs are generally constructed on medium-duty chassis which are supplied complete with engine and drivetrain components by major motor vehicle manufacturers. We then design, fabricate and install the living area and driver’s compartment of these motorized RVs. Class C RVs are built on consumer truck or van chassis which include an engine, drivetrain and a finished cab section. We design, fabricate and install the living area to connect to the driver’s compartment and the cab section.

According to the RV Consumer Report from 2011, an industry report published by the University of Michigan, approximately nine million households in the United States own an RV. Motorized RVs are a consumer leisure purchase and therefore factors that drive demand include: consumer wealth (including the value of primary housing residences and the stock market level), consumer confidence, availability of financing and levels of disposable income. We believe end customers tend to be brand-loyal and repeat buyers who make decisions based on brand, quality, product configuration (primarily floorplan design, features and product styling), service availability and experience and price. Lifestyle trends are expected to support the growth of the RV market. We believe RVs are becoming more popular through increased interest in nature-based tourism and a growing preference for adventure travel among the growing urban populations. According to the Recreation Vehicle Industry Association, or RVIA, RV sales will continue to benefit from the aging “baby boomers” as more people enter the primary RV ownership age group of 55 to 70 years old. RVIA estimates that the number of consumers between the ages of 55 and 70 will total 56 million by 2020, 27% higher than in 2010. In addition to the growth tied to aging demographics, there are approximately 45 million active U.S. campers, many of which are outside the aforementioned demographic, representing an opportunity to expand the RV customer base.

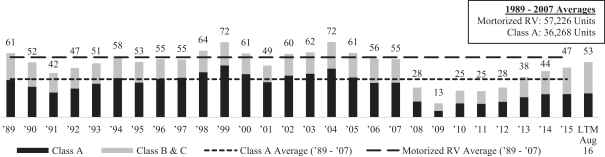

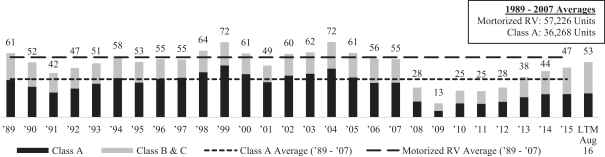

We believe the near-term RV industry outlook is positive. Year-over-year sales have increased for four years (2011 to 2015 and continuing through 2016) and participation rates continue to grow, which demonstrates a long-term trend toward RV ownership. In 2015, shipments of motorized RVs exceeded 47,000 units and approximately $3 billion of net sales, which is an increase of approximately 8% and 14%, respectively, compared to 2014 according to RVIA. In particular, approximately 21,950 Class A RVs were shipped in 2015, which represents a volume level that is approximately 40% below the pre-2008 recession historical average of shipped units from 1989 to 2007. Further, this volume level is approximately 53% below the industry’s peak volume in 2004 when approximately 46,000 Class A RV units were shipped. We believe industry volumes of Class A RVs, where REV’s market position is strongest, can recover to be in line with, or in excess of, pre-2008 recession historical averages.

8

Table of Contents

Motorized RV North American Market Size

Unit 000s

| Source: | RVIA |

| RV Participation |

| |||

| U.S. Households that Own RVs (in millions) |

|

RV Ownership % of U.S. Households |

| |

|

|

| |||

| Source: University of Michigan Study (The RV Consumer in 2011), RVdailyreport.com and U.S. Census Bureau |

| |||

Our Strengths

We believe we have the following competitive strengths:

Market Leader Across All Segments with a Large Installed Base—We believe we are a market leader in each of the fire and emergency, commercial and recreation vehicle markets. Approximately 72% of our net sales in LTM July 30, 2016 are in markets in which we believe we hold the first or second market share positions. We believe we are the largest manufacturer by unit volume of fire and emergency vehicles in the United States. We also believe our Commercial segment is the #1 producer of small- and medium-sized commercial buses as well as Type A school buses in the United States. We believe we are also a leading producer of transit buses, terminal trucks, mobility vans and street sweepers. Within our Recreation segment, we are one of the top producers of Class A diesel and gas motorized RVs with a 15% market share and we believe we are the fastest growing manufacturer, growing our Class A RV market share by approximately 200 basis point to 15% for calendar year-to-date July 2016 compared to the same period last year.

We estimate that the replacement value of our installed base of approximately 300,000 vehicles across our segments is approximately $33 billion, which we believe is a significant competitive advantage for both new unit

9

Table of Contents

sales and aftermarket parts and service sales, as brand awareness drives customer loyalty and fleet owners frequently seek to standardize their in-service fleets through repeat purchases of existing brands and product configurations. For example, one of the largest municipal fire departments in the U.S. has its fleet of ambulances standardized on REV branded product configuration and feature sets that satisfy this customer’s unique specifications and standards.

Broad Product Portfolio and Well-Recognized Brands—Our product portfolio is comprised of high-quality vehicles sold under 26 well-established principal vehicle brands that in many instances pioneered their market segments. For example, the first Type A yellow school bus was developed and sold by Collins Bus and the first Type I ambulance was developed and sold by Horton. We believe our product portfolio represents the broadest product offering in our markets and enables us to attract and retain top dealers who in many instances sell multiple REV brands in their territories. Our vehicle platforms are highly customizable and can meet nearly all product specifications demanded by our customers. In each of the markets that we serve, we believe our brands are among the most recognized in the industry, representing performance, quality, reliability, durability, technological leadership and superior customer service.

Selling into Attractive, Growing End Markets—Each of our segments serves end markets that are supported by what we believe to be favorable, long-term demographic, economic and secular trends. We believe that the growing aged population in the United States will increase demand for products across all of our segments, as older demographics are a key demand driver for products such as emergency vehicles, mobility vans and RVs. In the Fire & Emergency segment, increasing legislated changes requiring shorter replacement cycles will create a source of recurring demand for our products as in-service vehicles achieve mileage or age limits. Additionally, fire and emergency vehicle purchases fell below historical replacement rates following the 2008 recession, and we estimate the cumulative pent-up replacement demand is approximately 15,000 units, which represents 144% of the total unit sale volume in the United States and Canada in 2015. Our Commercial segment is poised to grow as a result of increasing urbanization within the United States which will require greater use of commercial buses. We believe demand for our school buses and our fire and emergency vehicles will grow with increasing state and local government spending. In addition, we believe our RV segment is poised for long-term growth driven by increased RV participation rates and market unit recoveries to historical average levels. Additionally, we believe the current U.S. camper base of 45 million people represents an opportunity to expand the RV customer base. Though our net sales are primarily derived from sales in the United States, similar positive market dynamics exist in other parts of the world providing an opportunity for future global growth in each of our segments. Only approximately 4% of our net sales in LTM July 30, 2016 were from sales to customers outside the United States.

Unique Scale and Business Model—As the only manufacturer of specialty vehicles across all three of our product segments and one of the largest participants in our markets by net sales, we enjoy a unique position relative to many of our competitors that we believe provides a competitive advantage and an enhanced growth profile. Many of our products contain similar purchased components, such as chassis, engines, lighting, wiring and other commodities which increase our leverage with and relevance to key suppliers. The operational processes across our different products are based on common elements, such as chassis preparation and production, body fabrication, product assembly and painting which allow us to develop best practices across our manufacturing system and implement those processes to drive operational efficiency. Our platform also allows us to leverage the combined engineering resources and product development resources from our broad network to bring new products, features and customer specific customization to market faster. Our business model makes us more desirable to our distribution channel partners as we are able to provide them with a full line of products to address their customers’ needs across a wider variety of price and product feature elements which gives them the opportunity to sell to a larger customer base and grow their sales and earnings. Additionally, our scale allows us to more efficiently amortize investments in service locations, parts sales infrastructure and information technology tools, among others.

10

Table of Contents

Business Model Produces Highly Attractive Financial Characteristics—Our core production processes are primarily design, engineering, component integration and assembly in nature, creating a business model that produces attractive financial characteristics such as a highly variable cost structure, low levels of maintenance capital expenditures as a percentage of net sales, attractive levels of return on invested capital and strong revenue visibility. We estimate that across all three of our segments, 85% of our cost of goods sold are variable in nature. In addition, our selling, general and administrative expenses are primarily comprised of salaried payroll expenses which we structure efficiently around the level of demand in our markets. Over the last three completed fiscal years, our capital expenditures, as a percentage of net sales, has totaled less than 1%. As a result of low levels of capital investments required and efficient use of working capital (including the taking of deposits in certain of our markets), we believe that our business produces attractive returns on invested capital. Finally, our business carries a high-quality backlog which enables strong visibility into future net sales which ranges from two to nine months depending on the product and market. This visibility into future production needs and net sales enables us to more effectively plan and predict our business.

Experienced Consolidator with Proven Ability to Integrate Acquisitions and Drive Business Improvement—Throughout our history, we have complemented organic growth with strategic acquisitions, resulting in meaningful cost and commercial synergies and accelerated growth. Over the last ten years, we have completed nine acquisitions across our Fire & Emergency, Commercial and Recreation segments and continue to actively consider future potential acquisitions that complement and expand our current product portfolio. Our scale and plant network, strong end market positions, access to low cost capital and reputation as an active and effective strategic acquirer, position us favorably to continue to grow and enhance value through strategic acquisitions. The specialty vehicle market is highly fragmented with a large number of smaller producers within our existing markets as well as in new markets where we believe there would be synergies with REV. Our management team is highly experienced in integrating and improving the businesses we acquire, as evidenced by the improved financial performance of many of our acquisitions under our ownership. We believe all of these attributes position REV as an acquirer of choice in the specialty vehicles market.

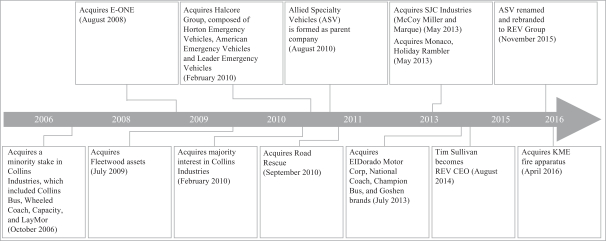

The Evolution of REV

Experienced Management Team with Proven Track Record—Our management team has an average of 28 years of industry experience, and a demonstrated track record of managing and growing publicly-traded industrial businesses. From fiscal year 2014 to LTM July 30, 2016, our management team has increased net income from $1.5 million to $31 million and Adjusted EBITDA from $62 million to $117 million, respectively,

11

Table of Contents

while expanding operating income and Adjusted EBITDA margins approximately 220 basis points and 279 basis points, respectively, over the same period. In addition to accomplishments at REV, key members of our leadership team have also had success in other public industrial companies such as Bucyrus International, Inc. and The Manitowoc Company Inc., among others.

Our Growth Strategies

We plan to pursue several strategies to grow our earnings, expand our market share and further diversify our revenue stream, including:

Drive Margin Expansion Through Controllable Operational Initiatives—Our focus on driving operational improvement initiatives across the organization has enabled the increase of our operating income and Adjusted EBITDA margins by 210 basis points and 279 basis points, respectively, from fiscal year 2014 to LTM July 30, 2016. Our initiatives have also resulted in improved safety results, as measured by the 37% decrease in our total recordable incident rate for the nine months ended July 30, 2016 versus the same period in the prior fiscal year. We have achieved these improvements as a result of successfully implementing lean manufacturing initiatives across the organization, consolidating procurement functions, centralizing certain commercial decision making, reducing cost of quality, improving operational and safety performance and improving the total life-cycle value proposition for our customers. We believe we have established an enterprise-wide culture focused on continuous improvement, implementing measurable performance targets and sharing of best practices across the entire organization. Our Fire & Emergency segment had an LTM July 30, 2016 Adjusted EBITDA margin of 11% and we are targeting to increase Adjusted EBITDA margins for our Commercial and Recreation segments to similar levels over time, as well as further enhance Adjusted EBITDA margins in our Fire & Emergency segment. We continuously strive to identify and act on additional profitability improvement initiatives in many of our business units.

Develop Innovative New Customer Offerings—Due to the specific customer requirements for our products, we are continually enhancing and customizing our product offerings by introducing new features to enhance customer utility across a variety of price points. We seek to expand our addressable market by developing innovative products and services that extend our market leading combination of features, performance, quality and price to new customer bases, new markets or new segments of existing markets. We introduced eight new products in fiscal year 2016. We currently have 11 new products in development that are expected to be released in fiscal year 2017. We believe our process of constant innovation will not only help us increase net sales but also achieve lower costs and generate higher margins as our new products are frequently designed to leverage existing procurement relationships and for ease of manufacturability. In addition, there are multiple natural product adjacencies where REV has valuable brand equity, leading technology and cost positions where we believe we can generate strong demand for new products. For example, we recently introduced a new M1 Ambulance under the Frontline brand in fiscal year 2016 to address a lower specification segment of the ambulance market. We introduced the Sabre terminal truck in 2015, which provided a new cab design and feature set while improving manufacturability for REV as a result of improved design features such as a weldless frame. By delivering innovative new customer offerings and customizations, we believe we can grow our net sales and market share.

Enhance Sales and Distribution Model—We believe that we are an attractive specialty vehicle OEM partner for dealers due to the breadth and quality of our product offerings, our brand recognition, our ability to produce products at varied price and feature points, as well as our aftermarket support capabilities. We intend to continue to leverage this strength to enhance our distribution network through selectively adding dealers in new territories, strengthening dealers in our existing network and expanding our direct sales and service capabilities in targeted markets. Our goal is to partner with the leading dealers in each market and to provide the necessary resources to ensure our partner dealers can best position REV products to compete successfully within their regions. We will also continue to optimize our go-to-market channel strategy (e.g., distribution or direct sale) based on the specific

12

Table of Contents

market dynamics and customer composition by region. We have historically focused on customers within the United States; however, we believe there is demand internationally for our products and we also seek to expand our distribution globally.

Accelerate Aftermarket Growth—Our end users’ large in-service fleets create strong demand for aftermarket parts in order to keep vehicles running and to support their residual value. We estimate the size of our installed base’s aftermarket parts market opportunity to be approximately $800 million annually, with significant importance placed on timely parts availability given the high cost of vehicle downtime. We have formalized an aftermarket strategy and are investing in building out capabilities to take advantage of this significant, high margin opportunity across our segments. We have created a dedicated management team to oversee our aftermarket business, and are centralizing our aftermarket parts and services business to broaden market coverage and ensure parts availability while reducing lead time. We are establishing a web-based technology platform to provide our customers with real time data on parts availability and pricing. We are also making substantial investments in our services network infrastructure including over $21 million in fiscal years 2015 and 2016 for the establishment of new RTCs across the United States, development of our parts system infrastructure and the expansion of capacity across several existing service locations. We believe we are well positioned to provide the most extensive and integrated service support network to our end customers and dealer partners.

Pursue Value Enhancing Acquisitions—We seek to pursue acquisitions which enhance our existing market positions, gain us entry to new products or markets and achieve our targeted financial returns. We have a long history of acquisitions with nine transactions completed over the past 10 years. Given our leadership positions within our markets and our existing facility, service and distribution network, we believe we have many inherent advantages in making acquisitions and have demonstrated the ability to successfully identify, execute and integrate acquisitions while realizing synergies. We believe that we have a clear acquisition strategy in place, targeting acquisitions with significant synergies to drive long-term value creation for shareholders. We will seek acquisitions of companies with strong brands and complementary products and distribution networks that align well with our aftermarket strategies and provide strong synergies with our existing business. In addition, we will target acquisitions which further diversify or broaden our product offerings and geographic reach, and simultaneously produce attractive financial returns.

Summary Risk Factors

An investment in shares of our common stock involves a high degree of risk. Any of the factors set forth under “Risk Factors” may limit our ability to successfully execute our strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, you should evaluate the specific factors set forth under “Risk Factors” in deciding whether to invest in the shares of common stock. Among these important risks are the following:

| • | The impact of economic factors and adverse developments in economic conditions; |

| • | The seasonal nature of the markets in which we operate; |

| • | Disruptions in the supply of vehicle chassis or other critical materials; |

| • | Our ability to compete with other participants in the end markets we serve; |

| • | Our ability to successfully identify and integrate acquisitions; |

| • | Our business has certain working capital requirements, and a decline in operating results may have an adverse impact on our liquidity position; |

| • | The realization of contingent obligations; |

| • | Increases in the price of commodities or impact of currency value fluctuations on the cost or price of our products; |

13

Table of Contents

| • | Our inability to successfully manage the implementation of a Company-wide enterprise resource planning system; |

| • | Our reliance on the performance of dealers; |

| • | The availability and terms of financing available to dealers and retail purchasers; |

| • | Our ability to retain and attract senior management and key employees; |

| • | Vehicle defects, delays in new model launches, recall campaigns, or increased warranty costs; |

| • | Cancellations, reductions or delays in customer orders; |

| • | The impact of federal, state and local regulations governing our products; |

| • | Unforeseen or recurring operational problems at any of our facilities; |

| • | Federal and local government spending levels; |

| • | Our operations and the industries in which we operate are subject to governmental laws and regulations, including relating to environmental, health and safety matters; |

| • | The influence of AIP over us after this offering, including its contractual right to nominate a majority of our directors and other contractual rights; |

| • | Changes to tax laws or exposure to additional tax liabilities; |

| • | Failure to maintain the strength and value of our brands; and |

| • | Our being a “controlled company” within the meaning of the rules and, as a result, qualifying for, and intending to rely on, exemptions from certain corporate governance requirements. |

Our Equity Sponsor

Our primary equity holders are funds and an investment vehicle associated with AIP, which indirectly own approximately 90% of our voting equity prior to giving effect to this offering. AIP is an operations and engineering-focused private equity firm headquartered in New York, New York, that has been investing in the industrial middle market for over 27 years. AIP invests when it believes it can significantly improve the underlying business’ performance through the implementation of an operating agenda to grow earnings and value—a “business building” investment strategy. As of July 30, 2016, AIP’s assets under management were $3.3 billion from three current funds on behalf of leading pension, endowment and financial institutions.

Corporate Information

REV Group, Inc. is a privately-owned corporation organized under the laws of the state of Delaware. Prior to November 1, 2015, the Company was known as Allied Specialty Vehicles, Inc. Our principal executive offices are located at 111 East Kilbourn Avenue, Suite 2600, Milwaukee, Wisconsin 53202. Our telephone number at that address is (414) 290-0190. Our website address is www.revgroup.com. The information on, or that can be accessed through, our website is not part of this prospectus, and you should not rely on any such information in making the decision whether to purchase shares of our common stock.

14

Table of Contents

THE OFFERING

| Common stock offered by us |

shares. |

| Common stock to be outstanding after this offering |

shares. |

| Option to purchase additional shares |

The underwriters have an option for a period of 30 days to purchase from the selling stockholders up to additional shares of our common stock at the initial offering price less the underwriting discount. |

| Use of proceeds |

We estimate that the net proceeds from this offering of our common stock will be approximately $ million at an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover of this prospectus, after deducting the underwriting discount and estimated offering expenses payable by us. We intend to use the net proceeds of this offering as follows: (i) first, to redeem in full our outstanding 8.500% senior secured notes due 2019 (the “Senior Secured Notes”) and pay the related call premium and (ii) second, to use the remaining proceeds, if any, to repay up to $ million aggregate principal amount of loans under our senior secured asset-based lending revolving credit and guaranty agreement (the “ABL Facility”) and for general and administrative expenses, capital expenditures, working capital and other general corporate purposes. |

| We will not receive any proceeds from the sale of shares by the selling stockholders if the underwriters exercise their option to purchase additional shares of common stock. See “Use of Proceeds.” |

| Dividend policy |

Following the completion of this offering and subject to legally available funds, we intend to pay a cash dividend at a rate initially equal to per share on our common stock, commencing in the quarter of fiscal year . The declaration, amount and payment of any future dividends will be at the sole discretion of our Board of Directors and we may reduce or discontinue entirely the payment of such dividends at any time. See “Dividend Policy.” |

| Risk factors |

You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

| Proposed symbol |

“REVG” |

Unless we specifically state otherwise or the context otherwise requires, the number of shares of common stock to be outstanding after this offering is based on shares of common stock outstanding as of , 2016 and does not give effect to or reflect the issuance of:

| • | shares of common stock issuable upon exercise of stock options outstanding as of July 30, 2016 at a weighted average exercise price of $ per share, including stock options that will vest upon completion of this offering as described under “Management’s Discussion and Analysis—Factors Affecting Our Performance—Stock Compensation Expense”; or |

15

Table of Contents

| • | shares of common stock reserved for future issuance under our equity incentive plan as of July 30, 2016. |

Unless we specifically state otherwise or the context otherwise requires, this prospectus reflects or assumes the following:

| • | the -for-one stock split of our common stock has been completed; |

| • | the adoption of our amended and restated certificate of incorporation and our amended and restated bylaws, to be effective upon the closing of this offering; |

| • | the reclassification of our outstanding Class A common stock and Class B common stock into one class of common stock that we will complete concurrently with the completion of the offering as described under “Description of Capital Stock—Reclassification of Class A and Class B Common Stock”; |

| • | the reclassification of contingently redeemable common stock to stockholders’ equity resulting from the expiration of the employee shareholders’ put options upon the completion of this offering; and |

| • | no exercise by the underwriters of their option to purchase from the selling stockholders up to additional shares of our common stock in this offering. |

16

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table summarizes our consolidated financial data. The summary consolidated financial data for the fiscal years ended October 31, 2015, 2014 and 2013 are derived from our audited consolidated financial statements appearing elsewhere in this prospectus. The summary consolidated financial data for the nine months ended July 30, 2016 and August 1, 2015 are derived from our unaudited consolidated financial statements appearing elsewhere in this prospectus. We have prepared the unaudited consolidated financial information set forth below on the same basis as our audited consolidated financial statements and have included all adjustments, consisting of only normal recurring adjustments, that we consider necessary for a fair presentation of our financial position and operating results for such periods.

The following table also includes summary unaudited pro forma financial information that gives effect to this offering and the use of proceeds from this offering to redeem in full all $200 million aggregate principal amount of our outstanding senior secured notes (the “Senior Secured Notes”) and pay the related call premium and repay approximately $ million aggregate principal amount of loans under our ABL Facility, as if such transactions had occurred on July 30, 2016 with respect to our consolidated balance sheet data and as if such transactions had occurred on November 1, 2014 with respect to our consolidated statements of operations data.

The results for any interim period are not necessarily indicative of the results that may be expected for a full year. Additionally, our historical results are not necessarily indicative of future results. Our historical share information gives effect to the reclassification that we will complete concurrently with the completion of the offering as described in “Description of Capital Stock—Reclassification of Class A and Class B Common Stock.” The summary historical consolidated data presented below should be read in conjunction with the sections entitled “Risk Factors,” “Selected Historical Consolidated Financial and Other Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes and other financial data appearing elsewhere in this prospectus.

| Pro Forma Nine Months Ended July 30, 2016(1) |

Nine Months Ended | Pro Forma Fiscal Year Ended October 31, 2015(1) |

Fiscal Year Ended October 31, |

|||||||||||||||||||||||||

| July 30, 2016 |

August 1, 2015 |

2015 | 2014 | 2013 | ||||||||||||||||||||||||

| (in thousands except per share data) |

||||||||||||||||||||||||||||

| Net sales |

$ | 1,381,247 | $ | 1,272,052 | $ | 1,735,081 | $ | 1,721,116 | $ | 1,173,051 | ||||||||||||||||||

| Cost of sales |

1,223,635 | 1,145,786 | 1,553,127 | 1,557,877 | 1,055,743 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Gross profit |

157,612 | 126,266 | 181,954 | 163,239 | 117,308 | |||||||||||||||||||||||

| Operating expenses: |

||||||||||||||||||||||||||||

| Selling, general and administrative |

97,901 | 75,429 | 102,309 | 111,820 | 88,618 | |||||||||||||||||||||||

| Research and development costs |

3,763 | 4,744 | 5,106 | 8,275 | 1,863 | |||||||||||||||||||||||

| Restructuring(2) |

2,807 | 3,268 | 3,869 | 3,376 | 11,178 | |||||||||||||||||||||||

| Amortization of intangibles |

6,948 | 6,438 | 8,586 | 8,790 | 6,159 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total operating expenses |

111,419 | 89,879 | 119,870 | 132,261 | 107,818 | |||||||||||||||||||||||

| Operating income |

46,193 | 36,387 | 62,084 | 30,978 | 9,490 | |||||||||||||||||||||||

| Interest expense |

20,828 | 20,851 | 27,272 | 26,195 | 23,222 | |||||||||||||||||||||||

| Gain on bargain purchase(3) |

— | — | — | — | (36,495 | ) | ||||||||||||||||||||||

| Loss on debt extinguishment(4) |

— | — | — | — | 9,220 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Income before provision (benefit) for income taxes |

25,365 | 15,536 | 34,812 | 4,783 | 13,543 | |||||||||||||||||||||||

| Provision (benefit) for income taxes |

7,254 | 5,170 | 11,935 | 3,295 | (11,483 | ) | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income |

$ | 18,111 | $ | 10,366 | $ | 22,877 | $ | 1,488 | $ | 25,026 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

17

Table of Contents

| Pro Forma Nine Months Ended July 30, 2016(1) |

Nine Months Ended | Pro Forma Fiscal Year Ended October 31, 2015(1) |

Fiscal Year Ended October 31, |

|||||||||||||||||||||||||

| July 30, 2016 |

August 1, 2015 |

2015 | 2014 | 2013 | ||||||||||||||||||||||||

| Basic Earnings Per Share: |

||||||||||||||||||||||||||||

| Weighted-average shares of common stock outstanding(5) |

||||||||||||||||||||||||||||

| Basic |

||||||||||||||||||||||||||||

| Diluted |

||||||||||||||||||||||||||||

| Earnings per share of common stock(5) |

||||||||||||||||||||||||||||

| Basic |

||||||||||||||||||||||||||||

| Diluted |

||||||||||||||||||||||||||||

| Pro Forma Earnings Per Share: |

||||||||||||||||||||||||||||

| Pro forma weighted-average shares of common stock outstanding(6) |

||||||||||||||||||||||||||||

| Basic |

— | — | — | — | — | |||||||||||||||||||||||

| Diluted |

— | — | — | — | — | |||||||||||||||||||||||

| Pro forma earnings per share of common stock(6) |

||||||||||||||||||||||||||||

| Basic |

— | — | — | — | — | |||||||||||||||||||||||

| Diluted |

— | — | — | — | — | |||||||||||||||||||||||

| Nine Months Ended | Fiscal Year Ended October 31, |

|||||||||||||||||||

| July 30, 2016 |

August 1, 2015 |

2015 | 2014 | 2013 | ||||||||||||||||

| ($ in thousands) | ||||||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||

| Capital expenditures |

$ | 30,566 | $ | 8,750 | $ | 15,430 | $ | 12,067 | $ | 9,110 | ||||||||||

| Adjusted EBITDA(7) |

85,219 | 57,995 | 90,126 | 61,513 | 44,038 | |||||||||||||||

| Adjusted EBITDA Margin(7) |

6.2 | % | 4.6 | % | 5.2 | % | 3.6 | % | 3.8 | % | ||||||||||

| Adjusted Net Income(7) |

36,109 | 19,139 | 34,017 | 14,457 | 9,620 | |||||||||||||||

| Backlog(8) |

870,851 | 660,358 | 702,839 | 701,176 | 622,000 | |||||||||||||||

| As of July 30, 2016 | ||||||||||||||||||||

| Pro Forma(1) | Actual | |||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | $ | 17,266 | |||||||||||||||||

| Property, plant and equipment, net |

134,474 | |||||||||||||||||||

| Total assets |

931,003 | |||||||||||||||||||

| Total liabilities |

682,986 | |||||||||||||||||||

| Contingently redeemable common stock |

16,099 | |||||||||||||||||||

| Total shareholders’ equity |

231,918 | |||||||||||||||||||

| (1) | Pro forma results give effect to the sale by us of shares of common stock in this offering, assuming an initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting the underwriting discount and estimated offering expenses payable by us and the application of the net proceeds to be received by us from this offering as described in “Use of Proceeds,” as if such transactions had occurred on July 30, 2016 with respect to our consolidated balance sheet data and as if such transactions had occurred on November 1, 2014 with respect to our consolidated statements of operations data. The pro forma adjustments to our consolidated statements of operations data represent a decrease of $ million and $ million of interest expense for the nine months ended July 30, 2016 and fiscal year 2015, respectively, and a loss on debt extinguishment which includes the write off of $ and $ million of previously capitalized debt issuance costs, the write off of the remaining unamortized debt discount of $ million and $ million and call premium of $ million and $ million related to the Senior Secured Notes for the nine months ended July 30, 2016 and fiscal year 2015, respectively. Pro forma results also give effect to the reclassification of contingently redeemable common stock to stockholders’ equity resulting from the expiration of the employee shareholders’ put options upon the completion of this offering. |

| (2) | Restructuring costs incurred in fiscal year 2013 include severance and relocation costs, related to the relocation of Navistar RV (since renamed Monaco RV (“MRV”)) manufacturing to Decatur, Indiana, and the relocation of manufacturing of the assets of SJC Industries, Inc. (“SJC”) to |

18

Table of Contents

| Winter Park, Florida. Restructuring costs incurred in fiscal year 2014 represent costs related to the MRV and SJC acquisitions, and include $3.4 million of personnel costs including severance, stay bonuses, vacation and dealer and distributor reassignment, and $4.1 million of costs to dispose of inventory for discontinued products through discounted sales and returning material to vendors at a discount. Restructuring costs related to inventory are recognized as a component of cost of sales in the Company’s consolidated statements of operations. |

Restructuring costs incurred in fiscal year 2015 and the nine months ended July 30, 2016 are related to the Company’s restructuring of its management functions (including the move of its corporate headquarters from Orlando, Florida to Milwaukee, Wisconsin) and various product lines including, but not limited to, severance and discontinued product costs. Restructuring costs in fiscal year 2015 includes $3.9 million of personnel costs including severance, stay bonuses, vacation and other benefits, and $0.8 million of inventory obsolescence reserves for discontinued product lines, which are recognized as a component of cost of sales in the Company’s consolidated statements of operations.

| (3) | Bargain purchase gains related to the acquisitions of MRV, the assets of SJC and the commercial bus businesses of Thor Industries, Inc. (the “Thor Bus Acquisition” and, together with the acquisition of MRV and SJC, the “2013 Acquisitions”). |

| (4) | On October 21, 2013, the Company issued $200 million of Senior Secured Notes maturing on November 1, 2019 and entered into the ABL Facility for $150 million to pay off existing indebtedness and pay a portion of the purchase price for the Thor Bus Acquisition. In connection with this refinancing, the Company recognized a loss on debt extinguishment of $9.2 million, which was comprised of prepayment fees and the write-off of previously capitalized debt issuance costs. |

| (5) | A reconciliation of the denominator used in the calculation of basic and diluted earnings per common share is as follows: |

| Nine Months Ended | Fiscal Year Ended October 31, |

|||||||||||||||||||

| July 30, 2016 |

August 1, 2015 |

2015 | 2014 | 2013 | ||||||||||||||||

| Basic weighted-average shares of common stock outstanding |

||||||||||||||||||||

| Dilutive stock options |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted weighted-average shares of common stock outstanding |

||||||||||||||||||||

|

|

|