Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RAYMOND JAMES FINANCIAL INC | a8-k_3q16shareholdersletter.htm |

(1) Includes acquisition-related expenses incurred to date associated with our announced acquisitions.

(2) The Other segment includes the results of our principal capital and private equity activities as well as certain corporate overhead costs of RJF, including the interest costs on our public debt, and the acquisition and integration

costs associated with certain acquisitions (including expenses incurred to-date associated with our announced acquisitions).

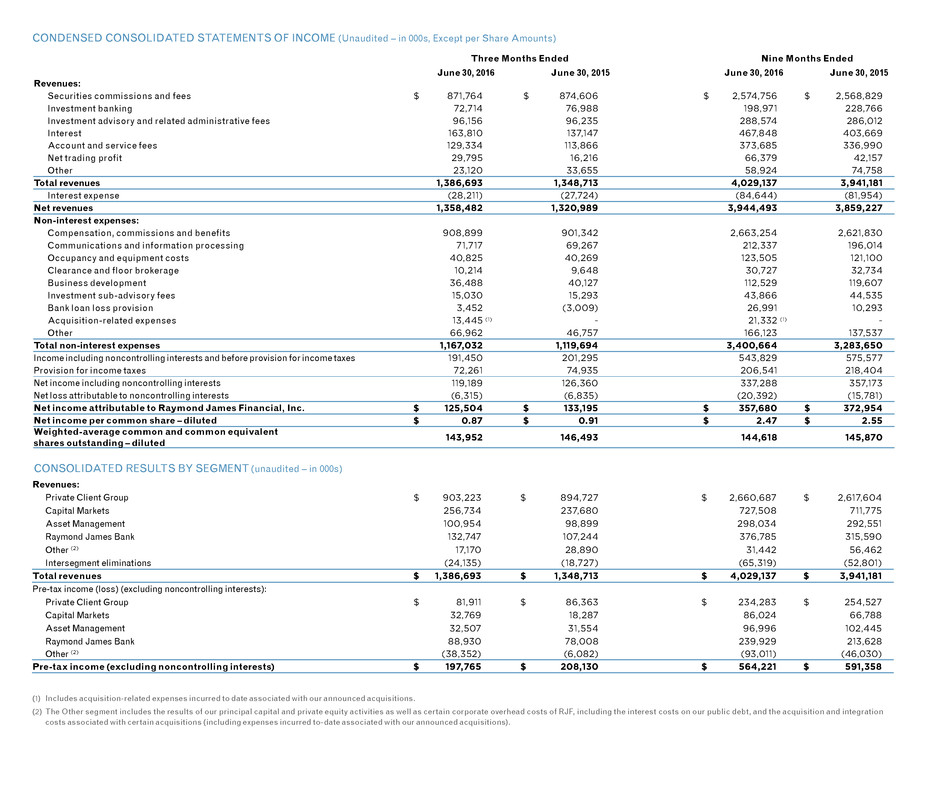

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited – in 000s, Except per Share Amounts)

CONSOLIDATED RESULTS BY SEGMENT (unaudited – in 000s)

Revenues:

Private Client Group $ 903,223 $ 894,727 $ 2,660,687 $ 2,617,604

Capital Markets 256,734 237,680 727,508 711,775

Asset Management 100,954 98,899 298,034 292,551

Raymond James Bank 132,747 107,244 376,785 315,590

Other (2) 17,170 28,890 31,442 56,462

Intersegment eliminations (24,135) (18,727) (65,319) (52,801)

Total revenues $ 1,386,693 $ 1,348,713 $ 4,029,137 $ 3,941,181

Pre-tax income (loss) (excluding noncontrolling interests):

Private Client Group $ 81,911 $ 86,363 $ 234,283 $ 254,527

Capital Markets 32,769 18,287 86,024 66,788

Asset Management 32,507 31,554 96,996 102,445

Raymond James Bank 88,930 78,008 239,929 213,628

Other (2) (38,352) (6,082) (93,011) (46,030)

Pre-tax income (excluding noncontrolling interests) $ 197,765 $ 208,130 $ 564,221 $ 591,358

Three Months Ended Nine Months Ended

June 30, 2016 June 30, 2015 June 30, 2016 June 30, 2015

Revenues:

Securities commissions and fees $ 871,764 $ 874,606 $ 2,574,756 $ 2,568,829

Investment banking 72,714 76,988 198,971 228,766

Investment advisory and related administrative fees 96,156 96,235 288,574 286,012

Interest 163,810 137,147 467,848 403,669

Account and service fees 129,334 113,866 373,685 336,990

Net trading profit 29,795 16,216 66,379 42,157

Other 23,120 33,655 58,924 74,758

Total revenues 1,386,693 1,348,713 4,029,137 3,941,181

Interest expense (28,211) (27,724) (84,644) (81,954)

Net revenues 1,358,482 1,320,989 3,944,493 3,859,227

Non-interest expenses:

Compensation, commissions and benefits 908,899 901,342 2,663,254 2,621,830

Communications and information processing 71,717 69,267 212,337 196,014

Occupancy and equipment costs 40,825 40,269 123,505 121,100

Clearance and floor brokerage 10,214 9,648 30,727 32,734

Business development 36,488 40,127 112,529 119,607

Investment sub-advisory fees 15,030 15,293 43,866 44,535

Bank loan loss provision 3,452 (3,009) 26,991 10,293

Acquisition-related expenses 13,445 - 21,332 -

Other 66,962 46,757 166,123 137,537

Total non-interest expenses 1,167,032 1,119,694 3,400,664 3,283,650

Income including noncontrolling interests and before provision for income taxes 191,450 201,295 543,829 575,577

Provision for income taxes 72,261 74,935 206,541 218,404

Net income including noncontrolling interests 119,189 126,360 337,288 357,173

Net loss attributable to noncontrolling interests (6,315) (6,835) (20,392) (15,781)

Net income attributable to Raymond James Financial, Inc. $ 125,504 $ 133,195 $ 357,680 $ 372,954

Net income per common share – diluted $ 0.87 $ 0.91 $ 2.47 $ 2.55

Weighted-average common and common equivalent

shares outstanding – diluted 143,952 146,493 144,618 145,870

(1) (1)

International Headquarters:

The Raymond James Financial Center

880 Carillon Parkway // St. Petersburg, FL 33716

800.248.8863 // raymondjames.com

©2016 Raymond James Financial

Raymond James® is a registered trademark of Raymond James Financial, Inc.

15-Fin-Rep-0017 KM 9/16

Stock Traded: NEW YORK STOCK EXCHANGE

Stock Symbol: RJF

corporate profile

Raymond James Financial, Inc., (NYSE: RJF) is a leading

diversified financial services company providing

private client, capital markets, asset management,

banking and other services to individuals, corporations

and municipalities. Its three principal wholly owned

broker/dealers, Raymond James & Associates, Raymond

James Financial Services and Raymond James Ltd.,

have approximately 6,800 financial advisors serving

in excess of 2.8 million client accounts in more than

2,800 locations throughout the United States, Canada

and overseas. Total client assets are approximately

$535 billion. Public since 1983, the firm has been listed

on the New York Stock Exchange since 1986 under the

symbol RJF. Additional information is available at

raymondjames.com.

2016

T H I R D Q U A R T E R

CHANGE

GROWTH

OPPORTUNITY

HEADWINDS

REGULATION

EXPLORATION

UNPREDICTABILITY

INVESTING WISELY

LIVING WELL

MOBILITY

2

1 6

Dear Fellow Shareholders,

As we write this letter, the S&P 500 index has

recovered from its precipitous drop following the

unexpected “Brexit” vote in June and is now hovering

near all-time highs. While corporate earnings in the June

quarter beat analysts’ estimates, adjusted earnings per

share for the S&P 500 still posted annual declines for the

fourth consecutive quarter. Meanwhile, global economic

and political concerns as well as unprecedented support

from central banks around the world have pushed high-

quality government bond yields to record lows.

Unfortunately, that financial stimulation has failed to

engender much corporate growth. Given these

crosscurrents, coupled with the seven-year bull market

in the United States, the increasingly widespread

apprehension among investors is justifiable.

Despite this suboptimal backdrop, Raymond James

generated record quarterly net revenues of $1.36 billion,

increasing 3% over the prior year’s fiscal third quarter

and 4% over the preceding quarter. All four of our core

operating segments produced revenue growth during the

quarter, and three of those segments – the Private Client

Group, Asset Management and Raymond James Bank –

achieved record quarterly revenues that were driven by

organic growth. Quarterly net income of $125.5 million,

or $0.87 per diluted share, declined 6% compared to the

prior year’s fiscal third quarter and was essentially flat

compared to the preceding quarter. Earnings were

hampered during the quarter by $13.4 million of

acquisition-related expenses as well as elevated legal

and regulatory expenses largely related to historical

anti-money laundering (AML) deficiencies, which will be

discussed later in this letter. The annualized return on

equity for the quarter was 10.7%, falling below our long-

term target of 12%-15% but still reflecting an acceptable

result given the lackluster market environment, the

aforementioned expenses and our relatively conservative

capital position.

For the first three quarters of fiscal 2016, net revenues

were $3.94 billion, up 2% over the same period in fiscal

2015 and representing a record start to our fiscal year.

Net income of $357.7 million, or $2.47 per diluted share,

declined 4%, which was primarily attributable to $21.3

million of acquisition-related expenses during the first

nine months of the fiscal year. We also achieved many

other records on June 30, including total balance sheet

assets of $28.8 billion, shareholders’ equity of $4.7 billion,

client assets under administration of $534.5 billion, total

number of Private Client Group financial advisors of 6,834,

financial assets under management of $71.7 billion and net

loans at Raymond James Bank of $14.8 billion. These

milestones are a testament to our firm’s steadfast

commitment on serving clients and should bode well for

future results.

During the quarter, the Private Client Group (PCG)

segment attained record quarterly net revenues of $900.5

million, increasing 1% compared to the prior year’s fiscal

third quarter and 2% compared to the preceding quarter.

Quarterly pre-tax income of $81.9 million was down 5% on

a year-over-year basis and 2% sequentially. Revenues in the

segment benefited from beginning the quarter with higher

assets in fee-based accounts as well as higher account and

service fees, which were both bolstered by excellent

financial advisor retention and recruiting. However, the

decline in PCG’s pre-tax income in the quarter was

attributable to subdued transactional commissions and

elevated legal and regulatory expenses. The strong net

recruiting results enabled PCG to achieve a record 6,834

financial advisors, impressive increases of 327 over June

2015 and 69 over March 2016. Client assets under

administration in the segment of $506 billion also reached

a new record, growing 6% compared to last year’s June and

4% compared to the preceding March. These records are

expected to be surpassed in the fourth quarter, as we are

on target to close the acquisition of the US Private Client

Services unit of Deutsche Bank Wealth Management in

September. We are also excited about the pending 3Macs

acquisition, which we are confident will be a high-quality

addition to our Private Client Group in Canada.

Quarterly net revenues in the Capital Markets segment

of $251.6 million increased 8% over last year’s June quarter

and 6% over the preceding quarter. Pre-tax income in the

quarter of $32.8 million was up a substantial 79% over last

year’s fiscal third quarter and 17% over the preceding

quarter. The segment’s results in the quarter were lifted by

record trading profits as well as an improvement in both

institutional equity and fixed income commissions

compared to the year-ago quarter. Trading profits and

institutional commissions were aided by increased market

volatility in June following the “Brexit” vote. After suffering

from a dearth of equity underwriting activity over the past

12 months, we are cautiously optimistic about our

investment banking pipelines, which should be helped by

more stable commodity prices as well as our acquisition

during the quarter of Mummert & Company, which

enhances our M&A platform in Europe.

The Asset Management segment generated record

quarterly net revenues of $100.9 million, improving 2% over

last year’s June quarter and 4% over the preceding March

quarter. Quarterly pre-tax income in the segment was $32.5

million, up 3% on a year-over-year basis and 4%

sequentially. Financial assets under management finished

the quarter at $71.7 billion, a new record, lifted by

increased managed account utilization in our Private

Client Group segment in addition to market appreciation.

Raymond James Bank’s quarterly net revenues of $126.6

million reached a new record, growing an impressive 22%

over last year’s fiscal third quarter and 1% over the

preceding quarter. Pre-tax income of $88.9 million for the

quarter also represented a new record, rising 14%

compared to the June 2015 quarter and 4% compared to the

preceding March quarter. The bank’s record results were

primarily attributable to attractive growth of its

outstanding loan balances as well as the relatively

consistent credit quality of the loan portfolio. Net loans in

Raymond James Bank grew a noteworthy 23% over June

2015 to a record $14.8 billion, and the bank’s net interest

margin was relatively resilient at 3.10% for the quarter.

Total revenues in the “Other” segment, which consists

primarily of private equity valuation gains, were $17.2

million, of which $7.4 million was attributable to

noncontrolling interests. Pre-tax income in the segment

was also impacted by the aforementioned $13.4 million of

acquisition-related expenses during the quarter.

There were several other notable accomplishments

during the quarter. In June, Raymond James was named to

the Fortune 500 list. During the quarter, we also extended

the naming rights for Raymond James Stadium by 12 years

through the 2027 season. Many of our associates and

affiliated financial advisors also earned noteworthy

accolades during the quarter, including: five advisors being

named to the Barron’s list of 2016 Top Women Financial

Advisors, six program managers within our Financial

Institutions Division were named to Bank Investment

Consultant’s list of Top 20 Program Managers, and advisor

Darin Robert Shebesta and Raymond James Network for

Women Advisors’ Michelle Lynch were named to

InvestmentNews’ Top 40 under 40. Within Investment

Banking, Raymond James was recognized with two

honors by The M&A Advisor: Technology Deal of the Year

for the over $250 million category as well as Corporate &

Strategic Acquisition of the Year for the $100 million to

$500 million category. Also, for the second year in a row,

our restructuring team won Turnaround Deal of the Year

from the Global M&A Network.

As discussed earlier in this letter, our fiscal year-to-date

results have been adversely impacted by elevated legal and

regulatory expenses associated with historical AML

deficiencies. Specifically, during the quarter, FINRA

announced a $17 million fine and the state of Vermont

announced a $6 million settlement ($4.5 million of which

will be set aside for possible future claims by investors)

that both essentially related to our past failure to establish

and implement adequate AML procedures to properly

detect and prevent suspicious activity. We take these

responsibilities very seriously, and we have made

significant progress in addressing the shortcomings in our

AML policies and procedures, including hiring a new Chief

AML Officer, hiring an additional 50 associates on the AML

team and implementing a new technology platform called

Mantas, which is also utilized by several of the largest

banks. Given the increasingly intense regulatory

environment, all firms in our industry, including Raymond

James, will be required to substantially increase their

ongoing investments in regulatory compliance and risk

management. Fortunately, we have the scale and resources

to utilize state-of-the-art industry best practices and tools.

The outlook for the rest of the calendar year is uncertain.

Presidential elections always breed angst, and there is

certainly no reason to believe the upcoming election will be

any different. Furthermore, the real implications of the

“Brexit” vote to Europe and the rest of the world will take at

least one or two years to unravel. Finally, the direct and

indirect consequences of the unprecedented support from

central banks across the globe are incalculable. While we

would not be surprised by increased market volatility over

the next year or two, we remain absolutely confident the

United States is relatively well-positioned in these

uncertain times, as disposable income and household

wealth continue to recover gradually, the unemployment

JUNE 30,

2016

SEPTEMBER 30,

2015

Assets:

Cash and cash equivalents $1,978,057 $2,601,006

Assets segregated pursuant

to regulations and other

segregated assets

3,668,989 2,905,324

Securities purchased under

agreements to resell and other

collateralized financings

444,812 474,144

Financial instruments,

at fair value 2,279,224 2,051,577

Receivables 18,352,356 16,435,340

Property & equipment, net 294,994 255,875

Other assets 1,824,999 1,756,418

Total assets $28,843,431 $26,479,684

Liabilities and equity:

Loans payable $1,759,329 $1,878,247

Payables 20,369,901 17,962,826

Trading instruments sold but

not yet purchased, at fair value 285,299 287,993

Securities sold under

agreements to repurchase 266,158 332,536

Other liabilities 1,168,614 1,231,984

Total liabilities $23,849,301 $21,693,586

Total equity attributable to

Raymond James Financial, Inc. 4,747,459 4,522,031

Noncontrolling interests 246,671 264,067

Total equity $4,994,130 $4,786,098

Total liabilities and equity $28,843,431 $26,479,684

CONDENSED CONSOLIDATED STATEMENTS

OF FINANCIAL CONDITION (Unaudited – in 000s)

RAYMOND JAMES FINANCIAL THIRD QUARTER REPORT 2016

Sincerely,

Thomas A. James Paul C. Reilly

Chairman CEO

August 31, 2016

rate remains low, and the cost of financing for both

businesses and consumers is attractive. If businesses

deploy more of their capital into long-term growth

investments instead of record levels of share repurchases,

domestic GDP growth would be further supported.

We sincerely appreciate your trust and ownership in

Raymond James. We remain committed to generating

superior long-term returns for our shareholders in any

market environment by always putting clients first.

(1) Includes acquisition-related expenses incurred to date associated with our announced acquisitions.

(2) The Other segment includes the results of our principal capital and private equity activities as well as certain corporate overhead costs of RJF, including the interest costs on our public debt, and the acquisition and integration

costs associated with certain acquisitions (including expenses incurred to-date associated with our announced acquisitions).

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited – in 000s, Except per Share Amounts)

CONSOLIDATED RESULTS BY SEGMENT (unaudited – in 000s)

Revenues:

Private Client Group $ 903,223 $ 894,727 $ 2,660,687 $ 2,617,604

Capital Markets 256,734 237,680 727,508 711,775

Asset Management 100,954 98,899 298,034 292,551

Raymond James Bank 132,747 107,244 376,785 315,590

Other (2) 17,170 28,890 31,442 56,462

Intersegment eliminations (24,135) (18,727) (65,319) (52,801)

Total revenues $ 1,386,693 $ 1,348,713 $ 4,029,137 $ 3,941,181

Pre-tax income (loss) (excluding noncontrolling interests):

Private Client Group $ 81,911 $ 86,363 $ 234,283 $ 254,527

Capital Markets 32,769 18,287 86,024 66,788

Asset Management 32,507 31,554 96,996 102,445

Raymond James Bank 88,930 78,008 239,929 213,628

Other (2) (38,352) (6,082) (93,011) (46,030)

Pre-tax income (excluding noncontrolling interests) $ 197,765 $ 208,130 $ 564,221 $ 591,358

Three Months Ended Nine Months Ended

June 30, 2016 June 30, 2015 June 30, 2016 June 30, 2015

Revenues:

Securities commissions and fees $ 871,764 $ 874,606 $ 2,574,756 $ 2,568,829

Investment banking 72,714 76,988 198,971 228,766

Investment advisory and related administrative fees 96,156 96,235 288,574 286,012

Interest 163,810 137,147 467,848 403,669

Account and service fees 129,334 113,866 373,685 336,990

Net trading profit 29,795 16,216 66,379 42,157

Other 23,120 33,655 58,924 74,758

Total revenues 1,386,693 1,348,713 4,029,137 3,941,181

Interest expense (28,211) (27,724) (84,644) (81,954)

Net revenues 1,358,482 1,320,989 3,944,493 3,859,227

Non-interest expenses:

Compensation, commissions and benefits 908,899 901,342 2,663,254 2,621,830

Communications and information processing 71,717 69,267 212,337 196,014

Occupancy and equipment costs 40,825 40,269 123,505 121,100

Clearance and floor brokerage 10,214 9,648 30,727 32,734

Business development 36,488 40,127 112,529 119,607

Investment sub-advisory fees 15,030 15,293 43,866 44,535

Bank loan loss provision 3,452 (3,009) 26,991 10,293

Acquisition-related expenses 13,445 - 21,332 -

Other 66,962 46,757 166,123 137,537

Total non-interest expenses 1,167,032 1,119,694 3,400,664 3,283,650

Income including noncontrolling interests and before provision for income taxes 191,450 201,295 543,829 575,577

Provision for income taxes 72,261 74,935 206,541 218,404

Net income including noncontrolling interests 119,189 126,360 337,288 357,173

Net loss attributable to noncontrolling interests (6,315) (6,835) (20,392) (15,781)

Net income attributable to Raymond James Financial, Inc. $ 125,504 $ 133,195 $ 357,680 $ 372,954

Net income per common share – diluted $ 0.87 $ 0.91 $ 2.47 $ 2.55

Weighted-average common and common equivalent

shares outstanding – diluted 143,952 146,493 144,618 145,870

(1) (1)

International Headquarters:

The Raymond James Financial Center

880 Carillon Parkway // St. Petersburg, FL 33716

800.248.8863 // raymondjames.com

©2016 Raymond James Financial

Raymond James® is a registered trademark of Raymond James Financial, Inc.

15-Fin-Rep-0017 KM 9/16

Stock Traded: NEW YORK STOCK EXCHANGE

Stock Symbol: RJF

corporate profile

Raymond James Financial, Inc., (NYSE: RJF) is a leading

diversified financial services company providing

private client, capital markets, asset management,

banking and other services to individuals, corporations

and municipalities. Its three principal wholly owned

broker/dealers, Raymond James & Associates, Raymond

James Financial Services and Raymond James Ltd.,

have approximately 6,800 financial advisors serving

in excess of 2.8 million client accounts in more than

2,800 locations throughout the United States, Canada

and overseas. Total client assets are approximately

$535 billion. Public since 1983, the firm has been listed

on the New York Stock Exchange since 1986 under the

symbol RJF. Additional information is available at

raymondjames.com.

2016

T H I R D Q U A R T E R

CHANGE

GROWTH

OPPORTUNITY

HEADWINDS

REGULATION

EXPLORATION

UNPREDICTABILITY

INVESTING WISELY

LIVING WELL

MOBILITY

2

1 6

International Headquarters:

The Raymond James Financial Center

880 Carillon Parkway // St. Petersburg, FL 33716

800.248.8863 // RaymondJames.com

©2016 Raymond James Financial

Raymond James® is a registered trademark of Raymond James Financial, Inc.

15-Fin-Rep-0015 KM 5/16

Stock Traded: NEW YORK STOCK EXCHANGE

Stock Symbol: RJF

corporate profile

Raymond James Financial, Inc. (NYSE: RJF) is a leading

diversified financial services company providing

private client, capital markets, asset management,

banking and other services to individuals, corporations

and municipalities. Its three principal wholly owned

broker/dealers, Raymond James & Associates, Raymond

James Financial Services and Raymond James Ltd.,

have approximately 6,700 financial advisors serving

in excess of 2.8 million client accounts in more than

2,700 locations throughout the United States, Canada

and overseas. Total client assets are approximately

$514 billion. Public since 1983, the firm has been listed

on the New York Stock Exchange since 1986 under the

symbol RJF. Additional information is available at

www.raymondjames.com.