Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Titan Energy, LLC | d264794d8k.htm |

Titan Energy, LLC October 11, 2016 Exhibit 99.1

Cautionary Note Regarding Forward Looking Statements Certain statements contained in this presentation and other written and oral statements made by the Company's representatives may be, forward-looking statements within the meaning of the federal securities laws. These forward-looking statements are based upon information presently available to the Company and assumptions that it believes to be reasonable. Risks, assumptions and uncertainties that could cause actual results to materially differ from the forward-looking statements include, but are not limited to the effects of the bankruptcy filing on the Company's business and the interests of various creditors, equity holders and other constituents; those associated with general economic and business conditions; changes in commodity prices and hedge positions; changes in the costs and results of drilling operations; uncertainties about estimates of reserves and resource potential; the impact of the Company's securities not being listed; inability to obtain capital needed for operations; changes in government environmental policies and other environmental risks; the availability of drilling equipment and the timing of production; tax consequences of business transactions; and other risks, assumptions and uncertainties detailed from time to time in the Company's reports filed with the SEC, including Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and Annual Reports on Form 10-K (including those reports of ARP as the Company's predecessor). Investors are cautioned that all such statements involve risks and uncertainties. Forward-looking statements speak only as of the date hereof, and the Company assumes no obligation to update such statements, except as may be required by applicable law.

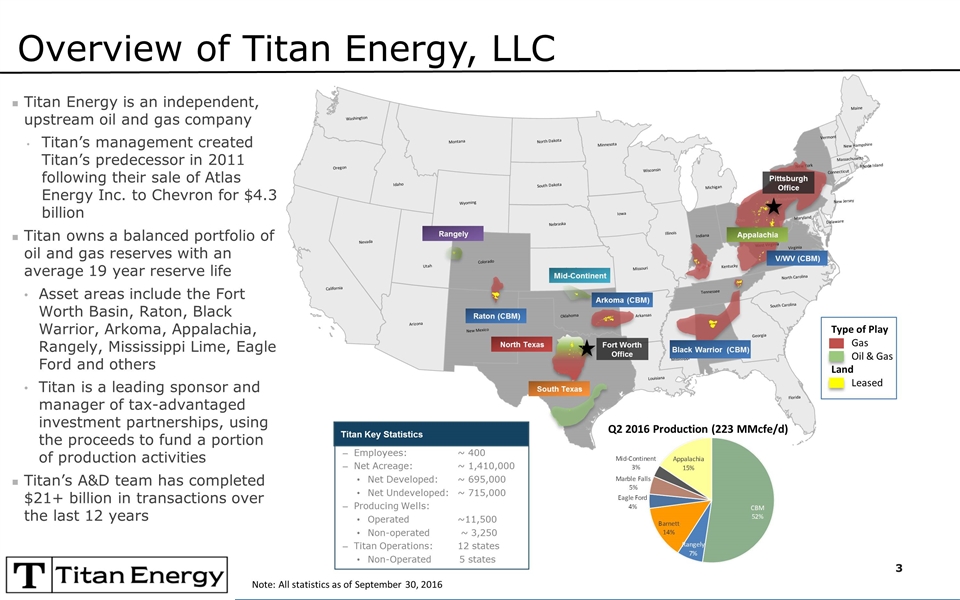

Q2 2016 Production (223 MMcfe/d) Type of Play Gas Oil & Gas Land Leased Overview of Titan Energy, LLC Vermont Alabama Arizona Arkansas California Colorado Connecticut Delaware Florida Georgia Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Virginia Washington West Virginia Wisconsin Wyoming Mid-Continent Type of Play Gas Oil & Gas Land Leased Fort Worth Office Raton (CBM) North Texas Rangely Appalachia South Texas Pittsburgh Office Arkoma (CBM) Black Warrior (CBM) V/WV (CBM) Titan Energy is an independent, upstream oil and gas company Titan’s management created Titan’s predecessor in 2011 following their sale of Atlas Energy Inc. to Chevron for $4.3 billion Titan owns a balanced portfolio of oil and gas reserves with an average 19 year reserve life Asset areas include the Fort Worth Basin, Raton, Black Warrior, Arkoma, Appalachia, Rangely, Mississippi Lime, Eagle Ford and others Titan is a leading sponsor and manager of tax-advantaged investment partnerships, using the proceeds to fund a portion of production activities Titan’s A&D team has completed $21+ billion in transactions over the last 12 years Employees:~ 400 Net Acreage:~ 1,410,000 Net Developed:~ 695,000 Net Undeveloped:~ 715,000 Producing Wells: Operated~11,500 Non-operated ~ 3,250 Titan Operations:12 states Non-Operated 5 states Titan Key Statistics Note: All statistics as of September 30, 2016

Strategic Initiatives to Enhance Value Titan is actively pursuing the following strategic initiatives to grow cash flow, reduce debt and create value for its shareholders: Develop core Eagle Ford position Recently completed 5 wells Fund raising for year end 2016 Tax Advantaged Drilling Partnership Continued optimization of operating expenses and general and administrative costs Titan has already reduced annualized operational and administrative costs by approximately $65 million since Q1 2015 Evaluate and execute transformative accretive acquisitions Reduce costs related to historical tax-advantaged drilling partnerships Sell non-core assets

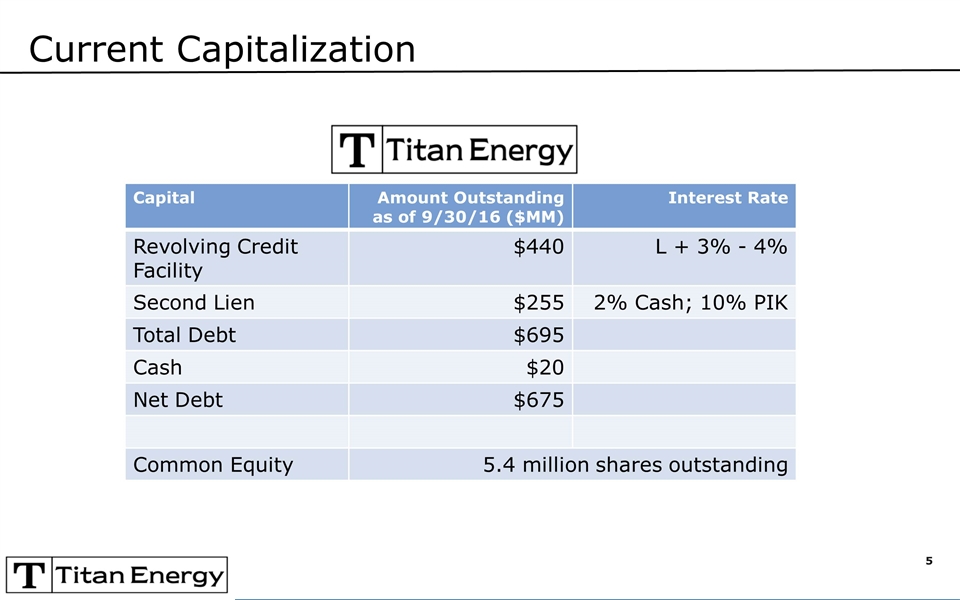

Current Capitalization Capital Amount Outstanding as of 9/30/16 ($MM) Interest Rate Revolving Credit Facility $440 L + 3% - 4% Second Lien $255 2% Cash; 10% PIK Total Debt $695 Cash $20 Net Debt $675 Common Equity 5.4 million shares outstanding

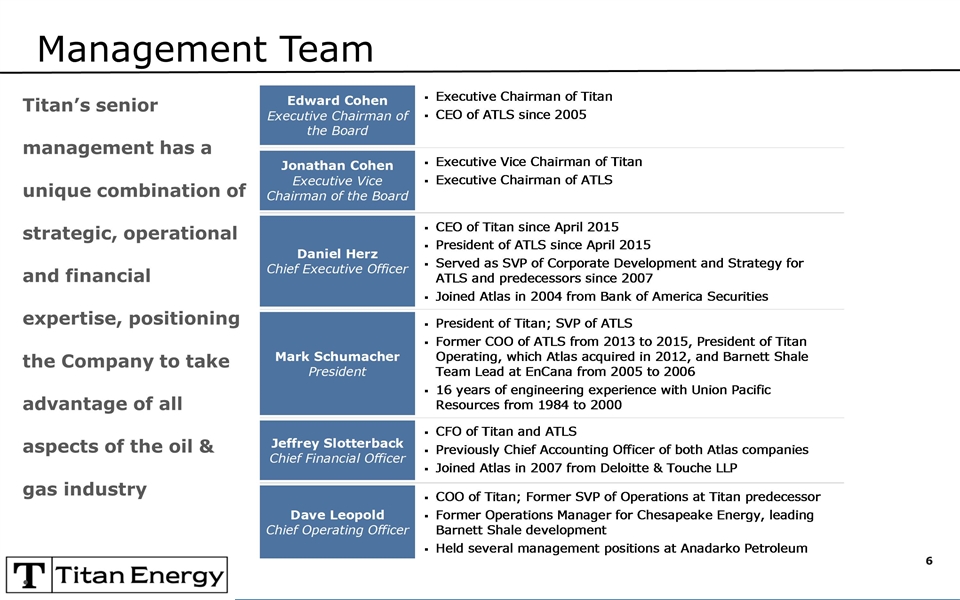

Management Team Titan’s senior management has a unique combination of strategic, operational and financial expertise, positioning the Company to take advantage of all aspects of the oil & gas industry Edward CohenExecutive Chairman of the BoardExecutive Chairman of TitanCEO of ATLS since 2005Jonathan CohenExecutive Vice Chairman of the BoardExecutive Vice Chairman of TitanExecutive Chairman of ATLSDaniel HerzChief Executive OfficerCEO of Titan since April 2015President of ATLS since April 2015Served as SVP of Corporate Development and Strategy for ATLS and predecessors since 2007Joined Atlas in 2004 from Bank of America SecuritiesMark SchumacherPresidentPresident of Titan; SVP of ATLSFormer COO of ATLS from 2013 to 2015, President of Titan Operating, which Atlas acquired in 2012, and Barnett Shale Team Lead at EnCana from 2005 to 200616 years of engineering experience with Union Pacific Resources from 1984 to 2000Jeffrey SlotterbackChief Financial OfficerCFO of Titan and ATLSPreviously Chief Accounting Officer of both Atlas companiesJoined Atlas in 2007 from Deloitte & Touche LLPDave LeopoldChief Operating OfficerCOO of Titan; Former SVP of Operations at Titan predecessorFormer Operations Manager for Chesapeake Energy, leading Barnett Shale developmentHeld several management positions at Anadarko Petroleum

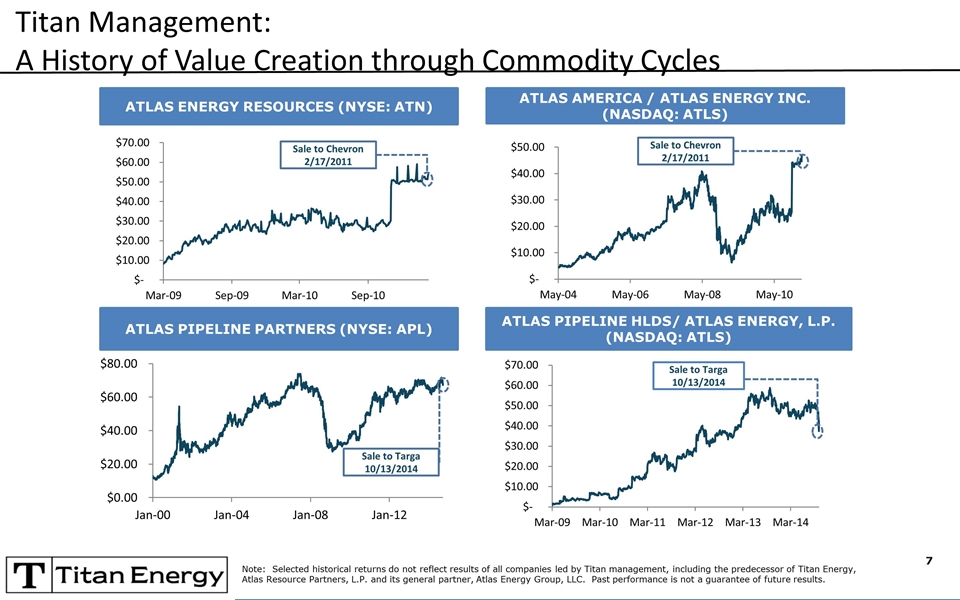

Titan Management: A History of Value Creation through Commodity Cycles ATLAS ENERGY RESOURCES (NYSE: ATN) ATLAS PIPELINE PARTNERS (NYSE: APL) ATLAS AMERICA / ATLAS ENERGY INC. (NASDAQ: ATLS) ATLAS PIPELINE HLDS/ ATLAS ENERGY, L.P. (NASDAQ: ATLS) Sale to Targa 10/13/2014 Sale to Targa 10/13/2014 Sale to Chevron 2/17/2011 Sale to Chevron 2/17/2011 Note: Selected historical returns do not reflect results of all companies led by Titan management, including the predecessor of Titan Energy, Atlas Resource Partners, L.P. and its general partner, Atlas Energy Group, LLC. Past performance is not a guarantee of future results.