Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - VOLT INFORMATION SCIENCES, INC. | a07312016-ex322.htm |

| EX-32.1 - EXHIBIT 32.1 - VOLT INFORMATION SCIENCES, INC. | a07312016-ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - VOLT INFORMATION SCIENCES, INC. | a07312016-ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - VOLT INFORMATION SCIENCES, INC. | a07312016-ex311.htm |

| EX-10.3 - EXHIBIT 10.3 - VOLT INFORMATION SCIENCES, INC. | voltaip.htm |

| 10-Q - 10-Q - VOLT INFORMATION SCIENCES, INC. | visi-07312016x10q.htm |

AMENDMENT NO. 3 TO RECEIVABLES FINANCING AGREEMENT

This AMENDMENT NO. 3 TO RECEIVABLES FINANCING AGREEMENT (this

“Amendment No. 3”), dated as of September 6, 2016, is by and among VOLT FUNDING CORP.

(“Volt Funding”), as borrower (the “Borrower”), the Persons from time to time party hereto as

Lenders and LC Participants, PNC BANK, NATIONAL ASSOCIATION (“PNC”), as LC Bank,

as an LC Participant, as a Lender and as Administrative Agent, and VOLT INFORMATION

SCIENCES, INC. (“Volt”), as initial servicer (the “Servicer”).

BACKGROUND

WHEREAS, the parties hereto entered into the Receivables Financing Agreement as of

July 30, 2015 (as amended, restated, supplemented or otherwise modified through the date hereof,

the “Receivables Financing Agreement”); and

WHEREAS, the parties hereto wish to amend the Receivables Financing Agreement

pursuant to the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the foregoing and other good and valuable

consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto

hereby agree as follows:

SECTION 1. Definitions. Capitalized terms used but not defined in this Amendment No.

3 shall have the meanings assigned to them in the Receivables Financing Agreement.

SECTION 2. Amendments to Receivables Financing Agreement. Effective as of the date

hereof and subject to the satisfaction of the conditions precedent set forth in Section 3 hereof, the

Receivables Financing Agreement is hereby amended as follows:

(a) The definition of “Facility Limit” set forth in Section 1.01 of the Receivables

Financing Agreement in hereby amended by deleting the amount “$150,000,000” in its entirety

and replacing it with the amount “$160,000,000”.

(b) Schedule I to the Receivables Financing Agreement is hereby deleted and replaced

in its entirety with the schedule set forth in Exhibit A attached hereto.

SECTION 3. Conditions Precedent. The effectiveness of this Amendment No. 3 is

subject to the satisfaction of all of the following conditions precedent:

(a) The Administrative Agent shall have received a fully executed counterpart of this

Amendment No. 3 and the First Amended and Restated Amendment Fee Letter, dated as of the

date hereof, by and among PNC as the Administrative Agent, a Lender, the LC Bank, and an LC

Participant, PNC Capital Markets LLC and the Borrower (collectively, the “Amendment No. 3

Documents”).

(b) The Administrative Agent shall have received such documents and certificates as

the Administrative Agent shall have reasonably requested on or prior to the date hereof.

101270756\V-3

2

(c) The Administrative Agent shall have received all fees and other amounts due and

payable to it under the Receivables Financing Agreement and in connection with the Amendment

No. 3 Documents on or prior to the date hereof, including, to the extent invoiced, payment or

reimbursement of all fees and expenses (including reasonable and documented out-of-pocket fees,

charges and disbursements of counsel) required to be paid or reimbursed on or prior to the date

hereof. To the extent such fees and other amounts have not yet been invoiced, the Borrower agrees

to remit payment to the applicable party promptly upon receipt of such invoice.

(d) No Event of Default or Unmatured Event of Default, as set forth in Section 10.01

of the Receivables Financing Agreement, shall have occurred and be continuing.

SECTION 4. Amendment. The Borrower, PNC as the LC Bank, an LC Participant, a

Lender, and the Administrative Agent, and the Servicer, hereby agree that the provisions and

effectiveness of this Amendment No. 3 shall apply to the Receivables Financing Agreement as of

the date hereof. Except as amended by this Amendment No. 3 and any prior amendments, the

Receivables Financing Agreement remains unchanged and in full force and effect. This

Amendment No. 3 is a Transaction Document.

SECTION 5. Counterparts. This Amendment No. 3 may be executed in any number of

counterparts, each of which when so executed shall be deemed an original and all of which when

taken together shall constitute one and the same agreement. Delivery of an executed counterpart

hereof by facsimile or other electronic means shall be equally effective as delivery of an originally

executed counterpart.

SECTION 6. Captions. The headings of the Sections of this Amendment No. 3 are

provided solely for convenience of reference and shall not modify, define, expand or limit any of

the terms or provisions of this Amendment No. 3.

SECTION 7. Successors and permitted assigns. The terms of this Amendment No. 3 shall

be binding upon, and shall inure to the benefit of the Borrower, PNC as the LC Bank, an LC

Participant, a Lender, and the Administrative Agent, and the Servicer, and their respective

successors and permitted assigns.

SECTION 8. Severability. Any provision of this Amendment No. 3 which is prohibited

or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of

such prohibition or unenforceability without invalidating the remaining provisions hereof, and any

such prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable

such provision in any other jurisdiction.

SECTION 9. Governing Law and Jurisdiction. The provisions of the Receivables

Financing Agreement with respect to governing law, jurisdiction, and agent for service of process

are incorporated in this Amendment No. 3 by reference as if such provisions were set forth herein.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

Amendment 3 to RFA (PNC/Volt)

S-1

IN WITNESS WHEREOF, the parties hereto have executed this Amendment No. 3 by

their duly authorized officers as of the date first above written.

VOLT FUNDING CORP.,

as the Borrower

By: /s/ Kevin Hannon

Name: Kevin Hannon

Title: Treasurer

VOLT INFORMATION SCIENCES, INC.,

as the Servicer

By: /s/ Kevin Hannon

Name: Kevin Hannon

Title: VP & Treasurer

Amendment 3 to RFA (PNC/Volt)

S-2

PNC BANK, NATIONAL ASSOCIATION,

as Administrative Agent

By: /s/ Eric Bruno

Name: Eric Bruno

Title: Senior Vice President

PNC BANK, NATIONAL ASSOCIATION,

as LC Bank and as an LC Participant

By: /s/ Eric Bruno

Name: Eric Bruno

Title: Senior Vice President

PNC BANK, NATIONAL ASSOCIATION,

as a Lender

By: /s/ Eric Bruno

Name: Eric Bruno

Title: Senior Vice President

Ex. A-1

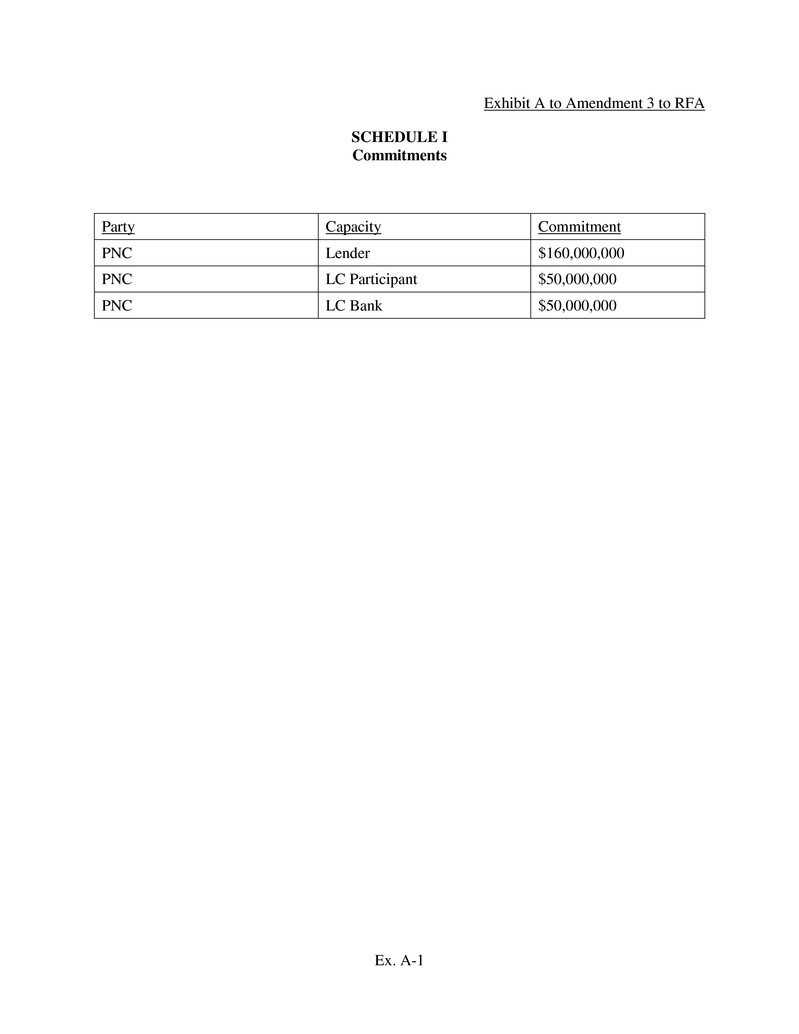

Exhibit A to Amendment 3 to RFA

SCHEDULE I

Commitments

Party Capacity Commitment

PNC Lender $160,000,000

PNC LC Participant $50,000,000

PNC LC Bank $50,000,000