Attached files

| file | filename |

|---|---|

| EX-3.2 - EX-3.2 - World Gold Trust | d192212dex32.htm |

| EX-99.1 - EX-99.1 - World Gold Trust | d192212dex991.htm |

| EX-10.10 - EX-10.10 - World Gold Trust | d192212dex1010.htm |

| EX-10.9 - EX-10.9 - World Gold Trust | d192212dex109.htm |

| EX-10.8 - EX-10.8 - World Gold Trust | d192212dex108.htm |

| EX-10.6 - EX-10.6 - World Gold Trust | d192212dex106.htm |

| EX-10.5 - EX-10.5 - World Gold Trust | d192212dex105.htm |

| EX-10.4 - EX-10.4 - World Gold Trust | d192212dex104.htm |

| EX-10.2 - EX-10.2 - World Gold Trust | d192212dex102.htm |

| EX-10.1 - EX-10.1 - World Gold Trust | d192212dex101.htm |

| EX-4.2 - EX-4.2 - World Gold Trust | d192212dex42.htm |

| EX-4.1 - EX-4.1 - World Gold Trust | d192212dex41.htm |

| S-1/A - S-1/A - World Gold Trust | d192212ds1a.htm |

Exhibit 10.7

International Swaps and Derivatives Association, Inc.

FORM OF SCHEDULE

to the

2002 Master Agreement

dated as of , 2016

between

MERRILL LYNCH INTERNATIONAL,

a company organized under the laws of England and Wales,

(“Party A”)

and

LONG DOLLAR GOLD TRUST (THE “FUND”),

a series of

WORLD CURRENCY GOLD TRUST (THE “TRUST”)

a statutory trust organized under the laws of the State of Delaware

(“Party B”)

Part 1

Termination Provisions

| (a) | “Specified Entity” means in relation to Party A for the purpose of Sections 5(a)(v), 5(a)(vi), 5(a)(vii) and 5(b)(v): none. |

“Specified Entity” means in relation to Party B for the purpose of Sections 5(a)(v), 5(a)(vi), 5(a)(vii) and 5(b)(v): none.

| (b) | “Specified Transaction” will have the meaning specified in Section 14 of this Agreement but shall also include any transaction with respect to margin loans, cash loans and short sales of any financial instrument, and as amended by inserting the words, “or any Affiliate of Party A” immediately after “Agreement” in the second line thereof. |

| (c) | The “Cross-Default” provisions of Section 5(a)(vi): |

will apply to Party A and

will apply to Party B;

provided, however, that such provision shall be amended by inserting the following after clause (2) thereof: “provided, however, that, notwithstanding the foregoing, an Event of Default shall not occur under Section 5(a)(vi)(2) above if (I) the failure to pay or deliver referred to in Section 5(a)(vi)(2) is caused by an error or omission of an administrative or operational nature, (II) funds were available to such Party to enable it to make the relevant payment or delivery when due and (III) such payment or delivery is made within three (3) Local Business Days following the date on which written notice about such failure to pay or deliver is given to such party.”

In connection therewith, “Specified Indebtedness” will not have the meaning specified in Section 14, and such definition shall be replaced by the following: “any obligation in respect of the payment or repayment of moneys (whether present or future, contingent or otherwise, as principal or surety or

1

otherwise) including, but without limitation, any obligation in respect of borrowed money, except that such term shall not include obligations in respect of deposits received in the ordinary course of a Party’s banking business.” In addition, with respect to Party B, “Specified Indebtedness” shall include, without limitation, the obligations of Party B under the Shares.

“Threshold Amount” means with respect to Party A an amount equal to three percent (3%) of the Shareholders’ Equity of Bank of America Corporation and with respect to Party B, an amount [equal to USD 10,000,000] (or the equivalent in another currency, currency unit or combination thereof).

“Shareholders’ Equity” means with respect to an entity, at any time, the sum (as shown in the most recent annual audited financial statements of such entity) of (i) its capital stock (including preferred stock) outstanding, taken at par value, (ii) its capital surplus and (iii) its retained earnings, minus (iv) treasury stock, each to be determined in accordance with generally accepted accounting principles.

| (d) | The “Credit Event Upon Merger” provisions of Section 5(b)(v): |

will apply to Party A and

will apply to Party B

| (e) | The “Automatic Early Termination” provision of Section 6(a): |

will not apply to Party A and

will not apply to Party B

| (f) | “Termination Currency” will not apply and, instead, payments shall be made in Bullion as provided herein. |

| (g) | Additional Termination Event will apply. Each of the following shall constitute an Additional Termination Event with respect to the Party as specified below. |

| (i) | [Material Adverse Change. A “Material Adverse Change” Additional Termination Event shall occur if; after a Transaction is entered into, and after giving effect to any applicable provision, disruption fallback or remedy specified in, or pursuant to, the relevant Confirmation or elsewhere in this Agreement, due to: (1) the adoption of, or any change in, any applicable law, directive, regulation, accounting rule, practice or principle; or (2) any change in the interpretation or application by any competent supranational, governmental, judicial or regulatory authority of any such applicable law, directive, regulation, rule, practice or principle, as a direct result of which the economic benefit of participation in any existing or future Transactions would be materially adversely affected; but excluding any event or circumstance which would otherwise constitute or give rise to an “Illegality”, a “Force Majeure” or a “Hedging Disruption/Change in Law”. |

Provided that, if a “Material Adverse Change” has occurred, as a condition to the right to designate an Early Termination Date under Section 6(b)(iv), the Parties shall use all reasonable efforts (which will not require either Party to incur a loss, other than immaterial, incidental expenses) to address the issue giving rise to the “Material Adverse Change” within 20 days (or such other period as the Parties may between them agree) after giving notice under Section 6(b)(i) (the “MAC Waiting Period”). Provided further that, on the expiration of the MAC Waiting Period, if the relevant Termination Event is then continuing, either Party may, by not more than 20 days’ notice to the other Party, designate a day not earlier than the day such notice is effective as an Early Termination Date in respect of all Affected Transactions, in accordance with the provisions of Section 6(b)(iv).]

| (ii) | Breach of Acknowledgement or Covenant. In the event of a breach of paragraph (a) or (b) of Part 6 (Additional Acknowledgments and Covenants) hereof, then an Additional Termination Event will occur. |

| (iii) | Breach of Authorized Participant provisions. In the event of a breach of Part 7 (Authorized Participants) hereof, then an Additional Termination Event will occur. |

| (g) | Optional Early Termination. Notwithstanding anything in the Agreement to the contrary, either Party may designate an Early Termination Date in respect of all Transactions (irrespective of whether any Shares are to be redeemed) upon not less than [six] months’ written notice, such notice to be given not earlier than the day falling on the [second] anniversary of the date of this Agreement. |

2

Part 2

[Tax Representations]

| (a) | [Payer Representations. For the purpose of Section 3(e) of this Agreement, Party A and Party B will make the following representation:- |

It is not required by any applicable law, as modified by the practice of any relevant governmental revenue authority, of any Relevant Jurisdiction to make any deduction or withholding for or on account of any Tax from any delivery or payment (other than interest under Section 9(h) of this Agreement) to be made by it to the other Party under this Agreement. In making this representation, it may rely on: (i) the accuracy of any representations made by the other Party pursuant to Section 3(f) of this Agreement; (ii) the satisfaction of the agreement contained in Sections 4(a)(i) or 4(a)(iii) of this Agreement and the accuracy and effectiveness of any document provided by the other Party pursuant to Sections 4(a)(i) or 4(a)(iii) of this Agreement; and (iii) the satisfaction of the agreement of the other Party contained in Section 4(d) of this Agreement, except that it will not be a breach of this representation where reliance is placed on clause (ii) and the other Party does not deliver a form or document under Section 4(a)(iii) of this Agreement by reason of material prejudice to its legal or commercial position.]

| (b) | [Payee Tax Representations. For the purpose of Section 3(f) of this Agreement, Party A and Party B make the representations specified below, if any: |

| (i) | The following representation will apply to Party A: |

| (A) | Party A is a company organized under the laws of England and Wales. It is a hybrid entity that is treated as a pass-thru entity for U.S. federal income tax purposes and each partner or owner of Party A is a “non-U.S. branch of a foreign person” for purposes of section 1.1441-4(a)(3)(ii) of the United States Treasury Regulations and a “foreign person” for purposes of section 1.6041-4(a)(4) of the United States Treasury Regulations. |

| (ii) | The following representations will apply to Party B: |

| (A) | Party B is a statutory trust organized under the laws of the State of Delaware. It is treated as a grantor trust for U.S. federal income tax purposes.] |

Part 3

Agreement to Deliver Documents

For the purpose of Section 4(a)(i) and 4(a)(ii) of this Agreement, each Party agrees to deliver the following documents, as applicable:

| (a) | Tax forms, documents or certificates to be delivered are:- |

| Party required to deliver document |

Document |

Date by which to be delivered | ||

| Party A | A correct and complete U.S. Internal Revenue Service Form W-8BEN-E or any successor thereto. | (i) Before the first Payment Date under this Agreement, (ii) before December 31 of each third succeeding calendar year, (iii) promptly upon reasonable demand by Party B, and (iv) promptly upon learning that any such tax form previously provided by Party A has become expired, obsolete or incorrect. | ||

| Party B | A valid U.S. Internal Revenue Service Form W-9 or any successor thereto. | (i) Upon execution and delivery of this Agreement, (ii) promptly upon reasonable demand by Party A, and (iii) promptly upon learning that any such tax form previously provided by Party B has become obsolete or incorrect. | ||

3

| (b) | Other documents to be delivered are:- |

| Party required to deliver document |

Form/Document/Certificate |

Date by which to be delivered |

Covered

by | |||

| Party A and Party B | Resolution(s) of its board of directors or other documents authorizing the execution and delivery of this Agreement and the Transactions thereunder. | Upon execution and delivery of this Agreement. | Yes | |||

| Party A and Party B | Incumbency certificate or other documents evidencing the authority of individuals executing this Agreement or any other document executed in connection with this Agreement. | Upon execution and delivery of this Agreement or any other documents executed in connection with this Agreement. | Yes | |||

| Party A | Annual Report of Bank of America Corporation containing audited, consolidated financial statements certified by independent certified public accountants and prepared in accordance with generally accepted accounting principles in the country in which such Party is organized. | To be made available on www.bankofamerica.com/investor/ as soon as available and in any event within 90 days after the end of each fiscal year of Party A. | Yes | |||

4

| Party required to deliver document |

Form/Document/Certificate |

Date by which to be delivered |

Covered

by | |||

| Party A | Quarterly Financial Statements of Bank of America Corporation thereof containing unaudited, consolidated financial statements of such Party’s fiscal quarter prepared in accordance with generally accepted accounting principles in the country in which such Party is organized. | To be made available on www.bankofamerica.com/investor/ as soon as available and in any event within 30 days after the end of each fiscal quarter of Party A. | Yes | |||

| Party B | Annual Report of Party B containing audited, consolidated financial statements certified by independent certified public accountants and prepared in accordance with generally accepted accounting principles in the country in which such Party is organized. | As soon as available and in any event within 90 days after the end of each fiscal year of Party B. | Yes | |||

| Party B | Quarterly Financial Statements of Party B containing unaudited, consolidated financial statements of such Party’s fiscal quarter prepared in accordance with generally accepted accounting principles in the country in which such Party is organized. | As soon as available and in any event within 30 days after the end of each fiscal quarter of Party B. | Yes | |||

| Party B | Legal opinion with respect to Party B from Morgan, Lewis & Bockius LLP as to Party B’s capacity, authorization and execution and as to Party B’s obligations under this Agreement being valid, binding and enforceable. | Upon execution and delivery of this Agreement | No | |||

| Party A and Party B | Such other documents as the other Party may reasonably request. | Promptly following reasonable demand by the other Party. | No | |||

Part 4

Miscellaneous

| (a) | Address for Notices. For the purpose of Section 12(a) of this Agreement: |

Address for notices or communications to Party A:

Bank of America Merrill Lynch

Bank of America Merrill Lynch Financial Centre

2 King Edward Street

London EC1A 1HQ

5

United Kingdom

Attention: Agreements & Documentation

Facsimile No.: (44-20) 7996 2995

With a copy to the following address:-

Email: dg.dg_gmg_cid_fax_notices@bofasecurities.com

Address for financial statements to Party A:-

Address: Bank of America Merrill Lynch, Bank of America Merrill Lynch Financial Centre, 2 King Edward Street, London EC1A 1HQ.

Attention: Financial Institutions Credit Risk; and Corporate Credit Risk

Address for notices or communications to Party B:

WGC USA Asset Management Company, LLC

685 Third Avenue, 27th Floor

New York, NY 10075

Attention: Legal Department

With a copy to the following email addresses:

Brian.bellardo@gold.org

Benoit.autier@gold.org

Greg.collett@gold.org

| (b) | Process Agent. For the purpose of Section 13(c): |

Party A appoints as its Process Agent: Bank of America, 25 W 51st St; New York, NY 10019.

Party B appoints as its Process Agent: Not applicable.

| (c) | Offices. The provisions of Section 10(a) will apply to this Agreement. |

| (d) | Multibranch Party. For the purpose of Section 10(b) of this Agreement: |

Party A is not a Multibranch Party.

Party B is not a Multibranch Party.

| (e) | Calculation Agent. |

For the purposes of this Agreement, the Calculation Agent shall be Party A, provided that if an Event of Default occurs and is continuing with respect to Party A, Party B shall appoint a Substitute Dealer to act as alternate Calculation Agent for so long as such Event of Default continues. If Party B is unable, after using commercially reasonable efforts, to appoint a Substitute Dealer by 12:00 P.M. (New York time) on the second Local Business Day after becoming aware of such Event of Default (the “Alternate Calculation Agent Appointment Date”), Party B shall act as the alternate Calculation Agent for so long as such Event of Default continues, provided that, immediately following 12:00 P.M. (New York time) on the Alternate Calculation Agent Appointment Date, Party B shall provide to Party A reasonable evidence of its efforts to contact at least four (4) qualified entities to serve as a Substitute Dealer by the Alternate Calculation Agent Appointment Date and Party B’s designation as the alternate Calculation Agent pursuant to the foregoing shall be contingent upon Party A’s receipt of evidence of Party B contacting at least four (4) qualified potential Substitute Dealers. Following any such designation of an alternate Calculation Agent, if no Event of Default in respect of Party A is then continuing, the Calculation Agent shall again be Party A.

For the purposes of these paragraphs, “Substitute Dealer” means a leading dealer in the relevant market that is not an Affiliate of either Party having a long-term senior unsecured debt rating ascribed

6

to it by each of S&P Global Ratings and Moody’s Investors Service, Inc., no lower than the higher of the equivalent ratings of Party A or its Credit Support Provider (or in the case of an Event of Default with respect to Party A and its Credit Support Provider, no lower than the higher of the equivalent ratings of Party A or its Credit Support Provider as of the date of this Agreement) that agrees to serve as a Substitute Dealer for no more than $10,000 per calculation or determination. The cost of any Substitute Dealer shall be borne by both Parties equally. All calculations and determinations by the Substitute Dealer shall be made in good faith and in a commercially reasonable manner.

No duty or liability of any nature whatsoever shall be owed by the Calculation Agent to any holder or potential holder of Shares in connection with any determination made hereunder.

| (f) | Credit Support Document. Details of any Credit Support Document: |

With respect to Party A: Guaranty of the Credit Support Provider.

With respect to Party B: Not applicable.

| (g) | Credit Support Provider. |

Credit Support Provider means in relation to Party A: Bank of America Corporation.

Credit Support Provider means in relation to Party B: Not applicable.

| (h) | Governing Law; Consent To Jurisdiction; Choice Of Forum. |

| (i) | This Agreement shall be construed in accordance with, and this Agreement and all claims and causes of action arising out of the transactions contemplated hereby shall be governed by, the laws of the State of New York (other than choice of law rules that would require the application of the laws of any other jurisdiction). |

| (ii) | Pursuant to Section 5-1402 of the New York General Obligations Law, all actions or proceedings arising in connection with this Agreement shall be tried and litigated in state or federal courts located in the borough of Manhattan, New York City, State of New York. Each Party hereto waives any right it may have to assert the doctrine of forum non conveniens, to assert that it is not subject to the jurisdiction of such courts or to object to venue to the extent any proceeding is brought in accordance with this section. |

| (i) | Netting of Payments. “Multiple Transaction Payment Netting” will apply for the purpose of Section 2(c) of this Agreement to all Transactions, starting as of the date of this Agreement. For the avoidance of doubt, this election shall also apply to any obligation to deliver Bullion (which shall be treated as the “payment” of an “amount” in accordance with Section 2(c)). |

| (j) | In respect of Party A, “Affiliate” will have the meaning specified in Section 14 of this Agreement. |

In respect of Party B, “Affiliate” will not be applicable.

| (k) | Absence of Litigation. For the purpose of Section 3(c): |

“Specified Entity” means in relation to Party A, none.

“Specified Entity” means in relation to Party B, none.

| (l) | No Agency. The provisions of Section 3(g) will apply to this Agreement. |

| (m) | Additional Representation will apply. For the purpose of Section 3 of this Agreement, each of the following will constitute an Additional Representation, which will be made by the Party indicated below at the times specified below: |

| (i) | Mutual Representations. Each Party makes the following representations to the other Party (which representations will be deemed to be repeated by each Party on each date on which a Transaction is entered into): |

| (A) | Relationship Between Parties. Absent a written agreement between the parties that expressly imposes affirmative obligations to the contrary for that Transaction: |

| (1) | Non-Reliance. It is acting for its own account, and it has made its own independent decisions to enter into that Transaction and as to whether that Transaction is appropriate or proper for it based upon its own judgment and upon advice from such advisors as it has deemed necessary. It is not relying on any communication (written or oral) of the other Party as investment advice or as a recommendation to enter into that Transaction, it being understood that information and explanations related to the terms and conditions of a Transaction shall not be considered investment advice or a recommendation to enter into that Transaction. No communication (written or oral) received from the other Party will be deemed to be an assurance or guarantee as to the expected results of that Transaction. |

7

| (2) | Assessment and Understanding. It is capable of assessing the merits of and understanding (on its own behalf or through independent professional advice), and understands and accepts, the terms, conditions and risks of that Transaction. It is also capable of assuming, and assumes, the risks of that Transaction. |

| (3) | Status of Parties. The other Party is not acting as a fiduciary for or an advisor to it in respect of that Transaction. |

| (B) | Eligible Contract Participant. It is an “eligible contract participant” and that each guarantor of its Swap Obligations, if any, is an “eligible contract participant,” as such term is defined in the U.S. Commodity Exchange Act, as amended. |

| (C) | Transfer free and unencumbered. At the time of transfer to the other Party of any Bullion; it will have the full and unqualified right to make such transfer and that such transfer of Bullion shall be free of all rights, title and interest in the Bullion such that the Bullion vests in the relevant transferee free and clear of any Encumbrance or any other interest of the relevant transferor or of any third person. |

| (ii) | Additional Representations of Party B. Party B hereby represents and warrants as follows, each of which Additional Representation shall be deemed to be made and repeated on the date of this Agreement and at all times until the termination of this Agreement: |

| (A) | Prospectus disclosures. That, to the best of its knowledge and belief, the Prospectus complies with all applicable laws and makes appropriate disclosure in relation to the Shares for the purposes of such laws. |

| (B) | Municipal entity. That it is not, and does not act on behalf of, either a “municipal entity” or “obligated person” (in each case as defined in Section 15B of the Securities Exchange Act of 1934 and the rules adopted by the SEC with respect to municipal advisor registration). |

| (C) | Non-ERISA Representation. [That for so long as shares of the Fund are held by 100 or more holders] it is not (i) an employee benefit plan (hereinafter an “ERISA Plan”), as defined in Section 3(3) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), subject to Title I of ERISA or a plan subject to Section 4975 of the Internal Revenue Code of 1986, as amended (the “Code”), or subject to any other statute, regulation, procedure or restriction that is materially similar to Section 406 of ERISA or Section 4975 of the Code (together with ERISA Plans, “Plans”), (ii) a person any of the assets of whom constitute assets of a Plan, or (iii) in connection with any Transaction under this Agreement, a person acting on behalf of a Plan, or using the assets of a Plan. It will provide notice to Party A in the event that it is aware that it is in breach of any aspect of this representation or is aware that with the passing of time, giving of notice or expiry of any applicable grace period it will breach this representation. |

| (n) | Recording of Conversations. Each Party to this Agreement acknowledges and agrees to the recording of conversations between trading and marketing personnel of the parties to this Agreement, whether by one or the other or both of the parties or their agents. |

8

Part 5

Other Provisions

| (a) | Financial Statements. Section 3(d) is hereby amended by adding in the third line thereof after the word “respect” and before the period: “or, in the case of financial statements, a fair presentation of the financial condition of the relevant Party”. |

| (b) | 2002 Master Agreement Protocol. Annexes 1 to 18 and Section 6 of the ISDA 2002 Master Agreement Protocol as published by ISDA on July 15, 2003 are incorporated into and apply to this Agreement. References in those definitions and provisions to any ISDA Master Agreement will be deemed to be references to this Master Agreement. |

| (c) | Consent to Disclosure. |

| (i) | (A) Party B consents to the disclosure to Party A’s Affiliates, as Party A may deem appropriate, of records and information disclosed to or otherwise provided to Party A by Party B for the purpose of processing and executing Party B’s instructions, or in pursuance of Party A’s or Party B’s commercial interest, and (B) for the avoidance of doubt, such consent gives Party A the right to allow any intended recipient of such Party B information access, by any means, to such Party B information. |

| (ii) | Each Party hereby consents to the disclosure of information: |

| (A) | to the extent required or permitted under, or made in accordance with, the provisions of any applicable law, rule or regulation, including EMIR and Dodd Frank and any applicable supporting law, rule or regulation (“Reporting Regulation”), which mandate reporting and/or retention of transaction and similar information or to the extent required or permitted under, or made in accordance with, any order or directive in relation to (and including) such Reporting Regulation regarding reporting and/or retention of transaction and similar information issued by any authority or body or agency in accordance with which the other Party is required or accustomed to act (“Reporting Requirements”); and |

| (B) | to and between the other Party’s head office, branches or Affiliates, or any persons or entities who provide services to such other Party or its head office, branches or Affiliates, in each case, in connection with such Reporting Requirements. Each Party acknowledges that pursuant to the relevant Reporting Regulation, regulators require reporting of trade data to increase market transparency and enable regulators to monitor systemic risk to ensure safeguards are implemented globally. |

| (iii) | Each Party acknowledges that: |

| (A) | disclosures made pursuant to this Part 5(c) may include, without limitation, the disclosure of trade information including a Party’s identity (by name, address, corporate affiliation, identifier or otherwise) to any trade repository registered or recognized in accordance with the relevant Reporting Regulation, including Article 55 of EMIR, Article 77 of EMIR or with CFTC Rule published on September 1, 2011 with respect to Swap Data Repositories (76 FR 54538) or one or more systems or services operated by any such trade repository (“TR”) and any relevant regulators (including without limitation, the U.S. Commodity Futures Trading Commission or other U.S. regulators in the case of trade reporting under applicable U.S. laws, the European Securities and Markets Authority and national regulators in the European Union) under the Reporting Regulation; |

9

| (B) | such disclosures could result in certain anonymous transaction and pricing data becoming available to the public; |

| (C) | for purposes of complying with regulatory reporting obligations, a Party may use a third party service provider to transfer trade information into a TR and any such TR may engage the services of a global trade repository regulated by one or more governmental regulators; and |

| (D) | disclosures made pursuant hereto may be made to recipients in a jurisdiction other than that of the disclosing party or a jurisdiction that may not necessarily provide an equivalent or adequate level of protection for personal data as the counterparty’s home jurisdiction. |

| (iv) | For the avoidance of doubt, (A) to the extent that applicable non-disclosure, confidentiality, bank secrecy, data privacy or other law imposes non-disclosure requirements on transaction and similar information required or permitted to be disclosed as contemplated herein but permits a Party to waive such requirements by consent, the consent and acknowledgements provided herein shall be a consent by each Party for purposes of such law; (B) any agreement between the parties to maintain confidentiality of information contained herein or in any non-disclosure, confidentiality or other agreement shall continue to apply to the extent that such agreement is not inconsistent with the disclosure of information in connection with the Reporting Requirements as set out herein; and (C) nothing herein is intended to limit the scope of any other consent to disclosure separately given by each Party to the other Party. |

| (d) | Transfer. Section 7 of this Agreement shall be amended by inserting the phrase “which consent shall not be unreasonably withheld or delayed” in the third line thereof after the word “party” and before the word “except”. |

Notwithstanding the provisions of Section 7, Party A may assign and delegate its rights and obligations under this Agreement, and all Transactions hereunder (the “Transferred Obligations”) to any direct or indirect affiliate of Bank of America Corporation ((i) which has at least the same creditworthiness as Party A (or in the case of an Event of Default with respect to Party A, at least the same creditworthiness as Party A disregarding such Event of Default) (the “Assignee”) and (ii) provided (a) Party B would not, at the time and as a result of such assignment, reasonably be expected to be required to pay (including a payment in kind) to the Assignee at such time or on any later date an amount in respect of an Indemnifiable Tax under Section 2(d)(i)(4) of the Agreement (except in respect of interest under Section 9(h) of the Agreement) greater than the amount in respect of which Party B would have been required to pay to Party A in the absence of such assignment, and (b) Party B would not, at the time and as a result of such assignment, reasonably be expected to receive a payment (including a payment in kind) from which at such time or on any later date an amount has been withheld or deducted, on account of a Tax under Section 2(d)(i) of the Agreement (except in respect of interest under Section 9(h) of the Agreement), in excess of that which Party A would have been required to so withhold or deduct in the absence of such assignment, unless the Assignee will be required to make additional payments pursuant to Section 2(d)(i)(4) of the Agreement in an amount equal to such excess), by notice specifying the effective date of such transfer and including an executed acceptance and assumption by the Assignee of the Transferred Obligations; and thereafter, as of the date specified: (a) Party A shall be released from all obligations and liabilities arising under the Transferred Obligations; and (b) if Party A has not assigned and delegated its rights and obligations under this Agreement and all Transactions hereunder, the Transferred Obligations shall cease to be Transaction(s) under this Agreement and shall be deemed to be Transaction(s) under the master agreement, if any, between Assignee and Party B, provided that, if at such time Assignee and Party B have not entered into a master agreement, Assignee and Party B shall be deemed to have entered into an ISDA 2002 form of Master Agreement with a Schedule substantially in the form hereof but amended to reflect the name of the Assignee and the address for notices and any amended representations under Part 2 hereof as may be specified in the notice of transfer.

10

| (e) | Set-off. Section 6(f) is hereby amended by inserting in the sixth line thereof the words “or any Affiliates of the Payee in circumstances where the Payee is the Non-defaulting Party or Non-Affected Party” following the words “payable by the Payee”. |

| (f) | Method of Notice. Section 12(a)(ii) of the Master Agreement is deleted in its entirety and replaced with “(ii) [RESERVED];”. |

| (g) | Withholding Tax imposed on payments to non-US counterparties under the United States Foreign Account Tax Compliance Act. “Tax” as used in Part 2(a) (Payer Tax Representation) and “Indemnifiable Tax” as defined in Section 14 of this Agreement shall not include any U.S. federal withholding tax imposed or collected pursuant to Sections 1471 through 1474 of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), any current or future regulations or official interpretations thereof, any agreement entered into pursuant to Section 1471(b) of the Code, or any fiscal or regulatory legislation, rules or practices adopted pursuant to any intergovernmental agreement entered into in connection with the implementation of such Sections of the Code (a “FATCA Withholding Tax”). For the avoidance of doubt, a FATCA Withholding Tax is a Tax the deduction or withholding of which is required by applicable law for the purposes of Section 2(d) of this Agreement. |

This Part 5(g) shall replace any Express Provisions. For these purposes, “Express Provisions” means any provisions expressly set out in any confirmation of a Transaction that supplements, forms a part of, and is subject to, this Agreement that provide for amendments to (i) any Payer Tax Representation contained in this Agreement, (ii) Section 2(d) of this Agreement, or (iii) the definition of “Indemnifiable Tax” in this Agreement, in each case, only in relation to FATCA Withholding Tax.

| (h) | HIRE Act. To the extent that either Party to this Agreement is not an adhering Party to the ISDA 2015 Section 871(m) Protocol published by ISDA on November 2, 2015 and available atwww.isda.org, as may be amended, supplemented, replaced or superseded from time to time (the “871(m) Protocol”), the parties agree that the provisions and amendments contained in the Attachment to the 871(m) Protocol are incorporated into and apply to this Agreement as if set forth in full herein. The parties further agree that, solely for purposes of applying such provisions and amendments to this Agreement, references to “each Covered Master Agreement” in the 871(m) Protocol will be deemed to be references to this Agreement, and references to the “Implementation Date” in the 871(m) Protocol will be deemed to be references to the date of this Agreement. |

| (i) | ISDA 2013 EMIR Portfolio Reconciliation, Dispute Resolution and Disclosure Protocol. The PDD Protocol is incorporated into and applies to this Agreement as if set out in full in this Agreement but with the following amendments and elections: |

| (i) | The definition of “Adherence Letter” is deleted and references to “Adherence Letter”, “such party’s Adherence Letter” and “Adherence Letter of such party” are deemed to be references to this Part 5(i). |

| (ii) | References to “Implementation Date” are deemed to be references to the date of this Agreement. |

| (iii) | The definition of “Protocol” is deemed to be deleted. |

| (iv) | The definitions of “Portfolio Data Sending Entity” and “Portfolio Data Receiving Entity” are replaced with the following: |

“Portfolio Data Receiving Entity” means Party B, subject to Part I(2)(a) above.

“Portfolio Data Sending Entity” means Party A, subject to Part I(2)(a) above.

| (v) | Local Business Days for the purposes of portfolio reconciliation and dispute resolution. |

| (A) | Party A specifies the following place(s) for the purposes of the definition of Local Business Day as it applies to it for the purposes of portfolio reconciliation and dispute resolution only: New York. |

| (B) | Party B specifies the following place(s) for the purposes of the definition of Local Business Day as it applies to it for the purposes of portfolio reconciliation and dispute resolution only: New York. |

11

| (vi) | Contact details for the purposes of portfolio reconciliation and dispute resolution. Notwithstanding the contact details provided by the Parties in Part 4 of this Agreement; unless otherwise agreed between the parties in writing, the following items shall be delivered to the respective Party for the purposes of the PDD Protocol, as follows: |

| (A) | Notices to Party A: | |||

| Portfolio Data: | collateral_recon_derivatives@bankofamerica.com | |||

| Notice of a discrepancy: | collateral_recon_derivatives@bankofamerica.com | |||

| Dispute Notice: | emir_disp_resolution@baml.com | |||

| (B) | Notices to Party B: | |||

| Portfolio Data: | Benoit.autier@gold.org

Robert.francess@gold.org

Greg.collett@gold.org | |||

| Notice of a discrepancy: | Benoit.autier@gold.org

Robert.francess@gold.org

Greg.collett@gold.org | |||

| Dispute Notice: | Benoit.autier@gold.org

Robert.francess@gold.org

Greg.collett@gold.org | |||

Any notice given by email in accordance with this Part 5(i), will be deemed effective on the date it is delivered unless the date of that delivery (or attempted delivery) is not a Local Business Day (in respect of the receiving party) or, subject to Part I(1)(a)(iv) of the PDD Protocol, that communication is delivered (or attempted) after the close of business on a Local Business Day (in respect of the receiving party), in which case that communication will be deemed given and effective on the first following day that is a Local Business Day (in respect of the receiving party).

| (vii) | Use of a third party service provider. For the purposes of Part I(3)(b), Party A and Party B confirm that they may use a third party service provider as may be separately agreed between them in writing from time to time. |

| (j) | General Conditions. The following new Section 2(a)(iv) shall be inserted immediately following Section 2(a)(iii) of this Agreement: |

“2(a)(iv) Without otherwise limiting the rights of a Non-defaulting Party or non-Affected Party (“X”), in the event that X suspends payments or deliveries in accordance with the conditions precedent specified in Section 2(a)(iii)(1) of this Agreement following the occurrence of an Event of Default or an event which would, with the passing of time, become an Event of Default (an “Occurrence”), X agrees that the condition precedent with respect to such Occurrence shall be deemed to expire on the date (the “Performance Date”) which is ten (10) calendar days after the first date of such suspension of payments or deliveries by X; provided, that the other Party has given written notice citing this provision five (5) calendar days prior to such Performance Date. Unless X has designated an Early

12

Termination Date as a result of a particular Occurrence on or before the Performance Date attributable to such Occurrence, such Occurrence shall cease to be a condition precedent with respect to the obligations under Section 2(a)(i) of this Agreement”.

| (k) | Failure to Pay or Deliver. Section 5(a)(i) of this Agreement is hereby amended by the addition of the following words at the end thereof: “provided, however, that, notwithstanding the foregoing, an Event of Default shall not occur if such party demonstrates, to the reasonable satisfaction of the other party, that: (I) such failure to make any payment or delivery is caused by an error or omission of an administrative or operational nature; (II) funds or assets were available to such party to enable it to make the relevant payment or delivery when due; and (III) such payment or delivery is made within three (3) Local Business Days following the date on which written notice of such failure to pay or deliver is given to such party.” |

| (l) | Misrepresentation. Section 5(a)(iv) of this Agreement is hereby amended by the addition at the end thereof of the words; “if such misrepresentation is not remedied on or before the fifth (5th) Local Business Day following notice of such failure being given to the party and two (2) Local Business Days’ notice of such failure to remedy has thereafter been given to the party.” |

| (m) | Payments on Early Termination. Section 6(e) shall be deleted and replaced by the following new Section 6(e): |

“(e) Payments on Early Termination. If an Early Termination Date occurs, the amounts, if any, deliverable or payable in respect of that Early Termination Date (the “Early Termination Amount”) will be determined pursuant to this Section 6(e) and will be subject to Section 6(f).

| (i) | Events of Default. If the Early Termination Date results from an Event of Default, the Early Termination Amount shall be that quantity of Bullion equal to the Bullion Close-Out Amount or Bullion Close-Out Amounts (whether positive or negative) determined by the Non-defaulting Party for each Terminated Transaction or group of Terminated Transactions, as the case may be. If such Early Termination Amount is a positive quantity, the Defaulting Party will deliver it to the Non-defaulting Party; if it is a negative quantity, the Non-defaulting Party will deliver the absolute quantity of such Early Termination Amount to the Defaulting Party. |

| (ii) | Termination Events. If the Early Termination Date results from a Termination Event: |

| (A) | One Affected Party. Subject to paragraph (C) below, if there is one Affected Party, the Early Termination Amount shall be that quantity of Bullion equal to the Bullion Close-Out Amount or Bullion Close-Out Amounts (whether positive or negative) determined by the Non-affected Party for each Terminated Transaction or group of Terminated Transactions, as the case may be. If such Early Termination Amount is a positive quantity, the Affected Party will deliver it to the Non-affected Party; if it is a negative quantity, the Non-affected Party will deliver the absolute quantity of such Early Termination Amount to the Affected Party. |

| (B) | Two Affected Parties. Subject to paragraph (C) below, if there are two Affected Parties, each Party will determine a Bullion Close-Out Amount or Bullion Close-Out Amounts (whether positive or negative) for each Terminated Transaction or group of Terminated Transactions, as the case may be. Thereafter, the Early Termination Amount will be a quantity equal to one-half of the difference between the higher Bullion Close-Out Amount so determined (by party “X”) and the lower Bullion Close-Out Amount so determined (by party “Y”). If such Early Termination Amount is a positive quantity, Y will deliver such Early Termination Amount to X; if it is a negative quantity, X will deliver the absolute quantity of such Early Termination Amount to Y. |

| (C) | Mid-Market Events. If that Termination Event is an Illegality or a Force Majeure Event, then the Early Termination Amount will be determined in accordance with paragraph (A) or (B) above, as appropriate, except that, for the purpose of determining a Bullion Close-Out Amount or Bullion Close-Out Amounts, the Determining Party will: |

| (1) | if obtaining quotations from one or more third parties (or from any of the Determining Party’s Affiliates), ask each third party or Affiliate: (I) not to take account of the current creditworthiness of the Determining Party or any existing Credit Support Document; and (II) to provide mid-market quotations; and |

| (2) | in any other case, use mid-market values without regard to the creditworthiness of the Determining Party. |

13

| (iii) | Pre-Estimate. The parties agree that a quantity or amount recoverable under this Section 6(e) is a reasonable pre-estimate of loss and not a penalty. Such quantity or amount is deliverable or payable for the loss of bargain and the loss of protection against future risks, and, except as otherwise provided in this Agreement, neither Party will be entitled to recover any additional damages as a consequence of the termination of the Terminated Transactions.” |

| (n) | Export of Defaults. The occurrence or designation of an Early Termination Date on account of an Event of Default or Termination Event with respect to a Party hereto (“X”) (where X is the Defaulting Party or sole Affected Party) shall constitute a material breach and event of default (howsoever described) under all transactions between X and the other Party (“Y”) (whether or not arising under this Agreement, whether or not matured, whether or not contingent and regardless of the currency, place of payment or booking office of the obligation) (together, the “Other Transactions”), whereupon Y shall have the right to terminate, liquidate and otherwise close out any such Other Transactions (and X shall be liable for any damages suffered by Y as a result thereof). |

| (o) | Single Relationship. The parties intend that all Transactions and all other obligations (whether or not arising under this Agreement, whether or not matured, whether or not contingent and regardless of the currency, place of payment or booking office of the obligation) shall be treated as mutual and part of a single, indivisible contractual and business relationship. |

| (p) | Form of Agreement. The parties hereby agree that the text of the body of the Agreement is intended to be the printed form of 2002 Agreement as published and copyrighted by ISDA. |

| (q) | Limited Recourse and non-petition. |

Party A agrees that its recourse against Party B in respect of the relevant Transaction is limited to the assets of the Fund only and not any other series of the Trust or any other person or entity, including, without limitation, the trustee of the Trust, the sponsor of the Trust and any employee, adviser, consultant or representative of the Trust. Party A shall not be entitled to institute, or join with any other person in bringing, instituting or joining, insolvency proceedings (whether court based or otherwise) in relation to Party B.

| (r) | Bail-in and Stay Clause. Notwithstanding and to the exclusion of any other provisions of this Agreement or any other agreements, arrangements or understandings between Party A and Party B: |

| (i) | Party B acknowledges and agrees that, where a Resolution Measure is taken in relation to Party A or any member of the same group as Party A and Party A or any member of its group is a Party to this Agreement (any such Party to this Agreement being an “Affected Party”), it shall only be entitled to exercise any termination right under, or rights to enforce a security interest in connection with, this Agreement against the Affected Party to the extent that it would be entitled to do so under the Special Resolution Regime if this Agreement were governed by English law; and |

| (ii) | Party B acknowledges and accepts that a BRRD Liability arising under this Agreement may be subject to the exercise of Bail-in Powers by the Relevant Resolution Authority, and acknowledges, accepts, and agrees to be bound by: |

| (A) | the effect of the exercise of Bail-in Powers by the Relevant Resolution Authority in relation to any BRRD Liability of Party A to Party B under this Agreement, that (without limitation) may include and result in any of the following, or some combination thereof: |

| (1) | the reduction of all, or a portion, of the BRRD Liability or outstanding amounts due thereon; |

14

| (2) | the conversion of all, or a portion, of the BRRD Liability into shares, other securities or other obligations of Party A or another person, and the issue to or conferral on Party B of such shares, securities or obligations; |

| (3) | the cancellation of the BRRD Liability; |

| (4) | the amendment or alteration of any interest, if applicable, thereon, the maturity or the dates on which any payments are due, including by suspending payment for a temporary period; and |

| (B) | the variation of the terms of this Agreement, as deemed necessary by the Relevant Resolution Authority, to give effect to the exercise of Bail-in Powers by the Relevant Resolution Authority. |

| (s) | Additional Definitions. Section 14 of this Agreement is hereby amended by the addition of the following defined terms. Each of the following defined terms shall be inserted in alphabetical order in Section 14. |

“Adjustment Notice” means a notice in the form at Appendix III to this Agreement in relation to the Daily Delivery Amount, the Aggregate Delivery Amount, the True-up Amount and such other calculations and determinations as are agreed between the Parties from time to time as forming part of the notice;

“Administrator” means The Bank of New York Mellon, as administrator, cash custodian and transfer agent for the Trust;

“Aggregate Delivery Amount” has the meaning given to it in Part 8 hereof;

“Allocated Bullion Account Agreement” means the agreement between the Trust and the Custodian which establishes the Fund Allocated Account;

“Authorized Participant” means a person who (1) is a registered broker-dealer or other securities market participant such as a bank or other financial institution which is not required to register as a broker-dealer to engage in securities transactions; (2) is a participant in DTC; (3) has entered into an Authorized Participant Agreement with the Administrator which has not been terminated; and (4) has established an Authorized Participant Unallocated Account with the Custodian;

“Authorized Participant Agreement” means a written agreement between Party B and another person in relation to Shares pursuant to which such other person acts as an Authorized Participant in relation to the Shares;

“Authorized Participant Unallocated Account” means an unallocated Gold Bullion account established with the Custodian by an Authorized Participant;

“Bail-in Legislation” means in relation to a member state of the European Economic Area which has implemented, or which at any time implements, the BRRD, the relevant implementing law, regulation, rule or requirement as described in the EU Bail-in Legislation Schedule from time to time;

“Bail-in Powers” means any Write-down and Conversion Powers as defined in the EU Bail-in Legislation Schedule, in relation to the relevant Bail-in Legislation;

“BRRD Liability” means a liability in respect of which the relevant Write-down and Conversion Powers in the applicable Bail-in Legislation may be exercised;

15

“BRRD” means Directive 2014/59/EU establishing a framework for the recovery and resolution of credit institutions and investment firms;

“Bullion Close-Out Amount” means, with respect to each Terminated Transaction or each group of Terminated Transactions and a Determining Party, the amount of the losses or costs of the Determining Party in respect of Bullion Denominated Obligations that are or would be incurred under then prevailing circumstances (expressed as a positive quantity of Bullion) or gains of the Determining Party that are or would be realized under then prevailing circumstances (expressed as a negative quantity of Bullion) in replacing, or in providing for the Determining Party the economic equivalent of the material terms of the Bullion Denominated Obligations under that Terminated Transaction or group of Terminated Transactions, including deliveries by the parties under Section 2(a)(i) in respect of that Terminated Transaction or group of Terminated Transactions that are or would, but for the occurrence of the relevant Early Termination Date, be or have been required after that date (assuming satisfaction of the conditions precedent in Section 2(a)(iii));

“Bullion Denominated Obligations” means obligations under a Transaction to Deliver Bullion or which are otherwise denominated in Bullion;

“Bullion Settlement Disruption Day” means a day on which an event has occurred and is continuing which is beyond the control of Party A and Party B, as a result of which a Delivery of Bullion required under a Transaction cannot be effected;

“Bullion Settlement Disruption” has the meaning given to it in the Master Confirmation;

“Bullion Transaction Settlement Date” has the meaning given to it in the 2005 Commodity Definitions;

“Bullion/U.S. Dollar Exchange Rate” means the mid-price of the bid and ask prices of the Bullion to U.S. Dollar exchange rate or U.S. Dollar to Bullion exchange rate used in the Index;

“Bullion” means gold satisfying the good delivery rules of the Market Association for Bullion;

“Close Out Amount” shall not have the meaning set out in Section 14 of this Agreement, but instead, the first paragraph of the definition of “Close-Out Amount” up to and including the words “in respect of that Terminated Transaction or group of Terminated Transactions” shall be deleted and replaced by the following words: ““Close-Out Amount” means a Bullion Close-Out Amount.”

“Creation” shall refer to the creation of Shares; and “Creation Order” shall be an order for the Creation of such Shares; each as provided for in accordance with the Prospectus (and “Create” and “Created” shall be construed accordingly);

“Creation Unit” means a block of 10,000 Shares or more or such other amount as established from time to time by the Sponsor; with multiple blocks being referred to as “Creation Units”;

“Currency(/ies)” means each of Euro, Japanese yen, British pounds sterling, Canadian dollars, Swedish krona and Swiss francs;

“Custodian Agreements” means the Allocated Bullion Account Agreement together with the Unallocated Bullion Account Agreement;

“Custodian” means HSBC Bank plc;

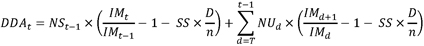

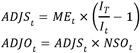

“Daily Delivery Amount” means the amount of Bullion to be Delivered into or out of the Fund on a daily basis to reflect the change in the Currencies comprising the FX Basket against USD, calculated on each Pricing Day in accordance with Appendix II of this Agreement;

“DDA Delivery Date” means in respect of any Pricing Day, the day that is the Bullion Transaction Settlement Date for such Pricing Day; provided that such day is not subject to a Bullion Settlement Disruption. If such day does not satisfy such conditions, then the relevant DDA Delivery Date shall be the next day on which such conditions are satisfied;

16

“Deliver” means good delivery in accordance with the standards of the Market Association for Bullion into: (a) in the case of amounts due from Party A to Party B under this Agreement, the Fund Unallocated Account; (b) in the case of amounts due from Party B to Party A under this Agreement, such unallocated account as Party A shall notify Party B of from time to time, (and “Delivery” shall be construed accordingly);

“Delivery Amount Payer” has the meaning given to it in Part 8;

“Delivery Amount Receiver” has the meaning given to it in Part 8;

“Determining Party” means the Party determining a Bullion Close-Out Amount;

“Dodd Frank” means the Dodd-Frank Wall Street Reform and Consumer Protection Act, Pub. L. No. 111-203, § 929-Z, 124 Stat. 1376, 1871 (2010) (codified at 15 U.S.C. § 78o);

“DTC” means The Depository Trust Company; which is a limited purpose trust company organized under New York law, a member of the U.S. Federal Reserve System and a clearing agency registered with the SEC pursuant to the provisions of Section 17A of the Exchange Act; and which will act as the securities depository for the Shares;

“EMIR” means the European Market Infrastructure Regulation, being Regulation (EU) No 648/2012 on OTC derivatives, central counterparties and trade repositories;

“Encumbrance” means any mortgage, charge (fixed or floating), pledge, lien, option, right to acquire, assignment by way of security or trust arrangement for the purpose of providing security or other security interest of any kind (including any retention arrangement) or any encumbrance or right of pre- emption, or any agreement to create any of the foregoing;

“EU Bail-in Legislation Schedule” means the document described as such, then in effect, and published by the Loan Market Association (or any successor person) from time to time at http://www.lma.eu.com/pages.aspx?p=499;

“Fallback Reference Price” has the meaning given to it in the Master Confirmation;

“Final Delivery Amount” has the meaning given to it in Part 8 of this Agreement;

“Fund” means the Long Dollar Gold Trust;

“Fund Allocated Account” means the allocated Bullion account of the Trust established with the Custodian on behalf of the Fund by the Allocated Bullion Account Agreement. The Fund Allocated Account will be used to hold the Bullion that is transferred from the Fund Unallocated Account to be held by the Fund in allocated form (i.e., as individually identified bars of Bullion);

“Fund Unallocated Account” means the unallocated Bullion account of the Trust established with the Custodian on behalf of the Fund by the Unallocated Bullion Account Agreement. The Fund Unallocated Account will be used to facilitate the transfer of Bullion in and out of the Fund. Specifically, it will be used to transfer Bullion deposits and Bullion redemption distributions between Authorized Participants and the Fund in connection with the Creation and Redemption of Creation Units, in connection with the transfers of Bullion to or from Party A pursuant to this Agreement, and in connection with sales of Bullion for the Fund;

“Funding Rate” means [ ];

“FX Basket” shall have the meaning set forth in the Index Rules.

“group” has the meaning given to it in the PRA Contractual Stay Rules for the purposes of Part 5(s);

“Hedging Disruption/Change in Law Day” means a day on which a Hedging Disruption/Change in Law has occurred and is continuing;

“Index” means the Solactive GLD® Long USD Gold Index, which is an Index of Solactive AG and is calculated and distributed by the Index Sponsor;

“Index Business Day” has the meaning specified in the Index Rules;

17

“Index Closing Level” has the meaning specified in the Index Rules;

“Index Rules” means the Guideline for the Solactive GLD® Long USD Gold Index, Version 0.7 dated 19 July 2016;

“Index Sponsor” means any entity which calculates and publishes (or causes to be published) the Index and at the date of this Agreement means Solactive AG;

“ISDA” means the International Swaps and Derivatives Association, Inc.;

“law” includes any treaty, law, rule or regulation (as modified, in the case of tax matters, by the practice of any relevant governmental revenue authority) and lawful and unlawful will be construed accordingly;

“LBMA” means the London Bullion Market Association;

“Local Business Day” means a day which is a London Business Day and a New York Business Day;

“London Bullion Market” means the over-the-counter market in gold and silver coordinated by the LBMA;

“London Business Day” means a day (other than a Saturday or a Sunday) on which commercial banks generally are open for the transaction of business in London;

“Market Association” means the LBMA or its successors;

“Market Disruption Event” has the meaning given to it in the Master Confirmation;

“Master Confirmation” means the Master Confirmation dated on or about the date of this Agreement and entered into between Party A and Party B, in substantially the form as is attached hereto as Appendix I;

“Metal Entitlement” means as at any date and in relation to any Share, the amount(s) of Bullion to which the holder of that Share is entitled on Redemption of that Share;

“New York Business Day” means a day (other than a Saturday or a Sunday) on which the NYSE ARCA is open for the transaction of business;

“Notional Settled” has the meaning given to it in Appendix II;

“Notional Unsettled” has the meaning given to it in Appendix II;

“Number” in relation to the entry into of Transactions in conjunction with an application for Creation or Redemption (as the case may be) of individual Shares, means the number of Transactions which is the same as the number of Shares to which the application for Creation or Redemption (as the case may be) relates;

“ounces or oz.” means troy ounces, being equal to 31.1034768 grams;

“Party” means a party to this Agreement including that party’s successors in title and assignees or transferees permitted in accordance with the terms of this Agreement;

“PDD Protocol” means Parts I to III of the attachment to the ISDA 2013 EMIR Portfolio Reconciliation, Dispute Resolution and Disclosure Protocol published by ISDA on 19 July 2013 and available on the ISDA website (www.isda.org);

“Platform Documents” means each of the [Transfer Agency and Service Agreement entered into between the Trust and the Administrator; the Fund Administration and Accounting Agreement entered into between the Trust and the Administrator; the Custody Agreement entered into between the Trust and the Administrator; and the Index License Agreement entered into between the Index Sponsor and the Sponsor];

18

“PRA Contractual Stay Rules” means the rules set out in the PRA Rulebook of the Bank of England Prudential Regulation Authority: CRR Firms and Non-Authorised Persons: Stay in Resolution Instrument 2015, as may be amended from time to time;

“Price Source Disruption” has the meaning given to it in the Master Confirmation;

“Pricing Day” means, in respect of a Transaction, a day that is a New York Business Day;

“Prospectus” means the Prospectus, as filed with the United States Securities and Exchange Commission on [ , 2016] under the Securities Act of 1933, of the Fund, a series of the Trust and sponsored by the Sponsor;

“Redemption” shall refer to the redemption of Shares; and “Redemption Order” shall be an order for the Redemption of such Shares; each as provided for in accordance with the Prospectus (and “Redeem” and “Redeemed” shall be construed accordingly);

“Relevant Resolution Authority” means the resolution authority with the ability to exercise any Bail-in Powers in relation to Party A;

“Resolution Measure” means a ‘crisis prevention measure’, ‘crisis management measure’ or ‘recognized third-country resolution action’, each with the meaning given in the PRA Contractual Stay Rules, provided, however, that ‘crisis prevention measure’ shall be interpreted in the manner outlined in Rule 2.3 of the PRA Contractual Stay Rules;

“security interest” has the meaning given to it in the PRA Contractual Stay Rules for the purposes of Part 5(s);

“Share” means units in the Fund representing an equal beneficial interest in the net assets of the Fund entitling the holder thereof to receive such holder’s pro rata share of distributions of income and capital gains, if any, made with respect to the Fund;

“Special Resolution Regime” has the meaning given to it in the PRA Contractual Stay Rules;

“Sponsor” means WGC USA Asset Management Company, LLC, a Delaware limited liability company wholly-owned by WGC (US) Holdings, Inc;

“Swap Formulae” means such calculations as are to be made in accordance with the provisions of Part 8, and as are set out in Appendix II;

“Swap Obligation” means any obligation incurred with respect to a transaction that is a “swap” as defined in the Section 1a(47) of the Commodity Exchange Act and CFTC Regulation 1.3(xxx);

“Tax” means any VAT, tax, income tax, capital gains tax, corporation tax, goods and services tax, withholding tax, stamp, financial institutions, registrations and other duties, bank accounts debits tax, import/export tax or tariff and any other taxes, levies, imposts, deductions, interest, penalties and charges imposed or levied by a government or government agency;

“Termination Date” means, with respect to any Transaction, the final date for payment or delivery, as appropriate, in respect of such Transaction;

“termination right” has the meaning given to it in the PRA Contractual Stay Rules for the purposes of Part 5(s);

[“True Up Amount” means the amount of Bullion to be Delivered into or out of the Fund on a daily basis to reflect the amount of the true-up calculated in accordance with the provisions of Part 8 and the Swap Formulae as set out in Appendix II;]

“Trust” means World Currency Gold Trust;

“U.S. Dollar Cash Equivalent” means in relation to an Early Termination Amount, the equivalent U.S. Dollar sum, calculated by converting the Bullion represented by such Early Termination Amount into U.S. Dollars at the Bullion/U.S. Dollar Exchange Rate on the relevant Early Termination Date;

“U.S. Dollars” or “USD” or “U.S.$” means the lawful currency of the United States of America; and

“Unallocated Bullion Account Agreement” means the agreement between the Trust and the Custodian which establishes the Fund Unallocated Account.

19

Part 6

Additional Acknowledgments and Covenants

| (a) | Party B Acknowledgements. Each of Party B and its successors in title acknowledges and agrees that: |

| (i) | Party B and its successors in title shall have sole responsibility for each of the following: |

| (A) | the establishment, structure or choice of assets of Party B (including without limitation for any costs in relation to the establishment of Party B); |

| (B) | the selection of any person performing services for or acting on behalf of Party B; |

| (C) | the economic terms or suitability of any Transaction; |

| (D) | the preparation of or passing on the disclosure and other information contained in the Prospectus or any other agreements or documents used by Party B or any other party in connection with the marketing and sale of Shares; |

| (E) | the ongoing operations and administration of Party B, including the furnishing of any information to Party B which is not specifically required under the agreements to which Party A is party; or |

| (F) | any other aspect of the existence of Party B except for those matters specifically identified in this Agreement. |

For the avoidance of doubt, Party A shall have no responsibility under this Agreement or otherwise for any such matter.

| (ii) | Shares represent obligations of Party B only and do not represent an interest in or obligation of Party A by virtue of this Agreement. No recourse may be had under this Agreement by the holders of Shares against Party A or its assets with respect to the Shares. |

| (iii) | The Shares have been structured and are being marketed or promoted by Party B and any service providers Party B engages to assist with marketing or promotion, and Party A has had and has no involvement in either of these processes other than in its capacity as an Authorized Participant where applicable. |

| (iv) | Party A’s involvement with the development of the Shares is limited to its roles as a Party to this Agreement and the Transactions. |

| (b) | Additional Party B Covenants. |

| (i) | Party B undertakes to comply with and perform its obligations and undertakings under the Platform Documents. |

| (ii) | Party B undertakes that it will not publish or distribute any written advertising materials (including without limitation internet advertising materials) relating to Shares other than in accordance with all applicable laws and it will not publish or distribute any offering or advertising materials which include any content relating to Party A or any of its Affiliates unless Party A has previously approved the content and form of such materials. |

| (iii) | Party B shall not, and shall require that each Authorized Participant does not, represent or suggest to any potential investors in or distributors of Shares that either Party A or any of its Affiliates has structured Shares or provided any advice or information in respect of Shares. |

| (iv) | For so long as any Shares are outstanding, Party B undertakes to provide to Party A, promptly upon Party A’s request, such information as Party B is required to deliver to the Trustee or any applicable regulator. |

20

| (v) | For so long as any Shares are outstanding, Party B undertakes to promptly (and, in any event, within two (2) Local Business Days) procure that the Bank of New York Mellon, as Administrator of the Fund, provide notice to Party A of the Creation and Redemption (each such term as defined in the Prospectus) of Shares. |

| (vi) | For so long as any Shares are outstanding, Party B undertakes to notify Party A in writing as soon as reasonably practicable if Party B is in breach of this Agreement. |

| (vii) | For so long as any Shares are outstanding, Party B undertakes to notify Party A in writing as soon as reasonably practicable in the event that Solactive AG or The Bank of New York Mellon is in breach of any of their respective obligations under the Platform Documents. |

| (viii) | Party B undertakes not to incur or permit to subsist in respect of any Bullion any indebtedness for borrowed money, lien, claim, charge or encumbrance over such Bullion, and not to give any guarantee or indemnity in respect of indebtedness of any person;[ provided, however, Party B may borrow from the Custodian, an amount of Bullion not exceeding one Good Delivery Bar (as such term is defined in accordance with the Good Delivery Rules of the Market Association for Bullion in place from time to time) to ensure that Shares are fully backed by Bullion.] |

| (ix) | Party B undertakes not to undertake any business save for the Creation and Redemption of Shares, the acquisition and disposal of Bullion, entering into Transactions, and entering into all other documents necessary for the purposes of the Shares (which includes documents appointing officers, administrators, registrars and advisers) and performing its obligations and exercising its rights thereunder. |

| (x) | Party B undertakes not to have any employees. |

| (xi) | Party B undertakes not to consolidate or merge with any other person or convey or transfer all, or substantially all, of its assets to any person. |

| (xii) | Party B undertakes not to permit the validity or effectiveness of this Agreement to be modified, terminated or discharged. |

| (xiii) | Party B undertakes not to have any subsidiaries or controlled Affiliates. |

| (xiv) | Party B undertakes to procure that the Bullion it holds is at all times maintained in a manner so that it is readily distinguishable from the property attributable to any other person, provided, however, Party B may hold Bullion in the Fund Unallocated Account for the amount of time necessary to effect transactions for the Fund. |

| (xv) | Party B undertakes not to open any bank account other than as contemplated in the Prospectus. |

| (c) | Indemnification of Party A. |

| (i) | Party B agrees to indemnify and hold harmless Party A, its directors, officers, employees, agents and affiliates, and each person, if any, who controls Party A within the meaning of either Section 15 of the Securities Act or Section 20 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), from and against any losses, claims, damages and liabilities, including, without limitation, any reasonable legal fees and other out-of-pocket costs and expenses incurred in connection with investigating, preparing for and responding to third party subpoenas, as such expenses are incurred, or other expenses incurred by Party A in connection with defending or investigating any action or claim to which they or any of them may become subject (the “Legal Fees”), insofar as such losses, claims, damages or liabilities (or actions in respect thereof) involve matters contemplated under this Agreement, the Index, or related to any Transaction and arise out of, are based upon or arise in connection with any untrue or misleading statement of any material fact contained in the Prospectus, or any of the other reports, financial statements, certificates or other information furnished by or on behalf of Party B to Party A on or prior to the date of this Agreement, or arise out of, are based upon or arise in connection with the omission to state therein a material fact necessary in order to make the statements therein, in the light of the circumstances in which they were made, not misleading. |

21

| (ii) | Party B will not, however, be liable under the foregoing indemnification provision for losses, claims, damages or liabilities (or actions in respect thereof) that have resulted from the negligence or willful misconduct of Party A or its directors, officers, employees, agents and affiliates and in these circumstances Party A shall reimburse Party B for all losses, claims, damages, liabilities, and Legal Fees or other expenses previously paid by Party B to Party A. |

| (iii) | Party B’s obligations pursuant to this Part 6(c) (Indemnification of Party A) shall inure to the benefit of any successors and assigns of each indemnified party. The obligations of Party B hereunder shall be in addition to any rights that any indemnified party may have at common law or otherwise. |

Part 7

Authorized Participants

| (a) | Appointment of Authorized Participants. Party B may appoint as an Authorized Participant: |

| (i) | Party A or any Affiliate of Party A; or |

| (ii) | any other person provided that this Part 7 is complied with in respect of such appointment, in addition to any other process or criteria as may apply from time to time. |

| (b) | Notification of new Authorized Participant. Party B shall promptly, and in any event no less than [ten (10)] Local Business Days prior to signing an Authorized Participant Agreement, provide notice to Party A of the names and addresses of each person whom Party B proposes should become an Authorized Participant and shall provide (or shall procure that Party A is provided with) such information as Party A may acting in good faith require (the “KYC information”) in order to consider whether or not the appointment of such proposed person as an Authorized Participant is appropriate. In the event that Party A in good faith objects to the appointment of any such Authorized Participant, Party A shall advise Party B of the rejection as soon as practicable and no later than [five (5)] Local Business Days after receiving the KYC information and Party B shall cease the appointment of that Authorized Participant. |

| (c) | Removal of Authorized Participant on notice. If, during the term of appointment of any Authorized Participant, Party A determines in good faith that such Authorized Participant is no longer an appropriate Authorized Participant due to their being a regulatory or reputational circumstance regarding that Authorized Participant which is beyond the control of either of the Parties to mitigate, then Party A shall provide notice of such to Party B, including evidence of the issue (subject to any confidentiality or regulatory restrictions regarding disclosure); and thereafter, Party B shall terminate such Authorized Participant Agreement as soon as reasonably practicable (but, in any event, within ten (10) Local Business Days) of receipt of such notification from Party A. |

| (d) | Cessation of appointment. Party B undertakes to notify Party A in writing as soon as reasonably practicable whenever an Authorized Participant ceases to be an Authorized Participant. |

Part 8

Provisions in respect of Daily Delivery Amounts

| (a) | Procedures for Confirming Transactions. On each and every Index Business Day, Party B shall procure that the Index Sponsor will in good faith and with reasonable due diligence calculate the value of the Index prior to 5:30 a.m. New York time and provide the value of the Index to Party A by no later than 5:30 a.m. New York time. |

| (b) | Adjustment Notice. On each Pricing Day Party A shall in good faith and with reasonable due diligence calculate the Daily Delivery Amount, the Aggregate Delivery Amount and the True-up Amount and provide the same to Party B as part of an Adjustment Notice in substantially the form set forth in Appendix III by 06:30 a.m. New York time. |

22

Each Adjustment Notice, when taken with the Master Confirmation, shall be deemed to be a “Confirmation” in respect of an individual Transaction for the purposes of this Agreement; provided that Party A shall have (and Party B shall procure that Party A has) the dispute rights detailed further below in relation to any Index calculations or determinations, including (i) the Index and any values or other determinations and calculations in respect thereof; (ii) the Swap Formulae as set out in Appendix II hereto; and (iii) calculation of the values for the purposes of the Adjustment Notice.

Party B shall promptly review any Adjustment Notice received from Party A and shall notify Party A promptly, but in any event no later than 08:00 a.m. New York Time, if it objects to any calculation therein. In the case of any objection the Parties shall use commercially reasonable efforts to resolve any dispute promptly and no later than 12:00 p.m. noon New York time on such day. If the Parties are unable to resolve such dispute, then the Parties shall select an independent Substitute Dealer to make such calculation by 01:00 p.m. New York time on such day. The cost of such Substitute Dealer shall be borne equally by the Parties. If the Parties are unable to agree on and appoint a Substitute Dealer, then each Party shall appoint one (1) Substitute Dealer, and those two (2) Substitute Dealers shall jointly appoint a third (3rd) Substitute Dealer to be the Substitute Dealer by 02:00 p.m. New York time on such day.

| (c) | Dispute rights of Party A. Party A, acting in good faith and in a commercially reasonable manner, may dispute a calculation or determination made in respect of the Index by the Index Sponsor (an “Index Disputed Matter”) by providing a written notice to Party B that specifies in reasonable detail (i) the nature of the objection and (ii) an alternative calculation or determination (“Index Objection Notice”) not later than the close of business on the Local Business Day immediately following receipt of such calculation or determination. |