Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - NextSource Materials Inc. | exh32_2.htm |

| EX-32.1 - EXHIBIT 32.1 - NextSource Materials Inc. | exh32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - NextSource Materials Inc. | exh31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - NextSource Materials Inc. | exh31_1.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended June 30, 2016

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15 (d) OF THE

SECURITIES EXCHANGE ACT OF 1934

SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 000-51151

ENERGIZER RESOURCES INC.

(Name of small business issuer as specified in its charter)

|

Minnesota

|

20-0803515

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

520 – 141 Adelaide Street West, Toronto, Ontario, Canada M5H 3L5

(Address of principal executive offices)

(Address of principal executive offices)

(416) 364-4911

(Issuer’s telephone number)

(Issuer’s telephone number)

_______________________

(Former name or former address, if changed since last report)

Securities Registered under Section 12(b) of the Exchange Act:

None

Securities Registered Under Section 12(g) of the Exchange Act:

Common Stock, $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [ X ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes [ ] No [ X ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ X ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [ X ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10K or any amendment to this Form 10-K or any amendment to this Form 10-K. [ X ]

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

Non-accelerated filer o

|

Accelerated filer o

Smaller reporting company x

|

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [ X ]

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed fiscal year was $16,230,310. For purposes of the above statement only, all directors, executive officers and 10% shareholders are assumed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of the registrant’s Common Stock, par value $0.01 per share (the "Common Stock"), as of September 28, 2016, was 460,995,711.

Documents Incorporated By Reference: None

FORWARD-LOOKING STATEMENTS

This Annual Report contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA") regarding management’s plans and objectives for future operations including plans and objectives relating to our planned marketing efforts and future economic performance. The forward-looking statements and associated risks set forth in this Annual Report include or relate to, among other things, (a) our growth strategies, (b) anticipated trends in the mining industry, (c) currency fluctuations, (d) our ability to obtain and retain sufficient capital for future operations, and (e) our anticipated needs for working capital. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Description of Business,”. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors”. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this report will in fact occur.

The forward-looking statements herein are based on current expectations that involve a number of risks and uncertainties. Such forward-looking statements are based on assumptions described herein. The assumptions are based on judgments with respect to, among other things, future economic, competitive and market conditions, and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Accordingly, although we believe that the assumptions underlying the forward-looking statements are reasonable, any such assumption could prove to be inaccurate and therefore there can be no assurance that the results contemplated in forward-looking statements will be realized. In addition, as disclosed in “Risk Factors”, there are a number of other risks inherent in our business and operations, which could cause our operating results to vary markedly, and adversely from prior results or the results contemplated by the forward-looking statements. Management decisions, including budgeting, are subjective in many respects and periodic revisions must be made to reflect actual conditions and business developments, the impact of which may cause us to alter marketing, capital investment and other expenditures, which may also materially adversely affect our results of operations. In light of significant uncertainties inherent in the forward-looking information included in the report statement, the inclusion of such information should not be regarded as a representation by us or any other person that our objectives or plans will be achieved.

Any statement in this report that is not a statement of an historical fact constitutes a “forward-looking statement”. Further, when we use the words “may”, “expect”, “anticipate”, “plan”, “believe”, “seek”, “estimate”, “internal”, and similar words, we intend to identify statements and expressions that may be forward- looking statements. We believe it is important to communicate certain of our expectations to our investors. Forward-looking statements are not guarantees of future performance. They involve risks, uncertainties and assumptions that could cause our future results to differ materially from those expressed in any forward-looking statements. Many factors are beyond our ability to control or predict. You are accordingly cautioned not to place undue reliance on such forward-looking statements. Important factors that may cause our actual results to differ from such forward-looking statements include, but are not limited to, the risks outlined under “Risk Factors” herein. The reader is cautioned that our Company does not have a policy of updating or revising forward-looking statements and thus the reader should not assume that silence by management of our Company over time means that actual events are bearing out as estimated in such forward-looking statements.

All references to “dollars”, “$” or “US$” are to United States dollars and all references to “CAD$” are to Canadian dollars. United States dollar equivalents of Canadian dollar figures are based on the noon exchange rate as reported by the Bank of Canada on the applicable date. All references to “common shares” refer to the common shares in our capital stock.

2

PART I

FINANCIAL INFORMATION

As used in these footnotes, “we”, “us”, “our”, “Energizer Resources”, “Energizer”, “Company” or “our company” refers to Energizer Resources Inc. and all of its subsidiaries.

All references to “dollars”, “$” or “US$” are to United States dollars and all references to “CAD$” are to Canadian dollars. United States dollar equivalents of Canadian dollar figures are based on the exchange rate as reported by the Bank of Canada on the applicable date.

ITEM 1. – BUSINESS

Cautionary Note

Based on the nature of our business, we anticipate incurring operating losses for the foreseeable future. We base this expectation, in part, on the fact that very few mineral properties in the exploration stage are ultimately developed into producing and profitable mines. Our future financial results are uncertain due to a number of factors, some of which are outside the Company’s control. These factors include, but are not limited to: (1) our ability to raise additional funding; (2) the market price for graphite and vanadium; (3) the results of the exploration programs and metallurgical analysis of our mineral properties; (4) the political instability and/or environmental regulations that may adversely impact costs and ability to operate in Madagascar; and (5) our ability to find joint venture and/or off-take partners in order to advance the development of our mineral properties.

Any future equity financing will cause existing shareholders to experience dilution of their ownership interest in the Company. In the event the Company is not successful in raising additional financing, we anticipate the Company will not be able to proceed with its existing business plan. In such a case, the Company may decide to discontinue or modify its business plan and seek other business opportunities in the resource sector.

During this period, the Company will need to maintain periodic filings with the appropriate regulatory authorities and will incur legal, accounting, administrative and exchange listing costs. In the event no other such opportunities are available and the Company cannot raise additional funding to sustain operations, the Company may be forced to discontinue the business. The Company does not have any specific alternative business opportunities under consideration and has not planned for any such contingency.

Due to accumulated losses and present inability to generate revenues, the Company auditors have stated in their opinion in the footnotes to our audited financial statements in this annual report on Form 10-K and the Company has included in Note 1 of this financial statements that there currently exists doubt as to the Company’s ability to continue as a going concern.

BACKGROUND – COMPANY OVERVIEW

We are incorporated in the State of Minnesota, USA and have a fiscal year end of June 30. We were originally incorporated in the State of Nevada on March 1, 2004 and reincorporated in the State of Minnesota on May 14, 2008. Our principal business is the acquisition, exploration and development of mineral resources. We have not generated operating revenues or paid dividends since inception on March 1, 2004 to the period ended June 30, 2016 and we are unlikely to do so in the immediate or foreseeable future. Our business activities have been entirely financed from the proceeds of securities subscriptions.

During fiscal 2008, we incorporated Energizer Resources (Mauritius) Ltd. (“ERMAU”), a Mauritius subsidiary, and Energizer Resources Madagascar Sarl. (“ERMAD”), a Madagascar subsidiary of ERMAU. During fiscal 2009, the Company incorporated THB Ventures Ltd. (“THB”), a Mauritius subsidiary of ERMAU, and Energizer Resources Minerals Sarl. (“ERMIN”), a Madagascar subsidiary of THB, which holds the 100% ownership interest of the Green Giant Property in Madagascar (see note 7). During fiscal 2012, the Company incorporated Madagascar‑ERG Joint Venture (Mauritius) Ltd. (“ERGJVM”), a Mauritius subsidiary of ERMAU, and ERG (Madagascar) Sarl. (“ERGMAD”), a Madagascar subsidiary of ERGJVM, which holds the Malagasy Joint Venture Ground. During fiscal 2014, the Company incorporated 2391938 Ontario Inc., an Ontario, Canada subsidiary.

On December 16, 2014, our authorized capital was increased from an aggregate of four hundred fifty million (450,000,000) shares to six hundred fifty million (650,000,000) shares, with a par value of $0.001 per share, of which 640,000,000 will be deemed common shares and the remaining 10,000,000 will be deemed eligible to be divisible into classes, series and types with rights and preferences as designated by our Board of Directors.

3

We have not had any bankruptcy, receivership or similar proceeding since incorporation. Except as described below, there have been no material reclassifications, mergers, consolidations or purchases or sales of any significant amount of assets not in the ordinary course of business since the date of incorporation.

Summary of Our Business

We are an exploration stage company primarily engaged in the advancement of the Molo Graphite Project, consisting of a commercially minable graphite deposit situated in the African country of Madagascar. We have additional exploration stage properties situated in Madagascar and in the Province of Québec, Canada.

Our executive offices are situated at 520–141 Adelaide Street West, Toronto, Ontario, Canada, M5H 3L5 and the primary telephone number is (416) 364-7024. Our website is www.energizerresources.com (which website is expressly not incorporated by reference into this filing).

Further details regarding each of our Madagascar properties, although not incorporated by reference, including the comprehensive geological report prepared in accordance Canada’s National Instrument 43-101 - Standards of Disclosure for Mineral Properties (“NI 43-101”) for the Molo Graphite Property and separately the technical report on the Green Giant Property in Madagascar can be found on the Company’s website at www.energizerresources.com (which website is expressly not incorporated by reference into this filing) or in the Company’s Canadian regulatory filings at www.sedar.com (which website and content is expressly not incorporated by reference into this filing). We report mineral reserve estimates in accordance with the Securities and Exchange Commission’s Industry Guide 7 (“Guide 7”) under the Securities Act of 1933, as amended (the “U.S. Securities Act”). As a reporting issuer in Canada with our primary trading market in Canada, we are also required to prepare reports on our mineral properties in accordance with NI 43-101. The technical reports referenced in this document uses the terms “mineral resource,” “measured mineral resource,” “indicated mineral resource” and “inferred mineral resource”. These terms are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under Guide 7 and are normally not permitted to be used in reports filed with the Securities and Exchange Commission. As a result, information in respect of our resources determined in accordance with NI 43-101 are not contained in this document.

Summary of Milestones

We are pursuing negotiations in respect of potential off-take agreements with graphite end-users and intermediaries with the intention of securing project financing alternatives, which may include debt, equity and derivative instruments. Discussions in respect of these matters have been ongoing for the past 24 months and are expected to continue during the coming months with no assurances as to the conclusion or results of these discussions.

In July 2016, we appointed UK-based HCF International Advisers Limited ("HCF") as advisor in negotiating and structuring strategic partnerships, off take agreements and debt financing for its Molo Graphite project.

In August 2016, we initiated a Front End Engineering Design Study (the “FEED Study”) for the Company's Molo graphite project in Madagascar. The FEED Study is being undertaken in order to determine potential development path options that have been presented to the Company by prospective strategic partners.

Our management continues to assess project optimization strategies with the intention of reducing the capital and operating costs relating to the Molo Graphite Property with no assurances as to the conclusion and results of these assessments.

Future Plans

With the completion of the Molo Feasibility Study, potential financiers and strategic partners have been approached, and the Company is seeking funding for the development of the Molo Deposit into a mine. In parallel, the Company has initiated a FEED Study, which is anticipated to continue through to the end of October, 2016.

From the date of this annual report, and subject to availability of capital, our plan is to incur between $250,000 and $13,250,000 on further engineering, exploration, testing and permitting to advance the Molo Graphite Property and on the potential creation of a pilot plant, subject to the availability of capital and any other unforeseen delays, by June 30, 2017. No assurances can be provided that we will achieve our objective by that date.

4

The following is a summary of the amounts budgeted to be incurred (presuming all $13,500,000 is required):

|

Front End Engineering Design (FEED) Study

|

$

|

250,000

|

||

|

Detailed engineering study

|

$

|

5,500,000

|

||

|

Bulk sampling program to secure off-take agreement

|

$

|

4,000,000

|

||

|

Value engineering study

|

$

|

2,500,000

|

||

|

Metallurgy

|

$

|

500,000

|

||

|

Permitting fees

|

$

|

750,000

|

||

|

Total

|

$

|

13,500,000

|

The above amounts may be revised based on actual costs and the timing may be delayed based on several factors, including the availability of capital to fund the budget. We anticipate that the source of funds required to complete the budgeted items disclosed above will come from private placements in the capital markets, but there can be no assurance that financing will be available on terms favorable to the Company or at all.

Although no assurances can be provided, the FEED Study is currently ongoing and is anticipated to continue through to the end of October 2016. This will be followed by a decision to pursue a bulk sample and/or the construction of a pilot plant.

Other Expenses

Management anticipates spending approximately $250,000 - $450,000 in ongoing general office and administration expenses and professional fees per quarter for the next twelve months. Expenses will vary in direct proportion with the level of activity relating to future acquisitions and exploration programs.

Employees

As of the date of this annual report, we have 3 full-time employees and in addition, we engage several consultants to serve important managerial and non-managerial functions.

Competitive Conditions in our Industry

The mineral exploration and mining industry is competitive in all phases of exploration, development and production. We compete with a number of other entities and individuals in the search for, and acquisition of, attractive mineral properties. As a result of this competition, the majority of which is with companies with greater financial resources than us, we may not in the future be able to acquire attractive properties on terms our management considers acceptable. Furthermore, we compete with other resource companies, many of whom have greater financial resources and/or more advanced properties that are better able to attract equity investments and other capital. Factors beyond our control may affect the marketability of minerals mined or discovered by us.

5

Mineral Properties

Cautionary Note Regarding Resource and Reserve Calculation – We report mineral reserve estimates in accordance with the Securities and Exchange Commission (the “SEC”) Industry Guide 7 (“Guide 7”) under the Securities Act of 1933, as amended (the “U.S. Securities Act”). As a reporting issuer in Canada with our primary trading market in Canada, we are also required to prepare reports on our mineral properties in accordance with NI 43-101. The technical reports referenced in this document uses the terms “mineral resource,” “measured mineral resource,” “indicated mineral resource” and “inferred mineral resource”. We advise investors that these terms are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under Guide 7 and are normally not permitted to be used in reports filed with the SEC. As a result, information in respect of our resources determined in accordance with NI 43-101 are not contained in this document. We reference these reports in this document for informational purposes only and such reports are not incorporated herein by reference. Investors are cautioned not to assume that any part or all of mineral deposits in the above categories will ever be converted into Guide 7 compliant reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained” minerals in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures. Canadian investors should review the Molo Graphite Project Feasibility Study (and the other technical reports filed by the Company, with the securities regulators in Canada), including the mineral resource estimates (which are not permitted to be disclosed under Industry Guide 7) for further details regarding our material mineral properties.

As used in this document, the terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”)—CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in Guide 7. Under Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. The reserves disclosed in this document also comply with the requirements of Guide 7.

Proven and probable reserves are based on extensive drilling, sampling, mine modeling and metallurgical testing from which we determined economic feasibility. The term “proven reserves” means mineral reserves for which (i) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; (ii) grade and/or quality are computed from the results of detailed sampling; and (iii) the sites for inspection, sampling and measurements are spaced so closely and the geologic character is sufficiently defined that size, shape, depth and mineral content of reserves are well established. The term “probable reserves” means mineral reserves for which quantity and grade are computed from information similar to that used for proven reserves, but the sites for sampling are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. The price sensitivity of reserves depends upon several factors including grade, metallurgical recovery, operating cost, waste-to-ore ratio and ore type. Metallurgical recovery rates vary depending on the metallurgical properties of each deposit and the production process used.

The proven and probable reserve figures presented herein are estimates based on information available at the time of calculation. No assurance can be given that the indicated levels of recovery of minerals will be realized. Minerals included in the proven and probable reserves are those contained prior to losses during metallurgical treatment. Reserve estimates may require revision based on actual production. Market fluctuations in the price of minerals, as well as increased production costs or reduced metallurgical recovery rates, could render certain proven and probable reserves containing lower grades of mineralization uneconomic to exploit and might result in a reduction of reserves

Mr. Craig Scherba, President and CEO of the Company, is designated as the “qualified person” who reviewed and approved the technical disclosure contained in this document.

6

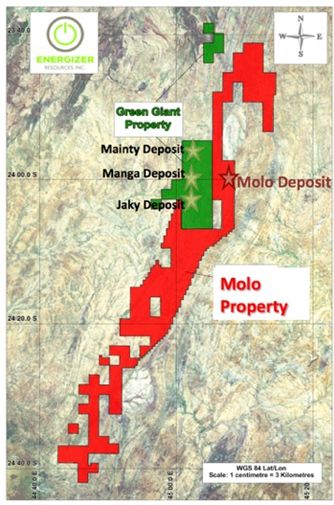

Molo Graphite Project, Southern Madagascar, Africa

On December 14, 2011, we entered into a Definitive Joint Venture Agreement ("JVA") with Malagasy Minerals Limited ("Malagasy"), a public company on the Australian Stock Exchange, to acquire a 75% interest to explore and develop a group of industrial minerals, including graphite, vanadium and approximately 25 other minerals. The land position covers 2,119 permits and 827.7 square kilometres and is mostly adjacent to the south and east of the Company's 100% owned Green Giant Property. We paid $2,261,690 and issued 7,500,000 common shares valued at $1,350,000.

On April 16, 2014, we signed a Sale and Purchase Agreement and a Mineral Rights Agreement with Malagasy to acquire the remaining 25% interest. We made the following payments at that time: $364,480 (CAD$400,000); issued 2,500,000 common shares subject to a 12 month voluntary vesting period and valued at $325,000; and issued 3,500,000 common share purchase warrants, valued at $320,950 using the Black Scholes pricing model with an exercise price of $0.14 and an expiry date of April 15, 2019.

On May 20, 2015 we paid $546,000 (CAD$700,000), and issued 1,000,000 common shares due to the completion of a bankable feasibility study (“BFS”) for the Molo Graphite Property. Further, a cash payment of $801,584 (CAD$1,000,000) will be due within five days of the commencement of commercial production. Malagasy retains a 1.5% net smelter return royalty ("NSR") on the property. We also acquired a 100% interest to the industrial mineral rights on approximately 1 1/2 additional claim blocks comprising 10,811 hectares to the east and adjoining the Molo Graphite Property.

7

The following is the extracted summary section from the Feasibility Study prepared by Dr. John Hancox, PhD. Geology, Pri.Sc.Nat, Mr. Desmond Subramani, B.Sc. Honours Geology, Pri.Sc.Nat, Dave Thompson, B.Tech Mining, Pr.Cert.Eng, Oliver Peters, M.Sc. Mineral Processing, Pr.Eng, Doug Heher, B.Sc. Mechanical Engineering, Pr.Eng, and John Stanbury, B.Sc. Industrial Engineering, Pr.Eng, each of whom is a “qualified person” and “independent”, as such terms are defined in NI 43-101. The following summary does not purport to be a complete summary of the Molo Graphite Project and is subject to all the assumptions, qualifications and procedures set out in the Feasibility Study and is qualified in its entirety with reference to the full text of the Feasibility Study. It is advised that this summary should be read in conjunction with the Feasibility Study (which is not incorporated by reference into this filing).

The summary includes an important modification from the original Feasibility Study, whereby the project’s economic indicators are now presented under two scenarios with equal prominence: (i) using the historical three-year average graphite price (not included in the Feasibility Study), and (ii) using a projected and escalating graphite basket price (as per the Feasibility Study).

Introduction

The Molo deposit is situated 160 kilometres (“km”) southeast of the city of Toliara, in the Tulear region of south-western Madagascar. The deposit occurs in a sparsely populated, dry savannah grassland region, which has easy access via a network of seasonal secondary roads radiating outward from the village of Fotadrevo. Fotadrevo in turn has an all-weather airstrip and access to a road system that leads to the regional capital (and port city) of Toliara and the Port of Ehoala at Fort Dauphin via the RN10, or RN13.

Geologically Molo is situated in the Bekikiy block (Tolagnaro-Ampanihy high grade metamorphic province) of southern Madagascar. The Molo deposit is underlain predominantly by moderately to highly metamorphosed and sheared graphitic (biotite, chlorite and garnet-rich) quartzo-feldspathic schists and gneisses, which are variably mineralised. Near surface rocks are oxidised, and saprolitic to a depth, usually of less than 5m.

Molo is one of several surficial graphite trends discovered by Energizer in late 2011 and announced in early January 2012. The deposit was originally drill tested in 2012, with an initial seven holes being completed. Resource delineation, drilling and trenching on Molo took place between May and November of 2012, and allowed for a maiden Indicated and Inferred Resource to be stated in early December of the same year. This maiden mineral resource estimate formed the basis for a Preliminary Economic Assessment (the “PEA”), which was undertaken by DRA Mineral Projects in 2013.

The positive outcome of this assessment lead Energizer to undertake another phase of exploratory drilling and sampling in 2014, which was done under the supervision of Caracle Creek International Consulting (Pty) Limited (“Caracle Creek” or “CCIC”). This phase of exploration was aimed at improving the geological confidence of the deposit and its contained mineral resources, and included an additional 32 diamond drill holes (totalling 2,063 metres) and 9 trenches (totalling 1,876 metres). Caracle Creek were subsequently engaged to update the geological model and resource estimate. The entire database on which this new model and resource estimate is based contains 80 drill holes (totalling 11,660 metres) and 35 trenches (totalling 8,492 metres). This new resource forms the basis for this Molo 2015 FS.

8

Project Location

The Molo deposit is located some 160 km SE of Madagascar’s administrative capital (and port city) of Toliara, in the Tulear region and about 220 km NW of Fort Dauphin. It is approximately 13 km NE of the local village of Fotadrevo. See Figure 1 below.

Figure 1: Project Location in Southern Madagascar

9

Project Description

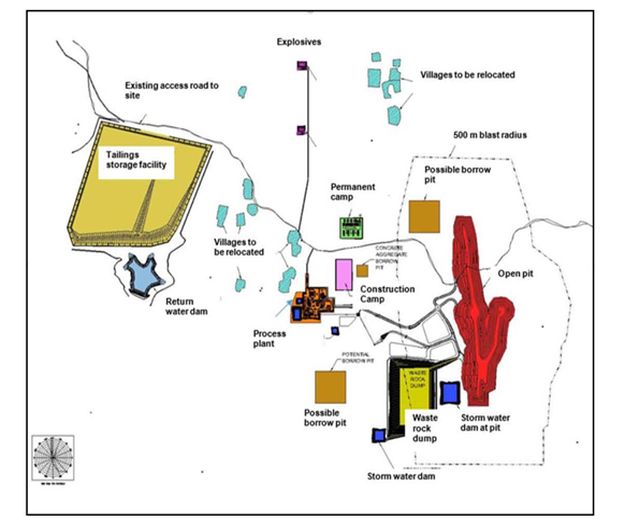

The proposed development of the Molo Graphite Project includes the construction of a green fields open pit mine, a processing plant with a capacity of 862,000 tonnes of ore per annum and all supporting infrastructure including water, fuel, power, tailings, buildings and permanent accommodation.

The mine will utilize four 2 megawatt diesel generators, with three running and one standby and water is supplied from a well field which has been defined by drilling and detailed geo-hydrological modelling. The processing plant will consist of conventional crushing, milling and flotation circuits followed by concentrate filtering, drying and screening. The waste heat generated by the power station will be utilized for the drying of the concentrate.

The tailings storage facility, in the form of a valley dam layout, is located approximately 1.5 kilometers to the west of the process plant and is designed to accommodate the run-of-mine tonnage for the 26 year Life of Mine (“LOM”).

See Figure 2 below for the proposed layout of the site.

Figure 2: Site layout

10

Summary of financial results

Table 1A, 1B and 1C below summarizes the financial results of the Molo 2015 FS. Table 2 below summarizes key mine and process data. These are based on a discounted flow analysis of the project using nominal cash flows, which include the effect of inflation.

Table 1A: Summary of Financial Results – Projected Escalating Basket Price

|

Category

|

Value

|

|

|

Average price / tonne of concentrate

|

US$1,867

|

|

|

Post-tax: NPV (10% Discount Cash Flow)(1)(2)

|

US$389,797,113

|

|

|

Post-tax: IRR (1)(2)

|

31.2%

|

|

|

Payback (2)

|

4.84 years

|

|

Table 1B: Economic Analysis of the Project – Historical Three-Year Average Price

|

Category

|

Value

|

|

Average price / tonne of concentrate

|

US$1,867

|

|

Post-tax: NPV (10% Discount Cash Flow)(1)(2)

|

25.6%

|

|

NPV @ 10% Discounted Cash Flow

|

US$168,138,467

|

|

Payback (2)

|

5.84 years

|

Table 1C: Summary of Financial Results

|

Category

|

Value

|

|

|

Capital cost (“CAPEX”)

|

US$149.9 million

|

|

|

Design Development Allowance (to cover potential quantity and rate changes during detailed design and execution)

|

US$13.8 million

|

|

|

Owners Contingency

|

US$24.6 million

|

|

|

On-site Operating Costs (“OPEX”) per tonne of concentrate, (year 3 onward)

|

US$353

|

|

|

Transportation per tonne of concentrate (from mine site to Madagascar Port year 3 onward)

|

US$182

|

|

|

Transportation per tonne of concentrate (from Madagascar Port to European Customer Port from year 3 onward)

|

US$155

|

|

|

Average annual production of concentrate

|

53,017 tonnes

|

|

|

Life of Mine

|

26 years

|

|

|

Graphite concentrate sale price (US$/tonne at Start Up - 2017)

|

US$1,689 per tonne

|

|

|

Average Head Grade

|

7.04%

|

|

|

Average ore mined per annum over Life of Mine

|

856,701 tonnes

|

|

|

Average stripping ratio

|

0.81:1

|

|

|

Average carbon recovery

|

87.80%

|

|

|

|

|

|

Notes

Note 1: Assumes project is financed with a 50% debt and 50% equity.

Note 2: Values shown are based on nominal cash flows, which include the effect of inflation. Costs are increased on an annual basis by the relevant inflation index.

Table 2: Mine & Process Data

|

Proven reserves

|

14,170,000

|

Tonnes @ 7.0% C grade

|

|

Probable reserves

|

8,367,000

|

Tonnes @ 7.04% C grade

|

|

Grade (graphitic carbon)

|

7.04%

|

Average plant head feed over LOM

|

|

Waste to ore ratio

|

0.81:1

|

|

|

Processing rate

|

856,701

|

Tonnes per annum

|

|

Mine life

|

26 years

|

|

|

Recovery

|

87.8%

|

|

|

Average annual product tonnes

|

53,017

|

|

11

Property Description and Ownership

Property description

The Molo Graphite Project is contained in a portion of Exploration Permit #3432. The Project is centred on UTM coordinates 413,390 Easting 7,345,713 Northing (UTM 38S, WGS 84 datum). The Molo Graphite Project is located 11.5 km ENE of the town of Fotadrevo and covers an area of 62.5 hectares (“ha”). The Government of Madagascar designates individual claims by a central LaBorde UTM location point, comprising a square with an area of 6.25 km2.

Ownership

On December 14, 2011, the Company entered into a Definitive Joint Venture Agreement (“JVA”) with Malagasy Minerals Limited (“Malagasy”), a public company on the Australian Stock Exchange, to acquire a 75% interest to explore and develop a group of industrial minerals, including graphite, vanadium and approximately 25 other minerals. On October 24, 2013, the Company signed a Memorandum of Understanding (“MOU”) with Malagasy to acquire the remaining 25% interest in the land position. On April 16, 2014, Energizer signed a Sale and Purchase Agreement and a Mineral Rights Agreement with Malagasy to acquire the remaining 25% interest. Malagasy retained a 1.5% net smelter return royalty (“NSR”).

The Molo Graphite Project is located within Exploration Permit #3432 as issued by the Bureau de Cadastre Minier de Madagascar pursuant to the Mining Code 1999 (as amended) and its implementing decrees.

CCIC has reviewed a copy of the Contrat d’amodiation pertaining to this right and are satisfied that the rights to explore this permit have been ceded to Energizer or one of its Madagascar subsidiaries.

Energizer holds the exclusive right to explore for a defined group of industrial minerals within the permits listed above. These industrial minerals include the following: Graphite, Vanadium, Lithium, Aggregates, Alunite, Barite, Bentonite, Vermiculite, Carbonatites, Corundum, Dimensional stone (excluding labradorite), Feldspar (excluding labradorite), Fluorspar, Granite, Gypsum, Kaolin, Kyanite, Limestone / Dolomite, Marble, Mica, Olivine, Perlite, Phosphate, Potash- Potassium minerals, Pumice Quartz, Staurolite, and Zeolites.

Reporting requirements of exploration activities carried out by the titleholder on a Research Permit are minimal. A titleholder must maintain a diary of events and record the names and dates present of persons active on the project. In addition, a site plan with a scale between 1/100 and 1/10,000 showing “a map of the work completed” must be presented. Upon establishment of a mineral resource, Research Permits may be converted into Exploitation Permits by application. CCIC is of the opinion that Energizer is compliant in terms of its commitments under these reporting requirements.

The Molo Graphite Project has not been legally surveyed; however, since all claim boundaries conform to the predetermined rectilinear LaBorde Projection grid, these can be readily located on the ground by use of Global Positioning System (“GPS”) instruments. Most current GPS units and software packages do not however offer LaBorde among their available options, and therefore defined shifts have to be employed to display LaBorde data in the WGS 84 system. For convenience, all Energizer positional data is collected in WGS 84, and if necessary converted back to LaBorde.

Royalties

There is a 1.5% net smelter return royalty on the Molo Graphite Project.

Permits

Exploration Permit #3432 is currently held under the name of a subsidiary of Malagasy Minerals called, Mada-Aust Sarl. The transformation or amendment of exploration and research mining permits within the country continues to be suspended from the time that Madagascar was run by a president who was not democratically elected. This current permit expired on August 17, 2011.

Energizer’s Madagascar domiciled subsidiary companies and Mada-Aust Sarl has continued to pay all taxes and administrative fees to the Madagascan government and its mining ministry with respect to all the mining permits held in country. These taxes and administrative fee payments have been acknowledged and accepted by the Madagascan government. In addition, Energizer management continues to diligently work with the Madagascan government to obtain the necessary permits in its name as the country clears its backlog of applications and amendments.

12

The research permit will be converted into an exploitation permit in due course. When the permit is transformed from a research permit to an exploitation permit, the exploitation permit will be issued in the name of Energizer. The exploitation permit is required to advance the Molo Graphite Project to the developmental stage.

Exploration

No further exploration is currently planned.

1.8 Mineral Reserve Estimate

As a result of the Molo 2015 FS, the following maiden proven and probable mineral reserves are declared, see Table 4 below.

Table 4: Mineral Reserves

|

Category

|

Tonnage

|

C Grade (%)

|

|

Proven

|

14,170,000

|

7.00

|

|

Probable

|

8,367,000

|

7.04

|

|

Proven and Probable

|

22,437,000

|

7.02

|

Proven Reserves are reported as the Measured Resources inside the designed open pit and above the grade cut off of 4.5% C. Similarly, the Probable Reserves are reported as the Indicated Resources inside the designed open pit and above the grade cut-off of 4.5% C.

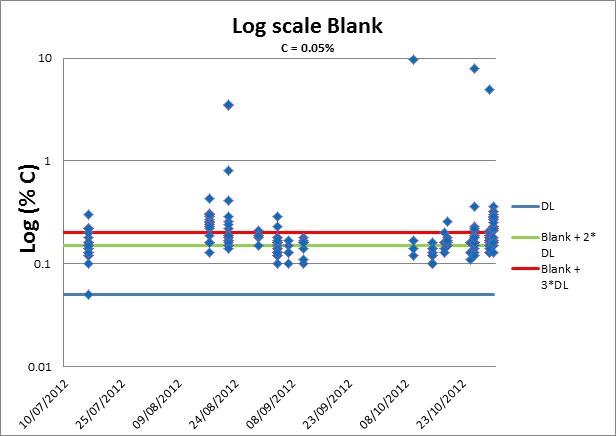

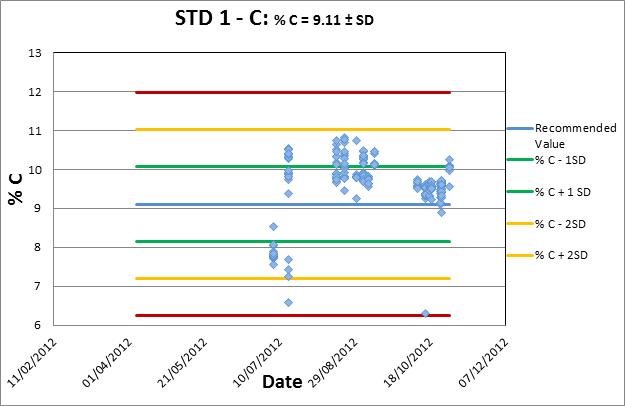

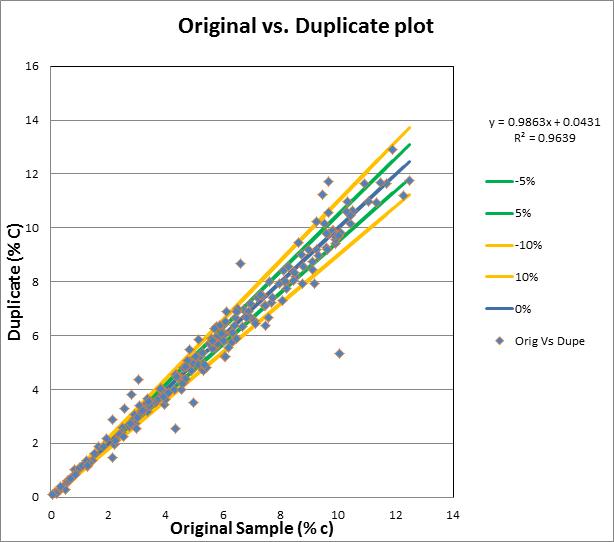

Metallurgical Test Work

The Molo 2015 FS is based on a full suite of metallurgical test work performed by SGS Canada Metallurgical Services Inc. (“SGS”) which is based in Lakefield, Ontario, Canada. These tests included laboratory scale metallurgical work and a 200 tonne bulk sample / pilot plant program. The laboratory scale work included comminution tests, process development and optimization tests, variability flotation, and concentrate upgrading tests.

Comminution test results place the Molo ore into the very soft to soft category with low abrasivity. A simple reagent regime consists of fuel oil number 2 and methyl isobutyl carbinol at dosages of approximately 120 g/t and 195 g/t, respectively. A total of approximately 150 open circuit and locked cycle flotation tests were completed on almost 70 composites as part of the process development, optimization, and variability flotation program. The metallurgical programs culminated in a process flowsheet that is capable of treating the Molo ore using proven mineral processing techniques and extraction has been successfully demonstrated in the laboratory and pilot plant campaigns.

The tests indicated that variability exists with regards to the metallurgical response of the ore across the deposit, which resulted in a range of concentrate grades between 88.8% total carbon and 97.8% total carbon. Optical mineralogy on representative concentrate samples identified interlayered graphite and non- sulphide gangue minerals as the primary source of impurities. The process risk was mitigated with the design of an upgrading circuit, which improved the grade of a concentrate representing the average mill product of the first five years of operation from 92.1% total carbon to 97.1% total carbon.

The overall graphitic carbon recovery into the final concentrate of the first 5 years of operation is 87.8% based on the metallurgical response of composites using samples from all drill holes within the five year pit design. The average composition of the combined concentrate grade is presented in the table below.

The area composites were generated by splitting the footprint of the five year mine plan into five zones of approximately the same size. All drill holes within one specific zone were then combined to form an area composite. A total of fifteen area composites were generated for metallurgical evaluation, (five zones with three depth intervals per zone). All assays were completed using control quality analysis and cross checks were completed during the mass balancing process to verify that the results were within the estimated measurement uncertainly of up to 1.7% relative for graphite concentrate grades greater than 90% total carbon.

13

Table 5: Metallurgical Data - Flake Size Distribution and Product Grade

|

Product Size

|

Mass Distribution %

|

Product Grade(%) Carbon

|

|

+48 mesh (jumbo flake)

|

23.6

|

96.9

|

|

+65 mesh (coarse flake)

|

14.6

|

97.1

|

|

+80 mesh (large flake)

|

8.2

|

97.0

|

|

+100 mesh (medium flake)

|

6.9

|

97.2

|

|

+150 mesh (medium flake)

|

15.5

|

97.3

|

|

+200 mesh (small flake)

|

10.1

|

98.1

|

|

-200 mesh (fine flake)

|

21.1

|

97.5

|

Table 6: Pricing Matrix - Flake Size Distribution Grouping and Product Grade

|

Product Size

|

Mass Distribution %

|

Product Grade (%) Carbon

|

|

>50 mesh

|

23.6

|

96.9

|

|

-50 to +80 mesh

|

22.7

|

97.1

|

|

-80 to +100 mesh

|

6.9

|

97.2

|

|

-100 mesh

|

46.8

|

97.6

|

Vendor testing including solid-liquid separation of tailings and concentrate, screening and dewatering of concentrate, and drying of concentrate was completed successfully.

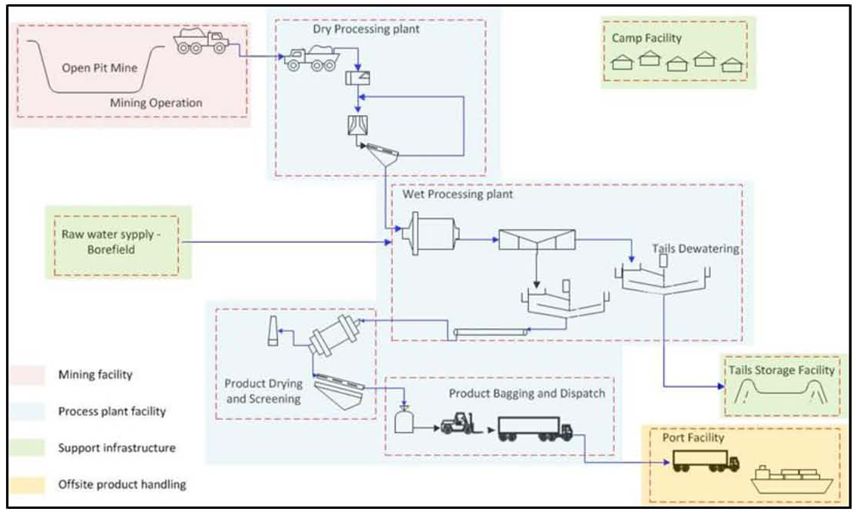

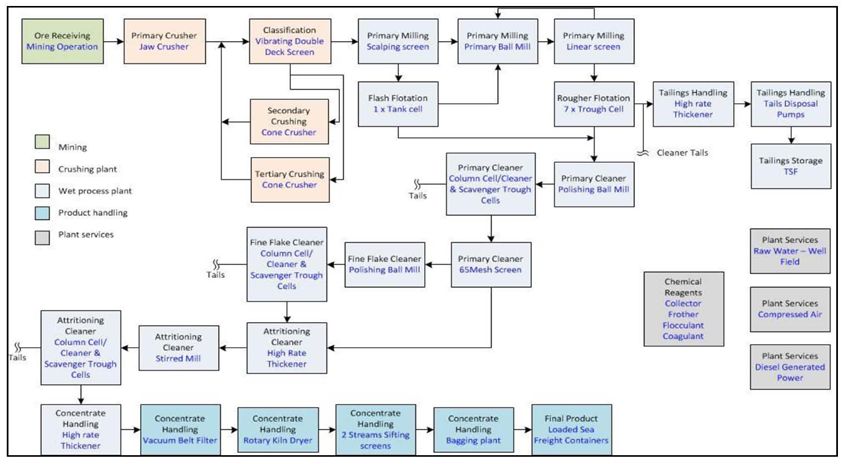

1.10 Recovery methods

The process design is based on an annual production capacity of 862 kilotonnes of plant feed material at a nominal head grade of 7.04% C(t) producing an estimated average of 53 kilotonnes per annum (“ktpa”) of final concentrate.

The ore processing circuit consists of three-stage crushing followed by primary milling and classification, a flotation separation and concentrate upgrading circuit, and graphite product and tailings effluent handling facilities.

The crushing circuit is designed to operate 365 days per annum for 24 hours per day at ±68% utilization and comprises a primary jaw crusher, a secondary cone crusher and a tertiary cone crusher in closed-circuit with a double-deck classifying screen. The crushed product (P80 of approximately 13 mm) passes through a surge bin from where it is fed to the milling circuit.

The milling and flotation circuits are designed to operate 365 days per annum for 24 hours per day at 91% utilization. A single stage primary ball milling circuit is employed, incorporating a closed circuit linear classifying screen and a scalping screen ahead of the mill. The scalping screen undersize feeds a single flash flotation cell before combining with the mill discharge material. Scalping and linear screen oversize are the feed to the primary mill. The primary ball mill size is 4.3m diameter (inside new liners) x 4.6m (EGL) with an installed motor power of 1000 kW.

Primary milling is followed by rougher flotation which, along with flash flotation, recovers the graphite to concentrate from the main stream. Rougher flotation employs seven forced-draught trough cells.

The primary, fine-flake and attritioning cleaning circuits upgrade the concentrate to the final product grade of above 94% C(t). Concentrate from the main stream feeds into the primary cleaning circuit consisting essentially of a dewatering screen, a polishing ball mill, a column flotation cell and flotation cleaner/cleaner scavenger trough cells.

The primary cleaner column cell concentrate gravitates to a 65 mesh classifying screen, from where the large-flake oversize is directed to a high rate thickener located ahead of a final concentrate attritioning circuit. Primary cleaner classifying screen undersize is pumped to the fine-flake cleaning circuit.

The fine flake cleaning circuit consists primarily of a dewatering screen, a polishing ball mill, a column flotation cell and flotation cleaner/cleaner scavenger trough cells. The attritioning cleaning circuit employs a high rate thickener, an attritioning stirred mill, a column flotation cell and flotation cleaner/cleaner scavenger trough cells. Fine flake column concentrate merges with the +65 mesh primary cleaner classifying screen oversize as it feeds the attritioning circuit thickener. Attritioning circuit column concentrate comprises the final concentrate stream feeding the final concentrate thickener.

14

Combined rougher and cleaner flotation final tailings are pumped to a guard de- gritting cyclone installation ahead of a high rate final tailings thickener. Cyclone overflow feeds the thickener. Cyclone and thickener underflows combine and are pumped for final disposal to the tailings storage facility (“TSF”).

Thickened final concentrate is pumped to a linear vacuum belt filter for further dewatering before the filter cake is fed into a rotary kiln drying circuit.

A three-stage, twin stream sifting plant screens the dry concentrate (dryer product) into the pre-determined size classes. A bagging plant is employed to weigh, sample and bag the different size fractions discretely for loading into sea freight containers for shipment.

Chemical reagents are used throughout the primary recovery and upgrading processes. Diesel fuel collector and liquid frother are added to various points-of- use within the flotation circuits.

Diesel collector is pumped from the main tank farm to a bulk tank at the plant, from where it enters a manifold system which supplies multiple variable speed peristaltic pumps which discretely pump the collector at set rates to the various points-of-use within the flotation circuits.

MIBC (methyl isobutyl carbinol) frother is delivered by road to a plant reagent store in 1m3 IBC’s, or 210 litre steel drums. The drums are collected by forklift as required and the contents pumped into a frother storage tank. A manifold system on the storage tank supplies multiple variable speed peristaltic pumps, which discretely pump the frother at set rates to the various points-of-use within the flotation circuits.

Flocculant powder (Magnafloc 919 and Magnafloc 24 for concentrate and tailings thickening facilitation respectively) is delivered by road to the plant reagent store in 25 kg bags. The bags are collected by forklift as required and delivered to a flocculant mixing and dosing area. Here the flocculant is diluted as required using parallel, duplicate vendor-package automated make-up plants, one each being dedicated to supplying the concentrate and tailings thickeners due to the flocculant types required being different for each application. Variable speed peristaltic pumps discretely pump the flocculant at set rates to the thickeners’ points-of-use.

Coagulant powder (Magnafloc 1707) for thickening enhancement is handled similarly to the flocculant as described above, the exception being that a single make-up system is provided to supply both the concentrate and tailings thickeners. Again, variable speed peristaltic pumps discretely pump the coagulant at set rates to the thickeners’ points-of-use.

15

Figure 3 below gives a high level overview of the project and Figure 4 below provides a block diagram depicting the basic process flow.

Figure 3: Project summary

Figure 4: Block Flow Diagram

16

Infrastructure

The project is located in a relatively remote part of South Western Madagascar, approximately 13 km NE of the local village of Fotadrevo. There is currently no infrastructure on site and everything will have to be constructed.

The following elements are all part of the project scope:

| · | Raw water supply (from a network of bore holes extracting ground water) |

| · | Power supply (temporary during construction) and then a permanent diesel power station to supply the plant and permanent camp |

| · | Sanitation for the plant, permanent camp, and temporary during construction) |

| · | Storm water control and management |

| · | Temporary accommodation during construction |

| · | Permanent accommodation (340 people) |

| · | All permanent buildings (offices, workshops, stores, laboratory) |

| · | All buried services (potable water, sewage, stormwater, electrical reticulation) |

| · | In plant roads |

| · | Haul road |

| · | Tailings Storage Facility |

| · | Tailings pipe line to the TSF |

| · | Return water pipe line from the TSF back to the plant |

| · | Rock dumps and Run of Mine Ore (“ROM”) pads |

See Figure 2 in section 1.3 for the site layout.

Raw Water Supply

Water is supplied by a network of boreholes. A detailed water demand and supply analysis was done as part of the Molo 2015 FS, and this has shown that the water demands of the plant can be accommodated by boreholes within a radius of 5km from the plant. The daily steady state raw water make up requirement is estimated to be 561m3 per day.

Power Supply

Power is supplied by four 2 MW diesel generators. The running load for the plant is estimated to be 2.7 MW with an additional 0.8 MW for the permanent camp and all mine infrastructure. Under normal operation there will only be two units running, with a third allowed to assist with mill starting, and the fourth unit as a spare for maintenance.

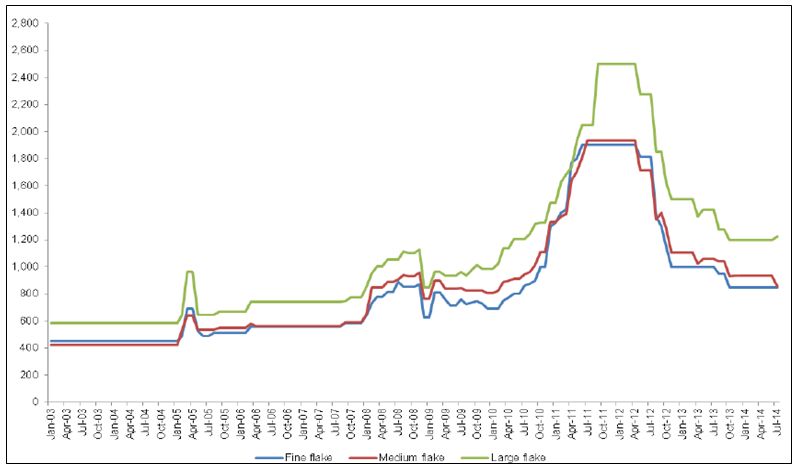

1.12 Product Pricing

Graphite prices are based on current quotes and projected estimates provided by UK-based Roskill Consulting Group Ltd (“Roskill”), recognized as a leader in providing independent and unbiased market research, pricing trends, and demand and supply analysis for the natural flake graphite market.

The historical 3 year average price in December 2014 was $1,867 per tonne. The weighted average price per tonne of graphite concentrate in December 2014 was US$1,375 per tonne. This is a basket price and reflects the contribution of the different flake sizes and carbon grades to the overall price.

The start-up price (in 2017 terms) for a tonne of Molo graphite concentrate is a projection based on Roskill information using the weighted average price per tonne. The graphite price then escalates in the financial model based on Roskill’s forecasts for supply and demand. The reader is cautioned that these are forecasts and may change subject to market dynamics.

17

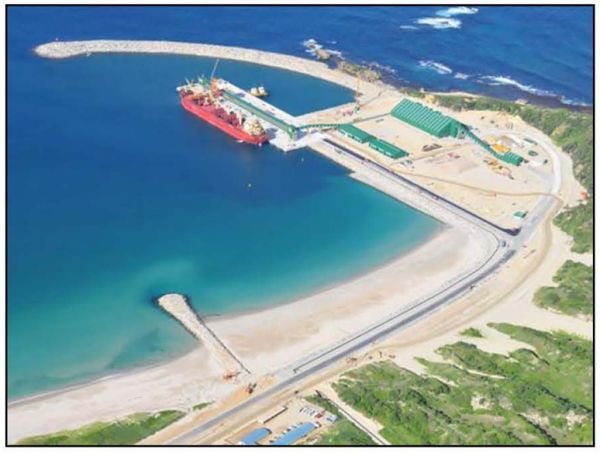

1.13 Logistics

The cost to transport one tonne of dry concentrate (0.5% moisture content) from Molo to Rotterdam via Fort Dauphin, Madagascar, in December 2014 terms is 337 US$ / tonne. This is based on shipping 26 tonnes of concentrate in 1 m3 bags placed inside a 40 ft. container.

The route from Molo to Fort Dauphin runs either via the RN 10 or the RN 13. Both these routes vary from reasonable to poor condition and trucks are expected to take between four and five days to make the round trip. A truck was run over the route by a Madagascan trucking contractor to gauge cycle times and they managed to complete the journey in two long days each way. This was in the dry season and in the wet season there may be periods of time when the roads become impassable. No money has been budgeted for roads repairs or upgrades.

The Port of Ehoala at Fort Dauphin is a modern (2009) port developed by Rio Tinto for the QMM project. It has a 15m draft with shipping lines calling on a regular basis. There are however no crane facilities and vessels require their own cranes.

Figure 5 below shows a picture of the Port of Ehoala at Fort Dauphin.

Figure 5: Port of Ehoala at Fort Dauphin

18

Figure 6, Figure 7, and Figure 8 below give some insight into the varying road conditions between Molo and Fort Dauphin.

Figure 6: Road Conditions (1)

Figure 7: Road Conditions (2)

Figure 8: Road Conditions (3)

19

1.14 Capital costs

The capital cost for the project is estimated to be 188.2 million US$, including a contingency of 24.5 million US$. Competitive bids were obtained for most mechanical equipment, and for the earthworks, civils, structural steel, mechanical erection, piping and electrical, control and instrumentation detailed Bills of Quantities were issued for competitive pricing.

The base date for the capital costs is December 2014 and no provision has been made for escalation. The accuracy of capital costs is considered to be with +/- 10%

Table 7: Construction Capital Costs

|

Category

|

Cost (US$ Million)

|

|

Capital Cost

|

149.9

|

|

Design Development Allowance

|

13.8

|

|

Subtotal

|

163.7

|

|

Contingency

|

24.5

|

|

Total

|

188.2*

|

|

*Excludes taxes, tariffs, duties and interest

|

|

Table 8: Initial Capital Cost Summary

|

Cost Centres

|

Cost (US$ Million)

|

|

Pre-production

|

37.3

|

|

Tailings Storage Facility

|

24.3

|

|

Mechanicals

|

20.8

|

|

Electrical, Control & Instrumentation

|

20.8

|

|

External services

|

17.9

|

|

Earthworks

|

11.8

|

|

Piping

|

7.4

|

|

Structural

|

5.6

|

|

Transport

|

5.5

|

|

Vendor packages

|

3.4

|

|

Civil works

|

2.5

|

|

Consumables and spares

|

2.4

|

|

Buildings, fittings

|

2.1

|

|

Plate work

|

1.9

|

|

Total Capital Costs

|

163.7

|

Future capital expenditure expected to be incurred has been allowed for in the financial model to cover the expansion of the TSF in year 2, the replacement of the mine fleet, the replacement of the power plant, and for rehabilitation at the end of the project. Over the life of mine this accounts for an additional 38.3 million US$ with 7 million US$ spent on the TSF expansion in year 2.

20

1.15 Operating costs

The average cash operating costs from year 3 onwards, after the expatriate staff complement is reduced, are estimated to be 21.7 US$ per mineralized tonne processed and 353 US$ per tonne of concentrate produced. The cash operating costs includes mine operations (owner operated), process plant operations and general and administrative charges. They do not include shipping from Molo to the end user, or any downstream processing costs.

Table 9: Operating Costs per Tonne of Feed

|

Category

|

Year 3 onwards

|

|

Mining

|

US$3.90

|

|

Processing

|

US$11.00

|

|

General and Administrative

|

US$6.80

|

|

Total OPEX per Tonne of Feed

|

US$21.70

|

|

Costs have been rounded.

|

|

Table 10: Operating Costs per Tonne of Concentrate produced at the Mine Site

|

Category

|

Year 3 onwards

|

|

Mining

|

US$64

|

|

Processing

|

US$179

|

|

General and Administrative

|

US$110

|

|

Total OPEX cost per Tonne of Concentrate at Mine Site

|

US$353

|

|

Costs have been rounded

|

|

The operating costs expressed above are considered to be accurate to +/- 10%, and assume a varying US$ inflation rate of 1.6% in 2015 and escalating to 2.0% from 2017 onward. Currency inflation rates were also considered in the financial model and were applied to the South African Rand and Malagasy Ariary portions of the opex costs.

Please note that these operating costs assume that the plant is able to successfully handle the variability in the ore body, as shown by the SGS test work discussed in detail in Section 13. Should the plant not perform as expected this could have a material impact on operating costs as:

• The flake size distribution could be worse than expected

• The product grade could be lower than expected

• The recoveries could be lower than expected or a combination of all of these

21

1.16 Economic analysis

Table 11A below summarizes the economic analysis of the project using discounted cash flow methods based on the projected and escalating graphite basket price.

Table 11A: Economic Analysis of the Project – Projected Escalating Basket Price

|

Category

|

Value

|

|

Average price / tonne of concentrate (at start up, 2017)

|

US$1,689

|

|

Internal Rate of Return (“IRR”) - Project Equity

|

31.2%

|

|

NPV @ 8% Discounted Cash Flow

|

US$521,602,408

|

|

NPV @ 10% Discounted Cash Flow

|

US$389,797,113

|

|

NPV @ 12% Discounted Cash Flow

|

US$293,649,899

|

|

Project Payback Period

|

4.84 years

|

|

* Assumes that the project is financed through 50% equity finance and 50% corporate debt. The debt assumptions used in the model assumes a rate of 5.75% over LIBOR, with LIBOR forecast to escalate to 3.54% by 2022. An arranging fee is also assumed.

|

|

Notes

All values in the above table do not account for inflation and assume that a satisfactory investment agreement is negotiated under Madagascar’s LGIM (Loi Sur les Grands Investissements Miniers) tax laws covering large scale mining investments, for which this project qualifies. Also included in the above table are forecasted prices for 2017, which coincides with the year the Molo mine is expected to be in production.

The exchange rates used in the financial model are as follows:

| · | 11.31 South African Rand (“ZAR”) to US$1, moving in line with purchasing power parity |

| · | 0.833 Euro to US$1, fixed for the modelled period |

| · | 2,746 Malagasy Ariary (“MGA”) to US$1, moving in line with purchasing power parity |

Table 11B below summarizes the economic analysis of the project using discounted cash flow methods based on the historical three-year average graphite price.

Table 11B: Economic Analysis of the Project – Historical Three-Year Average Price

|

Category

|

Value

|

|

Average price / tonne of concentrate

|

US$1,867

|

|

Internal Rate of Return (“IRR”) - Project Equity

|

25.6%

|

|

NPV @ 8% Discounted Cash Flow

|

US$223,903,960

|

|

NPV @ 10% Discounted Cash Flow

|

US$168,138,467

|

|

NPV @ 12% Discounted Cash Flow

|

US$126,029,578

|

|

Project Payback Period

|

5.84 years

|

|

* Assumes that the project is financed through 50% equity finance and 50% corporate debt. The debt assumptions used in the model assumes a rate of 5.75% over LIBOR, with LIBOR forecast to escalate to 3.54% by 2022. An arranging fee is also assumed.

|

|

Notes

All values in the above table do not account for inflation and assume that a satisfactory investment agreement is negotiated under Madagascar’s LGIM (Loi Sur les Grands Investissements Miniers) tax laws covering large scale mining investments, for which this project qualifies. Also included in the above table are forecasted prices for 2017, which coincides with the year the Molo mine is expected to be in production.

The exchange rates used in the financial model are as follows:

| · | 11.31 South African Rand (“ZAR”) to US$1, moving in line with purchasing power parity |

| · | 0.833 Euro to US$1, fixed for the modelled period |

| · | 2,746 Malagasy Ariary (“MGA”) to US$1, moving in line with purchasing power parity |

22

1.17 Environmental & Permitting

A comprehensive Environmental and Social Impact Assessment (“ESIA”) was completed to local Malagasy, Equator Principles, Word Bank and International Finance Corporation (“IFC”) standards. The process was preceded by an Environmental Legal Review and an Environmental and Social Screening Assessment; both providing crucial information to align the project development and design with international best practice on sustainable project development.

The ESIA submission is subject to approval of the investment amount by Madagascar’s Ministry of Mines. The application was submitted on 30th January 2015 and the approval of the investment amount is in progress. Energizer will receive a Global Environmental Permit upon approval of the ESIA, a process which is expected to take six months from date of submission.

A comprehensive permitting register is in place and additional sectorial permit applications will form part of the early execution phase. Approval of the sectorial applications is expected within the same six month period as the ESIA review.

No material issues were identified in relation to Environmental, Social and Permitting processes and through the stakeholder engagement process the local and regional community has expressed a desire for the project to move forward.

1.18 Conclusions

1.18.1 Geology

Energizer’s 2011 exploration program delineated a number of new graphitic trends in southern Madagascar. The resource delineation drilling undertaken during 2012-2014 focused on only one of these, the Molo deposit, and this has allowed for an independent, updated resource statement for the Molo deposit, which is stated in accordance with the CIM Guidelines.

1.18.2 Mining

Maiden mineral reserves of 22 437 000 tonnes have been declared for the Molo Graphite Project at an average grade of 7.02% and based on the information contained in the Molo 2015 FS it is possible to economically mine this deposit.

1.18.3 Metallurgical Test Work

Comprehensive metallurgical test programs culminated in a process flowsheet that is capable of treating the Molo ore using conventional and established mineral processing techniques. Process risks associated with the variability with regards to metallurgical performance have been mostly mitigated through the addition of an upgrading circuit.

1.18.4 Recovery Methods

The laboratory, pilot and vendor test work conducted prior to and during the study defined the required process flow sheet. This was duly translated into a full-scale production plant flow sheet as described within this report. The flow sheet unit processes were populated and individual component equipment selected according to either pilot plant precedents or, where these were not available, proven practice within the industry, in conjunction with suitably experienced vendors. All process designs and selections were based on conventional, proven mineral processing practices.

The processing selections and configurations built into the design are adequately suited to the requirements. Based on the mining and metallurgical test work information presented elsewhere within the Molo 2015 FS, and assuming within specification ROM ore is fed to the plant, the required recovery is expected to be attainable at the throughput stated. Note that this recovery is based on lab and pilot scale test work and may reduce slightly on a full scale plant due to operational inefficiencies. This possible reduction has not been taken into account in the financial analysis.

1.18.5 Infrastructure

All infrastructure required for the project has to be installed from scratch and has been allowed for in the project budget.

1.18.6 Water

The detailed hydrogeological analysis has concluded that the plant can be supplied from a well field.

23

1.18.7 Environmental, Social

A comprehensive Environmental and Social Impact Assessment has been done, and is in the process of being submitted to Madagascan government for approval.

1.18.8 Permitting

Various permits will have to be obtained for the project including an Environmental Permit and a Mining permit. The most urgent permit is for Energizer to renew the exploration permit covering the project.

1.18.9 Tailings

It is possible to construct the required tailings storage facility and a suitable site has been identified. Geochemical and hydrogeological test work has shown that the facility does not need to be lined.

1.18.10 Risks

The qualitative risk assessment identified 56 risks of which 9 were extremely high before controls. After controls were applied the number of extremely high risks was reduced to two. These risks are:

1. The exploration permit covering the Molo pit expired in 2011 and has yet to be officially renewed (Exploration Permit #3432 is the permit in question).

2. Current delays in issuing new mining permits.

After controls were applied the remaining high risks are as follows, (reduced from 39 to 18):

| 1. | Requirement that all voids / excavations be backfilled without exception. |

| 2. | Inaccurate landownership data. |

| 3. | The unit costs of moving product are high. |

| 4. | Project NPV and IRR lower than the PEA |

| 5. | Theft during construction & operation (diesel, cable, etc.) |

| 6. | No off take agreements signed yet or formal product specifications received. |

| 7. | The current execution strategy calls for contracts to be placed before permits are granted. |

| 8. | The project has modelled the diesel price at 0.8 US$ / litre. |

| 9. | ESIA review timeframes could extend past the planned project start date - indications are 6-9 months for ESIA approval from date of submission to the O.N.E (The Madagascan Government department of the Environment) |

| 10. | The process design may not achieve the optimal balance between the competing requirements of: |

| i. | Maximizing coarse flake recovery |

| ii. | Maximizing product carbon grade |

| iii. | Maximizing overall recovery |

| 11. | Future Land Claims (Ancestral Rights). |

| 12. | The process plant may not achieve a consistent on spec product, especially as the feed grade to the plant varies and this may make process control difficult. |

| 13. | Madagascan political situation remains potentially unstable. |

| 14. | Difficult logistics getting material on and off the island plus very bad roads. |

| 15. | Contractors P&G’s high due to locality. |

| 16. | The projects returns are reliant on a real term increase in the price of graphite. |

| 17. | Implementation of the preferential taxation arrangement may be difficult. |

| 18. | The debt funding assumptions may not be achievable. |

24

1.19 Recommendations

1.19.1 Geology

No further recommendations at present.

1.19.2 Mining

The long mine life of the Molo Graphite Project will allow for potential optimization of drilling and blasting designs during execution that could reduce operating costs slightly.

From a pure mining perspective the Molo Graphite Project is very small and provided reasonable levels of short term planning are applied it should have very few challenges in delivering the required tonnages at the required grade to meet the production targets set out in this Molo 2015 FS.

1.19.3 Metallurgical Test Work

The following recommendations are made for additional metallurgical testwork prior to the detailed engineering stage:

| · | Evaluate a range of different attrition mill media to determine if flake degradation can be reduced without affecting the concentrate grade; |

| · | Develop a grinding energy versus concentrate grade relationship for the best grinding media. This will allowa more accurate prediction of the required attrition mill grinding energy as a function of the final concentrate grade; |

| · | Conduct attrition mill vendor tests to aid in the sizing of the equipment; |

| · | Carry out vendor testing on graphite tailings using the optimized reagent regime proposed by the reagent supplier; and |

| · | Complete a series of flotation tests on samples covering the mine life past the initial 5 years. |

1.19.4 Recovery Methods

Optimization and refinement opportunities exist regarding the process design which could reveal benefits over the equipment selections and unit process detail within the current design. The latter are based essentially on test work outcomes pursued and reported on thus far for study purposes.

Appropriate test work is recommended prior to the initiation or during the course of a detailed design phase preceding construction. This would include the following:

| · | Bulk material flow test work; |

| · | Additional test work, in conjunction with vendors and in line with ongoing technical developments, aimed at further refinement of the polishing and attrition milling processes; |

| · | Concentrate attritioning circuit static and dynamic thickening tests, including reagent scoping and optimization trials; |

| · | Further investigation into potentially replacing the final tailings disposal positive displacement pumps withmore common centrifugal pump trains by reducing the slurry solids concentration for overland pumping. Thiswill include examination into whether the overall water balance and supply system can reasonably accommodate such a change. |

1.19.5 Infrastructure

The following are recommended prior to the detailed design stage:

| · | Additional geotechnical investigations at the proposed new construction and permanent camp site, particularly at the location of the new potable water storage tanks |

| · | A detailed geotechnical investigation will need to be undertaken to identify and confirm suitable sources of concrete aggregate and concrete sand materials at the location of the project site. This testing will need to include for concrete material testing and the production of concrete trial mixes with the material identified |

| · | The geotechnical information will also need to confirm the suitability for construction of all the material to beexcavated from the Return Water Dam (“RWD”). It is proposed that all the material excavated from the RWD is utilized in the works as processed fill material |

| · | Confirmation as to whether the material from the proposed borrow pit near Fotadrevo (which will be used to supply all fill material for the TSF starter wall construction) can be utilized as fill material, or if this material can be stabilized in some manner and used in the works |

| · | A detailed topographical survey will need to be undertaken of the proposed construction site, borrow pit areasand the access road between Fotadrevo and the mine site. This information is required prior to the final detailed design of the plant layout and associated earthworks |

25

1.19.6 Water

The following is recommended during the detailed design phase:

| · | Updating the current dynamic water balance including a dynamic TSF water balance. The current water balance only assumed average monthly inflows from the TSF into the RWD. It would be recommended to confirm the water availability on the Molo Graphite Project if drought conditions occur and the TSF model element is included in the dynamic water balance |

| · | Water quality and quantity data is required to provide a baseline for comparison once the Molo Mine is commissioned. To provide the necessary baseline data, regular ground and surface water quality monitoring must be carried out leading up to the date when the Molo Mine will be commissioned. Additionally proposed monitoring and scavenger wells must be installed. This also should include the installation of flow meters on relevant pipelines to verify the dynamic water balance with measured flow rates during operations |

| · | The installation of a weather station on the Molo Graphite Project site should be done as soon as possible. |

| · | The installation and testing of the additional well field boreholes must be undertaken. The groundwater resource model must be updated to include site specific borehole data. |

| · | The environmental geochemical test work of the Molo 2015 FS should be confirmed by selective testing of samples from the latest exploration and metallurgical test programs. The geochemical model should be updated accordingly. |

1.19.7 Environmental, Social

| · | GCS recommends the installation of a suitable weather station at or as near as possible to the proposed project site, even before construction commences. Accurate, local weather data is almost non-existent in Madagascar. This data will prove invaluable for model calibration, improvement in baseline understanding and for future energy supply options which could utilize wind and or solar power generation |

| · | Clean energy supply should be considered as a medium to long term target |

| · | Appointment of a community representative and the establishment of a mandate to sensitize the local communities prior to any project activities |

| · | Monitoring and auditing to commence at project preparation phase |

| · | Compilation of Standard Operating Procedures for Environmental and Social aspects requiring direct management and intervention |

| · | It is recommended that actual activity data, (e.g. kilometers travelled, or litres of diesel consumed) for a financial year is used when a Green House Gas (“GHG”) assessment is being calculated. Given that this project involves an estimation of a future GHG assessment for activities yet to begin, a series of assumptions have been made in order to obtain the activity data required to undertake this calculation |

| · | Community recruitment, skills development and training should begin at project preparation phase |

1.19.8 Permitting

| · | An application for the exploration permit in Energizer’s name is a critical step in the larger permitting and licensing regime and requires early attention and dedicated involvement |