Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - BANCORPSOUTH INC | d274235dex991.htm |

| 8-K - 8-K - BANCORPSOUTH INC | d274235d8k.htm |

BANCORPSOUTH, INC. Financial Information As of and for the Three Months Ended September 30, 2016 Exhibit 99.2

Forward Looking Information Certain statements contained in this this presentation and the accompanying slides may not be based upon historical facts and are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may be identified by their reference to a future period or periods or by the use of forward-looking terminology such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “foresee,” “hope,” “intend,” “may,” “might,” “plan,” “will,” or “would” or future or conditional verb tenses and variations or negatives of such terms. These forward-looking statements include, without limitation, those relating to the terms, timing and closings of the proposed mergers with Ouachita Bancshares Corp. and Central Community Corporation, the Company’s ability to operate its regulatory compliance programs consistent with federal, state ,and local laws, including its Bank Secrecy Act (“BSA”) and anti-money laundering (“AML”) compliance program and its fair lending compliance program, the Company’s compliance with the consent order it entered into with the Consumer Financial Protection Bureau (the “CFPB”) and the United States Department of Justice (“DOJ”) related to the Company’s fair lending practices (the “Consent Order”), the acceptance by customers of Ouachita Bancshares Corp. and Central Community Corporation of the Company’s products and services if the proposed mergers close, the outcome of any instituted, pending or threatened material litigation, amortization expense for intangible assets, goodwill impairments, loan impairment, utilization of appraisals and inspections for real estate loans, maturity, renewal or extension of construction, acquisition and development loans, net interest revenue, fair value determinations, the amount of the Company’s non-performing loans and leases, credit quality, credit losses, liquidity, off-balance sheet commitments and arrangements, valuation of mortgage servicing rights, allowance and provision for credit losses, early identification and resolution of credit issues, utilization of non-GAAP financial measures, the ability of the Company to collect all amounts due according to the contractual terms of loan agreements, the Company’s reserve for losses from representation and warranty obligations, the Company’s foreclosure process related to mortgage loans, the resolution of non-performing loans that are collaterally dependent, real estate values, fully-indexed interest rates, interest rate risk, interest rate sensitivity, calculation of economic value of equity, impaired loan charge-offs, diversification of the Company’s revenue stream, liquidity needs and strategies, sources of funding, net interest margin, declaration and payment of dividends, cost saving initiatives, improvement in the Company’s efficiencies, operating expense trends, future acquisitions and consideration to be used therefor and the impact of certain claims and ongoing, pending or threatened litigation, administrative and investigatory matters. The Company cautions readers not to place undue reliance on the forward-looking statements contained in this this presentation and the accompanying slides, in that actual results could differ materially from those indicated in such forward-looking statements as a result of a variety of factors. These factors may include, but are not limited to, the Company’s ability to operate its regulatory compliance programs consistent with federal, state, and local laws, including its BSA/AML compliance program and its fair lending compliance program, the Company’s ability to successfully implement and comply with the Consent Order, the ability of the Company, Ouachita Bancshares Corp. and Central Community Corporation to obtain regulatory approval of and close the proposed mergers, the willingness of Ouachita Bancshares Corp. and Central Community Corporation to proceed with the proposed mergers, the potential impact upon the Company of the delay in the closings of these proposed mergers, the impact of any ongoing, pending or threatened litigation, administrative and investigatory matters involving the Company, conditions in the financial markets and economic conditions generally, the adequacy of the Company’s provision and allowance for credit losses to cover actual credit losses, the credit risk associated with real estate construction, acquisition and development loans, limitations on the Company’s ability to declare and pay dividends, the availability of capital on favorable terms if and when needed, liquidity risk, governmental regulation, including the Dodd-Frank Act, and supervision of the Company’s operations, the short-term and long-term impact of changes to banking capital standards on the Company’s regulatory capital and liquidity, the impact of regulations on service charges on the Company’s core deposit accounts, the susceptibility of the Company’s business to local economic and environmental conditions, the soundness of other financial institutions, changes in interest rates, the impact of monetary policies and economic factors on the Company’s ability to attract deposits or make loans, volatility in capital and credit markets, reputational risk, the impact of the loss of any key Company personnel, the impact of hurricanes or other adverse weather events, any requirement that the Company write down goodwill or other intangible assets, diversification in the types of financial services the Company offers, the Company’s ability to adapt its products and services to evolving industry standards and consumer preferences, competition with other financial services companies, risks in connection with completed or potential acquisitions, the Company’s growth strategy, interruptions or breaches in the Company’s information system security, the failure of certain third-party vendors to perform, unfavorable ratings by rating agencies, dilution caused by the Company’s issuance of any additional shares of its common stock to raise capital or acquire other banks, bank holding companies, financial holding companies and insurance agencies, other factors generally understood to affect the assets, business, cash flows, financial condition, liquidity, prospects and/or results of operations of financial services companies and other factors detailed from time to time in the Company’s press and news releases, this presentation and the accompanying slides, reports and other filings with the SEC. Forward-looking statements speak only as of the date that they were made, and, except as required by law, the Company does not undertake any obligation to update or revise forward-looking statements to reflect events or circumstances that occur after the date of this this presentation and the accompanying slides.

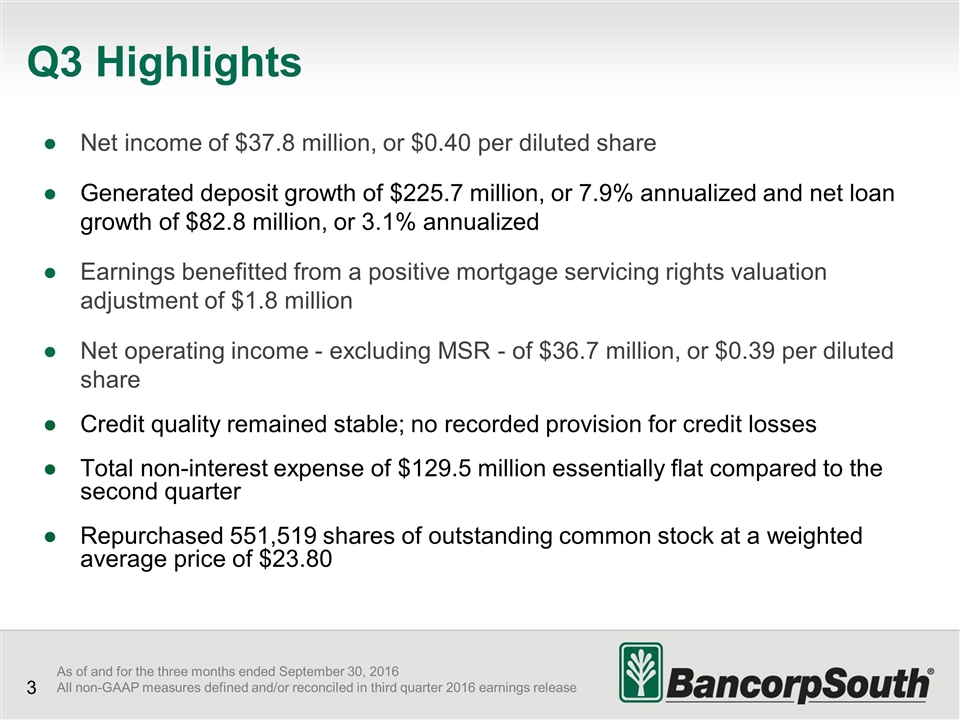

Q3 Highlights Net income of $37.8 million, or $0.40 per diluted share Generated deposit growth of $225.7 million, or 7.9% annualized and net loan growth of $82.8 million, or 3.1% annualized Earnings benefitted from a positive mortgage servicing rights valuation adjustment of $1.8 million Net operating income - excluding MSR - of $36.7 million, or $0.39 per diluted share Credit quality remained stable; no recorded provision for credit losses Total non-interest expense of $129.5 million essentially flat compared to the second quarter Repurchased 551,519 shares of outstanding common stock at a weighted average price of $23.80 As of and for the three months ended September 30, 2016 All non-GAAP measures defined and/or reconciled in third quarter 2016 earnings release

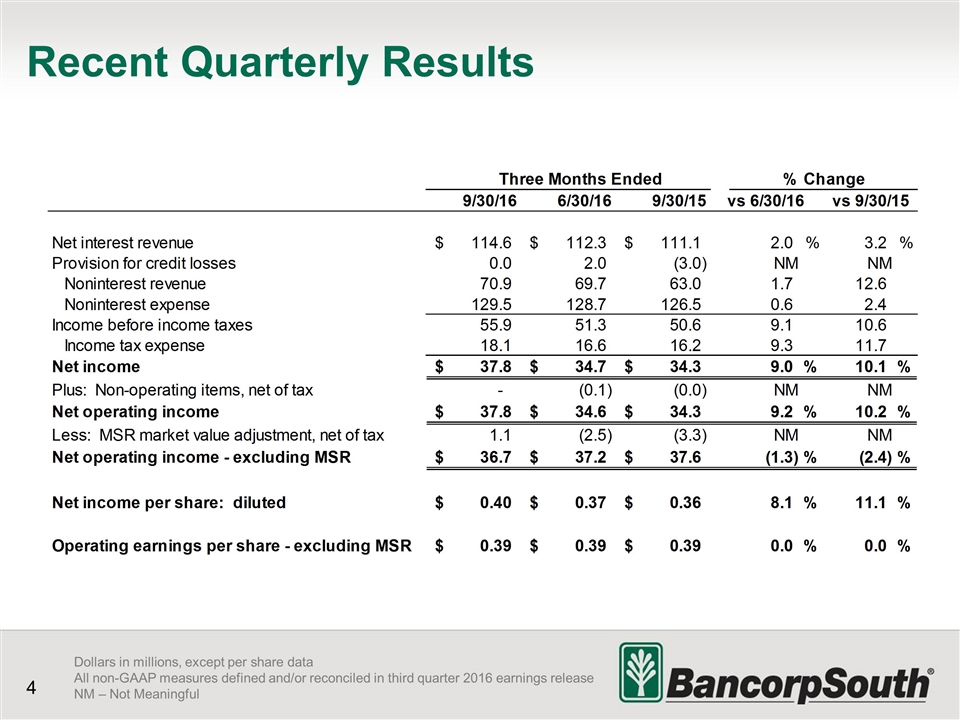

Recent Quarterly Results Dollars in millions, except per share data All non-GAAP measures defined and/or reconciled in third quarter 2016 earnings release NM – Not Meaningful

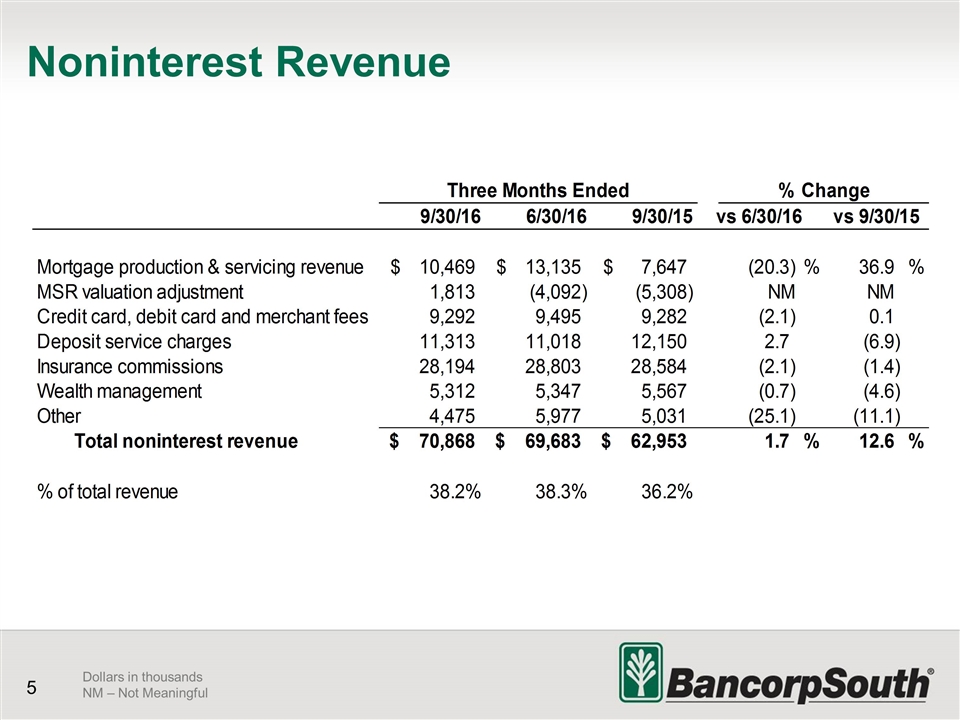

Noninterest Revenue Dollars in thousands NM – Not Meaningful

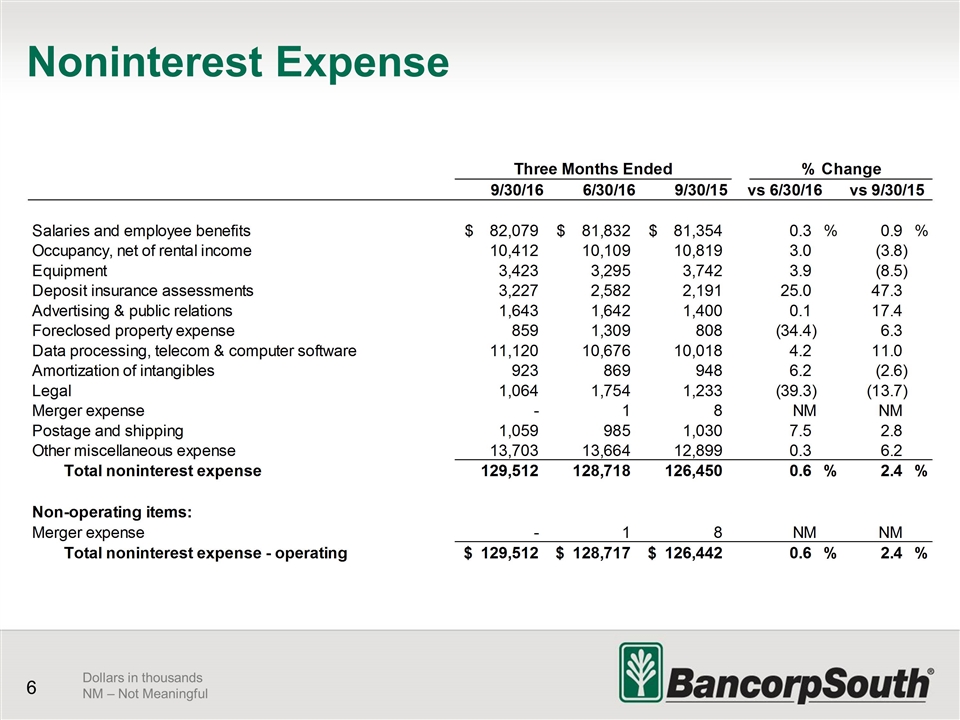

Dollars in thousands NM – Not Meaningful Noninterest Expense

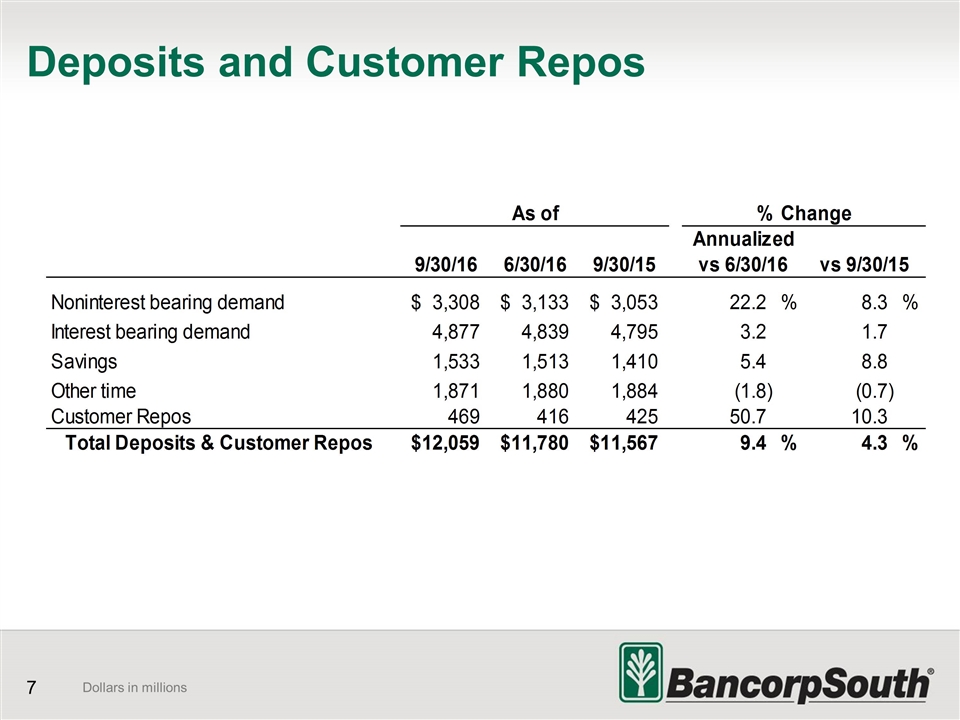

Dollars in millions Deposits and Customer Repos

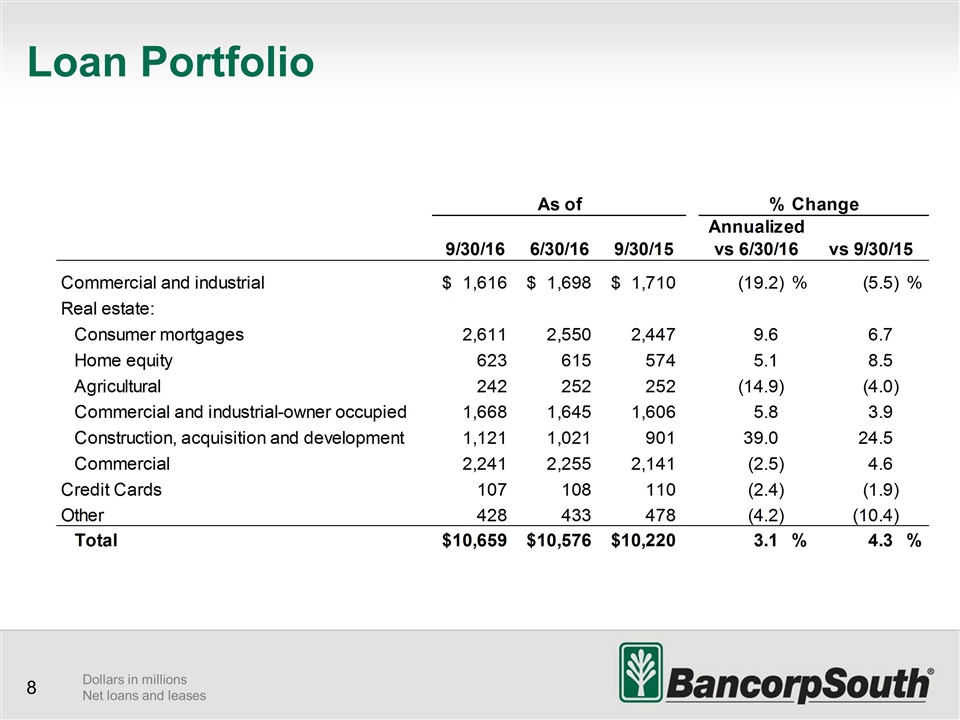

Dollars in millions Net loans and leases Loan Portfolio

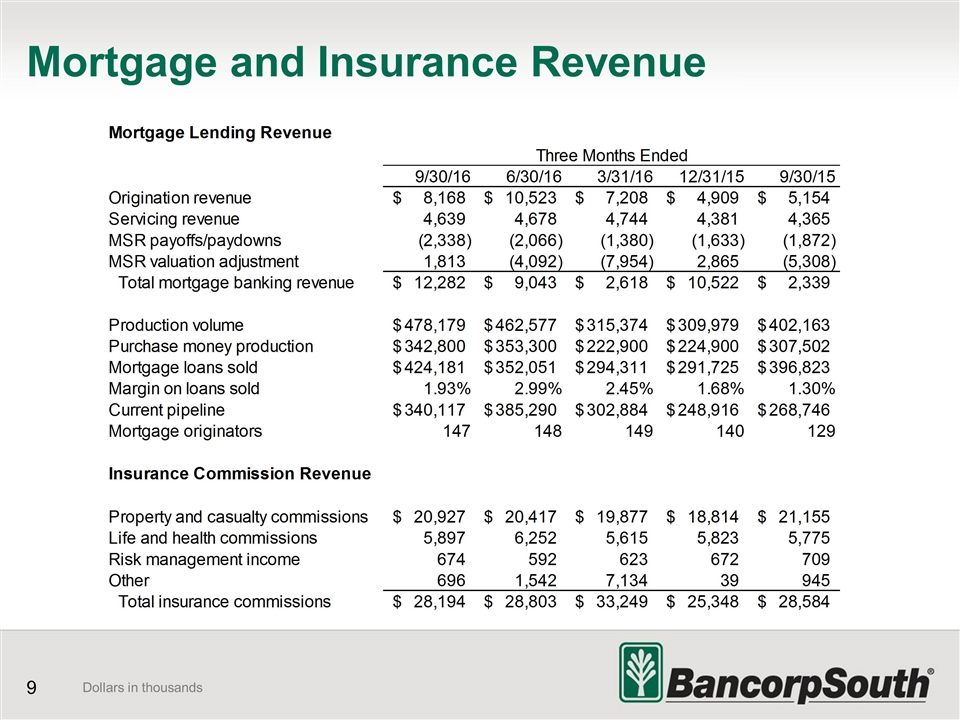

Dollars in thousands Mortgage and Insurance Revenue

As of and for the three months ended September 30, 2016 Credit Quality Highlights No recorded provision for credit losses for the quarter, compared with provision of $2.0 million for the second quarter of 2016 and negative provision of $3.0 million for the third quarter of 2015 Net charge-offs were $1.0 million for the third quarter compared with net charge-offs of $1.6 million for the second quarter of 2016 and net charge-offs of $2.3 million for the third quarter of 2015 Non-performing loans (“NPLs”) increased $10.7 million and non-performing assets (“NPAs”) increased $7.4 million during the third quarter Other real estate owned decreased $3.3 million Near-term delinquencies increased to $46.7 million

Highlights Continued net loan and deposit growth Stable credit quality Noninterest expense continues to hold in a steady range Repurchased 551,519 shares of common stock Current Focus Q & A Summary Continue to grow – loans, deposits, and fee revenue sources Challenge expenses and continue to improve efficiency Efficiently manage capital