Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Braemar Hotels & Resorts Inc. | ahpinvestorpresentation8-k.htm |

Company Presentation – September 2016

Certain statements and assumptions in this presentation contain or are based upon “forward-looking” information and are being made

pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to

risks and uncertainties. When we use the words “will likely result,” “may,” “anticipate,” “estimate,” “should,” “expect,” “be lieve,” “intend,” or

similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our

business and investment strategy, our understanding of our competition, current market trends and opportunities, and projected capital

expenditures. Such statements are subject to numerous assumptions and uncertainties, many of which are outside of our control.

These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ

materially from those anticipated, including, without limitation: general volatility of the capital markets, the general economy or the hospitality

industry, whether the result of market events or otherwise; our ability to deploy capital and raise additional capital at reasonable costs to repay

debts, invest in our properties and fund future acquisitions; unanticipated increases in financing and other costs, including a rise in interest

rates; the degree and nature of our competition; actual and potential conflicts of interest with Ashford Hospitality Trust, Inc., Ashford Hospitality

Advisors, LLC (“Ashford LLC”), Ashford Inc., Remington Lodging & Hospitality, LLC, our executive officers and our non-independent directors; our

ability to implement and execute on planned initiatives announced in connection with the conclusion of our independent directors’ strategic

review process; changes in personnel of Ashford LLC or the lack of availability of qualified personnel; changes in governmental regulations,

accounting rules, tax rates and similar matters; legislative and regulatory changes, including changes to the Internal Revenue Code and

related rules, regulations and interpretations governing the taxation of real estate investment trusts (“REITs”); and limitations imposed on our

business and our ability to satisfy complex rules in order for us to qualify as a REIT for U.S. federal income tax purposes. These and other risk

factors are more fully discussed in the section entitled “Risk Factors” in our Annual Report on Form 10-K, and from time to time, in our other filings

with the Securities and Exchange Commission (“SEC”).

The forward-looking statements included in this presentation are only made as of the date of this presentation. Investors should not place

undue reliance on these forward-looking statements. We are not obligated to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or circumstances, changes in expectations or otherwise.

EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA

divided by the purchase price. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net

operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA

flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP

measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC.

This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Prime

or any of its respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security.

2

Certain Disclosures

Recent Updates

3

Q2 2016 Adjusted EBITDA increased 13%

Q2 2016 Hotel EBITDA flow-through was 125%

Q2 2016 Hotel EBITDA margins increased 71 bps

Excellent progress on strategic alternatives to enhance shareholder

value

Announced corporate governance enhancements & appointment of

new independent director

Excellent Progress on Strategic Alternatives

4

Engaged search firm

Added Ken Fearn as an independent

director

Since April 8, 2016 we have bought

back approximately 2.9 million shares

for $39 million

Investment has been redeemed

Increased dividend 20% to $0.12

Courtyard Seattle sold for $84.5 million

at 6.7% TTM NOI cap rate

Increase dividend

WHAT WE SAID WE WOULD DO

Sell up to 4 non-strategic hotels

Liquidate investment fund

$50 million stock repurchase program

Add 2 independent directors

Appoint new CEO

WHAT WE HAVE DONE

Ashford Hospitality Prime Vision

Well defined

strategy investing in

luxury hotels in

gateway and resort

markets

5

Bardessono Hotel & Spa

Yountville, CA

Pier House Resort

Key West, FL

The Ritz-Carlton St. Thomas

St. Thomas, USVI

Grow platform

through accretive

acquisitions of high

quality assets

Highly-aligned

management team

and organizational

structure

Simple and

straightforward

investment profile

Grow organically

through strong

revenue and cost

control initiatives

Maintain conservative

capital structure

Execute on strategic

alternatives initiatives

to enhance

stockholder value

Utilize key money from

Ashford Inc. to assist

with accretive growth

$140.20

$148.64

$171.35

$199.43 $203.90

$0.00

$50.00

$100.00

$150.00

$200.00

$250.00

2012 2013 2014 2015 TTM 2016

6

AHP Leadership Has Delivered Results in Prudent, Accretive Growth

ACCRETIVE

GROWTH OF

HOTEL

PORTFOLIO

Acquired the Ritz-Carlton St. Thomas, Bardessono Hotel & Spa, Sofitel

Chicago Magnificent Mile, & Pier House Resort

Increased portfolio RevPAR since spin-off by over 45% to $204 as of TTM June

2016

Increased asset base by 50% since spin-off

7

$0.05

$0.10

$0.12

$0.00

$0.02

$0.04

$0.06

$0.08

$0.10

$0.12

$0.14

2013 Q2 15 2016

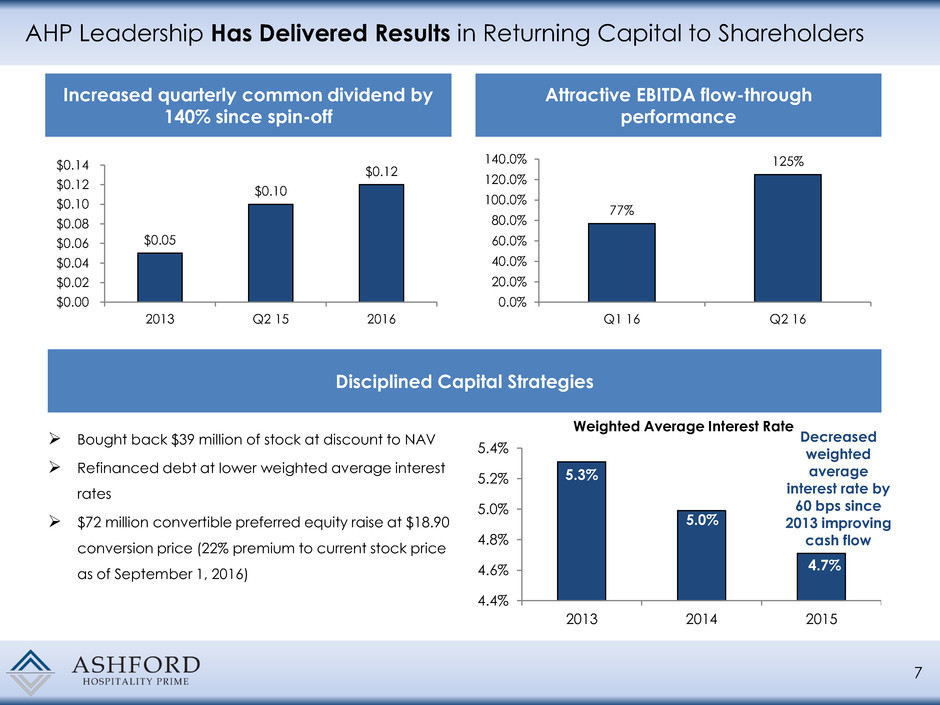

AHP Leadership Has Delivered Results in Returning Capital to Shareholders

Increased quarterly common dividend by

140% since spin-off

Attractive EBITDA flow-through

performance

Disciplined Capital Strategies

5.3%

5.0%

4.7%

4.4%

4.6%

4.8%

5.0%

5.2%

5.4%

2013 2014 2015

Weighted Average Interest Rate

Decreased

weighted

average

interest rate by

60 bps since

2013 improving

cash flow

Bought back $39 million of stock at discount to NAV

Refinanced debt at lower weighted average interest

rates

$72 million convertible preferred equity raise at $18.90

conversion price (22% premium to current stock price

as of September 1, 2016)

77%

125%

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

120.0%

140.0%

Q1 16 Q2 16

15%*

5.7%

3.4% 3.3% 3.3%

2.3% 2.2% 1.9% 1.8%

1.3% 1.2% 0.8% 0.5%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

AHP HT RLJ CLDT FCH Peer Avg CHSP INN HST PEB DRH SHO LHO

8

HIGHLY

ALIGNED

MANAGEMENT

TEAM

Insider ownership of 15%, 6x more than hotel REIT industry average

Insider ownership among the highest of its peers

Management has significant personal wealth invested in the Company

Incentive fee based on AHP total return outperformance vs. its peers

Insider Equity Ownership

Highly-aligned management team with

among highest insider equity ownership

of publicly-traded Hotel REITs

Public Lodging REITs include: CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHO

Source: Company filings.

* Insider equity ownership for Ashford Prime includes direct & indirect interests & interests of related

parties

AHP’s Management Team Is Aligned Like No Other

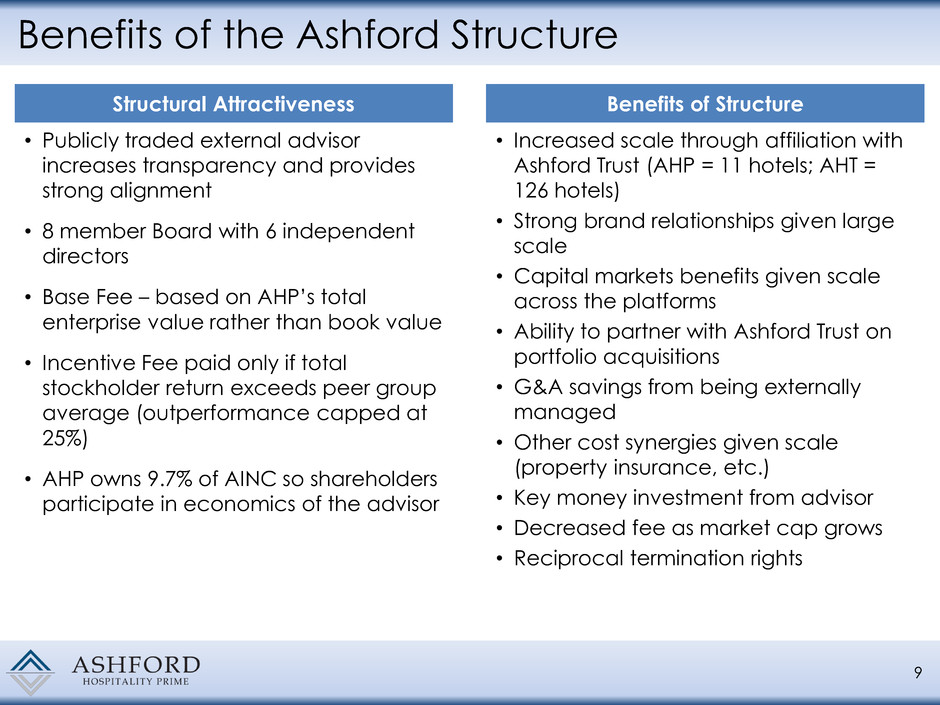

Benefits of the Ashford Structure

9

Structural Attractiveness

• Publicly traded external advisor

increases transparency and provides

strong alignment

• 8 member Board with 6 independent

directors

• Base Fee – based on AHP’s total

enterprise value rather than book value

• Incentive Fee paid only if total

stockholder return exceeds peer group

average (outperformance capped at

25%)

• AHP owns 9.7% of AINC so shareholders

participate in economics of the advisor

Benefits of Structure

• Increased scale through affiliation with

Ashford Trust (AHP = 11 hotels; AHT =

126 hotels)

• Strong brand relationships given large

scale

• Capital markets benefits given scale

across the platforms

• Ability to partner with Ashford Trust on

portfolio acquisitions

• G&A savings from being externally

managed

• Other cost synergies given scale

(property insurance, etc.)

• Key money investment from advisor

• Decreased fee as market cap grows

• Reciprocal termination rights

High Quality Portfolio

10 Ashford Prime Hotels

Marriott Seattle

Seattle, WA

Hilton Torrey Pines

La Jolla, CA

Bardessono Hotel & Spa

Yountville, CA

Pier House Resort

Key West, FL

Renaissance Tampa

Tampa, FL

Sofitel Chicago Magnificent Mile

Chicago, IL

Courtyard Philadelphia

Philadelphia, PA

Capital Hilton

Washington D.C.

Courtyard San Francisco

San Francisco, CAz Renaissance Tampa

Tampa, FL

Courtyard Philadelphia

Philadelphia, PA

Capital Hilton

ashington D.C.

Marriott Plano Legacy

Plano, TX

The Ritz-Carlton St. Thomas

St. Thomas, USVI

Portfolio Overview

11

(1) As of June 30, 2016

(2) Wells Fargo Securities Research; Lodging: TripAdvisor Rankings (June 21, 2016)

Note: Hotel EBITDA in thousands

High quality portfolio with total ADR and RevPAR of $249 and $204, respectively for

the TTM period

Geographically diversified portfolio located in strong markets

Highest TripAdvisor ranking among publicly-traded Hotel REITs(2)

Number of TTM TTM TTM TTM Hotel % of

Location Rooms ADR

(1) Occ. (1) RevPAR(1) EBITDA(1) Total

Courtyard Philadelphia Downtown Philadelphia, PA 499 $174 82% $143 $11,992 10.1%

Marriott Plano Legacy Dallas, TX 404 $196 71% $139 $11,260 9.5%

Courtyard San Francisco Downtown San Francisco, CA 405 $280 89% $249 $13,981 11.8%

Marriott Seattle Waterfront Seattle, WA 358 $261 82% $214 $14,910 12.5%

Renaissance Tampa Tampa, FL 293 $186 78% $146 $6,248 5.3%

Capital Hilton Washington D.C. 550 $226 87% $195 $15,994 13.5%

Hilton Torrey Pines La Jolla, CA 394 $193 84% $161 $11,773 9.9%

Sofitel Chicago Magnificent Mile Chicago, IL 415 $219 80% $176 $8,609 7.2%

Pier House Key West, FL 142 $403 89% $359 $9,974 8.4%

Bardessono Napa Valley, CA 62 $722 80% $581 $4,488 3.8%

Ritz-Carlton St. Thomas St. Thomas, USVI 180 $539 78% $423 $9,647 8.1%

Total Portfolio 3,702 $249 82% $204 $118,877 100.0%

Asset Management Initiatives

12

Pier House: Complexed GM and sales team resulting in significant labor savings

Renaissance Tampa: Recently completed significant guestrooms and lobby renovation

Bardessono: Evaluating construction of presidential villa consisting of 3 large-luxurious suites

The Ritz-Carlton St. Thomas: Implemented profit improvement plan estimated to save ~$800k

annually

Capital Hilton: Potentially releasing retail space to higher quality tenant and increased rent

Hilton Torrey Pines: Negotiating extension of ground lease, adding potential 52 years in term

Marriott Seattle: Adding 3 keys by moving concierge lounge to lobby level

Marriott Plano: Actively marketing ~15,000 sq. ft. of highly visible retail space

Courtyard San Francisco: Custom guestrooms renovation and consolidating F&B outlets

Sofitel Chicago Magnificent Mile: Renovation of lobby bar and fitness center; 2017 rooms

renovation

Courtyard Philadelphia: Meeting and pre-function space renovation starting Dec. 2016

Capital Structure and Net Working Capital

Conservative leverage in line with platform strategy

Targeted Net Debt / EBITDA of 5.0x

All debt is non-recourse, property level mortgage debt

Targeted cash balance of 25% to 30% of market capitalization

Maintain excess cash balance to capitalize on opportunities

Hedge unfavorable economic shocks

Dry powder to execute opportunistic acquisitions

13

As of June 30, 2016

(1) At market value as of September 1, 2016

(2) Adjusted for the sale of Courtyard Seattle Downtown

Total Enterprise Value Net Working Capital

Figures in millions except per share values

Stock Price (As of September 1, 2016) $15.53

Fully Diluted Shares Outstanding 31.0

Equity Value $482.1

Plus: Convertible Preferred Equity 72.3

Plus: Debt (2) 714.4

Total Market Capitalization $1,268.7

Less: Net Working Capital (158.4)

Total Enterprise Value $1,110.3

Cash & Cash Equivalents (2) $142.1

Restricted Cash 39.9

Accounts Receivable, net 16.9

Prepaid Expenses 5.2

Due From Affiliates, net (4.7)

Du from Third Party Hotel Managers 10.5

Investment in Ashford Inc. (1) 8.9

Total Current Assets $218.8

Accounts Payable, net & Accrued Expenses $55.4

Dividends Payable 5.0

Total Current Liabilities $60.3

Net Working Capital $158.4

$338.3

$8.1

$80.0

$152.0

$194.7

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

$350.0

$400.0

$450.0

2016 2017 2018 2019 2020 Thereafter

Fixed-Rate Floating-Rate

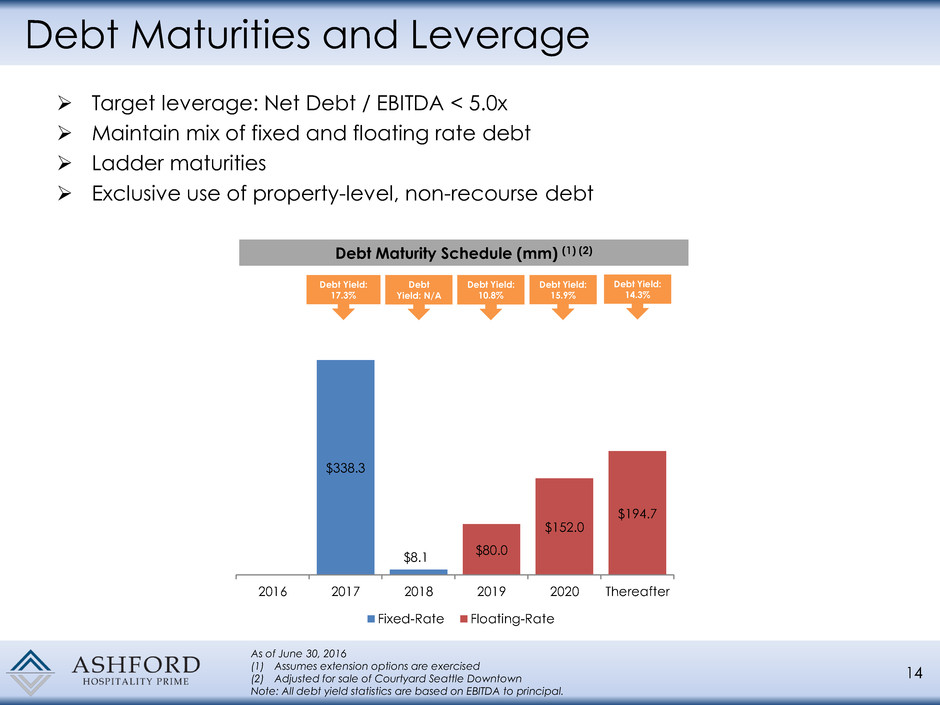

Debt Maturities and Leverage

Target leverage: Net Debt / EBITDA < 5.0x

Maintain mix of fixed and floating rate debt

Ladder maturities

Exclusive use of property-level, non-recourse debt

14

As of June 30, 2016

(1) Assumes extension options are exercised

(2) Adjusted for sale of Courtyard Seattle Downtown

Note: All debt yield statistics are based on EBITDA to principal.

Debt Maturity Schedule (mm) (1) (2)

Debt Yield:

17.3%

Debt

Yield: N/A

Debt Yield:

10.8%

Debt Yield:

15.9%

Debt Yield:

14.3%

Asset Management Expertise – Bardessono

15

Acquired in July 2015

2015 RevPAR of $564

62 keys, 1,350 sq. ft. of meeting space

Located in Yountville, CA the “Culinary

Capital of Napa Valley”

High barrier to entry market

One of only three LEED Platinum certified

hotels in the U.S., only hotel in California

2015 TripAdvisor Travelers' Choice Award

for Top Hotels - #3 in the U.S.

Hotel Overview

Received $2 million of Key Money from

AINC

Opportunity to add 2 to 3 luxury villas to

attract ultra-luxury guests

Cost control opportunities

Implementation of Remington revenue

initiatives

From August 2015 to June 2016 (since

acquisition): RevPAR up 6.0%, EBITDA

Margin up 481 bps, & EBITDA flow-through

of 152%

Opportunities

Bardessono – Yountville, CA

Bardessono – Yountville, CA

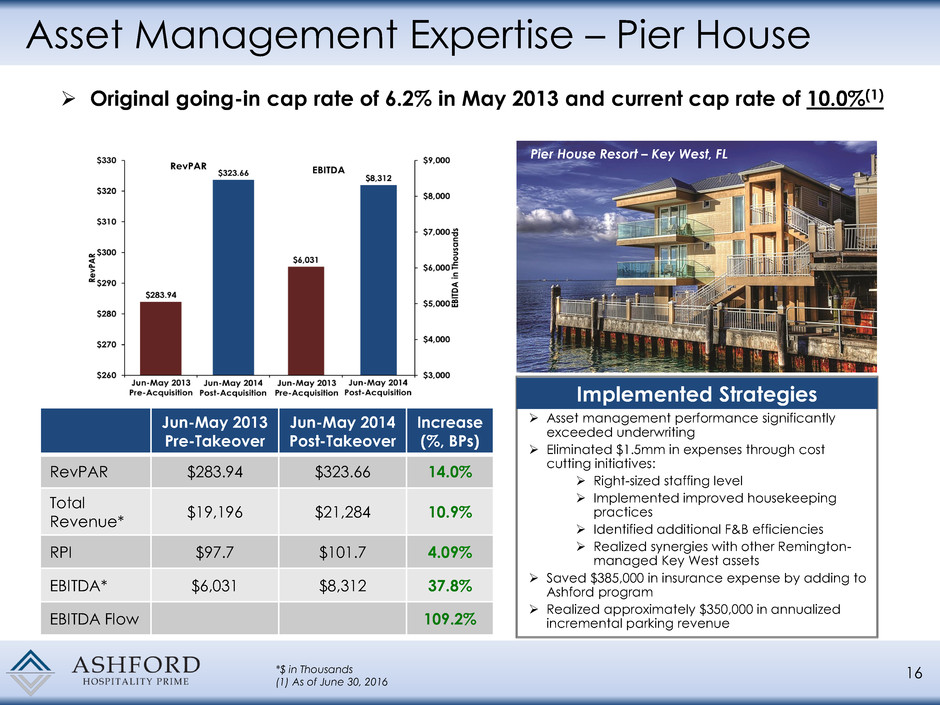

Asset Management Expertise – Pier House

16

Asset management performance significantly

exceeded underwriting

Eliminated $1.5mm in expenses through cost

cutting initiatives:

Right-sized staffing level

Implemented improved housekeeping

practices

Identified additional F&B efficiencies

Realized synergies with other Remington-

managed Key West assets

Saved $385,000 in insurance expense by adding to

Ashford program

Realized approximately $350,000 in annualized

incremental parking revenue

Implemented Strategies

Pier House Resort – Key West, FL

Jun-May 2013

Pre-Takeover

Jun-May 2014

Post-Takeover

Increase

(%, BPs)

RevPAR $283.94 $323.66 14.0%

Total

Revenue*

$19,196 $21,284 10.9%

RPI $97.7 $101.7 4.09%

EBITDA* $6,031 $8,312 37.8%

EBITDA Flow 109.2%

*$ in Thousands

(1) As of June 30, 2016

Original going-in cap rate of 6.2% in May 2013 and current cap rate of 10.0%(1)

Asset Management Expertise – Ritz St. Thomas

17

The Ritz-Carlton St. Thomas

Acquired in December 2015

180 keys, 10,000 sq. ft. of meeting space

Acquisition completed at favorable

metrics of 7.2x TTM EBITDA and 10% TTM

NOI cap rate

Located in St. Thomas in the U.S. Virgin

Islands with high barriers to entry

30 oceanfront acres along Great Bay

Recognized in the 2015 U.S. News &

World Report's Best Hotel Rankings

Hotel Overview

Significant upside after recently completed

extensive $22 million renovation of guest

rooms and public space

Since closing of the acquisition, our asset

management team has identified several

opportunities to improve performance

EBITDA Margin up 237 bps, & EBITDA flow-

through of 153% YTD Q2 2016 (1st full 2

quarters of ownership) with no change in

property manager

Opportunities

Great Bay View

The Ritz-Carlton St. Thomas

Corporate Governance Enhancements

18

Adoption of a majority voting standard for uncontested director elections

and a plurality voting standard in contested director elections

Separate the roles of Chairman and CEO

Prohibit share recycling with respect to share forfeitures, stock options and

stock appreciation rights under the Company’s stock plan by executives

and directors

Implementation of a mandatory equity award retention period for

executives and directors

Adoption of a proxy access resolution which would enable a shareholder, or

a group of not more than 20 shareholders, who have continuously owned

3% or more of the Company’s common stock for a minimum of 3 years to

include nominees in its proxy materials for the greater of two or 20% of the

Board

Addition of two independent directors to the Board. As part of this initiative,

the Company is pleased to announce that Ken Fearn has joined the Board

of Directors, bringing the total number of directors to eight and the total

independent directors to six

Key Takeaways

19

Completed sale of the Courtyard Seattle Downtown for $84.5 million

Commenced execution of strategic alternatives initiatives to enhance

stockholder value

Highly-aligned management team

Maximizing shareholder value is our #1 objective

Increased dividend 20% to $0.12 per quarter

Bought back approximately 2.9 million shares for $39 million

Company Presentation – September 2016