Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Horizon Therapeutics Public Ltd Co | d248693dex993.htm |

| EX-99.1 - EX-99.1 - Horizon Therapeutics Public Ltd Co | d248693dex991.htm |

| EX-2.1 - EX-2.1 - Horizon Therapeutics Public Ltd Co | d248693dex21.htm |

| 8-K - 8-K - Horizon Therapeutics Public Ltd Co | d248693d8k.htm |

Horizon Pharma plc Announced Acquisition of Raptor Pharmaceutical Corp. Further Strengthens Horizon Pharma’s Focus on Rare Diseases September 12, 2016 Exhibit 99.2

Forward-Looking Statements This presentation contains forward-looking statements, including, but not limited to, statements related to the anticipated consummation of the acquisition of Raptor Pharmaceutical Corp. (Raptor) and the timing and benefits thereof, Horizon Pharma’s strategy, plans, objectives, expectations (financial or otherwise) and intentions, future financial results and growth potential, anticipated product portfolio, development programs, patent terms and other statements that are not historical facts. These forward-looking statements are based on Horizon’s current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward looking statements as a result of these risks and uncertainties, which include, without limitation, risks related to Horizon’s ability to complete the transaction on the proposed terms and schedule; risks associated with acquisitions, such as the risk that the businesses will not be integrated successfully, that such integration may be more difficult, time-consuming or costly than expected or that the expected benefits of the transaction will not occur; risks related to future opportunities and plans for the acquired company and its products, including uncertainty of the expected financial performance of the acquired company and its products; disruption from the proposed transaction, making it more difficult to conduct business as usual or maintain relationships with customers, employees or suppliers; the calculations of, and factors that may impact the calculations of, the acquisition price in connection with the proposed merger and the allocation of such acquisition price to the net assets acquired in accordance with applicable accounting rules and methodologies; and the possibility that if the acquired company does not achieve the perceived benefits of the proposed transaction as rapidly or to the extent anticipated by financial analysts or investors, the market price of the combined company’s shares could decline, as well as other risks related to Horizon’s business detailed from time-to-time under the caption “Risk Factors” and elsewhere in Horizon Pharma's SEC filings and reports, including in its Annual Report on Form 10-K for the year ended December 31, 2015. Horizon Pharma undertakes no duty or obligation to update any forward-looking statements contained in this presentation as a result of new information, future events or changes in its expectations. For full prescribing information refer to product websites.

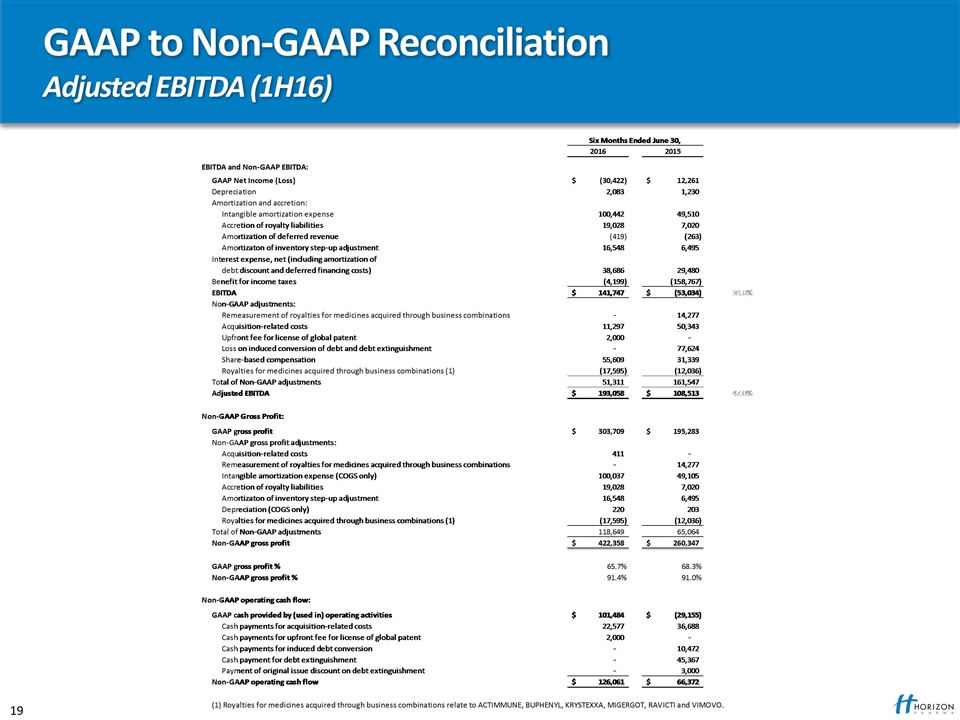

Note Regarding Use of Non-GAAP Financial Measures Horizon Pharma provides certain financial measures that include adjustments to GAAP figures, such as adjusted EBITDA, or earnings before interest, taxes, depreciation and amortization. These adjustments exclude acquisition-related expenses, an upfront fee for a license of a patent, loss on debt extinguishment and loss on sale of long-term investments, as well as non-cash items such as share-based compensation, depreciation and amortization, royalty accretion, non-cash interest expense, and other non-cash adjustments. Certain other special items or substantive events may also be included in the non-GAAP adjustments periodically when their magnitude is significant within the periods incurred. Horizon believes that these non-GAAP financial measures, when considered together with the GAAP figures, can enhance an overall understanding of Horizon's financial performance and expected benefits of the Raptor acquisition. Adjusted EBITDA is intended to provide additional information on Horizon's performance, operations, profitability and cash flows. Horizon maintains an established non-GAAP cost policy that guides the determination of what costs will be excluded in non-GAAP measures. Horizon believes that these non-GAAP financial measures, when considered together with the GAAP figures, can enhance an overall understanding of Horizon's financial and operating performance. The non-GAAP financial measures are included with the intent of providing investors with a more complete understanding of the Company's historical and expected 2016 financial results and trends and to facilitate comparisons between periods and with respect to projected information. In addition, these non-GAAP financial measures are among the indicators Horizon's management uses for planning and forecasting purposes and measuring the Company's performance. For example, adjusted EBITDA is used by Horizon as one measure of management performance under certain incentive compensation arrangements. These non-GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, non-GAAP financial measures used by other companies.

Additional Information and Where to Find It The tender offer referenced in this presentation has not yet commenced. This presentation is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell securities, nor is it a substitute for the tender offer (TO) materials that Horizon Pharma and its acquisition subsidiary will file with the U.S. Securities and Exchange Commission (the “SEC”). The solicitation and offer to buy Raptor common stock will only be made pursuant to an Offer to Purchase and related tender offer materials. At the time the tender offer is commenced, Horizon Pharma and its acquisition subsidiary will file a tender offer statement on Schedule TO and thereafter Raptor will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer. THE TO MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 WILL CONTAIN IMPORTANT INFORMATION. RAPTOR STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF RAPTOR SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SECURITIES. The Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of Raptor common stock at no expense to them. The tender offer materials and the Solicitation/Recommendation Statement will be made available for free at the SEC's website at www.sec.gov or by directing such requests to the Information Agent for the Offer, which will be named in the Offer to Purchase. In addition to the Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, Horizon Pharma and Raptor each file annual, quarterly and current reports and other information with the SEC. Such filings are available to the public from commercial document-retrieval services and the SEC’s website at http://www.sec.gov.

Horizon Pharma to Acquire Raptor Pharmaceutical Strategically and Financially Compelling Acquisition Expands Horizon Pharma’s orphan business with a highly differentiated orphan medicine with a long patent life PROCYSBI® (cysteamine bitartrate delayed release capsules) indicated for nephropathic cystinosis with patent protection out to 2034 PROCYSBI is a durable growth medicine with more than $300 million peak sales potential PROCYSBI is well aligned with Horizon Pharma’s current orphan disease expertise Strengthens Horizon’s focus on rare diseases and further shifts mix toward orphan medicines More than half of Horizon’s medicines will now treat orphan diseases (6 of 11 medicines) Including Raptor sales on a pro forma basis, 1H16 orphan sales would represent 45 percent of total Horizon Pharma sales Expands the Company’s commercial infrastructure and expertise into Europe and selected ROW markets Further diversifies Horizon Pharma’s net sales and portfolio from 9 medicines to 11 Expected to be accretive to adjusted EBITDA in 2017 (1) Horizon estimate. (1)

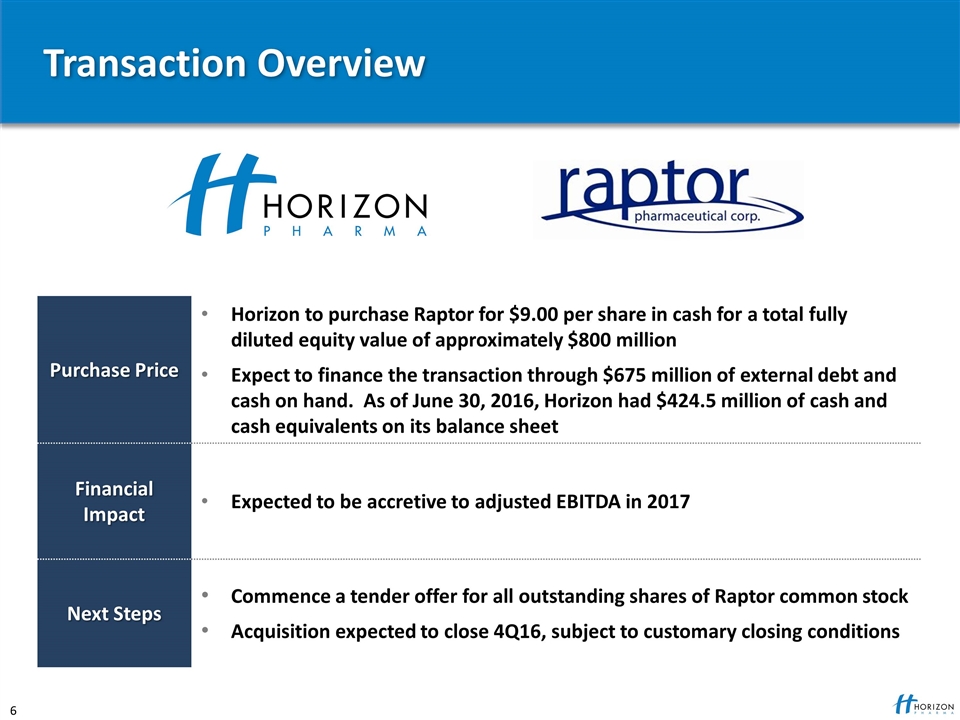

Transaction Overview Purchase Price Horizon to purchase Raptor for $9.00 per share in cash for a total fully diluted equity value of approximately $800 million Expect to finance the transaction through $675 million of external debt and cash on hand. As of June 30, 2016, Horizon had $424.5 million of cash and cash equivalents on its balance sheet Financial Impact Expected to be accretive to adjusted EBITDA in 2017 Next Steps Commence a tender offer for all outstanding shares of Raptor common stock Acquisition expected to close 4Q16, subject to customary closing conditions

Raptor Pharmaceutical Corp. Expands Horizon Pharma’s Rare Disease Portfolio Description Biopharmaceutical company focused on the development and commercialization of transformative therapeutics for rare, debilitating and often fatal diseases Location Headquartered in Novato, California with European operations headquartered in the Netherlands PROCYSBI® PROCYSBI approved in the U.S. and EU for nephropathic cystinosis, a rare and life-threatening metabolic disorder QUINSAIRTM QUINSAIR (aerosolized form of levofloxacin) a fluroquinolone antibiotic, approved in the EU and Canada for management of chronic pulmonary infections due to Pseudomonas aeruginosa in adult patients with Cystic Fibrosis. Not approved in the U.S.

PROCYSBI For Treatment of Nephropathic Cystinosis Indication Treatment of nephropathic cystinosis, a rare and life-threatening metabolic disorder that causes an amino acid, cystine, to accumulate in organs of the body Without treatment, high intracellular cystine concentrations can occur in virtually all organs and tissues, leading to irreversible cellular damage, progressive multi-organ failure and death Administration Delayed release capsules dosed 2x per day Intellectual Property 5 OB-listed patents extending through 2034 Orphan drug exclusivity: U.S. 2020/2022; EU 2023 Rights Worldwide rights Approved in U.S. and EU Product Differentiation PROCYSBI is a 2nd generation medicine with well-established efficacy/tolerability and 12-hour dosing 1st generation therapy requires every 6-hour dosing, causes GI side effects and has strong odor

Nephropathic Cystinosis (NC) A Rare, Life-Threatening Lysosomal Storage Disease NC is a rare metabolic disorder with an estimated prevalence as high as 1 in 100,000 live births(1),(2) ~550 estimated NC patients in the U.S., ~2,000 worldwide(2) Inherited as an autosomal-recessive disease affecting lysosomal storage processes within cells; amino acid cystine is not transported out of the lysosome, but instead accumulates and eventually crystallizes within the lysosomal lumen(1),(3) Without treatment, high intracellular cystine concentrations can occur in virtually all organs and tissues, leading to irreversible cellular damage, progressive multi-organ failure and death(4) Treatment with PROCYSBI may help prevent this irreversible cellular damage by providing continuous control of cystine when taken every 12 hours (1) Emma F, Nesterova G, Langman C, et al. Nephropathic cystinosis: an international consensus document. Nephrol Dial Transplant. 2014;29(Suppl 4):iv87-94. (2) Doyle M, Werner-Lin A. That eagle covering me: transitioning and connected autonomy for emerging adults with cystinosis. Pediatr Nephrol. 2015:30:281-91. (3) Gahl WA, Balog JZ, Kleta R. Nephropathic cystinosis in adults: natural history and effects of oral cysteamine therapy. Ann Intern Med. 2007;147:242-50. (4) Nesterova G, Gahl WA. Cystinosis: the evolution of a treatable disease. Pediatr Nephrol. 2013;28:51-9.

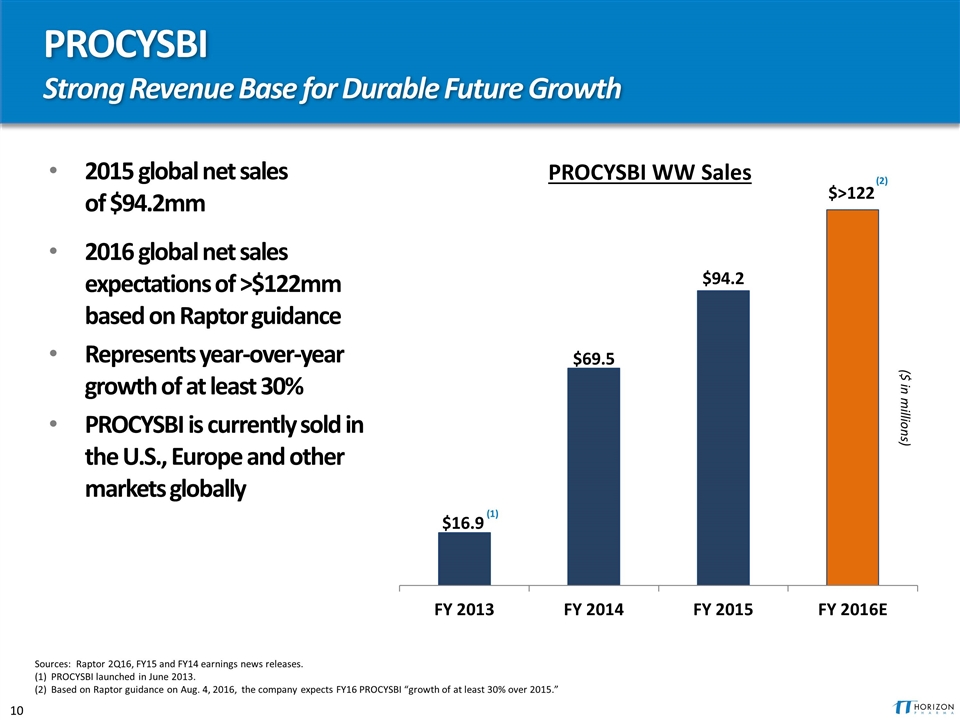

PROCYSBI Strong Revenue Base for Durable Future Growth 2015 global net sales of $94.2mm 2016 global net sales expectations of >$122mm based on Raptor guidance Represents year-over-year growth of at least 30% PROCYSBI is currently sold in the U.S., Europe and other markets globally Sources: Raptor 2Q16, FY15 and FY14 earnings news releases. (1) PROCYSBI launched in June 2013. (2) Based on Raptor guidance on Aug. 4, 2016, the company expects FY16 PROCYSBI “growth of at least 30% over 2015.” (1) ($ in millions) (2) PROCYSBI WW Sales

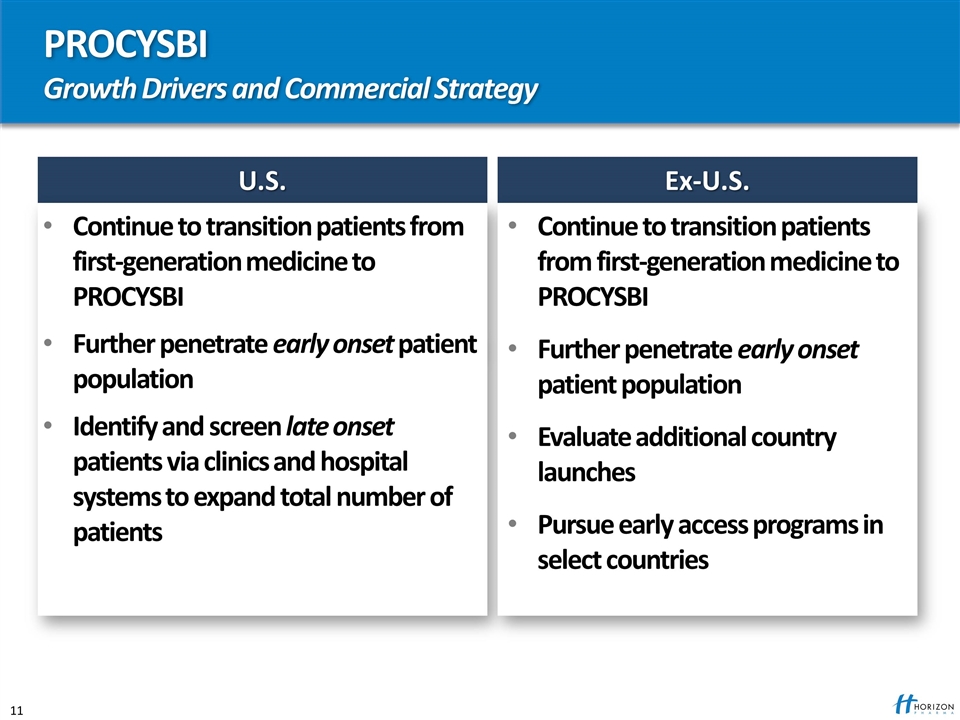

PROCYSBI Growth Drivers and Commercial Strategy U.S. Continue to transition patients from first-generation medicine to PROCYSBI Further penetrate early onset patient population Identify and screen late onset patients via clinics and hospital systems to expand total number of patients Ex-U.S. Continue to transition patients from first-generation medicine to PROCYSBI Further penetrate early onset patient population Evaluate additional country launches Pursue early access programs in select countries

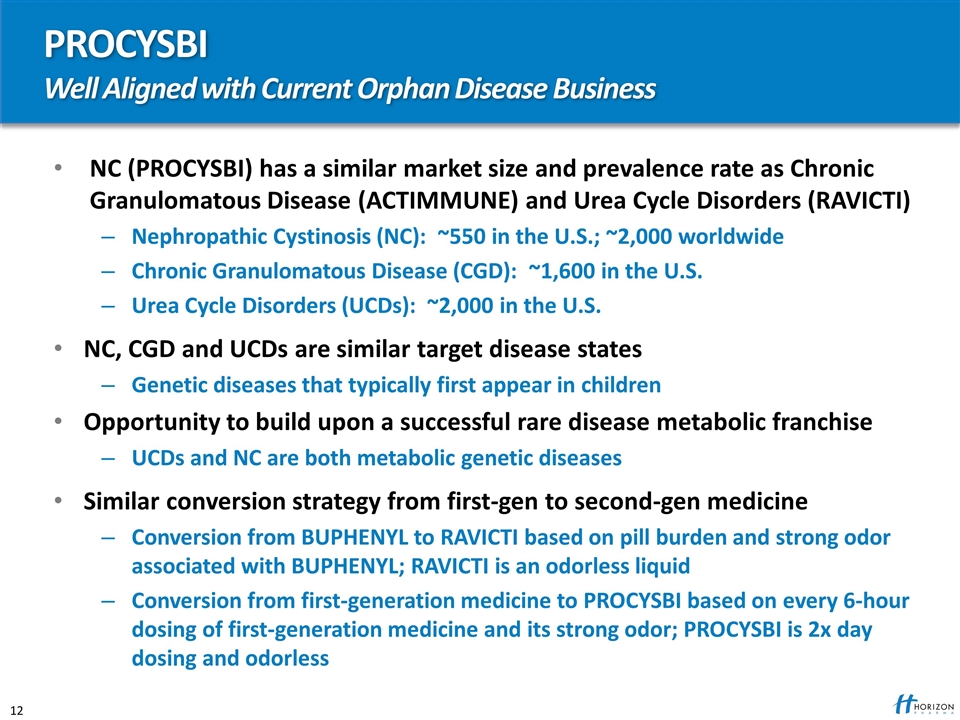

PROCYSBI Well Aligned with Current Orphan Disease Business NC (PROCYSBI) has a similar market size and prevalence rate as Chronic Granulomatous Disease (ACTIMMUNE) and Urea Cycle Disorders (RAVICTI) Nephropathic Cystinosis (NC): ~550 in the U.S.; ~2,000 worldwide Chronic Granulomatous Disease (CGD): ~1,600 in the U.S. Urea Cycle Disorders (UCDs): ~2,000 in the U.S. NC, CGD and UCDs are similar target disease states Genetic diseases that typically first appear in children Opportunity to build upon a successful rare disease metabolic franchise UCDs and NC are both metabolic genetic diseases Similar conversion strategy from first-gen to second-gen medicine Conversion from BUPHENYL to RAVICTI based on pill burden and strong odor associated with BUPHENYL; RAVICTI is an odorless liquid Conversion from first-generation medicine to PROCYSBI based on every 6-hour dosing of first-generation medicine and its strong odor; PROCYSBI is 2x day dosing and odorless

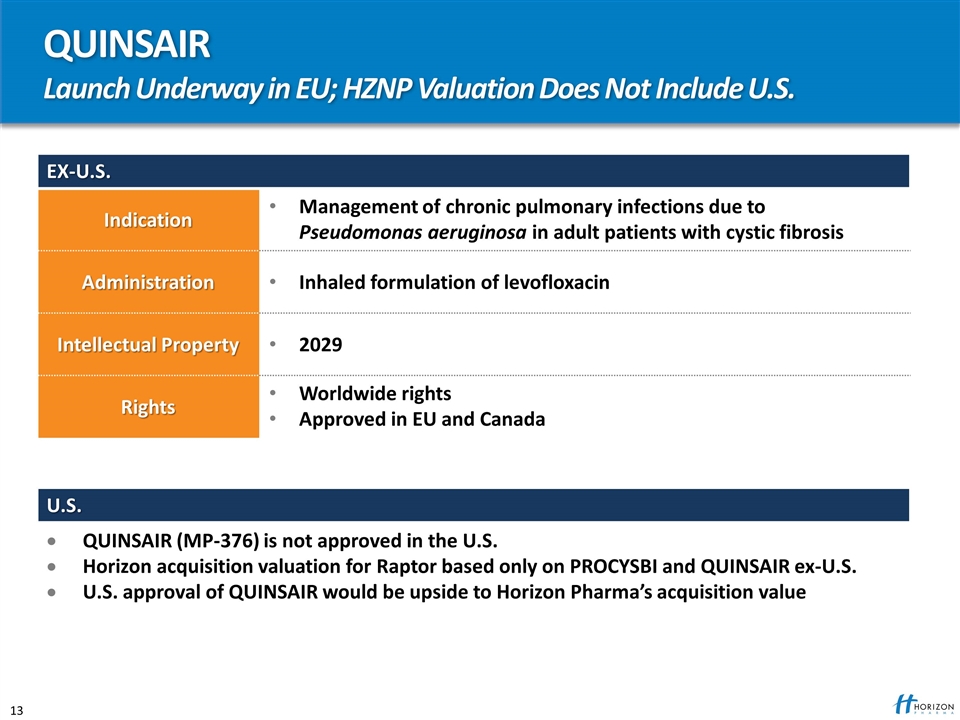

QUINSAIR Launch Underway in EU; HZNP Valuation Does Not Include U.S. EX-U.S. Indication Management of chronic pulmonary infections due to Pseudomonas aeruginosa in adult patients with cystic fibrosis Administration Inhaled formulation of levofloxacin Intellectual Property 2029 Rights Worldwide rights Approved in EU and Canada U.S. QUINSAIR (MP-376) is not approved in the U.S. Horizon acquisition valuation for Raptor based only on PROCYSBI and QUINSAIR ex-U.S. U.S. approval of QUINSAIR would be upside to Horizon Pharma’s acquisition value

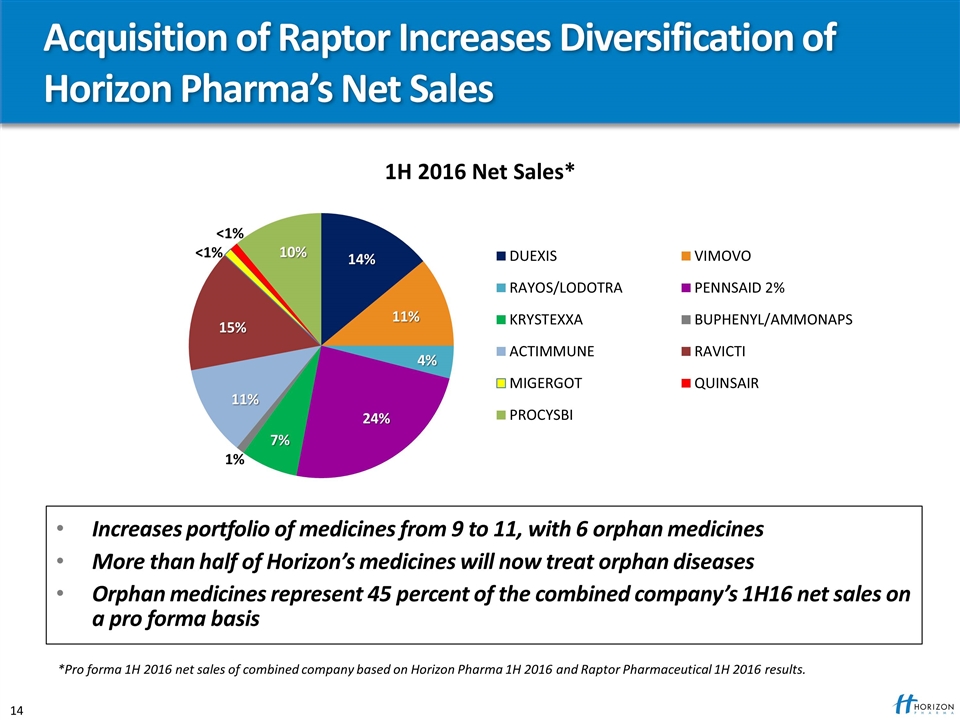

Acquisition of Raptor Increases Diversification of Horizon Pharma’s Net Sales Increases portfolio of medicines from 9 to 11, with 6 orphan medicines More than half of Horizon’s medicines will now treat orphan diseases Orphan medicines represent 45 percent of the combined company’s 1H16 net sales on a pro forma basis 1H 2016 Net Sales* *Pro forma 1H 2016 net sales of combined company based on Horizon Pharma 1H 2016 and Raptor Pharmaceutical 1H 2016 results.

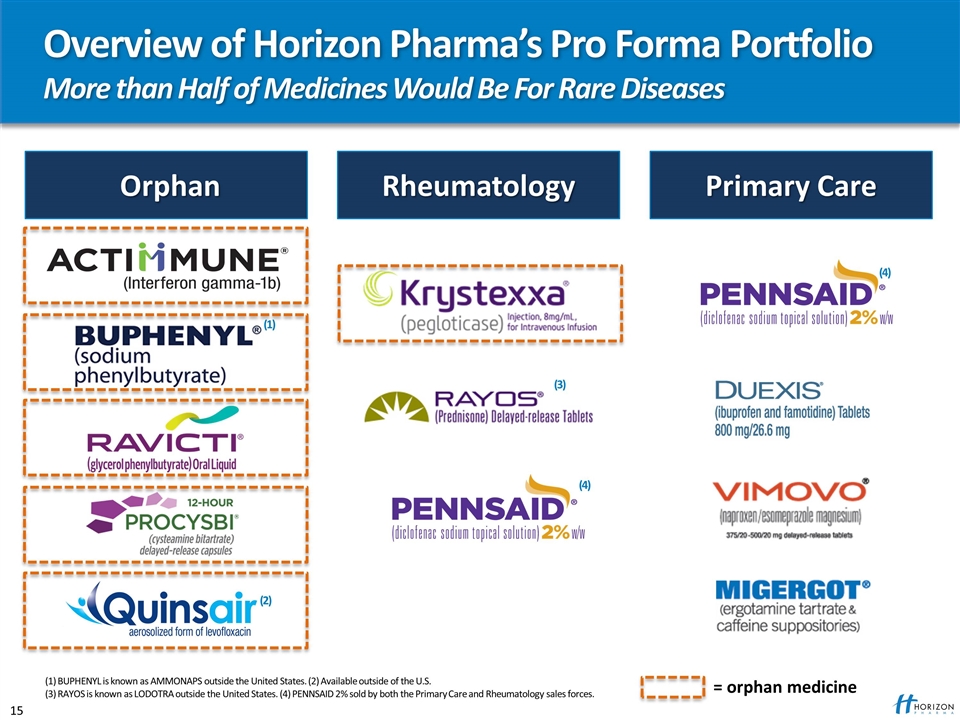

Orphan Primary Care (1) BUPHENYL is known as AMMONAPS outside the United States. (2) Available outside of the U.S. (3) RAYOS is known as LODOTRA outside the United States. (4) PENNSAID 2% sold by both the Primary Care and Rheumatology sales forces. (4) (4) = orphan medicine (3) (1) Overview of Horizon Pharma’s Pro Forma Portfolio More than Half of Medicines Would Be For Rare Diseases (2) Rheumatology

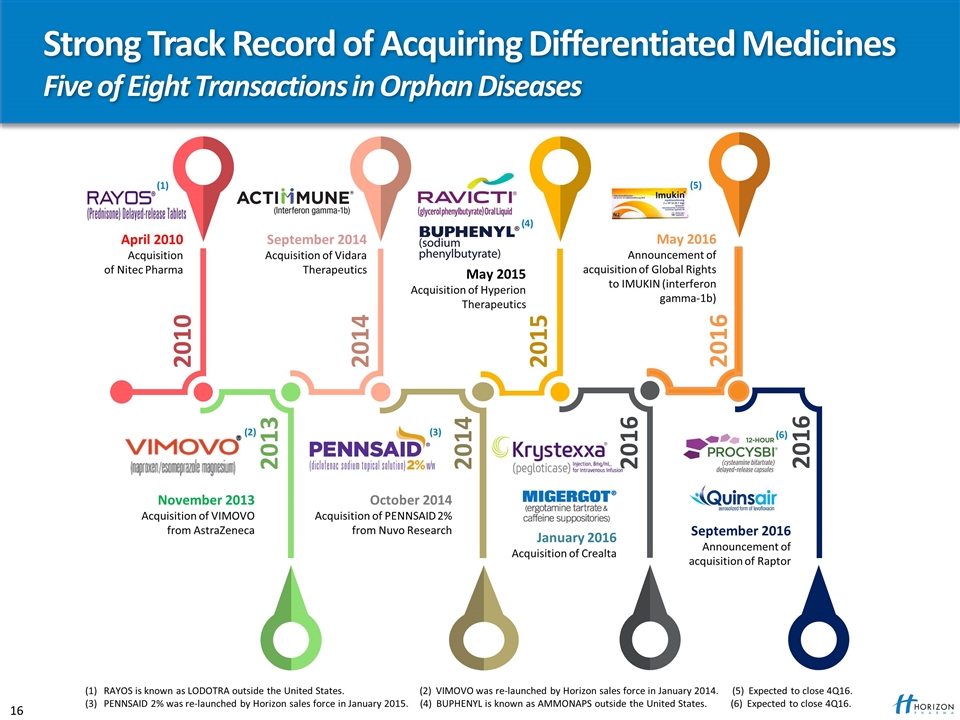

2010 2013 2014 2016 2014 2015 November 2013 Acquisition of VIMOVO from AstraZeneca October 2014 Acquisition of PENNSAID 2% from Nuvo Research April 2010 Acquisition of Nitec Pharma September 2014 Acquisition of Vidara Therapeutics May 2015 Acquisition of Hyperion Therapeutics January 2016 Acquisition of Crealta Strong Track Record of Acquiring Differentiated Medicines Five of Eight Transactions in Orphan Diseases 2016 May 2016 Announcement of acquisition of Global Rights to IMUKIN (interferon gamma-1b) (1) RAYOS is known as LODOTRA outside the United States. (2) VIMOVO was re-launched by Horizon sales force in January 2014. (5) Expected to close 4Q16. (3) PENNSAID 2% was re-launched by Horizon sales force in January 2015. (4) BUPHENYL is known as AMMONAPS outside the United States. (6) Expected to close 4Q16. (1) (2) (3) (4) (5) 2016 September 2016 Announcement of acquisition of Raptor (6)

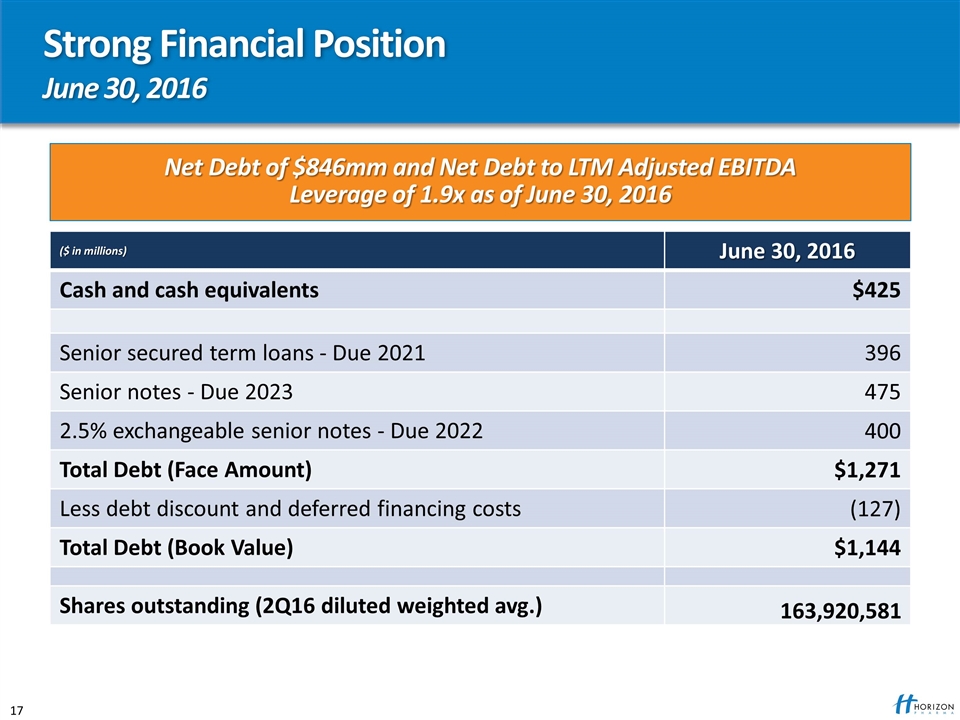

Strong Financial Position June 30, 2016 ($ in millions) June 30, 2016 Cash and cash equivalents $425 Senior secured term loans - Due 2021 396 Senior notes - Due 2023 475 2.5% exchangeable senior notes - Due 2022 400 Total Debt (Face Amount) $1,271 Less debt discount and deferred financing costs (127) Total Debt (Book Value) $1,144 Shares outstanding (2Q16 diluted weighted avg.) 163,920,581 Net Debt of $846mm and Net Debt to LTM Adjusted EBITDA Leverage of 1.9x as of June 30, 2016

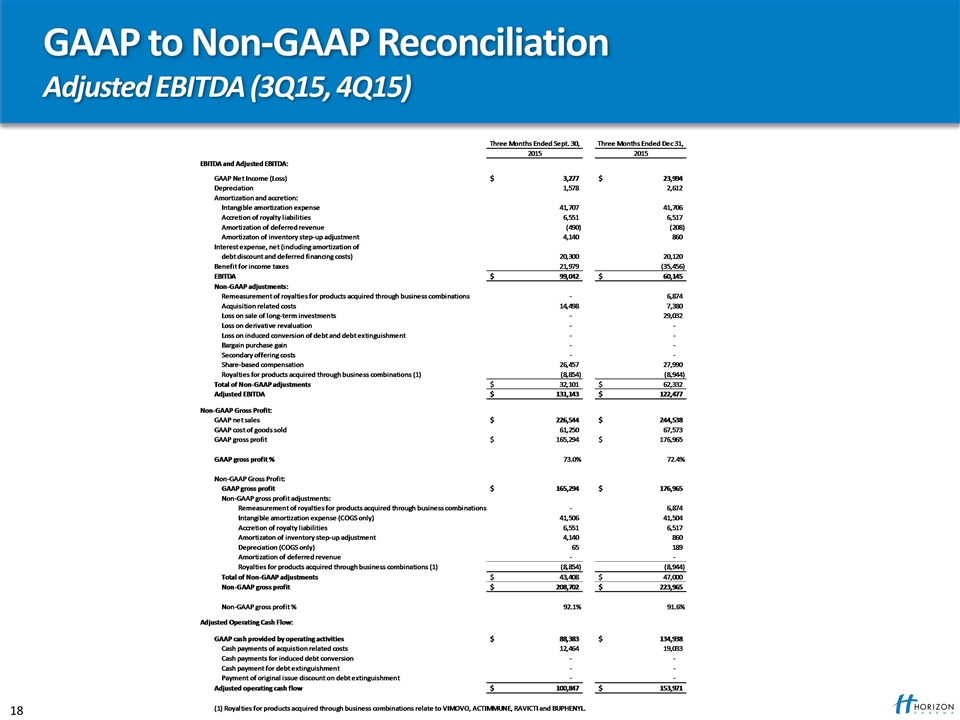

GAAP to Non-GAAP Reconciliation Adjusted EBITDA (3Q15, 4Q15)

GAAP to Non-GAAP Reconciliation Adjusted EBITDA (1H16)

Horizon Pharma plc Announced Acquisition of Raptor Pharmaceutical Corp. Further Strengthens Horizon Pharma’s Focus on Rare Diseases September 12, 2016