Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - MyoKardia, Inc. | d260307dex231.htm |

| EX-5.1 - EX-5.1 - MyoKardia, Inc. | d260307dex51.htm |

| EX-1.1 - EX-1.1 - MyoKardia, Inc. | d260307dex11.htm |

Table of Contents

As filed with the Securities and Exchange Commission on September 26, 2016

Registration No. 333- 213680

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MYOKARDIA, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 2834 | 44-5500552 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

333 Allerton Ave.

South San Francisco, California 94080

(650) 741-0900

(Address, including zip code and telephone number, including area code, of Registrant’s principal executive offices)

Tassos Gianakakos

President and Chief Executive Officer

MyoKardia, Inc.

333 Allerton Ave.

South San Francisco, California 94080

(650) 741-0900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Mitchell S. Bloom, Esq. Maggie L. Wong, Esq. Goodwin Procter LLP Three Embarcadero Center, 24th Floor San Francisco, California 94111 (415) 733-6000 |

Tassos Gianakakos President and Chief Executive Officer MyoKardia, Inc. 333 Allerton Ave. South San Francisco, California 94080 (650) 741-0900 |

B. Shayne Kennedy, Esq. Brian J. Cuneo, Esq. Latham & Watkins LLP 140 Scott Drive Menlo Park, CA 94025 (650) 328-4600 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ¨ | Accelerated Filer | ¨ | |||

| Non-Accelerated Filer | x (Do not check if a smaller reporting company) | Smaller Reporting Company | ¨ | |||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED SEPTEMBER 26, 2016

PRELIMINARY PROSPECTUS

Shares

Common Stock

MyoKardia, Inc. is offering 3,800,000 shares of common stock. Our common stock is listed on The NASDAQ Global Select Market under the symbol “MYOK.” The closing price of our common stock on The NASDAQ Global Select Market on September 23, 2016, was $16.92 per share.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, as amended, and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 8.

| Price to Public |

Underwriting |

Proceeds, before expenses, to | ||||

| Per Share |

$ | $ | $ | |||

| Total |

$ | $ | $ |

| (1) | The underwriters will receive compensation in addition to underwriting discounts and commissions. See “Underwriting” beginning on page 88 for additional information regarding underwriting compensation. |

We have granted the underwriters an option to purchase up to 570,000 additional shares of our common stock from us at the public offering price, less underwriting discounts and commissions. The underwriters can exercise this option at any time within 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Sanofi, our strategic collaboration partner and one of our existing stockholders (through its wholly owned subsidiary Aventis Inc.), has indicated an interest in purchasing up to an aggregate of approximately 450,000 shares of our common stock in this offering at the public offering price and on the same terms as the other purchasers in this offering. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell fewer shares to Sanofi than it indicated an interest in purchasing or sell no shares to Sanofi, and Sanofi could determine to purchase fewer shares than it indicated an interest in purchasing or purchase no shares in this offering. The underwriters will receive the same underwriting discount on any shares purchased by Sanofi as they will on any other shares sold to the public in this offering.

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2016.

| Credit Suisse | Cowen and Company | BMO Capital Markets | ||

| Wedbush PacGrow | ||||

The date of this prospectus is , 2016

Table of Contents

Prospectus

| Page | ||||

| 1 | ||||

| 8 | ||||

| 45 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 53 | ||||

| 74 | ||||

| 77 | ||||

| 82 | ||||

| MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX CONSEQUENCES TO NON-U.S. HOLDERS |

84 | |||

| 88 | ||||

| 94 | ||||

| 94 | ||||

| 94 | ||||

| 95 | ||||

We and the underwriters have not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing or incorporated by reference in this prospectus is accurate only as of its date. Our business, financial condition, results of operations and prospects may have changed since the respective dates of such information.

For investors outside of the United States: We have not, and the underwriters have not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

Table of Contents

This summary highlights information contained elsewhere and incorporated by reference in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including the section titled “Risk Factors” and the information in our filings with the U.S. Securities and Exchange Commission, or the SEC, incorporated by reference in this prospectus. Unless the context suggests otherwise, all references to “us,” “our,” “MyoKardia,” “we,” the “Company” and similar designations refer to MyoKardia, Inc. and, where appropriate, our subsidiary.

MyoKardia, Inc.

Our Company

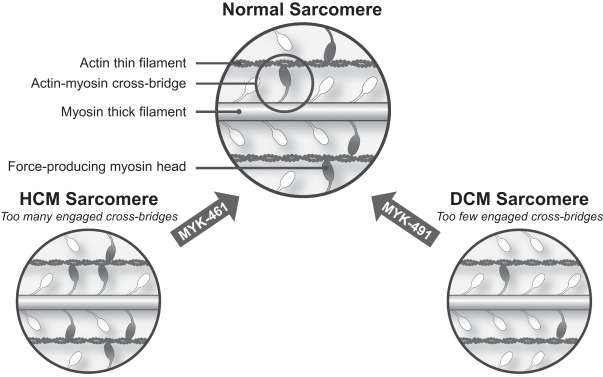

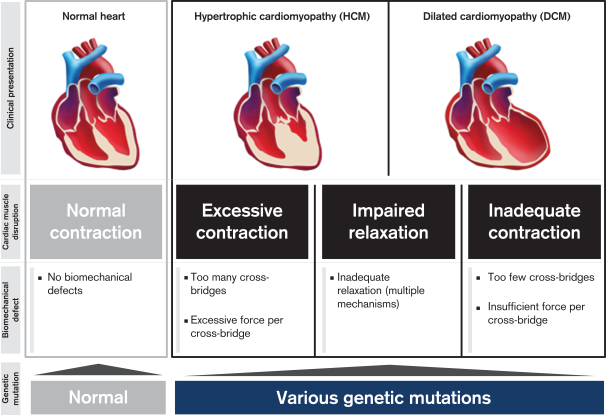

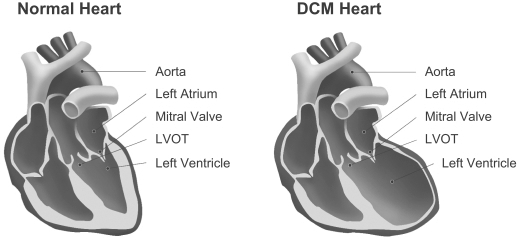

We are a clinical stage biopharmaceutical company pioneering a precision medicine approach to discover, develop and commercialize targeted therapies for the treatment of serious and neglected rare cardiovascular diseases. Our initial focus is on the treatment of heritable cardiomyopathies, a group of rare, genetically-driven forms of heart failure that result from biomechanical defects in cardiac muscle contraction. We have used our precision medicine platform to generate a robust pipeline of therapeutic programs for the chronic treatment of the two most common forms of heritable cardiomyopathy—hypertrophic cardiomyopathy, or HCM, and dilated cardiomyopathy, or DCM. We have generated several proprietary, orally administered small molecules to address a variety of biomechanical defects that cause disruptions in heart muscle contraction. By correcting the underlying biomechanical defects, we believe our targeted therapies can correct or offset the downstream disruption in cardiac muscle function that drives disease progression.

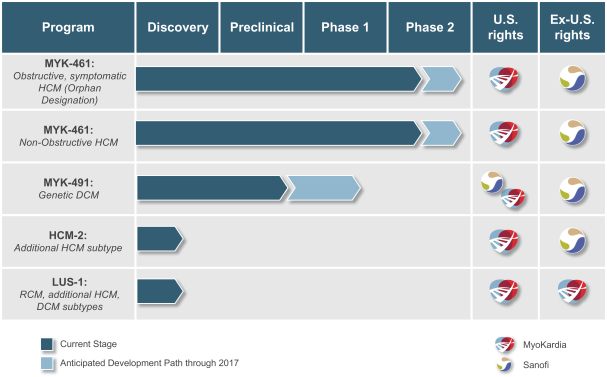

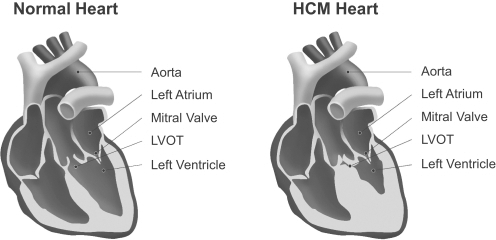

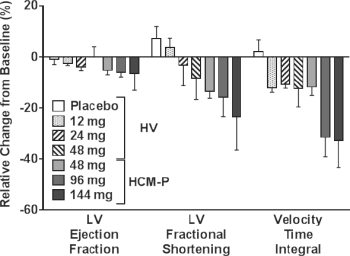

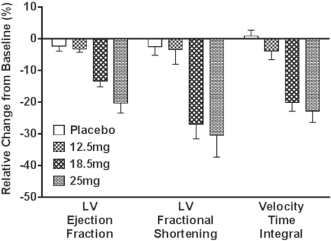

Our lead product candidate, MYK-461, is designed to reduce excessive cardiac muscle contractility leading to HCM. In September 2016, we began to initiate clinical sites to begin screening for patients in a Phase 2 clinical trial of MYK-461, which we refer to as PIONEER-HCM. In three Phase 1 clinical trials, we have observed favorable tolerability of single and multiple doses of MYK-461 in both healthy volunteers and HCM patients. Across the same group of trial subjects, we have demonstrated proof of mechanism, or the ability of MYK-461 to reduce cardiac muscle contraction, an important biomarker of disease. Additionally, we generated preliminary evidence in two patients with obstructive HCM that leads us to believe that MYK-461 has the potential to be effective in reducing obstruction of the left ventricular outflow tract, or LVOT. In 2016, MYK-461 was granted Orphan Drug Designation by the FDA for the treatment of symptomatic, obstructive HCM. We believe that if approved, MYK-461 would be the first targeted therapy to treat an underlying biomechanical defect leading to HCM. Our second product candidate, MYK-491, is designed to treat genetic DCM by restoring normal contractility in the diseased DCM heart. We intend to initiate a Phase 1 clinical trial of MYK-491 in the first half of 2017 and report topline results in the third quarter of 2017. In preclinical animal models, MYK-491 has been shown in separate experiments to improve systolic function (cardiac muscle contractility and cardiac output) with minimal impact on diastolic function. We believe that if approved, MYK-491 would be the first targeted therapy to treat an underlying biomechanical defect leading to DCM. Additionally, we have two discovery programs, HCM-2 and LUS-1. HCM-2 is intended to reduce cardiac muscle contractility to normal levels in HCM patients through a different mechanism than that of MYK-461. LUS-1 is intended to counteract a muscle disruption that results in impaired relaxation of the heart, a biomechanical defect found in specific HCM and genetic DCM patient subgroups, as well as in other less common heritable cardiomyopathies.

We have formed a strategic collaboration with Sanofi S.A., or Sanofi, to help fund a portion of our research and development expenses while leveraging Sanofi’s cardiovascular and rare disease expertise in exchange for certain program and product rights, pursuant to a license and collaboration agreement we entered into in August 2014 with Aventis Inc., a wholly-owned subsidiary of Sanofi, which we refer to as the Collaboration Agreement.

1

Table of Contents

In the United States, we retain the right to commercialize MYK-461 and HCM-2 as well as co-promotion rights for MYK-491. Additionally, we are entitled to receive tiered royalties in the mid-single digits to the mid-teens on net sales of certain HCM and DCM products outside the United States and on net sales of certain DCM products in the United States. We retain all rights to our LUS-1 program and our future programs.

Risks Associated with Our Business

Our business is subject to numerous risks that you should be aware of before making an investment decision. These risks are described more fully in the section entitled “Risk Factors” in this prospectus. These risks include, among others:

| • | We are a very early-stage company with a limited operating history, have incurred significant losses since our inception, and we anticipate that we will continue to incur significant losses for the foreseeable future and may never generate any revenue from product sales or be profitable; |

| • | Our precision medicine approach to the discovery and development of drugs for heritable cardiomyopathies is novel and may never lead to marketable products; |

| • | We are heavily dependent upon the success of MYK-461, which is in the early stages of clinical development, and all of our other programs are in discovery or preclinical development; |

| • | Preclinical and clinical drug development involves a lengthy and expensive process with an uncertain outcome, and we may never obtain regulatory approval for any product candidates; |

| • | We are substantially dependent on our collaboration agreement with Sanofi, and if this collaboration is unsuccessful or is terminated, for which Sanofi must make a decision as to whether to continue the collaboration prior to December 31, 2016, we will not receive additional funding from this relationship and may not be able to successfully commercialize certain product candidates, including MYK-461; |

| • | If we are unable to obtain and maintain sufficient intellectual property protection for our product candidates or our platform technology, we may not be able to compete effectively; |

| • | Even if this offering is successful, we will need to raise additional funding before we can expect to complete the development of any of our product candidates or generate any revenue from product sales; and |

| • | Our success depends in part upon our ability to retain our key employees, consultants and advisors and to attract, retain and motivate other qualified personnel. |

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended, or the JOBS Act. As an emerging growth company, we have elected to take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

| • | reduced disclosure about our executive compensation arrangements; |

| • | no non-binding advisory votes on executive compensation or golden parachute arrangements; and |

| • | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We may take advantage of these exemptions for up to five years from our initial public offering or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company on the date that is the earliest of (i) the last day of the fiscal year in which we have total annual gross revenues of $1.0 billion or more; (ii) December 31, 2020; (iii) the date on which we have issued more than $1.0 billion in nonconvertible debt during the previous three years; or (iv) the last day of the fiscal year in which we

2

Table of Contents

are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission, or SEC, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the prior June 30th. We may choose to take advantage of some but not all of these exemptions. We have taken advantage of reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different from the information you receive from other public companies in which you hold stock. Also, we have irrevocably elected to “opt out” of the exemption for the delayed adoption of certain accounting standards and, therefore, will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Corporate History and Information

We were incorporated under the laws of the State of Delaware in June 2012. Our principal executive office is located at 333 Allerton Ave., South San Francisco, California 94080, and our telephone number is (650) 741-0900. Our website address is www.myokardia.com. We do not incorporate the information on or accessible through our website into this prospectus, and you should not consider any information on, or that can be accessed through, our website as part of this prospectus.

We use various trademarks and trade names in our business, including without limitation our corporate name and logo. All other trademarks or trade names referred to in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

3

Table of Contents

THE OFFERING

| Common stock offered by us |

3,800,000 shares of common stock |

| Common stock to be outstanding after this offering |

30,812,201 shares of common stock |

| Underwriters’ option |

We have granted the underwriters an option to purchase a maximum of 570,000 additional shares of common stock from us. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

| Use of Proceeds |

We estimate that we will receive net proceeds from the sale of shares of our common stock in this offering of approximately $59.8 million, or $68.9 million if the underwriters fully exercise their option to purchase additional shares, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, assuming an offering price of $16.92 per share, the closing price of our common stock on The NASDAQ Global Select Market on September 23, 2016. We intend to use the net proceeds from this offering and our existing cash and cash equivalents to fund the advancement of our MYK-461 clinical development program, the progression of MYK-491 through clinical proof-of-concept, our ongoing preclinical, discovery and research programs and the expansion of our platform, as well as for working capital and general corporate purposes. See “Use of Proceeds” for additional information. |

| Risk Factors |

You should read carefully “Risk Factors” beginning on page 8 and other information included in, or incorporated by reference into, this prospectus for a discussion of factors that you should consider before deciding to invest in shares of our common stock. |

| NASDAQ Global Select Market Symbol |

MYOK |

Sanofi, our strategic collaboration partner and one of our existing stockholders (through its wholly owned subsidiary Aventis Inc.), has indicated an interest in purchasing up to an aggregate of approximately 450,000 shares of our common stock in this offering at the public offering price and on the same terms as the other purchasers in this offering. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell fewer shares to Sanofi than it indicated an interest in purchasing or sell no shares to Sanofi, and Sanofi could determine to purchase fewer shares than it indicated an interest in purchasing or purchase no shares in this offering.

The number of shares of common stock to be outstanding after this offering is based on 27,012,201 shares of common stock outstanding as of June 30, 2016, assumes the sale of 3,800,000 shares of common stock in this offering at an assumed offering price of $16.92 per share, the closing price of our common stock on The NASDAQ Global Select Market on September 23, 2016, and excludes:

| • | 2,044,636 shares of common stock issuable upon exercise of outstanding options as of June 30, 2016 at a weighted average exercise price of $4.96 per share; |

4

Table of Contents

| • | 34,000 shares of common stock issuable upon exercise of options granted subsequent to June 30, 2016 at a weighted-average exercise price of $16.38 per share; |

| • | 837,066 shares of common stock reserved for future issuance under our 2015 Stock Option and Incentive Plan, or the 2015 Plan, as of June 30, 2016; and |

| • | 229,971 shares of common stock reserved for future issuance under our 2015 Employee Stock Purchase Plan, or the 2015 ESPP, as of June 30, 2016. |

Except as otherwise indicated, all information in this prospectus assumes no exercise by the underwriters of their option to purchase a maximum of 570,000 additional shares of our common stock from us in this offering at the public offering price.

5

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables present summary consolidated financial data for our business. We derived the following financial statements of operations data for the years ended December 31, 2014 and 2015 from our audited financial statements. We derived the following consolidated statements of operations data for the six months ended June 30, 2015 and 2016 and the consolidated balance sheet data as of June 30, 2016 from our unaudited interim consolidated financial statements. The unaudited interim consolidated financial statements were prepared on a basis consistent with our audited financial statements and include, in management’s opinion, all adjustments, consisting only of normal recurring adjustments that we consider necessary for the fair statement of the financial information set forth in those statements. You should read this summary financial data together with the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2015 and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2016, and our financial statements and related notes included therein, each of which is incorporated by reference in this prospectus. Our historical results are not necessarily indicative of our future results and interim results are not necessarily indicative of results to be expected for the full year or any other period.

| Year Ended December 31, |

Six Months Ended June 30, |

|||||||||||||||

| 2014 | 2015 | 2015 | 2016 | |||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||

| Consolidated Statement of Operations Data: | ||||||||||||||||

| Collaboration and license revenue |

$ | 5,916 | $ | 14,199 | $ | 7,099 | $ | 7,099 | ||||||||

| Operating expenses |

||||||||||||||||

| Research and development |

18,296 | 28,393 | 13,345 | 17,409 | ||||||||||||

| General and administrative |

4,838 | 9,019 | 3,661 | 7,916 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

23,134 | 37,412 | 17,006 | 25,325 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(17,218 | ) | (23,213 | ) | (9,907 | ) | (18,226 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Interest and other income, net |

2 | (47 | ) | 18 | 46 | |||||||||||

| Change in fair value of redeemable convertible preferred stock call option liability |

387 | 314 | 314 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss and comprehensive loss |

(16,829 | ) | (22,946 | ) | (9,575 | ) | (18,180 | ) | ||||||||

| Cumulative dividend relating to redeemable convertible preferred stock |

(2,864 | ) | (5,151 | ) | (2,630 | ) | — | |||||||||

| Accretion of redeemable convertible preferred stock to redemption value |

(158 | ) | (98 | ) | (62 | ) | — | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss attributable to common stockholders |

$ | (19,851 | ) | $ | (28,195 | ) | $ | (12,267 | ) | $ | (18,180 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share attributable to common stockholders, basic and diluted(1) |

$ | (11.30 | ) | $ | (4.48 | ) | $ | (5.24 | ) | $ | (0.69 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average number of common shares used to compute net loss per share, basic and diluted(1) |

1,756,900 | 6,292,800 | 2,342,787 | 26,284,630 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | See Note 9 to our audited consolidated financial statements incorporated by reference in this prospectus from our Annual Report on Form 10-K for the year ended December 31, 2015 and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2016, respectively, for an explanation of the calculations of our basic and diluted net loss per share attributable to common stockholders and the weighted-average number of shares used in the computation of the per share amounts. |

6

Table of Contents

| As of June 30, 2016 |

||||||||

| Actual | As Adjusted(1)(2) |

|||||||

| (unaudited) | ||||||||

| (in thousands) | ||||||||

| Balance Sheet Data: |

||||||||

| Cash and cash equivalents |

$ | 87,615 | $ | 147,403 | ||||

| Working capital |

74,410 | 134,198 | ||||||

| Total assets |

91,900 | 151,688 | ||||||

| Additional paid-in capital |

159,918 | 219,706 | ||||||

| Accumulated deficit |

(82,865 | ) | (82,865 | ) | ||||

| Total stockholders’ equity |

77,056 | 136,844 | ||||||

| (1) | The as adjusted column reflects the sale by us of 3,800,000 shares of our common stock in this offering at an assumed public offering price of $16.92 per share, which was the closing price of our common stock on The NASDAQ Global Select Market on September 23, 2016 after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| (2) | Each increase (decrease) of $1.00 in the assumed public offering price of $16.92 per share, which was the closing price of our common stock on The NASDAQ Global Select Market on September 23, 2016, would increase (decrease) the amount of cash and cash equivalents, working capital, total assets and total stockholders’ equity by $3.6 million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions, and estimated offering expenses payable by us. We may also increase or decrease the aggregate number of shares we are offering. A 1,000,000 increase (decrease) in the number of shares offered by us would increase (decrease) the as-adjusted amount of cash and cash equivalents, working capital, total assets and total stockholders’ equity by approximately $15.9 million, assuming that the assumed public offering price per share, as set forth on the cover page of this prospectus, remains the same, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. The as-adjusted information discussed above is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing. |

7

Table of Contents

Investing in our common stock involves a high degree of risk. You should consider carefully the following risks, together with all the other information included and incorporated by reference in this prospectus, including our financial statements and notes thereto, before you invest in our common stock. If any of the following risks actually materializes, our operating results, financial condition and liquidity could be materially adversely affected. As a result, the trading price of our common stock could decline and you could lose all or part of your investment.

Risks Related to Our Limited Operating History, Financial Condition and Capital Requirements

Our limited operating history may make it difficult for you to evaluate the success of our business to date and to assess our future viability.

We are a very early-stage company. We were incorporated and commenced operations in June 2012. Our operations to date have been limited to organizing and staffing our company, business planning, raising capital, developing our technology, creating and expanding on our precision medicine platform, identifying potential product candidates, undertaking preclinical studies for our programs and commencing and conducting Phase 1 clinical trials for our most advanced product candidate, MYK-461. We have not yet demonstrated our ability to successfully complete the clinical development of a product candidate, including the completion of any clinical trials designed to show the efficacy of a product candidate, obtain marketing approvals, manufacture a commercial scale medicine, or arrange for a third party to do so on our behalf, or conduct sales and marketing activities necessary for successful commercialization. Typically, it takes many years to develop a new medicine from the time it is discovered to when it is available for treating patients. Consequently, any predictions you make about our future success or viability may not be as accurate as they could be if we had a longer operating history.

In addition, as a new business, we may encounter unforeseen expenses, difficulties, complications, delays and other known and unknown factors. We will need to transition from a company with a research focus to a company capable of supporting larger scale clinical development and commercial activities. If we are not successful in such a transition, our business, results and financial condition will be harmed.

We have a history of significant losses and may not achieve or sustain profitability and, as a result, you may lose all or part of your investment.

Our lead product candidate, MYK-461, is in the early stages of clinical testing and we must conduct significant additional clinical trials before we can seek the regulatory approvals necessary to begin commercial sales of MYK-461 or any other product candidates we may develop. We have incurred operating losses in each year since our inception due to costs incurred in connection with our research and development activities and general and administrative costs associated with our operations. Our net loss for the years ended December 31, 2014 and 2015 was $16.8 million and $22.9 million, respectively. As of June 30, 2016, we had an accumulated deficit of $82.9 million. We expect to incur increasing losses for several years as we continue our research activities and conduct development of, and seek regulatory approvals for, our initial product candidates, and commercialize any approved drugs. If our product candidates fail in clinical trials or do not gain regulatory approval, or if our product candidates do not achieve market acceptance, we will not be profitable. If we fail to become and remain profitable, or if we are unable to fund our continuing losses, you could lose all or part of your investment.

We have never generated any revenue from product sales and may never be profitable.

Our ability to generate revenue and achieve profitability depends on our ability, alone or with strategic collaborators, to successfully complete the development of, and obtain the regulatory approvals necessary to

8

Table of Contents

commercialize, our product candidates. We do not anticipate generating revenues from product sales for the foreseeable future, if ever. Our ability to generate future revenue from product sales depends heavily on our success in:

| • | completing research and preclinical and clinical development of our product candidates; |

| • | seeking and obtaining regulatory approvals to market product candidates for which we complete clinical trials; |

| • | developing a sustainable, scalable, reproducible and transferable manufacturing process for our product candidates; |

| • | establishing and maintaining supply and manufacturing relationships with third parties that can provide adequate (in amount and quality) products and services to support clinical development and the market demand, if any, for our product candidates, if approved; |

| • | launching and commercializing product candidates for which we obtain regulatory approval, either through a collaboration or, if launched independently, by establishing a sales force, marketing and distribution infrastructure; |

| • | obtaining market acceptance of our product candidates and the use of precision medicine as a viable treatment option for cardiovascular diseases; |

| • | addressing any competing technological and market developments; |

| • | implementing additional internal systems and infrastructure, as needed; |

| • | identifying and validating new product candidates from our platform; |

| • | maintaining our existing collaboration agreement with Sanofi and negotiating favorable terms in any new collaboration, licensing or other arrangements into which we may enter; |

| • | maintaining, protecting and expanding our portfolio of intellectual property rights, including patents, trade secrets and know-how; and |

| • | attracting, hiring and retaining qualified personnel who are suitable to our culture and mission. |

Even if one or more of the product candidates that we are developing is approved for commercial sale, we anticipate incurring significant costs associated with commercializing any approved product candidate. Our expenses could increase beyond our expectations if we are required by the U.S. Food and Drug Administration (the “FDA”), the European Medicines Agency (the “EMA”) or other regulatory agencies, domestic or foreign, to perform clinical trials and other studies in addition to those that we currently anticipate. Even if we are able to generate revenues from the sale of any approved products, we may not become profitable and may need to obtain additional funding to continue operations.

Even if this offering is successful, we will need to raise additional funding, which may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product development efforts or other operations.

We are currently advancing MYK-461, our lead product candidate, through clinical development, and conducting preclinical discovery and development activities in our other programs, including Investigational New Drug (IND)-enabling studies for MYK-491, our development candidate in DCM. Drug development is expensive, and we expect our research and development expenses to increase substantially in connection with our ongoing activities, particularly as we advance our product candidates in clinical trials.

As of June 30, 2016, our cash and cash equivalents were $87.6 million. We intend to use our cash and cash equivalents, together with the net proceeds from this offering, to fund the advancement of our MYK-461 clinical development program, the progression of MYK-491 through clinical proof-of-concept, our ongoing preclinical,

9

Table of Contents

discovery and research programs and the expansion of our platform, as well as for working capital and general corporate purposes. However, our operating plan may change as a result of many factors currently unknown to us, and we may need to seek additional funds sooner than planned, through public or private equity or debt financings, government or other third-party funding, marketing and distribution arrangements and other collaborations, strategic and licensing arrangements or a combination of these approaches. In any event, we will require additional capital to obtain regulatory approval for, and to commercialize, MYK-461 and our other product candidates. Even if we believe we have sufficient funds for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific strategic considerations.

Our funding requirements and the timing of our need for additional capital are subject to change based on a number of factors, including:

| • | the rate of progress and the cost of our ongoing and planned clinical trials of MYK-461 and any future clinical trials of MYK-491; |

| • | whether Sanofi determines to terminate or continue with our collaboration, which decision will come prior to December 31, 2016, and, as a result, whether we will receive any additional funding pursuant to the Collaboration Agreement and timing thereof; |

| • | the number of product candidates that we intend to develop using our precision medicine platform; |

| • | the costs of research and preclinical studies, including our IND-enabling studies for MYK-491, to support the advancement of additional product candidates into clinical development; |

| • | the timing of, and costs involved in, seeking and obtaining approvals from the FDA and comparable foreign regulatory authorities, including the potential by the FDA or comparable regulatory authorities to require that we perform more studies than those that we current expect; |

| • | the costs of preparing to manufacture MYK-461 on a larger scale, and to manufacture MYK-491 for clinical development; |

| • | the costs of commercialization activities if MYK-461 or any future product candidate is approved, including the formation of a sales force; |

| • | the degree and rate of market acceptance of any products launched by us or our partners; |

| • | the costs of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights; |

| • | our need and ability to hire additional personnel; |

| • | our ability to enter into additional collaboration, licensing, commercialization or other arrangements and the terms and timing of such arrangements; and |

| • | the emergence of competing technologies or other adverse market developments. |

Any additional fundraising efforts may divert our management from their day-to-day activities, which may adversely affect our ability to develop and commercialize our product candidates. In addition, we cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. Moreover, the terms of any financing may adversely affect the holdings or the rights of our stockholders and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our shares to decline. The sale of additional equity or convertible securities would dilute all of our stockholders. The incurrence of indebtedness would result in increased fixed payment obligations and we may be required to agree to certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. We could also be required to seek funds through arrangements with collaborative partners or otherwise at a different stage than otherwise would be

10

Table of Contents

desirable and we may be required to relinquish rights to some of our technologies or product candidates or otherwise agree to terms unfavorable to us, any of which may have a material adverse effect on our business, operating results and prospects.

If we are unable to obtain funding on a timely basis, we may be required to significantly curtail, delay or discontinue one or more of our research or development programs or the commercialization of any product candidates or be unable to expand our operations or otherwise capitalize on our business opportunities, as desired, which could materially and adversely affect our business, financial condition and results of operations.

Our reported financial results may be adversely affected by changes in accounting principles generally accepted in the U.S.

We prepare our financial statements in conformity with accounting principles generally accepted in the U.S. These accounting principles are subject to interpretation by the Financial Accounting Standards Board (“FASB”) and the Securities and Exchange Commission. A change in these policies or interpretations could have a significant effect on our reported financial results, may retroactively affect previously reported results, could cause unexpected financial reporting fluctuations, and may require us to make costly changes to our operational processes and accounting systems. In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers which supersedes nearly all existing U.S. GAAP revenue recognition guidance. The new standard and its amendments will be effective for our fiscal year 2018 with early adoption permitted for our fiscal year 2017. Although we are currently in the process of evaluating the impact of ASU 2014-09 on our consolidated financial statements, it could change the way we account for certain of our revenue transactions. Thus, adoption of the standard could have a significant impact on our financial statements and may retroactively affect the accounting treatment of transactions completed before adoption. See “Note 2—Summary of Significant Accounting Policies” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 incorporated by reference herein for additional discussion of the accounting changes.

Risks Related to Our Precision Medicine Platform and the Discovery and Development of Our Product Candidates

The precision medicine approach we are taking to discover and develop drugs for heritable cardiovascular diseases is novel and may never lead to marketable products.

We have concentrated our therapeutic product research and development efforts on the application of precision medicine to the treatment of heritable cardiovascular diseases, and our future success depends on the successful development of products based on our precision medicine platform and the continued development of this platform. We believe we are the first company to apply precision medicine to the treatment of cardiovascular disease, and neither we nor any other company has received regulatory approval to market therapeutics specifically targeting any form of heritable cardiomyopathy. The scientific discoveries that form the basis for our efforts to discover and develop product candidates are novel, and the scientific evidence to support the feasibility of developing product candidates based on these discoveries is both preliminary and limited. If we do not successfully develop and commercialize product candidates based upon our technological approach, we will not become profitable and the value of our common stock may decline.

Further, our focus solely on precision medicine for the development of drugs for heritable cardiomyopathies as opposed to multiple, more proven technologies for drug development increases the risks associated with the ownership of our common stock. If we are not successful in developing any product candidates using our precision medicine platform, we may be required to change the scope and direction of our product development activities. In that case, we may not be able to identify and implement successfully an alternative product development strategy, which would materially and adversely affect our business, financial condition and results of operations.

11

Table of Contents

We depend heavily on the success of MYK-461, our lead product candidate. Other than MYK-461, all of our other programs are in discovery or preclinical development. Preclinical testing and clinical trials of our product candidates may not be successful. If we are unable to commercialize our product candidates or experience significant delays in doing so, our business will be materially harmed.

We have invested a significant portion of our efforts and financial resources in the identification of our lead product candidate, MYK-461, for the treatment of HCM. We are currently evaluating MYK-461 in early-stage clinical trials for HCM, and, if MYK-461 fails to demonstrate safety or efficacy to the satisfaction of the FDA or other comparable regulatory authorities, we will need to identify and rely on other product candidates or target indications, or both, for clinical development. All of our other programs are still in discovery or preclinical development. Our ability to generate revenue from product sales, which we do not expect will occur for many years, if ever, will depend heavily on the successful development and eventual commercialization of MYK-461 or other product candidates that we may identify from our precision medicine platform.

The success of MYK-461 and any other product candidates that we discover and develop will depend on many factors, including the following:

| • | timely and successful initiation, enrollment in, and completion of, clinical trials, including our planned Phase 2 clinical trial of MYK-461 in HCM; |

| • | receipt of marketing approvals from applicable regulatory authorities; |

| • | establishing commercial manufacturing capabilities or making arrangements with third-party manufacturers; |

| • | obtaining and maintaining patent and trade secret protection and non-patent exclusivity for our medicines; |

| • | launching commercial sales of our products, if and when approved, whether alone or in collaboration with others; |

| • | acceptance of our products, if and when approved, by patients, the medical community and third-party payors; |

| • | effectively competing with other therapies; |

| • | a continued acceptable safety profile of our products following approval; |

| • | enforcing and defending intellectual property rights and claims; and |

| • | achieving desirable medicinal properties for the intended indications. |

If we do not achieve one or more of these factors in a timely manner or at all, we could experience significant delays or an inability to successfully commercialize our product candidates, which would materially harm our business.

Preclinical and clinical drug development involves a lengthy and expensive process with an uncertain outcome, and observations and results from earlier studies and trials may not be applicable or predictive in future clinical trials.

Preclinical and clinical testing is expensive and can take many years to complete, and its outcome is inherently uncertain. Failure can occur at any time during the preclinical development or clinical trial process. The results of preclinical studies and early clinical trials of our product candidates may not be predictive of the results of later-stage clinical trials. For example, although our preclinical observations and initial data from our Phase 1 clinical trials of MYK-461 support our hypothesis that MYK-461 has the potential to reduce cardiac muscle contractility and our belief that such data have demonstrated clinical proof of mechanism in both HCM patients and healthy volunteers, we have not completed clinical trials of MYK-461 in larger populations. In addition, our precision medicine platform is based on a translational medicine approach. Translational medicine,

12

Table of Contents

or the application of basic scientific findings to develop therapeutics that promote human health, is subject to a number of inherent risks. In particular, scientific hypotheses formed from preclinical or early clinical observations may prove to be incorrect, and the data generated in animal models or observed in limited patient populations may be of limited value, and may not be applicable in clinical trials conducted under the controlled conditions required by applicable regulatory requirements and our protocols. For example, although MYK-461 has been observed to reduce cardiac contractility as measured by certain established biomarkers in our first Phase 1 clinical trial in healthy volunteers, the predictive value of these biomarkers in HCM patients may prove to be less than anticipated in subsequent, larger clinical trials. The initial clinical data from our Phase 1 clinical trials of MYK-461 are preliminary in nature, based on limited doses and a small sample size, and the clinical development of MYK-461 is not complete. Early positive data may not be repeated or observed in ongoing or future trials involving our product candidates. Product candidates in later stages of clinical trials may fail to show the desired safety and efficacy traits despite having progressed through preclinical studies and initial clinical trials. There is a high failure rate for drugs and biologics proceeding through clinical trials, particularly in the field of cardiovascular medicine. A number of companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in clinical development even after achieving promising results in earlier studies, and any such setbacks in our clinical development could have a material adverse effect on our business and operating results.

We may encounter substantial delays in our clinical trials or we may fail to demonstrate safety and efficacy to the satisfaction of applicable regulatory authorities.

Before obtaining marketing approval from regulatory authorities for the sale of our product candidates, we must conduct extensive clinical trials to demonstrate the safety and efficacy of the product candidates in humans. Clinical testing is expensive, time-consuming and uncertain as to outcome. We cannot guarantee that any clinical trials will be conducted as planned or completed on schedule, if at all. A failure of one or more clinical trials can occur at any stage of testing. We may experience delays in our ongoing clinical trials and we do not know whether planned clinical trials will begin on time, need to be redesigned, enroll patients on time or be completed on schedule, if at all. Additionally, although we believe that our precision medicine approach should eliminate the need for MYK-461 to undergo the large outcomes-based studies that are often required for cardiovascular drugs as a condition to regulatory approval by the FDA or other regulatory authorities, regulatory authorities may nevertheless require us to conduct additional trials or generate additional data, including potential trials studying the interaction of our product candidates with other therapeutics commonly administered in the patient populations we are seeking to treat, which would increase the time and cost of our clinical development process. For example, our Phase 2 PIONEER-HCM trial of MYK-461 in HCM patients is designed to enroll 10 patients and to evaluate change in LVOT gradient as a primary endpoint; however, we will need to conduct larger clinical trials, and the FDA may subsequently require us to evaluate a larger number of patients than we presently anticipate, or to assess other endpoints, in order to support regulatory approval.

Clinical trials can be delayed for a variety of reasons, including:

| • | delays in reaching a consensus with regulatory agencies on trial design; |

| • | delays in reaching agreement on acceptable terms with prospective CROs and clinical trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and clinical trial sites; |

| • | delays in obtaining required Institutional Review Board (“IRB”) approval at each clinical trial site; |

| • | delays in recruiting and enrolling suitable patients to participate in our clinical trials; |

| • | imposition of a clinical hold by regulatory agencies, after an inspection of our clinical trial operations or trial sites; |

| • | failure by our CROs, other third parties or us to adhere to clinical trial requirements; |

13

Table of Contents

| • | failure by us or our CROs or other third-party contractors to perform clinical trials in accordance with the FDA’s good clinical practice (“GCP”) requirements or applicable regulatory guidelines in other countries; |

| • | delays in the testing, validation, manufacturing and delivery of our product candidates to the clinical sites; |

| • | delays in having patients complete participation in a study or return for post-treatment follow-up; |

| • | clinical trial sites deviating from a trial protocol or dropping out of a trial; |

| • | clinical trial subjects failing to comply with the trial regimen or dropping out of a trial; |

| • | adding new clinical trial sites; |

| • | failure to manufacture or supply sufficient quantities of product candidates for use in clinical trials; |

| • | occurrence of serious adverse events associated with the product candidate that are viewed to outweigh its potential benefits; or |

| • | changes in regulatory requirements and guidance that require amending or submitting new clinical protocols. |

We could encounter delays if a clinical trial is suspended or terminated by us, by the IRBs of the institutions in which such trials are being conducted, or suspension or termination is recommended by the Data Safety Monitoring Board (“DSMB”) for such trial or by the FDA or other regulatory authorities. Such authorities may impose such a suspension or termination due to a number of factors, including failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols, inspection of the clinical trial operations or trial site by the FDA or other regulatory authorities resulting in the imposition of a clinical hold, unforeseen safety issues or adverse side effects, failure to demonstrate a benefit from using a drug, changes in governmental regulations or administrative actions or lack of adequate funding to continue the clinical trial.

Moreover, principal investigators for our clinical trials may serve as scientific advisors or consultants to us from time to time and receive compensation in connection with such services. Under certain circumstances, we may be required to report some of these relationships to the FDA or other regulatory authority. The FDA or other regulatory authority may conclude that a financial relationship between us and a principal investigator has created a conflict of interest or otherwise affected interpretation of the study. The FDA or other regulatory authority may therefore question the integrity of the data generated at the applicable clinical trial site and the utility of the clinical trial itself may be jeopardized. This could result in a delay in approval, or rejection, of our marketing applications by the FDA or other regulatory authority, as the case may be, and may ultimately lead to the denial of marketing approval of one or more of our product candidates.

Any inability to successfully complete preclinical and clinical development could result in additional costs to us or impair our ability to generate revenues from product sales, regulatory and commercialization milestones and royalties. In addition, if we make manufacturing or formulation changes to our product candidates, we may need to conduct additional studies to bridge our modified product candidates to earlier versions. Clinical trial delays could also shorten any periods during which we may have the exclusive right to commercialize our product candidates or allow our competitors to bring products to market before we do, which could impair our ability to successfully commercialize our product candidates and may harm our business and results of operations. In addition, many of the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our product candidates.

If the results of our clinical trials are inconclusive or if there are safety concerns or adverse events associated with our product candidates, we may:

| • | be delayed in obtaining marketing approval for our product candidates, if at all; |

| • | obtain approval for indications or patient populations that are not as broad as intended or desired; |

| • | obtain approval with labeling that includes significant use or distribution restrictions or safety warnings; |

14

Table of Contents

| • | be subject to changes in the way the product is administered; |

| • | be required to perform additional clinical trials to support approval or be subject to additional post-marketing testing requirements; |

| • | have regulatory authorities withdraw their approval of the product or impose restrictions on its distribution in the form of a modified risk evaluation and mitigation strategy (“REMS”); |

| • | be subject to the addition of labeling statements, such as warnings or contraindications; |

| • | be sued; or |

| • | experience damage to our reputation. |

We may find it difficult to enroll patients in our clinical trials, which could delay or prevent clinical trials of our product candidates.

Identifying and qualifying patients to participate in clinical trials of our product candidates is critical to our success. The timing to commence and complete our clinical trials depends on the speed at which we can recruit patients to participate in testing our product candidates. If patients are unwilling to participate in our clinical trials because of a lack of familiarity with our approach to the treatment of cardiovascular diseases, negative publicity from adverse events in biotechnology or the fields of precision medicine or cardiovascular disease or for other reasons, including competitive clinical trials for similar patient populations, our timelines for recruiting patients, conducting clinical trials and obtaining regulatory approval of potential products may be delayed. These delays could result in increased costs, delays in advancing our product development, delays in testing the effectiveness of our technology or termination of our clinical trials altogether.

We may not be able to identify, recruit and enroll a sufficient number of patients, or those with required or desired characteristics to achieve diversity in a study, to complete our clinical trials in a timely manner. Patient enrollment is affected by factors including:

| • | severity of the disease under investigation; |

| • | design of the clinical trial protocol; |

| • | size and nature of the patient population; |

| • | eligibility criteria for the clinical trial in question; |

| • | perceived risks and benefits of the product candidate under study in relation to other available therapies, including any new drugs that may be approved for the indications we are investigating; |

| • | proximity and availability of clinical trial sites for prospective patients; |

| • | availability of competing therapies and clinical trials; |

| • | efforts to facilitate timely enrollment in clinical trials; |

| • | patient referral practices of physicians; and |

| • | ability to monitor patients adequately during and after treatment. |

In particular, each of the conditions in which we plan to evaluate our current product candidates is a rare genetic disorder with limited patient pools from which to draw for clinical trials. To date, the HCM and DCM patient populations have not been extensively evaluated in clinical trials. As a result, enrollment in our planned clinical trials is difficult to predict and may take longer or cost more than we anticipate.

We plan to seek initial marketing approval in the United States. We may not be able to initiate or continue clinical trials if we cannot enroll a sufficient number of eligible patients to participate in the clinical trials

15

Table of Contents

required by the FDA or other regulatory agencies. Our ability to successfully initiate, enroll and complete a clinical trial in any foreign country is subject to numerous risks unique to conducting business in foreign countries, including:

| • | difficulty in establishing or managing relationships with CROs and physicians; |

| • | different standards for the conduct of clinical trials; |

| • | our inability to locate qualified local consultants, physicians and partners; and |

| • | the potential burden of complying with a variety of foreign laws, medical standards and regulatory requirements, including the regulation of pharmaceutical and biotechnology products and treatment. |

If we have difficulty enrolling a sufficient number of patients to conduct our clinical trials as planned, we may need to delay, limit or terminate ongoing or planned clinical trials, any of which would have an adverse effect on our business.

We may not be successful in our efforts to identify or discover potential product candidates.

The success of our business depends primarily upon our ability to identify, develop and commercialize therapeutics for the treatment of genetic cardiovascular diseases based on our precision medicine approach. A key element of our strategy is to use our precision medicine platform to identify and study compounds that can be used to correct or offset the abnormal contraction caused by HCM and DCM. Our research programs may initially show promise in identifying potential product candidates, yet fail to yield product candidates for clinical development for a number of reasons, including:

| • | the research methodology used may not be successful in identifying appropriate biomarkers or potential product candidates; |

| • | our initial hypotheses based on our preclinical or early clinical observations may not be supported by later clinical results; |

| • | potential product candidates may, on further study, be shown to have harmful side effects or may have other characteristics that may make the products unmarketable or unlikely to receive marketing approval; or |

| • | research programs to identify new product candidates require substantial technical, financial and human resources. We may choose to focus our efforts and resources on a potential product candidate that ultimately proves to be unsuccessful. |

If we are unable to identify suitable compounds for preclinical and clinical development, we may be forced to abandon our development efforts for a research program or programs and we will not be able to obtain product revenues in future periods, which likely would result in significant harm to our financial position and adversely impact our stock price.

We may not be able to successfully use the Sarcomeric Human Cardiomyopathy Registry “SHaRe”, to identify or recruit patients for our clinical trials or to develop targeted precision therapeutics for the treatment of heritable cardiomyopathies.

We rely, and expect to continue to rely, on genetic and clinical data gathered through SHaRe to provide us with insight into risk profiles and disease progression in heritable cardiomyopathies. Although the body of information in SHaRe is growing, we may face challenges collecting additional data through SHaRe in the future for a variety of reasons, including:

| • | insufficient funding to support the research necessary to generate patient data for SHaRe; |

| • | our failure to maintain existing relationships and establish new relationships with clinical investigators and research institutions whose activities support SHaRe and provide us with access patient data; |

16

Table of Contents

| • | our failure to maintain or increase interest in SHaRe within our target patient communities; and |

| • | third parties may generate competing databases to which we do not have access. |

Additionally, the predictive value of the information generated through SHaRe to date may be limited. Although we expect to use this data to define and identify patient subgroups most likely to respond to our product candidates, our initial hypotheses regarding this data may prove to be incorrect, or our patient selection strategies based on our analysis of this data may fail to yield suitable patients for evaluation in our clinical trials or suitable indications and product candidates for clinical development.

Any of our product candidates may cause adverse effects or have other properties that could delay or prevent their regulatory approval, limit the scope of any approved label or market acceptance or result in other significant negative consequences following marketing approval, if any.

Adverse events or other unintended side effects or safety signals caused by our product candidates could cause us, IRBs or ethics committees, clinical trial sites or regulatory authorities to interrupt, delay or halt clinical trials and could result in the denial of regulatory approval. For example, through additional studies, we may determine that although MYK-461 has been shown to be specific to striated muscle, which includes both skeletal and cardiac muscle, and selective for cardiac muscle, it may target myosin in skeletal muscle, which could result in unintended adverse effects. We have observed a number of adverse events in our clinical trials of MYK-461. In particular, we have observed at least one serious adverse event to date that occurred in the highest dose cohort of our single ascending dose Phase 1 clinical trial of MYK-461 in HCM patients, which was described as a transient episode of hypotension and asystole, due to a vasovagal reaction, or low blood pressure and a temporary loss of heartbeat due to a nervous system reflex. Results of our ongoing and planned trials could reveal a high and unacceptable severity and prevalence of these or other adverse events in subjects treated with MYK-461. Additionally, if the adverse events we have observed are deemed to be unacceptable or other unacceptable side effects or safety signals are observed in any ongoing or subsequent preclinical studies or clinical trials of our product candidates, our trials could be suspended or terminated and the FDA or comparable foreign regulatory authorities could order us to cease further development of or deny approval of our product candidates for any or all targeted indications. Any adverse effects encountered in our preclinical studies or clinical trials, whether or not drug-related, could affect patient recruitment or the ability of enrolled patients to complete the trial or result in potential product liability claims. Additionally, adverse effects may represent safety signals that could influence the benefit-risk assessment for further development or commercialization of a product candidate and may warrant further clinical or nonclinical investigation, consultation with health authorities, changes to product labeling or guidelines for its safe use, or other scientific or regulatory actions. Any of these occurrences may harm our business, financial condition and prospects significantly.

Further, if any of our future products, if and when approved for commercial sale, cause serious or unexpected adverse events, a number of potentially significant negative consequences could result, including:

| • | regulatory authorities may withdraw their approval of the product or impose restrictions on its distribution in the form of a REMS or provide a medication guide outlining the risks of such side effects for distribution to patients; |

| • | regulatory authorities may require the addition of labeling statements, such as warnings or contraindications; |

| • | we may be required to change the way the product is administered or conduct additional clinical trials; |

| • | we could be sued and held liable for harm caused to patients; or |

| • | our reputation may suffer. |

Any of these events could prevent us or our partners from achieving or maintaining market acceptance of the affected product and could substantially increase the costs of commercializing our future products and impair our ability to generate revenues from the commercialization of these products.

17

Table of Contents

Risks Related to Government Regulation

We currently do not have regulatory approval to market any of our product candidates. The regulatory approval processes of the FDA and comparable foreign authorities are lengthy, time consuming and inherently unpredictable, and if we are ultimately unable to obtain regulatory approval for our product candidates, our business will be substantially harmed.

The time required to obtain approval by the FDA, EMA and comparable foreign authorities is unpredictable but typically takes many years following the commencement of clinical trials and depends upon numerous factors, including the substantial discretion of the regulatory authorities. In addition, approval policies, regulations, or the type and amount of clinical data necessary to gain approval may change during the course of a product candidate’s clinical development and may vary among jurisdictions. We have not obtained regulatory approval for any product candidate and it is possible that none of our existing product candidates or any product candidates we may seek to develop in the future will ever obtain regulatory approval.

Our product candidates could fail to receive regulatory approval for many reasons, including the following:

| • | the FDA or comparable foreign regulatory authorities may disagree with the design or implementation of our clinical trials; |

| • | we may be unable to demonstrate to the satisfaction of the FDA or comparable foreign regulatory authorities that a product candidate is safe and effective for its proposed indication; |

| • | the results of clinical trials may not meet the level of statistical significance required by the FDA or comparable foreign regulatory authorities for approval; |

| • | we may be unable to demonstrate that a product candidate’s clinical and other benefits outweigh its safety risks; |

| • | the FDA or comparable foreign regulatory authorities may disagree with our interpretation of data from preclinical studies or clinical trials; |

| • | the data collected from clinical trials of our product candidates may not be sufficient to support the submission of a New Drug Application (“NDA”) or other submission or to obtain regulatory approval in the United States or elsewhere; |

| • | the FDA or comparable foreign regulatory authorities may fail to approve the manufacturing processes or facilities of third-party manufacturers with which we contract for clinical and commercial supplies; or |

| • | the approval policies or regulations of the FDA or comparable foreign regulatory authorities may significantly change in a manner rendering our clinical data insufficient for approval. |

This lengthy approval process as well as the unpredictability of future clinical trial results may result in our failing to obtain regulatory approval to market MYK-461 or any other product candidate we may develop, which would significantly harm our business, results of operations and prospects.

In addition, even if we were to obtain approval, regulatory authorities may approve any of our product candidates for fewer or more limited indications than we request, may not approve the price we intend to charge for our products, may grant approval contingent on the performance of costly post-marketing clinical trials, or may approve a product candidate with a label that does not include the labeling claims necessary or desirable for the successful commercialization of that product candidate. Any of the foregoing scenarios could materially harm the commercial prospects for our product candidates.

18

Table of Contents

Even if we complete the necessary preclinical studies and clinical trials, we cannot predict when or if we will obtain regulatory approval to commercialize a product candidate or the approval may be for a more limited indication than we expect.

We cannot commercialize a product until the appropriate regulatory authorities have reviewed and approved the product candidate. Even if our product candidates demonstrate safety and efficacy in clinical trials, the regulatory agencies may not complete their review processes in a timely manner, or we may not be able to obtain regulatory approval. Additional delays may result if an FDA Advisory Committee or other regulatory authority recommends non-approval or restrictions on approval. In addition, we may experience delays or rejections based upon additional government regulation from future legislation or administrative action, or changes in regulatory agency policy during the period of product development, clinical trials and the review process. Regulatory agencies also may approve a treatment candidate for fewer or more limited indications than requested or may grant approval subject to the performance of post-marketing studies. In addition, regulatory agencies may not approve the labeling claims that are necessary or desirable for the successful commercialization of our treatment candidates. If we are unable to obtain regulatory approval for our product candidates for use in the treatment of heritable cardiomyopathies, our business may suffer.

Failure to obtain marketing approval in international jurisdictions would prevent our products from being marketed in such jurisdictions.

In order to market and sell our products in the European Union and many other jurisdictions, we or our third-party collaborators must obtain separate marketing approvals and comply with numerous and varying regulatory requirements. The approval procedure varies among countries and can involve additional testing. The time required to obtain approval may differ substantially from that required to obtain FDA approval. The regulatory approval process outside the United States generally includes all of the risks associated with obtaining FDA approval. In addition, in many countries outside the United States, it is required that the product be approved for reimbursement before the product can be approved for sale in that country. We or these third parties may not obtain approvals from regulatory authorities outside the United States on a timely basis, if at all. Approval by the FDA does not ensure approval by regulatory authorities in other countries or jurisdictions, and approval by one regulatory authority outside the United States does not ensure approval by regulatory authorities in other countries or jurisdictions or by the FDA. However, the failure to obtain approval in one jurisdiction may negatively impact our ability to obtain approval in other jurisdictions. We may not be able to file for marketing approvals, and even if we do, we may not obtain necessary approvals to commercialize our medicines in any market.

Even if we receive regulatory approval for any of our product candidates, we will be subject to ongoing obligations and continued regulatory review, which may result in significant additional expense. Additionally, our product candidates, if approved, could be subject to labeling and other restrictions and market withdrawal and we may be subject to penalties if we fail to comply with regulatory requirements or experience unanticipated problems with our products.

Any product candidate for which we obtain marketing approval, along with the manufacturing processes, post-approval clinical data, labeling, advertising and promotional activities for such product, will be subject to extensive and ongoing regulatory requirements and review by the FDA and other regulatory authorities. These requirements include submissions of safety and other post-marketing information and reports, registration and listing requirements, Current Good Manufacturing Practice (“cGMP”) requirements relating to quality control, quality assurance and corresponding maintenance of records and documents, and requirements regarding the distribution of samples to physicians and recordkeeping. For example, the holder of an approved NDA is obligated to monitor and report adverse events and any failure of a product to meet the specifications in the NDA. The holder of an approved NDA must also submit new or supplemental applications and obtain FDA approval for certain changes to the approved product, product labeling or manufacturing process.

19

Table of Contents