Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JPMORGAN CHASE & CO | jpmc2016ccbform8k.htm |

September 12, 2016

Gordon Smith, Chief Executive Officer – Consumer & Community Banking

Barclays Global Financial Services Conference

Agenda

Page

B

A

R

C

L

A

Y

S

G

L

O

B

A

L

F

I

N

A

N

C

I

A

L

S

E

R

V

I

C

E

S

C

O

N

F

E

R

E

N

C

E

1

State of the U.S. Consumer

1

Chase Consumer & Community Banking business fundamentals 7

Payments update 19

Summary 28

Appendix 30

S

T

A

T

E

O

F

T

H

E

U

.

S

.

C

O

N

S

U

M

E

R

We have relationships with more U.S. households than any other financial

services provider

Estimated penetration of U.S. households (mm)

~4

~18

~40

~49

~53mm

Charles Schwab

US Bank

Wells Fargo

Bank of America

Chase

~41

~47

~59

Wells Fargo

Bank of America

Chase

Chase account and transactions statistics

# of checking

accounts4

~32mm

# of credit, debit, and

pre-paid card

accounts5

~94mm

# of credit and debit

transactions6

~14B

1 As of June 2016. Includes consumer and business households

2 Source: Bank of America 2Q16 Earnings. Includes consumer and business households

3 Source: Wells Fargo Investor Day (May 2016). Includes consumer households only

4 As of 2Q16. Includes checking accounts and Liquid ® cards

5 As of 2Q16. Excludes Commercial Card

6 Last 12 months ending June 2016. Includes credit, debit, and pre-paid transactions on Chase cards

1

2

3

2

S

T

A

T

E

O

F

T

H

E

U

.

S

.

C

O

N

S

U

M

E

R

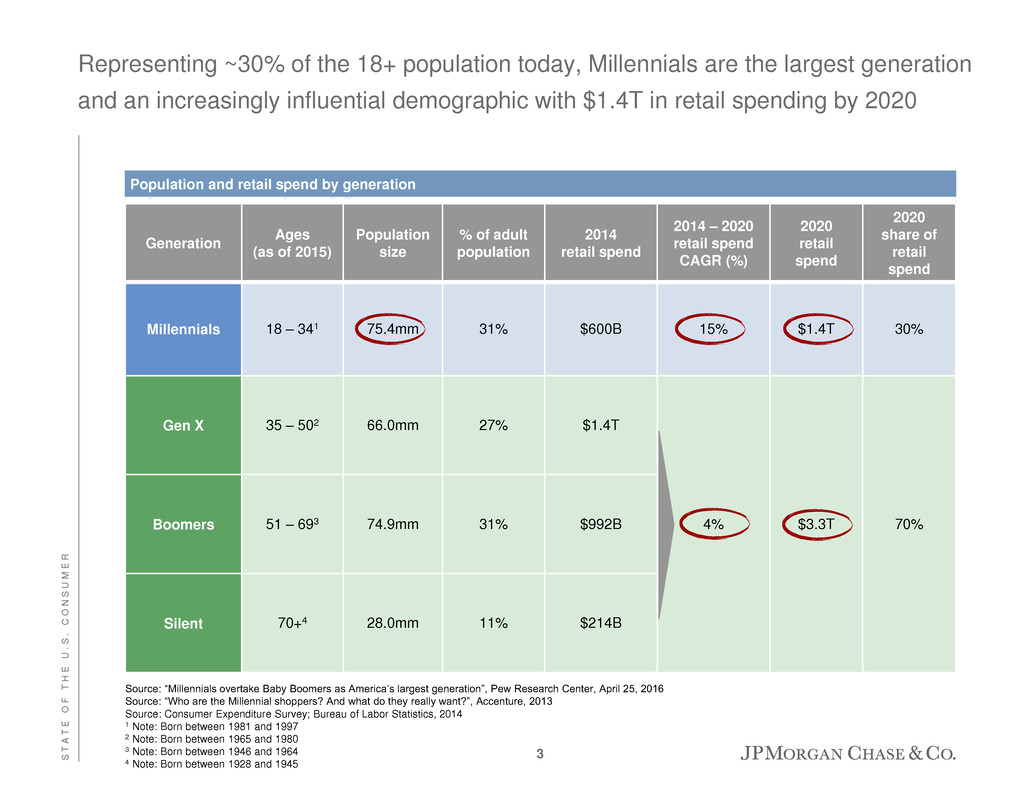

Representing ~30% of the 18+ population today, Millennials are the largest generation

and an increasingly influential demographic with $1.4T in retail spending by 2020

Source: “Millennials overtake Baby Boomers as America’s largest generation”, Pew Research Center, April 25, 2016

Source: “Who are the Millennial shoppers? And what do they really want?”, Accenture, 2013

Source: Consumer Expenditure Survey; Bureau of Labor Statistics, 2014

1 Note: Born between 1981 and 1997

2 Note: Born between 1965 and 1980

3 Note: Born between 1946 and 1964

4 Note: Born between 1928 and 1945

Generation

Ages

(as of 2015)

Population

size

% of adult

population

2014

retail spend

2014 – 2020

retail spend

CAGR (%)

2020

retail

spend

2020

share of

retail

spend

Millennials 18 – 341 75.4mm 31% $600B 15% $1.4T 30%

Gen X 35 – 502 66.0mm 27% $1.4T

4% $3.3T 70% Boomers 51 – 693 74.9mm 31% $992B

Silent 70+4 28.0mm 11% $214B

Population and retail spend by generation

3

S

T

A

T

E

O

F

T

H

E

U

.

S

.

C

O

N

S

U

M

E

R

Millennials make up the majority of our new deposit customers, and we lead

competitors in primary relationships with Millennials

Millennials primary financial institution by product type2

22%

19%

14%

3%

2%

2%

Chase

Bank of America

Wells Fargo

Citibank

Capital One

US Bank

19%

16%

9%

2%

3%

2%

Checking or savings Credit card

1 Includes new to bank and existing customer checking account openings from 3Q15 – 2Q16. Excludes accounts of customers under 18 years of age

2 Source: TNS Retail Banking Monitor. TNS defines Millennials as ages 18 – 34

Note: Respondents were asked to list all of the providers with whom they currently have a checking or savings account and/or a credit card account. If a customer had

multiple relationships, the customer was asked to identify primary bank by product type. Survey data includes interviews from 2Q15 – 1Q16. Survey sample was weighted to

be representative of the U.S. population as reflected by the Census Bureau. N=1,437

Chase checking account acquisitions by age1

18-24 25-30 31-35 36-40 41-45 46-50 51-55 56-60 61-65 66-70 71+

% of total acquired accounts57%

4

S

T

A

T

E

O

F

T

H

E

U

.

S

.

C

O

N

S

U

M

E

R

Millennials spend more of their “wallet” on experiences than other generations

Note: Millennials defined as born 1981 – 1997. Non-Millennials defined as born prior to 1981

Note: Includes Chase branded credit and debit card customers who used their card at least once a month from 01/2013 to 03/2016 and have at least one transaction in the

following categories during the entire time period: Grocery, Restaurant, Fuel/Transit, Clothing, Misc. Retail, Pharmacy, Home Supply, and Entertainment

Note: Numbers may not sum due to rounding

Spend category distribution by generation (credit + debit cards, 2015)

17% 19%

19%

20%

15%

18%

12%

11%

3%

6%

16%

11%

12% 10%

6% 7%

Millennials Non-Millennials

Travel

Dining

Grocery

Transportation/fuel

Retail

Other

Entertainment

Average annual spend per customer $20.0K $24.8K

Home improvement

Exp

e

rien

c

e

s

34% 28%

5

S

T

A

T

E

O

F

T

H

E

U

.

S

.

C

O

N

S

U

M

E

R

Chase customers as a percentage of total Millennial

population

Top 10 metro areas by Millennial population (mm)

In Chase footprint

Source: Population by metro area/age determined based on data from the 2010 – 2014 American Community Survey

Note: Millennials defined as born 1981 – 1997

Note: Chase Millennial share includes all Millennial customers with at least one Chase product, including deposit products, card, mortgage, auto lending, etc.

Note: Numbers may not sum due to rounding

We perform strongly with Millennials, particularly within our branch footprint

45%

38%

49%

35%

36%

13%

15%

34%

18%

16%

55%

62%

51%

65%

64%

87%

85%

66%

82%

84%

New York

Los Angeles

Chicago

Dallas

Houston

Philadelphia

Washington

D.C.

Miami

Atlanta

Boston

Chase customers All other Millennials

4.7

3.3

2.3

1.6

1.5

1.4

1.4

1.3

1.3

1.1

15.2

9.7

7.3

5.1

4.7

4.6

4.4

4.5

4.2

3.5

19.9

13.1

9.5

6.7

6.2

6.0

5.9

5.8

5.5

4.7

New York

Los Angeles

Chicago

Dallas

Houston

Philadelphia

Washington

D.C.

Miami

Atlanta

Boston

Millennials All other population

6

Agenda

Page

B

A

R

C

L

A

Y

S

G

L

O

B

A

L

F

I

N

A

N

C

I

A

L

S

E

R

V

I

C

E

S

C

O

N

F

E

R

E

N

C

E

7

Chase Consumer & Community Banking business fundamentals

7

State of the U.S. Consumer 1

Payments update 19

Summary 28

Appendix 30

C

H

A

S

E

C

O

N

S

U

M

E

R

&

C

O

M

M

U

N

I

T

Y

B

A

N

K

I

N

G

B

U

S

I

N

E

S

S

F

U

N

D

A

M

E

N

T

A

L

S

We have continued strong momentum across key business drivers, driven by

consistent investment strategy

$ in billions, except ratios and where otherwise noted 1H 2016 YoY ∆

Consumer &

Community Banking

Households (mm) 59.2 2%

Active mobile users (mm) 24.8 18%

Credit Card

New accounts opened1 (mm) 5.0 19%

Sales volume1 $258 8%

Average loans $128 2%

Net charge-off rate 2.66% 5bps

Commerce Solutions Merchant processing volume $511 12%

Auto Finance

Loan and lease originations $18 20%

Average loan and lease portfolio $72 16%

Mortgage Banking

Total mortgage originations $47 (12%)

Third-party mortgage loans serviced (end of period) $630 (13%)

Average loans $229 19%

Net charge-off rate2 0.10% (15)bps

Business Banking

Average deposits $106 10%

Average loans $21 6%

Loan originations $4 12%

Consumer Banking

Average deposits $452 11%

Client investment assets (end of period) $225 1%

1 Excludes Commercial Card

2 Excludes write-offs of purchased credit-impaired (PCI) loans

Key business drivers

8

C

H

A

S

E

C

O

N

S

U

M

E

R

&

C

O

M

M

U

N

I

T

Y

B

A

N

K

I

N

G

B

U

S

I

N

E

S

S

F

U

N

D

A

M

E

N

T

A

L

S

Our growth metrics are driven by deep relationships with high-performing customers

Checking balances per new account2

1H15 1H16

Business Banking average loan size

1H15 1H16

+25%

1 An engaged household is one that has two or more product relationships with Chase and meets certain thresholds for engagement on at least one of their relationships

2 Data represents average checking balance per new checking account on the last day of the month the account was opened

3 Represents sales on new accounts originated in that period. Excludes Commercial Card and certain terminated partner portfolios

4 Data per Experian Automotive and represents penetration for new car loans and leases

5 Source: Inside Mortgage Finance (IMF) and Chase internal data. Mortgage Banking only market share. Excludes Private Bank and Home Equity

+4%

Chase engaged households1

1H15 1H16

+1mm

Auto manufacturing partner

penetration4

1H15 1H16

+390 bps

Jumbo mortgage originations market

share5

1H15 1H16

+210 bps

Card in-year sales by vintage3

1H15 1H16

+27%

9

C

H

A

S

E

C

O

N

S

U

M

E

R

&

C

O

M

M

U

N

I

T

Y

B

A

N

K

I

N

G

B

U

S

I

N

E

S

S

F

U

N

D

A

M

E

N

T

A

L

S

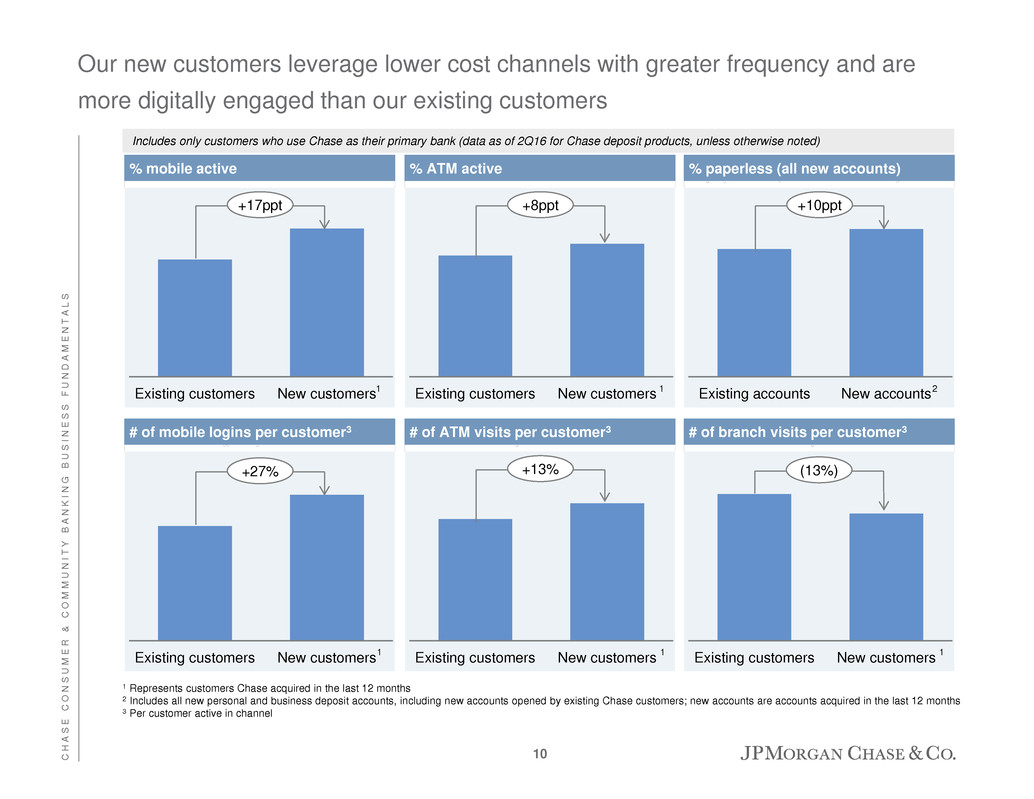

Our new customers leverage lower cost channels with greater frequency and are

more digitally engaged than our existing customers

% mobile active

07/20/11

% ATM active % paperless (all new accounts)

# of mobile logins per customer3 # of ATM visits per customer3 # of branch visits per customer3

1 Represents customers Chase acquired in the last 12 months

2 Includes all new personal and business deposit accounts, including new accounts opened by existing Chase customers; new accounts are accounts acquired in the last 12 months

3 Per customer active in channel

Existing customers New customers

+17ppt

Existing customers New customers

+8ppt

Existing accounts New accounts

+10ppt

Existing customers New customers

+27%

Existing customers New customers

+13%

Existing customers New customers

(13%)

Includes only customers who use Chase as their primary bank (data as of 2Q16 for Chase deposit products, unless otherwise noted)

2 1 1

1 1 1

10

C

H

A

S

E

C

O

N

S

U

M

E

R

&

C

O

M

M

U

N

I

T

Y

B

A

N

K

I

N

G

B

U

S

I

N

E

S

S

F

U

N

D

A

M

E

N

T

A

L

S

Consumer & Community Banking avg. loans1 ($B)

We continue to see strong growth in deposits and core loans

Consumer & Community Banking avg. deposits ($B)

$414

$453

$487

$531

$573

2012 2013 2014 2015 1H16

Note: Numbers may not sum due to rounding

1 Includes held-for-sale loans

2 Non-core loans include runoff portfolios, discontinued portfolios and portfolios the Firm has an intent to exit

3 Other includes securities-based lending of $0.2B in 2013, $0.8B in 2014, $1.4B in 2015, and $1.5B as of 1H16

$109 $110 $114 $118 $122

$53 $57

$69

$108

$145 $48 $51

$53

$56

$62

$15 $16

$18

$20

$21

$184 $159 $137

$115

$100

2012 2013 2014 2015 1H16

Card Mortgage Banking

Auto Business Banking/Other

Non-core loans (all LOBs)

$409

$393 $391

2012 – 1H 2016

CAGR

Non-core

loans:

(16%)

Core

loans:

+13%

Total:

+3%

2

Total: +8%

Core: +16%

3

$417

$450

CAGR

+10%

11

C

H

A

S

E

C

O

N

S

U

M

E

R

&

C

O

M

M

U

N

I

T

Y

B

A

N

K

I

N

G

B

U

S

I

N

E

S

S

F

U

N

D

A

M

E

N

T

A

L

S

4.40%

2.70% 2.56%

1.40%

1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

Net Charge-off % 30+ Day Delinquency %

Credit Card net charge-off and 30+ delinquency rates

0.28%

0.29%

0.79%

1.16%

1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

0.00%

0.40%

0.80%

1.20%

1.60%

2.00%

Net Charge-off % 30+ Day Delinquency %

2.20%

0.08%

5.05%

1.33%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

Net Charge-off % 30+ Day Delinquency %

Mortgage Banking non-credit impaired net charge-off and 30+ delinquency rates

Auto net charge-off and 30+ delinquency rates

2 3

7

6

Note: For footnoted information, refer to appendix

4

5

12

Credit trends across the businesses continue to be favorable1

C

H

A

S

E

C

O

N

S

U

M

E

R

&

C

O

M

M

U

N

I

T

Y

B

A

N

K

I

N

G

B

U

S

I

N

E

S

S

F

U

N

D

A

M

E

N

T

A

L

S

Credit Card

Mortgage Banking

Auto

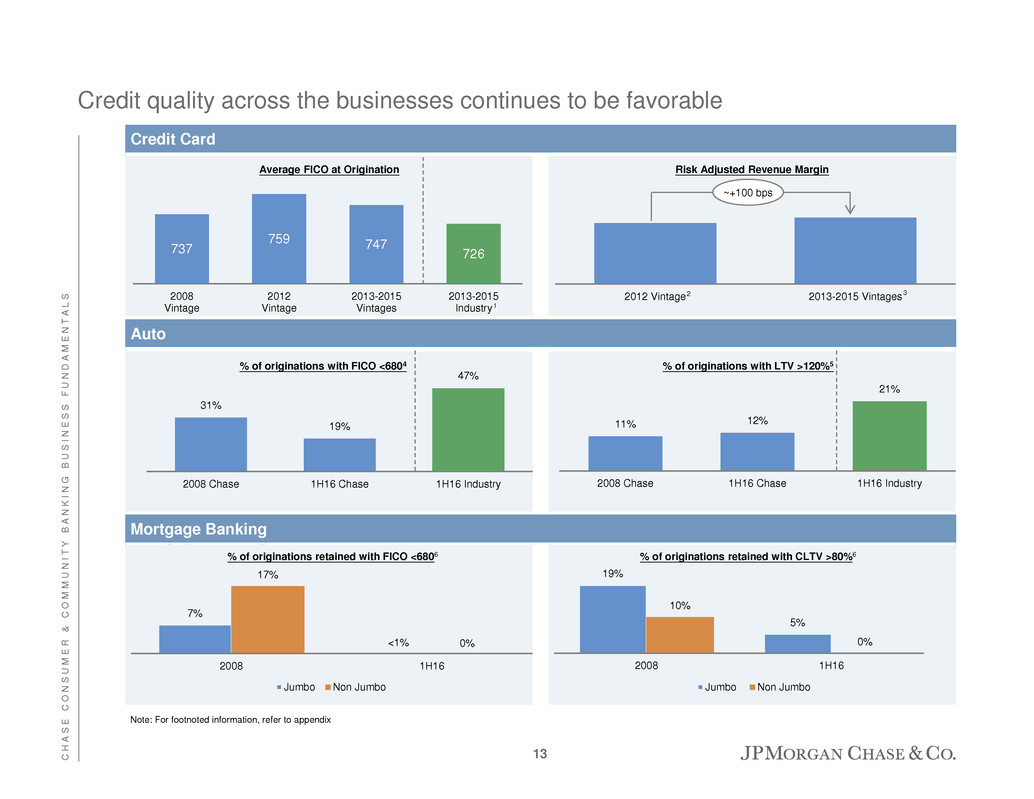

Credit quality across the businesses continues to be favorable

737

759 747

726

2008

Vintage

2012

Vintage

2013-2015

Vintages

2013-2015

Industry

Average FICO at Origination

7%

17%

0%

2008 1H16

Jumbo Non Jumbo

% of originations retained with FICO <6806

19%

5%

10%

0%

2008 1H16

Jumbo Non Jumbo

% of originations retained with CLTV >80%6

Note: For footnoted information, refer to appendix

2012 Vintage 2013-2015 Vintages

Risk Adjusted Revenue Margin

<1%

1

13

31%

19%

47%

2008 Chase 1H16 Chase 1H16 Industry

% of originations with FICO <6804

11% 12%

21%

2008 Chase 1H16 Chase 1H16 Industry

% of originations with LTV >120%5

~+100 bps

2 3

C

H

A

S

E

C

O

N

S

U

M

E

R

&

C

O

M

M

U

N

I

T

Y

B

A

N

K

I

N

G

B

U

S

I

N

E

S

S

F

U

N

D

A

M

E

N

T

A

L

S

14%

15%

31%

35%

24%

25%

17%

17%

16% 15%

12% 11%

2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

10%

15%

20%

25%

30%

35%

40%

Chase Cap One Wells Discover Citi BofA

26%

28% 28%

31%

34%

39%

Chase Amex Citi Discover Cap One BofA

Chase vs. Competitors – FICO <660 portfolio mix1

Chase Card has modest exposure to FICO <660, and is lowest in the 640-720 range

1 Based on Autonomous Research, U.S. Cards Subprime Plateau, 8/15/2016. Credit card loans without a FICO score included in FICO <660 category

2 Based on Lightspeed Behavioral Tracking Panel data for sample of existing portfolios’ customers polled between November 2014 and October 2015

Chase vs. Competitors FICO (640–720) portfolio mix2

14

C

H

A

S

E

C

O

N

S

U

M

E

R

&

C

O

M

M

U

N

I

T

Y

B

A

N

K

I

N

G

B

U

S

I

N

E

S

S

F

U

N

D

A

M

E

N

T

A

L

S

Chase Auto has managed layered risk

3%

4%

Chase Industry

<620 FICO Score1 – Chase Auto2 loan mix vs. Industry3

1%

5%

Chase Industry

3%

8%

Chase Industry

LTV > 120

Note: All percentages are of total auto loans for Chase and for the industry

1 FICO® is a registered trademark of Fair Isaac Corporation in the United States and other countries

2 Data is based on EOP loans as of 2Q 2016. Chase data excludes independent dealers to provide a better comparable to J.D. Power PIN data

3 Source: Power Information Network – PIN, a business division of J.D. Power. EOP industry portfolio mix is unavailable so the last 26 months of originations is used as a proxy

LTV < 100

LTV

101 – 120

15

C

H

A

S

E

C

O

N

S

U

M

E

R

&

C

O

M

M

U

N

I

T

Y

B

A

N

K

I

N

G

B

U

S

I

N

E

S

S

F

U

N

D

A

M

E

N

T

A

L

S

Card credit trends remain strong, but with modest deterioration in late stage

delinquencies

1 Includes loans held-for-sale

2 June 2012 adjusted for the effect of a change in charge-off policy for troubled debt restructurings and December 2014 adjusted to exclude losses from portfolio exits. These

are non-GAAP financial measures used by management to facilitate comparisons with prior periods. The reported delinquency roll-rates for June 2012 and December 2014

were 58.13% and 57.23%, respectively

Credit Card delinquency $ roll-rate from current to 60 days past due1

Credit Card delinquency $ roll-rate from 60 days past due to charge-off (60-180 days past due)1,2

0.0%

0.5%

1.0%

1.5%

2.0%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

16

C

H

A

S

E

C

O

N

S

U

M

E

R

&

C

O

M

M

U

N

I

T

Y

B

A

N

K

I

N

G

B

U

S

I

N

E

S

S

F

U

N

D

A

M

E

N

T

A

L

S

We expect to exit 2016 with CCB structural expense $2.35B lower than 2014

17

$2,700

$350

2016

Investor Day

target

Mortgage

Banking

Lower

foreclosure¹

Branch

transformation

Internal

technology

efficiencies

Paperless

adoption

Various

initiatives²

Other³ 4Q16 Exit

work in

progress

CCB structural expense ($mm)

¹ Includes mortgage operating losses, in large part foreclosure-related

² Includes various initiatives, such as vendor rationalization, real estate / location strategy, marketing efficiencies and training consolidation

³ Includes non-recurring items from 2014

Expect 2016 Firmwide adjusted expense to be ~$56B

C

H

A

S

E

C

O

N

S

U

M

E

R

&

C

O

M

M

U

N

I

T

Y

B

A

N

K

I

N

G

B

U

S

I

N

E

S

S

F

U

N

D

A

M

E

N

T

A

L

S

2014 to 1H 2016

We are investing in marketing to take advantage of attractive market opportunities

Credit Card

new account

marketing

Consumer

Banking new

account

marketing

ROE > 20%

Incremental Marketing Investments

On average ~$375mm annual investment yielded per year1:

~1.45mm new accounts

~$6.0B annual spend (~$11.3B steady state)

~$1.0B average outstandings (~$2.2B steady state)

On average ~$90mm annual investment yielded per year:

~290K new households

~$2.5B in average deposits

1 Before reduction for FAS91 loan origination costs which are amortized against revenue

Select examples

18

Agenda

Page

B

A

R

C

L

A

Y

S

G

L

O

B

A

L

F

I

N

A

N

C

I

A

L

S

E

R

V

I

C

E

S

C

O

N

F

E

R

E

N

C

E

19

Payments update

19

State of the U.S. Consumer 1

Chase Consumer & Community Banking business fundamentals 7

Summary 28

Appendix 30

P

A

Y

M

E

N

T

S

U

P

D

A

T

E

We deliver scale to each component of the payments ecosystem

16% 16%

18%

Credit and debit

payments

GPCC

outstandings

Merchant

processing

volume

Chase holds strong market share positions

07/20/11

3

~94mm credit, debit and pre-paid card accounts4

18mm digital and mobile logins each day

Consumer reach

Over $780B in total Chase credit and debit sales4, 5

38mm credit and debit card payments each day4

Payments scale

$1.0T processed5

Over 515K active global merchant outlets

Merchant scale

Chase’s scale across merchants and consumers is

unmatched

Position:

#1 #1 #2

2

1 Source: Nilson, February 2016, May 2016

2 Source: Nilson, February 2016. GPCC defined as General Purpose Credit Cards

3 Source: Nilson, March 2016. Chase is the #1 wholly-owned merchant acquirer in the U.S. When volume from JVs and revenue share arrangements are included in First Data’s

volume, First Data holds #1 share position in the U.S.

4 Excludes Commercial Card

5 From July 2015 – June 2016

1

20

P

A

Y

M

E

N

T

S

U

P

D

A

T

E

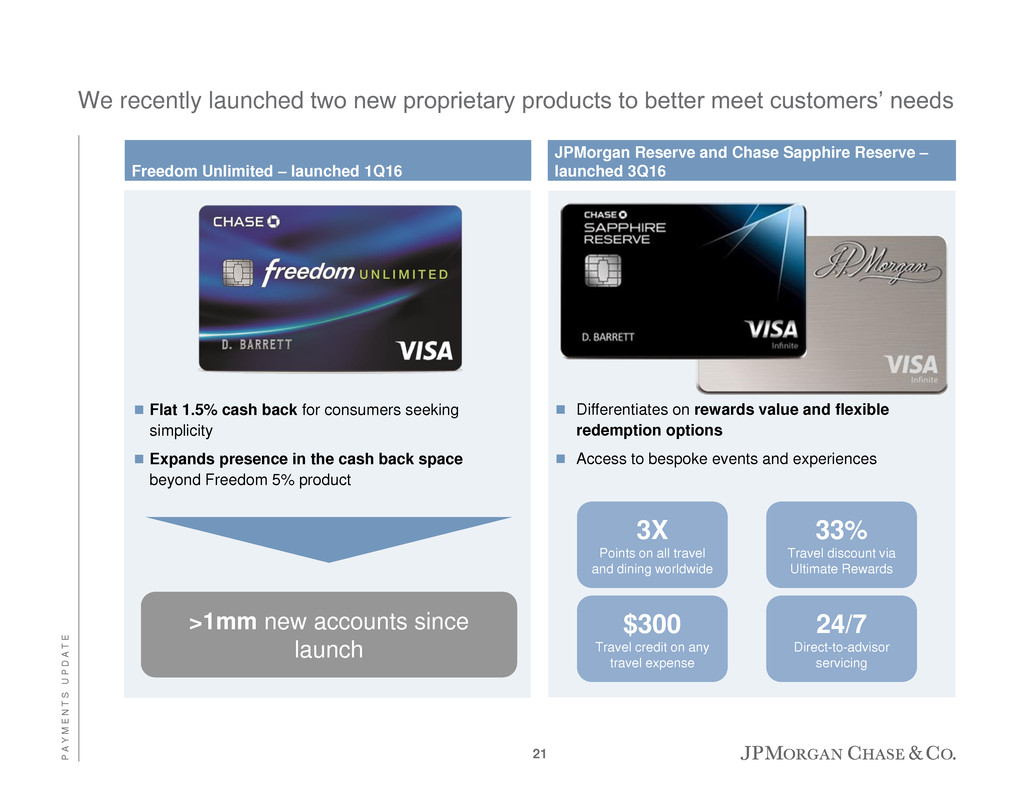

We recently launched two new proprietary products to better meet customers’ needs

Freedom Unlimited – launched 1Q16

JPMorgan Reserve and Chase Sapphire Reserve –

launched 3Q16

Flat 1.5% cash back for consumers seeking

simplicity

Expands presence in the cash back space

beyond Freedom 5% product

>1mm new accounts since

launch

Differentiates on rewards value and flexible

redemption options

Access to bespoke events and experiences

33%

Travel discount via

Ultimate Rewards

3X

Points on all travel

and dining worldwide

24/7

Direct-to-advisor

servicing

$300

Travel credit on any

travel expense

21

P

A

Y

M

E

N

T

S

U

P

D

A

T

E

1H12 1H16

1H12 1H16

Co-brand new accounts

Co-brand sales volumes1

We continue to grow our co-brand portfolio

Key co-brand partnerships overview

1 Excludes certain runoff and terminated partner portfolios

>50%

>50%

Partner for over 25 years

Partner for nearly 15 years

Partner for 20 years

22

P

A

Y

M

E

N

T

S

U

P

D

A

T

E

The mobile payments space is in its formative period; our intention is to be

wherever our customers want to spend

Apple Pay, Android Pay, and Samsung Pay

share of retail POS payments ($)2

All other retail POS

payments

Apple Pay, Android Pay,

and Samsung Pay

1 Source: comScore 1Q16. Population consisted of iPhone and Android smartphone owners. iPhone owners N = 696; Android phone owners N = 1,364

2 Source: “Merchant, Bank Mobile Wallets Prove Value Where Apple, Google, and Samsung Have Not”, Javelin Strategy & Research, August 2016

Awareness and usage among device owners1

52%

35%

31%

8%

3% 2%

Apple Pay Android Pay Samsung Pay

Awareness Usage

<1%

99%

23

P

A

Y

M

E

N

T

S

U

P

D

A

T

E

Chase maintains leading share in credit and debit purchase volumes

15% 15%

16% 16% 16% 16%

2010 2011 2012 2013 2014 2015

Chase share of purchase volume (credit + debit, % of total U.S. market)

Source: Nilson, 2011 – 2016

07/20/11

Position: #1 #1 #1 #1 #1 #1

24

P

A

Y

M

E

N

T

S

U

P

D

A

T

E

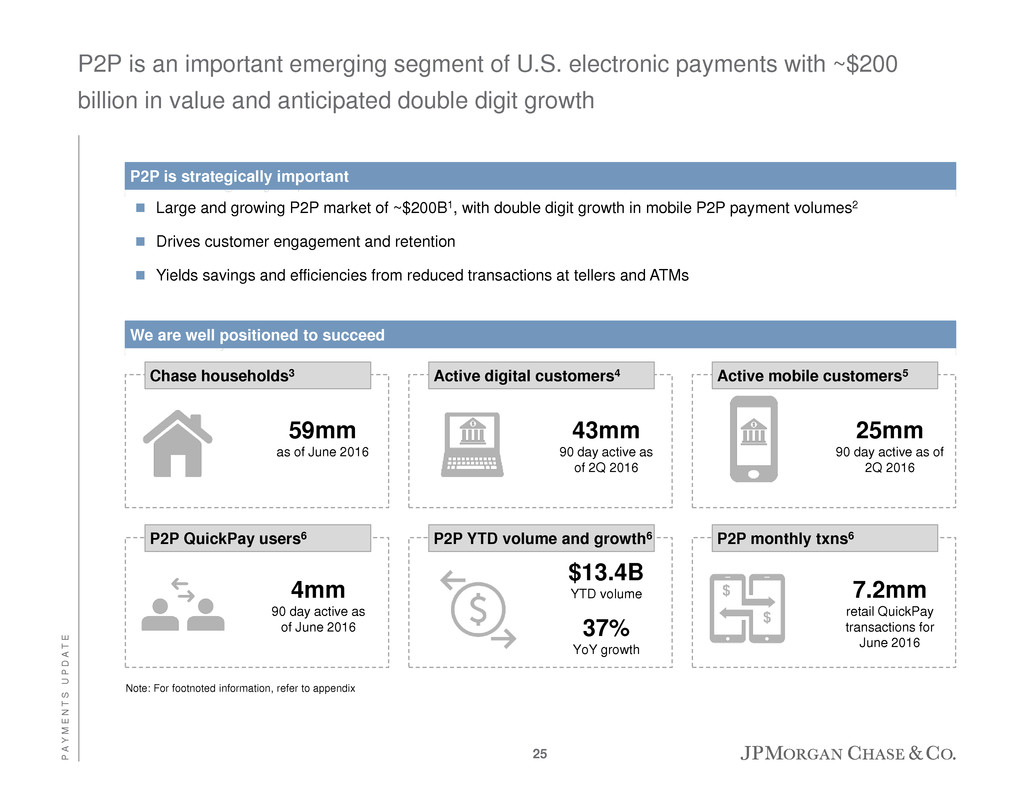

P2P is an important emerging segment of U.S. electronic payments with ~$200

billion in value and anticipated double digit growth

Large and growing P2P market of ~$200B1, with double digit growth in mobile P2P payment volumes2

Drives customer engagement and retention

Yields savings and efficiencies from reduced transactions at tellers and ATMs

P2P is strategically important

We are well positioned to succeed

Chase households3 Active digital customers4 Active mobile customers5

P2P QuickPay users6 P2P YTD volume and growth6 P2P monthly txns6

$13.4B

YTD volume 7.2mm

retail QuickPay

transactions for

June 2016

59mm

as of June 2016

43mm

90 day active as

of 2Q 2016

25mm

90 day active as of

2Q 2016

4mm

90 day active as

of June 2016 37%

YoY growth

Note: For footnoted information, refer to appendix

25

P

A

Y

M

E

N

T

S

U

P

D

A

T

E

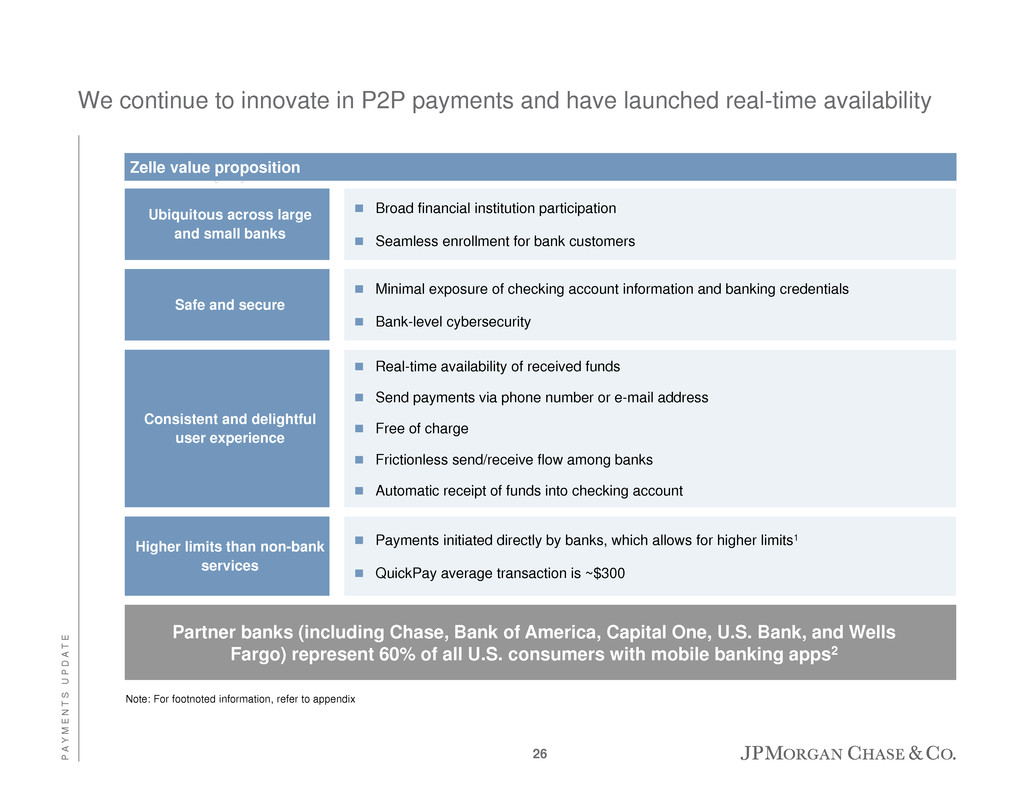

We continue to innovate in P2P payments and have launched real-time availability

Partner banks (including Chase, Bank of America, Capital One, U.S. Bank, and Wells

Fargo) represent 60% of all U.S. consumers with mobile banking apps2

Note: For footnoted information, refer to appendix

Zelle value proposition

Broad financial institution participation

Seamless enrollment for bank customers

Minimal exposure of checking account information and banking credentials

Bank-level cybersecurity

Real-time availability of received funds

Send payments via phone number or e-mail address

Free of charge

Frictionless send/receive flow among banks

Automatic receipt of funds into checking account

Payments initiated directly by banks, which allows for higher limits1

QuickPay average transaction is ~$300

Ubiquitous across large

and small banks

Safe and secure

Consistent and delightful

user experience

Higher limits than non-bank

services

26

P

A

Y

M

E

N

T

S

U

P

D

A

T

E

Chase’s enhanced, real-time QuickPay experience launched in July

Enhanced real-time QuickPay experience launched in July 2016

Select contact in Chase app Enter dollar amount and

include notes

Confirm transaction

27

Agenda

Page

B

A

R

C

L

A

Y

S

G

L

O

B

A

L

F

I

N

A

N

C

I

A

L

S

E

R

V

I

C

E

S

C

O

N

F

E

R

E

N

C

E

28

Summary

28

State of the U.S. Consumer 1

Chase Consumer & Community Banking business fundamentals 7

Payments update 19

Appendix 30

S

U

M

M

A

R

Y

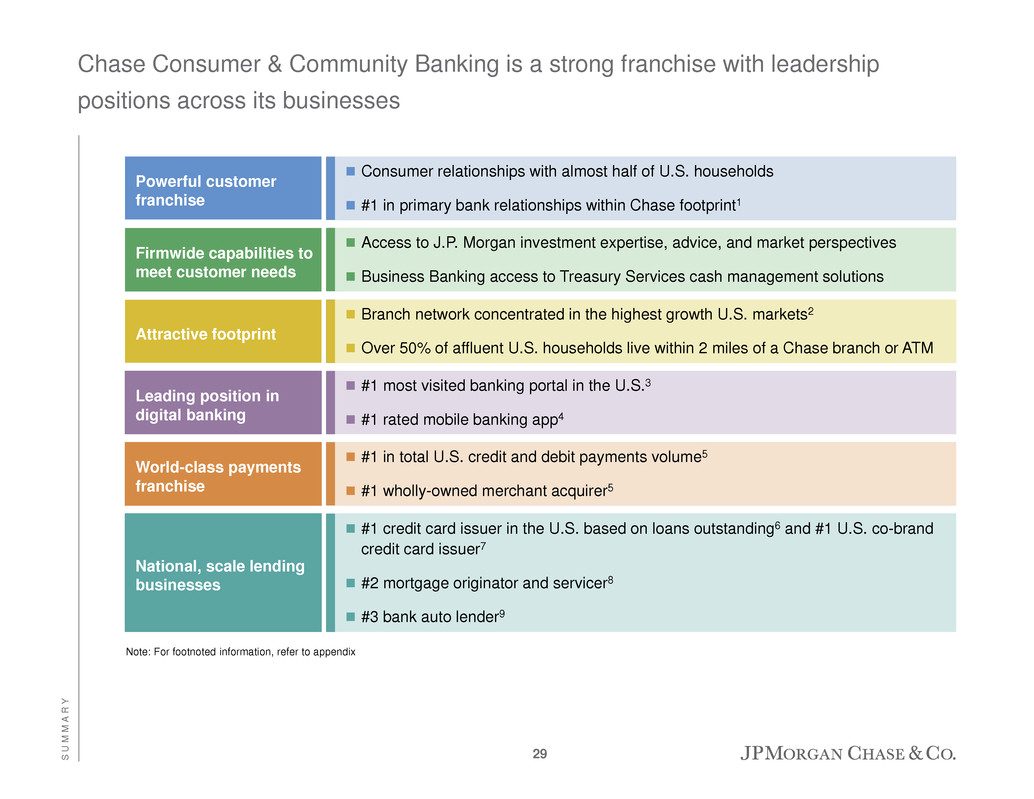

Chase Consumer & Community Banking is a strong franchise with leadership

positions across its businesses

Note: For footnoted information, refer to appendix

Consumer relationships with almost half of U.S. households

#1 in primary bank relationships within Chase footprint1

Powerful customer

franchise

Access to J.P. Morgan investment expertise, advice, and market perspectives

Business Banking access to Treasury Services cash management solutions

Firmwide capabilities to

meet customer needs

Branch network concentrated in the highest growth U.S. markets2

Over 50% of affluent U.S. households live within 2 miles of a Chase branch or ATM

Attractive footprint

#1 most visited banking portal in the U.S.3

#1 rated mobile banking app4

Leading position in

digital banking

#1 in total U.S. credit and debit payments volume5

#1 wholly-owned merchant acquirer5

World-class payments

franchise

#1 credit card issuer in the U.S. based on loans outstanding6 and #1 U.S. co-brand

credit card issuer7

#2 mortgage originator and servicer8

#3 bank auto lender9

National, scale lending

businesses

29

Agenda

Page

B

A

R

C

L

A

Y

S

G

L

O

B

A

L

F

I

N

A

N

C

I

A

L

S

E

R

V

I

C

E

S

C

O

N

F

E

R

E

N

C

E

30

Appendix

30

State of the U.S. Consumer 1

Chase Consumer & Community Banking business fundamentals 7

Payments update 19

Summary 28

A

P

P

E

N

D

I

X

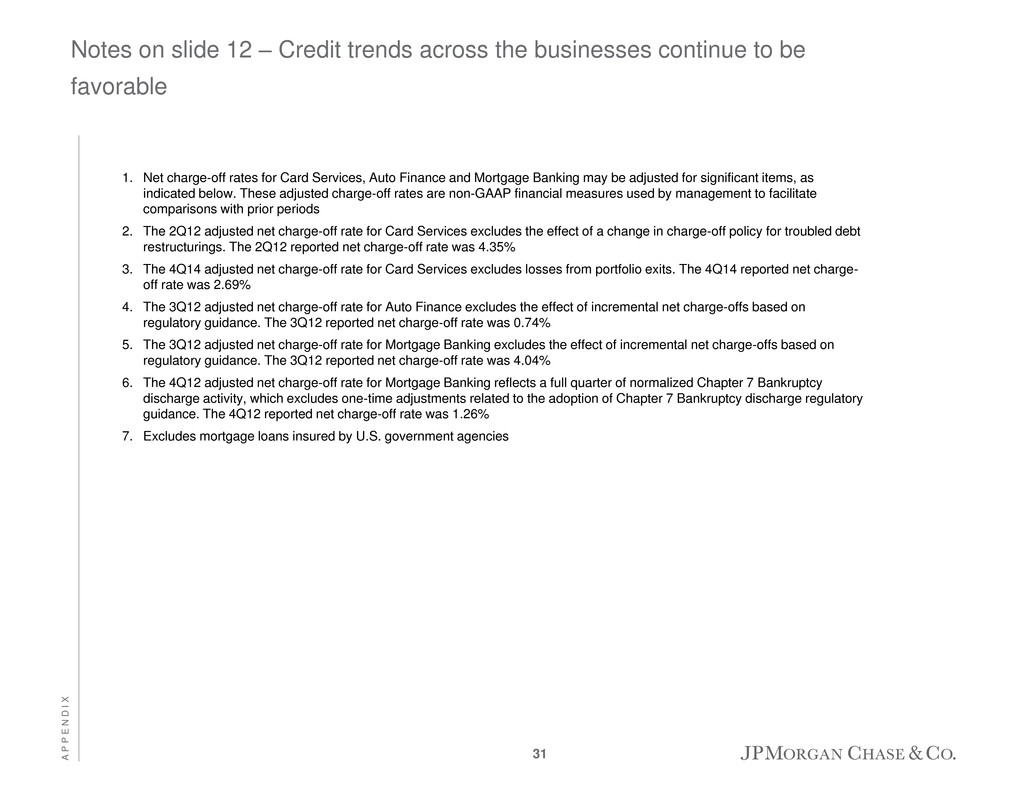

Notes on slide 12 – Credit trends across the businesses continue to be

favorable

1. Net charge-off rates for Card Services, Auto Finance and Mortgage Banking may be adjusted for significant items, as

indicated below. These adjusted charge-off rates are non-GAAP financial measures used by management to facilitate

comparisons with prior periods

2. The 2Q12 adjusted net charge-off rate for Card Services excludes the effect of a change in charge-off policy for troubled debt

restructurings. The 2Q12 reported net charge-off rate was 4.35%

3. The 4Q14 adjusted net charge-off rate for Card Services excludes losses from portfolio exits. The 4Q14 reported net charge-

off rate was 2.69%

4. The 3Q12 adjusted net charge-off rate for Auto Finance excludes the effect of incremental net charge-offs based on

regulatory guidance. The 3Q12 reported net charge-off rate was 0.74%

5. The 3Q12 adjusted net charge-off rate for Mortgage Banking excludes the effect of incremental net charge-offs based on

regulatory guidance. The 3Q12 reported net charge-off rate was 4.04%

6. The 4Q12 adjusted net charge-off rate for Mortgage Banking reflects a full quarter of normalized Chapter 7 Bankruptcy

discharge activity, which excludes one-time adjustments related to the adoption of Chapter 7 Bankruptcy discharge regulatory

guidance. The 4Q12 reported net charge-off rate was 1.26%

7. Excludes mortgage loans insured by U.S. government agencies

31

A

P

P

E

N

D

I

X

Notes on slide 13 – Credit quality across the businesses continues to be

favorable

The information supplied by Power Information Network, a business division of J.D. Power and Associates (“PIN”) is based on

data believed to be reliable but is neither all-inclusive nor guaranteed by PIN. Without limiting the generality of the foregoing,

specific data points may vary considerably from other information sources. Any opinions expressed herein reflect the judgment of

Chase Auto Finance at this date and are subject to change.

FICO® is a registered trademark of Fair Isaac Corporation in the United States and other countries.

1. Industry data is an average of Lightspeed’s Behavioral Tracking Panel average risk scores for a sample of new accounts

2. Actual 1H16 performance of Chase branded accounts booked in 2012

3. Expected year 3 performance of Chase branded accounts booked 2013 – 2015

4. Excludes operating leases. Industry FICO data per Experian Automotive. Chase originations include franchise and

independent dealers to provide a better comparable to Experian data

5. Excludes operating leases. Industry LTV data per PIN. Chase originations exclude independent dealers to provide a better

comparable to PIN data

6. Reflects first-lien originations retained on on-balance sheet. Excludes Home Equity and Private Bank loans, and excludes

loans where the FICO score or estimated property value is unavailable

32

A

P

P

E

N

D

I

X

Notes on slide 25 – P2P is an important emerging segment of U.S. electronic

payments with ~$200 billion in value and anticipated double digit growth

1. “P2P Payments in 2015: Market Sizing and Evaluation of P2P”, Javelin Strategy & Research, 2015. Market size includes

online and mobile person-to-person transfers via bank and non-bank providers and excludes wire transfers through banks

and money services businesses

2. Source: “Chase adds real-time P2P payments”, Business Insider, June 2016

3. As of June 2016; Includes consumer and business households

4. Users of all web and/or mobile platforms who have logged in within the past 90 days

5. Users of all mobile platforms who have logged in within the past 90 days

6. Represents figures for customers who have agreed to the QuickPay legal agreements and sent a payment via QuickPay

during the selected time frame (as of June 2016)

33

A

P

P

E

N

D

I

X

1. Limits for QuickPay users: Payments from Chase and verified non-Chase accounts: maximum of $2,000 per transaction, with

a maximum of $2,000 total per day, maximum of $8,000 in any seven-day period, maximum of $16,000 in any 30-day period;

Payments from Private Banking clients: maximum of $5,000 per transaction, with a maximum of $5,000 total per day,

maximum of $8,000 in any seven-day period, maximum of $16,000 in any 30-day period; Payments from Chase business

accounts: maximum of $5,000 per transaction, with a maximum of $5,000 total per day; maximum of $20,000 in any seven-

day period, maximum of $40,000 in any 30-day period; Invoice payments made using Chase QuickPay: maximum of $10,000

per transaction, with a maximum of $10,000 total per day, maximum of $20,000 in any seven-day period, maximum of

$40,000 in any 30-day period

2. Nilson, December 2015

34

Notes on slide 26 – We continue to innovate in P2P payments and have launched

real-time availability

A

P

P

E

N

D

I

X

Notes on slide 29 – Chase Consumer & Community Banking is a strong

franchise with leadership positions across all its businesses

1. TNS 1Q16 Retail Banking Monitor. Based on total U.S. (~5K surveys per quarter) and Chase footprint (~2.8K surveys per

quarter). TNS survey questions used to determine primary bank: “With which banks do you currently do business? Which do

you consider to be your main or primary bank?”

2. Highest growth U.S. markets refers to top 30 core based statistical areas by deposit balance growth from 2011 to 2015, per

SNL Financial

3. Per compete.com as of June 2016

4. Based on Javelin Research mobile banking app ratings as of May 2016; ranking is among large banks

5. Nilson data for full year 2015

6. Based on disclosures by peers through 2Q16 (Citi, Bank of America, Capital One, American Express, Discover)

7. Based on Phoenix Credit Card Monitor for 12-month period ending June 2016; based on card accounts, revolving balance

dollars and spending dollars

8. Based on Inside Mortgage Finance as of 2Q16 for Servicer and Originator rankings

9. Per Experian AutoCount data for June 2016 YTD; bank auto lenders are non-captive auto lenders

35

Forward-looking statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

These statements are based on the current beliefs and expectations of JPMorgan Chase’s management and are subject to

significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that

could cause JPMorgan Chase’s actual results to differ materially from those described in the forward-looking statements can be

found in JPMorgan Chase’s Annual Report on Form 10-K for the year ended December 31, 2015, and Quarterly Reports on

Form 10-Q for the quarters ended March 31, 2016, and June 30, 2016, which have been filed with the Securities and Exchange

Commission and are available on JPMorgan Chase’s website (http://investor.shareholder.com/jpmorganchase/sec.cfm) and on

the Securities and Exchange Commission's website (www.sec.gov). JPMorgan Chase does not undertake to update the forward-

looking statements to reflect the impact of circumstances or events that may arise after the date of the forward-looking

statements.