Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Atkore Inc. | a4q16deutschebankconferenc.htm |

PRINTING INSTRUCTIONS

CHECK TOC BEFORE PRINTING

Color/grayscale: Color (regardless of printing in b/w)

Scale to fit paper: OFF

Print hidden slides: OFF

POWERPOINT OPTIONS > ADVANCED > PRINT

Print in background: OFF

Deutsche Bank Leveraged Finance Conference

September 27, 2016

1

Cautionary statements

This presentation contains forward-looking statements that are subject to known and unknown risks and uncertainties, many of which are beyond our control. All statements other than statements of historical

fact included in this presentation are forward-looking statements. Forward-looking statements appearing throughout this presentation include, without limitation, statements regarding our intentions, beliefs,

assumptions or current expectations concerning, among other things, financial position; results of operations; cash flows; prospects; growth strategies or expectations; customer retention; the outcome (by

judgment or settlement) and costs of legal, administrative or regulatory proceedings, investigations or inspections, including, without limitation, collective, representative or class action litigation; and the impact

of prevailing economic conditions. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “believes,”

“expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,” “is optimistic,” “intends,” “plans,” “estimates,” “anticipates” and other comparable terms. We caution you that forward-looking

statements are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and

the development of the market in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this presentation. In addition, even if our results of

operations, financial condition and cash flows, and the development of the market in which we operate, are consistent with the forward-looking statements contained in this presentation, those results or

developments may not be indicative of results or developments in subsequent periods. A number of important factors, including, without limitation, the risks and uncertainties discussed under the captions “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the final prospectus filed pursuant to Rule 424(b)(4) of the Securities Act of 1933, as amended, filed

with the U.S. Securities and Exchange Commission on June 10, 2016 (File No. 333-209940), could cause actual results and outcomes to differ materially from those reflected in the forward-looking statements.

Because of these risks, we caution that you should not place undue reliance on any of our forward-looking statements. New risks and uncertainties arise from time to time, and it is impossible for us to predict

those events or how they may affect us. Further, any forward-looking statement speaks only as of the date on which it is made. We undertake no obligation to revise the forward-looking statements in this

presentation after the date of this presentation.

Market data and industry information used throughout this presentation are based on management’s knowledge of the industry and the good faith estimates of management. We also relied, to the extent

available, upon management’s review of independent industry surveys, forecasts and publications and other publicly available information prepared by a number of third party sources. All of the market data

and industry information used in this presentation involves a number of assumptions and limitations which we believe to be reasonable, and you are cautioned not to give undue weight to such estimates.

Although we believe that these sources are reliable, we cannot guarantee the accuracy or completeness of this information, and we have not independently verified this information. While we believe the

estimated market position, market opportunity and market size information included in this presentation are generally reliable, such information, which is derived in part from management’s estimates and

beliefs, is inherently uncertain and imprecise. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are subject to a high degree of

uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the

estimates prepared by independent parties.

We present Adjusted net sales, Adjusted EBITDA. Adjusted EBITDA margin, Adjusted net income, Adjusted earnings per share, and Leverage ratio (net debt over Adjusted EBITDA on a trailing twelve month

basis) to help us describe our operating and financial performance. Adjusted net sales, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income, Adjusted earnings per share, and Leverage ratio are

non-GAAP financial measures commonly used in our industry and have certain limitations and should not be construed as alternatives to net income, net sales and other income data measures (as determined

in accordance with generally accepted accounting principles in the United States, or GAAP), or as better indicators of operating performance. Adjusted net sales, Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted net income , Adjusted earnings per share and Leverage ratio, as defined by us may not be comparable to similar non-GAAP measures presented by other issuers. Our presentation of such measures

should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. See the appendix to this presentation for a reconciliation of Adjusted net sales to net sales,

Adjusted EBITDA to net income, Adjusted net income to net income, Adjusted earnings per share to earnings per share, and net debt over Adjusted EBITDA on a trailing twelve month basis.

We have a 52- or 53-week fiscal year that ends on the last Friday in September. Fiscal 2015, 2014 and 2013 were 52-week fiscal years which ended on September 25, 2015, September 26, 2014 and

September 27, 2013, respectively. Our next fiscal year will end on September 30, 2016, and will be a 53-week year. Our fiscal quarters end on the last Friday in December, March and June.

Review of this Presentation should be done in conjunction with the Company’s most recent filings with the SEC, as the filings contain additional information and relevant definitions of the terms used herein.

.

2

Who are we?

Atkore is all around you

Cable Tray, Wire Basket

Tray & Cable Ladder

Armored Cable,

Luminary Cable & Fittings

Metal Framing & Fittings

Flexible Electrical Conduit

and Liquidtight Flexible Metal

Conduit & Fittings

PVC Electrical

Conduit & Fittings

Metal Electrical

Conduit & Fittings

In-Line Galvanized

Mechanical Tube

3

OEM

18%

Int'l

7%

Other

5%

U.S.

Construction

70%

Leading Electrical Raceway and Mechanical Products & Solutions provider

■ #1 or #2 market positions in most of our products1

■ Offer must-stock products to distribution and OEM

customers via single integrated platform

■ Established reputation as an industry leader in

quality, availability, delivery, value and innovation

■ Organized into two complementary segments:

Electrical Raceway and Mechanical Products &

Solutions (“MP&S”)

■ U.S.-centric player with large addressable market

and close adjacent opportunities

FY 2015 net sales

By reportable segment2 By end market

Addressable market opportunity3

$1B4

$13

Bil

li

o

n

Electrical

raceway

market

$78

Billio

n

U.S. electrical

products

market

$500M4

$3.8

Billio

n

U.S. mechanical

products &

solutions market

Electrical Raceway Mechanical Products & Solutions

1 Based on U.S. Adjusted net sales.

2 Split based on FY 2015 Adjusted net sales.

3 Management estimates based on market data and industry knowledge.

4 Atkore management estimates based on U.S. Adjusted net sales relative to the estimated U.S. addressable market size.

LTM 6/2016 financials

Adj. Net Sales $1,496mm

Adj. EBITDA $228mm

Adj. EBITDA Margin 15.2%

Mechanical

Products &

Solutions

35%

Electrical

Raceway

65%

4

$67

$86

$107

$162

9.0% 8.9%

10.6%

16.7%

0.06

0.08

0.1

0.12

0.14

0.16

0.18

FY 2013 FY 2014 FY 2015 LTM 6/2016

Adjusted EBITDA ($mm) Adjusted EBITDA Margin

PVC Electrical

Conduit & Fittings

27%

Armored Cable &

Fittings

33%

Other

8%

Metal Electrical

Conduit & Fittings

32%

Atkore’s Electrical Raceway segment

FY2015 net sales by product category

Adjusted EBITDA evolution ($mm)

Products that deploy, isolate and protect a structure’s electrical

circuitry from the original power source to the final outlet

■ Must-stock products for over 12,000 U.S. electrical distributor

branches

■ Range of solutions offers customers convenient and efficient

purchasing

■ Unique ability to co-load and bundle Electrical Raceway

products provides substantial competitive advantage

■ Industry leading quality, availability, delivery and innovation

Core products and market positions

Principal brands:

Armored Cable

PVC Conduit

Steel Conduit

#1 #1 #1

Flexible and

Liquidtight Conduit

Cable Tray, Cable

Ladder & Fittings

#3 #3

1

1 Other represents total Electrical Raceway net sales for FY2015 ($1,005mm) less Armored Cables & Fittings ($332mm), Metal Electrical Conduit & Fittings ($320mm) and PVC

Electrical Conduit & Fittings ($270mm).

FY2015 Net Sales: $1,005.6 mm

5

Metal Framing

and Fittings

32%

Mechanical

Pipe

53%

Other

15%

■ Comprehensive offering of metal framing and in-line galvanized

tubular products

■ Offer critical combination of metal framing, value-added fittings

and construction services to industrial and electrical distributors

■ ~60% of framing used to mount Electrical Raceway products

■ One of only two companies in the U.S. that manufacture and

market in-line galvanized tubular products on a national basis

■ 90% of in-line galvanized tubular products are sold directly or

indirectly to OEMs

Atkore’s Mechanical Products & Solutions segment

FY2015 Adjusted net sales by product category

Adjusted EBITDA ($mm)1

Products and services that frame, support and secure component parts in a broad range of structures,

equipment and systems in electrical, industrial and construction applications

Core products and market positions

Principal brands:

Metal Framing &

Related Fittings

In-Line Galvanized

Mechanical Tube

#1 #2

TBU – Update LTM March Financials

Historical financial performance

$63

$60

$80

$91

11.8%

11.0%

14.6%

17.3%

0.08

0.1

0.12

0.14

0.16

0.18

0.2

FY 2013 FY 2014 FY 2015 LTM 6/2016

Adjusted EBITDA ($mm) Adjusted EBITDA Margin

1

1 Other represents total MP&S Adjusted net sales for FY2015 ($546mm) less Mechanical Pipe ($287mm) and Metal Framing and Fittings ($175mm).

FY2015 Net sales $724.8 mm

FY2015 Adjusted net sales $546.2 mm

6

Atkore’s significant transformation

■ Limited strategic vision

■ Little customer coordination

■ Underperforming leadership

■ No growth or M&A strategy

2011 2011 - 2015 Atkore strategy

■ Leading market positions/brands

■ Upgraded over 90% of leadership

■ Developed clear strategy

■ Implemented Atkore Business System

(“ABS”)

■ Transformed portfolio (6 acquisitions,

4 divestitures and 4 closures)

■ Invested in new product development

■ Improved quality, delivery & service

■ Reduced fixed overhead

■ Drive growth

− Market position expansion

− New product innovation

− M&A growth execution

■ Expand margin

− Strategic and tactical pricing

− Mix driven by innovation and pricing

− Raw material and material usage savings

− Manufacturing productivity savings

− Volume leverage

■ Deliver cash flow

− Strong cash flow from earnings

− Limited CapEx requirements

− Efficient Working Capital Management

Electrical

Raceway

44%

MP&S

30%

Divested

Businesses

26%

Proven track record

Electrical

Raceway

65%

MP&S

35%

Portfolio

20111 LTM 6/20162

Adjusted net sales ($mm) Adjusted EBITDA and margin

1 Based on net sales.

2 Based on Adjusted net sales.

$1,250

$1,496

2011 LTM 6/2016

’11 – ’16 LTM

CAGR: 4.1%

$74

$228

5.9%

15.2%

2011 LTM 6/2016

Adjusted EBITDA ($mm) Margin

’11 – ’16 LTM

CAGR: 28.4%

7

The foundation for our improvement….

■ Market Intelligence and analysis

■ Portfolio analysis

■ Business development

■ “Evergreen” strategy

■ Product management

■ Culture of innovation

■ Talent assessment and

acquisition

■ Talent engagement

and development

■ Aligned incentives and

compensation

■ Resource deployment

and allocation analysis

■ Lean production system

■ Lean transactional

process excellence

■ Commercial excellence

■ Supply chain excellence

Strategy

Process

People

Adjusted EBITDA margin increased over 900bps1

Defective parts per million down 34%2

Perfect order rate increased from 81% to 92%2

ABS driving performance

1 From FY 2011 to LTM 6/2016.

2 From FY 2011 to FY 2015.

8

Where are we going….

Continue… to drive growth with ABS

Leverage... the Electrical Raceway portfolio

Capitalize... on the markets we serve

Expand... into high growth segments

Innovate… with new product development

Transform... with an active M&A process and pipeline

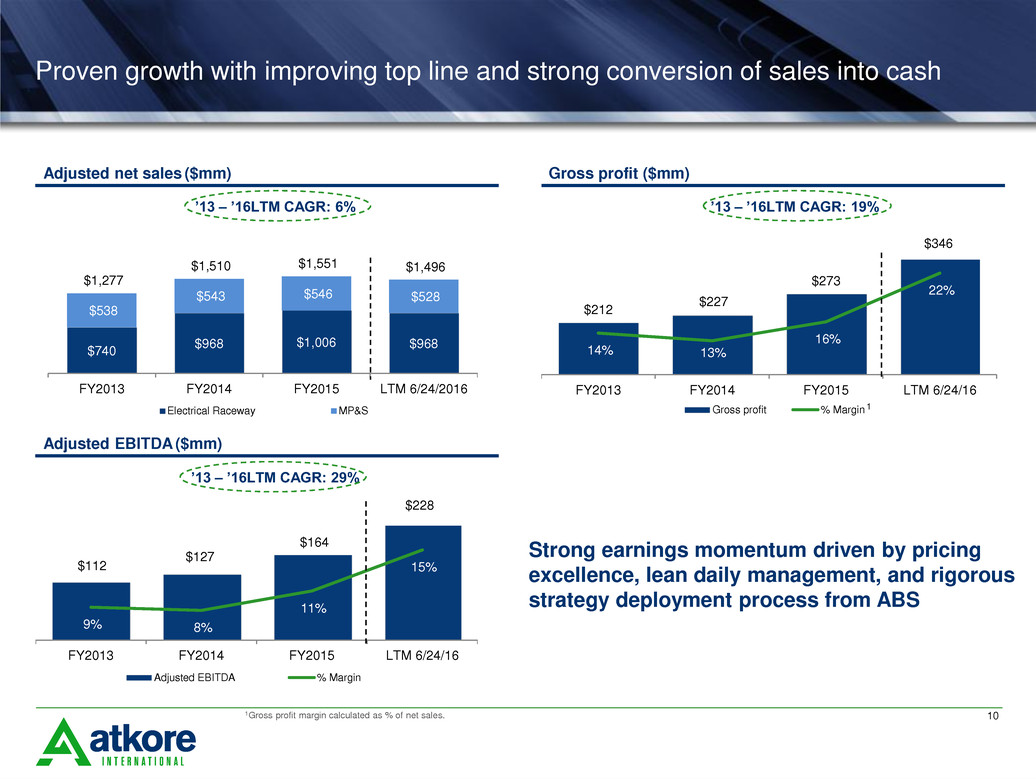

Financial overview

10

$112

$127

$164

$228

9% 8%

11%

15%

FY2013 FY2014 FY2015 LTM 6/24/16

Adjusted EBITDA % Margin

$740

$968 $1,006 $968

$538

$543 $546 $528

$1,277

$1,510 $1,551 $1,496

FY2013 FY2014 FY2015 LTM 6/24/2016

Electrical Raceway MP&S

Proven growth with improving top line and strong conversion of sales into cash

Adjusted net sales ($mm)

Adjusted EBITDA ($mm)

’13 – ’16LTM CAGR: 29%

’13 – ’16LTM CAGR: 6%

1Gross profit margin calculated as % of net sales.

$212

$227

$273

$346

14% 13%

16%

22%

FY2013 FY2014 FY2015 LTM 6/24/16

Gross profit % Margin

Gross profit ($mm)

’13 – ’16LTM CAGR: 19%

1

Strong earnings momentum driven by pricing

excellence, lean daily management, and rigorous

strategy deployment process from ABS

11

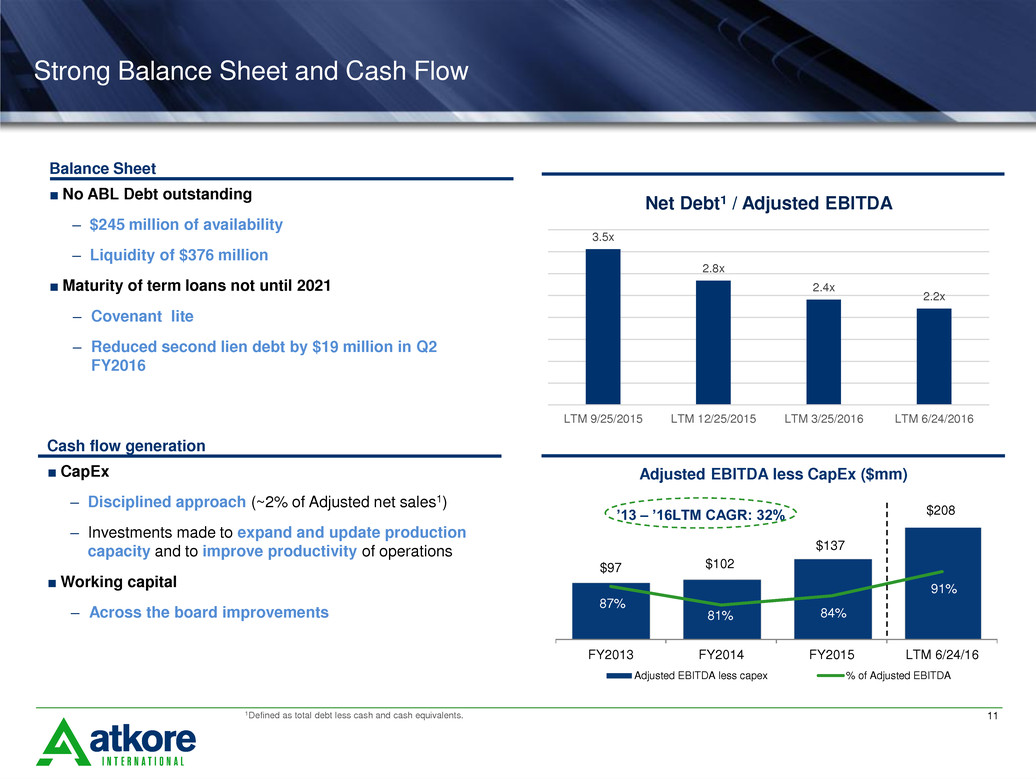

Strong Balance Sheet and Cash Flow

1Defined as total debt less cash and cash equivalents.

3.5x

2.8x

2.4x

2.2x

LTM 9/25/2015 LTM 12/25/2015 LTM 3/25/2016 LTM 6/24/2016

Net Debt1 / Adjusted EBITDA

$97 $102

$137

$208

87%

81% 84%

91%

FY2013 FY2014 FY2015 LTM 6/24/16

Adjusted EBITDA less capex % of Adjusted EBITDA

Adjusted EBITDA less CapEx ($mm)

’13 – ’16LTM CAGR: 32%

Cash flow generation

■ CapEx

‒ Disciplined approach (~2% of Adjusted net sales1)

‒ Investments made to expand and update production

capacity and to improve productivity of operations

■Working capital

‒ Across the board improvements

Balance Sheet

■ No ABL Debt outstanding

‒ $245 million of availability

‒ Liquidity of $376 million

■Maturity of term loans not until 2021

‒ Covenant lite

‒ Reduced second lien debt by $19 million in Q2

FY2016

Summary

13

Atkore’s key attributes – Strong company with growth upside

Leading market positions and strong brands

Superior customer value proposition with a compelling portfolio

Significant scale providing barriers to entry

Attractive growth strategy

Strong platform for growth across attractive end-markets

Incremental product innovation and M&A growth drivers

Strong profitability and cash flow profile with future runway

Team built to outperform

Appendix

15

3rd Quarter and Nine Month Financial Information

P&L and Cash Flow 4th Quarter

$mm FY2016 FY2015 $ % FY2016 FY2015 $ % FY2015

Net Sales 395.7$ 432.4$ (36.6)$ (8.5%) 1,107.1$ 1,291.4$ (184.2)$ (14.3%) 437.8$

Cost of Sales 284.2 353.8 (69.6) (19.7%) 831.8 1,089.6 (257.8) (23.7%) 366.8

Gross Profit 111.5 78.5 33.0 42.0% 275.3 201.8 73.6 36.5% 71.0

% margin 28.2% 18.2% 24.9% 15.6% 16.2%

SG&A 64.4 45.7 18.7 40.9% 162.4 130.5 31.9 24.5% 55.3

% sales 16.3% 10.6% 14.7% 10.1% 12.6%

Intangibles Amortization Expense 5.6 5.2 0.3 6.0% 16.7 15.8 0.9 5.6% 6.3

Impairment 0.0 0.0 0.0 NA 0.0 0.0 0.0 NA 27.9

Interest Expense 10.2 11.2 (1.0) (9.3%) 30.6 33.6 (3.0) (8.9%) 11.2

Income Tax Expense 10.7 (2.7) 13.4 n/a 24.1 (0.2) 24.3 n/a (2.7)

Net Income (Loss) 20.6 19.1 1.6 8.3% 43.2 22.1 21.1 95.6% (27.1)

Adjusted EBITDA 67.2 46.7 20.5 44.0% 173.6 110.0 63.7 57.9% 54.0

% sales 17.0% 10.8% 15.7% 8.5% 12.3%

Capital Expenditures 4.5 8.0 (3.5) (44.0%) 13.5 20.6 (7.1) (34.3%) 6.3

Operating Cash Flow 2.9$ 30.2$ (27.3)$ (90.5%) 85.0$ 30.2$ 54.8$ 181.3% 110.9$

Debt Metrics June Sept

$mm FY2016 FY2015 $ %

Total Debt 631.5$ 652.1$ (20.6)$ (3.2%)

Cash 131.1 80.6 50.5 62.7%

Net Debt 500.4$ 571.5$ (71.1)$ (12.4%)

LTM Leverage Ratio 2.2 3.4 (1.2) (35.8%)

Interest Coverage 6.6 4.2 2.4 58.8%

First Lien Debt 412.7 416.9 (4.2) (1.0%)

LTM First Lien Leverage Ratio 1.8 2.0 (0.2) (10.1%)

2016 H/(L) than 2015 2016 H/(L) than 2015Q3 YTD3rd Quarter

2016 H/(L) than 2015

16

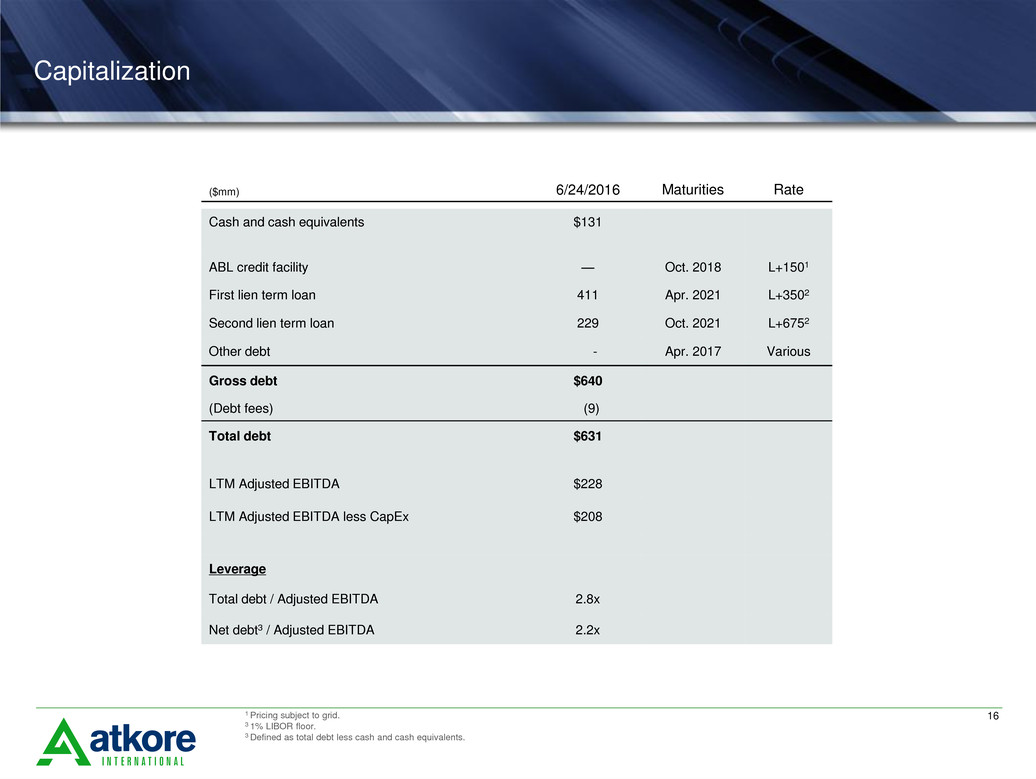

Capitalization

($mm)

6/24/2016 Maturities Rate

Cash and cash equivalents $131

ABL credit facility — Oct. 2018 L+1501

First lien term loan 411 Apr. 2021 L+3502

Second lien term loan 229 Oct. 2021 L+6752

Other debt - Apr. 2017 Various

Gross debt $640

(Debt fees) (9)

Total debt $631

LTM Adjusted EBITDA $228

LTM Adjusted EBITDA less CapEx $208

Leverage

Total debt / Adjusted EBITDA 2.8x

Net debt3 / Adjusted EBITDA 2.2x

1 Pricing subject to grid.

3 1% LIBOR floor.

3 Defined as total debt less cash and cash equivalents.

17

Fiscal year ended 3 months ended 9 months ended 12 months ended

($mm)

Sept. 27,

2013

Sept. 26,

2014

Sept. 25,

2015

Jun 26,

2015

Sep 25,

2015

Jun 24,

2016

Jun 26,

2015

Jun 24,

2016

Jun 26,

2015

Jun 24,

2016

Net sales

$1,476

$1,703

$1,729

$432 $438

$396 $1,291 $1,107 $1,746 $1,545

Impact of Fence and

Sprinkler exit (199) (193) (179) (45) (41) - (137) (8) (185) (49)

Adjusted net sales $1,277 $1,510 $1,551 $387 $396 $396 $1,154 $1,099 $1,560 $1,496

Adjusted net sales reconciliation

a) Restructuring amounts represent exit or disposal

costs including termination benefits and facility

closure costs. Impairment amounts represent write-

downs of goodwill, intangible assets and/or long-lived

assets

b) Represents pension costs in excess of cash funding

for pension obligations in the period

c) Represents stock-based compensation expenses

related to options awards and restricted stock units

d) Represents changes in our estimated exposure to

ABF matters

e) Represents amounts paid to CD&R and, until April 9,

2014, to Tyco. In connection with this offering, we

expect to enter into a termination agreement with

CD&R, pursuant to which the parties will agree to

terminate this consulting fee

f) Represents expenses associated with acquisition and

divestiture-related activities

g) Represents other items, such as lower of cost or

market inventory adjustments and the impact of

foreign exchange gains or losses related to our

divestiture in Brazil

h) Represents historical performance of Fence and

Sprinkler and related operating costs

A

B

C

D

E

F

G

H

a) Restructuring amounts represent exit or

disposal costs including termination

benefits and facility closure costs.

Impairment amounts represent write-

downs of goodwill, intangible assets

and/or long-lived assets

a) Includes items such as lower of

cost or market inventory

adjustments and the impact of

foreign exchange gains or

losses related to the Brazil

divestiture

Note: Numbers in each column may not sum to their respective reported Adjusted net sales figures due to rounding.

Consolidated Atkore

Fiscal year ended 3 months ended 9 months ended 12 months ended

($mm)

Sept. 27,

2013

Sept. 26,

2014

Sept. 25,

2015

Jun 26,

2015

Sep 25,

2015

Jun 24,

2016

Jun 26,

2015

Jun 24,

2016

Jun 26,

2015

Jun 24,

2016

Net sales

$737

$736

$725

$181 $184

$136 $541 $394 $736 $577

Impact of Fence and

Sprinkler exit (199) (193) (179) (45) (41) - (137) (8) (185) (49)

Adjusted net sales $538 $543 $546 $136 $142 $136 $404 $386 $551 $528

Mechanical Products & Solutions

18

Fiscal year ended 3 months ended 9 months ended 12 months ended

($mm)

Sept. 30,

20111

Sept. 28,

2012

Sept. 27,

2013

Sept. 26,

2014

Sept. 25,

2015

Jun 26,

2015

Jun 24,

2016

Jun 26,

2015

Jun 24,

2016

Jun 26,

2015

Jun 24,

2016

Net income (loss)

$(38.4)

$2.0

$(61.2)

$(73.9)

$(5.0)

$19.0

$20.6 $22.1 43.2 $(14.6) 16.2

Loss from discontinued

operations, net of tax 5.6 5.1 42.7 - - - - - - - -

Depreciation and

amortization

12.2

38.6

48.4

58.7

59.5

14.3

13.3 43.3 40.1 58.3 56.2

(Gain) on

extinguishment of debt

-

-

-

43.7

-

-

- - (1.7) - (1.7)

Interest expense, net

49.1

50.1

47.9

44.3

44.8

11.2

10.2 33.6 30.6 44.7 41.8

Income tax expense

(benefit)

(9.3)

(3.3)

(3.0)

(32.9)

(2.9)

(2.7)

10.7 (0.2) 24.1 (17.4) 21.4

Restructuring and

impairments

0.9

12.7

10.9

46.7

32.7

0.5

0.3 0.6 2.4 46.2 34.5

Net periodic pension

benefit cost

1.6

2.9

3.4

1.4

0.6

0.1

0.1 0.4 0.3 0.8 0.5

Stock-based

compensation

1.4

1.0

2.2

8.4

13.5

0.7

4.9 2.5 16.9 8.6 28.0

Consulting fee

6.0

6.0

6.0

4.9

3.5

0.9

13.7 2.6 15.4 3.5 16.3

Multi-employer pension

withdrawal - - 7.3 - - - - - - - -

Legal Settlements - - - - - - 1.3 - 1.3 - 1.3

Transaction costs

17.3

1.3

1.8

5.0

6.0 2.9 1.9 4.0 5.3 5.4 7.9

Other

33.5

11.5

9.1

15.5

14.1 3.2

(9.8) 6.0 (5.1) 13.0 2.3

Impact of Fence and

Sprinkler

(5.6)

(3.2)

(3.8)

5.0

(2.9)

(3.4)

- (4.9) 0.8 (1.2) 3.0

Adjusted EBITDA $74.3 $124.9 $111.6 $126.6 $164.0 $46.7 $67.2 $110.0 $173.6 $147.3 $227.6

Adjusted EBITDA reconciliation

a) Restructuring amounts represent exit or disposal

costs including termination benefits and facility

closure costs. Impairment amounts represent write-

downs of goodwill, intangible assets and/or long-lived

assets

b) Represents pension costs in excess of cash funding

for pension obligations in the period

c) Represents stock-based compensation expenses

related to options awards and restricted stock units

d) Represents changes in our estimated exposure to

ABF matters

e) Represents amounts paid to CD&R and, until April 9,

2014, to Tyco. In connection with this offering, we

expect to enter into a termination agreement with

CD&R, pursuant to which the parties will agree to

terminate this consulting fee

f) Represents expenses associated with acquisition and

divestiture-related activities

g) Represents other items, such as lower of cost or

market inventory adjustments and the impact of

foreign exchange gains or losses related to our

divestiture in Brazil

h) Represents historical performance of Fence and

Sprinkler and related operating costs

A

B

C

D

E

F

G

A

B

C

D

E

F

G

H

a) Restructuring amounts represent exit or

disposal costs including termination

benefits and facility closure costs.

Impairment amounts represent write-

downs of goodwill, intangible assets

and/or long-lived assets

a) Includes items such as lower of

cost or market inventory

adjustments and the impact of

foreign exchange gains or

losses related to the Brazil

divestiture

H

Confirm multi-employer pension for 6-month ended Mar 2015

and Mar 2016 - 1.2 and 3.4 in S-1 but 0 for full year ended

2015 and 2016

Note: Numbers in each column may not sum to their respective reported Adjusted EBITDA figures due to rounding.

1 Includes the predecessor period from September 25, 2010 through December 22, 2010 and the successor period from December 23. 2010 through September 30, 2011.

I

19

3 months ended 12 months ended

($mm) Sept. 25, 2015 Dec. 25, 2015 Mar. 25, 2016

Dec 25,

2015

Mar. 25,

2016

Net (loss) income $(27.1) $8.6 $14.0 $6.4

$14.6

Loss from discontinued operations,

net of tax - - - - -

Depreciation and amortization 16.1 13.5 13.2 58.2

57.2

(Gain) on extinguishment of debt - - (1.7) -

(1.7)

Interest expense, net 11.2 9.9 10.6 43.8

42.8

Income tax expense (benefit) (2.7) 4.6 8.7 2.0

8.0

Restructuring and impairments 32.1 1.3 0.8 34.0

34.6

Net periodic pension benefit cost 0.1 0.1 0.1 0.5

0.5

Stock-based compensation 11.1 2.0 10.0 14.1

23.8

Consulting fee 0.9 0.9

0.9 3.5

(0.9)

Multi-employer pension withdrawal - - - -

3.5

Legal Settlements - - - - -

Transaction costs 2.0 0.7

2.8 6.2

8.3

Other 8.1 5.7

(1.1) 18.0

16.7

Impact of Fence and Sprinkler 2.2 0.8

- (1.9)

(0.4)

Adjusted EBITDA $54.0 $48.1 $58.4 $184.9 $207.1

Adjusted EBITDA reconciliation

a) Restructuring amounts represent exit or disposal

costs including termination benefits and facility

closure costs. Impairment amounts represent write-

downs of goodwill, intangible assets and/or long-lived

assets

b) Represents pension costs in excess of cash funding

for pension obligations in the period

c) Represents stock-based compensation expenses

related to options awards and restricted stock units

d) Represents changes in our estimated exposure to

ABF matters

e) Represents amounts paid to CD&R and, until April 9,

2014, to Tyco. In connection with this offering, we

expect to enter into a termination agreement with

CD&R, pursuant to which the parties will agree to

terminate this consulting fee

f) Represents expenses associated with acquisition and

divestiture-related activities

g) Represents other items, such as lower of cost or

market inventory adjustments and the impact of

foreign exchange gains or losses related to our

divestiture in Brazil

h) Represents historical performance of Fence and

Sprinkler and related operating costs

A

B

C

D

E

F

G

A

B

C

D

E

F

G

H

a) Restructuring amounts represent exit or

disposal costs including termination

benefits and facility closure costs.

Impairment amounts represent write-

downs of goodwill, intangible assets

and/or long-lived assets

a) Includes items such as lower of

cost or market inventory

adjustments and the impact of

foreign exchange gains or

losses related to the Brazil

divestiture

H

Confirm multi-employer pension for 6-month ended Mar 2015

and Mar 2016 - 1.2 and 3.4 in S-1 but 0 for full year ended

2015 and 2016

Note: Numbers in each column may not sum to their respective reported Adjusted EBITDA figures due to rounding.

I

20

Adjusted EBITDA reconciliation (cont’d)

a) Restructuring amounts represent exit or disposal costs including termination benefits and facility closure costs. Impairment amounts

represent write-downs of goodwill, intangible assets and/or long-lived assets

b) Represents pension costs in excess of cash funding for pension obligations in the period

c) Represents stock-based compensation expenses related to options awards and restricted stock units

a) Represents amounts paid to CD&R and, until April 9, 2014, to Tyco.

a) Represents our proportional share of a multi-employer pension liability from which we withdrew in fiscal 2013

b) Represents gain/(loss) recognized in litigation settlements

c) Represents expenses associated with acquisition and divestiture-related activities

d) Represents other items, such as lower-of-cost-or-market inventory adjustments and the impact of foreign exchange gains or losses

related to our divestiture in Brazil, and changes in our exposure to ABF matters

e) Represents historical performance of Fence and Sprinkler and related operating costs

A

B

C

D

E

F

G

H

I

21

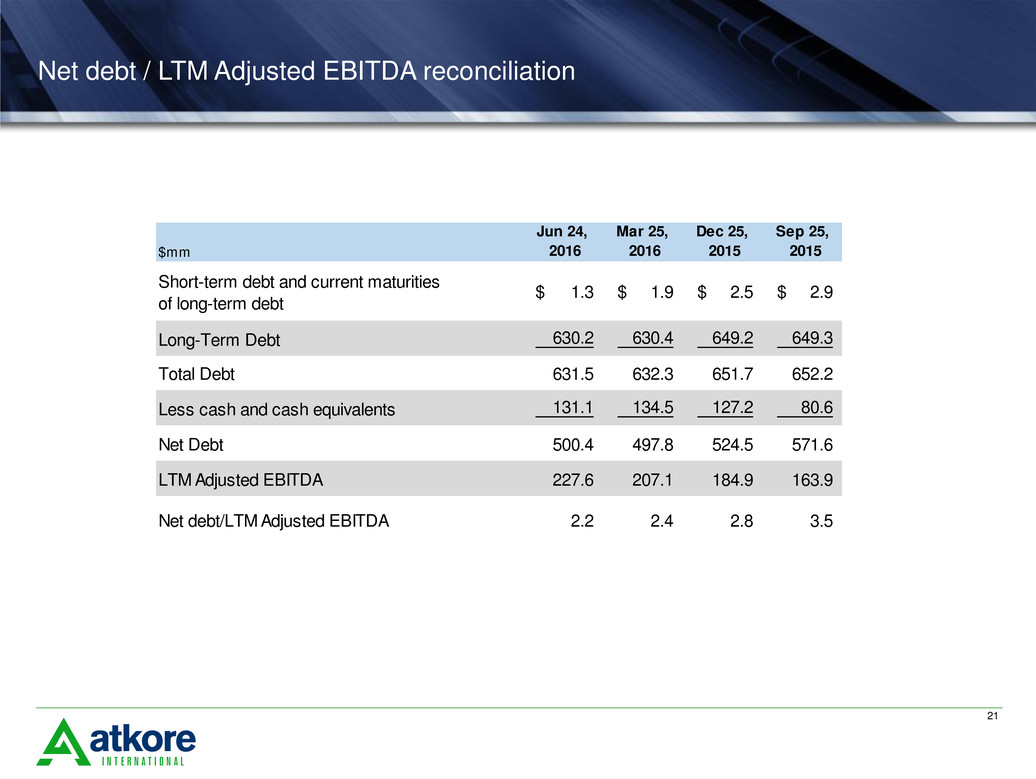

Net debt / LTM Adjusted EBITDA reconciliation

A

B

C

D

E

F

G

H

$mm

Jun 24,

2016

Mar 25,

2016

Dec 25,

2015

Sep 25,

2015

Short-term debt and current maturities

of long-term debt

1.3$ 1.9$ 2.5$ 2.9$

Long-Term Debt 630.2 630.4 649.2 649.3

Total Debt 631.5 632.3 651.7 652.2

Less cash and cash equivalents 131.1 134.5 127.2 80.6

Net Debt 500.4 497.8 524.5 571.6

LTM Adjusted EBITDA 227.6 207.1 184.9 163.9

Net debt/LTM Adjusted EBITDA 2.2 2.4 2.8 3.5