Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - Pacific Green Technologies Inc. | f10k2016ex32i_pacific.htm |

| EX-31.1 - CERTIFICATION - Pacific Green Technologies Inc. | f10k2016ex31i_pacific.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2016

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from [ ] to [ ]

Commission file number 000-54756

| PACIFIC GREEN TECHNOLOGIES INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | N/A | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

| 5205 Prospect Road, Suite 135-226, San Jose, CA | 95129 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (408) 538-3373

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange On Which Registered | |

| N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act:

| Shares of Common Stock, par value $0.001 |

| (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act . Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-K (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of Common Stock held by non-affiliates of the Registrant on September 30, 2013 was $57,425,170.14 based on a $6.62 average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date.

23,908,576 common shares issued and outstanding as of August 15, 2016.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

| Item 1. Business | 1 |

| Item 1A. Risk Factors | 14 |

| Item 1B. Unresolved Staff Comments | 18 |

| Item 2. Properties | 18 |

| Item 3. Legal Proceedings | 19 |

| Item 4. Mine Safety Disclosures | 19 |

| Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 19 |

| Item 6. Selected Financial Data | 21 |

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 21 |

| Item 7A. Quantitative and Qualitative Disclosures About Market Risk | 24 |

| Item 8. Financial Statements and Supplementary Data | 24 |

| Item 9A. Controls and Procedures | 26 |

| Item 9B. Other Information | 27 |

| Item 10. Directors, Executive Officers and Corporate Governance | 28 |

| Item 11. Executive Compensation | 33 |

| Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 35 |

| Item 13. Certain Relationships and Related Transactions, and Director Independence | 36 |

| Item 14. Principal Accounting Fees and Services | 37 |

| Item 15. Exhibits, Financial Statement Schedules | 38 |

Item 1. Business

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this annual report and unless otherwise indicated, the terms “we”, “us”, “our” and “our company” mean Pacific Green Technologies Inc., a Delaware corporation, and our wholly owned subsidiaries, Pacific Green Technologies Limited, a United Kingdom corporation, Pacific Green Energy Parks Limited, a British Virgin Islands corporation, and its wholly owned subsidiary, Energy Park Sutton Bridge, a United Kingdom corporation, unless otherwise indicated.

Corporate History

Our company was incorporated in Delaware on March 10, 1994, under the name of Beta Acquisition Corp. In September 1995, we changed our name to In-Sports International, Inc. In August 2002, we changed our name from In-Sports International, Inc. to ECash, Inc. In 2007, due to limited financial resources, we discontinued our operations. Over the course of the last five years, we have sought new business opportunities.

On June 13, 2012, we changed our name to Pacific Green Technologies Inc. and effected a reverse split of our common stock following which we had 27,002 shares of common stock outstanding with $0.001 par value.

Effective December 4, 2012, we filed with the Delaware Secretary of State a Certificate of Amendment of Certificate of Incorporation, wherein we increased our authorized share capital to 510,000,000 shares of stock as follows:

| ● | 500,000,000 shares of common stock with a par value of $0.001; and | |

| ● | 10,000,000 shares of preferred stock with a par value of $0.001. |

The increase of authorized capital was approved by our board of directors on July 1, 2012 and by a majority of our stockholders by a resolution dated July 1, 2012.

Historical Business Overview

On May 1, 2010 we entered into a consulting agreement with Sichel Limited. Sichel has investigated new opportunities for us and has subscribed for new shares of our company’s common stock. The consulting agreement entitles Sichel to $20,000 per calendar month. With an effective date of March 31, 2013, the consulting agreement, along with all amounts owed to Sichel, were assigned to Pacific Green Group Limited (“PGG”). As at our year ended March 31, 2015, we owed Sichel $Nil and we owed PGG approximately GBP295,438, USD$1,058,269 and CAD$4,362,768. Pursuant to the terms of the consulting agreement, if we are unable to pay the monthly consulting fee, PGG may elect to be paid in shares of stock, and if we are unable to make payments for more than six months in any 12 month period, PGG has the right to appoint an officer or director to the board, which right has not been exercised at this time.

| 1 |

New Strategy

Management, assisted by PGG, has identified an opportunity to build a business focused on marketing, developing and acquiring technologies designed to improve the environment by reducing pollution. To this end we entered into and closed an assignment and share transfer agreement, on June 14, 2012, for the assignment of a representation agreement and the acquisition of a company involved in the environmental technology industry.

The assignment and share transfer agreement provided for the acquisition of 100% of the issued and outstanding shares of Pacific Green Technologies Limited, formerly PGG’s subsidiary in the United Kingdom. Additionally, PGG has assigned to our company a ten year exclusive worldwide representation agreement with EnviroTechnologies Inc., (formerly EnviroResolutions, Inc.), a Delaware corporation, to market and sell EnviroTechnologies’ current and future environmental technologies. The representation agreement entitles PGG to a commission of 20% of all sales (net of taxes) generated by EnviroTechnologies. Pursuant to the terms of the assignment and share transfer agreement, all rights and obligations under the representation agreement have been transferred to our company. We currently anticipate that sales under the representation agreement will be our sole source of revenue for the foreseeable future. We had intended to complete an acquisition of EnviroTechnologies, as this would have been a logical step in our development. However, as discussed herein, we have settled with EnviroTechnologies as an alternative.

Both Sichel and PGG are wholly owned subsidiaries of the Hookipia Trust. PGG’s wholly owned subsidiary was Pacific Green Technologies Limited. As a result, we acquired Pacific Green Technologies Limited from PGG. Sichel is a significant shareholder of our company and also provides us with consulting services. The sole director of Sichel is also the sole director of PGG. Further, PGG is a significant shareholder of EnviroTechnologies.

The assignment and share transfer agreement closed on June 14, 2012 via the issuance of 5,000,000 shares of our common stock as well as a $5,000,000 promissory note to PGG. We have consequently undertaken the operations of Pacific Green Technologies Limited and PGG’s obligations under the representation agreement.

Full consideration contemplated by the assignment and share transfer agreement was $25,000,000 satisfied through the issue of 5,000,000 new shares of our common stock at a price of $4 per share with the balance of $5,000,000 structured as a promissory note over the next five years as follows:

| ● | June 12, 2013, $1,000,000 (which amount remains outstanding and has been rolled over to the following payment date); | |

| ● | June 12, 2014, $1,000,000 (this amount remains unpaid); | |

| ● | June 12, 2015, $1,000,000 (this amount remains unpaid); | |

| ● | June 12, 2016, $1,000,000; and | |

| ● | June 12, 2017, $1,000,000. |

Under the terms of the promissory note, the loan repayments specified above shall not exceed the amount we earn under the terms of the representation agreement. If we are unable to meet the repayment schedule set out above, PGG will have the option to either roll over any unpaid portion to the following payment date or to convert the outstanding amount into new shares of our common stock. However, the entire amount of the promissory note is due upon the maturity date on the fifth anniversary. The promissory note is unsecured.

The total consideration of $25,000,000 was a purchase price not determined under U.S. GAAP, and both the $25,000,000 total price and the deemed price of $4 per share does not represent the fair value of the stock issued or a value used in accounting for the acquisition. The number of shares issued and the terms of the promissory note were negotiated between the parties and are intended to represent full consideration for the acquisition of Pacific Green Technologies Limited and the representation agreement.

Information on EnviroTechnologies

EnviroTechnologies, a company incorporated in Delaware, has protected intellectual property rights throughout most of the world for its ENVI-Clean™ Emissions System (“ENVI-Clean™”). The ENVI-Clean™ system removes most of the sulphur dioxide, particulate matter, greenhouse gases and other hazardous air pollutants from the flue gases produced by the combustion of coal, biomass, municipal solid waste, diesel and other fuels.

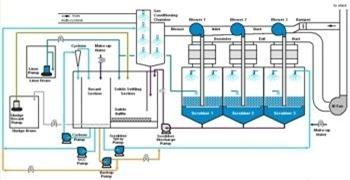

The ENVI-Clean™ system is comprised of five components:

| ● | an induced draft fan (“ID fan”); | |

| ● | a gas conditioning chamber; | |

| ● | the ENVI-Clean™ unit; | |

| ● | a demister; and | |

| ● | settling tanks. |

| 2 |

The ID fan creates the pressure differential required to force the gas through the scrubbing fluid suspended on each head and move it through the other components in the system. The gas conditioning chamber cools the hot flue gas prior to entering the ENVI-Clean™ System. The ENVI-Clean™ System contains the heads and the demister pads at the exhaust exit. The neutralizing fluid is constantly circulated and cleaned by mechanical means with the contaminated component of the separation going to a settling tank prior to dewatering. The settled solids are disposed of with the bottom ash produced by the combustion process.

The ENVI-CES™ technology forces 100% of the polluted exhaust flue gas into the neutralizing fluid to produce a highly turbulent interaction between the target pollutants and the fluid. The aggressive mixing produces small bubbles which create a very high surface contact area between the exhaust gas and fluid to enhance the transfer of particulate and targeted gaseous and hazardous pollutants from the exhaust to the fluid.

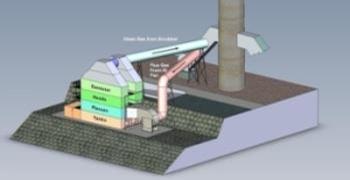

Schematic of the ENVI-Clean™ Emission’s System as installed for Biomass applications

Unique to the ENVI approach is the introduction of the gas in the lower section of the ENVI-Clean™ unit which makes the greatest portion of its cross section available for fluid–gas interaction. This permits a smaller and highly flexible footprint. Furthermore, the system design allows for multiple heads each containing different neutralizing fluids to remove various pollutants from the flue gas. The ordered removal of acid and greenhouse gases within a single unit makes the system highly desirable by industries whose fuels contain multiple contaminants. The resulting ENVI-Clean™ unit has high efficiency and is very simple to operate.

The neutralizing solution is selected to remove targeted pollutants: limestone and hydrated lime are used to neutralize the scrubbing solution for the removal of acid gases such as sulphur dioxide, hydrogen chloride and hydrogen fluoride. The unique design of the ENVI system allows for the sequential removal of pollutants by stacking heads and utilizing different neutralizing chemistry in each operating unit. This provides industry with a system that fulfills multiple applications.

| 3 |

The ENVI-Clean™ system has numerous new and retrofit applications:

| ● | coal and coal waste fuelled CFBC boilers; | |

| ● | pulverized coal and stoker-grate boilers; | |

| ● | heavy oil fired boilers; | |

| ● | biomass and waste to energy boilers; | |

| ● | lime kilns, dryers, shredders and foundries; | |

| ● | industrial exhaust scrubbing of particulates and acid gases; | |

| ● | diesel engines, large marine and stationary engines; and | |

| ● | sewage sludge, hazardous waste and MSW incinerators. |

Our management believes that the ENVI-Clean™ system has significant competitive advantages in the market for emission control systems including:

| 1. | Efficiency: tests performed at an 84MW coal power plant in West Virginia (USA) indicate that the ENVI-Clean™ system removed on average 99.3% of sulfur dioxide over a three day period from the plant’s emissions; | |

| 2. | Low Capital Cost: the system has a compact and flexible footprint relative to competitive products. For electricity generation applications, EnviroTechnologies’ system is priced for market at approximately $90 per kilowatt of electricity generation. In comparison, industry consultants state that comparable systems in North America are typically priced at $300-500 per kilowatt (Source: High Energy Services/Babcock & Wilson-wet scrubber systems for S02 removal in North America); | |

| 3. | Low Ongoing Operating Cost: the ENVI-Clean™ system is more affordable in the long term for customers compared to competitor products; | |

| 4. | New and Retrofit Applications: for retrofit applications in particular (as required by the 2011 EPA Boiler MACT Requirements), the system is considered by management to be more compact and adaptable than rival systems; | |

| 5. | Scalability: the ENVI-Clean™ system can be adapted for the largest power stations but also smaller applications such as diesel marine engines. It can also remove multiple pollutants in a single system, unlike much of the competition. |

On October 5, 2011, EnviroResolutions, a British Columbia corporation, signed a contract to supply the ENVI-Clean™ system to a new waste to energy plant being built in Peterborough, United Kingdom (the “Peterborough Contract”). The initial material term and condition of the contract was that EnviroResolutions demonstrate testing of the system that achieved the performance levels represented in regards to emissions by March 31, 2012. This condition was successfully satisfied and confirmed with Peterborough Renewable Energy Limited (“PREL”) prior to the required date. The Peterborough Contract entitles us, as the holder of the representation agreement, to a commission of approximately $4,600,000 before third party agency fees.

Effective March 5, 2013, we entered into a supplemental agreement with EnviroTechnologies and EnviroResolutions. The supplemental agreement amends the representation agreement between PGG and EnviroTechnologies dated June 7, 2010, which was later assigned to us from PGG in connection with an assignment and share transfer agreement dated June 14, 2012. The supplemental agreement entitles our company to a commission of equal to 50% (previously 20%) of any licensing revenue that may be generated by EnviroTechnologies Inc. in respect of its existing and future technologies.

In addition, pursuant to the supplemental agreement, we will receive from EnviroResolutions an amount equal to 50% of any assets or consideration received as compensation from PREL for PREL’s failure to perform under a contingent sale agreement dated October 5, 2011 between EnviroResolutions and PREL. We will receive the fee for our assistance to EnviroResolutions during their negotiations with PREL regarding PREL’s failure to perform. The fee, if any, provided to us will not constitute any repayment of our loans that were made to EnviroResolutions.

The supplemental agreement supplements the Peterborough Contract dated October 5, 2011 entered into among EnviroResolutions, PREL and GEPL. Pursuant to the Peterborough Contract, EnviroResolutions was to supply PREL with a wet scrubbing emission control system to a new waste to energy plant being built in Peterborough, United Kingdom.

Information on Pacific Green Technologies Limited

Pacific Green Technologies Limited is a limited liability company incorporated under the laws of England and Wales on April 5, 2011 (“PGT”). The director of PGT is Mr. Joseph Grigor Kelly. On November 7, 2012, Mr. Joseph Grigor Kelly tendered his resignation to the board of directors. PGT has no employees. Concurrently, Neil Carmichael consented to and was appointed as the sole director and chief executive and financial officer of PGT.

| 4 |

The purpose of incorporating PGT was to utilize local knowledge and contacts to build a platform for sales in the following regions: Western Europe, Eastern Europe, Russian Federation, Turkey, Middle East, Azerbaijan, Kazakhstan and Africa. However, our company has found that the cost to have physical presence in England far out weights the benefit. As a result, PGT is now in the process of being dissolved as of the date of the filing of this annual report.

Information on Pacific Green Energy Parks Limited

Pacific Green Energy Parks Limited (“PGEP”) sees an opportunity to develop renewable power stations with capacities up to 50MW in the biomass and waste to energy sectors. In addition to their positive impact on the world’s environment, these projects have the potential to deliver a sustainable post-tax equity IRR and may provide our company with an opportunity to deploy its technologies. To this end our company has been identifying and investigating appropriate projects worldwide.

On March 26, 2012, PGEP reached an agreement with the shareholders of Energy Park Sutton Bridge Limited (“EPSB”), whereby PGEP would fund a planning application for the development of a biomass energy plant in return for a 75% shareholding in EPSB. EPSB was incorporated in the UK in 2009 to develop a 49 MW biomass energy plant in Sutton Bridge, Lincolnshire, UK. A planning application for EPSB was submitted to South Holland District Council (“SHDC”) on September 4, 2012.

On March 5, 2013, PGEP acquired the remaining 25% of EPSB. On May 8, 2013, EPSB secured planning permission for a 49MW biomass power plant at Sutton Bridge, Lincolnshire.

The facility will have an installed energy capacity of 49MW. The export capacity of the facility will be circa 44MW. The electricity will be supplied to the National Grid. Heat from the operation will be used within the facility and the ancillary buildings whilst off-take points will be provided for future combined heat and power needs in the area. The location of the plant alongside an existing industrial estate and in proximity of an area proposed for future industrial expansion makes the realization of the potential for combined heat and power more likely than in other possible locations. EPSB has secured options to purchase the freehold of the Energy Park site from the land owners.

Biomass is considered to be carbon neutral because the quantity of CO2 released during combustion is the same as that absorbed by plants as a result of photosynthesis during their growth. This differs from fossil fuels in that, although both originating from organic matter, the carbon in fossil fuels has been locked away for millions of years, and when released during combustion, results in a net increase in CO2 levels in the atmosphere.

Biomass is also considered environmentally sustainable as in many cases it is derived from by-products of other industries such as agriculture and forestry management. This contains a closed carbon cycle with no net increase in atmospheric CO2 levels. As a result, EPSB will be entitled to renewables obligation certificates (“ROCs”) under the UK’s Renewable Obligation regime. As of April 2016, pure biomass will be afforded 1.4 ROCs/MWh of electricity produced, for a 20 year tariff period. EPSB’s forecasts assume:

EPSB will recover energy from virgin wood using steam turbine technology. The plant will require approximately 325,000 tonnes of virgin wood per annum (“Feedstock”).

Following discussions with industry experts, engineers, consultants and financiers, our company estimates that EPSB should cost approximately £165,000,000 to construct. Once the project is “spade ready”, construction should take 2 years. Previously, we anticipated that the project would be “spade ready” by March 2014. However, our company’s application for planning consent was not accepted by council and we resubmitted our application on June 20, 2014. The EPC contractor will provide a fixed cost turnkey completion guarantee. Planning consent was turned down April 2015 again.

A detailed carbon assessment has been submitted within the EIA presenting the carbon savings offered by the operation of the facility.

The project will deliver combined heat and power (“CHP”) infrastructure. Our company is investigating potential opportunities for supplying local heat customers at both existing and potential new developments off site. EPSB will maintain an open dialogue with the local authority and will ensure that an appropriate boiler and turbine design is selected to facilitate the distribution of heat.

A debt information memorandum has been produced by PwC for raising funding for the EPSB project.

Currently our company is identifying and assessing further renewable power plant developments that are complimentary to the use of ENVI-Emissions Systems where possible.

| 5 |

Current Business

Since signing the representation agreement, PGG has secured a worldwide network of agents to market the ENVI-Clean™ system. In Europe there are four agents, in North America there are five agents, in Asia and Australia there are two agents, and in the Middle East there is one agent. We have assumed these relationships as part of the assignment and continue to pursue the following main areas of focus.

i) Waste to Energy Plants across Europe

Increasing legislation relating to landfill of municipal solid waste has led to the emergence of increasing numbers of waste to energy plants (“WtE”). A WtE plant obviates the need for landfill, burning municipal waste for conversion to electricity. A WtE plant is typically 45-100MW. The ENVI-Clean™ system is particularly suited to WtE as it cleans multiple pollutants in a single system. The contract secured by EnviroResolutions in Peterborough (UK) relates to a WtE plant and the ENVI-Clean™ system was successfully tested at a WtE plant in Edmonton (UK) in March 2012.

ii) Coal fired power stations in North America and Asia

EnviroResolutions has successfully conducted sulphur dioxide demonstration tests at the American Bituminous Coal Partners power plant in Grant Town, West Virginia. The testing achieved a three test average of 99.3% removal efficiency. The implementation of US Clean Air regulations in July 2010 has created additional demand for sulphur dioxide removal in all industries emitting sulphur pollution. Furthermore, China consumes approximately one half of the world’s coal, but introduced measures designed to reduce energy and carbon intensity in its 12th Five Year Plan.

iii) Biomass

Applications include regional power facilities and heating for commercial buildings and greenhouses. Typical applications range in size from 1 to 20 megawatts (MW) with power generation occupying the larger end of the range. ENVI has operated a pilot ENVI-clean™ scrubber designed to remove particulate from a 6MW boiler used to heat a large scale, greenhouse facility. The optimization and testing took place in late 2009 through to March 2010 at the Katatheon Farms in Langley, British Columbia. The full scale system was purchased by the farm and installed in 2010.

iv) Land and marine diesel

Diesel exhaust includes ash and soot as particulate components and sulphur dioxide as an acid gas. The ENVI-Clean™ system is applicable for land power generation systems and marine engines. Diesel power has particular relevance in remote settings such as mining, oil and gas exploration camps in emerging nations.

Testing has been conducted on diesel shipping to confirm the application of seawater as a neutralizing agent for sulphur emissions. In addition to marine application these tests showed applicability of the system for large displacement engines such as stationary generators, compressors, container handling, heavy construction and mining equipment.

Our company continues to analyze new business opportunities under each of the categories stated above. As of the date of this annual report and with the exception of the agreements disclosed in this document, we have not entered into any definitive agreement with any party, nor have there been any specific discussions with any potential business combination candidates regarding business opportunities for us. We have unrestricted flexibility in seeking, analyzing and participating in potential business opportunities.

In accordance with our business purpose and strategy outlined above, our efforts to analyze potential business opportunities will consider the following factors:

| ● | potential for growth, indicated by new technology, anticipated market expansion or new products; | |

| ● | competitive position as compared to other firms of similar size and experience within the industry segment as well as within the industry as a whole; | |

| ● | strength and diversity of management, either in place or scheduled for recruitment; | |

| ● | capital requirements and anticipated availability of required funds, to be provided by us or from operations, through the sale of additional securities, through joint ventures or similar arrangements or from other sources; | |

| ● | the cost of participation by us as compared to the perceived tangible and intangible values and potentials; | |

| ● | the extent to which the business opportunity can be advanced; | |

| ● | the accessibility of required management expertise, personnel, raw materials, services, professional assistance and other required items; and | |

| ● | other relevant factors |

| 6 |

In applying the foregoing criteria, no one of which will be controlling, management will attempt to analyze all factors and circumstances and make a determination based upon reasonable investigative measures and available data. Potential business opportunities may occur at various stages of development, all of which will make the task of comparative investigation and analysis of such business opportunities extremely difficult and complex. Due to our limited capital available for investigation, we may not discover or adequately evaluate adverse facts about the opportunity to be acquired.

Securing additional financial and human capital

We have limited capital and three directors. It will be necessary for us to build a management team to fully exploit the representation agreement and it will also therefore be necessary to raise financial capital. We will therefore proactively seek the raising of additional financial capital as part of our new strategy.

Form of any subsequent acquisitions

The manner in which we participate in an opportunity will depend upon the nature of the opportunity, our respective needs and desires and those of the promoters of the opportunity, and our relative negotiating strength compared to that of such promoters.

It is likely that we will acquire further participations in business opportunities through the issuance of our common stock, or other of our securities. Although the terms of any such transaction cannot be predicted, it should be noted that in certain circumstances the criteria for determining whether or not an acquisition is a so-called “tax free” reorganization under Section 368(a)(1) of the Internal Revenue Code of 1986, as amended, or the Code, depends upon whether the owners of the acquired business own 80% or more of the voting stock of the surviving entity. If a transaction were structured to take advantage of these provisions rather than other “tax free” provisions provided under the Code, all prior stockholders would in such circumstances retain 20% or less of the total issued and outstanding shares of the surviving entity. Under other circumstances, depending upon the relative negotiating strength of the parties, prior stockholders may retain substantially less than 20% of the total issued and outstanding shares of the surviving entity. This could result in substantial additional dilution to the equity of those who were our stockholders prior to such reorganization.

Our stockholders will likely not have control of a majority of our voting securities following a reorganization transaction. As part of such a transaction, our directors may resign and one or more new directors may be appointed without any vote by stockholders.

In the case of an acquisition, the transaction may be accomplished upon the sole determination of management without any vote or approval by our stockholders. In the case of a statutory merger or consolidation directly involving our company, it will likely be necessary to call a stockholders’ meeting and obtain the approval of the holders of a majority of our outstanding securities. The necessity to obtain such stockholder approval may result in delay and additional expense in the consummation of any proposed transaction and will also give rise to certain appraisal rights to dissenting stockholders. Most likely, management will seek to structure any such transaction so as not to require stockholder approval.

It is anticipated that the investigation of specific business opportunities and the negotiation, drafting and execution of relevant agreements, disclosure documents and other instruments will require substantial management time and attention and substantial cost for accountants, attorneys and others. If a decision is made not to participate in a specific business opportunity, the costs theretofore incurred in the related investigation might not be recoverable. Furthermore, even if an agreement is reached for the participation in a specific business opportunity, the failure to consummate that transaction may result in the loss to us of the related costs incurred.

Other Business Matters

Effective December 18, 2012, we entered into a non-executive director agreement with Dr. Neil Carmichael, wherein Dr. Carmichael will receive compensation of $1,000 per year for the term of the agreement and was granted options to purchase up to 62,500 shares of common stock at an exercise price of $0.01 per share of common stock. The options will terminate the earlier of 24 months, or upon the termination of the agreement and Dr. Carmichael's engagement with our company. As of the date of this annual report, the options to Dr. Carmichael have not been exercised.

| 7 |

On April 3, 2013, we entered into and closed a share exchange agreement with certain shareholders of EnviroTechnologies. Pursuant to the terms of the share exchange agreement, we agreed to acquire 17,653,872 issued and outstanding common shares of EnviroTechnologies from the shareholders in exchange for the issuance of 1,765,395 shares of the common stock of our company. We issued an aggregate of 1,765,395 common shares to 47 shareholders.

On April 25, 2013, we entered into and closed share exchange agreements with certain shareholders of EnviroTechnologies. Pursuant to the terms of the share exchange agreement, we agreed to acquire 6,682,357 issued and outstanding common shares of EnviroTechnologies from the shareholders in exchange for the issuance of 668,238 shares of common stock of our company. We issued an aggregate of 668,238 common shares to 20 shareholders.

On May 15, 2013, we entered into and closed a stock purchase agreement with all five of the shareholders of Pacific Green Energy Parks Limited (“PGEP”), a company incorporated in the British Virgin Islands. PGEP is the sole shareholder of Energy Park Sutton Bridge Limited, a company incorporated in the United Kingdom. PGEP is developing a biomass power plant facility and holds an option to purchase the real property upon which the facility will be built.

Pursuant to the stock purchase agreement, we agreed to acquire all of the 1,752 issued and outstanding common shares of PGEP from the shareholders in exchange for:

| 1. | a payment of $100 upon execution of the stock purchase agreement, which has been paid by us; | |

| 2. | $14,000,000 paid in common shares in our capital stock at a deemed price at the lower of $4 per share or the average closing price per share of our capital stock in the ten trading days immediately preceding the date of closing of the stock purchase agreement, which have been issued by us; | |

| 3. | $3,000,000 payable in common shares of our capital stock at a deemed price at the lower of $4 per share or the average closing price per share of our capital stock in the ten trading days immediately preceding the date upon which PGEP either purchases the property or secures a lease permitting PGEP to operate the facility on the property, which has not yet occurred; and | |

| 4. | subject to leasing or purchasing the property and PGEP securing sufficient financing for the construction of the facility, $33,000,000 payable in common shares of our capital stock at a deemed price at the lower of $4 per share or the average closing price per share of our capital stock in the ten trading days immediately preceding the date that PGEP secures sufficient financing for the construction of the facility, which has not yet occurred. |

All consideration from our company to the shareholders has been and will be issued on a pro-rata, pari-passu basis in proportion to the respective number of shares of PGEP sold by each respective shareholder. On May 15, 2013, pursuant to the stock purchase agreement, we issued an aggregate of 3,500,000 common shares, at an agreed upon deemed price of $4 per share, to the five shareholders.

Pacific Green Energy Parks Limited and its wholly owned subsidiary, Energy Park Sutton Bridge, are now subsidiaries of our company.

On May 17, 2013, we entered into a debt settlement agreement with EnviroTechnologies and EnviroResolutions (collectively, the “Debtors”). Pursuant to the terms of the debt settlement agreement, we agreed to release and waive all obligations of the Debtors to repay debts, in the aggregate of $293,406 and CAD$38,079, to us and agreed to return an aggregate of 88,876,443 (as of March 31, 2015, 2,217,130 common shares of EnviroTechnologies remain to be returned) common shares of EnviroTechnologies to EnviroResolutions. As consideration for this release and waiver and return of shares, the Debtors agreed to transfer all rights, interests and title to certain intellectual property, the physical embodiments of such intellectual property, and to the supplemental agreement dated March 5, 2013 among EnviroResolutions, PREL and Green Energy Parks Limited (“GEPL”) (collectively, the “Debtors’ Assets”).

The Debtors’ Assets include the intellectual property rights throughout most of the world for the ENVI-Clean™ system, the ENVI-Pure™ system and the ENVI-SEA™ scrubber. The ENVI-Clean™ system removes most of the sulphur dioxide, particulate matter, greenhouse gases and other hazardous air pollutants from the flue gases produced by the combustion of coal, biomass, municipal solid waste, diesel and other fuels. The ENVI-Pure™ emission system combines the ENVI-Clean™ highly effective patent-pending wet scrubbing technology with an innovative wet electrostatic precipitator and a granular activated carbon adsorber to remove particulate matter, acid gases, regulated metals, dioxins and VOCs from the flue gas to levels significantly below those required by strictest international regulations. The ENVI-SEA™ scrubber can be applied to diesel exhaust emissions that require sulphur and particulate matter abatement. Using seawater on a single-pass basis as the scrubbing fluid in combination with its patent pending scrubbing head will provide a highly interactive zone of turbulent mixing for absorption of SO2, particulate matter and other pollutants from the engine’s exhaust.

| 8 |

The following is a brief description of further terms and conditions of the debt settlement agreement that are material to our company:

| 1. | we pay 25% of all funds, if any, received under the supplemental agreement to the Debtors within 14 days upon receipt of funds, if any, pursuant to the supplemental agreement; | |

| 2. | we enter into definitive agreements with the Debtors to: |

| a. | license the Debtors’ Assets back to the Debtors, under arm’s length commercial terms, for use in the USA and Canada, with the exception of NRG Energy, Inc. and Edison Mission and affiliates; and | |

| b. | have the Debtors provide engineering services to us on terms to be agreed upon, acting reasonably; |

| 3. | the Debtors pay pro-rata any third party broker fees and legal fees, if any, that are subsequent costs associated with the Supplemental Agreement; and | |

| 4. | the Debtors retain possession of, yet make a pilot-scale scrubber available for rental to our company at a nominal cost. |

On June 11, 2013, we submitted 24,336,229 common shares of EnviroTechnologies to EnviroTechnologies for cancellation pursuant to our debt settlement agreement with EnviroTechnologies and EnviroResolutions dated May 17, 2013.

Pursuant to a debt settlement agreement dated May 17, 2013 among our company, EnviroTechnologies and EnviroResolutions, on November 22, 2013, our company was transferred a 40% shareholding in PREL by GEPL (who had, prior to this transfer, held all the issued and outstanding shares of PREL). PREL is a limited liability company incorporated under the laws of the United Kingdom.

PREL was incorporated by GEPL to develop a 79MWe waste to energy power station at Peterborough, United Kingdom (the “Peterborough Plant”). The Peterborough Plant has full planning permission at 79MWe and environmental agency permits. It is understood that the Peterborough Plant will be built in two stages at a total capital cost of approximately GBP£500 million (approximately US$824,534,442). As of May 17, 2013, PREL owns 20% of Energy Park Investments Limited, the holding company that is currently intended to finance the development of the Peterborough Plant in turn through its wholly owned operating subsidiary Energy Park Peterborough Limited.

On June 17, 2013, we entered into and closed share exchange agreements with certain shareholders of EnviroTechnologies. Pursuant to the terms of the share exchange agreements we agreed to acquire 8,061,286 issued and outstanding common shares of EnviroTechnologies from the shareholders in exchange for the issuance of 806,132 shares of common stock of our company. We issued as aggregate of 806,132 shares of common stock to 19 shareholders.

On August 6, 2013, we entered into two share exchange agreements with two shareholders of EnviroTechnologies. Pursuant to the terms of the agreements, we agreed to acquire 440,000 issued and outstanding common shares of EnviroTechnologies from one shareholder in exchange for shares of common stock of our company on a 1 for 10 basis. Pursuant to the terms of the other agreement, we agreed to acquire 600,000 issued and outstanding common shares of EnviroTechnologies from one shareholder in exchange for shares of common stock of our company on a 1 for 15 basis.

On August 27, 2013, we entered into share exchange agreements with certain shareholders of EnviroTechnologies. Pursuant to the terms of the agreements, we have agreed to acquire 32,463,489 issued and outstanding common shares of EnviroTechnologies from the shareholders in exchange for shares of common stock of our company on a 1 for 10 basis.

On September 13, 2013, we submitted 41,564,775 common shares of EnviroTechnologies to EnviroTechnologies for cancellation pursuant to our debt settlement agreement with EnviroTechnologies and EnviroResolutions dated May 17, 2013.

On September 26, 2013, we entered into an agreement with Andrew Jolly, wherein Dr. Jolly agreed to serve as a director of our company. Pursuant to the agreement, our company is to compensate Dr. Jolly for serving as a director of our company at GBP£2,000 (approximately $3,235) per calendar month. Effective October 1, 2013, we appointed Dr. Jolly as a director of our company.

| 9 |

On October 11, 2013, we entered into share exchange agreements with certain shareholders of EnviroTechnologies. Pursuant to the terms of the agreements, we have agreed to acquire 674,107 issued and outstanding common shares of EnviroTechnologies from the shareholders in exchange for shares of common stock of our company on a 1 for 10 basis.

On October 22, 2013, we entered into an agreement with Mr. Chris Williams, wherein Mr. Williams agreed to serve as business development director of our company effective December 5, 2013. As business development director of our company, Mr. Williams was to focus on developing potential new business opportunities and generating sales from our existing assets

Pursuant to the agreement, our company agreed to compensate Mr. Williams for serving as a business development director of our company with:

| ● | GBP£450 (approximately $730) per day and a guarantee of a minimum of four days a month for six months; | |

| ● | GBP£50,000 (approximately $81,000) when we are in a position to drawdown funds in order to commence the development and construction (the “Financial Close”) of our 49MW biomass power plant at Sutton Bridge, Lincolnshire (the “Project”); | |

| ● | options on the Financial Close of the completion of the Project to purchase 10,000 common shares in our company at $2 per share; and | |

| ● | on the Financial Close of the Project, 20,000 common shares of our company from PGG. |

In addition to the above compensation, we agreed to compensate Mr. Williams with commissions of:

| ● | 10%, 8% and 6% for the first, second and third years, respectively, for Envi emissions control equipment sales on any license fees generated; | |

| ● | 3% of net sales for Envi emissions control equipment sales that are direct sales (with no third party commissions); | |

| ● | 1% of net sales of any for Envi emissions control equipment sales from third party agents; | |

| ● | 5% of any financial equity raised for our company prior to the close of the Project; | |

| ● | 0.25% of any debt introduced for the Project; | |

| ● | 0.5% of any financial equity introduced for the Project; | |

| ● | 10%, 6%, 4% and 2% for years 1, 2, 3 and thereafter, respectively, of any heat off-take sales related to the Project entered into before December 31, 2013; | |

| ● | 5%, 3% and 2% for years 1, 2 and thereafter, respectively, of any heat off-take sales related to the Project entered into on or after December 31, 2013; and | |

| ● | 0.25% and 0.2% for years 1 and 2, respectively, of power purchase agreements. |

Mr. Williams resigned effective April 23, 2014 and was compensated the equivalent of $13,918 by our company during the year ended March 31, 2014 on the basis of GBP£450 (approximately US$730) per day. Mr. Williams did not receive any other incentive amounts or commissions under the agreement.

Effective October 31, 2013, we entered into a private placement agreement. Pursuant to the agreement, we issued 18,750 common shares in our capital stock at a purchase price of $4.00 per share, for total proceeds of $75,000.

Effective December 19, 2013, we entered into private placement agreements with nine subscribers. Pursuant to the agreements, we issued an aggregate of 262,500 common shares in our capital stock at a purchase price of $3.20 per share, for total proceeds of $840,000.

On December 18, 2013, we announced that our company has engaged BlueMount Capital to spearhead the development of its proprietary emission control technologies, ENVI-Clean™ and ENVI-Pure™, in the People's Republic of China (“PRC”). In addition to corporate finance advisory services both within and outside China, BlueMount offers a tailored service to clients wishing to enter the PRC market with a particular emphasis on companies that own proprietary technology, intellectual property and expertise. To that end, BlueMount provides a comprehensive suite of services to enhance the effectiveness and long-term sustainability of foreign brands entering the PRC market via: Our company's strategic objective is to establish an operating presence in China with established local partners and rapidly rollout its technologies.

On December 27, 2013, we entered into and closed share exchange agreements with certain shareholders of EnviroTechnologies. Pursuant to the terms of the share exchange agreements, we acquired 130,000 issued and outstanding common shares of EnviroTechnologies from the shareholders in exchange for shares of common stock of our company on a 1 for 10 basis. On December 27, 2013, we issued an aggregate of 13,000 common shares to the shareholders of EnviroTechnologies.

| 10 |

On January 27, 2014, we entered into an agreement with Pöyry Management Consulting (UK) Limited. Pursuant to the agreement, Pöyry is to provide consulting services to us. Our company has agreed to compensate Pöyry a minimum of £5,000 (approximately $ 8,293) as consulting fees for the first year of the agreement and a variable hourly rate as set out in the agreement.

Effective March 10, 2014, we entered into a private placement agreement with one subscriber. Pursuant to the agreement with the subscriber, we agreed to the issuance of an aggregate of 125,000 common shares in our capital stock at a purchase price of $4.00 per share, for total proceeds of $500,000.

On May 27, 2014, we entered into a $200,000 convertible debenture with Intrawest Overseas Limited. Under the terms of the debenture, the amount is unsecured, bears interest at 10% per annum, and is due on May 27, 2015. Pursuant to the agreement, should any portion of loan remain outstanding past maturity the interest will increase to 15% per annum. The note is convertible into shares of common stock 180 days after the date of issuance (November 27, 2014) until maturity at a conversion rate of 75% of the average offer price of our company’s common stock for the 45 days ending one trading day prior to the date the conversion notice is sent by the holder to our company.

Our company analyzed the conversion option under ASC 815, “Accounting for Derivative Instruments and Hedging Activities”, and determined that the conversion feature should be classified as a liability and recorded at fair value due to there being no explicit limit to the number of shares to be delivered upon settlement of the conversion option. In accordance with ASC 815, our company recognized the intrinsic value of the embedded beneficial conversion feature of $33,922. On November 27, 2014, the note became convertible resulting in our company recording a derivative liability of $33,922 with a corresponding adjustment to loss on change in fair value of derivative liabilities.

On June 12, 2014, we entered into a $100,000 convertible debenture with Gerstle Consulting Pty Limited. Under the terms of the debenture, the amount is unsecured, bears interest at 10% per annum, and is due on June 12, 2015. Pursuant to the agreement, should any portion of loan remain outstanding past maturity the interest will increase to 15% per annum. The note is convertible into shares of common stock 180 days after the date of issuance (December 12, 2014) until maturity at a conversion rate of 75% of the average closing bid prices of our company’s common stock for the 45 days ending one trading day prior to the date the conversion notice is sent by the holder to our company.

Our company analyzed the conversion option under ASC 815, “Accounting for Derivative Instruments and Hedging Activities”, and determined that the conversion feature should be classified as a liability and recorded at fair value due to there being no explicit limit to the number of shares to be delivered upon settlement of the conversion option. In accordance with ASC 815, our company recognized the intrinsic value of the embedded beneficial conversion feature of $9,793. On December 12, 2014, the note became convertible resulting in our company recording a derivative liability of $9,793 with a corresponding adjustment to loss on change in fair value of derivative liabilities.

On June 30, 2015, through our wholly owned subsidiary, Pacific Green Energy Parks Limited, we purchased all of the issued and outstanding shares in Pacific Green Technologies Asia Limited for $1.00 from Alexander Shead.

We entered into an agreement dated July 20, 2015 with Mr. Alexander Shead. Pursuant to this agreement, Mr. Shead has agreed to serve as a director of our company. As a director of our company, Mr. Shead shall be compensated $1,000 for every calendar month of the term of the agreement. The term of the agreement is for 12 months. On July 20, 2015, we appointed Mr. Shead as a director of our company.

On September 22, 2015, our company entered into a consulting agreement (the “Agreement”) with Midam Ventures, LLC (“Midam”) wherein Midam will provide investor relations and business advisory services to us from September 23, 2015 to March 23, 2016. Any compensation described in the Agreement shall be deemed earned and vested by Midam even in the case of early termination of the Agreement.

Pursuant to the terms of the Agreement, we will to pay $30,000 in cash and 200,000 common restricted shares of our company to Midam. Effective October 20, 2015, we issued all of the shares pursuant to an exemption from registration relying on the provisions of Rule 506 of Regulation D promulgated under the Securities Act of 1933, as amended.

On October 24, 2015, our company entered into a marketing and consulting agreement with Red Rock Marketing Media, Inc. (“Red Rock”) wherein Red Rock will provide investor relations and business advisory services to us for a period of 40 business days starting on or before the 10 business days after Red Rock receives compensation from our company. Pursuant to the terms of the Agreement, we will to pay $100,000 in cash by October 29, 2015.

| 11 |

On October 27, 2015, our company entered into a loan agreement with a significant shareholder for proceeds of approximately $4,231. The loan is unsecured, bears an interest rate of US Prime Rate plus 4%, and is due on demand.

On November 10, 2015, we issued a convertible note (the “Note”) to Tangiers Investment Group, LLC (“Tangiers”) in exchange for an aggregate of $100,000 from Tangiers. The Note is for the aggregate sum of $110,000 with 10% interest as an original issue discount and convertible into our common shares of (the “Shares”) at a price of equal to the lower of: (a) $.40 per common share of our company or (b) 60% of the lowest trading price of our common stock during the 20 consecutive trading days prior to the date on which the holder of the Note elects to convert all or part of the Note.

On November 17, 2015, Pacific Green Technologies China Limited, a wholly-owned subsidiary of our company, entered into a commercial joint venture agreement with PowerChina SPEM Company Limited (“PowerChina”) wherein PowerChina would receive and process orders from our company for customers, and manufacture and install products as an engineering procurement construction process. In return, our company agreed to design the product and provide a technology license and technical supports to PowerChina. During the Agreement, we will provide PowerChina with a non-transferrable right and license to use Technology to manufacture and install our product within the Peoples’ Republic of China.

Upon receiving each order from us, PowerChina and we shall submit to each other the respective estimated budgets. For each project, after receipt of the revenue from the relevant customer, the budgets of our company and PowerChina shall be deducted and reimbursed from the revenue proportionally. We have agreed to share the gross profit pursuant to an even split of 50% to PowerChina and 50% to our company.

Competition

We face competition from various companies involved in the environmental technology industries and specifically companies involved in filtering of pollutants.

Many of our competitors have longer operating histories, better brand recognition and greater financial resources than we do. In order for us to successfully compete in our industry we will need to:

| ● | establish our product’s competitive advantage with customers; | |

| ● | develop a comprehensive marketing system; and | |

| ● | increase our financial resources. |

However, there can be no assurance that even if we do these things, we will be able to compete effectively with the other companies in our industry.

As we are a newly-established company, we face the same problems as other new companies starting up in an industry, such as lack of available funds. Our competitors may be substantially larger and better funded than us, and have significantly longer histories of research, operation and development than us. In addition, they may be able to provide more competitive products than we can and generally be able to respond more quickly to new or emerging technologies and changes in legislation and regulations relating to the industry. Additionally, our competitors may devote greater resources to the development, promotion and sale of their products or services than we do. Increased competition could also result in loss of key personnel, reduced margins or loss of market share, any of which could harm our business.

Research and Development Expenditures

We have not incurred any research expenditures over the past two fiscal years.

Intellectual Property

We do not own, either legally or beneficially, any patent or trademark, except for the foregoing.

We now own the proprietary emission abatement systems, currently known as ENVI-Clean™, ENVI-Pure™, for removing acid gases, particulate matter, dioxins, VOCs and other regulated hazardous air pollutants from the flue gases produced by the combustion of coal, biomass, municipal solid waste, diesel and other fuels, and ENVI-SEA™, scrubber that can be applied to diesel exhaust emissions that require sulphur and particulate matter abatement, previously owned or controlled by the Debtors, and includes, without limitation, all developments, improvements, and derivative works based upon or incorporating the Technology, all work product created by the Debtors, and all intellectual property in the foregoing.

| 12 |

The ENVI-Clean™ system has protected intellectual property rights throughout most of the world. Its technology is protected by Patent Cooperation Treaty (PCT) patent application no. PCT/CA210/000988 filed June 25, 2010 with a priority filing date of June 25, 2009. The International Preliminary Report on Patentability for this PCT application considered all patent claims of the application to be patentable. EnviroTechnologies has pending national or regional phase patent applications claiming priority from PCT/CA2010/000988 covering 127 countries. Once patents issue, patent rights in this technology will generally endure until June 25, 2030.

Further, we own the rights to the US provisional patent application no. US 61/614696 for the integrated wet scrubbing system. Additionally, we own the rights to US provisional patent application no. US 61/645874 for the flooded wet scrubbing head patent.

Identification of Certain Significant Employees

Currently, we do not have any employees. Other than as set out below, we have not entered into any consulting or employment agreements with any of our other directors.

Effective December 18, 2012, we entered into a non-executive director agreement with Dr. Neil Carmichael, wherein Dr. Carmichael received compensation of $1,000 for the term of the agreement and shall be granted options to purchase up to 62,500 shares of common stock at an exercise price of $0.01 per share of common stock. The options will terminate the earlier of 24 months, or upon the termination of the agreement and Dr. Carmichael's engagement with our company. As of the date of this annual report, the options to Dr. Carmichael have been granted and have not yet been exercised.

On September 26, 2013, we entered into an agreement with Andrew Jolly, wherein Dr. Jolly agreed to serve as a director of our company. Pursuant to the agreement, our company is to compensate Dr. Jolly for serving as a director of our company at GBP£2,000 (approximately $3,235) per calendar month. Effective October 1, 2013, we appointed Dr. Jolly as a director of our company.

On October 22, 2013, we entered into an agreement with Mr. Chris Williams, wherein Mr. Williams agreed to serve as business development director of our company effective December 5, 2013. As business development director of our company, Mr. Williams was to focus on developing potential new business opportunities and generating sales from our existing assets. Mr. Williams resigned effective April 23, 2014.

Our directors, executive officers and certain contracted individuals play an important role in the running of our company. We do not expect any material changes in the number of employees over the next 12 month period. We do and will continue to outsource contract employment as needed.

We engage contractors from time to time to consult with us on specific corporate affairs or to perform specific tasks in connection with our operations.

Government Regulations

Some aspects of our intended operations will be subject to a variety of federal, provincial, state and local laws, rules and regulations in North America and worldwide relating to, among other things, worker safety and the use, storage, discharge and disposal of environmentally sensitive materials. For example, we are subject to the Resource Conservation Recovery Act (“RCRA”), the principal federal legislation regulating hazardous waste generation, management and disposal.

Under some of the laws regulating the use, storage, discharge and disposal of environmentally sensitive materials, an owner or lessee of real estate may be liable for the costs of removing or remediating certain hazardous or toxic substances located on or in, or emanating from, such property, as well as related costs of investigation and property damage. Laws of this nature often impose liability without regard to whether the owner or lessee knew of, or was responsible for, the presence of the hazardous or toxic substances. These laws and regulations may require the removal or remediation of pollutants and may impose civil and criminal penalties for violations. Some of the laws and regulations authorize the recovery of natural resource damages by the government, injunctive relief and the imposition of stop, control, remediation and abandonment orders. The costs arising from compliance with environmental and natural resource laws and regulations may increase operating costs for both us and our potential customers. We are also subject to safety policies of jurisdictional-specific Workers Compensation Boards and similar agencies regulating the health and safety of workers.

| 13 |

We are not aware of any material violations of environmental permits, licenses or approvals issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our intended business. At this time, we do not anticipate any material capital expenditures to comply with environmental or various regulations and requirements.

While our intended projects or business activities have been designed to produce environmentally friendly green energy or other alternative products for which no specific regulatory barriers exist, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs and decreasing potential demand for our technologies, products or services, which could have a material adverse effect on our results of operations.

Subsidiaries

Both Sichel Limited and Pacific Green Group Limited are wholly owned subsidiaries of the Hookipia Trust. Pacific Green Group Limited’s wholly owned subsidiary was Pacific Green Technologies Limited. As a result, we acquired Pacific Green Technologies Limited from Pacific Green Group Limited. Sichel is a significant shareholder of our company, and also provides us with consulting services pursuant to a consulting agreement. The sole director of Sichel is also the sole director of Pacific Green Group Limited. Further, PGG is a significant shareholder of EnviroTechnologies.

Our company’s wholly owned subsidiaries are Pacific Green Technologies Marine Limited (formerly Pacific Green Technologies Limited), a United Kingdom corporation, Pacific Green Technologies International Limited (formerly Pacific Green Energy Parks Limited), a British Virgin Islands corporation, and its wholly owned subsidiaries, Energy Park Sutton Bridge, a United Kingdom corporation, and Pacific Green Technologies Asia Limited, a Hong Kong corporation, and its wholly owned subsidiary, Pacific Green Technologies China Limited, a Hong Kong corporation.

REPORTS TO SECURITY HOLDERS

We are required to file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission and our filings are available to the public over the internet at the Securities and Exchange Commission’s website at http://www.sec.gov. The public may read and copy any materials filed by us with the Securities and Exchange Commission at the Securities and Exchange Commission’s Public Reference Room at 100 F Street N.E. Washington D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the Securities and Exchange Commission at 1-800-732-0330. The SEC also maintains an Internet site that contains reports, proxy and formation statements, and other information regarding issuers that file electronically with the SEC, at http://www.sec.gov.

Employees

As of March 31, 2016, we did not have any full-time or part-time employees. Our president, treasurer, secretary and director, Neil Carmichael, works as a part-time consultant and devotes approximately 10 hours per week to our business. Our director, Jordan Starkman, works as a part-time consultant and devotes approximately 20 hours per month to our business. Our director, Andrew Jolly, works as a part-time consultant to our company and devotes his time to our business on an as needed basis. Our former director, Chris Williams, worked as a part-time consultant and devoted approximately 1 hour per week to our business. Mr. Williams resigned on April 23, 2014. If our financial position permits, as required by our business, we may enlist certain individuals on a full or part-time salaried basis to assist with marketing, advertising, administration and data management for our business.

Item 1A. Risk Factors

Risks Related to our Business

We have a limited operating history with significant losses and expect losses to continue for the foreseeable future.

We have yet to establish any history of profitable operations. We incurred a net loss of $60,130,794 for the period from April 5, 2011 (inception) to March 31, 2016. We had a net loss of $7,446,232 for the year ended March 31, 2016. We have not generated any revenues since our inception. We expect that our revenues will not be sufficient to sustain our operations for the foreseeable future. Our profitability will depend on our ability to successfully market and sell the ENVI-Clean™ system and there can be no assurance that we will be able to do so.

| 14 |

There is doubt about our ability to continue as a going concern due to recurring losses from operations, accumulated deficit and insufficient cash resources to meet our business objectives, all of which means that we may not be able to continue operations.

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with the consolidated financial statements for the years ended March 31, 2016 and 2015, respectively, with respect to their doubt about our ability to continue as a going concern. As discussed in Note 1 to our consolidated financial statements for the year ended March 31, 2016, we have incurred operating losses since inception, and our cash resources are insufficient to meet our planned business objectives, which together raises substantial doubt about our ability to continue as a going concern.

We may not be able to secure additional financing to meet our future capital needs due to changes in general economic conditions.

We anticipate needing significant capital to develop our sales force and effective market the ENVI-Clean™ system. We may use capital more rapidly than currently anticipated and incur higher operating expenses than currently expected, and we may be required to depend on external financing to satisfy our operating and capital needs. We may need new or additional financing in the future to conduct our operations or expand our business. Any sustained weakness in the general economic conditions and/or financial markets in the United States or globally could adversely affect our ability to raise capital on favorable terms or at all. From time to time we have relied, and may also rely in the future, on access to financial markets as a source of liquidity to satisfy working capital requirements and for general corporate purposes. We may be unable to secure debt or equity financing on terms acceptable to us, or at all, at the time when we need such funding. If we do raise funds by issuing additional equity or convertible debt securities, the ownership percentages of existing stockholders would be reduced, and the securities that we issue may have rights, preferences or privileges senior to those of the holders of our common stock or may be issued at a discount to the market price of our common stock which would result in dilution to our existing stockholders. If we raise additional funds by issuing debt, we may be subject to debt covenants, which could place limitations on our operations including our ability to declare and pay dividends. Our inability to raise additional funds on a timely basis would make it difficult for us to achieve our business objectives and would have a negative impact on our business, financial condition and results of operations.

We are a development stage company and we may not be successful in marketing the ENVI-Clean™ system and the value of your investment could decline.

We are a development stage company with no substantial tangible assets in a highly competitive industry. We have little operating history, no customers, and no revenues. This makes it difficult to evaluate our future performance and prospects. Our prospects must be considered in light of the risks, expenses, delays and difficulties frequently encountered in establishing a new business in an emerging and evolving industry, including the following factors:

| ● | our business model and strategy are still evolving and are continually being reviewed and revised; | |

| ● | we may not be able to raise the capital required to develop our initial client base and reputation; and | |

| ● | we may not be able to successfully develop our planned products and services. |

We cannot be sure that we will be successful in meeting these challenges and addressing these risks and uncertainties. If we are unable to do so, our business will not be successful and the value of your investment in us will decline.

Our business is subject to environmental and consumer protection legislation and any changes in such legislation could prevent us from becoming profitable.

The energy production and technology industries are subject to many laws and regulations which govern the protection of the environment, quality control standards, health and safety requirements, and the management, transportation and disposal of hazardous substances and other waste. Environmental laws and regulations may require removal or remediation of pollutants and may impose civil and criminal penalties for violations. Some environmental laws and regulations authorize the recovery of natural resource damages by the government, injunctive relief and the imposition of stop, control, remediation and abandonment orders. Similarly, consumer protection laws impose quality control standards on products marketed to the public and prohibit the distribution and marketing of products not meeting those standards.

The costs arising from compliance with environmental and consumer protection laws and regulations may increase operating costs for both us and our potential customers. Any regulatory changes that impose additional environmental restrictions or quality control requirements on us or on our potential customers could adversely affect us through increased operating costs and potential decreased demand for our services, which could prevent us from becoming profitable.

| 15 |

The development and expansion of our business through acquisitions, joint ventures, and other strategic transactions may create risks that may reduce the benefits we anticipate from these strategic alliances and may prevent us from achieving or sustaining profitability.

We intend to enter into technology acquisition and licensing agreements and strategic alliances such as joint ventures or partnerships in order to develop and commercialize our proposed technologies and services, and to increase our competitiveness. We currently do not have any commitments or agreements regarding acquisitions, joint ventures or other strategic alliances. Our management is unable to predict whether or when we will secure any such commitments or agreements, or whether such commitments or agreements will be secured on favorable terms and conditions.

Our ability to continue or expand our operations through acquisitions, joint ventures or other strategic alliances depends on many factors, including our ability to identify acquisitions, joint ventures, or partnerships, or access capital markets on acceptable terms. Even if we are able to identify strategic alliance targets, we may be unable to obtain the necessary financing to complete these transactions and could financially overextend ourselves.

Acquisitions, joint ventures or other strategic transactions may present financial, managerial and operational challenges, including diversion of management attention from existing business and difficulties in integrating operations and personnel. Acquisitions or other strategic alliances also pose the risk that we may be exposed to successor liability relating to prior actions involving a predecessor company, or contingent liabilities incurred before a strategic transaction. Due diligence conducted in connection with an acquisition, and any contractual guarantees or indemnities that we receive from sellers of acquired companies, may not be sufficient to protect us from, or compensate us for, actual liabilities. Liabilities associated with an acquisition or a strategic transaction could adversely affect our business and financial performance and reduce the benefits of the acquisition or strategic transaction. Any failure to integrate new businesses or manage any new alliances successfully could adversely affect our business and financial performance and prevent us from achieving profitability.

Our sole officer will only spend a modest portion of his available time managing our company. As a result, our success depends on the continuing efforts of other members of our senior management team and employees and the loss of the services of such key personnel could result in a disruption of operations which could result in reduced revenues.

We are dependent upon our officer for execution of our business plan. However, our sole officer, Neil Carmichael, will only spend a modest amount of his time in managing our company. As a result, our future success depends heavily upon the continuing services of the other members of our senior management team. If one or more of such other of our senior executives or other key personnel are unable or unwilling to continue in their present positions, we may not be able to replace them easily or at all, and our business may be disrupted and our financial condition and results of operations may be materially and adversely affected. Competition for senior management and key personnel is intense, the pool of qualified candidates is very limited, and we may not be able to retain the services of our senior executives or key personnel, or attract and retain high-quality senior executives or key personnel in the future. We do not currently maintain key man insurance on our senior managers. The loss of the services of our senior management team and employees could result in a disruption of operations which could result in reduced revenues.

We assumed debt as a result of the assignment agreement that we may not be able to repay, resulting in possible default and/or substantial dilution to our shareholders.

The assignment agreement was partly funded through a promissory note of $5 million as set out in this document. There is a risk that we may not be able to repay the promissory note when it is due on maturity. In addition, any failure by us to repay the promissory note may result in PGG converting the amount outstanding into new shares of our company’s common stock which would have the effect of diluting existing shareholders.

We are at risk that the ENVI-Clean™ system will not perform to expectations.

As at the date of this annual report, the ENVI-Clean™ system has been tested to satisfactory requirements but there is no guarantee that the ENVI-Clean™ system will continue to perform satisfactorily in the future which would damage our prospects following the Assignment.