Attached files

| file | filename |

|---|---|

| 8-K - 8-K RODMAN & RENSHAW PRESENTATION - CATALYST BIOSCIENCES, INC. | cbio-8k_20160914.htm |

Catalyst Biosciences Non-Confidential Company Update 12 September 2016 Essential Medicines for Hemophilia. Greater Convenience. Superior Outcomes

Forward Looking Statements This presentation includes forward-looking statements relating to the Catalyst Biosciences, Inc. (the “Company”). Forward-looking statements include statements about the potential markets for the Company’s product candidates, the potential advantages of the Company’s product candidates, product development plans and timelines, potential safety and efficacy of the Company’s product candidates, potential sales of product candidates, if approved, the Company’s intellectual property and any statement of belief or assumptions underlying any of the foregoing. These statements reflect the current views of the Company’s senior management with respect to future events. Forward-looking statements address matters that involve risks and uncertainties, such as the timing of, costs associated with and outcomes of development, clinical and regulatory activities, risks associated with third-party arrangements, including the risk that Catalyst must negotiate with Pfizer about obtaining manufacturing technology and know-how related to marzeptacog alfa (activated), potential adverse effects arising from the testing or use of the Company’s drug candidates, risks related to the Company’s ability to develop, manufacture and commercialize product candidates, to obtain regulatory approval of product candidates and to obtain marketplace acceptance of product candidates, to avoid infringing patents held by other parties and to secure and defend patents of the Company, and to manage and obtain capital, including through any future financing or the conversion of outstanding convertible promissory notes. Further information regarding these and other risks is included in the Company’s Form 10-K for the year ended December 2015 and Form 10-Q for the quarter ending June 30, 2016 filed with the Securities and Exchange Commission on March 9, 2016 and Aug 4, 2016 respectively, under the heading "Risk Factors”.

Hemostasis FVIIa, FIX & FXa Current products generate ~$3.3 billion/year in sales Catalyst Next Generation products have the potential for sales growth in subcutaneous prophylaxis, new markets & new indications Catalyst Biosciences : CBIO Essential Medicines for Hemophilia Greater Convenience Superior Outcomes

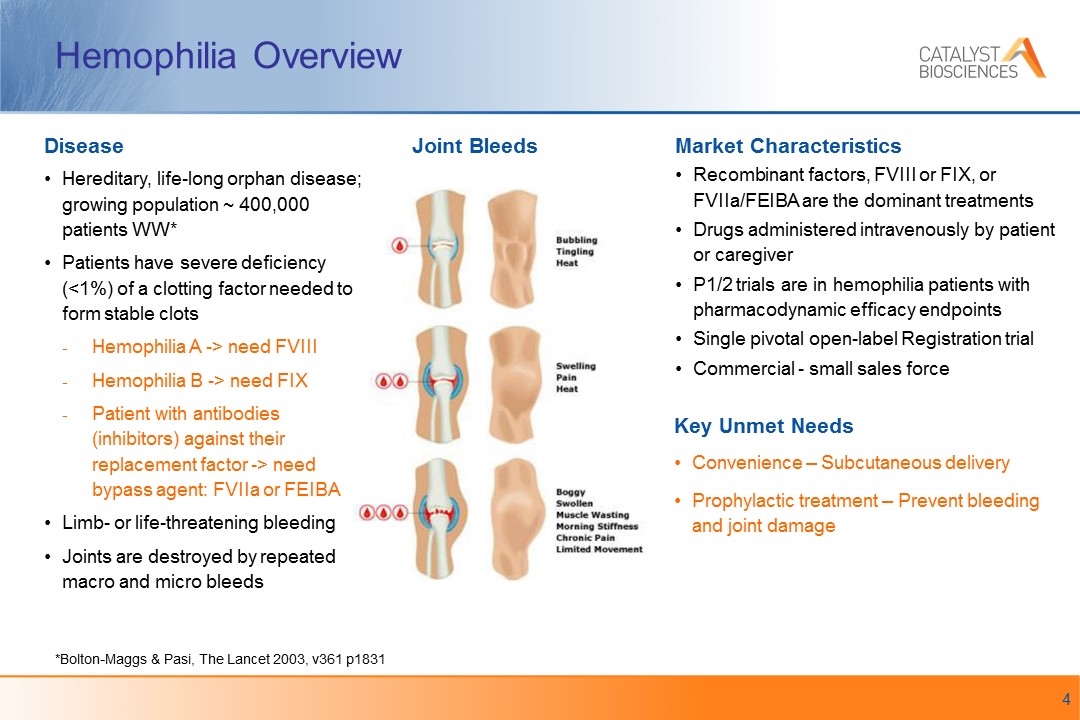

Hemophilia Overview Key Unmet Needs Convenience – Subcutaneous delivery Prophylactic treatment – Prevent bleeding and joint damage Market Characteristics Recombinant factors, FVIII or FIX, or FVIIa/FEIBA are the dominant treatments Drugs administered intravenously by patient or caregiver P1/2 trials are in hemophilia patients with pharmacodynamic efficacy endpoints Single pivotal open-label Registration trial Commercial - small sales force Disease Hereditary, life-long orphan disease; growing population ~ 400,000 patients WW* Patients have severe deficiency (<1%) of a clotting factor needed to form stable clots Hemophilia A -> need FVIII Hemophilia B -> need FIX Patient with antibodies (inhibitors) against their replacement factor -> need bypass agent: FVIIa or FEIBA Limb- or life-threatening bleeding Joints are destroyed by repeated macro and micro bleeds *Bolton-Maggs & Pasi, The Lancet 2003, v361 p1831 Joint Bleeds

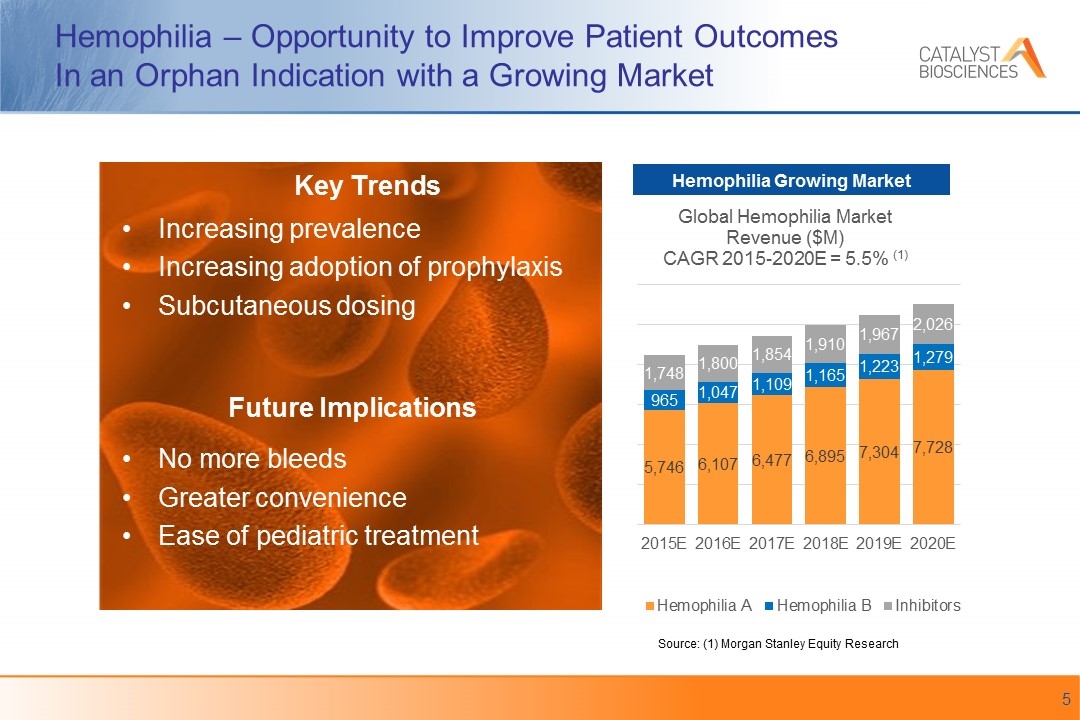

Hemophilia – Opportunity to Improve Patient Outcomes In an Orphan Indication with a Growing Market Increasing prevalence Increasing adoption of prophylaxis Subcutaneous dosing No more bleeds Greater convenience Ease of pediatric treatment Source: (1) Morgan Stanley Equity Research Hemophilia Growing Market Key Trends Future Implications

Management Team Nassim Usman, Ph.D. – President & Chief Executive Officer MIT, Ribozyme Pharma, Sirna Therapeutics, Morgenthaler Ventures Howard Levy, M.B.B.Ch., Ph.D., M.M.M. – Chief Medical Officer Lilly, Novo Nordisk, Sangart, Inspiration, CSL Behring Fletcher Payne – Chief Financial Officer IBM, Cell Genesys, Abgenix, Dynavax, Rinat, Plexxikon, CytomX Andrew Hetherington, M.B.A. – VP Manufacturing Operations GSK, Bayer, Novartis Jeffrey Landau, M.B.A. – VP Business Development Jazz Pharmaceuticals, Orphan Medical, Eli Lilly, Onyx, Threshold

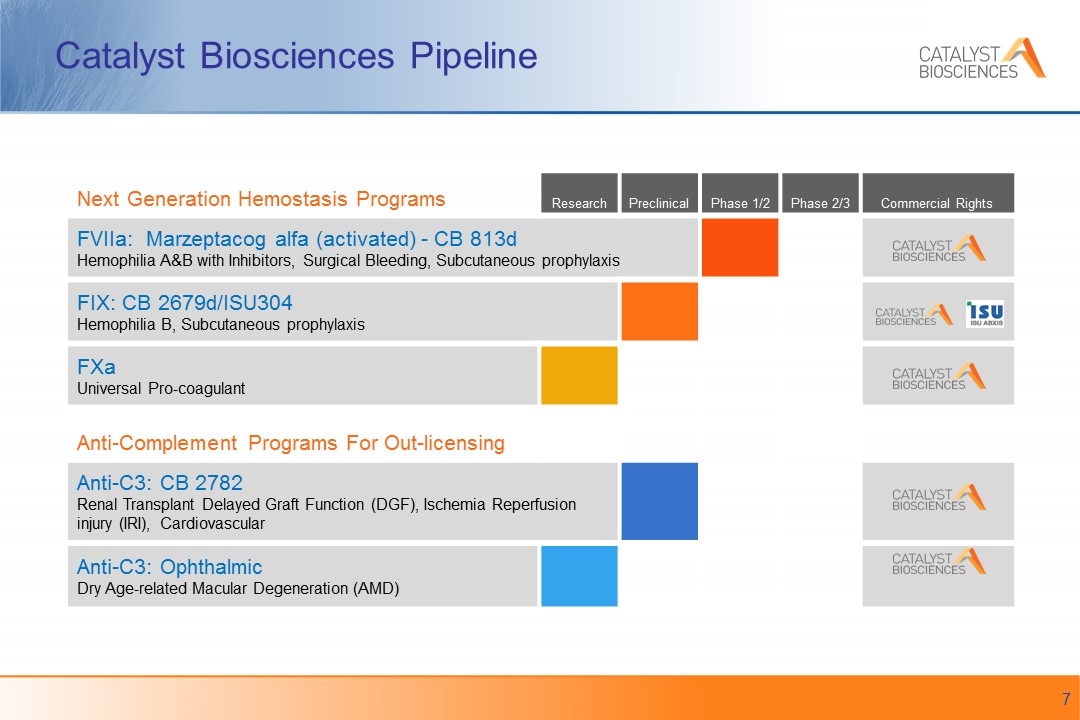

Next Generation Hemostasis Programs Research Preclinical Phase 1/2 Phase 2/3 Commercial Rights FVIIa: Marzeptacog alfa (activated) - CB 813d Hemophilia A&B with Inhibitors, Surgical Bleeding, Subcutaneous prophylaxis FIX: CB 2679d/ISU304 Hemophilia B, Subcutaneous prophylaxis FXa Universal Pro-coagulant Anti-Complement Programs For Out-licensing Anti-C3: CB 2782 Renal Transplant Delayed Graft Function (DGF), Ischemia Reperfusion injury (IRI), Cardiovascular Anti-C3: Ophthalmic Dry Age-related Macular Degeneration (AMD) Catalyst Biosciences Pipeline

IV Infusion “On-Demand” or Prophylaxis Intravenous Delivery IV infusion through painful needle stick Requires supervision and skilled insertion of needle into vein Dosage varies by agent and type of bleed Challenging for patient, family, school Requires replacement factor, rest, compression and elevation Proactive / Prophylactic Use Subcutaneous Delivery SQ injections are easier Home therapy - family or patient Prophylactic use should result in fewer bleeds; reduce damage to joints and muscles Fewer demands on healthcare system; reduce hospital stays & outpatient visits “I started helping Mom and Dad with the treatment…I don’t want to try to get the needle in the vein yet. Maybe when I’m ten.” Pediatric use of subcutaneous delivery is common for diabetes and regularly administered at home and school

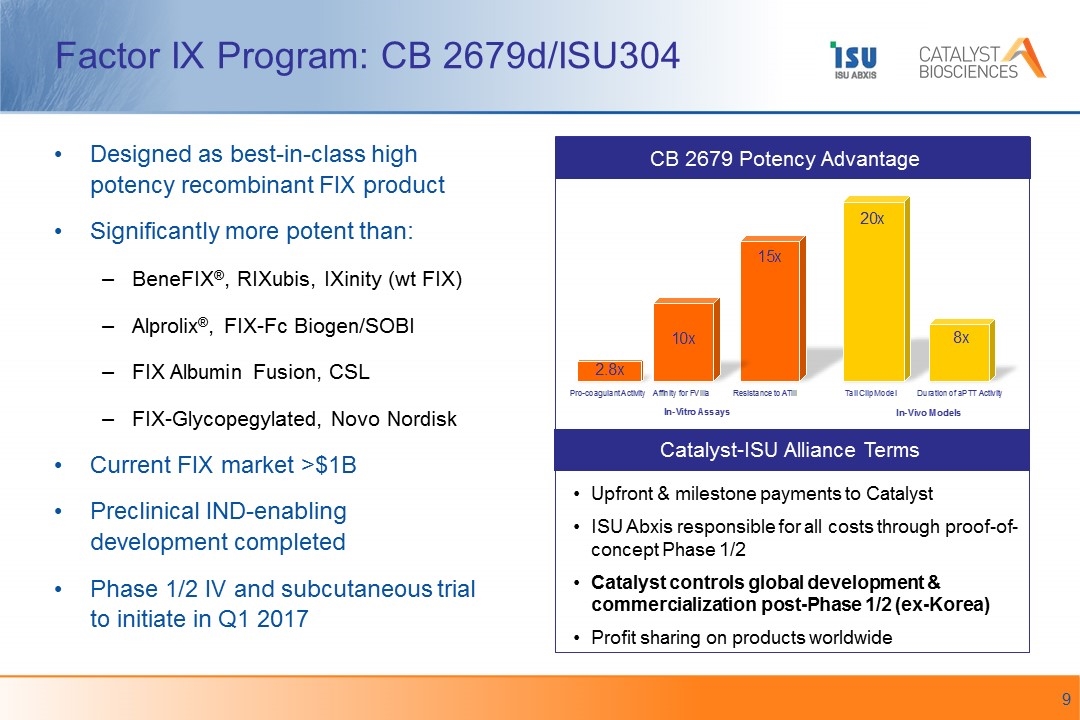

Factor IX Program: CB 2679d/ISU304 Catalyst-ISU Alliance Terms Upfront & milestone payments to Catalyst ISU Abxis responsible for all costs through proof-of-concept Phase 1/2 Catalyst controls global development & commercialization post-Phase 1/2 (ex-Korea) Profit sharing on products worldwide Designed as best-in-class high potency recombinant FIX product Significantly more potent than: BeneFIX®, RIXubis, IXinity (wt FIX) Alprolix®, FIX-Fc Biogen/SOBI FIX Albumin Fusion, CSL FIX-Glycopegylated, Novo Nordisk Current FIX market >$1B Preclinical IND-enabling development completed Phase 1/2 IV and subcutaneous trial to initiate in Q1 2017 CB 2679 Potency Advantage

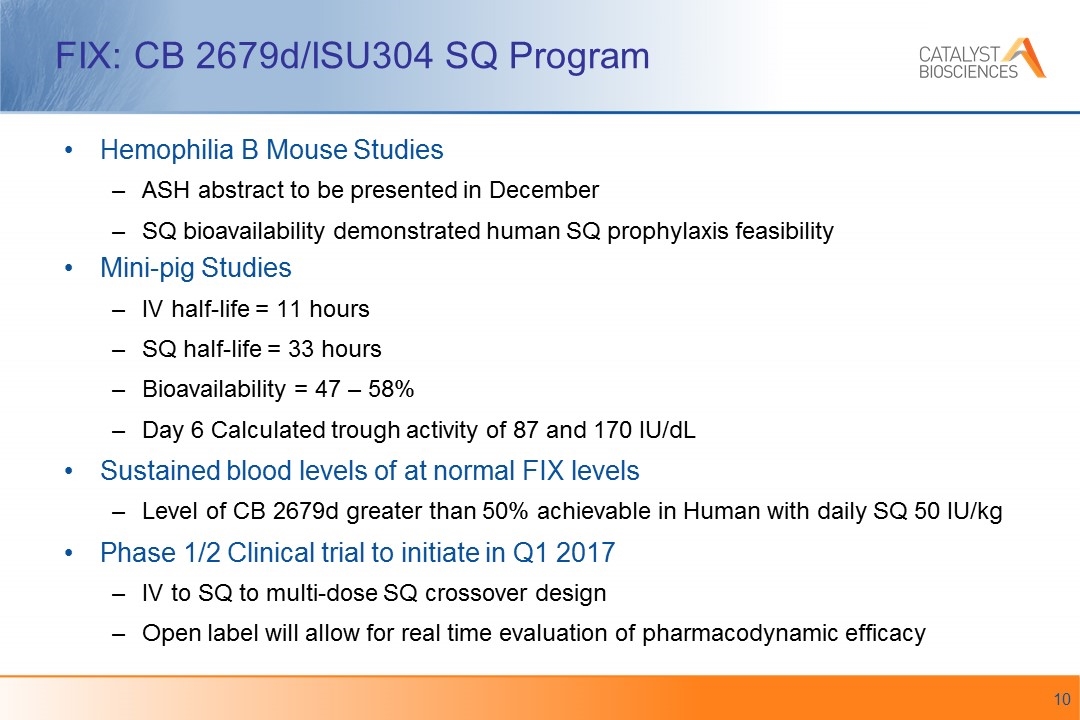

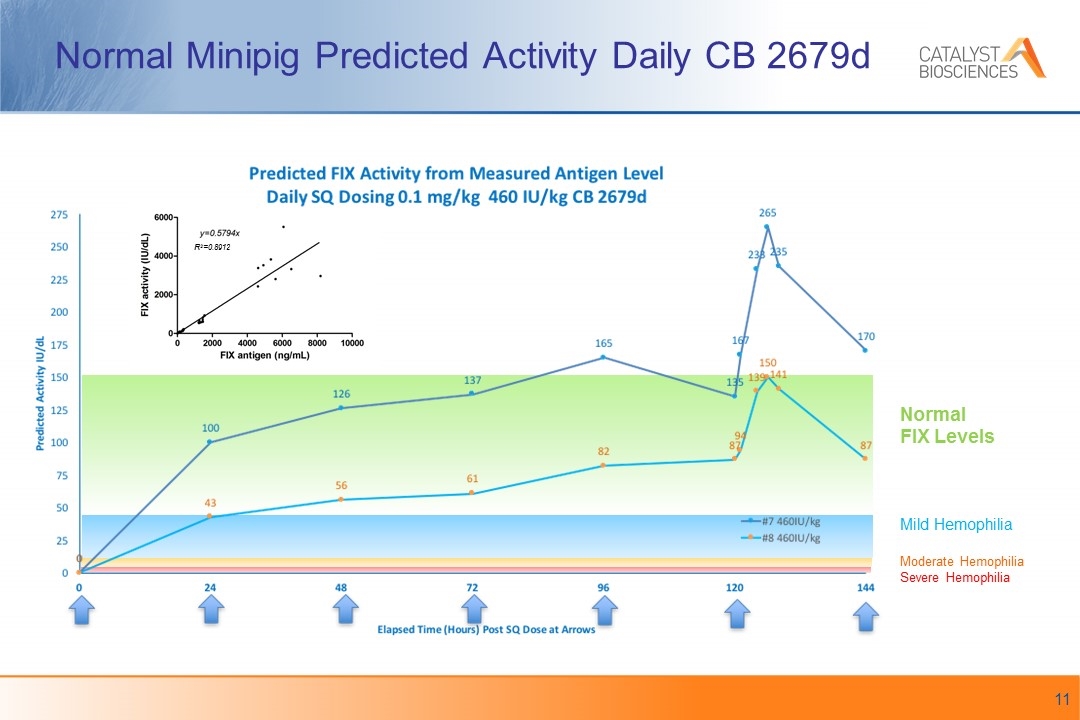

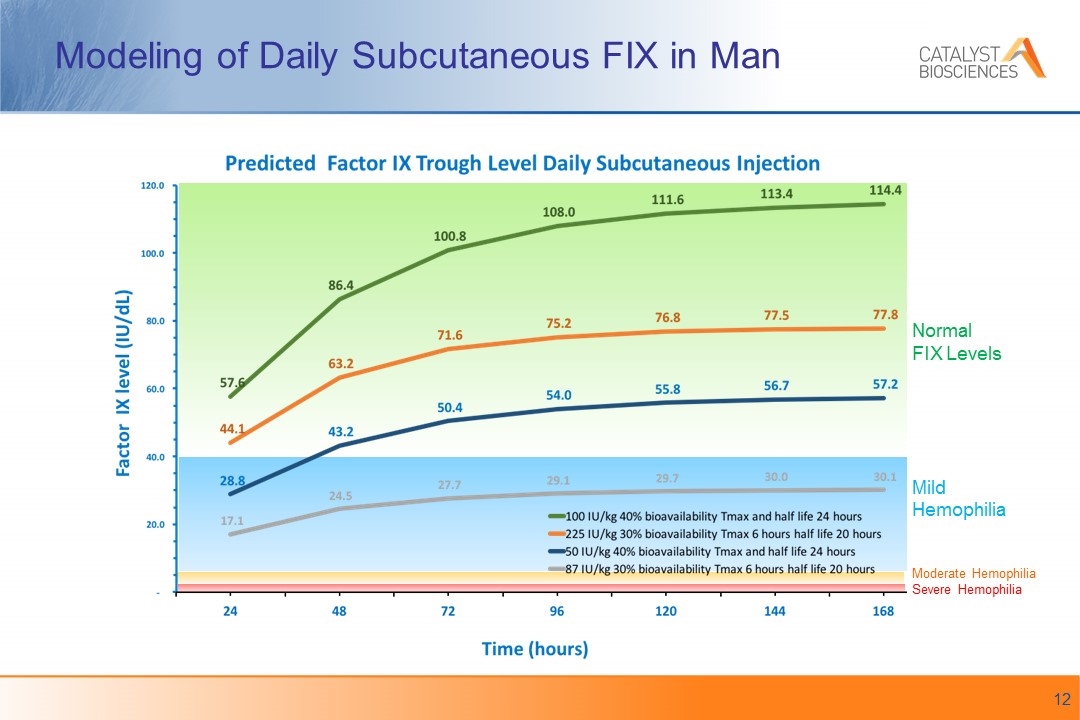

FIX: CB 2679d/ISU304 SQ Program Hemophilia B Mouse Studies ASH abstract to be presented in December SQ bioavailability demonstrated human SQ prophylaxis feasibility Mini-pig Studies IV half-life = 11 hours SQ half-life = 33 hours Bioavailability = 47 – 58% Day 6 Calculated trough activity of 87 and 170 IU/dL Sustained blood levels of at normal FIX levels Level of CB 2679d greater than 50% achievable in Human with daily SQ 50 IU/kg Phase 1/2 Clinical trial to initiate in Q1 2017 IV to SQ to multi-dose SQ crossover design Open label will allow for real time evaluation of pharmacodynamic efficacy

Normal Minipig Predicted Activity Daily CB 2679d R2=0.8912 Normal FIX Levels Mild Hemophilia Moderate Hemophilia Severe Hemophilia

Modeling of Daily Subcutaneous FIX in Man Normal FIX Levels Mild Hemophilia Moderate Hemophilia Severe Hemophilia

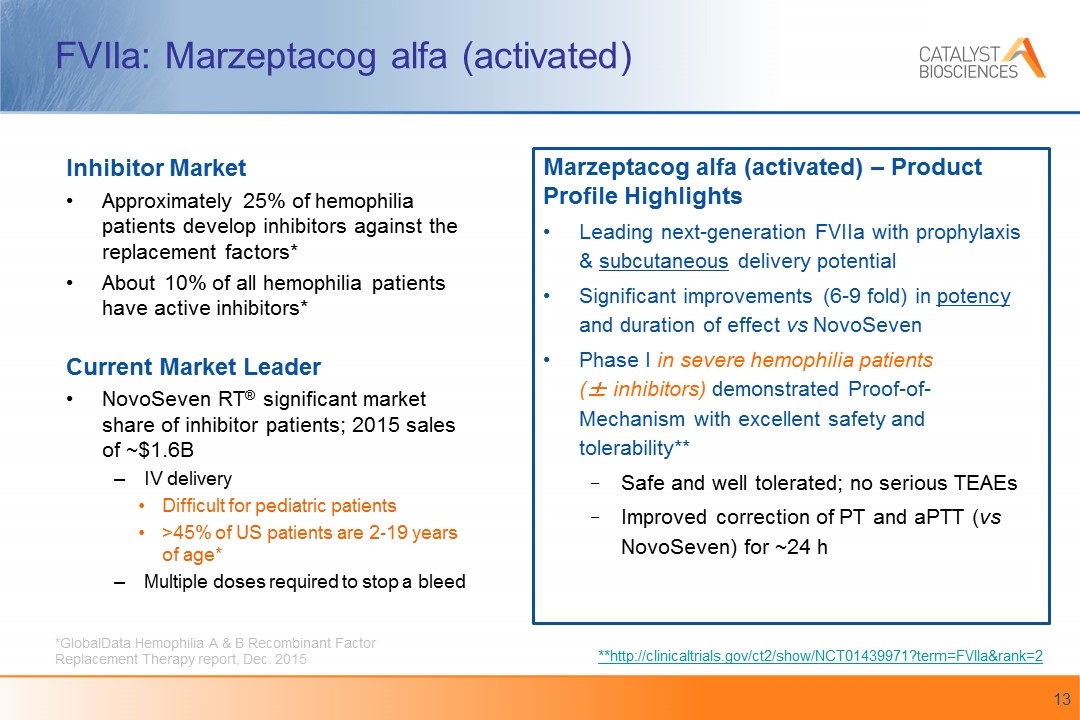

FVIIa: Marzeptacog alfa (activated) Inhibitor Market Approximately 25% of hemophilia patients develop inhibitors against the replacement factors* About 10% of all hemophilia patients have active inhibitors* Current Market Leader NovoSeven RT® significant market share of inhibitor patients; 2015 sales of ~$1.6B IV delivery Difficult for pediatric patients >45% of US patients are 2-19 years of age* Multiple doses required to stop a bleed Marzeptacog alfa (activated) – Product Profile Highlights Leading next-generation FVIIa with prophylaxis & subcutaneous delivery potential Significant improvements (6-9 fold) in potency and duration of effect vs NovoSeven Phase I in severe hemophilia patients (± inhibitors) demonstrated Proof-of-Mechanism with excellent safety and tolerability** Safe and well tolerated; no serious TEAEs Improved correction of PT and aPTT (vs NovoSeven) for ~24 h *GlobalData Hemophilia A & B Recombinant Factor Replacement Therapy report, Dec. 2015 **http://clinicaltrials.gov/ct2/show/NCT01439971?term=FVIIa&rank=2

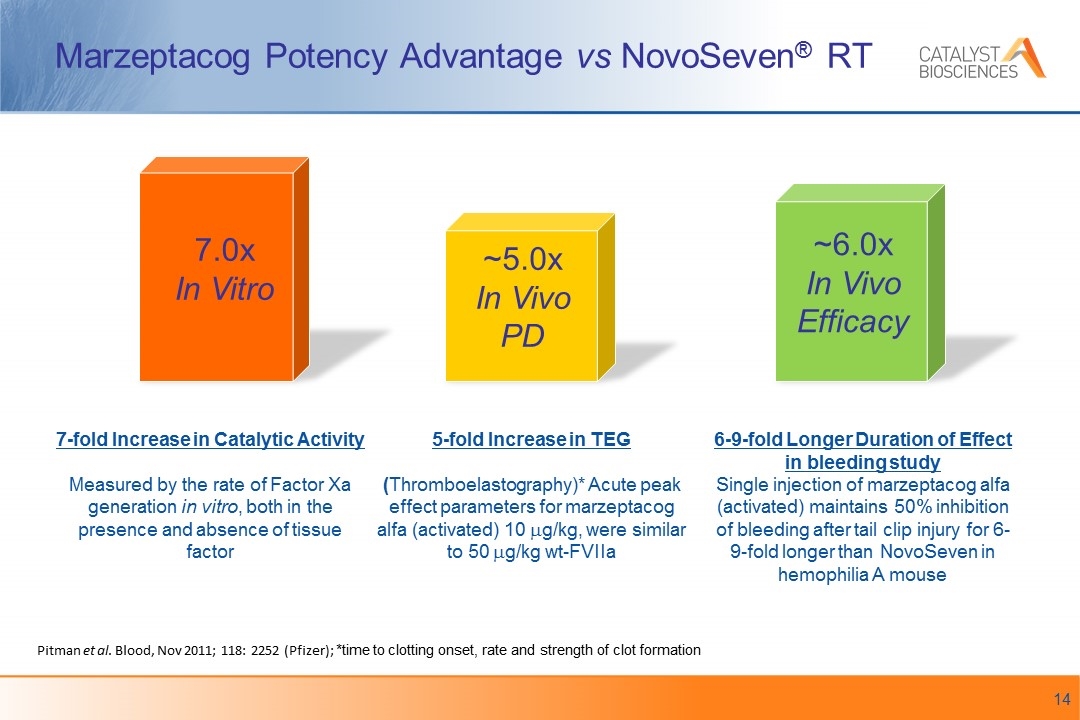

Marzeptacog Potency Advantage vs NovoSeven® RT Pitman et al. Blood, Nov 2011; 118: 2252 (Pfizer); *time to clotting onset, rate and strength of clot formation 7.0x In Vitro ~5.0x In Vivo PD 7-fold Increase in Catalytic Activity Measured by the rate of Factor Xa generation in vitro, both in the presence and absence of tissue factor 5-fold Increase in TEG (Thromboelastography)* Acute peak effect parameters for marzeptacog alfa (activated) 10 mg/kg, were similar to 50 mg/kg wt-FVIIa ~6.0x In Vivo Efficacy 6-9-fold Longer Duration of Effect in bleeding study Single injection of marzeptacog alfa (activated) maintains 50% inhibition of bleeding after tail clip injury for 6-9-fold longer than NovoSeven in hemophilia A mouse

Marzeptacog alfa (activated) SQ Program Hemophilia B Mouse aPTT reduction with SQ dosing Achieved FVIIa levels similar to those that showed efficacy in prior preclinical bleeding models Normal Mouse FVIIa levels demonstrate SQ dosing feasibility Hemophilia A Dog Daily SQ dosing to be presented at an upcoming scientific meeting

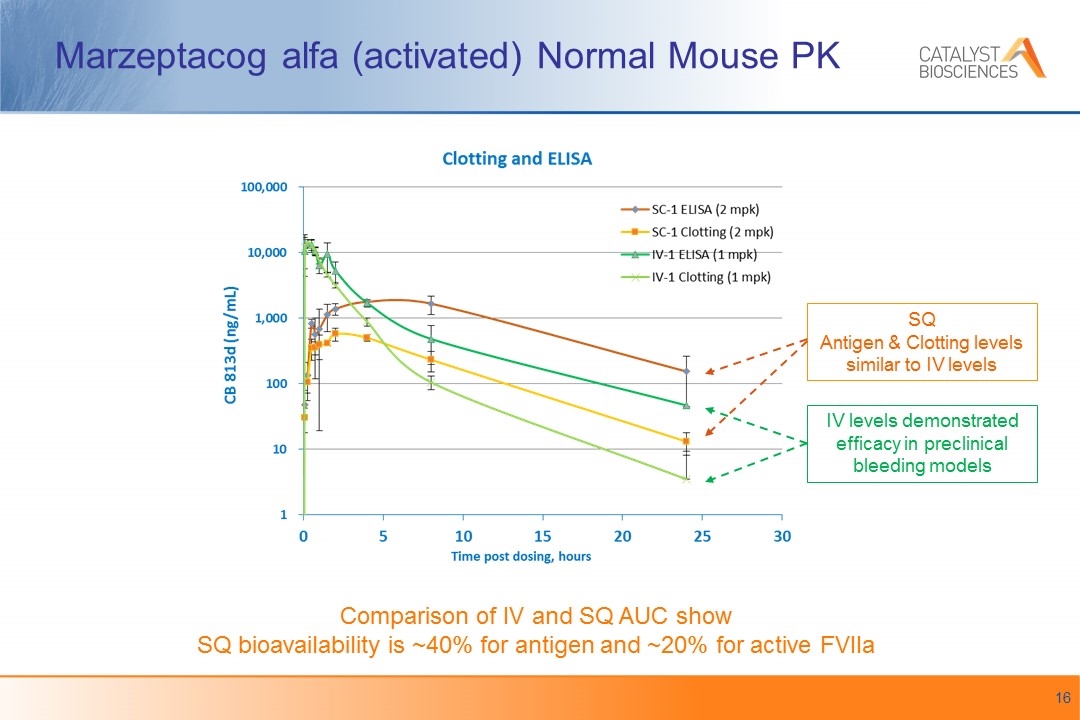

Marzeptacog alfa (activated) Normal Mouse PK Comparison of IV and SQ AUC show SQ bioavailability is ~40% for antigen and ~20% for active FVIIa SQ Antigen & Clotting levels similar to IV levels IV levels demonstrated efficacy in preclinical bleeding models

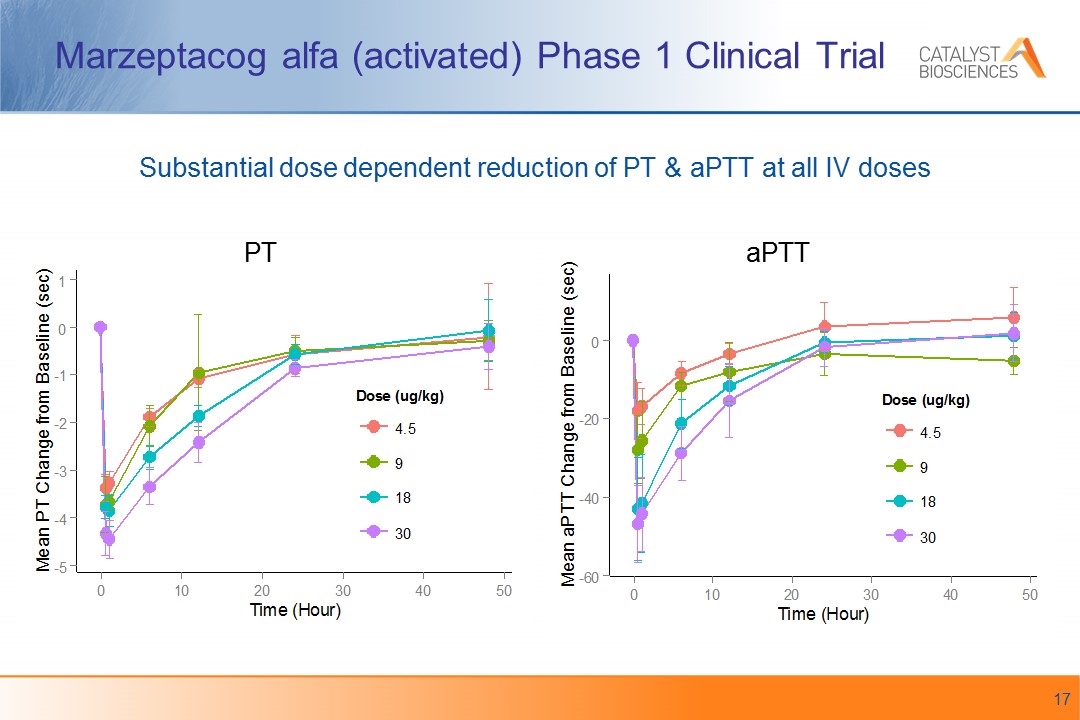

Marzeptacog alfa (activated) Phase 1 Clinical Trial PT aPTT Substantial dose dependent reduction of PT & aPTT at all IV doses

Marzeptacog alfa (activated) Clinical Trial Summary Single IV doses at 5 levels up to 30 μg/kg were very well tolerated when administered to 25 hemophilia A and B patients in Phase 1 No thrombosis or bleeding events Evidence of pharmacologic activity was observed with dose-dependent changes of PT, aPTT, F1+2, and TGA for up to 24 hours High potency suggests the potential for subcutaneous dosing “The results for safety and pharmacologic activity support further clinical development of marzeptacog alfa (activated) for treatment of individuals with hemophilia and inhibitors to FVIII or FIX”* Subcutaneous dosing trial anticipated to begin in 2017 with continuation as a pivotal trial *Gruppo et al. ISTH Abstract 1878 ISTH 2015 Safety, pharmacokinetics and pharmacodynamics of PF-05280602 (recombinant FVIIa variant): results from a single ascending dose phase I study in hemophilia A and B subjects

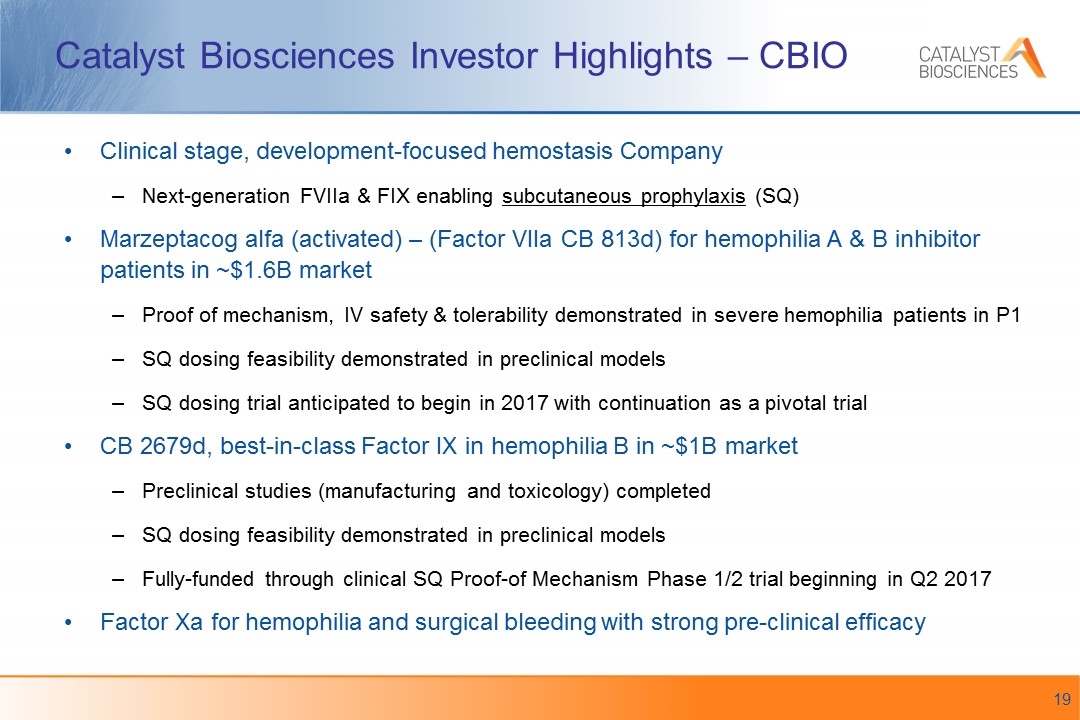

Catalyst Biosciences Investor Highlights – CBIO Clinical stage, development-focused hemostasis Company Next-generation FVIIa & FIX enabling subcutaneous prophylaxis (SQ) Marzeptacog alfa (activated) – (Factor VIIa CB 813d) for hemophilia A & B inhibitor patients in ~$1.6B market Proof of mechanism, IV safety & tolerability demonstrated in severe hemophilia patients in P1 SQ dosing feasibility demonstrated in preclinical models SQ dosing trial anticipated to begin in 2017 with continuation as a pivotal trial CB 2679d, best-in-class Factor IX in hemophilia B in ~$1B market Preclinical studies (manufacturing and toxicology) completed SQ dosing feasibility demonstrated in preclinical models Fully-funded through clinical SQ Proof-of Mechanism Phase 1/2 trial beginning in Q2 2017 Factor Xa for hemophilia and surgical bleeding with strong pre-clinical efficacy

Catalyst Biosciences www.catalystbiosciences.com Essential Medicines for Hemophilia. Greater Convenience. Superior Outcomes