Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - INTERPUBLIC GROUP OF COMPANIES, INC. | ipgq32016earningsreleaseex.htm |

| 8-K - 8-K - INTERPUBLIC GROUP OF COMPANIES, INC. | ipgq32016earningsrelease8-k.htm |

THIRD QUARTER 2016

EARNINGS CONFERENCE CALL

October 21, 2016

Overview – Third Quarter 2016

Page 2 See reconciliation of organic revenue change on pages 18 and 19 and adjusted diluted EPS on page 22.

• Total revenue increased 3.0% in Q3 and 3.0% for the 9M YTD

Organic growth was 4.3% in Q3 and 4.8% for the 9M YTD

• Operating margin was 10.8% in Q3, an improvement of 50 bps

• Q3 diluted EPS was $0.32, and was $0.31 as adjusted for below-

the-line items, an increase of 15% from comparable Q3-15

• Repurchased 3.5 million shares in Q3, using $81 million

2016 2015

Revenue 1,922.2$ 1,865.5$

Salaries and Related Expenses 1,228.8 1,202.2

Office and General Expenses 486.2 471.4

Operating Income 207.2 191.9

Interest Expense (21.7) (21.3)

Interest Income 4.7 5.6

Other Income (Expense), net 6.1 (37.2)

Income Before Income Taxes 196.3 139.0

Provision for Income Taxes 63.8 61.1

Equity in Net Income of Unconsolidated Affiliates 0.2 0.1

Net Income 132.7 78.0

Net Income Attributable to Noncontrolling Interests (4.1) (3.1)

128.6$ 74.9$

Earnings per Share Available to IPG Common Stockholders:

Basic 0.32$ 0.18$

Diluted 0.32$ 0.18$

Weighted-Average Number of Common Shares Outstanding:

Basic 397.7 407.6

Diluted 407.9 415.5

Dividends Declared per Common Share 0.15$ 0.12$

Three Months Ended September 30,

Net Income Available to IPG Common Stockholders

Operating Performance

(Amounts in Millions, except per share amounts)

Page 3

2016 2015 Total Organic 2016 2015 Total Organic

IAN ,503.2$ ,484.1$ 1.3% 3.0% 4,453.3$ 4,351.3$ 2.3% 4.7%

CMG 419.0 3 1.4 9.9 9.4 1,128.8 1,066. 5.9 5.3

Nine Months Ended

Change

Three Months Ended

S ptember 30, September 30,

Change

$ % Change $ % Change

September 30, 2015 1,865.5$ 5,417.6$

Total change 56.7 3.0% 164.5 3.0%

Foreign currency (31.0) (1.7%) (115.9) (2.1%)

Net acquisitions/(divestitures) 8.2 0.4% 19.8 0.3%

Organic 79.5 4.3% 260.6 4.8%

September 30, 2016 1,922.2$ 5,582.1$

Three Months Ended Nine Months Ended

Revenue

($ in Millions)

Page 4

Integrated Agency Networks (“IAN”): McCann Worldgroup, FCB (Foote, Cone & Belding), MullenLowe

Group, IPG Mediabrands, our digital specialist agencies and our domestic integrated agencies

Constituency Management Group (“CMG”): Weber Shandwick, Golin, Jack Morton,

FutureBrand, Octagon and our other marketing service specialists

See reconciliation of segment organic revenue change on pages 18 and 19.

Total Organic Total Organic

United States 2.4% 1.8% 5.3% 4.8%

International 4.0% 8.1% (0.3%) 4.9%

United Kingdom 5.2% 16.4% 1.7% 7.1%

Continental Europe 3.7% 8.3% (1.4%) 3.2%

Asia Pacific 0.5% (1.4%) (2.9%) (0.8%)

Latin America 6.0% 17.8% (3.8%) 15.4%

All Other Markets 8.1% 5.6% 6.6% 6.7%

Worldwide 3.0% 4.3% 3.0% 4.8%

Three Months Ended

September 30, 2016

Nine Months Ended

September 30, 2016

Geographic Revenue Change

Page 5

“All Other Markets” includes Canada, Africa and the Middle East.

See reconciliation of organic revenue change on pages 18 and 19.

(0.9%)

0.9%

3.8% 3.7%

(10.8%)

7.0%

6.1%

0.7%

2.8%

5.5%

6.1%

(12.0%)

(10.0%)

(8.0%)

(6.0%)

(4.0%)

(2.0%)

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

Q4-05 Q4-06 Q4-07 Q4-08 Q4-09 Q4-10 Q4-11 Q4-12 Q4-13 Q4-14 Q4-15

Organic Revenue Growth

Page 6

Trailing Twelve Months

Q3-16

See reconciliation on page 20.

4.9%

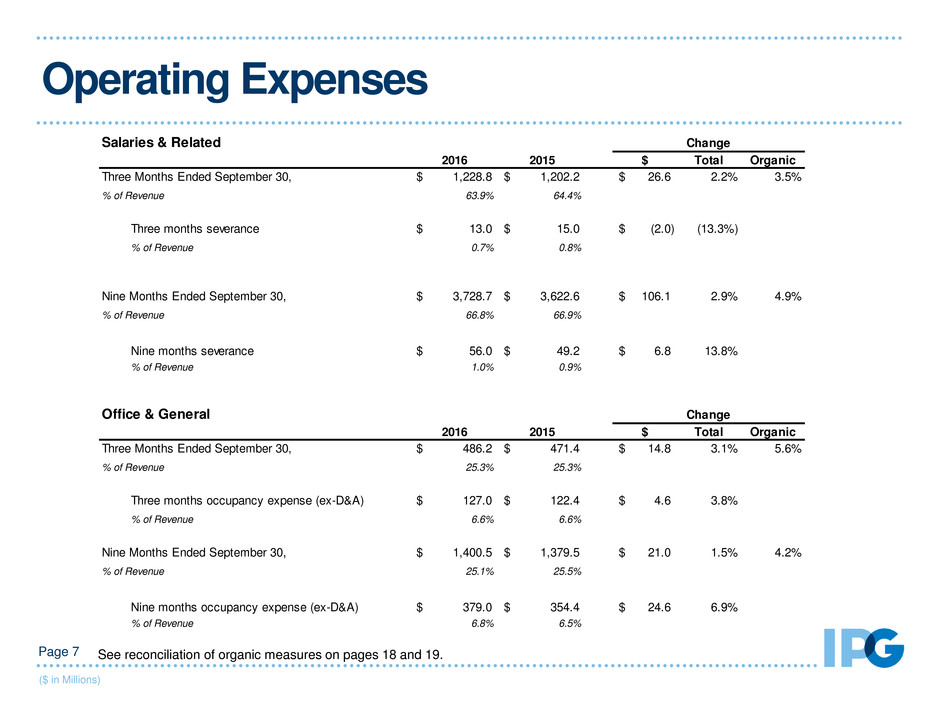

Salaries & Related

2016 2015 $ Total Organic

Three Months Ended September 30, 1,228.8$ 1,202.2$ 26.6$ 2.2% 3.5%

% of Revenue 63.9% 64.4%

Three months severance 13.0$ 15.0$ (2.0)$ (13.3%)

% of Revenue 0.7% 0.8%

Nine Months Ended September 30, 3,728.7$ 3,622.6$ 106.1$ 2.9% 4.9%

% of Revenue 66.8% 66.9%

Nine months severance 56.0$ 49.2$ 6.8$ 13.8%

% of Revenue 1.0% 0.9%

Office & General

2016 2015 $ Total Organic

Three Months Ended September 30, 486.2$ 471.4$ 14.8$ 3.1% 5.6%

% of Revenue 25.3% 25.3%

Three months occupancy expense (ex-D&A) 127.0$ 122.4$ 4.6$ 3.8%

% of Revenue 6.6% 6.6%

Nine Months Ended September 30, 1,400.5$ 1,379.5$ 21.0$ 1.5% 4.2%

% of Revenue 25.1% 25.5%

Nine months occupancy expense (ex-D&A) 379.0$ 354.4$ 24.6$ 6.9%

% of Revenue 6.8% 6.5%

Change

Change

Operating Expenses

($ in Millions)

Page 7 See reconciliation of organic measures on pages 18 and 19.

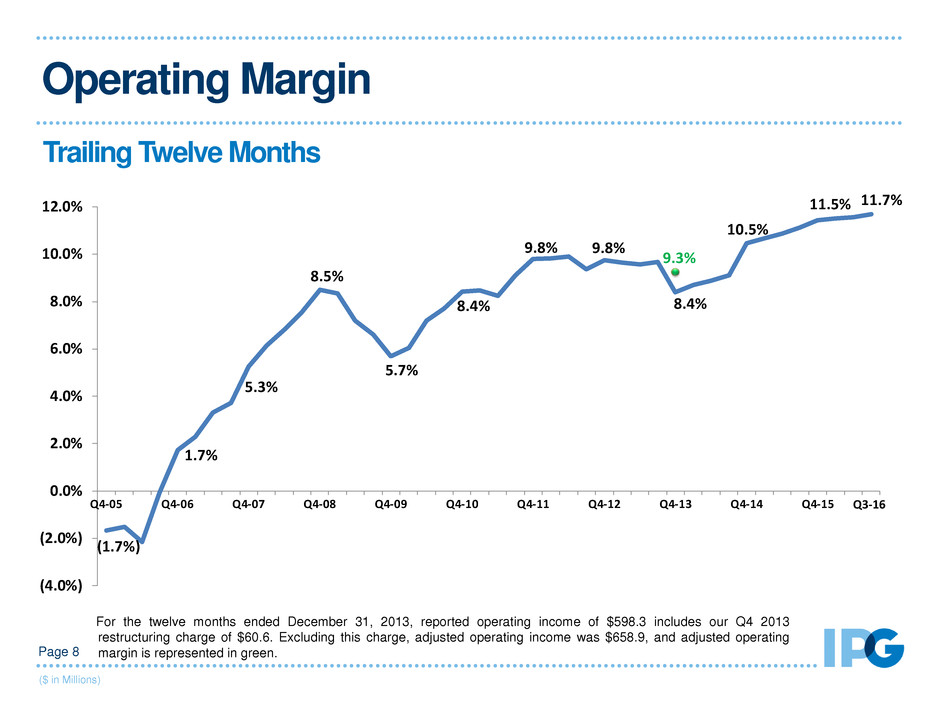

(1.7%)

1.7%

5.3%

8.5%

5.7%

8.4%

9.8% 9.8%

8.4%

10.5%

11.5% 11.7%

9.3%

(4.0%)

(2.0%)

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

Q4-05 Q4-06 Q4-07 Q4-08 Q4-09 Q4-10 Q4-11 Q4-12 Q4-13 Q4-14 Q4-15

Operating Margin

Page 8

Trailing Twelve Months

Q3-16

For the twelve months ended December 31, 2013, reported operating income of $598.3 includes our Q4 2013

restructuring charge of $60.6. Excluding this charge, adjusted operating income was $658.9, and adjusted operating

margin is represented in green.

($ in Millions)

As

Reported

Gain on Sale

of Business

Adoption of

ASU 2016-09

Adjusted

Results

Income Before Income Taxes 196.3$ 3.9$ 192.4$

Provision for Income Taxes 63.8 0.3$ 64.1

Effective Tax Rate 32.5% 33.3%

Diluted EPS Components:

Net Income Available to IPG Common Stockholders 128.6$ 3.9$ 0.3$ 124.4$

Weighted-Average Number of Common Shares Outstanding 407.9 1.6 406.3

Earnings Per Share Available to IPG Common Stockholders 0.32$ 0.01$ 0.00$ 0.31$

Three Months Ended September 30, 2016

($ in Millions)

Page 9

Adjusted Diluted Earnings Per Share

(1) During the three months ended September 30, 2016, we recorded a gain on the sale of a business in our international markets.

(2) In 2016 we early adopted Financial Accounting Standards Board Accounting Standards Update 2016-09.

See full reconciliation of adjusted diluted earnings per share on pages 22 and 23.

(1) (2)

September 30, December 31, September 30,

2016 2015 2015

CURRENT ASSETS:

Cash and cash equivalents 891.6$ 1,502.9$ 874.3$

Marketable securities 3.0 6.8 6.9

Accounts receivable, net 3,714.4 4,361.0 3,848.3

Expenditures billable to clients 1,843.7 1,594.4 1,590.2

Other current assets 280.5 228.0 349.1

Total current assets 6,733.2$ 7,693.1$ 6,668.8$

CURRENT LIABILITIES:

Accounts payable 6,025.9$ 6,672.0$ 5,753.4$

Accrued liabilities 629.0 760.3 688.9

Short-term borrowings 133.0 150.1 128.3

Current portion of long-term debt 24.5 1.9 2.0

Total current liabilities 6,812.4$ 7,584.3$ 6,572.6$

Balance Sheet – Current Portion

($ in Millions)

Page 10

2016 2015

NET INCOME 133$ 78$

OPERATING ACTIVITIES

Depreciation & amortization 61 56

Deferred taxes 6 (34)

Non-cash (gain) loss on sales of businesses (4) 38

Other non-cash items 7 8

Change in working capital, net 318 155

Change in other non-current assets & liabilities (1) (19)

Net cash provided by Operating Activities 520 282

INVESTING ACTIVITIES

Capital expenditures (51) (31)

Acquisitions, net of cash acquired (14) (6)

Other investing activities - (4)

Net cash used in Investing Activities (65) (41)

FINANCING ACTIVITIES

Net decrease in short-term bank borrowings (83) (26)

Repurchase of common stock (81) (70)

Common stock dividends (60) (48)

Acquisition-related payments (8) (4)

Distributions to noncontrolling interests (4) (5)

Exercise of stock options - 1

Other financing activities 2 -

Net cash used in Financing Activities (234) (152)

Currency Effect (2) (63)

Increase in Cash & S/T Marketable Securities 219$ 26$

Three Months Ended September 30,

Cash Flow

($ in Millions)

Page 11

$2,325

$2,102

$1,923

$1,719 $1,756

$1,644 $1,654

$1,722 $1,762 $1,741

$1,000

$1,500

$2,000

$2,500

$3,000

12/31/2007 12/31/2008 12/31/2009 12/31/2010 12/31/2011 12/31/2012 12/31/2013 12/31/2014 12/31/2015 9/30/2016

$2,431

Total Debt (1)

($ in Millions)

Page 12

(2)

(1) Includes current portion of long-term debt, short-term borrowings and long-term debt.

(2) Includes our November 2012 debt issuances of $800 aggregate principal amount of Senior Notes, which pre-funded

our plan to redeem a similar amount of debt in 2013.

Summary

Page 13

• Solid performance against FY-16 financial objectives

• Sustained traction from key strategic initiatives

Quality of our agency offerings, creative talent, embedded

digital, and “open architecture” solutions

Performance in high-growth disciplines

Effective expense management

• Focus is on continued growth and margin improvement

• Financial strength continues to be a source of value creation

Appendix

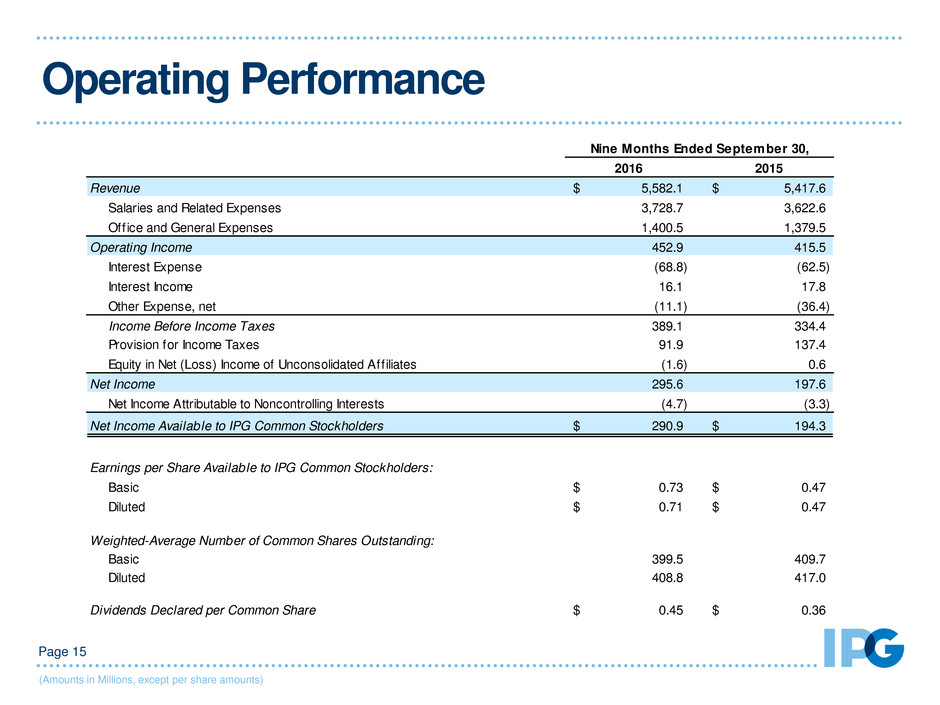

2016 2015

Revenue 5,582.1$ 5,417.6$

Salaries and Related Expenses 3,728.7 3,622.6

Office and General Expenses 1,400.5 1,379.5

Operating Income 452.9 415.5

Interest Expense (68.8) (62.5)

Interest Income 16.1 17.8

Other Expense, net (11.1) (36.4)

Income Before Income Taxes 389.1 334.4

Provision for Income Taxes 91.9 137.4

Equity in Net (Loss) Income of Unconsolidated Affiliates (1.6) 0.6

Net Income 295.6 197.6

Net Income Attributable to Noncontrolling Interests (4.7) (3.3)

290.9$ 194.3$

Earnings per Share Available to IPG Common Stockholders:

Basic 0.73$ 0.47$

Diluted 0.71$ 0.47$

Weighted-Average Number of Common Shares Outstanding:

Basic 399.5 409.7

Diluted 408.8 417.0

Dividends Declared per Common Share 0.45$ 0.36$

Net Income Available to IPG Common Stockholders

Nine Months Ended September 30,

Operating Performance

(Amounts in Millions, except per share amounts)

Page 15

2016 2015

NET INCOME 296$ 198$

OPERATING ACTIVITIES

Depreciation & amortization 181 170

Deferred taxes 2 (34)

Non-cash loss on sales of businesses 16 38

Other non-cash items 42 26

Change in working capital, net (500) (588)

Change in other non-current assets & liabilities (72) (48)

Net cash used in Operating Activities (35) (238)

INVESTING ACTIVITIES

Capital expenditures (114) (81)

Acquisitions, net of cash acquired (48) (6)

Other investing activities (10) (4)

Net cash used in Investing Activities (172) (91)

FINANCING ACTIVITIES

Repurchase of common stock (193) (172)

Common stock dividends (180) (147)

Acquisition-related payments (37) (32)

Net (decrease) increase in short-term bank borrowings (26) 29

Tax payments for employee shares withheld (23) (17)

Distributions to noncontrolling interests (11) (13)

Exercise of stock options 10 12

Excess tax benefit from share-based payment arrangements - 9

Other financing activities 1 2

Net cash used in Financing Activities (459) (329)

Currency Effect 51 (128)

Decrease in Cash & S/T Marketable Securities (615)$ (786)$

Nine Months Ended September 30,

Cash Flow

($ in Millions)

Page 16

(1)

(1) Excludes net purchases, sales and maturities of short-term marketable securities. See reconciliation on page 21.

(2) As part of the adoption of FASB ASU 2016-09, we have reclassified the tax payments for employee shares withheld balance into

Financing Activities in both periods presented. This amount was previously included in Change in working capital, net in Operating

Activities. Additionally, the excess tax benefit from share-based payment arrangements amount is now reflected within Net Income

for Q3 2016, as prospective adoption was required.

(2)

(2)

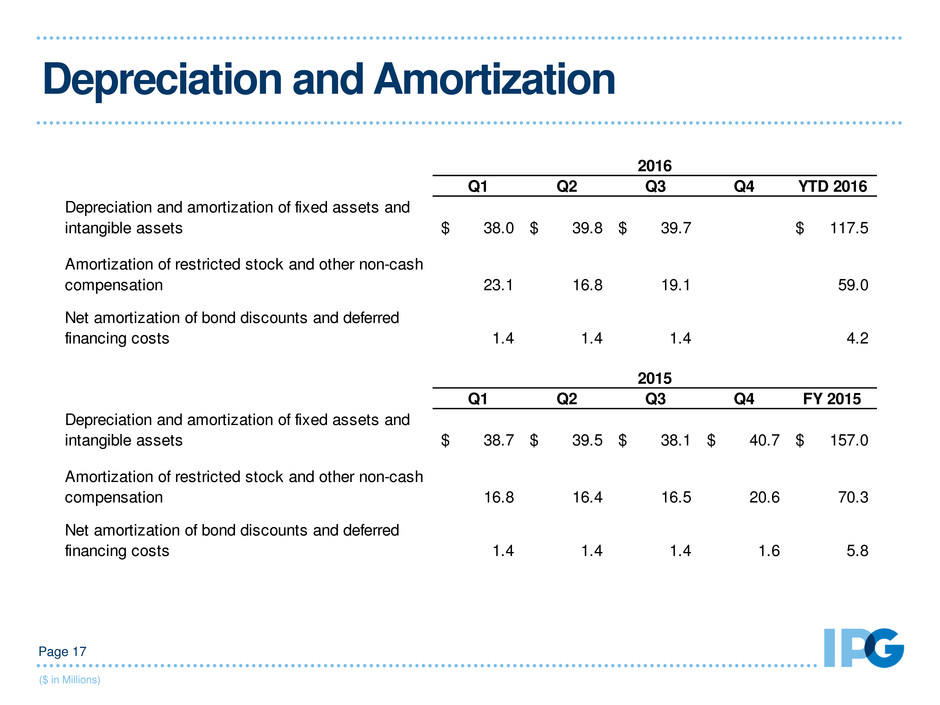

Q1 Q2 Q3 Q4 YTD 2016

Depreciation and amortization of fixed assets and

intangible assets 38.0$ 39.8$ 39.7$ 117.5$

Amortization of restricted stock and other non-cash

compensation 23.1 16.8 19.1 59.0

Net amortization of bond discounts and deferred

financing costs 1.4 1.4 1.4 4.2

Q1 Q2 Q3 Q4 FY 2015

Depreciation and amortization of fixed assets and

intangible assets 38.7$ 39.5$ 38.1$ 40.7$ 157.0$

Amortization of restricted stock and other non-cash

compensation 16.8 16.4 16.5 20.6 70.3

Net amortization of bond discounts and deferred

financing costs 1.4 1.4 1.4 1.6 5.8

2016

2015

Depreciation and Amortization

($ in Millions)

Page 17

Three Months

Ended

September 30, 2015

Foreign

Currency

Net Acquisitions /

(Divestitures) Organic

Three Months

Ended

September 30, 2016 Organic Total

Segment Revenue

IAN 1,484.1$ (23.5)$ (1.2)$ 43.8$ 1,503.2$ 3.0% 1.3%

CMG 381.4 (7.5) 9.4 35.7 419.0 9.4% 9.9%

Total 1,865.5$ (31.0)$ 8.2$ 79.5$ 1,922.2$ 4.3% 3.0%

Geographic

United States 1,138.5$ -$ 7.1$ 20.3$ 1,165.9$ 1.8% 2.4%

International 727.0 (31.0) 1.1 59.2 756.3 8.1% 4.0%

United Kingdom 165.4 (24.9) 6.4 27.1 174.0 16.4% 5.2%

Continental Europe 142.3 (0.1) (6.4) 11.8 147.6 8.3% 3.7%

Asia Pacific 216.9 2.9 1.1 (3.0) 217.9 (1.4%) 0.5%

Latin America 97.7 (7.1) (4.4) 17.4 103.6 17.8% 6.0%

All Other Markets 104.7 (1.8) 4.4 5.9 113.2 5.6% 8.1%

Worldwide 1,865.5$ (31.0)$ 8.2$ 79.5$ 1,922.2$ 4.3% 3.0%

Expenses

Salaries & Related 1,202.2$ (18.2)$ 2.6$ 42.2$ 1,228.8$ 3.5% 2.2%

Office & General 471.4 (7.8) (3.8) 26.4 486.2 5.6% 3.1%

Total 1,673.6$ (26.0)$ (1.2)$ 68.6$ 1,715.0$ 4.1% 2.5%

Components of Change Change

Reconciliation of Organic Measures

($ in Millions)

Page 18

Nine Months

Ended

September 30, 2015

Foreign

Currency

Net Acquisitions /

(Divestitures) Organic

Nine Months

Ended

September 30, 2016 Organic Total

Segment Revenue

IAN 4,351.3$ (96.5)$ (5.9)$ 204.4$ 4,453.3$ 4.7% 2.3%

CMG 1,066.3 (19.4) 25.7 56.2 1,128.8 5.3% 5.9%

Total 5,417.6$ (115.9)$ 19.8$ 260.6$ 5,582.1$ 4.8% 3.0%

Geographic

United States 3,254.4$ -$ 16.9$ 154.9$ 3,426.2$ 4.8% 5.3%

International 2,163.2 (115.9) 2.9 105.7 2,155.9 4.9% (0.3%)

United Kingdom 487.0 (43.1) 16.7 34.7 495.3 7.1% 1.7%

Continental Europe 474.8 (3.9) (18.1) 15.3 468.1 3.2% (1.4%)

Asia Pacific 636.4 (14.9) 1.5 (5.3) 617.7 (0.8%) (2.9%)

Latin America 265.7 (40.5) (10.3) 40.8 255.7 15.4% (3.8%)

All Other Markets 299.3 (13.5) 13.1 20.2 319.1 6.7% 6.6%

Worldwide 5,417.6$ (115.9)$ 19.8$ 260.6$ 5,582.1$ 4.8% 3.0%

Expenses

Salaries & Related 3,622.6$ (76.1)$ 5.4$ 176.8$ 3,728.7$ 4.9% 2.9%

Office & General 1,379.5 (33.0) (3.3) 57.3 1,400.5 4.2% 1.5%

Total 5,002.1$ (109.1)$ 2.1$ 234.1$ 5,129.2$ 4.7% 2.5%

Components of Change Change

Reconciliation of Organic Measures

($ in Millions)

Page 19

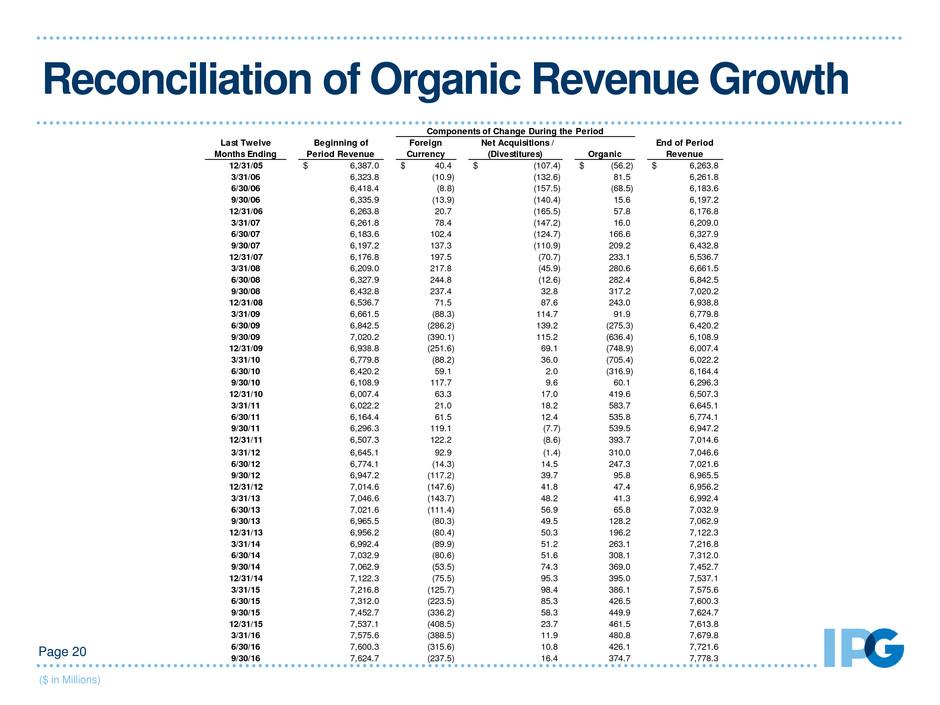

($ in Millions)

Page 20

Last Twelve

Months Ending

Beginning of

Period Revenue

Foreign

Currency

Net Acquisitions /

(Divestitures) Organic

End of Period

Revenue

12/31/05 6,387.0$ 40.4$ (107.4)$ (56.2)$ 6,263.8$

3/31/06 6,323.8 (10.9) (132.6) 81.5 6,261.8

6/30/06 6,418.4 (8.8) (157.5) (68.5) 6,183.6

9/30/06 6,335.9 (13.9) (140.4) 15.6 6,197.2

12/31/06 6,263.8 20.7 (165.5) 57.8 6,176.8

3/31/07 6,261.8 78.4 (147.2) 16.0 6,209.0

6/30/07 6,183.6 102.4 (124.7) 166.6 6,327.9

9/30/07 6,197.2 137.3 (110.9) 209.2 6,432.8

12/31/07 6,176.8 197.5 (70.7) 233.1 6,536.7

3/31/08 6,209.0 217.8 (45.9) 280.6 6,661.5

6/30/08 6,327.9 244.8 (12.6) 282.4 6,842.5

9/30/08 6,432.8 237.4 32.8 317.2 7,020.2

12/31/08 6,536.7 71.5 87.6 243.0 6,938.8

3/31/09 6,661.5 (88.3) 114.7 91.9 6,779.8

6/30/09 6,842.5 (286.2) 139.2 (275.3) 6,420.2

9/30/09 7,020.2 (390.1) 115.2 (636.4) 6,108.9

12/31/09 6,938.8 (251.6) 69.1 (748.9) 6,007.4

3/31/10 6,779.8 (88.2) 36.0 (705.4) 6,022.2

6/30/10 6,420.2 59.1 2.0 (316.9) 6,164.4

9/30/10 6,108.9 117.7 9.6 60.1 6,296.3

12/31/10 6,007.4 63.3 17.0 419.6 6,507.3

3/31/11 6,022.2 21.0 18.2 583.7 6,645.1

6/30/11 6,164.4 61.5 12.4 535.8 6,774.1

9/30/11 6,296.3 119.1 (7.7) 539.5 6,947.2

12/31/11 6,507.3 122.2 (8.6) 393.7 7,014.6

3/31/12 6,645.1 92.9 (1.4) 310.0 7,046.6

6/30/12 6,774.1 (14.3) 14.5 247.3 7,021.6

9/30/12 6,947.2 (117.2) 39.7 95.8 6,965.5

12/31/12 7,014.6 (147.6) 41.8 47.4 6,956.2

3/31/13 7,046.6 (143.7) 48.2 41.3 6,992.4

6/30/13 7,021.6 (111.4) 56.9 65.8 7,032.9

9/30/13 6,965.5 (80.3) 49.5 128.2 7,062.9

12/31/13 6,956.2 (80.4) 50.3 196.2 7,122.3

3/31/14 6,992.4 (89.9) 51.2 263.1 7,216.8

6/30/14 7,032.9 (80.6) 51.6 308.1 7,312.0

9/30/14 7,062.9 (53.5) 74.3 369.0 7,452.7

12/31/14 7,122.3 (75.5) 95.3 395.0 7,537.1

3/31/15 7,216.8 (125.7) 98.4 386.1 7,575.6

6/30/15 7,312.0 (223.5) 85.3 426.5 7,600.3

9/30/15 7,452.7 (336.2) 58.3 449.9 7,624.7

12/31/15 7,537.1 (408.5) 23.7 461.5 7,613.8

3/31/16 7,575.6 (388.5) 11.9 480.8 7,679.8

6/30/16 7,600.3 (315.6) 10.8 426.1 7,721.6

9/30/16 7,624.7 (237.5) 16.4 374.7 7,778.3

Components of Change During the Period

Reconciliation of Organic Revenue Growth

2016 2015

INVESTING ACTIVITIES

Net cash used in Investing Activities per presentation (172)$ (91)$

Net purchases, sales and maturities of short-term marketable securities, net 4 -

Net cash used in Investing Activities as reported (168)$ (91)$

Nine Months Ended September 30,

($ in Millions)

Page 21

Reconciliation of Investing Cash Flow

($ in Millions)

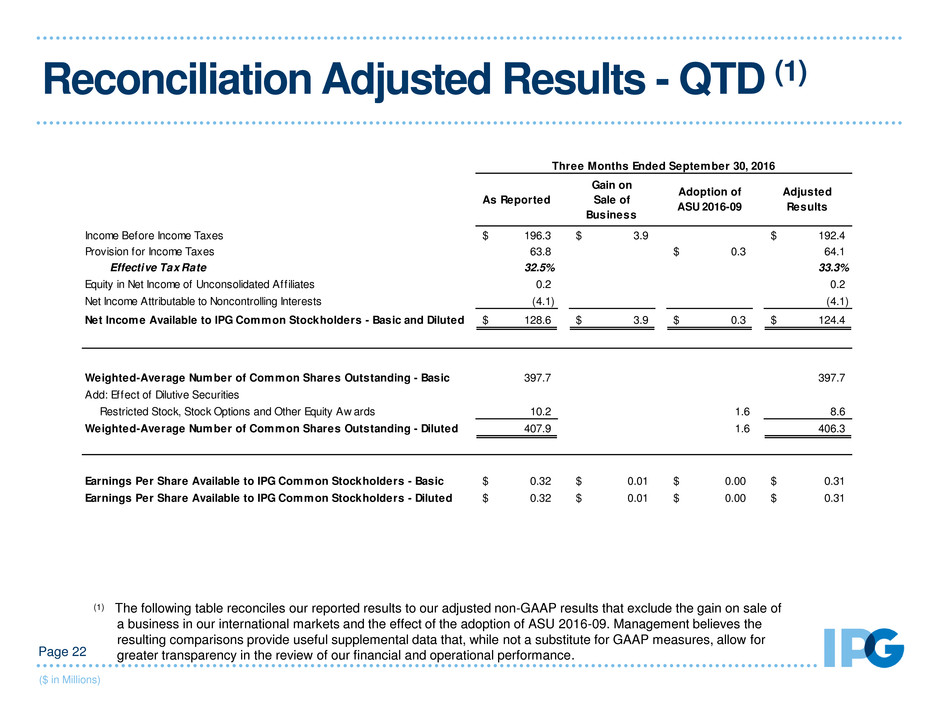

Page 22

Reconciliation Adjusted Results - QTD (1)

As Reported

Gain on

Sale of

Business

Adoption of

ASU 2016-09

Adjusted

Results

Income Before Income Taxes 196.3$ 3.9$ 192.4$

Provision for Income Taxes 63.8 0.3$ 64.1

Effective Tax Rate 32.5% 33.3%

Equity in Net Income of Unconsolidated Affiliates 0.2 0.2

Net Income Attributable to Noncontrolling Interests (4.1) (4.1)

128.6$ 3.9$ 0.3$ 124.4$

Weighted-Average Number of Common Shares Outstanding - Basic 397.7 397.7

Add: Effect of Dilutive Securities

Restricted Stock, Stock Options and Other Equity Aw ards 10.2 1.6 8.6

Weighted-Average Number of Common Shares Outstanding - Diluted 407.9 1.6 406.3

Earnings Per Share Available to IPG Common Stockholders - Basic 0.32$ 0.01$ 0.00$ 0.31$

Earnings Per Share Available to IPG Common Stockholders - Diluted 0.32$ 0.01$ 0.00$ 0.31$

Three Months Ended September 30, 2016

Net Income Available to IPG Common Stockholders - Basic and Diluted

(1) The following table reconciles our reported results to our adjusted non-GAAP results that exclude the gain on sale of

a business in our international markets and the effect of the adoption of ASU 2016-09. Management believes the

resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for

greater transparency in the review of our financial and operational performance.

($ in Millions)

Page 23

(1) The following table reconciles our reported results to our adjusted non-GAAP results that exclude the net losses on

sales of businesses in our international markets, valuation allowance reversals as a result of the disposition of

businesses in Continental Europe, the effect of the adoption of ASU 2016-09 and the release of reserves related to

the conclusion and settlement of a tax examination of previous tax years. Management believes the resulting

comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater

transparency in the review of our financial and operational performance.

As Reported

Net Losses on

Sales of

Businesses

Valuation

Allowance

Reversals

Adoption of

ASU 2016-09

Settlement

of Certain

Tax Positions

Adjusted

Results

Income Before Income Taxes 389.1$ (16.1)$ 405.2$

Provision for Income Taxes 91.9 0.4 12.2$ 10.5$ 23.4$ 138.4

Effective Tax Rate 23.6% 34.2%

Equity in Net Loss of Unconsolidated Affiliates (1.6) (1.6)

Net Income Attributable to Noncontrolling Interests (4.7) (4.7)

290.9$ (15.7)$ 12.2$ 10.5$ 23.4$ 260.5$

Weighted-Average Number of Common Shares Outstanding - Basic 399.5 399.5

Add: Effect of Dilutive Securities

Restricted Stock, Stock Options and Other Equity Aw ards 9.3 1.6 7.7

Weighted-Average Number of Common Shares Outstanding - Diluted 408.8 1.6 407.2

Earnings Per Share Available to IPG Common Stockholders - Basic 0.73$ (0.04)$ 0.03$ 0.03$ 0.06$ 0.65$

Earnings Per Share Available to IPG Common Stockholders - Diluted 0.71$ (0.04)$ 0.03$ 0.03$ 0.06$ 0.64$

Nine Months Ended September 30, 2016

Net Income Available to IPG Common Stockholders - Basic and Diluted

Reconciliation Adjusted Results - YTD (1)

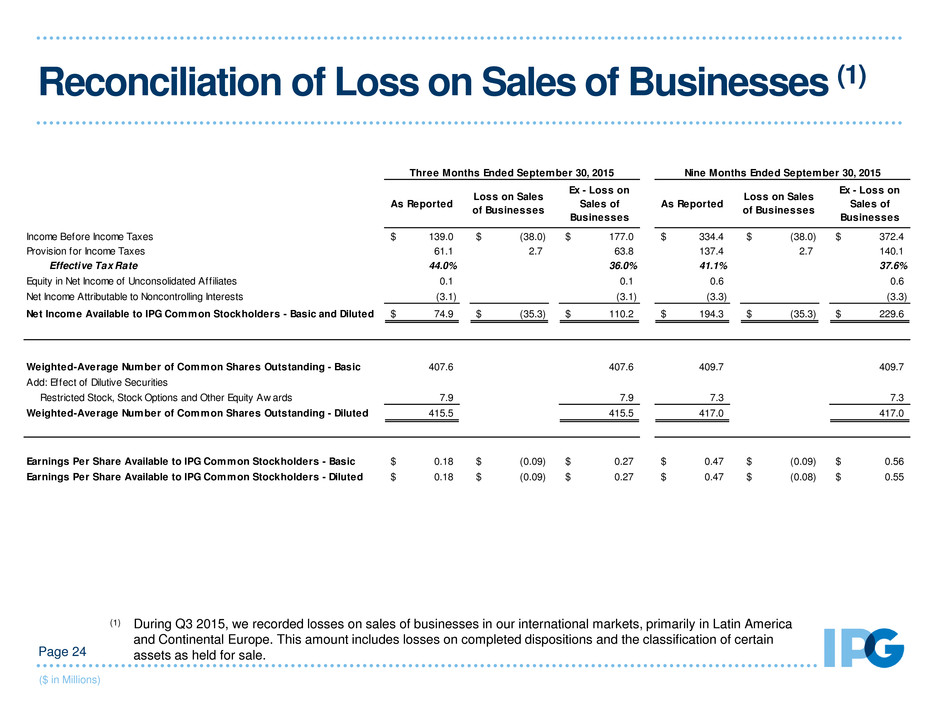

As Reported

Loss on Sales

of Businesses

Ex - Loss on

Sales of

Businesses

As Reported

Loss on Sales

of Businesses

Ex - Loss on

Sales of

Businesses

Income Before Income Taxes 139.0$ (38.0)$ 177.0$ 334.4$ (38.0)$ 372.4$

Provision for Income Taxes 61.1 2.7 63.8 137.4 2.7 140.1

Effective Tax Rate 44.0% 36.0% 41.1% 37.6%

Equity in Net Income of Unconsolidated Affiliates 0.1 0.1 0.6 0.6

Net Income Attributable to Noncontrolling Interests (3.1) (3.1) (3.3) (3.3)

74.9$ (35.3)$ 110.2$ 194.3$ (35.3)$ 229.6$

Weighted-Average Number of Common Shares Outstanding - Basic 407.6 407.6 409.7 409.7

Add: Effect of Dilutive Securities

Restricted Stock, Stock Options and Other Equity Aw ards 7.9 7.9 7.3 7.3

Weighted-Average Number of Common Shares Outstanding - Diluted 415.5 415.5 417.0 417.0

Earnings Per Share Available to IPG Common Stockholders - Basic 0.18$ (0.09)$ 0.27$ 0.47$ (0.09)$ 0.56$

Earnings Per Share Available to IPG Common Stockholders - Diluted 0.18$ (0.09)$ 0.27$ 0.47$ (0.08)$ 0.55$

Three Months Ended September 30, 2015 Nine Months Ended September 30, 2015

Net Income Available to IPG Common Stockholders - Basic and Diluted

(1) During Q3 2015, we recorded losses on sales of businesses in our international markets, primarily in Latin America

and Continental Europe. This amount includes losses on completed dispositions and the classification of certain

assets as held for sale.

($ in Millions)

Page 24

Reconciliation of Loss on Sales of Businesses (1)

Metrics Update

Metrics Update

Page 26

SALARIES & RELATED Trailing Twelve Months

(% of revenue) Base, Benefits & Tax

Incentive Expense

Severance Expense

Temporary Help

OFFICE & GENERAL Trailing Twelve Months

(% of revenue) Professional Fees

Occupancy Expense (ex-D&A)

T&E, Office Supplies & Telecom

All Other O&G

FINANCIAL Available Liquidity

$1.0 Billion 5-Year Credit Facility Covenants

Category Metric

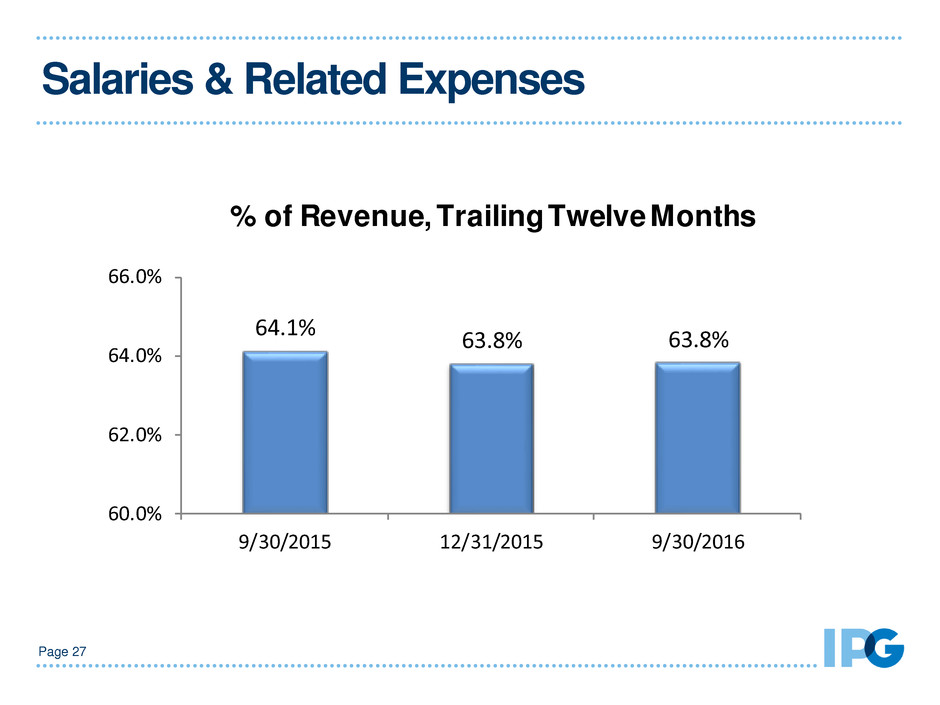

64.1%

63.8% 63.8%

60.0%

62.0%

64.0%

66.0%

9/30/2015 12/31/2015 9/30/2016

% of Revenue, Trailing Twelve Months

Salaries & Related Expenses

Page 27

0.7%

0.8%

1.0%

0.9%

0.0%

0.5%

1.0%

1.5%

Severance Expense

Three Months Nine Months

3.9% 3.7% 3.9% 3.8%

0.0%

2.0%

4.0%

6.0%

Temporary Help

Three Months Nine Months

3.7% 3.9% 3.8% 3.8%

0.0%

2.0%

4.0%

6.0%

Incentive Expense

Nine MonthsThree Months

53.6% 53.3%

55.6% 55.5%

45.0%

50.0%

55.0%

60.0%

Base, Benefits & Tax

Three Months Nine Months

Salaries & Related Expenses (% of Revenue)

Page 28

Three and Nine Months Ended September 30

“All Other Salaries & Related,” not shown, was 2.0% and 2.7% for the three months ended September 30, 2016 and 2015,

respectively, and 2.5% and 2.9% for the nine months ended September 30, 2016 and 2015, respectively.

2016 2015

24.8% 24.7% 24.5%

21.0%

23.0%

25.0%

27.0%

9/30/2015 12/31/2015 9/30/2016

% of Revenue, Trailing Twelve Months

Office & General Expenses

Page 29

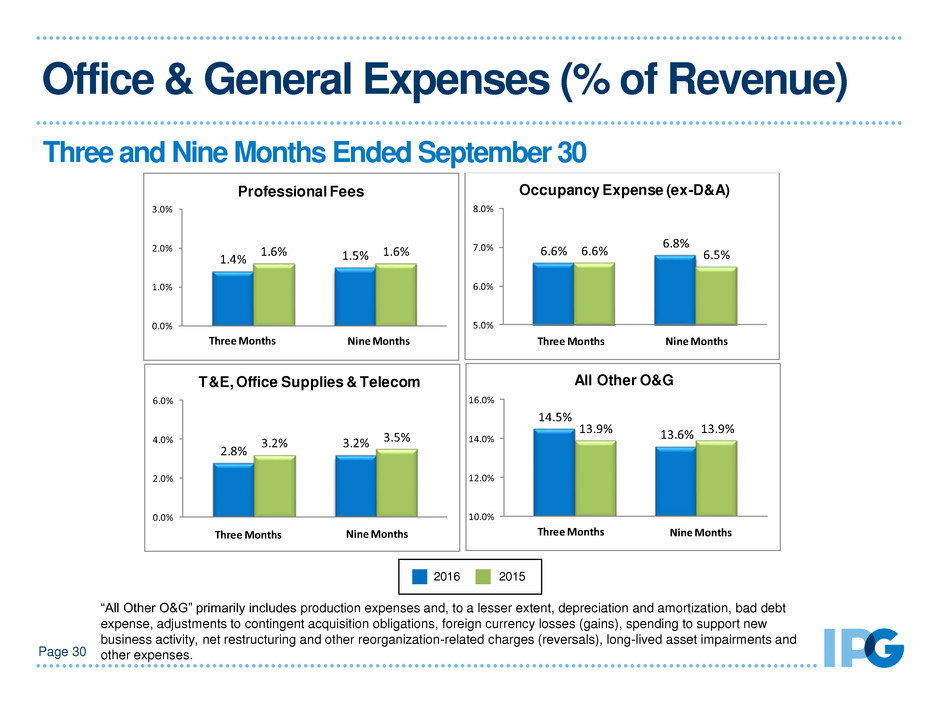

Office & General Expenses (% of Revenue)

Page 30

Three and Nine Months Ended September 30

“All Other O&G” primarily includes production expenses and, to a lesser extent, depreciation and amortization, bad debt

expense, adjustments to contingent acquisition obligations, foreign currency losses (gains), spending to support new

business activity, net restructuring and other reorganization-related charges (reversals), long-lived asset impairments and

other expenses.

1.4%

1.6% 1.5% 1.6%

0.0%

1.0%

2.0%

3.0%

Professional Fees

Three Months Nine Months

6.6% 6.6%

6.8%

6.5%

5.0%

6.0%

7.0%

8.0%

Occupancy Expense (ex-D&A)

Three Months Nine Months

14.5%

13.9% 13.6% 13.9%

10.0%

12.0%

14.0%

16.0%

All Other O&G

Three Months Nine Months

2.8%

3.2% 3.2% 3.5%

0.0%

2.0%

4.0%

6.0%

T&E, Office Supplies & Telecom

Three Months Nine Months

2016 2015

$881

$1,510

$680 $675

$895

$984

$996

$996 $995

$995

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

9/30/2015 12/31/2015 3/31/2016 6/30/2016 9/30/2016

Cash, Cash Equivalents and Short-Term Marketable Securities Available Committed Credit Facility

Available Liquidity

($ in Millions)

Page 31

Cash, Cash Equivalents and Short-Term Marketable Securities

+ Available Committed Credit Facility

Last Twelve Months

Ending September 30, 2016

I. Interest Coverage Ratio (not less than): 5.00x

Actual Interest Coverage Ratio: 18.19x

II. Leverage Ratio (not greater than): 3.50x

Actual Leverage Ratio: 1.52x

Interest Coverage Ratio - Interest Expense Reconciliation

Last Twelve Months

Ending September 30, 2016

Interest Expense: $92.1

- Interest income 21.1

- Other 7.9

Net interest expense : $63.1

EBITDA Reconciliation

Last Twelve Months

Ending September 30, 2016

Operating Income: $909.3

+ Depreciation and amortization 237.8

+ Other non-cash charges 0.5

EBITDA : $1,147.6

Covenants

$1.0 Billion 5-Year Credit F cility Covenants

($ in Millions)

Page 32 (1) Calculated as defined in the Credit Agreement.

(1)

(1)

Cautionary Statement

Page 33

This investor presentation contains forward-looking statements. Statements in this investor presentation that are

not historical facts, including statements about management’s beliefs and expectations, constitute forward-looking

statements. These statements are based on current plans, estimates and projections, and are subject to change

based on a number of factors, including those outlined in our most recent Annual Report on Form 10-K under Item

1A, Risk Factors. Forward-looking statements speak only as of the date they are made, and we undertake no

obligation to update publicly any of them in light of new information or future events.

Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause

actual results to differ materially from those contained in any forward-looking statement. Such factors include, but

are not limited to, the following:

➔ potential effects of a challenging economy, for example, on the demand for our advertising and

marketing services, on our clients’ financial condition and on our business or financial condition;

➔ our ability to attract new clients and retain existing clients;

➔ our ability to retain and attract key employees;

➔ risks associated with assumptions we make in connection with our critical accounting estimates,

including changes in assumptions associated with any effects of a weakened economy;

➔ potential adverse effects if we are required to recognize impairment charges or other adverse

accounting-related developments;

➔ risks associated with the effects of global, national and regional economic and political conditions,

including counterparty risks and fluctuations in economic growth rates, interest rates and currency

exchange rates; and

➔ developments from changes in the regulatory and legal environment for advertising and marketing

and communications services companies around the world.

Investors should carefully consider these factors and the additional risk factors outlined in more detail in our most

recent Annual Report on Form 10-K under Item 1A, Risk Factors.