Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - SoOum Corp. | ex322.htm |

| EX-32.1 - CERTIFICATION - SoOum Corp. | ex321.htm |

| EX-31.2 - CERTIFICATION - SoOum Corp. | ex312.htm |

| EX-31.1 - CERTIFICATION - SoOum Corp. | ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________________________

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _________________.

Commission File No. 000-07475

Indicate by check mark if the registrant is a well-known seasoned registrant, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [X ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

i

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer [ ] | Accelerated filer [ ] |

Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule l2b-2 of the Exchange Act). Yes [ ] No [X]

As of March 15, 2016, the aggregate market value of the common equity held by non-affiliates computed by reference to the price at which the common equity was last sold on such date was approximately $113,400.

The number of shares outstanding of the registrant’s common stock, par value $0.0001 per share, as of March 31, 2016 was 60,788,382.

DOCUMENTS INCORPORATED BY REFERENCE

None.

ii

FORM 10-K

Swordfish Financial, Inc.

INDEX

PAGE |

||

PART I |

| |

Item 1. | Business | 2 |

Item 1A. | Risk Factors | 6 |

Item 2. | Property | 6 |

Item 3. | Legal Proceedings | 6 |

Item 4. | Mine Safety Disclosures | 6 |

PART II | ||

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 6 |

Item 6. | Selected Financial Data | 7 |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 7 |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 8 |

Item 8. | Financial Statements and Supplementary Data | 8 |

Item 9. | Controls And Procedures | 8 |

PART III | ||

Item 10. | Directors, Executive Officers and Corporate Governance | 10 |

Item 11. | Executive Compensation | 12 |

Item 12. | Security Ownership of Certain Beneficial Owners and Management | 13 |

Item 13. | Certain Relationships and Related Transactions and Director Independence | 14 |

Item 14. | Principal Accountant Fees and Services | 14 |

PART IV | ||

Item 15. | Exhibits, Financial Statement Schedules | 15 |

Signatures | 16 |

1

Forward Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements”. Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “expect,” “anticipate,” “predict,” “project,” “forecast,” “potential,” “continue” and negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties associated with such forward-looking statements. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Annual Report on Form 10-K and include information concerning possible or assumed future results of our operations, including statements about business strategies; future cash flows; financing plans; plans and objectives of management; future cash needs; future operations; business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. All subsequent written and oral forward-looking statements concerning other matters addressed in this Annual Report on Form 10-K and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Annual Report on Form 10-K.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

PART I

Item 1. BUSINESS.

Corporate History

SoOum Corp. (2015 to Present), (f/k/a Swordfish Financial, Inc., (2009-2015) (f/k/a Photo Control Corporation (1959-2004) and Nature Vision, Inc. (2004-2009)) (the “Company”, “we,” or “us”) was incorporated as a Minnesota corporation on August 19, 1959. On August 31, 2004, the Company changed its name to Nature Vision, Inc. in connection with a merger transaction with Nature Vision Operating Inc. (f/k/a Nature Vision, Inc.) a Minnesota corporation that was incorporated in 1998. As a part of the merger, Nature Vision Operating Inc. became a wholly-owned subsidiary of the Company. Upon the merger with Swordfish Financial, Inc., a Texas corporation on August 17, 2009, the shareholders of the Company owning a majority of the outstanding common stock voted to change the Company’s name to Swordfish Financial, Inc. On November 12, 2014, SoOum, Corp., (“SoOum”) a Delaware corporation merged into the Company and on May 2, 2015 the shareholders voted to change the Company’s name to SoOum Corp. Our executive offices are located at P.O. Box 431, Vernon, Arizona 85940; our telephone number is (646) 801-3772; and our website is www.sooum.com.

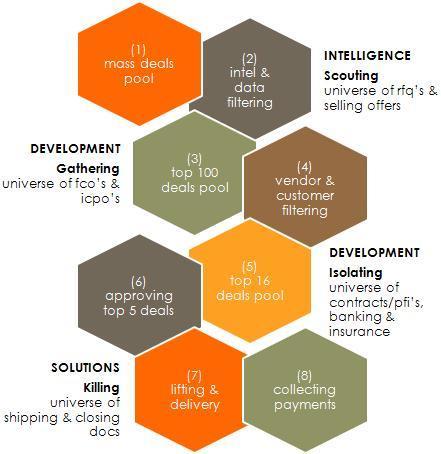

The Company is an international commodity trading arbitrage firm, which uses its own proprietary technology to identify and exploit arbitrage opportunities. The Company performs arbitrage on a defined supply and demand conditions creating price discrepancies of physical commodities in opposing markets. The Company also plans to distribute trade intelligence to global subscribers in order to solve supply shortages and to bring new business to local manufacturers. This part of the business is in the development stage. Unlike specialized supply chains, the Company’s solutions focus on broad, real time information management, reliable trade economics, fast computing and proprietary algorithms to find surpluses and fill shortages.

The Company takes a coordinated view of the global economy seeking out predictability within the global flow of commodities and finding the Company’s strategic position within that dynamic. Then, the Company implements tactics from the ancient persistence hunt model (hereafter “PHM”) to manage a pool of projects and brings a portion of these potential transactions to closing.

2

Opportunity in Arbitrage Model

![[soumtest001.jpg]](soumtest001.jpg)

Commodities

The Company primarily focuses on commodities highly demanded in areas of conflict and frontier marketplaces. The Company categorizes transactions as soft commodity trades and hard commodity trades.

- Soft Commodities Trades: rice, wheat, sugar, soybeans, meats, live cattle, seafood, live seafood and other soft commodities, as intelligence indicates.

-Hard Commodities Trades: iron ore, crude oil, coal, salt, aluminum, copper, gold, silver, palladium and platinum, cement, fly ash, precious metals and other such hard commodities, as intelligence indicates.

Completion of Transactions

Closing Model

Seek out the following results:

1. Persistence over the long-run alleviates risk | 2. Document accumulation creates a ratchet effect towards absolute finalization of transactions |

3

|

|

Methodology

1. Find - Intelligence Department (based upon scouting stage of the hunt)

a. Objectives:

i.Record first hand & economic “intelligence”

ii.Pool large groups of “target” prices

iii.Match (i.) “intelligence” & (ii.) - “targets” through the company’s fast computing system (hereafter “Medee”)

2. Filter - Development Department (based upon gathering and isolating stage of the hunt)

a. Objectives:

i.Attain due diligence on all matched transactions

ii.Filter a list of the best 16 transactions

iii.Attain binding agreements for all parties

3. Close - Solutions Department (based upon killing stage of the hunt)

a. Objectives:

i.Create a closing package on best 5 transactions

ii.Inspect, deliver and submit closing package to pertinent parties

4

Pricing Strategy

The Company seeks a pricing that offers the average or greater earnings taken from the pool of transactions. Earnings is calculated as the arbitrage existing across national borders, geographic barriers and economic shifts resulting from political activity or force majeure.

Since the Company is not building a supply chain it believes the following:

- It carries much less facilities and labor liability.

-It chooses transactions with least capital exposure by utilizing fast computing, discovering minimum costs and maximum exit.

-Its delivered price will normally fall beneath our competitors' using less efficient methods of partnerships and cooperative pricing tactics.

Finding opposing targets and intelligence

![[soumtest004.jpg]](soumtest004.jpg)

Business Operations

Effective on the date of our merger with SoOum, November 12, 2014, the Company changed its business focus to commodities trading.

5

Item 1A. RISK FACTORS.

Not applicable.

Item 1B. UNRESOLVED STAFF COMMENTS

None.

Item 2. PROPERTIES.

The Company does not own or lease any real estate as of December 31, 2015.

Item 3. LEGAL PROCEEDINGS.

From time to time, we may become party to litigation or other legal proceedings that we consider to be a part of the ordinary course of our business. We are not currently involved in legal proceedings that could reasonably be expected to have a material adverse effect on our business, prospects, financial condition or results of operations; provided that we do not currently have sufficient funds to satisfy our outstanding judgments as described above. We may become involved in material legal proceedings in the future.

Item 4. MINE SAFETY DISCLOSURES.

Not applicable.

PART II

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market Information.

We had 60,788,382 shares of our common stock issued and outstanding as of March 15, 2016, which shares were held by 375 record holders.

Our common stock is currently quoted on the OTC Pink market (commonly referred to as the “pinksheets”) under the symbol “SOUM”. The following table sets forth, for the periods indicated, the high and low sales prices for our common stock, for the quarters presented. Prices represent inter-dealer quotations without adjustments for markups, markdowns, and commissions, and may not represent actual transactions.

Common Stock

| Quarter Ended | ||

2015 |

High |

Low |

December 31 | $ 0.175 | $0.0012 |

September 30 | $ 0.100 | $ 0.001 |

June 30 | $ 0.200 | $ 0.100 |

March 31 | $ 0.500 | $ 0.200 |

2014 | ||

December 31 | $0.0001 | $0.0009 |

September 30 | $0.0002 | $0.001 |

June 30 | $0.0011 | $0.0002 |

March 31 | $.00034 | $0.0011 |

The Company's common stock is considered a "penny stock" as defined in the Commission's rules promulgated under the Exchange Act (the “Rules”). The Commission's rules regarding penny stocks impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally persons with net worth in excess of $1,000,000, exclusive of residence, or an annual income exceeding $200,000 or $300,000 jointly with their spouse). For transactions covered by the rules, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser's written agreement to the transaction prior to the sale. Thus the Rules affect the ability of broker-dealers to sell the Company's shares should they wish to do so because of the adverse effect that the Rules have upon liquidity of penny stocks. Unless the transaction is exempt under the Rules, under the Securities Enforcement Remedies and Penny Stock Reform Act of 1990, broker-dealers effecting customer transactions in penny stocks are required to provide their customers with (i) a risk disclosure document; (ii) disclosure of current bid and ask quotations if any; (iii) disclosure of the compensation of the broker-dealer and its sales personnel in the transaction; and (iv) monthly account statements showing the market value of each penny stock held in the customer's account. As a result of the penny stock rules, the market liquidity for the Company's securities may be severely adversely affected by limiting the ability of broker-dealers to sell the Company's securities and the ability of purchasers of the securities to resell them.

6

Dividends

We have not paid any dividends on our common stock to date and do not anticipate that we will be paying dividends in the foreseeable future. Any payment of cash dividends on our common stock in the future will be dependent upon the amount of funds legally available, our earnings, if any, our financial condition, our anticipated capital requirements and other factors that our Board of Directors may think are relevant. However, we currently intend for the foreseeable future to follow a policy of retaining all of our earnings, if any, to finance the development and expansion of our business and, therefore, do not expect to pay any dividends on our common stock in the foreseeable future. Additionally, the terms of our preferred stock impose restrictions on our ability to pay dividends.

Equity Compensation Plan Information

The Company does not have any outstanding stock incentive or similar plans through which it plans to issue securities at this time.

Recent Sales Of Unregistered Securities

During the three months ended December 31, 2015, the Company had no sales of unregistered securities.

Item 6. SELECTED FINANCIAL DATA

Not required for smaller reporting issuers.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following discussion and analysis of financial condition, results of operations, liquidity and capital resources should be read in conjunction with our audited consolidated financial statements and notes thereto appearing elsewhere in this report. This discussion contains forward-looking statements that involve risks and uncertainties, including information with respect to the plans, intentions and strategies for our businesses. The actual results may differ materially from those estimated or projected in any of these forward-looking statements.

Results of Operations

Year Ended December 31, 2015 Compared With Year Ended December 31, 2014

Net revenues for the years ended December 31, 2015 and 2014 was $46,842 and $1,992, respectively. Net income for the year ended December 31, 2015 was $11,023,787 compared to net loss of ($14,751,242) for the year ended December 31, 2014.

Total operating expenses were $2,003,041 for the year ended December 31, 2015 compared to $1,220,941 for the year ended December 31, 2014. The primary expenses for the year ended December 31, 2015 were general and administrative expenses of $1,338,849, interest expense of approximately $663,192 and compared to general and administrative expenses of $632,478, interest expense of $588,463 for the year ended December 31, 2014.

Total Other (Income) and Expenses were ($13,022,938) for the year ended December 31, 2015 compared to $13,532,293 for the year ended December 31, 2014. The primary other (income) and expenses for the year ended December 31, 2015 were gain on conversion feature of preferred shares of ($12,845,480) and loss on derivative of $37,878 and write-off of liabilities of $(215,336) compared to loss on conversion feature of preferred shares of $12,845,480, gain on derivative of ($86,998), impairment of goodwill of $480,000 loss on conversion of $293,811 and write off of accrued expenses of $0 for the year ended December 31, 2014.

7

Liquidity and Capital Resources

Our operations used approximately $45,345 in cash for the year ended December 31, 2015.

Investing activities used $297 for the year ended December 31, 2015. Cash required during the year ended December 31, 2015, came principally from cash proceeds from convertible notes payable of $41,300 and cash proceeds from notes payable affiliates of $4,379.

Our operations used approximately $180,107 in cash for the year ended December 31, 2014. Cash required during the year ended December 31, 2014, came principally from cash proceeds from debt of $164,500 and cash proceeds from equity purchase agreement of $10,000 for the year ended December 31, 2014.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and the liquidation of liabilities in the normal course of business. We incurred net income (losses) of $11,022,787 and ($14,751,242), respectively, for the years ended December 31, 2015 and 2014 and had an accumulated deficit of $15,110,830 as of December 31, 2015. We have managed our liquidity during the first, second and third quarters of 2015 through the issuance of convertible notes. These factors raise substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Item 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Pursuant to Item 305(e) of Regulation S-K (§ 229.305(e)), the Company is not required to provide the information required by this Item as it is a “smaller reporting company,” as defined by Rule 229.10(f)(1).

Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

See Financial Statements beginning on page 17.

Item 9. CONTROLS AND PROCEDURES.

Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our Principal Executive Officer and Principal Financial Officer, evaluated the effectiveness of our disclosure controls and procedures (as defined in the Securities Exchange Act of 1934 Rules 13a-15(e) and 15d-15(e)) as of the end of the period covered by this Annual Report on Form 10-K. In designing and evaluating the disclosure controls and procedures, management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives. In addition, the design of disclosure controls and procedures must reflect the fact that there are resource constraints and that management is required to apply its judgment in evaluating the benefits of possible controls and procedures relative to their costs.

Based on our evaluation, our Principal Executive Officer and Principal Financial Officer, after considering the existence of material weaknesses identified, determined that our internal control over financial reporting disclosure controls and procedures were not effective as of December 31, 2015.

Management’s Annual Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934, as amended. Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. generally accepted accounting principles.

8

Our internal control over financial reporting includes those policies and procedures that: (i) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of our assets, (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with the authorization of our management and directors, and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on our financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management, including our Principal Executive Officer and Principal Financial Officer, assessed the effectiveness of our internal control over financial reporting as of December 31, 2015. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control over Financial Reporting - Guidance for Smaller Public Companies.

We identified the following deficiencies which together constitute a material weakness in our assessment of the effectiveness of internal control over financial reporting as of December 31, 2015:

-The Company has inadequate segregation of duties within its cash disbursement control design.

-During the year ended December 31, 2015, the Company internally performed all aspects of its financial reporting process, including, but not limited to the underlying accounting records and the recording of journal entries and for the preparation of financial statements. This process was deficient, because these duties were performed often times by the same people, and therefore a lack of review was created over the financial reporting process that might result in a failure to detect errors in spreadsheets, calculations, or assumptions used to compile the financial statements and related disclosures as filed with the SEC. These control deficiencies could result in a material misstatement to our interim or annual financial statements that would not be prevented or detected.

The Company is continuing the process of remediating its control deficiencies. However, the material weakness in internal control over financial reporting that has been identified will not be remediated until numerous internal controls are implemented and operate for a period of time, are tested, and the Company is able to conclude that such internal controls are operating effectively. The Company cannot provide assurance that these procedures will be successful in identifying material errors that may exist in the financial statements. The Company cannot make assurances that it will not identify additional material weaknesses in its internal control over financial reporting in the future. Management plans, as capital becomes available to the Company, to increase the accounting and financial reporting staff and provide future investments in the continuing education and public company accounting training of our accounting and financial professionals.

It should be noted that any system of controls, however well designed and operated, can provide only reasonable, and not absolute, assurance that the objectives of the system are met. In addition, the design of any control system is based in part upon certain assumptions about the likelihood of future events. Because of these and other inherent limitations of control system, there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions.

This annual report does not include an attestation report of the Company's registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the Company's registered public accounting firm pursuant to rules of the Securities and Exchange Commission that permit us to provide only management's report in this annual report.

9

We regularly review our system of internal control over financial reporting to ensure we maintain an effective internal control environment. There were no changes in our internal controls over financial reporting during the quarter ended December 31, 2015 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART III

Item 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

Directors and Executive Officers

Our directors and executive officers are as follows:

Name and Address | Age | Position(s) |

William B. Westbrook PO Box 431 Vernon, AZ 85940 | 40 | President and Director |

Luis J. Vega 1773 Carthage Ct. Brownsville, TX 78520 | 49 | Secretary and Director |

Ronald Vega 222 Purchase Street #117 Rye, NY 10580 | 48 | Chief Financial Officer and Director |

BIOGRAPHY

The following sets forth biographical information regarding the Company’s directors:

William Westbrook

Since February, 2013 Mr. Westbrook has served as President and CEO, and as a member of the Board of Directors of SoOum. From 2008 to 2013 Mr. Westbrook served as CEO of Estmar Global, Inc. located in West Point, Utah. Estmar Global, Inc. is an international trade company involved in the buying and selling of physical commodities. From 2008 to 2009 Mr. Westbrook served as a business and management consultant for Aspen Technologies, located in Burlington, Massachusetts. From 2007 to 2008 Mr. Westbrook acted as the budget director for Romney for President. William Westbrook served as assistant controller of the Lennar Corporation, located in Tucson, Arizona from 2006 to 2007. In 2001 Mr. Westbrook received a Bachelor of Arts degree in Economics from Brigham Young University, located in Provo, Utah.

Ronald A. Vega

Mr. Ronald A. Vega served as a Senior Indirect Tax Manager for BP Corporation located in Houston, Texas from March, 2004 through May, 2012. From June, 2012 through February, 2014 Mr. Vega served as Vice President of Business Development for DL Trading, LLC located in Katy, Texas. DL Trading, LLC is involved in the trading of previously undeveloped duty drawback recoveries associated with the importation and exportation of specific petro chemicals, plastics and chemical products. From June, 2013 to the present Mr. Vega was employed by Stelle Innovations, LLC as Vice President of Business Development and Operations. Stelle Innovations, LLC is located in Rye, New York and it is a provider of procurement and sourcing supply chain logistic services for companies engaged in capital improvement projects. From April, 2014 to the present Mr. Vega has served as the Chief Financial Officer and a Director of SoOum Corporation. In 1991, Mr. Vega received a BBA degree in Accounting from the University of Texas-Pan American located in Edinburgh, Texas. In May, 2000 Mr. Vega received a Juris Doctorate Degree from Indiana University School of Law, located in Indianapolis, Indiana.

10

Luis J. Vega

Mr. Luis J. Vega served in the United States Army from 1985 to 2005 as a Nuclear Biological Chemical Warfare Specialist Senior Procurement and Operations manager. From June 2005 to October 2007 Mr. Vega was an employee of SMI GMS at Fort Polk, LA as Senior Logistics Manager assisting deploying military units. From 2007 to August 2009 Mr. Vega was Business Development Manager of Estmar Global. From August, 2009 to October, 2010 Mr. Vega was a Civil Service Employee for the Department of Defense (DOD) and with Cubic Defense Applications located in Ft. Irwin, California, where he was in charge of Middle East, Europe and Asia operations. Cubic Defense Applications is a DOD contractor, and Mr. Vega served as a Training Analyst there. From December, 2010 to August, 2011 Mr. Vega was also employed by ConsultNet which is located in Salt Lake City, Utah. ConsultNet is a staffing and recruiting business, and Mr. Vega served as a recruiter. From 2014, to the present Mr. Vega has served as Chief Operations Officer and a member of the Board of Directors of SoOum. Mr. Vega received a Bachelor of Science degree in Health and Administration from the University of Phoenix in 2011. The University of Phoenix is located in Phoenix, Arizona. In December 2014, he received his Master’s Degree in Health Administration from the University of Phoenix, located in Salt Lake City, Utah.

Corporate Governance

The Company promotes accountability for adherence to honest and ethical conduct; endeavors to provide full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with the Securities and Exchange Commission (the “SEC”) and in other public communications made by the Company; and strives to be compliant with applicable governmental laws, rules and regulations. The Company has not formally adopted a written code of business conduct and ethics that governs the Company’s employees, officers and directors as the Company is not required to do so.

In lieu of an Audit Committee, the Company’s Board of Directors, is responsible for reviewing and making recommendations concerning the selection of outside auditors, reviewing the scope, results and effectiveness of the annual audit of the Company's financial statements and other services provided by the Company’s independent public accountants. The Board of Directors reviews the Company's internal accounting controls, practices and policies.

Committees of the Board

Our Company currently does not have nominating, compensation, or audit committees or committees performing similar functions nor does the Company have a written nominating, compensation or audit committee charter. The Board of Directors believes that it is not necessary to have such committees, at this time, because the functions of such committees can be adequately performed by the directors.

Audit Committee Financial Expert

Our Board of Directors has determined that we do not have a board member that qualifies as an "audit committee financial expert " as defined in Item 407(D)(5) of Regulation S-K, nor do we have a Board member that qualifies as "independent" as the term is used in Item 7(d)(3)(iv)(B) of Schedule 14A under the Securities Exchange Act of 1934, as amended, and as defined by Rule 4200(a)(14) of the FINRA Rules.

We believe that our directors are capable of analyzing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. In addition, we believe that retaining an independent director who would qualify as an "audit committee financial expert" would be overly costly and burdensome and is not warranted in our circumstances given the stage of our development.

Board Meetings and Annual Meeting

During the fiscal year ended December 31, 2015, our Board of Directors held four formal meetings. We did not hold an annual meeting in 2014. All of our directors attended at least 75% of the meetings of the Board of Directors.

Code Of Business Conduct And Ethics

Each of the Company’s directors and employees, including its executive officers, are required to conduct themselves in accordance with ethical standards set forth in the Code of Business Conduct and Ethics adopted by the Board of Directors. The Code of Business Conduct and Ethics was previously filed as Exhibit 14.1 to the Company’s Annual Report on Form 10-KSB for the fiscal year ended December 31, 2005. Any amendments to or waivers from the code will be posted on our website. Information on our website does not constitute part of this filing.

11

Shareholder Proposals

Our Company does not have any defined policy or procedural requirements for shareholders to submit recommendations or nominations for directors. The Board of Directors believes that, given the stage of our development, a specific nominating policy would be premature and of little assistance until our business operations develop to a more advanced level. Our Company does not currently have any specific or minimum criteria for the election of nominees to the Board of Directors and we do not have any specific process or procedure for evaluating such nominees. The Board of Directors will assess all candidates, whether submitted by management or shareholders, and make recommendations for election or appointment to the Board.

Item 11. EXECUTIVE COMPENSATION.

The following table summarizes the compensation earned during the last two fiscal years by our executive officers.

SUMMARY COMPENSATION TABLE*

|

|

|

|

|

|

|

|

|

|

Name and Principal Position |

Year |

Salary (1) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Nonqualified Deferred Compensation ($) |

All Other Compensation ($) |

Total ($) (2) |

William Westbrook President, CEO and Director |

2015 2014 |

$-0- $-0- |

$-0- $-0- |

$-0- $-0- |

$-0- $-0- |

$-0- $-0- |

$-0- $-0- |

$-0- $-0- |

$-0- $-0- |

Luis Vega Secretary and Director |

2015 2014 |

$-0- $-0- |

$-0- $-0- |

$3,500 $-0- |

$-0- $-0- |

$-0- $-0- |

$-0- $-0- |

$-0- $-0- |

$3,500 $-0- |

Ronald Vega Chief Financial Officer and Director |

2015 2014 |

$-0- $-0- |

$-0- $-0- |

$-0- $-0- |

$-0- $-0- |

$-0- $-0- |

$-0- $-0- |

$-0- |

$-0- |

* No executive employees received any Bonus, Option Awards, Non-Equity Incentive Plan Compensation or Nonqualified Deferred Compensation Earnings during the periods presented. Does not include perquisites and other personal benefits, or property, unless the aggregate amount of such compensation is more than $10,000.

(1)

Since the time of the merger with SoOum on November 12, 2014 and the election of new officers and directors, no compensation was paid to the executive officers of the Company during fiscal years 2014 and 2015.

Employment Agreements

The Company has no employment contracts. There are no compensation plans or arrangements, including payments to be made by us with respect to our officers, directors, employees or consultants that would result from the resignation, retirement or any other termination of such directors, officers, employees or consultants. There are no arrangements for compensation to be paid to our directors, officers, employees or consultants that would result from a change-in-control.

12

Stock Options

The Company had no stock options outstanding at December 31, 2015.

Board of Director Compensation

Our executive directors did not receive any compensation, for their service as Directors of the Company for the years ended December 31, 2015 and 2014.

Item 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

The following table sets forth certain information as of March 31, 2016 with respect to the beneficial ownership of our common stock, by (i) each stockholder known to be the beneficial owner of 5% or more of the outstanding common stock of the Company (based solely on the Company’s record shareholders list as of March 15, 2016, and Schedule 13D’s and Section 16 reports filed with the SEC), (ii) each executive officer and director, and (iii) all executive officers and directors as a group.

Beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act. Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares is deemed to include the amount of shares beneficially owned by such person by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at any particular date.

We believe that, except as otherwise noted and subject to applicable community property laws, each person named in the following table has sole investment and voting power with respect to the shares of common stock shown as beneficially owned by such person.

Name and Address of Beneficial Owner |

Shares of Common Stock Beneficially Owned | Shares of Series D Preferred Stock Beneficial Owned (1) (2) | |

Number | Number | Percent | |

William Westbrook PO Box 431 Vernon, AZ 85940 | 0 | 1,575,000 | 49.1 |

Ronald A. Vega 222 Purchase Street #117 Rye, NY 10580 | 0 | 100,000 | 3.1 |

Luis J. Vega 1773 Carthage Ct. Brownsville, TX 78520 | 35,000,000 | 870,000 | 27.1 |

All Officers and Directors as a Group (3 persons) | 35,000,000 | 2,545,000 | 79.4 |

(1) As of March 31, 2016, applicable percentage ownership is based on 3,205,788,382 voting and conversion rights outstanding consisting of 60,788,382 shares of common stock and 3,145,000 shares of Series D Preferred stock.

(2) Each share of Series D Preferred stock is convertible into one thousand shares of common stock and grants the holder 1,000 votes.

13

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company's directors and officers, and persons who beneficially own more than 10% of a registered class of the Company's equity securities, to file reports of beneficial ownership and changes in beneficial ownership of the Company's securities with the SEC on Forms 3, 4 and 5. Officers, directors and greater than 10% stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on the Company's review of the copies of the forms received by it during the fiscal year ended December 31, 2015 and written representations that no other reports were required, the Company does not believe that any persons required to make filings under Section 16(a) during such fiscal year failed to file such reports or filed such reports late.

Item 13. CERTAIN RELATIONSHIPS, RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

Review, Approval and Ratification of Related Party Transactions

Given our small size and limited financial resources, we have not adopted formal policies and procedures for the review, approval or ratification of related party transactions, with our executive officers, directors and significant stockholders. We intend to establish formal policies and procedures in the future, once we have sufficient resources and have appointed additional directors, so that such transactions will be subject to the review, approval or ratification of our Board of Directors, or an appropriate committee thereof. On a moving forward basis, our directors will continue to approve any related party transaction.

Director Independence

We do not have an audit, compensation or nominating committee, but our entire Board of Directors acts in such capacities. Although our directors are not considered as “independent directors” pursuant to the provisions of Item 407(a) of Regulation S-K, we believe that the members of our Board of Directors are capable of analyzing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. The Board of Directors of our Company does not believe that it is necessary to have an audit committee, because we believe that the functions of an audit committee can be adequately performed by the Board of Directors. In addition, we believe that retaining an independent director who would qualify as an “audit committee financial expert” would be overly costly and burdensome and is not warranted in our circumstances given the early stage of our development.

Item 14. PRINCIPAL ACCOUNTING FEES AND SERVICES.

Swordfish Financial Independent Public Accountant’s Fees

The following table presents fees for professional services rendered by John Scrudato, CPA for the audit of the Company’s financial statements for the years ended December 31, 2014 and 2015:

2015 | 2014 | ||||

Audit Fees | $5,500.00 | $0 | |||

Audit Related Fees | $5,500.00 | $0 | |||

Tax Fees | $ 0 | $0 | |||

All Other Fees | $ 0 | $0 | |||

Total | $5,500.00 | $ 0 | |||

Audit Fees were for professional services for auditing and reviewing the Company’s financial statements, as well as for consents and assistance with and review of documents filed with the Securities and Exchange Commission.

Pre-Approval Policy for Services of SoOum Financial Independent Auditors

The Board of Directors review the Form 10-Q and Form 10-K filings before their filing. In addition, the Board of Directors reviews the audit plans and anticipated fees for audit and tax work prior to the commencement of that work. All fees paid to the independent auditors are pre-approved by the Board of Directors. These services may include audit services, audit-related services, tax services and other services.

14

PART IV

Item 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

1. Financial Statements

Financial Statements:

17

Balance Sheets

18

Statements Of Operations

19

Statements Of Stockholders' Deficits

20

Statements Of Cash Flows

21

Notes to Financial Statements

22

2. Financial Statement Schedules

Schedules have been omitted because they are not required, not applicable, or the required information is otherwise included.

3. Exhibits

See the Exhibit Index immediately following the signature page of this Annual Report on Form 10-K.

15

SIGNATURES

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

SoOum Corp.

Date: October 05, 2016

By /s/ William Westbrook

William Westbrook

Chief Executive Officer

(Principal Executive Officer)

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|

|

|

|

Signature |

| Title |

| Date |

/s/ Willaim Westbrook |

|

President, Chief Executive Officer and Director (Principal Executive Officer) |

|

October 05, 2016 |

/s/ Ronald Vega |

|

Treasurer, Chief Financial Officer and Director (Principal Financial/Accounting Officer) |

|

October 05, 2016 |

Exhibit Index

3.1 | Amended and Restated Articles of Incorporation (previously filed as Exhibit 3.1 to the Registrant’s Report on Form 8-K dated September 7, 2004). | |

3.2 | Amended of Articles of Incorporation Changing the Company’s Name to Swordfish Financial, Inc. (previously filed as Exhibit 3.1 to the Registrant’s Report on Form 8-K filed September 4, 2009). | |

3.3 | Amendment of Articles of Incorporation – Increasing Authorized Shares of Common Stock to 500,000,000 shares and Preferred Stock to 50,000,000 shares (filed as Exhibit 3.1 to Registrant’s Report on Form 8-K dated November 12, 2010). | |

3.4 | Amended and Restated Bylaws (previously filed as Exhibit 3.2 to the Registrant’s Report on Form 8-K dated September 7, 2004). | |

3.5 | Amended and Restated Articles of Incorporation changing the Company’s name to SoOum Corp. and initiating a 1,000 to 1 reverse stock split. (previously filed as an exhibit to the Registrant’s Information Statement dated August 12, 2015). | |

14.1 | Code of Business Conduct and Ethics (previously filed as Exhibit 14.1 to the Registrant’s Annual Report on Form 10-KSB for the fiscal year ended December 31, 2005). | |

31.1* | Certification of Principal Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act. | |

31.2* | Certification of Principal Accounting Officer pursuant to Section 302 of the Sarbanes-Oxley Act. | |

32.1** | Certification of Principal Executive Officer and Principal Financial Officer Pursuant to Section 906 of the Sarbanes-Oxley Act. | |

101.INS+ | XBRL Instance Document | |

101.SCH+ | XBRL Taxonomy Extension Schema Document | |

101.CAL+ | XBRL Taxonomy Extension Calculation Linkbase Document | |

101.DEF+ | XBRL Taxonomy Extension Definition Linkbase Document | |

101.LAB+ | XBRL Taxonomy Extension Label Linkbase Document | |

101.PRE+ | XBRL Taxonomy Extension Presentation Linkbase Document | |

* Filed herewith.

** Furnished herewith.

++XBRL (Extensible Business Reporting Language) information is furnished and not filed or a part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, is deemed not filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and otherwise is not subject to liability under these sections.

16

FINANCIAL STATEMENTS

SOOUM CORP.

New York, New York

FINANCIAL REPORTS |

AT |

DECEMBER 31, 2015 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Scrudato & Co., PA

CERTIFIED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of SoOum Holdings, Corp.

We have audited the accompanying balance sheets of SoOum Holdings, Corp. as of December 31, 2015 and 2014 and the related consolidated statements of operations, changes in stockholders’ deficit and cash flows for the years then ended. These financial statements are the responsibility of the Company management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of SoOum Holdings, Corp. at December 31, 2015 and 2014, and the results of their operations and their cash flows for the the years then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that SoOum Holdings, Corp. will continue as a going concern. As more fully described in Note D, the Company had an accumulated deficit at December 31, 2015, a net loss and net cash used in operating activities for the fiscal year then ended. These conditions raise substantial doubt about the ability of the Company to continue as a going concern. Management’s plans in regards to these matters are also described in Note D. The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the outcome of this uncertainty.

/s/ John Scrudato CPA

Califon, New Jersey

September 27, 2016

7 Valley View Drive Califon, New Jersey 07830 (908)534-0008

Registered Public Company Accounting Oversight Board Firm

17

SoOum Corp. |

New York, New York |

CONSOLIDATED BALANCE SHEETS |

December 31, | 2015 |

| 2014 |

ASSETS | |||

Cash and Cash Equivalents | $ 41 | $ 4 | |

Note Receivable - Related Party | 297 |

| — |

Total Assets | $ 338 |

| $ 4 |

LIABILITIES AND STOCKHOLDERS' DEFICIT | |||

Liabilities | |||

Term Notes Payable | $ 441,421 | $ 441,421 | |

Notes Payable - Affiliates | 1,102,785 | 1,100,611 | |

Judgements Payable | 1,138,264 | 1,102,510 | |

Convertible Notes Payable, net of discounts of $5,371 and $24,291 | 120,187 | 75,189 | |

Derivative Liability | 256,273 | 168,248 | |

Deferred Retirement Benefits | 438,782 | 438,782 | |

Accounts Payable | 844,542 | 822,182 | |

Advances from Shareholders | 149,185 | 149,185 | |

Accrued Expenses | 2,866,180 |

| 15,486,885 |

Total Liabilities | 7,357,619 |

| 19,785,013 |

Stockholders' Deficit | |||

Common Stock - $.0001 Par; 5,000,000,000 Shares Authorized, | |||

60,788,382 and 4,440,961 Issued and Outstanding, Respectively | 6,079 | 444 | |

Preferred Stock: $0.0001 Par; 200,000,000 Shares Authorized, 25,000,000 | |||

Issued and Outstanding, Respectively | 2,500 | 2,500 | |

Preferred Stock Class B: $0.0001 Par; 10,000,000 Shares Authorized, 9,100,000 and | |||

-0-, Issued and Outstanding, Respectively | 910 | 910 | |

Preferred Stock Class C: $0.0001 Par; 10,000,000 Shares Authorized, 1,690,000 | |||

Issued and Outstanding, Respectively | 169 | 169 | |

Stock Subscriptions Payable | — | 10,000 | |

Additional Paid-In-Capital | 7,743,891 | 6,334,585 | |

Accumulated Deficit | (15,110,830) |

| (26,133,617) |

Total Stockholders' Deficit | (7,357,281) |

| (19,785,009) |

Total Liabilities and Stockholders' Deficit | $ 338 |

| $ 4 |

The accompanying notes are an integral part of these

financial statements

18

SoOum Corp. |

New York, New York |

CONSOLIDATED STATEMENTS OF OPERATIONS |

For the Years Ended December 31, |

| 2015 |

| 2014 |

Sales | $ 46,842 | $ 1,992 | ||

Cost of Sales |

| 43,952 |

| — |

Gross Profit |

| 2,890 |

| 1,992 |

Expenses | ||||

General and Administrative | 1,339,849 | 632,478 | ||

Interest Expense |

| 663,192 |

| 588,463 |

Total Expenses | 2,003,041 | 1,220,941 | ||

Other (Income) and Expenses | ||||

(Gain) Loss on Conversion Feature of Preferred Shares | (12,845,480) | 12,845,480 | ||

(Gain) Loss on Derivative | 37,878 | (86,998) | ||

Impairment of Goodwill | — | 480,000 | ||

Loss on Conversion | — | 293,811 | ||

Write Off of Liabilities |

| (215,336) |

| — |

Total Other (Income) and Expenses |

| (13,022,938) |

| 13,532,293 |

Income (Loss) from Operations Before | ||||

Provision for Taxes | 11,022,787 | (14,751,242) | ||

Provision for Taxes |

| — |

| — |

Net Income (Loss) |

| $ 11,022,787 |

| $ (14,751,242) |

Weighted Average Number of Common Shares Outstanding | ||||

Basic and Diluted | 10,983,378 | 2,088,203 | ||

| ||||

Net Income (Loss) Per Common Share - Basic and Diluted |

| $ 1.00 |

| $ (7.06) |

The accompanying notes are an integral part of these

financial statements

19

SoOum Corp. |

New York, New York |

CONSOLIDATED STATEMENTS OF CASH FLOWS |

For the Years Ended December 31, |

| 2015 |

| 2014 | |

Cash Flows from Operating Activities | |||||

Net Loss | $ 11,022,787 | $ (14,751,242) | |||

Non-Cash Adjustments: | |||||

Amortization of Debt Discount | 404,041 | 311,864 | |||

(Gain) Loss on Derivative | 37,878 | (86,998) | |||

Impairment of Goodwill | — | 480,000 | |||

Interest on CNP paid with Stock | 2,539 | 4,015 | |||

Common Stock Issued in Exchange for Services Rendered | 1,050,000 | 288,245 | |||

Loss on Conversion | — | 293,811 | |||

Write off of Accrued Expenses | (215,336) | — | |||

Write off of Note Payable | — | (15,700) | |||

Changes in Assets and Liabilities: | — | ||||

Accounts Payable | 22,361 | — | |||

Judgements Payable | 35,754 | 35,755 | |||

Accrued Expenses |

| (12,405,369) |

| 13,260,143 | |

Net Cash Flows Used In Operating Activities |

| (45,345) |

| (180,107) | |

Cash Flows from Investing Activities | |||||

Cash Proceeds - Note Receivable Related Party |

| $ (297) |

| $ — | |

Cash Flows from Financing Activities | |||||

Cash Receipts from Equity Purchase Agreement | — | 10,000 | |||

Cash Proceeds from Notes Payable Affiliates | 4,379 | 5,611 | |||

Proceeds from Convertible Notes Payable |

| 41,300 |

| 164,500 | |

Net Cash Flows Used In Financing Activities |

| 45,679 |

| 180,111 | |

Net Change in Cash and Cash Equivalents | 37 | 4 | |||

Cash and Cash Equivalents - Beginning of Year |

| 4 |

| — | |

Cash and Cash Equivalents - End of Year |

| $ 41 |

| $ 4 | |

Cash Paid During the Year for: | |||||

Interest | $ — | $ — | |||

Income Taxes |

| $ — |

| $ — | |

SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING ACTIVITIES: | |||||

Issuance of Preferred Stock | $ — | $ 2,500 | |||

Common Stock Exchanged for Debt | $ 25,222 | $ 152,501 | |||

Assignment of Notes Payable Affiliates |

| $ — |

| $ 155,000 | |

The accompanying notes are an integral part of these

financial statements

20

SoOum Corp. |

New York, New York |

CONSOLIDATED STATEMENTS OF CHANGES IN DEFICIT FOR THE YEARS ENDED DECEMBER 31 2015 AND 2014 |

Common Stock | Preferred Stock | Preferred Stock - Class B | Preferred Stock - Class C | Stock | Additional | Total | |||||||||||||||||

$ .0001 Par | $ .0001 Par | $ .0001 Par | $ .0001 Par | Subscriptions | Paid-In | Accumulated | Stockholders' | ||||||||||||||||

| Shares |

| Amount |

| Shares |

| Amount |

| Shares |

| Amount |

| Shares |

| Amount |

| Payable |

| Capital |

| Deficit |

| Deficit |

Balance - January 1, 2014 | 843,410 | 84 | — | — | — | — | — | — | — | 4,691,796 | (11,382,375) | (6,690,495) | |||||||||||

Preferred Stock Issued in Merger | — | — | 25,000,000 | 2,500 | 9,100,000 | 910 | 1,690,000 | 169 | — | 478,921 | — | 482,500 | |||||||||||

Common Stock Issued in Exchange for Services | 459,033 | 46 | — | — | — | — | — | — | — | 285,199 | — | 285,245 | |||||||||||

Common Stock Issued for Note Payable Conversions | 3,138,517 | 314 | — | — | — | — | — | — | — | 345,679 | — | 345,993 | |||||||||||

Stock Subscription Issuance | — | — | — | — | — | — | — | — | 10,000 | — | — | 10,000 | |||||||||||

Discount on Convertible Note Payable | — | — | — | — | — | — | — | — | — | (25,290) | — | (25,290) | |||||||||||

Settlements of Derivative Liabilities | — | — | — | — | — | — | — | — | — | 558,280 | — | 558,280 | |||||||||||

Net Loss | — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| (14,751,242) |

| (14,751,242) |

Balance - December 31, 2014 | 4,440,961 | 444 | 25,000,000 | 2,500 | 9,100,000 | 910 | 1,690,000 | 169 | 10,000 | 6,334,585 | (26,133,617) | $ (19,785,009) | |||||||||||

Common Stock Issued in Exchange for Services | 35,000,000 | 3,500 | — | — | — | — | — | — | — | 1,046,500 | — | 1,050,000 | |||||||||||

Common Stock Issued to Relieve Accrued Expenses | 2,000,000 | 200 | — | — | — | — | — | — | — | (200) | — | — | |||||||||||

Common Stock Issued for Note Payable Conversions | 19,347,422 | 1,935 | — | — | — | — | — | — | — | 25,826 | — | 27,761 | |||||||||||

Convertible Note Payable Issued for Stock Subscription Payable | — | — | — | — | — | — | — | — | (10,000) | — | — | (10,000) | |||||||||||

Settlements of Derivative Liabilities | — | — | — | — | — | — | — | — | — | 334,974 | — | 334,974 | |||||||||||

Notes Payable Affiliates Forgiven by Officers | — | — | — | — | — | — | — | — | — | 2,206 | — | 2,206 | |||||||||||

Net Income | — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| 11,022,787 |

| $ 11,022,787 |

Balance - December 31, 2015 | 60,788,382 |

| $ 6,079 |

| 25,000,000 |

| $ 2,500 |

| 9,100,000 |

| $ 910 |

| 1,690,000 |

| $ 169 |

| $ — |

| $ 7,743,891 |

| $ (15,110,830) |

| $ (7,357,281) |

The accompanying notes are an integral part of these

financial statements

21

SOOUM CORP.

New York, New York

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE A – The Company

The Company “SoOum Corp.”, formerly known as Swordfish Financial, Inc., (a Texas Corporation) (the “Company”), acquired 80% of the outstanding common stock of Nature Vision, Inc. pursuant to a stock acquisition/merger agreement on August 14, 2009. Based a on a review of these factors, the August 2009 stock acquisition agreement with Swordfish Financial, Inc., the merger was accounted for as a reverse acquisition (i.e. Nature Vision, Inc. was considered as the acquired company and Swordfish Financial, Inc., was considered as the acquiring company). As a result, Nature Vision, Inc.’s assets and liabilities as of August 14, 2009, the date of the Merger closing, have been incorporated into Swordfish’s balance sheet based on the fair values of the net assets acquired. Further, the Company’s operating results (post-Merger) include Swordfish Financial, Inc., operating results prior to the date of closing and the results of the combined entity following the closing of the Merger. Also as a result of the merger the Company changed its name from Nature Vision to Swordfish Financial, Inc.

On September 23, 2014 the Company entered into a Securities Purchase Agreement with 100% of the common stock shareholders (the “Sellers”) of SoOum Corp. Upon the closing of the transaction on November 10, 2014, SoOum Corp. shareholders transferred all of their outstanding shares of common stock to SoOum Holdings, Inc., a wholly owned subsidiary of Swordfish. In consideration, Swordfish issued 9,100,000 shares of its Class B Preferred stock and 1,690,000 shares of its Class C preferred Stock. The Class B Preferred Stock is convertible at the rate of 1 common shares to 1. The Class C Preferred Stock is convertible at the rate of 10 common shares to 1. Class B and Class C have voting rights of 1,000 to 1 per share. Also as a result of the merger the Company changed its name from Swordfish Financial, Inc., to SoOum Corp.

Nature of Operations

Swordfish Financial, Inc., (f/k/a Nature Vision, Inc. and Photo Control Corporation) as Nature Vision, Inc. previously designed, manufactured and marketed outdoor recreation products primarily for the sport fishing and hunting markets.

The Company did not meet the minimum net worth covenants of a line of credit with M&I Business Credit LLC (M&I Bank) as of June 30, 2009, which put the Company in default on the line of credit. On August 14, 2009, simultaneously with the signing of the Swordfish Financial, Inc., the Texas corporation, stock Purchase/Merger Agreement (described above) M&I Bank, which was owed approximately $1,800,000 by the Company, foreclosed on the line of credit and forced the Company to enter into a Voluntary Surrender Agreement. The Voluntary Surrender Agreement gave M&I Bank total possession of the Company’s premises, its operations and all of the Company’s collateral, which consisted of all of Nature Vision’s assets. M&I Bank liquidated basically all of the Nature Vision assets to recover the line of credit debt.

22

SOOUM CORP.

New York, New York

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE A – The Company – continued

Based on the limited assets, product lines and resources remaining after the M&I Bank liquidation, the Company determined that there was not enough remaining of the Nature Vision operations to continue as an outdoor recreation product company and decided to concentrate on the business on being an asset recovery company and using the financial resources recovered to retire the Company’s debts and invest in other businesses domestically and internationally.

Effective approximately December 2012, the Company decided to discontinue its efforts on being an asset recovery company and changed its business focus to the pursuit of the acquisition of Internet media companies which provide service to home entertainment and cable business.

Effective with the merger of SoOum Corp., the Company changed its business focus to international commodity trading arbitrage. The Company will use its own proprietary technology to identify and exploit arbitrage opportunities. SoOum also plans to distribute trade intelligence to global subscribers in order to solve supply shortages and bring new business to local manufacturers.

Principles of Consolidation

The consolidated financial statements include the accounts of SoOum Corp., and its wholly owned subsidiaries; Nature Vision, Inc. and SoOum (the “Company”). All significant inter-company balances have been eliminated in consolidation.

NOTE B – Summary of Significant Accounting Policies

Method of Accounting

The Company maintains its books and prepares its financial statements on the accrual basis of accounting.

Cash and Cash Equivalents

Cash and cash equivalents include time deposits, certificates of deposit, and all highly liquid debt instruments with original maturities of three months or less. The Company maintains cash and cash equivalents at financial institutions, which periodically may exceed federally insured amounts.

Income Taxes

The Company accounts for income taxes in accordance with generally accepted accounting principles which prescribes the use of the liability method whereby deferred tax asset and liability account balances are determined based on differences between the financial reporting and tax bases of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. The Company provides a valuation allowance, if necessary, to reduce deferred tax assets to their estimated realizable value.

23

SOOUM CORP.

New York, New York

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE B – Summary of Significant Accounting Policies – continued

Income Taxes

The Company evaluates all significant tax positions as required by accounting principles generally accepted in the United States of America. As of December 31, 2015, the Company does not believe that it has taken any positions that would require the recording of any additional tax liability nor does it believe that there are any unrealized tax benefits that would either increase or decrease within the next year. It is the Company’s policy to recognize any interest and penalties in the provision for taxes.

Earnings per Share

Earnings per share of common stock are computed in accordance with FASB ASC 260 (prior authoritative literature: FASB Statement No. 128.), FASB ASC 260 replaces SFAS No, 128, “Earnings per Share”. Basic earnings per share are computed by dividing income or loss available to common shareholders by the weighted-average number of common shares outstanding for each period. Diluted earnings per share are calculated by adjusting the weighted average number of shares outstanding assuming conversion of all potentially dilutive stock options, warrants and convertible securities, if dilutive. Common stock equivalents that are anti-dilutive are excluded from both diluted weighted average number of common shares outstanding and diluted earnings per share.

Financial Instruments

The Company’s financial instruments consist of cash, long-term investments, and accounts payable. Unless otherwise noted, it is management’s opinion that the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments. The fair value of these financial instruments approximates their carrying value, unless otherwise noted.

Stock-Based Compensation

Stock-based compensation is computed in accordance with FASB ASC 718 (prior authoritative literature: FASB Statement No. 123R). FASB ASC 718 replaces SFAS No. 123R which requires all share-based payment to employees, including grants of employee stock options, to be recognized as compensation expense in the financial statements based on their fair values. That expense will be recognized over the period during which an employee is required to provide services in exchange for the award, known as the requisite service period (usually the vesting period). The Company has selected the Black-Scholes option pricing model as the most appropriate fair value method for our awards and have recognized compensation costs immediately as our awards are 100% vested.

The Company’s accounting policy for equity instruments issued to consultants and vendors in exchange for goods and services follows the provisions of FASB ASC 505-50 (prior authoritative literature, EITF 96-18, “Accounting for Equity Instruments That are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or Services” and EITF 00-18, “Accounting Recognition for Certain Transactions Involving Equity Instruments Granted to Other Than Employees.”) The measurement date for the fair value of the equity instruments issued is determined at the earlier of (i) the date at which a commitment for performance by the consultant or vendor is reached or (ii) the date at which the consultant or vendor’s performance is complete.

24

SOOUM CORP.

New York, New York

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE B – Summary of Significant Accounting Policies - continued

Stock-Based Compensation - continued

In the case of equity instruments issued to consultants, the fair value of the equity instrument is recognized over the term of the consulting agreement. Stock-based compensation related to non-employees is accounted for based on the fair value of the related stock or options or the fair value of the services, whichever is more readily determinable in accordance with ASC 718.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Derivative Financial Instruments

The Company does not use derivative instruments to hedge exposures to cash flow, market or foreign currency risks.

The Company reviews the terms of the common stock, warrants and convertible debt it issues to determine whether there are embedded derivative instruments, including embedded conversion options, which are required to be bifurcated and accounted for separately as derivative financial instruments. In circumstances where the host instrument contains more than one embedded derivative instrument, including the conversion option, that is required to be bifurcated, the bifurcated derivative instruments are accounted for as a single, compound derivative instrument.

Bifurcated embedded derivatives are initially recorded at fair value and are then revalued at each reporting date with changes in the fair value reported as non-operating income or expense. The Company uses a lattice model for valuation of the derivative.

When the equity or convertible debt instruments contain embedded derivative instruments that are to be bifurcated and accounted for as liabilities, the total proceeds received are first allocated to the fair value of all the bifurcated derivative instruments. The remaining proceeds, if any, are then allocated to the host instruments themselves, usually resulting in those instruments being recorded at a discount from their face value.

The discount from the face value of the convertible debt, together with the stated interest on the instrument, is amortized over the life of the instrument through periodic charges to interest expense, using the effective interest method.

Derivative instrument liabilities are classified in the balance sheet as current or non-current based on whether net cash settlement of the derivative instrument could be required within the 12 months of the balance sheet date.

25

SOOUM CORP.

New York, New York

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE C – Recently Issued Accounting Standards

There have been no recent accounting pronouncements issued which are expected to have a material effect on the Company’s financial statements.

NOTE D – Acquisition – iPoint Television

On January 15, 2014, the Company completed the acquisition of 90% of the issued and outstanding membership interest of iPoint. Pursuant to the Securities and Exchange Agreement the Company issued Clark Ortiz, the company’s CEO and Chairman 25,000,000 shares of Swordfish’s Series A Preferred Stock, which has voting rights equal to 100 shares of the Company’s common stock and is convertible into the Company’s common stock at the rate of 10 shares of common stock for each share of Series A. Preferred Stock. In addition to issuance of the Series A Preferred Stock the Company agreed as part of the purchase price to issue 50,000,000 shares of its common stock to Mr. Ortiz. At the date of the transaction, the Company didn’t have any authorized and unissued shares available to issue to Mr. Ortiz, however in order to close the transaction, Mr. Ortiz agreed to close the transaction pending the Company increasing the authorized shares of common stock, which the Company did on March 25, 2014. As a result of the transaction, the Company owns 90% of issued and outstanding membership interests in iPoint Television LLC and therefore a majority owned subsidiary of the Company and the Company will be able to report the results of iPoint on a consolidated basis in the Company’s financial statements. iPoint Television, also known as iPoint TV, is a Smart media and entertainment company, which holds development licenses from Apple, Android, Google, Roku, Kindle and most every smart device. iPoint is a full service Internet Protocol Television (IPTV), media entertainment company which develops applications for mobile and TV smart devices.

NOTE E – Going Concern

The Company’s consolidated financial statements have been presented on the basis that it is a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has reported recurring losses from operations. As a result, there is an accumulated deficit at December 31, 2015.

The Company’s continued existence is dependent upon its ability to raise capital or acquire a marketable company. The consolidated financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern.

NOTE F – Term Notes Payable

The Company is in default on all of the following unsecured term notes payable.

December 31, | 2015 | 2014 |

Jeff Zernov (Former Chief Executive Officer) | ||

Payable August 17, 2010 at 15% Interest. | $ 290,000 | $ 290,000 |

Castaic | ||

Installment note payable annually at $17,171 including interest at 8.0% from January 2009 through January 2011. | 30,620 | 30,620 |

Installment note payable monthly at $1,175 including interest at 8.0% from February 2008 through January 2011. | 20,246 | 20,246 |

Innovative Outdoors | ||

Installment note payable monthly at $4,632 including interest at 7.0% from August 2008 through July 2011. | 100,555 | 100,555 |

Total Notes Payable | $ 441,421 | $ 441,421 |

26

SOOUM CORP.

New York, New York

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE G – Convertible Promissory Notes Payable

As of December 31, 2015, the Company has outstanding eight (8) security purchase agreements with accredited investors for the sale of convertible promissory notes bearing interest at 10% - 12%, per annum. Pursuant to the convertible promissory notes the investor may convert the amount paid towards the Securities Purchase Agreements into common stock of the Company. Conversion prices vary based on the agreements and have various discount rates and terms. Trading price means the closing bid price on the OTC Market Over-the-Counter Bulletin Board Pink Sheets.

The conversion rights embedded in the Notes are accounted for as derivative financial instruments because of the down round feature of the conversion price. The beneficial conversion feature was valued at the date of issuance using the Black-Scholes-Merton options pricing model with the following assumptions: risk free interest rates ranging from .07% to .45%, contractual expected life of six (6) to twelve (12) months, expected volatility of 185% to 931%, calculated using the historical closing price of the company’s common stock, and dividend yield of zero, resulting in fair market value.

The Company had convertible debentures outstanding as follows:

December 31, 2015 |

| Outstanding Balance of Convertible Debenture | Unamortized Discount | Net of Principal and Unamortized Discount |

Convertible Debentures |

|

|

|

|

January 10, 2014 - Debenture | $ 7,150 | $ –– | $ 7,150 | |

February 28, 2014 – Debenture |

| 8,410 | –– | 8,410 |

April 2, 2014 – Debenture | 17,815 | –– | 17,815 | |

June 18, 2014 – Settlement Agreement | 58,420 | –– | 58,420 | |

October 05, 2015 - Debenture | 3,500 | –– | 3,500 | |

October 21, 2015 - Debenture | 6,275 | –– | 6,275 | |

November 23, 2015 - Debenture | 10,988 | –– | 10,988 | |

December 3, 2015 - Debenture | 13,000 | (5,371) | 7,629 | |

Total Convertible Debentures | $ 125,558 | $ (5,371) | $ 120,187 | |

27

SOOUM CORP.

New York, New York

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS