Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - Horizon Therapeutics Public Ltd Co | d268142dex994.htm |

| EX-99.3 - EX-99.3 - Horizon Therapeutics Public Ltd Co | d268142dex993.htm |

| EX-99.2 - EX-99.2 - Horizon Therapeutics Public Ltd Co | d268142dex992.htm |

| EX-23.1 - EX-23.1 - Horizon Therapeutics Public Ltd Co | d268142dex231.htm |

| 8-K - FORM 8-K - Horizon Therapeutics Public Ltd Co | d268142d8k.htm |

Exhibit 99.1

Overview

We are a biopharmaceutical company focused on improving patients’ lives by identifying, developing, acquiring and commercializing differentiated and accessible medicines that address unmet medical needs. We market nine medicines through our orphan, rheumatology and primary care business units. Our marketed medicines are ACTIMMUNE (interferon gamma-1b), BUPHENYL (sodium phenylbutyrate) Tablets and Powder, DUEXIS (ibuprofen/famotidine), KRYSTEXXA (pegloticase), MIGERGOT (ergotamine tartrate & caffeine suppositories), PENNSAID 2%, RAVICTI (glycerol phenylbutyrate) Oral Liquid, RAYOS (prednisone) delayed-release tablets and VIMOVO (naproxen/esomeprazole magnesium).

We developed DUEXIS and RAYOS, known as LODOTRA outside the United States, acquired the U.S. rights to VIMOVO from AstraZeneca AB (“AstraZeneca”) in November 2013, acquired certain rights to ACTIMMUNE as a result of our merger transaction with Vidara Therapeutics International Public Limited Company (“Vidara” and such transaction, the “Vidara Merger”) in September 2014, acquired the U.S. rights to PENNSAID 2% from Nuvo Research Inc. (“Nuvo”), in October 2014, acquired RAVICTI and BUPHENYL, known as AMMONAPS in certain European countries, as a result of our acquisition of Hyperion Therapeutics, Inc. (“Hyperion”) in May 2015, and acquired KRYSTEXXA and the U.S. rights to MIGERGOT as a result of our acquisition of Crealta Holdings LLC (“Crealta”) in January 2016.

On May 18, 2016, we entered into a definitive agreement with Boehringer Ingelheim International GmbH (“Boehringer Ingelheim International”), to acquire certain rights to interferon gamma-1b (the “IMUKIN Acquisition”), which Boehringer Ingelheim International currently commercializes under the trade names IMUKIN, IMUKINE, IMMUKIN and IMMUKINE in an estimated 30 countries, primarily in Europe and the Middle East. Under the terms of the agreement, we paid Boehringer Ingelheim International €5.0 million ($5.6 million when converted using a Euro-to-Dollar exchange rate of 1.1132) upon signing and will pay €20.0 million upon closing, for certain rights for interferon gamma-1b in all territories outside of the United States, Canada and Japan, as we currently hold marketing rights to interferon gamma-1b in these territories. We currently market interferon gamma-1b as ACTIMMUNE in the United States. The IMUKIN Acquisition is scheduled to close on December 31, 2016 and we are continuing to work with Boehringer Ingelheim International to enable the transfer of applicable marketing authorizations. Under the terms of a separate agreement, we also in-licensed certain U.S., European and Canadian intellectual property rights for interferon gamma-1b for the treatment of FA. Interferon gamma-1b is currently not indicated or approved for the treatment of Friedreich’s ataxia (“FA”).

On September 12, 2016, we, Misneach Corporation, a Delaware corporation and our indirect wholly owned subsidiary (“Merger Sub”), and Raptor Pharmaceutical Corp. (“Raptor”) entered into that certain Agreement and Plan of Merger (the “Merger Agreement”) to acquire Raptor. Raptor’s first commercial medicine, PROCYSBI (cysteamine bitartrate) delayed-release capsules, is an approved therapy for the management of nephropathic cystinosis, a rare, life-threatening metabolic lysosomal storage disorder that causes the rapid, toxic accumulation of cystine in all cells, tissues and organs in the body. Raptor’s second commercial medicine, QUINSAIR (aerosolized form of levofloxacin) a fluroquinolone antibiotic, has received marketing authorization by the European Medicines Agency (“EMA”) for treating chronic lung infection caused by the bacteria Pseudomonas aeruginosa in adults who have cystic fibrosis in March 2015 and by Health Canada in June 2015 for the management of cystic fibrosis in patients aged 18 years or older with chronic pulmonary Pseudomonas aeruginosa infections. QUINSAIR is not approved in the United States and may not be marketed or commercialized in the United States for any indication until it receives U.S. Food and Drug Administration (“FDA”) approval.

Our medicines are dispensed by retail and specialty pharmacies. Part of our commercial strategy for our primary care and rheumatology business units is to offer physicians the opportunity to have their patients fill prescriptions through pharmacies participating in our HorizonCares patient access program. This program does not involve us in the prescribing of medicines. The purpose of this program is solely to assist in ensuring that, when physicians determine that one of our medicines offers a potential clinical benefit to their patients and prescribe the medicine for an eligible patient, financial assistance may be available to reduce a commercial patient’s out-of-pocket costs. In the first six months of 2016, this resulted in 99.8 percent of commercial patients

1

having co-pay amounts of $10 or less when filling prescriptions for our medicines utilizing our patient access program. For commercial patients who are prescribed our primary care medicines or RAYOS, the HorizonCares program offers co-pay assistance when a third-party payer covers a prescription but requires an eligible patient to pay a co-pay or deductible, and offers full subsidization when a third-party payer rejects coverage for an eligible patient. For patients who are prescribed our orphan medicines, our patient access programs provide reimbursement support, a clinical nurse program, co-pay and other patient assistance. The aggregate commercial value of our patient access programs for the six months ended June 30, 2016 was $816.8 million. All pharmacies that dispense prescriptions for our medicines, which we estimate to be about 20,000 in the first half of 2016, are fully independent, including those that participate in HorizonCares. We do not own or possess any option to purchase an ownership stake in any pharmacy that distributes our medicines, and our relationship with each pharmacy is non-exclusive and arm’s length. All of our medicines are dispensed through pharmacies independent of our business.

As an alternative means of ensuring access to our medicines, we have also begun pursuing business arrangements with pharmacy benefit managers (“PBMs”) and other payers to secure formulary status and reimbursement of our medicines, such as our recently announced arrangements with CVS Caremark and Prime Therapeutics LLC (“Prime Therapeutics”). While we believe that, if successful, this strategy would result in broader inclusion of certain of our primary care medicines on healthcare plan formularies, and therefore increase payer reimbursement and lower our cost of providing patient access programs, these arrangements would generally require us to pay administrative and rebate payments to the PBMs and/or other payers.

We have a compliance program in place to address adherence with various laws and regulations relating to the selling, marketing and manufacturing of our medicines, as well as certain third-party relationships, including pharmacies. Specifically with respect to pharmacies, the compliance program utilizes a variety of methods and tools to monitor and audit pharmacies, including those that participate in our access programs, to confirm their activities, adjudication and practices are consistent with our compliance policies and guidance.

We market our medicines in the United States through our field sales force, which numbered approximately 500 representatives as of June 30, 2016. Our strategy is to use the commercial strength and infrastructure we have established in creating a global biopharmaceutical company to continue the successful commercialization of our existing medicine portfolio while also expanding and leveraging these capabilities by identifying, developing, acquiring and commercializing additional differentiated and accessible medicines that address unmet medical needs.

For the twelve months ended June 30, 2016, we generated net sales and adjusted EBITDA of $933 million and $447 million, respectively.

Merger with Raptor

On September 12, 2016, we, Merger Sub and Raptor entered into the Merger Agreement, pursuant to which we, through Merger Sub, commenced a tender offer to acquire all of the outstanding shares of Raptor’s common stock at a price of $9.00 per share in cash on September 26, 2016.

Vidara Merger and Hyperion Acquisition

The Vidara Merger occurred on September 19, 2014 and was accounted for as a reverse acquisition under the acquisition method of accounting for business combinations, with Horizon Pharma, Inc. (“HPI”) treated as the acquiring company for accounting purposes. As part of the Vidara Merger, a wholly owned subsidiary of Vidara merged with and into HPI, with HPI surviving the Vidara Merger as a wholly owned subsidiary of Vidara. Prior to the

2

Vidara Merger, Vidara changed its name to Horizon Pharma plc. Upon the consummation of the Vidara Merger, the historical financial statements of HPI became our historical financial statements.

On May 7, 2015, we completed our acquisition of Hyperion in which we acquired all of the issued and outstanding shares of Hyperion’s common stock for $46.00 per share in cash or approximately $1.1 billion on a fully-diluted basis. Following the completion of our acquisition of Hyperion, Hyperion became our wholly owned subsidiary and was renamed as Horizon Therapeutics, Inc. The consolidated financial statements presented in this report include the results of operations of the acquired business from the date of acquisition.

Competitive Strengths

We believe we have the following strengths:

| • | Diversified business model with increasing shift towards high growth, high margin, orphan medicines. We have successfully diversified our portfolio of medicines from two in 2013 to nine in January 2016, and which will be 11 assuming the completion of our proposed acquisition of Raptor (the “Raptor Acquisition”), across our three business units: orphan, rheumatology and primary care. While we continue to focus on strategies to grow our primary care medicines, we have made a strategic decision to expand our orphan medicine portfolio with the expectation that it will comprise the majority of the business by 2020. This strategy has led to our acquisitions of Crealta, Hyperion and Vidara, as well as the recently announced IMUKIN and Raptor Acquisitions. As a result, on a pro forma basis giving effect to the Raptor Acquisition, for the six months ended June 30, 2016, net sales of our orphan medicines represented approximately 45% of our total net sales. |

| • | Differentiated commercial strategy and significant experience in sales and marketing. Our senior leadership has experience in large pharmaceutical organizations and smaller companies alike with demonstrated capabilities to launch, expand, and grow commercial stage medicines in a variety of orphan, specialty and primary care indications. We have developed our own commercial programs, including HorizonCares, which provides increased patient access to medicines through co-pay assistance, reimbursement support or full subsidization of medicines. |

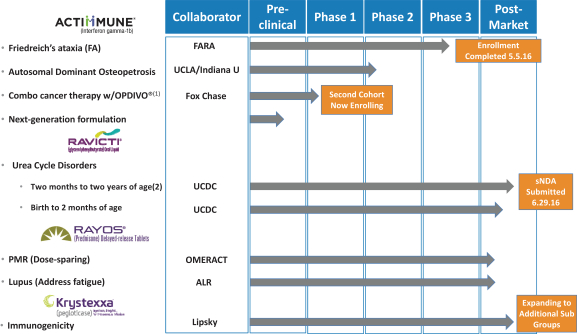

| • | Strong clinical development capabilities. We have worked diligently to unlock the full therapeutic potential of our medicines by collaborating closely with regulatory agencies, premier academic centers with established study consortiums, healthcare professionals and patient groups to facilitate our clinical development programs and generate data for possible new indications that may help more patients in need. We have a robust clinical development pipeline with a number of separate clinical programs underway for ACTIMMUNE, RAVICTI, KRYSTEXXA and RAYOS. |

| • | Ability to successfully execute business development strategies to drive growth. We completed our initial public offering in 2011 on the NASDAQ Stock Market. In 2013, we acquired VIMOVO, a commercial stage medicine, from AstraZeneca. In 2014, we acquired Vidara and acquired PENNSAID 2% from Nuvo, and in 2015, we acquired Hyperion. In 2016, we acquired Crealta, announced the IMUKIN Acquisition and recently announced the proposed acquisition of Raptor. These completed and proposed acquisitions, coupled with organic growth, have significantly increased, and we expect will continue to increase, our diversification, scale, revenues, profitability and cash flows. We have increased revenues from $75 million in 2013 to $933 million during the twelve months ended June 30, 2016. |

Business Strategy

Our strategy is to utilize the commercial strength and infrastructure we have established in creating a fully-integrated global specialty biopharmaceutical company to continue the successful commercialization of our

3

existing portfolio of medicines while expanding and leveraging these capabilities further through the acquisition of biopharmaceutical medicines and companies. After the completion of the Raptor Acquisition, our strategy will be to continue to enhance growth by driving volume and revenue growth in all three of our business units, integrate PROCYSBI and QUINSAIR into our orphan medicine portfolio, grow our footprint internationally by leveraging the Raptor infrastructure and selectively pursue additional acquisitions in our core areas of focus. We will execute on our strategy by:

| • | Driving volume and revenue growth in all three of our business units. We have seen continued growth in our medicines over the past several years. Net sales of our orphan medicines have grown 304% from the fourth quarter of 2014, the first quarter in which we recognized meaningful net sales from orphan medicines, to the second quarter of 2016, primarily as a result of the addition and growth of RAVICTI and KRYSTEXXA. With our primary care medicines and RAYOS, we have realized prescription volume growth of 173% from the second quarter of 2014 to the second quarter of 2016. During the same period, we have seen our average net realized price for these medicines increase only 8% cumulatively. We expect our recent contracts with pharmacy benefit managers CVS Caremark and Prime Therapeutics will provide increased access to patients as well as sustainability and durability for our primary care business. We continue to be in discussions and negotiations with other PBMs and payers with the goal of further increasing patient access for our clinically relevant primary care medicines. |

| • | Expanding indications across our existing orphan portfolio. As part of our effort to drive growth from our existing portfolio of medicines, we are conducting a number of clinical development programs with the goal of obtaining approval for additional or expanded indications. ACTIMMUNE is in a fully enrolled Phase 3 clinical trial for the treatment of FA, for which we expect to have data by the end of 2016. We estimate that in the United States, ACTIMMUNE in FA represents an annual $500 million to a $1 billion net sales opportunity. For RAVICTI, we have submitted a supplemental new drug application (“sNDA”) to expand its indication to cover patients aged two months to two years in the United States and also expect to launch the medicine in Canada in the second half of 2016 and Europe in 2017. For KRYSTEXXA, we expect to present additional safety and efficacy data at the 2016 American College of Rheumatology Annual Meeting in November 2016. |

| • | Leveraging the Raptor Acquisition to cost efficiently grow our orphan medicine portfolio and expand internationally. Based on our track record of integrating several acquisitions over the past few years, we believe we will be able to efficiently integrate Raptor into our business and that there are meaningful cost savings opportunities that could be realized as the integration is completed. In addition to PROCYSBI’s potential peak annual net sales, which we estimate will be at least $300 million, the Raptor Acquisition will also expand our commercial infrastructure into Europe and other international markets. With both PROCYSBI and QUINSAIR approved in the European Union (“EU”), Raptor has built commercial infrastructure in Europe and has established a number of distribution relationships in other selected international markets. We believe this European infrastructure can be leveraged to support additional international growth opportunities through the expansion of commercial markets for our existing medicines and/or medicines acquired in the future. |

| • | Selectively pursue additional acquisitions in our core areas of focus. We are shifting our business to become a predominantly rare disease focused company by 2020. We focus our business development efforts largely on commercial and late-stage development assets that address unmet medical needs, with orphan, rheumatology and other specialty medicines as priorities. |

4

Credit Highlights

We believe that our credit provides an attractive investment opportunity as we are well-positioned to execute our business strategy based on the following competitive advantages and key strengths:

| • | Increased focus on our long-life, well-protected orphan medicines; |

| • | Well-balanced portfolio of medicines with a diversified patient base; |

| • | Cash-generative and profitable business model; |

| • | Successful and differentiated commercial strategy; |

| • | Proven acquisition and integration capabilities; and |

| • | Highly experienced and capable management team. |

Our Medicines

We believe our medicines address unmet therapeutic needs in orphan diseases, arthritis, pain and/or inflammatory diseases and provide significant advantages over existing therapies.

Our current marketed medicine portfolio consists of the following:

| Medicine |

Disease |

Marketing Rights | ||

| ORPHAN BUSINESS UNIT MEDICINES: |

||||

| ACTIMMUNE |

Chronic granulomatous disease and severe, malignant osteopetrosis | United States and selected foreign countries | ||

| RAVICTI |

Urea cycle disorders | Worldwide(1) | ||

| BUPHENYL/AMMONAPS |

Urea cycle disorders | Worldwide(2) | ||

| RHEUMATOLOGY BUSINESS UNIT MEDICINES: |

||||

| RAYOS/LODOTRA |

Rheumatoid arthritis, polymyalgia rheumatic, systemic lupus erythematosus and multiple other indications | Worldwide(3) | ||

| KRYSTEXXA |

Chronic refractory gout | Worldwide | ||

| PRIMARY CARE BUSINESS UNIT MEDICINES: |

||||

| DUEXIS |

Signs and symptoms of osteoarthritis and rheumatoid arthritis | Worldwide(4) | ||

| VIMOVO |

Signs and symptoms of osteoarthritis, rheumatoid arthritis and ankylosing spondylitis | United States | ||

| PENNSAID 2% |

Pain of osteoarthritis of the knee(s) | United States | ||

| MIGERGOT |

Vascular headache | United States | ||

5

| (1) | RAVICTI distribution rights in the Middle East and North Africa have been licensed to Swedish Orphan Biovitrum AB (“SOBI”). |

| (2) | BUPHENYL/AMMONAPS distribution rights in Europe, certain Asian, Latin American, Middle Eastern, North African and other countries have been licensed to SOBI. |

| (3) | RAYOS/LODOTRA distribution rights in Europe, Australia, certain Asian, Latin American, Middle Eastern, African, and other countries have been licensed to Mundipharma International Corporation Limited (“Mundipharma”). |

| (4) | DUEXIS rights in Latin America have been licensed to Grünenthal S.A. (“Grünenthal”). |

ORPHAN BUSINESS UNIT

Market

Chronic Granulomatous Disease

Chronic granulomatous disease (“CGD”) is a genetic disorder of the immune system. It is described as a primary immunodeficiency disorder, which means it is not caused by another disease or disorder. In people who have CGD, a type of white blood cell, called a phagocyte, is defective. These defective phagocytes cannot generate superoxide, leading to an inability to kill harmful microorganisms such as bacteria and fungi. As a result, the immune system is weakened. People with CGD are more likely to have certain problems such as recurrent severe bacterial and fungal infections and chronic inflammatory conditions. These patients are prone to developing masses called granulomas, which can occur repeatedly in organs throughout the body and cause a variety of problems. CGD is considered to be a condition that patients can live with and manage. Studies suggest overall survival has improved over the last decade with more patients living well into adulthood. Approximately 1 out of every 100,000 to 200,000 babies in the United States is born with CGD.

Severe, Malignant Osteopetrosis

Severe, malignant osteopetrosis (“SMO”) is a form of osteopetrosis and is sometimes referred to as marble bone disease or malignant infantile osteopetrosis because it occurs in very young children. While exact numbers are not known, it has been estimated that 1 out of 250,000 children is born with SMO. During normal bone development, existing bone material is constantly being replaced by new bone. Cells called osteoblasts cause new bone formation while other cells called osteoclasts remove old bone through a process called resorption. In people with osteopetrosis, this balance is not maintained because their osteoclasts do not function properly. As a result, resorption of old bone material decreases while the formation of new bone continues. This leads to an abnormal increase in bone mass, which can make the bones more brittle. Because abnormal bone development affects many different systems in the body, osteopetrosis may cause problems such as blood disorders, decreased ability to fight infection, bone fractures, problems with vision and hearing, and abnormal appearance of the face and head.

Urea Cycle Disorders

Urea cycle disorders (“UCDs”) are inherited metabolic diseases caused by a deficiency of one of the enzymes or transporters that constitute the urea cycle. The urea cycle involves a series of biochemical steps in which ammonia, a potent neurotoxin, is converted to urea, which is excreted in the urine. UCD patients may experience episodes where they get symptoms from the ammonia in their blood being excessively high—called hyperammonemic crises—which may result in irreversible brain damage, coma or death. UCD symptoms may first occur at any age depending on the severity of the disorder, with more severe defects presenting earlier in life.

Our Solutions

ACTIMMUNE

ACTIMMUNE is a biologically manufactured protein called interferon gamma-1b that is similar to a protein the human body makes naturally. In the body, interferon gamma is produced by cells of the immune

6

system and helps to prevent infection in patients with CGD and enhances osteoclast function in patients with SMO. ACTIMMUNE is approved by the FDA to reduce the frequency and severity of serious infections associated with CGD and for delaying time to disease progression in patients with SMO. The precise way that ACTIMMUNE works to help prevent infection in patients with CGD and slow the worsening of SMO is not fully understood, but ACTIMMUNE is believed to work by modifying the cellular function of various cells, including those in the immune system and those that help form bones.

Efficacy in CGD

The International Chronic Granulomatous Disease Cooperative Study Group conducted a controlled clinical trial in 128 patients (ages ranging from 1 to 44 years old) at 13 medical centers across 4 countries. The purpose of this clinical trial was to evaluate the safety and efficacy of ACTIMMUNE in reducing the frequency and severity of serious infections in patients with CGD. Patients enrolled in the trial were randomly selected to receive either ACTIMMUNE or placebo in addition to antibiotics. The number and timing of serious infections were tracked in all patients for up to 1 year. Investigators concluded that ACTIMMUNE is an effective and safe therapy for patients with CGD, because the therapy statistically reduced the frequency of serious infections.

Efficacy in SMO

In a controlled clinical trial, 16 patients were randomized to receive either ACTIMMUNE with calcitriol or calcitriol alone. The age of patients ranged from 1 month to 8 years; with a mean age of 1.5 years. The median time to progression in the ACTIMMUNE plus calcitriol arm was 165 days versus a median of 65 days in the calcitriol only arm. In a separate analysis that combined data from a second trial, 19 of 24 patients on ACTIMMUNE therapy (with or without calcitriol) for at least 6 months had reduced trabecular bone volume compared to baseline.

Commercial Status

ACTIMMUNE is the only drug currently approved by the FDA for the treatment for CGD and SMO. Our licenses allow us to market and sell ACTIMMUNE in the United States, Canada and Japan. We currently commercialize ACTIMMUNE in the United States and also supply ACTIMMUNE to patients in Canada, if so requested by way of a prescription from their treating physicians, through Health Canada’s Special Access Program, which provides access to non-marketed drugs in Canada for practitioners treating patients with serious or life-threatening conditions when conventional therapies have failed, are unsuitable or are unavailable. We have not otherwise registered or sold ACTIMMUNE in any other territories for which we currently hold commercial rights.

Potential for ACTIMMUNE in Friedreich’s ataxia

FA, is a debilitating, life-shortening and degenerative neuro-muscular disorder that affects approximately 3,700 people in the United States. Onset of symptoms can vary from five years old to adulthood, with the childhood onset tending to be associated with a more rapid progression. A progressive loss of coordination and muscle strength leads to motor incapacitation and often the full-time use of a wheelchair. Most young people diagnosed with FA require mobility aids such as a cane, walker or wheelchair by their teens or early twenties. There are currently no approved treatments for FA.

In October 2014, we announced and presented data from the Phase 2 open-label study of ACTIMMUNE treatment in children with FA. The results showed ACTIMMUNE was well tolerated with no serious adverse events, and two subjects reporting severe events and subsequent dose reductions. The safety findings generally reflected the label safety profile for ACTIMMUNE. Changes in frataxin protein levels, the primary study endpoint, were statistically significant in red blood cells, white blood cells and platelets. Mean improvement in the modified Friedreich’s Ataxia Rating Scale (“mFARS”) was statistically significant. The mFARS score is used to measure neurological signs associated with FA, with higher scores reflecting a greater level of disability.

7

In June 2015, we initiated the Safety, Tolerability and Efficacy of ACTIMMUNE Dose Escalation in Friedreich’s Ataxia Study (“STEADFAST”) of ACTIMMUNE for the treatment of people with FA. This Phase 3 trial (NCT02415127) is a randomized, multi-center, double-blind, placebo-controlled study with patients randomized 1:1 to receive subcutaneous doses of either ACTIMMUNE or placebo three times a week for a total of 26 weeks. 92 patients were enrolled at four sites in the United States. The primary endpoint will measure the change in neurological outcome and evaluate the effect of ACTIMMUNE versus placebo as measured by the mFARS score focused on objective neurologic measures such as upper and lower extremity coordination change from baseline. In addition to safety and efficacy, the STEADFAST trial will evaluate the pharmacokinetic characteristics of ACTIMMUNE in people with FA. We completed enrollment in the second quarter of 2016, with top-line data anticipated to become available by the end of 2016. Assuming positive data from the trial, we would plan to submit a supplemental biologics license application in the first quarter of 2017, and given the fast-track designation of ACTIMMUNE for this potential indication, we would request priority review, which, if awarded, would allow us to potentially receive a decision from the FDA within six months of the submission, in the third quarter of 2017.

RAVICTI

RAVICTI is indicated for use as a nitrogen-binding agent for chronic management of adult and pediatric patients 2 years of age and older (2 months of age and older in Europe) with UCDs that cannot be managed by dietary protein restriction and/or amino acid supplementation alone. RAVICTI must be used with dietary protein restriction and, in some cases, dietary supplements (e.g., essential amino acids, arginine, citrulline, or protein-free calorie supplements).

Efficacy in the Treatment of UCDs in Adult Patients

A randomized, double-blind, active-controlled, crossover, noninferiority study compared RAVICTI to sodium phenylbutyrate by evaluating venous ammonia levels in patients with UCDs that had been on sodium phenylbutyrate prior to enrollment for control of their UCD. Patients adhered to a low-protein diet and received amino acid supplements throughout the study. After two weeks of dosing, by which time patients had reached a steady state on each treatment, all patients had 24 hours of ammonia measurements.

Another study was conducted to assess monthly ammonia control and hyperammonemic crisis over a 12-month period. A total of 51 adults were in the study and all but six had been converted from sodium phenylbutyrate to RAVICTI. Venous ammonia levels were monitored monthly. Of 51 adult patients participating in the 12-month, open-label treatment with RAVICTI, seven patients (14 percent) reported a total of 10 hyperammonemic crises.

The efficacy of RAVICTI in pediatric patients two to 17 years of age was evaluated in two fixed-sequence, open-label, sodium phenylbutyrate to RAVICTI switchover studies, seven and 10 days in duration. These studies compared blood ammonia levels of patients on RAVICTI to venous ammonia levels of patients on sodium phenylbutyrate in 26 pediatric UCD patients. Twenty-four hour blood ammonia levels of UCD patients six to 17 years of age (Study 3) and patients two to five years of age (Study 4) were similar between treatments but trended higher with sodium phenylbutyrate.

Long-term (12-month), uncontrolled, open-label studies were conducted to assess monthly ammonia control and hyperammonemic crisis over a 12-month period. Of the 26 pediatric patients six to 17 years of age participating in these two trials, five patients (19 percent) reported a total of five hyperammonemic crises.

Commercial Status

RAVICTI was approved for marketing in the United States in 2013.

On November 30, 2015, we announced the EMA had adopted a binding decision to approve RAVICTI for use as an adjunctive therapy for chronic management of adult and pediatric patients two months of age and

8

older with six subtypes of UCDs. This decision followed the Positive Opinion previously adopted on September 24, 2015 by the Committee for Medicinal Products for Human Use (the “CHMP”) of the EMA. The approval authorizes us to market RAVICTI in all 28 Member States of the EU and the centralized marketing authorization will form the basis for recognition by the Member States of the European Economic Area (the “EEA”), namely Norway, Iceland and Liechtenstein, for the medicine to be placed on the market.

We have worldwide rights to market and distribute RAVICTI. In relation to marketing and distribution rights in the Middle East and North Africa region, we have entered into a distribution agreement with SOBI until 2018. We market and sell RAVICTI in the United States and plan to begin commercializing RAVICTI in Europe in 2017.

We are in the process of seeking approval for label expansions for RAVICTI, with assessments in progress studying the use of RAVICTI in patients both from two months to two years (for which we submitted an sNDA, submission to the FDA in the second quarter of 2016), and from birth to two months (targeted sNDA submission in the first quarter of 2018). Current FDA approval is for patients from two years of age and older only. In patients with UCDs for which RAVICTI is an FDA-approved medicine, there is a variable age of diagnosis (from newborn to adulthood), and the severity of the disease can be associated with the age of onset and enzymatic deficit. However, a prompt diagnosis and careful management of the disease can lead to good clinical outcomes.

BUPHENYL

BUPHENYL tablets for oral administration and BUPHENYL powder for oral, nasogastric, or gastrostomy tube administration are indicated as adjunctive therapy in the chronic management of patients with UCDs involving deficiencies of carbamoyl phosphate synthetase, ornithine transcarbamylase or argininosuccinic acid synthetase.

BUPHENYL is indicated in all patients with neonatal-onset deficiency (complete enzymatic deficiency, presenting within the first 28 days of life). It is also indicated in patients with late-onset disease (partial enzymatic deficiency, presenting after the first month of life) who have a history of hyperammonemic encephalopathy. It is important that the diagnosis be made early and treatment initiated immediately to improve survival. BUPHENYL must be combined with dietary protein restriction and, in some cases, essential amino acid supplementation.

Commercial Status

BUPHENYL was approved by the FDA in the United States in 1996 and by the EMA in Europe in 1999. We commercially market and distribute BUPHENYL in the United States. BUPHENYL is known as AMMONAPS in certain European countries, and the marketing and distribution rights are licensed to SOBI through the end of 2016. We provide BUPHENYL in certain other countries through various Special Access Programs and licensed distributors.

Competition

ACTIMMUNE presently faces limited competition. ACTIMMUNE is the only drug currently approved by the FDA specifically for the treatment for CGD and SMO. While there are additional or alternative approaches used to treat patients with CGD and SMO, including the increasing trend towards the use of bone marrow transplants in patients with CGD, there are currently no medicines on the market that compete directly with ACTIMMUNE.

In the United States, RAVICTI and BUPHENYL compete with generic forms of sodium phenylbutyrate. In Europe and certain other countries, RAVICTI and BUPHENYL compete with Pheburane,

9

which is a sugar-coated version of sodium phenylbutyrate. Pheburane claims a taste advantage over BUPHENYL. However the volume of Pheburane that must be ingested multiple times per day is much greater than BUPHENYL, and significantly greater than RAVICTI, and is a barrier to patient compliance.

RHEUMATOLOGY BUSINESS UNIT

Market

Rheumatoid Arthritis

Rheumatoid arthritis (“RA”) is a chronic disease that causes pain, stiffness and swelling, primarily in the joints. According to a 2006 DataMonitor report, 2.9 million people in the United States suffer from RA, of which 1.8 million are diagnosed and treated with various drugs. RA has no known cause, but unlike osteoarthritis (“OA”), RA is not associated with factors such as aging. RA occurs when the body’s immune system malfunctions, attacking healthy tissue and causing inflammation, which leads to pain and swelling in the joints and may eventually cause permanent joint damage and painful disability. The primary symptoms of RA include progressive immobility and pain, especially in the morning, with long-term sufferers experiencing continual joint destruction for the remainder of their lives. There is no known cure for RA. Once the disease is diagnosed, treatment is prescribed for life to alleviate symptoms and/or to slow or stop disease progression. RA treatments include medications, physical therapy, exercise, education and sometimes surgery. Early, aggressive treatment of RA can delay joint destruction. Treatment of RA usually includes multiple drug therapies taken concurrently. Disease-modifying anti-rheumatic drugs (“DMARDs”) are the current standard of care for the treatment of RA, in addition to rest, exercise and antiinflammatory drugs such as nonsteroidal anti-inflammatory drugs (“NSAIDs”).

Polymyalgia Rheumatica

Polymyalgia Rheumatica (“PMR”) is an inflammatory disorder that causes significant muscle pain and stiffness. The pain and stiffness often occur in the shoulders, neck, upper arms and hip with pronounced morning stiffness lasting at least one hour. Most people who develop PMR are older than 65 years of age. It rarely affects people younger than 50. There are approximately 1.1 million patients with PMR in the United States and it afflicts one in every 133 people over the age of 50. Prednisone is the standard of care for treating PMR and treatment is generally initiated at a relatively high dose (e.g., 10-20 mg per day) and reduced as clinical improvement is seen. Treatment usually lasts 18-24 months. Similar to RA, PMR is associated with circadian patterns of Interleukin 6 (“IL-6”) elevation in early morning hours.

Systemic Lupus Erythematosus

Systemic Lupus Erythematosus (“SLE”) is a chronic autoimmune disease that causes inflammation and pain in the joints and muscles as well as overall fatigue. SLE affects from 161,000 to 322,000 adults in the United States. More than 90 percent of cases of SLE occur in women, frequently starting at childbearing age. In addition to affecting the muscles and joints, it can affect other organs in the body such as the kidneys, tissue lining the lungs (pleura), heart (pericardium), and brain. Most patients feel fatigue and have rashes, arthritis (painful and swollen joints) and fever. SLE flares vary from mild to serious.

In November 2015, we announced our collaboration with the Alliance for Lupus Research (“ALR”) to study the effect of RAYOS on the fatigue experienced by SLE patients. SLE is a chronic autoimmune disease that causes inflammation and pain in the joints and muscles, as well as overall fatigue. RAYOS is currently indicated for patients with SLE. The first study planned as part of the collaboration is an investigator-initiated, randomized, double-blind, active comparator, cross-over study in which patients will be randomized to receive either prednisone for three months or RAYOS at 10 p.m. for three months, and then switched to the alternative medication for an additional three months. Approximately 62 patients across 25 sites will be enrolled in the United States. The primary endpoint will assess fatigue as measured by Functional Assessment of Chronic Illness Therapy-Fatigue, a 13-question survey to be completed by study participants that focuses on the daily fatigue experienced in patients with chronic illnesses.

10

Chronic Refractory Gout

Chronic refractory gout (“CRG”) is a type of arthritis that occurs when uric acid build-up in the blood remains high and inflammation persists even after treatment with conventional therapies. Gout is one of the most common forms of inflammatory arthritis, estimated to affect 8.3 million in the United States, with CRG impacting 40,000 to 50,000 people in the United States. CRG frequently causes crippling disabilities and significant joint damage.

Market Opportunity and Limitations of Existing Treatments

Morning Stiffness, Pain and Immobility

A Medical Marketing Economics May 2008 study of 150 RA patients in the United States, which we sponsored, showed that despite the use of a combination of currently available treatments for RA, more than 90 percent of the patients reported suffering from morning stiffness, pain and immobility, which is linked to peak IL-6 levels in the early morning hours. Patients with RA in general have substantially increased IL-6 levels, with peak IL-6 levels tending to occur in the early morning hours, and low levels typically occurring in the afternoon and evening. Therefore, we believe an optimal treatment would reduce IL-6 levels in the early morning hours.

Side Effects of Current High-Dose Corticosteroid Treatments

According to the 2006 DataMonitor report, approximately 50 percent of RA patients in the United States, Japan, France, Italy, Spain, Germany and the United Kingdom are prescribed combination therapy which often includes corticosteroids, with prednisone being one of the most common. Corticosteroids, including prednisone, are used to suppress various autoimmune, inflammatory and allergic disorders by inhibiting the production of various pro- inflammatory cytokines, such as IL-6 and TNF-alpha. Joint inflammation in RA is driven by excessive production of inflammatory mediators and cytokines such as IL-6 and TNF-alpha. While corticosteroids are potent and effective agents to treat patients with RA, they are often used at high doses to treat RA flares or significant inflammation. High-dose oral corticosteroid treatment is not a viable long-term treatment option due to adverse side effects such as osteoporosis, cardiovascular disease and weight gain. However, clinical studies have shown that the long-term use of low-dose prednisone (<10 mg per day) does not dramatically increase total adverse events. In addition, low doses, typically less than 10 mg daily, of corticosteroids such as prednisone have been shown to treat the symptoms of RA while slowing the overall progression of the disease.

Our Solutions

RAYOS/LODOTRA

The medicine sold and marketed as RAYOS in the United States is known as LODOTRA outside the United States. While the FDA has approved RAYOS for the treatment of RA, ankylosing spondylitis (“AS”), PMR, primary systemic amyloidosis, asthma, chronic obstructive pulmonary disease, SLE and a number of other conditions, we have focused our promotion of RAYOS/LODOTRA on rheumatology indications, including RA and PMR.

The proprietary formulation technology of RAYOS/LODOTRA enables a delayed-release of prednisone approximately four hours after administration. The RAYOS/LODOTRA proprietary delivery system synchronizes the prednisone delivery time with the patient’s elevated cytokine levels, thereby taking effect at a physiologically optimal point to inhibit cytokine production, and thus significantly reduces the signs and symptoms of RA and PMR.

RAYOS/LODOTRA was developed using SkyePharma AG’s (“SkyePharma”) proprietary GeoClock and GeoMatrix technologies, for which we hold an exclusive worldwide license for the delivery of glucocorticoid, a class of corticosteroid. RAYOS/LODOTRA is composed of an active core containing

11

prednisone, which is encapsulated by an inactive porous shell. The inactive shell acts as a barrier between the medicine’s active core and a patient’s gastrointestinal (“GI”) fluids. RAYOS/LODOTRA is intended to be administered at bedtime. At approximately four hours following bedtime administration of RAYOS/LODOTRA, water in the digestive tract diffuses through the shell, causing the active core to expand, which leads to a weakening and breakage of the shell and allows the release of prednisone from the active core. Our pharmacokinetic studies have shown that the blood concentration of prednisone from RAYOS/LODOTRA is similar to immediate release prednisone except for the intended time delay of medicine release after administration.

Commercial Status

We began marketing RAYOS to U.S. rheumatologists in December 2012. LODOTRA received its first approval in Europe in March 2009 and is currently approved for marketing in more than 30 countries outside the United States where Mundipharma holds the commercial rights. Reimbursement has been approved in Germany, Italy and a number of other European countries.

KRYSTEXXA

KRYSTEXXA is an orphan biologic medicine which is the first and only FDA-approved medicine for the treatment of CRG. KRYSTEXXA is a PEGylated uric acid specific enzyme (uricase) indicated for the treatment of CRG in adult patients that are refractory to conventional therapy. Gout refractory to conventional therapy occurs in patients who have failed to normalize serum uric acid and whose signs and symptoms are inadequately controlled with xanthine oxidase inhibitors at the maximum medically appropriate dose or for whom these drugs are contraindicated. KRYSTEXXA has a unique mechanism of action which rapidly reverses disease progression. A PEGylated uric acid specific enzyme catalyzes the conversion of serum uric acid to allantoin, which is then excreted in urine. This PEGylated uric acid specific enzyme is given via an intravenous infusion to patients every two weeks.

Commercial Status

KRYSTEXXA was launched in January 2011. KRYSTEXXA has biologic exclusivity until 2022 and a composition of matter patent until 2026. Orphan drug exclusivity was granted on February 21, 2011, which exclusivity lasts for 7 years and will expire in February 2018.

Competition

RAYOS/LODOTRA competes with a number of medicines on the market to treat RA, including corticosteroids, such as prednisone, traditional DMARDs, such as methotrexate, and biologic agents, such as HUMIRA and Enbrel. The majority of RA patients are treated with DMARDs, which are typically used as initial therapy in patients with RA. Biologic agents are typically added to DMARDs as combination therapy. It is common for an RA patient to take a combination of a DMARD, an oral corticosteroid, an NSAID, and/or a biologic agent. We are not currently aware of any other delayed-release prednisone medicine in development.

As the only FDA approved medication for the treatment of CRG, KRYSTEXXA faces limited direct competition. We believe that the complexity of manufacturing KRYSTEXXA provides a barrier to potential generic competition. However, a number of competitors have medicines in Phase 1 or Phase 2 trials. On December 22, 2015, AstraZeneca secured approval from the FDA for ZURAMPIC (lesinurad) 200mg tablets in combination with a XOI for the treatment of hyperuricemia associated with gout in patients who have not achieved target serum uric acid levels with an xanthine oxidase inhibitor (“XOI”) alone. Although ZURAMPIC is not a direct competitor because it has not been approved for CRG, this therapy could be used prior to use of KRYSTEXXA, and if effective, could reduce the target patient population for KRYSTEXXA.

12

PRIMARY CARE BUSINESS UNIT

Market

Pain is a serious and costly public health concern. In 2010, the U.S. National Center for Health Statistics reported that approximately 30 percent of U.S. adults 18 years of age and over reported recent symptoms of pain, aching or swelling around a joint within the past 30 days.

Some of the most common and debilitating chronic inflammation and pain-related diseases are OA, RA, and acute and chronic pain. According to National Health Interview Survey data analyzed by the U.S. Centers for Disease Control and Prevention, from 2010-2012, 52.5 million U.S. adults 18 years of age and over had reported being diagnosed with some form of arthritis. With the aging of the U.S. population, the prevalence of arthritis is expected to rise by approximately 40 percent by 2030, impacting 67 million people in the United States.

Osteoarthritis

OA is a type of arthritis that is caused by the breakdown and eventual loss of the cartilage of one or more joints. Cartilage is a protein substance that serves as a cushion between the bones of the joints. Among the over 100 different types of arthritis conditions, OA is the most common and occurs more frequently with age. OA commonly affects the hands, feet, spine and large weight-bearing joints, such as the hips and knees. Symptoms of OA manifest in patients as joint pain, tenderness, stiffness, limited joint movement, joint cracking or creaking (crepitation), locking of joints and local inflammation. OA can also lead to joint deformity in later stages of the disease. Many drugs are used to treat the inflammation and pain associated with OA, including aspirin and other NSAIDs, such as ibuprofen, naproxen and diclofenac, that have a rapid analgesic and anti-inflammatory response.

Rheumatoid Arthritis

The market for RA is discussed above under “Rheumatology Business Unit.”

Ankylosing Spondylitis

AS is a type of arthritis that affects the spine. AS symptoms include pain and stiffness from the neck down to the lower back. The spine’s bones (vertebrae) may grow or fuse together, resulting in a rigid spine. These changes may be mild or severe, and may lead to a stooped-over posture. Early diagnosis and treatment helps control pain and stiffness and may reduce or prevent significant deformity.

Market Opportunity and Limitations of Existing Treatments

GI-Associated Adverse Events

NSAIDs are very effective at providing pain relief, including pain associated with OA and RA; however, there are significant upper GI-associated adverse events that can result from the use of NSAIDs. According to a 2004 article published in Alimentary Pharmacology & Therapeutics, significant GI side effects, including serious ulcers, afflict up to approximately 25 percent of all chronic arthritis patients treated with NSAIDs for three months, and OA and RA patients are two to five times more likely than the general population to be hospitalized for NSAID-related GI complications. It is estimated that NSAID-induced GI toxicity causes over 16,500 related deaths in OA and RA patients alone and over 107,000 hospitalizations for serious GI complications each year. In more than 70 percent of patients with these serious GI complications, there are no prior symptoms.

13

Despite the fact that GI ulcers are one of the most prevalent adverse events resulting from the use of NSAIDs in the United States, according to a 2006 article published in BMC Muskoskeletal Disorders, 11 observational studies indicated that physicians do not commonly co-prescribe GI protective agents to high-risk patients. Physicians prescribe concomitant therapy to only 24 percent of NSAID users, and studies show sub-optimal patient compliance with concomitant prophylaxis therapy. According to a 2003 article published in Alimentary Pharmacology & Therapeutics, in a study of 784 patients, 37 percent of patients were non-compliant, a rate increasing to 61 percent in patients treated with three or more drugs. This noncompliance results in a substantial unmet clinical need, which we believe can be appropriately addressed with DUEXIS or VIMOVO, creating smarter solutions for both patients and physicians.

Topical NSAIDs

Within the NSAID market there exists a significant niche for topical NSAIDs, which are prescribed more than 5 million times per year. Topical NSAID treatment may be appropriate for some patients, such as patients who may benefit from the lower systemic exposure in a topical NSAID, patients with OA in just one joint such as the knee, patients who have trouble taking oral medications, or patients who are older. However, applying the correct dosage of the topical NSAID amount can often be a barrier to patient compliance, and there exists a market for a more convenient and more accurate application technique.

Our Solutions

DUEXIS

DUEXIS is a proprietary single-tablet formulation containing a fixed-dose combination of ibuprofen, the most widely prescribed NSAID, and famotidine, a well-established GI agent used to treat dyspepsia, gastroesophageal reflux disease and active ulcers, in one pill. Based on clinical study results, DUEXIS has been proven to reduce the risk of NSAID-induced upper GI ulcers.

Ibuprofen: One of the World’s Most Widely Prescribed NSAIDs

Ibuprofen continues to be one of the most widely prescribed NSAIDs worldwide. According to Intercontinental Marketing Services (“IMS”), in the United States alone, there were over 42 million prescriptions written for ibuprofen in 2015. Ibuprofen’s flexible three times daily dosing allows it to be used for both chronic conditions such as arthritis and chronic back pain, and acute conditions such as sprains and strains.

Famotidine: A Safe and Effective GI Agent

Famotidine is the most potent marketed drug in the class of histamine-2 receptor antagonists (“H2RA”). H2RAs are a class of drugs used to block the action of histamine on the cells in the stomach that secrete gastric acid. Famotidine was chosen as the ideal GI protectant to be combined with ibuprofen as it is a well-studied compound with an estimated 18.8 million patients treated worldwide that provides distinct advantages including:

| • | rapid onset of action; and |

| • | well-tolerated with a low incidence of adverse drug reactions and a demonstrated safety margin of up to eight times the approved prescription dose for an extended period of greater than 12 months. |

Although famotidine as a standalone product is not indicated for risk reduction of GI ulcers, two well-controlled clinical trials of famotidine formulated in DUEXIS found a significant decrease in the risk of developing upper GI ulcers, which in the clinical trials was defined as a gastric and/or duodenal ulcer in patients who are taking ibuprofen for those indications.

14

Benefits of a Fixed-Dose Combination Therapy

Numerous studies have demonstrated that fixed-dose combination therapy provides significant advantages over taking multiple pills. Specifically, fixed-dose combinations can reduce the number of pills, ensure that the correct dosage of each component is taken at the correct time and improve compliance, often associated with better treatment outcomes. DUEXIS has been formulated to provide an optimal dosing regimen of ibuprofen and famotidine together in the convenience of a single pill. Data shows that physicians co-prescribe GI protective agents less than 25 percent of the time when prescribing an NSAID. On occasions where a patient is co-prescribed a GI protective agent, data shows that after three prescriptions, 61 percent of patients no longer take a GI protective agent.

Commercial Status

DUEXIS is indicated for the relief of signs and symptoms of RA and OA and to decrease the risk of developing GI ulcers in patients who are taking ibuprofen for these indications. We began marketing DUEXIS to physicians in December 2011.

In June 2012, we licensed DUEXIS rights in Latin America to Grünenthal, a private company focused on the promotion of pain medicines.

VIMOVO

VIMOVO is a proprietary, fixed-dose, delayed-release tablet. VIMOVO combines enteric-coated naproxen, an NSAID, surrounded by a layer of immediate-release esomeprazole magnesium surrounding the core. Naproxen has proven anti-inflammatory and analgesic properties and esomeprazole magnesium reduces the stomach acid secretions that can cause upper GI ulcers. Both naproxen and esomeprazole magnesium have well-documented and excellent long-term safety profiles and both medicines have been used by millions of patients worldwide. Based on clinical trial results, VIMOVO has been shown to decrease the risk of developing gastric ulcers in patients at risk of developing NSAID associated gastric ulcers.

Naproxen: One of the World’s Most Widely Prescribed NSAIDs

Naproxen is another of the most widely prescribed NSAIDs worldwide. According to IMS, in the United States alone, there were more than 17 million prescriptions written for naproxen in 2015. In addition, naproxen’s twice daily dosing allows it to be used for chronic conditions such as arthritis and AS.

Esomeprazole Magnesium: A Safe and Effective GI Agent

Esomeprazole magnesium, a gastroprotective agent, is a proton pump inhibitor (“PPI”) that works by inhibiting the secretion of gastric acid thus decreasing the amount of acid in the stomach. PPIs are considered to be very potent inhibitors of acid secretion. Esomeprazole magnesium is indicated for reducing the risk of NSAID-induced gastric ulcers.

Benefits of a Fixed-Dose Combination Therapy

VIMOVO is specifically formulated to allow esomeprazole magnesium to achieve its gastroprotective impact before naproxen is released into the system. VIMOVO’s design is intended to produce a sequential delivery of gastroprotective esomeprazole before exposure to naproxen. Data shows that physicians co-prescribe GI protective agents less than 25 percent of the time when prescribing an NSAID. On occasions where a patient is co-prescribed a GI protective agent, data shows that after three prescriptions, 61 percent of patients no longer take a GI protective agent.

15

Commercial Status

Following our acquisition of the U.S. rights to VIMOVO in November 2013, we began marketing VIMOVO in early January 2014.

PENNSAID 2%

PENNSAID 2% is a topical NSAID that is applied directly to the knee and is indicated for the treatment of pain of OA of the knee(s). PENNSAID 2% contains diclofenac sodium, a commonly prescribed NSAID to treat OA pain. PENNSAID 2% also includes dimethyl sulfoxide (“DMSO”), a powerful penetrating agent that helps ensure that diclofenac sodium is absorbed through the skin to the site of inflammation and pain. Topical NSAIDs such as PENNSAID 2% are an alternative to oral NSAID treatment because they reduce systemic exposure to a fraction of that provided by an oral NSAID. PENNSAID 2% is the only topical NSAID offered with the convenience of a metered-dose pump, which ensures that the patient will get the correct amount of PENNSAID 2% solution each time. PENNSAID 2% is easy to apply for patients because PENNSAID 2% is applied in two pumps, twice daily, delivering relief right to the site of OA knee pain.

Commercial Status

On January 16, 2014, the FDA approved PENNSAID 2% for the treatment of the pain of OA of the knee(s). We acquired the U.S. rights to PENNSAID 2% in October 2014, and began marketing PENNSAID 2% with our primary care sales force in early January 2015.

Competition

Our industry is highly competitive and subject to rapid and significant technological change. Our potential competitors in our primary care markets include large pharmaceutical and biotechnology companies, specialty pharmaceutical companies and generic drug companies, although we are not currently aware of any other ibuprofen/famotidine combination medicine or naproxen/esomeprazole magnesium combination medicine in development. We believe that the key competitive factors that will affect the commercial success of our medicines, as well as future drug candidates that we may develop, are their efficacy, safety and tolerability profile, convenience in dosing, price and reimbursement.

DUEXIS and VIMOVO compete with other NSAIDs, including Celebrex which is marketed by Pfizer Inc., and is also a generic medicine known as celecoxib and marketed by other pharmaceutical companies. Celecoxib is an NSAID that selectively inhibits the COX-2 enzyme and is an effective anti-arthritic agent that reduces the risk of ulceration compared to traditional NSAIDs such as ibuprofen.

In general, DUEXIS and VIMOVO also face competition from the separate use of NSAIDs for pain relief and GI medications to address the risk of NSAID-induced ulcers. Use of these therapies separately in generic form may be less expensive than DUEXIS and VIMOVO. We expect to compete with the separate use of NSAIDs and ulcer medications primarily through DUEXIS’ and VIMOVO’s advantages in dosing convenience and patient compliance, and by educating physicians about such advantages. DUEXIS is the only NSAID medicine containing a histamine-2 receptor antagonist with an indication to reduce the risk of NSAID-induced upper GI ulcers and VIMOVO is the only NSAID medicine containing a PPI with an indication to reduce the risk of NSAID-induced ulcers. Data shows that physicians co-prescribe GI protective agents less than 25 percent of the time when prescribing an NSAID. On occasions where a patient is co-prescribed a GI protective agent, data shows that after three prescriptions, 61 percent of patients no longer take a GI protective agent.

PENNSAID 2% faces competition from generic versions of diclofenac sodium topical solutions which are priced significantly lower than the price we charge for PENNSAID 2%. In addition, PENNSAID 2% competes with two other branded topical NSAIDS, including Voltaren Gel, marketed by Endo Pharmaceuticals,

16

which is the market leader in the topical NSAID category. We expect to compete with these other medicines primarily through PENNSAID 2%’s dosing convenience and patient compliance. Unlike the other two medicines that are dosed four times per day and require the patient to measure out the correct dose, only PENNSAID 2% is easy to apply with the convenience of twice-daily dosing and a metered-dose pump, which ensures that the patient will get the correct amount of PENNSAID 2% solution each time.

Distribution

Finished tablets of DUEXIS, VIMOVO, RAYOS, MIGERGOT and BUPHENYL, vials of ACTIMMUNE and KRYSTEXXA, bottles of RAVICTI and PENNSAID 2% and powder of BUPHENYL are shipped to central third-party logistics FDA-compliant warehouses for storage and distribution into the supply chain. Our third-party logistics providers specialize in integrated operations that include warehousing and transportation services that can be scaled and customized to our needs based on market conditions and the demands and delivery service requirements for our medicines and materials. Their services eliminate the need to build dedicated internal infrastructures that would be difficult to scale without significant capital investment. Our third-party logistics providers warehouse all medicines in controlled FDA-registered facilities. Incoming orders are prepared and shipped through an order entry system to ensure just in time delivery of the medicines.

Sales and Marketing

As of June 30, 2016, our sales force was composed of approximately 500 sales representatives consisting of approximately 15 orphan disease sales representatives, 90 rheumatology sales specialists and 395 primary care sales representatives. Our orphan disease representatives focus on marketing our orphan medicines to a limited number of healthcare practitioners who specialize in fields such as pediatric immunology, allergy, infectious diseases, hematology/oncology and metabolic disorders to help them understand the potential benefits of ACTIMMUNE for their patients with CGD and SMO, and the benefits of RAVICTI and BUPHENYL for patients with UCDs. Our rheumatology sales force markets RAYOS, KRYSTEXXA and PENNSAID 2%. With respect to KRYSTEXXA, since the Crealta acquisition, we have increased our sales force from approximately 15 sales representatives to approximately 85 sales representatives and we have added 10 medical scientific liaisons. Our primary care sales force markets DUEXIS, PENNSAID 2% and VIMOVO. We have entered into, and may continue to enter into, agreements with third parties for commercialization of our medicines outside the United States.

Our medicines are dispensed by retail and specialty pharmacies. Part of our commercial strategy for our primary care and rheumatology business units is to offer physicians the opportunity to have their patients fill prescriptions through pharmacies participating in our HorizonCares patient access program. This program does not involve us in the prescribing of medicines. The purpose of this program is solely to assist in ensuring that, when physicians determine that one of our medicines offers a potential clinical benefit to their patients and prescribe the medicine for an eligible patient, financial assistance may be available to reduce a commercial patient’s out-of-pocket costs. In the first six months of 2016, this resulted in 99.8 percent of commercial patients having co-pay amounts of $10 or less when filling prescriptions for our medicines utilizing our patient access program. For commercial patients who are prescribed our primary care medicines or RAYOS, the HorizonCares program offers co-pay assistance when a third-party payer covers a prescription but requires an eligible patient to pay a co-pay or deductible, and offers full subsidization when a third-party payer rejects coverage for an eligible patient. For patients who are prescribed our orphan medicines, our patient access programs provide reimbursement support, a clinical nurse program, co-pay and other patient assistance. The aggregate commercial value of our patient access programs for the six months ended June 30, 2016 was $816.8 million. All pharmacies that dispense prescriptions for our medicines, which we estimate to be about 20,000 in the first half of 2016, are fully independent, including those that participate in HorizonCares. We do not own or possess any option to purchase an ownership stake in any pharmacy that distributes our medicines, and our relationship with each pharmacy is non-exclusive and arm’s length. All of our medicines are dispensed through pharmacies independent of our business. As of December 31, 2015, approximately 25 independent pharmacies participated in the HorizonCares program for our primary care and rheumatology medicines.

17

We have a compliance program in place to address adherence with various laws and regulations relating to our sales, marketing, and manufacturing of our medicines, as well as certain third-party relationships, including pharmacies. Specifically with respect to pharmacies, the compliance program utilizes a variety of methods and tools to monitor and audit pharmacies, including those that participate in our access programs, to confirm their activities, adjudication and practices are consistent with our compliance policies and guidance.

Manufacturing, Commercial and Supply Agreements

We have agreements with third parties for active pharmaceutical ingredients (“APIs”) and product manufacturing, formulation and development services, fill, finish and packaging services, transportation, and distribution and logistics services for certain medicines. In most cases, we retain certain levels of safety stock or maintain alternate supply relationships that we can utilize without undue disruption of our manufacturing processes if a third party fails to perform its contractual obligations.

ACTIMMUNE

ACTIMMUNE is a recombinant protein that is produced by fermentation of a genetically engineered Escherichia coli bacterium containing the DNA which encodes for the human protein. Purification of the active drug substance is achieved by conventional column chromatography. The resulting active drug substance is then formulated as a highly purified sterile solution and filled in a single-use vial for subcutaneous injection, which is the ACTIMMUNE finished drug medicine. In support of its manufacturing process, we and Boehringer Ingelheim International store multiple vials of the Escherichia coli bacterium master cell bank and working cell bank in order to ensure that it will have adequate backup should any cell bank be lost in a catastrophic event.

Boehringer Ingelheim RCV GmbH & Co. KG Supply Agreement

In July 2013, Vidara and Boehringer Ingelheim RCV GmbH & Co. KG (“Boehringer Ingelheim”) entered into an exclusive supply agreement, which we assumed as a result of the Vidara Merger, and which was subsequently amended on June 1, 2015. Pursuant to the agreement, Boehringer Ingelheim manufactures the ACTIMMUNE active drug substance and commercial quantities of the ACTIMMUNE finished drug medicine. Boehringer Ingelheim is our sole source supplier for ACTIMMUNE active drug substance and finished drug medicine. Under the terms of this agreement, we are required to purchase minimum quantities of finished drug medicine of 75,000 vials per annum. Boehringer Ingelheim manufactures our commercial requirements of ACTIMMUNE on an annual basis, and based on our forecasts and the annual contractual minimum purchase quantity. The supply agreement has a term that runs until July 31, 2020 and which can be further renewed by agreement between parties. Under this supply agreement, either we or Boehringer Ingelheim may terminate the agreement for an uncured material breach by the other party or upon the other party’s bankruptcy or insolvency.

Under a development and marketing agreement with Boehringer Ingelheim, we are required to pay royalties on net sales in certain applicable markets in Latin America, Asia, Africa and Eastern Europe if we elect to commercialize ACTIMMUNE in those territories. To date, we have not pursued regulatory or other approvals or commercialized ACTIMMUNE in those territories.

Genentech License Agreement

As a result of the Vidara Merger, we acquired a license agreement, as amended, with Genentech, Inc. (“Genentech”), who was the original developer of ACTIMMUNE. Under such agreement, we are or were obligated to pay royalties to Genentech on our net sales of ACTIMMUNE as follows:

| • | Through November 25, 2014, a royalty of 45 percent of the first $3.7 million in net sales achieved in a calendar year, and 10 percent on all additional net sales in that year; |

18

| • | For the period from November 26, 2014 through May 5, 2018, a royalty in the 20 percent to 30 percent range for the first tier in net sales and in the 1 percent to 9 percent range for the second tier; and |

| • | From May 6, 2018 and for so long as we continue to commercially sell ACTIMMUNE, an annual royalty in the low-single digits as a percentage of annual net sales. |

Either Genentech or we may terminate the agreement if the other party becomes bankrupt or defaults, however, in the case of a default, the defaulting party has 30 days to cure the default before the license agreement may be terminated.

RAVICTI

We have clinical and commercial supplies of glycerol phenylbutyrate API manufactured for us by two alternate suppliers, Helsinn Advanced Synthesis SA (Switzerland) and DSM Fine Chemicals Austria (now known as DPx Fine Chemicals GmbH & Co KG) on a purchase order basis. We have finished RAVICTI drug medicine manufactured by Lyne Laboratories, Inc. under a manufacturing agreement and we have an agreement in place for a fill/finish supplier, Halo Pharmaceuticals, Inc., for European supplies.

Ucyclyd Asset Purchase Agreement

As a result of the Hyperion acquisition, we acquired an asset purchase agreement with Ucyclyd Pharma, Inc. (“Ucyclyd”), pursuant to which we are obligated to pay to Ucyclyd tiered mid- to high- single digit royalties on our global net sales of RAVICTI. The asset purchase agreement cannot be terminated by either party. However, we have a license to certain Ucyclyd manufacturing technology, and Ucyclyd may have a license to certain of our technology, and the party granting a license is permitted to terminate the license if the other party fails to comply with any payment obligations relating to the license and does not cure such failure within a defined time period.

Brusilow License Agreement

As a result of the Hyperion acquisition, we acquired a license agreement with Saul W. Brusilow, M.D. and Brusilow Enterprises, Inc. (“ Brusilow”), pursuant to which we license patented technology related to RAVICTI from Brusilow. Under such agreement, we are obligated to pay low- single digit royalties to Brusilow on net sales of RAVICTI that are covered by a valid claim of a licensed patent. The license agreement may be terminated for any uncured breach as well as bankruptcy. We may terminate also the agreement at any time by giving Brusilow prior written notice, in which case all rights granted to us would revert to Brusilow.

ASD Distribution Services Agreement

As a result of the Hyperion acquisition, we acquired a distribution services agreement, as amended, with ASD Healthcare, a division of ASD Specialty Healthcare, Inc. (“ASD”). Pursuant to the distribution services agreement, ASD is the exclusive reseller of RAVICTI and BUPHENYL in the United States. The distribution services agreement terminates on February 13, 2017, but may be renewed upon mutual written agreement with ASD. Either party may terminate the agreement without cause upon 120 days written notice to the other party, in the case of a material breach that is not cured by the other party, upon 30 days written notice, or in the case of bankruptcy or similar proceeding of the other party, immediately upon written notice.

BUPHENYL

When Hyperion purchased BUPHENYL, Hyperion assumed all of Ucyclyd’s rights and obligations under its manufacturing agreements for the medicine. We assumed these agreements when we acquired Hyperion. We purchase API for BUPHENYL from CU Chemie Uetikon GmbH and final manufacturing, testing and packaging of the medicine is provided by Pharmaceutics International Inc.

19

DUEXIS

The DUEXIS manufacturing process is well-established and we validated the process in accordance with regulatory requirements prior to commercialization in the United States.

The first API in DUEXIS is ibuprofen in a direct compression blend called DC85 and is manufactured for us by BASF Corporation (“BASF”), in Bishop, Texas. The second API in DUEXIS is famotidine, which is available from a number of international suppliers. We currently purchase famotidine manufactured by Dr. Reddy’s in India. We currently receive both APIs in powder form and each is blended with a number of U.S. Pharmacopeia inactive ingredients. We purchase DUEXIS in final, packaged form exclusively from Sanofi-Aventis U.S. LLC (“Sanofi”) for our commercial requirements in North America.

BASF Contract

In July 2010, we entered into a contract with BASF for the purchase of DC85. Pursuant to the agreement, we are obligated to purchase a significant majority of our commercial demand for DC85 from BASF. The contract expires in December 2017. Thereafter, the agreement automatically renews for successive renewal terms of three years each until terminated by either party giving specified prior written notice to the other party. Either party may also terminate the agreement in the event of uncured breach by the other party.

Manufacturing and Supply Agreement with Sanofi

In May 2011, we entered into a manufacturing and supply agreement with Sanofi, which was amended in September 2013. Pursuant to the agreement, Sanofi is obligated to manufacture and supply DUEXIS to us in final, packaged form, and we are obligated to purchase DUEXIS exclusively from Sanofi for our commercial requirements in North America and certain countries and territories in Europe, including the EU member states and Scandinavia, and South America. Sanofi must acquire the components necessary to manufacture DUEXIS, including the APIs, DC85 and famotidine, and is obligated to acquire all DC85 under the terms of our agreements with suppliers, including the current BASF contract. In order to allow Sanofi to perform its obligations under the agreement, we granted Sanofi a non-exclusive license to our related intellectual property. The price for DUEXIS under the agreement varies depending on the volume of DUEXIS we purchase and is subject to annual adjustments to reflect changes in costs as measured by the Producer Price Index published by the U.S. Department of Labor, Bureau of Labor Statistics, and certain other changes and events set forth in the agreement. We have paid for the purchase and installation of equipment necessary to manufacture DUEXIS tablets, and Sanofi is obligated to pay the costs of routine maintenance of the equipment. Upon expiration or termination of the agreement we may also be obligated to reimburse Sanofi for the depreciated net book value of any other equipment purchased by Sanofi in order to fulfill its obligations under the agreement.

The agreement term extends until May 2019, and automatically extends for successive two-year terms unless terminated by either party upon two years prior written notice. Either party may terminate the agreement upon 30 days prior written notice to the other party in the event of breach by the other party that is not cured within 30 days of notice (which notice period may be longer in certain, limited situations) or in the event we lose regulatory approval to market DUEXIS in all countries worldwide, and either party may terminate the agreement without cause upon two years prior written notice to the other party at any time after the third anniversary of the first commercial sale of DUEXIS in any country worldwide.

VIMOVO

AstraZeneca License Agreement

In November 2013, we entered into a license agreement with AstraZeneca (the “AstraZeneca license agreement”), pursuant to which AstraZeneca granted us an exclusive license under certain intellectual property

20

(including patents, know-how, trademarks, copyrights and domain names) of AstraZeneca and its affiliates to develop, manufacture and commercialize VIMOVO in the United States. AstraZeneca also granted us a non-exclusive license under certain intellectual property of AstraZeneca and its affiliates to manufacture, import, export and perform research and development activities with respect to VIMOVO outside the United States but solely for purposes of commercializing VIMOVO in the United States. In addition, AstraZeneca granted us a non-exclusive right of reference and use under certain regulatory documentation controlled by AstraZeneca and its affiliates to develop, manufacture and commercialize VIMOVO in the United States and to manufacture, import, export and perform research and development activities with respect to VIMOVO outside the United States but solely for purposes of commercializing VIMOVO in the United States.

Under the AstraZeneca license agreement, we granted AstraZeneca a non-exclusive sublicense under such licensed intellectual property and a non-exclusive right of reference under certain regulatory documentation controlled by us to manufacture, import, export and perform research and development activities with respect to VIMOVO in the United States but solely for purposes of commercializing VIMOVO outside the United States.