Attached files

| file | filename |

|---|---|

| EX-10.3 - EXHIBIT 10.3 - SPLUNK INC | exhibit10373116.htm |

| EX-10.2 - EXHIBIT 10.2 - SPLUNK INC | exhibit10273116.htm |

| EX-31.2 - EXHIBIT 31.2 - SPLUNK INC | exhibit31273116.htm |

| EX-31.1 - EXHIBIT 31.1 - SPLUNK INC | exhibit31173116.htm |

| EX-32.1 - EXHIBIT 32.1 - SPLUNK INC | exhibit32173116.htm |

| 10-Q - 10-Q - SPLUNK INC | a731201610q.htm |

Exhibit 10.1

THIRD AMENDMENT TO OFFICE LEASE

This THIRD AMENDMENT TO OFFICE LEASE ("Third Amendment") is made and entered into as of the 11th day of December, 2015, by and between KILROY REALTY, L.P., a Delaware limited partnership ("Landlord"), and SPLUNK INC., a Delaware corporation ("Tenant").

RECITALS :

A. Brannan Propco, LLC, a Delaware limited liability company, as predecessor-in-interest to Landlord, and Tenant entered into that certain Office Lease dated as of March 6, 2008 (the "Office Lease"), as amended by that certain First Amendment to Office Lease dated June 10, 2011 (the "First Amendment"), and that certain Second Amendment to Office Lease dated November 20, 2012 (the "Second Amendment") (the Office Lease, the First Amendment and the Second Amendment are collectively referred to herein as the "Lease"), whereby Landlord currently leases to Tenant and Tenant leases from Landlord all of the rentable office space (the "Office Premises") in that certain office building located and addressed at 250 Brannan Street, San Francisco, California, and more particularly defined in the Lease as the "Building." The Office Premises consists of 95,008 rentable square feet of space, consisting of 32,993 rentable square feet constituting the Expansion Premises defined in the Second Amendment (Suite 300) and 62,015 rentable square feet of space constituting the Existing Premises defined in the Second Amendment (Suites 100 and 200). The Building includes a parking garage area (the "Garage") that is currently part of the common area of the Building and is not currently included in the Premises.

B. Tenant desires to expand the Premises currently leased under the Lease to include the Garage. Landlord and Tenant desire to enter into this Third Amendment to provide for the inclusion of the Garage in the Premises covered by the Lease, and to make other modifications to the Lease.

AGREEMENT :

NOW, THEREFORE, in consideration of the foregoing recitals and the mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

1.Capitalized Terms. All initially capitalized defined terms used herein shall have the same meanings as are given such terms in the Lease unless expressly superseded by the terms of this Third Amendment.

2.Expansion of the Premises.

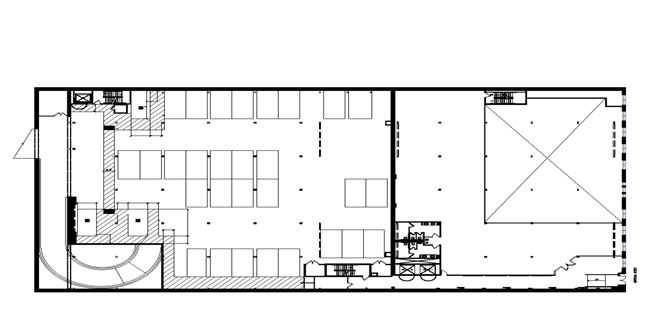

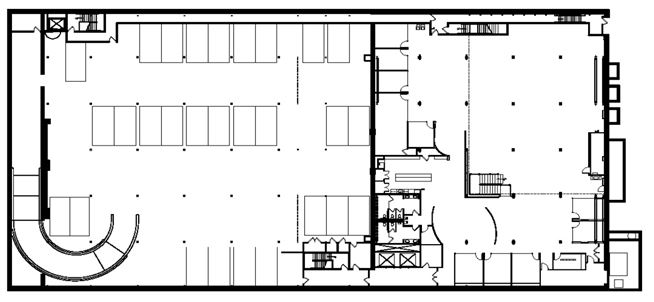

2.1 As of January 1, 2016 (the "Expansion Effective Date"), Tenant shall lease from Landlord and Landlord shall lease to Tenant the Garage. The Garage is outlined in the diagram attached as Exhibit G-1 hereto. Consequently, as of the Expansion Effective Date, (a) the "Premises" as defined in the Lease shall include both the Office Premises and the Garage, and (b) the Office Premises and the Garage shall be referred to collectively in the Lease as amended hereby (the "Amended Lease") as the "Premises" (except as otherwise provided in this Third Amendment). It is intended by the parties hereto that this Third Amendment shall constitute the "Parking Agreement" contemplated in Section 12.3 of the Second Amendment, and therefore the sole agreement of Landlord and Tenant with respect to the use of the Garage by Tenant for the remainder of the Term following the Expansion Effective Date. Following the Expansion Effective Date, Section 12 of the Second Amendment will be of no force or effect.

2.2 Subject to Landlord's certain repair and replacement obligations under the Amended Lease concerning the Premises, Landlord shall not be obligated to provide or pay for any improvement work or services related to the improvement, maintenance, repair and operation of the Garage, all of which shall be Tenant's responsibility as provided (and subject to any express limitations) in this Third Amendment. Tenant shall accept the Garage and continue to accept the Office Premises in their presently existing "as-is" condition, subject only to any express obligations of Landlord under the Amended Lease to the contrary.

3.Garage Term. The term of Tenant's leasing of the Garage, and Tenant's obligation to pay Rent with respect to the Garage as provided in this Third Amendment, shall commence on the Expansion Effective Date and expire, unless sooner terminated in accordance with the terms of the Amended Lease, on the New Term Expiration Date defined in the Second Amendment,

which is February 28, 2019 (the "Garage Term"). Tenant has no right to extend the Garage Term as to the Garage and the terms of Section 16 of the Second Amendment are not applicable to Tenant's lease of the Garage.

4.Base Rent.

4.1 Base Rent for the Office Premises. Tenant shall continue to pay Base Rent for the Office Premises at the rates provided in the Lease.

4.2 Base Rent for the Garage. Commencing on the Expansion Effective Date and continuing throughout the Garage Term, in addition to the Base Rent due on the Office Premises as required by the Lease, Tenant shall pay to Landlord installments of Base Rent for the Garage as follows:

Period During Garage Term | Monthly Installment of Base Rent |

1/1/16-12/31/16 | $26,306.25 |

1/1/17-12/31/17 | $27,226.97 |

1/1/18-12/31/18 | $28,179.92 |

1/1/19-2/28/19 | $29,174.67 |

All such Base Rent shall be payable by Tenant in accordance with the terms of the Lease.

5.Property Tax and Operating Expense and Direct Reimbursement Payments Adjustment. Prior to the Expansion Effective Date, Tenant shall continue to pay the Property Tax and Operating Expense and Direct Reimbursement Payments Adjustment in connection with the Office Premises in accordance with the terms of the Lease. In consideration of the fact that Tenant will be assuming responsibility for the operation of the Garage and for providing security services for the Building, including the Garage, effective as of the Expansion Effective Date, the statement attached as Schedule S-1 shall constitute the Base Year Operating Expenses applicable to the entire Premises pursuant to Section 5 of the Second Amendment. Without limiting the foregoing, for the purposes of calculating Operating Expenses attributable to each year or portion thereof during the Garage Term, Operating Expenses will in no event include the expenses of providing security services for the Building, unless required to secure the Building following failure of Tenant to provide security services in accordance with the Amended Lease, nor will such operating expenses include any costs of operation of the Garage, including, without limitation, any repair or maintenance of the Garage which Tenant is required to perform under the Amended Lease, the cost of hiring any Operator (as defined herein) to operate the Garage and/or the cost of utilities to the Garage, which shall constitute a Direct Reimbursement Expense reimbursable by Tenant to Landlord under the Amended Lease. There shall be no change in how Property Taxes are calculated and paid by Landlord and reimbursed by Tenant, either in the Base Year or through Property Tax Reimbursement Payments, by virtue of Tenant's lease of the Garage as provided herein.

6.Permitted Use of the Premises. Notwithstanding anything to the contrary provided in Section 6.1 of the Office Lease, Tenant and its employees, visitors, contractors, invitees and/or subtenants (subtenants being subject to the last paragraph of Section 8 below and the other terms of the Lease governing assignments and sublettings) may use the Garage in any lawful manner only for parking purposes; provided, however that if Tenant seeks to provide parking to any user other than Tenant and its permitted subtenants and their respective employees, visitors, contractors and/invitees or to use the Garage for other than ordinary parking purposes (herein a “Third Party Use”), such Third Party Use will comply with all applicable laws and will not be materially more intensive than was the use of the Garage in the period preceding the inclusion of the Garage in the Premises. Tenant shall be entitled to all revenue generated from any Third Party Use and such use will not be subject to the subleasing or assignment provisions, or any revenue sharing provisions of Article XIV of the Office Lease, including, without limitation, Section 14.5 thereof.

7.Maintenance. Tenant shall maintain and operate the Garage in reasonably good condition and repair and consistent with the standards in which Landlord has maintained and operated the Garage prior to the Expansion Effective Date (and otherwise in compliance with Sections 6.2 and 8.2 of the Office Lease as if the Garage was part of the Premises covered by the Office Lease), provided, however, that as concerns the Garage, Landlord shall be responsible for the work described in Section 6.2(E) and in clauses (c), (d), (e) and (f) of Section 8.1 the Office Lease, and the costs incurred by Landlord in connection therewith may be charged as Operating Expenses only to the extent permitted in Article IV of the Office Lease, unless the need for such work arises out of a particular change in use or a reconfiguration of the Garage by Tenant or any Operator defined below, in which case Tenant will reimburse Landlord for such costs without being limited by any of the limiting terms included in Article IV of the Office Lease.

8.Operation of the Garage. For so long as the Garage is operated as a commercial parking facility, Tenant shall operate the Garage to a standard at least consistent with the manner in which the Garage is being operated on the Expansion Effective Date. Without limiting the foregoing, while the Garage is operated as a commercial parking garage, Tenant shall, at Tenant’s sole cost, contract with a contractor reasonably satisfactory to Landlord to operate the Garage (Impark, ABM Parking, SP+, Tower Valet, Ace Parking, and Citypark, and any successors thereto by operation of law, being garage operators satisfactory to Landlord) (the “Operator”). Tenant shall cause such Operator to maintain such amounts of garagekeeper’s liability insurance or comparable coverage, as may be customary for such Operator’s operations of parking garages similar to the Garage in the City and County of San Francisco. Tenant shall cause Operator’s garagekeeper’s liability insurance to name Landlord and Tenant as additional insureds under such coverage. Any agreement entered into between Tenant and such Operator shall provide that the Operator shall provide written evidence of the coverage required hereunder promptly after written request by Landlord or Tenant. Additionally, the parties agree that, during the Garage Term, changes in the insurance industry may require alternative insurance with respect to the type of insurance provided, the insured risk, amount of deductibles, etc. Accordingly, Tenant shall purchase (or shall cause the Operator to purchase), if required by such circumstances and at Tenant's (or the Operator's) sole cost and expense, substitute or additional insurance of a type generally available and prudently purchased by operators of similar parking facilities and exposed to similar risks, taking into account a prudent cost/benefit analysis of the purchase of such insurance. Such alternative insurance must provide at least the same degree of protection and coverage as that originally required under this Section. Landlord will not be required to provide security, janitorial or cleaning services for the Garage. Without limiting the foregoing, any additional security measures in the Garage instituted by Tenant to protect the Premises from entry by unauthorized persons shall not be deemed to violate Tenant’s obligation to operate the Garage to a standard at least consistent with the manner in which the Garage is being operated on the Expansion Effective Date, so long as any alterations related thereto shall be subject to Landlord’s consent to the extent required under, and in accordance with the standards specified in, Article IX of the Office Lease. Tenant may in its discretion, discontinue parking operations in all or a portion of the Garage so long as any portion of the Garage operated as a commercial parking facility shall comply with the foregoing, and any use of the portion of the Garage not operated as a commercial parking facility is reasonably ancillary to the Permitted Use specified in the Lease, and such ancillary use otherwise complies with the Lease. Without limiting the terms of Section 7 above or this Section 8, because the Premises originally leased by Tenant under the Lease was "office space" and the Lease therefore did not contemplate Tenant operating, maintaining and repairing a garage facility, and in order to avoid doubt, from and after the Expansion Effective Date, Tenant shall, at its sole cost, with respect to the Garage, do or cause the following to be done:

8.1 Clean and maintain all surfaces of the Garage and keep such surfaces level and evenly covered with the type of surfacing material originally installed thereon, or such substitute thereof as shall be reasonably equal thereto in quality, appearance and durability;

8.2 Remove all papers, debris, filth and refuse from the Garage and wash or thoroughly sweep paved areas;

8.3 Remove trash from trash receptacles and clean trash receptacles;

8.4 Clean, maintain, repair and replace entrance, exit and directional signs, traffic control signage, markers and lights into and within the Garage;

8.5 Clean lighting fixtures and relamp and reballast;

8.6 Maintain, repair and replace striping and curbing;

8.7 Repaint and refinish all painted and finished surfaces and keep all surfaces free of graffiti;

8.8 Clean, maintain and repair all stairs, stairwells and stairwell doors within the Garage;

8.9 Purchase, maintain, repair and replace, if needed, all mechanical, electrical and utility facilities and systems that are (a) a part of or serve the Garage as of the Expansion Effective Date, (b) installed, or required as a result of anything installed, by Tenant or an Operator after the Expansion Effective Date, and/or (c) required because of Tenant's (or any Operator's) particular use of the Garage or the Office Premises, including, without limitation, sprinkler and fire control systems, parking revenue control equipment, parking access control equipment, security systems and equipment, mechanical venting systems, lighting and emergency lighting systems, and traffic barriers;

8.10 If Tenant desires to operate a valet parking program at its sole cost, then such program shall be on terms and with a company reasonably satisfactory to Landlord (Landlord hereby pre-approving the companies identified in the introductory paragraph of this Section 8 above);

8.11 Obtain all operating permits and file all operating reports as required by Applicable Law;

8.12 Handle customer complaints and damage claims (including damage to personal property, theft, and injuries to third parties), purchase supplies, arrange and supervise the handling of receipts, and conduct any and all other services customarily performed by operators of similar parking garages in San Francisco; and

8.13 Employ or contract with such personnel (such as the Operator) as may be necessary to operate the Garage (which personnel shall at all times conduct themselves in a courteous manner and be neat, clean, and properly uniformed), and oversee or cause the Operator to oversee the performance of such personnel. All such personnel shall be the employees or contractors of Tenant or Tenant's Operator and shall have no authority to act as the agent of Landlord.

Additionally, Tenant shall have no right to sublease any portion of the Garage separately from a sublease of the Office Premises permitted under the terms of the Lease. Further, at Landlord's option and upon Tenant assigning the Amended Lease or subleasing more than one (1) full floor of the Office Premises (other than to a Permitted Transferee as Tenant may be permitted to do without Landlord's consent under the Lease), Landlord shall have the right to terminate this Third Amendment upon written notice to Tenant, in which event this Third Amendment shall terminate, the Garage shall no longer be part of the Premises, and neither party shall have any further rights or obligations under this Third Amendment (except for those which are intended to survive such termination) and the Lease will consist of the Office Lease, the First Amendment and the Second Amendment as if this Third Amendment had never been entered into. For avoidance of doubt, Tenant may allow an on-demand valet parking and car services company such as ZIRX to access the Garage at Tenant's sole risk, and such arrangement shall not constitute an assignment or subleasing which is prohibited by the terms of this paragraph.

9.Inspection by CASp. For purposes of Section 1938 of the California Civil Code, Landlord hereby discloses to Tenant, and Tenant hereby acknowledges, that neither the Garage nor the Office Premises have undergone inspection by a Certified Access Specialist (CASp).

10.Tax Status. Tenant recognizes and acknowledges that Landlord and/or certain beneficial owners of Landlord may from time to time qualify as real estate investment trusts pursuant to the Internal Revenue Code and that avoiding (a) the loss of such status, (b) the receipt of any income derived under any provision of this Third Amendment that does not constitute "rents from real property" (in the case of real estate investment trusts), and (c) the imposition of income, penalty or similar taxes (each an "Adverse Event") is of material concern to Landlord and such beneficial owners. In the event that this Third Amendment or any document contemplated hereby could, in the opinion of counsel to Landlord, result in or cause an Adverse Event, Tenant agrees to reasonably cooperate with Landlord in negotiating an amendment or modification thereof and shall at the request of Landlord execute and deliver such documents reasonably required to effect such amendment or modification. Any amendment or modification pursuant to this Section 10 shall be structured so that the economic results to Landlord and Tenant shall be substantially similar to those set forth in this Third Amendment without regard to such amendment or modification. Tenant expressly covenants and agrees not to enter into any sublease or assignment which provides for rental or other payment for such use, occupancy, or utilization based in whole or in part on the net income or profits derived by any person from the property leased, used, occupied, or utilized (other than an amount based on a fixed percentage or percentages of receipts or sales) if any portion of such rental or other payment is payable to Landlord, and that any such purported sublease or assignment that violates the foregoing shall be absolutely void and ineffective as a conveyance of any right or interest in the possession, use, occupancy, or utilization of any part of the Garage. This Section 10 will not in any event be deemed to prohibit the collection of parking revenue in connection with a Third Party Use permitted under this Third Amendment.

11.No Brokers. Landlord and Tenant hereby warrant to each other that they have had no dealings with any real estate broker or agent in connection with the negotiation of this Third Amendment, and that they know of no real estate broker or agent who is entitled to a commission in connection with this Third Amendment. Each party agrees to indemnify and defend the other party against and hold the other party harmless from any and all claims, demands, losses, liabilities, lawsuits, judgments, and costs and expenses (including, without limitation, reasonable attorneys' fees) with respect to any leasing commission or equivalent compensation claimed against the beneficiary of the indemnity alleged to arise from or on account of the indemnifying party's dealings with any real estate broker or agent. The terms of this Section 11 shall survive the expiration or earlier termination of the Amended Lease.

12.Miscellaneous. This Third Amendment sets forth the entire agreement between the parties with respect to the matters set forth herein. There have been no additional oral or written representations or agreements. Under no circumstances shall Tenant be entitled to any Rent abatement, improvement allowance, leasehold improvements, or other work to the Premises, or any similar economic incentives that may have been provided Tenant in connection with entering into the Lease, unless specifically set forth in this Third Amendment. Submission of this Third Amendment by Landlord is not an offer to enter into this

Third Amendment but rather is a solicitation for such an offer by Tenant. Landlord shall not be bound by this Third Amendment until Landlord has executed and delivered the same to Tenant.

13.No Further Modification; Conflict. Except as set forth in this Third Amendment, all of the terms and provisions of the Lease are hereby ratified and confirmed and shall apply with respect to the Garage as part of the Premises under the Lease and shall remain unmodified and in full force and effect. In the event of any conflict between the terms and conditions of the Lease and the terms and conditions of this Third Amendment, the terms and conditions of this Third Amendment shall prevail.

14.Schedules and Exhibits. The following Schedules and Exhibits are attached hereto and incorporated herein:

Schedule S-1 | Line Item Breakdown of 2014 Base Year Operating Expenses, excluding Garage expenses |

Exhibit G-1 | Outline of Garage Premises |

IN WITNESS WHEREOF, this Third Amendment has been executed as of the day and year first above written.

"LANDLORD" | KILROY REALTY, L.P., | |||||

a Delaware limited partnership | ||||||

By: | Kilroy Realty Corporation, | |||||

a Maryland corporation | ||||||

General Partner | ||||||

By: | /s/ Richard Buziak | |||||

Name: | Richard Buziak | |||||

Its: | Senior Vice President | |||||

Asset Management | ||||||

By: | /s/ Mike L. Sanford | |||||

Name: | Mike L. Sanford | |||||

Its: | Executive Vice President | |||||

Northern California | ||||||

"TENANT" | SPLUNK INC., | |||||

a Delaware corporation | ||||||

By: | /s/ Timothy Emanuelson | |||||

Name: | Timothy Emanuelson | |||||

Its: | VP, Controller | |||||

By: | /s/ Raman Kapur | |||||

Name: | Raman Kapur | |||||

Its: | VP Finance | |||||

Schedule S-1

Line Item Breakdown of 2014 Base Year Operating Expenses, excluding Garage Expenses

2014 | |

Description | Base Year |

Utilities: Electric | $316,387.05 |

Utilities: Gas | $33,413.37 |

Utilities: Water & Sewer | $14,808.67 |

Utilities: Rubbish | $12,760.77 |

Utilities: Tenant Reimbursements | -$362,648.55 |

Contract Services: Elevators | $7,124.30 |

Contract Services: Security | $0.00 |

Contract Services: Parking | $0.00 |

Contract Services: Janitorial | $0.00 |

Contract Services: Janit'l - Vacancy Cr | $0.00 |

Janitorial Supplies | $0.00 |

Dayporter | $21,705.00 |

Janitorial Services Other | $5,773.32 |

Contract Services: Window Cleaning | $1,450.00 |

Contract Services: Engineers | $86,850.63 |

Contract Services: HVAC Monitoring | $13,376.91 |

Contract Services: FLS Monitoring | $5,705.48 |

Contract Services: Pest Control | $1,096.00 |

Contract Services Other | $1,415.48 |

Contract Services: Landscaping | $3,425.16 |

Interior Plant Maintenance | $36.70 |

Insurance: General | $0.00 |

Insurance: Amortization | $66,367.34 |

R & M: Supplies | $781.53 |

R & M: Tools | $0.00 |

R & M: Repairs | $12,855.14 |

R & M: Elevator | $1,394.00 |

R & M: Electrical Repairs | $5,590.81 |

R & M: HVAC Repairs | $4,976.72 |

R & M: Landscape Repairs | $1,573.33 |

R & M: Plumbing Repairs | $5,115.50 |

R & M: Roof Repairs | $3,993.00 |

Reimburseable Legal Fees | $0.00 |

R & M: Other | $14,856.89 |

Management Fee | $365,134.70 |

Office of the Building | $157.50 |

Communications | $5,693.70 |

Misc Prop Exp: Gross Receipts Tax | $17,350.55 |

Fees, Permits and Licenses | $1,562.00 |

Misc Prop Exp: Reimb Legal Fees | $922.50 |

Other Direct Expense | $1,875.00 |

Reimbursable Expenses | -$1,050.00 |

Property Tax: Other | $58.73 |

Property Tax: Thomson Maint. Fee | $500.00 |

Property Tax: Thomson Spec Project Fees | $0.00 |

Prop Tax: Estimated Supplemental | $0.00 |

Prop Tax: Amortization APT | $406,777.20 |

Prop Tax: Amort SPT Estimates | $0.00 |

Prop Tax: Amort SPT Actuals | $0.00 |

$1,079,166.43 | |

Exhibit G-1

Outline of Garage Premises