Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Sorrento Tech, Inc. | pipeexhibit992.htm |

| EX-3.1 - EXHIBIT 3.1 - Sorrento Tech, Inc. | pipeexhibit31.htm |

| EX-10.4 - EXHIBIT 10.4 - Sorrento Tech, Inc. | pipeexhibit104.htm |

| EX-10.3 - EXHIBIT 10.3 - Sorrento Tech, Inc. | pipeexhibit103.htm |

| EX-10.2 - EXHIBIT 10.2 - Sorrento Tech, Inc. | pipeexhibit102.htm |

| EX-10.1 - EXHIBIT 10.1 - Sorrento Tech, Inc. | pipeexhibit101.htm |

| 8-K - 8-K - Sorrento Tech, Inc. | pipe8-k.htm |

CONFIDENTIAL

ROKA BIOSCIENCE

June 2016

CONFIDENTIAL

Cautionary Note Regarding Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E

of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act, as amended (the “Exchange Act”). These

forward-looking statements are based on current expectations, estimates, forecasts and projections about the industry and markets in

which we operate and management’s current beliefs and assumptions. Any statements contained herein (including, without limitation,

statements to the effect that we “believe”, “expect”, “anticipate”, “plan” and similar expressions) that are not statements of historical fact

should be considered forward-looking statements. These statements relate to future events or our financial performance and involve

known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or

achievement to differ materially from those expressed or implied by these forward looking statements. There are a number of important

factors that could cause actual results to differ materially from those indicated by such forward-looking statements. Such factors include

those set forth in the company’s filings with the Securities and Exchange Commission. We expressly disclaim any obligation to update

any forward-looking statements, except as may be required by law. Given these uncertainties, you should not place undue reliance on

these forward-looking statements. These forward-looking statements represent our estimates and assumptions only as of the date of this

presentation and, except as required by law, we undertake no obligation to update or review publicly any forward-looking statements,

whether as a result of new information, future events or otherwise after the date of this presentation.

2

CONFIDENTIAL

Key Highlights

Founded in 2009 via

acquisition of the industrial

testing assets of Gen-Probe,

a global leader in molecular

diagnostics

Pure Play in Growing $2 Billion Food Safety

Market*

IPO completed in July 2014

Early Adoption By Strategic Customers

Full Menu of Molecular Pathogen tests on

Fully Automated Instrument Platform

Positioned to Benefit from Market

Consolidation and Regulatory Initiatives

Insider Participation by Leading Investors

3

*Capella Advisors, Company Estimates

CONFIDENTIAL

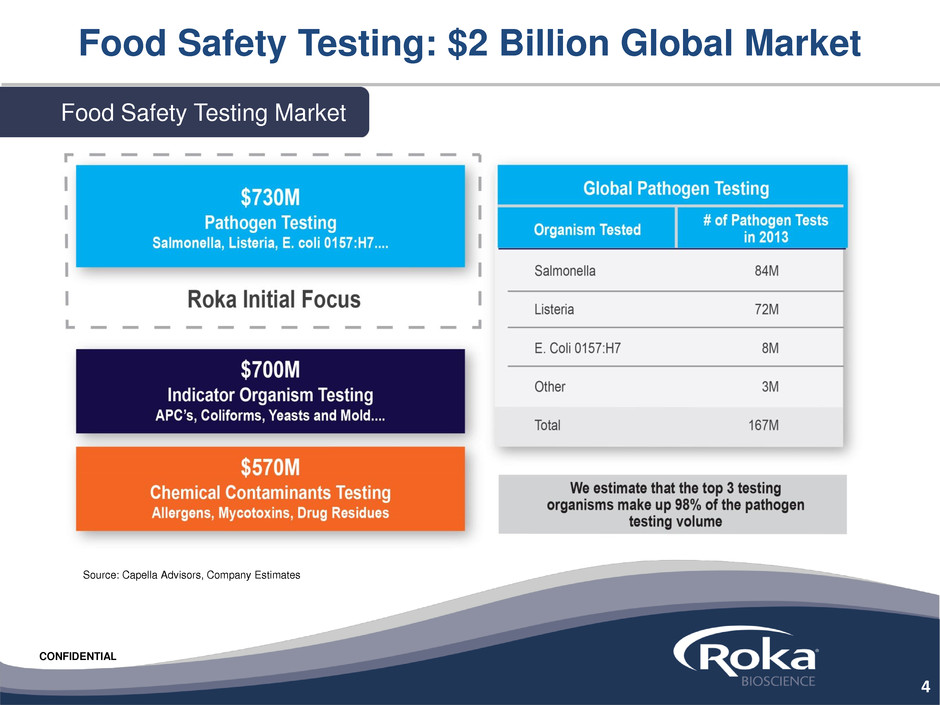

Food Safety Testing: $2 Billion Global Market

Source: Capella Advisors, Company Estimates

Food Safety Testing Market

4

CONFIDENTIAL

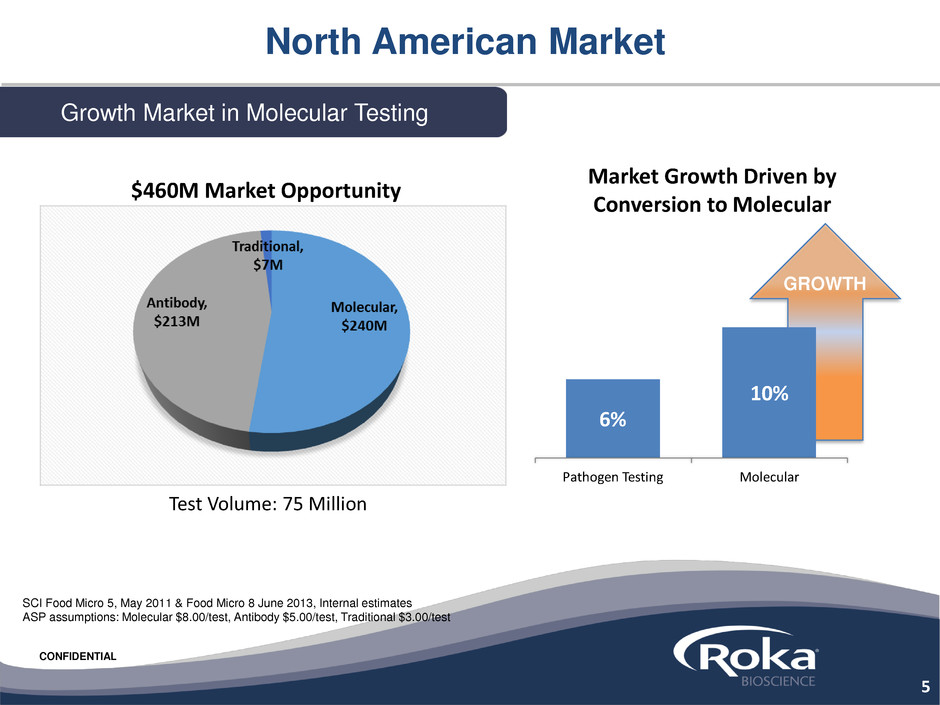

North American Market

Growth Market in Molecular Testing

Market Growth Driven by

Conversion to Molecular

Test Volume: 75 Million

SCI Food Micro 5, May 2011 & Food Micro 8 June 2013, Internal estimates

ASP assumptions: Molecular $8.00/test, Antibody $5.00/test, Traditional $3.00/test

5

$460M Market Opportunity

6%

10%

Pathogen Testing Molecular

GROWTH

CONFIDENTIAL

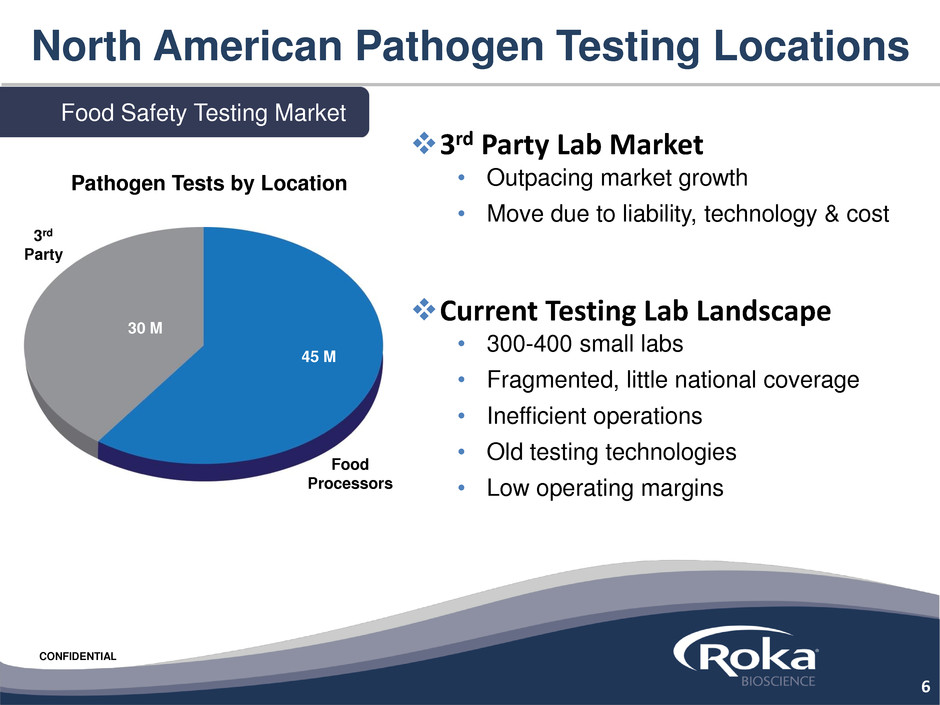

North American Pathogen Testing Locations

Food Safety Testing Market

45 M

30 M

Food

Processors

3rd

Party

Pathogen Tests by Location

3rd Party Lab Market

• Outpacing market growth

• Move due to liability, technology & cost

Current Testing Lab Landscape

• 300-400 small labs

• Fragmented, little national coverage

• Inefficient operations

• Old testing technologies

• Low operating margins

6

CONFIDENTIAL

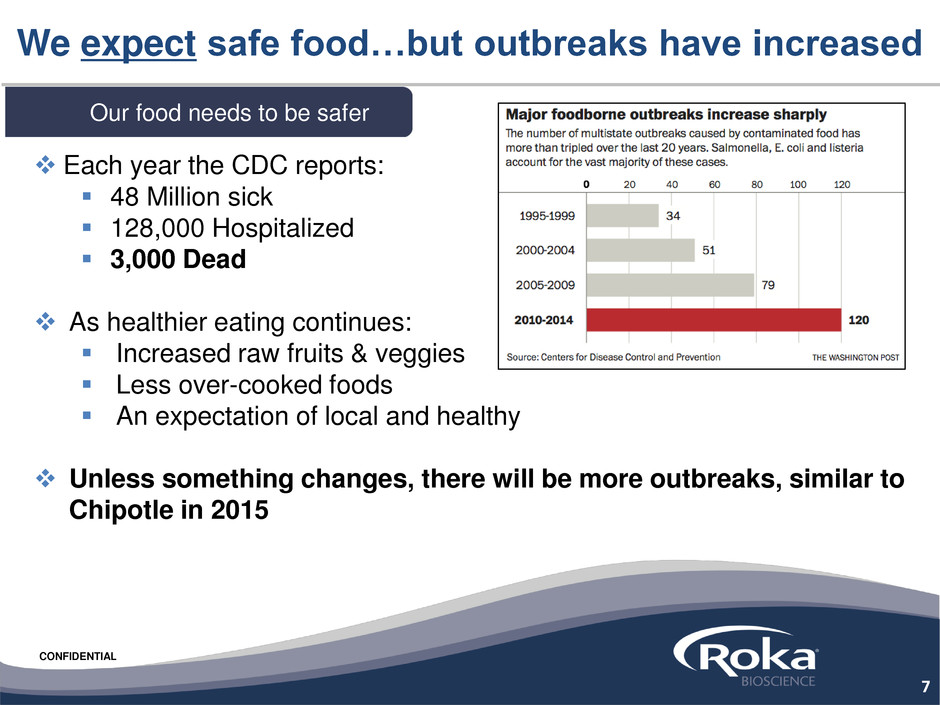

Each year the CDC reports:

48 Million sick

128,000 Hospitalized

3,000 Dead

As healthier eating continues:

Increased raw fruits & veggies

Less over-cooked foods

An expectation of local and healthy

Unless something changes, there will be more outbreaks, similar to

Chipotle in 2015

We expect safe food…but outbreaks have increased

Our food needs to be safer

7

CONFIDENTIAL

Finding pathogens means additional cost of operations, e.g.

diverting product, cleaning facilities, etc.

Most used environmental tests (antibody-based) misses up to

50% of pathogenic bacteria*

Consistent negative results satisfied regulators until now

Rarely caught for poor testing, until now…

Technology adoption has not happened….why?

Processors have tested to get negative results

8

*Study Outline: Thirty‐five environmental sponges were collected each week for 6 weeks from areas in a

plant known to have high positivity for environmental Listeria. All ELFA testing was conducted by an

accredited third party commercial laboratory. Results: VIDAS 51.5% False Negatives; Atlas 4%

The CDC, the DoJ and new regulations are driving change of this culture

CONFIDENTIAL

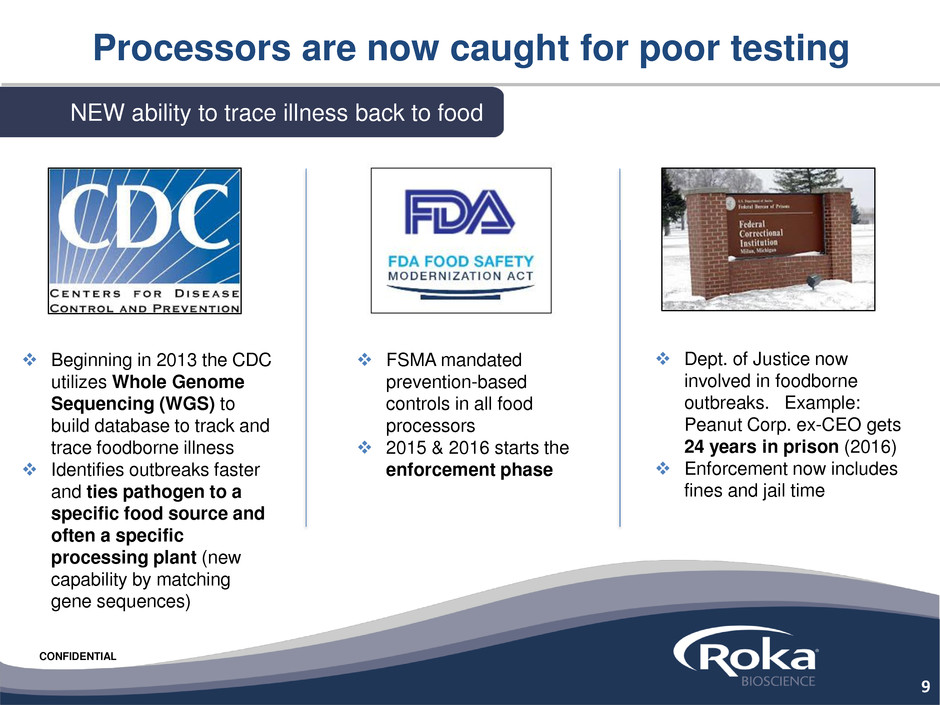

Processors are now caught for poor testing

NEW ability to trace illness back to food

9

FSMA mandated

prevention-based

controls in all food

processors

2015 & 2016 starts the

enforcement phase

Beginning in 2013 the CDC

utilizes Whole Genome

Sequencing (WGS) to

build database to track and

trace foodborne illness

Identifies outbreaks faster

and ties pathogen to a

specific food source and

often a specific

processing plant (new

capability by matching

gene sequences)

Dept. of Justice now

involved in foodborne

outbreaks. Example:

Peanut Corp. ex-CEO gets

24 years in prison (2016)

Enforcement now includes

fines and jail time

CONFIDENTIAL

WGS will be a change agent for the industry

Listeria WGS launched in

2013; Salmonella, others to

follow

Testing to get a negative is no longer acceptable

10

Whole Genome Sequencing Impact

6 to 93 cases linked to food source in first 2 years

Traceability: Now linking outbreak to specific processor

Dramatically increases risk

of poor food safety to

processor

FEAR is a great motivator of

change

We expect processors to

increase testing with more

accurate tests

Reference: CDC 2016

CONFIDENTIAL

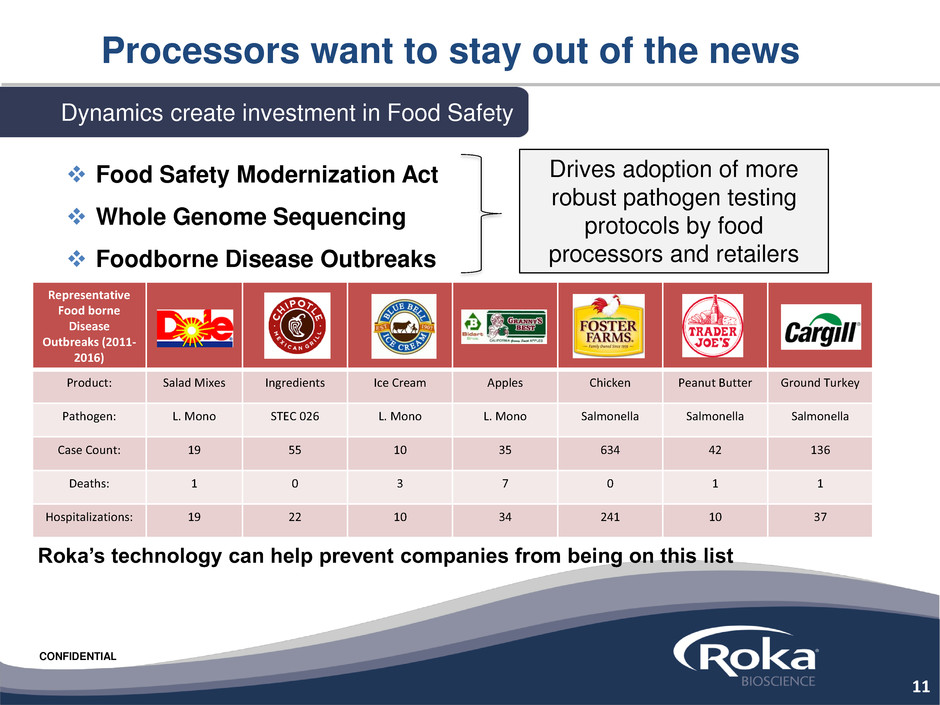

Processors want to stay out of the news

Representative

Food borne

Disease

Outbreaks (2011-

2016)

Product: Salad Mixes Ingredients Ice Cream Apples Chicken Peanut Butter Ground Turkey

Pathogen: L. Mono STEC 026 L. Mono L. Mono Salmonella Salmonella Salmonella

Case Count: 19 55 10 35 634 42 136

Deaths: 1 0 3 7 0 1 1

Hospitalizations: 19 22 10 34 241 10 37

Dynamics create investment in Food Safety

Drives adoption of more

robust pathogen testing

protocols by food

processors and retailers

Food Safety Modernization Act

Whole Genome Sequencing

Foodborne Disease Outbreaks

11

Roka’s technology can help prevent companies from being on this list

CONFIDENTIAL

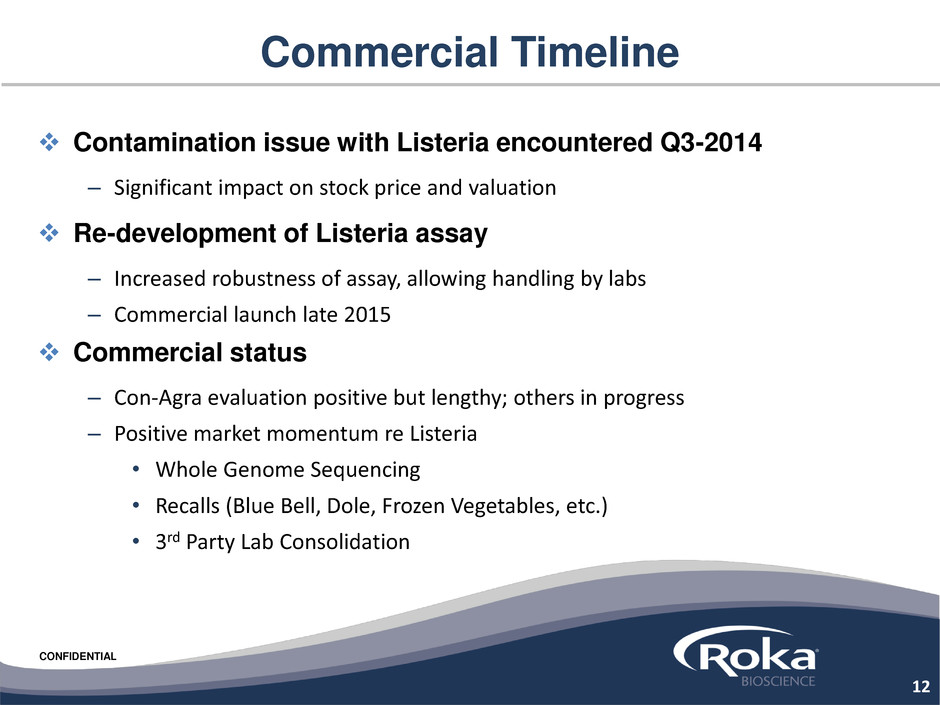

Commercial Timeline

Contamination issue with Listeria encountered Q3-2014

– Significant impact on stock price and valuation

Re-development of Listeria assay

– Increased robustness of assay, allowing handling by labs

– Commercial launch late 2015

Commercial status

– Con-Agra evaluation positive but lengthy; others in progress

– Positive market momentum re Listeria

• Whole Genome Sequencing

• Recalls (Blue Bell, Dole, Frozen Vegetables, etc.)

• 3rd Party Lab Consolidation

12

CONFIDENTIAL

Relaunch with full suite of high quality assays

Listeria – NEW assay

Salmonella

E. coli O157:H7

Listeria Monocytogenes

Shiga toxin-producing

E. coli (STEC)

Atlas Detection AssaysAtlas Instrument Full Commercial Menu

Roka Value Proposition

Accurate, Rapid, Fully-Automated Test Results

As market need for quality increases – Roka is positioned to win

Current AOAC Certified Menu

covers >98% of Pathogen

testing volume

13

CONFIDENTIAL

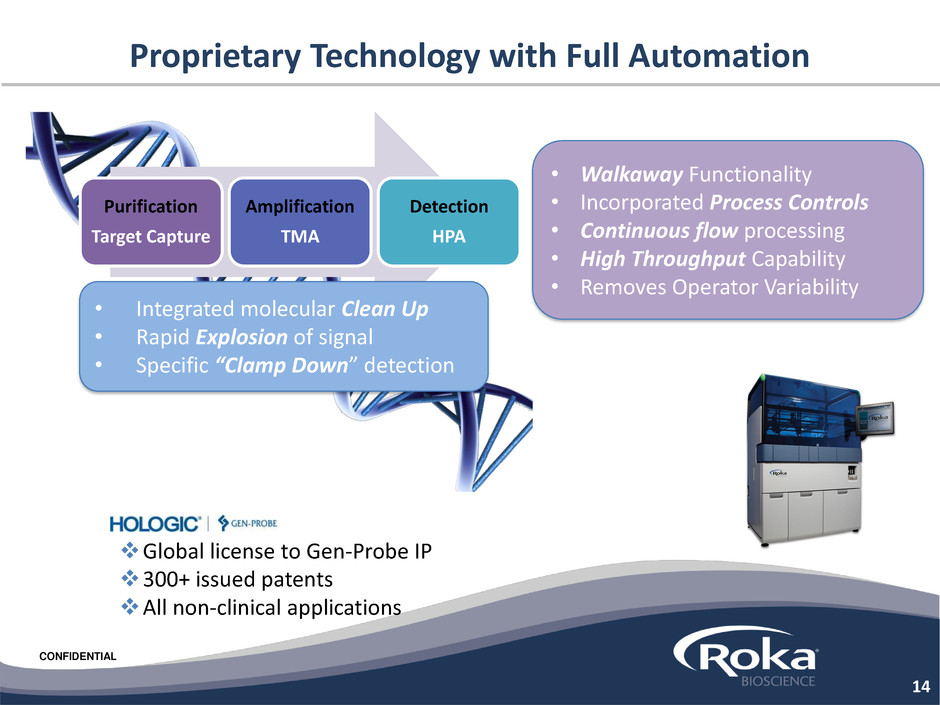

Proprietary Technology with Full Automation

• Walkaway Functionality

• Incorporated Process Controls

• Continuous flow processing

• High Throughput Capability

• Removes Operator Variability

Purification

Target Capture

Amplification

TMA

Detection

HPA

• Integrated molecular Clean Up

• Rapid Explosion of signal

• Specific “Clamp Down” detection

Global license to Gen-Probe IP

300+ issued patents

All non-clinical applications

14

CONFIDENTIAL

-

50

100

150

200

250

300

350

400

Q1-2016

Average

Q1-2016

High

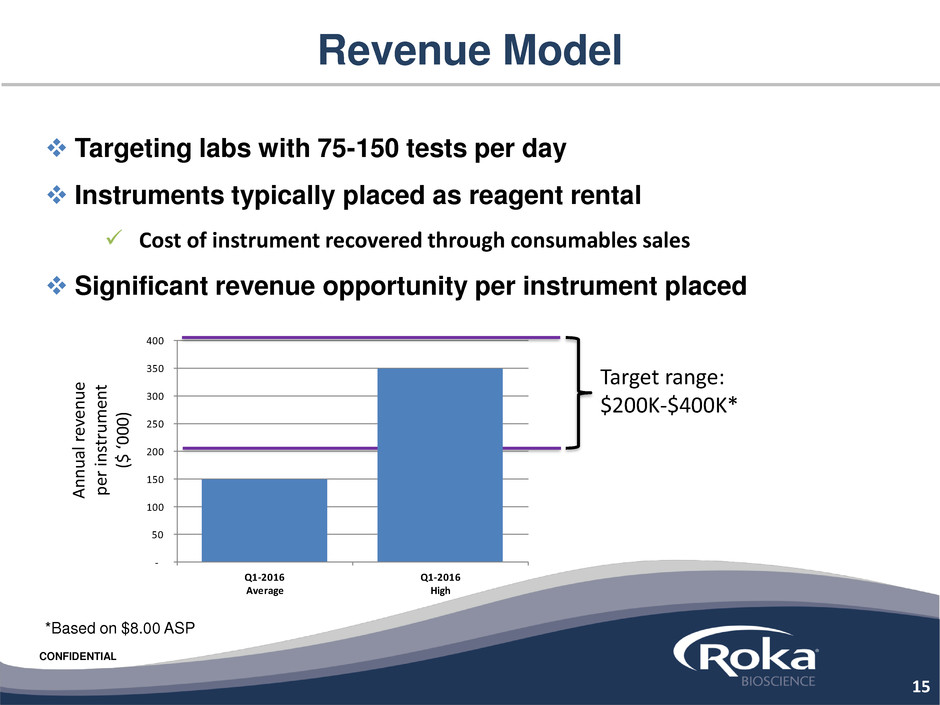

Revenue Model

Targeting labs with 75-150 tests per day

Instruments typically placed as reagent rental

Cost of instrument recovered through consumables sales

Significant revenue opportunity per instrument placed

15

*Based on $8.00 ASP

Target range:

$200K-$400K*

An

n

u

al

r

ev

en

u

e

p

er

in

str

u

m

en

t

($ ‘00

0)

CONFIDENTIAL

Commercial Success to Date

16

DoD Food Analysis & Diagnostics

Laboratory

*Actual customers

*

CONFIDENTIAL

Commercial Strategy

Capitalize on new market drivers

Drive a segment focused organization

Focused promotional activities

• Listeria Environmental Monitoring – all markets

• Capitalize on processors fear of WGS

Key Strategic Initiatives

• Partnership with significant third party lab

• Beef industry

17

CONFIDENTIAL

How to Win in the Lab Market

Sample Pick-Up Logistics

Leverage Existing Food Safety Business

Strong Balance Sheet

Efficient Lab Operations

Automation, flexibility

High volume, scalable instruments

Direct labor reductions

18

Enabled by Roka’s

Atlas

CONFIDENTIAL

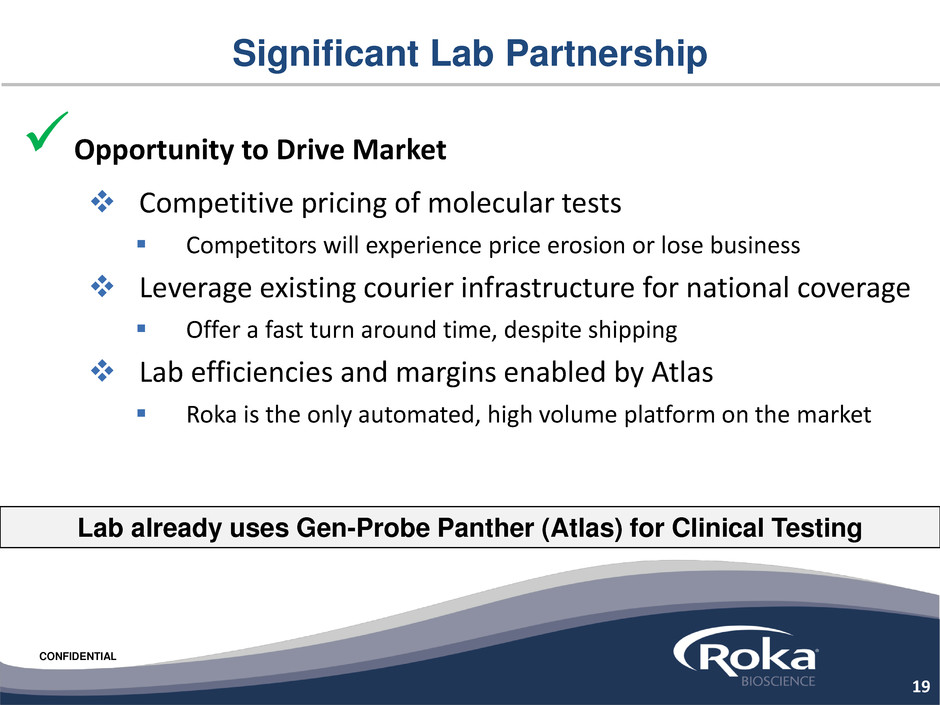

Significant Lab Partnership

Opportunity to Drive Market

Competitive pricing of molecular tests

Competitors will experience price erosion or lose business

Leverage existing courier infrastructure for national coverage

Offer a fast turn around time, despite shipping

Lab efficiencies and margins enabled by Atlas

Roka is the only automated, high volume platform on the market

19

Lab already uses Gen-Probe Panther (Atlas) for Clinical Testing

CONFIDENTIAL

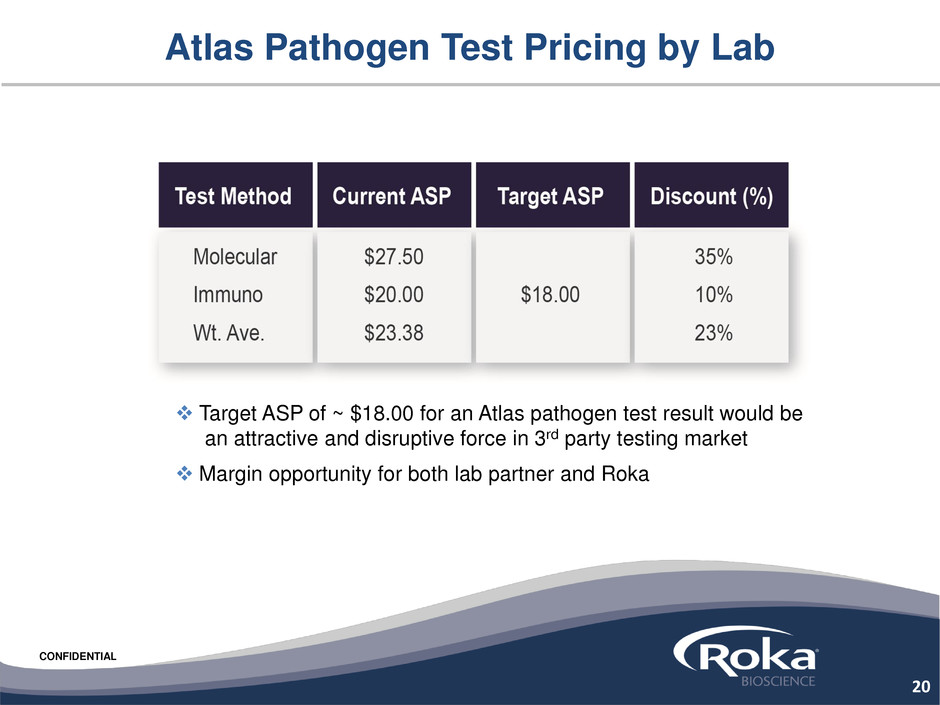

Atlas Pathogen Test Pricing by Lab

45.2 M

30.2 M

4%

31%

65%

Target ASP of ~ $18.00 for an Atlas pathogen test result would be

an attractive and disruptive force in 3rd party testing market

Margin opportunity for both lab partner and Roka

20

CONFIDENTIAL

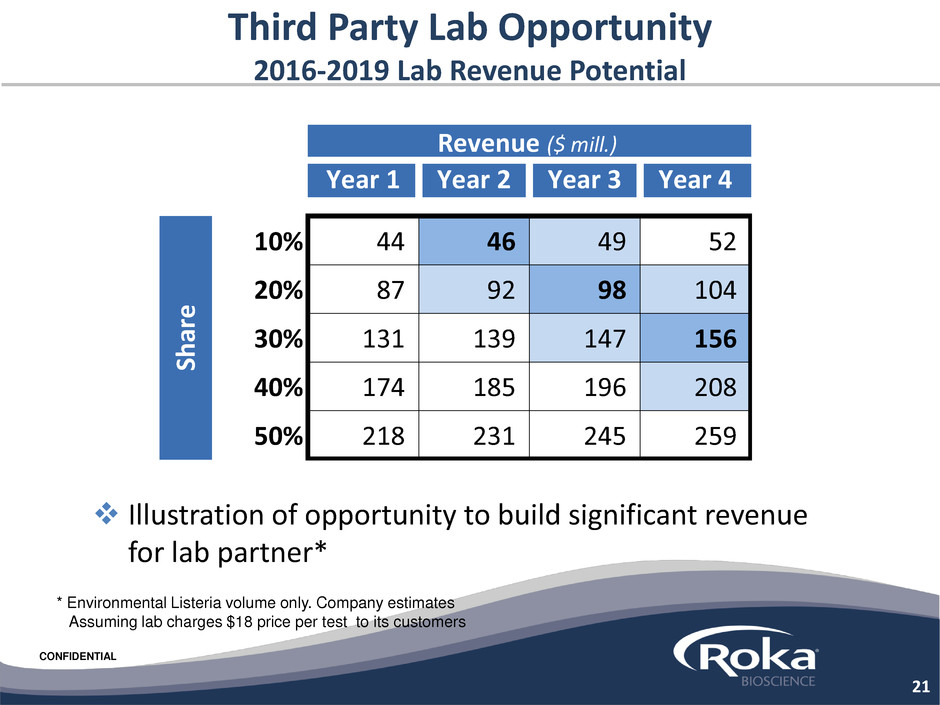

Third Party Lab Opportunity

2016-2019 Lab Revenue Potential

Illustration of opportunity to build significant revenue

for lab partner*

21

* Environmental Listeria volume only. Company estimates

Assuming lab charges $18 price per test to its customers

Year 1 Year 2 Year 3 Year 4

10% 44 46 49 52

20% 87 92 98 104

30% 131 139 147 156

40% 174 185 196 208

50% 218 231 245 259

Sh

are

Revenue ($ mill.)

CONFIDENTIAL

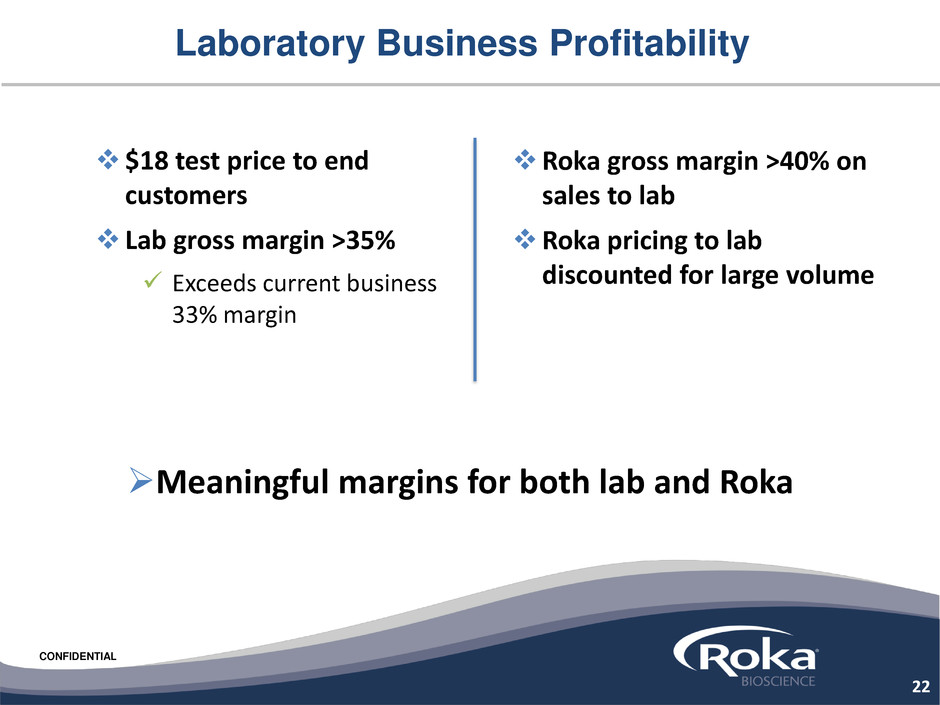

$18 test price to end

customers

Lab gross margin >35%

Exceeds current business

33% margin

Laboratory Business Profitability

22

Roka gross margin >40% on

sales to lab

Roka pricing to lab

discounted for large volume

Meaningful margins for both lab and Roka

CONFIDENTIAL

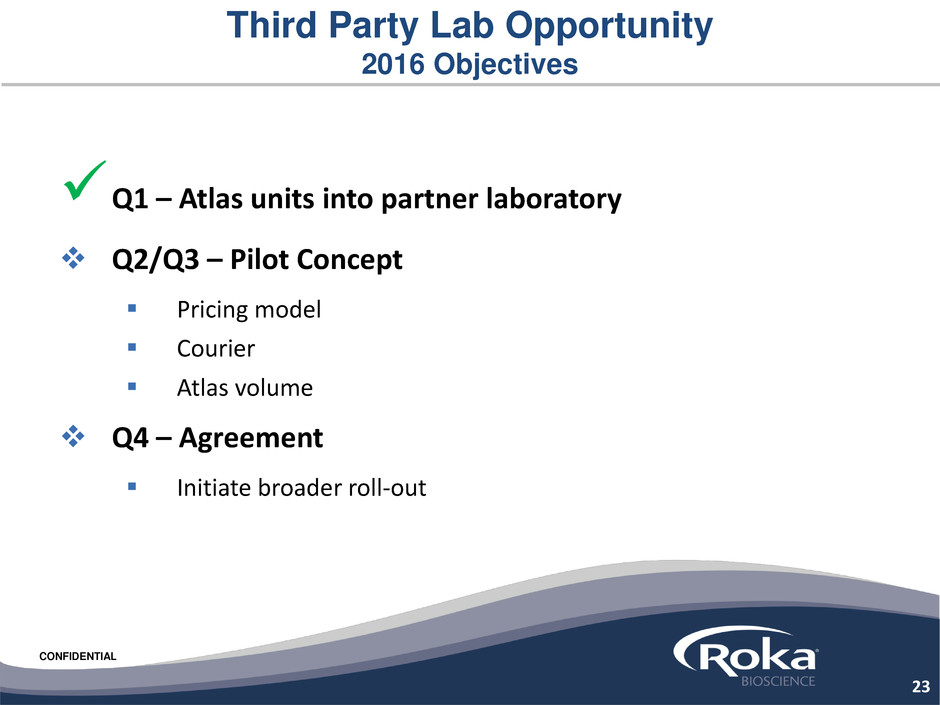

Third Party Lab Opportunity

2016 Objectives

Q1 – Atlas units into partner laboratory

Q2/Q3 – Pilot Concept

Pricing model

Courier

Atlas volume

Q4 – Agreement

Initiate broader roll-out

23

CONFIDENTIAL

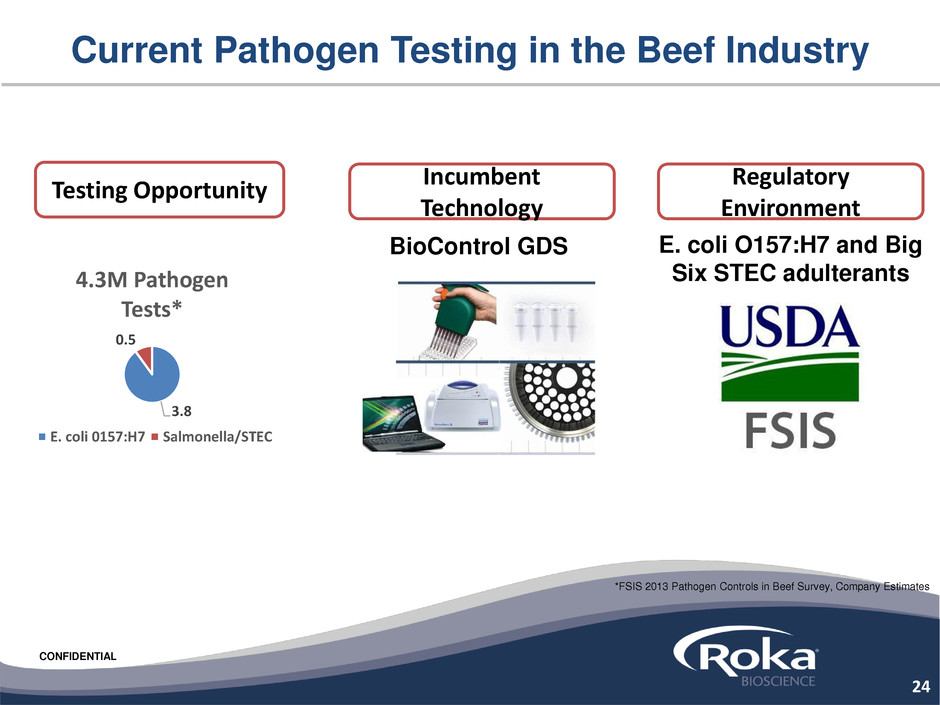

Current Pathogen Testing in the Beef Industry

Testing Opportunity

3.8

0.5

4.3M Pathogen

Tests*

E. coli 0157:H7 Salmonella/STEC

Incumbent

Technology

BioControl GDS

Regulatory

Environment

E. coli O157:H7 and Big

Six STEC adulterants

24

*FSIS 2013 Pathogen Controls in Beef Survey, Company Estimates

CONFIDENTIAL

Pathway to Market Adoption

Roka engaged with leading beef processor over the

past two years to meet external & internal

adoption requirements

Gain Atlas Adoption by one of the Big Four Beef

Producers

25

CONFIDENTIAL

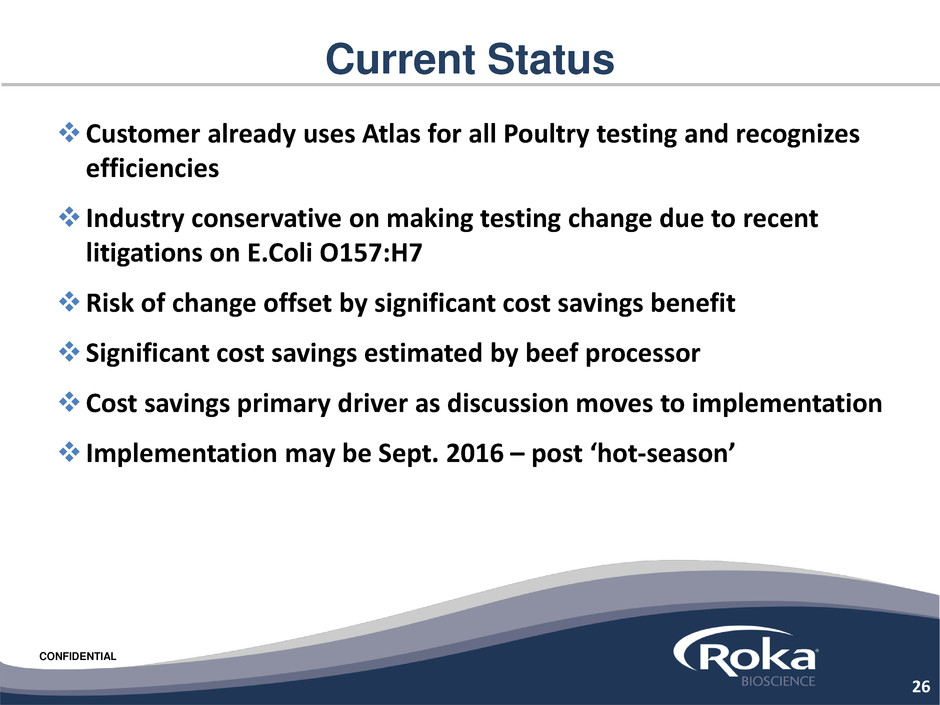

Current Status

Customer already uses Atlas for all Poultry testing and recognizes

efficiencies

Industry conservative on making testing change due to recent

litigations on E.Coli O157:H7

Risk of change offset by significant cost savings benefit

Significant cost savings estimated by beef processor

Cost savings primary driver as discussion moves to implementation

Implementation may be Sept. 2016 – post ‘hot-season’

26

CONFIDENTIAL

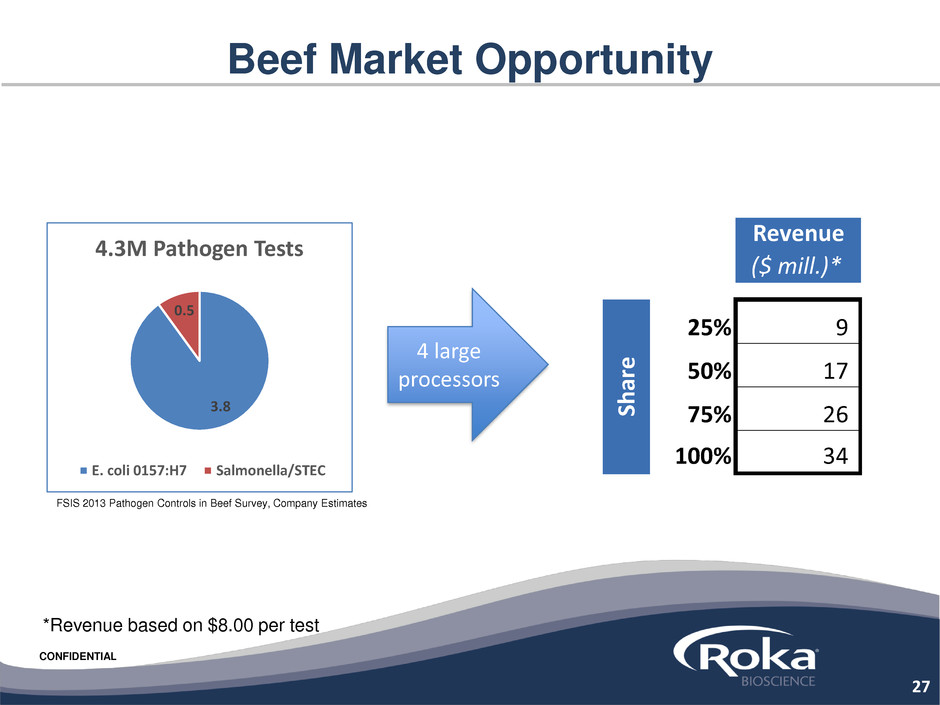

Beef Market Opportunity

27

3.8

0.5

4.3M Pathogen Tests

E. coli 0157:H7 Salmonella/STEC

4 large

processors

*Revenue based on $8.00 per test

Revenue

($ mill.)*

25% 9

50% 17

75% 26

100% 34

Sh

ar

e

FSIS 2013 Pathogen Controls in Beef Survey, Company Estimates

CONFIDENTIAL

Funding Summary

Well positioned to benefit from a changing food safety

market

Lab partnership and beef present exciting opportunities

$25M Financing sought to fund significant revenue growth

Insider participation by leading investors

28

CONFIDENTIAL

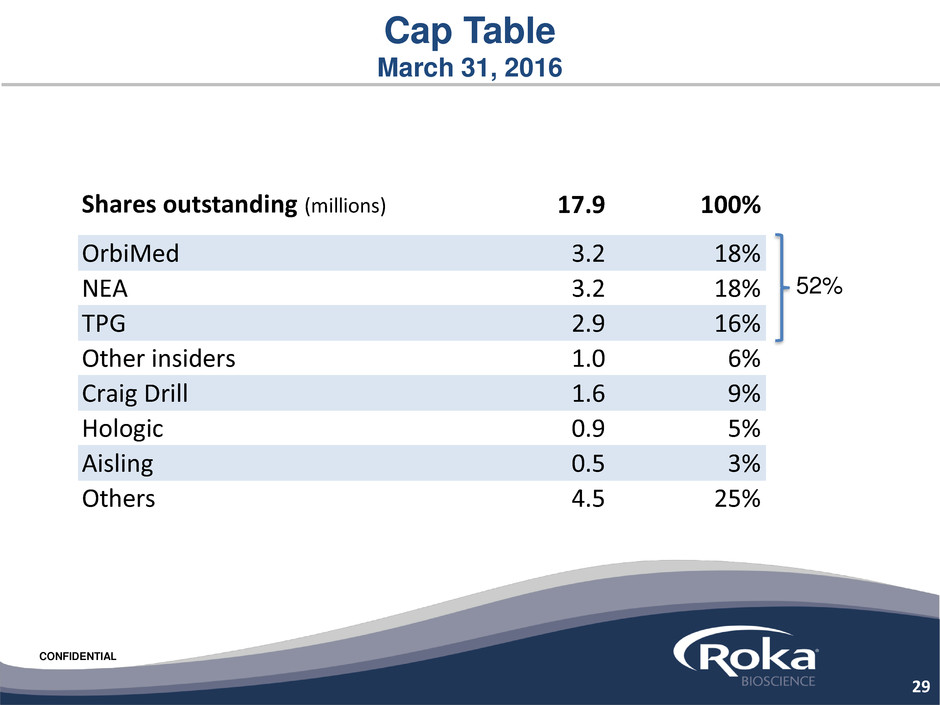

Cap Table

March 31, 2016

52%

29

Shares outstanding (millions) 17.9 100%

OrbiMed 3.2 18%

NEA 3.2 18%

TPG 2.9 16%

Other insiders 1.0 6%

Craig Drill 1.6 9%

Hologic 0.9 5%

Aisling 0.5 3%

Others 4.5 25%

CONFIDENTIAL

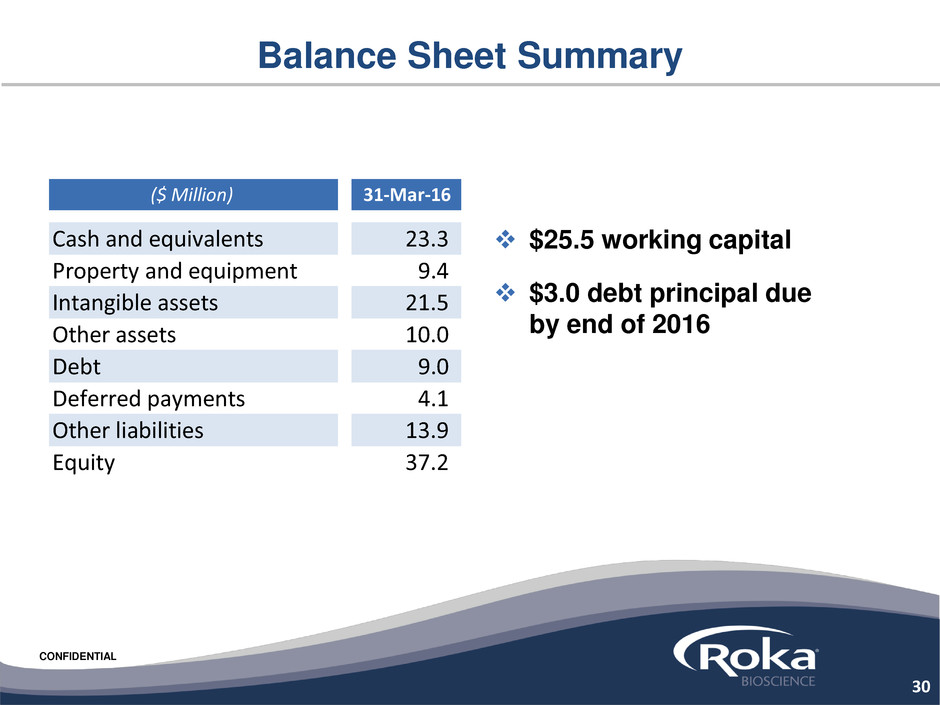

Balance Sheet Summary

$25.5 working capital

$3.0 debt principal due

by end of 2016

($ Million) 31-Mar-16

Cash and equivalents 23.3

Property and equipment 9.4

Intangible assets 21.5

Other assets 10.0

Debt 9.0

Deferred payments 4.1

Other liabilities 13.9

Equity 37.2

30