Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ARROWHEAD PHARMACEUTICALS, INC. | d278290dex991.htm |

| 8-K - FORM 8-K - ARROWHEAD PHARMACEUTICALS, INC. | d278290d8k.htm |

Arrowhead/Amgen Collaboration Call September 29, 2016 Exhibit 99.2

Safe Harbor Statement This presentation contains forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. These statements are based upon our current expectations and speak only as of the date hereof. Our actual results may differ materially and adversely from those expressed in any forward-looking statements as a result of various factors and uncertainties, including, without limitation, our developmental stage and limited operating history, our ability to successfully and timely develop products, enter into collaborations and achieve other projected milestones, rapid technological change in our markets, demand for our future products, legislative, regulatory and competitive developments and general economic conditions. Our Annual Report on Form 10-K, recent and forthcoming Quarterly Reports on Form 10-Q, recent Current Reports on Forms 8-K, and other SEC filings discuss some of the important risk factors that may affect our ability to achieve the anticipated results, as well as our business, results of operations and financial condition. Readers are cautioned not to place undue reliance on these forward-looking statements. Additionally, Arrowhead disclaims any intent to update these forward-looking statements to reflect subsequent developments.

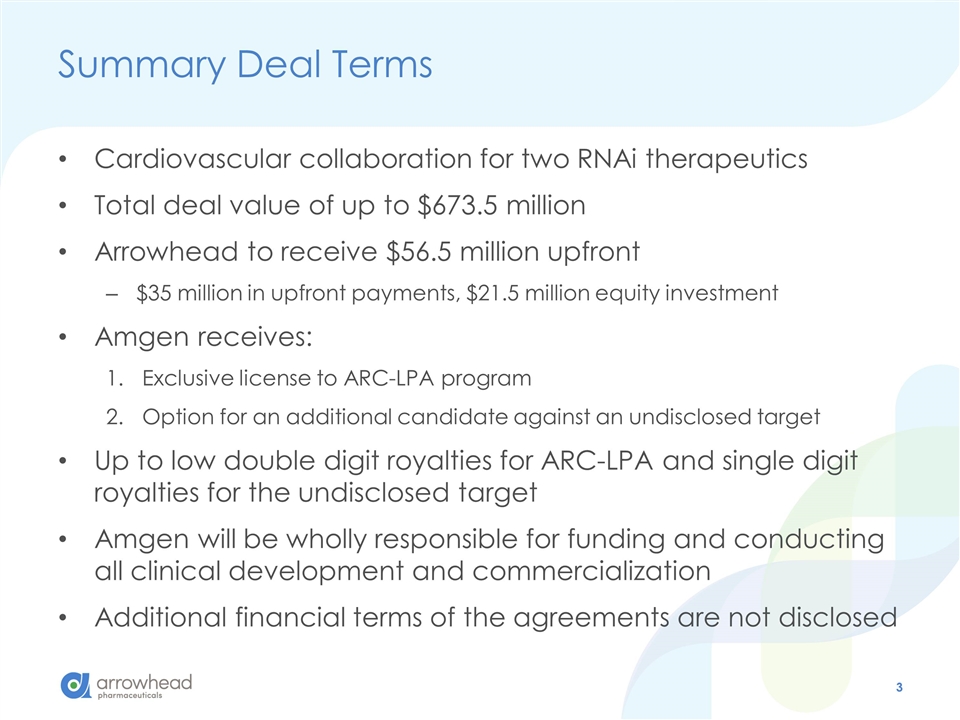

Summary Deal Terms Cardiovascular collaboration for two RNAi therapeutics Total deal value of up to $673.5 million Arrowhead to receive $56.5 million upfront $35 million in upfront payments, $21.5 million equity investment Amgen receives: Exclusive license to ARC-LPA program Option for an additional candidate against an undisclosed target Up to low double digit royalties for ARC-LPA and single digit royalties for the undisclosed target Amgen will be wholly responsible for funding and conducting all clinical development and commercialization Additional financial terms of the agreements are not disclosed

Significance to Arrowhead Achievement of a strategic corporate goal Immediate and potentially ongoing source of capital Reduces some forward cash burn Gain a partner with commitment to cardiovascular franchise Validation of Arrowhead’s proprietary RNAi technologies Possible signal of renewed interest RNAi deals Arrowhead is a partner-of-choice for RNAi therapeutics