Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MUFG Americas Holdings Corp | investorpresentation8kcove.htm |

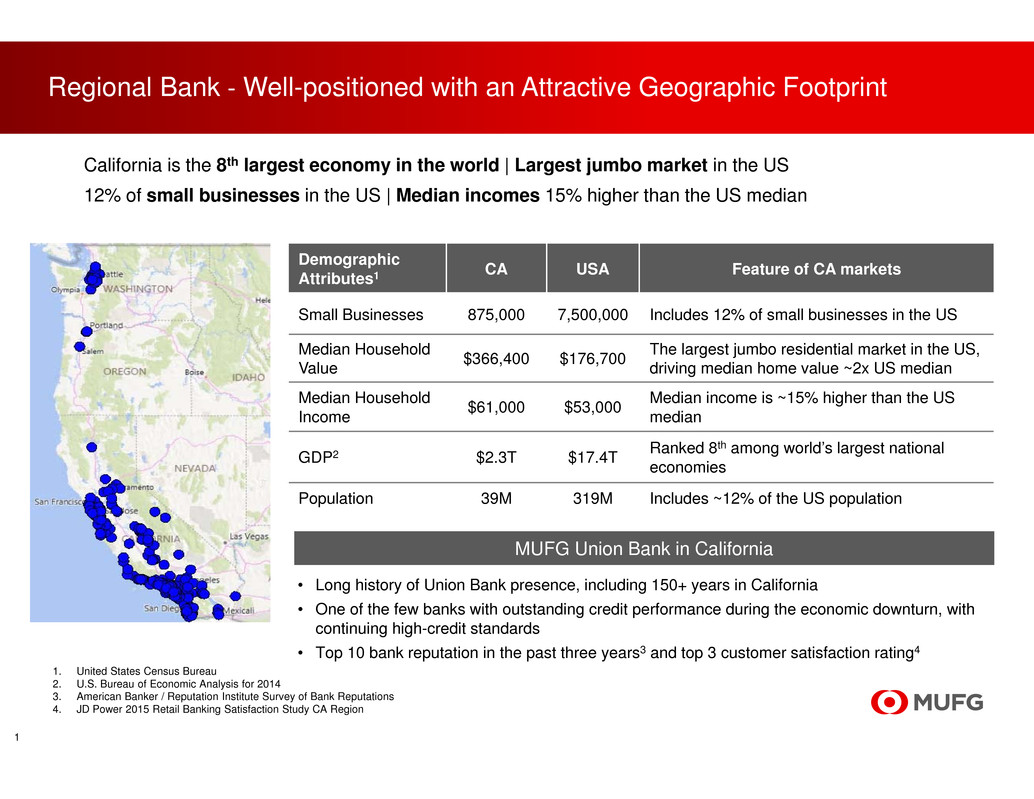

• Long history of Union Bank presence, including 150+ years in California

• One of the few banks with outstanding credit performance during the economic downturn, with

continuing high-credit standards

• Top 10 bank reputation in the past three years3 and top 3 customer satisfaction rating4

1. United States Census Bureau

2. U.S. Bureau of Economic Analysis for 2014

3. American Banker / Reputation Institute Survey of Bank Reputations

4. JD Power 2015 Retail Banking Satisfaction Study CA Region

Demographic

Attributes1 CA USA Feature of CA markets

Small Businesses 875,000 7,500,000 Includes 12% of small businesses in the US

Median Household

Value $366,400 $176,700

The largest jumbo residential market in the US,

driving median home value ~2x US median

Median Household

Income $61,000 $53,000

Median income is ~15% higher than the US

median

GDP2 $2.3T $17.4T Ranked 8

th among world’s largest national

economies

Population 39M 319M Includes ~12% of the US population

California is the 8th largest economy in the world | Largest jumbo market in the US

12% of small businesses in the US | Median incomes 15% higher than the US median

Regional Bank ‐Well-positioned with an Attractive Geographic Footprint

MUFG Union Bank in California

1

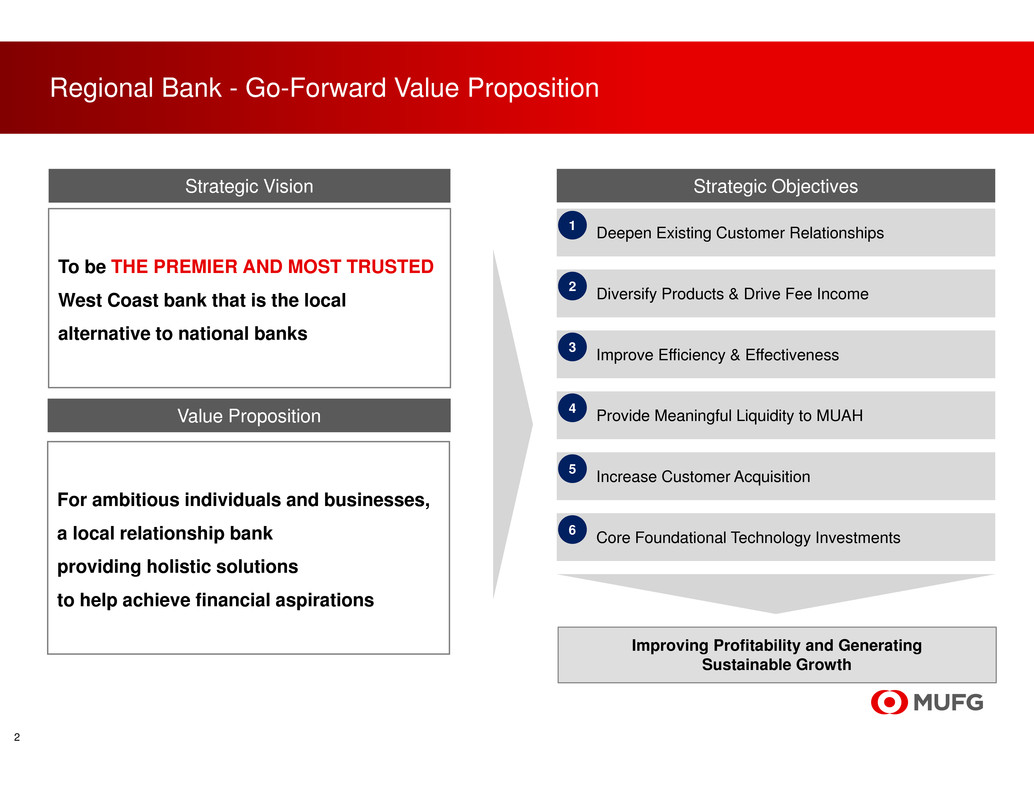

Regional Bank - Go-Forward Value Proposition

To be THE PREMIER AND MOST TRUSTED

West Coast bank that is the local

alternative to national banks

Strategic Vision

For ambitious individuals and businesses,

a local relationship bank

providing holistic solutions

to help achieve financial aspirations

Value Proposition

Deepen Existing Customer Relationships1

Diversify Products & Drive Fee Income2

Improve Efficiency & Effectiveness3

Provide Meaningful Liquidity to MUAH4

Increase Customer Acquisition 5

Core Foundational Technology Investments 6

Strategic Objectives

Improving Profitability and Generating

Sustainable Growth

2

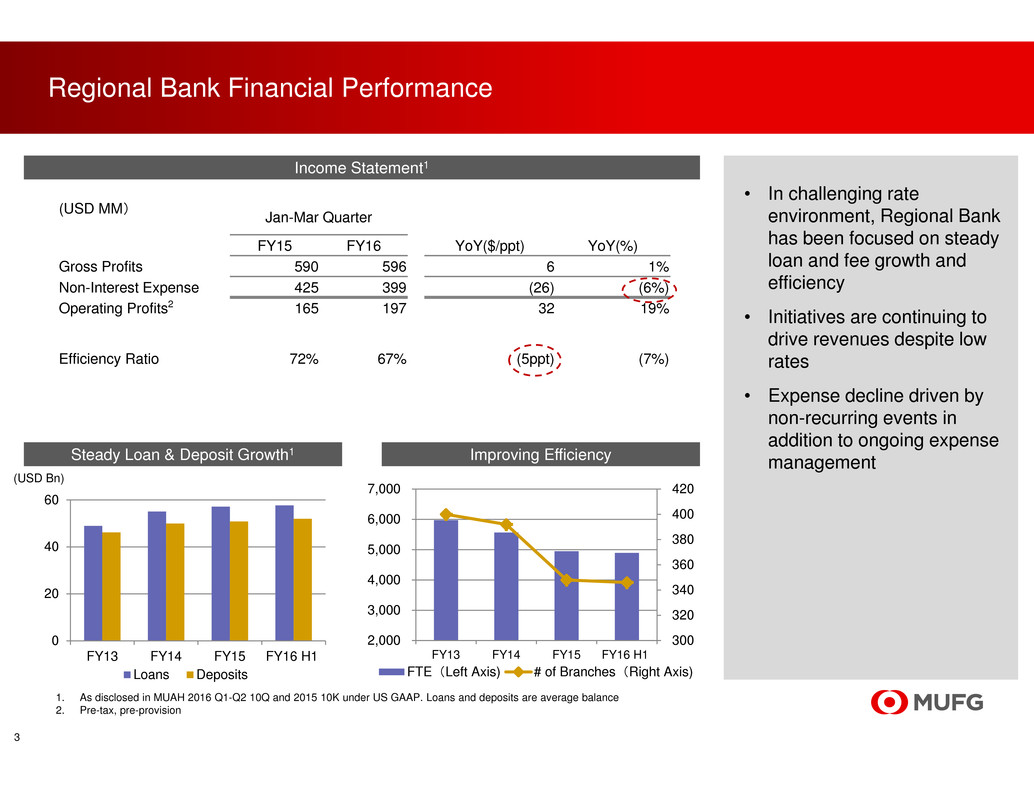

(USD MM) Jan-Mar Quarter

FY15 FY16 YoY($/ppt) YoY(%)

Gross Profits 590 596 6 1%

Non-Interest Expense 425 399 (26) (6%)

Operating Profits2 165 197 32 19%

Efficiency Ratio 72% 67% (5ppt) (7%)

Regional Bank Financial Performance

1. As disclosed in MUAH 2016 Q1-Q2 10Q and 2015 10K under US GAAP. Loans and deposits are average balance

2. Pre-tax, pre-provision

• In challenging rate

environment, Regional Bank

has been focused on steady

loan and fee growth and

efficiency

• Initiatives are continuing to

drive revenues despite low

rates

• Expense decline driven by

non-recurring events in

addition to ongoing expense

management

(USD Bn)

Steady Loan & Deposit Growth1 Improving Efficiency

Income Statement1

3

0

20

40

60

FY13 FY14 FY15 FY16 H1

Loans Deposits

300

320

340

360

380

400

420

2,000

3,000

4,000

5,000

6,000

7,000

FY13 FY14 FY15 FY16 H1

FTE(Left Axis) # of Branches(Right Axis)

Key Initiatives for Profitability and Sustainable Growth3

4

In August 2016, Union Bank converted its consumer and small business credit card

portfolio from First National Bank of Omaha and initiated the sale of new Union Bank-

issued credit cards

Initial activation rates, retention rates, and new card production volumes have

been strong and in-line with forecasts

The Regional Bank is focused on driving incremental credit card balance growth

through the following priorities and initiatives:

Regional Bank - Key Initiative 1

Diversifying Lending Products: Consumer Credit Card Expansion

5

Strategic Priorities & Initiatives

Increase

Application

Volume

• Deliver targeted marketing offers

across bank channels

• Enhance digital account opening

processes

Enhance

Servicing

Improve

Approval Rates

Expand

Product Suite

• Deliver expanded card controls and

alerts

• Enhance Union Bank rewards program

to drive greater relationship value

• Enable digital wallet support and

integration

• Expand card offerings to optimize

penetration within our risk profile

• Enhance relationship-based

underwriting processes

• Launch small business, vertical-based

card offering

• Launch card offering for high net

worth segment

• Provide U.S. card offerings to

Japanese expats

Regional Bank - Key Initiative 2

Deepening Existing Relationships: Collaboration Among Business Segments

6

Unified Regional Bank under single leadership to enhance collaboration across business lines (e.g., Commercial

Banking, Jumbo Mortgages and Wealth)

Wealth Markets represents a significant opportunity to deepen existing client relationships and to generate

recurring fee income

Increase

Sales Execution

• Scale salesforce

• Disciplined sales management

• Align incentives

• Leverage data

• Enhance sales support

Drive

Partner

Dialogue

• Expand relationship mortgage

program with wealth

• Increase investment penetration

among Retail clients

• Improve joint account planning and

referrals between wealth and

commercial

Upgrade

Core & Digital

Technology

• Unify online and mobile experience

and increase functionality

• Partner to develop low-cost

automated investment platform

• Upgrade core tools and technology

Enhance

Capabilities

• Expand high net worth products

• Leverage client events and social

media to drive increased client

engagement, thought leadership and

brand awareness

Strategic Priorities

Cross Regional Bank Initiatives Example: Wealth Initiatives

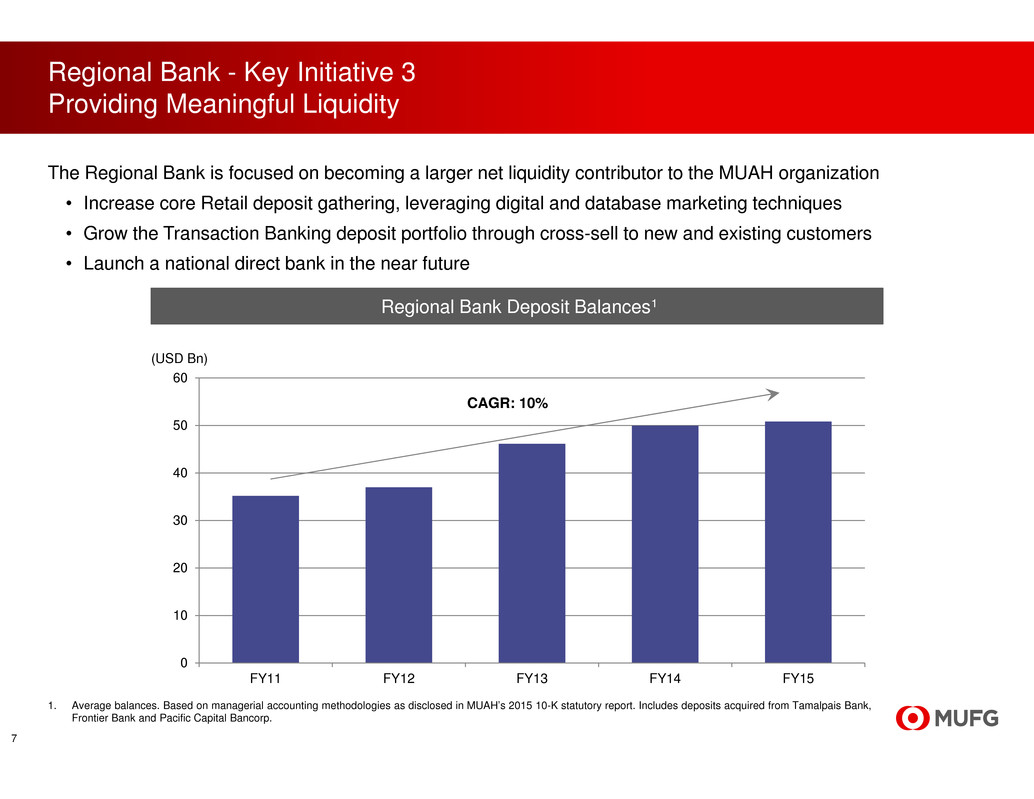

Regional Bank - Key Initiative 3

Providing Meaningful Liquidity

7

The Regional Bank is focused on becoming a larger net liquidity contributor to the MUAH organization

• Increase core Retail deposit gathering, leveraging digital and database marketing techniques

• Grow the Transaction Banking deposit portfolio through cross-sell to new and existing customers

• Launch a national direct bank in the near future

Regional Bank Deposit Balances1

0

10

20

30

40

50

60

FY11 FY12 FY13 FY14 FY15

(USD Bn)

1. Average balances. Based on managerial accounting methodologies as disclosed in MUAH’s 2015 10-K statutory report. Includes deposits acquired from Tamalpais Bank,

Frontier Bank and Pacific Capital Bancorp.

CAGR: 10%