Attached files

| file | filename |

|---|---|

| EX-23.2.3 - EX-23.2.3 - Athene Holding Ltd | d170639dex2323.htm |

| EX-23.2.2 - EX-23.2.2 - Athene Holding Ltd | d170639dex2322.htm |

| EX-23.2.1 - EX-23.2.1 - Athene Holding Ltd | d170639dex2321.htm |

| EX-16.1 - EX-16.1 - Athene Holding Ltd | d170639dex161.htm |

Table of Contents

As filed with the Securities and Exchange Commission on August 31, 2016

Registration No. 333-211243

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ATHENE HOLDING LTD.

(Exact name of registrant as specified in its charter)

| Bermuda | 6311 | 98-0630022 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

96 Pitts Bay Road

Pembroke, HM08, Bermuda

(441) 279-8400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

CT Corporation System

111 Eighth Avenue

New York, New York 10011

(212) 894-8940

(Name, address and telephone number, including area code, of agent for service)

Copies to:

| Perry J. Shwachman Samir A. Gandhi Sidley Austin LLP One South Dearborn Chicago, Illinois 60603 Telephone: (312) 853-7000 Telecopy: (312) 853-7036 |

Harvey M. Eisenberg Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, New York 10153 Telephone: (212) 310-8000 Telecopy: (212) 310-8007 |

Daniel J. Bursky Fried, Frank, Harris, Shriver & Jacobson LLP One New York Plaza New York, New York 10004 Telephone: (212) 859-8000 Telecopy: (212) 859-4000 |

Charles G.R. Collis Conyers Dill & Pearman Clarendon House, 2 Church Street, PO Box HM 666 Hamilton, HM CX Bermuda Telephone: (441) 295-1422 Telecopy: (441) 292-4720 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

Table of Contents

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We and the selling shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated August 31, 2016.

SHARES

Athene Holding Ltd.

Class A Common Shares

This is the initial public offering of Class A common shares of Athene Holding Ltd. We are offering Class A common shares.

The selling shareholders identified in this prospectus are selling Class A common shares. We will not receive any proceeds from the sale of the selling shareholders’ Class A common shares.

Prior to this offering, there has been no public market for the Class A common shares. We expect the initial public offering price to be between $ and $ per Class A common share. We intend to apply to list our Class A common shares on the New York Stock Exchange under the symbol “ATH.”

Investing in our Class A common shares involves risks. See “Risk Factors” beginning on page 25 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share |

Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to Athene |

$ | $ | ||||||

| Proceeds, before expenses, to the selling shareholders |

$ | $ | ||||||

| (1) | See “Underwriting” for a detailed description of compensation payable to the underwriters. |

We currently have two classes of voting shares outstanding, Class A common shares and Class B common shares. Each such Class A common share and Class B common share is economically equivalent to each other – the dollar value of one Class A common share is equal to the dollar value of one Class B common share. However, Class A common shares and Class B common shares differ in terms of voting power. The Class A common shares currently account for 55% of our aggregate voting power and the Class B common shares currently account for the remaining 45% of our aggregate voting power. See “Description of Share Capital—Common Shares.”

We have granted the underwriters an option to purchase, within 30 days of the date of this prospectus, up to additional Class A common shares from us, at the public offering price, less the underwriting discount. The selling shareholders have granted the underwriters an option to purchase, within 30 days of the date of this prospectus, up to additional Class A common shares from the selling shareholders, at the public offering price, less the underwriting discount.

The shares will be ready for delivery on or about , 2016.

| Barclays | Citigroup | Goldman, Sachs & Co. | Wells Fargo Securities |

| BofA Merrill Lynch | BMO Capital Markets | Credit Suisse | Deutsche Bank Securities | |||

| J.P. Morgan | Morgan Stanley | RBC Capital Markets |

| Apollo Global Securities | Dowling & Partners Securities LLC | Evercore ISI | Keefe, Bruyette & Woods A Stifel Company | |||

| Lazard | Raymond James | Rothschild | The Williams Capital Group, L.P. |

The date of this prospectus is , 2016.

Table of Contents

| Page | ||||

| ii | ||||

| ENFORCEMENT OF CIVIL LIABILITIES UNDER U.S. FEDERAL SECURITIES LAW |

ii | |||

| 1 | ||||

| 25 | ||||

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND MARKET DATA |

75 | |||

| 77 | ||||

| 78 | ||||

| 79 | ||||

| 81 | ||||

| SELECTED HISTORICAL CONSOLIDATED FINANCIAL AND OPERATING DATA |

83 | |||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

86 | |||

| 154 | ||||

| 207 | ||||

| 219 | ||||

| 241 | ||||

| 247 | ||||

| 262 | ||||

| 271 | ||||

| 274 | ||||

| 281 | ||||

| 284 | ||||

| 297 | ||||

| 304 | ||||

| 305 | ||||

| 305 | ||||

| 307 | ||||

| F-1 | ||||

| GLOSSARY OF SELECTED INSURANCE, REINSURANCE AND FINANCIAL TERMS |

G-1 | |||

You should rely only on the information contained in this prospectus or in any free writing prospectus that we authorize to be delivered to you. Neither we nor the selling shareholders or underwriters have authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. This prospectus is an offer to sell only the Class A common shares offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. You should assume the information contained in this prospectus and any free writing prospectus we authorize to be delivered to you is accurate only as of their respective dates or the date or dates specified in those documents. Our business, financial condition, results of operations or prospects may have changed since those dates.

For investors outside the United States: neither we, the selling shareholders nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Class A common shares and the distribution of this prospectus outside the United States.

i

Table of Contents

We obtained the industry, market and competitive position data throughout this prospectus from (1) our own internal estimates and research, (2) industry and general publications and research, (3) studies and surveys conducted by third parties and (4) other publicly available information. Independent research reports and industry publications generally indicate that the information contained therein was obtained from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. While we believe that the information included in this prospectus from such publications, research, studies and surveys is reliable, neither we nor the underwriters have independently verified data from these third-party sources. In addition, while we believe our internal estimates and research are reliable and the definitions of our market and industry are appropriate, neither such estimates and research nor such definitions have been verified by any independent source. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties as the other forward-looking statements in this prospectus.

ENFORCEMENT OF CIVIL LIABILITIES UNDER U.S. FEDERAL SECURITIES LAWS

We are incorporated under the laws of Bermuda. In addition, some of our directors and officers may reside outside the United States, and all or a substantial portion of our assets and the assets of these persons are, or may be, located in jurisdictions outside the United States. Therefore, it may be difficult for investors to recover against us or our non-United States based directors and officers, or obtain judgments of U.S. courts, including judgments predicated upon the civil liability provisions of U.S. federal securities laws. Although we may be served with process in the United States with respect to actions against us arising out of or in connection with violations of U.S. federal securities laws relating to offers and sales of Class A common shares made by this prospectus by serving CT Corporation, our U.S. agent irrevocably appointed for that purpose, it may be difficult for investors to effect service of process within the United States on our directors and officers who reside outside the United States.

We have been advised by our Bermuda counsel that there is no treaty in force between the United States and Bermuda providing for the reciprocal recognition and enforcement of judgments in civil and commercial matters. A judgment for the payment of money rendered by a court in the United States based on civil liability would not be automatically enforceable in Bermuda. A final and conclusive judgment obtained in a court of competent jurisdiction in the United States under which a sum of money is payable as compensatory damages may be the subject of an action in a Bermuda court under the common law doctrine of obligation, by action on the debt evidenced by the U.S. court judgment without examination of the merits of the underlying claim. In order to maintain an action in debt evidenced by a U.S. court judgment, the judgment creditor must establish that:

| • | the court that gave the judgment over the defendant was competent to hear the claim in accordance with private international law principles as applied in the courts in Bermuda; and |

| • | the judgment is not contrary to public policy in Bermuda and was not obtained contrary to the rules of natural justice in Bermuda. |

In addition, and irrespective of jurisdictional issues, the Bermuda courts will not enforce a U.S. federal securities law that is either penal or contrary to Bermuda public policy. It is the advice of our Bermuda counsel that an action brought pursuant to a public or penal law, the purpose of which is the enforcement of a sanction, power or right at the instance of the state in its sovereign capacity, will not be entertained by a Bermuda court. Certain remedies available under the laws of U.S. jurisdictions, including certain remedies under U.S. federal securities laws, would not be available under Bermuda law or enforceable in a Bermuda court, as they would be contrary to Bermuda public policy. U.S. judgments for multiple damages may not be recoverable in Bermuda court enforcement proceedings under the provisions of the Protection of Trading Interests Act 1981. A claim to enforce the compensatory damages before the multiplier was applied would be maintainable in the Bermuda court. Further, no claim may be brought in Bermuda against us or our directors and officers in the first instance for violation of federal securities laws because these laws have no extraterritorial jurisdiction under Bermuda law and do not have force of law in Bermuda. A Bermuda court may, however, impose civil liability on us or our directors and officers if the facts alleged in a complaint constitute or give rise to a cause of action under Bermuda law. See “Comparison of Shareholder Rights—Differences in Corporate Law—Shareholders’ Suits.”

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in our Class A common shares. You should carefully read this prospectus in its entirety before making an investment decision. In particular, you should read “Risk Factors” beginning on page 25, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 86 and the consolidated financial statements and notes thereto and other financial information included elsewhere in this prospectus. As used in this prospectus, unless the context otherwise indicates, any reference to “Athene,” “our company,” “the company,” “us,” “we” and “our” refers to Athene Holding Ltd. together with its consolidated subsidiaries and any reference to “AHL” refers to Athene Holding Ltd. only.

Unless otherwise indicated, the information included in this prospectus assumes (1) the sale of our Class A common shares in this offering at an offering price of $ per Class A common share, which is the mid-point of the pricing range set forth on the cover page of this prospectus and (2) that the underwriters have not exercised their option to purchase up to additional Class A common shares.

In this prospectus, we refer to a number of terms to describe our insurance and reinsurance businesses and financial and operating metrics such as “base of earnings,” “investment margin,” “VOBA,” “invested assets” and “alternative investments,” among others. For a detailed explanation of these terms and other terms used in this prospectus and not otherwise defined, please refer to “Glossary of Selected Insurance, Reinsurance and Financial Terms” in this prospectus.

In this prospectus, we make certain forward-looking statements, including expectations relating to our future performance. These expectations reflect our management’s view of our prospects and are subject to the risks described under “Risk Factors” and “Special Note Regarding Forward-Looking Statements and Market Data” in this prospectus. Our expectations of our future performance may change after the date of this prospectus and there is no guarantee that such expectations will prove to be accurate.

Our Company

We are a leading retirement services company that issues, reinsures and acquires retirement savings products designed for the increasing number of individuals and institutions seeking to fund retirement needs. We generate attractive financial results for our policyholders and shareholders by combining our two core competencies of (1) sourcing long-term, generally illiquid liabilities and (2) investing in a high quality investment portfolio, which takes advantage of the illiquid nature of our liabilities. Our steady and significant base of earnings generates capital that we opportunistically invest across our business to source attractively-priced liabilities and capitalize on opportunities. Our differentiated investment strategy benefits from our strategic relationship with Apollo Global Management, LLC (“Apollo”) and its indirect subsidiary, Athene Asset Management, L.P. (“AAM”). AAM provides a full suite of services for our investment portfolio, including direct investment management, asset allocation, mergers and acquisition asset diligence, and certain operational support services, including investment compliance, tax, legal and risk management support. Our relationship with Apollo and AAM also provides us with access to Apollo’s investment professionals across the world as well as Apollo’s global asset management infrastructure that, as of June 30, 2016, supported more than $186 billion of assets under management (“AUM”) across a broad array of asset classes. We are based in Bermuda with our U.S. subsidiaries’ headquarters located in Iowa.

We began operating in 2009 when the burdens of the financial crisis and resulting capital demands caused many companies to exit the retirement market, creating the need for a well-capitalized company with an experienced management team to fill the void. Taking advantage of this market dislocation, we have been able to

Table of Contents

acquire substantial blocks of long-duration liabilities and reinvest the related investments to produce profitable returns. We have been able to generate strong financial returns in a multi-year low rate environment. We believe we have fewer legacy liability issues than our peers given that all of our retail and flow reinsurance liabilities were underwritten after the financial crisis, and the majority of the liabilities we acquired through our acquisitions and block reinsurance were acquired at a discount to book value.

We have established a significant base of earnings and as of June 30, 2016 have an expected annual investment margin of 2-3% over the 8.0 year weighted-average life of our deferred annuities, which make up a substantial portion of our reserve liabilities. Even as we have grown to $65.3 billion in investments, including related parties, $70.0 billion in invested assets and $80.6 billion of total assets as of June 30, 2016, we have continued to approach both sides of the balance sheet with an opportunistic mindset because we believe quickly identifying and capitalizing on market dislocations allows us to generate attractive, risk-adjusted returns for our shareholders. Further, our multiple funding channels support growing origination across market environments and better enable us to achieve continued balance sheet growth while maintaining attractive profitability. We believe that in a typical market environment, we will be able to profitably grow through our organic funding channels, including retail, flow reinsurance (a transaction in which the ceding company cedes a portion of newly issued policies to the reinsurer) and institutional products. In more challenging market environments, we believe that we will see additional opportunities to grow through our inorganic funding channels, including acquisitions and block reinsurance (a transaction in which the ceding company cedes all or a portion of a block of previously issued annuity contracts through a reinsurance agreement), due to market stress during those periods. We are diligent in setting our return targets based on market conditions and risks inherent to our products offered and acquisitions or block reinsurance transactions. In general, we may accept lower returns on products which may provide more certain return characteristics, such as funding agreement backed notes (“FABN”), and we may require higher returns for products or transactions where there is more inherent risk in meeting our return targets, such as with acquisitions. If market conditions or risks inherent to a product or transaction create return profiles that are not acceptable to us, we generally will not sacrifice our profitability merely to facilitate growth.

As a result of our focus on issuing, reinsuring and acquiring attractively-priced liabilities, our differentiated investment strategy and our significant scale, for the six months ended June 30, 2016 and the year ended December 31, 2015, we generated an annualized investment margin on deferred annuities of 2.61% and 2.44%, respectively, and an annualized operating return on equity (“ROE”) excluding accumulated other comprehensive income (loss) (“AOCI”) of 19.0% and 22.9%, respectively, for our Retirement Services segment, described below. We currently maintain what we believe to be high capital ratios for our rating and hold more than $1 billion of capital in excess of the level we believe is needed to support our current operating strategy, and view this excess as strategic capital available to reinvest into organic and inorganic growth opportunities. Because we hold this strategic capital to implement our opportunistic strategy and to enable us to explore deployment opportunities as they arise, and because we are investing for future growth, our consolidated annualized ROE for the six months ended June 30, 2016 and the year ended December 31, 2015 was 10.4% and 11.4%, respectively, and our consolidated annualized operating ROE excluding AOCI for the same period was 11.7% and 15.9%, respectively, in each case, without the benefit of any holding company financial leverage or capital return through dividends or share buyback programs in a low interest rate environment. On a consolidated basis, for the six months ended June 30, 2016 and the year ended December 31, 2015, we generated net income available to AHL shareholders of $306 million and $563 million, respectively, and operating income, net of tax, of $337 million and $755 million, respectively. Investment margin, operating income, net of tax, and operating ROE excluding AOCI are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operating and Non-GAAP Measures” for additional discussions regarding non-GAAP measures.

2

Table of Contents

As of June 30, 2016, we had $6.5 billion of total AHL shareholders’ equity and $5.9 billion of total AHL shareholders’ equity excluding AOCI. Our top-level U.S. insurance subsidiary, Athene Annuity & Life Assurance Company (formerly known as Liberty Life, “AADE”), had a risk based capital ratio (“U.S. RBC ratio”) of 552% and our Bermuda reinsurer, Athene Life Re Ltd. (“ALRe”), had a Bermuda Solvency Capital Requirement (“BSCR”) ratio of 323%, each as of December 31, 2015. Our main insurance subsidiaries are rated A- for financial strength by each of Standard & Poor’s Financial Services LLP (“S&P”) and Fitch Ratings, Inc. (“Fitch”), each with a stable outlook, and by A.M. Best Company, Inc. (“A.M. Best”), with a positive outlook. AHL has a counterparty credit rating of BBB from S&P and an issuer default rating of BBB from Fitch, each with a stable outlook, and an issuer credit rating of bbb- from A.M. Best, with a positive outlook. We currently have no holding company financial leverage, and have an undrawn $1.0 billion credit facility in place to provide an additional liquidity cushion in challenging economic or business environments or to provide additional capital support.

We operate our core business strategies out of one reportable segment, Retirement Services. In addition to Retirement Services, we report certain other operations in Corporate and Other. Retirement Services is comprised of our U.S. and Bermuda operations which issue and reinsure retirement savings products and institutional products. Retirement Services has retail operations, which provide annuity retirement solutions to our policyholders. Retirement Services also has reinsurance operations, which reinsure multi-year guaranteed annuities (“MYGAs”), fixed indexed annuities (“FIAs”), traditional one year guarantee fixed deferred annuities, immediate annuities and institutional products from our reinsurance partners. In addition, our FABN program is included in our Retirement Services segment. Corporate and Other includes certain other operations related to our corporate activities and our German operations, which is primarily comprised of participating long-duration savings products. In addition to our German operations, included in Corporate and Other are corporate allocated expenses, merger and acquisition costs, debt costs, certain integration and restructuring costs, certain stock-based compensation and intersegment eliminations. In Corporate and Other we also hold more than $1 billion of capital in excess of the level of capital we hold in Retirement Services to support our operating strategy. We view this excess as strategic capital, which we expect to deploy for additional organic and inorganic growth opportunities as well as expect to contribute to ratings improvements over time. We manage our capital to levels which we believe would remain consistent with our current ratings in a recessionary environment. For additional information regarding our segments, refer to “Note 15 – Segment Information” to our unaudited condensed consolidated financial statements and notes thereto and “Note 20 – Segment Information” to our audited consolidated financial statements and notes thereto.

We have developed organic and inorganic funding channels to address the retirement services market and grow our assets and liabilities. By focusing on the retirement services market, we believe that we will benefit from several demographic and economic trends, including the increasing number of retirees in the United States, the lack of tax advantaged alternatives for people trying to save for retirement and expectations of a rising interest rate environment. To date, most of our products sold and acquired have been fixed annuities, which offer people saving for retirement a product that is tax advantaged, has a minimum guaranteed rate of return or minimum cash value and provides protection against investment loss. Our policies often include surrender charges (85% of our annuity products, as of June 30, 2016) or market value adjustments (“MVAs”) (72% of our annuity products, as of June 30, 2016), both of which increase persistency (the probability that a policy will remain in force from one period to the next) and protect our ability to meet our obligations to policyholders.

Our organic funding channels have provided deposits of $4.0 billion and $1.8 billion for the six months ended June 30, 2016 and 2015, respectively, and $3.9 billion, $2.9 billion and $1.5 billion for the years ended December 31, 2015, 2014 and 2013, respectively, and include:

| • | Retail, from which we provide retirement solutions to our policyholders primarily through approximately 60 independent marketing organizations (“IMOs”). Within our retail platform we had fixed annuity sales of $1.8 billion and $1.3 billion for the six months ended June 30, 2016 and 2015, respectively, and $2.5 billion, $2.5 billion and $1.3 billion for the years ended December 31, 2015, 2014 and 2013, respectively. |

3

Table of Contents

| • | Flow reinsurance, which provides an opportunistic channel for us to source long-term liabilities with attractive crediting rates. Within our flow reinsurance channel, we generated $2.2 billion and $435 million in deposits for the six months ended June 30, 2016 and 2015, respectively, and $1.1 billion, $349 million and $167 million in deposits for the years ended December 31, 2015, 2014 and 2013, respectively. |

| • | Institutional products, focused on the sale of funding agreements. Within our institutional products platform, in October 2015, we sold a $250 million funding agreement in our inaugural transaction under our FABN program. |

We believe the 2015 upgrade of our financial strength ratings to A- by each of S&P, Fitch and A.M. Best, as well as our 2016 outlook upgrade to positive by A.M. Best and our recent FIA and MYGA new product launches have enabled and will continue to enable us to increase penetration in our existing organic funding channels and access new markets within our retail channel, such as financial institutions. This increased penetration will allow us to source additional volumes of profitably underwritten liabilities.

Our inorganic funding channels, including acquisitions and block reinsurance, have contributed significantly to our growth. We believe our internal acquisitions team, with support from Apollo, has an industry-leading ability to source, underwrite, and expeditiously close transactions, which makes us a competitive counterparty for acquisition or block reinsurance transactions. In connection with our five acquisitions through June 30, 2016, we sourced reserve liabilities backed by approximately $65.7 billion in total assets (net of $9.3 billion in assets ceded through reinsurance). The aggregate purchase price of our acquisitions was less than the aggregate statutory book value of the businesses acquired.

We have sourced a high quality portfolio of invested assets. Because we have remained disciplined in underwriting attractively priced liabilities, we have the ability to invest in a broad range of high quality assets and generate attractive earnings. As of June 30, 2016, approximately 93.8% of our available for sale (“AFS”) fixed maturity securities, including related parties, were rated National Association of Insurance Commissioners (“NAIC”) 1 and NAIC 2, the two highest credit rating designations under the NAIC’s criteria (with investments of our German operations rated by applying nationally recognized statistical ratings organization (“NRSRO”) equivalent ratings to map NAIC ratings). In addition to our core fixed income portfolio, we opportunistically allocate 5-10% of our portfolio to alternative investments where we primarily focus on fixed income-like, cash flow-based investments. For instance, our alternative investment positions include significant equity stakes in two asset platforms that originate high quality credit assets (such as residential mortgage loans (“RMLs”), leveraged loans and mortgage servicing rights) that are well aligned with our investment strategy. Our relationship with AAM and Apollo allows us to take advantage of our generally illiquid liability profile and identify asset opportunities with an emphasis on earning incremental yield by taking liquidity risk and complexity risk, rather than assuming solely credit risk. While alternative investments are a relatively small portion of our overall portfolio, our alternative investments strategy has been an important driver of returns.

We operate through insurance and reinsurance subsidiaries and have built what we believe to be a scalable operating platform to support our current operations and future opportunities without significant additional investment in infrastructure and with very little incremental fixed operating cost. As a result, we believe we will be able to convert a significant portion of incremental net investment income from additional invested assets and liabilities into operating income.

Relationship with Apollo

We have a strategic relationship with Apollo which allows us to leverage the scale of its asset management platform. Apollo’s indirect subsidiary, AAM, serves as our investment manager. In addition to co-founding the company, Apollo assists us in identifying and capitalizing on acquisition opportunities that have been critical to our ability to significantly grow our business. Members of the Apollo Group are significant owners of our common shares and Apollo employees serve on our board of directors. We expect our strategic relationship with

4

Table of Contents

Apollo to continue for the foreseeable future. See “Certain Relationships and Related Party Transactions—Relationships and Related Party Transactions with Apollo or its Affiliates” and “Principal and Selling Shareholders.”

The Apollo Group controls and is expected, subsequent to the completion of our initial public offering, to continue to control 45% of the total voting power of AHL and holds a number of the seats on our board of directors. Further, our bye-laws generally limit the voting power of our Class A common shares (and certain other of our voting securities) such that no person owns (or is treated as owning) more than 9.9% of the total voting power of our common shares (with certain exceptions). See “Description of Share Capital—Common Shares.”

Our Market Opportunity

The number of individuals reaching retirement age is growing rapidly while some traditional retirement funding sources have declined in the wake of the financial crisis and the ensuing prolonged low interest rate environment. Our tax-efficient savings products are well positioned to meet this increasing customer demand.

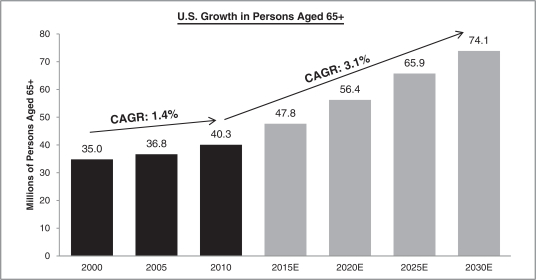

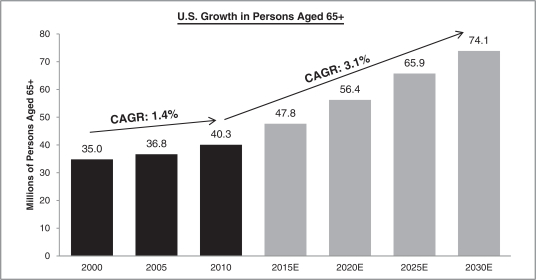

| • | Increasing Retirement-Age Population. Over the next three decades, the retirement-age population is expected to experience unprecedented growth. According to the U.S. Census Bureau, there were approximately 40 million Americans age 65 and older in 2010, representing 13% of the U.S. population. By 2030, this segment of the population is expected to increase by 34 million or 85% to approximately 74 million, which would represent approximately 21% of the U.S. population. Technological advances and improvements in healthcare are projected to continue to contribute to increasing average life expectancy, and aging individuals must be prepared to fund retirement periods that will last longer than ever before. Furthermore, many working households in the United States do not have adequate retirement savings. Demand for traditional fixed rate annuities and FIAs will likely be bolstered by this gap resulting from the growing need for guaranteed income streams and the expanding retirement population’s insufficient savings base. |

|

| Source: U.S. Census Bureau. |

| • | Increasing Demand for Tax-efficient Savings Products. According to a 2015 report published by the Government Accountability Office, approximately 50% of individuals age 55 and older have no |

5

Table of Contents

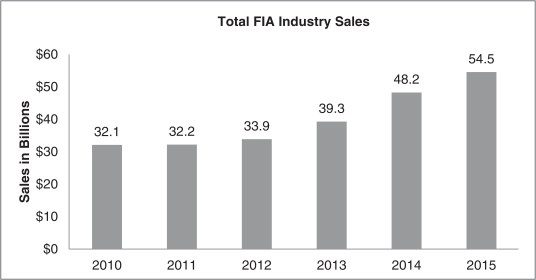

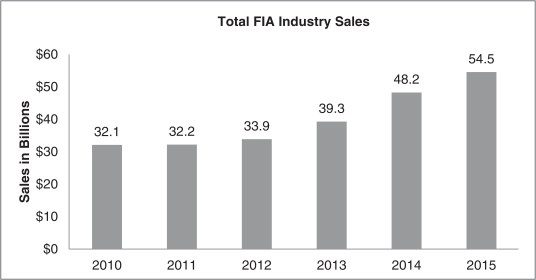

| retirement savings. As a tool for addressing the unmet need for retirement planning, we believe that many Americans have begun to look to tax-efficient savings products with low-risk or guaranteed return features and potential equity market upside, particularly as federal, state and local marginal tax rates have increased. As a result, sales of FIAs increased by approximately 70% from 2010 to 2015 and FIAs as a percentage of total fixed annuities increased from 39% in 2010 to 53% in 2015 according to the Life Insurance and Market Research Association (“LIMRA”). If interest rates rise, we expect to benefit from increased demand for our tax-efficient savings products as crediting and participation rates become more attractive on an absolute basis, and relative to alternative fixed income and savings vehicles such as certificates of deposit (“CDs”) and corporate bonds. |

|

| Source: U.S. Individual Annuity Yearbook 2014 and 4Q 2015 LIMRA Secure Retirement Institute US Individual Annuity Sales Report. |

6

Table of Contents

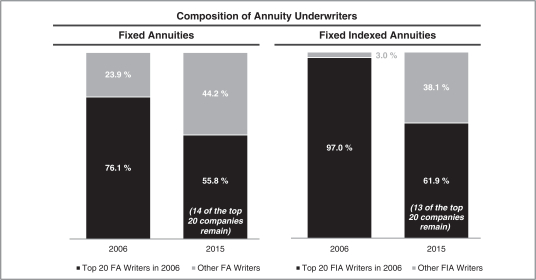

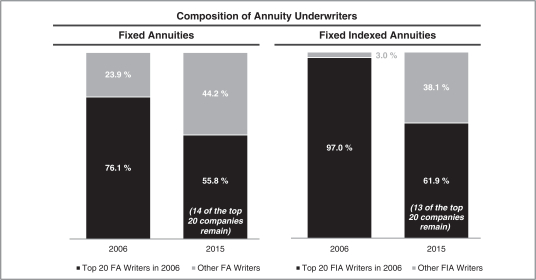

| • | Shift in the Competitive Environment. Products with guarantees require superior asset and risk management expertise to balance policyholder security, regulatory demands and shareholder returns on equity. Since the financial crisis, many companies have placed their fixed annuity businesses in run-off and have sold substantial blocks to third parties including us. The current market and regulatory environment, including the newly-issued U.S. Department of Labor (“DOL”) regulations regarding fiduciary obligations of distributors of products to retirement accounts, which we expect to continue, could provide us additional sources of growth through reinsurance and/or acquisitions to the extent that competitors divest in-force blocks of business as a result of such environment. However, we have also seen and may in the future see additional competitors enter the market who could compete for such sources of growth. |

|

|

Source: Estimated based on sales reported to LIMRA in 2006 and 2015. |

| • | Increasing Asset Opportunities. Regulatory changes in the wake of the financial crisis have made it less profitable for banks and other traditional lenders to hold certain illiquid and complex asset classes, notwithstanding the fact that these assets may have prudent credit characteristics. This market pullback has resulted in a supply-demand imbalance, which has created the opportunity for knowledgeable investors to acquire high-quality assets that offer attractive returns. As these institutions continue to comply with these new rules, we believe additional assets will become available which could be attractive for our business. |

Competitive Strengths

We believe the following strengths will allow us to capitalize on the growth prospects for our business:

| • | Ideal Platform to Capitalize on Positive Demographic and Market Trends. We have designed our products to capitalize on the growing need for retirement savings solutions. Our products provide protection against market downturns and offer interest which compounds on a tax-deferred basis until funds are distributed. Many of our products also provide the potential to earn interest based on the performance of a market index. These features provide distinct advantages over traditional savings vehicles such as bank CDs and variable annuities. Despite a challenging interest rate environment, we have been able to profitably source $1.8 billion of fixed annuity products through our retail platform in the first six months of 2016 by leveraging our product design capabilities, our investment acumen, which allows us to invest at appropriate |

7

Table of Contents

| investment margins, and our scalable operating platform. We offer prudent product features at attractive prices. If investment rates increase due to a rise in interest rates or widening credit spreads, we would be able to offer higher crediting rates, which we believe would generate additional demand for our products and therefore increased sales. Despite a challenging interest rate environment, we have been able to profitably sell new fixed annuity products by leveraging our product design capabilities, our investment acumen, and our scalable fixed operating platform. Even in a long-term low rate environment, we believe our underwriting expertise and ability to find and compete in areas of the market that are rationally priced will allow us to maintain strong operating results. For example, in prior years, our retail operations have generally not competed aggressively in the guaranteed income rider segment as we historically believed that such riders were not priced within our pricing discipline. However, recently competitors have been issuing annuities with what we believe are more rationally-priced lifetime income benefit features. In the current environment, we believe that we can grow our retail sales by offering competitive guaranteed income rates while earning an attractive return. |

| • | Strong Fixed Annuity Underwriting and Multiple Distribution Platforms. We believe that our strong fixed annuity underwriting provides us with long-dated and persistent liabilities, which we price at desirable levels to enable us to achieve attractive returns. Further, among our organic and inorganic funding channels, we have four dedicated distribution platforms to capitalize on retirement services opportunities across market environments and grow our liabilities. Our key distribution platforms are retail, reinsurance (including flow and block reinsurance), institutional products (focused on the sale of funding agreements) and acquisitions. We believe that having these four distribution platforms has given us the flexibility to respond to changing market conditions in one or more channels and the ability to opportunistically grow liabilities that generate our desired levels of profitability. In a rising interest rate environment, we believe we will be able to profitably increase the volume of our retail, flow reinsurance and institutional product sales and we believe we will see increased acquisition and block reinsurance opportunities in more challenging market environments. We are diligent in setting our return targets based on market conditions and risks inherent to our products offered and acquisitions or block reinsurance transactions. In general, we may accept lower returns on products which may provide more certain return characteristics, such as FABN, and we may require higher returns for products or transactions where there is more inherent risk in meeting our return targets, such as with acquisitions. If market conditions or risks inherent to a product or transaction create return profiles that are not acceptable to us, we generally will not sacrifice our profitability merely to facilitate growth. |

| • | Superior and Unique Investment Capabilities. We believe our relationships with AAM and Apollo provide access to superior and unique investment capabilities that allow us to invest a portion of our assets in securities that earn us incremental yield by taking liquidity risk and complexity risk, capitalizing on our long-dated and persistent liability profile to prudently achieve higher net investment earned rates, rather than assuming solely credit risk. Our investing capabilities support our ability to sell fixed annuities profitably and to price acquisitions competitively while meeting our return targets. Through AAM, we have access to more than 100 investment and operations professionals who are highly familiar with our business objectives and funding structure. This enables AAM to customize asset allocations and select investments for us that are most appropriate for our business. In addition, our strategic relationship with Apollo provides us with access to Apollo’s broad credit and alternative investment platforms and allows us to leverage the scale, sourcing and investing capabilities, and infrastructure of an asset manager with more than $186 billion of AUM, which includes approximately $67.8 billion of our invested assets, each as of June 30, 2016. Apollo’s global asset sourcing capabilities in a diverse array of asset classes provide AAM with the opportunity to capitalize on attractive investments for us. |

| • | In each of our U.S. acquisitions, we have successfully reinvested our acquired investment portfolio with the objective of achieving higher returns than were achieved on such investments |

8

Table of Contents

| prior to the acquisition. For example, we have reinvested a substantial portion of the investment portfolio acquired in our acquisition of Aviva USA Corporation (“Aviva USA,” now known as Athene USA Corporation, “Athene USA”), which contributed to the increase in fixed income and other net investment earned rates on this block of business to 4.11% for the year ended December 31, 2015 from 3.50% (on an annualized basis) for the fourth quarter of 2013. |

| • | Apollo and AAM work collaboratively to identify and quickly capitalize on opportunities in various asset classes. For example, we were an early investor in distressed non-agency residential mortgage-backed securities (“RMBS”) during 2009 and 2010, prior to the strong recovery of that market in later years. By the end of 2010, we had acquired a portfolio of $448 million (approximately 24% of our total invested assets at such time) of non-agency RMBS at discounts to par, well in advance of the significant price improvements in these investments. |

| • | AAM selects investments and develops investment strategies prior to our purchase in accordance with our investment limits, and works in concert with our risk management team to stress-test the underwritten assets and asset classes under various negative scenarios. For the six months ended June 30, 2016 and the year ended December 31, 2015, our annualized other-than-temporary-impairment (“OTTI”) as a percentage of our average invested assets was 6 basis points and 5 basis points, respectively. |

| • | We also have access to expertise and capabilities to directly originate a wide range of asset classes through AAM and Apollo. Direct origination allows the selection of assets that meet our liability profile and the sourcing of better quality investments. |

| • | Visible Paths to Earnings Growth. As of June 30, 2016, we had total liabilities of approximately $74.2 billion and approximately $68.5 billion in reserve liabilities that primarily consisted of deferred annuities with an expected annual investment margin of 2-3% over the 8.0 year weighted average life of such products. Complementing our significant base of earnings, we have developed compelling revenue and margin drivers to fuel future earnings growth, including the following key elements: |

| • | We are well positioned to grow through incremental retail and institutional product sales, reinsurance transactions and opportunistic acquisitions, which are driven by favorable demographic and macroeconomic trends. We also believe the 2015 upgrade of our financial strength ratings to A- by each of S&P, Fitch and A.M. Best, as well as our 2016 outlook upgrade to positive by A.M. Best, have enabled and will continue to enable us to increase penetration in our existing organic funding channels and access new markets within our retail channel, such as financial institutions, and have enhanced and will continue to enhance our attractiveness as a reinsurance partner. This increased penetration will allow us to source additional volumes of profitably underwritten liabilities. |

| • | We should benefit from the completion of the reinvestment of our Aviva USA asset portfolio, which has impacted our investment margin due to the mark to market accounting treatment of assets at the time of acquisition. |

| • | Furthermore, we have built a scalable corporate platform which allows us to onboard incremental business without significant additional investment in infrastructure and with very little incremental fixed operating cost. As a result, we believe we will be able to convert a significant portion of incremental net investment income from additional invested assets and liabilities into operating income. |

| • | We believe our earnings also stand to further benefit if interest rates or credit spreads increase or if we receive an upgrade of our financial strength by the ratings agencies which we expect will allow us to grow our annuity sales, increase our profitability, and benefit from an asset-liability position that has a significant allocation to floating rate investments and cash. |

9

Table of Contents

| • | Strength of Balance Sheet Supported by Robust Risk Management. We believe that our strong balance sheet and our comprehensive risk management philosophy have been important in gaining the confidence of our various constituencies and growing our business. We have established a comprehensive enterprise risk management (“ERM”) framework and risk management controls throughout our organization, which are further supported by AAM’s and Apollo’s own risk management capabilities that are intended to help us maintain our continued financial strength. We manage our business, capital and liquidity profile with the objective of withstanding severe adverse shocks, such as the 2007-2008 financial crisis, while maintaining a meaningful buffer above regulatory minimums and above certain capital thresholds to meet our desired ratings. Risk management is deeply embedded in all of our business decisions and processes, including acquisitions, asset purchases, product design and underwriting, liquidity and liability management. Certain of the key attributes of our risk management profile are: |

| • | We maintain our financial flexibility and currently have no holding company financial leverage. |

| • | We believe that we underwrite liabilities and manage new product development prudently. |

| • | Our asset liability management (“ALM”) procedures protect against sudden changes in interest rates. |

| • | As of June 30, 2016, approximately 85% of our annuity products had surrender charges and 72% had MVAs, each of which provide stability to our reserve liabilities. |

| • | As of June 30, 2016, 27% of our invested assets were floating rate investments which would allow us the flexibility to quickly increase our crediting rates in a rising interest rate environment, if desired. |

| • | We maintain an appropriate amount of assets that could be quickly liquidated and have an additional liquidity cushion through a $1.0 billion revolving credit facility, which is undrawn as of the date hereof. |

| • | We evaluate our assets both at the time of acquisition and over time, using AAM’s proprietary, independent credit models, and hold a high-quality portfolio with approximately 93.8% of our AFS fixed maturity securities, including related parties, rated as NAIC 1 and NAIC 2 as of June 30, 2016 (with investments of our German operations rated by applying NRSRO equivalent ratings to map NAIC ratings). |

| • | Highly Experienced Management Team with Demonstrable Track Record. Our highly successful, entrepreneurial senior management team has extensive experience in building companies, insurance operations, and investment management. We have assembled a management team of individuals who bring strong capabilities and experience to each facet of running our company. We are led by three well known and well respected industry executives with an average of 30 years of experience. James R. Belardi, our Chairman and founder, spent the majority of his career as the President of SunAmerica Life Insurance Company and Chief Investment Officer of AIG Retirement Services, Inc. William J. Wheeler, our President, served as President of the Americas Group at MetLife Inc. prior to joining our company, and Martin P. Klein, our Chief Financial Officer, was previously Chief Financial Officer of Genworth Financial, Inc. |

Growth Strategy

The key components of our growth strategy are as follows:

| • | Continue Organic Growth by Expanding Our Distribution Platforms. We plan to grow organically by expanding our retail, reinsurance and institutional product distribution platforms. We believe that |

10

Table of Contents

| we have the right people, infrastructure and scale to position us for continued growth. We aim to grow our retail platform in the United States by deepening our relationships with our approximately 60 IMOs and approximately 29,000 independent agents. Our strong financial position and capital efficient products allow us to be a dependable partner with IMOs and consistently write new business. We work with our IMOs to develop customized, and at times exclusive, products that help drive sales. |

We expect our retail platform to continue to benefit from the ratings upgrade in 2015, our improving credit profile and recent product launches. We believe this should support growth in sales at our desired cost of crediting through increased volumes via current IMOs, new relationships with IMOs that can only do business with insurers rated A- or higher, and access to new distribution platforms, including small to mid-sized banks and regional broker-dealers. We are implementing the necessary technology platform, hiring and training a specialized sales force, and have created products to capture new potential distribution opportunities.

Our reinsurance platform also benefited from the 2015 ratings upgrade. We target reinsurance business consistent with our preferred liability characteristics, and as such, reinsurance provides another opportunistic channel for us to source long-term liabilities with attractive crediting rates. For the six months ended June 30, 2016, we generated deposits through our flow reinsurance channel of $2.2 billion, while for the full year of 2015, we generated deposits of $1.1 billion, up from $167 million in 2013. We expect to grow this channel further as we continue to add new partners, some of which prefer to do business with higher rated counterparties such as us.

In addition, after having sold our first funding agreement under our FABN program in 2015, we expect to grow our institutional products platform over time.

| • | Pursue Attractive Acquisitions. We plan to continue leveraging our expertise in sourcing and evaluating transactions to grow our business profitably. From our founding through June 30, 2016, we have grown to $70.0 billion in invested assets and $68.5 billion in reserve liabilities, primarily through acquisitions and block reinsurance transactions. We believe that our demonstrated ability to successfully consummate complex transactions, as well as our relationship with Apollo, provide us with distinct advantages relative to other acquirers and reinsurance companies. Furthermore, our business has achieved sufficient scale to provide meaningful operational synergies for the businesses and blocks of business that we acquire. Consequently, we believe we are often sought out by companies looking to transact in the acquisitions and block reinsurance markets. |

| • | Expand Our Product Offering and International Presence. Our efforts to date have focused on developing and sourcing retirement savings products and we are continuing such efforts by expanding our retail product offerings. On April 11, 2016, we launched our largest new retail product initiative, whereby we: (1) enhanced our most popular accumulation product, “Performance Elite,” with two new indices, (2) announced a new MYGA product designed for the bank and broker-dealer channel and (3) introduced an income-focused product, “Ascent Pro.” With the introduction of our new MYGA product and Ascent Pro, our retail channel is now competing in a much broader segment of the overall retirement market. See “Business—Products.” |

Additionally, while our organic growth initiatives and acquisitions have largely been focused on opportunities in the United States, our recent acquisition of Delta Lloyd Deutschland AG (“DLD,” now known as Athene Deutschland GmbH, “AD”) has demonstrated the geographic scalability of our strategy and our ability to capitalize quickly on international market environments as well. Due to the European Union’s Directive (2009/138/EC) (“Solvency II”), which became effective in 2016, many players in various international insurance markets are retrenching to core products, a reaction similar to that of U.S.-based insurers during the financial crisis. We believe this retrenching has created an opportunity for us to expand internationally primarily through reinsurance. In particular, we believe that ALRe, as a Bermuda-based reinsurer, is well-positioned to expand our reinsurance activities in

11

Table of Contents

Europe as a result of Bermuda’s achievement of equivalency under Solvency II. See “Business—Regulation—Germany —Solvency II.”

| • | Leverage Our Unique Relationship with Apollo and AAM. We intend to continue leveraging our unique relationship with Apollo and AAM to source high-quality assets with attractive risk-adjusted returns. Apollo’s global scale and reach provide us with broad market access across environments and geographies and allow us to actively source assets that exhibit our preferred risk and return characteristics. For instance, through our relationship with Apollo and AAM, we have indirectly invested in companies including MidCap FinCo Limited (“MidCap”) and AmeriHomeMortgage Company, LLC (“AmeriHome”). In 2013, Apollo presented us with an opportunity to fund the acquisition of MidCap, a middle-market lender focused on asset-backed loans, leveraged loans, real estate, rediscount loans and venture loans. Our equity investment in MidCap provides us with an alternative investment that meets the key characteristics we look for including an attractive risk-return profile. Our equity investment in MidCap is held indirectly through an investment fund, AAA Investments (Co-Invest VII), L.P. (“Co-Invest VII”), of which MidCap constituted 99% of the investments of such fund. Co-Invest VII returned an annualized net investment earned rate of 7.91% and 15.98% for the six months ended June 30, 2016 and for the year ended December 31, 2015, respectively. As of June 30, 2016, our equity investment and loans to Midcap were valued at $490 million and $237 million, respectively. |

Similarly, in 2013, AAM proposed that Athene and an Apollo co-investor fund and launch AmeriHome, a mortgage lender and servicer with expertise in mortgage industry fundamentals that we believe are key to operating a successful and sustainable mortgage lender/servicer. Like our investment in MidCap, our equity investment in AmeriHome meets the key characteristics we look for in an alternative investment. Our equity investment in AmeriHome is held indirectly through an investment fund, A-A Mortgage Opportunities, L.P. (“A-A Mortgage”), and AmeriHome is currently A-A Mortgage’s only investment. Abiding by its core principles, AmeriHome has grown profitably, with A-A Mortgage returning an annualized net investment earned rate of 10.21% and 14.05% for the six months ended June 30, 2016 and for the year ended December 31, 2015, respectively. As of June 30, 2016, our equity investment in A-A Mortgage was valued at $347 million.

| • | Dynamic Approach to Asset Allocation during Market Dislocations. As we have done successfully in the past, we plan to fully capitalize on future market dislocations to opportunistically reposition our portfolio to capture incremental yield. For example, during 2009-2010, we reinvested a significant portion of our portfolio into RMBS. Additionally, regulatory changes in the wake of the financial crisis have made it more expensive for banks and other traditional lenders to hold certain illiquid and complex assets, notwithstanding the fact that these assets may have prudent credit characteristics. This change in demand has provided opportunities for investors to acquire high-quality assets that offer attractive returns. For example, we see emerging opportunities as banks retreat from direct mortgage lending, structured and asset-backed products, and middle-market commercial loans. We intend to maintain a flexible approach to asset allocation, which will allow us to act quickly on similar opportunities that may arise in the future across a wide variety of asset types. |

| • | Maintain Risk Management Discipline. Our risk management strategy is to proactively manage our exposure to risks associated with interest rate duration, credit risk and structural complexity of our invested assets. We address interest rate duration and liquidity risks through managing the duration of the liabilities we source with the assets we acquire, and through ALM modeling. We assess credit risk by modeling our liquidity and capital under a range of stress scenarios. We manage the risks related to the structural complexity of our invested assets through AAM’s modeling efforts. The goal of our risk management discipline is to be able to continue growth and to achieve profitable results across various market environments. |

12

Table of Contents

Additional Information

Athene is an exempted company organized under the laws of Bermuda. Our principal executive offices are located at Chesney House, First Floor, 96 Pitts Bay Road, Pembroke, HM08, Bermuda, and our telephone number is (441) 279-8400. Our website address is www.athene.com. Information contained on our website or connected thereto does not constitute a part of, and is not incorporated by reference into, this prospectus or the registration statement of which it forms a part.

Summary Risk Factors

An investment in our common shares involves numerous risks described in “Risk Factors” and elsewhere in this prospectus. You should carefully consider these risks before making an investment in our Class A common shares. Key risks include, but are not limited to, the following:

| • | our business, financial condition, liquidity, results of operations and cash flows depend on the accuracy of our management’s assumptions and estimates, and we could face significant losses if these assumptions and estimates differ significantly from actual results; |

| • | the amount of statutory capital that our insurance and reinsurance subsidiaries have can vary significantly from time to time and is sensitive to a number of factors outside of our control; |

| • | interest rate fluctuations could adversely affect our business, financial condition, liquidity, results of operations and cash flows; |

| • | we may want or need additional capital in the future and such capital may not be available to us on favorable terms or at all due to volatility in the equity or credit markets, adverse economic conditions or our creditworthiness; |

| • | if we do not manage our growth effectively, our financial performance could be adversely affected; our historical growth rates may not be indicative of our future growth; |

| • | if our risk management policies and procedures, which include the use of derivatives and reinsurance, are not adequate to protect us, we may be exposed to unidentified, unanticipated or inadequately managed risks; |

| • | we operate in a highly competitive industry that includes a number of competitors, many of which are larger and more well-known than we are, which could limit our ability to achieve our growth strategies and could materially and adversely affect our business, financial condition, results of operations, cash flows and prospects; |

| • | we are subject to general economic conditions, including prevailing interest rates, levels of unemployment and financial and equity and credit market performance, which may affect, among other things, our ability to sell our products, the fair value of our investments and whether such investments become impaired and the surrender rate and profitability of our policies; |

| • | our investments are subject to market and credit risks that could diminish their value and these risks could be greater during periods of extreme volatility or disruption in the financial and credit markets, which could adversely impact our business, financial condition, liquidity and results of operations; |

| • | our investments linked to real estate are subject to credit, market and servicing risk which could diminish the value that we obtain from such investments; |

| • | many of our invested assets are relatively illiquid and we may fail to realize profits from these assets for a considerable period of time, or lose some or all of the principal amount we invest in these assets if we are required to sell our invested assets at a loss at inopportune times to cover policyholder withdrawals or to meet our insurance, reinsurance or other obligations; |

13

Table of Contents

| • | our investment portfolio may be subject to concentration risk, particularly with regards to our investments in MidCap, AmeriHome and real estate; |

| • | our investment portfolio may include investments in securities of issuers based outside the United States, including emerging markets, which may be riskier than securities of U.S. issuers; |

| • | we previously identified material weaknesses in our internal control over financial reporting and if we fail to maintain effective internal control over financial reporting, we may not be able to accurately report our consolidated financial results; |

| • | our growth strategy includes acquiring business through acquisitions of other insurance companies and reinsurance of insurance obligations written by unaffiliated insurance companies, and our ability to consummate these acquisitions on economically advantageous terms acceptable to us in the future is unknown; |

| • | we may not be able to successfully integrate future acquisitions and such acquisitions may result in greater risks to us, our business, financial condition, results of operations, cash flows and prospects; |

| • | a financial strength rating downgrade, potential downgrade or any other negative action by a rating agency could make our product offerings less attractive, inhibit our ability to acquire future business through acquisitions or reinsurance and increase our cost of capital, which could have a material adverse effect on our business; |

| • | we are subject to significant operating and financial restrictions imposed by our credit agreement; |

| • | we are subject to the credit risk of our counterparties, including ceding companies who reinsure business to ALRe, reinsurers who assume liabilities from our subsidiaries and derivative counterparties; |

| • | we rely significantly on third parties for investment services and certain other services related to our policies, and we may be held responsible for obligations that arise from the acts or omissions of third parties under their respective agreements with us if they are deemed to have acted on our behalf; |

| • | the vote by the United Kingdom mandating its withdrawal from the European Union (“EU”) could have an adverse effect on our business, investments and potential growth into Europe; |

| • | interruption or other operational failures in telecommunications, information technology and other operational systems or a failure to maintain the security, integrity, confidentiality or privacy of sensitive data residing on those systems, including as a result of human error, could have a material adverse effect on our business; |

| • | we may be the target or subject of, and may be required to defend against or respond to, litigation (including class action litigation), enforcement investigations or regulatory scrutiny; |

| • | the historical performance of AAM and Apollo Asset Management Europe, LLP (“AAME”) should not be considered as indicative of the future results of our investment portfolio, our future results or any returns expected on our common shares; |

| • | if either AAM or AAME loses or fails to retain its senior executives or other key personnel and is unable to attract qualified personnel, its ability to provide us with investment management and advisory services could be impeded or adversely affected, which could significantly and negatively affect our business; |

| • | increased regulation or scrutiny of alternative investment advisers and certain trading methods may affect AAM’s and AAME’s ability to manage our investment portfolio or affect our business reputation; |

14

Table of Contents

| • | our industry is highly regulated and we are subject to significant legal restrictions, regulations and regulatory oversight in connection with the operations of our business, including the discretion of various governmental entities in applying such restrictions and regulations and these restrictions may have a material adverse effect on our business, financial condition, liquidity, results of operations, cash flows and prospects; |

| • | our failure to obtain or maintain approval of insurance regulators and other regulatory authorities as required for the operations of our insurance subsidiaries may have a material adverse effect on our business, financial condition, results of operations and prospects; |

| • | changes in the laws and regulations governing the insurance industry or otherwise applicable to our business, including the newly-issued DOL fiduciary regulation, may have a material adverse effect on our business, financial condition, liquidity, results of operations and prospects; |

| • | AHL or ALRe may be subject to U.S. federal income taxation; |

| • | U.S. persons who own our Class A common shares may be subject to U.S. federal income taxation at ordinary rates on our undistributed earnings and profits; |

| • | U.S. persons who own our Class A common shares may be subject to U.S. federal income taxation at ordinary income rates on a disproportionate share of our undistributed earnings and profits attributable to related person insurance income (“RPII”); |

| • | the interest of the Apollo Group, which controls and is expected to continue to control 45% of the total voting power of AHL and holds a number of the seats on our board of directors, may conflict with those of other shareholders and could make it more difficult for you and other shareholders to influence significant corporate decisions; |

| • | our bye-laws contain provisions that cause a holder of Class A common shares to lose the right to vote the shares if the holder owns an equity interest in Apollo, AP Alternative Investments, L.P. (“AAA”), or certain other entities; |

| • | our bye-laws contain provisions that could discourage takeovers and business combinations that our shareholders might consider in their best interests, including provisions that prevent a holder of Class A common shares from having a significant stake in Athene; and |

| • | other risks and factors listed under “Risk Factors” and elsewhere in this prospectus. |

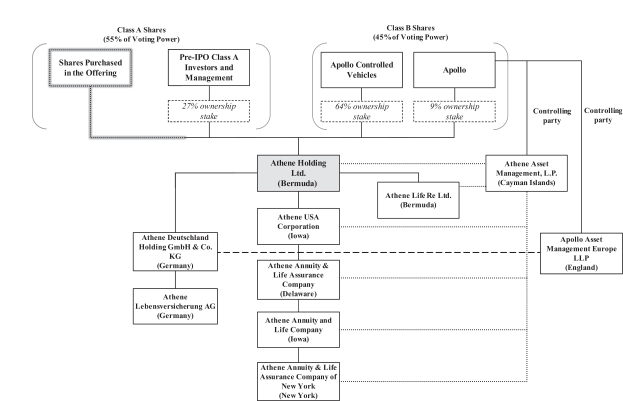

Organizational Chart

Below is an organizational chart that summarizes our ownership and corporate structure. We have two classes of voting shares outstanding, Class A common shares and Class B common shares. Each such Class A common share and Class B common share is economically equivalent – the dollar value of one Class A common share is equivalent to the dollar value of one Class B common share. However, Class A common shares and Class B common shares differ in terms of voting power. The Class A common shares currently account for 55% of our aggregate voting power and the Class B common shares currently account for the remaining 45% of our aggregate voting power. The Class B common shares are held by members of the Apollo Group, which includes funds managed by affiliates of Apollo, and accordingly, the Apollo Group beneficially owns or exercises voting control over all of the Class B common shares. Holders of the Class B common shares may convert any or all of their Class B common shares into Class A common shares on a one-to-one basis, at any time, including upon a sale of their shares (subject to any applicable lock-up restrictions), upon notice to us. So long as any member of the Apollo Group owns at least one Class B common share, such member will still be able to assert voting control over 45% of our aggregate voting power. See “Description of Share Capital—Common Shares—Voting Rights.”

15

Table of Contents

As a result of certain regulatory and tax limitations, our bye-laws prohibit holders of Class A common shares and their Control Groups (as defined herein) and certain other classes of common shares (other than those owned by the Apollo Group) from having more than 9.9% of the total voting power of our common shares. Any amounts in excess of such 9.9% will be reallocated proportionately among all other of our Class A common shareholders who were not members of the relevant Control Group so long as such reallocation does not cause such other shareholder or its related Control Group to hold more than 9.9% of the total voting power of our shares. See “Description of Share Capital—Common Shares—Voting Rights—Class A Common Shares.”

AAM acts as the investment manager to our U.S. and Bermuda companies. AAME acts as the investment adviser to our German subsidiaries.

The dotted lines connecting AAM to AHL and certain of its subsidiaries and the dashed line connecting AAME to Athene Deutschland Holding GmbH & Co. KG (“ADKG”) denote our investment management and advisory relationships, respectively.

The ownership percentages shown reflect our percentage ownership prior to the offering.(1)(2)

| (1) | The organizational chart shows AHL and its material insurance company and holding company subsidiaries and omits certain of its subsidiaries, including certain insurance companies and intermediate holding companies. For a complete list of subsidiaries of AHL, please see Exhibit 21.1 to the registration statement of which this prospectus is a part. |

| (2) | The ownership structure of AHL shown in the organizational chart is representational only and does not include the names of the direct or beneficial owners of our common shares. For more information about the beneficial owners of our common shares, please see “Principal and Selling Shareholders.” |

16

Table of Contents

| The Offering | ||

| Class A common shares offered by us in this offering | Class A common shares (plus up to an additional Class A common shares that we may issue and sell upon the exercise of the underwriters’ option to purchase additional Class A common shares) | |

| Class A common shares offered by the selling shareholders in this offering | Class A common shares (plus up to an additional Class A common shares that the selling shareholders may sell upon the exercise of the underwriters’ option to purchase additional Class A common shares) | |

| Class A common shares outstanding prior to this offering | shares | |

| Class A common shares to be outstanding after this offering | shares ( shares if the underwriters exercise their option to purchase additional Class A common shares in full from us) | |

| Class B common shares outstanding | shares | |

| Class M common shares outstanding | shares | |

| Total common shares to be outstanding after this offering | shares ( shares if the underwriters exercise their option to purchase additional Class A common shares in full from us) | |

| Voting Rights | The Class A common shares collectively represent 55% of the total voting power of our common shares, subject to certain voting restrictions and adjustments. The Class B common shares, which are beneficially owned by members of the Apollo Group, represent, in aggregate, 45% of the total voting power of our common shares, subject to certain adjustments. Our Class A common shares may be subject to a cap of the voting power attributable to such shares or may be deemed to be non-voting depending upon whether a holder of such shares is subject to the restrictions set forth in our bye-laws. See “Description of Share Capital—Common Shares—Voting Rights.” | |

| Use of proceeds | We expect the total net proceeds that we receive in this offering will be approximately $ , assuming an offering price of $ per share (which is the mid-point of the price range set forth on the cover page of this prospectus) after deducting the underwriters’ discounts and commissions in connection with this offering and estimated offering expenses. If the underwriters exercise their option to purchase additional Class A common shares in full, our total net proceeds will be approximately $ after deducting the underwriters’ discounts and commissions in connection with this offering and estimated offering expenses. | |

17

Table of Contents

| We intend to use the net proceeds we receive from this offering for general corporate purposes. We will not receive any proceeds from the sale of the selling shareholders’ Class A common shares. | ||

| Conflicts of Interest |

Apollo Global Securities, LLC is an underwriter in this offering and is an affiliate of entities controlled by or affiliated with Apollo, which beneficially own more than 10% of our outstanding common equity. Accordingly, Apollo Global Securities, LLC is deemed to have a “conflict of interest” within the meaning of Rule 5121 of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Accordingly, this offering will be made in compliance with the applicable provisions of FINRA Rule 5121. See “Underwriting (Conflicts of Interest).” | |

| Dividend policy | We do not currently pay dividends on any of our common shares and we currently intend to retain all available funds and any future earnings for use in the operation of our business. We may, however, pay cash dividends on our common shares, including our Class A common shares, in the future. Any future determination to pay dividends will be made at the discretion of our board of directors and will depend upon many factors, including our financial condition, earnings, legal and regulatory requirements, restrictions in our debt agreements and other factors our board of directors deems relevant. See “Dividend Policy” and “Description of Certain Indebtedness—Credit Facility.” | |

| Proposed New York Stock Exchange symbol | We intend to apply to list our Class A common shares on the New York Stock Exchange (“NYSE”) under the symbol “ATH.” | |

18

Table of Contents

Summary Historical Consolidated Financial and Operating Data