Attached files

| file | filename |

|---|---|

| EX-99.1 - FORM SUBSCRIPTION - Battlers Corp. | ex99-1.htm |

| EX-23.1 - AUDITOR'S CONSENT - Battlers Corp. | ex23-1.htm |

| EX-10.2 - LEASE AGREEMENT - Battlers Corp. | ex10-2.htm |

| EX-10.1 - VERBAL AGREEMENT - Battlers Corp. | ex10-1.htm |

| EX-5.1 - LEGAL OPINION - Battlers Corp. | ex5-1.htm |

| EX-3.2 - BYLAWS - Battlers Corp. | ex3-2.htm |

| EX-3.1 - ARTICLES OF INCORPORATION - Battlers Corp. | ex3-1.htm |

Registration No. 333-___________

As filed with the Securities and Exchange Commission on August 31, 2016

![]()

![]()

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

________________________

Battlers Corp.

(Exact name of registrant as specified in its charter)

|

Nevada |

7812 |

|

(State or Other Jurisdiction of |

Primary Standard Industrial |

|

Incorporation or Organization) |

Classification Code Number |

|

38-3990249 | |

|

IRS Employer | |

|

Identification Number | |

Battlers Corp.

No.1 Street, Sophora Court,

1/27, Larnaka, Cyprus, 6021

Tel. 302111983153

Email: company@battlerscorp.com

(Address and telephone number of principal executive offices)

INCORP SERVICES, INC.

2360 CORPORATE CIRCLE, STE. 400

HENDERSON, NEVADA 89074-7722

Tel. (702) 866-2500

(Name, address and telephone number of agent for service)

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box: X

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering:

If this form is a post-effective registration statement filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering:

If this form is a post-effective registration statement filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering:

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one):

Large accelerated filer: -

Accelerated filer: -

Non-accelerated filer: - (Do not check if a smaller reporting company)

Smaller reporting company: X

|

Securities to be Registered |

Amount to be Registered |

(1) |

|

Offering Price Per Share |

(2) |

|

Aggregate Offering Price |

|

Registration Fee |

||||||

|

Common Stock: |

4,000,000 |

$ |

0.02 |

$ |

80,000 |

$ |

8.06 |

(1) In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended.

(2) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

PROSPECTUS

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

Battlers Corp.

4,000,000 SHARES OF COMMON STOCK

$0.02 PER SHARE

This is the initial offering of common stock of Battlers Corp. and no public market currently exists for the securities being offered. We are offering for sale a total of 4,000,000 shares of common stock at a fixed price of $0.02 per share. There is no minimum number of shares that must be sold by us for the offering to proceed, and we will retain the proceeds from the sale of any of the offered shares. The offering is being conducted on a self-underwritten, best efforts basis, which means our President Stepan Feodosiadi, will attempt to sell the shares.

This Prospectus will permit our President to sell the shares directly to the public, with no commission or other remuneration payable to him for any shares he may sell. In offering the securities on our behalf, he will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934. The shares will be offered at a fixed price of $0.02 per share for a period of two hundred and forty (240) days from the effective date of this prospectus. The offering shall terminate on the earlier of (i) when the offering period ends (240 days from the effective date of this prospectus), (ii) the date when the sale of all 4,000,000 shares is completed, (iii) when the Board of Directors decides that it is in the best interest of the Company to terminate the offering prior to the completion of the sale of all 4,000,000 shares registered under the Registration Statement of which this Prospectus is part.

Battlers Corp. is a recently organized company and as of the day of this filing we have been involved primarily in organizational activities. Any investment in the shares offered herein involves a high degree of risk. You should only purchase shares if you can afford a loss of your investment. Our independent registered public accountant has issued an audit opinion for Battlers Corp., which includes a statement expressing a substantial doubt as to our ability to continue as a going concern.

There has been no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority (“FINRA”) for our common stock to be eligible for trading on the Over-the-Counter Bulletin Board. To be eligible for quotation, issuers must remain current in their quarterly and annual filings with the SEC. If we are not able to pay the expenses associated with our reporting obligations we will not be able to apply for quotation on the OTC Bulletin Board. We do not yet have a market maker who has agreed to file such application. There can be no assurance that our common stock will ever be quoted on a stock exchange or a quotation service or that any market for our stock will develop.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (“JOBS Act”).

THE PURCHASE OF THE SECURITIES OFFERED THROUGH THIS PROSPECTUS INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY READ AND CONSIDER THE SECTION OF THIS PROSPECTUS ENTITLED “RISK FACTORS” ON PAGES 8 THROUGH 17 BEFORE BUYING ANY SHARES OF BATTLERS CORP.’S COMMON STOCK.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

SUBJECT TO COMPLETION, DATED AUGUST 31, 2016

TABLE OF CONTENTS

|

PROSPECTUS SUMMARY |

6 |

||

|

RISK FACTORS |

8 |

||

|

FORWARD-LOOKING STATEMENTS |

17 |

||

|

USE OF PROCEEDS |

18 |

||

|

DETERMINATION OF OFFERING PRICE |

19 |

||

|

DILUTION |

19 |

||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS |

20 |

||

|

DESCRIPTION OF BUSINESS |

27 |

||

|

LEGAL PROCEEDINGS |

30 |

||

|

DIRECTORS, EXECUTIVE OFFICERS, PROMOTER AND CONTROL PERSONS |

30 |

||

|

EXECUTIVE COMPENSATION |

32 |

||

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS |

33 |

||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

33 |

||

|

PLAN OF DISTRIBUTION |

35 |

||

|

DESCRIPTION OF SECURITIES |

38 |

||

|

INDEMNIFICATION |

39 |

||

|

INTERESTS OF NAMED EXPERTS AND COUNSEL |

39 |

||

|

EXPERTS |

39 |

||

|

AVAILABLE INFORMATION |

40 |

||

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

40 |

||

|

INDEX TO THE FINANCIAL STATEMENTS |

40 |

WE HAVE NOT AUTHORIZED ANY DEALER, SALESPERSON OR OTHER PERSON TO GIVE ANY INFORMATION OR REPRESENT ANYTHING NOT CONTAINED IN THIS PROSPECTUS. YOU SHOULD NOT RELY ON ANY UNAUTHORIZED INFORMATION.

THIS PROSPECTUS IS NOT AN OFFER TO SELL OR BUY ANY SHARES IN ANY STATE OR OTHER JURISDICTION IN WHICH IT IS UNLAWFUL. THE INFORMATION IN THIS PROSPECTUS IS CURRENT AS OF THE DATE ON THE COVER. YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS PROSPECTUS

PROSPECTUS SUMMARY

AS USED IN THIS PROSPECTUS, UNLESS THE CONTEXT OTHERWISE REQUIRES, “WE,” “US,” “OUR,” AND “BATTLERS CORP.” REFERS TO BATTLERS CORP. THE FOLLOWING SUMMARY DOES NOT CONTAIN ALL OF THE INFORMATION THAT MAY BE IMPORTANT TO YOU. YOU SHOULD READ THE ENTIRE PROSPECTUS BEFORE MAKING AN INVESTMENT DECISION TO PURCHASE OUR COMMON STOCK.

Battlers Corp.

We are a newly organized company and intend to commence operations in the video production area. The videos can be presented in advertising, marketing, developing and presenting projects. We are offering full service in the area and are able to satisfy our future clients. Our sole officer and director has the experience and needed skills for such work and we believe it is the main tool of our business development in this area.

Battlers Corp. was incorporated in Nevada on February 3, 2016. We intend to use the net proceeds from this offering to develop our business operations (See “Description of Business” and “Use of Proceeds”). To implement our plan of operations we require a minimum of $20,000 for the next twelve month as described in our Plan of Operations. Our sole officer and director, Stepan Feodosiadi has verbally agreed to loan the needed amount for the Company on demand for the registration and production process. There is no assurance that we will generate any revenue in the first twelve months after completion of our offering or ever generate any revenue.

Being a newly organized company, we have very limited operating history. As of June 30, 2016 we have developed our business plan for a period of twelve months, registered the domain name for our website and filled it with initial information about the Company, signed lease agreement for a period of one year with the option of extension and signed a sales service contract. In accordance to our Plan of Operations if we are unable to raise a minimum funding of $20,000 required for conducting our business over the next twelve months, our business will be harmed. After the twelve-month period we may need additional financing to continue our operations. The Company’s registration office is located at No.1 Street, Sophora Court, 1/27, Larnaka, Cyprus, 6021. Our management believes that video production business has more opportunities and more the production area is more extensive in Greece, because of that reason we decided to start our operations there. Our phone number is 302111983153.

From inception until the date of this filing, we have had limited operating activities. Our financial statements from inception (February 3, 2016) through June 30, 2016, report no revenues and a net loss of $673. Our independent registered public accounting firm has issued an audit opinion for Battlers Corp., which includes a statement expressing a substantial doubt as to our ability to continue as a going concern.

To date, we have formed the Company, developed our business plan, set up our web site, and we have purchased needed equipment, signed a lease agreement for a period of one year with the option of extension and signed a sales service contract. As of the date of this prospectus, there is no public trading market for our common stock and no assurance that a trading market for our securities will ever develop. The company is publicly offering its shares to raise funds in order for our business to develop its operations and increase its likelihood of commercial success.

As we have limited operating history and limited revenues we are a “shell company,” as applicable federal securities law defines that term. We expect that we will continue to be a “shell company” until we have more operations and have substantial revenues and assets. We anticipate that if we receive $80,000 from this offering we should have enough money to expand our business of video production that it will be sufficient to cause us to not be considered as a “shell company”. We cannot provide any guarantee or assurance, however, that in the event we raise $80,000 from this offering we will have enough money to engage in profitable operations. During the time that we are a “shell company”, holders of our restricted securities will not be able to rely on Rule 144 in connection with the sale of those restricted securities.

We have no plans, arrangements, commitments or understandings to engage in a merger with or acquisition of another company or an unidentified company or companies, or other entity or person.

As of the date of this prospectus, there is no public trading market for our common stock and no assurance that a trading market for our securities will ever develop. The Company is publicly offering its shares to raise funds in order for our business to develop its operations and increase its likelihood of commercial success. Our sole officer and director, Stepan Feodosiadi will be devoting approximately twenty hours a week to our operations, because we do not need to devote more time at the current stage of our business. As far as we will increase the number of customers, our sole officer and director will devote more time on Battlers Corp. As a result, our operations may be sporadic and occur at times, which are convenient to our sole officer and director Stepan Feodosiadi.

THE OFFERING

|

The Offering |

This is a self-underwritten, direct primary offering with no minimum purchase requirement.

|

||

|

The Issuer: |

Battlers Corp.

|

||

|

Securities Being Offered:

Shares outstanding prior to offering:

Shares outstanding after (assuming all the shares are sold) offering:

|

4,000,000 shares of common stock.

On July 5, 2016 there were 4,000,000 shares purchased.

8,000,000 shares.

|

||

|

Price Per Share: |

$ |

0.02 |

|

|

Duration of the Offering: |

The shares will be offered for a period of two hundred and forty (240) days from the effective date of this prospectus. The offering shall terminate on the earlier of (i) when the offering period ends (240 days from the effective date of this prospectus), (ii) the date when the sale of all 4,000,000 shares is completed, (iii) when the Board of Directors decides that it is in the best interest of the Company to terminate the offering prior to the completion of the sale of all 4,000,000 shares registered under the Registration Statement of which this Prospectus is part.

|

||

|

Gross Proceeds from selling 100% of shares:

Gross Proceeds from selling 75% of shares:

Gross Proceeds from selling 50% of shares:

Gross Proceeds from selling 25% of shares:

Gross Proceeds from selling 10% of shares:

|

$80,000

$60,000

$40,000

$20,000

$8,000

Further more, if the Company does not sell any shares from this offering, it will not receive gross proceeds accordingly.

|

||

|

Securities Issued and Outstanding: |

There are 4,000,000 shares of common stock issued and outstanding as of the date of this prospectus, held by our sole officer and director, Stepan Feodosiadi.

|

||

|

Subscriptions: |

All subscriptions once accepted by us are irrevocable.

|

||

|

Registration Costs |

We estimate our total offering registration costs to be approximately $8,000.

|

||

|

Risk Factors |

See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

SUMMARY FINANCIAL INFORMATION

The tables and information below are derived from our audited financial statements for the period from February 3, 2016 (Inception) to June 30, 2016 as following:

|

|

June 30, 2016 |

||

|

Financial Summary |

($) |

||

|

(Audited) |

|||

|

Cash and cash equivalents |

1,989 |

||

|

Total Assets |

1,989 |

||

|

Total Liabilities |

2,662 |

||

|

Total Stockholder’s Deficit |

673 |

||

|

|

Accumulated From February 3, 2016 (Inception) to June 30, 2016 |

||

|

Statement of Operations |

($) |

||

|

(Audited) |

|||

|

Total Expenses |

673 |

||

|

Net Loss for the Period |

(673) |

|

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our common stock, when and if we trade at a later date, could decline due to any of these risks, and you may lose all or part of your investment.

RISKS ASSOCIATED TO OUR BUSINESS

WE HAVE YET TO EARN REVENUE AND OUR ABILITY TO SUSTAIN OUR OPERATIONS IS DEPENDENT ON OUR ABILITY TO RAISE FINANCING. OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTANT HAS EXPRESSED A SUBSTANTIAL DOUBT ABOUT OUR ABILITY TO CONTINUE AS A GOING CONCERN.

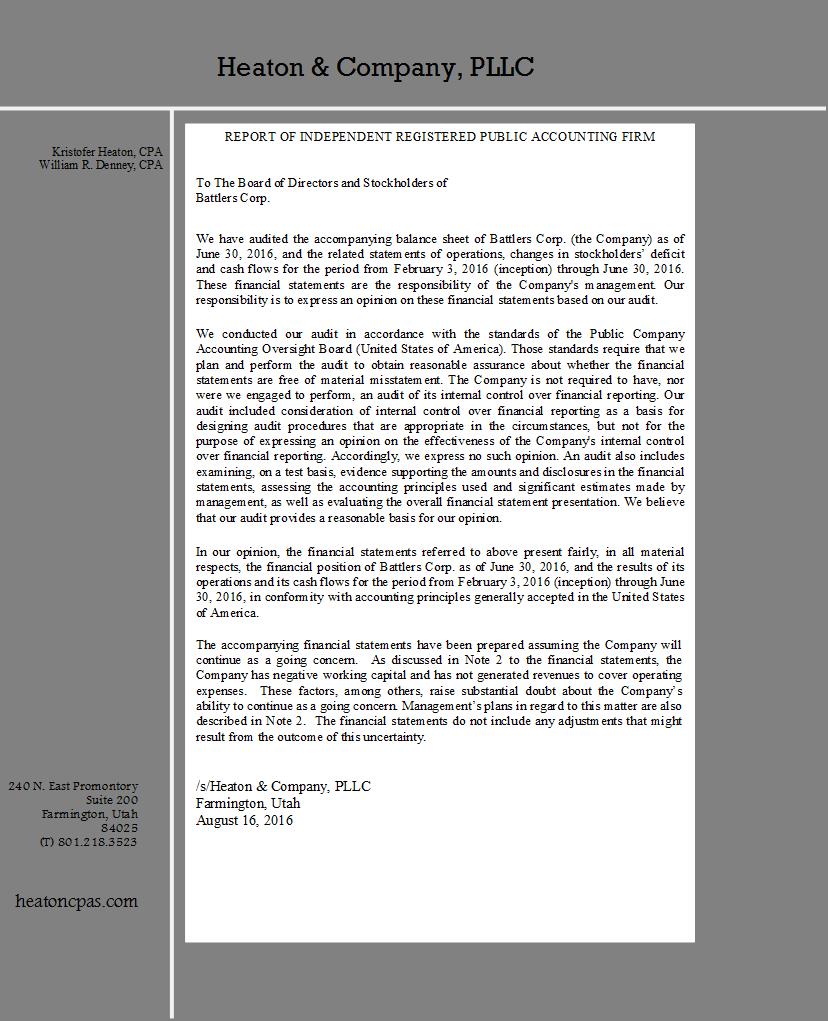

We have accrued net losses of $673 for the period from our inception on February 3, 2016 (Inception) to June 30, 2016 and have no revenues as of this date. Our future is dependent upon our ability to obtain financing and upon future profitable operations in video production. Further, the finances required to fully develop our plan cannot be predicted with any certainty and may exceed any estimates we set forth. These factors raise a substantial doubt that we will be able to continue as a going concern. Heaton & Company, PLLC, our independent registered public accounting firm, has expressed a substantial doubt about our ability to continue as a going concern. This opinion could materially limit our ability to raise additional funds by issuing new debt or equity securities or otherwise. In case if our sole officer and director Stepan Feodosiadi is not able to loan to the Company the needed amount of funds, and in case the Company is not generating the sufficient amount of $20,000 from selling its service, we will not be able to complete our business plan. As a result we may have to liquidate our business and you may lose your investment. You should consider our independent registered public accountant’s comments when determining if an investment in Battlers Corp. is suitable.

WE ARE SOLELY DEPENDENT UPON THE FUNDS TO BE RAISED IN THIS OFFERING TO START OUR BUSINESS, THE PROCEEDS OF WHICH MAY BE INSUFFICIENT TO ACHIEVE REVENUES AND PROFITABLE OPERATIONS. WE MAY NEED TO OBTAIN ADDITIONAL FINANCING WHICH MAY NOT BE AVAILABLE.

Our current operating funds are less than necessary to complete our intended operations in video production. We need the proceeds from this offering to start our operations as described in the “Plan of Operation” section of this prospectus. As of June 30, 2016, we had cash in the amount of $1,989 and liabilities of $2,662. As of this date, we have limited income and just recently started our operation. The proceeds of this offering may not be sufficient for us to achieve revenues and profitable operations. We may need additional funds to achieve a sustainable sales level where ongoing operations can be funded out of revenues. There is no assurance that any additional financing will be available or if available, on terms that will be acceptable to us.

WE ARE A NEWLY ORGANIZED COMPANY AND HAVE COMMENCED LIMITED OPERATIONS IN OUR BUSINESS. WE EXPECT TO INCUR SIGNIFICANT OPERATING LOSSES FOR THE FORESEEABLE FUTURE.

We were incorporated on February 3, 2016 and to date have been involved primarily in organization activities. We have commenced limited business operations such as formed the Company, developed our business plan, set up our web site, and have purchased firstly needed equipment. Accordingly, we have no way to evaluate the likelihood that our business will be successful. Potential investors should be aware of the difficulties normally encountered by new companies. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the operations that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to the ability to generate sufficient cash flow to operate our business, and additional costs and expenses that may exceed current estimates. We anticipate that we will incur increased operating expenses without realizing any substantial revenues. We expect to incur significant losses into the foreseeable future. We recognize that if the effectiveness of our business plan is not forthcoming, we will not be able to continue business operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely be harmed.

We require minimum funding of approximately $20,000 to conduct our proposed operations for a period of one year. If we are not able to raise this amount, or if we experience a shortage of funds prior to funding we may utilize funds from Stepan Feodosiadi, our sole officer and director, who has informally agreed to advance funds to allow us to pay for professional fees, including fees payable in connection with the filing of this registration statement and operation expenses. However, Stepan Feodosiadi has no formal commitment, arrangement or legal obligation to advance or loan funds to the company. After one year we may need additional financing. We do not currently have any arrangements for additional financing.

If we are successful in raising the funds from this offering, we plan to commence activities to continue our operations. We cannot provide investors with any assurance that we will be able to raise sufficient funds to continue our business plan according to our plan of operations.

WE FACE STRONG COMPETITION FROM LARGER AND WELL ESTABLISHED COMPANIES, WHICH COULD HARM OUR BUSINESS AND ABILITY TO OPERATE PROFITABLY.

Our work area is extensive. There are many different concepts of video production in Greece and our services are not unique to their services. Even though the industry is fragmented, it has a number of well-established companies, such as Expose Prod Video Production, Production Service Network, XYZ Productions and others, which are profitable and have developed a brand name. Marketing tactics implemented by our competitors could impact our limited financial resources and adversely affect our ability to compete in our market.

BECAUSE WE ARE SMALL AND DO NOT HAVE MUCH CAPITAL, OUR MARKETING CAMPAIGN MAY NOT BE ENOUGH TO ATTRACT A SUFFICIENT NUMBER OF CUSTOMERS TO OPERATE PROFITABLY. IF WE DO NOT MAKE A PROFIT, WE WILL SUSPEND OPERATIONS OR OUR BUSINESS WILL BE HARMED.

Due to the fact we are small and do not have much capital, we have limited marketing activities and may not be able to make our service known to potential customers. Because we will be limiting our marketing activities, we may not be able to attract enough customers to operate profitably. If we cannot operate profitably, we may have to suspend operations.

DIFFERENT OPINIONS ABOUT VIDEO STRUCTURE

Because our service depends on the personality of the customer and the opinion about different video and design aspects can be different, our time frames of video production can be postponed and our customer would not recommend us to others. In this case we will not look attractive to the potential customers and our video production service can be harmed.

BECAUSE OUR SOLE OFFICER AND DIRECTOR WILL OWN A SUBSTANTIAL PART OF OUR OUTSTANDING COMMON STOCK, HE WILL MAKE AND CONTROL CORPORATE DECISIONS THAT MAY BE DISADVANTAGEOUS TO MINORITY SHAREHOLDERS.

Stepan Feodosiadi, our sole officer and director, will own a substantial part of the outstanding shares of our common stock. Accordingly, he will have significant influence in determining the outcome of all corporate transactions or other matters, including the election of directors, mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. The interests of Mr. Feodosiadi may differ from the interests of the other stockholders and may result in corporate decisions that are disadvantageous to other shareholders.

BECAUSE OUR SOLE OFFICER AND DIRECTOR STEPAN FEODOSIADI HAS OTHER INTERESTS, HE MAY NOT BE ABLE OR WILLING TO DEVOTE A SUFFICIENT AMOUNT OF TIME TO OUR BUSINESS OPERATIONS, WHICH COULD AFFECT REVENUE.

Stepan Feodosiadi, our sole officer and director will devote approximately twenty hours per week providing management services to the Company. While he presently possesses adequate time to attend to our interest, it is possible that the demands on his time from other obligations could increase, with the result that he would no longer be able to devote sufficient time to the management of our business. Other interests of Mr. Feodosiadi are mostly based on his personal life, family and relatives, where he has obligations and responsibilities. In this case the Company’s business development could be negatively impacted.

BECAUSE THE COMPANY’S HEADQUARTERS AND ASSETS ARE LOCATED OUTSIDE THE UNITED STATES, U.S. INVESTORS MAY EXPERIENCE DIFFICULTIES IN ATTEMPTING TO EFFECT SERVICE OF PROCESS AND TO ENFORCE JUDGMENTS BASED UPON U.S. FEDERAL SECURITIES LAWS AGAINST THE COMPANY AND ITS NON-U.S. RESIDENT OFFICER AND DIRECTOR.

While we are organized under the laws of State of Nevada, our officer and director is a non-U.S. resident also our headquarters together with assets are located outside the United States. Consequently, it may be difficult for investors to affect service of process on them in the United States and to enforce in the United States judgments obtained in United States courts against him based on the civil liability provisions of the United States securities laws. Since all our assets will be located outside U.S. it may be difficult for U.S. investors to collect a judgment against us. As well, any judgment obtained in the United States against us may be enforceable in the United States.

If Stepan FeODOSIADI, our PRESIDENT and director resigns or dies, we WILL not have a chief executive officer WHICH could result in our operations BEING SUSPENDED. If that should occur, you could lose your investment.

We extremely depend on the services of our president and director, Stepan Feodosiadi, for the future success of our business. The loss of the services of Mr. Feodosiadi could have an adverse effect on our business, financial condition and results of operations. If he should resign or die we will not have a chief executive officer. If that should occur, until we find another person to act as our chief executive officer, our operations could be suspended. In that event it is possible you could lose your entire investment.

HAVING ONLY ONE DIRECTOR LIMITS OUR ABILITY TO ESTABLISH EFFECTIVE INDEPENDENT CORPORATE GOVERNANCE PROCEDURES AND INCREASES THE CONTROL OF OUR PRESIDENT OVER OPERATIONS AND BUSINESS DECISIONS.

We have only one director, who is our principal executive officer. Accordingly, we cannot establish board committees comprised of independent members to oversee functions like compensation or audit issues. In addition, a tie vote of board members is decided in favor of the chairman, which gives him significant control over all corporate issues, including all major decisions on operations and corporate matters such as approving business combinations.

Until we have a larger board of directors that would include some independent members, if ever, there will be limited oversight of our president’s decisions and activities and little ability for minority shareholders to challenge or reverse those activities and decisions, even if they are not in the best interests of minority shareholders.

AS AN “EMERGING GROWTH COMPANY” UNDER THE JOBS ACT, WE ARE PERMITTED TO RELY ON EXEMPTIONS FROM CERTAIN DISCLOSURE REQUIREMENTS.

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

· Have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act;

· Provide an auditor attestation with respect to management’s report on the effectiveness of our internal controls over financial reporting;

· Comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

· Submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and-“say-on-frequency;” and

· Disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the Chief Executive’s compensation to median employee compensation.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards. We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period. Even if we no longer qualify for the exemptions for an emerging growth company, we may still be, in certain circumstances, subject to scaled disclosure requirements as a smaller reporting company. For example, smaller reporting companies, like emerging growth companies, are not required to provide a compensation discussion and analysis under Item 402(b) of Regulation S-K or auditor attestation of internal controls over financial reporting.

Until such time, however, we cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

RISKS ASSOCIATED WITH THIS OFFERING

SINCE THERE IS NO MINIMUM FOR OUR OFFERING, IF ONLY A FEW PERSONS PURCHASE SHARES THEY WILL LOSE THEIR MONEY IMMEDIATELY WITHOUT US BEING EVEN ABLE TO DEVELOP A MARKET FOR OUR SHARES.

Since there is no minimum with respect to the number of shares to be sold directly by the Company in its offering, if only a few shares are sold, we will be unable to even attempt to create a public market of any kind for our shares. In such an event, it is highly likely that the entire investment of the early and only share purchasers would be lost immediately.

YOU MAY NOT REVOKE YOUR SUBSCRIPTION AGREEMENT ONCE IT IS ACCEPTED BY THE COMPANY OR RECEIVE A REFUND OF ANY FUNDS ADVANCED IN CONNECTION WITH YOUR ACCEPTED SUBSCRIPTION AGREEMENT AND AS A RESULT, YOU MAY LOSE ALL OR PART OF YOUR INVESTMENT IN OUR COMMON STOCK.

Once your subscription agreement is accepted by the Company, you may not revoke the agreement or request a refund of any monies paid in connection with the subscription agreement, even if you subsequently learn information about the Company that you consider to be materially unfavorable. The Company reserves the right to begin using the proceeds from this offering as soon as the funds have been received and will retain broad discretion in the allocation of the net proceeds of this offering. The precise amounts and timing of the Company's use of the net proceeds will depend upon market conditions and the availability of other funds, among other factors. Additionally, you may be unable to sell your shares of our common stock at a price equal to or greater than the subscription price you paid for such shares, and you may lose all or part of your investment in our common stock.

OUR PRESIDENT, STEPAN FEODOSIADI DOES NOT HAVE ANY PRIOR EXPERIENCE OFFRERING AND SELLING SECURITIES, AND OUR OFFERING DOES NOT REQUIRE A MIMIMUM AMOUNT TO BE RAISED. AS A RESULT OF THIS WE MAY NOT BE ABLE TO RAISE ENOUGH FUNDS TO COMMENCE AND SUSTAIN OUR BUSINESS AND INVESTORS MAY LOSE THEIR ENTIRE INVESTMENT.

Stepan Feodosiadi does not have any experience conducting a securities offering. Consequently, we may not be able to raise any funds successfully. Also, the best effort offering does not require a minimum amount to be raised. If we are not able to raise sufficient funds, we may not be able to fund our operations as planned, and our business will suffer and your investment may be materially adversely affected. Our inability to successfully conduct a best-effort offering could be the basis of your losing your entire investment in us.

BECAUSE THE COMPANY HAS ARBITRARILY SET THE OFFERING PRICE, YOU MAY NOT REALIZE A RETURN ON YOUR INVESTMENT UPON RESALE OF YOUR SHARES.

The offering price and other terms and conditions relative to the Company’s shares have been arbitrarily determined by us and do not bear any relationship to assets, earnings, book value or any other objective criteria of value. Additionally, as the Company was formed on February 3, 2016 and has only a limited operating history and no revenues, the price of the offered shares is not based on its past earnings and no investment banker, appraiser or other independent third party has been consulted concerning the offering price for the shares or the fairness of the offering price used for the shares, as such our stockholders may not be able to receive a return on their investment when they sell their shares of common stock.

WE ARE SELLING THIS OFFERING WITHOUT AN UNDERWRITER AND MAY BE UNABLE TO SELL ANY SHARES.

This offering is self-underwritten, that is, we are not going to engage the services of an underwriter to sell the shares; we intend to sell our shares through our President, who will receive no commissions. There is no guarantee that he will be able to sell any of the shares. Unless he is successful in selling at least 25% of the shares and we receive the proceeds in the amount of $20,000 from this offering and the Company will proceed with plan in accordance to our Plan of Operation section.

ANY ADDITIONAL FUNDING WE ARRANGE THROUGH THE SALE OF OUR COMMON STOCK IN THE FUTURE WILL RESULT IN DILUTION TO PURCHASERS OF SECURITIES IN THIS OFFERING.

We are a newly organized company and have generated no revenue to date. Long-term financing beyond the maximum aggregate amount of this offering may be required to expand our business. The exact amount of funding will depend on the scale of our development and expansion. We do not currently have plans for expansion, and we have not decided yet on the scale of our development and expansion and on the exact amount of funding needed for our long-term financing. Our most likely sources of additional capital will be through the sale of additional shares of common stock and through selling our service of video production. The stock issuances will cause interests of purchasers of securities in this offering to be diluted. Such dilution will negatively affect the value of investors’ shares.

THE TRADING IN OUR SHARES WILL BE REGULATED BY THE SECURITIES AND EXCHANGE COMMISSION RULE 15G-9 WHICH ESTABLISHED THE DEFINITION OF A “PENNY STOCK.”

The shares being offered are defined as a penny stock under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), and rules of the Commission. The Exchange Act and such penny stock rules generally impose additional sales practice and disclosure requirements on broker-dealers who sell our securities to persons other than certain accredited investors who are, generally, institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 ($300,000 jointly with spouse), or in transactions not recommended by the broker-dealer. For transactions covered by the penny stock rules, a broker dealer must make certain mandated disclosures in penny stock transactions, including the actual sale or purchase price and actual bid and offer quotations, the compensation to be received by the broker-dealer and certain associated persons, and deliver certain disclosures required by the Commission. Consequently, the penny stock rules may make it difficult for you to resell any shares you may purchase, if at all.

DUE TO THE LACK OF A TRADING MARKET FOR OUR SECURITIES, YOU MAY HAVE DIFFICULTY SELLING ANY SHARES YOU PURCHASE IN THIS OFFERING.

We are not registered on any market or public stock exchange. There is presently no demand for our common stock and no public market exists for the shares being offered in this prospectus. We plan to contact a market maker immediately following the completion of the offering and apply to have the shares quoted on the Over the Counter Bulletin Board (“OTCBB”). The OTCBB is a regulated quotation service that displays real-time quotes, last sale prices and volume information in over-the-counter securities. The OTCBB is not an issuer listing service, market or exchange. Although the OTCBB does not have any listing requirements, to be eligible for quotation on the OTCBB, issuers must remain current in their filings with the SEC or applicable regulatory authority. If we are not able to pay the expenses associated with our reporting obligations we will not be able to apply for quotation on the OTC Bulletin Board. Market makers are not permitted to begin quotation of a security whose issuer does not meet this filing requirement. Securities already quoted on the OTCBB that become delinquent in their required filings will be removed following a 30 to 60 day grace period if they do not make their required filing during that time. We cannot guarantee that our application will be accepted or approved and our stock listed and quoted for sale. As of the date of this filing, there have been no discussions or understandings between Battlers Corp. and anyone acting on our behalf, with any market maker regarding participation in a future trading market for our securities. If no market is ever developed for our common stock, it will be difficult for you to sell any shares you purchase in this offering. In such a case, you may find that you are unable to achieve any benefit from your investment or liquidate your shares without considerable delay, if at all. In addition, if we fail to have our common stock quoted on a public trading market, your common stock will not have a quantifiable value and it may be difficult, if not impossible, to ever resell your shares, resulting in an inability to realize any value from your investment.

WE WILL INCUR ONGOING COSTS AND EXPENSES FOR SEC REPORTING AND COMPLIANCE. WITHOUT REVENUE WE MAY NOT BE ABLE TO REMAIN IN COMPLIANCE, MAKING IT DIFFICULT FOR INVESTORS TO SELL THEIR SHARES, IF AT ALL.

The estimated cost of this registration statement is $8,000. We will have to utilize funds from Stepan Feodosiadi, our sole officer and director, who has verbally agreed to loan the company funds, in the amount of $20,000, to complete the registration process. After the effective date of this prospectus, we will be required to file annual, quarterly and current reports, or other information with the SEC as provided by the Securities Exchange Act. We plan to contact a market maker immediately following the close of the offering and apply to have the shares quoted on the OTC Electronic Bulletin Board. To be eligible for quotation, issuers must remain current in their filings with the SEC. In order for us to remain in compliance we will require future revenues to cover the cost of these filings, which could comprise a substantial portion of our available cash resources. If we are unable to generate sufficient revenues to remain in compliance it may be difficult for you to resell any shares you may purchase, if at all. Also, if we are not able to pay the expenses associated with our reporting obligations we will not be able to apply for quotation on the OTC Bulletin Board.

WE MAY BE EXPOSED TO POTENTIAL RISKS AND SIGNIFICANT EXPENSES RESULTING FROM THE REQUIREMENTS UNDER SECTION 404 OF THE SARBANES-OXLEY ACT OF 2002.

We will be required, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, to include in our annual report our assessment of the effectiveness of our internal control over financial reporting. We expect to incur significant continuing costs, including accounting fees and staffing costs, in order to maintain compliance with the internal control requirements of the Sarbanes-Oxley Act of 2002. Development of our business will necessitate on going changes to our internal control systems, processes and information systems. If our business develops and grows, our current design for internal control over financial reporting will not be sufficient to enable management to determine that our internal controls are effective for any period, or on an ongoing basis. Accordingly, as we develop our business, such development and growth will necessitate changes to our internal control systems, processes and information systems, all of which will require additional costs and expenses. In the future, if we fail to complete the annual Section 404 evaluation in a timely manner, we could be subject to regulatory scrutiny and a loss of public confidence in our internal controls. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations. However, as an “emerging growth company,” as defined in the JOBS Act, our independent registered public accounting firm will not be required to formally attest to the effectiveness of our internal control over financial reporting pursuant to Section 404 of the Sarbanes Oxley Act of 2002 until the later of the year following our first annual report required to be filed with the SEC, or the date we are no longer an emerging growth company. At such time, our independent registered public accounting firm may issue a report that is adverse in the event it is not satisfied with the level at which our controls are documented, designed or operating.

UNITED STATES STATE SECURITIES LAWS MAY LIMIT SECONDARY TRADING, WHICH MAY RESTRICT THE STATES IN WHICH AND CONDITIONS UNDER WHICH YOU CAN SELL THE SHARES OFFERED BY THIS PROSPECTUS.

There is no public market for our securities, and there can be no assurance that any public market will develop in the foreseeable future. Secondary trading in securities sold in this offering will not be possible in any state in the U.S. unless and until the common shares are qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in such state. There can be no assurance that we will be successful in registering or qualifying our securities for secondary trading, or identifying an available exemption for secondary trading in our securities in every state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the securities in any particular state, the securities could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our securities, the market for our securities could be adversely affected.

BECAUSE WE ARE A “SHELL COMPANY”, THE HOLDERS OF OUR RESTRICTED SECURITIES WILL NOT BE ABLE TO SELL THEIR SECURITIES IN RELIANCE ON RULE 144, UNTIL WE CEASE BEING A “SHELL COMPANY”.

We are a “shell company” as the applicable federal securities law defines that term. Specifically, because of the nature and amount of our assets, our limited operations history and limited revenues pursuant to applicable federal rules, we are considered a “shell company”. Applicable provisions of Rule 144 specify that during that time that we are a “shell company” holders of our restricted securities cannot sell those securities in reliance on Rule 144. Another implication of us being a “shell company” is that we cannot file registration statements under Section 5 of the Securities Act using a Form S-8, a short form of registration to register securities issued to employees and consultants under an employee benefit plan. For us, to cease being a “shell company”, we must have more than nominal operations and more that nominal assets or assets which do not consist solely of cash or cash equivalents.

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve risk and uncertainties. We use words such as “anticipate”, “believe”, “plan”, “expect”, “future”, “intend”, and similar expressions to identify such forward- looking statements. Investors should be aware that all forward-looking statements contained within this filing are good faith estimates of management as of the date of this filing. Our actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us as described in the “Risk Factors” section and elsewhere in this prospectus.

USE OF PROCEEDS

Our offering is being made on a self-underwritten and “best-efforts” basis: no minimum number of shares must be sold in order for the offering to proceed. The offering price per share is $0.02. The following table sets forth the uses of proceeds assuming the sale of 25%, 50%, 75% and 100%, respectively, of the securities offered for sale by the Company. There is no assurance that we will raise the full $80,000 as anticipated.

|

Items Description |

|

25% are sold |

|

50% are sold |

|

75% are sold |

|

100% are sold |

|||||||

|

|

Fee |

|

Fee |

|

Fee |

|

Fee |

||||||||

|

Gross proceeds |

$ |

20,000 |

$ |

40,000 |

$ |

60,000 |

$ |

80,000 |

|||||||

|

Offering expenses |

$ |

8,000 |

$ |

8,000 |

$ |

8,000 |

$ |

8,000 |

|||||||

|

Net proceeds |

$ |

12,000 |

$ |

32,000 |

$ |

52,000 |

$ |

72,000 |

|||||||

|

Establishing an office |

$ |

500 |

$ |

2,300 |

$ |

5,500 |

$ |

8,500 |

|||||||

|

Sales employee salary |

$ |

- |

$ |

2,400 |

$ |

3,600 |

$ |

4,800 |

|||||||

|

Equipment |

$ |

1,500 |

$ |

5,200 |

$ |

12,200 |

$ |

15,200 |

|||||||

|

Software |

$ |

400 |

$ |

1,300 |

$ |

3,000 |

$ |

4,500 |

|||||||

|

Marketing and advertising |

$ |

1,000 |

$ |

3,860 |

$ |

6,000 |

$ |

8,000 |

|||||||

|

SEC reporting and compliance |

$ |

8,000 |

$ |

8,000 |

$ |

8,000 |

$ |

8,000 |

|||||||

|

Workers |

$ |

- |

$ |

3,600 |

$ |

5,400 |

$ |

10,800 |

|||||||

|

Lease expenses |

$ |

- |

$ |

3,840 |

$ |

4,800 |

$ |

7,200 |

|||||||

|

Miscellaneous expenses |

$ |

600 |

$ |

1,500 |

$ |

3,500 |

$ |

5,000 |

The above figures represent only estimated costs. If necessary, Stepan Feodosiadi, our president and director, has verbally agreed to loan the Company funds to complete the registration process. Also, these loans would be necessary if the proceeds from this offering will not be sufficient to implement our business plan and maintain reporting status and quotation on the OTC Electronic Bulletin Board when and if our common stock becomes eligible for trading on the Over-the-Counter Bulletin Board. Mr. Feodosiadi will not be paid any compensation or anything from the proceeds of this offering. There is no due date for the repayment of the funds advanced by Stepan Feodosiadi. Mr. Feodosiadi will be repaid from revenues of operations if and when we generate revenues to pay the obligation.

DETERMINATION OF OFFERING PRICE

We have determined the offering price of the shares arbitrarily. The price does not bear any relationship to our assets, book value, earnings, or other established criteria for valuing a privately held company. In determining the number of shares to be offered and the offering price, we took into consideration our cash on hand and the amount of money we would need to implement our business plan. Accordingly, the offering price should not be considered an indication of the actual value of the securities.

DILUTION

Dilution represents the difference between the Offering price and the net tangible book value per share immediately after completion of this Offering. Net tangible book value is the amount that results from subtracting total liabilities and from total assets. Dilution arises mainly as a result of our arbitrary determination of the Offering price of the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by our existing stockholder.

The historical net tangible book value as of June 30, 2016 was negative $673 or approximately $0.0002 per share. Historical net tangible book value per share of common stock is equal to our total tangible assets less total liabilities, divided by the number of shares of common stock outstanding as of June 30, 2016.

The following table sets forth as of June 30, 2016, the number of shares of common stock purchased from us and the total consideration paid by our existing stockholders and by new investors in this offering if new investors purchase 25%, 50%, 75% or 100% of the offering, after deduction of offering expenses payable by us, assuming a purchase price in this offering of $0.02 per share of common stock.

|

Funding level |

100 |

% |

75 |

% |

50 |

% |

25 |

% | |||||||

|

Proceeds |

$ |

80,000 |

$ |

60,000 |

$ |

40,000 |

$ |

20,000 |

|||||||

|

Shares outstanding |

8,000,000 |

7,000,000 |

6,000,000 |

5,000,000 |

|||||||||||

|

Offering price per share |

$ |

0.02 |

$ |

0.02 |

$ |

0.02 |

$ |

0.02 |

|||||||

|

Net tangible book value per share prior to offering |

$ |

(0.0002 |

) |

$ |

(0.0002 |

) |

$ |

(0.0002 |

) |

$ |

(0.0002 |

) | |||

|

Increase per Share attributable to Investors |

$ |

0.0091 |

$ |

0.0075 |

$ |

0.0054 |

$ |

0.0025 |

|||||||

|

Pro forma net tangible book value per share after offering |

$ |

0.0089 |

$ |

0.0073 |

$ |

0.0052 |

$ |

0.0023 |

|||||||

|

Dilution to investors |

$ |

0.0111 |

$ |

0.0127 |

$ |

0.0148 |

$ |

0.0177 |

|||||||

|

Dilution as a percentage of offering price |

55.5 |

% |

63.5 |

% |

74 |

% |

88.5 |

% |

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

You should read the following discussion and analysis of our financial condition and results of operations together with our financial statements and the related notes and other financial information included elsewhere in this prospectus. Some of the information contained in this discussion and analysis or set forth elsewhere in this prospectus, including information with respect to our plans and strategy for our business and related financing, includes forward-looking statements that involve risks and uncertainties. You should review the “Risk Factors” section of this prospectus for a discussion of important factors that could cause actual results to differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis.

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

· Have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act;

· Provide an auditor attestation with respect to management’s report on the effectiveness of our internal controls over financial reporting;

· Comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

· Submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and

· Disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the CEO’s compensation to median employee compensation.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period. Even if we no longer qualify for the exemptions for an emerging growth company, we may still be, in certain circumstances, subject to scaled disclosure requirements as a smaller reporting company. For example, smaller reporting companies, like emerging growth companies, are not required to provide a compensation discussion and analysis under Item 402(b) of Regulation S-K or auditor attestation of internal controls over financial reporting.

Our cash balance is $1,989 as of June 30, 2016. We have been utilizing and may utilize funds from Stepan Feodosiadi, our Chairman and President, who has informally agreed to advance funds to allow us to pay for offering costs, filing fees, and professional fees. As of June 30, 2016, Mr. Feodosiadi advanced us $2,662. Mr. Feodosiadi, however, has no formal commitment, arrangement or legal obligation to advance or loan funds to the company. In order to implement our plan of operations for the next twelve months period, we require a minimum of $20,000 of funding from this offering.

Being a newly organized company, we have very limited operating history which includes developing our business plan, setting up our web site, and purchasing our firstly needed equipment. After twelve months period we may need additional financing. We do not currently have any arrangements for additional financing. The Company’s registration office is located at No.1 Street, Sophora Court, 1/27, Larnaka, Cyprus, 6021. Our management believes that video production business has more opportunities and more the production area is more extensive in Greece, because of that reason we decided to start our operations there. Our phone number is 302111983153.

We are a newly organized company and have generated no revenues to date. Our full business plan entails activities described in the Plan of Operation section below. Long term financing beyond the maximum aggregate amount of this offering may be required to expand our business. The exact amount of funding will depend on the scale of our development and expansion. Our expansion may include expanding our office facilities, hiring sales personnel and entering into agreements with new clients. We have not planned our expansion, and we have not decided yet on the scale of our development and expansion and on the exact amount of funding needed for our long-term financing.

Our independent registered public accountant has issued a going concern opinion. This means that there is a substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our bills. This is because we have generated only limited revenues to date.

To meet our needs for cash we are attempting to raise money from this offering and from selling our video production service. We believe that we will be able to raise enough money through this offering or through selling our service to continue our proposed operations but we cannot guarantee that once we continue operations we will stay in business after doing so. If we are unable to successfully find customers we may quickly use up the proceeds from this offering and will need to find alternative sources. At the present time, we have not made any arrangements to raise additional cash, other than through this offering. We have signed a sales contract, and we believe that we might get a production order from this customer in the near future.

If we need additional cash and cannot raise it, we will either have to suspend operations until we do raise the cash, or cease operations entirely. Even if we raise $80,000 from this offering, it will last one year, but we may need more funds for business operations in the next year, and we will have to revert to obtaining additional money.

PLAN OF OPERATION

We intend to commence operations in the video production business. Our business is making short videos for promotion and marketing needs. Our sole office and director is in charge for all of our activities. Our target market is advertising, marketing, business development and analytics companies and event agencies together with personal customers. The Company has offered service in the range of the following: advertising videos, project development and presentation videos, family videos and all related to the above mentioned.

Our current cash balance will not be sufficient to fund our operations for the next twelve months, if we are unable to successfully raise money in this offering. However, if we sell half of the securities offered for sale by the Company and raise the gross proceeds of $40,000, this will satisfy cash requirements for twelve months and we will not be required to raise additional funds to meet operating expenses, but our growth plan of operations will be limited. If we sell more than half of the shares in this offering, we will utilize funds in accordance to our plan of estimated expanses. If we need more money we will have to revert to obtaining additional financing by way of a private debt or equity financing. We may also utilize funds from Stepan Feodosiadi, our Sole Officer and Director, who has informally agreed to advance funds to allow us to pay for offering costs, filing fees, professional fees, including fees payable in connection with the filing of this registration statement and operation expenses. There is no a maximum amount of funds that our President has agreed to advance. Mr. Feodosiadi, however, has no formal commitment, arrangement or legal obligation to advance or loan funds to the Company.

We will not be conducting any product research or development. Further we do not expect significant changes in the number of employees. Upon completion of our public offering, our specific goal is selling service of the video production.

After the effectiveness of our registration statement by the Securities and Exchange Commissions, we intend to concentrate our efforts on raising capital. During this period, our operations will be limited due to the limited amount of funds on hand. Upon completion of our public offering, our specific goal is to profitably sell our video production service. Our plan of operation following the completion is as follows:

Establish our Office

Time Frame: 1st - 2nd months. Material costs: $500-$8,500.

Upon completion of the offering we plan to set up an office in Athens, Greece, and acquire the necessary equipment. We plan to purchase office equipment such as telephone, office supplies and furniture. Our sole officer and director, Stepan Feodosiadi, is providing his own laptop for the office and will take care of our initial administrative duties. We believe that it will cost at least $500 to set up an office and obtain needed things to continue operations in the event of selling 25% of the shares and expenses for our equipment is going to be $1,500. The equipment includes purchasing a powerful computer needed for our video production and necessary related items.

If we sell 50% of the shares offered we would modernize our office. In this case, set up costs will be approximately $2,300 and our equipment costs will be $5,200. If we sell 75% of the shares offered our office set up fees would be $5,500 in connection with leasing bigger office space and our equipment will cost us $12,000. The Company is also planning to purchase a big screen TV for presenting the videos to our future customers. In the event we sell all of the shares offered we will buy additional and more advanced equipment that will help us in everyday production together with a big screen TV, therefore the office set up costs will be approximately $8,500 and cost for the equipment approximately $15,200.

Develop Our Website

Time Frame: from 3rd month. No Material costs

During this period, we intend to begin developing our website. Our sole officer and director, Stepan Feodosiadi will be in charge of all website activities. As of the date of this prospectus we have registered a domain name for our website www.battlerscorp.com and filled it with general information about the Company and the production process. Further more our director Stepan Feodosiadi is responsible for our website development and promotion. We do not have any agreements with our sole officer and director regarding website development activities. Updating and improving our website will continue throughout the lifetime of our operations.

Marketing

Time Frame: 2nd - 12th months. Material costs: $1,000-$8,000.

We intend to use marketing tools, such as web advertisements, direct mailing, and phone calls to acquire potential customers. Once we have completed our website and it is fully operational we will begin to market our website using the following online social media avenues: Facebook, Twitter, Google AdWords, Blogging.

We will develop our client base by focusing our marketing efforts on short video production. We also plan to attend trade shows in our industry such as marketing exhibition, exhibition of advertising and others to showcase our product with a view to find new customers. We intend to spend from $1,000 to $8,000 on marketing efforts during the first year, which will depend on the amount of sold shares. Marketing is an ongoing matter that will continue during the life of our operations.

If we do not raise less than $20,000 in this offering, we must limit our marketing activities and may not be able to make our service known to potential customers. Because we will be limiting our marketing activities, we may not be able to attract enough customers to operate profitably. If we cannot operate profitably, our operations will be harmed.

Negotiations with potential customers

Time Frame: 1st -12th months. No material costs.

We plan to put in our marketing plan and start negotiation with potential customers. We plan to enter the market in a way of offering our service to the potential customers such as advertising companies, marketing and related agencies, to the companies in development stage and single clients in our city location and might sign agreements with them. We will negotiate terms and conditions of collaboration. This activity will be ongoing throughout our operations. Even if we are able to obtain a sufficient number of customers and agreements with them in the end of the twelve months period, there is no guarantee that we will be able to attract and more importantly retain enough customers to justify our expenditures. If we are unable to generate a significant amount of revenue and to successfully protect ourselves against those risks, then it would materially affect our financial condition and our business could be harmed.

Hire a sales and workers

Time Frame: 5th - 12th months. Material costs: $2,400-$4,800.

One person with special knowledge and skills can perform our offered service of short video production, so our sole director and officer can execute these operations by himself, but further in the event of selling all of the shares of this offering we are planning to hire additional workers to help our sole director and officer Stepan Feodosiadi in the Company’s operations. We believe that until this time we will have orders for our services and we will need additional staff to perform the work.

If we sell at least half of the shares in this offering, we intend to hire one salesperson with good knowledge and connections in our market area that will execute duties for two days a week and one additional worker with experience in the video production area. The salary of them in this case will be $2,400 and $3,600 accordingly. The salesperson’s responsibilities will be finding potential customers, introduce our service and negotiate with them regarding all related questions. The worker’s responsibilities will be to help our sole officer and director to perform the service of video production and related areas. If we sell 75% shares in this offering we intend to hire sales persons for a half working day and a worker for a full working day. The sales person’s salary will be $3,600 and the worker’s will be $5,400. The negotiation of additional agreements with potential customers will be ongoing during the life of our operations. In the event of selling all of the shares our sales person will work an entire working day and two workers with experience in the area for the same working time. For such work our future employee might have $4,800 and $10,800 of salary.

In summary, during 1st -2nd month we should establish our office and until 3rd month develop our website. After this point we should be ready to start more significant operations and start receiving orders and selling our service. During 2nd -12th month we will be developing our marketing campaign. Further we are planning to negotiate with the potential customers and hiring sales person and workers for our sole director and officer accordingly to the plan described above and in accordance with sold shares in this offering. Our other expenses include software maintenance and other funds, which we are going to spend on paying the Company’s bills and other related charges. The cost for such service will be from $600- $5,000 completion for miscellaneous expenses and from $400 to $4,500 for software maintenance. There is no assurance that we will generate any revenue in the first twelve months after completion our offering or ever generate any revenue.

Stepan Feodosiadi, our president and director will be devoting 75% of his time for planning and organizing activities for Battlers Corp. Once we expand operations, and are able to attract more and more customers to order our service, Mr. Feodosiadi has informally agreed to commit more time as required and hire an assistant in the future if needed.

Estimated Expenses for the Next Twelve Month Period

The following provides an overview of our estimated expenses to fund our plan of operation over the next twelve months.

|

Items Description |

|

25% are sold |

|

50% are sold |

|

75% are sold |

|

100% are sold |

|||||||

|

|

Fee |

|

Fee |

|

Fee |

|

Fee |

||||||||

|

Gross proceeds |

$ |

20,000 |

$ |

40,000 |

$ |

60,000 |

$ |

80,000 |

|||||||

|

Offering expenses |

$ |

8,000 |

$ |

8,000 |

$ |

8,000 |

$ |

8,000 |

|||||||

|

Net proceeds |

$ |

12,000 |

$ |

32,000 |

$ |

52,000 |

$ |

72,000 |

|||||||

|

Establishing an office |

$ |

500 |

$ |

2,300 |

$ |

5,500 |

$ |

8,500 |

|||||||

|

Sales employee salary |

$ |

- |

$ |

2,400 |

$ |

3,600 |

$ |

4,800 |

|||||||

|

Equipment |

$ |

1,500 |

$ |

5,200 |

$ |

12,200 |

$ |

15,200 |

|||||||

|

Software |

$ |

400 |

$ |

1,300 |

$ |

3,000 |

$ |

4,500 |

|||||||

|

Marketing and advertising |

$ |

1,000 |

$ |

3,860 |

$ |

6,000 |

$ |

8,000 |

|||||||

|

SEC reporting and compliance |

$ |

8,000 |

$ |

8,000 |

$ |

8,000 |

$ |

8,000 |

|||||||

|

Workers |

$ |

- |

$ |

3,600 |

$ |

5,400 |

$ |

10,800 |

|||||||

|

Lease expenses |

$ |

- |

$ |

3,840 |

$ |

4,800 |

$ |

7,200 |

|||||||

|

Miscellaneous expenses |

$ |

600 |

$ |

1,500 |

$ |

3,500 |

$ |

5,000 |

The various offering amounts presented in the table above are for illustrative purposes only and the actual amount of proceeds raised, if any, may differ significantly.

OFF-BALANCE SHEET ARRANGEMENTS

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

LIMITED OPERATING HISTORY; NEED FOR ADDITIONAL CAPITAL

There is no historical financial information about us upon which to base an evaluation of our performance. We are in start-up stage operations and have generated limited revenues to date. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources and possible cost overruns due to price and cost increases in services and products.

We have no assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations. Equity financing could result in additional dilution to existing shareholders.

Results of Operations

From Inception on February 3, 2016 to June 30, 2016

During the period we have formed the Company, developed our business plan, set up our web site, and we have purchased our printing machine and raw materials. Our loss since inception is $673. We have not meaningfully commenced our proposed business operations.

LIQUIDITY AND CAPITAL RESOURCES

As of June 30, 2016, the Company had $1,989 cash and our liabilities were $2,662, comprising $2,662 owed to Stepan Feodosiadi, our sole officer and director. The available capital reserves of the Company are not sufficient for the Company to remain operational.

We are attempting to raise funds to proceed with our plan of operation. We will have to utilize funds from Stepan Feodosiadi, our sole officer and director, who has verbally agreed to loan the company funds to complete the registration process. However, Stepan Feodosiadi has no formal commitment, arrangement or legal obligation to advance or loan funds to the company. To proceed with our operations within twelve months, we need a minimum of $20,000.

We cannot guarantee that we will be able to sell all the shares required to satisfy our 12 months financial requirement. If we are successful, any money raised will be applied to the items set forth in the Use of Proceeds section of this prospectus. We will attempt to raise at least the minimum funds necessary to proceed with our plan of operation. In the long term we may need additional financing. We do not currently have any arrangements for additional financing. Obtaining additional funding will be subject to a number of factors, including general market conditions, investor acceptance of our business plan and initial results from our business operations. These factors may impact the timing, amount, terms or conditions of additional financing available to us. There is no assurance that any additional financing will be available or if available, on terms that will be acceptable to us.

Our auditors have issued a “going concern” opinion, meaning that there is a substantial doubt if we can continue as an on-going business for the next twelve months unless we obtain additional capital. No substantial revenues are anticipated until we have completed the financing from this offering and implemented our plan of operation. Our only source for cash at this time is investments by others in this offering. We must raise cash to implement our strategy and stay in business. The amount of the offering will likely allow us to operate for at least one year and have the capital resources required to cover the material costs with becoming a publicly reporting entity.