Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CROWN HOLDINGS INC | d247826d8k.htm |

Exhibit 99.1

For purposes of this Exhibit 99.1, unless the context otherwise requires: (i) “Crown” refers to Crown Holdings, Inc. and its subsidiaries on a consolidated basis; (ii) “Crown Cork” refers to Crown Cork & Seal Company, Inc. and not its subsidiaries; and (iii) “Crown European Holdings” refers to Crown European Holdings S.A. and not its subsidiaries. References to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Crown’s consolidated financial statements refer to the corresponding sections of Crown’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2016 and Crown’s Annual Report on Form 10-K for the year ended December 31, 2015. The “new euro notes” or the “euro notes” refers to the notes due 2024, issued by Crown European Holdings. The “dollar notes” refers to the notes due 2026, issued by Crown Americas LLC and Crown Americas Capital Corp. V. The “notes”, the “new senior notes” or the “new notes” refers, collectively, to the new euro notes and the dollar notes.

FORWARD-LOOKING STATEMENTS

Statements included herein that are not historical facts (including any statements concerning plans and objectives of management for future operations or economic performance, or assumptions related thereto) are “forward-looking statements” within the meaning of the U.S. federal securities laws. Forward-looking statements can be identified by words, such as “believes,” “estimates,” “anticipates,” “expects” and other words of similar meaning in connection with a discussion of future operating or financial performance. These may include, among others, statements relating to:

| • | Crown’s senior notes offerings and the use of proceeds therefrom described herein, and Crown’s ability to implement the offerings on the terms described herein; |

| • | Crown’s plans or objectives for future operations, products or financial performance; |

| • | Crown’s indebtedness and other contractual obligations; |

| • | the impact of an economic downturn or growth in particular regions; |

| • | anticipated uses of cash; |

| • | cost reduction efforts and expected savings; |

| • | Crown’s policies with respect to executive compensation; and |

| • | the expected outcome of contingencies, including with respect to asbestos-related litigation and pension and postretirement liabilities. |

These forward-looking statements are made based upon Crown’s expectations and beliefs concerning future events impacting it and, therefore, involve a number of risks and uncertainties. Crown cautions that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking statements.

Important factors that could cause the actual results of operations or financial condition of Crown to differ include, but are not necessarily limited to:

| • | the ability of Crown to expand successfully in international and emerging markets; |

| • | whether the acquisition of Empaque will be accretive to Crown’s earnings; |

| • | whether the sales and profits of Empaque will continue to grow; |

| • | whether the combination of Crown and Empaque will provide benefits to customers and shareholders; |

| • | whether the operations of Empaque can be successfully integrated into the Crown’s operations; |

| • | the ability of Crown to repay, refinance or restructure its short and long-term indebtedness on adequate terms and to comply with the terms of its agreements relating to debt; |

| • | the impact of the recent European Sovereign debt crisis; |

1

| • | the impact of the vote in the recent referendum in the United Kingdom to exit the European Union, including (without limitation) any disruption to the United Kingdom’s access to the single market and any adverse effect on the economies of the United Kingdom and the European Union resulting therefrom; |

| • | Crown’s ability to generate significant cash to meet its obligations and invest in its business and to maintain appropriate debt levels; |

| • | restrictions on Crown’s use of available cash under its debt agreements; |

| • | changes or differences in U.S. or international economic or political conditions, such as inflation or fluctuations in interest or foreign exchange rates (and the effectiveness of any currency or interest rate hedges), tax rates and tax laws (including with respect to taxation of unrepatriated non-U.S. earnings or as a result of the depletion of net loss or foreign tax credit carryforwards); |

| • | the impact of healthcare reform in the United States; |

| • | the impact of foreign trade laws and practices; |

| • | the collectability of receivables; |

| • | war or acts of terrorism that may disrupt Crown’s production or the supply or pricing of raw materials, including in Crown’s Middle East operations, impact the financial condition of customers or adversely affect Crown’s ability to refinance or restructure its remaining indebtedness; |

| • | changes in the availability and pricing of raw materials (including aluminum can sheet, steel tinplate, energy, water, inks and coatings) and Crown’s ability to pass raw material, energy and freight price increases and surcharges through to its customers or to otherwise manage these commodity pricing risks; |

| • | Crown’s ability to obtain and maintain adequate pricing for its products, including the impact on Crown’s revenue, margins and market share and the ongoing impact of price increases; |

| • | energy and natural resource costs; |

| • | the cost and other effects of legal and administrative cases and proceedings, settlements and investigations; |

| • | the outcome of asbestos-related litigation (including the number and size of future claims and the terms of settlements, and the impact of bankruptcy filings by other companies with asbestos-related liabilities, any of which could increase the asbestos-related costs of Crown Cork & Seal Company, Inc., a subsidiary of Crown (“Crown Cork”) over time, the adequacy of reserves established for asbestos-related liabilities, Crown Cork’s ability to obtain resolution without payment of asbestos-related claims by persons alleging first exposure to asbestos after 1964, and the impact of state legislation dealing with asbestos liabilities and any litigation challenging that legislation and any future state or federal legislation dealing with asbestos liabilities); |

| • | Crown’s ability to realize deferred tax benefits; |

| • | changes in Crown’s critical or other accounting policies or the assumptions underlying those policies; |

| • | labor relations and workforce and social costs, including Crown’s pension and postretirement obligations and other employee or retiree costs; |

| • | investment performance of Crown’s pension plans; |

2

| • | costs and difficulties related to the acquisition of a business and integration of acquired businesses; |

| • | the impact of any potential dispositions, acquisitions or other strategic realignments, which may impact Crown’s operations, financial profile, investments or levels of indebtedness; |

| • | Crown’s ability to realize efficient capacity utilization and inventory levels and to innovate new designs and technologies for its products in a cost-effective manner; |

| • | competitive pressures, including new product developments, industry overcapacity, or changes in competitors’ pricing for products; |

| • | Crown’s ability to achieve high capacity utilization rates for its equipment; |

| • | Crown’s ability to maintain, develop and capitalize on competitive technologies for the design and manufacture of products and to withstand competitive and legal challenges to the proprietary nature of such technology; |

| • | Crown’s ability to protect its information technology systems from attacks or catastrophic failure; |

| • | the strength of Crown’s cyber-security; |

| • | Crown’s ability to generate sufficient production capacity; |

| • | Crown’s ability to improve and expand its existing product and product lines; |

| • | the impact of overcapacity on the end-markets Crown serves; |

| • | loss of customers, including the loss of any significant customers; |

| • | changes in consumer preferences for different packaging products; |

| • | the financial condition of Crown’s vendors and customers; |

| • | weather conditions, including their effect on demand for beverages and on crop yields for fruits and vegetables stored in food containers; |

| • | the impact of natural disasters, including in emerging markets; |

| • | changes in governmental regulations or enforcement practices, including with respect to environmental, health and safety matters and restrictions as to foreign investment or operation; |

| • | the impact of increased governmental regulation on Crown and its products, including the regulation or restriction of the use of bisphenol-A; |

| • | the impact of Crown’s recent initiatives to generate additional cash, including the reduction of working capital levels and capital spending; |

| • | the ability of Crown to realize cost savings from its restructuring programs; |

| • | Crown’s ability to maintain adequate sources of capital and liquidity; |

| • | costs and payments to certain of Crown’s executive officers in connection with any termination of such executive officers or a change in control of Crown; |

| • | the impact of existing and future legislation regarding refundable mandatory deposit laws in Europe for non-refillable beverage containers and the implementation of an effective return system; and |

| • | changes in Crown’s strategic areas of focus, which may impact Crown’s operations, financial profile or levels of indebtedness. |

3

Some of the factors noted above are discussed elsewhere herein. In addition, other factors have been or may be discussed from time to time in Crown’s filings with the SEC. While Crown periodically reassesses material trends and uncertainties affecting its results of operations and financial condition, Crown does not intend to review or revise any particular forward-looking statement in light of future events.

4

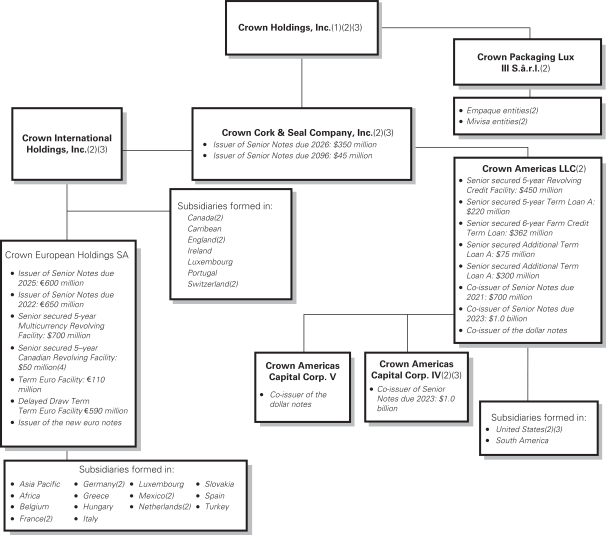

Organizational Structure

The following chart shows a summary of Crown’s current organizational structure, as well as the applicable obligors under the new notes, other outstanding notes, and Crown’s senior secured credit facilities as of the date hereof after giving effect to the euro notes offering and the dollar notes offering. Crown may modify this corporate structure in the future, subject to the covenants in the indenture governing the notes and compliance with the agreements governing Crown’s other outstanding indebtedness. The new euro notes will be guaranteed on an unsecured basis by (i) Crown and, subject to applicable law and exceptions, each of Crown’s subsidiaries in the United States, Canada, England, Luxembourg, Mexico, the Netherlands, Switzerland and Spain that is an obligor under Crown’s senior secured credit facilities or that guarantees or otherwise becomes liable with respect to any other indebtedness of Crown, the issuer or another guarantor and (ii) subject to applicable law and exceptions, each of the issuer’s subsidiaries that guarantees or otherwise becomes liable with respect to any indebtedness of Crown, the issuer or another guarantor or is otherwise an obligor under Crown’s senior secured credit facilities which as of the issue date of the notes is expected to include certain subsidiaries organized under the laws of France, Germany, Mexico and the Netherlands. The dollar notes will be unsecured and guaranteed by Crown and each of Crown’s U.S. subsidiaries that guarantees obligations under Crown’s senior unsecured credit facilities (other than Crown Americas LLC, Crown Americas Capital Corp., Crown Americas Capital Corp. II, Crown Americas Capital Corp. III, Crown Americas Capital Corp. IV and Crown Americas Capital Corp V). The guarantees will rank equal in right of payment to all existing and future senior debt of Crown and such guarantors.

5

| 1) | Guarantor of outstanding debentures of Crown Cork. |

| 2) | Guarantors of outstanding senior notes and senior secured credit facilities of Crown European Holdings and its subsidiaries and guarantors of Crown European Holdings’ obligations under the new euro notes, with the exception of: (i) the U.S. subsidiaries Crown Americas Capital Corp., Crown Americas Capital Corp. II, Crown Americas Capital Corp. II, Crown Americas Capital Corp. III, Crown Americas Capital Corp. IV and Crown Americas Capital Corp. V which guarantee the senior secured credit facilities but not the outstanding senior notes of Crown European Holdings, the new euro notes offered or the dollar notes, (ii) the U.S. subsidiaries Crownway Insurance Company and Crown, Cork & Seal Receivables (DE) Corporation, who do not guarantee the senior secured credit facilities, the outstanding senior notes of Crown European Holdings, the new euro notes or the dollar notes and (iii) the Spanish subsidiary Adularia Inversiones 2010, S.L.U., which guarantees the senior secured credit facilities but not the outstanding senior notes of Crown European Holdings or the new euro notes. |

| 3) | Guarantors of the outstanding senior notes of Crown Americas LLC and Crown Americas Capital Corp. IV and the dollar notes with the exception of the following U.S. subsidiaries: Crown Americas Capital Corp., Crown Americas Capital Corp. II, Crown Americas Capital Corp. III, Crown Americas Capital Corp. IV, Crownway Insurance Company and Crown, Cork & Seal Receivables (DE) Corporation. |

| 4) | Crown Metal Packaging Canada LP serves as the Canadian borrower. |

Crown is a Pennsylvania corporation. Crown’s principal executive offices are located at One Crown Way, Philadelphia, Pennsylvania 19154, and its telephone number is (215) 698-5100. Crown European Holdings (formerly known as CarnaudMetalbox SA) is a société anonyme organized under the laws of France. Crown European Holdings is an indirect, wholly-owned subsidiary of Crown.

6

Summary Historical and Adjusted Consolidated Financial Data

The following table sets forth summary historical and adjusted consolidated financial data for Crown as of and for the periods presented. The summary of operations data and other financial data for each of the years in the three-year period ended December 31, 2015 and the balance sheet data as of December 31, 2014 and 2015 have been derived from Crown’s audited consolidated financial statements and the notes thereto, excluding non-GAAP measures. The summary of operations data and other financial data for the six-month period ended June 30, 2016, the six-month period ended June 30, 2015 and the balance sheet data as of June 30, 2016 have been derived from Crown’s unaudited interim consolidated financial statements, excluding non-GAAP measures. The summary of operations data and other financial data for the twelve-month period ended June 30, 2016 have been derived by adding the summary of operations data for the year ended December 31, 2015 to the summary of operations data for the six-month period ended June 30, 2016 and subtracting the summary of operations data for the six-month period ended June 30, 2015, excluding non-GAAP measures. The December 31, 2013 balance sheet data has been derived from Crown’s audited consolidated financial statements. The adjusted financial data gives effect to the issuance of the new euro notes and the expected application of the net proceeds therefrom described under the caption “Use of Proceeds” and the issuance of the dollar notes and the anticipated use of proceeds therefrom.

You should read the following financial information in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Crown’s audited consolidated financial statements and the related notes.

| (dollars in millions) | ||||||||||||||||||||||||

| Year Ended December 31, |

Six Months Ended June 30, |

Twelve Months Ended June 30, |

||||||||||||||||||||||

| 2013 | 2014 | 2015 | 2015 | 2016 | 2016 | |||||||||||||||||||

| Summary of Operations Data: |

||||||||||||||||||||||||

| Net sales |

$ | 8,656 | $ | 9,097 | $ | 8,762 | $ | 4,275 | $ | 4,035 | $ | 8,522 | ||||||||||||

| Cost of products sold, excluding depreciation and amortization |

7,180 | 7,525 | 7,116 | 3,503 | 3,212 | 6,825 | ||||||||||||||||||

| Depreciation and amortization |

134 | 190 | 237 | 113 | 125 | 249 | ||||||||||||||||||

| Selling and administrative expense |

425 | 398 | 390 | 197 | 185 | 378 | ||||||||||||||||||

| Provision for asbestos |

32 | 45 | 26 | — | — | 26 | ||||||||||||||||||

| Restructuring and other |

34 | 129 | 66 | 17 | (1 | ) | 48 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income from operations |

851 | 810 | 927 | 445 | 514 | 996 | ||||||||||||||||||

| Loss from early extinguishments of debt |

41 | 34 | 9 | 9 | 27 | 27 | ||||||||||||||||||

| Interest expense |

236 | 253 | 270 | 134 | 122 | 258 | ||||||||||||||||||

| Interest income |

(5 | ) | (7 | ) | (11 | ) | (4 | ) | (5 | ) | (12 | ) | ||||||||||||

| Foreign exchange |

3 | 14 | 20 | 5 | (17 | ) | (2 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income before income taxes and equity earnings |

576 | 516 | 639 | 301 | 387 | 725 | ||||||||||||||||||

| Provision for income taxes |

148 | 41 | 178 | 86 | 103 | 195 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net Income |

428 | 475 | 461 | 215 | 284 | 530 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income attributable to noncontrolling interests |

(104 | ) | (88 | ) | (68 | ) | (29 | ) | (36 | ) | (75 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income attributable to Crown Holdings |

$ | 324 | $ | 387 | $ | 393 | $ | 186 | $ | 248 | 455 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

7

| (dollars in millions) | ||||||||||||||||||||||||

| Year Ended December 31, |

Six Months Ended June 30, |

Twelve Months Ended June 30, |

||||||||||||||||||||||

| 2013 | 2014 | 2015 | 2015 | 2016 | 2016 | |||||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||||||

| Net cash flows provided by/(used for): |

||||||||||||||||||||||||

| Operating activities |

$ | 885 | $ | 912 | $ | 956 | $ | (15 | ) | $ | 63 | $ | 1,034 | |||||||||||

| Investing activities |

(246 | ) | (1,021 | ) | (1,548 | ) | (1,302 | ) | (125 | ) | (371 | ) | ||||||||||||

| Financing activities |

(306 | ) | 445 | 406 | 679 | (281 | ) | (554 | ) | |||||||||||||||

| EBITDA(1) |

941 | 952 | 1,135 | 544 | 629 | 1,220 | ||||||||||||||||||

| Adjusted EBITDA(2) |

1,054 | 1,194 | 1,263 | 577 | 634 | 1,320 | ||||||||||||||||||

| Capital expenditures |

275 | 328 | 354 | 111 | 143 | 386 | ||||||||||||||||||

| Ratio of earnings to fixed charges(3) |

3.2x | 2.9x | 3.2x | 3.1x | 3.9x | 3.6x | ||||||||||||||||||

| Adjusted Financial Data: |

||||||||||||||||||||||||

| Adjusted total secured debt(4) |

1,677 | |||||||||||||||||||||||

| Adjusted total debt(5) |

5,337 | |||||||||||||||||||||||

| Adjusted net interest expense(6) |

255 | |||||||||||||||||||||||

| Ratio of adjusted total secured debt to Adjusted EBITDA |

1.3x | |||||||||||||||||||||||

| Ratio of adjusted total debt to Adjusted EBITDA |

4.0x | |||||||||||||||||||||||

| Ratio of Adjusted EBITDA to adjusted net interest expense |

5.2x | |||||||||||||||||||||||

| (dollars in millions) | ||||||||||||||||||||

| Year Ended December 31, |

Six Months Ended June 30, |

|||||||||||||||||||

| 2013 | 2014 | 2015 | 2015 | 2016 | ||||||||||||||||

| Balance Sheet Data (at end of period): |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 689 | $ | 965 | $ | 717 | $ | 288 | $ | 370 | ||||||||||

| Working capital(7) |

256 | 695 | 141 | 445 | 131 | |||||||||||||||

| Total assets |

7,993 | 9,643 | 10,020 | 10,293 | 9,776 | |||||||||||||||

| Total debt |

3,805 | 5,194 | 5,518 | 5,819 | 5,284 | |||||||||||||||

| Total equity |

289 | 387 | 435 | 404 | 623 | |||||||||||||||

| (1) | EBITDA is a non-GAAP measurement that consists of net income plus the sum of income taxes, interest expense (net of interest income) and depreciation and amortization. The reconciliation from income from continuing operations to EBITDA is as follows: |

| (dollars in millions) | ||||||||||||||||||||||||

| Year Ended December 31, |

Six Months Ended June 30, |

Twelve Months Ended June 30, |

||||||||||||||||||||||

| 2013 | 2014 | 2015 | 2015 | 2016 | 2016 | |||||||||||||||||||

| Net Income |

$ | 428 | $ | 475 | $ | 461 | $ | 215 | $ | 284 | $ | 530 | ||||||||||||

| Add/(deduct): |

||||||||||||||||||||||||

| Provision for income taxes |

148 | 41 | 178 | 86 | 103 | 195 | ||||||||||||||||||

| Interest income |

(5 | ) | (7 | ) | (11 | ) | (4 | ) | (5 | ) | (12 | ) | ||||||||||||

| Interest expense |

236 | 253 | 270 | 134 | 122 | 258 | ||||||||||||||||||

| Depreciation and amortization |

134 | 190 | 237 | 113 | 125 | 249 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| EBITDA |

$ | 941 | $ | 952 | $ | 1,135 | $ | 544 | $ | 629 | $ | 1,220 | ||||||||||||

8

| (2) | Adjusted EBITDA is a non-GAAP measurement that consists of EBITDA plus the sum of provision for asbestos, restructuring and other, loss from early extinguishments of debt, the impact of fair value adjustments to inventory acquired in an acquisition, timing impact of hedge ineffectiveness and foreign exchange. The reconciliation from EBITDA to Adjusted EBITDA is as follows: |

| (dollars in millions) | ||||||||||||||||||||||||

| Year Ended December 31, |

Six Months Ended June 30, |

Twelve Months Ended June 30, |

||||||||||||||||||||||

| 2013 | 2014 | 2015 | 2015 | 2016 | 2016 | |||||||||||||||||||

| EBITDA |

$ | 941 | $ | 952 | $ | 1,135 | $ | 544 | $ | 629 | $ | 1,220 | ||||||||||||

| Add/(deduct): |

||||||||||||||||||||||||

| Provision for asbestos* |

32 | 45 | 26 | — | — | 26 | ||||||||||||||||||

| Restructuring and other** |

37 | 129 | 66 | 17 | (1 | ) | 48 | |||||||||||||||||

| Loss from early extinguishments of debt |

41 | 34 | 9 | 9 | 27 | 27 | ||||||||||||||||||

| Impact of hedge ineffectiveness |

— | 1 | 1 | (4 | ) | (4 | ) | 1 | ||||||||||||||||

| Fair value adjustment to inventory |

— | 19 | 6 | 6 | — | — | ||||||||||||||||||

| Foreign exchange |

3 | 14 | 20 | 5 | (17 | ) | (2 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

$ | 1,054 | $ | 1,194 | $ | 1,263 | $ | 577 | $ | 634 | $ | 1,320 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| * | Crown made asbestos-related payments of $30 million in both 2015 and 2014 and $28 million in 2013. |

| ** | For the year ended December 31, 2013, restructuring and other includes $3 million of transaction costs incurred in connection with Crown’s acquisition of Mivisa that were reported in selling and administrative expense in Crown’s Consolidated Statement of Operations. |

EBITDA and Adjusted EBITDA are provided for illustrative and informational purposes only and do not purport to represent, and should not be viewed as indicative of, Crown’s actual or future financial condition or results of operations. EBITDA and Adjusted EBITDA do not represent and should not be considered as alternatives to net income, operating income, net cash provided by operating activities or any other measure of operating performance or liquidity that is calculated in accordance with U.S. GAAP. EBITDA and Adjusted EBITDA information is unaudited and has been included in this exhibit because Crown believes that certain analysts, rating agencies and investors may use it as supplemental information to evaluate a company’s ability to service its indebtedness and overall performance over time. However, EBITDA and Adjusted EBITDA have material limitations as analytical tools and should not be considered in isolation, or as substitutes for analysis of Crown’s results as reported under U.S. GAAP. A limitation associated with EBITDA and Adjusted EBITDA is that they do not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenues in Crown’s business. Any measure that eliminates components of Crown’s capital structure and costs associated with carrying significant amounts of assets on its balance sheet has material limitations as a performance measure. Management evaluates the costs of such tangible and intangible assets through other financial measures such as capital expenditures. In addition, in evaluating EBITDA and Adjusted EBITDA, you should be aware that the adjustments may vary from period to period and in the future Crown will incur expenses such as those used in calculating these measures. Furthermore, EBITDA and Adjusted EBITDA, as calculated by Crown, may not be comparable to calculations of similarly titled measures by other companies. In light of the foregoing limitations, Crown does not rely solely on EBITDA and Adjusted EBITDA as performance measures and also considers its results as calculated in accordance with U.S. GAAP. For purposes of the covenants in the indenture governing the notes, EBITDA is defined differently, and for purposes of our credit facility and reviewing goodwill for impairment, Adjusted EBITDA is defined differently.

| (3) | For purposes of computing the ratio of earnings to fixed charges, earnings consist of income before income taxes and equity earnings plus fixed charges (exclusive of interest capitalized during the period), amortization of interest previously capitalized and distributed income from less-than-50%-owned companies. Fixed charges include interest incurred, expensed and capitalized, amortization of debt issue costs and the portion of rental expense that is deemed representative of an interest factor. For purposes of the covenants in the indenture governing Crown’s outstanding notes, the ratio of earnings to fixed charges is defined differently. |

| (4) | Adjusted total secured debt as of June 30, 2016 is presented as the principal outstanding after giving effect to the expected issuance of the new notes and the expected application of the net proceeds therefrom described under the caption “Use of Proceeds”, and consists of $781 million of U.S. dollar Term Loan, $388 million (€355 million) of Euro Term Loan, $355 million under the farm credit facility, $148 million under the revolving credit facilities and $5 million of other secured indebtedness. |

9

| (5) | Adjusted total debt as of June 30, 2016 is presented as the principal outstanding after giving effect to the expected issuance of the new notes and the expected application of the net proceeds therefrom described under the caption “Use of Proceeds.” Adjusted total debt of $5,337 million consists of $1,677 million of secured indebtedness, $3,483 million of senior notes, including the new notes and debentures and $177 million of other indebtedness. |

| (6) | Adjusted net interest expense reflects the use of proceeds from the issuance of the new notes, together with other available funds to repay the Term Loan facility. The rate used to calculate adjusted interest expense for the above facility was 2.35% on the U.S. dollar Term Loan and 2.00% on the Euro Term Loan. These amounts would differ, and adjusted total debt and/or secured debt would increase, if Crown uses the proceeds from the offering for general corporate purposes other than repaying indebtedness under the senior secured credit facilities (such as repayment of senior notes). |

| (7) | Working capital consists of current assets less current liabilities. |

10

The following table sets forth the consolidated cash and cash equivalents and capitalization of Crown as of June 30, 2016:

| • | on an actual basis; |

| • | as adjusted to give adjusted effect to the offering of the dollar notes and the application of the net proceeds therefrom; and |

| • | as further adjusted to give adjusted effect to the offering of the new euro notes and the application of the net proceeds therefrom. |

You should read this table in conjunction with “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Description of Certain Indebtedness” and Crown’s audited consolidated financial statements and the related notes thereto.

| (dollars in millions) | ||||||||||||

| June 30, 2016 | ||||||||||||

| Actual | As Adjusted | As Further Adjusted |

||||||||||

| Cash and cash equivalents(1) |

$ | 370 | $ | 365 | $ | 360 | ||||||

|

|

|

|

|

|

|

|||||||

| Debt (principal outstanding): |

||||||||||||

| Senior secured facilities: |

||||||||||||

| Revolving credit facilities due 2018 |

148 | 148 | 148 | |||||||||

| Term loan facilities |

||||||||||||

| U.S. dollar at LIBOR plus 1.75% due 2018 |

1,131 | 781 | 781 | |||||||||

| Euro (€665 million actual and as adjusted, and €355 million as further adjusted, at June 30, 2016) at EURIBOR plus 1.75% due 2018 |

738 | 738 | 388 | |||||||||

| Farm credit facility at LIBOR plus 2.00% due 2019 |

355 | 355 | 355 | |||||||||

| Senior notes and debentures: |

||||||||||||

| Euro (€650 million at June 30, 2016) 4.0% due 2022 |

722 | 722 | 722 | |||||||||

| U.S. dollar 4.50% due 2023 |

1,000 | 1,000 | 1,000 | |||||||||

| Euro (€600 million at June 30, 2016) 3.375% Senior notes due 2025 |

666 | 666 | 666 | |||||||||

| Euro % Senior notes due 2024(2) |

— | — | 350 | |||||||||

| U.S. dollar % Senior notes due 2026(3) |

— | 350 | 350 | |||||||||

| U.S. dollar 7.375% due 2026 |

350 | 350 | 350 | |||||||||

| U.S. dollar 7.50% due 2096 |

45 | 45 | 45 | |||||||||

| Other indebtedness in various currencies |

182 | 182 | 182 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total debt |

5,337 | 5,337 | 5,337 | |||||||||

| Noncontrolling interests |

305 | 305 | 305 | |||||||||

| Crown Holdings shareholders’ equity(4) |

318 | 315 | 311 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total capitalization |

$ | 5,960 | $ | 5,957 | $ | 5,953 | ||||||

|

|

|

|

|

|

|

|||||||

| (1) | As adjusted cash and cash equivalents decrease by $5 million, reflecting an increase of $350 million from the issuance of the dollar notes, offset by $5 million of fees and expenses paid in connection therewith and $350 million used to repay Crown’s Term Loan facility. As further adjusted cash and cash equivalents decrease by $5 million, reflecting an increase of $350 million from the issuance of the new euro notes, offset by $5 million of fees and expenses paid in connection therewith and $350 million used to repay Crown’s Term Loan facility. These |

11

| amounts would differ, and adjusted total debt and/or secured debt would increase, if Crown uses the proceeds from the offering of the new notes not used to repay the Term Loan facility for general corporate purposes other than repaying indebtedness under the revolving credit facilities (such as repayment of senior notes). |

| (2) | Consists of €310 million aggregate principal amount of the new euro notes and does not give effect to original issue discount, if any. The €310 million in aggregate principal amount of the new euro notes are reflected at an assumed exchange rate of 1.13. |

| (3) | Consists of $350 million senior notes offered in the dollar notes offering and does not give effect to original issue discount, if any. |

| (4) | As adjusted and as further adjusted amount reflects the write off of $3 million and $4 million, respectively, of unamortized debt issue costs. |

12