Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OMNOVA SOLUTIONS INC | a9_22x16xinvestor8k.htm |

COMPANY CONFIDENTIAL

Why OMNOVA Solutions?

A Look Forward

3rd Quarter 2016

Investor Presentation

Global Innovator of Performance-Enhancing

Chemistries and Surfaces

Exhibit 99.1

COMPANY CONFIDENTIAL

Cautionary Statements

2

Forward-Looking Statements

This presentation includes descriptions of OMNOVA's current business, operations, assets and other matters affecting the Company as well as "forward-looking statements" as defined by federal

securities laws. All forward-looking statements by the Company, including verbal statements, are intended to qualify for the protections afforded forward-looking statements under the Private Securities

Litigation Reform Act of 1995. Forward-looking statements reflect management's current expectation, judgment, belief, assumption, estimate or forecast about future events, circumstances or results

and may address business conditions and prospects, strategy, capital structure, debt and cash levels, sales, profits, earnings, markets, products, technology, operations, customers, raw materials,

claims and litigation, financial condition, and accounting policies among other matters. Words such as, but not limited to, "will," "may," "should," "projects," "forecasts," "seeks," "believes," "expects,"

"anticipates," "estimates," "intends," "plans," "targets," "optimistic," "likely," "would," "could," "committed," and similar expressions or phrases identify forward-looking statements.

All descriptions of OMNOVA's current business, operations and assets, as well as all forward-looking statements, involve risks and uncertainties. Many risks and uncertainties are inherent in business

generally. Other risks and uncertainties are more specific to the Company's businesses and strategy, or to any new businesses the Company may enter into or acquire. There also may be risks and

uncertainties not currently known to the Company. The occurrence of any such risks and uncertainties and the impact of such occurrences is often not predictable or within the Company's control. Such

impacts could adversely affect the Company's business, operations or assets as well as the Company's results and the value of your investment in the Company. In some cases, such impact could be

material. Certain risks and uncertainties facing the Company are described below or in the Company's Quarterly Report on Form 10-Q and Annual Report and the value of your investment in the

Company on Form 10-K.

All written and verbal descriptions of OMNOVA's current business, operations and assets and all forward-looking statements attributable to the Company or any person acting on the Company's behalf

are expressly qualified in their entirety by the risks, uncertainties, and cautionary statements contained or referenced herein. All such descriptions and any forward-looking statement speak only as of

the date on which such description or statement is made, and the Company undertakes no obligation, and specifically declines any obligation, other than that imposed by law, to publicly update or

revise any such description or forward-looking statements whether as a result of new information, future events or otherwise.

The Company's actual results and the value of your investment in OMNOVA may differ, perhaps materially, from expectations due to a number of risks and uncertainties including, but not limited to: (1)

the Company's exposure to general economic, business, and industry conditions; (2) the risk of doing business in foreign countries and markets; (3) changes in raw material prices and availability; (4)

the highly competitive markets the Company serves; (5) extraordinary events such as natural disasters, political disruptions, terrorist attacks and acts of war; (6) extensive and increasing United States

and international governmental regulation, including environmental, health and safety regulations; (7) the Company's failure to protect its intellectual property or defend itself from intellectual property

claims; (8) claims and litigation; (9) changes in accounting policies, standards, and interpretations; (10) the actions of activist shareholders; (11) the Company's inability to achieve, or achieve in a timely

manner, the objectives and benefits of cost reduction initiatives; (12) the Company's ability to develop and commercialize new products at competitive prices; (13) the concentration of OMNOVA's

Performance Chemicals business and certain Engineered Surfaces market segments, among several large customers; (14) the creditworthiness of the Company's customers; (15) the failure of a joint

venture partner to meet its commitments; (16) the Company's ability to identify and complete strategic transactions; (17) the Company's ability to successfully integrate acquired companies; (18)

unanticipated capital expenditures; (19) risks associated with the use, production, storage, and transportation of chemicals; (20) information system failures and breaches in security; (21) continued

increases in healthcare costs; (22) the Company's ability to retain or attract key employees; (23) the Company's ability to renew collective bargaining agreements with employees on acceptable terms

and the risk of work stoppages; (24) the Company's contribution obligations under its U.S. pension plan; (25) the Company's reliance on foreign financial institutions to hold some of its funds; (26) the

effect of goodwill impairment charges; (27) the volatility in the market price of the Company's common shares; (28) the Company's substantial debt position; (29) the decision to incur additional debt;

(30) the operational and financial restrictions contained in the Company's indenture; (31) a default under the Company's term loan or revolving credit facility; and (32) the Company's ability to generate

sufficient cash to service its outstanding debt.

OMNOVA Solutions provides greater detail regarding these risks and uncertainties in its 2015 Form 10-K and subsequent filings, which are available online at www.omnova.com and www.sec.gov.

OMNOVA Solutions Inc. is a global innovator of performance-enhancing chemistries and surfaces used in products for a variety of commercial, industrial and residential applications. As a strategic

business-to-business supplier, OMNOVA provides The Science in Better Brands, with emulsion polymers, specialty chemicals, and functional and decorative surfaces that deliver critical performance

attributes to top brand-name, end-use products sold around the world. OMNOVA's sales for the fiscal year ended August 31, 2016, were $773 million. The Company has a global workforce of

approximately 1,950. Visit OMNOVA Solutions on the internet at www.omnova.com.

Non-GAAP Financial Measures

This presentation includes certain non-GAAP financial measures as defined by the Securities and Exchange Commission, such as Adjusted Segment Operating Profit, Adjusted Segment

EBITDA, Adjusted Income from Continuing Operations, Adjusted Diluted Earnings Per Share from Continuing Operations, Adjusted Consolidated EBITDA and Net Leverage Ratio. For a

reconciliation to the most directly comparable GAAP financial measures, refer to the Appendix.

COMPANY CONFIDENTIAL 3

COMPANY CONFIDENTIAL 4

COMPANY CONFIDENTIAL 5

COMPANY CONFIDENTIAL 6

COMPANY CONFIDENTIAL 7

COMPANY CONFIDENTIAL

OMNOVA Solutions Today

Global innovator of performance enhancing chemistries and surfaces

8

$773M*

SALES

26%

Performance Chemicals

Latex Binders │ Acrylics │ Resins │Hollow

Plastic Pigments │ Fluorosurfactants │

Opacifiers │ Bio-Based Polymers

Engineered Surfaces

Coated Fabrics │ Specialty Laminates │

Performance Films

*OMNOVA consolidated sales for LTM ended August 31, 2016.

Deep and broad technical

expertise

Leading player in key specialty

applications

Small percentage of finished product

cost, but critical to overall performance

8

$216M

72%

$557M

Operating in two business segments

COMPANY CONFIDENTIAL

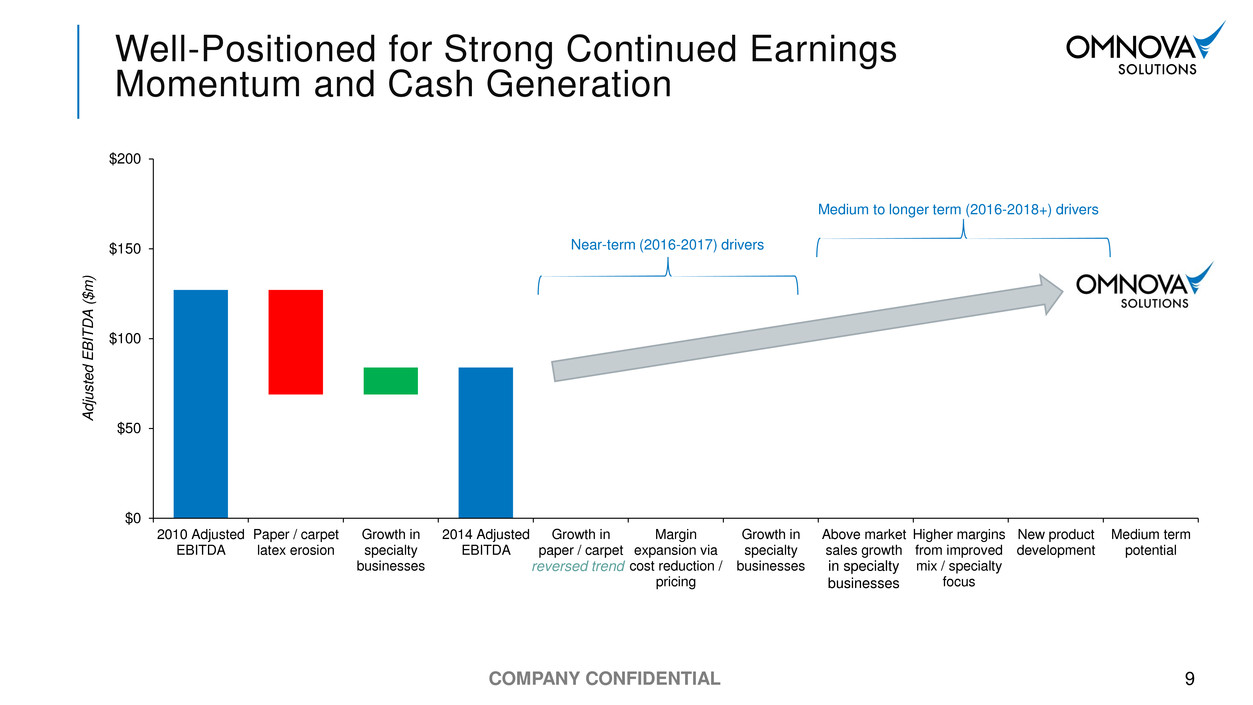

Well-Positioned for Strong Continued Earnings

Momentum and Cash Generation

9

Near-term (2016-2017) drivers

Medium to longer term (2016-2018+) drivers

reversed trend in specialty

businesses

$0

$50

$100

$150

$200

2010 Adjusted

EBITDA

Paper / carpet

latex erosion

Growth in

specialty

businesses

2014 Adjusted

EBITDA

Growth in

paper / carpet

Margin

expansion via

cost reduction /

pricing

Growth in

specialty

businesses

Above market

sales growth

Higher margins

from improved

mix / specialty

focus

New product

development

Medium term

potential

A

d

justed

E

B

IT

D

A

(

$m

)

COMPANY CONFIDENTIAL

Goals Reflect Continuing Transition To

Specialty Focus

Adjusted Segment

Operating Margin*

6.9%

8.9%

Mid

Teens

*Non-GAAP adjusted values, GAAP reconciliation in the appendix.

10

2014 2015 Goal

Growth:

2X Underlying Specialty Markets

› Specialty Volume

Growth

› High Margin New

Product Introductions

› Commercial

Excellence

› Cost Reductions

› Value Based Pricing

› Mix

Market Spectrum

Small, Low Price, Local

Chemical Companies

↓

Le

vel

o

f

T

e

c

hnolog

y

Willingness to Collaborate and

Customize

High Low

High

↑

Large Global, Vertically

Integrated Chemical

Companies

Market Opportunity

OMNOVA

↓

10.6%

LTM

Q3 2016

COMPANY CONFIDENTIAL

Drive

Improved

Return On

Investment

Accelerate

Growth

In Specialty

Businesses

Deploy a

Balanced

Capital

Allocation

Policy

Our Value-Creating Strategic Priorities

How we’ll get there

11

OPERATIONAL

FINANCIAL

Expand Margins,

Generate Cash In

Performance

Materials

Businesses

COMPANY CONFIDENTIAL

Accelerate Growth In Specialty Businesses

Grow specialty greater than underlying markets

12

Targeting Specialty

Growth Markets

› Higher growth, higher

margin businesses

› Strong position from

which to build…significant

opportunities to grow

share

› Footprint actions enhance

specialty focus

Strengthening

Commercial

Excellence

› Sales, marketing and

product development

working as one

› Cross-selling

› Value based pricing

› More aggressive strategic

marketing plans

› Stronger key account

value added selling

Accelerate

Growth

In Specialty

Businesses

Strengthening

Leadership &

Capabilities

› Enhanced organization in

place end of 2015

Strong, Broad-

Based Technology

w/ Global Footprint

› Facilities on three

continents

› Global quality and

consistency

› Willingness and ability to

customize

Deploy a

Balanced

Capital

Allocation

Policy

Drive

Improved

Return On

Investment

Expand Margins,

Generate Cash In

Performance

Materials

Businesses

COMPANY CONFIDENTIAL

Specialty Growth: Targeted Markets

Targeting robust markets with demand for high performance, high margin products

13

% = Estimated Market Growth Rate

*Market data based on internal estimates and OMNOVA’s place in the value chain.

PC ES PC PC/ES PC PC ES

Common characteristics: higher margin, large and growing markets, customer need

for differentiation, strong OMNOVA niche position with ability to grow

Coatings

CASE

Laminates Nonwovens

Construction

Materials

Elastomeric

Modifiers

Oil & Gas

Coated

Fabrics

› Masonry

› Intumescent (fire

resistant)

› Direct-to-metal

› Primers

› Odor and stain

blocking

› Wood treatment

$25.0B

Market

Potential*

3 – 4%/yr

› Retail display

› Cabinets

› Food service

› Kitchen and bath

› Recreational vehicles

› Flooring

› Healthcare

› Commercial furniture

$4.5B

Market

Potential*

2 - 3%/yr

› Diapers

› Adult incontinence

› Healthcare

› Wipes

› Transportation

› Filtration

$25.0B

Market

Potential*

3 - 5%/yr

› Concrete

› Adhesives

› Tape

› Release coatings

› Wallboard

› Roofing

>$25.0B

Market

Potential*

3 - 5%/yr

› Transportation

› Industrial

› Consumer

thermoplastic

products

>$10.0B

Market

Potential*

3 - 5%/yr

› Drilling

› Cementing

› Fracking

$5.5B

Market

Potential*

3 - 5%/yr

› Asian auto market

› Hospital applications

› Restaurant seating

› Mass-transit seating

>$1.0B

Market

Potential*

4 - 6%/yr

COMPANY CONFIDENTIAL

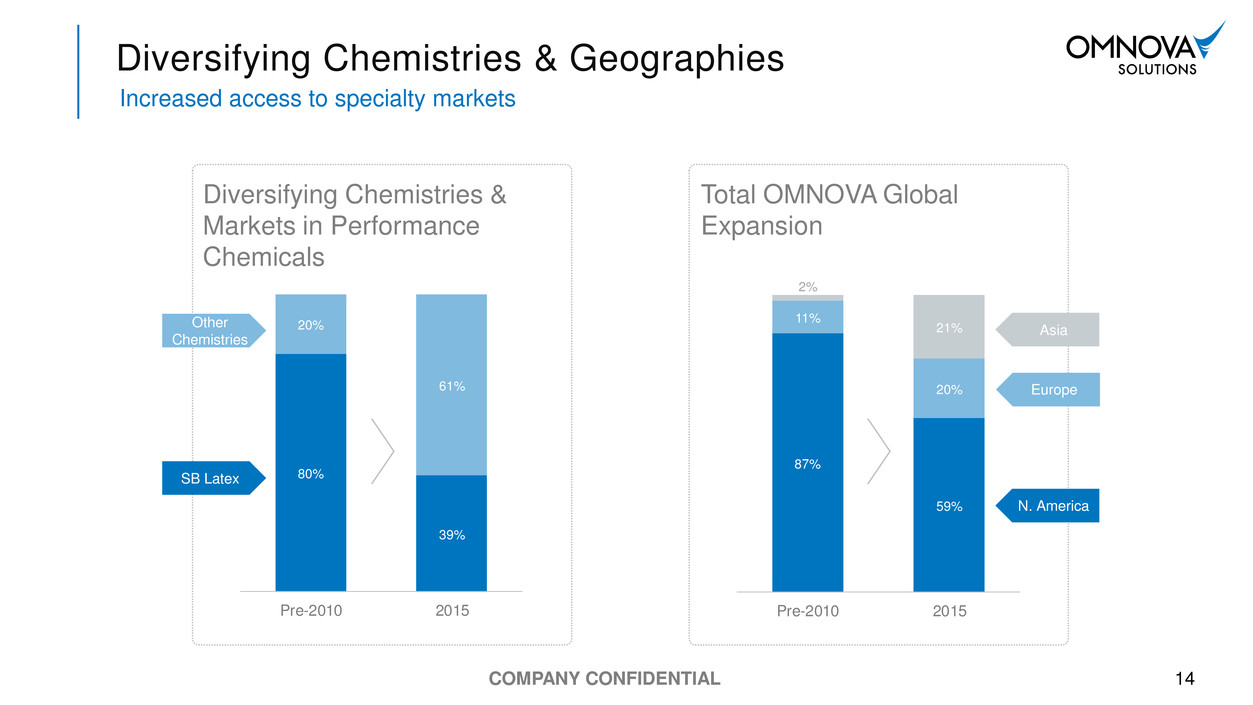

80%

39%

20%

61%

Pre-2010 2015

87%

59%

11%

20%

2%

21%

Pre- 0 2015

Diversifying Chemistries & Geographies

Increased access to specialty markets

14

Other

Chemistries

SB Latex

Asia

Europe

N. America

Diversifying Chemistries &

Markets in Performance

Chemicals

Total OMNOVA Global

Expansion

COMPANY CONFIDENTIAL

OMNOVA

Performance*

Enhancing Product Development

Examples of recent new product platform innovations

15

New team, new processes, improved outcomes

Softwick

Finishing treatment for disposables

› Superior fluid management

› Less bulk, weight, cost

› Excellent softness

› Broad market applications

Pliotec

Direct-to-metal coating additive

› Best in class corrosion resistance &

adhesion

› Fewer formulating steps / lower costs

› No solvents

surf(x)

Retail display and chain-restaurant

elements

› 30% lower cost vs. high pressure laminates

› Up to 50% savings in life cycle maintenance

› Better design and appearance = higher

customer sales and profit

› Large market opportunity – including fast

growing food service

Nonwovens Coatings Laminates

Competitor

Performance*

*Actual results from ASTM performance test.

Several new

product

platforms

introduced

recently

COMPANY CONFIDENTIAL

Strengthening

Customer

Relationships

› Capture growth in carpet

and non-carpet flooring

› Greater focus on higher

growth specialty

paper/packaging

segments

› Value-based pricing

Expand Margins, Increase Cash Generation In

Performance Materials Businesses

16

Performance Materials – Paper, Carpet, Tire Cord, Antioxidants & Reinforcing Rubber

Lowering Our Cost

Base

› Realigning manufacturing

› Improving SG&A

effectiveness & efficiency

Improving Ability to

Serve

› New GM & management

team

› Target technology

offerings

Expand Margins,

Generate Cash In

Performance

Materials

Businesses

Deploy a

Balanced

Capital

Allocation

Policy

Accelerate

Growth

In Specialty

Businesses

Drive

Improved

Return On

Investment

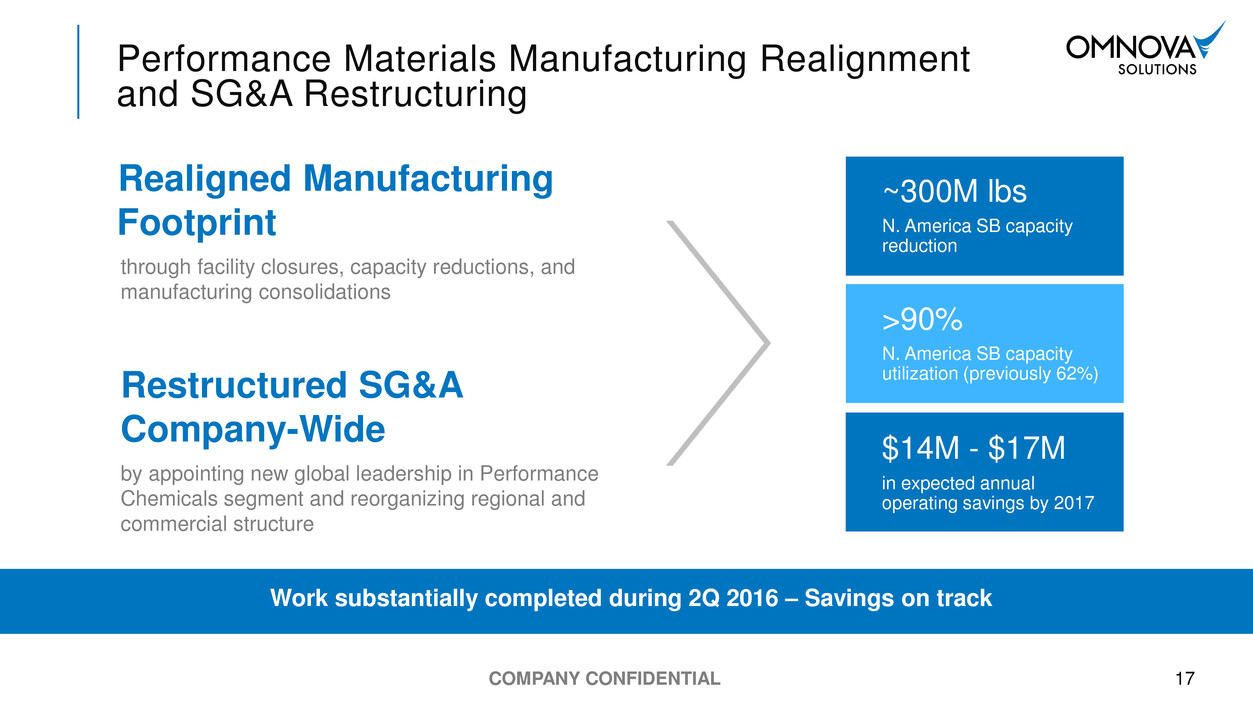

COMPANY CONFIDENTIAL 17

Performance Materials Manufacturing Realignment

and SG&A Restructuring

Work substantially completed during 2Q 2016 – Savings on track

~300M lbs

N. America SB capacity

reduction

>90%

N. America SB capacity

utilization (previously 62%)

$14M - $17M

in expected annual

operating savings by 2017

Realigned Manufacturing

Footprint

through facility closures, capacity reductions, and

manufacturing consolidations

Restructured SG&A

Company-Wide

by appointing new global leadership in Performance

Chemicals segment and reorganizing regional and

commercial structure

COMPANY CONFIDENTIAL

Drive Improved Return On Investment

Driving to returns in excess of cost of capital

18

Lowering Our Cost

Base

› Increased capacity

utilization

› Footprint optimization

› Repurposing to

specialty

› Cost reductions

› LEAN SixSigma

Managing Working

Capital

› Significant reduction of

working capital days by

2019

› More robust SOIP

process

› Incentive alignment

Expanding Margins

Through

Commercial

Excellence

› New high-margin product

initiatives

› Value-pricing

› Specialty growth

Drive

Improved

Return On

Investment

Deploy a

Balanced

Capital

Allocation

Policy

Expand Margins,

Generate Cash In

Performance

Materials

Businesses

Accelerate

Growth

In Specialty

Businesses

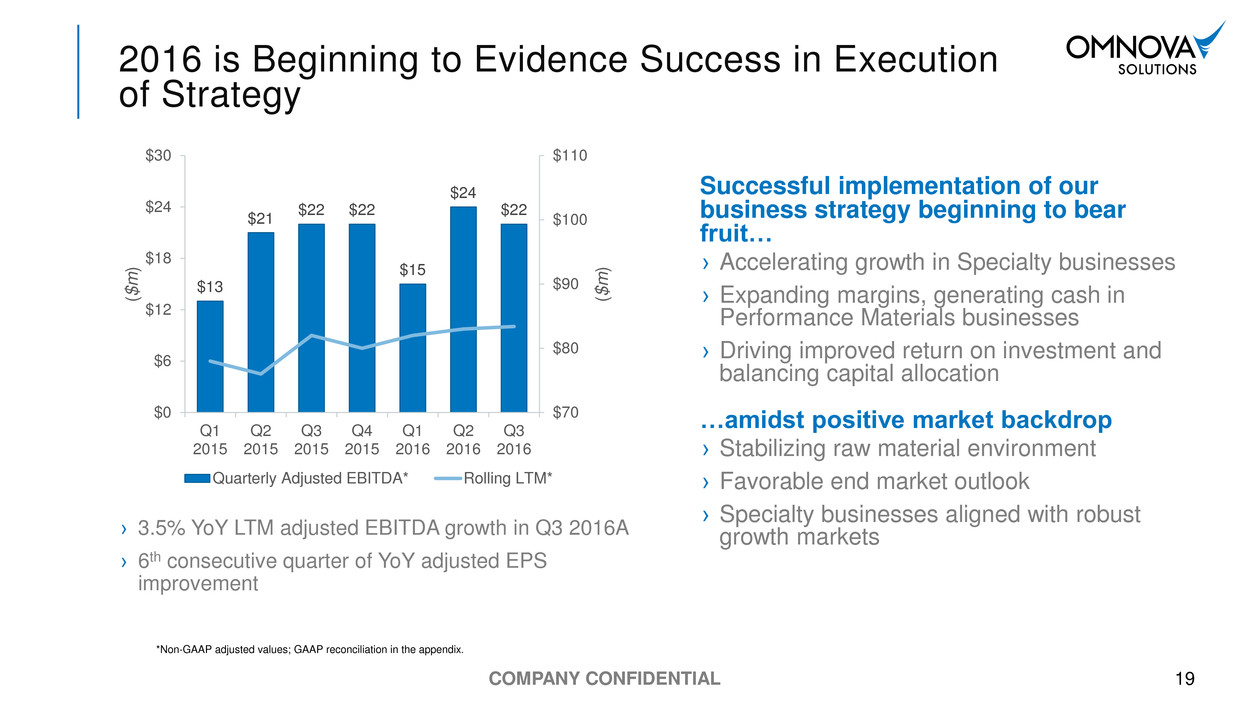

COMPANY CONFIDENTIAL

Successful implementation of our

business strategy beginning to bear

fruit…

› Accelerating growth in Specialty businesses

› Expanding margins, generating cash in

Performance Materials businesses

› Driving improved return on investment and

balancing capital allocation

…amidst positive market backdrop

› Stabilizing raw material environment

› Favorable end market outlook

› Specialty businesses aligned with robust

growth markets

2016 is Beginning to Evidence Success in Execution

of Strategy

› 3.5% YoY LTM adjusted EBITDA growth in Q3 2016A

› 6th consecutive quarter of YoY adjusted EPS

improvement

19

*Non-GAAP adjusted values; GAAP reconciliation in the appendix.

$13

$21

$22 $22

$15

$24

$22

$70

$80

$90

$100

$110

$0

$6

$12

$18

$24

$30

Q1

2015

Q2

2015

Q3

2015

Q4

2015

Q1

2016

Q2

2016

Q3

2016

($

m

)

($

m

)

Quarterly Adjusted EBITDA* Rolling LTM*

COMPANY CONFIDENTIAL

Deploy a Balanced Capital Allocation Policy

Strategy

20

Strategic Growth

Investments

› Bolt-on M&A to support

specialty businesses

› Funded by growth in

EBITDA and cash flow

Disciplined

Approach to

Capital Spending

› Focused on key growth

markets

De-Levering

Business

› Targeting 2.0x total net

leverage through cycle

Drive

Improved

Return On

Investment

Deploy a

Balanced

Capital

Allocation

Policy

Expand Margins,

Generate Cash In

Performance

Materials

Businesses

Accelerate

Growth

In Specialty

Businesses

COMPANY CONFIDENTIAL 21

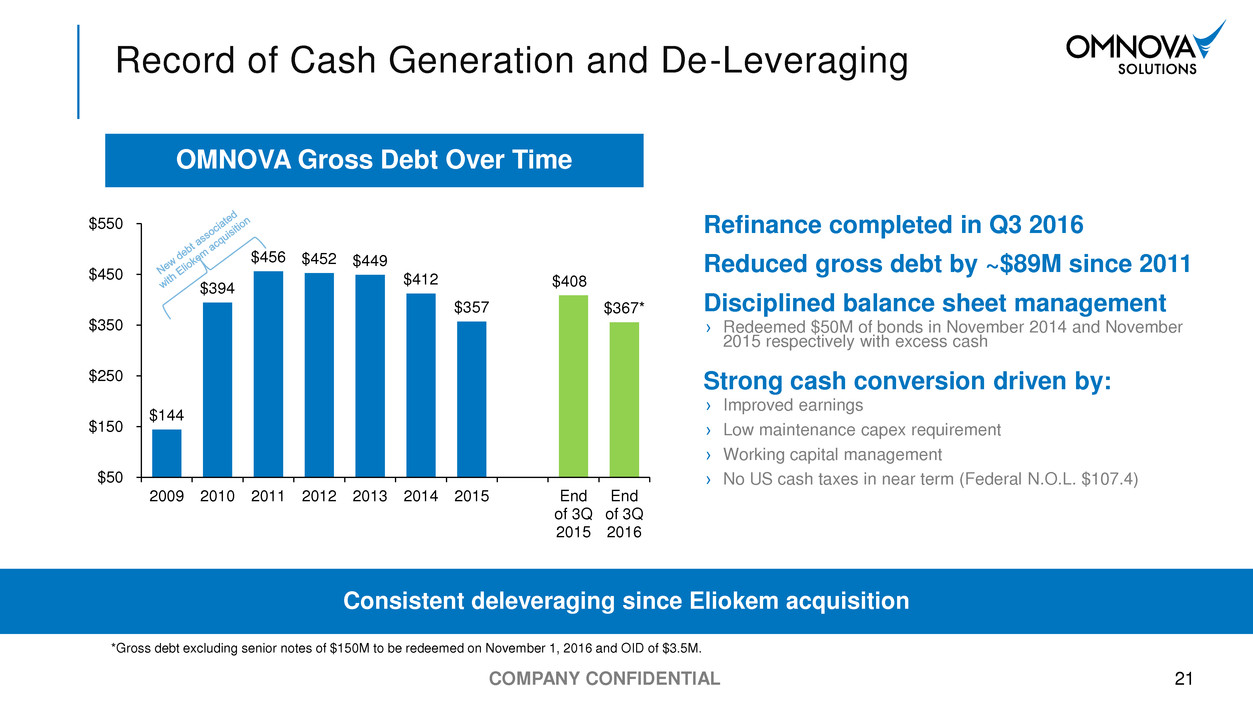

Consistent deleveraging since Eliokem acquisition

Record of Cash Generation and De-Leveraging

Refinance completed in Q3 2016

Reduced gross debt by ~$89M since 2011

Disciplined balance sheet management

› Redeemed $50M of bonds in November 2014 and November

2015 respectively with excess cash

Strong cash conversion driven by:

› Improved earnings

› Low maintenance capex requirement

› Working capital management

› No US cash taxes in near term (Federal N.O.L. $107.4)

OMNOVA Gross Debt Over Time

*Gross debt excluding senior notes of $150M to be redeemed on November 1, 2016 and OID of $3.5M.

$144

$394

$456 $452 $449

$412

$357

$408

$367*

$50

$150

$250

$350

$450

$550

2009 2010 2011 2012 2013 2014 2015 End

of 3Q

2015

End

of 3Q

2016

COMPANY CONFIDENTIAL

Capital Structure / Liquidity / Net Leverage

Liquidity

Revolver $64

• Balance Drawn

• Letters of Credit

$0

$0

Remaining Capacity $64

Cash** $70

Total Liquidity $134

22

As of August 31, 2016

(In millions)

Third quarter debt cost ~ 5.8% / sufficient liquidity

Net Leverage Ratio

Total Net Debt*** $291

LTM EBITDA*** $83

Net Leverage Ratio*** 3.5x

DEBT = $367*

$17

$350

Foreign Debt & Other

• Capital lease

• Letters of credit

Term Loan B

(excluding OID 3.5M)

• 2023 maturity

• L+425; floor 1.00%

• Total Net Leverage Ratio

Covenant

. * Debt is Total Debt less $150M of senior notes which will be redeemed on November 1, 2016.

** Cash is Total Cash less $156M committed to the redemption of senior notes, including accrued but unpaid interest, on November 1, 2016.

***Non-GAAP adjusted values, GAAP reconciliation in the appendix.

COMPANY CONFIDENTIAL 23

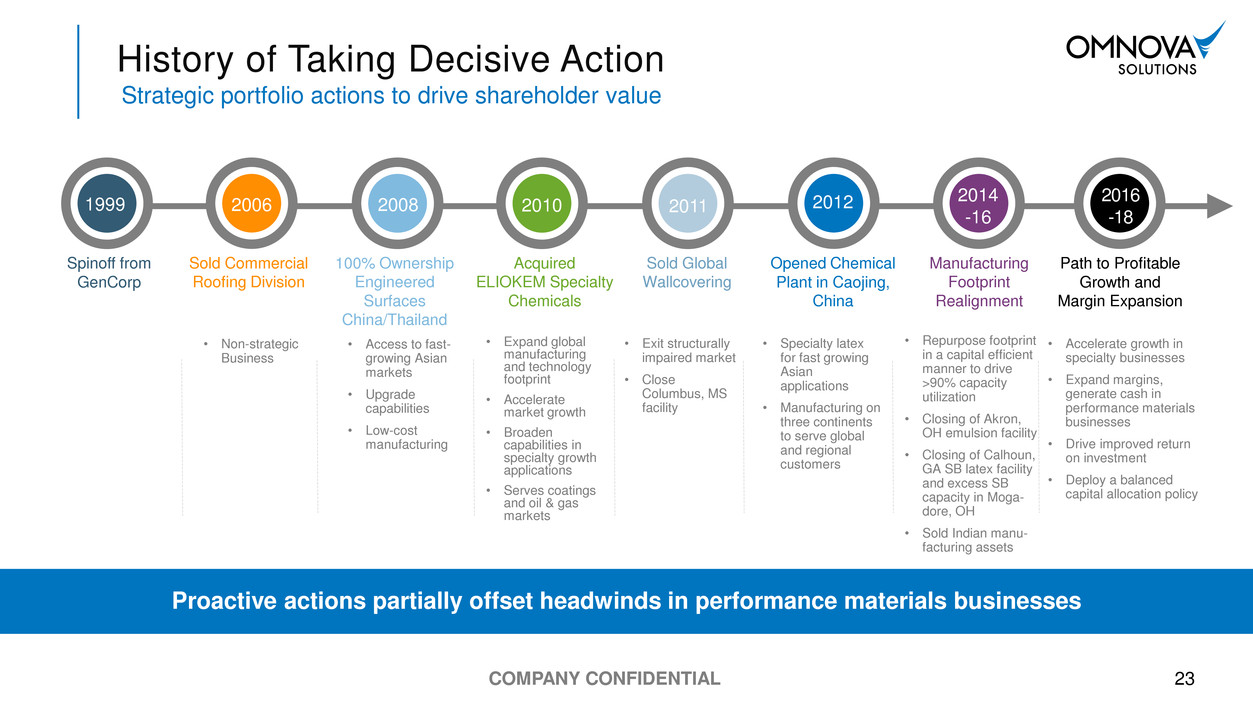

History of Taking Decisive Action

Strategic portfolio actions to drive shareholder value

Proactive actions partially offset headwinds in performance materials businesses

• Access to fast-

growing Asian

markets

• Upgrade

capabilities

• Low-cost

manufacturing

• Expand global

manufacturing

and technology

footprint

• Accelerate

market growth

• Broaden

capabilities in

specialty growth

applications

• Serves coatings

and oil & gas

markets

• Exit structurally

impaired market

• Close

Columbus, MS

facility

• Specialty latex

for fast growing

Asian

applications

• Manufacturing on

three continents

to serve global

and regional

customers

• Non-strategic

Business

• Accelerate growth in

specialty businesses

• Expand margins,

generate cash in

performance materials

businesses

• Drive improved return

on investment

• Deploy a balanced

capital allocation policy

• Repurpose footprint

in a capital efficient

manner to drive

>90% capacity

utilization

• Closing of Akron,

OH emulsion facility

• Closing of Calhoun,

GA SB latex facility

and excess SB

capacity in Moga-

dore, OH

• Sold Indian manu-

facturing assets

Spinoff from

GenCorp

Sold Commercial

Roofing Division

100% Ownership

Engineered

Surfaces

China/Thailand

Acquired

ELIOKEM Specialty

Chemicals

Sold Global

Wallcovering

Opened Chemical

Plant in Caojing,

China

1999 2006 2008 2010 2011 2012

2016

-18

Path to Profitable

Growth and

Margin Expansion

2014

-16

Manufacturing

Footprint

Realignment

COMPANY CONFIDENTIAL

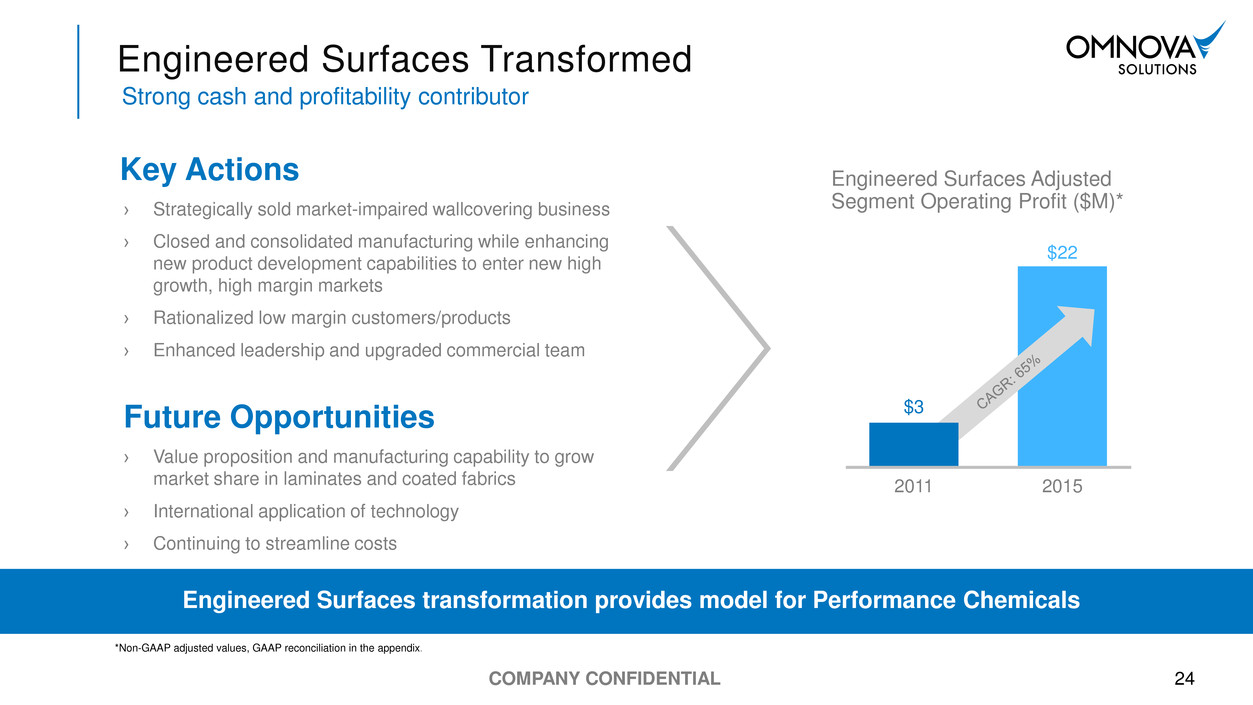

Engineered Surfaces Adjusted

Segment Operating Profit ($M)*

24

Engineered Surfaces transformation provides model for Performance Chemicals

Strong cash and profitability contributor

2011

Key Actions

› Strategically sold market-impaired wallcovering business

› Closed and consolidated manufacturing while enhancing

new product development capabilities to enter new high

growth, high margin markets

› Rationalized low margin customers/products

› Enhanced leadership and upgraded commercial team

Future Opportunities

› Value proposition and manufacturing capability to grow

market share in laminates and coated fabrics

› International application of technology

› Continuing to streamline costs

2015

$3

$22

Engineered Surfaces Transformed

*Non-GAAP adjusted values, GAAP reconciliation in the appendix.

COMPANY CONFIDENTIAL

› Exciting opportunities to grow higher margin Specialty businesses

› Strengthened innovation and commercial excellence process

› Positive momentum in margin expansion, earnings growth and cash

generation

› Significantly lowered cost base and reconfigured manufacturing

footprint

› Diverse technologies and global footprint enhance Specialty

businesses

› Upgraded leadership team

Why OMNOVA Solutions?

On track to achieve our future state

25

26

Appendix

COMPANY CONFIDENTIAL

0

30

60

90

120

150

Ce

nts

pe

r lb

27

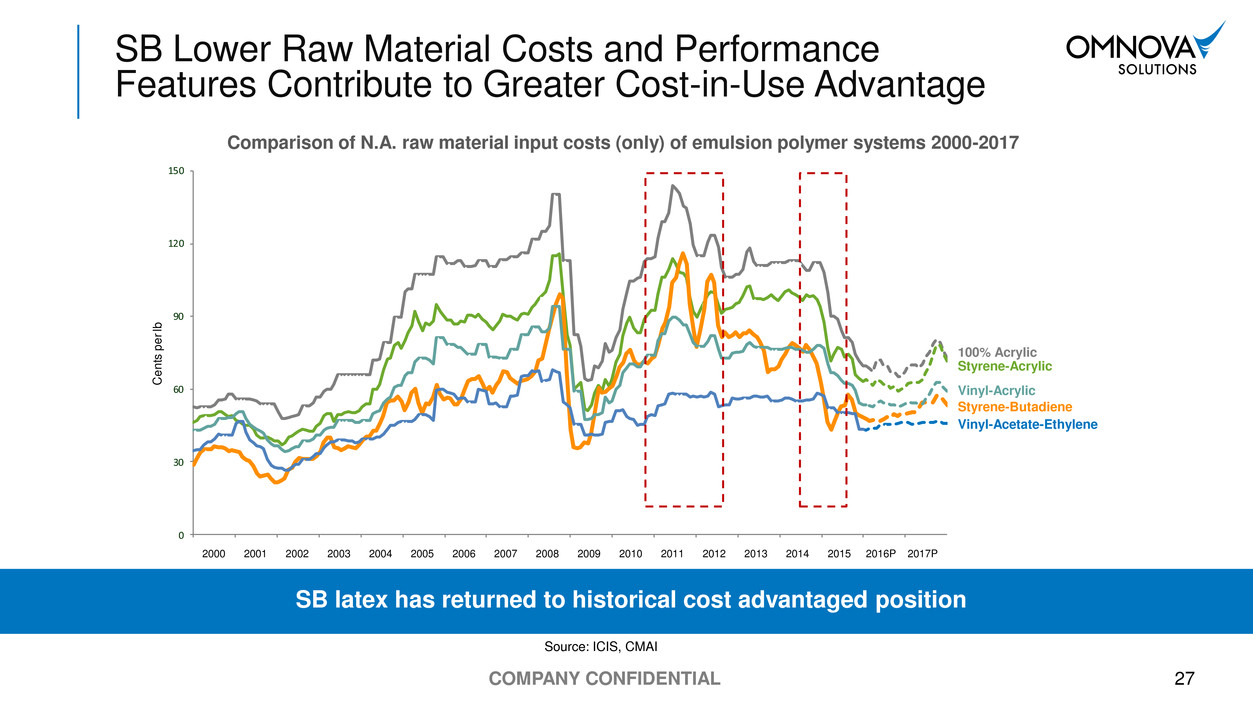

SB Lower Raw Material Costs and Performance

Features Contribute to Greater Cost-in-Use Advantage

SB latex has returned to historical cost advantaged position

Comparison of N.A. raw material input costs (only) of emulsion polymer systems 2000-2017

Source: ICIS, CMAI

Vinyl-Acetate-Ethylene

Vinyl-Acrylic

Styrene-Butadiene

Styrene-Acrylic

100% Acrylic

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016P 2017P

COMPANY CONFIDENTIAL

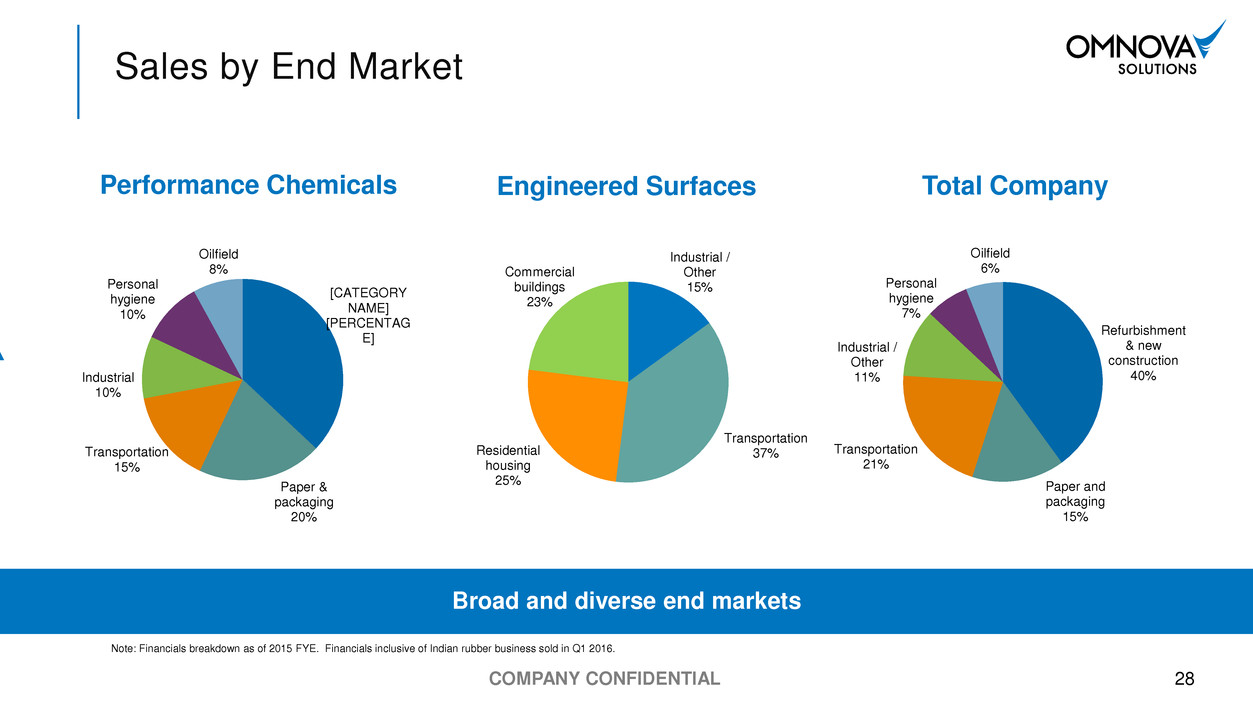

Total Company

Sales by End Market

28

Refurbishment

& new

construction

40%

Paper and

packaging

15%

Transportation

21%

Industrial /

Other

11%

Personal

hygiene

7%

Oilfield

6%

Note: Financials breakdown as of 2015 FYE. Financials inclusive of Indian rubber business sold in Q1 2016.

Engineered Surfaces

Industrial /

Other

15%

Transportation

37% Residential

housing

25%

Commercial

buildings

23%

[CATEGORY

NAME]

[PERCENTAG

E]

Paper &

packaging

20%

Transportation

15%

Industrial

10%

Personal

hygiene

10%

Oilfield

8%

Performance Chemicals

Broad and diverse end markets

COMPANY CONFIDENTIAL

This presentation includes Adjusted Segment Operating Profit, Adjusted Segment EBITDA, Adjusted Income from Continuing Operations Before Income

Taxes, Adjusted Consolidated EBITDA and other financial measures which are Non-GAAP financial measures as defined by the Securities and Exchange

Commission.

OMNOVA’s Adjusted Segment Operating Profit is calculated as Segment Operating Profit (Loss) less restructuring and severance expenses, asset

impairments and other items. Adjusted Segment EBITDA is calculated as Adjusted Segment Operating Profit less depreciation and amortization expense

less accelerated depreciation.

OMNOVA’s Adjusted Income from Continuing Operations Before Income Taxes is calculated as Adjusted Segment Operating Profit less corporate expenses,

interest, restructuring and severance, asset impairments and other items. OMNOVA’s Adjusted EBITDA is calculated as Adjusted Income from Continuing

Operations Before Income Taxes less interest expense less debt premium and depreciation and amortization expense less accelerated depreciation.

Adjusted Segment Operating Profit and Adjusted Segment and/or Consolidated EBITDA and the other financial measures (collectively, the “Non-GAAP

financial measures”) are not calculated in the same manner by all companies and, accordingly, are not necessarily comparable to similarly titled measures of

other companies and may not be appropriate measures for comparing performance relative to other companies. The Non-GAAP financial measures should

not be construed as indicators of the Company’s operating performance or liquidity and should not be considered in isolation from or as a substitute for net

income (loss), cash flows from operations or cash flow data, which are all prepared in accordance with GAAP. The Non-GAAP financial measures are not

intended to represent, and should not be considered more meaningful than or as an alternative to, measures of operating performance as determined in

accordance with GAAP. Management believes that presenting this information is useful to investors because these measures are commonly used as

analytical indicators to evaluate performance and by management to allocate resources. Set forth in the appendices are the reconciliations of these Non-

GAAP financial measures to their most directly comparable GAAP financial measure.

All appendix results are pro forma reflecting continuing business (including the acquisition of ELIOKEM and excluding the sale of the global wallcovering

business).

Appendix – Non-GAAP Financial Measures

29

COMPANY CONFIDENTIAL

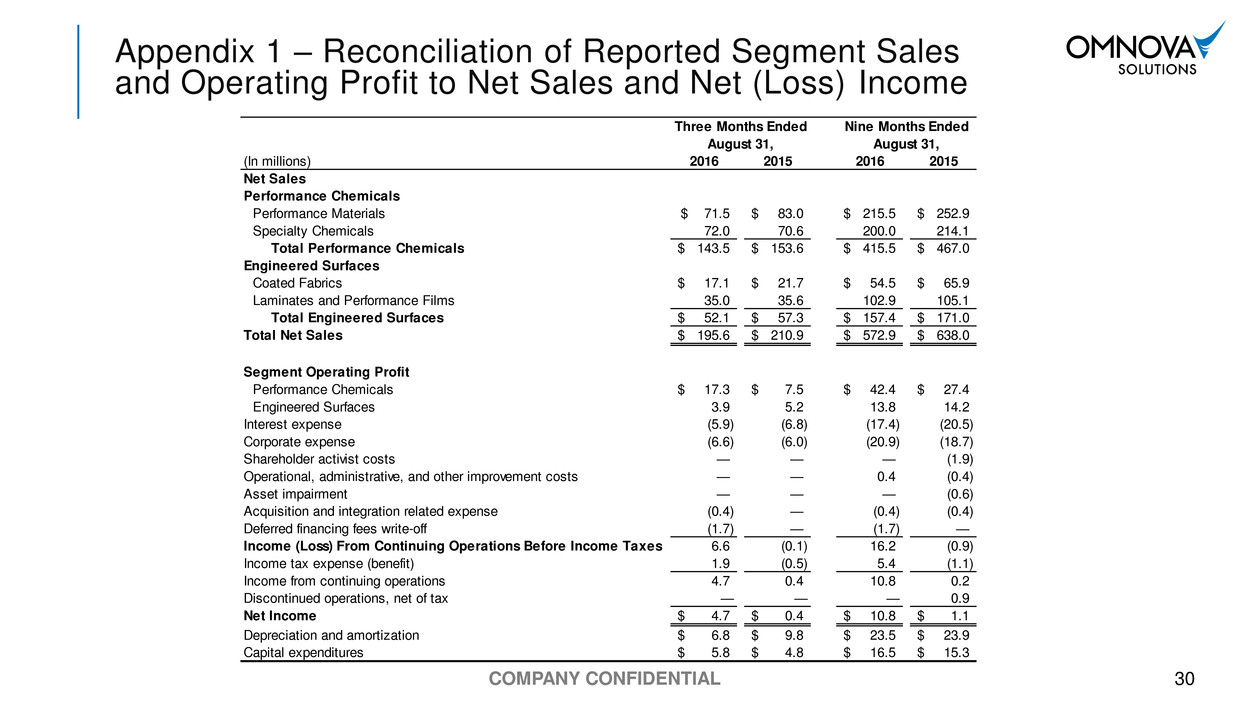

Appendix 1 – Reconciliation of Reported Segment Sales

and Operating Profit to Net Sales and Net (Loss) Income

30

(In millions) 2016 2015 2016 2015

Net Sales

Performance Chemicals

Performance Materials 71.5$ 83.0$ 215.5$ 252.9$

Specialty Chemicals 72.0 70.6 200.0 214.1

Total Performance Chemicals 143.5$ 153.6$ 415.5$ 467.0$

Engineered Surfaces

Coated Fabrics 17.1$ 21.7$ 54.5$ 65.9$

Laminates and Performance Films 35.0 35.6 102.9 105.1

Total Engineered Surfaces 52.1$ 57.3$ 157.4$ 171.0$

Total Net Sales 195.6$ 210.9$ 572.9$ 638.0$

Segment Operating Profit

Performance Chemicals 17.3$ 7.5$ 42.4$ 27.4$

Engineered Surfaces 3.9 5.2 13.8 14.2

Interest expense (5.9) (6.8) (17.4) (20.5)

Corporate expense (6.6) (6.0) (20.9) (18.7)

Shareholder activist costs — — — (1.9)

Operational, administrative, and other improvement costs — — 0.4 (0.4)

Asset impairment — — — (0.6)

Acquisition and integration related expense (0.4) — (0.4) (0.4)

Deferred financing fees write-off (1.7) — (1.7) —

Income (Loss) From Continuing Operations Before Income Taxes 6.6 (0.1) 16.2 (0.9)

Income tax expense (benefit) 1.9 (0.5) 5.4 (1.1)

Income from continuing operations 4.7 0.4 10.8 0.2

Discontinued operations, net of tax — — — 0.9)

Net Income 4.7$ 0.4$ 10.8$ 1.1$

Depreciation and amortization 6.8$ 9.8$ 23.5$ 23.9$

Capital expenditures 5.8$ 4.8$ 16.5$ 15.3$

Three Months Ended Nine Months Ended

August 31, August 31,

COMPANY CONFIDENTIAL

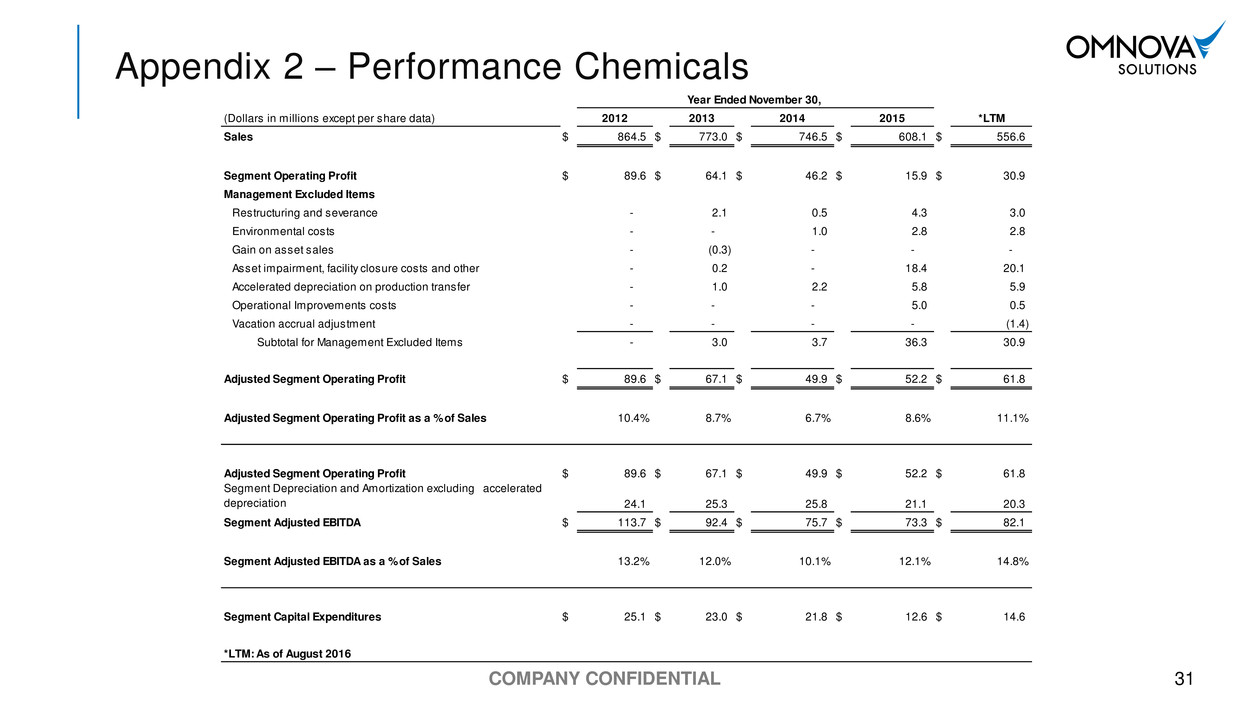

Appendix 2 – Performance Chemicals

31

(Dollars in millions except per share data) 2012 2013 2014 2015 *LTM

Sales $ 864.5 $ 773.0 $ 746.5 $ 608.1 $ 556.6

Segment Operating Profit $ 89.6 $ 64.1 $ 46.2 $ 15.9 $ 30.9

Management Excluded Items

Restructuring and severance - 2.1 0.5 4.3 3.0

Environmental costs - - 1.0 2.8 2.8

Gain on asset sales - (0.3) - - -

Asset impairment, facility closure costs and other - 0.2 - 18.4 20.1

Accelerated depreciation on production transfer - 1.0 2.2 5.8 5.9

Operational Improvements costs - - - 5.0 0.5

Vacation accrual adjustment - - - - (1.4)

Subtotal for Management Excluded Items - 3.0 3.7 36.3 30.9

Adjusted Segment Operating Profit $ 89.6 $ 67.1 $ 49.9 $ 52.2 $ 61.8

Adjusted Segment Operating Profit as a % of Sales 10.4% 8.7% 6.7% 8.6% 11.1%

Adjusted Segment Operating Profit $ 89.6 $ 67.1 $ 49.9 $ 52.2 $ 61.8

Segment Depreciation and Amortization excluding accelerated

depreciation 24.1 25.3 25.8 21.1 20.3

Segment Adjusted EBITDA $ 113.7 $ 92.4 $ 75.7 $ 73.3 $ 82.1

Segment Adjusted EBITDA as a % of Sales 13.2% 12.0% 10.1% 12.1% 14.8%

Segment Capital Expenditures $ 25.1 $ 23.0 $ 21.8 $ 12.6 $ 14.6

*LTM: As of August 2016

Year Ended November 30,

COMPANY CONFIDENTIAL

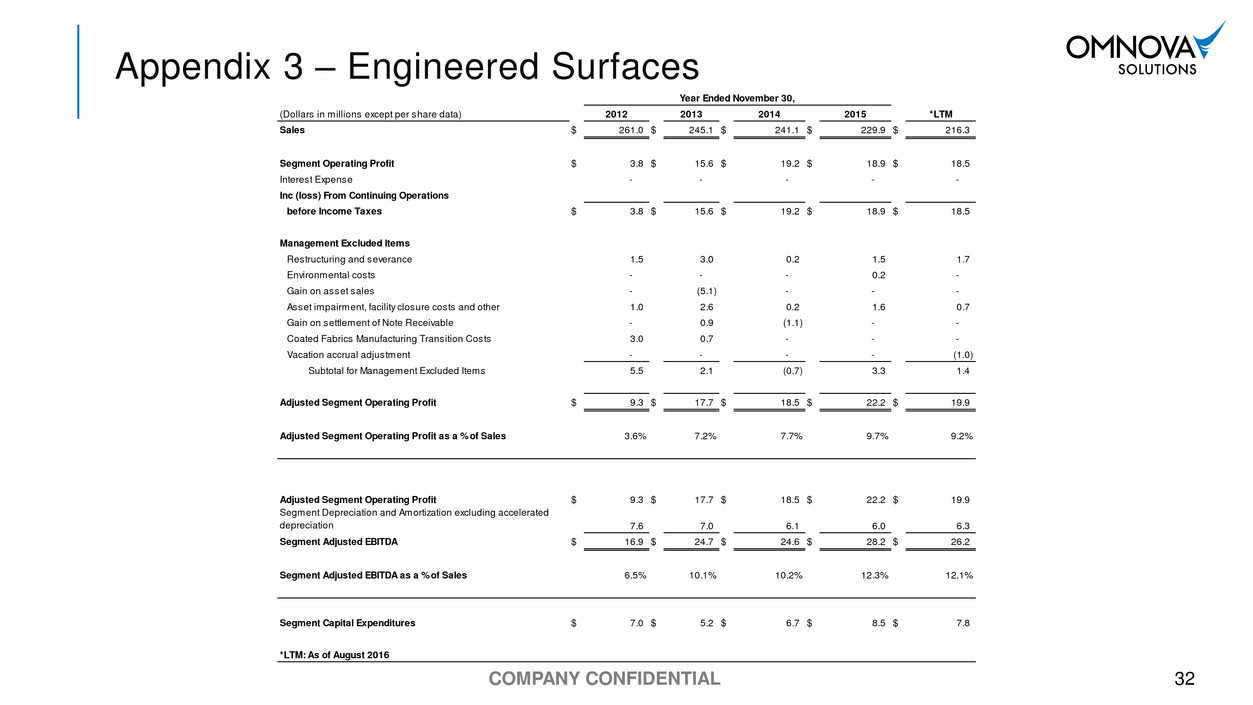

Appendix 3 – Engineered Surfaces

32

(Dollars in millions except per share data) 2012 2013 2014 2015 *LTM

Sales $ 261.0 $ 245.1 $ 241.1 $ 229.9 $ 216.3

Segment Operating Profit $ 3.8 $ 15.6 $ 19.2 $ 18.9 $ 18.5

Interest Expense - - - - -

Inc (loss) From Continuing Operations

before Income Taxes $ 3.8 $ 15.6 $ 19.2 $ 18.9 $ 18.5

Management Excluded Items

Restructuring and severance 1.5 3.0 0.2 1.5 1.7

Environmental costs - - - 0.2 -

Gain on asset sales - (5.1) - - -

Asset impairment, facility closure costs and other 1.0 2.6 0.2 1.6 0.7

Gain on settlement of Note Receivable - 0.9 (1.1) - -

Coated Fabrics Manufacturing Transition Costs 3.0 0.7 - - -

Vacation accrual adjustment - - - - (1.0)

Subtotal for Management Excluded Items 5.5 2.1 (0.7) 3.3 1.4

Adjusted Segment Operating Profit $ 9.3 $ 17.7 $ 18.5 $ 22.2 $ 19.9

Adjusted Segment Operating Profit as a % of Sales 3.6% 7.2% 7.7% 9.7% 9.2%

Adjusted Segment Operating Profit $ 9.3 $ 17.7 $ 18.5 $ 22.2 $ 19.9

Segment Depreciation and Amortization excluding accelerated

depreciation 7.6 7.0 6.1 6.0 6.3

Segment Adjusted EBITDA $ 16.9 $ 24.7 $ 24.6 $ 28.2 $ 26.2

Segment Adjusted EBITDA as a % of Sales 6.5% 10.1% 10.2% 12.3% 12.1%

Segment Capital Expenditures $ 7.0 $ 5.2 $ 6.7 $ 8.5 $ 7.8

*LTM: As of August 2016

Year Ended November 30,

COMPANY CONFIDENTIAL

Appendix 4 – OMNOVA Consolidated

33

(Dollars in millions except per share data) 2012 2013 2014 2015 *LTM

Sales $ 1,125.5 $ 1,018.1 $ 987.4 $ 838.0 $ 772.9

PC Adjusted Segment Operating Profit $ 89.6 $ 67.1 $ 49.9 $ 52.2 $ 61.8

ES Adjusted Segment Operating Profit 9.3 17.7 18.5 22.2 19.9

Total Adjusted Segment Operating Profit $ 98.9 $ 84.8 $ 68.4 $ 74.4 $ 81.7

Adjusted Segment Operating Profit as a % of Sales 8.8% 8.3% 6.9% 8.9% 10.6%

Corporate Expense (20.0) (21.3) (20.8) (27.6) (28.1)

Interest Expense (36.5) (31.9) (32.9) (28.3) (25.2)

Corporate Excluded Items

Restructuring and severance - - - 0.1 0.1

Enviornmental Costs - - - - -

Asset impairment, facility closure costs and other - - - 0.6 -

Accelerated depreciation on production transfer - - - - -

Operational Improvements costs - - - 0.4 -

Deferred Financing Fees Written-Off - 1.5 0.8 0.6 2.4

Corporate Headquarters Relocation Costs - 0.1 0.6 - (0.2)

Other financing costs - - 2.4 1.0 1.0

Shareholder activist costs - - - 1.9 -

Acquisition and integration related expense - - - 0.4 0.4

Vacation accrual adjustment - - - - (0.6)

Subtotal for Management Excluded Items - 1.6 3.8 5.0 3.1

Adjusted Income from Continuing Operations before Income Taxes $ 42.4 $ 33.2 $ 18.5 $ 23.5 $ 31.5

Tax Expense (30% rate)** (12.7) (10.0) (5.6) (7.0) (9.5)

Adjusted Income From Continuing Operations 29.7 23.2 $ 12.9 $ 16.5 $ 22.0

Adjusted Diluted Earnings Per Share from Adjusted

Income from Continuing Operations *** $ 0.65 $ 0.50 $ 0.28 $ 0.36 $ 0.49

**Tax rate is based on the Company's estimated normalized annual effective tax rate

*** Adjusted EPS is calculated using Diluted Shares Outstanding at the end of the period

Adjusted Income from Continuing Operations before Income Taxes $ 42.4 $ 33.2 $ 18.5 $ 23.5 $ 31.5

Interest Expense (Excluding debt premium ) 36.5 31.9 30.9 27.3 24.2

Depreciation and Amortization excluding accelerated depreciation 32.0 32.6 32.5 28.2 27.7

Consolidated Adjusted EBITDA $ 110.9 $ 97.7 $ 81.9 $ 79.0 $ 83.4

Consolidated Adjusted EBITDA as a % of Sales 9.9% 9.6% 8.3% 9.4% 10.8%

Consolidated Capital Expenditures $ 32.9 $ 29.2 $ 29.8 $ 24.0 $ 25.1

Net Leverage

Total Short and Long Term Debt**** 452.2 448.6 412.0 356.7 517.0

Less Cash and Restricted Cash (148.5) (164.9) (99.5) (44.9) (226.2)

Net Debt 303.7 283.7 312.5 311.8 290.8

Net Leverage Ratio***** 2.7 X 2.9 X 3.8 X 3.9 X 3.5 X

**** LTM Excludes OID of $3.5M

***** The above calculation is not intended to be used for purposes of calculating debt covenant compliance

Year Ended November 30,

COMPANY CONFIDENTIAL

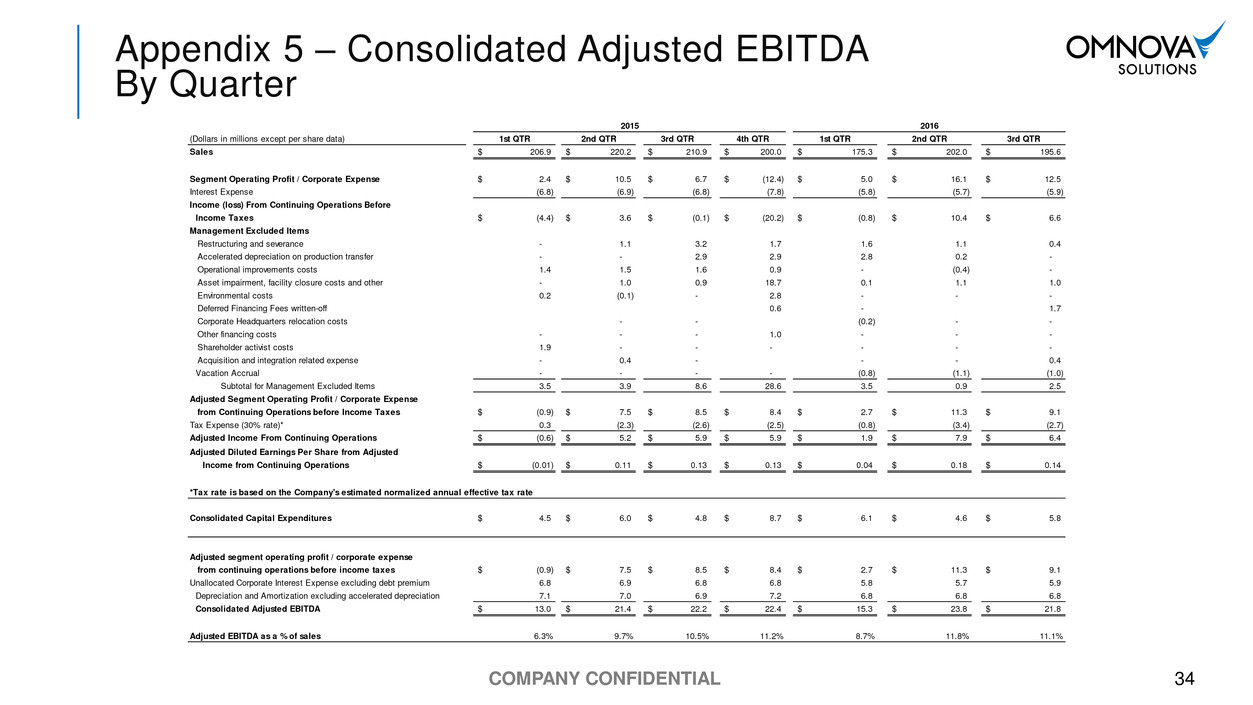

Appendix 5 – Consolidated Adjusted EBITDA

By Quarter

34

(Dollars in millions except per share data) 1st QTR 2nd QTR 3rd QTR 4th QTR 1st QTR 2nd QTR 3rd QTR

Sales 206.9$ 220.2$ 210.9$ 200.0$ 175.3$ 202.0$ 195.6$

Segment Operating Profit / Corporate Expense 2.4$ 10.5$ 6.7$ (12.4)$ 5.0$ 16.1$ 12.5$

Interest Expense (6.8) (6.9) (6.8) (7.8) (5.8) (5.7) (5.9)

Income (loss) From Continuing Operations Before

Income Taxes (4.4)$ 3.6$ (0.1)$ (20.2)$ (0.8)$ 10.4$ 6.6$

Management Excluded Items

Restructuring and severance - 1.1 3.2 1.7 1.6 1.1 0.4

Accelerated depreciation on production transfer - - 2.9 2.9 2.8 0.2 -

Operational improvements costs 1.4 1.5 1.6 0.9 - (0.4) -

Asset impairment, facility closure costs and other - 1.0 0.9 18.7 0.1 1.1 1.0

Environmental costs 0.2 (0.1) - 2.8 - - -

Deferred Financing Fees written-off 0.6 - 1.7

Corporate Headquarters relocation costs - - (0.2) - -

Other financing costs - - - 1.0 - - -

Shareholder activist costs 1.9 - - - - - -

Acquisition and integration related expense - 0.4 - - - 0.4

Vacation Accrual - - - - (0.8) (1.1) (1.0)

Subtotal for Management Excluded Items 3.5 3.9 8.6 28.6 3.5 0.9 2.5

Adjusted Segment Operating Profit / Corporate Expense

from Continuing Operations before Income Taxes (0.9)$ 7.5$ 8.5$ 8.4$ 2.7$ 11.3$ 9.1$

Tax Expense (30% rate)* 0.3 (2.3) (2.6) (2.5) (0.8) (3.4) (2.7)

Adjusted Income From Continuing Operations (0.6)$ 5.2$ 5.9$ 5.9$ 1.9$ 7.9$ 6.4$

Adjusted Diluted Earnings Per Share from Adjusted

Income from Continuing Operations (0.01)$ 0.11$ 0.13$ 0.13$ 0.04$ 0.18$ 0.14$

*Tax rate is based on the Company's estimated normalized annual effective tax rate

Consolidated Capital Expenditures 4.5$ 6.0$ 4.8$ 8.7$ 6.1$ 4.6$ 5.8$

Adjusted segment operating profit / corporate expense

from continuing operations before income taxes (0.9)$ 7.5$ 8.5$ 8.4$ 2.7$ 11.3$ 9.1$

Unallocated Corporate Interest Expense excluding debt premium 6.8 6.9 6.8 6.8 5.8 5.7 5.9

Depreciation and Amortization excluding accelerated depreciation 7.1 7.0 6.9 7.2 6.8 6.8 6.8

Consolidated Adjusted EBITDA 13.0$ 21.4$ 22.2$ 22.4$ 15.3$ 23.8$ 21.8$

Adjusted EBITDA as a % of sales 6.3% 9.7% 10.5% 11.2% 8.7% 11.8% 11.1%

2015 2016

COMPANY CONFIDENTIAL

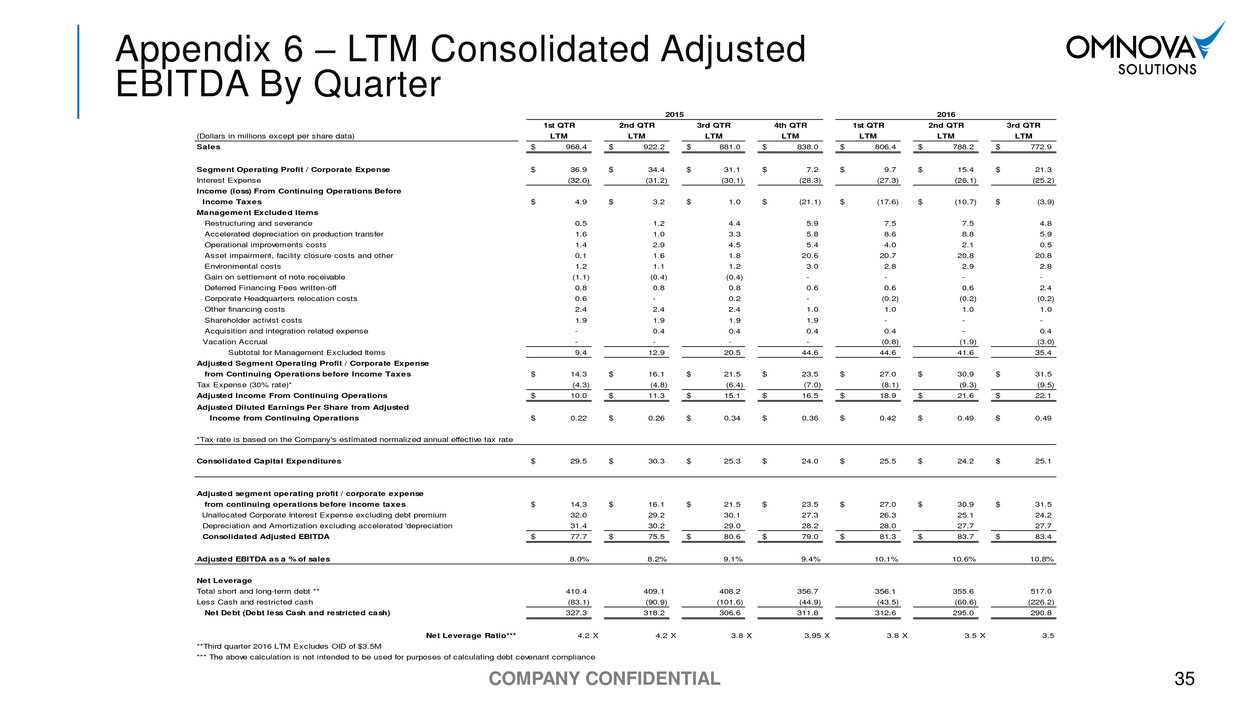

Appendix 6 – LTM Consolidated Adjusted

EBITDA By Quarter

35

1st QTR 2nd QTR 3rd QTR 4th QTR 1st QTR 2nd QTR 3rd QTR

(Dollars in millions except per share data) LTM LTM LTM LTM LTM LTM LTM

Sales 968.4$ 922.2$ 881.0$ 838.0$ 806.4$ 788.2$ 772.9$

Segment Operating Profit / Corporate Expense 36.9$ 34.4$ 31.1$ 7.2$ 9.7$ 15.4$ 21.3$

Interest Expense (32.0) (31.2) (30.1) (28.3) (27.3) (26.1) (25.2)

Income (loss) From Continuing Operations Before

Income Taxes 4.9$ 3.2$ 1.0$ (21.1)$ (17.6)$ (10.7)$ (3.9)$

Management Excluded Items

Restructuring and severance 0.5 1.2 4.4 5.9 7.5 7.5 4.8

Accelerated depreciation on production transfer 1.6 1.0 3.3 5.8 8.6 8.8 5.9

Operational improvements costs 1.4 2.9 4.5 5.4 4.0 2.1 0.5

Asset impairment, facility closure costs and other 0.1 1.6 1.8 20.6 20.7 20.8 20.8

Environmental costs 1.2 1.1 1.2 3.0 2.8 2.9 2.8

Gain on settlement of note receivable (1.1) (0.4) (0.4) - - - -

Deferred Financing Fees written-off 0.8 0.8 0.8 0.6 0.6 0.6 2.4

Corporate Headquarters relocation costs 0.6 - 0.2 - (0.2) (0.2) (0.2)

Other financing costs 2.4 2.4 2.4 1.0 1.0 1.0 1.0

Shareholder activist costs 1.9 1.9 1.9 1.9 - - -

Acquisition and integration related expense - 0.4 0.4 0.4 0.4 - 0.4

Vacation Accrual - - - - (0.8) (1.9) (3.0)

Subtotal for Management Excluded Items 9.4 12.9 20.5 44.6 44.6 41.6 35.4

Adjusted Segment Operating Profit / Corporate Expense

from Continuing Operations before Income Taxes 14.3$ 16.1$ 21.5$ 23.5$ 27.0$ 30.9$ 31.5$

Tax Expense (30% rate)* (4.3) (4.8) (6.4) (7.0) (8.1) (9.3) (9.5)

Adjusted Income From Continuing Operations 10.0$ 11.3$ 15.1$ 16.5$ 18.9$ 21.6$ 22.1$

Adjusted Diluted Earnings Per Share from Adjusted

Income from Continuing Operations 0.22$ 0.26$ 0.34$ 0.36$ 0.42$ 0.49$ 0.49$

*Tax rate is based on the Company's estimated normalized annual effective tax rate

Consolidated Capital Expenditures 29.5$ 30.3$ 25.3$ 24.0$ 25.5$ 24.2$ 25.1$

Adjusted segment operating profit / corporate expense

from continuing operations before income taxes 14.3$ 16.1$ 21.5$ 23.5$ 27.0$ 30.9$ 31.5$

Unallocated Corporate Interest Expense excluding debt premium 32.0 29.2 30.1 27.3 26.3 25.1 24.2

Depreciation and Amortization excluding accelerated 'depreciation 31.4 30.2 29.0 28.2 28.0 27.7 27.7

Consolidated Adjusted EBITDA 77.7$ 75.5$ 80.6$ 79.0$ 81.3$ 83.7$ 83.4$

Adjusted EBITDA as a % of sales 8.0% 8.2% 9.1% 9.4% 10.1% 10.6% 10.8%

Net Leverage

Total short and long-term debt ** 410.4 409.1 408.2 356.7 356.1 355.6 517.0

Less C sh and restricted cash (83.1) (90.9) (101.6) (44.9) (43.5) (60.6) (226.2)

Net Debt (Debt less Cash and restricted cash) 327.3 318.2 306.6 311.8 312.6 295.0 290.8

Net Leverage Ratio*** 4.2 X 4.2 X 3.8 X 3.95 X 3.8 X 3.5 X 3.5

**Third quarter 2016 LTM Excludes OID of $3.5M

*** The above calculation is not intended to be used for purposes of calculating debt covenant compliance

2015 2016

COMPANY CONFIDENTIAL

Appendix 7 – Adjusted Return on Invested Capital

36

(In millions)

Trailing Twelve

Months Ended

August 31,

Adjusted Net Operating Profit after Tax 2016 2015 2014

Adjusted Income from Continuing Operations 22.0$ 16.5$ 12.9$

Interest add back excluding debt premium 24.2 27.3 30.9

Tax effect of interest add back* (7.3) (8.2) (9.3)

Total Adjusted Net Operating Profit after Tax 38.9$ 35.6$ 34.5$

Debt and Equity

Short-term Debt 4.0$ 2.5$ 5.6$

Senior Notes 150.0 150.0 200.0

Long-term Debt 359.5 204.2 206.4

Total Shareholders' Equity 130.4 109.1 150.5

Total Debt and Equity 643.9$ 465.8$ 562.5$

Adjusted Return on Invested Capital 6.0% 7.6% 6.1%

*Tax rate is based on the Company's estimated normalized annual effective tax rate of 30%.

Twelve Months Ended

November 30,