Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Virtu KCG Holdings LLC | d235621d8k.htm |

KCG Holdings, Inc. (KCG) Barclays Global Financial Services Conference September 12, 2016 Exhibit 99.1

Safe Harbor Certain statements contained herein and the documents incorporated by reference containing the words “believes,” “intends,” “expects,” “anticipates,” and words of similar meaning, may constitute forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These “forward-looking statements” are not historical facts and are based on current expectations, estimates and projections about KCG's industry, management's beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Any forward-looking statement contained herein speaks only as of the date on which it is made. Accordingly, readers are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict including, without limitation, risks associated with: (i) the inability to manage trading strategy performance and sustain revenue and earnings growth; (ii) the receipt of additional payments from the sale of KCG Hotspot that are subject to certain contingencies; (iii) changes in market structure, legislative, regulatory or financial reporting rules, including the increased focus by Congress, federal and state regulators, the SROs and the media on market structure issues, and in particular, the scrutiny of high frequency trading, best execution, internalization, alternative trading systems, market fragmentation, colocation, access to market data feeds, and remuneration arrangements such as payment for order flow and exchange fee structures; (iv) past or future changes to KCG's organizational structure and management; (v) KCG's ability to develop competitive new products and services in a timely manner and the acceptance of such products and services by KCG's customers and potential customers; (vi) KCG's ability to keep up with technological changes; (vii) KCG's ability to effectively identify and manage market risk, operational and technology risk, cybersecurity risk, legal risk, liquidity risk, reputational risk, counterparty and credit risk, international risk, regulatory risk, and compliance risk; (viii) the cost and other effects of material contingencies, including litigation contingencies, and any adverse judicial, administrative or arbitral rulings or proceedings; (ix) the effects of increased competition and KCG's ability to maintain and expand market share; (x) the announced plan to relocate KCG’s global headquarters from Jersey City, NJ to New York, NY; and (xi) KCG’s ability to complete the sale or disposition of any or all of the assets or businesses that are classified as held for sale. The list above is not exhaustive. Because forward looking statements involve risks and uncertainties, the actual results and performance of KCG may materially differ from the results expressed or implied by such statements. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Unless otherwise required by law, KCG also disclaims any obligation to update its view of any such risks or uncertainties or to announce publicly the result of any revisions to the forward-looking statements made herein. Readers should carefully review the risks and uncertainties disclosed in KCG’s reports with the U.S. Securities and Exchange Commission (“SEC”), including those detailed in “Risk Factors” in Part I, Item 1A of KCG's Annual Report on Form10-K for the year ended December 31, 2015, “Legal Proceedings” in Part I, Item 3, under “Certain Factors Affecting Results of Operations” in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7, in “Quantitative and Qualitative Disclosures About Market Risk” in Part II, Item 7A, and in other reports or documents KCG files with, or furnishes to, the SEC from time to time. This information should be read in conjunction with KCG’s Consolidated Financial Statements and the Notes thereto contained in its Annual Report on Form 10-K, Quarterly Report on Form 10-Q, and in other reports or documents KCG files with, or furnishes to, the SEC from time to time. For additional disclosures, please see https://www.kcg.com/legal/global-disclosures.

A better model for the emerging competitive landscape – an independent, pure-play, technology-driven intermediary for banks, brokers and asset managers A developer of sophisticated trading technologies driving the shift in trading from analog to digital across asset classes and regions Prospects for multiyear organic growth direct from core capabilities requiring minimal additional investment plus greater operational efficiencies A demonstrated record of capital return with strong cash flow generation and the pending monetization of an investment Categorized among a group of specialized firms emerging as alternatives to the global banks across disciplines KCG Investment Rationale

KCG facilitates the efficient trading of liquid financial instruments among market participants allowing investors to put more money to work in the real economy A leading, independent global securities firm dedicated exclusively to trading Applies intellectual capital, data, trading models, and technology to principal trading as a market maker and agency-based trading Delivers consistent, high-quality trade executions on behalf of clients that drive trading performance for retail and institutional investors Contributes to better price discovery, deeper liquidity, tighter spreads and lower costs for all market participants The KCG Model Market Making Agency Execution Trading Venues

Since the merger on July 1, 2013, activities focused on deleveraging, restructuring and capital return. Debt cut from $1.2 billion at the merger to $453 million at June 30, 2016 Asset sales covering KCG Hotspot, KCG Futures and KCG DMM, discontinuation of certain units and consolidation of broker dealers Overall headcount reduced 41% to 942 full-time employees at June 30, 2016 More than one-third of all FTEs joined KCG following the merger Non-personnel, non-transaction based expenses cut approximately 8%1 Total share and warrant repurchases of $554 million as of June 30, 2016 KCG shares outstanding reduced 26% since the merger Appreciation in KCG’s stock price of 36% since the merger2 compared to rises in the Financial Select Sector SPDR ETF (XLF) of 22% and Russell 2000 (^RUT) of 26%3 Primary Activities To Date 1 Represents a comparison of full year 2014 to full year 2015; See addendum for a reconciliation of GAAP to non-GAAP financial results; 2 Represents the appreciation from the conversion price of $11.25 per share on July 1, 2013 to the avg. midpoint for the 30 trading days ended September 9, 2016; 3 Represents the appreciation from the avg midpoint for the 30 trading days ended June 30, 2013 to that for the 30 trading days ended September 9, 2016

Grow and diversify revenues from market making and agency-based trading Agency-based algorithmic trading on behalf of asset managers in U.S. equities Market making in fixed income, currencies and commodities International expansion in Europe and Asia Reengineer trading architecture and support functions to realize greater operational efficiencies Complete the corporate relocation in the second half of 2016 Continue to return capital to stockholders opportunistically under the stock repurchase program Attain the management target for a double-digit return on equity in 2017 Current Initiatives

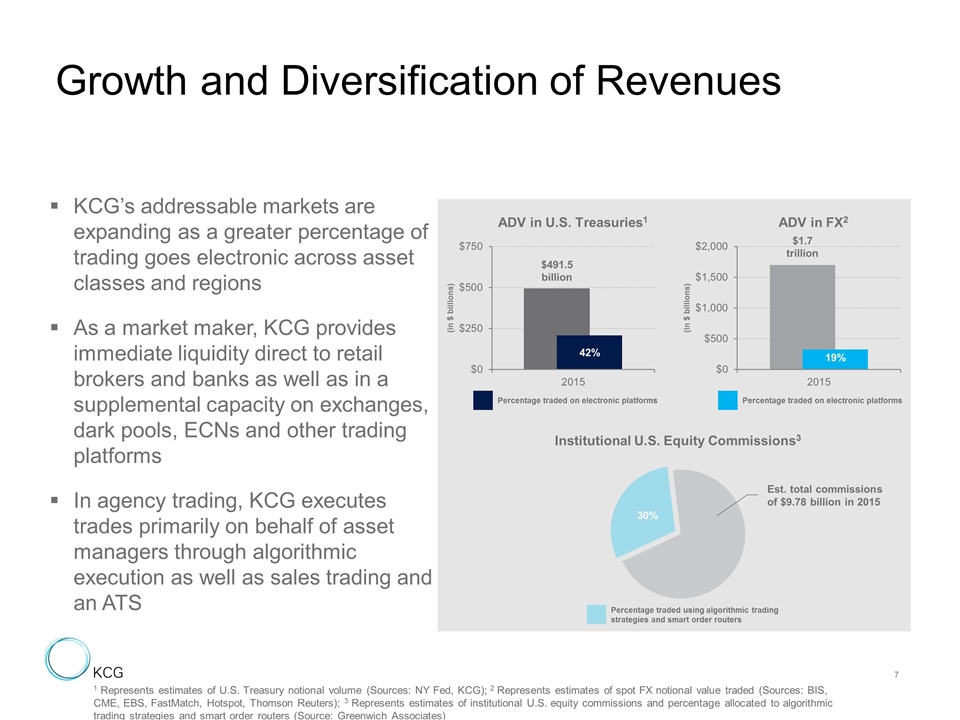

KCG’s addressable markets are expanding as a greater percentage of trading goes electronic across asset classes and regions As a market maker, KCG provides immediate liquidity direct to retail brokers and banks as well as in a supplemental capacity on exchanges, dark pools, ECNs and other trading platforms In agency trading, KCG executes trades primarily on behalf of asset managers through algorithmic execution as well as sales trading and an ATS Growth and Diversification of Revenues Percentage traded on electronic platforms Percentage traded on electronic platforms Percentage traded using algorithmic trading strategies and smart order routers Est. total commissions of $9.78 billion in 2015 1 Represents estimates of U.S. Treasury notional volume (Sources: NY Fed, KCG); 2 Represents estimates of spot FX notional value traded (Sources: BIS, CME, EBS, FastMatch, Hotspot, Thomson Reuters); 3 Represents estimates of institutional U.S. equity commissions and percentage allocated to algorithmic trading strategies and smart order routers (Source: Greenwich Associates)

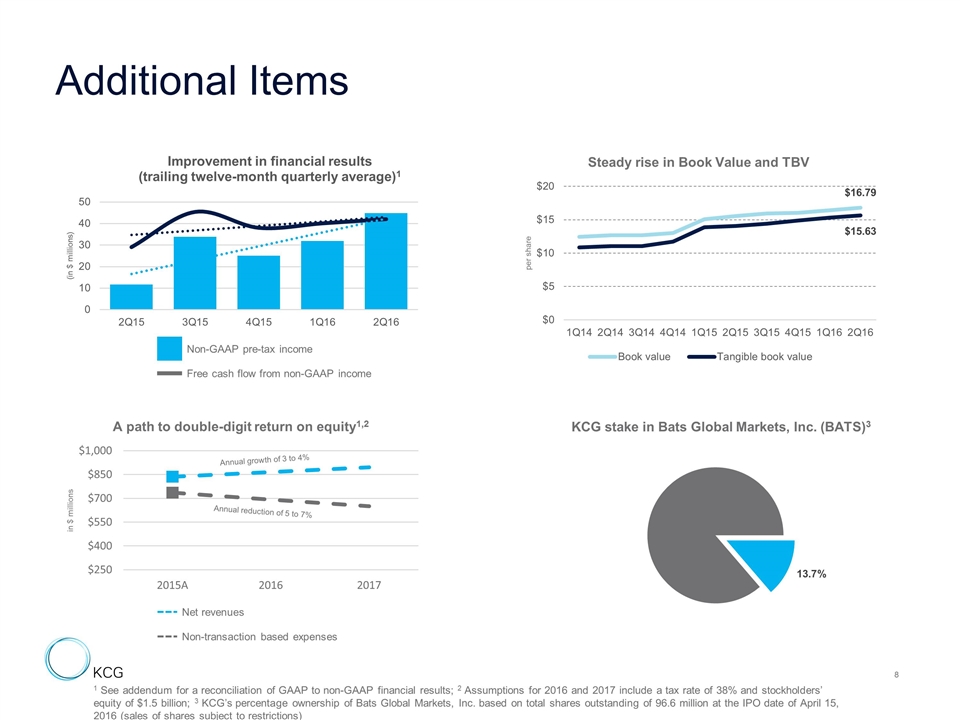

Additional Items Non-GAAP pre-tax income Free cash flow from non-GAAP income 1 See addendum for a reconciliation of GAAP to non-GAAP financial results; 2 Assumptions for 2016 and 2017 include a tax rate of 38% and stockholders’ equity of $1.5 billion; 3 KCG’s percentage ownership of Bats Global Markets, Inc. based on total shares outstanding of 96.6 million at the IPO date of April 15, 2016 (sales of shares subject to restrictions) Annual growth of 3 to 4% Annual reduction of 5 to 7% Net revenues Non-transaction based expenses

Addendum

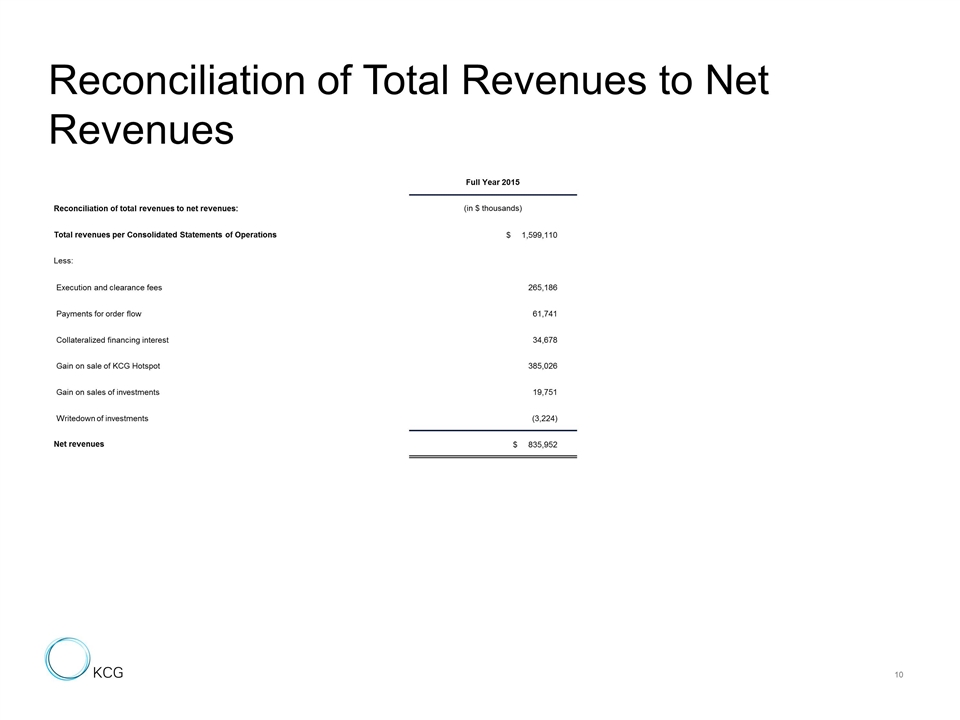

Reconciliation of Total Revenues to Net Revenues Full Year 2015 Reconciliation of total revenues to net revenues: (in $ thousands) Total revenues per Consolidated Statements of Operations $ 1,599,110 Less: Execution and clearance fees 265,186 Payments for order flow 61,741 Collateralized financing interest 34,678 Gain on sale of KCG Hotspot 385,026 Gain on sales of investments 19,751 Writedown of investments (3,224) Net revenues $ 835,952

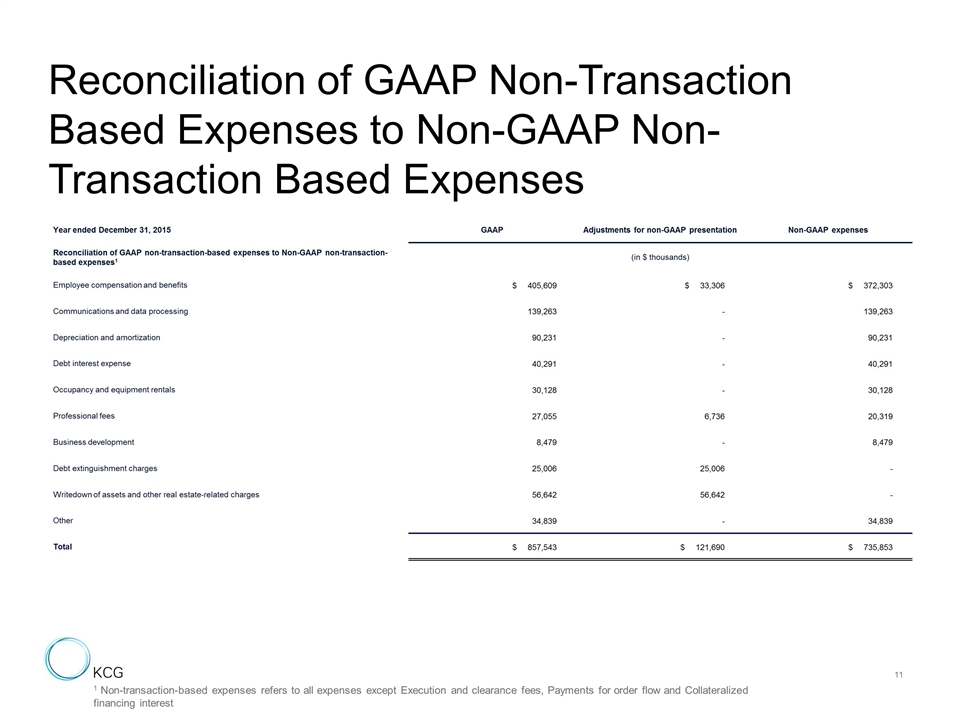

Reconciliation of GAAP Non-Transaction Based Expenses to Non-GAAP Non-Transaction Based Expenses Year ended December 31, 2015 GAAP Adjustments for non-GAAP presentation Non-GAAP expenses Reconciliation of GAAP non-transaction-based expenses to Non-GAAP non-transaction-based expenses1 (in $ thousands) Employee compensation and benefits $ 405,609 $ 33,306 $ 372,303 Communications and data processing 139,263 - 139,263 Depreciation and amortization 90,231 - 90,231 Debt interest expense 40,291 - 40,291 Occupancy and equipment rentals 30,128 - 30,128 Professional fees 27,055 6,736 20,319 Business development 8,479 - 8,479 Debt extinguishment charges 25,006 25,006 - Writedown of assets and other real estate-related charges 56,642 56,642 - Other 34,839 - 34,839 Total $ 857,543 $ 121,690 $ 735,853 1 Non-transaction-based expenses refers to all expenses except Execution and clearance fees, Payments for order flow and Collateralized financing interest

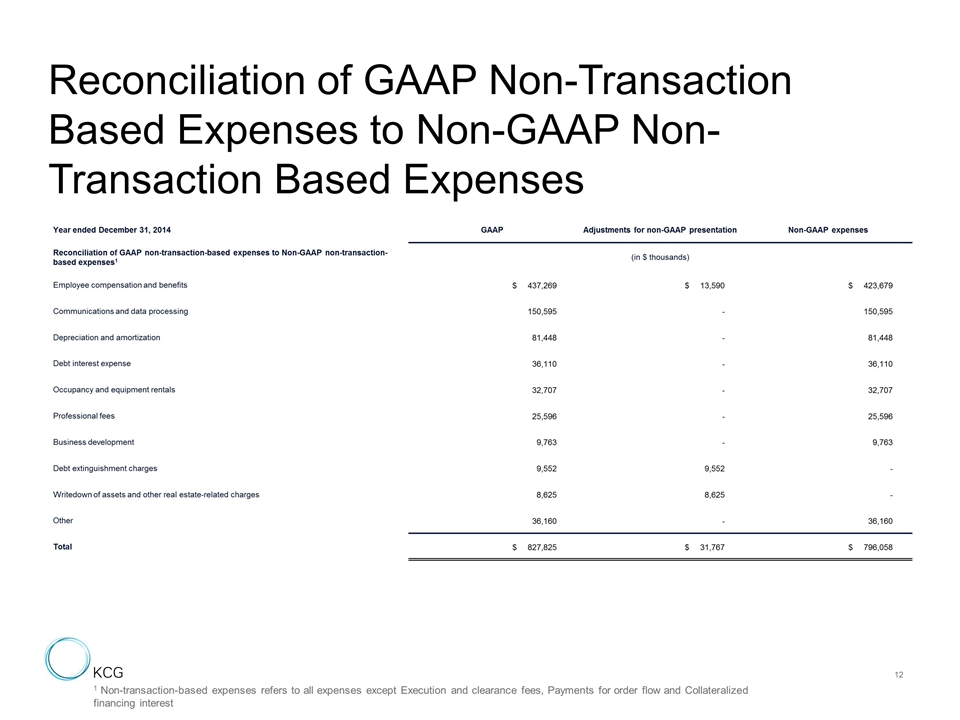

Reconciliation of GAAP Non-Transaction Based Expenses to Non-GAAP Non-Transaction Based Expenses Year ended December 31, 2014 GAAP Adjustments for non-GAAP presentation Non-GAAP expenses Reconciliation of GAAP non-transaction-based expenses to Non-GAAP non-transaction-based expenses1 (in $ thousands) Employee compensation and benefits $ 437,269 $ 13,590 $ 423,679 Communications and data processing 150,595 - 150,595 Depreciation and amortization 81,448 - 81,448 Debt interest expense 36,110 - 36,110 Occupancy and equipment rentals 32,707 - 32,707 Professional fees 25,596 - 25,596 Business development 9,763 - 9,763 Debt extinguishment charges 9,552 9,552 - Writedown of assets and other real estate-related charges 8,625 8,625 - Other 36,160 - 36,160 Total $ 827,825 $ 31,767 $ 796,058 1 Non-transaction-based expenses refers to all expenses except Execution and clearance fees, Payments for order flow and Collateralized financing interest

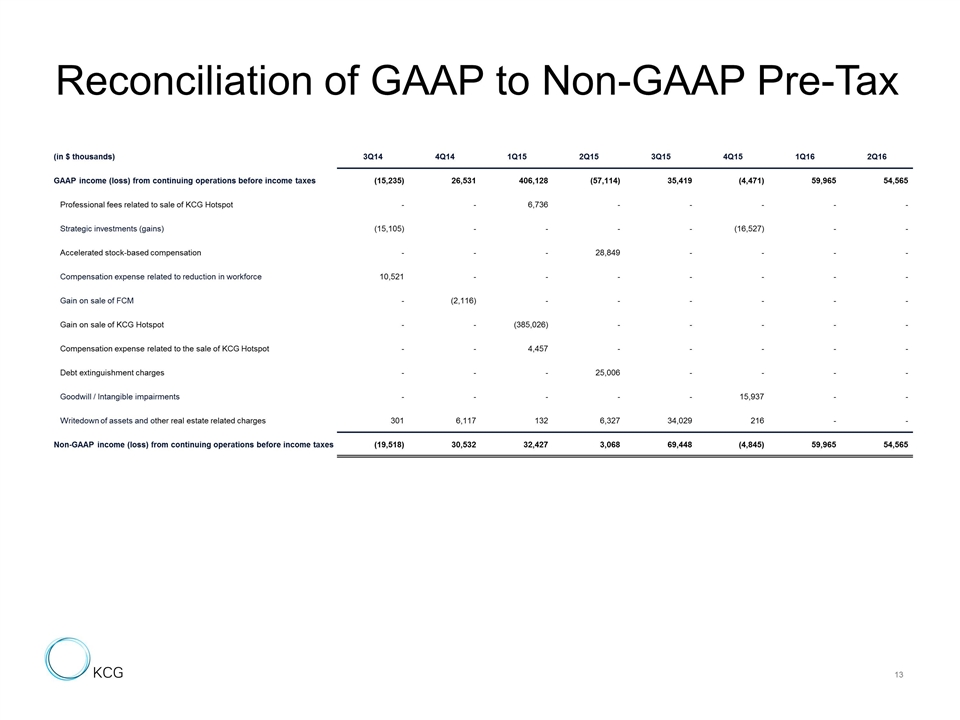

Reconciliation of GAAP to Non-GAAP Pre-Tax (in $ thousands) 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 GAAP income (loss) from continuing operations before income taxes (15,235) 26,531 406,128 (57,114) 35,419 (4,471) 59,965 54,565 Professional fees related to sale of KCG Hotspot - - 6,736 - - - - - Strategic investments (gains) (15,105) - - - - (16,527) - - Accelerated stock-based compensation - - - 28,849 - - - - Compensation expense related to reduction in workforce 10,521 - - - - - - - Gain on sale of FCM - (2,116) - - - - - - Gain on sale of KCG Hotspot - - (385,026) - - - - - Compensation expense related to the sale of KCG Hotspot - - 4,457 - - - - - Debt extinguishment charges - - - 25,006 - - - - Goodwill / Intangible impairments - - - - - 15,937 - - Writedown of assets and other real estate related charges 301 6,117 132 6,327 34,029 216 - - Non-GAAP income (loss) from continuing operations before income taxes (19,518) 30,532 32,427 3,068 69,448 (4,845) 59,965 54,565