Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - ENTERPRISE FINANCIAL SERVICES CORP | ex991pressrelease101116.htm |

| EX-2.1 - EXHIBIT 2.1 - ENTERPRISE FINANCIAL SERVICES CORP | ex21mergeragreement101016.htm |

| 8-K - 8-K - ENTERPRISE FINANCIAL SERVICES CORP | a2016-10announcement.htm |

ACQUISITION OF JEFFERSON COUNTY BANCSHARES, INC.

OCTOBER 11, 2016

ENTERPRISE FINANCIAL SERVICES CORP

NASDAQ: EFSC

1

SAFE HARBOR STATEMENT

FORWARD-LOOKING STATEMENTS

CERTAIN STATEMENTS CONTAINED IN THIS PRESENTATION MAY BE CONSIDERED FORWARD-LOOKING STATEMENTS. THESE FORWARD-LOOKING STATEMENTS MAY INCLUDE:

STATEMENTS REGARDING THE MERGER, THE RANGE OF CONSIDERATION OF THE MERGER AND THE ABILITY OF THE PARTIES TO CONSUMMATE THE MERGER. FORWARD-

LOOKING STATEMENTS ARE TYPICALLY IDENTIFIED BY WORDS SUCH AS “BELIEVE,” “EXPECT,” “ANTICIPATE,” “INTEND,” “OUTLOOK,” “ESTIMATE,” “FORECAST,” “PROJECT,” “PRO

FORMA” AND OTHER SIMILAR WORDS AND EXPRESSIONS. FORWARD-LOOKING STATEMENTS ARE SUBJECT TO NUMEROUS ASSUMPTIONS, RISKS AND UNCERTAINTIES, WHICH

CHANGE OVER TIME. FORWARD-LOOKING STATEMENTS SPEAK ONLY AS OF THE DATE THEY ARE MADE. EFSC DOES NOT ASSUME ANY DUTY AND DOES NOT UNDERTAKE TO

UPDATE FORWARD-LOOKING STATEMENTS. BECAUSE FORWARD-LOOKING STATEMENTS ARE SUBJECT TO ASSUMPTIONS AND UNCERTAINTIES, ACTUAL RESULTS OR FUTURE

EVENTS COULD DIFFER, POSSIBLY MATERIALLY, FROM THOSE THAT EFSC ANTICIPATED IN ITS FORWARD-LOOKING STATEMENTS AND FUTURE RESULTS COULD DIFFER

MATERIALLY FROM HISTORICAL PERFORMANCE. FACTORS THAT COULD CAUSE OR CONTRIBUTE TO SUCH DIFFERENCES INCLUDE, BUT ARE NOT LIMITED TO, THE POSSIBILITY:

THAT EXPECTED BENEFITS MAY NOT MATERIALIZE IN THE TIMEFRAME EXPECTED OR AT ALL, OR MAY BE MORE COSTLY TO ACHIEVE; THAT THE TRANSACTION MAY NOT BE

TIMELY COMPLETED, IF AT ALL; THAT PRIOR TO THE COMPLETION OF THE TRANSACTION OR THEREAFTER, EFSC’S RESPECTIVE BUSINESSES MAY NOT PERFORM AS EXPECTED

DUE TO TRANSACTION-RELATED UNCERTAINTY OR OTHER FACTORS; THAT THE PARTIES ARE UNABLE TO SUCCESSFULLY IMPLEMENT INTEGRATION STRATEGIES; THAT REQUIRED

REGULATORY, SHAREHOLDER OR OTHER APPROVALS ARE NOT OBTAINED OR OTHER CLOSING CONDITIONS ARE NOT SATISFIED IN A TIMELY MANNER OR AT ALL; REPUTATIONAL

RISKS AND THE REACTION OF THE COMPANIES’ CUSTOMERS TO THE TRANSACTION; DIVERSION OF MANAGEMENT TIME ON MERGER-RELATED ISSUES; AND THOSE FACTORS AND

RISKS REFERENCED FROM TIME TO TIME IN EFSC’S FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION. FOR ANY FORWARD-LOOKING STATEMENTS MADE IN THIS

PRESENTATION OR IN ANY DOCUMENTS, EFSC CLAIMS THE PROTECTION OF THE SAFE HARBOR FOR FORWARD-LOOKING STATEMENTS CONTAINED IN THE PRIVATE SECURITIES

LITIGATION REFORM ACT OF 1995.

ADDITIONAL INFORMATION ABOUT THE MERGER AND WHERE TO FIND IT

IN CONNECTION WITH THE PROPOSED MERGER TRANSACTION, EFSC WILL FILE WITH THE SECURITIES AND EXCHANGE COMMISSION A REGISTRATION STATEMENT ON FORM

S-4 THAT WILL INCLUDE A PROXY STATEMENT OF JCB, AND A PROSPECTUS OF EFSC, AS WELL AS OTHER RELEVANT DOCUMENTS CONCERNING THE PROPOSED

TRANSACTION. SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT

BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION.

A FREE COPY OF THE PROXY STATEMENT/PROSPECTUS, AS WELL AS OTHER FILINGS CONTAINING INFORMATION ABOUT EFSC AND JCB, MAY BE OBTAINED AT THE SEC’S

INTERNET SITE (HTTP://WWW.SEC.GOV).

EFSC AND JCB AND CERTAIN OF THEIR DIRECTORS AND EXECUTIVE OFFICERS MAY BE DEEMED TO BE PARTICIPANTS IN THE SOLICITATION OF PROXIES FROM THE

SHAREHOLDERS OF JCB IN CONNECTION WITH THE PROPOSED MERGER. INFORMATION ABOUT THE DIRECTORS AND EXECUTIVE OFFICERS OF EFSC IS SET FORTH IN THE

PROXY STATEMENT FOR EFSC’S 2016 ANNUAL MEETING OF SHAREHOLDERS, AS FILED WITH THE SEC ON A SCHEDULE 14A ON MARCH 16, 2016. ADDITIONAL INFORMATION

REGARDING THE INTERESTS OF THOSE PARTICIPANTS AND OTHER PERSONS WHO MAY BE DEEMED PARTICIPANTS IN THE TRANSACTION MAY BE OBTAINED BY READING THE

PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER WHEN IT BECOMES AVAILABLE. FREE COPIES OF THIS DOCUMENT MAY BE OBTAINED AS DESCRIBED IN

THE PRECEDING PARAGRAPH.

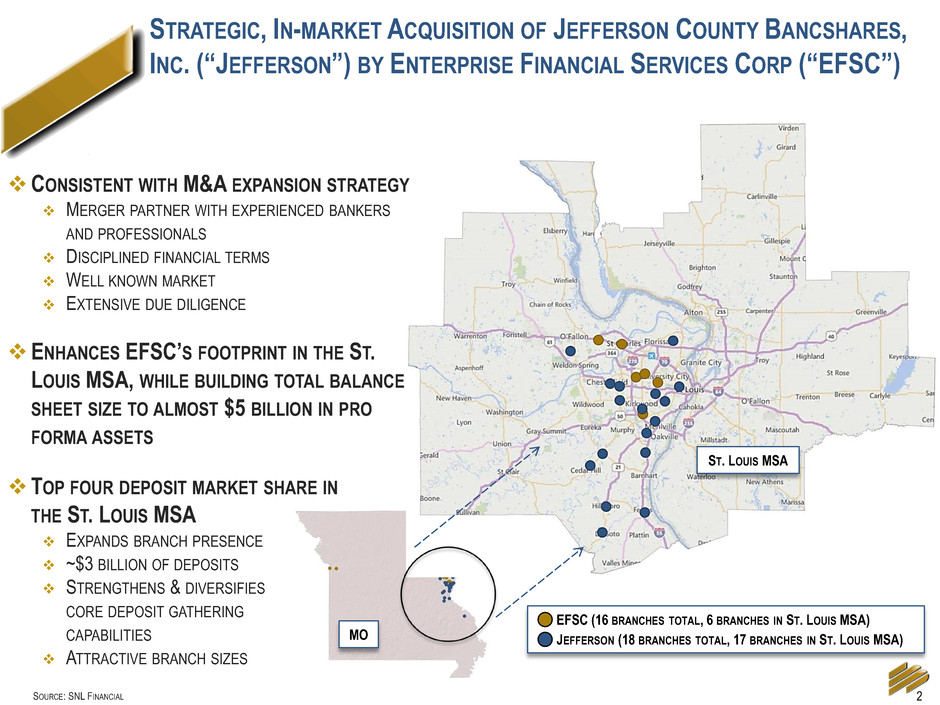

2 SOURCE: SNL FINANCIAL

EFSC (16 BRANCHES TOTAL, 6 BRANCHES IN ST. LOUIS MSA)

JEFFERSON (18 BRANCHES TOTAL, 17 BRANCHES IN ST. LOUIS MSA)

ST. LOUIS MSA

STRATEGIC, IN-MARKET ACQUISITION OF JEFFERSON COUNTY BANCSHARES,

INC. (“JEFFERSON”) BY ENTERPRISE FINANCIAL SERVICES CORP (“EFSC”)

CONSISTENT WITH M&A EXPANSION STRATEGY

MERGER PARTNER WITH EXPERIENCED BANKERS

AND PROFESSIONALS

DISCIPLINED FINANCIAL TERMS

WELL KNOWN MARKET

EXTENSIVE DUE DILIGENCE

ENHANCES EFSC’S FOOTPRINT IN THE ST.

LOUIS MSA, WHILE BUILDING TOTAL BALANCE

SHEET SIZE TO ALMOST $5 BILLION IN PRO

FORMA ASSETS

TOP FOUR DEPOSIT MARKET SHARE IN

THE ST. LOUIS MSA

EXPANDS BRANCH PRESENCE

~$3 BILLION OF DEPOSITS

STRENGTHENS & DIVERSIFIES

CORE DEPOSIT GATHERING

CAPABILITIES

ATTRACTIVE BRANCH SIZES

MO

3

TRANSACTION SNAPSHOT

(1)

TRANSACTION

VALUE (1)

(1) BASED ON JEFFERSON’S 1,472,853 COMMON SHARES OUTSTANDING, 108,295 OPTIONS OUTSTANDING WITH A WAEP OF $54.72 AND EFSC’S 15-DAY VWAP OF $31.52

AS OF OCTOBER 10, 2016; ASSUMES ALL STOCK OPTIONS ARE CASHED OUT AT CLOSING

(2) ACCRETION AS COMPARED TO EFSC ANALYST CONSENSUS EPS ESTIMATES

CONSIDERATION

~ 3.5% EPS ACCRETION IN PARTIAL YEAR 2017 (2), EXCLUDING ONE-TIME CHARGES

~ 7.4% EPS ACCRETION IN 2018 (2)

~ 3.6% DILUTION TO TBVPS AT CLOSING

TBVPS DILUTION EARN-BACK PERIOD LESS THAN 3.25 YEARS

ESTIMATED

FINANCIAL IMPACT

APPROXIMATELY $130.6 MILLION TRANSACTION VALUE

3,300,000 MILLION EFSC COMMON SHARES ISSUED TO JEFFERSON SHAREHOLDERS

APPROXIMATELY $26.6 MILLION IN CASH PAID, INCLUDING CASH-OUT VALUE OF

JEFFERSON STOCK OPTIONS

CONSIDERATION MIX TO JEFFERSON SHAREHOLDERS OF ~ 81.5% STOCK, ~ 18.5% CASH

PRICE / TBVPS OF 140.7%

PRICE / LTM JUNE 2016 EPS OF 19.8X

PRICE / LTM JUNE 2016 EPS INCLUDING FULLY-PHASED COST SAVINGS OF 10.9X

TRANSACTION VALUE

& CONSIDERATION (1)

4

OVERVIEW OF JEFFERSON

JEFFERSON COUNTY BANCSHARES, INC.

ESTABLISHED IN 1911; ONE OF THE OLDEST

COMMUNITY BANKS IN THE REGION

WELL RUN, TRADITIONAL COMMUNITY BANK

17 BRANCH LOCATIONS THROUGHOUT THE ST. LOUIS

MSA AND 1 BRANCH IN PERRYVILLE, MO (1)

AVG. DEPOSITS PER BRANCH OF ~$63 MILLION (2)

COMMERCIALLY-FOCUSED LENDING PRACTICE

JEFFERSON HAS DEMONSTRATED DISCIPLINED

BALANCE SHEET GROWTH IN RECENT YEARS

5-YEAR LOAN CAGR OF 3.9%

5-YEAR DEPOSIT CAGR OF 2.8%

JEFFERSON HAS BEEN CONSISTENTLY PROFITABLE

NET INCOME OF $7.7 MILLION FOR THE TWELVE

MONTHS ENDED JUNE 30, 2016

LTM ROAA OF 0.85%

FINANCIAL HIGHLIGHTS (3)

(1) COMPRISED OF 13 FULL-SERVICE BRANCHES, 4 MOBILE, LIMITED-SERVICE BRANCHES AND 1 OTHER LOCATION

(2) REPRESENTS THE AVERAGE DEPOSITS PER BRANCH FOR THE 13 FULL-SERVICE BRANCH LOCATIONS ONLY, AS OF JUNE 30, 2016

(3) BANK LEVEL DATA FOR JEFFERSON; AS OF AND FOR THE TWELVE MONTH PERIOD ENDED JUNE 30, 2016

SOURCE: SNL FINANCIAL

Dollar Values in Millions

Total Assets $928

Gross Loans $670

Deposits $766

Gross Loans / Deposits 87%

ROAA 0.85%

ROAE 7.67%

Net Interest Margin 3.53%

Efficiency Ratio 64.4%

NPAs / Assets 2.90%

5

TRANSACTION RATIONALE

MATERIALLY ACCRETIVE TO EPS IN 2017 AND FORWARD YEAR EARNINGS

MODEST TBVPS DILUTION; EARNED BACK IN SLIGHTLY OVER THREE YEARS

STRONG PRO FORMA CAPITAL RATIOS SUPPORT FUTURE GROWTH AND EXPANSION

INTERNAL RATE OF RETURN OF 19.7%, CONSISTENT WITH MANAGEMENT OBJECTIVES

TRANSACTION STRUCTURED TO PROVIDE CERTAINTY TO EFSC SHAREHOLDERS WITH

REGARD TO FIXED NUMBER OF SHARES ISSUED AND FIXED AMOUNT OF CASH PAID

FINANCIALLY

ATTRACTIVE

COMPREHENSIVE DUE DILIGENCE PROCESS COMPLETED, INCLUDING AN EXTENSIVE

AND HIGHLY TRANSPARENT CREDIT REVIEW COVERING 80% OF JEFFERSON’S PORTFOLIO

CONSERVATIVE CREDIT MARK OF 4%; IDENTIFIED AND ACHIEVABLE COST SAVINGS OF 29.9%

IN-MARKET TRANSACTION WITH EXTENSIVE LOCAL KNOWLEDGE

INTEGRATION RISK IS OFFSET BY RETENTION OF KEY JEFFERSON MANAGEMENT AS WELL AS

PRIOR EFSC ACQUISITION EXPERIENCE

LOW

EXECUTION RISK

CONSISTENT WITH EFSC’S EXPANSION STRATEGY

SIGNIFICANTLY ACCELERATES ST. LOUIS MARKET EXPANSION AND LEVERAGES EXISTING

TEAM OF EXPERIENCED BANKERS AND IN-MARKET RESOURCES

ADDS VALUABLE SCALE AND OPERATING LEVERAGE IN LARGEST MARKET

REVENUE SYNERGIES COULD PROVIDE ENHANCED BENEFITS NOT CURRENTLY MODELED

STRATEGICALLY

COMPELLING

6

(1) COMMUNITY BANKS DEFINED AS INSTITUTIONS HAVING LESS THAN $10 BILLION IN DEPOSITS

SOURCE: SNL FINANCIAL, FDIC; DEPOSIT DATA AS OF JUNE 30, 2016

STRENGTHENS EFSC’S ALREADY SIGNIFICANT ST.

LOUIS FOOTPRINT

PRO FORMA DEPOSITS IN EXCESS OF $2.9 BILLION

CREATES THE LARGEST COMMUNITY BANK BY DEPOSITS IN

THE ST. LOUIS MSA (1)

TOP 4 PRO FORMA DEPOSIT MARKET SHARE

EFSC IS THE SECOND LARGEST COMMUNITY BANK BY

DEPOSITS IN MISSOURI (1)

PRO FORMA DEPOSITS IN EXCESS OF $3.1 BILLION

STATEWIDE DEPOSIT MARKET SHARE RANK TO #6

MISSOURI ST. LOUIS MSA

June '16

Total Market

# of Deposits Share

Rank Institution Branches ($000) (%)

1 U.S. Bancorp (MN) 235 17,351,269 12.36

2 Bank of America Corp. (NC) 81 15,479,896 11.03

3 Commerce Bancshares Inc. (MO) 114 14,648,091 10.43

4 UMB Financial Corp. (MO) 52 11,464,627 8.17

5 Central Bancompany Inc. (MO) 125 8,147,263 5.80

6 Pro Forma Company 26 3,103,635 2.21 %

6 EFSC 8 2,337,334 1.66 %

7 Great Southern Bancorp Inc. (MO) 71 2,284,048 1.63

8 Regions Financial Corp. (AL) 62 2,271,517 1.62

9 PNC Financial Services Group (PA) 39 2,163,914 1.54

10 First Banks Inc. (MO) 46 1,910,547 1.36

11 National Bank Holdings Corp. (CO) 31 1,735,745 1.24

12 First State Bancshares Inc. (MO) 51 1,707,262 1.22

13 Stupp Bros. Inc. (MO) 21 1,449,099 1.03

14 Arvest Bank Group Inc. (AR) 44 1,271,314 0.91

15 Bank of Montreal 21 1,258,282 0.90

16 NASB Financial Inc. (MO) 11 1,243,998 0.89

17 First Busey Corp. (IL) 13 1,189,821 0.85

18 Landrum Co. (MO) 17 1,181,649 0.84

19 Reliable Community Bcshs Inc. (MO) 22 1,016,055 0.72

20 Hawthorn Bancshares Inc. (MO) 23 1,011,230 0.72

Top 20 Institutions 1,087 91,122,961 64.92

26 JEFFERSON 18 766,301 0.55 %

Total for Institutions in Market 2,436 140,392,492 100.00 %

June '15

Total Market

# of Deposits Share

Rank Institution Branches ($000) (%)

1 U.S. Bancorp (MN) 117 13,440,724 19.26

2 Bank of America Corp. (NC) 53 11,264,321 16.15

3 Commerce Bancshares Inc. (MO) 50 6,450,739 9.25

4 Pro Forma Company 23 2,980,987 4.28 %

4 Regions Financial Corp. (AL) 64 2,761,735 3.96

5 EFSC 6 2,271,986 3.26 %

6 PNC Financial Services Group (PA) 44 2,231,254 3.20

7 First Banks Inc. (MO) 52 2,187,788 3.14

8 Banc Ed Corp. (IL) 20 1,533,999 2.20

9 Stupp Bros. Inc. (MO) 21 1,449,099 2.08

10 Central Bancompany Inc. (MO) 15 1,310,776 1.88

11 UMB Financial Corp. (MO) 16 1,288,303 1.85

12 First Busey Corp. (IL) 13 1,189,821 1.71

13 Bank of Montreal 16 1,151,536 1.65

14 First Co Bancorp Inc. (IL) 16 1,081,209 1.55

15 Midland States Bancorp Inc. (IL) 20 1,060,598 1.52

16 Reliance Bancshares Inc. (MO) 20 917,596 1.32

17 CBX Corp. (IL) 8 825,966 1.18

18 JEFFERSON 17 709,001 1.02 %

19 Cass Information Systems (MO) 4 651,214 0.93

20 First Mid-Il l inois Bancshares (IL) 10 597,400 0.86

Top 20 Institutions 582 54,375,065 77.97

Total for Institutions in Market 903 69,769,443 100.00 %

7

SIMILARLY ATTRACTIVE DEPOSIT MAKE-UP AND COST

(1)

(1) BANK LEVEL DATA AS OF JUNE 30, 2016

(2) SIMPLE SUMMATION OF JUNE 30, 2016 DEPOSIT DATA; EXCLUDES PURCHASE ACCOUNTING ADJUSTMENTS

SOURCE: SNL FINANCIAL

JEFFERSON’S DESIRABLE DEPOSIT MIX ENHANCES COMBINED CORE FUNDING CAPABILITIES

EXPANDED BRANCH NETWORK PROVIDES PLATFORM FOR CONTINUED ST. LOUIS MSA DEPOSIT GROWTH

Q2 ‘16 Cost of Deposits: 0.35% Q2 ‘16 Cost of Deposits: 0.42% Combined Cost of Deposits: 0.36%

EFSC (1) JEFFERSON (1) COMBINED (2)

25.0%

57.8%

17.2% 20.1%

60.2%

19.7%

24.0%

58.3%

17.7%

Deposits ($000)

Non-Interest Bearing 758,642

Int. Bearing Trans & Svgs. 1,752,053

Time Deposits 522,030

3,032,725

57.8%

Deposits ($000)

Non-Interest Bearing 154,109

Int. Bearing Trans & Svgs. 461,453

Time Deposits 150,739

766,301

60.2%

Deposits ($000)

Non-Interest Bearing 912,751

Int. Bearing Trans & Svgs. 2,213,506

Time Deposits 672,769

3,799,026

58.3%

8

Loans ($000)

Construction & Land 272,437

1-4 Family 367,724

Multifamily 89,220

CRE - Income Producing 638,913

CRE - Owner Occupied 438,927

C&I 1,591,582

Consumer & Other 221,228

3,620,031

12.1%

Loans ($000)

Construction & Land 95,136

1-4 Family 131,853

Multifamily 36,305

CRE - Income Producing 205,787

CRE - Owner Occupied 99,697

C&I 47,627

Consumer & Other 53,519

669,924

Loans ($000)

Construction & Land 177,301

1-4 Family 235,871

Multifamily 52,915

CRE - Income Producing 433,126

CRE - Owner Occupied 339,230

C&I 1,543,955

Consumer & Other 167,709

2,950,107

DIVERSIFIED LOAN PORTFOLIO, WITH STRENGTH IN C&I AND CRE

(1) BANK LEVEL DATA AS OF JUNE 30, 2016

(2) SIMPLE SUMMATION OF JUNE 30, 2016 LOAN DATA; EXCLUDES PURCHASE ACCOUNTING ADJUSTMENTS

SOURCE: SNL FINANCIAL

(1)

JEFFERSON’S SOLID CRE PORTFOLIO IN THE ST. LOUIS MSA MESHES WELL WITH EFSC’S C&I FOCUS

CRE AND ADC CONCENTRATION LEVELS REMAIN ATTRACTIVE

EFSC (1) JEFFERSON (1) COMBINED (2)

6.0%

8.0%

1.8%

14.7%

11.5%

52.3%

5.7%

14.2%

19.7%

5.4%

30.7%

14.9%

7.1%

8.0% 7.5%

10.2%

2.5%

17.6%

12.1%

44.0%

6.1%

CRE / Total Risk-Based Capital

ADC / Total Risk-Based Capital

178%

41%ADC / Total Risk-Based Capital

295%

92%

CRE / Total Risk-Based CapitalCRE / Total Risk-Based Capital

ADC / Total Risk-Based Capital

200%

51%

9

JEFFERSON’S EXPANDED COMMERCIAL AND RETAIL CUSTOMER BASES ARE COMPLEMENTARY TO

EFSC’S EXISTING PRODUCT SETS

POTENTIAL FINANCIAL BENEFITS OF FUTURE FEE INCOME OPPORTUNITIES ARE NOT INCLUDED IN

TRANSACTION MODELING

FEE INCOME OPPORTUNITIES (1)

(1) REPRESENT ILLUSTRATIVE AREAS OF POTENTIAL FEE INCOME ENHANCEMENT; POTENTIAL REVENUE ENHANCEMENTS NOT INCLUDED IN ESTIMATES OF FINANCIAL IMPACT PROVIDED HEREIN

WEALTH

MANAGEMENT

CARD

SERVICES

JEFFERSON’S GREATER RETAIL FOCUS AND

DISTRIBUTION PLATFORM PROVIDE OPPORTUNITIES

TO ENHANCE REVENUE THROUGH EXISTING EFSC

PRODUCTS AND SERVICES

TREASURY

MANAGEMENT

EFSC’S HIGHLY COMPETITIVE TREASURY

MANAGEMENT SUITE AFFORDS ADDITIONAL

REVENUE OPPORTUNITIES TO EXISTING AND

FUTURE JEFFERSON COMMERCIAL CUSTOMERS

MORTGAGE

10

TRANSACTION STRUCTURE AND VALUE

(1)

$130.6 MILLION

BLENDED PRICE PER SHARE OF $86.44

PRICE / Q2’16 TANGIBLE BOOK VALUE: 140.7%

PRICE / LTM JUNE 2016 EPS: 19.8X

PRICE / LTM JUNE 2016 EPS INCLUDING FULLY-PHASED IN COST SAVINGS: 10.9X

TRANSACTION

VALUE (1)

(1) BASED ON JEFFERSON’S 1,472,853 COMMON SHARES OUTSTANDING, 108,295 OPTIONS OUTSTANDING WITH A WAEP OF $54.72 AND EFSC’S 15-DAY VWAP OF $31.52

AS OF OCTOBER 10, 2016; ASSUMES ALL STOCK OPTIONS ARE CASHED OUT AT CLOSING

81.5% OF JEFFERSON COMMON SHARES RECEIVE STOCK CONSIDERATION;

18.5% OF JEFFERSON COMMON SHARES RECEIVE CASH CONSIDERATION

FIXED NUMBER OF EFSC COMMON SHARES OF 3,300,000 ISSUED TO JEFFERSON

COMMON SHARES RECEIVING STOCK; FIXED EXCHANGE RATIO OF 2.75 EFSC

SHARES ISSUED FOR EACH JEFFERSON SHARE RECEIVING STOCK CONSIDERATION

FIXED AMOUNT OF CASH OF APPROXIMATELY $26.6 MILLION PAID, INCLUDING THE

CASH-OUT OF UNEXERCISED JEFFERSON STOCK OPTIONS

CONSIDERATION

JEFFERSON TO MERGE WITH AND INTO EFSC

EAGLE BANK & TRUST COMPANY OF MISSOURI TO MERGE WITH AND INTO

ENTERPRISE BANK & TRUST

TRANSACTION

STRUCTURE

11

NO REVENUE SYNERGIES ASSUMED

REVENUE

SYNERGIES

PURCHASE

ACCOUNTING

ADJUSTMENTS

(4.0)% CREDIT MARK TO LOAN PORTFOLIO EQUATING TO $27.9 MILLION

(6.8)% MARK ON FIXED ASSETS EQUATING TO $1.5 MILLION

CORE DEPOSIT INTANGIBLE OF $10.3 MILLION AMORTIZED SYD OVER 10 YEARS

COST

SAVINGS

29.9% COST SAVINGS, ANNUAL PRE-TAX RUN-RATE OF APPROXIMATELY $8.0 MILLION

63% OF EFFICIENCIES REALIZED IN YEAR ONE, 100% ANNUALLY THEREAFTER

MERGER RELATED

CHARGES

PRE-TAX, ONE-TIME TRANSACTIONS COSTS OF APPROXIMATELY $10 MILLION

30% REALIZED PRIOR TO CLOSING, 70% POST CLOSING

KEY TRANSACTION ASSUMPTIONS

EXPECTED

TIMING

TRANSACTION CLOSE IN Q1 2017, SYSTEMS CONVERSION ANTICIPATED IN Q2 2017

CUSTOMARY REGULATORY AND JEFFERSON SHAREHOLDER APPROVALS REQUIRED

EFSC SHAREHOLDER APPROVAL NOT REQUIRED

JEFFERSON

LEADERSHIP

CEO OF JEFFERSON, MICHAEL W. WALSH, TO SERVE ON ENTERPRISE BANK

& TRUST SENIOR MANAGEMENT TEAM AND BANK-LEVEL BOARD OF DIRECTORS

JEFFERSON WILL BE GIVEN ONE BOARD SEAT ON THE EFSC BOARD OF DIRECTORS

12

~ 3.5% ACCRETIVE IN PARTIAL YEAR 2017

~ 7.4% ACCRETIVE IN 2018

EPS IMPACT (1)

TANGIBLE BOOK

VALUE PER SHARE

IMPACT

~ 3.6% DILUTION TO TANGIBLE BOOK VALUE PER SHARE AT CLOSE

TBVPS DILUTION EARN-BACK PERIOD LESS THAN 3.25 YEARS (2)

PRO FORMA

CONSOLIDATED

CAPITAL RATIOS (3)

~ 8.5% TANGIBLE COMMON EQUITY / TANGIBLE ASSETS RATIO

~ 9.9% TIER I LEVERAGE RATIO

~ 11.5% TOTAL RISK BASED CAPITAL RATIO

INTERNAL RATE OF

RETURN

~ 19.7%

ESTIMATED FINANCIAL IMPACT

(1) ACCRETION AS COMPARED TO EFSC ANALYST CONSENSUS EPS ESTIMATES; 2017 EXCLUDES TRANSACTION RELATED ONE-TIME COSTS

(2) CROSS-OVER METHOD UTILIZED IN CALCULATION OF TANGIBLE BOOK VALUE PER SHARE DILUTION EARN-BACK

(3) ESTIMATED AT TIME OF CLOSING

13

APPENDIX

14

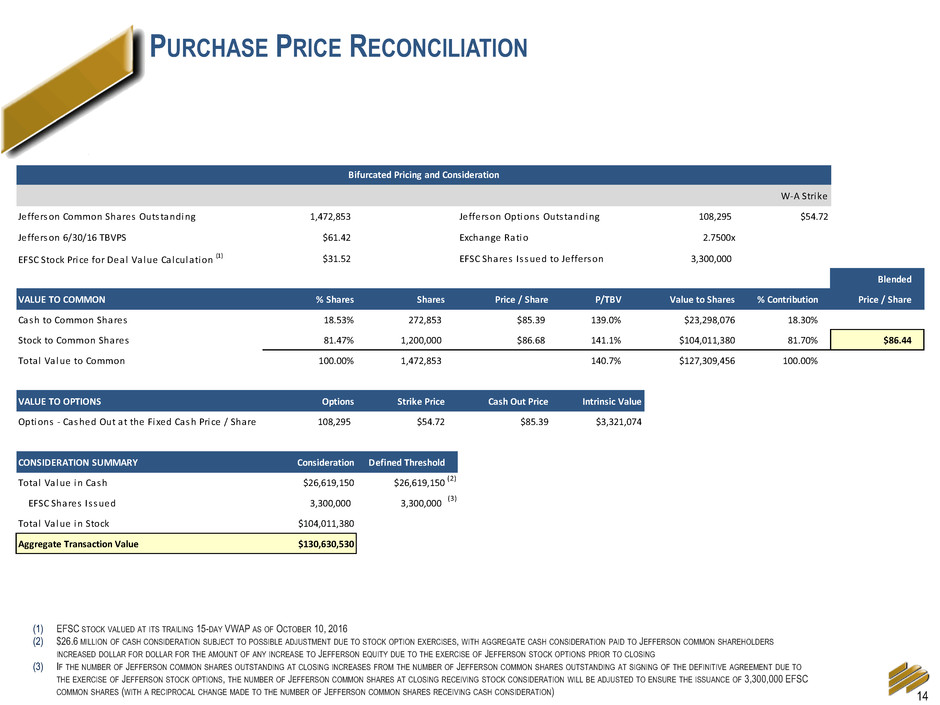

(1) EFSC STOCK VALUED AT ITS TRAILING 15-DAY VWAP AS OF OCTOBER 10, 2016

(2) $26.6 MILLION OF CASH CONSIDERATION SUBJECT TO POSSIBLE ADJUSTMENT DUE TO STOCK OPTION EXERCISES, WITH AGGREGATE CASH CONSIDERATION PAID TO JEFFERSON COMMON SHAREHOLDERS

INCREASED DOLLAR FOR DOLLAR FOR THE AMOUNT OF ANY INCREASE TO JEFFERSON EQUITY DUE TO THE EXERCISE OF JEFFERSON STOCK OPTIONS PRIOR TO CLOSING

(3) IF THE NUMBER OF JEFFERSON COMMON SHARES OUTSTANDING AT CLOSING INCREASES FROM THE NUMBER OF JEFFERSON COMMON SHARES OUTSTANDING AT SIGNING OF THE DEFINITIVE AGREEMENT DUE TO

THE EXERCISE OF JEFFERSON STOCK OPTIONS, THE NUMBER OF JEFFERSON COMMON SHARES AT CLOSING RECEIVING STOCK CONSIDERATION WILL BE ADJUSTED TO ENSURE THE ISSUANCE OF 3,300,000 EFSC

COMMON SHARES (WITH A RECIPROCAL CHANGE MADE TO THE NUMBER OF JEFFERSON COMMON SHARES RECEIVING CASH CONSIDERATION)

PURCHASE PRICE RECONCILIATION

W-A Strike

Jefferson Common Shares Outstanding 1,472,853 Jefferson Options Outstanding 108,295 $54.72

Jefferson 6/30/16 TBVPS $61.42 Exchange Ratio 2.7500x

EFSC Stock Price for Deal Value Calculation

(1) $31.52 EFSC Shares Issued to Jefferson 3,300,000

Blended

VALUE TO COMMON % Shares Shares Price / Share P/TBV Value to Shares % Contribution Price / Share

Cash to Common Shares 18.53% 272,853 $85.39 139.0% $23,298,076 18.30%

Stock to Common Shares 81.47% 1,200,000 $86.68 141.1% $104,011,380 81.70% $86.44

Total Value to Common 100.00% 1,472,853 140.7% $127,309,456 100.00%

VALUE TO OPTIONS Options Strike Price Cash Out Price Intrinsic Value

Options - Cashed Out at the Fixed Cash Price / Share 108,295 $54.72 $85.39 $3,321,074

CONSIDERATION SUMMARY Consideration Defined Threshold

Total Value in Cash $26,619,150 $26,619,150

EFSC Shares Issued 3,300,000 3,300,000

Total Value in Stock $104,011,380

Aggregate Transaction Value $130,630,530

Bifurcated Pricing and Consideration

(2)

(3)

15

NOTE: FINANCIAL DATA AS OF JUNE 30, 2016; BANK LEVEL DATA; DOLLARS IN THOUSANDS

SOURCE: SNL FINANCIAL

OVERVIEW OF JEFFERSON

79.5% 83.4% 83.9%

84.8% 84.9% 87.4%

0.0%

25.0%

50.0%

75.0%

100.0%

2012 2013 2014 2015 2016Q1 2016Q2

Total Assets Gross Loans

Total Deposits Gross Loans / Total Deposits

$884 $891 $888 $906 $920 $928

$0

$500

$1,000

2012 2013 2014 2015 2016Q1 2016Q2

$730 $754 $742 $758 $768 $766

$0

$250

$500

$750

$1,00

2012 2013 2014 2015 2016Q1 2016Q2

$580

$629 $623 $643 $652

$670

-$10

$100

$300

$500

$700

$900

2012 2013 2014 2015 2016Q1 2016Q2

16

(1) PROFITABILITY MEASURES AS OF THE TWELVE MOTHS ENDED JUNE 30, 2016

NOTE: BANK LEVEL DATA; DOLLARS IN THOUSANDS

SOURCE: SNL FINANCIAL

OVERVIEW OF JEFFERSON

0.57%

0.77%

0.86% 0.85% 0.84% 0.85%

0.00%

1.00%

2012 2013 2014 2015 2016L1 2016L2

5.49%

7.70%

8.21% 7.77% 7.63% 7.67%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

2012 2013 2014 2015 2016L1 2016L2

$4,950

$6,850

$7,640 $7,679 $7,619 $7,733

$0

$5,000

$1 ,000

2012 2013 2014 2015 2016L1 2016L2

ROAA (1) ROAE (1)

Net Income (1) Net Interest Margin (1)

3.33%

3.58% 3.45% 3.53% 3.57% 3.53%

0.00%

1.00%

2.00%

3.00%

4.00%

5.0 %

201 2013 2014 2015 2016L1 2016L2

17

NOTE: FINANCIAL DATA AS OF JUNE 30, 2016; BANK LEVEL DATA

SOURCE: SNL FINANCIAL

OVERVIEW OF JEFFERSON

TCE / TA Tier 1 Leverage Ratio

NPAs / Assets NCOs / Average Loans

9.62% 9.47%

10.35% 10.53% 10.54% 10.51%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

2012 2013 2014 2015 2016Q1 2016Q2

9.45% 9.72%

10.17% 10.46% 10.47% 10.37%

0.00%

3.00%

6.00%

9.00%

12.00%

2012 2013 2014 2015 2016Q1 2016Q2

5.28%

3.74% 3.48%

3.08% 2.94% 2.90%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.0 %

2012 2013 2014 2015 2016Q1 2016Q2

0.69%

0.15% 0.19%

0.26%

0.05% 0.04%

0.00%

0.50%

1.0 %

2012 2013 2014 2015 2016Q1 2016Q2