Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TERRAFORM GLOBAL, INC. | glblexhibit991preliminary2.htm |

| 8-K - 8-K - TERRAFORM GLOBAL, INC. | glbl8-kpreliminary2q2016re.htm |

P. 1

Logo to be

replaced

TerraForm Global

Preliminary Summary Results for 2Q 2016

September 16, 2016

P. 2

Forward Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of

1934. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements involve estimates, expectations,

projections, goals, assumptions, known and unknown risks, and uncertainties and typically include words or variations of words such as “expect,” “anticipate,” “believe,” “intend,”

“plan,” “seek,” “estimate,” “predict,” “project,” “goal,” “guidance,” “outlook,” “objective,” “forecast,” “target,” “potential,” “continue,” “would,” “will,” “should,” “could,” or “may” or other

comparable terms and phrases. All statements that address operating performance, events, or developments that TerraForm Global expects or anticipates will occur in the future

are forward-looking statements. They may include estimates of expected adjusted EBITDA, cash available for distribution (CAFD), earnings, revenues, capital expenditures,

liquidity, capital structure, future growth, financing arrangement and other financial performance items (including future dividends per share), descriptions of management’s plans

or objectives for future operations, products, or services, or descriptions of assumptions underlying any of the above. Forward-looking statements provide TerraForm Global’s

current expectations or predictions of future conditions, events, or results and speak only as of the date they are made. Although TerraForm Global, believes its respective

expectations and assumptions are reasonable, it can give no assurance that these expectations and assumptions will prove to have been correct and actual results may vary

materially.

By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking

statements. Factors that might cause such differences include, but are not limited to, our relationship with SunEdison, including SunEdison’s bankruptcy filings and our reliance

on SunEdison for management, corporate and accounting services, project level operation and maintenance and asset management services, to maintain critical information

technology and accounting systems and to provide our employees; risks related to events of default and potential events of default arising under project-level financings and

other agreements related to the chapter 11 proceedings of SunEdison and our failure to obtain corporate and project-level audits; risks related to our failure to satisfy the

requirements of Nasdaq; our ability to integrate the projects we acquire from third parties or otherwise realize the anticipated benefits from such acquisitions, including through

refinancing or future sales; actions of third parties, including but not limited to the failure of SunEdison to fulfill its obligations; price fluctuations, termination provisions and buyout

provisions in offtake agreements; delays or unexpected costs during the completion of projects we intend to acquire; our ability to successfully identify, evaluate, and

consummate acquisitions from third parties, including SunEdison or changes in expected terms and timing of any acquisitions; our ability to complete our pending acquisitions;

regulatory requirements and incentives for production of renewable power; operating and financial restrictions under agreements governing indebtedness; the condition of the

debt and equity capital markets and our ability to borrow additional funds and access capital markets; the impact of foreign exchange rate fluctuations; our ability to compete

against traditional and renewable energy companies; hazards customary to the power production industry and power generation operations, such as unusual weather conditions

and outages or other curtailment of our power plants; departure of some or all of SunEdison’s employees, particularly executive officers or key employees and operations and

maintenance or asset management personnel that we significantly rely upon; pending and future litigation; and our ability to operate our business efficiently, to operate and

maintain our information technology, technical, accounting and generation monitoring systems, to manage and complete governmental filings on a timely basis, and to manage

our capital expenditures, economic, social and political risks and uncertainties inherent in international operations, including operations in emerging markets and the impact of

foreign exchange rate fluctuations, the imposition of currency controls and restrictions on repatriation of earnings and cash, protectionist and other adverse public policies,

including local content requirements, import/export tariffs, increased regulations or capital investment requirements, conflicting international business practices that may conflict

with other customs or legal requirements to which we are subject, inability to obtain, maintain or enforce intellectual property rights, and being subject to the jurisdiction of courts

other than those of the United States, including uncertainty of judicial processes and difficulty enforcing contractual agreements or judgments in foreign legal systems or

incurring additional costs to do so. Furthermore, any dividends are subject to available capital, market conditions, and compliance with associated laws and regulations. Many of

these factors are beyond TerraForm Global’s control.

TerraForm Global disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new

information, data, or methods, future events, or other changes, except as required by law. The foregoing list of factors that might cause results to differ materially from those

contemplated in the forward-looking statements should be considered in connection with information regarding risks and uncertainties which are described in TerraForm Global’s

Prospectus, dated July 31, 2015, and Forms 10-Q with respect to the second and third quarters of 2015, the risk factors furnished to the Securities and Exchange Commission

as part of the Current Report on Form 8-K on July 20, 2016, as well as additional factors it may describe from time to time in other filings with the Securities and Exchange

Commission or incorporated herein. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to

be a complete set of all potential risks or uncertainties.

P. 3

Introduction & Importance of our Risk Factors

The financial information presented on the following slides is preliminary and

unaudited. Financial information may change materially as a result of the completion of the

audit for fiscal year 2015 and review procedures for 1Q 2016 and 2Q 2016

The information does not represent a complete picture of the financial position, results of

operation or cash flows of TerraForm Global (“TerraForm Global” or the “Company”), and is

not a replacement for full financial statements prepared in accordance with U.S. GAAP

The Company’s last annual or quarterly report was its Form 10-Q for the period ended

September 30, 2015. The Company has not filed its Form 10-K for 2015 or its Form 10-Qs

for the periods ending March 31, 2016 or June 30, 2016. The circumstances of the

Company and the risks it faces have changed substantially since the Company’s initial

public offering in August 2015 and the date of its last filing on Form 10-Q in November

2015. You should review the updated Risk Factors relating to the Company furnished

to the SEC as part of our current report on Form 8-K on July 20, 2016, which include

a description of important new risks relating to the chapter 11 proceedings of

SunEdison, the consequences of the absence of audited financial information,

pending litigation and other matters, and the subsequent Form 8-K filings since July

20, 2016. You should refer also to the unaudited financial information for the fiscal year

2015 and for the fiscal quarter 1Q 2016 and the other periodic filings we have made with

the SEC

P. 4

Overview

This presentation provides certain preliminary unaudited summary financial

results for 2Q 2016

The results are provided in a format consistent with the preliminary

unaudited results we previously published for 2H 2015 and 1Q 2016

Please review these results together with the risk factors detailed in our 8 -K

filed on July 20, 2016 and with our subsequent 8-K filings

TerraForm Global remains focused on key areas of execution

– Continuity of operations

– Independence: governance, systems, employees

– Stabilize and strengthen balance sheet

P. 5

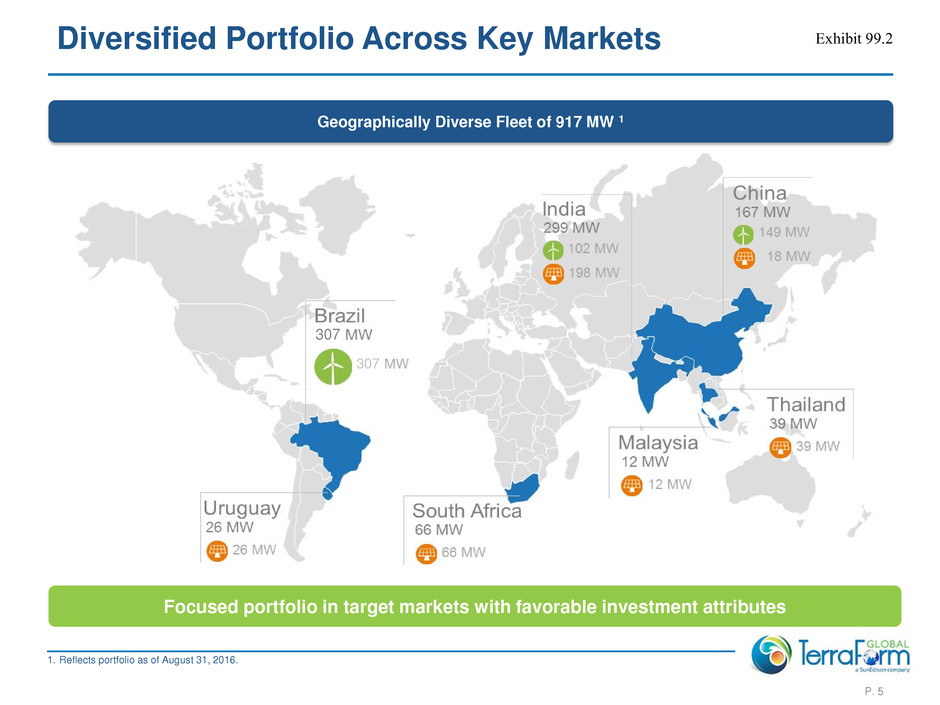

Diversified Portfolio Across Key Markets

Focused portfolio in target markets with favorable investment attributes

Geographically Diverse Fleet of 917 MW 1

1. Reflects portfolio as of August 31, 2016.

307

307

P. 6

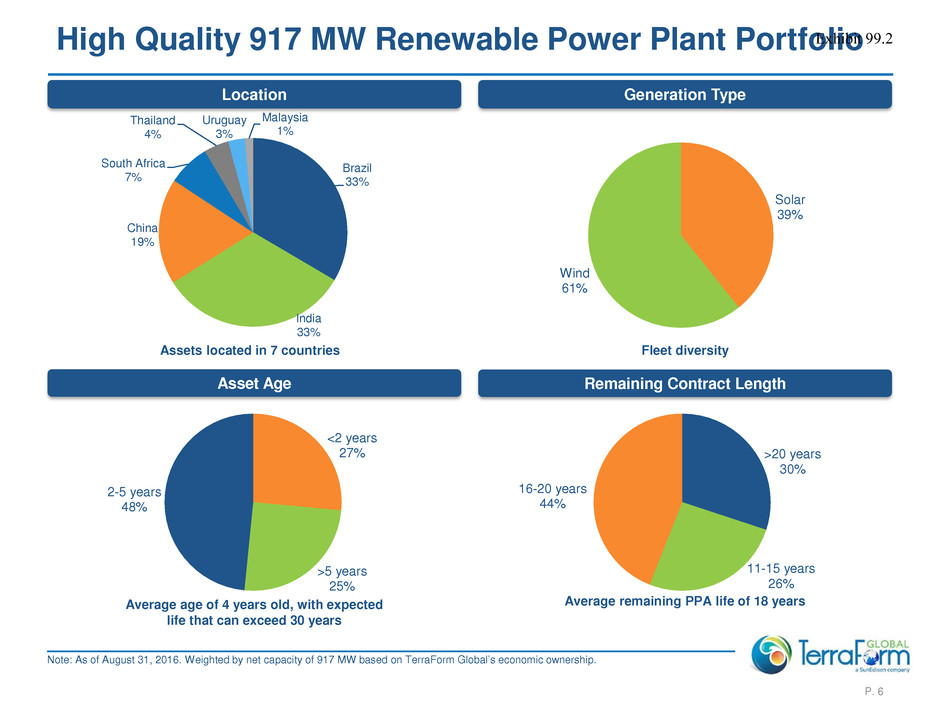

High Quality 917 MW Renewable Power Plant Portfolio

Location

Assets located in 7 countries

Generation Type

Fleet diversity

Asset Age Remaining Contract Length

Average remaining PPA life of 18 yearsAverage age of 4 years old, with expected

life that can exceed 30 years

Note: As of August 31, 2016. Weighted by net capacity of 917 MW based on TerraForm Global’s economic ownership.

Solar

39%

Wind

61%

Brazil

33%

India

33%

China

19%

South Africa

7%

Thailand

4%

Uruguay

3%

Malaysia

1%

>20 years

30%

11-15 years

26%

16-20 years

44%

<2 years

27%

>5 years

25%

2-5 years

48%

P. 7

677

728

917

51

102

25 18

18

26

10-Q Reported

9/30/2015

Portfolio

Adjust. for

Econ.

Ownership &

Capacity

Update

Adjusted

9/30/2015

Portfolio

FERSA

(October)

Addt'l Econ.

Ownership

(October)

NPS Star

(February)

WXA

(February)

Alto Cielo

(April)

6/30/2016

Portfolio

Current View of Portfolio Formation

MW

1

3

2

Note: Reflects net capacity of shares of economic ownership for all projects acquired.

1. In Form 10-Q for the period ended 9/30/2015, net capacity reflected a combination of equity and economic ownership; net capacity has been updated to reflect net capacity

based on economic ownership. Salvador & Bahia also updated to have 307 MW, from 294 MW previously reported.

2. Includes Bhakrani (20 MW), Gadag (31 MW) and Hanumanhatti (50 MW).

3. Transfer of additional economic ownership of NSM L’Volta, Focal, Millenium and Brakes.

4. 33 MW BioTherm acquisition is pending lender consent and $9M remains to be paid upon closing. The Company does not expect that it will be

able to complete the transfers of Bora Bora, Del Litoral, El Naranjal and the India 425 MW assets from SunEdison.

4

12/31/15:

855 MW

3/31/16:

890 MW

P. 8

Preliminary 2Q 2016 Results

Metric 2Q 2016

Net MW Owned (Period End) 917

Production (GWh) 605

Capacity Factor 28%

Revenue $52M - $56M

Revenue / MWh $87M - $91M

Net Income $0M - $8M

Adjusted EBITDA $40M - $46M

CAFD $18M - $24M

Commentary

Net MW Owned increased by 26 MW in 2Q

due to the acquisition of Alto Cielo (Uruguay

solar) in April

Production and Revenue below management

expectations due primarily to curtailment in

China, and some wind turbines offline in India

and Brazil

Total production up 20% from 1Q 2016

primarily due to normal seasonality

Revenue / MWh down 11% from 1Q 2016 due

to mix, as a larger percentage of total

production was from lower priced wind PPAs

in 2Q 2016

CAFD negatively impacted by $13M in

accumulation of restricted cash in South

Africa and India due to SunEdison

bankruptcy-triggered or related defaults

Note: Ranges have been provided for key financial metrics as the interim financial statements for the period ended June 30, 2016 are still under review.

Capacity factor calculated based on gross capacity of 990 MW, which generated 605 GWh in the 91 days in 2Q

P. 9

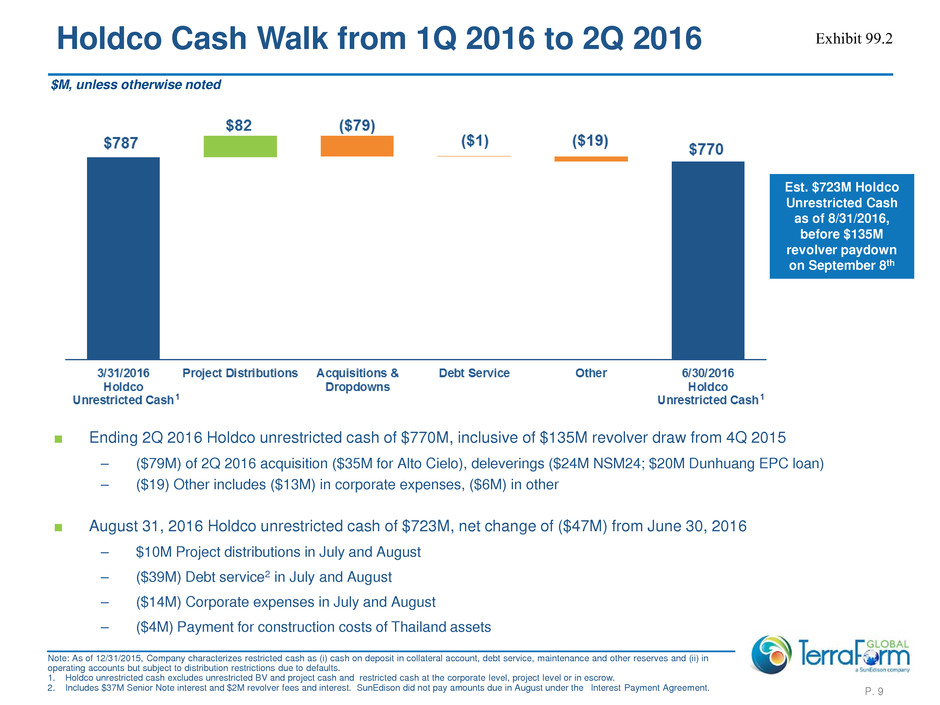

Holdco Cash Walk from 1Q 2016 to 2Q 2016

$M, unless otherwise noted

■ Ending 2Q 2016 Holdco unrestricted cash of $770M, inclusive of $135M revolver draw from 4Q 2015

– ($79M) of 2Q 2016 acquisition ($35M for Alto Cielo), deleverings ($24M NSM24; $20M Dunhuang EPC loan)

– ($19) Other includes ($13M) in corporate expenses, ($6M) in other

■ August 31, 2016 Holdco unrestricted cash of $723M, net change of ($47M) from June 30, 2016

– $10M Project distributions in July and August

– ($39M) Debt service2 in July and August

– ($14M) Corporate expenses in July and August

– ($4M) Payment for construction costs of Thailand assets

Note: As of 12/31/2015, Company characterizes restricted cash as (i) cash on deposit in collateral account, debt service, maintenance and other reserves and (ii) in

operating accounts but subject to distribution restrictions due to defaults.

1. Holdco unrestricted cash excludes unrestricted BV and project cash and restricted cash at the corporate level, project level or in escrow.

2. Includes $37M Senior Note interest and $2M revolver fees and interest. SunEdison did not pay amounts due in August under the Interest Payment Agreement.

Est. $723M Holdco

Unrestricted Cash

as of 8/31/2016,

before $135M

revolver paydown

on September 8th

P. 10

Appendix

P. 11

Risk Factors

Please refer to the risk factors furnished to the SEC on Form

8-K filed July 20, 2016 and to subsequent Form 8-K filings

P. 12

Definitions: Adjusted EBITDA and CAFD

Adjusted EBITDA

We define Adjusted EBITDA as net income (loss) plus depreciation, accretion and amortization, non-cash affiliate general and

administrative costs, acquisition related expenses, interest expense, gains (losses) on interest rate swaps, foreign currency gains

(losses), income tax (benefit) expense and stock compensation expense, and certain other non-cash charges, unusual or non-

recurring items and other items that we believe are not representative of our core business or future operating performance. Our

definitions and calculations of these items may not necessarily be the same as those used by other companies. Adjusted EBITDA

is not a measure of liquidity or profitability and should not be considered as an alternative to net income, operating income, net

cash provided by operating activities or any other measure determined in accordance with U.S. GAAP.

Cash Available For Distribution (CAFD)

We define CAFD as net cash provided by (used in) operating activities of Global LLC (i) plus or minus changes in operating assets

and liabilities as reflected on our statements of cash flows, (ii) minus deposits into (or plus withdrawals from) restricted cash

accounts required by project level financing agreements to the extent they decrease (or increase) cash provided by operating

activities, (iii) minus cash distributions paid to non-controlling interests in our facilities, if any, (iv) minus scheduled project level

and other debt service payments in accordance with the related borrowing arrangements, to the extent they are paid from

operating cash flows during a period, (v) minus non-expansionary capital expenditures, if any, to the extent they are paid from

operating cash flows during a period, (vi) plus cash contributions from SunEdison pursuant to the Interest Payment Agreement,

(vii) plus or minus operating items as necessary to present the cash flows we deem representative of our core business

operations, with the approval of our audit committee.

Note: As of December 31, 2015, TerraForm Global changed its policy regarding restricted cash to characterize the following as

restricted cash: (i) cash on deposit in collateral accounts, debt service reserve accounts, maintenance and other reserve accounts,

and (ii) cash on deposit in operating accounts but subject to distribution restrictions due to debt defaults. Previously, cash

available for operating purposes, but subject to compliance procedures and lender approvals prior to distribution from project level

accounts, was also considered restricted. This cash is now considered unrestricted but is designated as unavailable for immediate

corporate purposes. The impact of the new accounting policy on reported CAFD for 2Q 2016 difference is immaterial.

P. 13

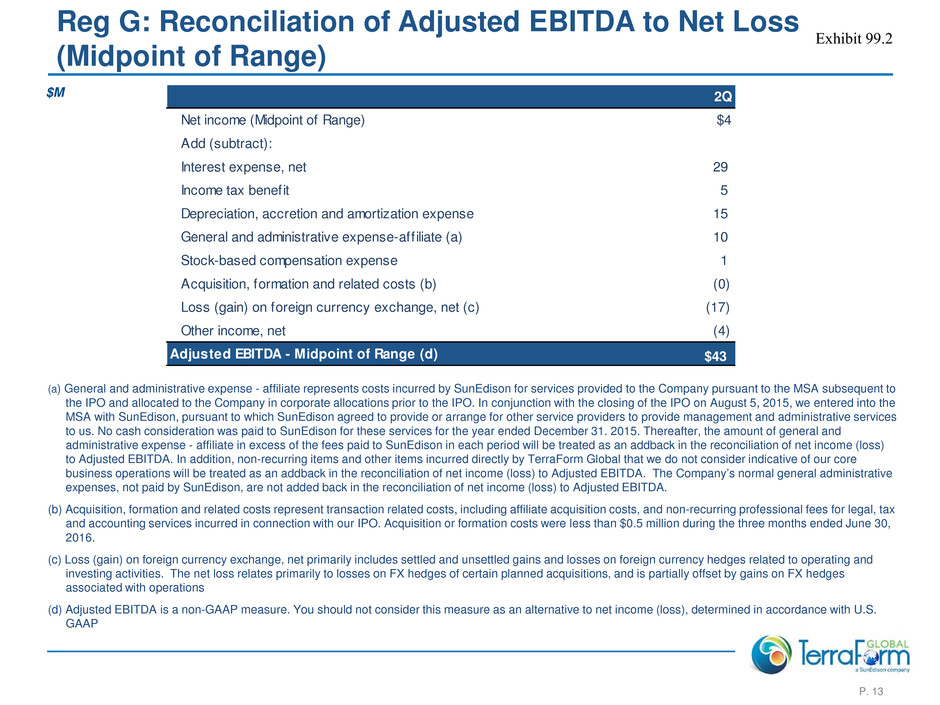

Reg G: Reconciliation of Adjusted EBITDA to Net Loss

(Midpoint of Range)

(a) General and administrative expense - affiliate represents costs incurred by SunEdison for services provided to the Company pursuant to the MSA subsequent to

the IPO and allocated to the Company in corporate allocations prior to the IPO. In conjunction with the closing of the IPO on August 5, 2015, we entered into the

MSA with SunEdison, pursuant to which SunEdison agreed to provide or arrange for other service providers to provide management and administrative services

to us. No cash consideration was paid to SunEdison for these services for the year ended December 31. 2015. Thereafter, the amount of general and

administrative expense - affiliate in excess of the fees paid to SunEdison in each period will be treated as an addback in the reconciliation of net income (loss)

to Adjusted EBITDA. In addition, non-recurring items and other items incurred directly by TerraForm Global that we do not consider indicative of our core

business operations will be treated as an addback in the reconciliation of net income (loss) to Adjusted EBITDA. The Company’s normal general administrative

expenses, not paid by SunEdison, are not added back in the reconciliation of net income (loss) to Adjusted EBITDA.

(b) Acquisition, formation and related costs represent transaction related costs, including affiliate acquisition costs, and non-recurring professional fees for legal, tax

and accounting services incurred in connection with our IPO. Acquisition or formation costs were less than $0.5 million during the three months ended June 30,

2016.

(c) Loss (gain) on foreign currency exchange, net primarily includes settled and unsettled gains and losses on foreign currency hedges related to operating and

investing activities. The net loss relates primarily to losses on FX hedges of certain planned acquisitions, and is partially offset by gains on FX hedges

associated with operations

(d) Adjusted EBITDA is a non-GAAP measure. You should not consider this measure as an alternative to net income (loss), determined in accordance with U.S.

GAAP

$M 2Q

Net income (Midpoint of Range) $4

Add (subtract):

Interest expense, net 29

Income tax benefit 5

Depreciation, accretion and amortization expense 15

General and administrative expense-aff iliate (a) 10

Stock-based compensation expense 1

Acquisition, formation and related costs (b) (0)

Loss (gain) on foreign currency exchange, net (c) (17)

Other income, net (4)

Adjusted EBITDA - Midpoint of Range (d) $43

P. 14

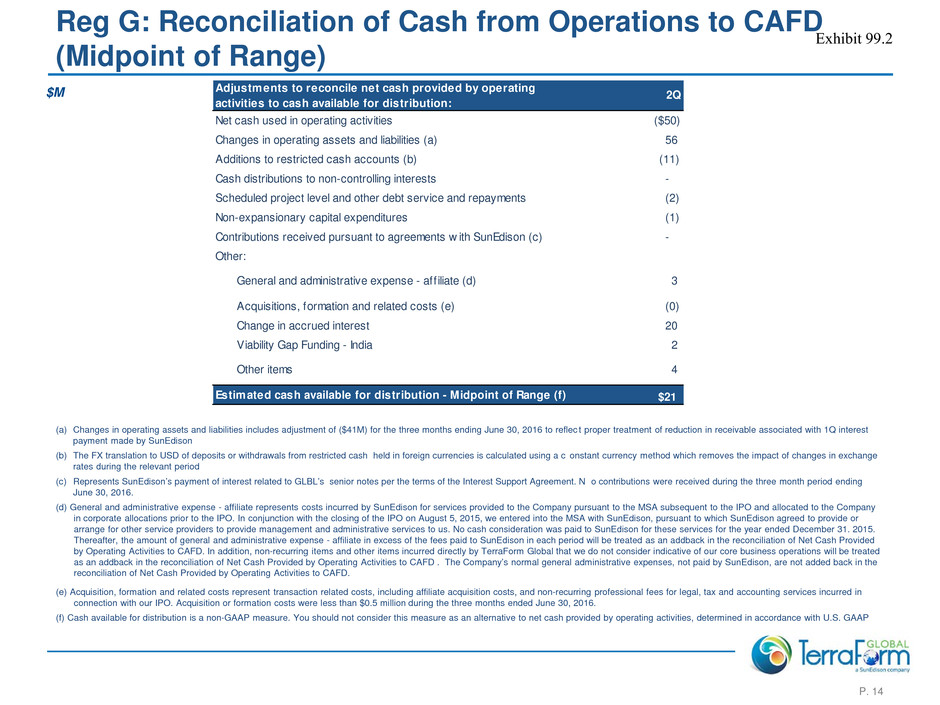

Reg G: Reconciliation of Cash from Operations to CAFD

(Midpoint of Range)

(a) Changes in operating assets and liabilities includes adjustment of ($41M) for the three months ending June 30, 2016 to reflec t proper treatment of reduction in receivable associated with 1Q interest

payment made by SunEdison

(b) The FX translation to USD of deposits or withdrawals from restricted cash held in foreign currencies is calculated using a c onstant currency method which removes the impact of changes in exchange

rates during the relevant period

(c) Represents SunEdison’s payment of interest related to GLBL’s senior notes per the terms of the Interest Support Agreement. N o contributions were received during the three month period ending

June 30, 2016.

(d) General and administrative expense - affiliate represents costs incurred by SunEdison for services provided to the Company pursuant to the MSA subsequent to the IPO and allocated to the Company

in corporate allocations prior to the IPO. In conjunction with the closing of the IPO on August 5, 2015, we entered into the MSA with SunEdison, pursuant to which SunEdison agreed to provide or

arrange for other service providers to provide management and administrative services to us. No cash consideration was paid to SunEdison for these services for the year ended December 31. 2015.

Thereafter, the amount of general and administrative expense - affiliate in excess of the fees paid to SunEdison in each period will be treated as an addback in the reconciliation of Net Cash Provided

by Operating Activities to CAFD. In addition, non-recurring items and other items incurred directly by TerraForm Global that we do not consider indicative of our core business operations will be treated

as an addback in the reconciliation of Net Cash Provided by Operating Activities to CAFD . The Company’s normal general administrative expenses, not paid by SunEdison, are not added back in the

reconciliation of Net Cash Provided by Operating Activities to CAFD.

(e) Acquisition, formation and related costs represent transaction related costs, including affiliate acquisition costs, and non-recurring professional fees for legal, tax and accounting services incurred in

connection with our IPO. Acquisition or formation costs were less than $0.5 million during the three months ended June 30, 2016.

(f) Cash available for distribution is a non-GAAP measure. You should not consider this measure as an alternative to net cash provided by operating activities, determined in accordance with U.S. GAAP

$M Adjustments to reconcile net cash provided by operating

activities to cash available for distribution:

2Q

Net cash used in operating activities ($50)

Changes in operating assets and liabilities (a) 56

Additions to restricted cash accounts (b) (11)

Cash distributions to non-controlling interests -

Scheduled project level and other debt service and repayments (2)

Non-expansionary capital expenditures (1)

Contributions received pursuant to agreements w ith SunEdison (c) -

Other:

General and administrative expense - aff iliate (d) 3

Acquisitions, formation and related costs (e) (0)

Change in accrued interest 20

Viability Gap Funding - India 2

Other items 4

Estimated cash available for distribution - Midpoint of Range (f) $21

P. 15

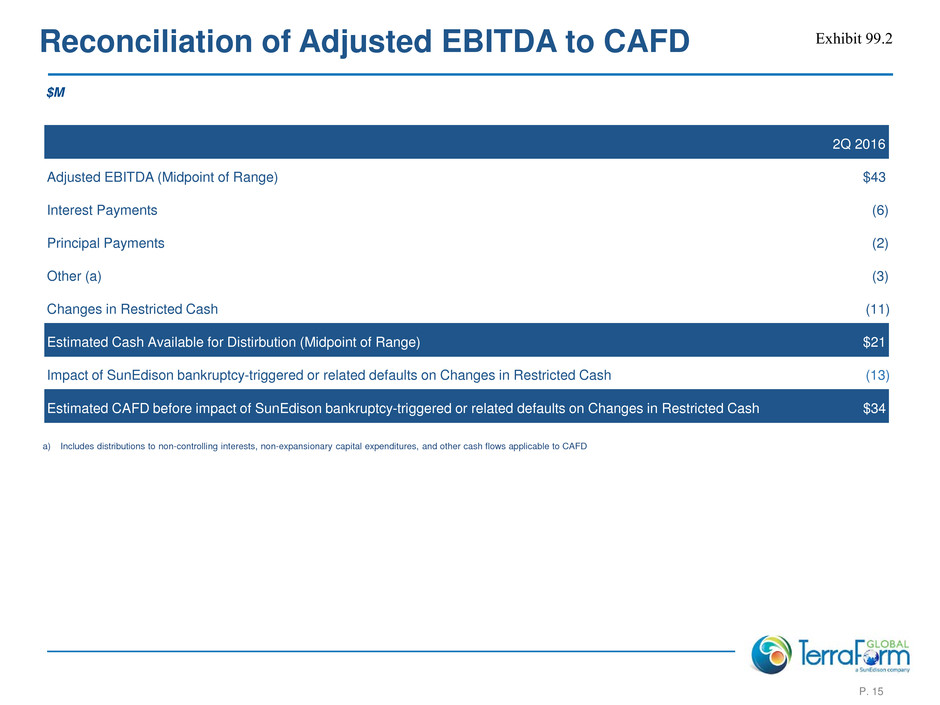

Reconciliation of Adjusted EBITDA to CAFD

$M

a) Includes distributions to non-controlling interests, non-expansionary capital expenditures, and other cash flows applicable to CAFD

2Q 2016

Adjusted EBITDA (Midpoint of Range) $43

Interest Payments (6)

Principal Payments (2)

Other (a) (3)

Changes in Restricted Cash (11)

Estimated Cash Available for Distirbution (Midpoint of Range) $21

Impact of SunEdison bankruptcy-triggered or related defaults on Changes in Restricted Cash (13)

Estimated CAFD before impact of SunEdison bankruptcy-triggered or related defaults on Changes in Restricted Cash $34

P. 16