Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WashingtonFirst Bankshares, Inc. | a2ndq2016investorpresentat.htm |

NASDAQ: WFBI

www.wfbi.com

Investor Presentation

September 2016

Disclaimer

1

WashingtonFirst Bankshares, Inc. and its subsidiaries (the “Company”) make forward-

looking statements in this presentation that are subject to risks and uncertainties. These

forward-looking statements include: statements of goals, intentions, earnings expectations,

and other expectations; estimates of risks and of future costs and benefits; assessments of

probable loan losses; assessments of market risks; and statements of the ability to achieve

financial and other goals. These forward-looking statements are subject to significant

uncertainties because they are based upon or are affected by: management’s estimates and

projections of future interest rates, market behavior, and other economic conditions; future

laws and regulations; and a variety of other matters which, by their nature, are subject to

significant uncertainties. Because of these uncertainties, the Company’s actual future

results may differ materially from those indicated. In addition, the Company’s past results

of operations do not necessarily indicate its future results. Please also see the discussion of

“RISK FACTORS” in the Company’s 10-K filed March 15, 2016 which is available online

at www.sec.gov.

For further information on the company please contact:

Matthew R. Johnson

Executive Vice President / Chief Financial Officer

(703) 840-2410

mjohnson@wfbi.com

Corporate Overview

2

Full service commercial bank founded in 2004, headquartered in Reston, VA,

with 19 branches in the Washington, DC metro area

Excellent market position as the 4th largest bank headquartered in the

Washington, DC metro area(1)

$1.9 billion in total assets as of June 30, 2016

• 5-year asset CAGR: 32%

• Demonstrated organic growth and successful acquisitions

Superior asset quality: NPAs of 0.71% as of June 30, 2016

Experienced management team

Strong earnings with diverse revenue channels

Recent market superlatives

• Top 10 Most Profitable Banks in DC metro area(2)

• Top 20 Fastest Growing Banks in USA(3)

• One of the fastest growing companies in the DC metro area (2014 and 2015)(2)

• Added to the Russell 2000® in 2016

(1) Source: SNL Financial; based on deposits. Includes recently announced acquisition of Cardinal Financial Corp by United Bankshares

(2) Source: Washington Business Journal

(3) Source: SNL Financial

Locations

3

Our Strategy

WashingtonFirst seeks to capitalize on market opportunities while maintaining disciplined

and conservative credit underwriting that has been the cornerstone of our past profitability.

Opportunity

Organic Growth

Focus on relationships

Enhance existing footprint

Hire seasoned lenders

Blueprint for Success

Profitability

Continued emphasis on Net Interest Margin

Enhance fee income

Continued diligence to minimize overhead

Opportunistic

Growth

Explore potential acquisitions

Cultivate relationships with institutional

investors

Maintain Credit

Quality

Continued diligence on credit quality

Conservative credit culture

Disciplined underwriting

4

Board of Directors

Physicians

Attorneys

Consulting/Government Relations Professionals

Real Estate Professionals

Entrepreneurs

Joseph S. Bracewell *

Chairman of the Board

William C. Oldaker *

Oldaker Law

Group, LLP

Honorable

Joe R. Reeder

Greenberg Traurig

Josephine S. Cooper

Josephine Cooper, LLC

Honorable

John H. Dalton

The Financial

Services Roundtable

Juan A. Mencia *

CubeCorp/ByteTech

Mark C. Michael

Occasions Caterers, Inc.

Larry D. Meyers

Meyers & Associates

Madhu K. Mohan, MD *

Riverside Medical Group

Randall S. Peyton, MD

Arthritis & Sports

Orthopaedics &

Physical Therapy

James P. Muldoon

METCOR, Ltd.

Gail R. Steckler

Infrastructure Management

Group, Inc.

General (Ret.)

Johnnie E. Wilson

JWIL, LLC

William G. Reilly

Champion Title &

Settlements, Inc.

Kenneth Morrissette *

Interstate Worldwide

Relocation Services

Diverse experience with strong ties to the Washington, DC metropolitan area

Richard D. Horn

General Counsel

Bankers

Caren D. Merrick

Pocket Mentor

C.E. Andrews *

MorganFranklin Consulting

Shaza L. Andersen *

President & Chief Executive

Officer

Donald W. Fisher, PhD

American Medical Group

Association

5

Jon M. Peterson

The Peterson Companies

* Executive Committee

Stephen M. Cumbie

NVCommercial, NVRetail,

Metro Realty

Senior Leadership Overview

Longevity amongst experienced, diverse management team

Significant experience and impressive track record in community banking,

acquisitions, and creation of franchise value

Well-connected in the Washington DC metro business community

Excellent regulatory relationships

Significant insider ownership

6

Name Age Title

Joseph S. Bracewell 69 Chairman of the Board

Shaza L. Andersen 49 President/CEO

George W. Connors, IV 56 Bank President/CCO

Matthew R. Johnson 52 EVP/CFO

Richard D. Horn 54 General Counsel

Michael J. Rebibo 50 EVP/President Mortgage & 1st Portfolio

Senior Leadership Team

Joseph S. Bracewell – Chairman of the Board

Chairman of the Board of Directors of the Bank and the Company

Over 40 years of experience in the banking and legal industries

Principal organizer or founding director of six newly-chartered banks, five of which have been

profitably sold

Previously a member of the Board of Directors of the Independent Community Bankers of America as

well as a director and vice chairman of the Federal Home Loan Bank of Atlanta

Shaza L. Andersen –President/CEO

Founder and Chief Executive Officer of WashingtonFirst Bank

Over 25 years of experience in banking including serving as the EVP and COO of Century National

Bank from 1994 to 2001 until acquired by United Bank in 2001

Extensive M&A experience

Serves on several Boards including Amalgamated Casualty Insurance, Washington Redskins

Leadership Council, Blitz for the Better Foundation, and George Mason University Dean’s Advisory

Council, and previously served on the Board of Directors of the Federal Home Loan Bank of Atlanta

7

Matthew R. Johnson – EVP / CFO

Executive Vice President and Chief Financial Officer of WashingtonFirst

Has been with WashingtonFirst since its inception in 2004

Extensive financial institution planning and development as well as acquisition experience

Prior to WashingtonFirst served as the Chief Financial Officer of another community bank in the DC

metro area and also held management positions with Olson Research Associates, Caledonian Venture

Partners and Chesapeake Ventures

George W. Connors, IV – Bank President / CCO

Founding director and President and Chief Credit Officer of WashingtonFirst

Has been in commercial banking for over 30 years, serving in executive management positions at

WashingtonFirst, Century National Bank and its successor, United Bank

Served as SVP and DC Group Lending Manager for United from 2001 to 2004 and was a voting

member of its 7-member Executive Loan Committee

Senior Leadership Team

Richard D. Horn – General Counsel & Corporate Secretary

Founding director and General Counsel for both the Bank and the Company

Prior to joining WashingtonFirst was a partner with the law firm of Bracewell & Giuliani, LLP in

Washington, DC

Admitted to practice law in Virginia, Maryland and the District of Columbia

8

Michael J. Rebibo, CFP® – EVP/ President Mortgage & 1st Portfolio

Founder and President/CEO of subsidiaries WashingtonFirst Mortgage & 1st Portfolio Wealth Advisors

Prior to founding 1st Portfolio was founder and CEO of Financial Security Corporation

Served as a founding organizer of Access National Corporation, a publicly traded holding company

in the Washington, DC metro area

$66,642

$74,567

$92,441

$53,706

Virginia Maryland Washington

D.C. MSA

Nation

Attractive Market – Washington D.C.

9

Washington D.C. Market Highlights

Median Household Income 2015

Projected Population Change (1)

Projected Household Income Change (1)

4.7%

3.9%

6.3%

3.5%

Virginia Maryland Washington

D.C. MSA

Nation

8.2%

10.0%

8.4%

6.7%

Virginia Maryland Washington

D.C. MSA

Nation

Source: SNL Financial

(1) Growth projections for 2015-2020

• 6th largest population in the nation (6.1

million)

• $163 billion in deposits

• 2.3 million households

• 219,675 businesses

• 4.3% unemployment rate

Summary 5-Year Financial Performance

10

Source: Company documents

(Dollars in Thousands) At or for the year ended, '11-'15 Quarter Ended,

Except per share data 12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 CAGR 03/31/16 6/30/16

Balance Sheet

Total Assets $ 559,462 $ 1,147,818 $ 1,127,559 $ 1,335,310 $ 1,674,466 31.7% $ 1,759,383 $ 1,853,666

Total Net Loans 415,005 747,095 829,586 1,056,869 1,332,228 33.9% 1,371,167 1,431,126

Deposits 479,001 972,660 948,903 1,086,063 1,333,242 29.2% 1,407,560 1,548,877

Total Equity 53,477 101,520 107,604 134,538 178,595 35.2% 184,128 188,300

Balance Sheet Ratios

Loans HFI / Deposits 87.7% 77.5% 88.3% 98.1% 98.1% 95.6% 89.8%

TCE / TA 5.77% 6.97% 7.64% 8.60% 9.95% 9.79% 9.52%

Leverage Ratio 9.06% 9.97% 10.53% 10.23% 10.67% 10.55% 10.06%

Total Capital Ratio 11.84% 13.77% 14.05% 13.20% 14.86% 14.74% 14.56%

Performance

Net Income - Common $ 1,930 $ 2,057 $ 6,161 $ 9,263 $ 12,181 58.5% $ 3,924 $ 4,398

Diluted EPS $ 0.59 $ 0.56 $ 0.76 $ 1.12 $ 1.19 19.2% $ 0.32 $ 0.35

ROAA 0.53% 0.39% 0.60% 0.75% 0.83% 0.94% 0.98%

ROAE 5.24% 3.92% 6.01% 8.36% 8.48% 8.58% 9.42%

Net Interest Margin 4.02% 4.14% 3.97% 3.92% 3.74% 3.51% 3.37%

Efficiency Ratio 67.4% 75.3% 67.2% 66.4% 64.0% 64.7% 64.7%

Asset Quality

NPAs / Assets 1.25% 1.92% 1.97% 0.84% 0.86% 0.80% 0.71%

NCOs / Avg Loans* 0.22% 0.43% 0.32% 0.24% 0.04% 0.20% 0.20%

Reserves / Loans HFI 1.17% 0.83% 1.02% 0.87% 0.94% 0.92% 0.91%

* 6/30/2016 Annualized

Consistent Balance Sheet Growth

11

Total Assets (Dollars in Millions)

Source: Company documents and SNL Financial

*Peers defined as banks in MD, VA, DC with total assets between $1 billion and $5 billion; peer data through 2Q2016

**Represents quarter-over-quarter growth in 1Q 2016 and 2Q2016

$559

$1,148 $1,128

$1,335

$1,674

$1,759

$1,854

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

2011 2012 2013 2014 2015 Q1 2016 Q2 2016

2011 2012 2013 2014 2015 Q1 2016** Q2 2016 **

WFBI 22.8% 105.2% (1.8%) 18.4% 25.8% 5.1% 5.4%

Peers* (1.1%) 8.5% (1.6%) 4.8% 4.2% 1.7% 1.9%

Total Asset Size As of June 30, 2016

12

Loans, Held for Investment As of June 30, 2016

13

Diversified loan portfolio with a strong credit culture

Amount

(in thousands)

Construction and Development 270,476$

Commercial Real Estate (Owner Occupied) 226,949

Commercial Real Estate (Investment Property) 465,445

Residential Real Estate 254,520

Commercial and Industrial 166,941

Consumer 7,192

Total HFI 1,391,523$

Construction and

Development

19%

Commercial Real

Estate (Owner

Occupied)

16%

Commercial Real

Estate

(Investment

Property)

34%

Residential Real

Estate

18%

Commercial and

Industrial

12%

Consumer

1%

Note: Multifamily loans included in Commercial Real Estate (Investment Property)

Asset Quality

14

Nonperforming Assets (Dollars in Thousands)

NPAs / Assets

Source: Company documents and SNL Financial

* Peers defined as banks in MD, VA, DC with total assets between $1 billion and $5 billion; peer data through 2Q2016

WFBI Peers*

$6,987

$22,051 $22,265

$11,206

$14,498

$14,059

$13,205

$0

$5,000

$10,000

$15,000

$20,000

$25,000

2011 2012 2013 2014 2015 Q1 2016 Q2 2016

Nonaccruals TDRs OREO 90+ PD NPA / L+O

1.25%

1.92% 1.97%

0.84% 0.86% 0.80% 0.71%

2.98%

2.48% 2.33% 2.41%

1.69% 1.56% 1.50%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

2011 2012 2013 2014 2015 Q1 2016 Q2 2016

Our Credit Culture

We regard the money we are lending as our own money

We do not engage in speculative lending and expect our borrowers to have a vested

interest

We believe in well-documented files and thorough credit analysis, and have received

numerous accolades from our regulators and auditors

We look for a primary source of repayment based on a demonstrated cash flow history

We model or analyze for an economically independent secondary source of

repayment, which usually consists of hard collateral and/or personal guarantees

Our approval process involves multiple loan officers, and all significant loans require

the prior approval of a Board Committee

We strive to identify problems early and work them out expeditiously

We have zero tolerance for compliance violations or any kind of insider self-dealing

15

Strong Core Deposit Base

16

06/30/2016 Deposit Composition ($ in Millions) Non-Maturity Deposits

Cost of Deposits = 0.60%

Source: Company documents

*Jumbo Time Deposits are those time deposits over $250,000

Noninterest

Bearing

Deposits,

$418.4

NOW & Other

Trans. Accts,

$153.3

MMDA & Other

Savings, $485.1

Retail Time

Deposits,

$349.3

Jumbo Time

Deposits*,

$142.8

$277.5

$590.4

$624.5

$715.2

$893.1

$936.4

$1,056.8

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

$0.0

$200.0

$400.0

$600.0

$800.0

$1,000.0

2011 2012 2013 2014 2015 1Q 2016 2Q 2016

C

os

t o

f

D

ep

os

it

s

(%

)

N

on

-M

at

u

rit

y

D

ep

os

it

s

(D

oll

ar

s

in

Milli

on

s)

Earnings Growth

17

Net Income (Dollars in Thousands)

Source: Company documents

Net Income - Common ($000)

$1,930.0 $2,057.0

$6,161.0

$9,263.0

$12,181.0

$3,924.0

$4,398.0

$0.0

$2,000.0

$4,000.0

$6,000.0

$8,000.0

$10,000.0

$12,000.0

$14,000.0

2011 2012 2013 2014 2015 1Q 2016 2Q 2016

N

et

I

n

co

m

e

2011 2012 2013 2014 2015 Q1 2016 Q2 2016

Diluted

EPS

$0.59 $0.56 $0.76 $1.12 $1.19 $0.32 $0.35

Recent Financial Performance

18

Efficiency Ratio (%)(1) Core ROAA (%)(2)

Source: SNL Financial and Company documents

(1) Efficiency ratio excludes extraordinary items, non-recurring items, foreclosure expense, gains/losses on sale of securities, debt extinguishment and amortization of intangibles

(2) Core income excludes extraordinary items, non-recurring items and gains/losses on sale of securities; 1Q2016 and 2Q2016 annualized

(3) Peers defined as banks in MD, VA, DC with total assets between $1 billion and $5 billion; peer data through 2Q2016

(3) (3)

0.53%

0.65%

0.64%

0.75%

0.86%

0.94%

0.98%

0.82%

0.90%

0.91% 0.92%

0.86% 0.92% 0.92%

0.50%

0.75%

1.00%

2011 2012 2013 2014 2015 Q1 2016 Q2 2016

WFBI Peer Median

64.3%

61.4%

65.0%

65.2%

64.0%

64.7% 64.7%

64.3%

65.3%

66.8%

66.6%

65.7%

64.9%

63.4%

60.0%

62.5%

65.0%

67.5%

2011 2012 2013 2014 2015 Q1 2016 Q2 2016

WFBI Peer Median

19

Net Interest Margin

Net Interest Margin Over Time

Positioned for a rising interest rate environment; nearly 68% of the loan portfolio

consists of floating and adjustable rate as of 06/30/2016

Modeling +200bp interest rate shock results in an increase in net interest income of

8.2% based on 6/30/2016 data

Source: Company documents (1) Peers defined as banks in MD, VA, DC with total assets between $1 billion and $5 billion; peer data through 2Q2016

WFBI Peer Median (1)

4.03% 4.01%

3.89% 3.89%

3.65%

3.63%

3.65%

4.02%

4.14%

3.97%

3.92%

3.68%

3.51%

3.37%

3.20%

3.45%

3.70%

3.95%

4.20%

2011 2012 2013 2014 2015 Q1 2016 Q2 2016

Current Capital Position

20

Consolidated Capital Components

Source: Company documents

(1) Common Equity adjusted for other tier 1 components

(2) Recorded on the balance sheet at its fair value of $7.9 million

Regulatory capital levels are

above “well-capitalized” levels

under regulatory guidelines for

prompt corrective action

$10.3 million of par value of

trust preferred(2) yielding 3

Month LIBOR + 315 bps with

weighted average cost of 3.78%

as of 06/30/2016

$25.0 million of subordinated

debt with a 6% fixed-to-floating

rate coupon matures 10/15/2025,

callable 10/15/2020.

(1)

0

50,000

100,000

150,000

200,000

2009 2010 2011 2012 2013 2014 2015 Q1 2016 Q2 2016

Common Equity SBLF / TARP Sub Debt TruPS All other Tier 2 Capital

WFBI Stock Performance (LTM) As of September 2, 2016

21

Source : SNL Financial

Volume

$24.90 37.7% year over year

Price

37,112 avg daily (3 months)

M&A Track Record

22

Proven track record of completing acquisitions

WFBI acquisition of 1st Portfolio Holding Corporation, in 2015 (all stock)

WFBI assumption of Millennium Bank, NA in 2014 (FDIC assisted)

WFBI acquisition of Alliance Bankshares in 2012 (cash and stock)

WFB acquisition of First Liberty Bancorp in 2006 (cash and stock)

WFB acquisition of Sterling branch in 2005

WFB acquisition of DC branch in 2004

Century National Bank (CNB) sale to United Bankshares in 2001

CNB acquisition of GrandBank in 2000

CNB acquisition of Reston branch in 1998

CNB acquisition of McLean branch in 1997 (including capital raising contingency)

CNB acquisition of DC branch from RTC in 1994

Strong management team

Insider ownership aligns management and stakeholder

interests

Demographically attractive market area

Demonstrated track record of quality growth

Excellent asset quality and risk management

Strong profitability with attractive earnings growth

Concluding Remarks

23

NASDAQ: WFBI

www.wfbi.com

Thank you

Appendix

25

Facts About Our Common Stock As of September 2, 2016

26

Exchange NASDAQ Stock Market

Ticker symbol WFBI

Current Market Price1 $24.90

Common shares outstanding 10,431,016 voting; 12,252,430 total

Market capitalization1 $305.1 million

Insider ownership2 25.4% total

Institutional ownership2 44.6% total

Stock dividends 5% in 2012, 2013 and 2014

Cash dividend Consecutive quarterly dividends since January 2014

Current quarterly dividend $0.06 (0.96% yield)

Average volume1 (3 mo. average) 37,112

Fully Diluted EPS (LTM) $1.29

Tangible book value (6/30/2016) $14.30

1 Data as of close of business September 2, 2016.

2 SNL Financial

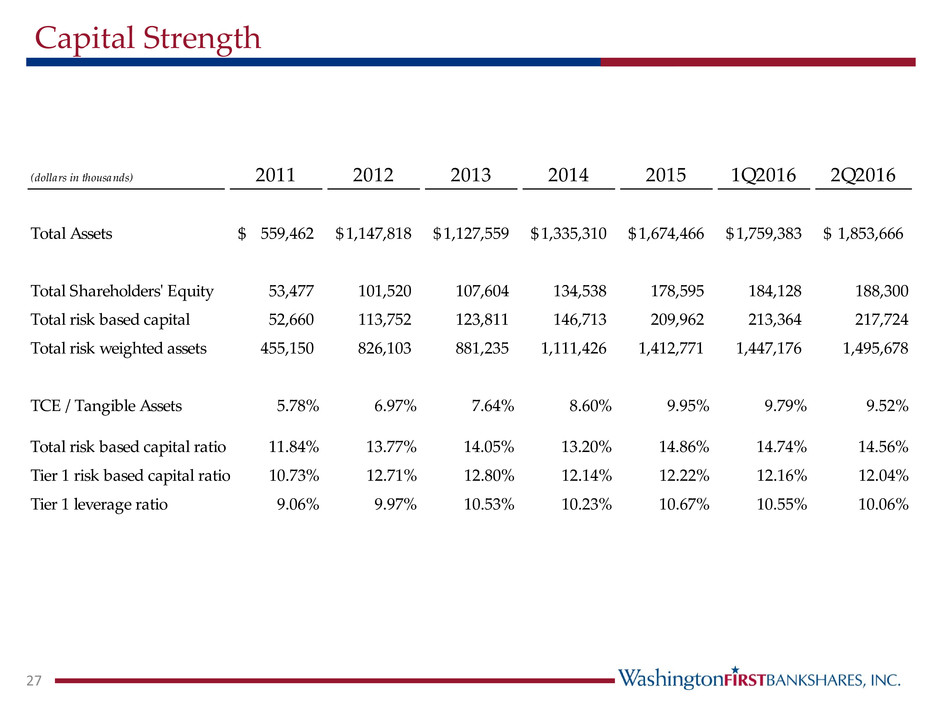

Capital Strength

27

(dollars in thousands) 2011 2012 2013 2014 2015 1Q2016 2Q2016

Total Assets 559,462$ 1,147,818$ 1,127,559$ 1,335,310$ 1,674,466$ 1,759,383$ 1,853,666$

Total Shareholders' Equity 53,477 101,520 107,604 134,538 178,595 184,128 188,300

Total risk based capital 52,660 113,752 123,811 146,713 209,962 213,364 217,724

Total risk weighted assets 455,150 826,103 881,235 1,111,426 1,412,771 1,447,176 1,495,678

TCE / Tangible Assets 5.78% 6.97% 7.64% 8.60% 9.95% 9.79% 9.52%

Total risk based capital ratio 11.84% 13.77% 14.05% 13.20% 14.86% 14.74% 14.56%

Tier 1 risk based capital ratio 10.73% 12.71% 12.80% 12.14% 12.22% 12.16% 12.04%

Tier 1 leverage ratio 9.06% 9.97% 10.53% 10.23% 10.67% 10.55% 10.06%

Historical Balance Sheet

28

* Retroactively adjusted to reflect the effect of all stock dividends.

(dollars in thousands) 2011 2012 2013 2014 2015 1Q2016 2Q2016

Cash and cash equivalents 72,321$ 224,207$ 109,164$ 62,306$ 62,753$ 69,117$ 99,441$

Investment securities and other investments 59,477 138,221 148,897 171,733 226,241 263,617 265,156

Loans held for sale - - - 1,068 36,494 37,439 52,198

Loans held investment, net of allowance 415,005 747,095 829,586 1,055,801 1,295,794 1,333,728 1,378,928

Other real estate owned 615 3,294 1,463 361 - 1,675 2,159

Intangibles 3,601 4,029 3,943 6,894 13,319 13,240 13,173

Other assets 8,443 30,972 34,506 37,147 39,865 40,567 42,611

Total Assets 559,462$ 1,147,818$ 1,127,559$ 1,335,310$ 1,674,466$ 1,759,383$ 1,853,666$

Deposits 479,001$ 972,660$ 948,903$ 1,086,063$ 1,333,242$ 1,407,560$ 1,548,877$

Borrowings 24,350 64,923 63,489 104,311 149,913 154,988 103,563

Other liabilities 2,634 8,715 7,563 10,398 12,716 12,707 12,926

Total Liabilities 505,985 1,046,298 1,019,955 1,200,772 1,495,871 1,575,255 1,665,366

Preferred stock 17,796 17,796 17,796 13,347 - - -

Common equity 35,757 83,757 91,317 120,757 178,722 182,375 186,395

Accumulated OCI (76) (33) (1,509) 434 (127) 1,753 1,905

Total Shareholders' Equity 53,477 101,520 107,604 134,538 178,595 184,128 188,300

Total Liabilities and Shareholders' equity 559,462$ 1,147,818$ 1,127,559$ 1,335,310$ 1,674,466$ 1,759,383$ 1,853,666$

Summary ratios:

Tangible book value per share* 10.01$ 10.12$ 10.69$ 11.95$ 13.55$ 13.98$ 14.30$

Loans HFI / Deposits 87.7% 77.5% 88.3% 98.1% 98.1% 95.6% 89.8%

Historical Income Statement

29

* Retroactively adjusted to reflect the effect of all stock dividends.

(dollars in thousands) 2011 2012 2013 2014 2015 1Q2016 2Q2016

Interest income 24,387$ 28,219$ 46,829$ 55,119$ 63,183$ 17,544$ 18,182$

Interest expense 5,009 4,949 6,130 7,219 9,211 2,991 3,181

Net interest income 19,378 23,270 40,699 47,900 53,972 14,553 15,001

Provision for loan losses 2,301 3,225 4,755 3,005 3,550 625 980

Net interest income after provision for loan losses 17,077 20,045 35,944 44,895 50,422 13,928 14,021

Non-interest income 1,159 3,541 1,139 1,998 7,891 4,781 8,490

Non-interest expense 13,835 20,178 28,117 33,116 39,589 12,501 15,535

Income before provision for income taxes 4,401 3,408 8,966 13,777 18,724 6,208 6,976

Provision for income taxes 1,794 1,173 2,627 4,353 6,469 2,284 2,578

Net income 2,607 2,235 6,339 9,424 12,255 3,924 4,398

Preferred stock dividends and accretion 677 178 178 161 74 - -

Net income available to common shareholders 1,930$ 2,057$ 6,161$ 9,263$ 12,181$ 3,924$ 4,398$

Fully diluted earnings per share* 0.59$ 0.56$ 0.76$ 1.12$ 1.19$ 0.32$ 0.35$

Credit Composition and Quality

30

(dollars in thousands) 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

Non-accrual 8,558$ 8,694$ 5,638$ 5,920$ 8,379$ 10,201$ 8,790$ 7,417$

90+ days still accruing 157 - - 113 73 28 - 13

TDRs 1,807 2,151 3,090 4,362 3,959 4,269 3,594 3,616

OREO 1,161 361 451 291 109 - 1,675 2,159

Other - - - - - - - -

Non-performing assets 11,683$ 11,206$ 9,179$ 10,686$ 12,520$ 14,498$ 14,059$ 13,205$

Loans 30-89 days past due / Loans HFI 0.75% 0.57% 0.11% 0.41% 0.49% 0.35% 0.51% 0.20%

NPAs & 90+ days past due / Assets 0.87% 0.84% 0.64% 0.70% 0.78% 0.86% 0.80% 0.71%

Reserves / Loans HFI 0.88% 0.87% 0.91% 0.90% 0.92% 0.94% 0.92% 0.91%

Non-GAAP, adjusted reserves / Loans HFI 1.58% 1.46% 1.45% 1.36% 1.31% 1.30% 1.25% 1.22%

Reserves / NPLs 85.29% 85.36% 112.91% 102.22% 93.25% 84.76% 99.56% 114.02%

Net charge-offs / Average loans HFI* 0.10% 0.20% 0.04% 0.03% 0.04% 0.04% 0.20% 0.20%

* 1Q2016 and 2Q2016 Annualized