Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - FOTV Media Networks Inc. | d261105dex322.htm |

| EX-32.1 - EX-32.1 - FOTV Media Networks Inc. | d261105dex321.htm |

| EX-31.2 - EX-31.2 - FOTV Media Networks Inc. | d261105dex312.htm |

| EX-31.1 - EX-31.1 - FOTV Media Networks Inc. | d261105dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2016

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 333-212396

FOTV MEDIA NETWORKS INC.

(Exact name of registrant as specified in its charter)

| Delaware | 45-3343730 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 338 N. Canon Drive, 3rd Floor, Beverly Hills, CA | 90210 | |

| (Address of principal executive offices) | (Zip code) | |

(877) 733-1830

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (SS 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer, “accelerated filer,” “non-accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | |||||||||||||

| Non-accelerated Filer | ☐ | Smaller Reporting Company | ☒ | |||||||||||||

| (Do not check if smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

As of September 30, 2016, there were 39,225,294 shares of the registrant’s common stock outstanding.

Table of Contents

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (this “Form 10-Q”) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements contained in this Form 10-Q other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including those described in Part II, Item 1A, “Risk Factors” in this Form 10-Q. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this Form 10-Q may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

Unless expressly indicated or the context requires otherwise, the terms “FOTV,” the “Company,” “we,” “us,” and “our” in this Form 10-Q refer to FOTV Media Networks Inc., a Delaware corporation, and, where appropriate, its wholly owned subsidiaries.

3

Table of Contents

PART I — FINANCIAL INFORMATION

| ITEM 1. | FINANCIAL STATEMENTS |

FOTV Media Networks Inc.

Condensed Consolidated Balance Sheets

(in thousands, except for share amounts and par value amounts)

| June 30, 2016 |

December 31, 2015 |

|||||||

| (Unaudited) | (restated) | |||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 473 | $ | 659 | ||||

| Accounts receivable, net |

1,222 | 3,190 | ||||||

| Advances to related entities |

655 | — | ||||||

| Inventory |

67 | 12 | ||||||

| Current prepaid content library, net |

109 | 230 | ||||||

| Other current assets |

1,273 | 1,056 | ||||||

|

|

|

|

|

|||||

| Total current assets |

3,799 | 5,147 | ||||||

| Non-current prepaid content library, net |

181 | 234 | ||||||

| Property and equipment, net |

2,650 | 1,984 | ||||||

| Film library, net |

2,150 | 1,723 | ||||||

| Intangibles, net |

20,218 | 15,900 | ||||||

| Goodwill |

5,415 | — | ||||||

| Other non-current assets |

12 | 27 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 34,425 | $ | 25,015 | ||||

|

|

|

|

|

|||||

| Liabilities and Stockholders’ Equity |

||||||||

| Current liabilities: |

||||||||

| Accounts payable and other current liabilities, including related parties |

$ | 10,553 | $ | 9,404 | ||||

| Deferred Revenue |

145 | 230 | ||||||

| Notes payable – related parties – current portion |

50 | — | ||||||

| Deferred tax liability – current portion |

325 | 176 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

11,073 | 9,810 | ||||||

| Notes payable – related parties less current portion |

481 | 641 | ||||||

| Deferred tax liability, less current portion |

4,744 | 2,640 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

16,298 | 13,091 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies |

— | — | ||||||

| Stockholders’ equity: |

||||||||

| Series A Convertible Preferred Stock, $0.001 par value; 381,247 and no shares issued and outstanding, respectively |

— | — | ||||||

| Common Stock, $0.001 par value; 39,225,294 and 37,312,500 shares issued and outstanding, respectively |

39 | 37 | ||||||

| Additional paid-in capital |

87,690 | 68,979 | ||||||

| Accumulated deficit |

(69,651 | ) | (57,419 | ) | ||||

| Accumulated other comprehensive income |

49 | 327 | ||||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

18,127 | 11,924 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 34,425 | $ | 25,015 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these condensed consolidated interim financial statements

F-1

Table of Contents

FOTV Media Networks Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(in thousands, except for share and per share amounts)

| For three months ended June 30, | For six months ended June 30, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| Revenues |

$ | 2,575 | $ | 4,528 | $ | 6,064 | $ | 6,764 | ||||||||

| Cost of revenues |

(2,931 | ) | (3,341 | ) | (6,795 | ) | (5,969 | ) | ||||||||

| Platform technology and development expense |

(739 | ) | (377 | ) | (1,274 | ) | (773 | ) | ||||||||

| Depreciation and amortization expense |

(1,402 | ) | (339 | ) | (2,569 | ) | (692 | ) | ||||||||

| General and administrative expenses |

(4,216 | ) | (2,504 | ) | (8,225 | ) | (4,966 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(6,713 | ) | (2,033 | ) | (12,799 | ) | (5,636 | ) | ||||||||

| Other income (expense) |

||||||||||||||||

| Interest expense – related party |

— | (86 | ) | 430 | (86 | ) | ||||||||||

| Other income |

430 | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss before income taxes |

(6,283 | ) | (2,119 | ) | (12,369 | ) | (5,722 | ) | ||||||||

| Provision for income taxes |

81 | — | 137 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

(6,202 | ) | (2,119 | ) | (12,232 | ) | (5,722 | ) | ||||||||

| Other comprehensive loss |

||||||||||||||||

| Foreign currency translation loss |

(196 | ) | (692 | ) | (278 | ) | (113 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive loss |

$ | (6,398 | ) | $ | (2,811 | ) | $ | (12,510 | ) | $ | (5,835 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share – basic and dilutive |

$ | (0.16 | ) | $ | (0.08 | ) | $ | (0.33 | ) | $ | (0.16 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average common shares outstanding – basic and dilutive |

39,356,919 | 37,312,500 | 38,440,784 | 37,312,500 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of these condensed consolidated interim financial statements

F-2

Table of Contents

FOTV Media Networks Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

(in thousands)

| For the six months ended June 30, |

||||||||

| 2016 | 2015 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Cash Flows From Operating Activities: |

||||||||

| Net Loss |

$ | (12,232 | ) | $ | (5,722 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Additions to prepaid content library |

(62 | ) | (452 | ) | ||||

| Depreciation and amortization expense |

2,686 | 808 | ||||||

| Stock option expense |

393 | — | ||||||

| Deferred tax liability |

(137 | ) | — | |||||

| Gain on sale of asset |

(430 | ) | — | |||||

| Changes in operating assets and liabilities: |

||||||||

| Account receivable |

2,195 | 3,362 | ||||||

| Inventory |

(55 | ) | — | |||||

| Other current assets |

(292 | ) | 4 | |||||

| Other assets |

81 | — | ||||||

| Accounts payable and other current liabilities |

737 | (504 | ) | |||||

| Deferred Revenue |

(75 | ) | — | |||||

|

|

|

|

|

|||||

| Net Cash Used in Operating Activities |

(7,191 | ) | (2,504 | ) | ||||

|

|

|

|

|

|||||

| Cash Flows From Investing Activities: |

||||||||

| Purchase of property and equipment |

(1,278 | ) | (224 | ) | ||||

| Additions to intangible – film library |

(621 | ) | (290 | ) | ||||

| Advances to related parties |

(655 | ) | (138 | ) | ||||

| Cash from sale of asset |

430 | — | ||||||

| Cash paid for acquisition of OVG, net of cash received |

51 | — | ||||||

|

|

|

|

|

|||||

| Net Cash Used in Investing Activities |

(2,073 | ) | (652 | ) | ||||

|

|

|

|

|

|||||

| Cash Flows From Financing Activities: |

||||||||

| Issuance of series A convertible preferred stock for cash, net of issuance costs |

2,113 | — | ||||||

| Issuance of common stock for cash |

7,241 | — | ||||||

| Capital contribution from stockholder |

— | 5,963 | ||||||

| Capital distributions to stockholder |

— | (3,070 | ) | |||||

| Repayment of notes payable – hologram, net |

(210 | ) | — | |||||

| Advances from director, net |

— | 863 | ||||||

|

|

|

|

|

|||||

| Net Cash Provided by Financing Activities |

9,144 | 3,756 | ||||||

|

|

|

|

|

|||||

| Net Increase in cash and cash equivalents |

(120 | ) | 600 | |||||

| Effect of exchange rate differences on cash and cash equivalents |

(66 | ) | (39 | ) | ||||

| Cash and cash equivalents, Beginning of Period |

659 | 377 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents, End of Period |

$ | 473 | $ | 938 | ||||

|

|

|

|

|

|||||

| Supplemental disclosure of cash flow information: |

||||||||

| Cash paid for interest |

$ | — | $ | — | ||||

|

|

|

|||||||

| Cash paid for income taxes |

$ | — | $ | — | ||||

|

|

|

|

|

|||||

| Noncash investing and financing activities: |

||||||||

| Stock options issued for acquisition of OVG |

$ | 903 | $ | — | ||||

|

|

|

|

|

|||||

| Shares of common stock for acquisition of OVG |

$ | 8,063 | $ | — | ||||

|

|

|

|

|

|||||

| Issuance of note payable for acquisition of Hologram |

$ | 1,530 | $ | — | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these condensed consolidated interim financial statements

F-3

Table of Contents

FOTV Media Networks Inc.

Unaudited Condensed Consolidated Statements of Changes in Stockholders’ Equity

For the Six Months Ended June 30, 2016

(Unaudited)

(in thousands, except for share amounts)

| Series A Convertible Preferred Stock |

Common Stock | Additional Paid-In Capital |

Accumulated Deficit |

Accumulated Other Comprehensive Income/(Loss) |

Total Stockholders’ Equity |

|||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||||||||||||||||||

| January 1, 2016 |

— | $ | — | 37,312,500 | $ | 37 | $ | 68,979 | $ | (57,419 | ) | $ | 327 | $ | 11,924 | |||||||||||||||||

| Issuance of series A convertible preferred stock |

381,247 | — | — | — | 2,113 | — | — | 2,113 | ||||||||||||||||||||||||

| Issuance of shares for cash — related party |

— | — | 904,980 | 1 | 7,240 | — | — | 7,241 | ||||||||||||||||||||||||

| Fair value of shares issued for acquisition |

— | — | 1,007,814 | 1 | 8,062 | — | — | 8,063 | ||||||||||||||||||||||||

| Fair value of stock options issued for acquisition |

— | — | — | — | 903 | — | — | 903 | ||||||||||||||||||||||||

| Fair value of equity issued for services |

— | — | — | — | 393 | — | — | 393 | ||||||||||||||||||||||||

| Foreign currency translation adjustment |

— | — | — | — | — | — | (278 | ) | (278 | ) | ||||||||||||||||||||||

| Net loss |

— | — | — | — | — | (12,232 | ) | — | (12,232 | ) | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| June 30, 2016 |

381,247 | $ | — | 39,225,294 | $ | 39 | $ | 87,690 | $ | (69,651 | ) | $ | 49 | $ | 18,127 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated interim financial statements

F-4

Table of Contents

FOTV Media Networks Inc.

Notes to the Unaudited Condensed Consolidated Financial Statements

For the three and Six Months June 30, 2016 and 2015

Note 1 – Basis of Presentation

Nature of operations

FOTV Media Networks Inc. (the “Company”, “we”, “our”, “us”, or the “Group”) was founded in the United Kingdom (“UK”) in 2007 and began operations in the United States (“US”) in 2010. The Company operates an internet-based IPTV platform serving video streams monthly to a global audience who watch the Company’s live programming, 700 linear channels, 90,000 on demand movies, documentaries, podcasts, music videos and social TV services. The Company’s programming reaches satellite audiences via DISH Network in the US, and FreeSat in Europe. In April 2016, the Company changed its name from FilmOn.TV Networks Inc. to FOTV Media Networks Inc.

In April 2016, as part of a group reorganization under common control, the Company acquired HUSA Development Inc., a company owned by the majority shareholder of the Company, which had commenced business operations during November 2015. (see Note 2 – Acquisitions). These transactions are being accounted for on the predecessor values basis as common control transactions. Upon consummation of the transaction, the results of operations of the Company, its existing subsidiaries and HUSA Development Inc. were included in the consolidated financial statements as if the companies had always been owned by the Company.

Basis of Presentation

The accompanying interim condensed consolidated financial statements as of June 30, 2016 and for the six months ended June 30, 2016 and 2015 are unaudited. The unaudited interim condensed consolidated financial statements have been prepared on the same basis as the annual consolidated financial statements and, in the opinion of management, reflect all adjustments, which are of a normal recurring nature, necessary to present fairly the Company’s financial position as of June 30, 2016, results of operations for the six months ended June 30, 2016 and 2015, and cash flows for the six months ended June 30, 2016 and 2015. The Company’s results for an interim period are not necessarily indicative of the results that may be expected for the year.

Although the Company believes that all adjustments necessary for a fair presentation of the interim periods presented are included and that the disclosures are adequate, these condensed consolidated financial statements and notes thereto are unaudited and should be read in conjunction with the audited consolidated financial statements and notes thereto for the year ended December 31, 2015 included in our final prospectus dated August 12, 2016 contained in our registration statement on Form S-1. The accompanying balance sheet at December 31, 2015 has been derived from audited financial statements, except that it has been adjusted to take account of the common control transaction that occurred in April 2016, as discussed in the basis of presentation above, but does not include all disclosures required by generally accepted accounting principles in the United States of America (“USGAAP”).

The interim condensed consolidated financial statements have been prepared on the basis of continuity of operations, realization of assets, and the satisfaction of liabilities in the ordinary course of business. The consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded assets and liabilities that might be necessary should the Company be unable to continue as a going concern (see Note 1—Going Concern).

Reverse Stock Split

On November 10, 2015, our Board of Directors and the holder of a majority of the outstanding shares of our common stock approved an amendment to our certificate of incorporation to effect a 0.375-for-1 reverse stock split of our outstanding common stock and authorized our executive officers to implement such reverse stock split at such time as they deem advisable. In February 2016, the executive officers, implemented the reverse stock split decreasing the Company’s common stock outstanding from 99,500,000 shares to 37,312,500 shares. As such, all share and per share numbers have been adjusted to reflect the reverse stock split.

F-5

Table of Contents

Going Concern

The accompanying condensed consolidated interim financial statements have been prepared assuming that the Company will continue as a going concern. The Company has experienced recurring losses since its inception. The Company incurred a net loss of $12,232,000 and used $7,191,000 in cash from operations for the six months ended June 30, 2016, and had an accumulated deficit of $69,651,000 as of June 30, 2016. Since inception, the Company has financed its activities principally from regular financing injections from its majority shareholder. Management expects to incur additional losses and cash outflows in the foreseeable future in connection with development of its operating activities. The Company’s consolidated financial statements have been presented on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

The Company is subject to a number of risks similar to those of other similar stage companies, including dependence on key individuals, successful product development, marketing and branding of products; uncertainty of product development and generation of revenues; dependence on outside sources of financing; risks associated with research and development; dependence on third-party content providers, suppliers and collaborators; protection of intellectual property; and competition with larger, better-capitalized companies. Ultimately, the attainment of profitable operations is dependent on future events, including obtaining adequate financing to fulfil its development activities and generating a level of revenues adequate to support the Company’s cost structure. To support the Company’s financial performance, management has undertaken several initiatives, including the raising of additional financing subsequent to the period end:

In December 2015, February 2016 and May 2016, we made strategic acquisitions of businesses in order to increase our ability to generate future cash flows and enhance product offerings.

In May 2016 and June 2016, the Company raised $2,440,000 through a private placement. In the private placement, the Company placed 381,247 new shares of Series A Convertible Preferred Stock (see Note 4).

During the six months ended June 30, 2016, the majority shareholder purchased 904,980 shares of common stock for a purchase price of $7,241,000, throughout the period.

There can be no assurance however that financing will be available in sufficient amounts, when and if needed, on acceptable terms or at all. If results of operations for the remainder of 2016 do not meet management’s expectations, or additional capital is not available, management believes it has the ability to reduce certain expenditures. The precise amount and timing of the funding needs cannot be determined accurately at this time, and will depend on a number of factors, including the market demand for the Company’s products, the quality of product development efforts, management of working capital, and continuation of normal payment terms and conditions for purchase of services. The Company is uncertain whether its existing cash balances and cash flow from operations will be sufficient to fund its operations for the next twelve months. If the Company is unable to substantially increase revenues, reduce expenditures, or otherwise generate cash flows for operations, then the Company will need to raise additional funding to continue as a going concern through its major shareholder, or through other avenues.

Goodwill

Goodwill is not subject to amortization and is tested for impairment annually and whenever events or changes in circumstances indicate that impairment may have occurred. Management has established the last day of its year end as the date of our annual goodwill and indefinite-lived intangible asset impairment assessment. Impairment testing is performed for each of our reporting units. We compare the carrying value of a reporting unit, including goodwill, to the fair value of the unit. Carrying value is based on the assets and liabilities associated with the operations of that reporting unit, which often requires allocation of shared or corporate items among reporting units. If the carrying amount of a reporting unit exceeds its fair value, we revalue all assets and liabilities of the reporting unit, excluding goodwill, to determine if the fair value of the net assets is greater than the net assets including goodwill. If the fair value of the net assets is less than the carrying amount of net assets including goodwill, impairment has occurred. Our estimates of fair value are determined based on a discounted cash flow model. Growth rates for sales and profits are determined using inputs from our long-range planning process. We also make estimates of discount rates, perpetuity growth assumptions, market comparables, and other factors.

F-6

Table of Contents

Note 2 – Acquisitions and Sale of Assets

OV Guide Inc. Acquisition

On March 8, 2016, we completed the acquisition of OVGuide Inc. (“OVG”). For accounting consideration, we had effective control of OVG on February 29, 2016. Founded in 2006, OVG is a privately held company where users can search and discover video content on the internet. Also headquartered in Los Angeles, California, we believe this deal enables the Company to broaden its content offering by leveraging the innovative video search technology employed by OVG.

The acquisition took place using a statutory merger instrument which involved the Company issuing 1,007,814 shares of the Company’s common stock in exchange for 100% of the outstanding share capital and eligible share options in OVG, which subsequently became a wholly owned subsidiary of the Company. The Company is in the process of determining the fair value of the assets and liabilities acquired in accordance with ASC 805. The following information is based on management’s estimate.

The Company has estimated the fair value at the consideration due; subject to the contingent payments, (see below), as follows (in thousands):

| Estimated fair value of shares issued |

$ | 8,063 | ||

| Estimated fair value of stock options purchased |

903 | |||

| Estimated cash acquired |

(51 | ) | ||

|

|

|

|||

| Purchase price |

$ | 8,915 | ||

|

|

|

Fair value of shares issued

The Company has estimated the fair value of the shares to be $8.00 per share for a total estimated value of $8,063,000. Of the total shares issuable, 100,782 shares are being held in an escrow account (“Hold-Back Participants”). The Hold-Back Participants are being retained for indemnity obligations. Of the total Hold-Back Participants, 50,391 shares will be released on the six-month anniversary of the acquisition and the remaining 50,391 shares will be released on the one-year anniversary of the acquisition.

Fair value of stock options purchased

In accordance with the merger agreement, the Company was required to replace, with the Company’s stock options, the outstanding stock options, which were in the money, of OVG as of the date of the merger. As of the acquisition date, OVG had a total of 5,620,500 stock options, in the money, outstanding. Of the total stock options outstanding, 5,135,823 options were vested. The value of the vested option was estimated to be $903,000. The Company has attributed the $903,000 as a component of the purchase price. The remaining value of the outstanding stock options will be treated as post-merger compensation and be charged to income over the vesting period of one year. The Company estimated the value of the stock options to be approximately $259,000 using the Black-Scholes option pricing formula. For the three and six months ended June 30, 2016, The Company has recorded stock option expenses of approximately $97,000 and $129,000, respectively.

F-7

Table of Contents

Bonus Shares

The Company is obligated to issue shares of the Company’s common stock for an aggregate fair value of $800,000 as a bonus to key employees (“Bonus Shares”). The Bonus Shares Plan will provide that (i) Bonus Shares will vest one year following closing, provided that the key employee remains employed by the Company or one the Company’s affiliates, except that the Bonus Shares will fully vest in the event of a termination of a key employee’s employment without cause; (ii) the Bonus Share, to the extent vested, shall be settled in shares of the Company’s common stock on the one year anniversary of the closing; and (iii) any Bonus Shares forfeited as a result of not vesting may be reallocated among the key employees within one year following the closing by mutual agreement between the chief executive officer of the Company and the chief executive officer of OVG. The Company has determined that the bonus shares are post-merger compensation, as such, the bonus shares will be accounted for in accordance with ASC 718 Compensation – Stock Compensation and charged to income over the period earned.

Purchase price adjustment

The acquisition agreement sets out a formula for issuing additional shares to the OVG shareholders if the Company does not succeed in having a successful initial public offering (“IPO”) of its shares, with the Securities and Exchange Commission, within twelve months of the closing date. Also, if the share price, in the IPO, is less than $8.00, there is a formula for additional shares to the OVG shareholders, as follows:

| (a) | Upon the effectiveness of an IPO of the Company that is consummated on or before the one-year anniversary of the closing, if the initial price to public of the Company’s common stock in the IPO is less than the Company’s common stock (Cash) value per share, then Company shall issue additional shares of Company’s common stock to the Holdback Participants, Option holders and Bonus Recipients (with each Holdback Participant, Option holder and Bonus Recipient having the right to receive such person’s Pro Rata Portion of such aggregate number of shares of the Company’s common stock), for no additional consideration), equal to (i) the quotient of (1) $10,000,000 divided by (2) the IPO True-Up Price (as defined below), minus (ii) the quotient of (1) $10,000,000 divided by (2) the Company’s common stock (cash) value per share. “IPO True-Up Price” means a price per share calculated by dividing the pre- money valuation of the Company for purposes of the IPO by the Company’s fully diluted capitalization immediately prior to the IPO; provided, that the IPO True-Up Price shall not exceed the Company’s common stock (cash) value per share and shall not be less than the price per share obtained by dividing $200,000,000 by the Company’s fully diluted capitalization immediately prior to the IPO. |

| (b) | If the Company does not consummate an IPO on or before the one-year anniversary of the closing, then the Company shall issue additional shares of the Company’s common stock to the Holdback Participants, Option Holders and Bonus Recipients (with each Holdback Participant, Option holder and Bonus Recipient having the right to receive such person’s Pro Rata Portion of such aggregate number of shares of the Company’s common stock), for no additional consideration, equal to (i) the quotient of (1) $10,000,000 divided by (2) the Alternative True-Up Price (as defined below), minus (ii) the quotient of (1) $10,000,000 divided by (2) the Company’s common stock (cash) value per share. “Alternative True- Up Price” means a price per share calculated by dividing $250,000,000 by the Company’s fully diluted capitalization on the first day following the one-year anniversary of the closing. |

The Company’s management has evaluated the above provision and determined the provision to be a free- standing derivate instrument in accordance with ASC 815—Derivatives and Hedging. As such, the Company will fair value the instrument, each reporting period, with the fair value adjustment to the statement of operations. At issuance date the fair value of the derivative was $nil, and at June 30, 2016, the fair value of the derivative was also estimated by management to be $nil.

Purchase Price Allocation

The Company negotiated the purchase price based on the expected cash flows to be derived from their operations after integration into the Company’s existing distribution, production and service networks. The acquisition purchase price is allocated on a preliminary basis based on the fair values of the assets acquired and liabilities assumed, which are based on management estimates and third-party appraisals. The following table summarizes (in thousands) the preliminary fair values of the assets acquired and liabilities assumed related to the acquisition:

F-8

Table of Contents

| Current assets |

$ | 468 | ||||||

| Property and equipment |

12 | |||||||

| Other assets |

8 | |||||||

| Intangible assets: |

||||||||

| Trade name |

500 | |||||||

| Customer relationships |

4,200 | |||||||

| Developed technology |

1,300 | 6,000 | ||||||

|

|

|

|||||||

| Current liabilities |

(498 | ) | ||||||

| Notes payable |

(100 | ) | ||||||

| Deferred tax liability |

(2,390 | ) | ||||||

| Goodwill |

5,415 | |||||||

|

|

|

|||||||

| Purchase price |

$ | 8,915 | ||||||

|

|

|

Intangible Assets

The developed technology intangible assets relate to OVG’s products across all of their product lines that have reached technological feasibility, primarily the technology to operate the Company’s website. Customer relationships represent existing contracted relationships with affiliate marketing partners. The estimated lives of each component is as follows:

| Intangible Asset |

Life in Years |

|||

| Trade name |

10 | |||

| Customer relationships |

6 | |||

| Developed technology |

8 | |||

The estimated fair values of the identifiable intangible assets, which include developed technology, trade name and customer relationships were primarily determined using either the relief-from-royalty or excess earnings methods. The rates utilized to discount net cash flows to their present values ranged from 24.5% to 25.9% and were determined after consideration of the overall enterprise rate of return and the relative risk and importance of the assets to the generation of future cash flows. The estimated fair values of the studio relationships and content library were determined under the cost method.

The Company did not record any in-process research and development assets as OVG’s major technology projects are either substantially complete or primarily represent improvements and additional functionality to existing products for which a substantial risk of completion does not exist.

Developed technology, trade names and customer relationships will be amortized on a straight-line basis over their estimated useful lives.

Deferred tax liability

The Company has recorded a deferred tax liability for the difference between the book and tax basis of the intangible assets.

F-9

Table of Contents

Unaudited Pro forma operating results

The following unaudited pro forma information presents the combined results of operations as if the acquisition had been completed on January 1, 2015, the beginning of the comparative interim reporting period. The unaudited pro forma results include amortization associated with preliminary estimates for the acquired intangible assets on these unaudited pro forma adjustments.

The unaudited pro forma results do not reflect any cost saving synergies from operating efficiencies or the effect of the incremental costs incurred in integrating the two companies. Accordingly, these unaudited pro forma results are presented for informational purpose only and are not necessarily indicative of what the actual results of operations of the combined company would have been if the acquisition had occurred at the beginning of the period presented, nor are they indicative of future results of operations (in thousands).

Revenue and earnings of the combined entity as though the business combination occurred as of the beginning of January 2015 are as follows:

| Six Months Ended June 30, |

||||||||

| 2016 | 2015 | |||||||

| Revenues |

$ | 6,721 | $ | 13,888 | ||||

|

|

|

|

|

|||||

| Net Loss |

$ | (12,105 | ) | $ | (10,084 | ) | ||

|

|

|

|

|

|||||

Revenue and earnings recognized since the date of acquisition are as follows from March 1, 2016 through June 30, 2016:

| Revenues |

$ | 873 | ||

|

|

|

|||

| Net Loss |

$ | (956 | ) | |

|

|

|

Hologram Acquisition

In May 2016, the Company formed a wholly owned subsidiary Hologram USA Productions Inc. (“Hologram”) as a vehicle to enter into a transaction with HUSA Development Inc. (“HUSA”), a company owned by the majority shareholder of the Company. Hologram acquired the net assets and liabilities of HUSA’s Holographic Projection System installation business (the “Business”), which constitute a business, as defined by ASC 805. The Business relates to the use of certain technology for projecting hologram images. The Business installs the projection equipment, on a permanent basis, in facilities that desire the ability to project hologram content. The purchase price is equal to the equity investment of the Business, as defined by USGAAP. The purchase price is approximately $1,530,000, as follows (in thousands):

| Current assets |

$ | 99 | ||

| Property and equipment |

1,620 | |||

|

|

|

|||

| Current liabilities |

(369 | ) | ||

| Accumulated deficit |

180 | |||

|

|

|

|||

| Purchase price |

$ | 1,530 | ||

|

|

|

The purchase price is due and payable within thirty-six months from May 11, 2016. Since the transaction is between entities under common control, the Company accounted for the transaction on a predecessor basis and, as such, the consolidated financial statements as of December 31, 2015 have been revised to represent the new business on a pooling of interest basis to include the Business from its date of inception in November 2015.

Revenue and earnings recognized for the six months ended June 30, 2016, as follows (in thousands):

F-10

Table of Contents

| Revenues |

$ | — | ||

|

|

|

|||

| Net Loss |

$ | (360 | ) | |

|

|

|

In conjunction with the acquisition of the Business, Hologram and HUSA have entered into an exclusive distribution agreement for Hologram to control the sales, licensing, distribution and other commercial exploitation of holograms owned by HUSA. The term of the distribution agreement is five years, with successive one-year extensions unless written notice of termination by either party. The parties will share, in equal proportion, the net revenues from all exploitation of the holograms. Net revenues is defined as the gross revenue less all direct costs and expenses incurred by Hologram in the distribution and commercial exploitation of the holograms.

Sale of asset the Sky Channel

In May 2016, the Company sold its Sky Channel (“Channel”) to unrelated third party for approximately $430,000. The sales price of $430,000 was paid in-full upon transfer of the Channel.

Note 3 – Related Parties

During the normal course of business, the Group enters into various transactions with both Anakando Limited and other related parties whereby the Company or the related parties pay expense on behalf of the other company. As of June 30, 2016, the net balance due from the related parties (ETV, Inc., Hologram USA Production Inc., Alki David Productions, Inc. and Hologram USA, Inc.) was approximately $655,000.

Notes Payable – related parties

Notes payable to related parties consisted of the following

| June 30, 2016 |

December 31, 2015 |

|||||||

| (Unaudited) | ||||||||

| Note payable to a shareholder of the Company, various dates, due on demand, interest at 2.38% per annum |

$ | 25,000 | $ | — | ||||

| Note payable to a shareholder of the Company, various dates, due on demand, interest at 2.38% per annum |

25,000 | — | ||||||

| Note payable to a shareholder of the Company, dated December 31, 2011 and February 2018, interest at 2.38% per annum |

50,000 | — | ||||||

| Note payable to HUSA for purchase of Hologram, non-interest bearing, due in May 2019 |

431,000 | 641,000 | ||||||

|

|

|

|

|

|||||

| Total |

531,000 | 641,000 | ||||||

| Less current portion |

50,000 | — | ||||||

|

|

|

|

|

|||||

| Long-term portion |

$ | 481,000 | $ | 641,000 | ||||

|

|

|

|

|

|||||

As of June 30, 2016, the remaining balance due for the Hologram acquisition note payable was approximately $431,000. For the period from November 2015 through June 30, 2016, the Company made payments on behalf of HUSA. These payments of approximately $1,099,000 were used to reduce the principal balance due.

F-11

Table of Contents

Services provided by related party

Alki David Productions, an entity owned by the Company’s Chairman and Chief Executive Officer, Alkiviades (Alki) David, performed production services for the Company. The production cost totaled approximately nil and $139,000 for the three months ended June 30, 2016 and 2015, respectively, $38,000 and $240,000 for the six months ended June 30, 2016 and 2015, respectively, which has been recorded as additions to intangible – film library.

The Company has contracted with 111 PIX UA to provide services for the development and maintenance of the Company’s technology platform. 111 PIX UA is owned and operated by the Company’s Chief Technology Officer, who is a stockholder of the Company. The Company has paid for these services approximately $395,000 and $430,000 for the three months ended June 30, 2016 and 2015, respectively, $821,000 and $790,000 for the six months ended June 30, 2016 and 2015, respectively, which has been charged in platform technology and development expenses. There was no liability due to 111 PIX UA as of June 30, 2016 and 2015, respectively.

Note 4 – Stockholders’ Equity

For the three and six months ended June 30, 2016, the Director contributed $2,151,000 and $7,241,000, respectively, to fund the Company’s operating deficits. The Company issued to the Director 268,882 and 904,980 shares, respectively, of the Company’s common stock at a value of $8.00 per share as settlement for the contribution.

Stock Options

In conjunction with the acquisition of OVG, the Company was required to issue stock options to purchase 5,620,500 shares of the Company’s common stock (“Options”). The Options were issued to the OVG employees who held OVG stock option that were vested and in-the-money at the date of the acquisition. The Options have an exercise price of $2.0503, expire three months from the date the employee terminates employment with the Company. The Options shall vest 50% on the six-month anniversary of the Closing, and the remaining 50% shall vest in equal monthly installments over the six months thereafter. As of June 30, 2016, none of the options were vested, the weighted average fair value was approximately $0.21 per option for a total aggregate fair value of approximately $1,162,000. Of the total aggregate fair value approximately $903,000 was attributed to pre-acquisition cost with the remaining $259,000 relating to post acquisition cost. During the three and six months ended June 30, 2016, the Company expensed approximately $297,000 and $393,000, respectively.

Issuance of Series A Convertible Preferred Stock

On May 2, 2016, we received gross proceeds of approximately $2,214,000, or $1,928,000 after issuance cost of approximately $286,000, from a private placement of our series A convertible preferred stock (the “2016 Private Placement”), convertible into 345,997 shares of our common stock, and warrants to purchase 51,894 shares of common stock, pursuant to the terms of a Securities Purchase Agreement with a small number of accredited investors. We subsequently received on June 24, 2016, an additional $226,000 in gross proceeds, or $185,000 after issuance cost of approximately $41,000, from the sale of our series A preferred stock, convertible into 35,250 shares of our common stock, and warrants to purchase 5,287 shares of common stock, in a second closing of the 2016 Private Placement. The series A preferred stock is convertible into shares of common stock automatically upon the closing of our pending initial public offering. The conversion price of the series A preferred stock is $6.40 per share, representing a 20% discount to the initial public offering price per share in our pending initial offering. The conversion price is subject to adjustment if at any time during the period commencing on the closing date of our pending initial offering and ending on the first anniversary of that date, we issue in a financing additional shares of common stock or other equity or equity linked securities that exceed an aggregate of 10,000 shares at a purchase, conversion or exercise price less than $6.40 per share. In any such case, we have agreed to issue additional shares of common stock to the investors so that the effective purchase price per share in the 2016 Private Placement is the same per share purchase, conversion or exercise price of such additional shares. The Company’s management has evaluated this provision and determined the provision to be a free-standing derivate instrument in accordance with ASC 815 - Derivatives and Hedging. As such, the Company will fair value the instrument, each reporting period, with the fair value adjustment to the statement of operations. At issuance date the fair value of the derivative was $nil, and at June 30, 2016, the fair value of the derivative was also estimated by management to be $nil.

F-12

Table of Contents

Note 5 – Business Segments and Geographic Information

Following the acquisition of CinemaNow on December 28, 2015, OVG on February 29, 2016 and Hologram on May 11, 2016, the Company now operates and internally manages four distinct operating segments. The reportable segments are each managed separately because they operate and manage distinct products with different revenue models.

FOTV

FOTV operates an internet-based IPTV platform serving video streams monthly to a global audience who watch the Company’s live programming, linear channels, and on demand movies, documentaries, podcasts, music videos and social TV services. The Company’s programming reaches satellite audiences via DISH Network in the US, and FreeSat in Europe.

CinemaNow

CinemaNow is an over-the-top provider that enables transactional digital storefronts across multiple territories by managing the entire content supply chain from licensing to encoding, storage, delivery and commerce reporting.

OVG

OVG is the comprehensive guide that facilitates the discovery, and consumption, of online video. OVG cross platform service has millions of monthly users globally across desktop, mobile web, iOS, Android and Roku. The OVG portal provides millions of ad supported videos across over 20 categories, but is focused on Movies and TV shows. OVG provides this service with a robust, automated, cloud based infrastructure that includes a comprehensive OTT data set, a streaming video platform that supports OVG and third party applications, and proprietary tagging technology. Since the acquisition of CinemaNow was recorded as of December 31, 2015 and OVG was recorded as of February 29, 2016, all operating activity for the three and six months ended June 30, 2016 are a result of the FOTV segment.

Hologram

Hologram uses patented technology for the projecting of hologram images. Hologram will enter into contracts with theaters owners (“Theaters”) to install the projection equipment, on a permanent basis, in Theaters that desire the ability to project hologram content. Hologram is responsible for the maintaining the installed equipment and providing the Theaters with hologram content. The Hologram and the Theaters will share equally in the box office receipts for the showing of the hologram content. As of June 30, 2016, Hologram has not in entered into an agreement with a Theater. Currently, Hologram is creating its own theater in Hollywood, California. Hologram has entered into an agreement to lease a theater and is renovating and installing the projection technology.

The reportable operations by segment are as follows for the three and six months ended June 30, 2016, in thousands:

| Revenue | ||||||||||||||||

| Three months ended June 30, |

Six months ended June 30, |

|||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| FOTV |

$ | 721 | $ | 4,528 | $ | 2,271 | $ | 6,764 | ||||||||

| CinemaNow |

1,208 | — | 2,920 | — | ||||||||||||

| OVGuide |

646 | — | 873 | — | ||||||||||||

| Hologram |

— | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 2,575 | $ | 4,528 | $ | 6,064 | $ | 6,764 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss | ||||||||||||||||

| Three months ended June 30, |

Six months ended June 30, |

|||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| FOTV |

$ | (3,895 | ) | (2,119 | ) | $ | (8,190 | ) | (5,772 | ) | ||||||

| CinemaNow |

(1,307 | ) | — | (2,727 | ) | — | ||||||||||

| OVGuide |

(640 | ) | — | (955 | ) | — | ||||||||||

| Hologram |

(360 | ) | — | (360 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | (6,202 | ) | (2,119 | ) | $ | (12,232 | ) | (5,772 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

F-13

Table of Contents

Total segment assets as of June 30, 2016:

| FOTV |

$ | 6,063 | ||

| CinemaNow |

14,948 | |||

| OVGuide |

11,755 | |||

| Hologram |

1,659 | |||

|

|

|

|||

| Total assets |

$ | 34,425 | ||

|

|

|

Geographical information

Total revenues are attributed to a particular geographic area based on the bill-to-location of the customer. The Company operates primarily in four geographic regions: North America, United Kingdom, Central Europe and Rest of the world. The following table presents total revenues by geographic regions for the three and six months ended June 30 (in thousands):

| Three months ended June 30, |

Six months ended June 30, |

|||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| North America |

$ | 2,152 | $ | 441 | $ | 4,791 | $ | 1,029 | ||||||||

| Central Europe |

148 | 1,466 | 582 | 2,317 | ||||||||||||

| United Kingdom |

197 | 2,430 | 489 | 3,191 | ||||||||||||

| Rest of world |

78 | 191 | 202 | 227 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 2,575 | $ | 4,528 | $ | 6,064 | $ | 6,764 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

For the three and six months ended June 30, 2016, the Company had no significant customers.

For the three and six months ended June 30, 2015, the Company had one and two customers, respectively, whose revenues were approximately 17%, 39% and 12% of total revenues for that period.

Note 6 – Subsequent Events

On August 12, 2016, the Company’s registration statement on Form S-1 was declared effective by the Securities and Exchange Commission (the “SEC”) in connection with its IPO for the issuance and sale, on a best efforts basis, of a minimum of 2,500,000 shares and a maximum of 3,750,000 shares of the Company’s common stock. The Company will have an initial closing of the IPO at such time as 2,500,000 shares are sold in the offering, subject to customary closing conditions contained in the Company’s Underwriting Agreement for the IPO, and the offering will continue until the earlier of the sale of all 3,750,000 shares or October 11, 2016.

Subsequent to June 30, 2016, the Company’s Director contributed approximately $4,400,000 to fund the Company’s operations.

F-14

Table of Contents

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

On August 12, 2016, the Company’s registration statement on Form S-1 was declared effective by the Securities and Exchange Commission (the “SEC”) in connection with its IPO for the issuance and sale, on a best efforts basis, of a minimum of 2,500,000 shares and a maximum of 3,750,000 shares of the Company’s common stock. The Company will have an initial closing of the IPO at such time as 2,500,000 shares are sold in the offering, subject to customary closing conditions contained in the Company’s Underwriting Agreement for the IPO, and the offering will continue until the earlier of the sale of all 3,750,000 shares or October 11, 2016.

Special Note Regarding Forward-Looking Information

The following discussion and analysis is provided to increase the understanding of, and should be read in conjunction with, our consolidated financial statements and related notes included elsewhere in this report. Historical results and percentage relationships among any amounts in these financial statements are not necessarily indicative of trends in operating results for any future period. This report contains “forward-looking statements.” The statements, which are not historical facts contained in this report, including this Management’s Discussion and Analysis of Financial Condition and Results of Operations, and notes to our consolidated financial statements, particularly those that utilize terminology such as “may,” “would,” “could,” “should,” “should,” “expects,” “anticipates,” “estimates,” “believes,” “intends,” or “plans” or comparable terminology are forward-looking statements. Such statements are based on currently available operating, financial and competitive information, and are subject to various risks and uncertainties. Future events and our actual results may differ materially from the results reflected in these forward-looking statements. Factors that might cause such a difference include, but are not limited to, our ability to raise additional funding (including our initial public offering), our ability to maintain and grow our business, variability of operating results, our ability to maintain and enhance our brand, our development and introduction of new products and services, the successful integration of acquired companies, technologies and assets into our portfolio of software and services, marketing and other business development initiatives, competition in the industry, general government regulation, economic conditions, dependence on key personnel, the ability to attract, hire and retain personnel who possess the technical skills and experience necessary to meet the service requirements of our clients, our ability to protect our intellectual property, the potential liability with respect to actions taken by our existing and past employees, risks associated with international sales, and other risks described herein and in our other filings with the SEC.

All forward-looking statements in this document are based on our current expectations, intentions and beliefs using information currently available to us as of the date of this report, and we assume no obligation to update any forward-looking statements, except as required by law. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements.

4

Table of Contents

Company History

In 2007, Alkiviades (Alki) David, the Chairman and Chief Executive Officer of our company, formed FilmOn TV UK Ltd. (formerly known as FilmOn.com Plc) in the United Kingdom. Through FilmOn TV UK Ltd., he began amassing digital video content and streaming it over the internet. In September 2010, Mr. David brought the FilmOn concept to the United States, establishing multiple FilmOn entities for the creation, collection and distribution of digital video content. He also established operations in Beverly Hills, California. In September 2011, Mr. David formed FilmOn.TV Networks Inc. in Delaware. He used FilmOn.TV Networks Inc. as the United States holding company for the United States-based FilmOn entities and operations he had established. In August 2012, as part of a reorganization of the FilmOn group of companies, FilmOn.TV Networks Inc. acquired FilmOn TV UK Ltd. in a stock-for-stock exchange in which FilmOn.TV Networks Inc. became the holding company for all the United Kingdom -based FilmOn operations. In August 2015, pursuant to a further reorganization, all of the other United States FilmOn entities consolidated under FilmOn.TV Networks Inc.

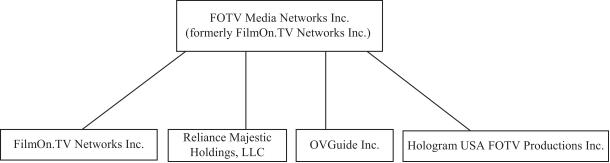

Expanding thereafter in the United States, in December 2015, we acquired 100% of the membership interests of CinemaNow, LLC through our acquisition of its parent holding company Reliance Majestic Holdings, LLC and, in February 2016, we acquired 100% ownership of OVGuide Inc. through the merger of our newly-formed, wholly-owned subsidiary with and into OVGuide. Following the acquisitions, we changed our corporate name to FOTV Media Networks Inc. from FilmOn.TV Networks Inc. to reflect our broader media focus and transferred all of our contracts, assets and properties relating to our historical FilmOn.TV Networks operations to a separate newly-formed subsidiary that we named FilmOn.TV Networks Inc. In April 2016, we formed a wholly owned subsidiary, Hologram USA FOTV Productions Inc. , as a vehicle to acquire the holographic projection system installation business of HUSA, a company affiliated with Mr. David. The following chart reflects the current corporate structure of our key operating units:

5

Table of Contents

Overview

We are a fast growing OTT provider of streaming video, audio and other digital media content. We offer live and on-demand video streams, including our live programming, linear channels, on-demand movies and television shows, documentaries, music videos, podcasts and original social television programming, to a global audience of more than 75 million viewers. Our current operations are conducted through our four primary operating subsidiaries.

| • | CinemaNow – CinemaNow, LLC, which we acquired in December 2015, is an OTT provider of on-demand movies and television shows in the United States, Canada and the United Kingdom through its site cinemanow.com, which allows users to purchase or rent movies and television shows directly from CinemaNow on internet-enabled devices. CinemaNow was founded in 1999 as one of the first OTT platforms and has long standing arrangements with major television and film studios and a library of over 65,000 titles. |

| • | Hologram – Hologram USA FOTV Productions Inc. holds the exclusive global broadcast and streaming distribution rights for all media for original holographic shows in which the holograms of famous deceased singers such as Whitney Houston, Liberace, Tammy Wynette, Nat King Cole and Roy Orbison and comedians such as Red Foxx and Andy Kaufman perform for new live audiences, known as “resurrection shows.” These shows are developed for Hologram USA Productions Inc. in cooperation with HUSA Development Inc. (a company affiliated with Alkiviades (Alki) David, our Chairman and Chief Executive Officer), and distributed pursuant to a license from Hologram USA Inc., the exclusive patent license holder in the United States and Canada of the projection system technology for presenting holographic shows. We acquired Hologram in April 2016. |

| • | FilmOn – FilmOn.TV Networks Inc.’s FilmOn.com and its related television broadcast network FilmOnTV offer live and on demand video streams, including live events, linear channels, on-demand movies, documentaries, music videos, podcasts and original social television programming. FilmOn.com, which was launched in 2007, has been our core operating business since our inception and is available worldwide and FilmOnTV is available in the United States and Europe. |

| • | OVGuide – OVGuide Inc., which we acquired in March 2016, is an online portal that allows users to search and discover videos online through its website OVGuide.com. The site offers OTT viewing of all types of videos including free full-length movies, television shows, trending viral videos and short video clips. If free streaming content is not available on OVGuide.com for a movie or television title, OVGuide.com also directs users to the right platform, subscription service or VOD site to access the desired content. OVGuide began operations in 2006 and is accessible worldwide in mobile web format and as an app for Android, iOS and Roku. |

All of our OTT platforms, which contain multiple interactive features and are highly customizable, are available through any internet-connected device including computers, smart phones (iPhone or Android), tablets and iPads, and internet-enabled set-top boxes and devices. Through these various portals, we monetize our platform through advertising, premium subscriptions, transactional video on demand, and other video and audio offerings such as pay-per-view events and licensing of our digital media. In addition to our vast digital media content offerings, we offer our proprietary FilmOn.com Affiliate System platform to verified partners for interest-specific programming, which can be managed through a user-friendly, web-based control panel. We also carry a number of interactive online communities such as BattleCam, a popular social television channel that incorporates user chats and user-generated live video and audio streams into our BattleCam broadcast channel. Since August 2012, under a partnership agreement with a subsidiary of Lenovo Group Ltd., the world’s largest personal computer vendor by unit sales according to Gartner, Inc., an independent information technology research and advisory company, our FilmOn app has been preloaded as the default OTT app on more than 19 million personal and tablet computers manufactured by Lenovo, according to Lenovo’s data, as well as offered for download in its app store, providing direct access to our platform to millions more Lenovo users.

6

Table of Contents

In 2007, Alkiviades (Alki) David, the Chairman and Chief Executive Officer of our company, formed FilmOn TV UK Ltd. (formerly known as 111PIX Ltd.) in the United Kingdom. Through FilmOn TV UK Ltd., he began amassing digital video content and streaming it over the internet. In September 2010, Mr. David brought the FilmOn concept to the United States, establishing multiple FilmOn entities for the creation, collection and distribution of digital video content. He also established operations in Beverly Hills, California. In September 2011, Mr. David formed FilmOn.TV Networks Inc. in Delaware. He used FilmOn.TV Networks Inc. as the United States holding company for the United States-based FilmOn entities and operations he had established. In August 2012, as part of a reorganization of the FilmOn group of companies, FilmOn.TV Networks Inc. acquired FilmOn TV UK Ltd. in a stock-for-stock exchange in which FilmOn.TV Networks Inc. became the holding company for all the UK-based FilmOn operations. In August 2015, pursuant to a further reorganization, all of the other U.S. FilmOn entities consolidated under FilmOn.TV Networks Inc.

Expanding thereafter in the United States, in December 2015, we acquired 100% of the membership interests of CinemaNow, LLC through our acquisition of its parent holding company Reliance Majestic Holdings, LLC and, in March 2016, we acquired 100% ownership of OVGuide.com, Inc. through the merger of our newly-formed, wholly-owned subsidiary with and into OVGuide. Following the acquisitions, we changed our corporate name to FOTV Media Networks Inc. from FilmOn.TV Networks Inc. to reflect our broader media focus and transferred all of our contracts, assets and properties relating to our historical FilmOn.TV Networks operations to a separate newly-formed subsidiary that we named FilmOn.TV Networks Inc. In April 2016, we formed a wholly owned subsidiary, Hologram, as a vehicle to acquire the holographic projection system installation business of HUSA, a company affiliated with Mr. David.

Revenue Model

Currently, the majority of our content is free, and our business model can presently be characterized as “freemium,” meaning that our content is largely advertising supported and is available to be watched at no cost. We also offer premium subscription-based video content. For a fee ranging from $9.99 to $19.99 per month (depending on the amount of digital video recording storage space selected), premium subscribers have access to our premium channels, pay-per-view specials, special live events (e.g., boxing and music concerts), an HD quality signal for all channels (where available), no advertising and the ability to record a set number of hours of programs. Free viewers are entitled to only an SD quality signal. In addition, we offer transactional VOD (pay-per-view, as well as digital video purchases) viewing that allows users to purchase or rent only the digital video content that they wish to own or view for a limited time.

Our FilmOn and CinemaNow platforms are customizable for affiliate partner video services and white label opportunities, and we have a team of platform developers who are constantly upgrading and customizing our video service platforms. These platforms may be licensed to third parties at market rates. Additionally, in August 2012, we entered into a strategic alliance with a subsidiary of Lenovo Group Ltd., the world’s largest personal computer vendor by unit sales, to preload the FilmOn app on Lenovo products.

We have to date financed our operations through equity investments and loans made through Anakando Ltd., which is owned by Alkiviades (Alki) David, our Chairman and Chief Executive Officer, and affiliated companies and with the net proceeds of our recent private placement. As of the initial closing of this offering, all related party notes payable and stockholder advances reflected in our consolidated financial statements will be converted to equity as additional paid-in capital and we will have no outstanding indebtedness. See “Certain Relationships and Related Party Transactions.”

Recent Developments

No recent developments.

7

Table of Contents

Results of Operations

The following discussion should be read in conjunction with the information set forth in the consolidated financial statements included in our final prospectus dated August 12, 2016 contained in our registration statement on Form S-1.

Three Months Ended June 30, 2016 Compared to Three Months Ended June 30, 2015

The following table sets forth the results of our operations for the three months ended June 30, 2016 compared to our results of operations for the three months ended June 30, 2015:

| Three Months Ended June 30, (in thousands) |

||||||||

| 2016 | 2015 | |||||||

| Statement of Operations Data: |

||||||||

| Revenues |

$ | 2,575 | $ | 4,528 | ||||

| Operating expenses: |

||||||||

| Cost of revenues |

2,931 | 3,341 | ||||||

| Platform technology and development expenses |

739 | 377 | ||||||

| Depreciation expenses |

1,402 | 339 | ||||||

| General and administrative expenses |

4,216 | 2,504 | ||||||

|

|

|

|

|

|||||

| Total operating expenses |

9,288 | 6,561 | ||||||

|

|

|

|

|

|||||

| Loss from operations |

(6,713 | ) | (2,033 | ) | ||||

| Total other income (expense) |

430 | (86 | ) | |||||

|

|

|

|

|

|||||

| Loss before income taxes |

(6,283 | ) | (2,119 | ) | ||||

| Provision for income taxes |

81 | — | ||||||

|

|

|

|

|

|||||

| Net loss |

$ | (6,202 | ) | $ | (2,119 | ) | ||

|

|

|

|

|

|||||

Revenue

Total revenue for the three months ended June 30, 2016 was $2,575,000 compared to $4,528,000 for the same period in 2015, a decrease of 43%.

| Three Months Ended June 30, (in thousands) |

||||||||

| 2016 | 2015 | |||||||

| Total Revenue: |

||||||||

| Advertising revenue |

$ | 702 | $ | 4,411 | ||||

| Transactional revenue |

835 | — | ||||||

| Affiliate revenue |

267 | — | ||||||

| Subscription revenue |

169 | 117 | ||||||

| White-label revenue |

373 | — | ||||||

| Sponsorship revenue |

154 | — | ||||||

| Other revenue |

75 | — | ||||||

|

|

|

|

|

|||||

| Total Revenue |

$ | 2,575 | $ | 4,528 | ||||

|

|

|

|

|

|||||

8

Table of Contents

| Three Months Ended June 30, |

||||||||

| 2016 | 2015 | |||||||

| Key Advertising Metrics: |

||||||||

| Total available pre-roll video ad impressions (in thousands) |

81,647 | 6,460,372 | ||||||

| Sell through % |

23.7 | % | 7.05 | % | ||||

| Total pre-roll video ad impressions sold (in thousands) |

19,002 | 455,606 | ||||||

| Average monthly subscribers |

2,542 | 2,215 | ||||||

| Average monthly number of DVR hours ordered |

3,013 | 2,507 | ||||||

The largest portion of our revenue is derived from pre-roll video and display advertising and streaming (“Advertising Revenue”) and rental of video assets (“Transactional Revenue”), from our acquisition of CinemaNow, which accounted for 27% and 32%, respectively, of total revenue during the three months ended June 30, 2016.

Of our 2016 Advertising Revenue, $379,000, or 54% was derived from the acquisition of OVG. The remaining 2016 Adverting Revenue of $323,000 decreased by $4,088,000, from the same period in 2015. The primary decrease in Advertising Revenue was driven by the ramp-up of advertising network relationships for the sale of video pre-roll ad inserts and our shift away from selling print display ads that have a significantly lower revenue yield than video ads. While our ad inventory available to be sold to advertisers decreased significantly, the percentage sell-through rate, which is the rate at which we are able to sell our total available video ad opportunities, increased in large measure due to the migration of our advertising sales operations from our United Kingdom office to our United States office. The sell-through rate increased to 23.7% in 2016 from 7.05% in 2015, even though our sell-through rate increased the absolute number of ad impressions sold decreased significantly resulting in the decrease in revenue realized for the three months ended June 30, 2016 when compared to the same period in 2015.

Transactional Revenue is derived from the delivery of the CinemaNow titles. For the three months ended June 30, 2016, Transactional Revenue of $835,000 was derived from a total 116,634 customers who transacted 306,963 titles consisting of 164,278 purchased titles and 142,685 rented titles. 55% of customers were newly registered users for the three months while the average transaction total per customer was 2.63 titles for the period.

Affiliate revenues are generated by OVG referring its users, based on the content they are searching for or browsing, to various third party paid services at which the user executes some transaction. The affiliate fees are one time fees, or a percentage of lifetime revenue, for any subscriber who signs up for a subscription video on demand (SVOD) service, or a percentage of the rental or purchase fee on a transactional video on demand (TVOD) or ecommerce service. The majority of affiliate revenues are earned through users of the website and mobile website, with a small portion also coming from iOS and Android applications. The majority of reporting for this revenue comes from third party dashboards, since all of the tracking and transaction confirmation data comes from the third party service.

Our paid subscriber base revenue for the three months ended June 30, 2016 increased to $169,000, or 44% when compared to the same period in 2015. Also, the average number of DVR hours contracted per month by subscribers for the three months ended June 30, 2016 grew to an average of 3,013, or 20%, from an average of 2,507 hours per month for the same period in 2015, indicating an increase in subscriber loyalty and viewership of our content.

Our white labeling revenue is attributable to our acquisition of CinemaNow, which accounted for 14% of our total revenue for the three months ended June 30, 2016. During the three months ended June 30, 2016, the Company was providing white labeling services to three customers.

9

Table of Contents

During the first quarter of 2016, the Company engaged in sponsorship activities. For the three months ended June 30, 2016, sponsorship revenue of approximately $154,000 was from three customers each related to three separate productions.

Cost of Revenues

Cost of revenues consists primarily of the costs associated with the operations of our websites, services and CinemaNow’s movie rental royalties owed to the licensor major studio. The operational costs consist of the delivery of CinemaNow titles and the operation FilmOn and OVG websites and services, namely datacenter and bandwidth costs and traffic acquisition costs. Our cost of revenues for the three months ended June 30, 2016 decreased to $2,931,000, down 12% from $3,341,000 for the same period in 2015. The decrease was a result of additional cost of $1,458,000 from our acquisition of CinemaNow and OVG offset by a $1,867,000 decrease in FilmOn’s cost of revenues due to our decreased advertising spending.

Operating Expenses

Platform Technology and Development Expenses

Our technology and website maintenance expenses consist primarily of labor and related costs to maintain our websites and streaming infrastructure. Technology and website maintenance expenses for the three months ended June 30, 2016 increased to $739,000, or 96%, from $377,000 for the same period in 2015. The increase was attributable to the additional maintenance associated with the websites purchased from the acquisitions of CinemaNow and OVG.

Depreciation and Amortization Expenses

Depreciation expenses for the three months ended June 30, 2016 increased to $1,402,000, an increase of 314%, from $339,000 for the same period in 2015. The increase was attributable to amortization expense resulting from the intangible assets purchased from the acquisitions of CinemaNow and OVG.

General and Administrative Expenses

General and administrative expenses consist primarily of compensation-related expenses (including stock-based compensation expense) related to corporate departments and fees for professional services and includes costs related to our non-data center facilities and sales operations. General and administrative expenses for the three months ended June 30, 2016 increased to $4,216,000, an increase of 68%, from $2,504,000 for the same period in 2015. The increase was primarily attributable to the acquisition of CinemaNow, OVG and Hologram, which accounted for $1,614,000 of the increase. Also, we expanded our headquarters office space in Beverly Hills, with the addition of a Hologram demo facility and we had additional legal and professional fees related to our audits and public offering.

Other Income

Other income for the three months ended June 30, 2016 was derived from the sale of the Company’s cable channel Sky EPG in the United Kingdom.

10

Table of Contents

Six Months Ended June 30, 2016 Compared to Six Months Ended June 30, 2015