Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Alliance HealthCare Services, Inc | d275408d8k.htm |

| Exhibit 99.1

|

Alliance HealthCare Services

Investor Presentation

October 24, 2016

1

|

|

Disclaimer

During the course of this presentation, the Company may make projections or other forward-looking statements regarding, among other things, our business outlook, operations and strategy; service areas; competition; changes in laws and regulations and the impact of such changes on us; our estimates for future performance and operating results, including future revenues, cash flows and capital requirements. In some cases you can identify these statements by words such as “could,” “may,” “expects,” “anticipates,” “believes,” “intends,” “estimates,” or similar words. These forward-looking statements are based largely on the Company’s current expectations and are subject to a number of known or unknown risks and uncertainties (some of which are beyond the Company’s control). We urge you to review the factors discussed under the caption “Risk Factors” in the Company’s Form 10-K for the year ended December 31, 2015, and the Company’s Form 10Q for the quarter ended March 30, 2016, filed with the Securities and Exchange Commission. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements made during this presentation will in fact be realized. Except as otherwise required by applicable securities laws, we disclaim any intention or obligation to publicly update or revise forward-looking statements, whether as a result of new information, future events or otherwise.

2

|

|

Disclaimer

This presentation includes certain supplemental measures of our performance and liquidity that are not required by, or presented in accordance with, U.S. generally accepted accounting principles (“GAAP“), including Adjusted EBITDA. We present Adjusted EBITDA because we believe that, in addition to GAAP metrics, this non-GAAP metric is a useful measure for investors, for a variety of reasons. Our management regularly communicates Adjusted EBITDA and their interpretation of such results to our board of directors. We also compare actual periodic Adjusted EBITDA against internal targets as a key factor in determining cash incentive compensation for executives and other employees, largely because we view Adjusted EBITDA results as indicative of how our radiology, radiation oncology and interventional healthcare services businesses are performing and are being managed. Adjusted EBITDA is a non-GAAP financial measures and should not be considered as an alternative to net (loss) income attributable to Alliance HealthCare Services, Inc. as a measure of financial performance or cash flows from operations as a measure of liquidity, or any other performance measure derived in accordance with GAAP. The presentation of a non-GAAP metric does not imply that the reconciling items presented are non-recurring, infrequent or unusual. In general, non-GAAP metrics have certain limitations as analytical financial measures and are used in conjunction with GAAP results to evaluate our operating performance and by considering independently the economic effects of the items that are, or are not, reflected in non-GAAP metrics. We compensate for such limitations by providing GAAP-based disclosures concerning the excluded items in our financial disclosures. As a result of these limitations, and because non-GAAP metrics may not be directly comparable to similarly titled measures reported by other companies, however, the non-GAAP metrics are not an alternative to the most directly comparable GAAP measure, or as an alternative to any other GAAP measure of operating performance. Please refer to page 44 of this presentation for reconciliations of Adjusted EBITDA attributable to Alliance HealthCare Services, Inc. The term “LTM ended June 30, 2016” used in this presentation means last twelve months ended June 30, 2016, which data has been calculated by subtracting the data for the six months ended June 30, 2015 from the data for the year ended December 31, 2015 and adding the data for the six months ended June 30, 2016.

3

|

|

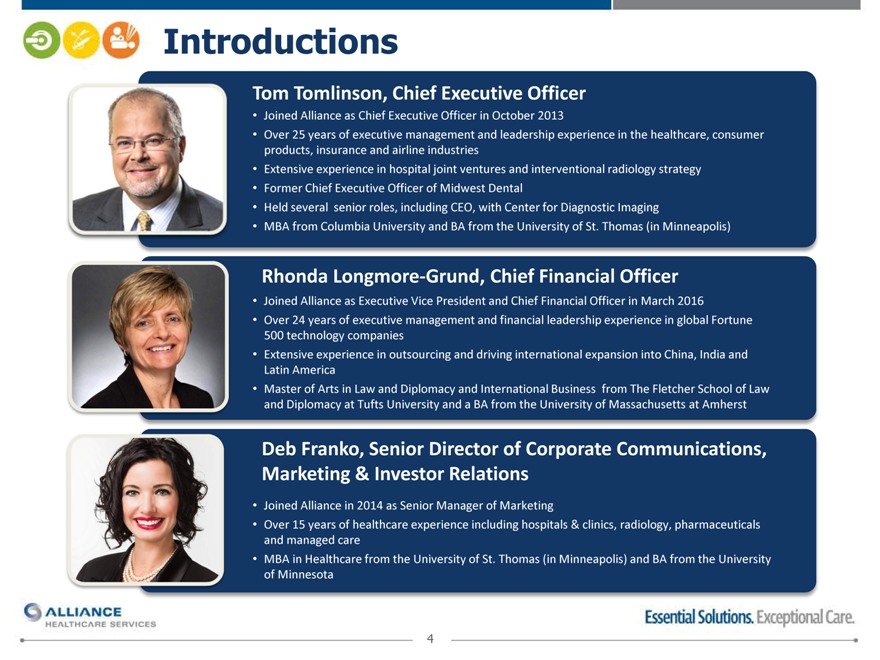

Introductions

Tom Tomlinson, Chief Executive Officer

Joined Alliance as Chief Executive Officer in October 2013

Over 25 years of executive management and leadership experience in the healthcare, consumer products, insurance and airline industries

Extensive experience in hospital joint ventures and interventional radiology strategy

Former Chief Executive Officer of Midwest Dental

Held several senior roles, including CEO, with Center for Diagnostic Imaging

MBA from Columbia University and BA from the University of St. Thomas (in Minneapolis)

Rhonda Longmore-Grund, Chief Financial Officer

Joined Alliance as Executive Vice President and Chief Financial Officer in March 2016

Over 24 years of executive management and financial leadership experience in global Fortune 500 technology companies

Extensive experience in outsourcing and driving international expansion into China, India and Latin America

Master of Arts in Law and Diplomacy and International Business from The Fletcher School of Law and Diplomacy at Tufts University and a BA from the University of Massachusetts at Amherst

Deb Franko, Senior Director of Corporate Communications, Marketing & Investor Relations

Joined Alliance in 2014 as Senior Manager of Marketing

Over 15 years of healthcare experience including hospitals & clinics, radiology, pharmaceuticals and managed care

MBA in Healthcare from the University of St. Thomas (in Minneapolis) and BA from the University of Minnesota

4

|

|

Alliance HealthCare Services

The leading provider of radiology,

oncology and interventional

healthcare solutions to hospitals

and healthcare providers

Partnering with over

1,000 OVER

Hospitals and healthcare

providers in 45 states 30

YEAR

Track record of

successful partnering

Complementary

$473 MILLION businesses align with Hospital-centric

our vision to provide business model

In revenue & multiple service lines aligns with ACA-

$131 to a single hospital driven industry

MILLION customer alternative change payment and

In adjusted EBITDA in models

Fiscal 2015

5

|

|

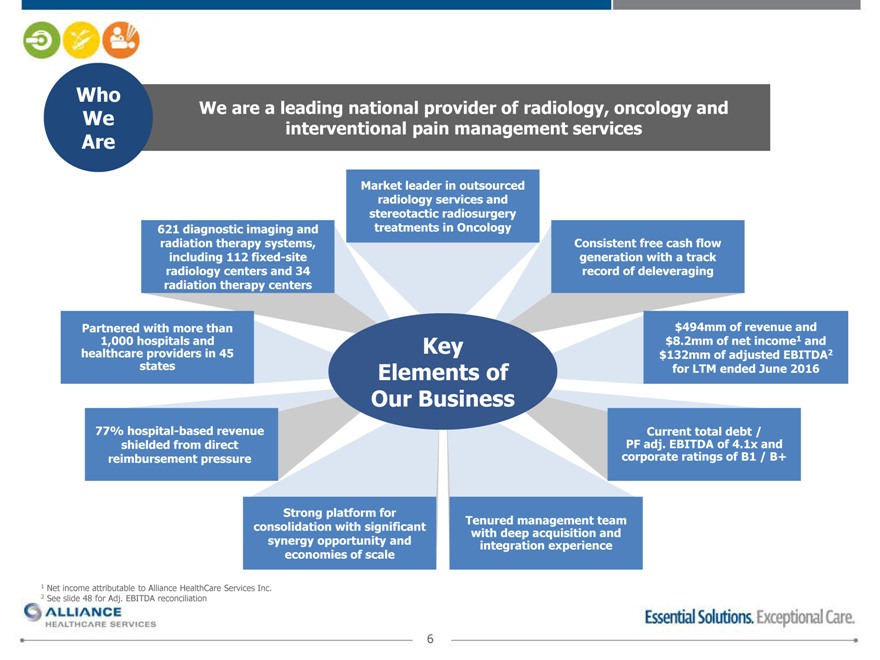

Who

We We are a leading national provider of radiology, oncology and

Are interventional pain management services

Market leader in outsourced

radiology services and

stereotactic radiosurgery

621 diagnostic imaging and treatments in Oncology

radiation therapy systems, Consistent free cash flow

including 112 fixed-site generation with a track

radiology centers and 34 record of deleveraging

radiation therapy centers

Partnered with more than $494mm of revenue and

1,000 hospitals and Key $8.2mm of net income1 and

healthcare providers in 45 $132mm of adjusted EBITDA2

states Elements offor LTM ended June 2016

Our Business

77% hospital-based revenue Current total debt /

shielded from direct PF adj. EBITDA of 4.1x and

reimbursement pressure corporate ratings of B1 / B+

Strong platform for

consolidation with significant Tenured management team

with deep acquisition and

synergy opportunity and integration experience

economies of scale

1 Net income attributable to Alliance HealthCare Services Inc.

2 See slide 48 for Adj. EBITDA reconciliation

6

|

|

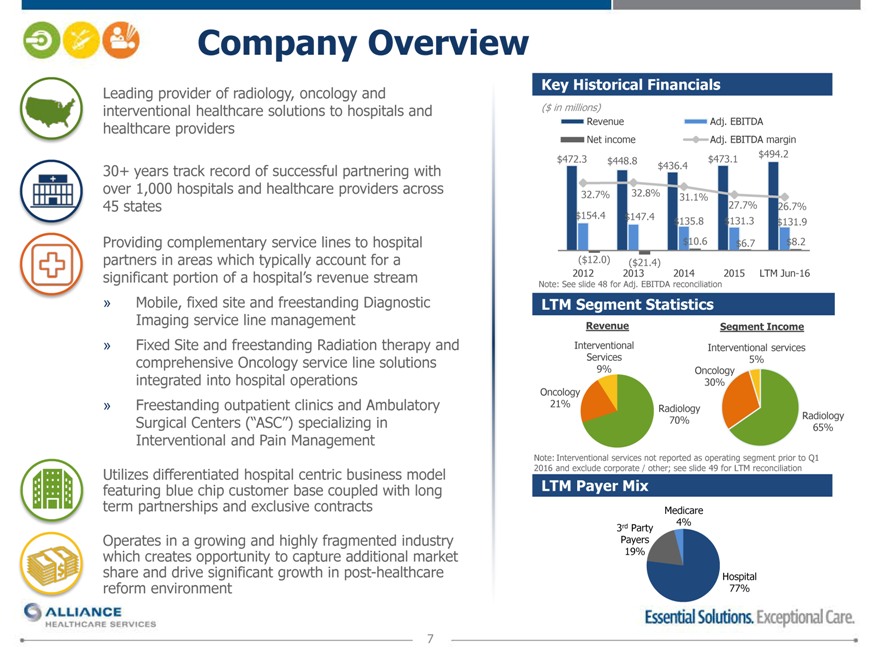

Company Overview

Leading provider of radiology, oncology and interventional healthcare solutions to hospitals and healthcare providers

30+ years track record of successful partnering with over 1,000 hospitals and healthcare providers across 45 states

Providing complementary service lines to hospital partners in areas which typically account for a significant portion of a hospital’s revenue stream

Mobile, fixed site and freestanding Diagnostic Imaging service line management

Fixed Site and freestanding Radiation therapy and comprehensive Oncology service line solutions integrated into hospital operations

Freestanding outpatient clinics and Ambulatory Surgical Centers (“ASC”) specializing in Interventional and Pain Management

Utilizes differentiated hospital centric business model featuring blue chip customer base coupled with long term partnerships and exclusive contracts

Operates in a growing and highly fragmented industry which creates opportunity to capture additional market share and drive significant growth in post-healthcare reform environment

Key Historical Financials

($ in millions)

Revenue Adj. EBITDA

Net income Adj. EBITDA margin

$472.3 $448.8 $473.1$494.2

$436.4

32.7% 32.8% 31.1%

27.7%26.7%

$154.4 $147.4 $135.8$131.3$131.9

$10.6$6.7$8.2

($12.0) ($21.4)

2012 2013 20142015LTM Jun-16

Note: See slide 48 for Adj. EBITDA reconciliation

LTM Segment Statistics

Revenue Segment Income

Interventional Interventional services

Services 5%

9% Oncology

30%

Oncology

21% Radiology

70%Radiology

65%

Note: Interventional services not reported as operating segment prior to Q1

2016 and exclude corporate / other; see slide 49 for LTM reconciliation

LTM Payer Mix

Medicare

3rd Party 4%

Payers

19%

Hospital

77%

7

|

|

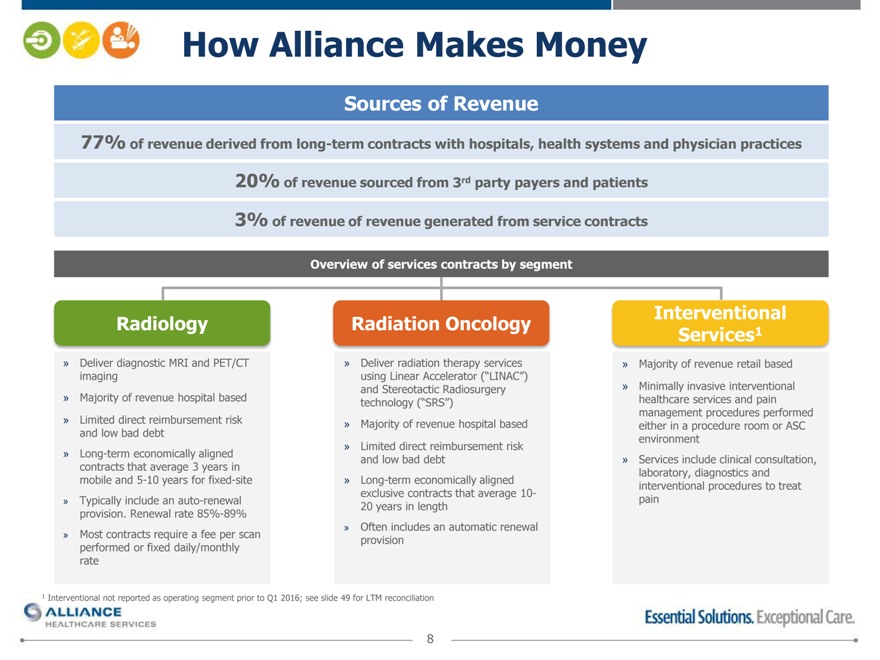

How Alliance Makes Money

Sources of Revenue

77% of revenue derived from long-term contracts with hospitals, health systems and physician practices 20% of revenue sourced from 3rd party payers and patients 3% of revenue of revenue generated from service contracts

Overview of services contracts by segment

Radiology Radiation Oncology Interventional

Services1

Deliver diagnostic MRI and PET/CT Deliver radiation therapy services

imaging using Linear Accelerator (“LINAC”)

and Stereotactic Radiosurgery

Majority of revenue hospital based technology (“SRS”)

Limited direct reimbursement risk Majority of revenue hospital based

and low bad debt

Limited direct reimbursement risk

Long-term economically aligned and low bad debt

contracts that average 3 years in

mobile and 5-10 years for fixed-site Long-term economically aligned

exclusive contracts that average 10-

Typically include an auto-renewal 20 years in length

provision. Renewal rate 85%-89%

Often includes an automatic renewal

Most contracts require a fee per scan provision

performed or fixed daily/monthly

rate

1 Interventional not reported as operating segment prior to Q1 2016; see slide 49 for LTM reconciliation

Minimally invasive interventional healthcare services and pain management procedures performed either in a procedure room or ASC environment

Services include clinical consultation, laboratory, diagnostics and interventional procedures to treat pain

8

|

|

Growth Strategy Industry Leading Provider and Platforms

Drive Same Store Growth

Capitalize on recent investment in marketing and business development

Tailored approach to local market needs

Cross-sale opportunities of additional services to existing customers

RAD360TM

Comprehensive outsourced solution for radiology services

Growth through acquisitions, JV radiology centers and Management Services Agreements

Drives improved same store growth, customer retention and pricing

1 IMV 2014. Radiation Therapy Market Summary Report.

Accelerate Growth in Oncology & Build Intervention Platform

Strong value proposition to hospital partners

Substantial historical investments

34% of U.S. healthcare facilities planning to upgrade Oncology systems within three years

Rapidly growing and highly fragmented Intervention market and attractive unit- level economics

Growth through JVs, partnerships and acquisitions

Strategic Market Re-Pricing in Radiology Largely Complete

Radiology segment embarked upon a price reset in 2014 to maintain and grow market share

Also terminated/spun off unprofitable contracts

» ~$23mm cumulative

revenue and EBITDA

impact from FY15-FY16

($15mm in FY15 and

$8mm estimate in FY16)

Restructuring has largely been completed, enabling future margin expansion and growth opportunities

c

Cross Sell Opportunities

Leverage hospital relationships across all divisions

Partner alongside acute operations to drive performance

Building more comprehensive JV opportunities

Strong synergistic relationship between all three segments

9

|

|

Business Overview

10

|

|

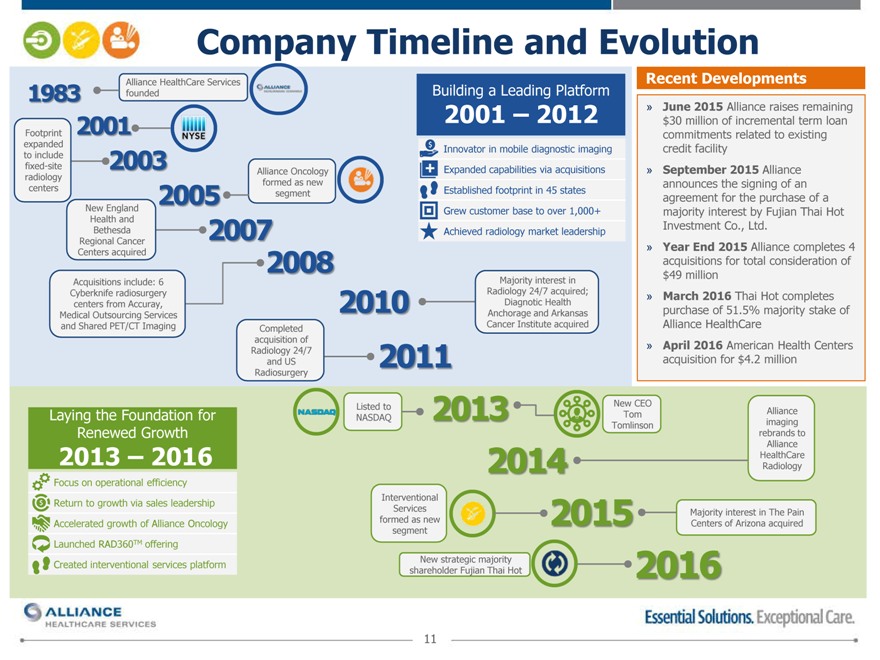

Company Timeline and Evolution

Alliance HealthCare Services

1983 founded Building a Leading Platform

2001 2001 – 2012

Footprint

expande Innovator in mobile diagnostic imaging

to include

fixed-site 2003 Alliance OncologyExpanded capabilities via acquisitions

radiology formed as new

centers 2005 segment Established footprint in 45 states

New England Grew customer base to over 1,000+

Health and

Bethesda 2007Achieved radiology market leadership

Regional Cancer

Centers acquired 2008

Acquisitions include: 6 Majority interest in

Cyberknife radiosurgery Radiology 24/7 acquired;

centers from Accuray, 2010Diagnotic Health

Medical Outsourcing Services Anchorage and Arkansas

and Shared PET/CT Imaging CompletedCancer Institute acquired

acquisition of

Radiology 24/7

and US2011

Radiosurgery

Recent Developments

June 2015 Alliance raises remaining $30 million of incremental term loan commitments related to existing credit facility

September 2015 Alliance announces the signing of an agreement for the purchase of a majority interest by Fujian Thai Hot Investment Co., Ltd.

Year End 2015 Alliance completes 4 acquisitions for total consideration of $49 million

March 2016 Thai Hot completes purchase of 51.5% majority stake of Alliance HealthCare

April 2016 American Health Centers acquisition for $4.2 million

Listed to 2013New CEO

Laying the Foundation for NASDAQ Tom imaging Alliance

Renewed Growth Tomlinsonrebrands to

Alliance

HealthCare

2013 – 2016 2014Radiology

Focus on operational efficiency

Interventional

Return to growth via sales leadership ServicesMajority interest in The Pain

Accelerated growth of Alliance Oncology formed as new 2015Centers of Arizona acquired

segment

Launched RAD360TM offering

Created interventional services platform New strategic majority

shareholder Fujian Thai Hot2016

11

|

|

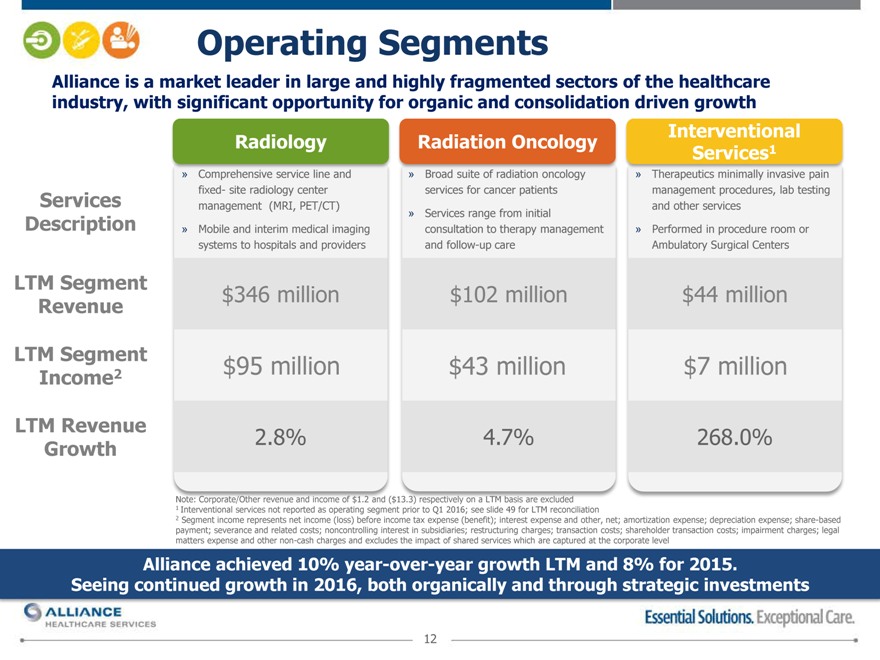

Operating Segments

Alliance is a market leader in large and highly fragmented sectors of the healthcare industry, with significant opportunity for organic and consolidation driven growth

RadiologyRadiation Oncology

» Comprehensive service line and” Broad suite of radiation oncology

fixed- site radiology centerservices for cancer patients

Services management (MRI, PET/CT)

Description » Mobile and interim medical imaging” consultation Services range to from therapy initial management

systems to hospitals and providers and follow-up care

LTM Segment $346 million$102 million

Revenue

Interventional Services1

Therapeutics minimally invasive pain management procedures, lab testing and other services

Performed in procedure room or Ambulatory Surgical Centers

$44 million

LTM Segment $95 million $43 million$7 million

Income2

LTM Revenue 2.8% 4.7%268.0%

Growth

Note: Corporate/Other revenue and income of $1.2 and ($13.3) respectively on a LTM basis are excluded 1 Interventional services not reported as operating segment prior to Q1 2016; see slide 49 for LTM reconciliation

2 Segment income represents net income (loss) before income tax expense (benefit); interest expense and other, net; amortization expense; depreciation expense; share-based payment; severance and related costs; noncontrolling interest in subsidiaries; restructuring charges; transaction costs; shareholder transaction costs; impairment charges; legal matters expense and other non-cash charges and excludes the impact of shared services which are captured at the corporate level

Alliance achieved 10% year-over-year growth LTM and 8% for 2015. Seeing continued growth in 2016, both organically and through strategic investments

12

|

|

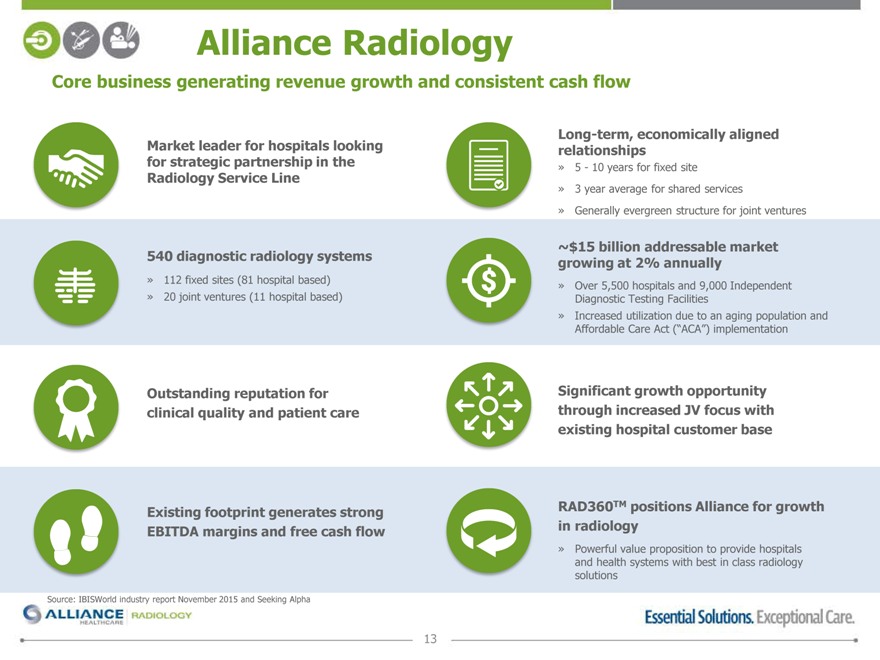

Alliance Radiology

Core business generating revenue growth and consistent cash flow

Long-term, economically aligned

Market leader for hospitals looking relationships

for strategic partnership in the » 5—10 years for fixed site

Radiology Service Line

» 3 year average for shared services

» Generally evergreen structure for joint ventures

~$15 billion addressable market

540 diagnostic radiology systems growing at 2% annually

» 112 fixed sites (81 hospital based) » Over 5,500 hospitals and 9,000 Independent

» 20 joint ventures (11 hospital based) Diagnostic Testing Facilities

» Increased utilization due to an aging population and

Affordable Care Act (“ACA”) implementation

Outstanding reputation for Significant growth opportunity

clinical quality and patient care through increased JV focus with

existing hospital customer base

Existing footprint generates strong

EBITDA margins and free cash flow

RAD360TM positions Alliance for growth

in radiology

Powerful value proposition to provide hospitals and health systems with best in class radiology solutions

Source: IBISWorld industry report November 2015 and Seeking Alpha

13

|

|

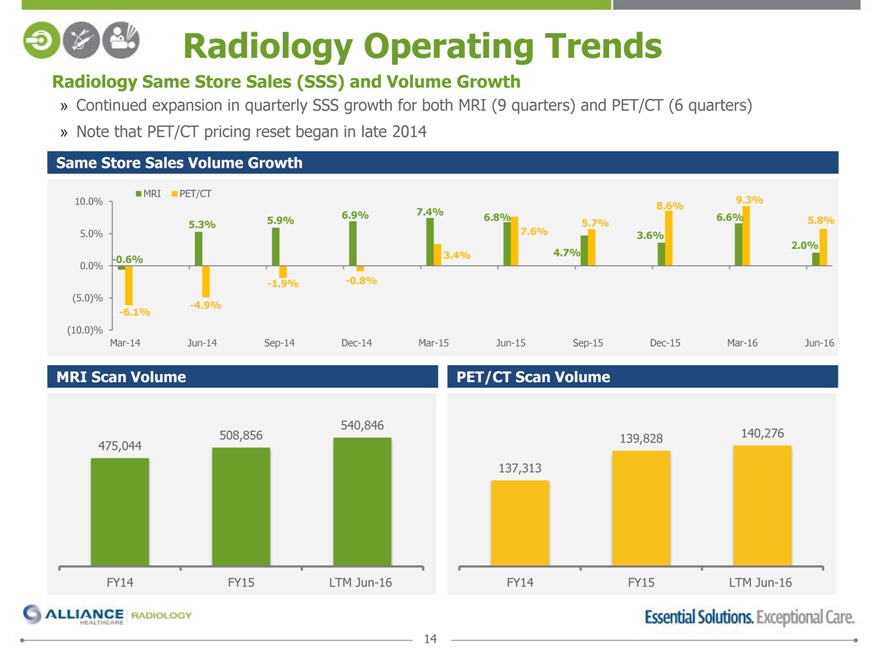

Radiology Operating Trends

Radiology Same Store Sales (SSS) and Volume Growth

Continued expansion in quarterly SSS growth for both MRI (9 quarters) and PET/CT (6 quarters)

Note that PET/CT pricing reset began in late 2014

Same Store Sales Volume Growth

MRI PET/CT

10.0% 8.6%9.3%

5.9%6.9%7.4%6.8%6.6%

5.3% 5.7%5.8%

5.0% 7.6%3.6%

2.0%

-0.6% 3.4%4.7%

0.0%

-1.9%-0.8%

(5.0)%

-6.1% -4.9%

(10.0)%

Mar-14 Jun-14 Sep-14Dec-14Mar-15Jun-15Sep-15Dec-15Mar-16Jun-16

MRI Scan Volume PET/CT Scan Volume

540,846

475,044 508,856139,828140,276

137,313

FY14

FY15

LTM Jun-16

FY14

FY15

LTM Jun-16

14

|

|

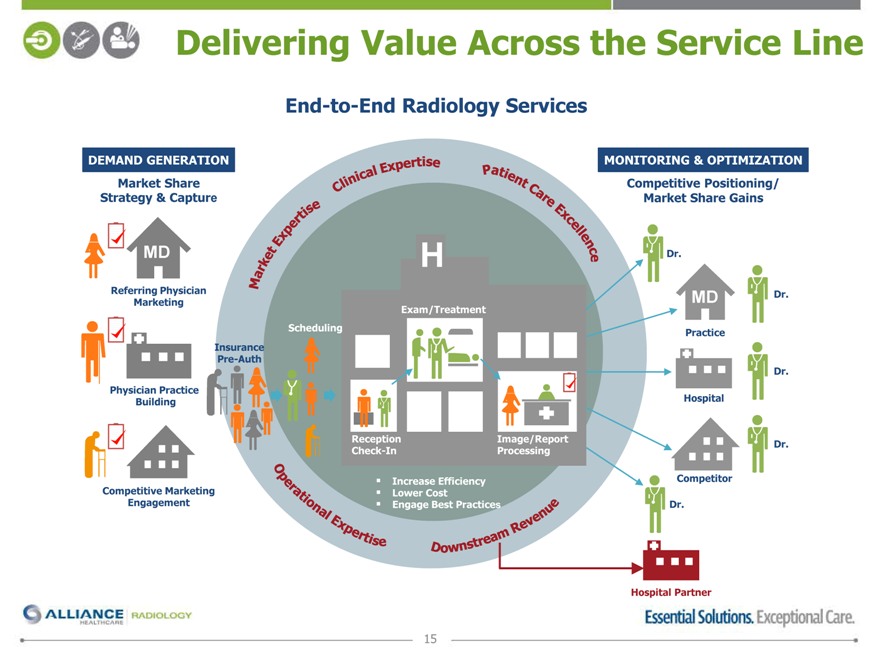

Delivering Value Across the Service Line

End-to-End Radiology Services

DEMAND GENERATION MONITORING & OPTIMIZATION

Market Share Competitive Positioning/

Strategy & Capture Market Share Gains

MD H Dr.

Referring Physician MDDr.

Marketing Exam/Treatment

Scheduling Practice

Insurance

Pre-Auth

Dr.

Physician Practice

Building Hospital

ReceptionImage/Report Dr.

Check-InProcessing

Increase EfficiencyCompetitor

Competitive Marketing Lower Cost

Engagement Engage Best Practices Dr.

Hospital Partner

15

|

|

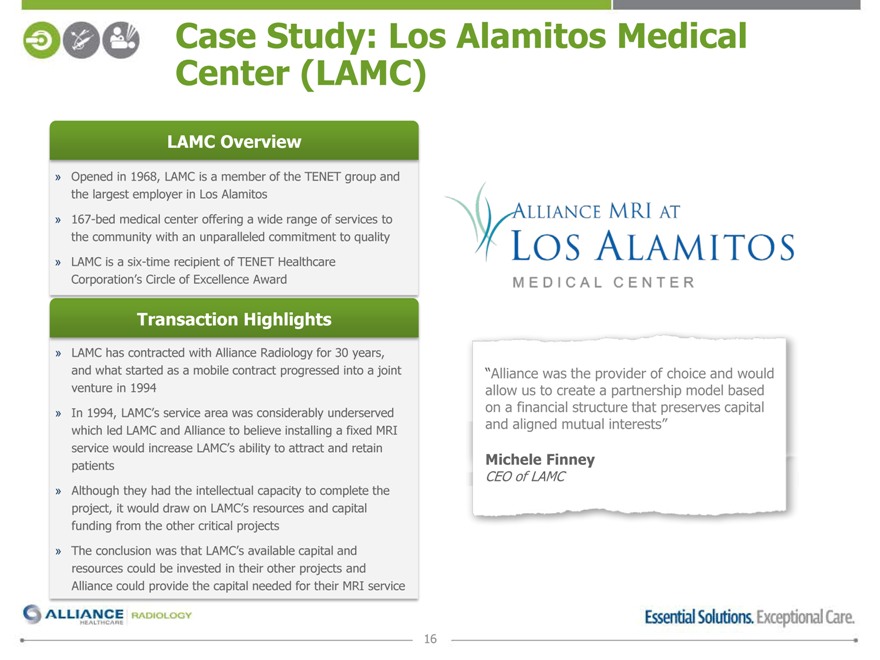

Case Center Study: (LAMC) Los Alamitos Medical

LAMC Overview

Opened in 1968, LAMC is a member of the TENET group and the largest employer in Los Alamitos

167-bed medical center offering a wide range of services to the community with an unparalleled commitment to quality

LAMC is a six-time recipient of TENET Healthcare Corporation’s Circle of Excellence Award

Transaction Highlights

LAMC has contracted with Alliance Radiology for 30 years, and what started as a mobile contract progressed into a joint venture in 1994

In 1994, LAMC’s service area was considerably underserved which led LAMC and Alliance to believe installing a fixed MRI service would increase LAMC’s ability to attract and retain patients

Although they had the intellectual capacity to complete the project, it would draw on LAMC’s resources and capital funding from the other critical projects

The conclusion was that LAMC’s available capital and resources could be invested in their other projects and Alliance could provide the capital needed for their MRI service

“Alliance was the provider of choice and would allow us to create a partnership model based on a financial structure that preserves capital and aligned mutual interests”

Michele Finney

CEO of LAMC

16

|

|

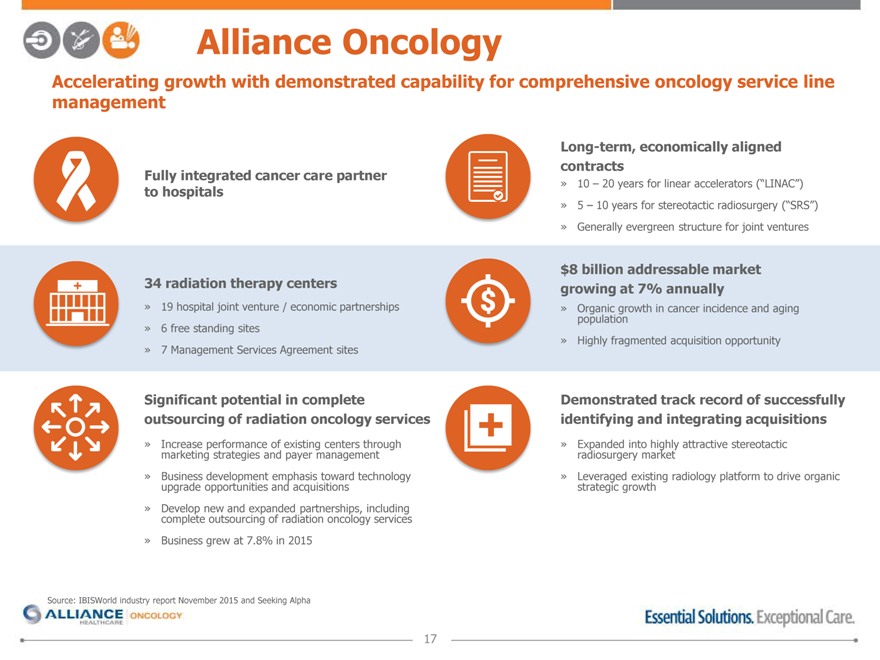

Alliance Oncology

Accelerating growth with demonstrated capability for comprehensive oncology service line management

Fully integrated cancer care partner to hospitals

34 radiation therapy centers

19 hospital joint venture / economic partnerships

6 free standing sites

7 Management Services Agreement sites

Significant potential in complete outsourcing of radiation oncology services

Increase performance of existing centers through marketing strategies and payer management

Business development emphasis toward technology upgrade opportunities and acquisitions

Develop new and expanded partnerships, including complete outsourcing of radiation oncology services

Business grew at 7.8% in 2015

Source: IBISWorld industry report November 2015 and Seeking Alpha

Long-term, economically aligned $99 .4 contracts

10 – 20 years for linear accelerators (“LINAC”)

5 – 10 years for stereotactic radiosurgery (“SRS”)

Generally evergreen structure for joint ventures

$8 billion addressable market

growing at 7% annually

Organic growth in cancer incidence and aging population

Highly fragmented acquisition opportunity

Demonstrated track record of successfully identifying and integrating acquisitions

Expanded into highly attractive stereotactic radiosurgery market

Leveraged existing radiology platform to drive organic strategic growth

17

|

|

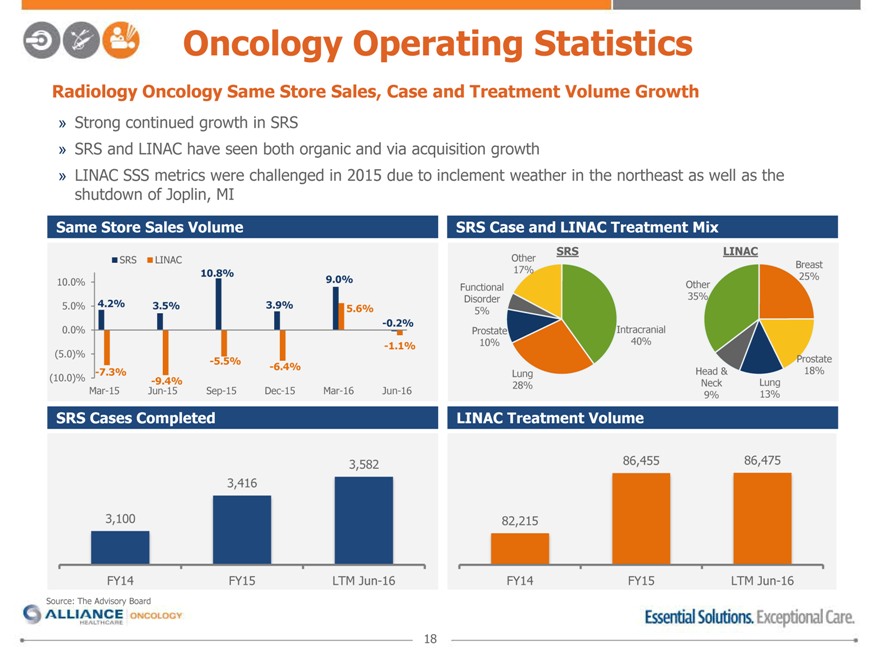

Oncology Operating Statistics

Radiology Oncology Same Store Sales, Case and Treatment Volume Growth

Strong continued growth in SRS

SRS and LINAC have seen both organic and via acquisition growth

LINAC SSS metrics were challenged in 2015 due to inclement weather in the northeast as well as the shutdown of Joplin, MI

Same Store Sales Volume SRS Case and LINAC Treatment Mix

SRSLINAC

SRS LINAC 10.8%Other 17%Breast 25%

10.0% 9.0%FunctionalOther

4.2% 3.5% 3.9%Disorder35%

5.0% 5.6%5%

-0.2%

0.0% ProstateIntracranial

-1.1%10%40%

(5.0)% -5.5%Prostate

-7.3% -6.4%LungHead &18%

(10.0)% -9.4% 28%NeckLung

Mar-15 Jun-15 Sep-15Dec-15Mar-16Jun-169%13%

SRS Cases Completed LINAC Treatment Volume

3,58286,45586,475

3,416

3,100 82,215

FY14 FY15LTM Jun-16FY14FY15LTM Jun-16

Source: The Advisory Board

18

|

|

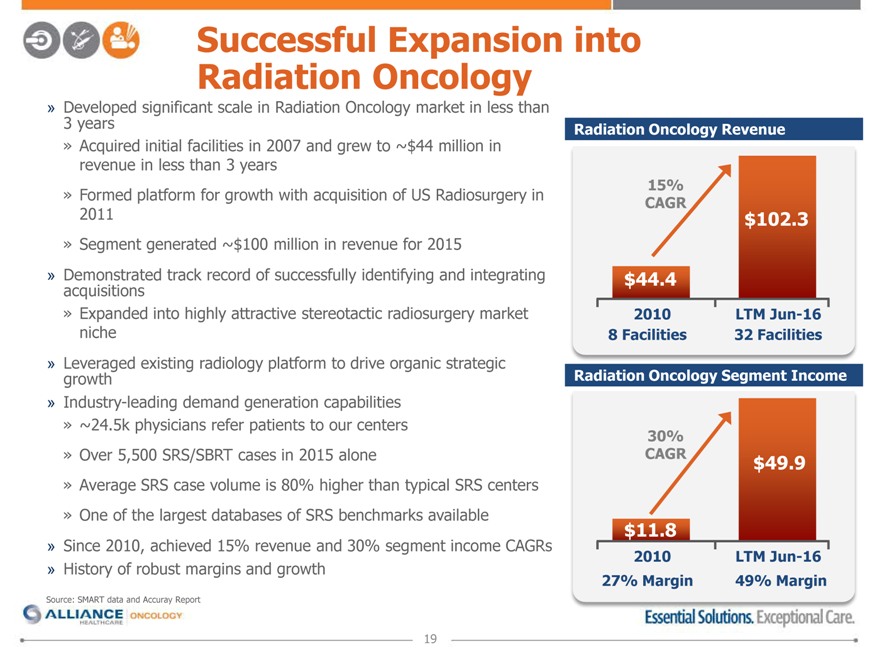

Radiation Successful Oncology Expansion into

Developed significant scale in Radiation Oncology market in less than 3 years » Acquired initial facilities in 2007 and grew to ~$44 million in

revenue in less than 3 years

» Formed platform for growth with acquisition of US Radiosurgery in 2011

» Segment generated ~$100 million in revenue for 2015

Demonstrated track record of successfully identifying and integrating acquisitions

Expanded into highly attractive stereotactic radiosurgery market niche

Leveraged existing radiology platform to drive organic strategic growth

Industry-leading demand generation capabilities

~24.5k physicians refer patients to our centers

Over 5,500 SRS/SBRT cases in 2015 alone

Average SRS case volume is 80% higher than typical SRS centers

One of the largest databases of SRS benchmarks available

Since 2010, achieved 15% revenue and 30% segment income CAGRs

History of robust margins and growth

Source: SMART data and Accuray Report

Radiation Oncology Revenue

15%

CAGR

$102.3

$44.4

2010 LTM Jun-16

8 Facilities 32 Facilities

Radiation Oncology Segment Income

30%

CAGR $49.9

$11.8

2010 LTM Jun-16

27% Margin 49% Margin

19

|

|

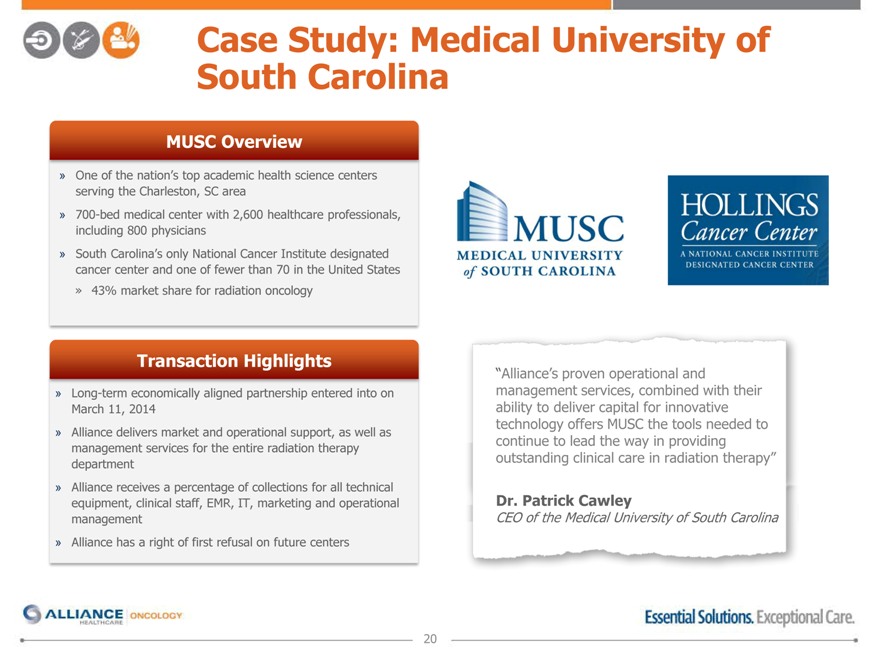

Case South Study: Carolina Medical University of

MUSC Overview

One of the nation’s top academic health science centers serving the Charleston, SC area

700-bed medical center with 2,600 healthcare professionals, including 800 physicians

South Carolina’s only National Cancer Institute designated cancer center and one of fewer than 70 in the United States » 43% market share for radiation oncology

Transaction Highlights

Long-term economically aligned partnership entered into on March 11, 2014

Alliance delivers market and operational support, as well as management services for the entire radiation therapy department

Alliance receives a percentage of collections for all technical equipment, clinical staff, EMR, IT, marketing and operational management

Alliance has a right of first refusal on future centers

“Alliance’s proven operational and management services, combined with their ability to deliver capital for innovative technology offers MUSC the tools needed to continue to lead the way in providing outstanding clinical care in radiation therapy”

Dr. Patrick Cawley

CEO of the Medical University of South Carolina

20

|

|

Alliance Interventional Partners

Synergistic business segment in a high growth, fragmented market space

$11 Billion addressable market growing at 8% annually

Highly fragmented market

Market share held by leader is less than 1%

JV partnerships to expand

geographic footprint

Acquired The Pain Center of Arizona (February 2015) and PRC Associates (October 2015)

Incremental revenues in 2015 of $33 million

Post acquisition synergy opportunities; ancillary services like lab services and diagnostic imaging

Management team with interventional healthcare experience

CEO Tom Tomlinson

SVP of Sales Strategy Holly Huso

President of Interventional Services Steven Siwek, MD

Source: Seeking Alpha

Attractive reimbursement

environment

Lower cost to deliver services in an outpatient setting

Ambulatory Surgical Centers (ASCs) have higher reimbursement given the facility fee

Trend of migration to lower cost Ambulatory Surgical Centers

Increased patient satisfaction in an outpatient setting

Lower cost to deliver services

Easy to access for patients

Expansion into this segment provides cross-sell opportunities to drive growth

Interventional healthcare patient flow will drive volumes to the existing diagnostic radiology business

Operational synergies such as patient scheduling and insurance verification

21

|

|

Capitalizing on Strong Market Forces

Trends Causing Interventional Procedures to Migrate from Hospitals to Outpatient Facilities

3 Poor Access to Specialists4Accountable Care Act

pecialist recruitment remains anhift to value from volume with

issue, resulting in growth ofincentives for patient satisfaction

outsource market (e.g., TeamHealth)driving CPT migration to outpatient

clinics (e.g., pain, vascular)

2 Patient Preference5Insufficient Scale

nvenience and lower co-paysall patient volumes at some

are decision factors where word- hospitals make economics for

of-mouth referrals are keyinvestment unfavorable

1 CPTs6 Networks Are At Capacity

Payers ost Pressure shunting from patients Payers to MigratingCOs unable to absorb more lives

outpatient clinics for certain Towithout further losses incurred from

CPTs due to lower fees Outpatient long wait patient times experience and related poor

Settings

Source: Axia analysis; CMS; Expert interviews

22

|

|

Industry Overview

23

|

|

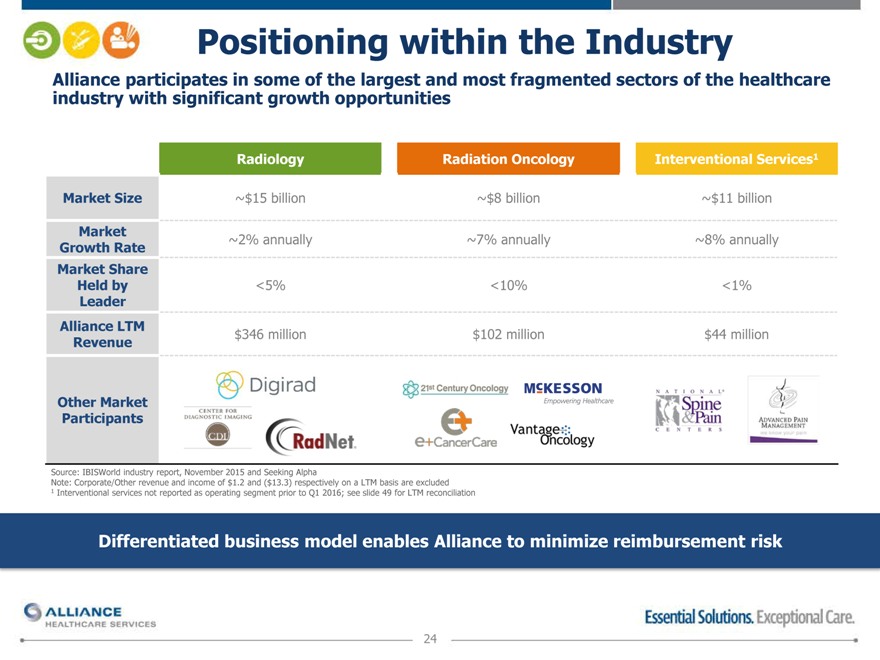

Positioning within the Industry

Alliance industry participates with significant in some growth of the opportunities largest and most fragmented sectors of the healthcare

Radiology Radiation Oncology Interventional Services1

Market Size ~$15 billion ~$8 billion~$11 billion

Market

Growth Rate ~2% annually ~7% annually~8% annually

Market Share

Held by <5% <10%<1%

Leader

Alliance LTM

Revenue $346 million $102 million$44 million

Other Market

Participants

Source: IBISWorld industry report, November 2015 and Seeking Alpha

Note: Corporate/Other revenue and income of $1.2 and ($13.3) respectively on a LTM basis are excluded

1 Interventional services not reported as operating segment prior to Q1 2016; see slide 49 for LTM reconciliation

Differentiated business model enables Alliance to minimize reimbursement risk

24

|

|

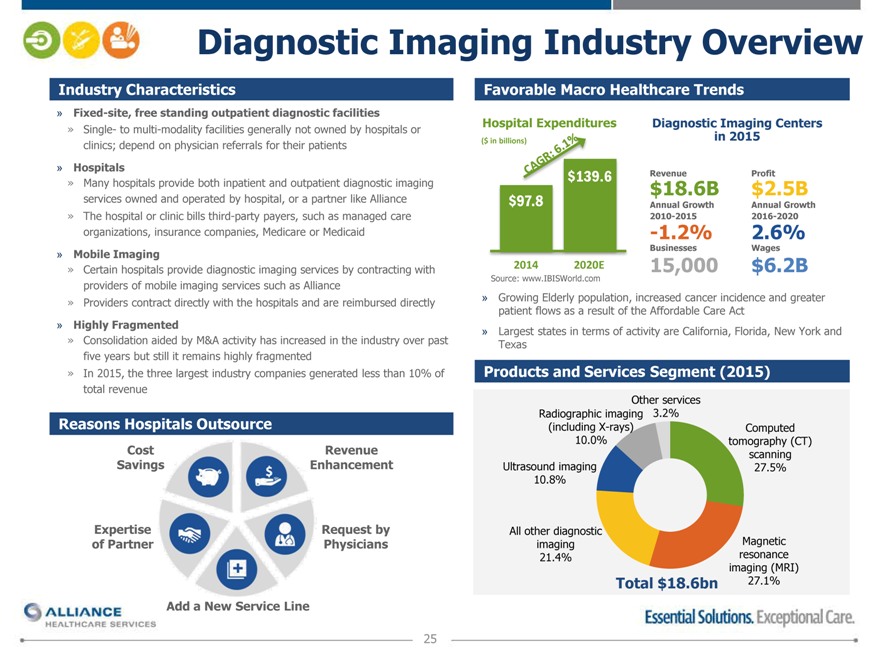

Diagnostic Imaging Industry Overview

Industry Characteristics

Fixed-site, free standing outpatient diagnostic facilities

Single- to multi-modality facilities generally not owned by hospitals or clinics; depend on physician referrals for their patients

Hospitals

Many hospitals provide both inpatient and outpatient diagnostic imaging services owned and operated by hospital, or a partner like Alliance

The hospital or clinic bills third-party payers, such as managed care organizations, insurance companies, Medicare or Medicaid

Mobile Imaging

Certain hospitals provide diagnostic imaging services by contracting with

providers of mobile imaging services such as Alliance

» Providers contract directly with the hospitals and are reimbursed directly

Highly Fragmented

Consolidation aided by M&A activity has increased in the industry over past five years but still it remains highly fragmented

In 2015, the three largest industry companies generated less than 10% of total revenue

Reasons Hospitals Outsource

Cost Revenue

Savings Enhancement

Expertise Request by

of Partner Physicians

Favorable Macro Healthcare Trends

Hospital Expenditures Diagnostic Imaging Centers

($ in billions) in 2015

.6 RevenueProfit

$18.6B$2.5B

$97.8 Annual Growth Annual Growth

2010-20152016-2020

-1.2%2.6%

Businesses Wages

2014 2020E 15,000$6.2B

Source: www.IBISWorld.com

Growing Elderly population, increased cancer incidence and greater patient flows as a result of the Affordable Care Act

Largest states in terms of activity are California, Florida, New York and Texas

Products and Services Segment (2015)

Other services

Radiographic imaging 3.2%

(including X-rays) Computed

10.0% tomography (CT)

scanning

Ultrasound imaging 27.5%

10.8%

All other diagnostic

imaging Magnetic

21.4% resonance

imaging (MRI)

Total $18.6bn 27.1%

Add a New Service Line

25

|

|

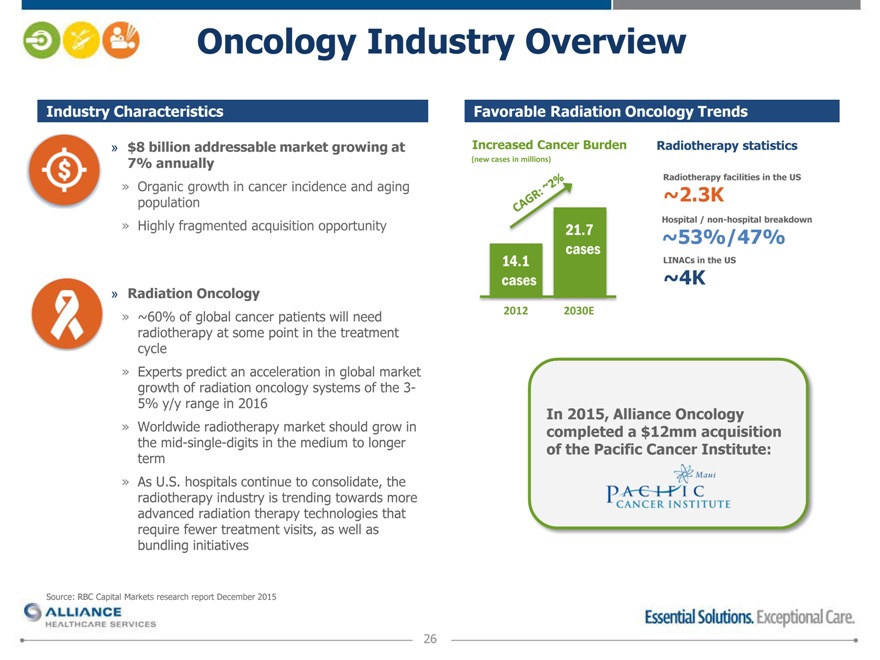

Oncology Industry Overview

Industry Characteristics

$8 billion addressable market growing at 7% annually

Organic growth in cancer incidence and aging population

Highly fragmented acquisition opportunity

Radiation Oncology

~60% of global cancer patients will need radiotherapy at some point in the treatment cycle

Experts predict an acceleration in global market growth of radiation oncology systems of the 3- 5% y/y range in 2016

Worldwide radiotherapy market should grow in the mid-single-digits in the medium to longer term

As U.S. hospitals continue to consolidate, the radiotherapy industry is trending towards more advanced radiation therapy technologies that require fewer treatment visits, as well as bundling initiatives

Source: RBC Capital Markets research report December 2015

Favorable Radiation Oncology Trends

Increased Cancer Burden Radiotherapy statistics

(new cases in millions)

Radiotherapy facilities in the US

~2.3K

Hospital / non-hospital breakdown

7 ~53%/47%

cases

14.1 LINACs in the US

cases ~4K

2012 2030E

In 2015, Alliance Oncology

completed a $12mm acquisition

of the Pacific Cancer Institute:

26

|

|

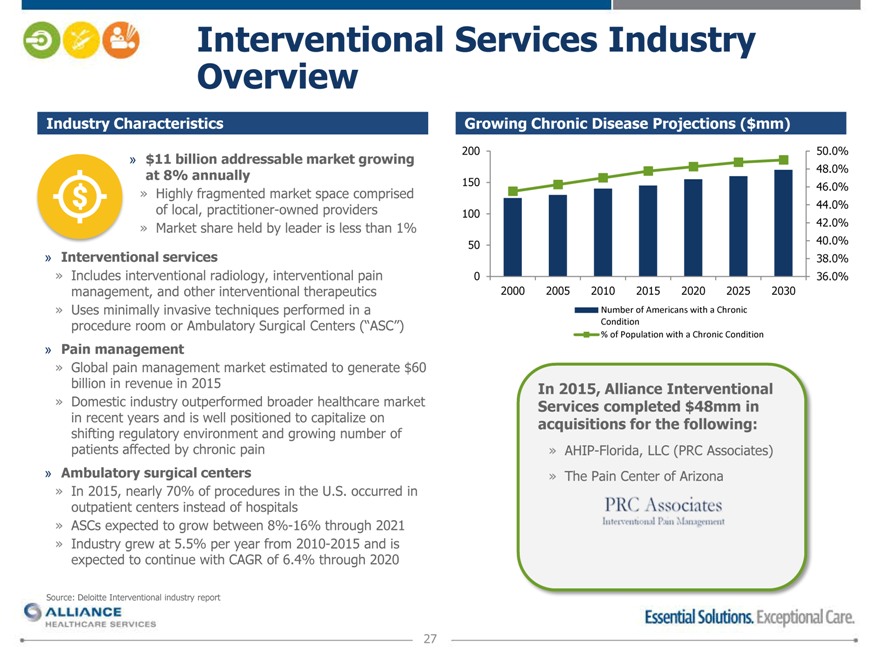

Overview Interventional Services Industry

Industry Characteristics

» $11 billion addressable market growing at 8% annually

» Highly fragmented market space comprised of local, practitioner-owned providers

» Market share held by leader is less than 1%

Interventional services

Includes interventional radiology, interventional pain management, and other interventional therapeutics

Uses minimally invasive techniques performed in a procedure room or Ambulatory Surgical Centers (“ASC”)

Pain management

Global pain management market estimated to generate $60 billion in revenue in 2015

Domestic industry outperformed broader healthcare market in recent years and is well positioned to capitalize on shifting regulatory environment and growing number of patients affected by chronic pain

Ambulatory surgical centers

In 2015, nearly 70% of procedures in the U.S. occurred in outpatient centers instead of hospitals

ASCs expected to grow between 8%-16% through 2021

Industry grew at 5.5% per year from 2010-2015 and is expected to continue with CAGR of 6.4% through 2020

Source: Deloitte Interventional industry report

Growing Chronic Disease Projections ($mm)

200 50.0%

48.0%

150 46.0%

44.0%

100

42.0%

50 40.0%

38.0%

0 36.0%

2000 2005 2010 2015 2020 2025 2030

Number of Americans with a Chronic Condition % of Population with a Chronic Condition

In 2015, Alliance Interventional Services completed $48mm in acquisitions for the following:

AHIP-Florida, LLC (PRC Associates)

The Pain Center of Arizona

27

|

|

Key Investment Highlights

Compelling Entry Point for Investment

Industry Leading Provider and Platforms

Hospital Centric Model Aligns with Favorable Industry Trends Exclusive, Long-Term Partnerships Coupled with Outsourced Services Model Strong Free Cash Flow with History of Deleveraging Supportive and Growth Oriented Strategic Investor Experienced and Committed Management Team

28

|

|

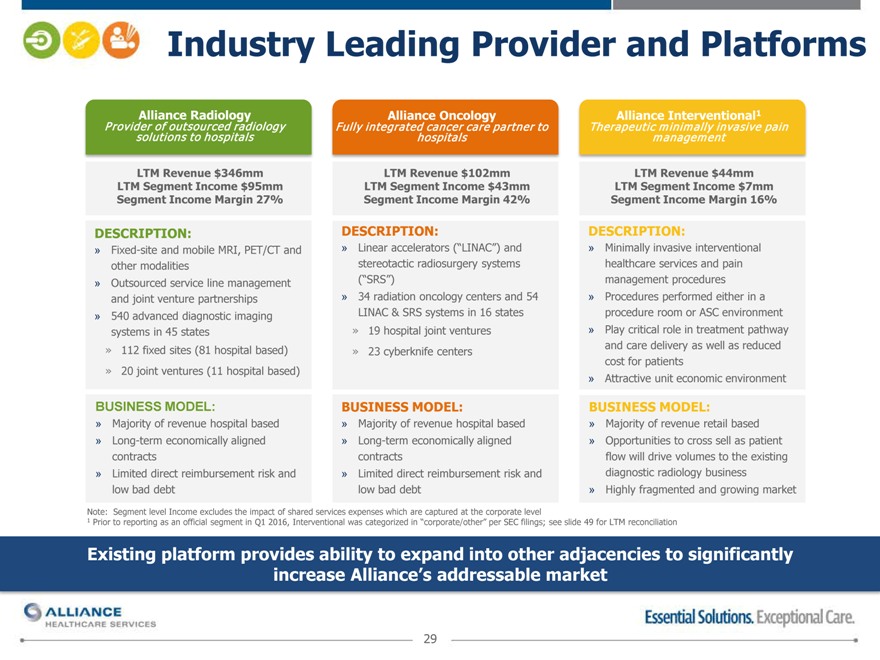

Industry Leading Provider and Platforms

Provider Alliance of outsourced Radiology radiology solutions to hospitals

LTM Revenue $346mm LTM Segment Income $95mm Segment Income Margin 27%

DESCRIPTION:

Fixed-site and mobile MRI, PET/CT and other modalities

Outsourced service line management and joint venture partnerships

540 advanced diagnostic imaging systems in 45 states

112 fixed sites (81 hospital based)

20 joint ventures (11 hospital based)

Fully integrated Alliance cancer Oncology care partner to

hospitals

LTM Revenue $102mm

LTM Segment Income $43mm

Segment Income Margin 42%

Alliance Interventional1

Therapeutic minimally invasive pain

management

LTM Revenue $44mm

LTM Segment Income $7mm

Segment Income Margin 16%

DESCRIPTION:

Linear accelerators (“LINAC”) and stereotactic radiosurgery systems (“SRS”)

34 radiation oncology centers and 54 LINAC & SRS systems in 16 states

19 hospital joint ventures

23 cyberknife centers

DESCRIPTION:

Minimally invasive interventional healthcare services and pain management procedures

Procedures performed either in a procedure room or ASC environment

Play critical role in treatment pathway and care delivery as well as reduced cost for patients

Attractive unit economic environment

BUSINESS MODEL: BUSINESS MODEL: BUSINESS MODEL:

» Majority of revenue hospital based » Majority of revenue hospital based » Majority of revenue retail based

» Long-term economically aligned » Long-term economically aligned » Opportunities to cross sell as patient

contracts contracts flow will drive volumes to the existing

» Limited direct reimbursement risk and » Limited direct reimbursement risk and diagnostic radiology business

low bad debt low bad debt » Highly fragmented and growing market

Note: Segment level Income excludes the impact of shared services expenses which are captured at the corporate level

1 Prior to reporting as an official segment in Q1 2016, Interventional was categorized in “corporate/other” per SEC filings; see slide 49 for LTM reconciliation

Existing platform provides ability to expand into other adjacencies to significantly increase Alliance’s addressable market

29

|

|

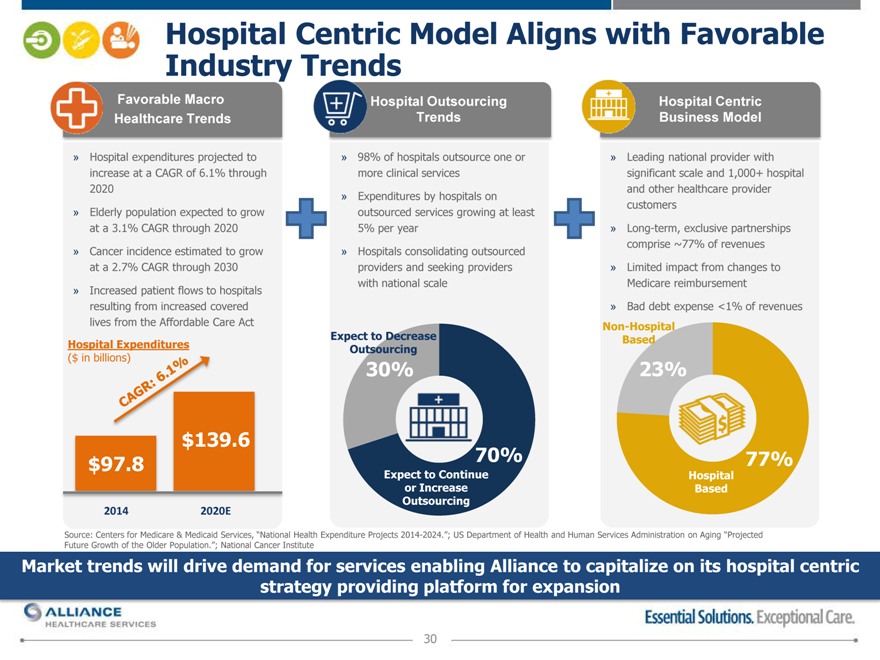

Hospital Industry Centric Trends Model Aligns with Favorable

Favorable Macro Hospital Outsourcing Hospital Centric

Healthcare Trends Trends Business Model

» Hospital expenditures projected to »98% of hospitals outsource one or»Leading national provider with

increase at a CAGR of 6.1% through more clinical servicessignificant scale and 1,000+ hospital

2020 and other healthcare provider

»Expenditures by hospitals on

» Elderly population expected to grow outsourced services growing at least customers

at a 3.1% CAGR through 2020 5% per year»Long-term, exclusive partnerships

» Cancer incidence estimated to grow »Hospitals consolidating outsourced comprise ~77% of revenues

at a 2.7% CAGR through 2030 providers and seeking providers»Limited impact from changes to

» Increased patient flows to hospitals with national scaleMedicare reimbursement

resulting from increased covered »Bad debt expense <1% of revenues

lives from the Affordable Care Act Non-Hospital

Expect to Decrease Based

Hospital Expenditures Outsourcing

($ in billions) 30%23%

$139.6

$97.8 70%77%

Expect to Continue Hospital

or Increase Based

Outsourcing

2014 2020E

Source: Centers for Medicare & Medicaid Services, “National Health Expenditure Projects 2014-2024.”; US Department of Health and Human Services Administration on Aging “Projected Future Growth of the Older Population.”; National Cancer Institute

Market trends will drive demand for services enabling Alliance to capitalize on its hospital centric strategy providing platform for expansion

30

|

|

Exclusive, Coupled with Long Outsourced -Term partnerships Service Contracts

Long-Term Contracts Selected existing customers

» Limited risk due to lower customer

concentration

» No single customer accounts for more

than 10% of consolidated revenues

» Deliver services through exclusive, long-

term contracts which provide durability and

continuity in both revenue and cash flow

» Joint Venture arrangements generally

for 10 years with evergreen feature

» Outsourced services contract period for

3+ years – many with auto renewal

» Dedicated renewal team focused on strong

customer retention and performance

» Hospital-based approach is key competitive A member of Ascension

strength. As patient care continues to

coalesce around the hospital network,

Alliance is already well positioned within

this environment to serve as a value-add

partner

31

|

|

Exclusive, Coupled with Long Outsourced -Term partnerships Service Contracts

Business model comparison1

Hospital Based Outsourced & JV Revenue

~77% of LTM revenue

» Alliance bills the hospital for services performed

Retail Revenue

~20% of LTM revenue

Alliance bills the patient and third party payers directly

Hospital

Insurance Hospital or provider Physician referral Patient Insurance Patient provider

Reimbursements Payments Referral

1 Balance of revenue breakdown from service fee contracts

32

|

|

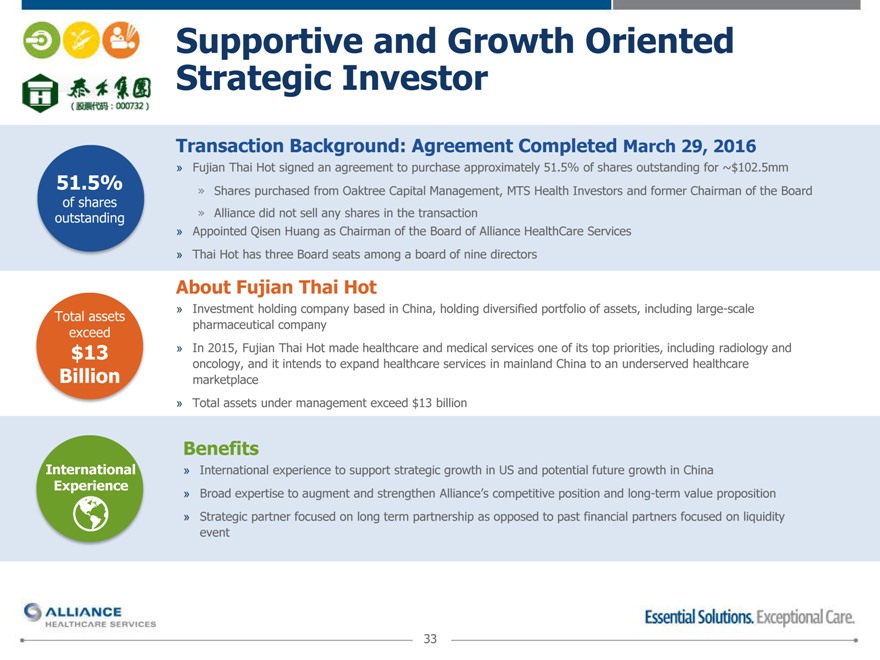

Supportive and Growth Oriented

Strategic Investor

Transaction Background: Agreement Completed March 29, 2016

» Fujian Thai Hot signed an agreement to purchase approximately 51.5% of shares outstanding for ~$102.5mm

51.5% »Shares purchased from Oaktree Capital Management, MTS Health Investors and former Chairman of the Board

of shares

outstanding »Alliance did not sell any shares in the transaction

» Appointed Qisen Huang as Chairman of the Board of Alliance HealthCare Services

» Thai Hot has three Board seats among a board of nine directors

About Fujian Thai Hot

Total assets » Investment holding company based in China, holding diversified portfolio of assets, including large-scale

exceed pharmaceutical company

$13 » In 2015, Fujian Thai Hot made healthcare and medical services one of its top priorities, including radiology and

oncology, and it intends to expand healthcare services in mainland China to an underserved healthcare

Billion marketplace

» Total assets under management exceed $13 billion

Benefits

International » International experience to support strategic growth in US and potential future growth in China

Experience » Broad expertise to augment and strengthen Alliance’s competitive position and long-term value proposition

Strategic partner focused on long term partnership as opposed to past financial partners focused on liquidity event

33

|

|

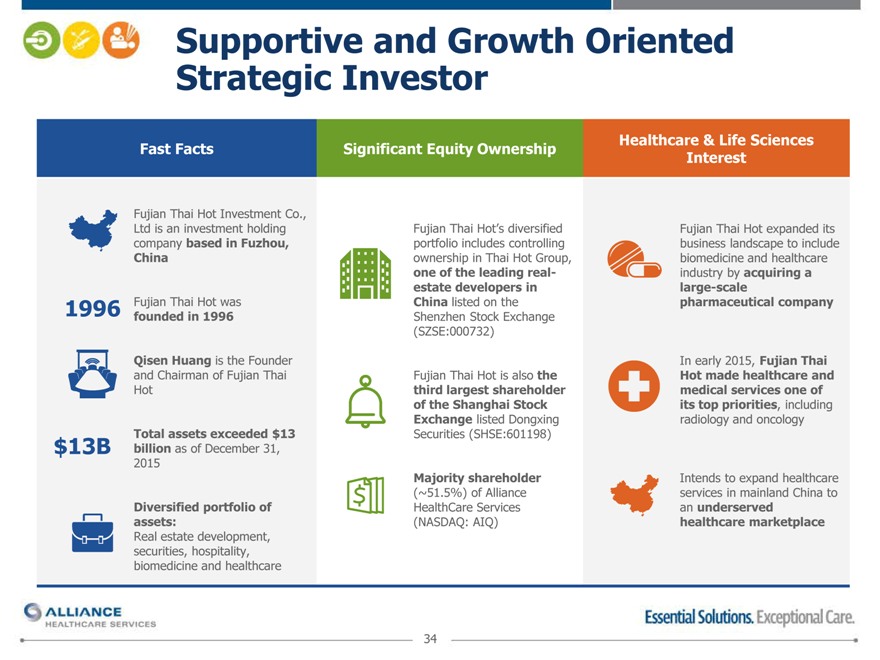

Supportive and Growth Oriented

Strategic Investor

Fast Facts Significant Equity OwnershipHealthcare & Life Sciences

Interest

Fujian Thai Hot Investment Co.,

Ltd is an investment holding Fujian Thai Hot’s diversifiedFujian Thai Hot expanded its

company based in Fuzhou, portfolio includes controllingbusiness landscape to include

China ownership in Thai Hot Group,biomedicine and healthcare

one of the leading real-industry by acquiring a

estate developers inlarge-scale

1996 Fujian Thai Hot was China listed on thepharmaceutical company

founded in 1996 Shenzhen Stock Exchange

(SZSE:000732)

Qisen Huang is the Founder In early 2015, Fujian Thai

and Chairman of Fujian Thai Fujian Thai Hot is also theHot made healthcare and

Hot third largest shareholdermedical services one of

of the Shanghai Stock its top priorities, including

Exchange listed Dongxingradiology and oncology

Total assets exceeded $13 Securities (SHSE:601198)

$13B billion as of December 31,

2015

Majority shareholderIntends to expand healthcare

(~51.5%) of Allianceservices in mainland China to

Diversified portfolio of HealthCare Servicesan underserved

assets: (NASDAQ: AIQ)healthcare marketplace

Real estate development,

securities, hospitality,

biomedicine and healthcare

34

|

|

New AIQ Board Members

Qisen Huang

Founder and Chairman of Fujian Thai Hot, a company he founded approximately 19 years ago.

Chairman and General Manager of Thai Hot since March 2013.

Non-Executive Chairman of the Board for Alliance Healthcare Services.

Representative of the 12th National Committee of the Chinese People’s Political Consultative Conference since February 2013, and is also the Vice President of the Fujian Chamber of Commerce, and Director of Fujian Haixia Bank.

BA in engineering from Fuzhou University.

Dr. Tao Zhang

Founded United Pacific Healthcare in August 2014 in order to capitalize on the dynamic growth opportunities in the Chinese healthcare marketplace.

Previously, he worked directly under Dr. Thomas Frist, Jr., the co-founder of HCA, for six years, three years of which Dr. Zhang was in the U.S. on a part time basis. Dr. Zhang spent the remaining three years in China as the full-time chairman and CEO of CHC, Dr. Frist’s China venture in the healthcare delivery sector.

Earned his MD degree in China and underwent cardiac surgery training for three years before he joined CITIC Pacific in 2001.

Worked at CITIC Pacific for four years in the healthcare division and invested and built two of the top ten private hospitals in China.

Dr. Zhang also holds an MBA and a Master’s Degree in Health Sector Management from Duke University.

Heping Feng

Serves as the Supervisor of China Galaxy Securities Company Limited since June 2015.

Senior Advisor of PricewaterhouseCoopers since October 2014.

Held various executive positions at PricewaterhouseCoopers, Morgan Stanley and Arthur Anderson

Independent Non-Executive Director at Bank of Tianjin Co., Ltd. since December 2014.

BA in Accounting from Shanxi College of Finance and Economics Law and holds an MA in Accounting from the Research Institute for Fiscal Science of the Ministry of Finance. Obtained the Chinese Certified Public Accountant qualification from the Chinese Institute of Certified Public Accountants.

35

|

|

Experienced and Committed

Management Team

Years of Tenure

In Current

Name Title Prior ExperienceAllianceExperiencePosition as

of

Midwest Dental, Center for

Tom Tomlinson CEO 3322013

Diagnostic Imaging (CDI)

Rhonda Longmore- Printronix, Ingram Micro, Exult,

Grund CFO Velocium1302016

LaVie Care Centers, Foley &

Richard Johns COO & CLO 4342012

Lardner

Human Resources, Gen-E, Ingram Micro, Texas

Laurie Miller Marketing & 3282013

Communications EVP Instruments

Center for Diagnostic Imaging

Holly Huso Sales, SVP 2272014

(CDI), Mayo Clinic, Biologics

President of Several leadership roles in

Rich Jones hospitals and the commercial18332012

Radiology healthcare sector

US Radiosurgery, NeoSpine,

Greg Spurlock President of Oncology 10312011

Imaging One

President of The Pain Center of Arizona,

Steven Siwek, MD Interventional 1172015

Services Freedom Pain Hospital

36

|

|

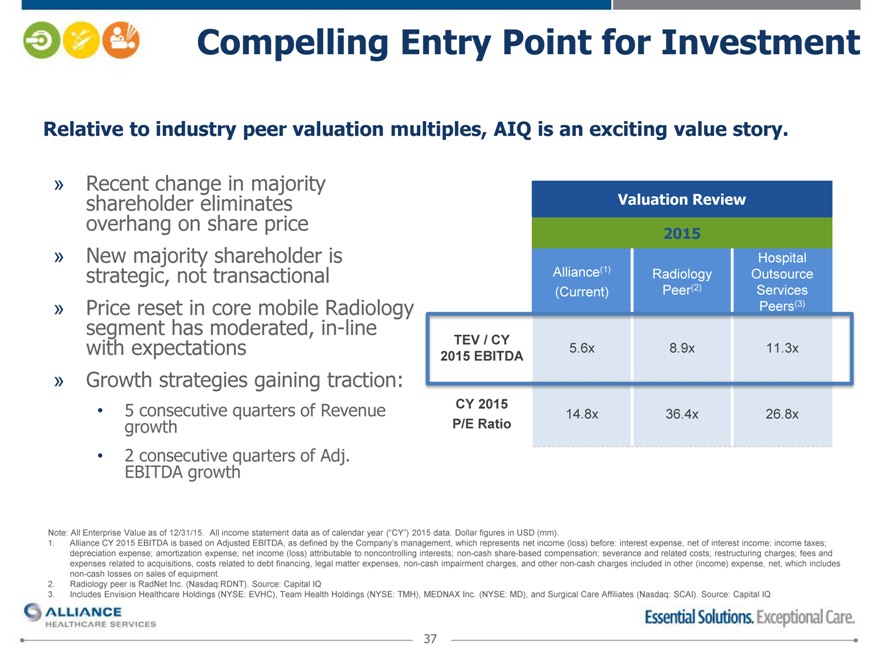

Compelling Entry Point for Investment

Relative to industry peer valuation multiples, AIQ is an exciting value story.

Recent change in majority shareholder eliminates overhang on share price

New majority shareholder is strategic, not transactional

Price reset in core mobile Radiology segment has moderated, in-line with expectations

Growth strategies gaining traction:

5 consecutive quarters of Revenue growth

2 consecutive quarters of Adj. EBITDA growth

Valuation Review

2015

Hospital

Alliance(1) Radiology Outsource

(Current) Peer(2) Services

Peers(3)

CY 2015

P/E Ratio 14.8x 36.4x26.8x

Note: All Enterprise Value as of 12/31/15. All income statement data as of calendar year (“CY”) 2015 data. Dollar figures in USD (mm).

Alliance CY 2015 EBITDA is based on Adjusted EBITDA, as defined by the Company’s management, which represents net income (loss) before: interest expense, net of interest income; income taxes; depreciation expense; amortization expense; net income (loss) attributable to noncontrolling interests; non-cash share-based compensation; severance and related costs; restructuring charges; fees and expenses related to acquisitions, costs related to debt financing, legal matter expenses, non-cash impairment charges, and other non-cash charges included in other (income) expense, net, which includes non-cash losses on sales of equipment.

Radiology peer is RadNet Inc. (Nasdaq:RDNT). Source: Capital IQ

Includes Envision Healthcare Holdings (NYSE: EVHC), Team Health Holdings (NYSE: TMH), MEDNAX Inc. (NYSE: MD), and Surgical Care Affiliates (Nasdaq: SCAI). Source: Capital IQ

37

|

|

Financial Performance

In adjusted EBITDA in

Fiscal 2015

38

|

|

Financial Strategy

Financial Policy Summary

Focus on History of operating in levered environment with proven track record of delevering

Conservative Near term increase in leverage with longer-term goal to reduce leverage to ~3.5x target range

Leverage

Profile Paid down approximately $145 million of debt between 2010-2014 prior to exercising

remaining balance on incremental term loan facility in June 2015

Decline in revenue and pricing pressure has been addressed with new growth strategy,

Return resulting in positive revenue year over year growth in last six quarters and positive adjusted

to EBITDA growth in the last three quarters

Hos Growth rePoised for expansion through complementary higher growth segments and cross selling

pr sopportunities

Strong Allows for optionality in regards to capital allocation

Free

Cash Historical track record of consistent cash flow generation and strong margin structure

Flow Supports future growth initiatives and strategic investments as well as deleveraging

Increased maintenance capital expenditures in 2014-2015 but will revert to long-run average

Capital

Allocation Disciplined growth capex investment to strengthen EBITDA

Strategy inOpportunistic approach in evaluating new opportunities to augment existing segments with

targeted investments and strategic acquisitions

39

|

|

Return to Growth Strategy

Launched in 2014, the multi-faceted growth strategy has begun to gain traction.

In 2013, sold 24/7 and terminated loss contracts taking $18M out of revenue base

Continued progress executing our new growth strategy since 2014, resulting in 8% year-over-year growth

– Mid-point of 2016 guidance implies growth of 10%

Positive momentum and revenue growth demonstrated last five quarters

Growth despite pricing pressure and concessions of $15M and $8M in revenues in 2015 & 2016, respectively

Annual Revenue

Quarterly Revenue

Q/Q Growth

7%

10%

13%

13%

6%

$505—$535

$125

Guidance

$124

$124

$473

$121

$449

$119

$119

$436

$111

$110

$110

$109

FY13 FY14 FY15FY16EQ2Q2Q3Q3Q4Q4Q1Q1Q2Q2

14151415141515161516

40

|

|

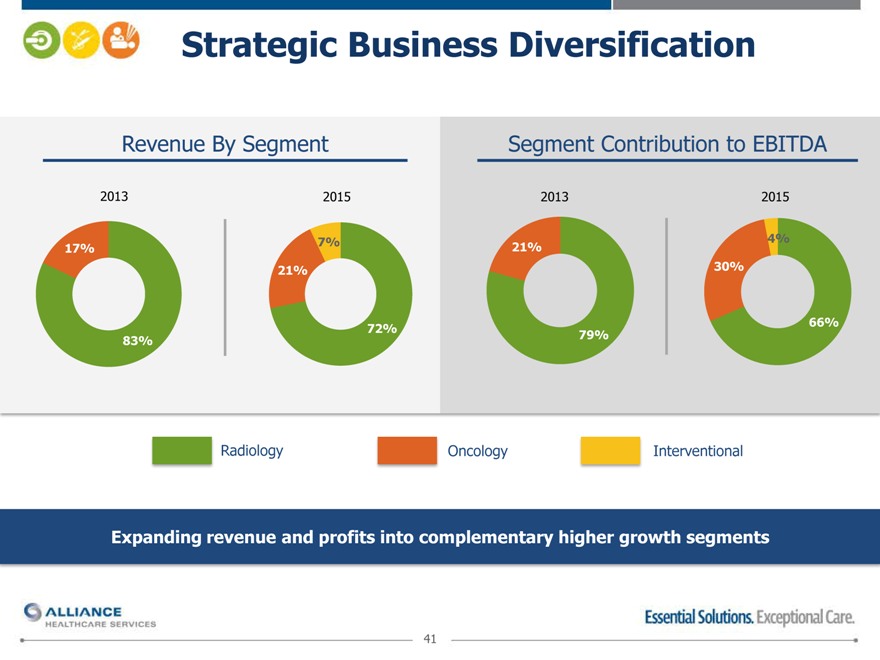

Strategic Business Diversification

Revenue By Segment Segment Contribution to EBITDA

2013 201520132015

17% 7%21%4%

21%30%

72%66%

83% 79%

RadiologyOncologyInterventional

Expanding revenue and profits into complementary higher growth segments

41

|

|

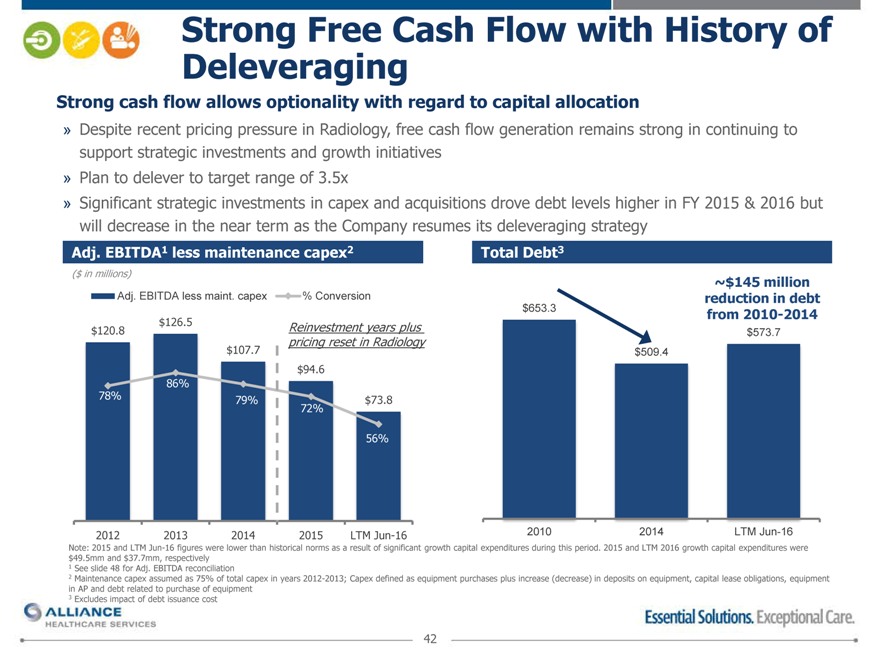

Strong Deleveraging Free Cash Flow with History of

Strong cash flow allows optionality with regard to capital allocation

Despite recent pricing pressure in Radiology, free cash flow generation remains strong in continuing to support strategic investments and growth initiatives

Plan to delever to target range of 3.5x

Significant strategic investments in capex and acquisitions drove debt levels higher in FY 2015 & 2016 but will decrease in the near term as the Company resumes its deleveraging strategy

2012

2013

2014

2015

LTM Jun-16

2010

2014

LTM Jun-16

Note: 2015 and LTM Jun-16 figures were lower than historical norms as a result of significant growth capital expenditures during this period. 2015 and LTM 2016 growth capital expenditures were

$49.5mm and $37.7mm, respectively

1 See slide 48 for Adj. EBITDA reconciliation

2 Maintenance capex assumed as 75% of total capex in years 2012-2013; Capex defined as equipment purchases plus increase (decrease) in deposits on equipment, capital lease obligations, equipment in AP and debt related to purchase of equipment

3 Excludes impact of debt issuance cost

42

|

|

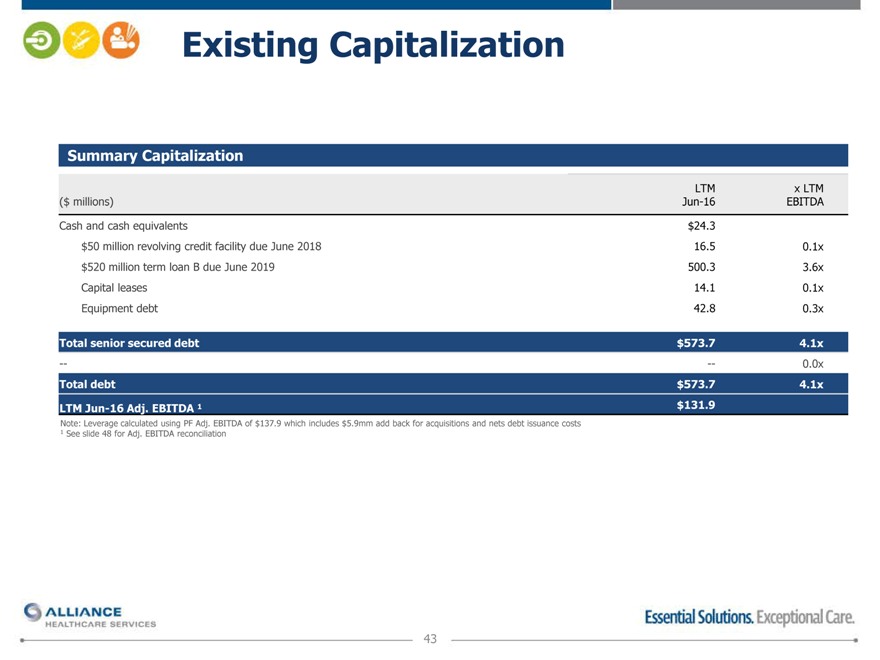

Existing Capitalization

Summary Capitalization

LTM x LTM

($ millions) Jun-16 EBITDA

Cash and cash equivalents $24.3

$50 million revolving credit facility due June 2018 16.5 0.1x

$520 million term loan B due June 2019 500.3 3.6x

Capital leases 14.1 0.1x

Equipment debt 42.8 0.3x

Total senior secured debt $573.7 4.1x

— — 0.0x

Total debt $573.7 4.1x

LTM Jun-16 Adj. EBITDA 1 $131.9

Note: Leverage calculated using PF Adj. EBITDA of $137.9 which includes $5.9mm add back for acquisitions and nets debt issuance costs

1 See slide 48 for Adj. EBITDA reconciliation

43

|

|

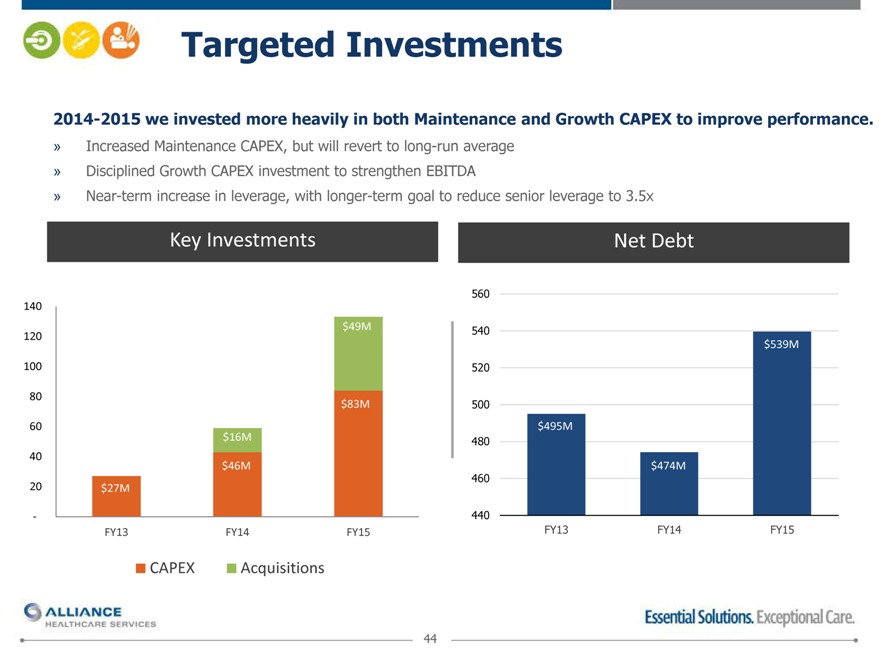

Targeted Investments

2014-2015 we invested more heavily in both Maintenance and Growth CAPEX to improve performance.

Increased Maintenance CAPEX, but will revert to long-run average

Disciplined Growth CAPEX investment to strengthen EBITDA

Near-term increase in leverage, with longer-term goal to reduce senior leverage to 3.5x

Key Investments

Net Debt

560

140

$49M540

120 $539M

100 520

80 $83M500

60 $495M

$16M480

40

$46M$474M

20 $27M 460

- 440

FY13 FY14FY15FY13FY14FY15

CAPEXAcquisitions

44

|

|

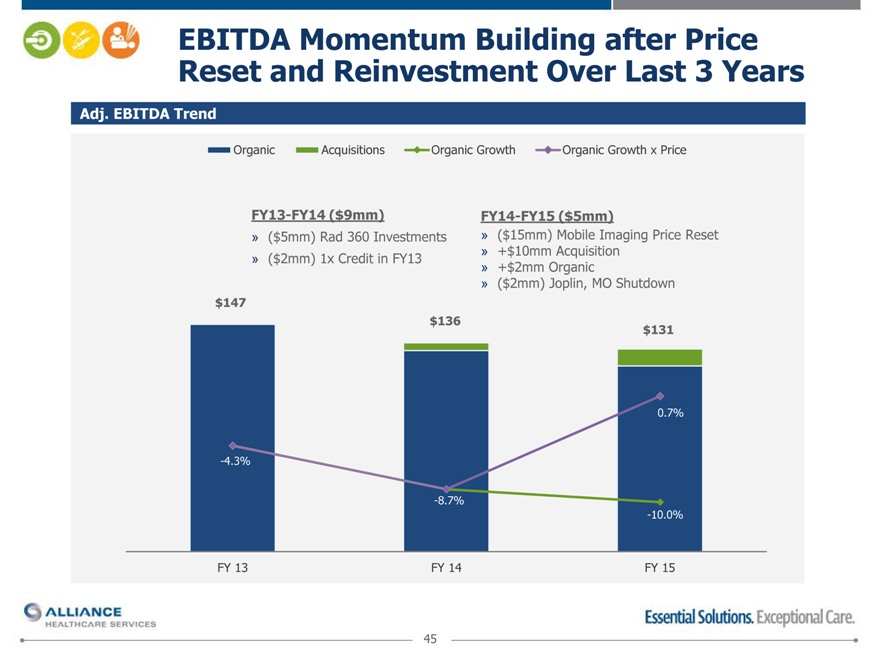

Reset EBITDA and Momentum Reinvestment Building Over after Last Price 3 Years

Adj. EBITDA Trend

Organic

Acquisitions

Organic Growth

Organic Growth x Price

FY13-FY14 ($9mm) FY14-FY15 ($5mm)

($5mm) Rad 360 Investments ($15mm) Mobile Imaging Price Reset

($2mm) 1x Credit in FY13 +$10mm Acquisition

+$2mm Organic

($2mm) Joplin, MO Shutdown

$147

$ 136$131

0.7%

-4.3%

-8.7%

-10.0%

FY 13 FY 14 FY 15

45

|

|

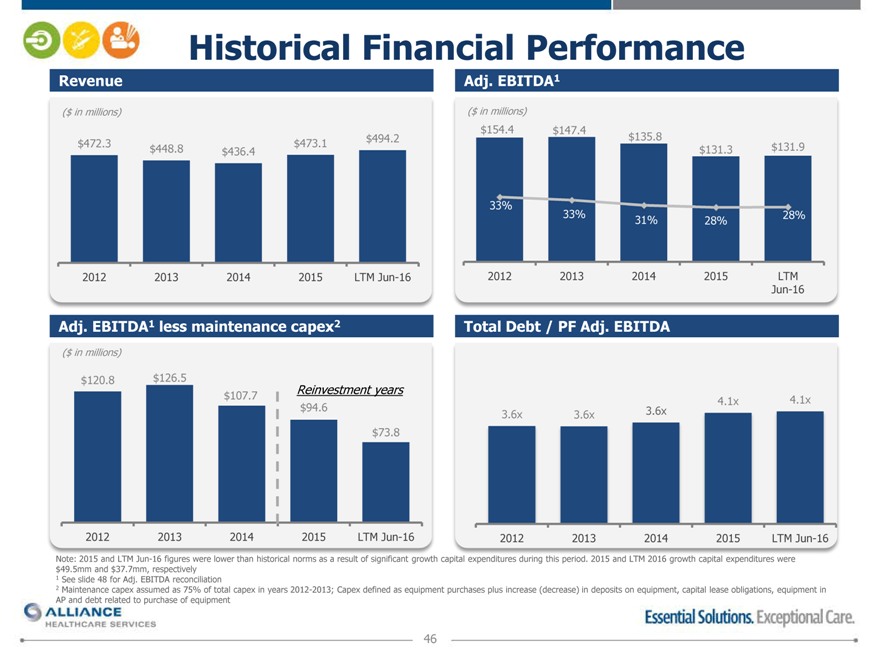

Historical Financial Performance

Revenue Adj. EBITDA1

($ in millions) ($ in millions)

$154.4$147.4

$494.2$135.8

$472.3 $448.8 $436.4$473.1$131.3$131.9

33%

33%31%28%28%

2012 2013 20142015LTM Jun-162012201320142015LTM

Jun-16

Adj. EBITDA1 less maintenance capex2 Total Debt / PF Adj. EBITDA

($ in millions)

$120.8 $126.5

Reinvestment years

$107.74.1x4.1x

$94.63.6x3.6x3.6x

$73.8

2012

2013

2014

2015

LTM Jun-16

2012

2013

2014

2015

LTM Jun-16

Note: 2015 and LTM Jun-16 figures were lower than historical norms as a result of significant growth capital expenditures during this period. 2015 and LTM 2016 growth capital expenditures were

$49.5mm and $37.7mm, respectively

1 See slide 48 for Adj. EBITDA reconciliation

2 Maintenance capex assumed as 75% of total capex in years 2012-2013; Capex defined as equipment purchases plus increase (decrease) in deposits on equipment, capital lease obligations, equipment in AP and debt related to purchase of equipment

46

|

|

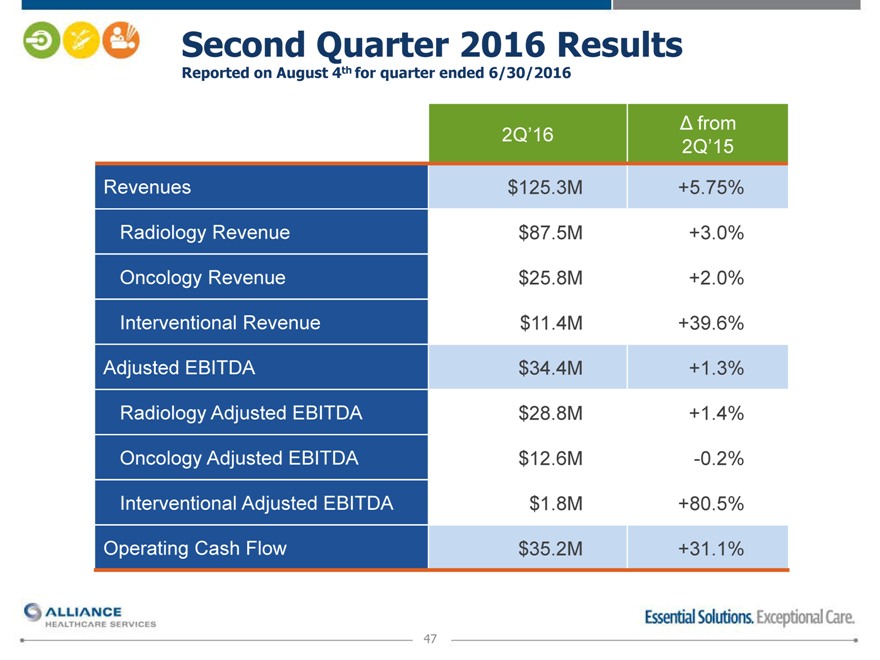

Second Quarter 2016 Results

Reported on August 4th for quarter ended 6/30/2016

? from

2Q’16 2Q’15

Revenues $125.3M +5.75%

Radiology Revenue $87.5M +3.0%

Oncology Revenue $25.8M +2.0%

Interventional Revenue $11.4M +39.6%

Adjusted EBITDA $34.4M +1.3%

Radiology Adjusted EBITDA $28.8M +1.4%

Oncology Adjusted EBITDA $12.6M -0.2%

Interventional Adjusted EBITDA $1.8M +80.5%

Operating Cash Flow $35.2M +31.1%

47

|

|

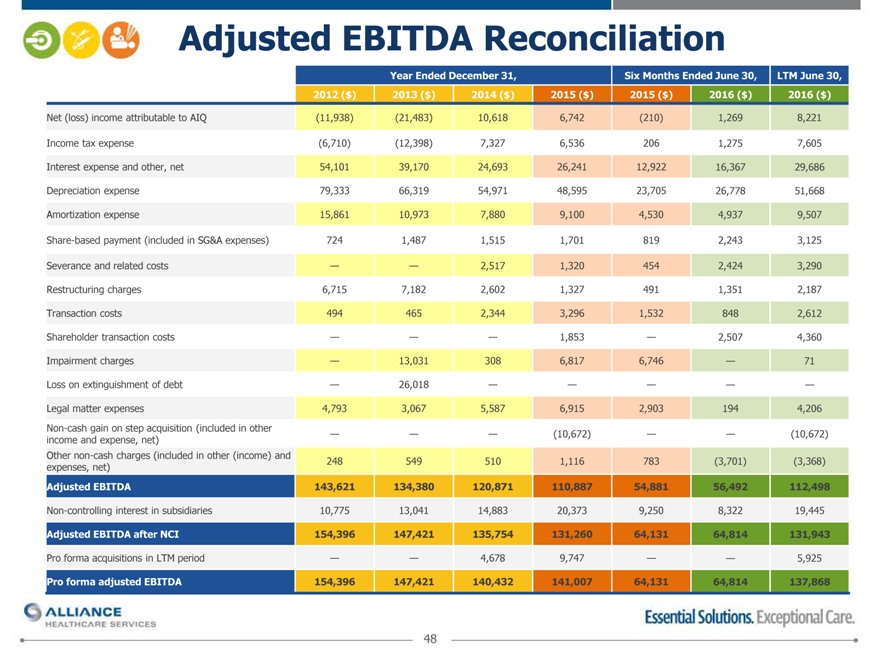

Adjusted EBITDA Reconciliation

Year Ended December 31,Six Months Ended June 30,LTM June 30,

2012 ($) 2013 ($)2014 ($)2015 ($)2015 ($)2016 ($)2016 ($)

Net (loss) income attributable to AIQ (11,938) (21,483)10,6186,742(210)1,2698,221

Income tax expense (6,710) (12,398)7,3276,5362061,2757,605

Interest expense and other, net 54,101 39,17024,69326,24112,92216,36729,686

Depreciation expense 79,333 66,31954,97148,59523,70526,77851,668

Amortization expense 15,861 10,9737,8809,1004,5304,9379,507

Share-based payment (included in SG&A expenses) 724 1,4871,5151,7018192,2433,125

Severance and related costs — —2,5171,3204542,4243,290

Restructuring charges 6,715 7,1822,6021,3274911,3512,187

Transaction costs 494 4652,3443,2961,5328482,612

Shareholder transaction costs — ——1,853—2,5074,360

Impairment charges — 13,0313086,8176,746—71

Loss on extinguishment of debt — 26,018—————

Legal matter expenses 4,793 3,0675,5876,9152,9031944,206

Non-cash gain on step acquisition (included in other

income and expense, net) — ——(10,672)——(10,672)

Other non-cash charges (included in other (income) and

expenses, net) 248 5495101,116783(3,701)(3,368)

Adjusted EBITDA 143,621 134,380120,871110,88754,88156,492112,498

Non-controlling interest in subsidiaries 10,775 13,04114,88320,3739,2508,32219,445

Adjusted EBITDA after NCI 154,396 147,421135,754131,26064,13164,814131,943

Pro forma acquisitions in LTM period — —4,6789,747——5,925

Pro forma adjusted EBITDA 154,396 147,421140,432141,00764,13164,814137,868

48

|

|

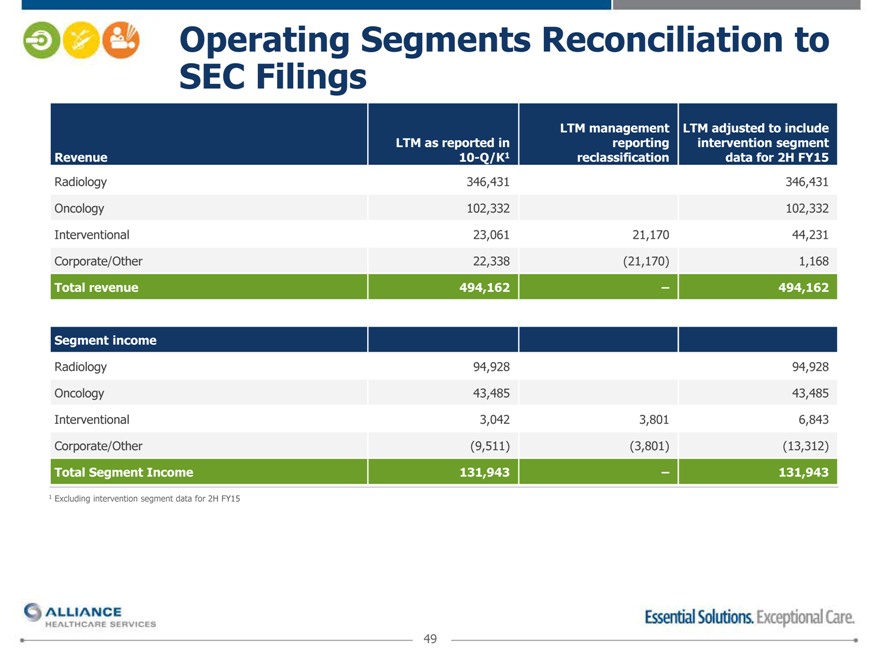

Operating SEC Filings Segments Reconciliation to

LTM managementLTM adjusted to include

LTM as reported in reportingintervention segment

Revenue 10-Q/K1 reclassificationdata for 2H FY15

Radiology 346,431 346,431

Oncology 102,332 102,332

Interventional 23,061 21,17044,231

Corporate/Other 22,338 (21,170)1,168

Total revenue 494,162 –494,162

Segment income

Radiology 94,928 94,928

Oncology 43,485 43,485

Interventional 3,042 3,8016,843

Corporate/Other (9,511) (3,801)(13,312)

Total Segment Income 131,943 –131,943

1 Excluding intervention segment data for 2H FY15

49

|

|

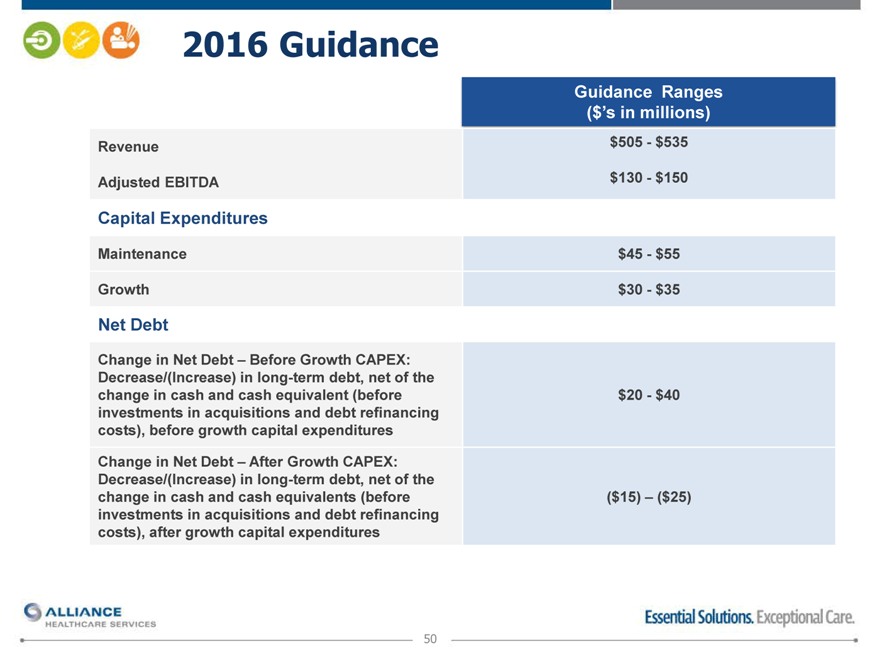

2016 Guidance

Guidance Ranges

($’s in millions)

Revenue $505—$535

Adjusted EBITDA $130—$150

Capital Expenditures

Maintenance $45—$55

Growth $30—$35

Net Debt

Change in Net Debt – Before Growth CAPEX:

Decrease/(Increase) in long-term debt, net of the

change in cash and cash equivalent (before $20—$40

investments in acquisitions and debt refinancing

costs), before growth capital expenditures

Change in Net Debt – After Growth CAPEX:

Decrease/(Increase) in long-term debt, net of the

change in cash and cash equivalents (before ($15) – ($25)

investments in acquisitions and debt refinancing

costs), after growth capital expenditures

50

|

|

investors@aiq-us.com