Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - ASPEN GROUP, INC. | aspu_8k.htm |

EXHIBIT 99.1

Gateway ConferenceSeptember 7, 2016 OTCQB: ASPUwww.aspen.edu ASPEN GROUP, INC.

SAFE HARBOR STATEMENT 1 Certain statements in this presentation and responses to various questions include forward-looking statements including statements regarding our opportunities and expectations from the nursing education sector, the impact from our increased marketing spend, future liquidity, and our strategic plans and financial forecasts and projections. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Important factors that could cause actual results to differ from those in the forward-looking statements include competition, ineffective media and/or marketing, changes in the nursing industry which make having a degree less attractive, failure to maintain growth in degree seeking students, and failure to generate sufficient revenue. Further information on our risk factors is contained in our filings with the SEC, including the 10-K dated July 27, 2016. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.Regulation G - Non-GAAP Financial Measures This presentation includes a discussion of Adjusted EBITDA and Adjusted Gross Margins, non-GAAP financial measures. Certain information regarding these non-GAAP financial measures (including reconciliations to GAAP) is provided on the Investor Relations section of the Aspen website at www.ir.aspen.edu.

ASPEN UNIVERSITY DISRUPTING THE ONLINE FOR-PROFIT EDUCATION SECTOR 2 Debtless Education Solution:Monthly Payment Plans Targeting the High-GrowthNursing Sector Ability to Deliver Sub-$1,000 Enrollments at Scale Aspen Among the Fasting GrowingUniversities in U.S.

ASPEN FIRST UNIVERSITY EVER TO VERTICALLY INTEGRATE MARKETING 3 Best-in-class customer acquisitionManagement’s expertise in Internet advertising and lead generation allowed Aspen to bring all marketing in-houseDo not utilize third-party lead gen firmsAll Aspen branded adsDirect publisher relationshipsAverage customer acquisition costs <$900 is 1/5th the cost of competitors (~$4,000 - $5,000)Completely variable teaching costs<$150 per student course completionHigh-quality faculty – 61% hold Doctorate

ASPEN UNIVERSITY’S DEBTLESSEDUCATION SOLUTION 4 Aspen University offers world class online education at half the cost of its competitors; committed to cash-based, pay-as-you-go educationAnnounced the ‘debtless’ education vision in March, 2014 “Let’s Change Higher Education Forever” Students can pay $325/month for a Master’s degree = $11,700 (36 monthly payments)Students can pay $250/month for a Bachelor’s Degree = $18,000 (72 monthly payments)Students can pay $375/month for a Doctoral Degree = $27,000 (72 monthly payments)

DEBTLESS EDUCATION SOLUTION NOW THE MAJORITY PAYMENT TYPE 5 Recurring Monthly Tuition Billing Now Exceeds $435,000Over 2,200 degree-seeking students enrolled in a monthly payment method (as of 8/16/16)Total value of monthly payment plan contracts exceeds $15 million (as of 8/16/16) Tuition Revenues by Payment Type (last 90 days avg.): Debtless Education Solution 56% -Monthly Payment Plan 49% -Monthly Installment Plan 7%Cash 12%Federal Financial Aid 23%Other (Corporate Tuition Reimbursement/Military) 9%Total 100%

THE NURSING DILEMNA 6 Critical Nursing shortage projected next decade (260,000 RN shortage by 2025)More than 1 million RNs will reach retirement age within next 10-15 years (average age of RNs is 47 years old); 525,000 replacement Nurses expected, bringing the job openings growth to 1.05mm by 2022Nursing expected to be among fastest growing occupations in U.S. through 2022 -- RN workforce expected to grow from 2.71mm RNs in 2012 to 3.24mm in 2022 (19%)*U.S. Nursing schools turned away 79,659 qualified applicants from Baccalaureate and Graduate programs in 2012 due to insufficient number of Faculty and classroom sites***Bureau of Labor Statistics **American Association of Colleges of Nursing Report

ASPEN’S NURSING PROGRAM NOWSTUDENT BODY MAJORITY, LED BY BSN 7 Aspen’s CCNE-Accredited Master of Science in Nursing (MSN) program has grown to over 1,400 students since marketing began in 2012RN to BSN program was accredited by CCNE in November, 2014; over 1,200 BSN students todayBSN program pacing to grow on an annualized basis by +1,080 – net (or +90/month – net) School of Nursing now pacing to grow on annualized basis by +1,375 (or +115/month – net)

ASPEN CAPTURING >2% OF BSN COMPLETION STARTS WSJ Article, March 6, 2016 Approximately 140K students currently enrolled in BSN Completion program; or approx. 50,000 new enrolls/year

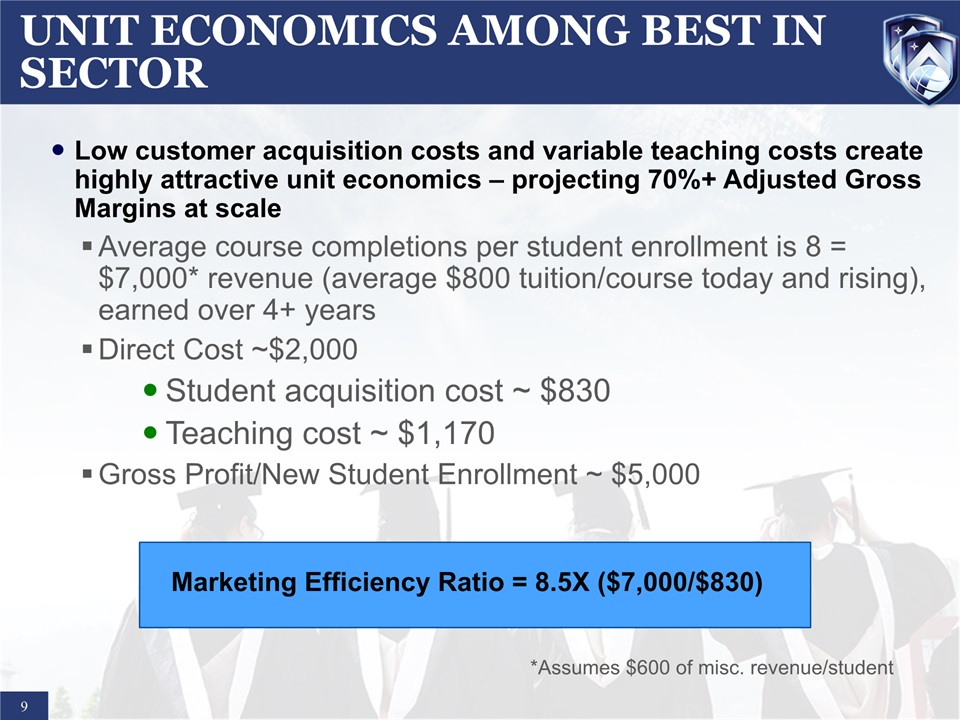

UNIT ECONOMICS AMONG BEST IN SECTOR 9 Low customer acquisition costs and variable teaching costs create highly attractive unit economics – projecting 70%+ Adjusted Gross Margins at scaleAverage course completions per student enrollment is 8 = $7,000* revenue (average $800 tuition/course today and rising), earned over 4+ yearsDirect Cost ~$2,000Student acquisition cost ~ $830 Teaching cost ~ $1,170Gross Profit/New Student Enrollment ~ $5,000 *Assumes $600 of misc. revenue/student Marketing Efficiency Ratio = 8.5X ($7,000/$830)

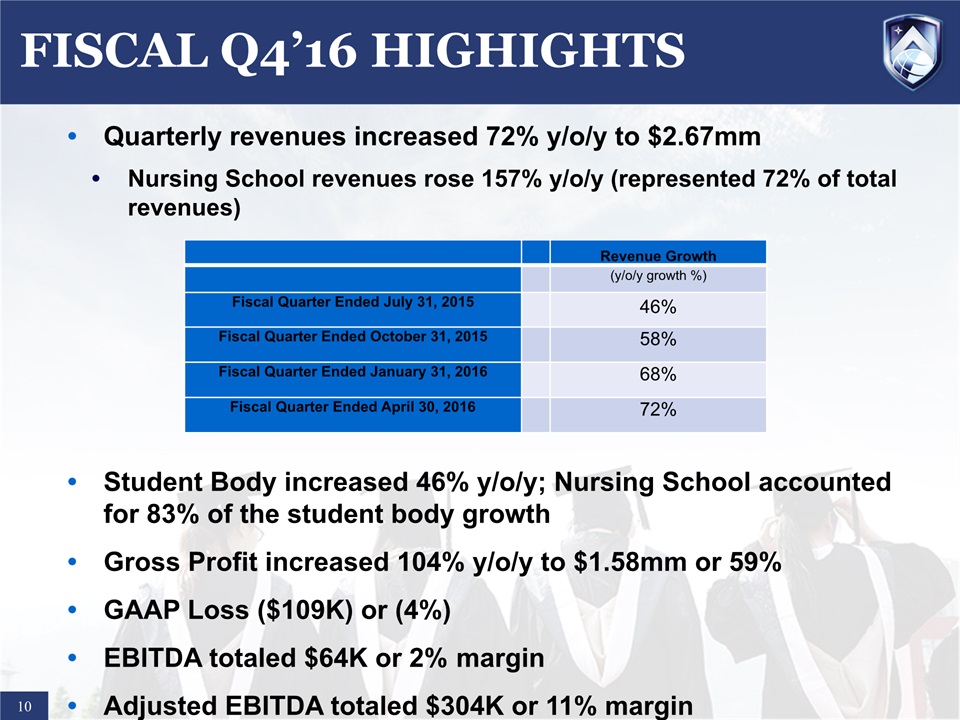

FISCAL Q4’16 HIGHIGHTS 10 Quarterly revenues increased 72% y/o/y to $2.67mmNursing School revenues rose 157% y/o/y (represented 72% of total revenues)Student Body increased 46% y/o/y; Nursing School accounted for 83% of the student body growthGross Profit increased 104% y/o/y to $1.58mm or 59%GAAP Loss ($109K) or (4%)EBITDA totaled $64K or 2% marginAdjusted EBITDA totaled $304K or 11% margin Revenue Growth (y/o/y growth %) Fiscal Quarter Ended July 31, 2015 46% Fiscal Quarter Ended October 31, 2015 58% Fiscal Quarter Ended January 31, 2016 68% Fiscal Quarter Ended April 30, 2016 72%

FISCAL 2017 GUIDANCE 11 Expect CAGR of 50%+ (>$12.7mm)Student Body Growth from 5,000 to ~7,000Estimating ($0.01) EPS or betterEstimating >12% Adjusted EBITDA MarginNet Income Positive Before Fiscal Year End ‘17 Note: $3mm LOC announcement earlier today with largest shareholder, Leon Cooperman

EQUITY SNAPSHOT 12 As of 9/2/16 Ticker on OTCQB: ASPU Share Price: $0.19 52 Week Range: $0.10 - $0.20 Market Cap: $26.2 Million Shares Outstanding : 138 Million Mgmt & BOD Ownership: 19%

QUESTIONS & ANSWERS ASPEN GROUP, INC.