Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Coeur Mining, Inc. | a3q16productionpre-release.htm |

NEWS RELEASE

Coeur Reports Third Quarter 2016 Production Results

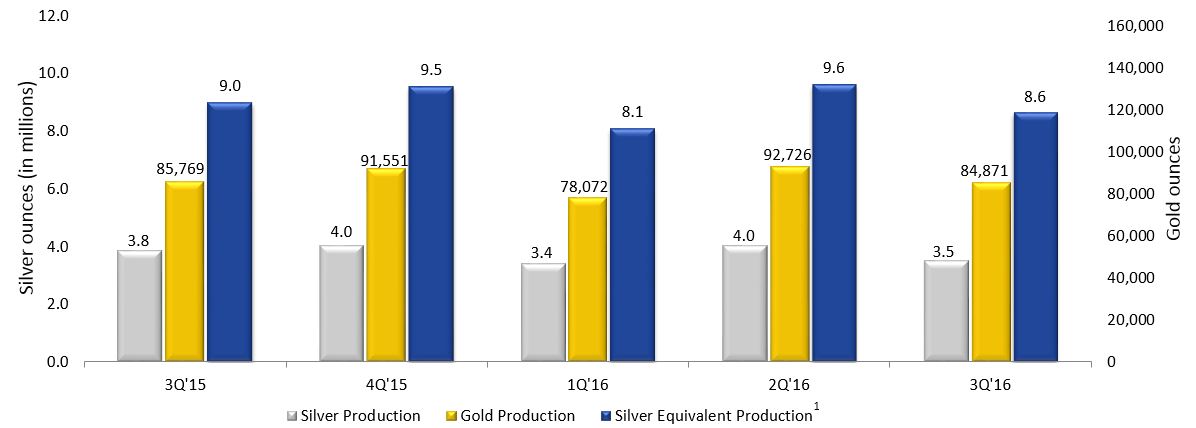

Chicago, Illinois - October 6, 2016 - Coeur Mining, Inc. (the "Company" or "Coeur") (NYSE:CDE) today announced third quarter production of 3.5 million ounces of silver and 84,871 ounces of gold, or 8.6 million silver equivalent1 ounces. Coeur is raising its 2016 production guidance to 34.4 - 37.0 million silver equivalent1 ounces from 33.8 - 36.8 million silver equivalent1 ounces.

Quarterly Production Results

Third quarter production highlights for each of Coeur's operations are provided below.

Palmarejo, Mexico | 3Q 2016 | 2Q 2016 | 1Q 2016 | 4Q 2015 | 3Q 2015 |

Underground Operations: | |||||

Tons mined | 253,681 | 283,971 | 215,642 | 189,383 | 190,399 |

Average silver grade (oz/t) | 3.96 | 5.40 | 4.21 | 3.96 | 4.11 |

Average gold grade (oz/t) | 0.08 | 0.08 | 0.07 | 0.06 | 0.10 |

Surface Operations: | |||||

Tons mined | — | 1,695 | 35,211 | 102,018 | 247,071 |

Average silver grade (oz/t) | — | 7.77 | 4.18 | 3.86 | 3.56 |

Average gold grade (oz/t) | — | 0.07 | 0.04 | 0.03 | 0.03 |

Processing: | |||||

Total tons milled | 274,644 | 270,142 | 246,533 | 301,274 | 427,635 |

Average recovery rate – Ag | 85.5% | 89.5% | 89.1% | 95.4% | 87.9% |

Average recovery rate – Au | 77.7% | 86.4% | 92.1% | 88.8% | 84.7% |

Silver production ounces (000's) | 933 | 1,307 | 933 | 1,126 | 1,422 |

Gold production ounces | 16,608 | 18,731 | 14,668 | 14,326 | 22,974 |

Silver-equivalent1 production ounces (000's) | 1,930 | 2,431 | 1,813 | 1,985 | 2,800 |

1

• | Transition to lower-tonnage, higher-grade, higher-margin underground operations is progressing on schedule with Guadalupe mining nearly 2,300 tons per day during the quarter, surpassing its target mining rate of 2,200 tons per day |

• | Development of Independencia remains on-track to achieve a mining rate of 1,000 tons per day by year-end |

• | Silver and gold production decreased as a result of the installation of a new Merrill Crowe processing circuit during the quarter. Recovery rates and grades are expected to increase in the fourth quarter |

• | Limited mining of the legacy underground area has extended into the fourth quarter |

• | Increasing full-year 2016 production guidance to 4.1 - 4.6 million silver ounces from 3.9 - 4.4 million silver ounces and 70,000 - 75,000 gold ounces from 67,000 - 72,000 gold ounces |

Rochester, Nevada | 3Q 2016 | 2Q 2016 | 1Q 2016 | 4Q 2015 | 3Q 2015 |

Tons placed | 4,901,039 | 6,402,013 | 4,374,459 | 4,411,590 | 4,128,868 |

Average silver grade (oz/t) | 0.54 | 0.54 | 0.64 | 0.60 | 0.59 |

Average gold grade (oz/t) | 0.003 | 0.003 | 0.004 | 0.003 | 0.003 |

Silver production ounces (000's) | 1,161 | 1,197 | 929 | 1,107 | 1,086 |

Gold production ounces | 12,120 | 13,940 | 10,460 | 11,564 | 10,892 |

Silver equivalent1 production ounces (000's) | 1,888 | 2,033 | 1,557 | 1,800 | 1,740 |

• | Silver equivalent1 production decreased 7% quarter-over-quarter due to longer-than-expected recovery time from the Stage III leach pad |

• | Crushing rates remained strong while tons placed moderated in the third quarter as a result of a lower portion of run-of-mine material placed |

• | Construction of the Stage IV leach pad expansion commenced in July 2016 and is expected to be complete in mid-2017 |

• | Revising full-year 2016 silver production guidance to 4.5 - 5.0 million ounces from 4.8 - 5.3 million ounces and maintaining gold production guidance of 48,000 - 55,000 ounces |

Kensington, Alaska | 3Q 2016 | 2Q 2016 | 1Q 2016 | 4Q 2015 | 3Q 2015 |

Tons milled | 140,322 | 157,117 | 159,360 | 159,666 | 165,198 |

Average gold grade (oz/t) | 0.20 | 0.22 | 0.21 | 0.22 | 0.19 |

Average recovery rate | 94.8% | 94.1% | 95.8% | 96.0% | 93.9% |

Gold production ounces | 26,459 | 32,210 | 31,974 | 33,713 | 28,799 |

• | Gold production decreased 18% quarter-over-quarter due to mill downtime at the end of the quarter relating to a blocked tailings line. The blockage has been cleared and the mill has resumed operations at full capacity |

• | Development of the Jualin decline continues to advance with initial production expected in the second half of 2017 |

• | Raising the low-end of full-year 2016 production guidance to 120,000 - 125,000 gold ounces from 115,000 - 125,000 gold ounces |

2

Wharf, South Dakota | 3Q 2016 | 2Q 2016 | 1Q 2016 | 4Q 2015 | 3Q 2015 |

Tons placed | 1,199,008 | 915,631 | 974,663 | 1,147,130 | 1,149,744 |

Average gold grade (oz/t) | 0.033 | 0.037 | 0.031 | 0.032 | 0.035 |

Average plant recovery rate - Au | 95.5% | 89.6% | 96.6% | 97.3% | 92.8% |

Gold production ounces | 29,684 | 27,846 | 20,970 | 31,947 | 23,104 |

Silver production ounces (000's) | 25 | 35 | 13 | 18 | 19 |

Gold equivalent1 production ounces | 30,106 | 28,433 | 21,186 | 32,231 | 23,427 |

• | Gold equivalent1 production remained strong during the third quarter, increasing 6% over the second quarter largely due to a 31% increase in tons placed as well as a return to higher plant recovery rates |

• | Increasing full-year 2016 production guidance to 95,000 - 100,000 gold ounces from 90,000 - 95,000 gold ounces |

San Bartolomé, Bolivia | 3Q 2016 | 2Q 2016 | 1Q 2016 | 4Q 2015 | 3Q 2015 |

Tons milled | 450,409 | 440,441 | 407,806 | 475,695 | 373,201 |

Average silver grade (oz/t) | 3.43 | 3.79 | 3.64 | 3.84 | 3.76 |

Average recovery rate | 88.7% | 87.4% | 93.1% | 84.9% | 84.0% |

Silver production ounces (000's) | 1,370 | 1,458 | 1,382 | 1,550 | 1,178 |

• | Silver production decreased 6% quarter-over-quarter. While civil unrest in Bolivia during the quarter did not impact mining operations, it hindered shipments of purchased ore to San Bartolomé's processing facilities. This led to a lower contribution of 27% of purchased ore to total production, down from approximately one-third in the second quarter |

• | Revising full-year 2016 production guidance to 5.5 - 5.8 million silver ounces from 5.8 - 6.1 million silver ounces |

Coeur Capital, Inc.

Endeavor, Australia | 3Q 2016 | 2Q 2016 | 1Q 2016 | 4Q 2015 | 3Q 2015 |

Silver production ounces (000's) | 56 | 33 | 115 | 171 | 121 |

• | Silver production received from the Company's silver stream on the Endeavor mine in Australia remained at decreased levels following a curtailment of production by the operator earlier this year due to lower lead and zinc prices |

• | Coeur is increasing its revised 2016 production guidance for Endeavor to 215,000 - 235,000 silver ounces from 175,000 - 200,000 silver ounces |

3

2016 Production Outlook

Coeur's 2016 silver and gold production guidance has been revised as shown below.

(silver and silver equivalent ounces in thousands) | Silver | Gold | Silver Equivalent1 |

Palmarejo | 4,100 - 4,600 | 70,000 - 75,000 | 8,300 - 9,100 |

Rochester | 4,500 - 5,000 | 48,000 - 55,000 | 7,380 - 8,300 |

San Bartolomé | 5,500 - 5,800 | — | 5,500 - 5,800 |

Endeavor | 215 - 235 | — | 215 - 235 |

Kensington | — | 120,000 - 125,000 | 7,200 - 7,500 |

Wharf | 80 - 100 | 95,000 - 100,000 | 5,780 - 6,100 |

Total | 14,395 - 15,735 | 333,000 - 355,000 | 34,375 - 37,035 |

4

Financial Results and Conference Call

Coeur will report its full operational and financial results for third quarter 2016 on October 26, 2016 after the New York Stock Exchange closes for trading. There will be a conference call on October 27, 2016 at 11:00 a.m. Eastern time.

Dial-In Numbers: (855) 560-2581 (US)

(855) 669-9657 (Canada)

(412) 542-4166 (International)

Conference ID: Coeur Mining

The conference call and presentation will also be webcast on the Company’s website www.coeur.com. Hosting the call will be Mitchell J. Krebs, President and Chief Executive Officer of Coeur, who will be joined by Peter C. Mitchell, Senior Vice President and Chief Financial Officer, Frank L. Hanagarne, Jr., Senior Vice President and Chief Operating Officer, Hans Rasmussen, Senior Vice President of Exploration, and other members of management. A replay of the call will be available through November 10, 2016.

Replay numbers: (877) 344-7529 (US)

(855) 669-9658 (Canada)

(412) 317-0088 (International)

Conference ID: 100 94 273

About Coeur

Coeur Mining is a well-diversified, growing precious metals producer with five precious metals mines in the Americas employing approximately 2,000 people. Coeur produces from its wholly owned operations: the Palmarejo silver-gold complex in Mexico, the Rochester silver-gold mine in Nevada, the Kensington gold mine in Alaska, the Wharf gold mine in South Dakota, and the San Bartolomé silver mine in Bolivia. The Company also has a non-operating interest in the Endeavor mine in Australia as well as a royalty interest in Ecuador. In addition, the Company has two silver-gold exploration stage projects - the La Preciosa project in Mexico and the Joaquin project in Argentina. Coeur conducts ongoing exploration activities in Alaska, Nevada, South Dakota and Mexico.

Cautionary Statement

This news release contains forward-looking statements within the meaning of securities legislation in the United States and Canada, including statements regarding anticipated production, operations at the Palmarejo complex, mining rates, recovery rates, grades, expansion at Rochester, development efforts at Kensington and crushing rates. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Coeur's actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risk that anticipated production levels are not attained, the risks and hazards inherent in the mining business (including risks inherent in developing large-scale mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold and silver and a sustained lower price environment, the uncertainties inherent in Coeur's production, exploratory and developmental activities, including risks relating to permitting and regulatory delays, ground conditions, grade variability, any future labor disputes or work stoppages, the uncertainties inherent in the estimation of gold and silver reserves, changes that could result from Coeur's future acquisition of new mining properties or businesses, reliance on third parties to operate certain mines where Coeur owns silver production and reserves and the absence of control over mining operations in which Coeur or its subsidiaries hold royalty or streaming interests and risks related to these mining operations including results of mining and exploration activities, environmental, economic and political risks of the jurisdiction in which the mining operations are located, the loss of any third-party smelter to which Coeur markets silver and gold, the effects of environmental and other governmental regulations, the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries, Coeur's ability to raise additional financing necessary to conduct its business,

5

make payments or refinance its debt, as well as other uncertainties and risk factors set out in filings made from time to time with the United States Securities and Exchange Commission, and the Canadian securities regulators, including, without limitation, Coeur's most recent report on Form 10-K. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities.

Dana Willis, Coeur's Director, Resource Geology and a qualified person under Canadian National Instrument 43-101, approved the scientific and technical information concerning Coeur's mineral projects in this news release. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and resources, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, socio-political, marketing or other relevant factors, Canadian investors should refer to the Technical Reports for each of Coeur's properties as filed on SEDAR at sedar.com.

Notes

1. Silver and gold equivalence calculated using a 60:1 silver to gold ratio.

For Additional Information:

Courtney Lynn, Vice President, Investor Relations and Treasurer

(312) 489-5837

Rebecca Hussey, Manager, Investor Relations

(312) 489-5827

www.coeur.com

6