Attached files

| file | filename |

|---|---|

| 8-K - CTWS FORM 8-K 09-07-2016 - CONNECTICUT WATER SERVICE INC / CT | form8-kxctwsinvestorpresen.htm |

Connecticut Water Service, Inc.

NASDAQ: CTWS

Investor Presentation

September 2016

NASDAQ: CTWS www.ctwater.com 2

Forward-Looking Statements

Except for the historical statements and discussions, some statements contained in this

presentation constitute “forward-looking statements” within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-

looking statements are based on current expectations and rely on a number of assumptions

concerning future events, and are subject to a number of uncertainties and other factors, many

of which are outside our control, that could cause actual results to differ materially from such

statements.

These forward-looking statements speak only as of the date of this presentation. Connecticut

Water does not assume any obligation to update or revise any forward-looking statement made

in this presentation or that may, from time to time, be made by or on behalf of the Company.

Neither this presentation nor any verbal communication shall constitute an invitation or

inducement to any person to subscribe for or otherwise acquire any Connecticut Water

securities.

For further information regarding risks and uncertainties associated with Connecticut Water’s

business, please refer to Connecticut Water’s annual, quarterly and periodic SEC filings which can

be found on the investor relations page of the Company’s website www.ctwater.com and at

www.sec.gov.

NASDAQ: CTWS www.ctwater.com 3

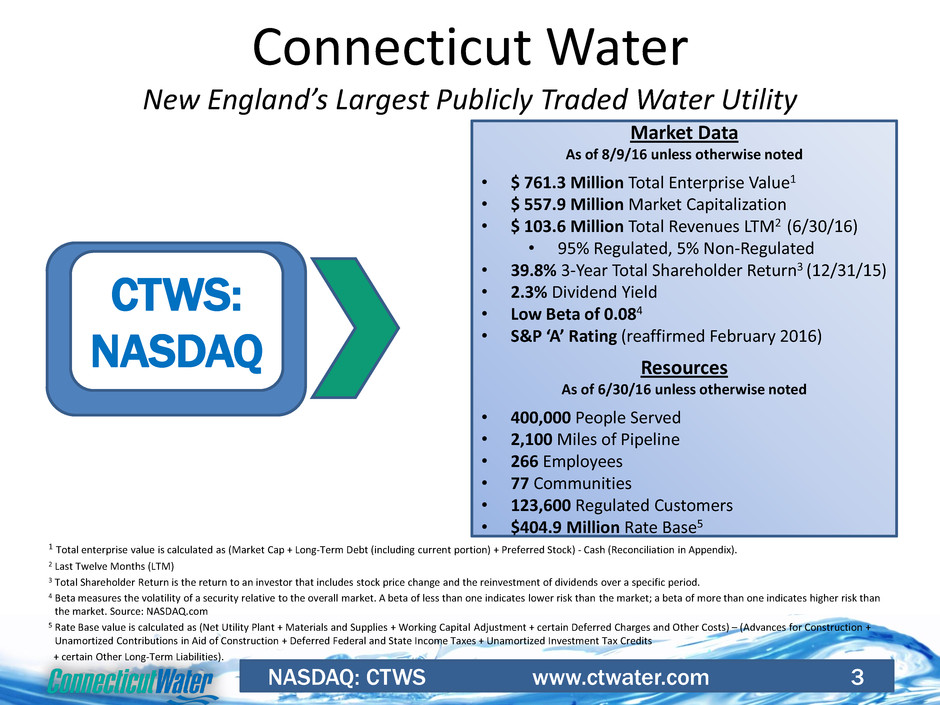

Connecticut Water

New England’s Largest Publicly Traded Water Utility

Market Data

As of 8/9/16 unless otherwise noted

• $ 761.3 Million Total Enterprise Value1

• $ 557.9 Million Market Capitalization

• $ 103.6 Million Total Revenues LTM2 (6/30/16)

• 95% Regulated, 5% Non-Regulated

• 39.8% 3-Year Total Shareholder Return3 (12/31/15)

• 2.3% Dividend Yield

• Low Beta of 0.084

• S&P ‘A’ Rating (reaffirmed February 2016)

Resources

As of 6/30/16 unless otherwise noted

• 400,000 People Served

• 2,100 Miles of Pipeline

• 266 Employees

• 77 Communities

• 123,600 Regulated Customers

• $404.9 Million Rate Base5

CTWS:

NASDAQ

1 Total enterprise value is calculated as (Market Cap + Long-Term Debt (including current portion) + Preferred Stock) - Cash (Reconciliation in Appendix).

2 Last Twelve Months (LTM)

3 Total Shareholder Return is the return to an investor that includes stock price change and the reinvestment of dividends over a specific period.

4 Beta measures the volatility of a security relative to the overall market. A beta of less than one indicates lower risk than the market; a beta of more than one indicates higher risk than

the market. Source: NASDAQ.com

5 Rate Base value is calculated as (Net Utility Plant + Materials and Supplies + Working Capital Adjustment + certain Deferred Charges and Other Costs) – (Advances for Construction +

Unamortized Contributions in Aid of Construction + Deferred Federal and State Income Taxes + Unamortized Investment Tax Credits

+ certain Other Long-Term Liabilities).

NASDAQ: CTWS www.ctwater.com 4

Connecticut Water Value Proposition

• Regionally focused, regulated water utilities (93% regulated earnings LTM as of 6/30/16)

• Maine acquisitions provide diversified, multi-state utility base and greater business scale

• Constructive regulatory environment with attractive investment recovery mechanisms

Diversified,

Regulated

Utility Business

Conservative growth strategy focused on utility infrastructure investment

Proven track record executing accretive acquisitions

Complementary, low-risk, non-regulated utility services business

Focus on maintaining a strong balance sheet and liquidity

“A” credit rating from S&P (as of February 11, 2016)

Balanced approach to financing growth and prudent operating cost management

Consistently raised dividend payments for 47 consecutive years

High-quality, well-maintained asset system

Experienced management team with an average of 25 years utility experience

≥ 85% customer satisfaction distinction in each of the last 15 years

(GreatBlue – Independent Research Firm)

Low Risk,

Regulated

Growth Plan

Strong

Financial

Profile

Operational

Excellence

5

• CapEx investment in water utility infrastructure and

earning a return “of and on” that investment

• Constructive regulatory relations with state commissions

to align customer and shareholder interests

• Prudent acquisitions of other water systems

• Supplement regulated earnings with low risk, core water

utility services where a competitive advantage exists

Our Growth Strategy

NASDAQ: CTWS www.ctwater.com 5

NASDAQ: CTWS www.ctwater.com 6

1 After tax return in Connecticut

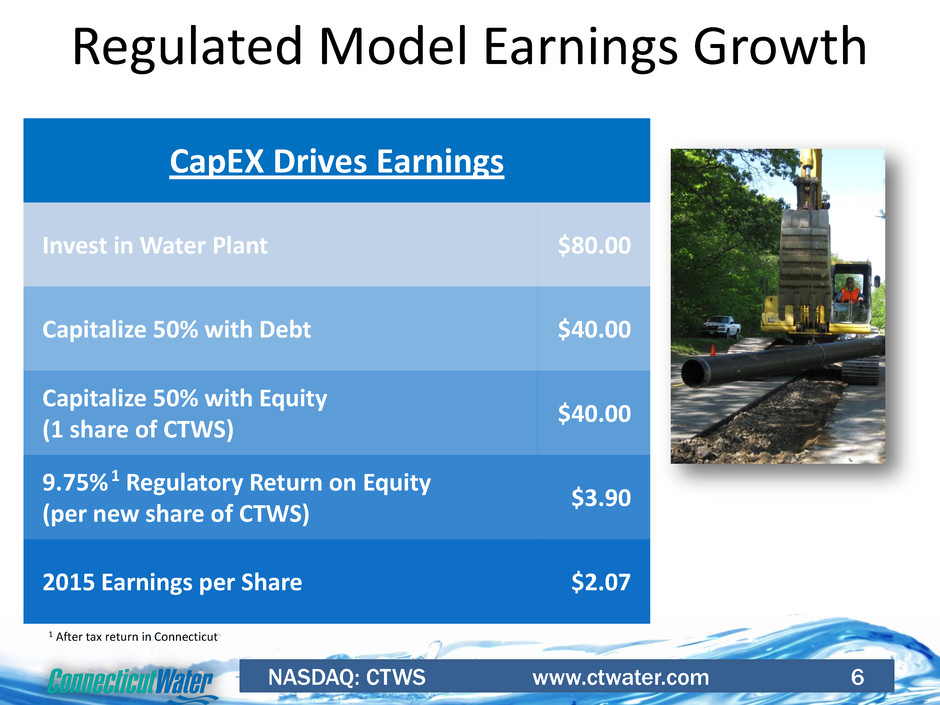

Regulated Model Earnings Growth

CapEX Drives Earnings

Invest in Water Plant $80.00

Capitalize 50% with Debt $40.00

Capitalize 50% with Equity

(1 share of CTWS)

$40.00

9.75% 1 Regulatory Return on Equity

(per new share of CTWS)

$3.90

2015 Earnings per Share $2.07

NASDAQ: CTWS www.ctwater.com 7

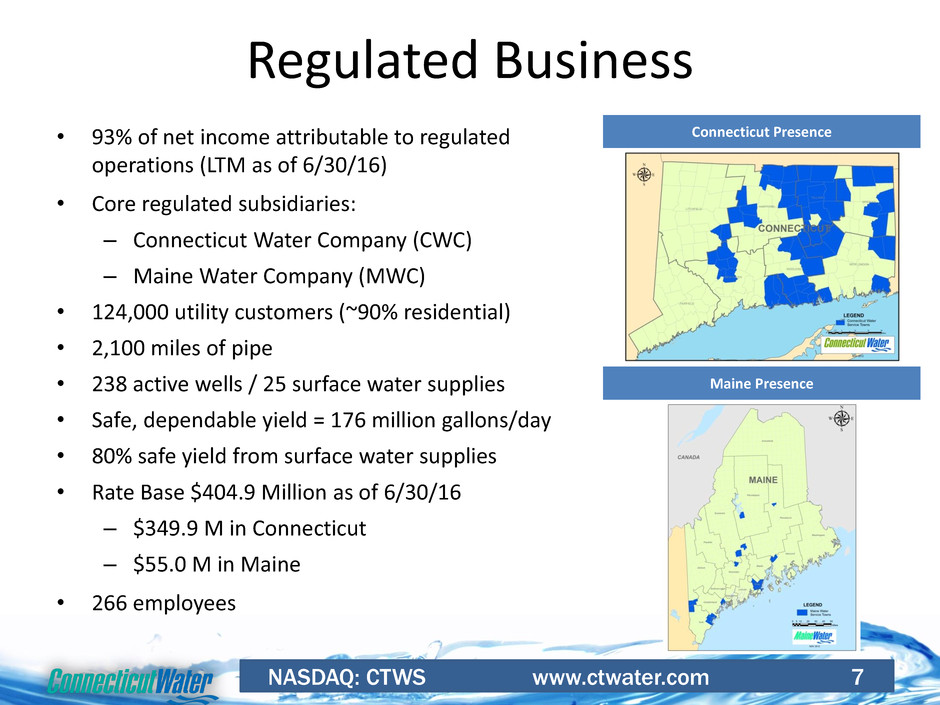

Regulated Business

• 93% of net income attributable to regulated

operations (LTM as of 6/30/16)

• Core regulated subsidiaries:

– Connecticut Water Company (CWC)

– Maine Water Company (MWC)

• 124,000 utility customers (~90% residential)

• 2,100 miles of pipe

• 238 active wells / 25 surface water supplies

• Safe, dependable yield = 176 million gallons/day

• 80% safe yield from surface water supplies

• Rate Base $404.9 Million as of 6/30/16

– $349.9 M in Connecticut

– $55.0 M in Maine

• 266 employees

Connecticut Presence

Maine Presence

NASDAQ: CTWS www.ctwater.com 8

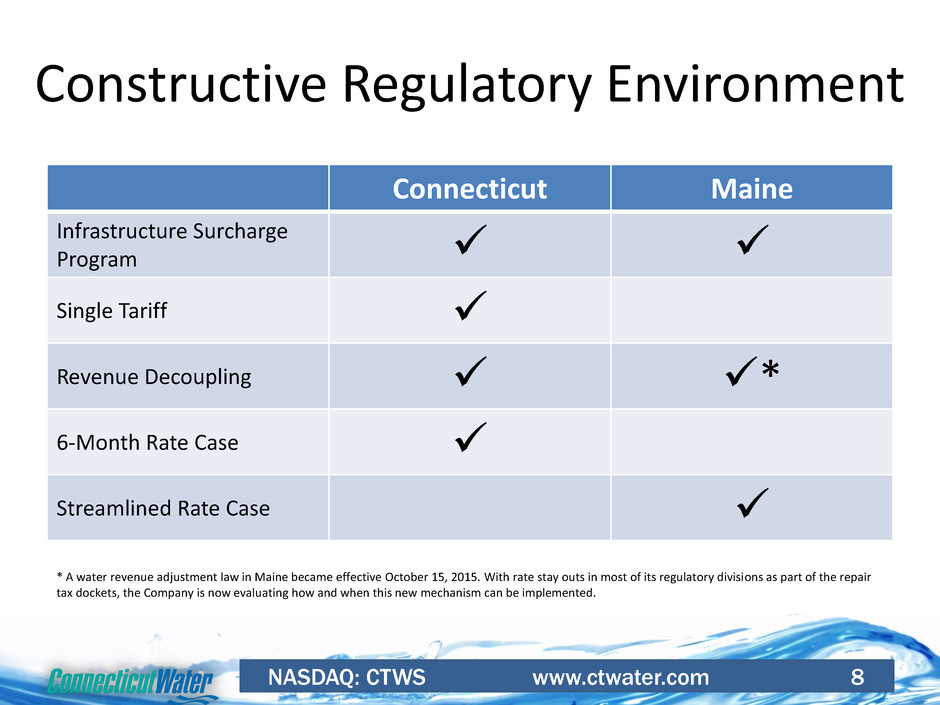

Constructive Regulatory Environment

Connecticut Maine

Infrastructure Surcharge

Program

Single Tariff

Revenue Decoupling *

6-Month Rate Case

Streamlined Rate Case

* A water revenue adjustment law in Maine became effective October 15, 2015. With rate stay outs in most of its regulatory divisions as part of the repair

tax dockets, the Company is now evaluating how and when this new mechanism can be implemented.

NASDAQ: CTWS www.ctwater.com 9

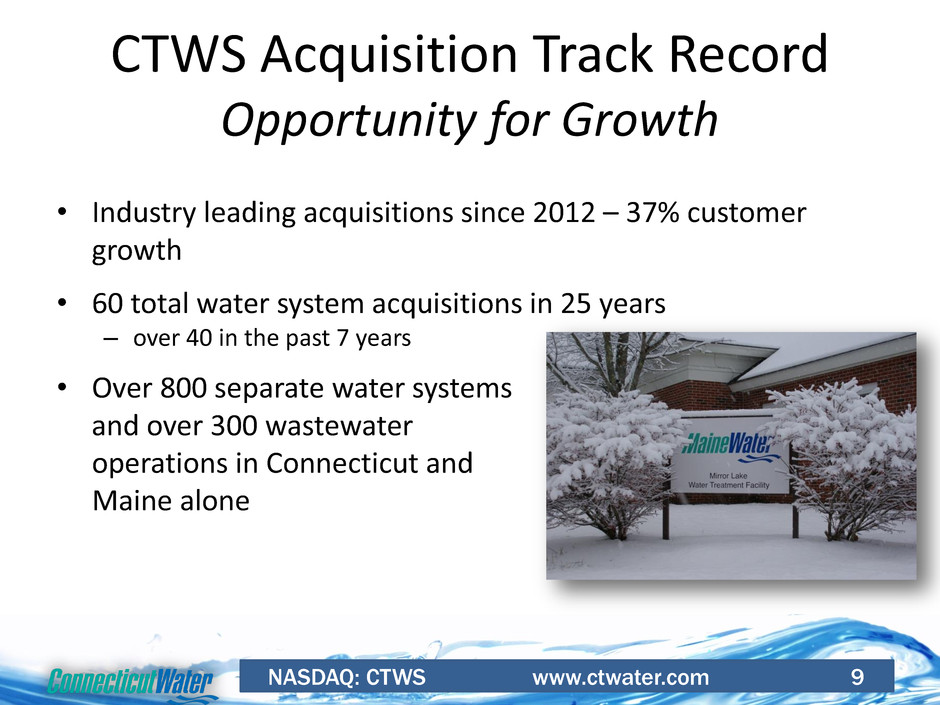

CTWS Acquisition Track Record

Opportunity for Growth

• Industry leading acquisitions since 2012 – 37% customer

growth

• 60 total water system acquisitions in 25 years

– over 40 in the past 7 years

• Over 800 separate water systems

and over 300 wastewater

operations in Connecticut and

Maine alone

NASDAQ: CTWS www.ctwater.com 10

Pending Acquisitions

• Heritage Village Water Company

– Acquisition announced May 10th

– 4,700 Water Customers

– 3,000 Waste Water Customers

– Serving in Southbury,

Middlebury & Oxford

– Enterprise Value $20.5 Million

– Expected to Close Q4 2016

NASDAQ: CTWS www.ctwater.com 11

Recent Acquisitions

Aqua Maine

– Closed January 1, 2012

– $53.5 million enterprise value (100% cash consideration)

– 16,000 Maine customers

– Retained highly regarded local management team

• Biddeford and Saco Water Company

– Closed December 10, 2012

– $19.8 million enterprise value (stock-for-stock consideration)

– 15,500 Maine customers

– Merged into Maine Water in 2014

– November 2014 rate case settled through Stipulation Agreement in March 2015

• 76.5% of revenue increase requested was approved

• Rate Base of Maine acquisitions was $55.0 Million as of 6/30/16

NASDAQ: CTWS www.ctwater.com 12

• Selected as long-term water provider for UConn and

surrounding area

– Acquiring 150+ off-campus customers

– Supplemental source of supply for growing

University

• Pipeline construction started July 2015

– Complete in August 2016

– In Service as early as September 2016

• Locks in expanded service area

Territory Acquisition

NASDAQ: CTWS www.ctwater.com 13

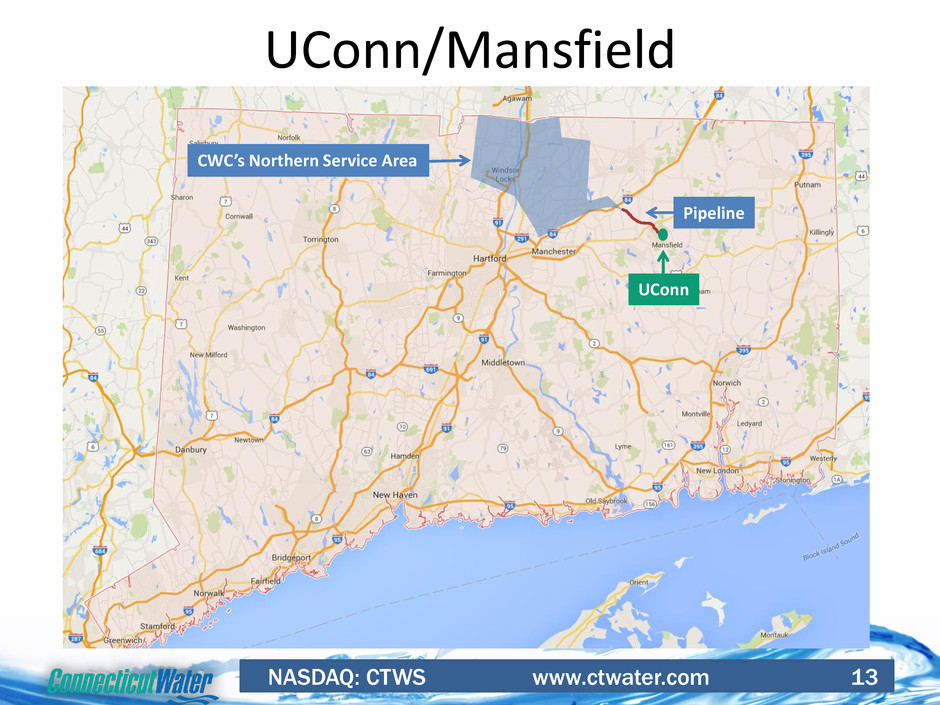

UConn/Mansfield

Pipeline

CWC’s Northern Service Area

UConn

FINANCIAL OVERVIEW

NASDAQ: CTWS www.ctwater.com 15

Financial Management

• Maintain continuing improvement to operating margin

• Balanced capital structure

• Use tools provided by legislation

– Maximize rate base in rates (WICA/WISC)

– Conservation adjustment

• Drive down borrowing costs

NASDAQ: CTWS www.ctwater.com 16

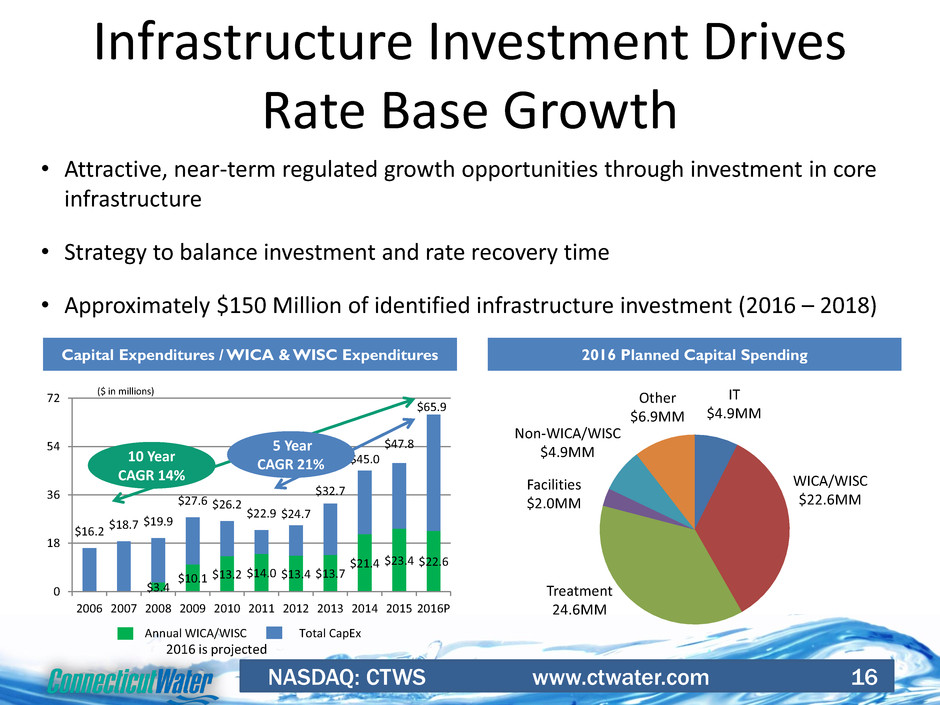

Infrastructure Investment Drives

Rate Base Growth

• Attractive, near-term regulated growth opportunities through investment in core

infrastructure

• Strategy to balance investment and rate recovery time

• Approximately $150 Million of identified infrastructure investment (2016 – 2018)

2016 Planned Capital Spending Capital Expenditures / WICA & WISC Expenditures

($ in millions)

Annual WICA/WISC

$3.4

$10.1 $13.2 $14.0 $13.4 $13.7

$21.4 $23.4 $22.6

$16.2

$18.7 $19.9

$27.6 $26.2

$22.9 $24.7

$32.7

$45.0

$47.8

$65.9

0

18

36

54

72

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016P

WICA/WISC

$22.6MM

Treatment

24.6MM

Non-WICA/WISC

$4.9MM

IT

$4.9MM

Other

$6.9MM

Facilities

$2.0MM

Total CapEx

10 Year

CAGR 14%

5 Year

CAGR 21%

2016 is projected

NASDAQ: CTWS www.ctwater.com 17

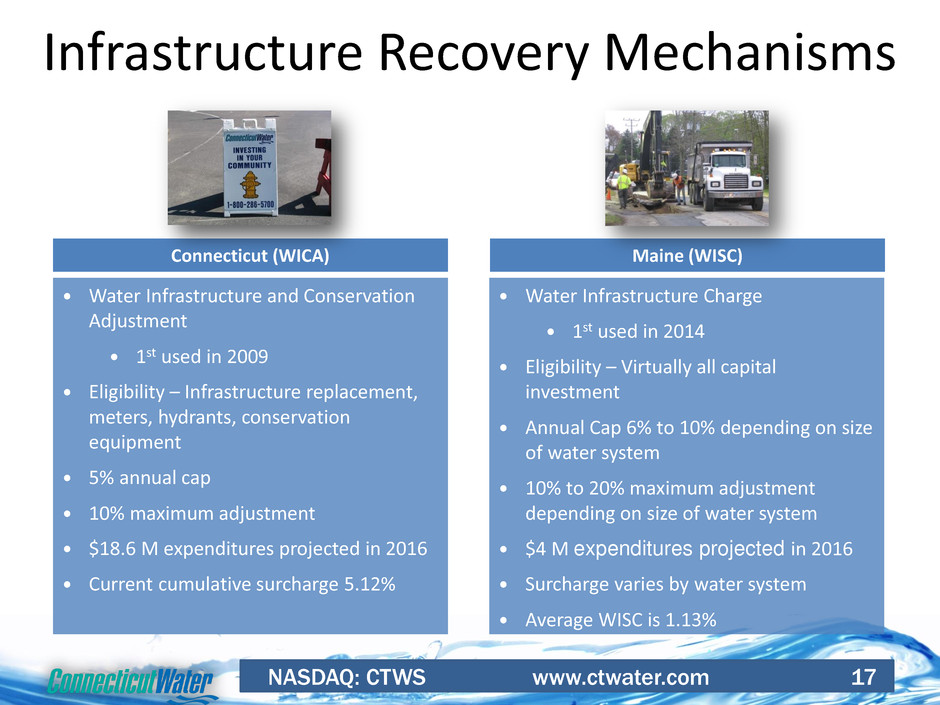

Infrastructure Recovery Mechanisms

Connecticut (WICA) Maine (WISC)

Water Infrastructure and Conservation

Adjustment

1st used in 2009

Eligibility – Infrastructure replacement,

meters, hydrants, conservation

equipment

5% annual cap

10% maximum adjustment

$18.6 M expenditures projected in 2016

Current cumulative surcharge 5.12%

Water Infrastructure Charge

1st used in 2014

Eligibility – Virtually all capital

investment

Annual Cap 6% to 10% depending on size

of water system

10% to 20% maximum adjustment

depending on size of water system

$4 M expenditures projected in 2016

Surcharge varies by water system

Average WISC is 1.13%

NASDAQ: CTWS www.ctwater.com 18

Efficiently Managing Costs

Win for Shareholders and Customers

• Manage Employee Benefits

– Closed pension plans to new hires

– Subsidizing prescription drug coverage

• Repair Tax Adoption

• Manage Interest Expense

• Consolidation of corporate functions

within Maine

• Procurement initiative

• Ongoing expense control program

– Led by senior managers more than $4.0 million in sustained O&M

expense reductions offsetting other increases (2011 – 2015)

NASDAQ: CTWS www.ctwater.com 19

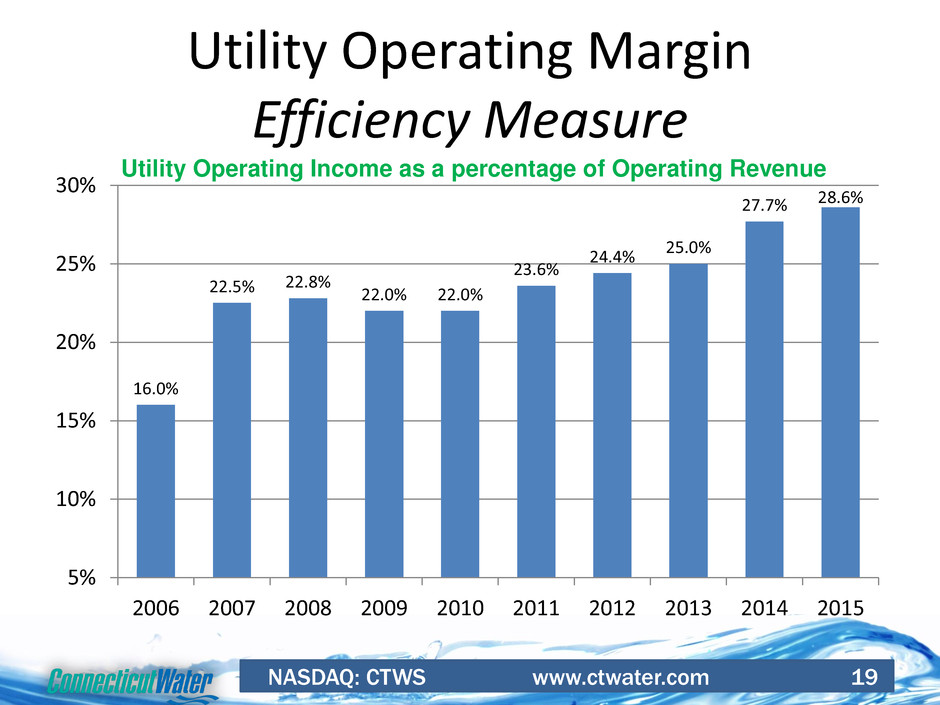

Utility Operating Margin

Efficiency Measure

16.0%

22.5% 22.8% 22.0% 22.0%

23.6%

24.4%

25.0%

27.7% 28.6%

5%

10%

15%

20%

25%

30%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Utility Operating Income as a percentage of Operating Revenue

NASDAQ: CTWS www.ctwater.com 20

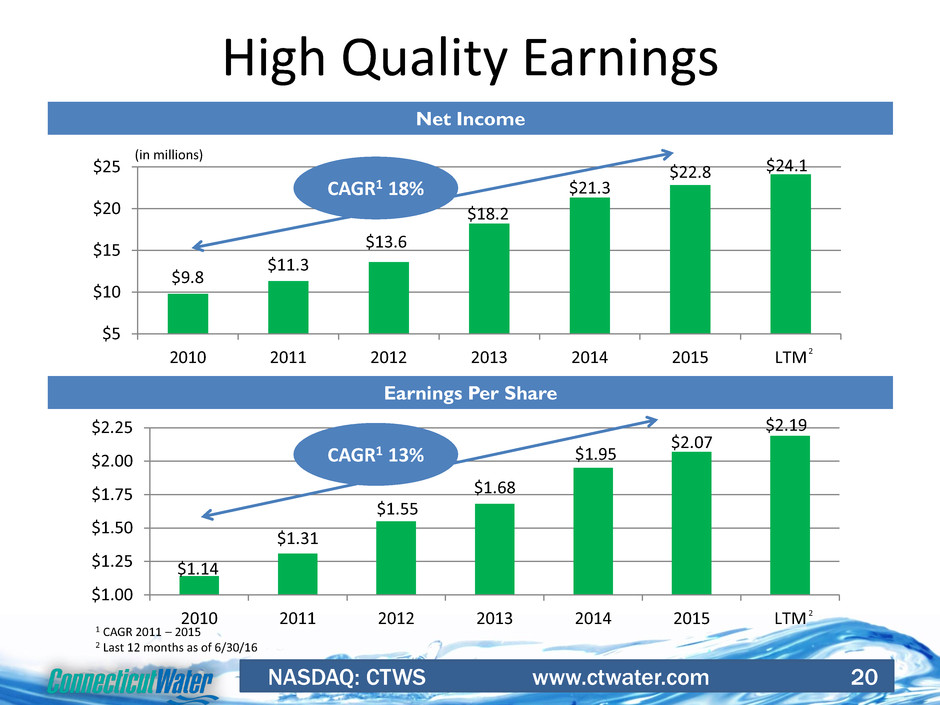

High Quality Earnings

$9.8

$11.3

$13.6

$18.2

$21.3

$22.8 $24.1

$5

$10

$15

$20

$25

2010 2011 2012 2013 2014 2015 LTM

Net Income

$1.14

$1.31

$1.55

$1.68

$1.95

$2.07

$2.19

$1.00

$1.25

$1.50

$1.75

$2.00

$2.25

2010 2011 2012 2013 2014 2015 LTM

Earnings Per Share

(in millions)

CAGR1 18%

CAGR1 13%

1 CAGR 2011 – 2015

2 Last 12 months as of 6/30/16

2

2

NASDAQ: CTWS www.ctwater.com 21

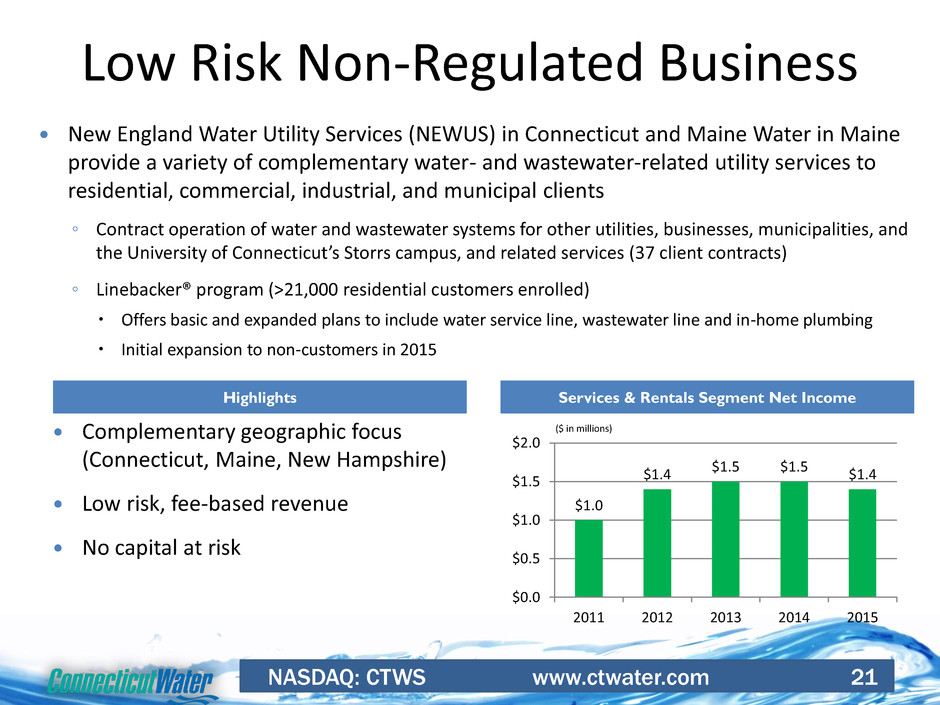

New England Water Utility Services (NEWUS) in Connecticut and Maine Water in Maine

provide a variety of complementary water- and wastewater-related utility services to

residential, commercial, industrial, and municipal clients

◦ Contract operation of water and wastewater systems for other utilities, businesses, municipalities, and

the University of Connecticut’s Storrs campus, and related services (37 client contracts)

◦ Linebacker® program (>21,000 residential customers enrolled)

Offers basic and expanded plans to include water service line, wastewater line and in-home plumbing

Initial expansion to non-customers in 2015

Low Risk Non-Regulated Business

Services & Rentals Segment Net Income

($ in millions)

Highlights

Complementary geographic focus

(Connecticut, Maine, New Hampshire)

Low risk, fee-based revenue

No capital at risk

$1.0

$1.4 $1.5 $1.5 $1.4

$0.0

$0.5

$1.0

$1.5

$2.0

2011 2012 2013 2014 2015

NASDAQ: CTWS www.ctwater.com 22

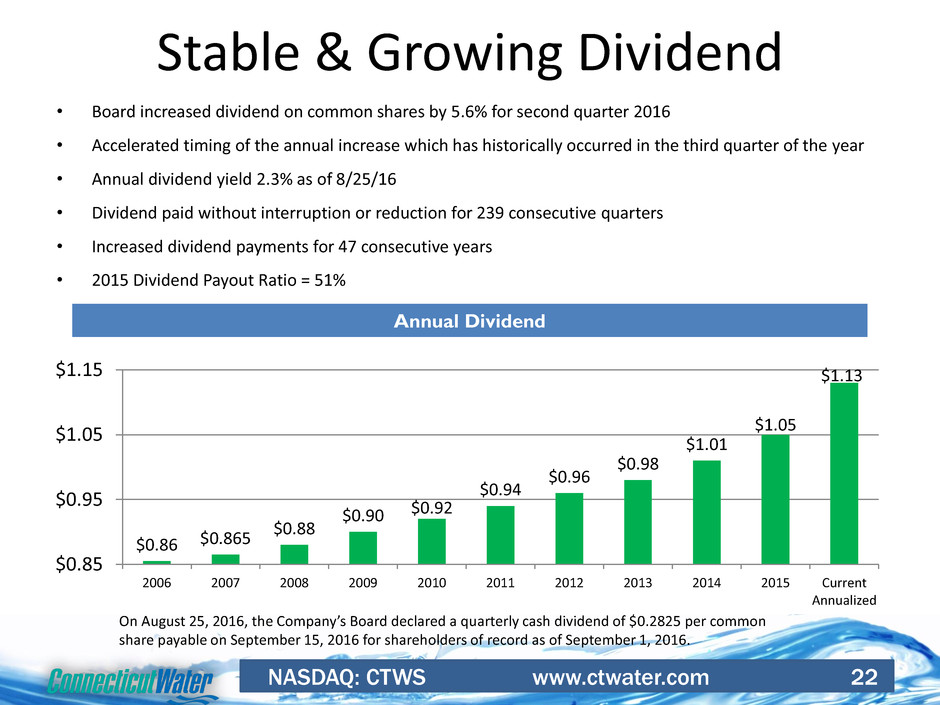

Stable & Growing Dividend

• Board increased dividend on common shares by 5.6% for second quarter 2016

• Accelerated timing of the annual increase which has historically occurred in the third quarter of the year

• Annual dividend yield 2.3% as of 8/25/16

• Dividend paid without interruption or reduction for 239 consecutive quarters

• Increased dividend payments for 47 consecutive years

• 2015 Dividend Payout Ratio = 51%

Annual Dividend

$0.86 $0.865

$0.88

$0.90 $0.92

$0.94

$0.96

$0.98

$1.01

$1.05

$1.13

$0.85

$0.95

$1.05

$1.15

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Current

Annualized

On August 25, 2016, the Company’s Board declared a quarterly cash dividend of $0.2825 per common

share payable on September 15, 2016 for shareholders of record as of September 1, 2016.

NASDAQ: CTWS www.ctwater.com 23

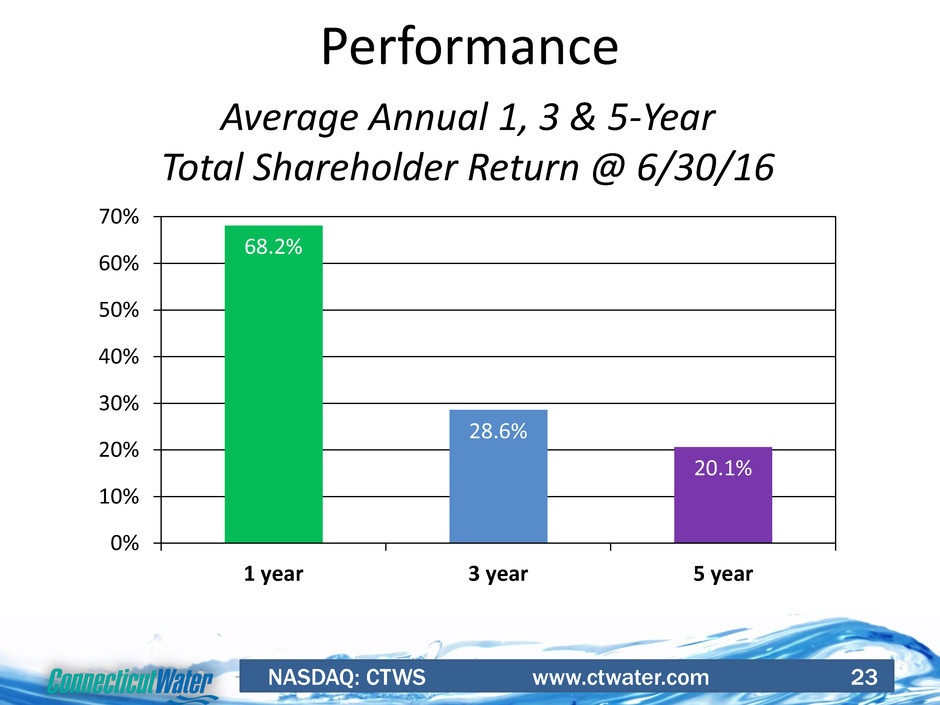

Performance

68.2%

28.6%

20.1%

0%

10%

20%

30%

40%

50%

60%

70%

1 year 3 year 5 year

Average Annual 1, 3 & 5-Year

Total Shareholder Return @ 6/30/16

NASDAQ: CTWS www.ctwater.com 24

Indices Constituent

• CTWS is a constituent of diverse NASDAQ

indices including:

– US Broad Dividend Achievers Index

– US 1500 Index

– Green Universe

– Global Utilities Index

– US OMX US Water Index

– US Small Cap Growth Index

NASDAQ: CTWS www.ctwater.com 25

Water, the basic ingredient of Life…

NASDAQ: CTWS www.ctwater.com 27

Our Vision… Serving Our Customers,

Shareholders and Employees at World

Class Levels

Appendix

NASDAQ: CTWS www.ctwater.com 28

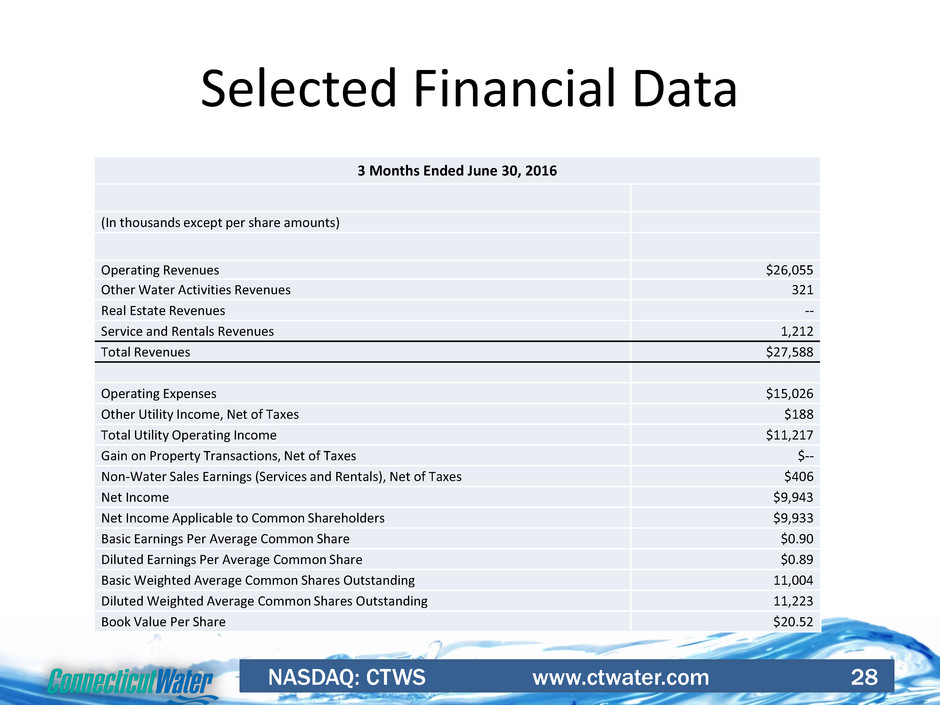

Selected Financial Data

3 Months Ended June 30, 2016

(In thousands except per share amounts)

Operating Revenues $26,055

Other Water Activities Revenues 321

Real Estate Revenues --

Service and Rentals Revenues 1,212

Total Revenues $27,588

Operating Expenses $15,026

Other Utility Income, Net of Taxes $188

Total Utility Operating Income $11,217

Gain on Property Transactions, Net of Taxes $--

Non-Water Sales Earnings (Services and Rentals), Net of Taxes $406

Net Income $9,943

Net Income Applicable to Common Shareholders $9,933

Basic Earnings Per Average Common Share $0.90

Diluted Earnings Per Average Common Share $0.89

Basic Weighted Average Common Shares Outstanding 11,004

Diluted Weighted Average Common Shares Outstanding 11,223

Book Value Per Share $20.52

NASDAQ: CTWS www.ctwater.com 29

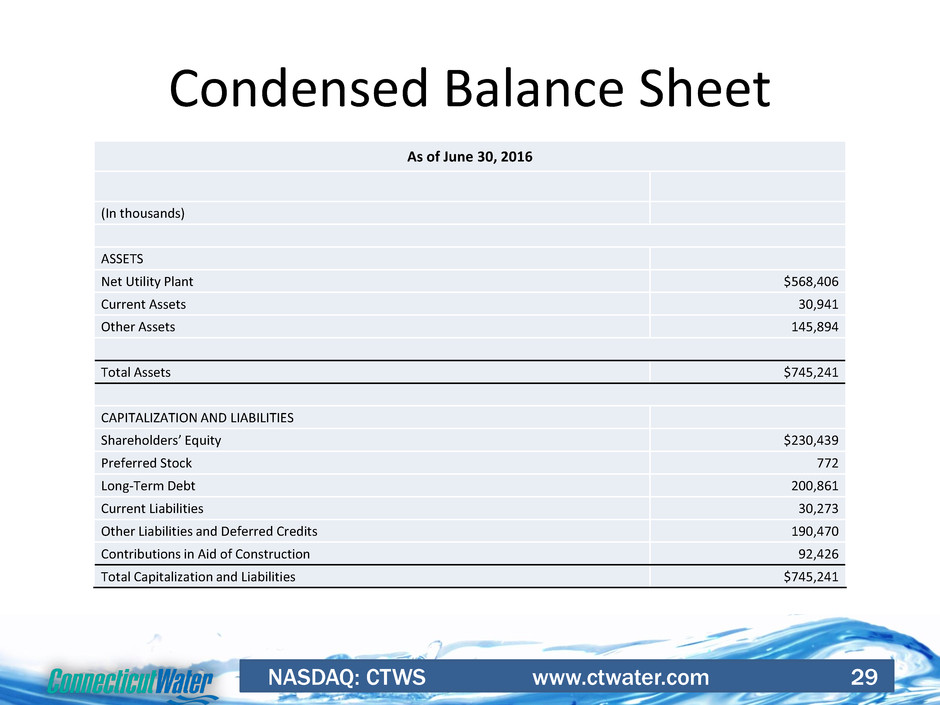

Condensed Balance Sheet

As of June 30, 2016

(In thousands)

ASSETS

Net Utility Plant $568,406

Current Assets 30,941

Other Assets 145,894

Total Assets $745,241

CAPITALIZATION AND LIABILITIES

Shareholders’ Equity $230,439

Preferred Stock 772

Long-Term Debt 200,861

Current Liabilities 30,273

Other Liabilities and Deferred Credits 190,470

Contributions in Aid of Construction 92,426

Total Capitalization and Liabilities $745,241

NASDAQ: CTWS www.ctwater.com 30

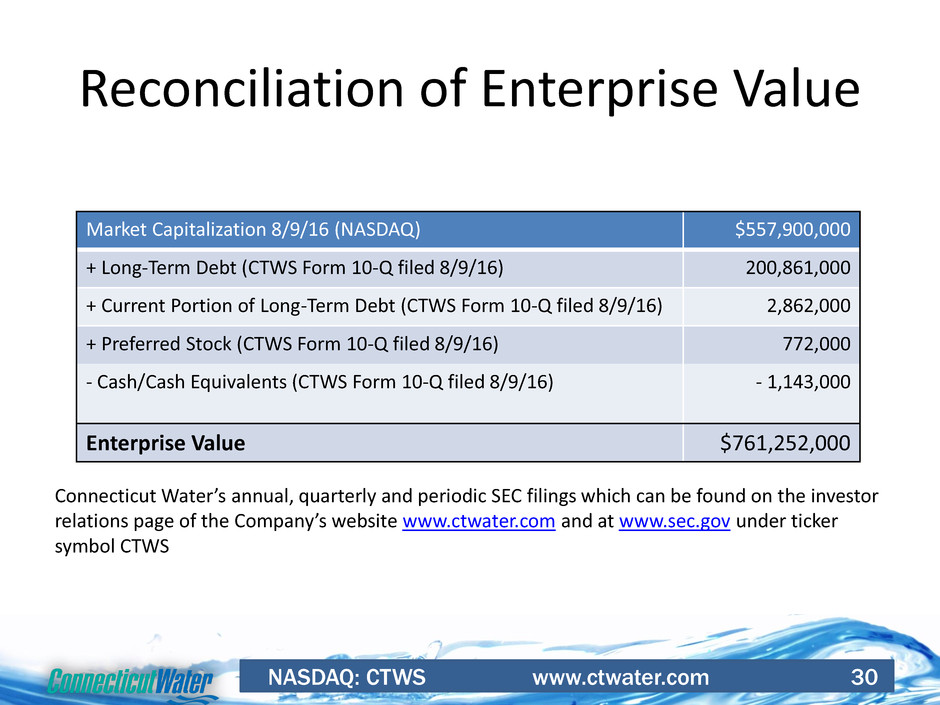

Reconciliation of Enterprise Value

Market Capitalization 8/9/16 (NASDAQ) $557,900,000

+ Long-Term Debt (CTWS Form 10-Q filed 8/9/16) 200,861,000

+ Current Portion of Long-Term Debt (CTWS Form 10-Q filed 8/9/16) 2,862,000

+ Preferred Stock (CTWS Form 10-Q filed 8/9/16) 772,000

- Cash/Cash Equivalents (CTWS Form 10-Q filed 8/9/16)

- 1,143,000

Enterprise Value $761,252,000

Connecticut Water’s annual, quarterly and periodic SEC filings which can be found on the investor

relations page of the Company’s website www.ctwater.com and at www.sec.gov under ticker

symbol CTWS

NASDAQ: CTWS www.ctwater.com 31

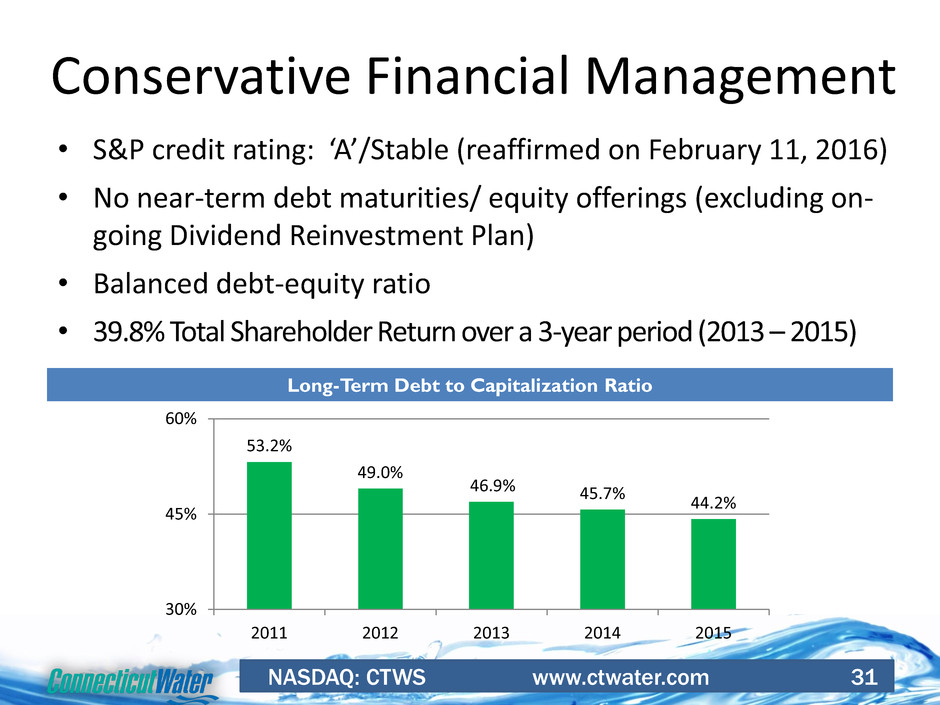

Conservative Financial Management

• S&P credit rating: ‘A’/Stable (reaffirmed on February 11, 2016)

• No near-term debt maturities/ equity offerings (excluding on-

going Dividend Reinvestment Plan)

• Balanced debt-equity ratio

• 39.8% Total Shareholder Return over a 3-year period (2013 – 2015)

Long-Term Debt to Capitalization Ratio

53.2%

49.0%

46.9% 45.7%

44.2%

30%

45%

60%

2011 2012 2013 2014 2015

NASDAQ: CTWS www.ctwater.com 32

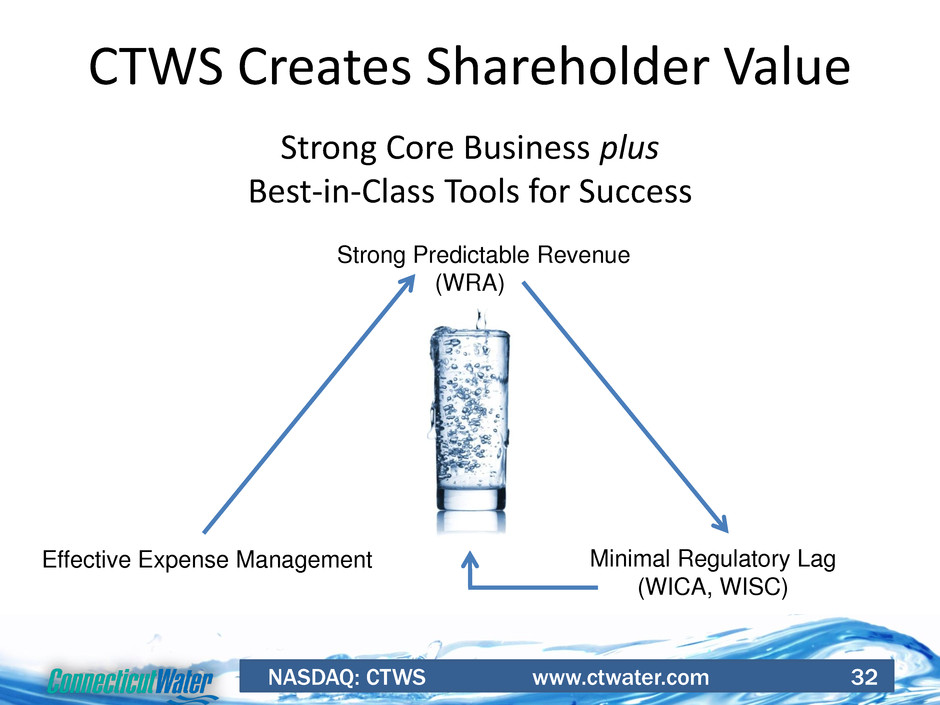

CTWS Creates Shareholder Value

Strong Core Business plus

Best-in-Class Tools for Success

Strong Predictable Revenue

(WRA)

Minimal Regulatory Lag

(WICA, WISC)

Effective Expense Management

NASDAQ: CTWS www.ctwater.com 33

Company Strategy

Environment Shareholders/Growth

Customers Employees

Passionate about stewardship of water

Protect and manage water and watershed for

sustainability to serve current and future generations

Harness power of WRA to reduce carbon footprint

and resource consumption

Business is water service – not selling water

Leverage regulatory compact

Infrastructure investment and earning a return “of

and on” investment

Low risk, supplemental non-regulated earnings

Maintain constructive regulatory relationships

Deliver acquisitions that deliver shareholder value

Provide high-quality water

Responsive and courteous service

High level of community engagement

Deliver world-class service

Customer satisfaction is a compensation metric for all

employees

Passionate employees delivering a life sustaining

service

Values-based, team-oriented approach

Employee satisfaction is executive compensation

metric

Safe and secure workplace

NASDAQ: CTWS www.ctwater.com 34

• National Management Innovation Award for Customer

Protection Program

– Protects customers from utility worker imposters

• Invest and maintain infrastructure to deliver high-quality

water and reliable service

• Assistance Programs for low income/hardship

• Responsive and Courteous Service

• Leverage technology to drive

convenience and efficiency

• Customer Satisfaction!

– World-Class 15 straight years

Customer Strategy

NASDAQ: CTWS www.ctwater.com 35

• Leadership is a privilege

• Values-based

• Team & service oriented

professionals

• “Satisfied Employees

Satisfy Customers”

• Employee Satisfaction

– Executive compensation metric

Employee Strategy

NASDAQ: CTWS www.ctwater.com 36

Environmental Strategy

• Leverage CT’s Water Revenue

Adjustment (WRA) to promote water

conservation

• Donate/sell unneeded land as

protected open space

• Replace aging pipe, valves and pumps

to conserve natural resources

• Aggressively manage energy usage

• Invest in and protect watershed lands

NASDAQ: CTWS www.ctwater.com 37

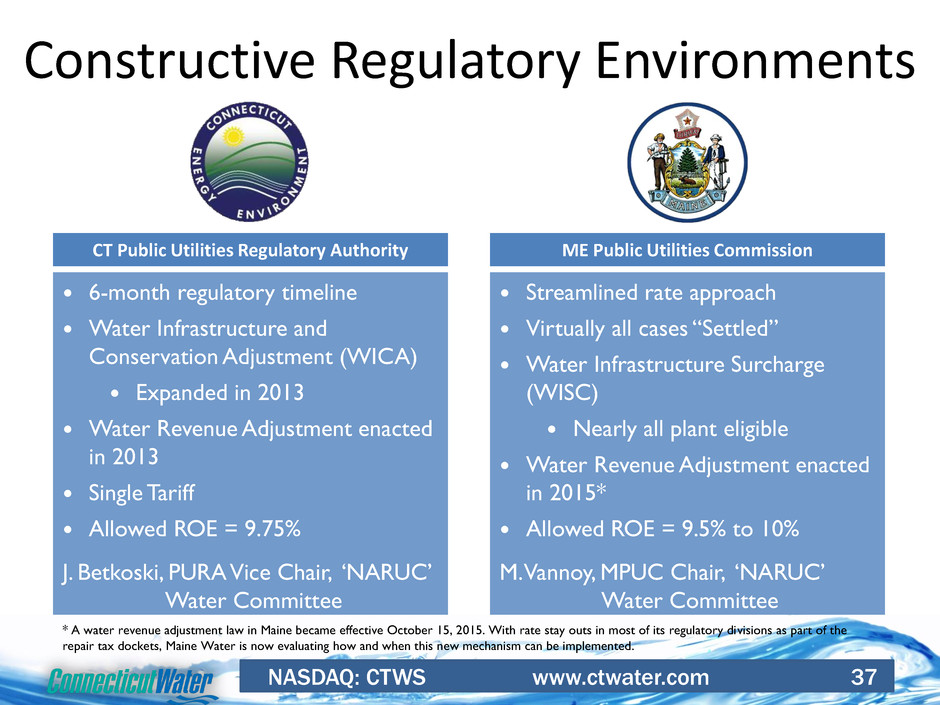

6-month regulatory timeline

Water Infrastructure and

Conservation Adjustment (WICA)

Expanded in 2013

Water Revenue Adjustment enacted

in 2013

Single Tariff

Allowed ROE = 9.75%

Constructive Regulatory Environments

Streamlined rate approach

Virtually all cases “Settled”

Water Infrastructure Surcharge

(WISC)

Nearly all plant eligible

Water Revenue Adjustment enacted

in 2015*

Allowed ROE = 9.5% to 10%

CT Public Utilities Regulatory Authority ME Public Utilities Commission

* A water revenue adjustment law in Maine became effective October 15, 2015. With rate stay outs in most of its regulatory divisions as part of the

repair tax dockets, Maine Water is now evaluating how and when this new mechanism can be implemented.

J. Betkoski, PURA Vice Chair, „NARUC‟

Water Committee

M. Vannoy, MPUC Chair, „NARUC‟

Water Committee

NASDAQ: CTWS www.ctwater.com 38

Repair Tax Facts - CTWS

• Adopted by CTWS

– In Connecticut for 2012

– In Maine for 2014

– Required “flow-through”

tax treatment in both states

• What it means

– Vast majority of annual investment in infrastructure

replacement is immediately deductible for tax purposes

– The same investment grows rate base as it always has

NASDAQ: CTWS www.ctwater.com 39

Repair Tax Facts - CTWS

• It is NOT temporary. Our annual commitment to

replacing 1% - 2% of our pipe will continue to generate

deductions that significantly lower or eliminate

annual tax expense. Single digit effective tax rate

expected to be the norm.

• Closes rate differential with municipalities

• Utility Operating Margin vastly improved

due to a lower portion of each dollar

collected required to support Operating

Costs

NASDAQ: CTWS www.ctwater.com 40

Repair Tax Facts - CTWS

• Cash flow improvement allows for increased capital

investment with less reliance on financing

• We are replacing Operating Expense

with Capital Expense (Virtually tripling

from 2011 to 2016)

• Customers and Regulators will

realize the benefits in the form of

manageable increases despite level

of capital investment

NASDAQ: CTWS www.ctwater.com 41

Additional Information About the Merger and Where to Find It

In connection with the proposed acquisition of The Heritage Village Water Company by Connecticut Water Service, Inc. (“CTWS”), CTWS will

be filing a registration statement on Form S- 4 with the SEC under the Securities Act of 1933 containing a proxy or information statement of

Heritage Village Water Company that also constitutes a prospectus of CTWS (the “Statement/Prospectus”) and other documents regarding

the proposed transaction.

Before making any voting or investment decisions, we urge investors and security holders to read the Statement/Prospectus (including all

amendments and supplements thereto) and other documents filed with the SEC carefully and in their entirety when they become available,

because they will contain important information about CTWS, Heritage Village Water Company and the proposed merger.

When available, copies of the Statement/Prospectus will be mailed to the shareholders of Heritage Village Water Company. Copies of the

Statement/Prospectus may be obtained free of charge at the SEC's web site at www.sec.gov, or by directing a request to CTWS's Corporate

Secretary, Kristen A. Johnson, at Connecticut Water Service, Inc., 93 West Main Street, Clinton, Connecticut 06413, or by telephone at 1-800-

428-3985, ext. 3056, or on our website at www.ctwater.com. Copies of other documents filed by CTWS with the SEC may also be obtained

free of charge at the SEC's web site or by directing a request to CTWS at the address provided above.

CTWS and Heritage Village Water Company and certain of their directors and executive officers may be deemed to be participants in the

solicitation of proxies in connection with the approval of the proposed merger. Information regarding CTWS's directors and executive officers

and their respective interests in CTWS by security holdings or otherwise is available in its Annual Report on Form 10-K filed with the SEC on

March 14, 2016 and its Proxy Statement on Schedule 14A filed with the SEC on March 31, 2016. Certain information regarding Heritage

Village Water Company’s directors and executive officers is available in its Annual Report for 2014 filed with the PURA and available at the

PURA's website, www.ct.gov/pura. Additional information regarding the interests of such potential participants will be included in the

Statement/Prospectus and registration statement, and other relevant materials to be filed with the SEC, when they become available,

including in connection with the solicitation of proxies to approve the proposed merger.

This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of

securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of such jurisdiction. No offer or sale of securities shall be made except by means of a prospectus meeting the requirements of Section 10

of the Securities Act of 1933.