Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K 09/12/2016 - KITE REALTY GROUP TRUST | form8k_09122016.htm |

INVESTOR UPDATE

Q2 2016

Chapel Hill (Dallas, TX)

Livingston Center (Livingston, NJ)

© 2016 Kite Realty Group kiterealty.com Investor Update | 2

COMPANY SNAPSHOT

KITE REALTY GROUP TRUST

Note: All data as of 06/30/16 unless otherwise noted.

1.) Source: SNL; Dividend yield calculated as most recent dividend, annualized and expressed as a percent of the security price.

2.) Demographic data for income pulled on a 3-mile radius, and population data based on a 5-mile radius. Source: STI: Popstats.

Note: Cities referenced denote regional office locations.

Number of Properties 121

Number of States 20

Total GLA (SF) 24mm

Total Retail Operating Leased 95.2%

Retail Operating Shop Leased 88.3%

Annualized Base Rent (Per SF) -

Operating Portfolio

$15.27

Average Center Size (SF) ~200,000

Portfolio Demographics (2)

Average Household Income $84,000

Population 167,000

PORTFOLIO SUMMARY

RETAIL PORTFOLIO PRODUCT BREAKDOWN

67% Of Assets Anchored With A Grocery

Grocery

Anchored,

13%

Hybrid

(Power

W/

Grocery),

54%

Power /

Regional

Center,

29%

Other, 4%

© 2016 Kite Realty Group kiterealty.com Investor Update | 3

KITE’S STRATEGY FOCUSES ON THE “CORE” OF THE BUSINESS

C

ULTURE & PASSION

• MANAGEMENT CONSISTENCY

• EFFICIENT OPERATING PLATFORM

O

PERATIONAL EXCELLENCE

• HIGH-QUALITY PORTFOLIO

• TOP-TIER FINANCIAL RESULTS

R

ESILIENT BALANCE SHEET

• WELL-STAGGERED MATURITIES

• FREE CASH FLOW >$50mm

E

XECUTION

• STRONG REDEVELOPMENT,

REPOSITION AND REPURPOSE (“3-

R”) PLATFORM

• PROVEN HISTORY OF EXECUTED

DEALS

Eddy Street Commons (South Bend, IN)

EDDY STREET COMMONS (IN)

CITY CENTER (NY)

© 2016 Kite Realty Group kiterealty.com Investor Update | 4

KITE’S 3-YEAR CORE ROADMAP TO UNLOCK VALUE

FFO, as Adjusted

Per Share

Free Cash Flow

Net Debt / Adjusted

EBITDA

Floating Rate Debt

Shops Leased

Dividend

Per Share

2017 2018YE Goal 2015YE 2016

$1.99

6.98x

12%

87.6%

~$50mm

$1.09

6.0x – 6.25x

< 15%

90%

+12%-16%

+~5% / Year

+15%-20%

Note: The numbers set forth under 2018YE Goal represent aspirational goals only, and do not represent guidance or projections as to the Company’s expected performance. For the Company’s stated guidance with

respect to FFO, as Adjusted, for 2016, we refer to the Company’s quarterly press releases. The Company’s actual performance will be subject to various contingencies, many of which are beyond the Company’s control,

and may well not meet these goals. Dividends are determined solely by the Company’s Board of Trustees.

© 2016 Kite Realty Group kiterealty.com Investor Update | 5

KITE’S CORE MODEL INTERTWINED IN ALL ASPECTS

CORPORATE IDENTITY

& OPERATIONS

HIGH-QUALITY

PORTFOLIO

PORTFOLIO

TRANSFORMATION

INVESTMENT GRADE

BALANCE SHEET

Long-standing,

experienced

management team

Community

involvement

Top-tier operating

metrics

Historical same-

store NOI growth

of ~4.0%

92% Internet

resistant / Omni-

channel

Need-based and

value oriented

retailers

Over 70% ABR

coming from top

50 MSAs

Highly-trafficked

centers; over 67%

of assets include

grocer

Recent portfolio

transformation

History of creating

synergies, driving

growth

Expected net seller

in 2016 of $50-

65mm

Enhancing assets

via the 3-Rs;

Redevelop,

Reposition,

Repurpose

> $50mm in free

cash flow annually

Minimal debt

maturities through

2020

9% floating rate

debt exposure

Target net debt /

adjusted EBITDA of

6.0x-6.25x

KITE’S CORE MODEL IS THE FOUNDATION FOR ACHIEVING SUCCESS IN THE FOLLOWING AREAS:

© 2016 Kite Realty Group kiterealty.com Investor Update | 6

EARNINGS GROWTH FURTHER SUPPORTS INVESTMENT

STATED GOAL: 12-16% FFO GROWTH (2015-2018E) (1)

$1.99

2015 2018E

Goal: +12-16%

20-25%

25-30%

30-35%

15-20%

COMPONENTS OF FFO GROWTH

Minimum Rent

Other 3-R

Shop Lease Up/SSNOI

Under

Construction

Dev./Redev.

Transitional

Dev./ Redev.

COMPLETE EXISTING DEVELOPMENT PROJECT, PARKSIDE PHASE II

FINALIZE TRANSITIONAL REDEVELOPMENT/DEVELOPMENT PROJECTS

LEASE SMALL SHOPS TO 90%

MAINTAIN ~$100MM IN 3-R PIPELINE, TO RETURN 9-11%

Results in

annualized cash

NOI of ~$11mm

Reduced CAM

Leakage

82%

9% 9%

Interest Savings

1.) 2015 FFO for KRG reflects the Company’s defined FFO, as adjusted per share metric.

Note: The numbers described as goals represent aspirational goals only, and do not represent guidance or projections as to the Company’s expected performance. For the Company’s stated guidance with respect to FFO,

as Adjusted, for 2016, we refer to the Company’s quarterly press releases. The Company’s actual performance will be subject to various contingencies, many of which are beyond the Company’s control, and may well

not meet these goals.

© 2016 Kite Realty Group kiterealty.com Investor Update | 7

KRG PROVIDES ATTRACTIVE INVESTMENT OPPORTUNITY

1.) Source: SNL Financial; Total Return (RMS Index) and implied dividend contribution (estimated as RMS less RMZ index) from December 2009 – September 2016.

2.) 2016E FFO per share refers to consensus estimate for companies as of September 2016 per Bloomberg, which may not reflect the Company’s or the applicable peer company’s estimates. FFO Payout Ratio calculated as

dividends divided by 2016E FFO, on a per share basis.

56.1%

BRX KRG DDR REG RPAI AKR WRI EQY KIM FRT ROIC

Peer Group Median 63.7%

DIVIDEND VS. 2016E FFO (2)

RELATIVELY MODEST FFO PAYOUT RATIO SUPPORTS FUTURE

DIVIDEND INCREASES

DISCOUNTED MULTIPLE SUPPORTS VALUATION THESIS

14.4x

BRX KRG DDR RPAI WRI ROIC KIM EQY AKR REG FRT

Peer Group Median 21.4x

PRICE VS. 2016E FFO (2)

40%

60%

Dividend

Contribution

Price

Contribution

COMPONENTS OF TOTAL RETURN (1)

Historically, REITs’ total returns

have had an implied contribution

from dividends of ~40%

CORPORATE IDENTITY & OPERATIONS

© 2016 Kite Realty Group kiterealty.com Investor Update | 9

$1.70

$2.06

2010 2016E

Transformed 86% of portfolio into

higher-quality assets since 2010 (1)

Obtained investment grade rating by

Moody’s and S&P (Baa3 / BBB-)

Executed inaugural private placement

bond deal in 2015

Increased free cash flow from less than

$10mm in 2010 to over $50mm

Achieved dividend per share growth of

19.8% over the last 4 years

COMPANY AND PORTFOLIO TRANSFORMATION SINCE 2010

REVENUE GROWTH AND IMPROVED PORTFOLIO

QUALITY WHILE STRENGTHENING THE BALANCE SHEET

1.) Transformed defined as current operating portfolio GLA that has been sold, recycled, or redeveloped since 2010.

2.) 2010 FFO adjusted for reverse stock split in 2014. 2016E per consensus data per SNL Financial, which may not reflect the Company’s internal estimates.

KITE MILESTONES

+~21%

FFO Per Share Growth (2)

9.1x

6.9x

2010 Current

~2x

lower

Net Debt / Adjusted EBITDA

$12.80

$15.27

2010 Current

Annualized Base Rent PSF

+~19%

1.8x

3.7x

2010 Current

~2x

higher

Fixed Charge Coverage

P P

P P

© 2016 Kite Realty Group kiterealty.com Investor Update | 10

KITE CONSISTENTLY MAINTAINS TOP-TIER SSNOI GROWTH

4.9%

4.3%

4.0%

3.7%

3.5%

3.3% 3.3%

3.1%

2.9% 2.8% 2.8%

2.6%

1.9%

ROIC AKR KRG EQY BRX REG WRI DDR RPT FRT RPAI KIM CDR

QUARTERLY AVERAGE SSNOI GROWTH FROM Q2’14-Q2’16 (1)

Peer average

~3.3%

1.) Figures exclude redevelopments, when available, averaged on a quarterly basis from supplemental data for Q2’14-Q2’16.

© 2016 Kite Realty Group kiterealty.com Investor Update | 11

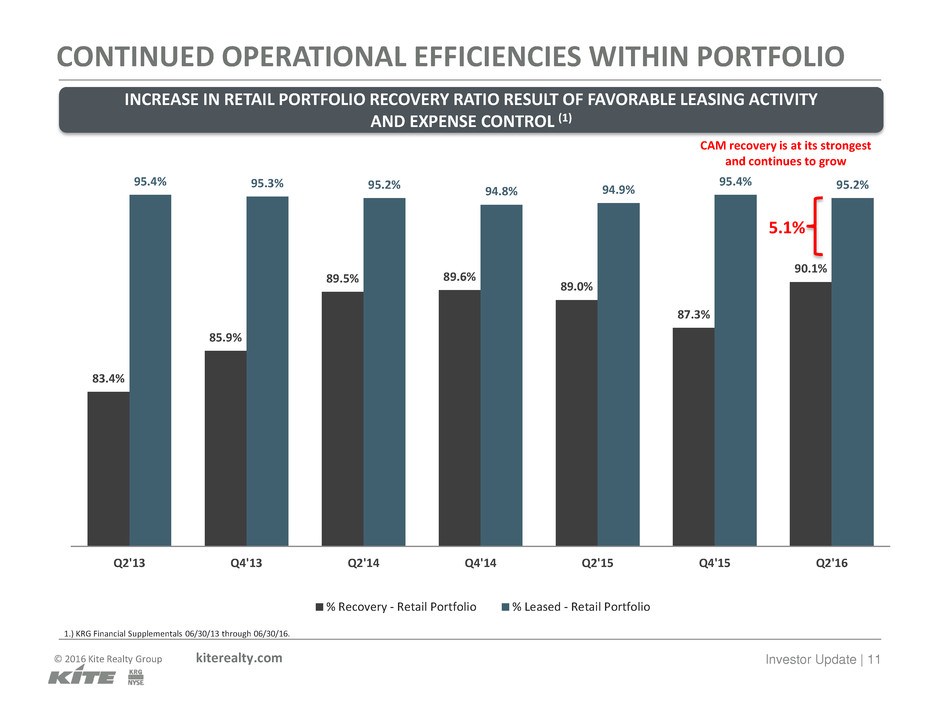

CONTINUED OPERATIONAL EFFICIENCIES WITHIN PORTFOLIO

83.4%

85.9%

89.5% 89.6%

89.0%

87.3%

90.1%

95.4% 95.3% 95.2%

94.8% 94.9%

95.4% 95.2%

Q2'13 Q4'13 Q2'14 Q4'14 Q2'15 Q4'15 Q2'16

% Recovery - Retail Portfolio % Leased - Retail Portfolio

1.) KRG Financial Supplementals 06/30/13 through 06/30/16.

INCREASE IN RETAIL PORTFOLIO RECOVERY RATIO RESULT OF FAVORABLE LEASING ACTIVITY

AND EXPENSE CONTROL (1)

5.1%

CAM recovery is at its strongest

and continues to grow

© 2016 Kite Realty Group kiterealty.com Investor Update | 12

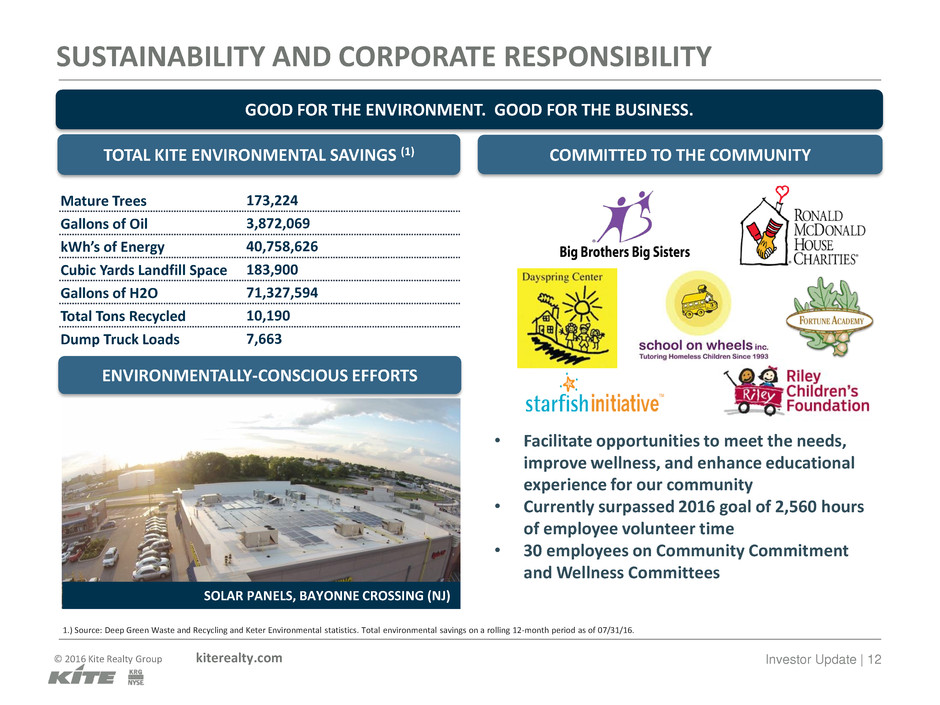

SUSTAINABILITY AND CORPORATE RESPONSIBILITY

COMMITTED TO THE COMMUNITY

ENVIRONMENTALLY-CONSCIOUS EFFORTS

TOTAL KITE ENVIRONMENTAL SAVINGS (1)

• Facilitate opportunities to meet the needs,

improve wellness, and enhance educational

experience for our community

• Currently surpassed 2016 goal of 2,560 hours

of employee volunteer time

• 30 employees on Community Commitment

and Wellness Committees

GOOD FOR THE ENVIRONMENT. GOOD FOR THE BUSINESS.

Mature Trees 173,224

Gallons of Oil 3,872,069

kWh’s of Energy 40,758,626

Cubic Yards Landfill Space 183,900

Gallons of H2O 71,327,594

Total Tons Recycled 10,190

Dump Truck Loads 7,663

SOLAR PANELS, BAYONNE CROSSING (NJ)

1.) Source: Deep Green Waste and Recycling and Keter Environmental statistics. Total environmental savings on a rolling 12-month period as of 07/31/16.

HIGH-QUALITY PORTFOLIO

© 2016 Kite Realty Group kiterealty.com Investor Update | 14

Midwest

17%

Northeast

11%

Mid-

Central

17% West

12%

Southeast

18%

Florida

25%

HIGH-QUALITY, DIVERSE TENANT BASE AND GEOGRAPHY

Top Tenants By ABR # Stores % ABR

1 Publix 18 3.1%

2 TJ Maxx 22 2.5%

3 Petsmart 20 2.3%

4 Bed Bath & Beyond 19 2.2%

5 Ross Dress For Less 18 2.1%

6 Lowe’s 5 1.9%

7 Office Depot / Max 18 1.9%

8 Dick’s Sporting Goods 9 1.7%

9 Ascena 36 1.6%

10 Michaels 14 1.4%

Total 179 20.7%

H

IG

H

-Q

U

AL

IT

Y

T

EN

A

N

T

B

AS

E INVESTMENT GRADE RATED TOP TENANTS

G

EO

G

RAPHICA

LL

Y

DIVE

R

SE

2016 LEASE ACTIVITY EXAMPLES

First In Florida:

Gainesville Plaza (FL)

ABR % BY REGION

HIGH-QUALITY, DIVERSE REVENUE SOURCES IN TERMS OF TENANTS AND GEOGRAPHIES

First Bath & Body Works, White Barn Candle Combo

Store: University Town Center (Norman, OK)

Note: All data as of 06/30/16 unless otherwise noted.

© 2016 Kite Realty Group kiterealty.com Investor Update | 15

ASSET QUALITY SUPPORTED BY MARKET DEMOGRAPHICS

ASSETS ACROSS THE TOP 5 MARKETS SUPERIORLY POSITIONED

Median Household Income

Source: STI: Popstats; information based on a 3-mile radius for the KRG portfolio.

$54K

$68K

$66K

$61K

$66K

$47K

$49K

$53K

$51K

$47K

Florida Indiana Texas Nevada North Carolina

KRG State Median Household Income State Median Household Income

© 2016 Kite Realty Group kiterealty.com Investor Update| 16

INTERNET RESISTANT 54%

SERVICES, ENTERTAINMENT 19%

GROCERY, SPECIALTY STORES 19%

RESTAURANTS 16%

OMNI-CHANNEL 38%

DISCOUNT RETAILERS 15%

HOME IMPROVEMENT/GOODS 11%

SOFT GOODS 8%

SPORTING GOODS 4%

NON-RESISTANT 8%

ELECTRONICS / BOOKS 5%

OFFICE SUPPLIES 3%

NECESSITY DRIVEN AND INTERNET RESISTANT RETAILER BASE

1.) Data reflects Q2’16 Supplemental.

2.) Source: ICSC Article, June 2016: “In-Store vs. Online: Brick & Mortar is the Dominant Format.”

78% of Consumers Prefer Shopping In-Store

Internet

Resistant,

54%

Omni-

channel,

38%

Non-

Resistant,

8%

TENANT TYPE COMPOSITION

CONSUMER TRENDS (2)

KITE’S PORTFOLIO IS WELL-EQUIPPED TO MANAGE EVOLVING CONSUMER PREFERENCES (1)

In-Store Online

Consumer Purchase / Month 7.5 2.2

Time Spent 54 min. 38 min.

Money Spent / Month $1,710 $247

© 2016 Kite Realty Group kiterealty.com Investor Update| 17

Dallas, TX

Owned

GLA

126,755

ABR per

SF

$24.09

% Leased 92.5%

PORTFOLIO OF HIGH-QUALITY, DIVERSE ASSETS

DELRAY MARKETPLACE CHAPEL HILL

RIVERS EDGE CENTENNIAL CENTER

Delray, FL

Owned

GLA

260,094

ABR per

SF

$25.16

% Leased 96.7%

Indianapolis, IN

Owned

GLA

149,209

ABR per

SF

$20.21

% Leased 100.0%

Las Vegas, NV

Owned

GLA

334,705

ABR per

SF

$22.79

% Leased 93.7%

PORTFOLIO TRANSFORMATION

© 2016 Kite Realty Group kiterealty.com Investor Update | 19

STABILIZED GROUND-UP DEVELOPMENTS

Power center consisting of

premier national retailers

Accelerated development

timing resulted in early store

openings

Future growth expected via

contractual rent terms and

outparcel opportunities

TAMIAMI CROSSING (NAPLES, FL)

HOLLY SPRINGS TOWNE CENTER (RALEIGH, NC)

Two-phased lifestyle

development project

Total of 326K SF (includes

Phase I & Phase II)

Average HHI in primary

trade area exceeds $100K

14,600+ future approved

homes in primary trade area

© 2016 Kite Realty Group kiterealty.com Investor Update | 20

In-process projects of ~$43.5mm

Major Redevelopment:

City Center

Optimizing Existing Vacancies /

Right-sizing:

Bolton Plaza Phase II

Northdale Promenade

Hitchcock Plaza

Shops at Moore

Tarpon Bay Plaza

IN-PROCESS REDEVELOPMENT & 3-R PLATFORM

IN-PROCESS 3-Rs

REDEVELOPMENT PIPELINE: THE 3-Rs

Redevelop: substantial renovations; e.g.

teardowns, remerchandising, exterior / interior

improvements

Repurpose: substantial alterations including

changing the product-type

Reposition: less substantial asset enhancements,

generally $5mm or less

60%

22%

18%

Average 3-R Return: 9-11%

Redevelopment

Reposition

Repurpose

Portofino Phase I (TX)

Outparcel Opportunities:

Portofino Phase I

Castleton Crossing

City Center (NY)

© 2016 Kite Realty Group kiterealty.com Investor Update | 21

PROVEN ABILITY TO CREATE ONGOING SYNERGIES

NO

I MAR

G

IN

69.3%

77.8%

PRE-TRANSACTION Q2'16

72.1%

76.8%

PRE-TRANSACTION Q2'16

RECOVERY

RATI

O

70.1%

82.6%

PRE-TRANSACTION Q2'16

80.5%

92.7%

PRE-TRANSACTION Q2'16

9 Property Portfolio Acquisition

Seller: Private Equity Firm

+850 bps

+1,250 bps

+470 bps

+1,220 bps

Avg.

Increase:

+660 bps

Avg.

Increase:

+1,235 bps

KITE’S TRANSACTION TRACK RECORD UNDERSCORES MANAGEMENT’S ABILITY TO DRIVE ONGOING

VALUE THROUGH EFFICIENT OPERATIONS

INVESTMENT GRADE BALANCE SHEET

© 2016 Kite Realty Group kiterealty.com Investor Update | 23

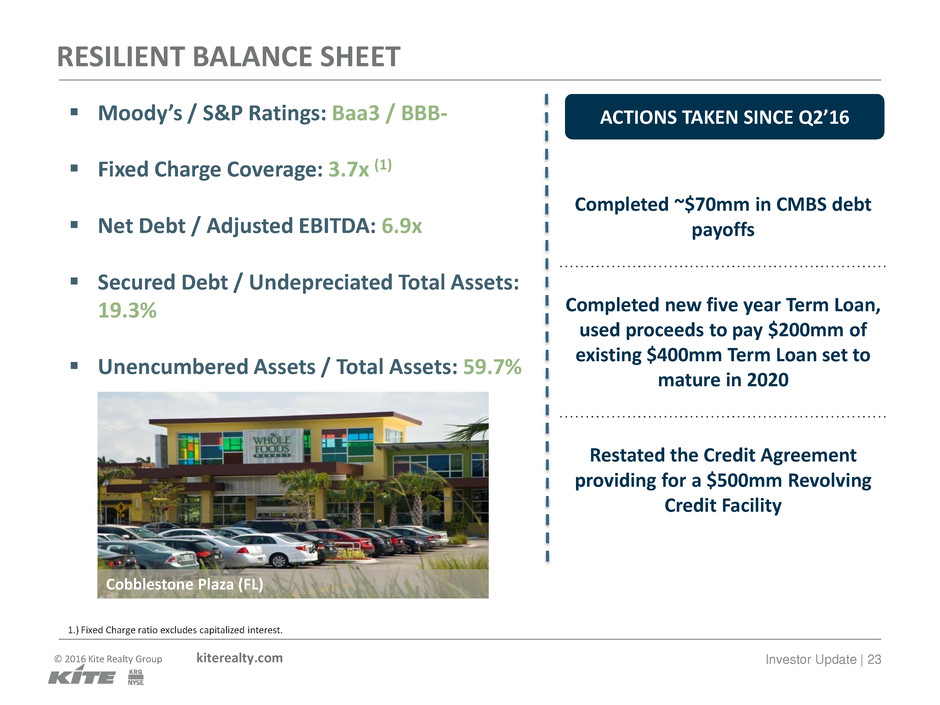

RESILIENT BALANCE SHEET

Moody’s / S&P Ratings: Baa3 / BBB-

Fixed Charge Coverage: 3.7x (1)

Net Debt / Adjusted EBITDA: 6.9x

Secured Debt / Undepreciated Total Assets:

19.3%

Unencumbered Assets / Total Assets: 59.7%

1.) Fixed Charge ratio excludes capitalized interest.

ACTIONS TAKEN SINCE Q2’16

Completed ~$70mm in CMBS debt

payoffs

Completed new five year Term Loan,

used proceeds to pay $200mm of

existing $400mm Term Loan set to

mature in 2020

Restated the Credit Agreement

providing for a $500mm Revolving

Credit Facility

Cobblestone Plaza (FL)

© 2016 Kite Realty Group kiterealty.com Investor Update | 24

2010 Q2'16

~2x

higher

FURTHER ENHANCED FINANCIAL FLEXIBILITY

NET DEBT / ADJUSTED

EBITDA

2010 Q2'16

FLOATING RATE EXPOSURE

21%

9%

-1,200 bps

FIXED CHARGE COVERAGE

x

3.7x

2010 Q2'16

6.9x

~2x

lower

9.1x

Maintain and continue to improve investment grade metrics

Continue to manage debt maturity profile

Maintain floating rate debt exposure of 15% or less

Reduce leverage to 6.0x-6.25x by year-end 2018

BALANCE SHEET INITIATIVES ON TRACK TO MEET 3-YEAR ROADMAP GOALS

1.8x

© 2016 Kite Realty Group kiterealty.com Investor Update | 25

WELL-STAGGERED DEBT MATURITY PROFILE

1. Data is as of Q2’16 with pro forma adjustments. Chart excludes annual principal payments and net premiums on fixed rate debt. Pro forma adjustments include: Term Loan & Revolver Recast –

completed in July, Delray Refinance – completed in July, Pay-offs for Pine Ridge, Riverchase, & Traders Point – completed in July and August.

PRO FORMA SCHEDULE OF DEBT MATURITIES (1)

76

17

64 46

171

216 215

12

72

200

200

200

95

155

2016 2017 2018 2019 2020 2021 2022 2023 2024+

Construction Loan Mortgage Debt Line of Credit Term Loan Private Placement

© 2016 Kite Realty Group kiterealty.com Investor Update | 26

FORWARD-LOOKING STATEMENTS

This presentation, together with other statements and information publicly disseminated by us, contains certain forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such statements are based on assumptions and expectations that may

not be realized and are inherently subject to risks, uncertainties and other factors, many of which cannot be predicted with accuracy and some of which might not even

be anticipated. Future events and actual results, performance, transactions or achievements, financial or otherwise, may differ materially from the results, performance,

transactions or achievements, financial or otherwise, expressed or implied by the forward-looking statements. Risks, uncertainties and other factors that might cause such

differences, some of which could be material, include but are not limited to: national and local economic, business, real estate and other market conditions, particularly in

light of low growth in the U.S. economy as well as uncertainty added to the economic forecast due to oil and energy prices remaining relatively low in 2016; financing

risks, including the availability of and costs associated with sources of liquidity; our ability to refinance, or extend the maturity dates of, our indebtedness; the level and

volatility of interest rates; the financial stability of tenants, including their ability to pay rent and the risk of tenant bankruptcies; the competitive environment in which

we operate; acquisition, disposition, development and joint venture risks; property ownership and management risks; our ability to maintain our status as a real estate

investment trust (“REIT”) for federal income tax purposes; potential environmental and other liabilities; impairment in the value of real estate property we own; risks

related to the geographical concentration of our properties in Florida, Texas, and Indiana; insurance costs and coverage; risks related to cybersecurity attacks and the loss

of confidential information and other business disruptions; other factors affecting the real estate industry generally; and other risks identified in our Annual Report on

Form 10-K and, from time to time, in other reports we file with the Securities and Exchange Commission (the “SEC”) or in other documents that we publicly disseminate.

The Company undertakes no obligation to publicly update or revise these forward-looking statements, whether as a result of new information, future events or

otherwise.

DISCLAIMER

© 2016 Kite Realty Group kiterealty.com Investor Update | 27

NON-GAAP FINANCIAL MEASURES

Funds from Operations

Funds from Operations (FFO) is a widely used performance measure for real estate companies and is provided here as a supplemental measure of

operating performance. We calculate FFO in accordance with the best practices described in the April 2002 National Policy Bulletin of the National

Association of Real Estate Investment Trusts (NAREIT), which we refer to as the White Paper. The White Paper defines FFO as net income

(determined in accordance with generally accepted accounting principles (GAAP)), excluding gains (or losses) from sales and impairments of

depreciated property, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures.

Considering the nature of our business as a real estate owner and operator, we believe that FFO is helpful to investors in measuring our operational

performance because it excludes various items included in net income that do not relate to or are not indicative of our operating performance, such as

gains or losses from sales of depreciated property and depreciation and amortization, which can make periodic and peer analyses of operating

performance more difficult. For informational purposes, we have also provided FFO adjusted for a severance charge in 2016, transaction costs in 2016

and 2015 and a gain on settlement in 2015. We believe this supplemental information provides a meaningful measure of our operating performance.

We believe our presentation of FFO, as adjusted, provides investors with another financial measure that may facilitate comparison of operating

performance between periods and among our peer companies. FFO should not be considered as an alternative to net income (determined in

accordance with GAAP) as an indicator of our financial performance, is not an alternative to cash flow from operating activities (determined in

accordance with GAAP) as a measure of our liquidity, and is not indicative of funds available to satisfy our cash needs, including our ability to make

distributions. Our computation of FFO may not be comparable to FFO reported by other REITs that do not define the term in accordance with the

current NAREIT definition or that interpret the current NAREIT definition differently than we do. A reconciliation of net earnings (computed in

accordance with GAAP) to FFO is included elsewhere in this Financial Supplement.

Adjusted Funds from Operations

Adjusted Funds From Operations (“AFFO”) is a non-GAAP financial measure of operating performance used by many companies in the REIT

industry. AFFO should not be considered an alternative to net earnings, as an indication of the company's performance or to cash flow as a measure of

liquidity or ability to make distributions. Management considers AFFO a useful supplemental measure of the company’s performance. The company’s

computation of AFFO may differ from the methodology for calculating AFFO used by other REITs, and therefore, may not be comparable to such

other REITs. A reconciliation of net earnings (computed in accordance with GAAP) to AFFO is included elsewhere in this Financial Supplement.

Net Operating Income

Net operating income (NOI) is provided here as a supplemental measure of operating performance. NOI is defined as property revenues less property

operating expenses, excluding depreciation and amortization, interest expense, impairment, and other items. We believe this presentation of NOI is

helpful to investors as a measure of our operational performance because it is widely used in the real estate industry to measure the performance of

real estate assets without regard to various items, included in net income, that do not relate to or are not indicative of operating performance, such as

depreciation and amortization, which can vary depending upon accounting methods and book value of assets. We also believe NOI helps our investors

to meaningfully compare the results of our operating performance from period to period by removing the impact of our capital structure (primarily

interest expense on our outstanding indebtedness) and depreciation of the basis in our assets from our operating results. NOI should not, however, be

considered as an alternative to net income (determined in accordance with GAAP) as an indicator of our financial performance. The Company’s

computation of NOI may differ from the methodology for calculating NOI used by other REITs, and therefore, may not be comparable to

such other REITs.

Free Cash Flow

Free Cash Flow reflected on an annual basis defined as Funds From Operations (FFO) as adjusted less capital expenditures, tenant improvements, plus non-cash items,

and after dividends paid.

© 2016 Kite Realty Group kiterealty.com Investor Update | 28

NON-GAAP FINANCIAL MEASURES

Earnings Before Interest Expense, Income Tax Expense, Depreciation and Amortization (EBITDA)

We define EBITDA, a non-GAAP financial measure, as net income before depreciation and amortization, interest expense and income tax expense of

taxable REIT subsidiary. For informational purposes, we have also provided Adjusted EBITDA, which we define as EBITDA less (i) EBITDA from

unconsolidated entities, (ii) severance charge, (iii) transaction costs, (iv) other income and expense and (v) noncontrolling interest EBITDA.

Annualized Adjusted EBITDA is Adjusted EBITDA for the most recent quarter multiplied by four. EBITDA, Adjusted EBITDA and Annualized

Adjusted EBITDA, as calculated by us, are not comparable to EBITDA reported by other REITs that do not define EBITDA exactly as we do.

EBITDA, Adjusted EBITDA and Annualized Adjusted EBITDA do not represent cash generated from operating activities in accordance with GAAP,

and should not be considered alternatives to net income as an indicator of performance or as alternatives to cash flows from operating activities as an

indicator of liquidity.

Considering the nature of our business as a real estate owner and operator, we believe that EBITDA and Adjusted EBITDA are helpful to investors in

measuring our operational performance because they exclude various items included in net income that do not relate to or are not indicative of our

operating performance, such as gains or losses from sales of depreciated property and depreciation and amortization, which can make periodic and

peer analyses of operating performance more difficult. For informational purposes, we have also provided Annualized Adjusted EBITDA, adjusted as

described above. We believe this supplemental information provides a meaningful measure of our operating performance. We believe presenting

EBITDA in this manner allows investors and other interested parties to form a more meaningful assessment of our operating results.

For more information on the foregoing non-GAAP financial measures and reconciliations of net income to FFO, FFO, as adjusted, AFFO, NOI, same

property NOI, EBITDA and Adjusted EBITDA for the quarter ended June 30, 2016, please see the Company’s Quarterly Financial Supplement for the

quarter ended June 30, 2016, which is available on the Company’s website at http://ir.kiterealty.com/QuarterlyResults. For reconciliations of net

income to FFO, FFO, as adjusted, AFFO, NOI, same property NOI, EBITDA and Adjusted EBITDA for the year ended December 31, 2015, please see the

Company’s Annual Report on Form 10-K for the year ended December 31, 2015, which was filed with the Securities and Exchange Commission and is

available on the Company’s website at http://ir.kiterealty.com/Docs.

Same Property Net Operating Income

The Company believes that Net Operating Income ("NOI") is helpful to investors as a measure of its operating performance because it excludes various items included in

net income that do not relate to or are not indicative of its operating performance, such as depreciation and amortization, interest expense, and impairment, if any. The

Company believes that Same Property NOI is helpful to investors as a measure of its operating performance because it includes only the NOI of properties that have been

owned for the full period presented, which eliminates disparities in net income due to the redevelopment, acquisition or disposition of properties during the particular

period presented and thus provides a more consistent metric for the comparison of the Company's properties. NOI and Same Property NOI should not, however, be

considered as alternatives to net income (calculated in accordance with GAAP) as indicators of the Company's financial performance. The Company’s computation of

Same Property NOI may differ from the methodology for calculating Same Property NOI used by other REITs, and therefore, may not be comparable to such other REITs.

When evaluating the properties that are included in the same property pool, we have established specific criteria for determining the inclusion of properties acquired or

those recently under development. An acquired property is included in the same property pool twelve months after the acquisition date. A development property is

included in the same property pool twelve months after construction is substantially complete, which is typically between six and twelve months after the first date a

tenant is open for business. A redevelopment property is included in the same property pool twelve months after the construction of the redevelopment property is

substantially complete. A redevelopment property is first excluded from the same property pool when the execution of a redevelopment plan is likely and we begin

recapturing space from tenants. For the three months ended June 30, 2016, we excluded 11 redevelopment properties from the same property pool that met these

criteria and were owned in all periods compared.

© 2016 Kite Realty Group kiterealty.com Investor Update | 29

APPENDIX – RECONCILIATION OF FFO TO NET INCOME (LOSS)

1.) “Funds From Operations of the Kite Portfolio" measures 100% of the operating performance of the Operating Partnership’s real estate properties and construction and service subsidiaries in which the Company owns an interest. “Funds From Operations

attributable to Kite Realty Group Trust common shareholders” reflects a reduction for the redeemable noncontrolling weighted average diluted interest in the Operating Partnership.

($ in thousands, except per share data)

Funds From Operations

Consolidated net (loss) income $ (1,496 ) $ 7,235 $ 477 $ 15,096

Less: cash dividends on preferred shares ) )

Less: net income attributable to noncontrolling interests in properties ) ) ) )

Less: gains on sales of operating properties ) ) )

Add: depreciation and amortization of consolidated entities, net of noncontrolling interests

Funds From Operations of the Kite Portfolio1

Less: Limited Partners' interests in Funds From Operations ) ) ) )

Funds From Operations attributable to Kite Realty Group Trust common shareholders $ 40,585 $ 44,915 $ 83,170 $ 86,198

FFO per share of the Operating Partnership - basic $ 0.49 $ 0.54 $ 1 $ 1.03

FFO per share of the Operating Partnership - diluted $ 0.48 $ 0.54 $ 0.99 $ 1.03

Funds From Operations of the Kite Portfolio1 $ 41,394 $ 45,839 $ 84,960 $ 87,929

Less: gain on settlement ) )

Add: transaction costs

Add: severance charge

Funds From Operations of the Kite Portfolio, as adjusted $ 44,165 $ 41,621 $ 88,231 $ 83,870

FFO per share of the Operating Partnership, as adjusted - basic $ 0.52 $ 0.49 $ 1.03 $ 0.98

FFO per share of the Operating Partnership, as adjusted - diluted $ 0.52 $ 0.49 $ 1.03 $ 0.98

Weighted average Common Shares outstanding - basic

Weighted average Common Shares outstanding - diluted

Weighted average Common Shares and Units outstanding - basic

Weighted average Common Shares and Units outstanding - diluted

Funds From Operations per share

Consolidated net (loss) income $ (0.02 ) $ 0.08 $ 0.01 $ 0.18

Less: cash dividends on preferred shares ) )

Less: net income attributable to noncontrolling interests in properties ) ) )

Less: gains on sales of operating properties )

Add: depreciation and amortization of consolidated entities, net of noncontrolling interests

Funds From Operations of the Kite Portfolio per share1 $ 0.48 $ 0.54 $ 1.00 $ 1.03

Funds From Operations of the Kite Portfolio per share1 $ 0.48 $ 0.54 $ 1.00 $ 1.03

Less: gain on settlement ) )

Add: transaction costs

Add: severance charge

Funds From Operations of the Kite Portfolio per share, as adjusted $ 0.52 $ 0.49 $ 1.03 $ 0.98

0.04 — 0.03 —

— — — —

— (0.05 — (0.05

— — — (0.04

0.51 0.48 1.00 0.95

— (0.02 — (0.05

(0.01 — (0.01 (0.01

85,420,633 85,529,084 85,394,353 85,501,987

83,475,474 83,803,879 83,460,521 83,818,890

85,320,923 85,231,284 85,295,968 85,202,110

83,375,765 83,506,078 83,362,136 83,519,013

2,771 302 2,771 461

— — 500 —

— (4,520 — (4,520

$ 41,394 $ 45,839 $ 84,960 $ 87,929

(809 (924 (1,790 (1,731

(194 — (194 (3,363

43,545 41,132 85,599 81,425

— (2,114 — (4,228

(461 (414 (922 (1,001

June 30,

2016 2015 2016 2015

Three Months Ended

June 30,

Six Months Ended

© 2016 Kite Realty Group kiterealty.com Investor Update | 30

APPENDIX – RECONCILIATION OF SAME PROPERTY NOI TO NET

INCOME

1.) Same property analysis excludes operating properties in redevelopment as well as office properties (Thirty South Meridian and Eddy Street Commons).

2.) Excludes leases that are signed but for which tenants have not yet commenced the payment of cash rent. Calculated as a weighted average based on the timing of cash rent commencement during the period.

3.) Same property net operating income excludes net gains from outlot sales, straight-line rent revenue, bad debt expense and recoveries, lease termination fees, amortization of lease intangibles and significant prior year expense recoveries and adjustments, if

any.

4.) Includes non-cash accounting items across the portfolio as well as net operating income from properties not included in the same property pool.

5.) See pages 26 and 27 of the Company’s Q2 2016 supplemental for further detail of the properties included in the 3-R initiative.

($ in thousands)

% Change % Change

Number of properties for the quarter1

Leased percentage % % % %

Economic Occupancy percentage2 % % % %

M inimum rent $ 54,827 $ 53,982 $ 109,178 $ 107,327

Tenant recoveries

Other income

Property operating expenses ) ) ) )

Real estate taxes ) ) ) )

) ) ) )

Net operating income - same properties3 $ 52,460 $ 51,146 2.60% $ 104,684 $ 101,648 3.00%

Net operating income - same properties excluding

the impact o f the 3-R initiative5

3.60%

Reconciliation of Same Property NOI to M ost

Directly Comparable GAAP M easure:

Net operating income - same properties $ 52,460 $ 51,146 $ 104,684 $ 101,648

Net operating income - non-same activity4

Other expense, net ) ) ) )

General, administrative and other ) ) ) )

Transaction costs ) ) ) )

Depreciation expense ) ) ) )

Interest expense ) ) ) )

Gain on settlement

Gains on sales of operating properties

Net income attributable to noncontrolling interests ) ) ) )

Dividends on preferred shares ) )

Net (loss) income attributable to common

shareholders

$ (1,895 ) $ 4,613 $ (494 ) $ 9,677

(399 (508 (971 (1,191

— (2,114 — (4,228

— 4,520 — 4,520

194 — 194 3,363

(43,841 (41,212 (86,082 (81,648

(15,500 (13,181 (30,825 (27,114

(4,856 (4,566 (10,147 (9,572

(2,771 (302 (2,771 (461

13,266 11,033 26,266 24,614

(448 (203 (842 (254

(17,162 (17,619 (34,949 (36,355

(8,245 (9,006 (16,763 (18,821

(8,917 (8,613 (18,186 (17,534

69,622 68,765 139,633 138,003

14,557 14,488 29,892 30,107

238 295 563 569

94 93.8 94 93.8

95.3 95.4 95.3 95.4

2016 2015 2016 2015

102 102

Three M onths Ended June 30, Six M onths Ended June 30,

© 2016 Kite Realty Group kiterealty.com Investor Update | 31

APPENDIX – RECONCILIATION OF EBITDA / ADJUSTED EBITDA

TO NET INCOME (LOSS)

1.) Represents Adjusted EBITDA for the three months ended June 30, 2016 (as shown in the table above) multiplied by four.

Three Months Ended 2016

June 30, 2016

Consolidated net loss $ (1,496)

Adjustments to net loss:

Depreciation and amortization 43,841

Interest expense 15,500

Income tax expense of taxable REIT subsidiary 338

Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) 58,183

Adjustments to EBITDA:

Unconsolidated EBITDA 34

Transaction costs 2,771

Gain on sale of operating property (194)

Other expense, net 110

Noncontrolling interest (461)

Adjusted EBITDA $ 60,443

Annualized Adjusted EBITDA(1) $241,773

Company share of net debt:

Mortgage and other indebtedness $ 1,740,487

Less: Partner share of consolidated joint venture debt (13,745)

Less: Cash, Cash Equivalents, and Restricted Cash (49,402)

Less: Net debt premiums and issuance costs, net (5,973)

Company Share of Net Debt $ 1,671,367

Net Debt to EBITDA 6.9x