Attached files

| file | filename |

|---|---|

| 8-K - COGENTIX MEDICAL INC 8-K 9-26-2016 - COGENTIX MEDICAL INC /DE/ | form8k.htm |

Exhibit 99.1

NASDAQ: CGNTSeptember 2016 Ladenburg Thalmann2016 Healthcare Conference

Disclaimer This presentation includes forward-looking statements. These forward-looking statements generally can be identified by the use of words such as “anticipate,” “expect,” “plan,” “could,” “may,” “will,” “believe,” “estimate,” “forecast,” “goal,” “project,” and other words of similar meaning. Forward-looking statements in this presentation include, but are not limited to, statements about the benefits of proposed transactions; expected revenue growth rates; and our plans, objectives, expectations and intentions with respect to future operations, products and services. Each forward-looking statement contained in this presentation is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statement. Applicable risks and uncertainties include, among others, the effects of industry, economic or political conditions outside of our control; the failure to appropriately apply the proceeds from a proposed transaction or to realize the benefits of potential reduction in our debt, or delay in realization thereof; operating costs and business disruption following completion of the proposed transactions; transaction and related costs; actual or contingent liabilities; the adequacy of our capital resources; and the risks identified under the heading “Risk Factors” in the annual report on Form 10-K, for the fiscal year ended March 31, 2015, filed with the Securities and Exchange Commission (the “SEC”) on June 25, 2015, our transition report on Form 10-K for the transition period from April 1, 2015 through December 31, 2015, as well as our subsequent quarterly reports on Form 10-Q and other information filed by us with the SEC. Cogentix Medical cautions investors not to place undue reliance on the forward-looking statements contained in this presentation. You are encouraged to read our filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The forward-looking statements in this presentation speak only as of the date of this presentation, and Cogentix Medical undertakes no obligation to update or revise any of these statements. Cogentix Medical businesses are subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties.

Other Information Additional Information About the Transactions and Where to Find ItThis presentation includes information regarding proposed transactions that will be submitted to the shareholders of Cogentix Medical for their approval. In connection with that approval, Cogentix will file with the SEC a proxy statement containing information about the proposed transactions. Shareholders are urged to read the proxy statement when it becomes available, because it will contain important information. Shareholders will be able to obtain a free copy of the proxy statement, as well as other filings containing information about Cogentix, without charge at the SEC’s website (www.sec.gov) or by calling 1-800-SEC-0330. Copies of the proxy statement and other filings with the SEC can also be obtained, without charge, by directing a request to Brett Reynolds, Senior Vice President and Chief Financial Officer, Cogentix Medical, Inc., 5420 Feltl Road, Minnetonka, MN 55343, 952-426-6152.Participants in the SolicitationCogentix and some or all of its directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from Cogentix shareholders in respect of the proposed transactions discussed in this presentation. Information regarding the directors and executive officers of Cogentix is contained in the proxy statement for our 2016 annual meeting of shareholders, which was filed with the SEC on April 25, 2016. Additional information regarding the interests of such potential participants will also be included in the proxy statement when it becomes available.

Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures that are not in conformity with generally accepted accounting principles in the United States, including operating income or loss excluding non-cash expenses and certain one-time costs, as well as revenue excluding a discontinued distribution agreement. We use this non-GAAP financial information for internal managerial purposes because we believe such measures are important indicators of the strength and the operating performance of our business. The Company’s management believes these measures provide investors with information useful to evaluating our overall operating performance, and as a means of comparing period-to-period results excluding certain non-cash and one-time items that may not be indicative of our ongoing performance, and comparing our results with the results of other companies in our industry.

Cogentix is… Providing innovative solutions to the $5.0 billion urology device marketGenerating double digit revenue growth and cash from operations excluding one time costsAiming to acquire the resources to accelerate our growth trajectoryPositioning the company to build shareholder returns

2 2 Summary Gross Margin Cogentix Medical At-a-Glance Revenue Growth NASDAQ: CGNTTTM revenue: $50.7 millionTTM op loss: $(5.5) millionTTM cash op. profit excluding one time costs: $1.5 million1185 team members at 6/30/16 Product Revenue Mix $ Thousands 1 GAAP operating income plus non-cash expenses of $4.2 million plus $2.8 million of one-time proxy contest and merger related expenses 2 Excludes revenue from Stryker Ureteroscope distribution agreement ($0.08 million for the six months ended 6/30/2016 and $1.60 million for the six months ended 6/30/2015), which CGNT ended in December 2015

Innovative Technologies Serving Urology EndoSheath Technology“Always Ready, Always Sterile” Urgent PCPTNS for Overactive Bladder (OAB) MacroplastiqueBulking Agent for Female Stress Urinary Incontinence (SUI)

Urology Market Dynamics Costs of practice are rising while reimbursement is flat to decliningPatient population with urologic disorders is predominantly beyond middle age (> 55 years); growth in the senior population, along with the large volume of chronic conditions, is increasing patient demand Forecasted shortage of urologists (450 annual retirees “replaced” by 280 annual graduates) in combination with increasing demand highlights need for improved efficiencyLack of effective therapies for many conditions; market seeking innovative new diagnostic and therapeutic solutions to address unmet treatment needs By 2020, some project urology as the most “in-demand” specialty

Overactive Bladder (OAB) – Urgent PC Transformative Treatment Options to Voiding Dysfunction Patients Urgent PC® The Leading Non-Drug, Non-Surgical Treatment for Overactive Bladder (OAB)Simple and effectiveClinical validationAttractive economicsLarge unmet market

OAB – AUA/SUFU Treatment Guideline

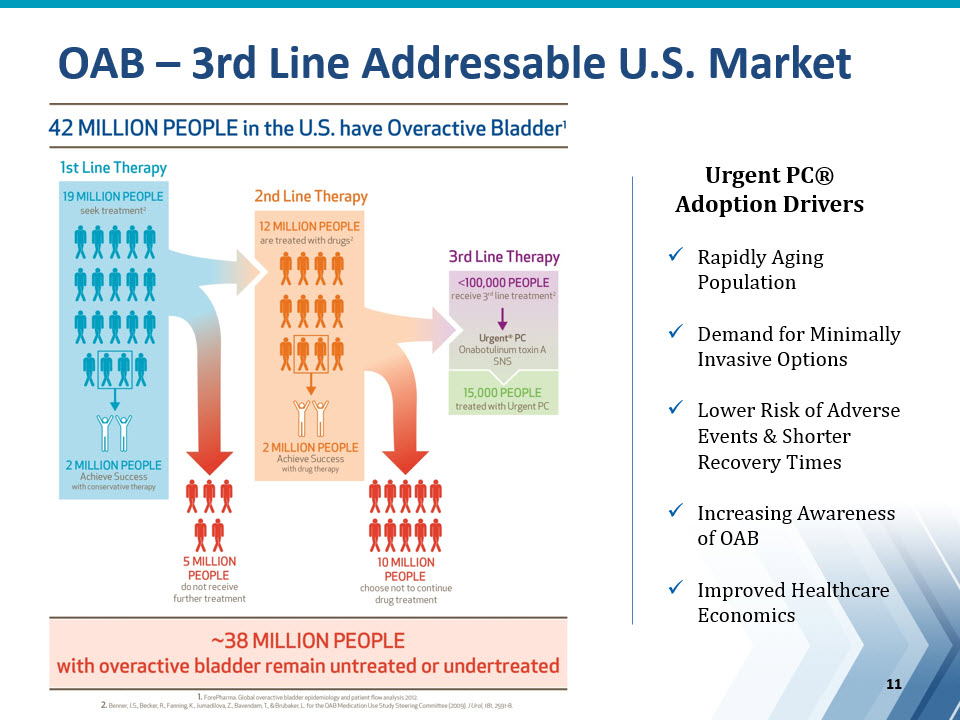

Urgent PC® Adoption DriversRapidly Aging PopulationDemand for Minimally Invasive OptionsLower Risk of Adverse Events & Shorter Recovery TimesIncreasing Awareness of OABImproved Healthcare Economics OAB – 3rd Line Addressable U.S. Market

The Growing Need Met by EndoSheath® Dirty Endoscopes Tops ECRI Institute’s 2016 Technology Hazards List Listed in the “Top 10” from 2010-2015; #1 in 2016

The EndoSheath® Solution Innovative technology ensures an “Always Ready, Always Sterile” endoscope Conventional Endoscope Our Unique Concept EndoSheath Endoscope

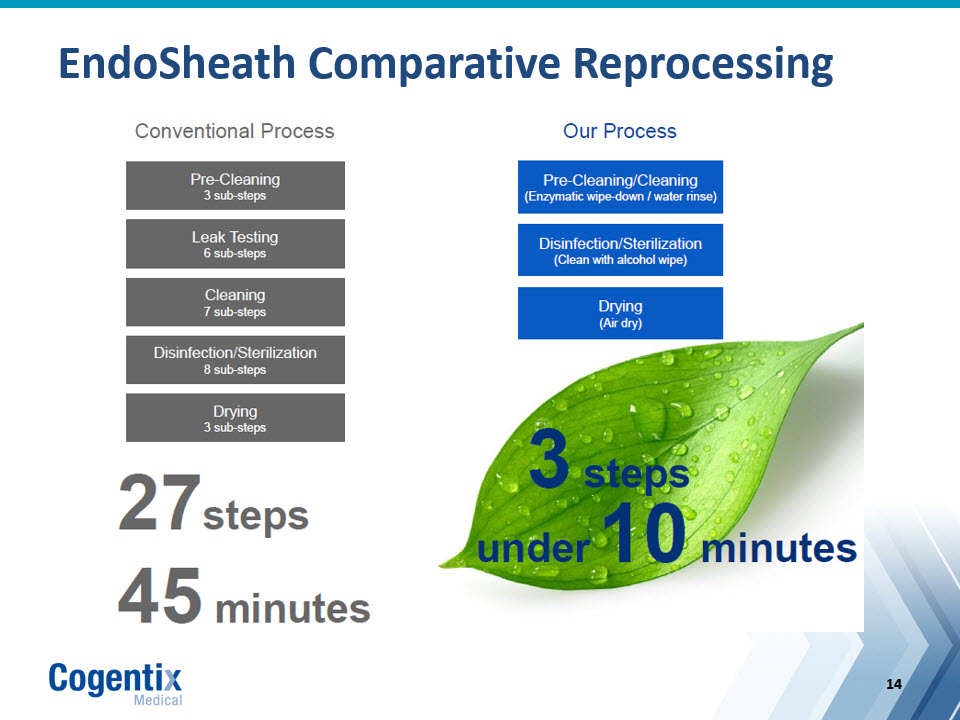

EndoSheath Comparative Reprocessing

EndoSheath Value Proposition “Always Ready, Always Sterile” Patented system allows for complete isolation of reusable endoscope from patient and user Enables Practices to Safely and Cost-Effectively Treat More Patients in Less Time, Providing Physicians with Flexibility to Better Manage Increasing Demand

Macroplastique Transformative Treatment Options to Voiding Dysfunction Patients Macroplastique® A minimally invasive option for the treatment of female Stress Urinary IncontinenceWe believe Macroplastique is the “Best in Class” injectable bulking agent Market is matureAttractive gross margins

Growth of Our Current Products Annualized Revenue$50.7 Million TTM Revenue GrowthYear-Over-Year (YoY) 10.2% $ Thousands, TTM Ending June 30, 2016. Revenue and Growth Cogentix Medical

Strong Q2 Financial Performance Revenue of $13.0 million+17.0% as reported+22.0% excluding discontinued Stryker distribution agreement1 U.S. represented 73.9% of total company revenueUrgent PC revenue +15.0% PrimeSight Urology revenue +20.0%Gross Margin = 68.6%, up 140 bps from year agoOperating Loss = $(2.3) millionCash operating profit = $0.8 million, excluding $0.9 million of non-cash items and $2.2 million of one-time costs, increased $2.5 million from the cash operating loss of $1.7 million year ago 1 Excludes revenue from Stryker Ureteroscope distribution agreement ($49 thousand for the quarter ended 6/30/2016 and $494 thousand for the quarter ended 6/30/2015), which CGNT ended in December 2015

BUT, Resource Constrained… $29.5 million in convertible debt, due March 2020$2.9 million in cash as of June 30, 2016$1.5 million TTM cash operating profit excluding one time costsand Market Has Not Valued Recent Results…Cogentix Medical Stock Performance (April 1, 2015 – September 1, 2016) April 1, 2015Uroplasty and Vision-Sciences Complete Merger to form Cogentix Medical (CGNT)Day +1 Stock Price: $1.69 March 3, 2016CGNT Reports 18% Proforma Qtrly Revenue Growth; Achieves Cash Operating Profit Milestone. Day +1 Stock Price: $1.13 August 2, 2016CGNT Reports 17% Q2 Revenue Growth; Achieves Third Consecutive Quarter of Cash Operating Profit. Day +1 Stock Price: $1.10 May 14, 2015: CGNT Reports 12% Pro Forma Qtrly Revenue GrowthAug. 10, 2015: CGNT Reports 10% Pro Forma Qtrly Revenue Growth; +13% CCNov. 3, 2015: CGNT Reports 12% Pro Forma Qtrly Revenue Growth

The Proposed Transactions Definitive agreements announced September 7, 2016, subject to shareholder approval$25 million cash investment from leading medical device venture capital firm Investment made at 29% PREMIUM to market close the day prior to announcementConversion of ALL debt to equity at 36% PREMIUM to market close the day prior to announcement~60.3 million shares outstanding after closingNo debt after closingTwo new board members expand industry expertiseResources to execute urology market leadership strategy

Depth & Breadth of Leadership TeamDistribution Platform42 U.S. Sales Reps – Urology8 U.S. Sales Reps – Airway Mgmt.8 International Sales RepsDistributor RelationshipsFunctional ExpertiseSalesMarketingRegulatoryQuality Reimbursement Proposed Transaction Enables Execution on Growth Strategy Licensing & acquisition opportunities exist to add underperforming yet innovative assets COGENTIX MEDICAL to exploit…Poor execution Due to weak leadership and sales teamsInability to fund sales teams and R&D Orphaned technologies Often within larger organizationsBalance sheet inefficiencies The wrong capital structureNew technologies ready for commercializationCogentix sales organization can penetrate market more quickly Leverage Our Assets Organic Growth + Expanded Product Portfolio

Expanded Product Portfolio Focus Opportunities that fit well within our existing sales call pointTargets include existing products or high potential development opportunitiesSeveral opportunities currently being assessedGoal: Complete at least one agreement within 6 months of transaction close

NASDAQ: CGNTSeptember 2016