Attached files

| file | filename |

|---|---|

| EX-99.4 - EXHIBIT 99.4 - Celanese Corp | q320168-kex994.htm |

| 8-K - 8-K - Celanese Corp | q320168-kdocslidesscripts.htm |

© Celanese Celanese Corporation 1

Celanese Q3 2016 Earnings

Monday, October 17, 2016

Conference Call / Webcast

Tuesday, October 18, 2016 10:00 a.m. Eastern Time

Mark Rohr, Chairman and Chief Executive Officer

Chris Jensen, SVP Finance and Chief Financial Officer

Scott Sutton, EVP and President, Materials Solutions

Exhibit 99.3

© Celanese Celanese Corporation 2

Forward-Looking Statements

This presentation contains "forward-looking statements," which include information concerning the company's plans, objectives, goals, strategies, future revenues or

performance, capital expenditures, financing needs and other information that is not historical information. All forward-looking statements are based upon current

expectations and beliefs and various assumptions, including the announced stock purchase transaction. There can be no assurance that the company will realize these

expectations or that these beliefs will prove correct. There are a number of risks and uncertainties that could cause actual results to differ materially from the results

expressed or implied in the forward-looking statements contained in this presentation, including with respect to the acquisition. These risks and uncertainties include, among

other things: changes in general economic, business, political and regulatory conditions in the countries or regions in which we operate; the length and depth of product and

industry business cycles, particularly in the automotive, electrical, textiles, electronics and construction industries; changes in the price and availability of raw materials,

particularly changes in the demand for, supply of, and market prices of ethylene, methanol, natural gas, wood pulp and fuel oil and the prices for electricity and other energy

sources; the ability to pass increases in raw material prices on to customers or otherwise improve margins through price increases; the ability to maintain plant utilization

rates and to implement planned capacity additions and expansions; the ability to reduce or maintain their current levels of production costs and to improve productivity by

implementing technological improvements to existing plants; increased price competition and the introduction of competing products by other companies; market

acceptance of our technology; the ability to obtain governmental approvals and to construct facilities on terms and schedules acceptable to the company; changes in the

degree of intellectual property and other legal protection afforded to our products or technologies, or the theft of such intellectual property; compliance and other costs and

potential disruption or interruption of production or operations due to accidents, interruptions in sources of raw materials, cyber security incidents, terrorism or political unrest

or other unforeseen events or delays in construction or operation of facilities, including as a result of geopolitical conditions, the occurrence of acts of war or terrorist

incidents or as a result of weather or natural disasters; potential liability for remedial actions and increased costs under existing or future environmental regulations,

including those relating to climate change; potential liability resulting from pending or future litigation, or from changes in the laws, regulations or policies of governments or

other governmental activities in the countries in which we operate; changes in currency exchange rates and interest rates; our level of indebtedness, which could diminish

our ability to raise additional capital to fund operations or limit our ability to react to changes in the economy or the chemicals industry; and various other factors discussed

from time to time in the company's filings with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which it is made, and

the company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which it is made or to reflect the

occurrence of anticipated or unanticipated events or circumstances.

Results Unaudited

The results in this document, together with the adjustments made to present the results on a comparable basis, have not been audited and are based on internal financial

data furnished to management. Quarterly results should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full

fiscal year.

Presentation

This document presents the Company's business segments in two subtotals, reflecting our two cores, the Acetyl Chain and Materials Solutions, based on similarities among

customers, business models and technical processes. As described in the Company's annual report on Form 10-K and quarterly reports on Form 10-Q, the Acetyl Chain

includes the Company's Acetyl Intermediates segment and the Industrial Specialties segment. Materials Solutions includes the Company's Advanced Engineered Materials

segment and the Consumer Specialties segment. For comparative purposes, the historical financial information included herein has been presented to reflect the Acetyl

Chain and Materials Solutions subtotals. There has been no change to the composition of the Company's business segments.

Non-GAAP Financial Measures

This presentation, and statements made in connection with this presentation, refer to non-GAAP financial measures. For more information on the non-GAAP financial

measures used by the Company, including the most directly comparable GAAP financial measure for each non-GAAP financial measures used, including definitions and

reconciliations of the differences between such non-GAAP financial measures and the comparable GAAP financial measures, please refer to the Non-US GAAP Financial

Measures and Supplemental Information document available on our website, www.celanese.com, under Investor Relations/Financial Information/Non-GAAP Financial

Measures.

Important Information

© Celanese Celanese Corporation 3

• Signed a definitive agreement to acquire 100% of the shares of Forli, Italy

based SO.F.TER. Group, one of the world's largest independent

thermoplastic compounders

• Issued €750 million of 1.125% Senior Notes due 2023 and used €367 million

of the proceeds to repay short term revolver borrowings

• Began production at the new vinyl acetate ethylene (VAE) unit in Singapore

• Showcasing the Art of Material Selection at K 2016 and highlighting polymers

that support:

◦ Consumer goods and electronics manufacturers as they design and

produce effective, functional and attractive products

◦ Manufacturers of medical devices, from surgical tools to orthopedic

implants, to improve product design, safety and effectiveness

◦ Original equipment manufacturers (OEMs) to secure a competitive edge

with more attractive, lightweight, better-designed vehicles

Recent Highlights

© Celanese Celanese Corporation 4

Differentiated

model enables

Step 1:

April 2015

Differentiated Model

Implementation

Step 2:

Organic

Platform

Extensions

Step 3:

Organic

Platform

Expansion

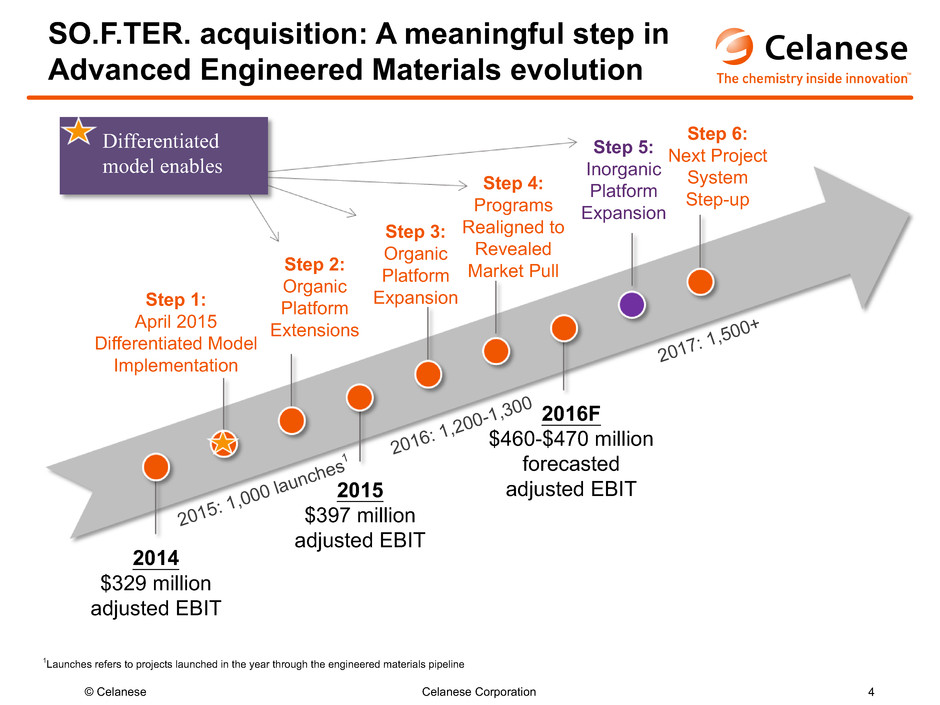

SO.F.TER. acquisition: A meaningful step in

Advanced Engineered Materials evolution

Step 4:

Programs

Realigned to

Revealed

Market Pull

Step 5:

Inorganic

Platform

Expansion

Step 6:

Next Project

System

Step-up

2014

$329 million

adjusted EBIT

2015

$397 million

adjusted EBIT

2016F

$460-$470 million

forecasted

adjusted EBIT

2015: 1,000 launche

s1

2016: 1,200-1,30

0

2017: 1,500

+

1Launches refers to projects launched in the year through the engineered materials pipeline

© Celanese Celanese Corporation 5

SO.F.TER. acquisition: New compounds

strengthen Celanese’s portfolio

© Celanese Celanese Corporation 6

SO.F.TER. acquisition: Global footprint

Worldwide Presence

• 4 plants in Europe

• 4 plants in Americas

• Sales in 60 countries

Overall Capacity

• 55 production lines

• 200 kT/year

• 550 Employees

Product Range

• 9 platforms

• 6000 SKUs

© Celanese Celanese Corporation 7

Opportunity Pipeline Examples

Multi-Purpose CookwareUnder-Water Pool Lighting

• Industry is switching to LEDs, which require heat

dissipation but metal heat sinks get corroded

• CoolPoly® polymer solutions provide both heat

transfer and corrosion resistance to extend the

life span of under-water lights

• Additional opportunities in submersible and

marine applications

• Cookware in commercial foodservice endure a

wide range of extreme temperatures, acidic

foods, harsh detergents and multiple wash cycles

• Our polymers replace multiple different cookware

parts with a single container from freezer to table

• Low-wear technology and easy to mold polymers

broaden design options

© Celanese Celanese Corporation 8

Net sales (in millions)

Factors Affecting Net Sales

$1,500

$1,000

$500

$0

30%

20%

10%

0%

Q3 2015 Q2 2016 Q3 2016

21.6% 23.1%

24.1%

$1,413 $1,351 $1,323

Q3 Performance

• Adjusted earnings per share of $1.67, a third quarter record

• Adjusted EBIT of $319 million and adjusted EBIT margin of 24.1%

• Operating cash flow of $304 million

• Free cash flow of $237 million, a third quarter record

*QoQ represents Q3 2016 as compared to Q2 2016; YoY represents Q3 2016 compared to Q3 2015.

GAAP

Diluted EPS

Adjusted

EPS

Q3 2016 $1.83 $1.67

Q2 2016 $1.50 $1.59

Q3 2015 $1.07 $1.50

Total segment income margin

QoQ* YoY*

3%

0%

-3%

-6%

-9%

-12%

Volume Price CurrencyOther Total

Celanese Corporation Q3 2016 Highlights

© Celanese Celanese Corporation 9

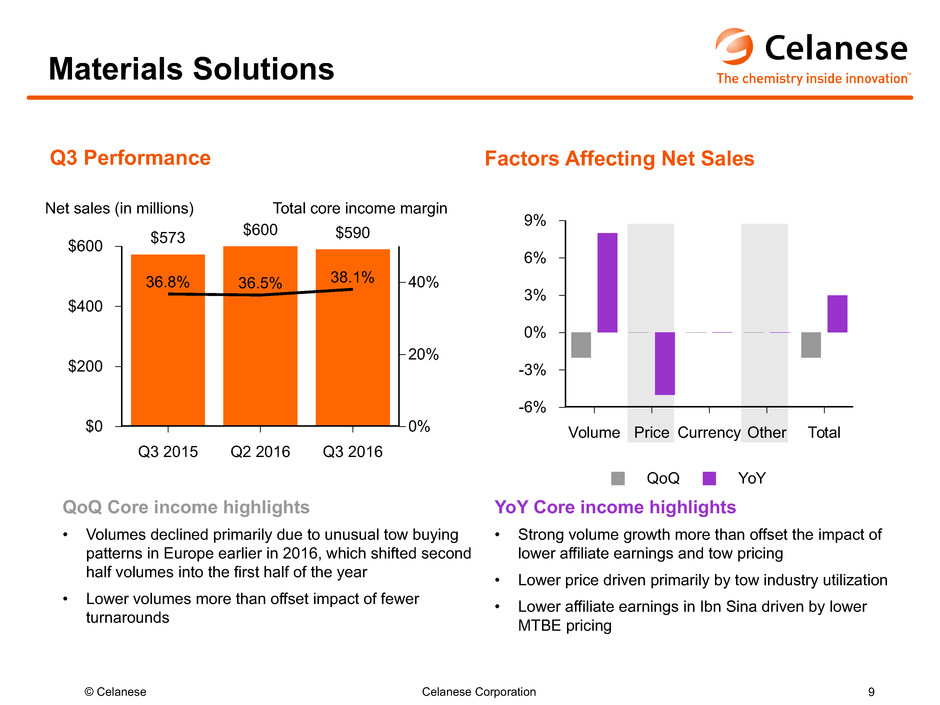

Net sales (in millions)

Q3 Performance Factors Affecting Net Sales

$600

$400

$200

$0

40%

20%

0%

Q3 2015 Q2 2016 Q3 2016

36.8% 36.5% 38.1%

$573 $600 $590

Total core income margin

YoY Core income highlights

• Strong volume growth more than offset the impact of

lower affiliate earnings and tow pricing

• Lower price driven primarily by tow industry utilization

• Lower affiliate earnings in Ibn Sina driven by lower

MTBE pricing

QoQ Core income highlights

• Volumes declined primarily due to unusual tow buying

patterns in Europe earlier in 2016, which shifted second

half volumes into the first half of the year

• Lower volumes more than offset impact of fewer

turnarounds

Materials Solutions

QoQ YoY

9%

6%

3%

0%

-3%

-6%

Volume Price Currency Other Total

© Celanese Celanese Corporation 10

Q3 Performance Factors Affecting Net Sales

YoY Core income highlights

• Lower acetic acid and derivatives price principally

driven by China and lower methanol prices, which

more than offset the benefits of productivity initiatives

QoQ Core income highlights

• Lower volume, primarily in Industrial Specialties,

driven by overcapacity in Asia

• Core income impacted by higher energy costs

Net sales (in millions) Total core income margin

$900

$600

$300

$0

30%

20%

10%

0%

Q3 2015 Q2 2016 Q3 2016

12.8% 14.2% 14.3%

$872

$780 $763

QoQ YoY

5%

0%

-5%

-10%

-15%

Volume Price Currency Other Total

Acetyl Chain

© Celanese Celanese Corporation 11

Q3 2016

• Operating cash flow of $304 million

• Free cash flow $237 million; expect our free

cash flow in 2016 to exceed $850 million; on

track to achieving our goal of generating

$2.5 billion in FCF for the period 2016

through 2018

• Net capital expenditures were $58 million;

expect 2016 to be at the lower end of

$250 million to $300 million range

Strong cash generation; tracking to record year of free cash flow

Free Cash Flow

(in millions)

Cash flow from operations

Free cash flow (FCF)

$400

$300

$200

$100

$0

Q3 2015 Q2 2016 Q3 2016

$173

$349

$304

$101

$285

$237

Cash Flow

© Celanese Celanese Corporation 12

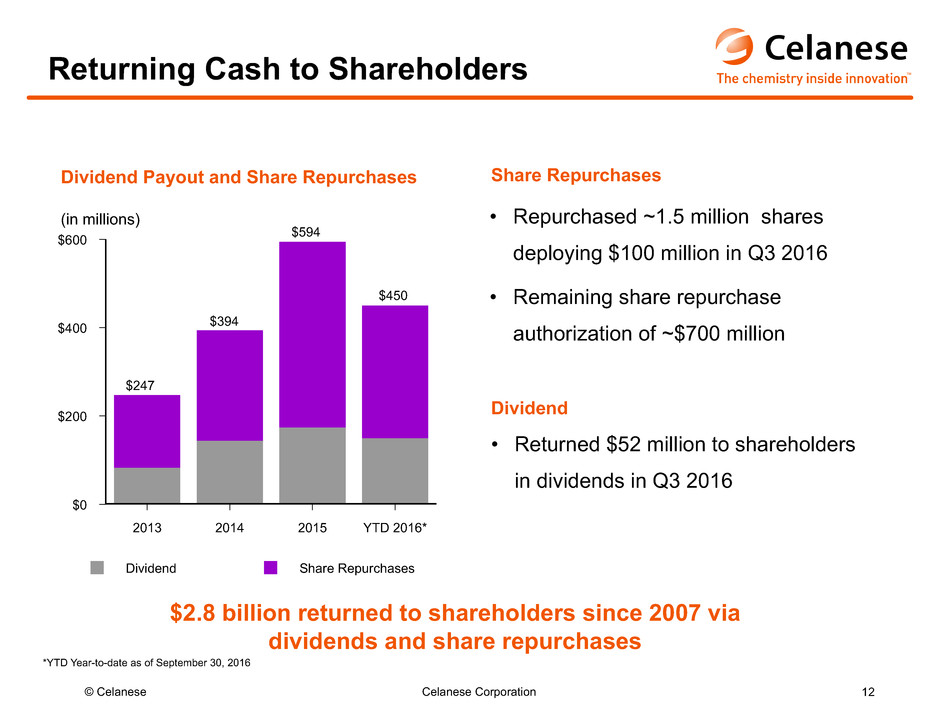

$2.8 billion returned to shareholders since 2007 via

dividends and share repurchases

Dividend Payout and Share Repurchases

(in millions)

Dividend Share Repurchases

$600

$400

$200

$0

2013 2014 2015 YTD 2016*

Share Repurchases

Dividend

• Repurchased ~1.5 million shares

deploying $100 million in Q3 2016

• Remaining share repurchase

authorization of ~$700 million

• Returned $52 million to shareholders

in dividends in Q3 2016

$247

$594

$394

Returning Cash to Shareholders

*YTD Year-to-date as of September 30, 2016

$450