Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BROADVIEW NETWORKS HOLDINGS INC | a8-kinvestorpresentation8x.htm |

Broadview Networks Holdings, Inc.

Company Overview

Updated on August 31, 2016

Quarter Ended

June 30, 2016

© Broadview Networks Holdings, Inc.

Safe Harbor Statement

This presentation may contain forward-looking statements, including statements regarding, among other items, the

Company’s expected financial position, business, risk factors and financing plans. These statements may be identified by

the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “estimates,” or “anticipates” or

the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy that involve risks

and uncertainties. These forward-looking statements are subject to a number of uncertainties and risks, many of which are

outside of Broadview’s control that could cause actual results to differ materially from such statements. Some of these risks

can be found in Broadview's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed with the

Securities and Exchange Commission.

Adjusted EBITDA, Free Cash Flow and other financial measures as presented herein are not necessarily comparable with

those of other companies. Adjusted EBITDA as presented herein represents net loss before depreciation and amortization,

interest income and expense, other income, provision for income taxes, severance and related separation and retention

costs, certain non-recurring professional fees, post-petition reorganization items, early lease termination costs and certain

other adjustments. Adjusted EBITDA is not a measure of financial performance under GAAP. Adjusted EBITDA is a non-

GAAP financial measure used by our management, together with financial measures prepared in accordance with GAAP

such as net loss, income from operations and revenues, to assess our historical and prospective operating performance.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date

they are made. The Company undertakes no obligation to publicly update or revise any forward-looking statements,

whether as of a result of new information, future events or otherwise.

© Broadview Networks Holdings, Inc. 2

Broadview Highlights

© Broadview Networks Holdings, Inc. 3

Proprietary Cloud-Based UCaaS Platform – We Own It

100% Cloud, using specialized protocols and advanced web technologies to deliver responsive,

user-centric services. Voice, presence, chat, contact center, video/web collaboration, CRM

integration and mobile applications, managed through an industry-leading portal

Nationwide Distribution

National sales team supporting nationwide channel partners and customers

Unlevered Free Cash Flow

16% LTM Adjusted EBITDA margin and ~8% LTM free cash flow margin

Proprietary Support Services and Systems

Leverages Integrated Operational Support System (OSS) to provide award-winning portals for

customers and channel partners resulting in industry leading customer satisfaction

Top Ten National Provider of Unified Communication Services

Serving business customers of all sizes nationwide

Corp

o

rate

Metric

s

(2

)

Total Business

Customers >20K

Avg. Monthly Revenue

per Customer ~$980

Total

Revenue

$290M

~300 Master Agents

Thousands of Distribution

Partners Nationwide

~ 750 Employees

including ~ 115 Sales Reps

Cloud Services – Delivered!

LQA Wholesale

Cloud Revenue $6M

~ 165K End-User Licenses

~ 7,200 Customer Accounts

(1) LQA Cloud Revenue Qtr ended 6/30/16 includes Cloud Access Revenue

(2) Corporate Metrics as of June 2016

2Q15 to 2Q16

~ 19% Pure Cloud Growth

~ 9% Cloud Access Growth

$89 Million Cloud Business(1)

LQA End-User

Cloud Revenue $83M

© Broadview Networks Holdings, Inc. 4

Carrier “White Label” of OfficeSuite

License Revenue from Proprietary IP

Data Collocation Revenue

+ +

Solid platform for

wholesale partners

Empower employees to

improve their own work

Online collaboration tools

included to get work done

Know your business with

big data & analytics

Instantly communicate

from any device or office

See who is available

before try to connect

Turn smartphones and

laptops into your office

Make your business apps

UC enabled to save time

Add employees and

offices anywhere instantly.

5 © Broadview Networks Holdings, Inc.

TM

PC and Mobile Softphones

Voicemail Transcription

Call Recording

HD Video, Audio Meeting

Online Fax

Secure chat

Advanced Reporting

Integrations with Google,

Microsoft, Salesforce etc.

Call Center Services

Premium Customer Service

24/7 Help

Natively Multi-location

Online management

call. chat. meet. connect. done.

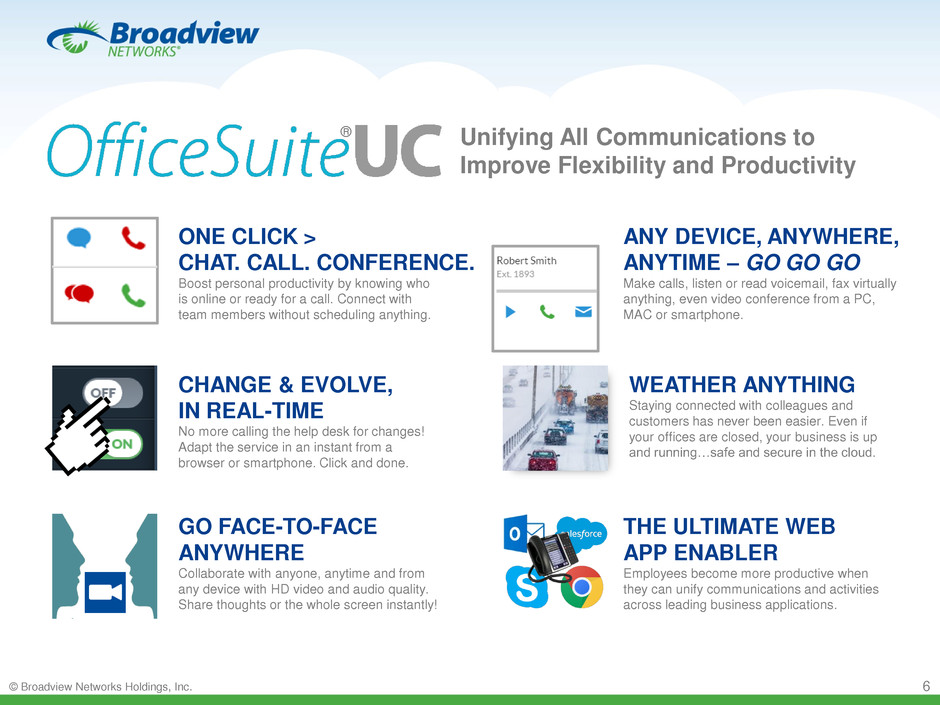

ONE CLICK >

CHAT. CALL. CONFERENCE.

Boost personal productivity by knowing who

is online or ready for a call. Connect with

team members without scheduling anything.

CHANGE & EVOLVE,

IN REAL-TIME

No more calling the help desk for changes!

Adapt the service in an instant from a

browser or smartphone. Click and done.

ANY DEVICE, ANYWHERE,

ANYTIME – GO GO GO

Make calls, listen or read voicemail, fax virtually

anything, even video conference from a PC,

MAC or smartphone.

GO FACE-TO-FACE

ANYWHERE

Collaborate with anyone, anytime and from

any device with HD video and audio quality.

Share thoughts or the whole screen instantly!

WEATHER ANYTHING

Staying connected with colleagues and

customers has never been easier. Even if

your offices are closed, your business is up

and running…safe and secure in the cloud.

THE ULTIMATE WEB

APP ENABLER

Employees become more productive when

they can unify communications and activities

across leading business applications.

Unifying All Communications to

Improve Flexibility and Productivity

®

© Broadview Networks Holdings, Inc. 6

Unified Communications with MyOfficeSuite®

Enhancing business efficiency with presence, chat and analytics

© Broadview Networks Holdings, Inc. 7

2

2

OfficeSuite® Call Center Services

Delivering intelligence and clarity to call centers of all sizes

© Broadview Networks Holdings, Inc. 8

Consistently Recognized for Products,

Innovations & Support

2015, 2014, 2013

2015, 2014, 2011, 2010 2015, 2014, 2013

2012, 2011

2016, 2015, 2013, 2012, 2010

For Sales & Customer Service

Stevie

Award

© Broadview Networks Holdings, Inc. 9

All Other

Traditional

Products,

16.2%

Traditional

Voice Attached

to a T-1, 15.5%

T-1 & IP Based

Services, 34.5%

Cloud Access

Services, 8.4%

Pure Cloud

Services,

25.4%

Diversified, High Quality End-User and

Wholesale Revenue Base

© Broadview Networks Holdings, Inc. 10

(1) Percent of End-User Voice & Data revenue (excludes certain ancillary revenue classified as Voice and Data).

33.8% of End-User Voice and Data Revenue from Cloud-based Services

83.8% of End-User V&D Revenue from Accounts with T1 & IP + Cloud-based Services

20%+ of Wholesale Revenue is Cloud-based

End-User Revenue by Product 2Q16

(1)

End-User

88%

Wholesale

9%

Carrier

2%

Other

1%

Total Revenue by Type 2Q16

$0 - $500

11%

$500 - $1,000

12%

$1,000 - $5,000

37%

$5,000-$10,000

12%

> $10,000,

28%

$300

$400

$500

$600

$700

$800

$900

$1,000

$1,100

Jun '12 Jun '13 Jun '14 Jun '15 Jun '16

Average MRR per End-User Business Customer

Q2 2016 Revenue Loss OfficeSuite vs. Non-OfficeSuite (1)

(1) Average of monthly revenue loss. Broadview’s calculation of revenue loss is a comprehensive metric and

may not be comparable to revenue loss or churn metrics reported by other companies in the industry.

End-User Monthly Recurring Revenue (MRR) by Account Size

Delivering Enterprise-Grade Systems and

Services to Any Size Organization

© Broadview Networks Holdings, Inc. 11

Trended Revenue Loss By Account Size (1)

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

$0-$500 $500-$10,000 >$10,000

2012 2013 2014 2015 LTM 2Q160.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

Non-OfficeSuite OfficeSuite BV TOTAL

Compelling OfficeSuite® Cloud Economics

© Broadview Networks Holdings, Inc. 12

Greater profitability of Cloud-based OfficeSuite® customers compared to

traditional and T-1 access based products

- Incremental gross profit margins of SaaS business model achieved on pure cloud revenue

Greater expected revenue retention/customer life of OfficeSuite® customers

results in greater lifetime value of customer relationship

- Revenue loss experience roughly 50% better than T-1 based and traditional telecom products

Opportunity for more products per customer in OfficeSuite® bundle

Direct

47%

Channel

Partners

33%

Wholesale

20%

Pure

Cloud

Services

50%

Cloud

Access

Services

12%

NonCloud-

based

Services

38%

Diversified Channel Strategy with

Cloud-based Focus of New Sales Efforts

~ 115 Quota-bearing sales reps across all channels

Direct - 47% of new sales

• Dedicated teams focused on new customer acquisition,

conversion, renewals and customer retention

• Operations team up-selling based on existing customer needs

Channel Partners - 33% of new sales

• Approximately 300 agents

• Primary go-to-market for cloud-based services nationwide

Wholesale - 20% of new sales

• Sells our cloud and traditional products and services to other

carriers and service providers

© Broadview Networks Holdings, Inc. 13

Last Twelve Months (LTM) as of June 30, 2016.

Sales of End-User Cloud-based Services

(1)

60%+

All sales channels selling Cloud-based Services

Last Twelve Months (LTM) as of June 30, 2016.

(1) Cloud-based Services includes Cloud Access.

Extensive Cloud and Network

Service Offerings

Comprehensive Systems

and Product Development

Proprietary, Comprehensive and

Integrated Software Development

We “own the code” and set the development

priorities for OfficeSuite

®

Phone and build

software and applications which provide:

• a high degree of automation for service

delivery

• a higher degree of value beyond just

“integrated” services

• intuitive interfaces/systems for both

customers and our employees

• an ability to combine off-the-shelf

and customized software and applications

for cost-efficient deployments

• award-winning internally developed

applications in modern, scalable

languages

© Broadview Networks Holdings, Inc. 14

Broadview’s Back Office Systems

Are a Strategic Differentiator

© Broadview Networks Holdings, Inc. 15

Building Blocks

• Singular applications

• Integrated systems

• Consolidated data

• High degree of automation

• System consolidation enabler

…A well designed solution

What it means…

• Higher customer satisfaction

• Reduced operating costs

• Faster revenue realization

• Effective sales experience

• Increased sales

• Scalable

• Adaptable

Completely Integrated Company with

Proprietary Cloud/Hosted Platform and OSS

© Broadview Networks Holdings, Inc. 16

2005

Allow Broadview to

control the

developmental roadmap

to key OfficeSuite ®

technology

O

b

je

c

ti

v

e

Enhance scale,

diversify product

portfolio, expand

fiber network O

b

je

c

ti

v

e

Create merger of

equals with a new,

T-based strategy,

scale and

operational

efficiencies

O

b

je

c

ti

v

e

2008 2007 2006 2009

Improve product

offerings and

strengthen and increase

market footprint O

b

je

c

ti

v

e

Strengthen presence in

existing market, expand

next-gen product

portfolio O

b

je

c

ti

v

e

2013

Broaden OfficeSuite® IP

control, expand next-gen

product portfolio O

bje

c

ti

v

e

© Broadview Networks Holdings, Inc.

Enhanced Value of Customer Base Revenue $M

Cloud is Our Growth Engine

Revenue trajectory

Cloud revenue growing and

becoming material % of Total

Revenue

Legacy/traditional revenue decline

slowing as increasingly bundled with

Cloud and T-1 & IP

Shifting revenue to higher

value-added “UCaaS”

cloud services

Cloud offers higher margin

services for Broadview and

enhanced features and

functionality for customer

Greater % of revenue coming from

larger clients, resulting in reduced

churn

Higher life time value of

revenue/customers being added

compared to revenue/customers

churning

30% 30%

28% 29%

27% 27%

50%

47%

45% 45%

43% 42%

20%

23%

27%

26%

30% 31%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2013 2014 2015 2Q-15 1Q-16 2Q-16

Total Revenue %

Total Cloud

T-1 Acct Revenue

Other Revenue

17

'14 / '15 / Q2-16/

'13 '14 Q2-15

End-User Pure Cloud $40.7 $45.5 $53.5 $13.2 $15.0 $15.7 11.6% 17.6% 19.3%

End-User Cloud Access 16.9 17.5 19.2 4.7 5.1 5.2 3.4% 9.8% 9.0%

End-User Cloud 57.7 63.0 72.7 17.9 20.1 20.9 9.2% 15.5% 16.5%

Whls Pure Cloud 1.9 2.4 2.6 0.6 0.7 0.7 30.2% 6.1% 11.6%

Whls Cloud Data Collo & Cloud Access 4.0 3.9 3.2 0.8 0.8 0.8 -2.7% -19.6% -0.5%

Wholesale Cloud 5.9 6.4 5.8 1.4 1.5 1.5 7.7% -9.8% 4.7%

TOTAL CLOUD 63.6 69.4 78.5 19.3 21.6 22.3 9.0% 13.1% 15.7%

T-1 & IP Accts 156.1 141.6 130.3 32.8 31.1 31.0 -9.3% -7.9% -5.5%

Other Revenue 95.6 89.5 82.3 21.0 19.2 19.5 -6.4% -8.1% -6.8%

Total $315.4 $300.5 $291.1 $73.1 $71.9 $72.9 -4.7% -3.1% -0.3%

1Q-16 2Q-162Q-152014Revenue Trend 2013 2015

$40.7 $45.5

$53.5 $58.3

$62.7

$0

$20

$40

$60

$80

$100

2013 2014 2015 LTM 2Q16 LQA 2Q16

Whls Data Collo & Cloud Access Whls Pure Cloud End-User Cloud Access End-User Pure Cloud

$13.2 $13.5 $14.2

$15.0 $15.7

$0

$5

$10

$15

$20

$25

2Q15 3Q15 4Q15 1Q16 2Q16

Whls Data Collo & Cloud Access Whls Pure Cloud End-User Cloud Access End-User Pure Cloud

Revenue Years

$21.6

$19.3

$20.7

$19.8

$M $M

Cloud Revenue Trends

$22.3

© Broadview Networks Holdings, Inc. 18

Revenue Quarters

$84.5

$63.6

$78.5

$69.4

$M

$89.4

$21.8

$15.1 $14.2

$21.9

$0

$5

$10

$15

$20

$25

2013 2014 2015 LTM 2Q16

$23.3

$24.2

$25.4

$23.9

$22

$23

$23

$24

$24

$25

$25

$26

$26

2013 2014 2015 LTM 2Q16

$45.1

$39.3 $39.6

$45.8

14.3%

13.1% 13.6%

15.8%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

$0

$15

$30

$45

$60

$75

2013 2014 2015 LTM 2Q16

Reinvesting Free Cash Flow in Transformation

• Continued spend to expand

OfficeSuite® functionality and

service offering

• Capital expenditure increase driven

by success based expenditures, only

made once new revenue is acquired

• Redirecting new revenue acquisition

spend on nationwide distribution

Unlevered Free Cash Flow (1,2)

Capital Expenditures Adjusted EBITDA (1)

(1) 2013 Adjusted EBITDA and Unlevered Free Cash Flow include add back of $1M

non recurring tax charge recorded in 4Q13.

(2) Unlevered Free Cash Flow defined as Adjusted EBITDA less Capital Expenditures.

$M $M

$M

© Broadview Networks Holdings, Inc. 19

$9.7 $10.3

$11.4 $11.5

$12.6

13.3% 14.0%

15.8% 16.0%

17.2%

0%

5%

10%

15%

20%

-$1

$1

$3

$5

$7

$9

$11

$13

2Q15 3Q15 4Q15 1Q16 2Q16

$19.3 $19.8 $20.7 $21.6

$22.3

$0

$15

$30

$45

$60

$75

$90

2Q15 3Q15 4Q15 1Q16 2Q16

Other Re ve nue T-1 & I P Accts Cloud

$3.4 $3.1

$6.3

$5.7

$6.8

$0

$2

$4

$6

$8

2Q15 3Q15 4Q15 1Q16 2Q16

(1) Unlevered Free Cash Flow defined as Adjusted EBITDA less Capital Expenditures.

Capital Expenditures

Adjusted EBITDA

$6.3

$7.2

$5.1

$5.8 $5.8

$0

$2

$4

$6

$8

2Q15 3Q15 4Q15 1Q16 2Q16

Revenue

Unlevered Free Cash Flow (1)

$71.9 $73.1 $72.1 $73.0

$M $M

$M $M

Reinvesting Free Cash Flow in Transformation

$72.9

© Broadview Networks Holdings, Inc. 20

Balance Sheet

© Broadview Networks Holdings, Inc. 21

Components of Debt $M

($ Millions) 12/31/15 06/30/16

Assets

Cash and Cash Equivalents $15.2 $15.8

Certificates of Deposit 1.0 1.0

Accounts Receivable 23.2 22.4

Other Current Assets 6.5 6.9

Total Current Assets 45.9 46.1

Gross PP&E 340.3 351.9

Accumulated Depreciation (286.2) (300.1)

Property & Equipment, net 54.1 51.8

Goodwill 98.2 98.2

Intangible Assets, net 1.4 1.0

Other Assets 3.3 3.3

Total Assets $202.9 $200.3

Liabilities & Stockholders' Deficiency

Current Liabilities $34.4 $32.4

Current Portion of Debt 0.3 0.2

Total Current Liabilities 34.7 32.6

Revolving Credit Facility 12.5 11.5

Long Term Notes 150.0 150.0

Capital Lease Obligations 0.2 0.1

Other Liabilities 16.3 16.5

Total Liabilities 213.7 210.7

Total Stockholders' Deficiency (10.8) (10.4)

Liabilities & Stockholders' Deficiency $202.9 $200.3

12/31/15 06/30/16

Revolving Credit Facility $12.5 $11.5

Capital Lease Obligs. (incl. CP) 0.5 0.4

Senior Secured Notes 150. 150.0

Total Debt $163.0 $161.9

Debt and Liquidity

© Broadview Networks Holdings, Inc. 22

• Top Down Run Rate – $45.8M LTM Adjusted EBITDA less $23.9M LTM Capex less

$17M interest and related debt service

• Cash balance at 6/30/16: $15.8M

• $7.8M Interest Coupon was paid 5/13/16

• $25M revolving credit facility due October 2017 provided by CIT, $11.5M drawn at

6/30/16

• $150M 10.5% senior secured notes due November 2017

Broadview Highlights

© Broadview Networks Holdings, Inc. 23

Proprietary Cloud-Based UCaaS Platform – We Own It

100% Cloud, using specialized protocols and advanced web technologies to deliver responsive,

user-centric services. Voice, presence, chat, contact center, video/web collaboration, CRM

integration and mobile applications, managed through an industry-leading portal

Nationwide Distribution

National sales team supporting nationwide channel partners and customers

Unlevered Free Cash Flow

16% LTM Adjusted EBITDA margin and ~8% LTM free cash flow margin

Proprietary Support Services and Systems

Leverages Integrated Operational Support System (OSS) to provide award-winning portals for

customers and channel partners resulting in industry leading customer satisfaction

Top Ten National Provider of Unified Communication Services

Serving business customers of all sizes nationwide

APPENDIX

© Broadview Networks Holdings, Inc. 24

EBITDA Reconciliation (Non GAAP measure)

© Broadview Networks Holdings, Inc. 25

Fiscal Year Ended December 31, June 30, Sept 30, Dec 31, March 31, June 30,

($ in Thousands) 2013 2014 2015 2015 2015 2015 2016 2016

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited)

Statement of Operations Data:

315,363$ 300,469$ 291,109$ 73,079$ 73,040$ 72,137$ 71,923$ 72,865$

147,505 139,412 129,977 32,313 32,101 31,995 31,309 30,818

167,858 161,057 161,132 40,766 40,939 40,142 40,614 42,047

124,001 122,354 123,667 31,212 31,188 30,237 29,097 29,844

32,839 29,831 29,440 7,350 7,348 7,283 7,175 7,134

11,018 8,872 8,025 2,204 2,403 2,623 4,342 5,069

(1,072) - - - - - - -

(17,196) (16,790) (16,485) (4,017) (4,019) (4,226) (4,189) (4,202)

33 23 26 5 6 8 10 8

(7,217) (7,895) (8,434) (1,808) (1,610) (1,595) 163 875

(1,264) (1,332) (1,358) (415) (332) (280) (323) (306)

(8,481)$ (9,227)$ (9,792)$ (2,223)$ (1,942)$ (1,875)$ (160)$ 569$

Other Financial Data:

42,785$ 38,703$ 37,465$ 9,554$ 9,751$ 9,905$ 11,517$ 12,203$

44,098 39,265 39,622 9,701 10,260 11,406 11,531 12,551

14.0% 13.1% 13.6% 13.3% 14.0% 15.8% 16.0% 17.2%

(8,481)$ (9,227)$ (9,792)$ (2,223)$ (1,942)$ (1,875)$ (160)$ 569$

17,196 16,790 16,485 4,017 4,019 4,226 4,189 4,202

(33) (23) (26) (5) (6) (8) (10) (8)

1,264 1,332 1,358 415 332 280 323 306

32,839 29,831 29,440 7,350 7,348 7,283 7,175 7,134

42,785 38,703 37,465 9,554 9,751 9,905 11,517 12,203

Costs associated with early termination of lease................ - - - - - - - 91

Severance and related separation costs............................ 241 562 193 147 46 - - -

Professional fees related to strategic initiatives.................. - - 696 - 463 233 14 257

Reorganization items....................................................... 1,072 - - - - - - -

Costs associated with settlements................................... - - 1,268 - - 1,268 - -

44,098 39,265 39,622 9,701 10,260 11,406 11,531 12,551

(23,335) (24,203) (25,431) (6,288) (7,185) (5,121) (5,822) (5,763)

20,763$ 15,062$ 14,191$ 3,413$ 3,075$ 6,285$ 5,709$ 6,788$

(1) Adjusted EBITDA represents net loss before depreciation and amortization, interest income and expense, provision for income taxes,

and other non-recurring items described in the table above that are not part of our core operations.

(2) Capital expenditures reflect all additions to PP&E during the calendar year, regardless of timing of cash payments for such purchases. Such presentation differs from

the Cash Flow statement in the Company's SEC-filed financial statements.

(3) 2013 capital expenditures includes full pro forma cost of Common Voices acquisition.

(4) Free Cash Flow defined as Adjusted EBITDA less capital expenditures.

Free Cash Flow (4)................................................................

Revenues...............................................................................

Cost of revenues (exclusive of depreciation and amortization)......

Selling, general and administrative............................................

Depreciation and amortization..................................................

Gross profit..........................................................................

Income (loss) from operations................................................

Adjusted EBITDA (1)...............................................................

Reorganization items...............................................................

Provision for income taxes.......................................................

EBITDA..................................................................................

Net loss...............................................................................

Interest expense.....................................................................

Adjusted EBITDA margin.........................................................

Capital expenditures (2), (3).....................................................

Interest income.......................................................................

Loss before provision for income taxes....................................

Net loss.................................................................................

Interest expense.....................................................................

Depreciation and amortization..................................................

Interest income.......................................................................

Provision for income taxes.......................................................

Adjusted EBITDA..................................................................

EBITDA................................................................................