Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - UNITED COMMUNITY FINANCIAL CORP | d245125dex991.htm |

| 8-K - FORM 8-K - UNITED COMMUNITY FINANCIAL CORP | d245125d8k.htm |

Acquisition of Ohio Legacy Corp September 8, 2016 Exhibit 99.2

Matters set forth in this presentation contain certain forward-looking statements. These forward-looking statements may include: management plans relating to the transaction; the expected timing of the completion of the transaction; the ability to complete the transaction; the ability to obtain any required regulatory, shareholder or other approvals; statements of the plans and objectives of management for future operations, products or services, including the execution of integration plans; statements about the benefits of the proposed merger between United Community Financial Corp. (“United Community” or “UCFC”) and Ohio Legacy Corp (“Ohio Legacy” or “OLCB”), statements of expectation or belief; projections related to certain financial metrics; and statements of assumptions underlying any of the foregoing. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project” and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time and are beyond our control. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those that United Community anticipates in its forward-looking statements and future results could differ materially from historical performance. Factors that could cause or contribute to such differences include, but are not limited to, those included under Item 1A “Risk Factors” in United Community’s Annual Report on Form 10-K and those disclosed in United Community’s other periodic reports filed with the Securities and Exchange Commission (the “SEC”), as well as the possibility: that expected benefits may not materialize in the timeframe expected or at all, or may be more costly to achieve; that the transaction may not be timely completed, if at all; that prior to the completion of the transaction or thereafter, United Community’s and Ohio Legacy’s respective businesses may not perform as expected due to transaction-related uncertainty or other factors; that the parties are unable to successfully implement integration strategies; that required regulatory, shareholder or other approvals are not obtained or other customary closing conditions are not satisfied in a timely manner or at all; reputational risks and the reaction of the companies’ customers, employees and other constituents to the transaction; and diversion of management time on merger-related matters. For any forward-looking statements made in this presentation or in any documents, annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. All forward-looking statements included in this presentation are based on information available at the time of the presentation. Forward-looking statements speak only as of the date they are made. United Community does not assume any duty or undertake to update forward-looking statements. Forward-Looking Statement Disclosure

Shareholders of Ohio Legacy and other interested parties are urged to read the proxy statement/prospectus that will be included in the Form S-4 registration statement that United Community will file with the SEC in connection with the merger because it will contain important information about United Community, Ohio Legacy, the merger and other related matters. A proxy statement/prospectus will be mailed to shareholders of Ohio Legacy prior to the Ohio Legacy shareholder meeting, which has not yet been scheduled. In addition, when the registration statement, which will include the proxy statement/prospectus and other related documents, is filed by United Community with the SEC, it may be obtained for free at the SEC's website at http://www.sec.gov, on the NASDAQ website at http://www.nasdaq.com and from either the United Community or Ohio Legacy websites at http://www.ucfonline.com or at http://www.ohiolegacycorp.com. Additional Information about the Transaction

Transaction Rationale Increased Commercial Lending & Balance Sheet Migration: UCFC’s larger balance sheet combined with OLCB’s commercial lending expertise provides opportunity for accelerated expansion of the commercial lending platform 22.6% CAGR1 in OLCB’s commercial loan portfolio from 2011 – 2016 YTD Attractive loan mix with commercial loans2 representing 53% of OLCB’s loan portfolio Increases UCFC’s commercial loan portfolio by over 40% Transaction facilitates Home Savings’ evolution to a commercial bank chartered institution Diversification of Revenue Streams & Geography: Establishes UCFC’s lending presence in the Canton-Akron MSA with meaningful deposit market share Adds wealth management and trust capabilities to the Home Savings franchise – revenue synergies expected though not modeled Improving ROE Through Deployment of Excess Capital: Acquisition allows UCFC to leverage excess capital through a highly accretive acquisition Talent: Retained leadership team with Rick Hull joining Home Savings as Regional President and Denise Penz leading Home Savings’ new wealth management and trust divisions Consistent with UCFC’s Strategic Objectives CAGR represents Compound Annualized Growth Rate Commercial loans defined as commercial real estate and C&I loans, based on Q2 2016 call reports

Financially Attractive Opportunity Transaction Rationale Expected to be ~15% accretive to 2017 EPS(1) Tangible book value (“TBV”) dilution of less than 6.0% at close TBV earn-back ~3.9 years using the “crossover method”(2) and including all merger-related expenses, purchase accounting adjustments and cost savings Internal rate of return in the high-teens Remain in excess of “Well-Capitalized” guidelines on a pro forma basis Excludes merger-related charges; assumes 80% cost savings phase-in in 2017 Crossover method defined as the number of years for projected pro forma TBV per share to exceed projected stand-alone TBV per share

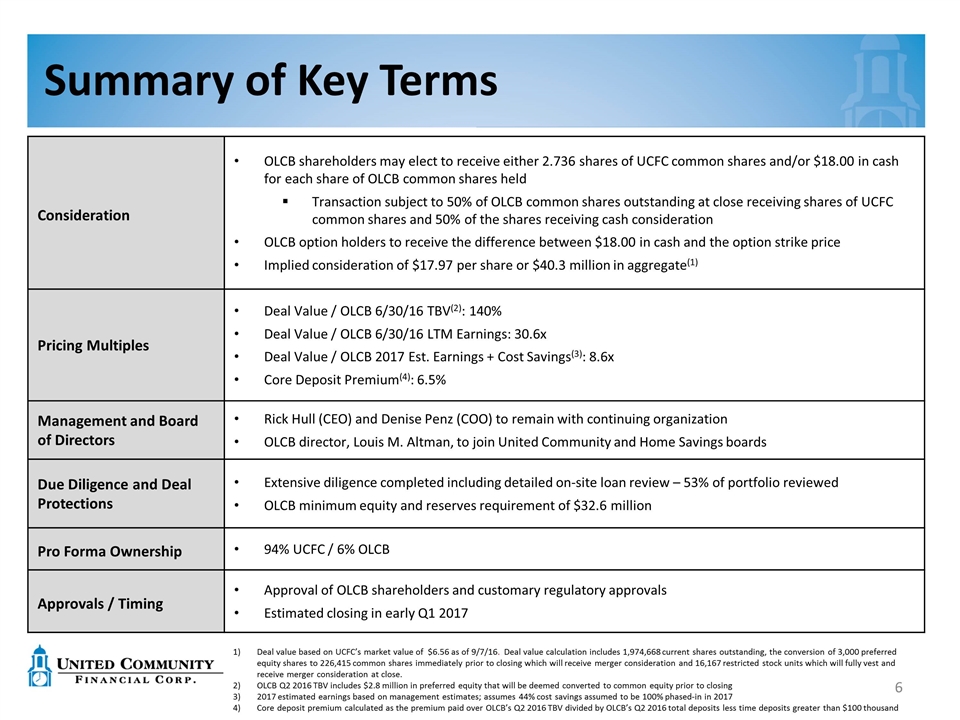

Deal value based on UCFC’s market value of $6.56 as of 9/7/16. Deal value calculation includes 1,974,668 current shares outstanding, the conversion of 3,000 preferred equity shares to 226,415 common shares immediately prior to closing which will receive merger consideration and 16,167 restricted stock units which will fully vest and receive merger consideration at close. OLCB Q2 2016 TBV includes $2.8 million in preferred equity that will be deemed converted to common equity prior to closing 2017 estimated earnings based on management estimates; assumes 44% cost savings assumed to be 100% phased-in in 2017 Core deposit premium calculated as the premium paid over OLCB’s Q2 2016 TBV divided by OLCB’s Q2 2016 total deposits less time deposits greater than $100 thousand Summary of Key Terms Consideration OLCB shareholders may elect to receive either 2.736 shares of UCFC common shares and/or $18.00 in cash for each share of OLCB common shares held Transaction subject to 50% of OLCB common shares outstanding at close receiving shares of UCFC common shares and 50% of the shares receiving cash consideration OLCB option holders to receive the difference between $18.00 in cash and the option strike price Implied consideration of $17.97 per share or $40.3 million in aggregate(1) Pricing Multiples Deal Value / OLCB 6/30/16 TBV(2): 140% Deal Value / OLCB 6/30/16 LTM Earnings: 30.6x Deal Value / OLCB 2017 Est. Earnings + Cost Savings(3): 8.6x Core Deposit Premium(4): 6.5% Management and Board of Directors Rick Hull (CEO) and Denise Penz (COO) to remain with continuing organization OLCB director, Louis M. Altman, to join United Community and Home Savings boards Due Diligence and Deal Protections Extensive diligence completed including detailed on-site loan review – 53% of portfolio reviewed OLCB minimum equity and reserves requirement of $32.6 million Pro Forma Ownership 94% UCFC / 6% OLCB Approvals / Timing Approval of OLCB shareholders and customary regulatory approvals Estimated closing in early Q1 2017

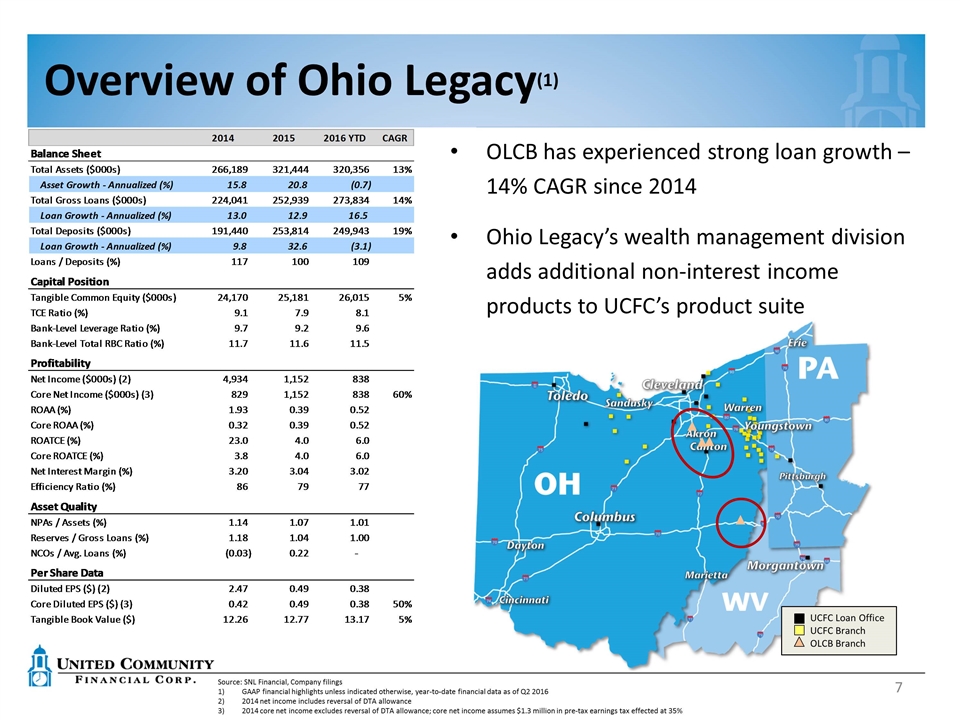

Overview of Ohio Legacy(1) Source: SNL Financial, Company filings GAAP financial highlights unless indicated otherwise, year-to-date financial data as of Q2 2016 2014 net income includes reversal of DTA allowance 2014 core net income excludes reversal of DTA allowance; core net income assumes $1.3 million in pre-tax earnings tax effected at 35% UCFC Loan Office UCFC Branch OLCB Branch OLCB has experienced strong loan growth – 14% CAGR since 2014 Ohio Legacy’s wealth management division adds additional non-interest income products to UCFC’s product suite

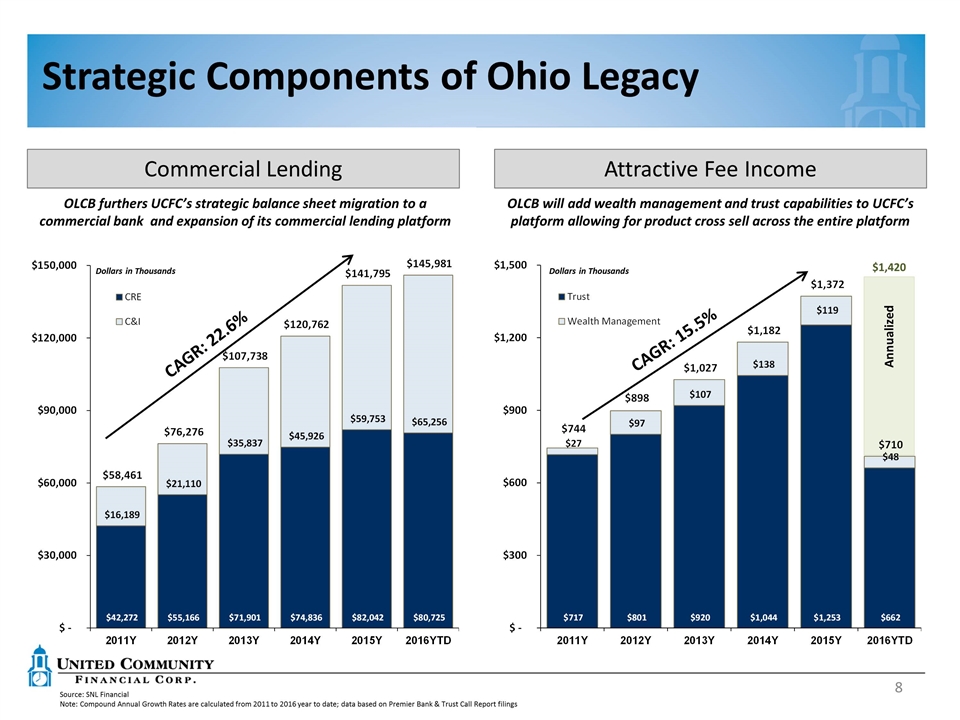

Attractive Fee Income OLCB will add wealth management and trust capabilities to UCFC’s platform allowing for product cross sell across the entire platform CAGR: 15.5% Dollars in Thousands $1,420 Annualized Strategic Components of Ohio Legacy Source: SNL Financial Note: Compound Annual Growth Rates are calculated from 2011 to 2016 year to date; data based on Premier Bank & Trust Call Report filings Commercial Lending OLCB furthers UCFC’s strategic balance sheet migration to a commercial bank and expansion of its commercial lending platform CAGR: 22.6% Dollars in Thousands

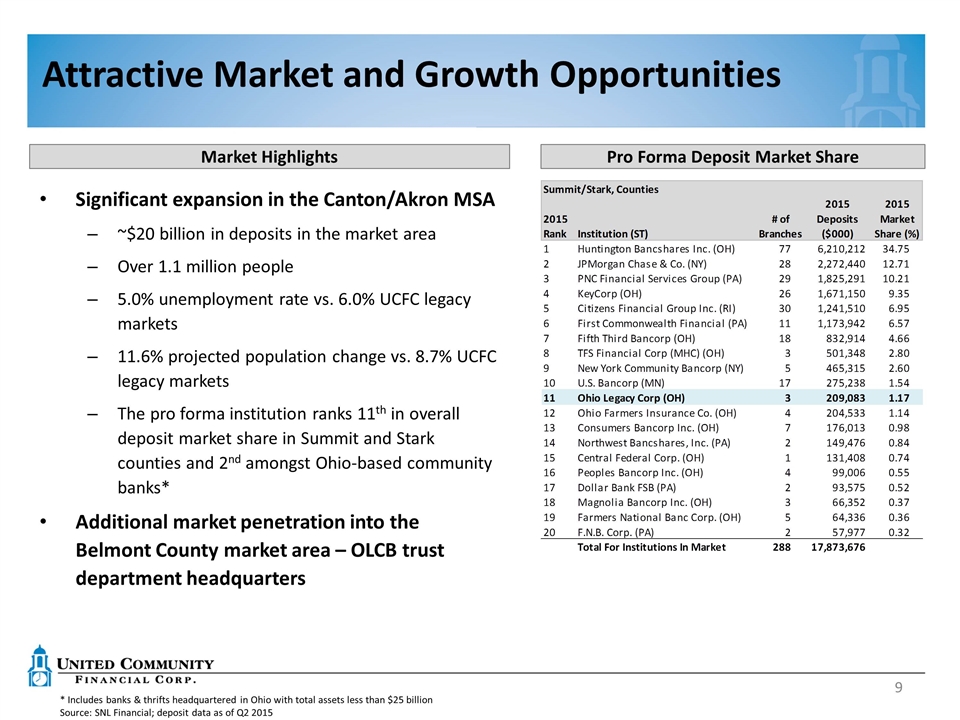

Attractive Market and Growth Opportunities Significant expansion in the Canton/Akron MSA ~$20 billion in deposits in the market area Over 1.1 million people 5.0% unemployment rate vs. 6.0% UCFC legacy markets 11.6% projected population change vs. 8.7% UCFC legacy markets The pro forma institution ranks 11th in overall deposit market share in Summit and Stark counties and 2nd amongst Ohio-based community banks* Additional market penetration into the Belmont County market area – OLCB trust department headquarters Pro Forma Deposit Market Share * Includes banks & thrifts headquartered in Ohio with total assets less than $25 billion Source: SNL Financial; deposit data as of Q2 2015 Market Highlights

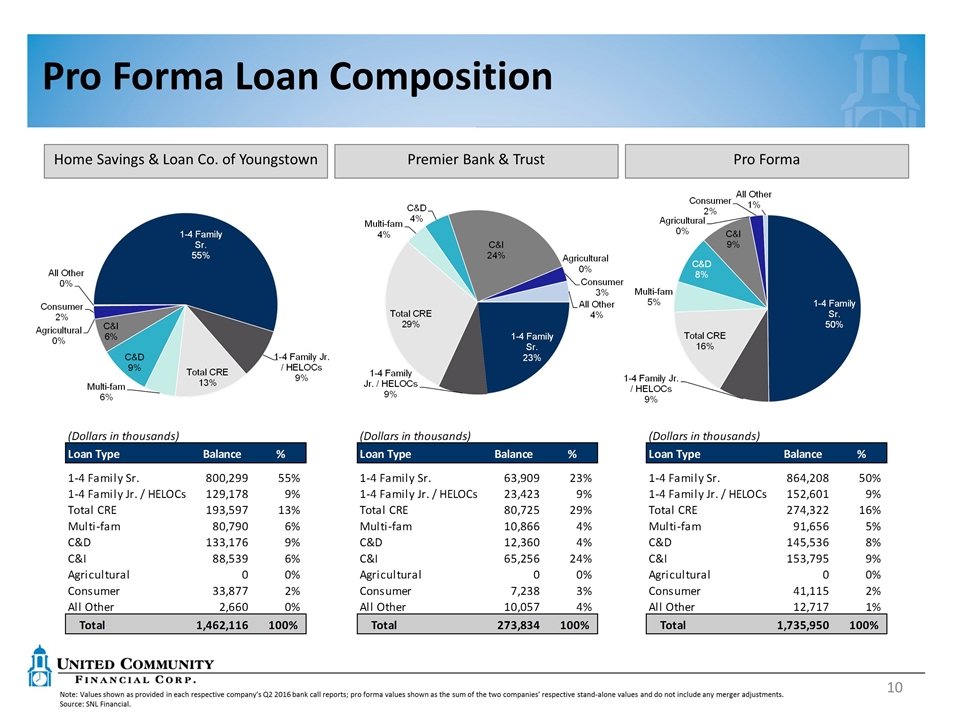

Pro Forma Loan Composition Note: Values shown as provided in each respective company’s Q2 2016 bank call reports; pro forma values shown as the sum of the two companies’ respective stand-alone values and do not include any merger adjustments. Source: SNL Financial. Home Savings & Loan Co. of Youngstown Premier Bank & Trust Pro Forma

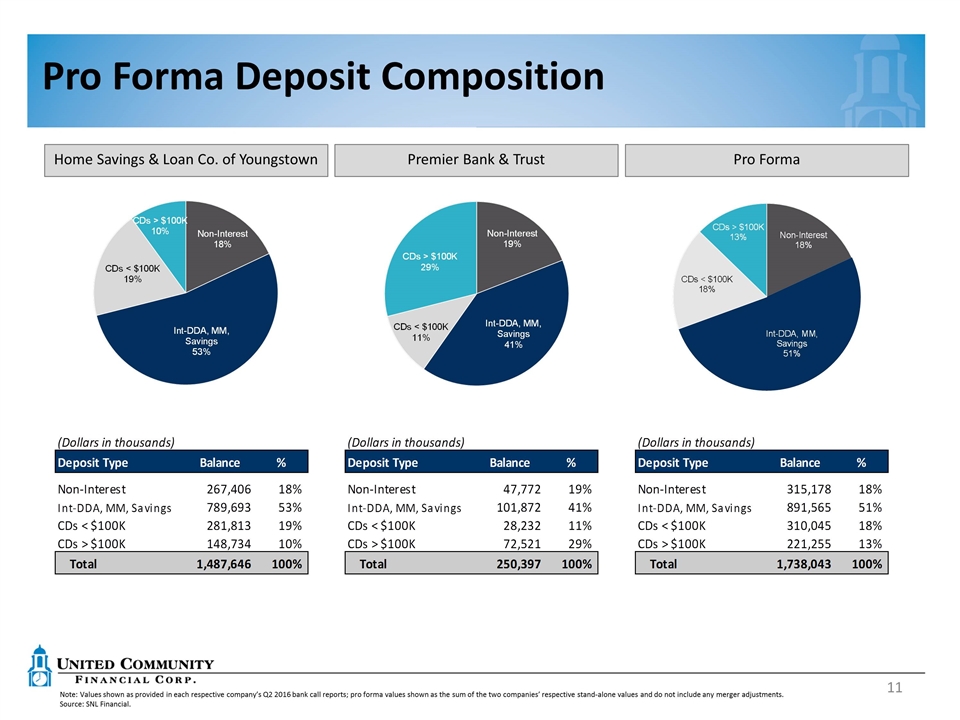

Pro Forma Deposit Composition Note: Values shown as provided in each respective company’s Q2 2016 bank call reports; pro forma values shown as the sum of the two companies’ respective stand-alone values and do not include any merger adjustments. Source: SNL Financial. Home Savings & Loan Co. of Youngstown Premier Bank & Trust Pro Forma

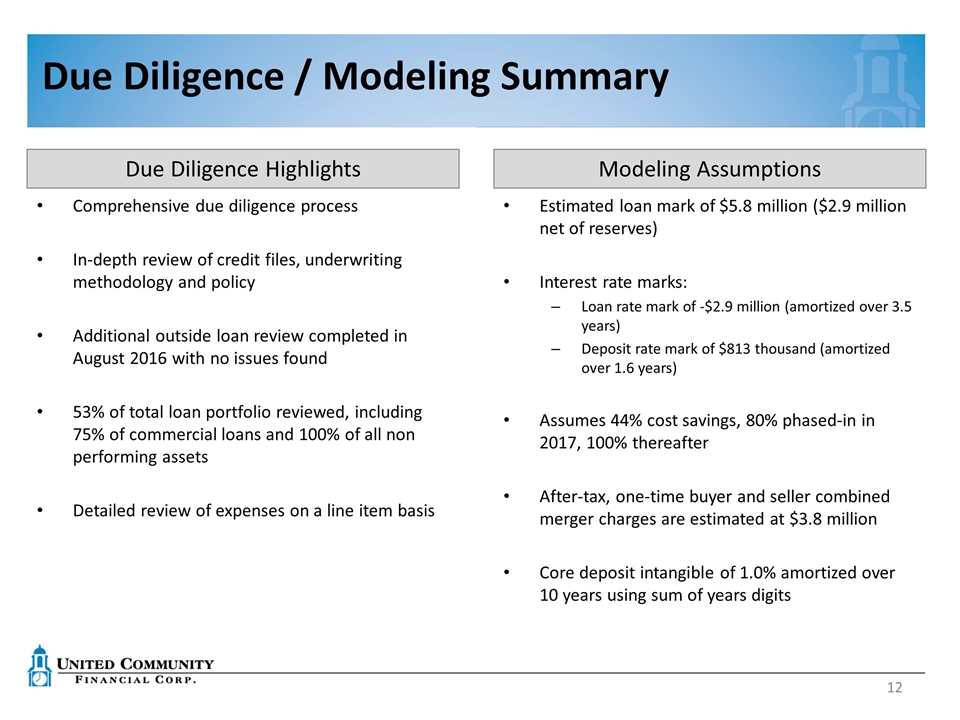

Due Diligence / Modeling Summary Comprehensive due diligence process In-depth review of credit files, underwriting methodology and policy Additional outside loan review completed in August 2016 with no issues found 53% of total loan portfolio reviewed, including 75% of commercial loans and 100% of all non performing assets Detailed review of expenses on a line item basis Modeling Assumptions Estimated loan mark of $5.8 million ($2.9 million net of reserves) Interest rate marks: Loan rate mark of -$2.9 million (amortized over 3.5 years) Deposit rate mark of $813 thousand (amortized over 1.6 years) Assumes 44% cost savings, 80% phased-in in 2017, 100% thereafter After-tax, one-time buyer and seller combined merger charges are estimated at $3.8 million Core deposit intangible of 1.0% amortized over 10 years using sum of years digits Due Diligence Highlights

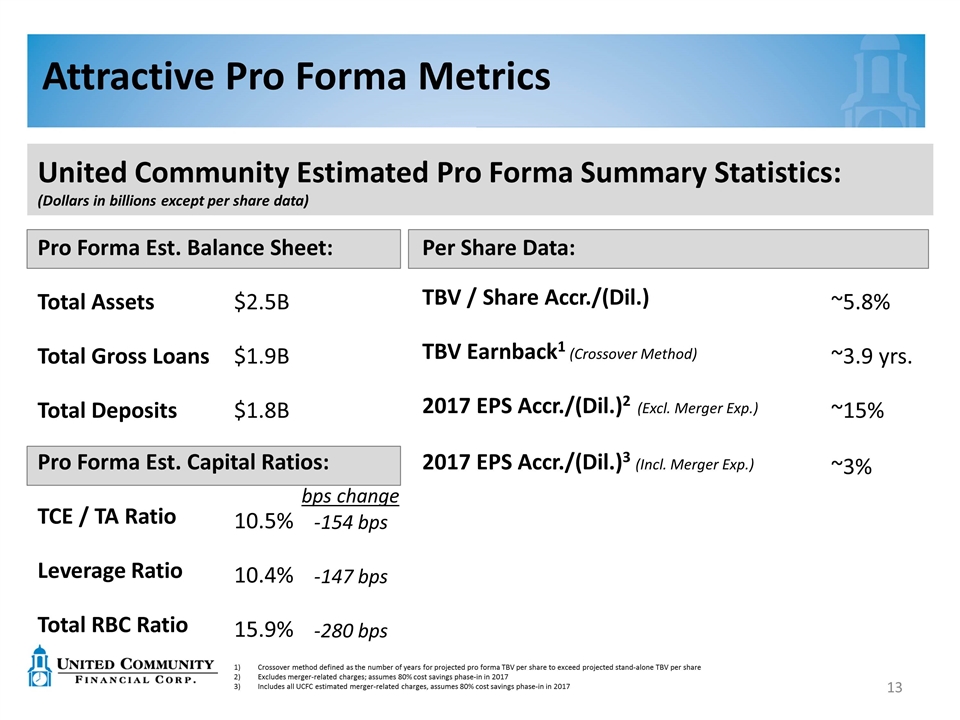

Attractive Pro Forma Metrics Crossover method defined as the number of years for projected pro forma TBV per share to exceed projected stand-alone TBV per share Excludes merger-related charges; assumes 80% cost savings phase-in in 2017 Includes all UCFC estimated merger-related charges, assumes 80% cost savings phase-in in 2017 bps change United Community Estimated Pro Forma Summary Statistics: (Dollars in billions except per share data) Pro Forma Est. Balance Sheet: Per Share Data: Total Assets $2.5B TBV / Share Accr./(Dil.) ~5.8% Total Gross Loans $1.9B TBV Earnback1 (Crossover Method) ~3.9 yrs. Total Deposits $1.8B 2017 EPS Accr./(Dil.)2 (Excl. Merger Exp.) ~15% Pro Forma Est. Capital Ratios: 2017 EPS Accr./(Dil.)3 (Incl. Merger Exp.) ~3% TCE / TA Ratio 10.5% -154 bps Leverage Ratio 10.4% -147 bps Total RBC Ratio 15.9% -280 bps

Summary Highlights Accelerates UCFC’s achievement of strategic business drivers Commercially oriented franchise with strong asset quality Enhances UCFC’s position in the Canton and Akron markets and expands the franchise into the Belmont County market Retention of Rick Hull and Denise Penz, Board representation, and key business team to preserve franchise value Provides new wealth management and trust business to be implemented across UCFC Financially compelling: Approximately ~15% accretive to EPS in the first full year(1) Modest TBV dilution with ~3.9 year earn back (crossover method)(2) Pro forma capital levels well above minimum requirements; flexibility to continue organic growth and future acquisitions Excludes merger-related charges; assumes 80% cost savings phase-in in 2017 Crossover method defined as the number of years for projected pro forma TBV per share to exceed projected stand-alone TBV per share

Investor Relations Contact: Troy Adair 330.742.0472 tadair@homesavings.com